The role of agricultural sector performance in attracting foreign direct investment in the food and beverages sector. Evidence from planned investments in Africa

Abstract

Using a novel dataset on foreign direct investment (FDI), this paper analyzes the correlates of planned FDI in the food and beverages sector in 49 African countries over the period 2003–2017. It applies the random effects model and augments the standard specification of FDI determinants with a set of factors related to the agricultural sector performance, hypothesized to be essential from the perspective of supply chain linkages and access to raw materials. The results indicate that well-performing and well-capitalized agricultural sector of the host country is a key factor associated with the choice of investment location by foreign investors, especially those from the Global North. Capital investment in agriculture, as proxied by agricultural gross fixed capital formation and net capital stock, is particularly important. Public investment in agriculture, in the form of government expenditure and official development assistance, is also associated with higher FDI. These factors, however, are not significant in case of the least developed countries where only market potential appears to matter for foreign investors. The results suggest that complementarities may exist between different types of investments and that policy-makers willing to attract food and beverages FDI should prioritize agricultural sector development. [EconLit Citations: E22, E24, F21, F23, Q00, Q13, Q18].

Practitioner points

-

Planned FDI in the food and beverages sector in Africa are driven by the potential that a domestic emerging consumer class represents and investors choose large and fast-growing markets.

-

Well-performing and well-capitalized agricultural sector of the host country appears to be a key factor associated with the choice of investment location by foreign investors, especially those from the Global North. Capital investment in agriculture, as proxied by agricultural gross fixed capital formation and net capital stock, is particularly important.

-

The results suggest that complementarities may exist between different types of investments and that policy-makers willing to attract food and beverages FDI should prioritize agricultural sector development.

-

In the least developed countries in Africa, only the market potential, as reflected by both the market size and its dynamics, is associated with higher FDI, while the evidence is missing for the agricultural sector performance indicators.

Abbreviations

-

- FDI

-

- foreign direct investment

-

- GDP

-

- gross domestic product

-

- GFCF

-

- gross fixed capital formation

-

- GMM

-

- generalized method of moments

-

- LDC

-

- least developed country

-

- MNE

-

- multinational enterprise

-

- M&A

-

- mergers and acquisitions

-

- ODA

-

- official development assistance

-

- OECD

-

- Organisation for Economic Co-operation and Development

-

- OLI

-

- ownership-localization-internalization

-

- OLS

-

- ordinary least squares

-

- SIC

-

- standard industrial classification

-

- UN

-

- United Nations

-

- UNCTAD

-

- United Nations Conference on Trade and Development

-

- WGI

-

- Worldwide Governance Indicators

1 INTRODUCTION

The last decade has witnessed a revived interest in the food and beverages sector in Africa. Foreign direct investment (FDI) has become an important feature of this trend. It has been argued that to foreign investors, the African food and beverages sector offers prospects of high returns and opportunities to capitalize on high food prices and growing domestic demand (FAO, 2013; Fiedler & Iafrate, 2016). Accordingly, policy-makers across developing countries, including in Africa, consider that agriculture and agri-business have the highest potential, among all sectors of the economy, to attract FDI (UNCTAD, 2015). At the same time, FDI has the potential to bring investments necessary to keep pace with the growing food demand in Africa. It is also expected to bring new technologies that increase productivity and have spillover effects to domestic investors (Zhan et al., 2018). However, compared with other regions of the world, FDI in the food and beverages sector in Africa remains low, at only 10.5% of the global figure (Fiedler & Iafrate, 2016); it is also unevenly distributed across countries.

Thus, considering the potential positive effects of FDI on host countries, an important policy question is which factors drive FDI in the food and beverages sector in Africa, and to which extent policy-makers can influence how attractive their countries are to prospective foreign investors. It is hypothesized here that the performance of the host country's agricultural sector, for instance in terms of production, value added, private and public investment, and availability of agricultural land, plays a major role in the choice of investment location by foreign investors seeking to establish robust supply chain linkages. Hollinger and Staatz (2015) indicate that agro-industry development in Africa has so far been hampered by a limited ability of local farmers to consistently procure reliable quality raw materials.

Second, since the potential benefits of foreign investments could be higher in less developed countries—because of the diminishing marginal returns to capital—while at the same time these countries receive much less FDI, and because investors may employ different investment strategies in different countries (Antonakakis & Tondl, 2011), it is relevant to ask whether the drivers of FDI are systematically different in the least developed countries (LDCs)1 compared with non-LDCs. Finally, considering the growing importance of South–South FDI (Amighini & Sanfilippo, 2014; Awokuse & Reardon, 2018), and their potentially different impacts on the host economies (Allan et al., 2013; Munjal et al., 2022; Prasenjit & Perry, 2020), it is also relevant to examine whether investors from the Global South2 are driven by different motives compared with investors from the Global North.

This paper contributes to the debate on FDI by addressing these three questions. Specifically, it focuses on the role of the agricultural sector performance as a driver of FDI in the food and beverages sector; it distinguishes between FDI from the Global North and the Global South; and it disaggregates the analysis between LDCs and non-LDCs. The analysis looks at planned FDI in the food and beverages sector across 49 African countries over the period 2003–2017. It uses a novel highly disaggregated dataset on greenfield FDI, which allows for a comprehensive coverage of the food and beverages sector and it employs random effects model to exploit the 15 years of observations for all but five African countries.

The focus on the food and beverages sector is relevant in that such investments, apart from direct effects on output, value added, employment and productivity, can have important economy-wide effects (Kapstein et al., 2012) and, by improving food availability and quality, they might also enhance food security, nutrition and food safety (Karlsson, 2014). These aspects are of particular importance to Africa (Baumüller et al., 2021). The literature on FDI in the food and beverages sector has been growing, albeit remains scarce. Three recent papers, Fiedler and Iafrate (2016), Husmann and Kubik (2019), and Punthakey (2020), offer a detailed account of the investment trends over the last two decades. Husmann and Kubik (2019) and Punthakey (2020) also show—based on self-reported information provided by the investors—that investment decisions are mainly driven by the growth potential of the domestic markets. However, they are also underpinned by a range of other strategic factors, especially access to inputs, raw materials and agricultural land. Investors also consider favorable business climate and regulations, transparent and predictable policies, availability of natural resources, infrastructure and logistics.

