Financial Absorption of Cohesion Policy Funds: How Do Programmes and Territorial Characteristics Influence the Pace of Spending?

Abstract

Using data from the execution of 2014–2020 cohesion policy, this article presents a novel indicator to measure how fast European territories were able to spend their allocated budget and then explores the drivers of such financial performance. This analysis aims to fill a gap in scientific literature as most existing studies tend to focus solely on the total absorption at the end of the period without looking at the average financial performance over time. The article also explores the influence on financial absorption of the governance model (nationally or regionally managed programmes) and the thematic structure of the funds, which has never been done before. The determinants of the speed of financial absorption are investigated through a Tobit model. Results show that both programme-specific and territorial characteristics are relevant factors in explaining the varying levels of fund absorption. This suggests that increased flexibility in spending rules and the adoption of more tailored strategies could be instrumental in improving fund absorption.

Introduction

The European Union (EU) cohesion policy is the largest regional development programme in the world with a budget of over €372 billion for the period 2021–2027. There is a substantial body of literature on the economic impact of this policy, with a growing number of analyses finding positive albeit heterogeneous effects on macro-economic indicators (see, e.g., Bachtrögler et al., 2020; Crescenzi and Giua, 2020; Di Caro and Fratesi, 2022). Various studies have explored additional effects (Mairate, 2006), such as those on the decentralisation process in some countries (Bache et al., 2011), enhancement of capacity-building potential in local authorities (Polverari et al., 2022) and adoption of reforms and policies (Berkowitz et al., 2017). To fully realise these benefits, timely expenditure of the funds allocated through cohesion policy is essential. Consequently, absorption capacity – defined as the ability or capability of a territory to absorb or use the funds allocated to it by the EU (Moreno, 2020) – is a crucial dimension. In our analysis, ‘capacity’ has a double meaning. It refers to both the ability of the authorities managing the funds to spend the funds and to the absorptive capacity of a territory, given contextual factors. This article aims to cover both dimensions in order to measure the speed of absorption and to assess the determinants of the capacity of territories to absorb funds quickly or slowly.

The debate on the financial implementation of cohesion policy has largely been framed by academics and policy-makers in terms of the sheer capacity to absorb the funds. Much less attention has been paid to the related issue of the pace or speed at which cohesion policy funds are absorbed. This matter is far from trivial. The first obvious reason is that a slower spending may prevent the full absorption of the funds. In addition, it can be assumed that the effects of the funds on the economy will be greater if they are more evenly spread over time. This seems to be indirectly confirmed by some empirical studies. In particular, Becker et al. (2013) find that the economic impact of cohesion policy on growth fades when the funding intensity is too high and concentrated. Dicharry (2023) shows that spending too fast in a short time span is associated with worse economic outcomes. Unfortunately, it is common for a disproportionately large share of spending to be concentrated in the final years of the programming period (Molica, 2021). In the last budgetary period (2014–2020), about half of the funds were spent only in the period N + 1 to N + 3 (2021–2023) and about a quarter in 2023. In the programming period 2021–2027, delays in the implementation are already seen as a very serious problem, which may challenge ‘national, regional and local authorities' capacity to plan effectively (…) [to] ensure European regions' economic recovery and resilience’ (European Parliament, 2022). At the same time, the speed of absorption should not always be viewed positively. Studies such as Dicharry (2023) and Cunico et al. (2022) show that accelerated spending can compromise the funds' impact. In other words, the capacity to absorb funds more rapidly is important, but it may become counterproductive under certain circumstances if pushed too far. Moreover, as highlighted by the Barca (2009) report, the issue of faster financial execution often attracts disproportionate attention from policy-makers overshadowing discussions on ‘the objectives of the policy’ and its ‘conceptual foundations’. It is also sometimes mistakenly equated with a measure of the quality of spending.

In addition to the economic impact, slower absorption can also damage the reputation of the policy and create an additional administrative burden related to the pressure to meet spending targets. Finally, the issue of speed of absorption cannot be overlooked at a time when the overall size of EU investment for the period 2021–2027 is the largest ever recorded. The EU's Multiannual Financial Framework (MFF) has a budget of around €2 trillion, with €800 billion coming from the NextGenerationEU (NGEU) programme and €372 billion from cohesion policy. Such an unprecedented EU budget has raised concerns amongst both policy-makers and academics about the capacity of EU Member States to spend faster (see, e.g., Alcidi et al., 2020; Crescenzi et al., 2021).

