Farmers' willingness to invest in mechanized maize shelling and potential financial benefits: Evidence from Tanzania

Abstract

Sub-Saharan Africa has the least mechanized agriculture in the world due to various reasons including low effective demand at farm level, low policy attention, and ineffective mechanization strategies. However, the situation has changed since recently in favor of mechanization while limited empirical evidence is available on how mechanization can be enhanced among smallholder farmers. In this study, we explore farmers' willingness to invest in mechanization services by considering the group business model (GBM) and the individual business model (IBM) of mechanized maize shelling in Tanzania. Moreover, we analyze the potential financial benefit for those farmers who would like to invest in mechanized maize shelling. We use data mainly collected through a household survey and apply econometric and mathematical models for analysis. The results show that about 65% of the sample farmers are willing to invest in mechanized maize shelling within the GBM, while about 10% of them would like to do so within the IBM. Moreover, the results show that investment in mechanized maize shelling is profitable considering both small-scale (4 and 7 HP engine capacity) machines and medium-scale (16 and 20 HP engine capacity) machines. The results show that expanding agricultural mechanization in Tanzania through investments coming from smallholder farmers, as also experienced elsewhere, is possible while they suggest that policy instruments such as targeted loan programs, entrepreneurial and technical trainings, and smart subsidies or tax exemptions are important to encourage and enable smallholder farmers to participate in the mechanization supply chain. [EconLit Citations: Q120, Q130, D250].

Abbreviations

-

- DBDC

-

- double-bound dichotomous choice

-

- GBM

-

- group business model

-

- HP

-

- horsepower

-

- IBM

-

- individual business model

-

- MT

-

- metric ton

-

- SBDC

-

- single-bound dichotomous choice

-

- SSA

-

- sub-Saharan Africa

-

- TLU

-

- tropical livestock units

-

- WTI

-

- willingness to invest

1 INTRODUCTION

Sub-Saharan Africa (SSA) has the least mechanized agriculture in the world. Until recently, engine-powered mechanization was limited to a few countries in this region, and where such mechanization exists, it is most likely to be found in large-scale commercial farms (Mrema et al., 2008). By contrast, smallholder farms, which dominate agricultural production in the region, are not mechanized (Mrema et al., 2008; B. G. Sims & Kienzle, 2006). The main reason for the low level of agricultural mechanization in SSA is that there has been hardly any demand in these countries until recently while critics of mechanization have argued that the widespread use of farm machinery could have serious equity consequences in terms of labor displacement (Pingali, 2007). The lack of demand for mechanization has been explained from two main angles. The first explanation has been given based on the Boserupian theory, which posits that population pressure induces the transformation of agriculture from a primitive farming, where farming is done using rudimentary tools, to an intensified one, where more advanced technologies are used to increase productivity (Aryal et al., 2021; Boserup, 1965; Cossar, 2016; Headey et al., 2014; Jayne et al., 2014; Pingali et al., 1987). Using the R value as an indicator of intensification, Ruthenberg (1971) showed that most SSA farming systems had been in a premechanization stage before the 1970s.1 Pingali et al. (1987) argued that farms became more mechanized as their level of intensification increased. More recently, Diao et al. (2014) showed that the demand for mechanization in Ghana had been very low before the mid-1990s, when the R value was below 33%.

The second argument regarding the lack of demand for mechanization in SSA is based on the theory of induced innovation, which states that the demand for agricultural innovation emerges in response to changes in relative factor prices, with attempts to replace expensive (scarce) factors with cheap (abundant) ones (Aryal et al., 2021; Hayami & Ruttan, 1985). The argument is that since labor was abundant and cheap in many rural areas of SSA in the past, demand for labor-saving technologies (i.e., machinery) was not induced (Diao et al., 2014). This could also be related to the low growth of the nonfarm sector; that is, the growth in the nonfarm sector did not increase the demand for farm mechanization through its effect on the farm wage rate, as the shift of rural labor away from agriculture did not go beyond the Lewis turning point. In line with this theory, Diao et al. (2014) showed that the rapid expansion of the service sector in Ghana in recent decades has increased rural wages, increasing the demand for machinery.

Despite the demand side problem, several SSA governments tried to promote agricultural mechanization, particularly during the initial years after independence (Mrema et al., 2008). For instance, there was substantial public sector promotion of agricultural mechanization in Tanzania from the early 1960s to the mid-1980s (Mrema & Kahan, 2020). This was done through imports, domestic supply of various types of machinery, particularly tractors, and through the provision of hiring services. In Uganda and Swaziland, medium-sized tractors were promoted in the 1970s using donor funds (Mrema & Kahan, 2020). However, these initial efforts to expand farm mechanization failed due to the lack of demand for mechanization services and the poor governance of the mechanization schemes (Daum & Birner, 2017; Diao et al., 2014; Pingali et al., 1987; Pingali, 20072). Such bad experiences led to the marginalization of mechanization in development and research agendas in the 1980s and the 1990s. For instance, none of the government policy documents in Tanzania issued between the mid-1980s and the early 2000s considered mechanization an important target of action (Malabo Montpellier Panel, 2018; Mrema & Kahan, 2020).

Nevertheless, evidence shows that the demand for agricultural mechanization in SSA has been increasing since recently and the policy context has changed in favor of mechanization (Ayele, 2022; Diao et al., 2014; Hodjo et al., 2021; Mrema et al., 2008). For instance, a study carried out in eastern and southern Africa demystifies a much higher demand for mechanization than what was suggested by macroeconomic analyses, pointing to a problem of access rather than demand (Baudron et al., 2019). Similarly, a study in West Africa shows the availability of high latent demand for mechanization among smallholder farmers (Hodjo et al., 2021). The rising demand has led to a new interest in mechanization in many African countries. Kenya, Nigeria, Tanzania, Mali, Uganda, and Zimbabwe, for example, have crafted new policies and allocated resources to promote mechanization (Daum & Birner, 2020; Diao et al., 2016; Mrema & Kahan, 2020; Mrema et al., 2008). While mechanization has been embedded in a broader policy in some countries, specific strategies have been designed to enhance mechanization. For instance, Tanzania's Agricultural Mechanization Strategy forms part of the broader policy document known as the Agricultural Sector Development Program (ASDP1) having some details to guide stakeholders' interventions in mechanization (Mrema & Kahan, 2020). Some countries, such as Nigeria, Ghana, Mozambique, and Ethiopia, have tried to promote mechanization through private service providers with strong technical and financial supports given by government offices (Ayele, 2022; Daum & Birner, 2020). Unlike past policies which focused on large-scale commercial farms, recent interventions have paid more attention to smallholder farmers.