The literature on FDI determinants has rarely employed a sectoral approach, and in the rare cases, FDI flows were usually disaggregated into primary, secondary, and tertiary sector (Doytch & Eren, 2012; Walsh & Yu, 2010). Only one paper looks at the food sector specifically, based on the evidence from the United Kingdom (Giulietti et al., 2004). The scant literature on FDI determinants in Africa has so far not differentiated between sectors. This strand of literature has focused on the role of natural resources, geography and institutions (Asiedu, 2006; Naudé & Krugell, 2007), human capital (Naudé & Krugell, 2003; Suliman & Mollick, 2009), tax incentives (Cleeve, 2008), and foreign aid (Anyanwu, 2012; Yasin, 2005), among others. More recent papers have looked at the determinants of the Chinese and the Indian FDI to Africa (Munjal et al., 2022; Shan et al., 2018; Varma et al., 2020). With the exception of Anyanwu (2012), these studies are based on a limited sample of African countries, and many do not address the potential endogeneity issues.

This is the first paper to systematically analyze the correlates of planned FDI in the food and beverages sector in Africa. The results indicate that investments are driven by the potential that a domestic emerging consumer class represents, and that investors choose large and fast-growing markets. At the same time, well-performing and well-capitalized agricultural sector of the host country appears to be a key factor associated with the choice of investment location by foreign investors, especially those from the Global North. Capital investment in agriculture, as proxied by agricultural gross fixed capital formation (GFCF) and net capital stock, is particularly important. In addition, public investment in agriculture, in the form of government expenditure and inward official development assistance (ODA), is also associated with higher FDI. The results suggest that complementarities may exist between different types of investments and that policy-makers willing to attract food and beverages FDI should prioritize agricultural sector development. However, the evidence is strong only in the case of non-LDCs, but is missing for the LDCs. In LDCs, only the market potential, as reflected by both the market size and its dynamics, is associated with higher FDI. In this case, more research is necessary to provide relevant policy recommendations.

This paper contributes to the literature in several ways. First, it adds to the literature on FDI in the food and beverages sector which has so far remained scant, despite the growing academic and policy interest. The unique dataset allows for a comprehensive coverage of the sectoral FDI. Second, it proposes a new set of variables related to agricultural sector performance that have so far not been analyzed in the literature on FDI determinants but which are expected to be relevant for FDI in the food and beverages sector. Third, it adds to the literature on FDI flows to Africa by analyzing sectoral FDI in 49 countries over the period 2003–2017. Fourth, it distinguishes between FDI flows originating from the Global North and from the Global South. Lastly, it disaggregates the analysis between LDCs and non-LDCs.

The remainder of the paper is structured as follows: literature review is presented in Section 2, conceptual framework in Section 3, and data in Section 4. Section 5 provides details of econometric specification, Section 6 presents main findings, and Section 7 reports robustness checks. Finally, the last section concludes.

2 LITERATURE REVIEW

The empirical literature on FDI determinants is vast; for comprehensive reviews, see Caves (1996), Bloningen (2005), and Faeth (2009). The literature has largely followed various theoretical approaches, or the combination of thereof, either at the firm-level, that is, by looking at the firm-specific factors that motivate a firm to invest abroad, or at the country-level, that is, by looking at the country-specific factors that make a potential host country attractive for foreign investors. In the latter case, FDI has been modeled either as bilateral flows between countries or as aggregate inflows into the host countries (see, for instance, Faeth (2009) for a review of studies falling into the different categories). This paper follows the second category.

A wide range of factors that could potentially explain the location and the scale of FDI flows have been analyzed in the literature, including market size and market dynamics, macroeconomic factors such as inflation or exchange rate, labor costs, human capital, infrastructure, trade openness and trade protection, taxation, natural resources and institutions (Antonakakis & Tondl, 2011). Broadly, the empirical evidence has given support to the relevance of these factors for foreign investors. However, the findings are often context-dependent and sensitive to the econometric specification. In addition, a bulk of this literature is based on the evidence from high-income countries.

The literature on FDI determinants in emerging and developing countries has been growing, especially in recent years, but it has largely focused on regions other than Africa, for instance Latin America and Eastern Europe (Campos & Kinoshita, 2008; Love & Lage-Hidalgo, 2000; Trevino et al., 2008) or Asia (Nguyen & Cieślik, 2020; Petri, 2012; Sahoo, 2006). Studies covering a broader group of developing countries usually only include a limited subset of African countries (Noorbakhsh et al., 2001; Sekkat & Veganzones-Varoudakis, 2007).

The literature focusing on Africa specifically remains scant (Asiedu, 2006) and, again, mostly based on a limited sample of countries. The study by Anyanwu (2012) is the only exception in this respect. Asiedu (2002) notes that Africa appears to be consistently different and attracts less FDI compared with other developing countries, even once the standard FDI determinants are controlled for. Asiedu (2006) shows that African countries with large markets and natural resource endowments attract more FDI. However, even small resource-poor countries may attract FDI if they implement policies resulting in macroeconomic and political stability, good infrastructure, educated labor force, and efficient legal system. Similar findings are provided in Morisset (2000) who emphasizes the importance of business climate, and Naudé and Krugell (2007) who show that institutions—but not geography—matter. Lemi and Asefa (2003) analyze the impact of economic and political uncertainty on FDI flows to African economies and show that while both factors do not appear to be major concerns for the aggregate FDI, they are important for manufacturing FDI when economic instability is combined with political instability. Yasin (2005) points out that bilateral—but not multilateral—ODA has a significant positive effect on FDI inflows. Anyanwu (2012), apart from standard FDI determinants discussed above, provides evidence that past FDI inflows affect the current inflows.