- What are the main determinants driving progress in spending over time within the context of EU cohesion policy?

- How do governance structures and thematic concentration of funds influence the pace of spending within EU cohesion policy?

Using data from the European Commission's Cohesion Open Data Platform, this article proposes a measure of the speed of absorption that accounts for both performance over time and the spending rate achieved in the last observed year. This indicator also captures differences in the governance models of Operational Programmes (OPs), distinguishing between those that are nationally or regionally managed (NUTS 1 or NUTS 2 levels); previous research has focused on country-level (e.g., Incaltarau et al., 2020; Tosun, 2014) or regional absorption (Kersan-Škabić and Tijanić, 2017) without making this distinction. Then, using a Tobit regression model, we investigate the main determinants of the speed of absorption during the 2014–2020 period, employing two distinct sets of explanatory variables: one set related to the programme's features and the other to the characteristics of the territories. Some of these variables have not been previously tested, at least not at regional the level.

The article is structured in five sections. After the introduction, Section I provides a review of the literature and a description of the hypotheses to be tested. Section II describes the data used and the methodological approach. Section III discusses the results, and Section IV concludes this article.

I Literature Review and Research Hypotheses

The theoretical underpinnings of this analysis are derived from various bodies of research, including public policy implementation theory, multi-level governance theory and studies on the performance of EU structural funds. Public policy implementation theory has extensively discussed the weaknesses and strengths of top-down (centralised) versus bottom-up (decentralised) approaches (Hill and Hupe, 2021; Sabatier, 1986). Multi-level governance theories, hailing from EU studies, have more specifically focused on the involvement of local and regional authorities in the decision-making of cohesion policy funds (Bache, 2008; Hooghe and Marks, 2001; Marks, 1993; Piattoni, 2009). The economic literature on the performance of structural funds has increasingly sought to identify the factors that explain the marked differences in their impact as well as their financial implementation (see, e.g., Bachtrögler et al., 2020; Crescenzi and Giua, 2020; Fratesi and Wishlade, 2017; Incaltarau et al., 2020; Tosun, 2014). Whilst there is a large body of work focusing on the former aspect (i.e., impact), the latter has been much less studied, despite the existence of relevant works in the field (e.g., Incaltarau et al., 2020; Tosun, 2014). This article aims to address three research gaps in this particular topic. The first one concerns the factors influencing the absorption of funds at the territorial (NUTS 2) level, as most studies concentrate on specific countries or use country-level data. The second pertains to the influence of programme and governance arrangements on the speed of absorption of funds, an aspect largely neglected by the vast majority of existing studies, which focus on socio-economic factors. The third gap relates to the speed of absorption itself, which, as mentioned earlier, has been overlooked in extant literature. Additionally, this article is also based on multi-level governance theories stemming from the field of EU studies (Bache, 2008; Hooghe and Marks, 2001; Marks, 1993; Piattoni, 2009).

The literature has stressed from different theoretical perspectives the benefits of sub-national authorities' participation in the management of the funds (Marks, 1993). Under an adequate political and institutional environment (Sow and Razafimahefa, 2015), a decentralised governance may increase efficiency of public spending (Charbit, 2011; O'dwyer and Ziblatt, 2006), as regional governments have a deeper understanding of local preferences and needs (Kahkonen and Lanyi, 2001). However, studies have also highlighted that a decentralised (or regional) governance may affect negatively the capacity to spend the funds as co-ordination with central government is complex (Scharpf, 1988) or sub-national authorities may not have the capacity to manage the funds (Piattoni, 2009), generating administrative burden and potential delays in the implementation. These two arguments lead us to define our first hypothesis.

H1.A decentralised (regional) governance model influences negatively the speed of absorption of EU funds.

The literature on policy implementation has also identified the size and nature of the expenditures as important elements explaining financial performance. For instance, the amount of EU funds allocated to a territory may affect negatively the speed of absorption of funds, as it could be more difficult for public bodies (especially with limited capacity) to manage and implement a larger budget (Darvas et al., 2019) or there could be lack of demand for certain types of funding in a specific region, especially if less developed (Santos and Conte, 2024). Similarly, changes in the EU budget of cohesion policy programmes leading to reprogramming or reallocation of resources could also affect their implementation. Budgetary fluctuations can have a negative impact on the speed of implementation as public authorities have to adapt to these changes by reassessing their priorities, which may generate delays in spending (Bachtler et al., 2020; Molica, 2021). In addition, the speed of the implementation of programmes may be affected by the size of the projects financed through cohesion policy. Large-scale projects often entail more complex planning, co-ordination and execution, which can lead to a slower absorption of funds (Milio, 2007). Finally, concentrating funding on a few thematic areas can speed up the territorial absorption of funds, as it may be easier to plan and implement programmes, whereas the management of programmes covering several thematic areas may be more complex and time-consuming from an administrative point of view (Bachtler et al., 2017). These arguments are reflected in our second hypothesis.