Appropriate supply models can meet the rising demand for mechanization services. One possibility is adopting a supply model in which nonfarmer specialized professional entrepreneurs provide mechanization services to farmers. Successful examples of such a supply model are available. For instance, in China, migratory professional enterprises provide mechanization services to farmers in different parts of the country (Diao et al., 2014; Gao et al., 2012; Yang et al., 2013). Similarly, in Ghana, specialized enterprises, known as Agricultural Machinery Service Enterprise Centers, provide machinery hiring services to farmers who do not own machines (Diao et al., 2014). In another possible supply model, farmers who own machinery provide services for nonowner farmers. This mechanization service supply model, hereafter referred to as the farmer-to-farmer (FtF) model, is common in Asia while it is emerging in some African countries. In India, medium-scale farmers provide most of the machinery hiring services, while in Bangladesh, such services are mostly provided by small-scale farmers (Biggs et al., 2011; Diao et al., 2014). In Ghana, the role of medium-scale farmers in mechanization services is increasing (Diao et al., 2018).

One of the advantages of the FtF model over the professional enterprise model is that the former can create a double incentive for the investing farmers, arising from their direct access to farm machinery and the income they earn from hiring services, which enhances the spread of mechanization and makes it sustainable (B. Sims et al., 2011). Studies show that Bangladesh has one of the most mechanized agriculture in Asia (even better than India, which is the biggest tractor producer in the world), particularly in using two-wheel tractors, thanks to the millions of small-scale farmers who provide mechanization services to their fellow farmers (Biggs et al., 2011; Diao et al., 2014). Successful FtF mechanization service provisions have also been observed in Europe. For instance, “Machinery Rings” in Germany, or the cooperative model (Coopératives d'Utilisation de Matériel Agricole—CUMAs) in France, are notable FtF models which enhanced the access of farmers to farm machinery in those countries (B. Sims & Kienzle, 2017).

Agricultural mechanization of smallholder farms in SSA has received notable attention among researchers since recently (Adu-Baffour et al., 2019; Baudron et al., 2019; Daum & Birner, 2020; Diao et al., 2014; Houssou et al., 2013). However, most studies on mechanization have focused on tillage operations while giving marginal attention to postharvest activities. This could be because of the traditional thinking that mechanization development would follow a specific sequence of farm operations and that tillage operations would be mechanized before other operations (Biggs et al., 2011; Pingali, 2007). However, such a linear pattern of mechanization is not universal, and patterns depend on local contexts. Since postharvest operations, specifically, threshing/shelling, are power-intensive activities, and labor is becoming scarce among rural households in SSA, complementary power sources are required to reduce human drudgery, save labor, and reduce the cost of production (Baudron et al., 2019; Fischer et al., 2021; Pingali, 2007). Studies show that mechanized shelling sharply reduces drudgery for smallholder farmers; hence, farmers' interest in using machines is high (Fischer et al., 2021; Hodjo et al., 2021). For instance, Hodjo et al. (2021) found that about 58% of their sample farmers in Burkina Faso used threshing machines, including maize shellers.

Nevertheless, limited peer-reviewed studies have been conducted to provide a broad picture of the status of mechanized maize shelling among smallholder farmers in SSA. Moreover, most studies put farmers on the demand side of the equation of the mechanization market only, ignoring the fact that they can also play a crucial role on the supply side (Diao et al., 2014; Paudel et al., 2019; B. Sims & Kienzle, 2017; Takeshima et al., 2020). This study aims to fill this research gap. Specifically, it explores the possibility that farmers engage in the supply side of mechanized maize shelling and analyzes the potential financial gains for farmers who would like to participate in such an endeavor. To achieve our objective, we follow two steps in our analysis. First, we explore farmers' willingness to invest (WTI) in mechanized maize shelling using a household survey dataset based on the double-bound dichotomous choice (DBDC) method. We consider two business models in our analysis: the group business model (GBM), where groups of farmers own and use maize shelling machines collectively, and the individual business model (IBM), where farmers own and use the machines individually. In both cases, machine owners are expected to provide services to other farmers for payment. Second, we consider different types of maize shellers available in the market and analyze the potential financial benefit that farmers who invest in mechanized maize shelling may enjoy.

The rest of this paper is organized as follows. Section 2 describes the methodology and the data used for our analysis. Section 3 presents the WTI results, while Section 4 provides the results of profitability analysis. Section 5 discusses the results and makes policy recommendations.

2 METHODOLOGY

2.1 Sampling strategy and data collection

The study mainly depends on survey data. The survey was conducted in five purposively selected villages in central Tanzania.3 It covered 400 randomly selected farm households based on the village membership list. About 50% of the respondents were female (household heads or spouses). This is to factor in gender differences in our analysis. The decision whether to interview the male or the female household member was made based on a prior random assignment. The interviews were conducted using a structured questionnaire prepared for this purpose with Surveybe, a computer-assisted personal interviewing software. A 4-HP diesel-powered shelling machine was used as an example machine to elicit farmers' WTI as it was promoted in the area (see Supporting Information Table A6 for more information about the machine). The market price of the machine was about 1.4 million Tanzanian shillings (US$630) during the survey time (i.e., May–June 2017). The sample farmers watched a 5-min video showing the machine in operation and received a brief complementary oral explanation from the enumerators. All of the sample farmers were to be made aware of the maize shelling machine through this process. Enumerators and supervisors were trained for 5 days on mechanized maize shelling, survey techniques, contents of the survey questionnaire, and how to deploy the survey questionnaire on electronic devices.