Finally, recent studies look at the determinants of South–South FDI to Africa. More specifically, Shan et al. (2018) analyze the Chinese FDI to Africa and find that market size is the most significant driver of these investments, but, contrary to expectations, natural resources do not play a significant role. Varma et al. (2020) look at the Indian FDI to Africa and show that these investments are, to a large extent, also market-seeking. Finally, Munjal et al. (2022) adopt the concept of institutional imprinting to compare the Indian and the Chinese FDI to Africa and argue that the former are driven by institutional factors and good governance, in contrast to the latter.

The literature on FDI determinants in Africa has not so far distinguished between sectors. Sectoral approach has rarely been used in the literature on FDI. Yet, the available evidence shows that the factors affecting investment decision vary depending on the sector (Walsh & Yu, 2010). As far as one is aware, the only analysis that explicitly focuses on FDI determinants in the food sector is the study by Giulietti et al. (2004) based on the evidence from the United Kingdom. Their analysis is grounded in the Ownership–Location–Internalization (OLI) framework (Dunning, 1979) and the results emphasize the importance of ownership-specific and industry characteristics in determining the presence of foreign-owned firms in this sector while macroeconomic factors were found to only have a marginal effect. Hence, high level of FDI would be expected in industries where product differentiation is important, where there is a high level of managerial skills and where there is a relatively high level of capital intensity. On the other hand, high levels of concentration and import penetration would tend to reduce the level of FDI in any particular food industry. While the findings by Giulietti et al. (2004) provide important insights, it is likely that the factors affecting FDI in the food and beverages sector in African countries may be different since the market structure as well as other conditions vary greatly in African countries compared to the United Kingdom.

3 CONCEPTUAL FRAMEWORK

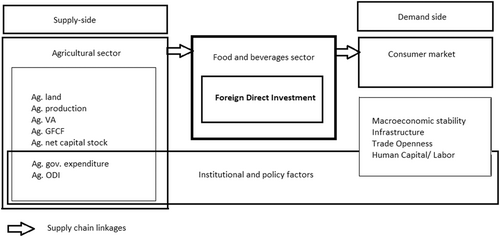

The conceptual framework that guides the analysis in this paper is demonstrated in Figure 1. According to this framework, FDI in the food and beverages sector is driven by a number of factors that can be broadly divided into demand-side, supply-side, and institutional and policy factors. This is in line with most of the earlier literature, as described above, and could apply to any sector of the economy. However, to account for the sectoral nature of the analysis in this paper, drivers specific to the food and beverages sector are explicitly added in the framework. These drivers fall under the category of the supply-side factors at the intersection with the policy factors. More specifically, they reflect the performance of the host country's agricultural sector and can be conceptualized either in terms of the outcomes, that is, agricultural production or value added, or factors that have the potential to condition the outcomes, that is, availability of agricultural land, or private and public investment in agriculture (GFCF, net capital stock, government expenditure on agriculture, and agricultural ODA).

It is hypothesized here that the agricultural sector performance of the host country plays a major role in attracting foreign investors in the food and beverages sector. This is because investors seek to establish robust supply chain linkages and to ensure a reliable access to raw materials used in the food and beverages production. So far, the qualitative evidence from Africa has pointed out that the limited capacity of local farmers to consistently procure reliable quality raw materials has been a major impediment to the agro-industry development (Hollinger & Staatz, 2015), resulting in a high degree of reliance on imported inputs among the food and beverages sector firms (Allen et al., 2016; Kubik et al., 2022; Punthakey, 2020). Hence, a well-performing agricultural sector of the host country may represent essential locational advantages for the foreign investors.

In this sense, the conceptual framework relates closely to the Dunning's OLI eclectic paradigm (Dunning, 1979, 1980; Dunning & Lundan, 2008) which posits that a firm will engage in productive activities in a foreign country in the presence of competitive advantages, location advantages and internalization advantages. In particular, location advantages provide a foreign investor access to the country's endowments, as well as special tax regimes, lower production, and transportation costs, market size, access to protected markets, and lower risk (Dunning & Lundan, 2008). Previously, a similar approach was adopted by Giulietti et al. (2004) in their study on FDI in the UK food sector. However, owing to availability of industry-level data, the authors were able to reflect the OLI paradigm more comprehensively compared with the analysis in this paper. Here, the paucity of cross-country data on the food and beverages sector precludes an accurate representation of the OLI paradigm. Instead, the focus lies on selected proxies of the locational advantages.3

Because of its eclectic and flexible framework, the OLI paradigm is convenient to accommodate the analysis in this paper. Nevertheless, common elements can also be found with other theoretical frameworks, for instance Helpman (1984, 1985), Zhang and Markusen (1999), Ekholm et al. (2007) and, to some extent, Krugman (1991). Contrary to these approaches, however, the conceptual framework in this paper does not explicitly aim at distinguishing between market-seeking and resource-seeking FDI (Dunning, 1993) or between horizontal (Markusen, 1984; Markusen & Venables, 1998, 2000) and vertical FDI (Helpman, 1984, 1985; Zhang & Markusen, 1999).

While foreign investment in agro-industry has often been subject to debates on land grabbing (von Braun & Meinzen-Dick, 2009), thus making the case for resource-seeking motives of foreign investors, the data at hand shows a more nuanced picture. In fact, the food and beverages FDI in Africa is more diversified than usually considered. Crop production, even though it ranks second among the top subsectors, only accounts for 10% of the food and beverages FDI.4 Hence, while the resource-seeking aspect may be nonnegligible, it is unlikely that foreign investors are purely driven by access to natural resources. Instead, it is hypothesized here that investors seek to secure access to raw materials and inputs necessary in the production process.

In line with earlier literature, the conceptual framework also includes a set of other drivers, such as market potential, that is market size and market dynamics (Dunning, 1979; Markusen, 1984; Markusen & Venables, 1998, 2000), infrastructure (Campos & Kinoshita, 2008), macroeconomic factors, that is, exchange rate, inflation, external debt (Campos & Kinoshita, 2008; Trevino et al., 2008), human capital and labor markets (Bellak et al., 2008), trade openness, and policies and institutions (Bénassy-Quéré et al., 2007; Grosse & Trevino, 2005; Mudambi et al., 2013), including fiscal incentives (Cleeve, 2008). In the empirical analysis, these variables serve as controls. Due to the lack of comparable cross-country data, only selected variables are included in the analysis.