H2.The higher the budget of programmes, size of projects and thematic diversity, the lower the speed of absorption of funds.

In addition to programmes and spending characteristics, existing literature has also highlighted that macroeconomic characteristics of the territories are important drivers of the financial implementation of funds. Tosun (2014) finds that high-income Member States have a lower absorption capacity, whilst Achim and Borlea (2015) and Incaltarau et al. (2020) estimate a non-significant relationship between absorption and gross domestic product (GDP). A tentative explanation for these opposing results may be that, on the one hand, a more well-off country or region might necessitate less support from cohesion policy, resulting in slower absorption, whilst it has also the right conditions in place (better quality of institutions, more vibrant private sector, etc.) to absorb faster. Alongside GDP, there are two additional socio-economic factors – unemployment rate and human capital – that appear to be related to the capacity to absorb. The unemployment rate has been shown to have a negative effect at least in less developed regions (Kersan-Škabić and Tijanić, 2017). In the same vein, our article assumes that high levels of unemployment can be seen as a proxy for the lack of entrepreneurship or adverse economic conditions, discouraging investment (Basile et al., 2008) with negative effects on the demand for funds. Conversely, a skilled labour force (high human capital) is likely to participate more in funding calls as well as better plan and execute projects funded by the EU, thus improving resource efficiency (Becker et al., 2013; Hussain et al., 2020). One more dimension that has also been vastly tested in literature is the (positive) relationship between administrative quality and spending rate (Bachtler et al., 2014; Boeckhout et al., 2002; Horvat, 2005; Milio, 2007; Surubaru, 2017). This discussion brings us to our third hypothesis.

H3.More developed territories with better institutional quality, higher level of GDP, more qualified human resources, and lower unemployment rates absorb the funds faster.

Previous studies have indicated that economic cycles are an important factor explaining the absorption of funds. For instance, periods of economic crisis are expected to negatively affect the absorption of EU funds, since they tend to discourage investment due to economic uncertainty and reduce financial liquidity (Cace et al., 2009; Incaltarau et al., 2020; Tosun, 2014). Additionally, past investment growth may affect positively the spending of funds as regions with higher investment growth rates tend to have a more active and dynamic economy (Cuaresma et al., 2014). However, in a context where investment is cyclical (Bernanke, 1983), a negative relationship between past investment growth and the speed of absorption of EU funds can be assumed.

H4a.Periods of economic crisis slow down the absorption of funds.

H4b.As investments are cyclical, past investment dynamics may positively or negatively influence the absorption of funds.

II Data and Methods

Speed of Absorption Indicator

Methodological Approach

To measure the speed of absorption (SA) of EU funds, we use data from the Cohesion Open Data Platform on European Structural and Investment Funds (https://cohesiondata.ec.europa.eu/). We analyse in particular data on the funds planned and spent 1 for the programming period 2014–2020. 2 We exclude all resources classified under Thematic Objective 13 (fostering crisis repair and resilience) like REACT-EU, since they are related to new actions created from 2020 due to unexpected events. Inter-regional collaboration programmes (like Interreg), as well as Thematic Objective 12 (outermost and sparsely populated) and technical assistance programmes or axes, are also not included in the analysis due to their specific geographical scope. Programmes that are discontinued over time because they were merged with others are also left out from the analysis.

The earlier in time is closer to , the larger the indicator will be, since an closer to 1 will appear with a higher frequency in our estimated average. A territory could be a region (NUTS 1 or NUTS 2 level) or a country, depending on the governance model of the programmes (national or regional). However, because we are not only interested in the average performance ( ) but also in the overall level of expenditure in the last year (2022), we corrected the by the level of absorption in 2022. This step allows us to ensure that territories with a lower average performance but able to spend the full budget in 2022 are better ranked than territories with good average performance but unable to spend the full budget until 2022 (see Tables A1 and A2 in Appendix S1 for an illustrative example).