2.2 Analytical framework

2.2.1 Elicitation of WTI and estimation strategy

We used the DBDC method to elicit the WTI. The DBDC entails asking farmers a sequence of two dichotomous response questions proposing different offers or bids. The bids considered in the first question were fixed based on the data we had collected earlier from key informants and companies selling maize shelling machines. The bids were randomly assigned to the sample farmers using the Surveybe software. The bids in the follow-up question were adjusted upward or downward depending on farmers' responses to the first question (see Supporting Information Figure A1 for the overall elicitation procedure, Text A for the DBDC questions and Supporting Information Tables A1 and A2 for bid amounts). This procedure resulted in four response options, that is, (1) “Yes” to the first question and “No” to the follow-up question (Yes–No), (2) “No” to the first question and “Yes” to the follow-up question (No–Yes), (3) “Yes” to the first question and “Yes” to the follow-up question (Yes–Yes), and (4) “No” to the first question and “No” to the follow-up question (No–No). The DBDC has an advantage over the single-bound dichotomous choice (SBDC) approach because the additional information derived from the follow-up question in the DBDC helps improve the efficiency of parameter estimates (Hanemann et al., 1991).

-

, for “Yes–No” responses.

-

, for “No–Yes” responses.

-

, for “Yes–Yes” responses.

-

, for “No–No” responses.

To test whether a shift effect is an issue in our case, we estimated a Seemingly Unrelated Bivariate Probit (SUBP) model by using the binary (yes/no) responses of the farmers to the initial and the follow-up bids as dependent variables. Upon finding insignificant correlations between the twin-equation error terms (ρ = 0) in SUBP models, which indicates the absence of a notable shift effect, we ran the interval regression model (Krishna et al., 2013) (see Supporting Information Tables A3 and A4 for the SUBP model results).

2.2.2 Profitability analysis

We used Equation (12) to conduct the profitability analysis. We fixed the values of the components of Equation (12) based on the data collected from key informant interviews, dealers in maize shelling machinery, and published documents. We used the straight-line method to estimate the depreciation rate while assuming a salvage value of 10% of the purchase price. We considered 1000 TZS/bag (or about US$0.45/bag) shelling service charge which was the prevailing charge in the area during the survey time. We assumed that this service charge accounted for the costs of transporting the machines. We considered 3.3% bank interest rate on saving deposits which was prevailing at the time of the study as an opportunity cost for farmers' capital, and we used the bank lending interest rate of 16.2% for borrowed capital (Bank of Tanzania, 2017). We considered four types of shelling machines in the profitability analysis. These machines have different engine capacities ranging from 4 to 20 HP and different service lives ranging from 5 to 15 years (see Supporting Information Table A6 for details).

3 RESULTS OF WTI ANALYSIS

3.1 Farmers' characteristics and mechanization activities

Table 1 presents descriptive statistics for primary factors considered in the WTI study. We had an equal number of responses from male and female household members. The typical household had six members, out of which about 50% are in the working-age category (i.e., 15–64 years) comprising the household labor supply for agricultural and nonagricultural activities. There was no substantial difference between male and female members of working age. A typical household head was about 46 years old and attended primary school. The mean cultivated land was about 2.5 ha, out of which about 92% was allocated to maize production. The mean maize production was about 2.2 MT per household. The mean livestock owned was about five Tropical Livestock Units valued at about $766.4 The standard deviations were large relative to the means in the case of the size of cultivated land and livestock owned. This demonstrates that the sample farmers' wealth varied significantly, which may have an impact on their decisions.

| Variable | Mean | Std. dev. | Minimum | Maximum |

|---|---|---|---|---|

| Household size (number of household members) | 5.90 | 2.40 | 1.00 | 10.00 |

| Age of respondents (years) | 46.00 | 14.80 | 17.00 | 94.00 |

| Number of working-age female members | 1.50 | 1.00 | 0.00 | 7.00 |

| Number of working-age male members | 1.60 | 1.10 | 0.00 | 6.00 |

| Livestock ownership (TLU) | 4.70 | 6.90 | 0.00 | 57.00 |

| Labor–land ratio (total household labor divided by total land cultivated by the household) | 1.30 | 1.40 | 0.02 | 10.00 |

| Education of household head (years) | 5.70 | 3.40 | 0.00 | 17.00 |

| Land allocated to all crops (ha) | 2.10 | 2.50 | 0.10 | 19.00 |

| Land allocated to maize (ha) | 1.90 | 2.10 | 0.10 | 14.00 |

| If respondent was male (yes = 1; no = 0) | 0.50 | 0.00 | 1.00 | |

| If household mechanized maize shelling (yes = 1; no = 0) | 0.70 | 0.00 | 1.00 | |

| If household mechanized tillage (yes = 1; no = 0) | 0.50 | 0.00 | 1.00 | |

| If household incurred higher labor cost than mean value (yes = 1; no = 0) | 0.30 | 0.00 | 1.00 | |

| If household has ever used maize shelling machines (yes = 1; no = 0) | 0.70 | 0.00 | 1.00 | |

| If respondent was a resident of Babati district (yes = 1; no = 0) | 0.60 | 0.00 | 1.00 | |

| If respondent was a resident of Kongwa district (yes = 1; no = 0) | 0.20 | 0.00 | 1.00 | |

| If respondent was a resident of Kiteto district (yes = 1; no = 0) | 0.20 | 0.00 | 1.00 |

- Abbreviation: TLU, tropical livestock unit.

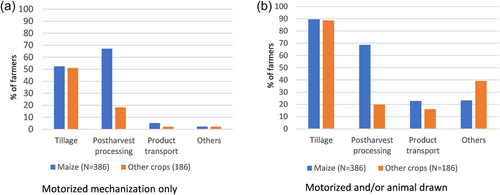

Figure 1a,b compares maize and other crops in terms of the percentage of farmers who used motorized machines (Figure 1a) and those who used either motorized machines and/or animal-drawn tools (Figure 1b). They show that maize was not different from other crops in terms of tillage mechanization. However, maize was more mechanized than other crops regarding postharvest processing and product transportation. The attention given to maize among the farmers could be because of its dominance in the households' cropping mix and the associated demand for labor, as well as better access to maize-specific machines, such as maize shellers.