4 DATA

The analysis in this paper is based on data from multiple sources. The data on FDI in the African food and beverages sector comes from fDi Markets, an intelligence unit of the Financial Times.5 The dataset comprises cross-border greenfield investments6 and is based on the publicly announced investment plans. Hence, it does not convey information on whether a given project has been realized, when and to which extent, in comparison to the original investment plan.7 The US$ value8 of planned FDI in the food and beverages sector in a given year in a given country is used as the principal measure of FDI. The number of planned FDI deals is used as a robustness check, following Amighini and Sanfilippo (2014) who consider it to be a more reliable measure of FDI based on the fDi Markets dataset.

Despite these caveats, the data also presents several advantages compared with the standard FDI data sources widely used in the literature. First, it strictly focuses on investments in the real economy, in contrast to other data sources which also include investment flows that only represent bookkeeping entries in corporate accounts but no economic activity (Lipsey & Sjöholm, 2011). Furthermore, fDi Markets data offers a more comprehensive definition of the food and beverages sector compared to the Standard Industrial Classification (SIC) definition. The analysis in this paper covers investments classified as food, beverages, and tobacco cluster in the fDi Markets data—this encompasses the whole food and beverages value chain.9 The remainder of the paper refers to it as the food and beverages sector.

In the econometric analysis, additional data from different sources is used. Main explanatory variables, that is, indicators of the agricultural sector performance, include agricultural value added, production, agricultural land area, GFCF, net capital stock, government expenditure on agriculture, and agricultural ODA. The control variables include gross domestic product (GDP) per capita growth rate, logarithm of GDP per capita and population size as proxies for market potential, share of population with access to electricity and a landlocked dummy as proxies for infrastructure and locational characteristics, and finally corporate tax rate and governance indices, including delivery quality and democratic quality, as proxies for institutional environment. Table A1 in the Appendix provides definitions of variables and details of the data sources, and Table A2 reports the descriptive statistics. The econometric analysis covers 49 African countries over the period 2003–2017.10

5 ESTIMATION STRATEGY

denotes agriculture and is the main focus of this analysis. Various proxies of the agricultural sector performance, or factors that influence it, are employed: agricultural land area, agricultural value added, agricultural production, agricultural GFCF, agricultural net capital stock, government expenditure on agriculture and agricultural ODA. All these variables are used in logarithmic form and all but the land area are used in monetary value. They are expected to have a positive sign since they proxy the availability of raw materials relevant for food and beverages production. Because of the multicollinearity problem potentially arising between these variables, they are all entered in the estimations separately—along with the control variables as specified above. Finally, corresponds to the random effect, and is the remaining unobservable disturbance.

Equation (1) is estimated using a panel data approach. More specifically, random effects model has been selected as the preferred specification. This choice is based on the nature of the data at hand, and also corresponds to the practice employed in earlier literature, for instance by Giulietti et al. (2004) in their study on FDI determinants in the food sector in the United Kingdom. Several tests were conducted to check the structure of the data and the suitability of the random effects model compared to the fixed effects model. First, random effects and fixed effects models were estimated and compared. The Hausman test failed to reject the null hypothesis of no systematic difference in coefficients between fixed effects and random effects models and the Breusch–Pagan Lagrange multiplier test for random effects suggested that random effects should be preferred over the pooled OLS. An additional argument against using fixed effects is that it can substantially reduce the variation in the explanatory variables. In case of this analysis, where most of the variables do not change or change very little over time, this leads to large standard errors, and this effect is additionally inflated by the small number of observations. The Wald statistic for group-wise heteroskedasticity in the fixed effects model strongly rejected the null of homoscedasticity and the Lagrange multiplier test revealed first-order, but no second-order serial correlation. Finally, the test for multiple structural breaks by Ditzen et al. (2021) did not provide evidence for structural breaks in the planned FDI value data12 (Table A3 in the Appendix). Based on these considerations, the random effects model has been retained as the preferred specification. Cluster-robust standard errors are employed and time dummies are included to control for the year effects.

A well-known concern in the empirical literature on FDI determinants is the potential endogeneity bias resulting from reverse causality between measures of FDI and (some of) the explanatory variables as well as the omitted variable bias. The risk of reverse causality is attenuated, if not eliminated, by the nature of the FDI data used in this analysis—it tracks investments that have been announced rather than implemented. It is therefore unlikely that an announcement of FDI project could influence the real economy variables. On the other hand, the risk of omitted variable bias cannot be excluded. In fact, the consistency of the random effects estimator relies on the assumption that the unobserved effect is uncorrelated with the explanatory variables. A number of earlier studies used the generalized method of moments (GMM) estimators, specifically the Arellano–Bond difference-GMM or the system-GMM from Blundell and Bond (1998) to address the endogeneity issues. However, estimating a dynamic model is not justified in this analysis for two reasons. First, the lagged dependent variable is not significant—similarly as, for instance, in Giulietti et al. (2004). Second, these estimators are known to have poor small sample properties (Hayashi, 2000). Unfortunately, the sample used in this paper is small, as it includes only 49 countries, observed over a moderate time span of 15 years. The structure of the data consistently results in the problem of instrument proliferation, irrespective of the GMM specification. Nevertheless, the one-step system-GMM estimator is used as a robustness check. To avoid the instrumentation proliferation, is employs data aggregated over 3-year periods.