To identify the type of governance arrangements corresponding to each operational programme (OP), we use the description in the title of the OP. When the name of a region (NUTS 1 or NUTS 2 level) is included in the title, the OP is classified as a regional OP or as a national OP otherwise. Then, to attribute a NUTS code to each OP, we use the correspondence tables between region names and NUTS codes available in the Eurostat webpage (https://ec.europa.eu/eurostat/web/nuts/history). We use the NUTS Version 2021 classification for all the regional OPs, except for OPs in Ireland 3 where we use the NUTS Version 2013 due to the impossibility to attribute a single NUTS classification to these programmes when using the NUTS Version 2021. For this reason, multi-regional OPs 4 and territorial co-operation OPs (like Interreg) are also excluded from the analysis.

Speed of Absorption and Governance of the Funds

Cohesion policy is a key policy area where multi-level governance has been theorised and operationalised (Marks, 1993). This key feature of the policy entails the involvement of sub-national authorities in its decision-making process, which takes place in different ways. One approach involves sub-national authorities and other non-state actors being consulted by a central body under nationally (centrally) managed funding programmes. Alternatively, sub-national authorities may be entrusted with direct competences over the funds through regionally (decentralised) managed funding programmes. There is an intermediate form of governance arrangements where certain tasks of nationally (or even regionally) managed programmes are delegated to sub-national authorities (regions or municipalities) that act as so-called intermediate bodies. Moreover, in some instances, the national level plays a primary role in the management of regional programmes.

In our article, we use only the more straightforward distinction between regionally managed and nationally managed programmes as proxies for centralised versus decentralised governance of the funds. The speed of absorption indicator is estimated for 163 territories at both NUTS 1 and NUTS 2 levels, as well as country level, depending on the governance of the programmes (regional vs. national) (see list in Table B1 in Appendix S2).

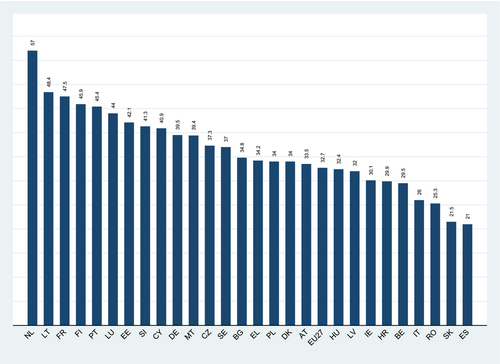

The EU27 average is 32.7 (Figure 1). Looking at the speed of absorption performance by country, the Netherlands has the highest value (57) and Spain the lowest (21). There is a considerable difference between the best and worst scored countries, confirming very heterogeneous absorption performances. At first sight, there does not appear to be a clear trend in relation to country characteristics. The same holds true when comparing the performance of regionally and nationally managed programmes in the 10 countries where both typologies are in place (Table 1).

| Country | National operational programme | Regional operational programme | ||

|---|---|---|---|---|

| Speed of absorption | % EU budget | Speed of absorption | % EU budget | |

| FR | 62.3 | 24% | 40.4 | 76% |

| NL | 61.4 | 61% | 52.6 | 39% |

| PT | 53.1 | 57% | 36.2 | 43% |

| DE | 51.1 | 15% | 37.6 | 85% |

| IE | 38.4 | 54% | 21.4 | 46% |

| PL | 34.4 | 65% | 33.4 | 35% |

| SE | 34.1 | 89% | 40.6 | 11% |

| EL | 33.3 | 78% | 36.7 | 22% |

| IT | 26.1 | 37% | 26 | 63% |

| ES | 19.6 | 58% | 22.8 | 42% |

| EU27 | 33 | 69% | 32.2 | 31% |

- Source: Own estimation based on Equation (1).

- Note: The values do not correspond to the average; they are estimated using the total values by country and governance model of the operational programmes (regional versus national).

The EU average performance for both types of governance arrangements is very similar, but there are important differences between countries. For instance, in France or Ireland, national programmes perform better than regional ones, whereas in Spain or Sweden, the opposite occurs. This might also be explained by differences in the characteristics of the programmes (e.g., size and thematic concentration).