Maize shelling is a tiresome activity that farmers would like to mechanize. Most of the sample farmers (about 71%) had an experience of using maize shelling machines at least once. A few farmers began using maize shellers in the 1980s and the 1990s, while most of them (about 71%) did so in the second half of the 2010s. This could be because of the promotion made by the Africa RISING5-NAFAKA project of small-scale maize shelling machines in the study areas.6 About 70% of the farmers used maize shelling machines during this period. On average, 34.1% of the sample farmers also used manual methods (i.e., using hand and stick) to shell maize. While most farmers used household labor to shell their maize, some (46%) also used hired labor. The mean payment rate for hired labor was about $0.45 per 100-kg bag. This amount was equal to the payment rate for rental machine services.

3.2 Responses to the WTI questions

The bid-response results align with our prior expectations, as informed by economic theory; the proportion of positive answers generally goes down as the bid amount goes up (Supporting Information Tables A1 and A2). About 78% of the farmers accepted at least one of the two bids in the GBM (Table 2). The percentage of men who responded positively to both questions was slightly higher than that of women. At the same time, there was no statistically significant difference between the two groups regarding the remaining response categories. This implies that gender had a marginal effect on WTI in the machines regarding the GBM. The mean group size suggested by respondents was 10. Women suggested larger group sizes than men. The difference was statistically significant at the 1% alpha level. The higher figure presented by women could be associated with their lower financial position forcing them to invite a larger number of people to share the investment and operational costs of the machines.

| Business model | Response | Male | Female | Pooled sample | t/χ2 value |

|---|---|---|---|---|---|

| GBM | Exogenous price for the first WTP bid (TZS) | 131,667 (48,035) | 128,040 (48,738) | 130,000 (48,227) | 0.747 |

| Endogenous price for the second WTP bid (TZS) | 158,485 (77,935) | 151,306 (78,201) | 155,175 (78,139) | 0.916 | |

| Proposed group size | 9 (5.8) | 11 (5.7) | 10 (5.8) | 3.714*** | |

| First “Yes” and second “Yes” (YY) (%) | 35.0 | 26.7 | 30.9 | 3.209* | |

| First “Yes” and second “No” (YN) (%) | 27.9 | 33.8 | 30.9 | 1.613 | |

| First “No” and second “Yes” (NY) (%) | 15.2 | 16.9 | 16.2 | 0.209 | |

| First “No” and second “No” (NN) (%) | 21.8 | 22.6 | 22.0 | 0.031 | |

| IBM | Exogenous price for the first WTP bid (TZS) | 1,316,367 (480,350) | 1,280,402 (487,384) | 1,300,000 (482,267) | 0.747 |

| Endogenous price for the second WTP bid (TZS) | 1,295,960 (758,896) | 1,031,658 (581,232) | 1,165,500 (688,655) | 3.894*** | |

| First “Yes” and second “Yes” (YY) (%) | 14.7 | 4.1 | 9.4 | 12.926*** | |

| First “Yes” and second “No” (YN) (%) | 23.9 | 16.4 | 20.3 | 3.378* | |

| First “No” and second “Yes” (NY) (%) | 19.3 | 23.1 | 21.2 | 0.842 | |

| First “No” and second “No” (NN) (%) | 42.1 | 56.4 | 49.1 | 7.993*** |

- Notes: Bid offers are measured in Tanzania Shillings (TZS) (1 US$ = TZS2220 on average during the survey time). Figures in parentheses are standard deviations. *, **, and *** show statistical significance at 10%, 5%, and 1% alpha levels, respectively.

- Abbreviations: GBM, group business model; IBM, individual business model; WTP, willingness to pay.

About 50% of the sample farmers accepted at least one of the bids offered to them regarding the IBM. This figure is substantially lower than the one associated with the GBM. The lower acceptance rate associated with the IBM could be because of its higher capital requirement compared to the GBM, reducing the possibility of resource-poor farmers joining the business. Female respondents were less willing to invest than men within the IBM. This could be because of women's lower access to resources necessary for investment. A close look at the data shows that the average annual income of female-headed households was less (by about 43%) than that of male-headed households. Even female respondents in male-headed households reported lower income than male respondents from male-headed households.

3.3 Determinants of farmers' WTI

Table 3 shows interval regression results for the GBM and the IBM. The likelihood ratio tests show that the explanatory variables taken together are different from zero in both regressions. The skewness and kurtosis normality tests show that the distributions of residuals in both GBM and IBM regressions do not significantly deviate from normality (see Supporting Information Table A5). While we tested for possible shifting effects in our data and results did not justify the existence of such a starting point bias, our result could be affected by another form of starting point bias (i.e., anchoring effect) which we did not test and control for. In this regard, we examined the potential effect of anchoring on the estimated WTI based on Equation (4). The results show that WTI could be underestimated in the case of GBM while it could be overestimated in the case of IBM (see Supporting Information Figure A2). Therefore, our results should be interpreted within this caveat.