6 RESULTS

The results are presented in two steps. First, estimation results from the benchmark regression are presented in Table 1. The benchmark regression includes the control variables as specified in Equation (1). It includes only one selected agricultural variable—agricultural land area. Then, in Table 2, alternative agricultural variables are added one by one to the benchmark regression, replacing the agricultural land area. The estimates are reported for all countries and all types of FDI (Column 1), for FDI originating from the Global North (Column 2), and from the Global South (Column 3), and for LDCs (Column 4), and non-LDCs (Column 5).

| Planned FDI (million US$), log | |||||

|---|---|---|---|---|---|

| Total | North | South | LDCs | Non-LDCs | |

| (1) | (2) | (3) | (4) | (5) | |

| GDP pc growth (%) | 2.600** | 1.818* | 1.648** | 1.656* | 3.075 |

| (1.100) | (1.054) | (0.777) | (0.961) | (2.727) | |

| GDP pc (US$), log | −0.111 | −0.0601 | −0.120 | 0.885** | −1.104*** |

| (0.244) | (0.200) | (0.145) | (0.373) | (0.309) | |

| Population (million) | 0.0330*** | 0.0268*** | 0.0225*** | 0.0431*** | 0.0343*** |

| (0.00653) | (0.00430) | (0.00657) | (0.0144) | (0.00823) | |

| Electricity (% of population) | 0.0179** | 0.0161** | 0.00733 | −0.00556 | 0.0304** |

| (0.00846) | (0.00667) | (0.00671) | (0.00800) | (0.0143) | |

| Landlocked, dummy (1 = yes) | −0.0794 | −0.0330 | −0.0807 | 0.154 | −0.0769 |

| (0.354) | (0.282) | (0.190) | (0.451) | (0.690) | |

| Tax (% of profits) | −0.000889 | −0.000211 | −0.00146** | 0.000248 | 0.00834 |

| (0.000982) | (0.000784) | (0.000644) | (0.00131) | (0.0204) | |

| Democratic quality (index) | 0.590* | 0.527** | 0.183 | 0.401 | 1.879** |

| (0.308) | (0.265) | (0.205) | (0.266) | (0.847) | |

| Delivery quality (index) | −0.108 | −0.195 | 0.0166 | 0.227 | −1.290* |

| (0.422) | (0.313) | (0.272) | (0.458) | (0.712) | |

| Agricultural land (km2), log | 0.256*** | 0.237*** | 0.0416 | 0.111 | 0.261* |

| (0.0787) | (0.0666) | (0.0545) | (0.117) | (0.136) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes |

| Constant | −1.159 | −1.828 | 1.006 | −12.45*** | 12.24** |

| (3.345) | (2.706) | (1.848) | (4.800) | (5.033) | |

| Number of observations | 682 | 682 | 682 | 416 | 266 |

- Note: Standard errors in parentheses.

- Abbreviations: FDI, foreign direct investment; GDP, gross domestic product.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author's own calculations. Random effects model with cluster-robust standard errors. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Column 1: total FDI. Column 2: FDI originating from the Global North. Column 3: FDI originating from the Global South. Column 4: FDI to least developed countries (LDCs). Column 5: FDI to non-LDCs. LDCs: Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Congo Dem. Rep., Djibouti, Ethiopia, The Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Sudan, Sudan, Tanzania, Togo, Uganda, and Zambia.

| Planned FDI (million US$), log | |||||

|---|---|---|---|---|---|

| Total | North | South | LDCs | Non-LDCs | |

| (1) | (2) | (3) | (4) | (5) | |

| Ag. VA (million US$), log | 0.387*** | 0.298*** | 0.153** | 0.161 | 0.596** |

| (0.113) | (0.0939) | (0.0661) | (0.160) | (0.267) | |

| Ag. prod. (million US$), log | 0.423*** | 0.383*** | 0.100 | −0.370 | 0.408 |

| (0.131) | (0.118) | (0.0795) | (0.273) | (0.273) | |

| Ag. GFCF (million US$), log | 0.405*** | 0.305*** | 0.144*** | 0.247 | 0.627*** |

| (0.0888) | (0.0830) | (0.0543) | (0.158) | (0.112) | |

| Ag. net capital stock (million US$), log | 0.435*** | 0.392*** | 0.121*** | 0.176 | 0.568*** |

| (0.0768) | (0.0705) | (0.0394) | (0.186) | (0.135) | |

| Ag. gov. expenditure (million US$), log | 1.120 | 0.849 | 0.732 | −0.242 | 1.871** |

| (0.719) | (0.522) | (0.841) | (1.149) | (0.912) | |

| Ag. ODA (million US$), log | 0.171*** | 0.163*** | 0.102* | 0.0855 | 0.173 |

| (0.0647) | (0.0545) | (0.0558) | (0.0943) | (0.115) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes |

| Number of observations | 682 | 682 | 682 | 416 | 266 |

- Note: Standard errors in parentheses.

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. government expenditure, government expenditure on agriculture; Ag. land, agricultural land; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. production, agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author's own calculations. Random effects model with cluster-robust standard errors. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Column 1: total FDI. Column 2: FDI originating from the Global North. Column 3: FDI originating from the Global South. Column 4: FDI to least developed countries (LDCs). Column 5: FDI to non-LDCs. LDCs: Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Congo Dem. Rep., Djibouti, Ethiopia, The Gambia, Guinea, Guinea–Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Sudan, Sudan, Tanzania, Togo, Uganda and Zambia. Control variables included and specified as in Table 1. Full regression results for total planned FDI reported in Table A4 in the Appendix.

The figures in Table 1 are in line with much of the earlier literature. First, market potential appears to be a major factor associated with the location decision of foreign investors. In case of Africa, similar results were shown for instance by Asiedu (2006), Anyanwu (2012), as well as Shan et al. (2018) and Varma et al. (2020) in case of the Chinese and Indian FDI to Africa, respectively. The coefficient of GDP per capita growth in particular is significant and of high magnitude. On the other hand, the logarithm of GDP per capita, a proxy of purchasing power, turns out mostly insignificant. The coefficient of population size is positive and significant in all columns, even though the magnitude of the impact is small, whereby an increase in population size by 1 million is associated with an increase in planned food and beverages FDI by between 2.3% and 4.4%. These results suggest that foreign investors weigh future prospects more than the current opportunities and choose large fast-growing markets. The only exception are LDCs (Column 4). In this sample, prospective investors target countries where consumers already have higher purchasing power.