Speed of Absorption and Thematic Areas

Additionally, to assess if there are differences in terms of performance depending on the thematic areas of the OPs, we use the 2014–2020 thematic objective classification to estimate the speed of absorption for five thematic areas, as described in Table 2.

| 2014-2020 thematic objectives | Study's thematic areas | ||

|---|---|---|---|

| Description | SA | Description | SA |

| TO01 – strengthening research, technological development and innovation | 29.3 | 1. Innovation | 29.3 |

| TO03 – enhancing the competitiveness of SMEs | 49.7 | 2. SMEs | 49.7 |

| TO04 – supporting the shift towards a low-carbon economy in all sectors | 24.5 | 3. Green transition | 24.8 |

| TO05 – promoting climate change adaptation, risk prevention and management | 27.3 | ||

| TO06 – preserving and protecting the environment and promoting resource efficiency | 24.6 | ||

| TO02 – enhancing access to, and use and quality of, ICT (part) | 24.9 | 4. Infrastructure and networks | 34.2 |

| TO07 – promoting sustainable transport and removing bottlenecks in key network infrastructures | 36.4 | ||

| TO08 – promoting sustainable and quality employment and supporting labour mobility | 36.7 | 5. Employment, inclusion and education | 34.3 |

| TO09 – promoting social inclusion, combating poverty and any discrimination | 30.5 | ||

| TO10 – investing in education, training and vocational training for skills and lifelong learning | 35.7 | ||

- Source: Own estimation based on Equation (1).

- Note: The values do not correspond to the average; they are estimated using the total values by areas.

The estimation of the speed of absorption by thematic area (Table 2) shows that the value attributed to investments targeting small and medium-sized enterprises (SMEs) is much higher (49.7) than other areas. A possible explanation is the significant use of cohesion policy funds to shore up a distressed business fabric throughout the Covid-19 pandemic, as well as the shocks generated by the Russian aggression against Ukraine. Overall, the nature of cohesion policy subsidies for SMEs (amounts capped by state aid rules; financing of intangible investments) might suggest faster spending compared to other areas. It is noteworthy that the thematic area related to the green transition has the lowest value (24.8), whilst when we look at the breakdown by thematic objective (reflecting the thematic menu for 2014–2020), resources for the digital transition show also a low value.

Explaining the Speed of Absorption: Econometric Model

- the programme's governance characteristics, classified into two categories: (i) decentralised management at the regional level and (ii) centralised at the national level (reference category);

- EU budget per capita: average EU budget per capita of territory (source: estimated using data from the Cohesion Open Data Platform and Eurostat data for the population in the territory – demo_r_d2jan). As the total EU budget for the 2014–2020 programming period may change during the execution, we used the average amount observed in the period under analysis;

- large projects: share of EU funds allocated to projects with an eligible expenditure higher than €50 million in territory over the programming period 2014–2020 (source: estimated using data from Kohesio);

- change in EU budget: average (2016–2022) percentage change of the EU budget in territory between year and (source: estimated using data from the Cohesion Open Data Platform); and

- average (2016–2022) thematic objective concentration index (TOCI): estimated using a similar methodological approach to the Herfindahl (1950) and Hirschman (1945) index, as expressed in Equation (6), where refers to the EU planned budget in thematic objective in territory over the total EU budget in territory (source: estimated using data from the Cohesion Open Data Platform).

- share of population with tertiary education: average (2013–2015) share of population with tertiary education (source: estimated using Eurostat data – lfst_r_lfsd2pop and demo_r_d2jan);

- unemployment rate: average (2013–2015) share of unemployed population over total population (source: estimated using Eurostat data – lfst_r_lfu3pers and demo_r_d2jan);

- investment growth: average (2013–2015) real growth rate of gross fixed capital formation (GFGF) between t and t − 1 (source: estimated using Eurostat data – nama_10r_2gfcf and nama_10_gdp);

- GDP negative effect of Covid-19: dummy variable = 1 if real change in GDP between 2019 and 2020 is negative, 0 otherwise (source: estimated using Eurostat – nama_10r_2gdp and nama_10_gdp);

- Territorial governance captured by the European Quality of Government Index 6 (EQI) in 2013 (Charron et al., 2015). The EQI is available at NUTS 2 level (and only at NUTS 1 level for Belgium and Germany). As our dataset is composed by regions at NUTS 2 or NUTS 1 level, as well as country, and taking into the geographical unit of the EQI, when need we transform the EQI until NUTS 1 level or country using the population weigthed average of the NUTS 2 within the NUT 1 level or country.

- As an alternative for decentralisation, we also use the Regional Authority Index 7 (Hooghe et al., 2016), referring to the average between 2013 and 2015.