| Variable | GBM | IBM | ||

|---|---|---|---|---|

| Coefficient | Robust SE | Coefficient | Robust SE | |

| Male | 17,079 | 13,200 | 467,636*** | 117,304 |

| Age | −897* | 540 | −6678 | 4357 |

| Education | 6752*** | 2495 | 67,660*** | 22,713 |

| Number of adult males | −2149 | 6615 | 41,324 | 53,135 |

| Number of adult females | 4351 | 6615 | 15,756 | 48,755 |

| Labor–land ratio | −2192 | 2471 | −48,501*** | 17,872 |

| TLU | 2413* | 1320 | 16,288** | 8264 |

| Used maize shelling machines in the past | 32,993** | 16,092 | 329,939** | 149,784 |

| Mechanized tillage | 3672 | 15,047 | −35,776 | 126,190 |

| Incurred higher labor cost | 58,913*** | 15,907 | 66,689 | 119,792 |

| Babati district | 5499 | 20,665 | 340,830* | 187,503 |

| Kiteto district | −24,844 | 20,899 | −47,110 | 215,461 |

| Constant | 102,108*** | 38,690 | −19.4*** | 312,773 |

| /lnsigma | 11.58*** | 0.06 | 13.7*** | 0.07 |

| Sigma | 107,201 | 6889 | 863,727 | 58,530 |

| Number of observations | 345 | 345 | ||

| Wald χ2 | 61.41*** | 71.80*** | ||

| Mean WTI (TZS) | 153,108*** | 6568 | 740,097*** | 58,081 |

| Market price (MP) (TZS1000) | 140 | 1400 | ||

| t Value for WTI = MP | 6.3*** | 21.1*** | ||

- Notes: WTI values are measured in Tanzania Shillings (TZS) (1 US$ = TZS2220 on average during the survey time). *, **, and *** show statistical significance at 10%, 5%, and 1% alpha levels, respectively.

- Abbreviations: GBM, group business model; IBM, individual business model; TLU, tropical livestock unit; WTI, willingness to invest.

The results show that several factors account for variability in farmers' WTI in small-scale mechanized maize shelling. In the case of the GBM, WTI was higher for households with greater wealth (as proxied by livestock ownership), incurred higher labor costs than the prevailing machine service rate, had a better education, and had an experience of using maize shelling machines. However, age was negatively related to WTI, implying that elderly farmers were more fearful of failure associated with managing and using the machine under the GBM. In the case of the IBM, WTI was higher for farmers characterized by greater wealth, better education, and greater experience in using maize shellers. Moreover, male respondents had a higher WTI than their female counterparts, while those households who were endowed with relatively abundant labor (as proxied by labor–land ratio) had a lower WTI in the machines.

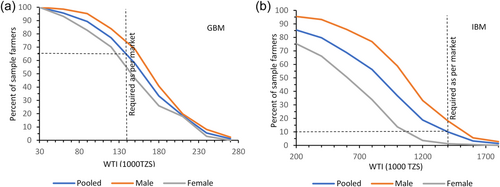

The mean amount of cash farmers would like to invest in the machine under the GBM was about $69.7 If a group comprises 10 members, as suggested by most of the interviewed farmers, this result shows that a total of about $690 would be made available by group members to purchase the shelling machine. This amount was enough to purchase the machine selected for our WTI analysis at the time of the survey, implying that the GBM could be realized in the study areas. About 65% of the farmers had predicted values of at least equal to the minimum contribution required for the investment, indicating that most farmers would be able to invest in small-scale mechanized maize shelling within the GBM (Figure 2a). The mean sum of financial capital which farmers were willing to invest within the IBM was about $335. This amount was significantly greater than zero, indicating that a typical farmer was willing to invest in the machines individually. However, this amount was lower by about 47% than the market price of the machine at the time of the survey implying that the IBM was not an affordable business model for most farmers in the study areas (Figure 2b). Only 10% of the farmers had predicted values greater than or equal to the actual market price of the machine. These farmers could be considered as potential investors in small-scale mechanized maize shelling under the IBM.

Figure 2 displays the cumulative distribution of farmers' WTI predicted by the interval regression model for the GBM (panel a) and the IBM (panel b). The cumulative distributions are plotted separately for male respondents, female respondents, and the pooled sample. In both panels, the distribution associated with female respondents lies to the left of the distribution associated with male respondents. This shows that the percentage of female respondents who were willing to invest at least the amount of money indicated at a point along the horizontal axis was lower than the percentage of male respondents who were willing to make the same decision. This could be because of women's lower access to financial and other resources required to invest. The difference is more visible in the case of the IBM, which needs higher resource capacity than the GBM, as indicated by the greater distance between the lines associated with the two groups and by the statistical significance of the regression coefficient associated with the “male” variable.

4 RESULTS OF PROFITABILITY ANALYSIS

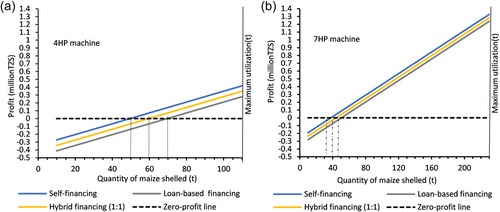

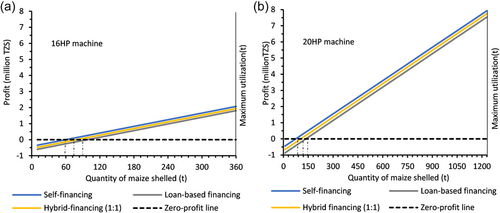

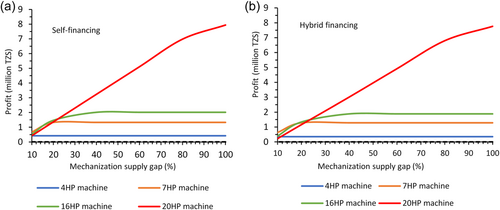

In this section, we show the potential financial benefit for those farmers who would like to invest in mechanized maize shelling. Figures 3 and 4 show annual profit levels corresponding to different machine types and quantities of maize shelled. The horizontal dash lines are zero-profit lines representing a nonarbitrage condition displayed in Equation (12). Profit levels are displayed by the three sloping lines representing three possible models of investment financing. The three vertical dash lines show the quantity of maize shelled at zero profit considering the three scenarios associated with the models of investment financing. The border lines on the right show full capacity utilization of the machines, based on the assumption that the period for maize shelling lasts for a month after harvesting, with a 2-day break per week, and that the machines are used for 5–8 h/day8 (see Supporting Information Table A6 for optimal running hours of the machines).