Another prominent finding from Table 1 is the importance of supply-side factors in attracting foreign investment. In particular, the logarithm of the agricultural land area, one of the indicators of the agricultural sector performance, turns out to be statistically and economically significant. A 1% increase in the agricultural land area is associated with an increase in total food and beverages FDI by 0.26% (Column 1). The effect of land availability is relevant for FDI from the Global North, and FDI to non-LDCs. These findings are in line with expectations, especially that land is an essential factor of production in agri-business, whether directly in crop production, or indirectly, via supply chain linkages, in other segments of the value chain. They might nevertheless raise questions of long-run sustainability if foreign investments result in land expansion at the expense of forests, or if land is appropriated by foreign investors at the expense of local populations (Allan et al., 2013; Deininger, 2011; Deininger & Byerlee, 2012).

Among other correlates, infrastructure appears as an important factor. Infrastructure is proxied with electricity, measured as a share of population with access to the grid. Availability of reliable sources of energy is crucial for the viability of businesses, and reduction of production risk and costs. It has been found to be an important predictor of FDI flows in the literature (Inglesi-Lotz & Ajmi, 2021). The same pattern is observed for FDI from the Global North, and for FDI to non-LDCs. The coefficient of the landlocked dummy is negative throughout most estimations, but is not significant. Landlocked countries, because of their remoteness and lack of direct access to ports and maritime routes, are exposed to higher transport and transit costs which is expected to negatively affect business operations, logistic performance and input costs of firms. In case of the food and beverages sector, this might even be more important when inputs or final products are highly perishable (Phuntakey, 2020). However, because FDI in the food and beverages sector is mainly put in place to serve domestic consumers, the limited international connectedness may not be as important as long as access to local input and output markets is granted.

Finally, policy variables, including tax incentives and governance indicators, do matter as well for how attractive a host country appears to foreign investors. Lower taxes are an effective incentive for investors from the Global South only (Column 3). In line with the institutional theory (Bénassy-Quéré et al., 2007), quality of governance in the host country plays an important role in foreign investors’ location decision. In particular, the coefficient of democratic quality turns out positive and significant. An improvement in democratic quality by one standard deviation13 is associated with an increase in planned FDI by more than half. This effect is observed for total FDI, FDI from the Global North and FDI to non-LDCs. This result is in line with earlier evidence from Africa (Asiedu, 2006; Morisset, 2000; Naudé & Krugell, 2007). While the coefficients of institutional factors are not significant in case of FDI from the Global South (Column 3), Munjal et al. (2022) find significant effect of institutional quality on the Indian FDI, but not on the Chinese FDI to Africa.

The findings presented in Table 1 are broadly in line with the earlier literature on FDI determinants in Africa, especially with respect to the importance of market potential and natural resources (Asiedu, 2006). In addition, these results point to systematic differences between FDI from the Global North and Global South. While both types of investors are mainly attracted by the market potential that African countries represent, investors from the Global North are also attracted by land availability, infrastructure and democracy in the host countries. In contrast with the debates on land grabs by investors from the Global South, including Gulf countries and China (see, e.g., the discussion in Allan et al., 2013), the figures in Table 1 do not offer evidence that these investors are motivated by access to land. It is important to note, however, that the variance of FDI inflows from the Global South is only half of the variance of FDI inflows from the Global North, which can affect how precise the estimates are.

Having established the benchmark specification, the remainder of this section discusses the evidence on the importance of the host country's agricultural sector performance in attracting food and beverages FDI. It is expected that foreign investors in the food and beverages sector might prefer to locate their investments in countries with better performing agricultural sector and where agriculture features more prominently in the private and public investment. African agriculture, despite positive developments over recent years, remains largely undercapitalized, compared with other regions of the world (Kubik, 2021). In consequence, the development of agro-industries is hampered by poor vertical coordination with domestic farming and a limited ability of local farmers to consistently procure reliable quality raw materials which forces agro-industries to rely on raw material imports (Hollinger & Staatz, 2015).

Table 2 presents the results of the benchmark specification augmented with alternative agricultural variables as specified above. For simplicity, only the coefficients of the agricultural variables are reported in Table 2. Full regression results for total planned FDI are reported in Table A4 in the Appendix. The figures in Table 2 emphasize the relevance of agricultural variables in shaping the perceptions of prospective foreign investors. With the exception of government expenditure, coefficients of all other agricultural variables turn out to be positive and significant in most specifications. In particular, proxies of capital investment appear to be strongly associated with planned FDI. A 1% increase in agricultural GFCF is associated with an increase in planned FDI by between 0.14% and 0.63%, and a 1% increase in the agricultural net capital stock is associated with an increase in planned FDI by between 0.12% and 0.57%, depending on the type of FDI origin and host countries. The evidence for public investment in agriculture, whether domestic or foreign, is less strong. Government expenditure is only significant for the non-LDCs and ODA for the total FDI, FDI originating from the Global North and the Global South.

Strikingly, the evidence is missing for LDCs as none of the agricultural variables is statistically significant in Column 4, in contrast to non-LDCs. This finding does not appear to be driven by a different composition of investments, as the ranking and the shares of subsectors are roughly similar for LDCs and non-LDCs, despite the fact that the former receive much less of them in absolute terms (Table A5 in the Appendix). The only notable difference is that the share of crop production is lower in LDCs compared to non-LDCs, at 7% compared with 12%, respectively, while the share of pesticides and fertilizer is higher, at 52% compared with 39%, respectively.14 On the other hand, there are clear differences between the two groups of countries in terms of the agricultural sector performance indicators, with LDCs reporting worse outcomes, that is, the average net capital stock of a LDC is roughly a fifth of that of a non-LDC, and the average agricultural value added is less than a third of that of a non-LDC (Table A6 in the Appendix). Importantly, not only the reported means are lower for the LDCs, but also the standard deviations—which may affect the precision of the estimates for the LDCs.

Taken together, these findings show that for foreign investors in the food and beverages sector, agricultural sector performance is an important factor in their investment decision. Capital investment in agriculture, whether private of public, plays an essential role in creating a conducive environment for the agriculture sector directly, but also indirectly for the agro-industries. Supposedly, capital investment in agriculture may send a positive signal to the prospective foreign investors. Importantly, the results in Table 2 suggest that complementarities exist between private and public financial flows to Africa. This is in line with earlier evidence on the aggregate FDI and ODA flows (Yasin, 2005). On the other hand, it is puzzling that none of the indicators of agricultural sector performance is significant for the LDCs. In case of these countries, only market potential, as proxied by the GDP per capita, its growth rate, and population size, appear to matter for prospective foreign investors.