- Geographical territory group dummies include northern, southern, eastern and western. Northern Europe comprises Denmark (DK), Estonia (EE), Finland (FI), Ireland (IE), Latvia (LV), Lithuania (LT) and Sweden (SE). Southern Europe includes Croatia (HR), Cyprus (CY), Greece (EL), Italy (IT), Malta (MT), Portugal (PT), Slovenia (SI) and Spain (ES). Western Europe consists of Austria (AT), Belgium (BE), France (FR), Germany (DE), Luxembourg (LU) and the Netherlands (NL). Eastern Europe encompasses Bulgaria (BG), Czech Republic (CZ), Hungary (HU), Poland (PL), Romania (RO) and Slovakia (SK).

Equation (8) is estimated for 162 observations (instead of the 163), because after visual inspection of box plots and scatter plots to identify any data points deviating significantly from the overall data distribution (Figure D1 in Appendix S4), we detected an outlier for the planned EU budget per capita variable. Although the direction and significance of the parameters remained consistent with or without the outlier (Table D1 in Appendix S4), excluding it resulted in an improvement in the model specification quality.

III Results and Discussion

The results of the two-limit Tobit regression model (Equation 8) are reported in Table 3, with the lower limit set at 11.2 (minimum observed value) and the upper limit set at 64.3 (maximum observed value). Both columns report the results of the model with programme and territory characteristics. The difference between columns (1) and (2) lies in the variables used as a proxy for territorial governance. In column (1), we include the dummy variable about the governance model of the programme management (decentralised vs. centralised) and the perceived overall territorial quality of government. In column (2), we replaced the previous dummy variable on the governance of the programmes by the degree of Regional Authority Index, which is a proxy for the degree of autonomy of regional governments within their countries. Due to multi-collinearity issues, the three above-mentioned variables are not included in the same model specification. Both model specifications show a good fit to the data and that they are not biased by the presence of omitted variables, based on the results of the Wald and Ramsey tests at the bottom of Table 3. The VIF and the correlation matrix (Table C2 in Appendix S3) also do not reveal the presence of multi-collinearity biasing the results. For comparison purposes, Table E1 in Appendix S5 shows the results of the pooled OLS estimation model.

| Variables | (1) | (2) |

|---|---|---|

| Decentralised governance (Y/N) | −7.526*** | - |

| (2.299) | - | |

| European Quality of Government Index (2013) | 1.798 | - |

| (1.264) | - | |

| Regional Authority Index (2013–2015) | - | −0.246*** |

| - | (0.0685) | |

| EU budget per capita (€1000) | −0.878 | −0.0318 |

| (2.271) | (1.632) | |

| Share big projects (>50M) – % | −0.226*** | −0.166*** |

| (0.0341) | (0.0393) | |

| Change in EU budget – % | −1.923*** | −1.201** |

| (0.486) | (0.528) | |

| Concentration index (budget by TO) | 0.277*** | 0.304*** |

| (0.0908) | (0.0866) | |

| Share pop. with tertiary education (2013–2015) – % | 0.209 | 0.471*** |

| (0.217) | (0.178) | |

| Unemployment rate (2013–2015) – % | −0.425*** | −0.686*** |

| (0.159) | (0.240) | |

| Investment growth (2013–2015) – % | −0.262** | −0.277** |

| (0.129) | (0.135) | |

| GDP negative effect of Covid-19 (Y/N) | 4.993** | 6.673*** |

| (1.933) | (1.576) | |

| Geographical group | Yes | Yes |

| Constant | 34.73*** | 30.02*** |

| (5.422) | (3.358) | |

| Observations | 162 | 162 |

| Variance of the error term | 94.35*** | 95.82*** |

| (20.55) | (21.99) | |

| Log pseudolikelihood | −595.93 | −597.09 |

| Joint significance test (p-value) | 0.0000 | 0.0000 |

| Pseudo R2 | 0.0544 | 0.0526 |

| Ramsey test (p-value) | 0.453 | 0.3227 |

| Mean VIF | 1.89 | 1.83 |

| Max VIF | 3.25 | 2.48 |

- Source: Own elaboration.

- Notes: Country-cluster robust standard errors in parentheses. Significance level:

- *** p < 0.01.

- ** p < 0.05.

- * p < 0.1.