The four machines are associated with different profit potentials. The profit with full capacity utilization ranges from about $135 to about $3560, depending on machine type and source of capital. The 4-HP machine is not profitable when its capacity utilization level is below 50%, while the threshold quantity depends on the model of financing (Figure 3a). Profit begins at about 45% capacity utilization for self-financed machine owners, begins at about 63% for those who fully depend on bank loans, and begins at about 54% for those who partly depend on bank loans. The annual profit for the 7-HP machine ranges from about $541 for bank-loan users to $586 for self-financed machine owners (Figure 3b). For this machine, profit begins at about 38 MT of maize shelled for self-financed machine owners and increases monotonically with the quantity shelled to reach about $586 at full utilization. The 16-HP machine is associated with a higher profit than the two lower capacity machines (Figure 4a). The profit with full capacity utilization ranges from about $811 (in the case of loan-based investment) to about $900 (in the case of self-sponsored investment). However, the minimum threshold quantity (i.e., about 60 MT) to make a profit is higher than the minimum quantities associated with the lower capacity machines. The highest profit can be realized when the 20-HP machine is used. The profit associated with full capacity utilization of the 20-HP machine ranges from about $3423 for loan users to about $3560 for self-financed machine owners (Figure 4b). The minimum quantity of maize shelled to make a profit is about 75 MT, which is the highest compared with the minimum threshold levels of the other machines.

The profit from the maize shelling investment depends not only on machine capacity, however. It also depends on the effective demand for maize shelling services. This, in turn, depends on the total maize production in a season, which we estimated based on the survey data and secondary data.9 We assume that the demand for maize shelling would begin in the neighborhood of a machine owner and spread outwards in all directions. Accordingly, people who live close by the machine owner would have the highest likelihood of applying for maize shelling services, whereas those who live far away would have the lowest likelihood of doing so.

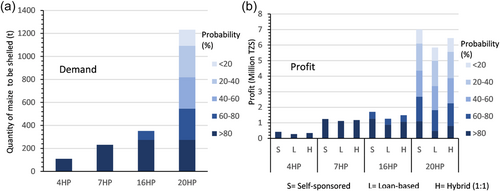

Figure 5a,b displays the potential demand for shelling services and the potential profit associated with the services, respectively. The gradient of colors used to build the vertical bars show probabilities (or risk levels) associated with the realization of the potential (latent) demand (Figure 5a) or the potential profit (Figure 5b). The likelihood that a projected demand (or profit) will materialize increases with a bar's darker (deeper) color. In other words, the potential demand (or profit) associated with the darkest bars is more likely to materialize, but the one associated with the lightest bars is less likely to do so. The results show that the potential demand to be met and the potential profit to be made both increase with machine capacity. However, as the machine capacity increases, the possibility of satisfying the demand commensurate with it will decrease; thus, the machine owner must work harder to draw clients to realize the potential profit. This implies that the 4-HP machine is most likely to be fully utilized, whereas the 20-HP machine is most likely to be underutilized. The chances of the other two machines being used fully or insufficiently also depend on their relative sizes. Therefore, owning larger machines enhances the potential benefit from the investment in mechanization but requires more work to realize it.

Yet, potential demand is unsatisfied demand. Thus, it depends not only on the production level but also on the demand already satisfied. Figure 5 assumes that the existing demand is not fully satisfied, that is, there is a full supply gap. However, this is a strong assumption, given that some farmers in the study areas had access to mechanized maize shelling. In Figure 6, we relax this assumption by considering different levels of supply gaps associated with varying levels of competition. The slopes of the lines show the rate at which potential profit grows as the supply gap increases or as competition in the mechanized maize shelling market decreases. The figure displays the context of a self-financed investment (panel a) and a hybrid-financed (loan-complemented) investment (panel b), considering different levels of supply gaps. The potential profit increases as the gap in the supply of mechanized maize shelling increases, up to the point of full capacity of the machine. This is because it becomes easier to ensure full utilization of the machines when the supply gap is higher. In other words, the diseconomies of scale associated with the indivisible nature of machines become relaxed as the supply gap increases. However, the relationship between potential profit and supply gap depends on the shelling capacity of a machine. The potential profit associated with the 4-HP machine can reach its peak even at a 10% supply gap; hence, demand constraint is expected to be minimal after this point. However, potential profit will be constrained by the supply gap at 10% for the other machines considered in the study, although the point at which the constraint sets in varies among the machines. Demand constraint may set in at about 17% for the 7-HP machine, at about 26% for the 16-HP machine, and at about 90% for the 20-HP machine. As the supply gap decreases, the potential profits associated with the larger machines tend to converge toward those associated with the smallest machine due to the diseconomies of scale associated with the larger machines. This suggests that conducting a more thorough demand study is necessary before investing in larger machines, especially the 20-HP machine.

5 DISCUSSION AND POLICY IMPLICATIONS

The results show that farmers were willing to invest in mechanized maize shelling implying that the FtF approach can effectively be used to enhance mechanization in smallholder agriculture. About 65% of the sample farmers were willing to invest in mechanized maize shelling within the GBM, and about 10% of them would like to do so within the IBM. Farmers having better formal education, greater wealth, and experience in using shelling machines, and those who experienced the high cost of hired labor, had the highest probability of investing in mechanized maize shelling within the GBM. Male-educated farmers who had better wealth and experience in using maize shelling machines, but encountered labor constraints in their farming, were more likely to go for the IBM. The results corroborate the findings of earlier studies on smallholder farmers' WTI in farm machinery and factors affecting their decisions (Hodjo et al., 2021; Mottaleb et al., 2016; Paudel et al., 2019).

Our findings suggest that the FtF strategy can be used to expand mechanical maize shelling in rural Tanzania. Experiences in some Asian countries show that the FtF strategy has enhanced the spread of agricultural mechanization among smallholder farmers (Biggs et al., 2011; Diao et al., 2014; Mrema et al., 2008; Paudel et al., 2019; Pingali, 2007; B. Sims et al., 2011). For instance, smallholder farmers provide most of the agricultural mechanization services in Bangladesh, whereas medium-scale farmers play the leading role in India (Biggs et al., 2011). One advantage of the FtF mechanization strategy is that the suppliers can adjust quickly to the demands of those who need the service as they have a better knowledge of local demands/contexts compared with migratory service providers (B. Sims et al., 2011). Moreover, FtF service providers may show better commitments to local mechanization than migratory service providers. Furthermore, the engagement of farmers in mechanization service provision can increase their income while reducing their fixed costs associated with the machinary.