7 ROBUSTNESS

The robustness of the results presented above may be compromised for several reasons. First, because of how the dependent variable is measured, and second, because of the potential endogeneity bias which remains unaddressed by the random effects model. To assess the extent to which these issues affect the main findings, a set of robustness checks is performed below.

7.1 Alternative measures of the dependent variable

The measure of planned FDI used in this paper is comprehensive and reflects all elements of the food and beverages value chain. While this is considered an advantage, it may also represent some challenges. For instance, the measure of planned FDI includes foreign investment in the fertilizer sector.15 It may be expected that the drivers of investments in this sector are different compared to other subsectors of the food and beverages. In particular, it is well-known that fertilizer production is exposed to unique supply-side constraints, mainly in terms of the access to natural resources, such as natural gas, phosphate rock, sulfur, and potassium salts (Gregory & Bumb, 2006). In addition, investments in the fertilizer sector usually comprise relatively few large-scale investment deals. For instance, in the data at hand, these investments constitute only 8% of the total number of FDI deals, but close to a half of the total FDI value over the 2003–2017 period. Hence, they may also be considered as important outliers and affect the distribution of the data.

To account for that, Column 2 in Table 3 reports the estimates of planned FDI in the food and beverages sector excluding fertilizer. In addition, Column 3 reports the estimates of planned FDI in the food and beverages sector according to the narrow definition that corresponds to the SIC classification. Finally, following Amighini and Sanfilippo (2014) who consider that the value of investments reported in the fDi Markets dataset is not entirely reliable, Column 4 reports the estimates of the number of planned FDI deals. Because this is a count variable, a Poisson panel regression model is used in Column 4.16 For comparison, the benchmark regression results are reported in the first column. The figures in Table 3 suggest that the principal results are not sensitive to the alternative measures of the dependent variable, with the exception of the coefficients of electricity and democratic quality. Most importantly, however, the agricultural variables remain highly significant, as evidenced by agricultural land in Table 3, and the alternative agricultural variables reported in Table A7 in the Appendix.

| Food and beverages | ||||

|---|---|---|---|---|

| Benchmark | Excluding fertilizer | SIC | Deals | |

| Planned FDI (total) | ||||

| (million US$, log) | (count) | |||

| (1) | (2) | (3) | (4) | |

| GDP pc growth (%) | 2.600** | 2.368** | 2.056** | 2.634** |

| (1.100) | (1.028) | (1.015) | (1.145) | |

| GDP pc (US$), log | −0.111 | −0.0148 | 0.0607 | −0.0200 |

| (0.244) | (0.212) | (0.193) | (0.338) | |

| Population (million) | 0.0330*** | 0.0306*** | 0.0319*** | 0.0215** |

| (0.00653) | (0.00538) | (0.00496) | (0.0105) | |

| Electricity (% of population) | 0.0179** | 0.00938 | 0.00184 | 0.0118 |

| (0.00846) | (0.00728) | (0.00692) | (0.0110) | |

| Landlocked, dummy (1 = yes) | −0.0794 | −0.153 | −0.110 | −0.172 |

| (0.354) | (0.337) | (0.329) | (0.485) | |

| Tax (% of profits) | −0.000889 | −0.000905 | −0.000942 | −0.00265 |

| (0.000982) | (0.000853) | (0.000855) | (0.00414) | |

| Democratic quality (index) | 0.590* | 0.555* | 0.675** | 0.797 |

| (0.308) | (0.292) | (0.273) | (0.543) | |

| Delivery quality (index) | −0.108 | −0.0860 | −0.204 | −0.304 |

| (0.422) | (0.372) | (0.350) | (0.659) | |

| Agricultural land (km2), log | 0.256*** | 0.219*** | 0.156** | 0.478*** |

| (0.0787) | (0.0755) | (0.0720) | (0.0873) | |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Constant | −1.159 | −1.845 | −1.960 | −6.536 |

| (3.345) | (2.989) | (2.698) | (4.923) | |

| Number of observations | 682 | 682 | 682 | 682 |

- Note: Standard errors in parentheses.

- Abbreviations: FDI, foreign direct investment; GDP, gross domestic product; SIC, standard industrial classification.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author’ sown calculations. Random effects model with cluster-robust standard errors in Columns 1–3. Poisson panel regression model in Column 4; coefficients are reported. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Column 1: total FDI as defined in the data section. Column 2: total FDI excluding fertilizer sector. Column 3: total FDI in the food and beverages sector as defined by the SIC. Column 4: total number of FDI deals.

7.2 Omitted variable bias

The major shortcoming of the random effects model used throughout the paper is that it does not address the potential sources of endogeneity that may be present in the estimation. Because the consistency of the random effects estimator relies on the assumption that the unobserved effect is uncorrelated with the explanatory variables, the problem of the omitted variable bias cannot be ruled out. This and other sources of endogeneity have often been addressed in earlier literature by employing a dynamic model, such as the Arellano–Bond difference-GMM or the system-GMM estimator from Arellano and Bover (1995) and Blundell and Bond (1998). Such models do not only allow to handle the dynamic structure of the data, but are also able to deal with fixed effects and endogenous regressors (Roodman, 2009a, 2009b).