The results in columns (1) and (2) of Table 3 show that per capita budget is not a statistically significant programme characteristic explaining the speed of absorption, 8 as we initially expected, but the change in the programme budget is negatively correlated with the dependent variable. Our findings indicate that it is not the budget per se that causes delays in the financial implementation of programmes but the changes that occur overtime in the volume of the budget. Indeed, changes in the budget may lead to the need to re-plan priorities to allocate such additional budget, which may not be an easy task and may cause delays in the absorption of funds. Larger projects are also negatively correlated with the speed of absorption. This could be explained with the fact that they are more resource intensive, in both financial and human resource terms, and more complex to implement. They may therefore require additional time for proper design and implementation, leading to delays in the overall absorption process. The thematic concentration of the fund is positively correlated with the speed of absorption, suggesting that the less dispersed the use of the funds in different areas, the faster is the financial implementation. This finding could also be linked to the fact that the funds are easier to manage when priorities are more concentrated. All this leads to a partial confirmation of our Hypothesis 2.

With regard to the regional characteristics of the territories, all the variables are statistically significant, with the exception of the education level of the population. Territories with higher unemployment at the beginning of the programming period seem to have lower values of the speed of absorption, which is partly consistent with the findings of Kersan-Škabić and Tijanić (2017) for convergence regions and in line with our Hypothesis 3. In the present study, the negative coefficient of the unemployment rate could be due to the fact that higher values of the SA are essentially driven by measures to support SMEs, as observed in Table 2. As higher unemployment could be a proxy for the lack of entrepreneurship, this could justify that regions with higher unemployment rates are less willing to develop investment projects and consequently to use EU funds.

The level of investment growth at the beginning of the programming period is negatively correlated with the SA. Given that cohesion policy funds are more concentrated in less developed regions, high initial investment levels in such regions could lead to a more saturated market, reducing the immediate need for additional investment and subsequent absorption of funds, validating our Hypothesis 4b. Such findings could be also related to the previous one and be associated with the lack of strong entrepreneurship in less developed regions.

Being negatively affected by Covid-19 between 2019 and 2020 seems to be positively associated with higher SA values, results that do not allow us to validate our Hypothesis 4a. Our finding is probably due to the use of cohesion policy funds to mitigate the effect of the health crisis. Indeed, even if previous studies (see, e.g., Incaltarau et al., 2020) have shown that periods of economic crisis are associated with negative effects on the absorption of funds (Hypothesis 4a), the different origin and nature of the policy responses to the Covid-19 pandemic may justify our findings.

Looking at the results of column (1), we observe that a decentralised (or regional) governance model has a negative effect on the speed of absorption in comparison with territories under a national (centralised) model. This finding is aligned with the results in column (2), where the coefficient of the Regional Authority Index also reports a negative sign. These results validate our Hypothesis 1 and might be explained by two reasons: first, national authorities are likely to have a higher administrative and operational capacity (e.g., larger staff) than regional ones; second, national programmes are covering larger geographical areas than regional ones, which may entail a higher demand for funds. As we have a particular interest in understanding whether the effect of territories' (or programmes') characteristics on the speed of absorption depends on the governance model, we re-estimate Equation (8) including non-factorial interaction terms. Results displayed on Table F2 in Appendix S6 show that the budget per capita and share of big projects are only negatively affecting the speed of absorption under a decentralised governance model, which may be strongly related to the structural problems of the territories, as unemployment rate and investment growth. Indeed, these factors are also both negatively correlated to the speed of absorption in territories with a decentralised governance model. Conversely, the unemployment rate is positively correlated with the speed of absorption in territories centrally managed. Such differences in terms of unemployment relationship with our dependent variable are aligned with the findings of Kersan-Škabić and Tijanić (2017), if we consider that territories under a decentralised governance model possess a distinct socio-economic profile characterised by factors indicative of regions in a different stage of development (lower GDP, higher unemployment and less educated population – Table F1 in Appendix S6) compared to their counterpart under analysis. Furthermore, territories with a decentralised governance also attracted less competitive EU funds 9 than the territories with a centralised governance (Table F1 in Appendix S6), which may also reflect the investment dynamics in these territories due to challenges in their innovation ecosystem, capacity building and infrastructures.

On the other side, changes in the EU budget planned and the thematic concentration of funds are both affecting the speed of absorption in a similar way in both governance models (columns 4 and 5 in Table F2 in Appendix S6), without statistical differences between the two coefficients.