Profitability is one of the most important factors determining success in agricultural mechanization. Farmers (as individuals or in organized groups) can continue providing mechanization services if they retain some income after paying for all costs associated with service provision. Considering different machine capacities, our analysis shows that investment in mechanized maize shelling is potentially profitable. However, potential profit can be constrained by the demand for maize shelling services leading to underutilization of the machines. Such a constraint might be binding especially for larger machines. One way of increasing machine capacity utilization, and hence profitability, is by broadening the service range of the machines (Gao et al., 2012; Mrema et al., 2008). For instance, maize shelling machines can be designed to provide multiple services, such as shelling/threshing of multiple crops and combining dehusking, shelling, and winnowing services. Studies show that the multifunctional service model would enable service providers to effectively use the machine, reducing fixed costs while increasing profit (Adu-Baffour et al., 2019; Daum & Birner, 2017; Roy & Singh, 2008). For instance, Roy and Singh (2008) found that smallholder power tiller owners in Bangladesh could repay their purchase cost after 1 or 2 years by providing multifunctional services to other farmers. Similarly, Daum and Birner (2017) found that tractor owners in Ghana could enhance their profitability by engaging in maize shelling. Therefore, exploring the possibilitiy of multifunctional service provision is useful. Such an approach may enhance the spread of mechanization among smallholder farmers as it can address their demands associated with diverse agricultural activities.

Unlike many agricultural inputs such as fertilizers and seeds, maize shelling machines are indivisible and hence may not be fully utilized by individual smallholder farmers because of the small amounts they produce. The indivisible nature of machinery can also hinder smallholder farmers from investing in mechanization as they have limited access to financial resources. One way of overcoming problems associated with factor indivisibility is to adopt the GBM. Our results show that larger number of farmers could join mechanization investment within the GBM than within the IBM. The GBM may be attractive for resource-poor farmers who cannot afford to buy the machines individually. The GBM can facilitate cost-sharing and service-sharing among co-owners enhancing profitability as it creates a guaranteed demand for the service from the co-owners. Moreover, it can strengthen social cohesion, and enhance entrepreneurial skills, as it facilitates sharing of ideas among co-owners. However, within the GBM, co-owners may encounter problems associated with collective action, as they may not show the same level of commitment to their joint business (Olson, 1965; Ostrom, 1990). For instance, the co-owners may encounter a free-rider problem arising from the low commitment of some co-owners, while simultaneous requests for services from co-owners can lead to disputes among them. The free-rider problem can be exacerbated as group size increases (Agrawal & Goyal, 2001; Olson, 1965). These challenges can be overcome by formulating suitable rules to govern the interaction of co-owners with regard to their joint business, and limiting the number of co-owners to a manageable size (Ostrom, 1990, 2005).

Another way of overcoming the problem associated with the indivisible nature of machinery is to improve access to loans for those farmers who would like to invest in mechanization. Our findings of WTI analysis shows that low asset endowment could reduce the willingness of farmers to invest in mechanization. This suggests that there is a latent demand for loans to purchase farm machinery and that FtF-oriented mechanization efforts may fail if the farmers' access to finance is not improved. Moreover, our findings show that engaging in mechanized maize shelling business is profitable under loan-based financing, suggesting that access to credit is useful. Nevertheless, financial service providers are mostly reluctant to lend to smallholder farmers for various reasons, including lack of usable collateral, high transaction costs per unit of loan, the risks (drought, pests, low price, etc.) associated with smallholder agriculture, and general lack of understanding of the agricultural sector and the opportunities it offers (Adesina et al., 2014; Langyintuo, 2020). Rural-oriented microfinance institutions try to fill the gap, but they have had only modest success due, among other things, to their poor capital base and high interest rates (Poulton et al., 2006). This situation necessitates public policy intervention, including incentivizing financial institutions (e.g., through tax holidays, co-insurance for weather-related shocks) so that they target smallholder farmers who would like to invest in agricultural mechanization. Tanzania's current agricultural development policy recognizes the country's smallholder farmers' financial constraints and urges for coordinated action to address these issues and enable all farmers to invest (United Republic of Tanzania, 2013). However, the policy places little emphasis on mechanization and instead concentrates on agricultural inputs, like, fertilizers and improved seeds.

Finally, the spread of agricultural mechanization can be enhanced by enabling all actors in the entire mechanization value chain. This requires improving the business enabling environment, including establishing an efficient business registration system, provision of tax motivations (or smart subsidies) for new business initiatives along the mechanization value chain, particularly for rural businesses, and putting in place a well-integrated mechanization support system. Experience from Asian countries shows that focusing on small-scale machines rather than large-scale ones can lead to a faster spread of mechanization. Bangladesh and Sri Lanka, for instance, are better mechanized than India, due to the extensive presence of small-scale machines, including two-wheel tractors and threshing machines (Biggs et al., 2011). A well-designed mechanization strategy is needed to support local-level inventions and their transformation into technologies. Focusing on local manufacturing capacity is important, because local manufacturers or technology centers can easily understand local contexts and, if capacitated, can swiftly respond to local needs. For instance, in Tanzania, the Intermech Engineering Limited and the Centre for Agricultural Mechanization and Rural Technology produce locally adapted threshing machines which have attracted many customers who used to rely on imported ones (B. Sims et al., 2018). Moreover, local manufacturers have a greater positive impact on the rural economy than companies that import fully processed machinery since they can generate more local jobs.

AUTHOR CONTRIBUTIONS

Bekele Hundie Kotu: Conceptualization, data curation, methodology, formal analysis, writing—original draft, and writing—review and editing. Julius Manda: Writing—review and editing. Christopher Mutungi: Writing—review and editing, and data curation. Gundula Fischer: Writing—review and editing. Audifas Gaspar: Data curation.