Conclusion: Policy Implications and Avenues for Future Research

The results of our analysis suggest several relevant policy conclusions. First, since the governance model of EU programmes and their characteristics are significant factors in explaining a territory's capacity to absorb funds, the design of future regulations should consider more this aspect. The article reinforces the case for strengthening thematic concentration obligations to improve the spending performance of programmes. Second, although a streamlined governance model could positively affect absorption, this must not compromise the critical role and knowledge of local and regional authorities.

Moreover, our research has also demonstrated that various territorial variables account for differing absorption performances. The fact that territories do not have uniform capacities for rapid absorption indicates a need for flexibility in the application of spending requirements. Echoing Dicharry (2023), it could be proposed that territories with weaker socio-economic performance be granted more time to absorb funds. Notable differences in the speed of absorption by thematic areas also suggest the potential benefits of increased flexibility.

The absorption index for investments targeting SMEs is much higher than for other areas, likely due to the cohesion policy funds supporting enterprises during the Covid-19 pandemic. In contrast, the thematic area related to the green transition has the lowest value. This finding is particularly pertinent in the current context, given that estimated climate expenditure accounts for approximately 40% of the overall costs in the recovery and resilience plans financed by the NGEU.

Regarding the future design of programmes, the observed disparities in the absorption capacity of cohesion policy funds for 2014–2020 underscore the importance of tailoring strategies to the unique characteristics of each EU territory. Understanding the factors behind this heterogeneity is essential for devising targeted interventions to address slow absorption. Recognising that a one-size-fits-all strategy may not effectively maximise budget impact is crucial. Learning from the analysis of the 2014–2020 cohesion policy funds can guide the EU towards a more efficient and impactful use of its unprecedented financial resources. In conclusion, further research is needed to deepen our understanding of the drivers of cohesion policy funds' spending. Future studies could examine the influence of different governance arrangements on spending performance with a more nuanced categorisation that transcends the simple binary distinction between regional and national programmes. Additionally, the extent to which characteristics of the managing authority (e.g., size of staff) affect spending capacity warrants investigation. Lastly, identifying what influences spending capacity across various thematic areas remains an area ripe for exploration.

Acknowledgements

The authors are grateful to the participants in the XLVII International Conference on Regional Science; Joachim Maes, Benoit Nadler and John Walsh from the European Commission; and the three anonymous reviewers for their valuable comments in an early version of the article.

Disclaimer

The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of the European Commission.

References

- 1 European Regional Development Fund (ERDF), European Social Fund (ESF), Cohesion Fund (CF) and Youth Employment Initiative (YEI).

- 2 We use the dataset ‘ESIF 2014–2020 categorisation ERDF-ESF-CF planned vs implemented’ available here: https://cohesiondata.ec.europa.eu/2014-2020-Categorisation/ESIF-2014-2020-categorisation-ERDF-ESF-CF-planned-/3kkx-ekfq (extracted on 30 July 2023).

- 3 Border Midland and Western Regional – ERDF (2014IE16RFOP001): IE01 NUTS Version 2013 corresponding to IE04 and IE06 in the NUTS Version 2021; Southern and Eastern Regional Programme – IE – ERDF (2014IE16RFOP002): IE02 NUTS Version 2013 corresponding to IE05 and IE06 in the NUTS Version 2021.

- 4 Wallonie-Bruxelles 2020.eu – ESF/YEI (2014BE05M9OP001), Interregional Alpes – ERDF (2014FR16RFOP001), Interregional Loire – ERDF (2014FR16RFOP002), Interregional Massif Central – ERDF (2014FR16RFOP003), Interregional Pyrénées – ERDF (2014FR16RFOP004), Interregional Rhône Saône – ERDF (2014FR16RFOP005), Continental Greece – ERDF/ESF (2014GR16M2OP007) and Development of Eastern Poland – ERDF (2014PL16RFOP003).

- 5 File including ESIF 2014-2020 categorisation ERDF-ESF-CF planned vs implemented (updated on 6 March 2023).

- 6 This index expresses both perceptions and experiences with public sector corruption, along with the extent to which citizens believe various public sector services are impartially allocated and of good quality in the EU.

- 7 It is a country index that measures the authority in self-rule and shared rule exercised by regional governments within their countries.

- 8 As a robustness test, Table E1 in Appendix S5 reports the results of mono-variable regression estimation – columns (1) to (5). The result in column (2) confirms that there is no statistical relationship between the budget and the SA.

- 9 Namely, the EU's Seventh Framework Programme for Research and Technological Development (FP7), which runs from 2007 to 2013.