ACKNOWLEDGMENTS

The study was funded by United States Agency for International Development (grant number: AID-BFS-G-11-00002) within the frame of the program “Africa, Research In Sustainable Intensification for the Next Generation (Africa RISING).” The authors are grateful for the financial support.

ETHICAL STATEMENT

The survey was conducted following the ethical standards of the International Institute of Tropical Agriculture. A clear explanation was given to the participants on the objectives of the survey and all of them were asked for their verbal informed consent to willingly participate in the study. Participants were informed that they could skip any question they did not want to answer. They were made aware that they could even withdraw at any time from the interview. The names of the participants have been mentioned nowhere in the manuscript.

Biographies

Bekele Hundie Kotu is an agricultural economist at International Institute of Tropical Agriculture (www.iita.org) based in Ghana. He holds PhD in agricultural and resource economics. His research interest lies in the areas of sustainable intensification of smallholder agriculture and resilience of smallholder livelihoods. His studies aim at assessing ex ante and ex post impacts of new agricultural technologies, profitability of new agricultural technologies, and, among others, the interlinkages among microeconomic variables, such as resilience capacity, commercialization, diversification, and food security. Bekele has also conducted multiple studies on institutional analysis of common property resources with a special focus on pastoral areas in Ethiopia. His research covers several African countries, including Ghana, Tanzania, Malawi, Mali, and Ethiopia.

Julius Manda is an Agricultural Economist at the International Institute of Tropical Agriculture (IITA), based in Arusha, Tanzania. He received his MSc and PhD in Development and Agricultural Economics from Wageningen University and Research, the Netherlands. His research primarily focuses on the adoption and impacts of new agricultural technologies on smallholder farmers' welfare, value chain analysis, and economic analysis of sustainable intensification practices. He was a senior planner in the ministry of health in Zambia before joining IITA in 2012 as an Associate Professional Officer-Agricultural Economist.

Christopher Mutungi is a food scientist by training. He obtained a Doctorate in Food Engineering from Technische Universität Dresden, Germany, in 2011, and has accumulated over 15 years of research and training interests in nutrition, food safety, food processing, and post-harvest management for smallholder systems. His latest assignment (2017–2020) was with the International Institute of Tropical Agriculture (IITA) as a Scientist in charge of Food Technology Post-harvest and Nutrition Research in the Eastern Africa Hub (Dar es Salaam, Tanzania) where he contributed to an R4D program known as Africa RISING (https://africa-rising.net/).

Gundula Fischer is a Social Scientist and Gender Expert at International Institute of Tropical Agriculture. She obtained her Master's degree in Social Anthropology and German as a second language at Ludwig Maximilians University, Munich, Germany (1993) and her PhD in Social Anthropology at the University of Bayreuth, Germany (2006). Prior to her current appointment, she worked as a Research Coordinator at the Southern Highlands Culture Solutions (EU—funded Development Project). She was a Senior Lecturer, Cultural Anthropology Director of Research (2009–2014) at the University of Iringa. She was a Visiting Lecturer at the University of Gottingen, Germany (2014) and a Lecturer of Sociology at St. Augustine University of Tanzania (2006–2009).

Audifas Gaspar is a Food Science and Technologist with a BSc from Sokoine University of Agriculture (SUA), Morogoro-Tanzania. He is currently working with the International Institute of Tropical Agriculture based in Dar es Salaam, Tanzania as a Research Supervisor. Audifas has over 9 years of engagement in research and training in postharvest management and value addition of roots and tubers, legumes, maize grains, and rice since 2014 to date. He has interacted with different projects and organizations with multidisciplinary teams operating in Tanzania and beyond the borders. In the recent times he worked with the team under the Africa Research in Sustainable Intensification for the Next Generation (Africa RISING project) to specifically identify, test, and adapt best-practice technologies to sustainably reduce post-harvest losses and keep the produce up the market standards (using harmonized EAC standards for maize and rice) to enhance household consumption of safe and quality food and increase the market price of the grain (maize and rice) and legume crops for the improvement of farmers' livelihoods in Tanzania.

Open Research

DATA AVAILABILITY STATEMENT

The dataset used in the study has been deposited at the Dataverse online repository (managed by Harvard). It can be accessed at: https://doi.org/10.7910/DVN/13YBCW.

REFERENCES

- 1 The R value is the number of years of cultivation multiplied by 100 and divided by the length of the cycle of land utilization.

- 2 Pingali et al. (1987), for instance, reported that nearly all mechanization schemes in Africa which they could evaluate collapsed.

- 3 The villages are Ndurugumi/Kibaigwa (in Kongwa district), Kiperesa (in Kiteto district), and Long, Sabilo, and Seloto (in Babati district).

- 4 This is equivalent to 1.7 million Tanzanian shillings based on the prevailing exchange rate at the time of the survey.

- 5 Africa RISING stands for “Africa, Research In Sustainable Intensification for the Next Generation” (https://africa-rising.net/).

- 6 About 16% of the sample farmers participated in Africa RISING demonstration events for maize shellers.

- 7 The mean WTI was calculated from the interval regression by keeping the regressors at the mean level. This was done using Stata 16.

- 8 We fixed this duration based on our survey data. Our survey data shows that the mean duration between harvesting and shelling maize is about 1 month. However, we are aware that some farmers are used to storing maize cobs for a longer time.

- 9 The total maize production in a typical village in the study areas was about 1365 MT. This was estimated from the survey data on maize production at household level, and the total number of households at village level. The latter data was obtained from village administrations. While we have tried our best to make a good estimate of the total maize production in the study villages, our estimate could be far from perfect. To address the possibility of underestimation or overestimation, we computed potential profit at 10% higher and 10% lower levels. The results are reported in the annex (see Supporting Information Figure A3). The results show that our base profit estimation will not be affected substantially if the total production is assumed to be higher or lower by 10% than the base value while sensitivity of the potential profit to the changes in total production increases with the shelling capacity of the maize shellers.