While the structure of the data at hand does not justify the use of the difference-GMM or the system-GMM as the preferred specification—mainly due to the consistently insignificant lagged dependent variable on the one hand, and the small sample size on the other, as explained in Section 5, nevertheless the properties of the GMM estimator may help address the potential omitted variable bias present in the random effects estimator. Table 4 reports the results of the one-step system-GMM estimator. Because of the low number of countries, 49, relative to the number of years, 15, the problem of too many instruments (Roodman, 2009b) consistently arises when using the yearly data, as evidenced by the number of instruments and the suspicious behavior of the difference-in-Hansen test, even after reducing the instrument count.

| Planned FDI (million US$), log | ||||||

|---|---|---|---|---|---|---|

| Random effects | System-GMM | |||||

| Total | North | South | Total | North | South | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Planned FDI (million US$, log), log | 0.0355 | 0.140 | −0.0354 | |||

| (0.139) | (0.141) | (0.139) | ||||

| GDP pc growth (%) | 0.810 | −1.170 | 6.102* | 8.036 | 2.864 | −3.514 |

| (4.154) | (3.719) | (3.227) | (25.45) | (20.68) | (18.60) | |

| GDP pc (US$), log | −0.647 | −0.613 | −0.176 | −0.357 | −0.372 | −0.249 |

| (0.437) | (0.403) | (0.317) | (0.557) | (0.485) | (0.426) | |

| Population (million) | 0.0344*** | 0.0292*** | 0.0374*** | 0.0336*** | 0.0256*** | 0.0395*** |

| (0.00818) | (0.00561) | (0.00987) | (0.00947) | (0.00669) | (0.0110) | |

| Electricity (% of population) | 0.0392*** | 0.0435*** | 0.00804 | 0.0316** | 0.0339*** | 0.00968 |

| (0.0134) | (0.0125) | (0.0104) | (0.0144) | (0.0117) | (0.0124) | |

| Landlocked, dummy (1 = yes) | −0.178 | 0.0431 | −0.242 | −0.184 | 0.0271 | −0.121 |

| (0.598) | (0.538) | (0.467) | (0.652) | (0.514) | (0.513) | |

| Tax (% of profits) | −0.00440* | −0.00321 | −0.00340* | 0.00229 | 0.00215 | −0.00176 |

| (0.00236) | (0.00226) | (0.00186) | (0.00477) | (0.00389) | (0.00374) | |

| Democratic quality (index) | 1.216 | 0.859 | 0.743 | 1.057 | 0.694 | 0.884 |

| (0.794) | (0.713) | (0.644) | (0.862) | (0.689) | (0.682) | |

| Delivery quality (index) | −0.655 | −0.486 | −0.172 | −0.418 | −0.251 | −0.144 |

| (0.955) | (0.893) | (0.735) | (0.999) | (0.832) | (0.797) | |

| Agricultural land (km2), log | 0.533*** | 0.525*** | 0.176* | 0.527*** | 0.474*** | 0.223* |

| (0.121) | (0.114) | (0.100) | (0.141) | (0.112) | (0.120) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 3.485 | 2.401 | 1.065 | −0.574 | −0.440 | 1.591 |

| (6.211) | (5.819) | (4.090) | (7.434) | (6.868) | (5.336) | |

| Number of observations | 193 | 193 | 193 | 192 | 192 | 192 |

| Number of groups | 49 | 49 | 49 | |||

| Number of instruments | 20 | 20 | 20 | |||

| Hansen test of overidentification restrictions (p value) | 0.285 | 0.437 | 0.434 | |||

- Note: Standard errors in parentheses.

- Abbreviations: FDI, foreign direct investment; GDP, gross domestic product; GMM, generalized method of moments.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author's own calculations. Random effects model with cluster-robust standard errors in Columns 1–3. One-step system-GMM model with cluster-robust standard errors in Columns 4–6. All estimations based on data aggregated over 3-year periods. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Columns 1 and 3: total FDI. Columns 2 and 4: FDI originating from the Global North. Columns 3 and 6: FDI originating from the Global South.

To overcome this issue, instead of yearly observations, the data was aggregated into 3-year observations which significantly reduced the count of instruments. For comparison, the random effects estimates based on the same data structure are provided in Columns 1–3 of Table 4. The system-GMM results for total planned FDI are reported in Column 4, FDI originating from the Global North in Column 5, and Global South in Column 6. The results for the sample of LDCs and non-LDCs are omitted as such disaggregation would further reduce the number of observations again inflating the instrument count. The results including the additional set of agricultural variables are available in Table A8 in the Appendix. In this specification, apart from the lagged dependent variable, one additional potentially endogenous regressor, the corporate tax rate, is also instrumented with the lagged value.

The figures in Table 4 reveal several observations. First, as mentioned above, the lagged dependent variable turns out not significant in all columns.17 Second, most of the principal regressors behave similarly in both the random effects and the system-GMM models. Hence, it can be cautiously asserted that the results of the random effects model are robust and that the potential omission variable bias is not a serious threat to the main results. Importantly, the agricultural variables, that is, agricultural land as specified in Table 4 and alternative measures as reported in Table A8 in the Appendix, remain highly significant, with the only exception of the value of agricultural production in two of the three columns. On the other hand, it is noteworthy that two variables, government expenditure on agriculture and ODA to agriculture, which were significant only is some cases in the random effects model, turn out to be significant in the system-GMM model, with a large increase in the magnitude of their respective coefficients.

8 CONCLUSION

Using a novel dataset on FDI, this paper analyzes the correlates of planned FDI in the food and beverages sector in 49 African countries over the period 2003–2017. It examines which factors are associated with FDI in the food and beverages sector in Africa, and to which extent policy-makers can influence how attractive their countries are to the prospective foreign investors. More specifically, it hypothesizes that the performance of the host country's agricultural sector, for instance in terms of production, value added, private and public investment, and the availability of agricultural land, plays a major role in the choice of investment location by foreign investors seeking to establish robust supply chain linkages. The analysis distinguishes between FDI from the Global North and the Global South and between FDI to LDCs and non-LDCs.

The results indicate that investments are driven by the potential that a domestic emerging consumer class represents, and that investors choose large and fast-growing markets. At the same time, a well-performing and well-capitalized agricultural sector of the host country appears to be a key factor associated with the choice of investment location by foreign investors, especially those from the Global North. Capital investment in agriculture, as proxied by agricultural GFCF and net capital stock, is particularly important. In addition, public investment in agriculture, in the form of ODA and government expenditure, is also associated with higher FDI, even though the evidence is less strong. The agricultural sector performance is particularly relevant for non-LDCs. The evidence is, however, missing for LDCs. In case of LDCs, only market potential, both in terms of market size and market dynamics, appears to be associated with FDI.

Systematic differences exist between the determinants of planned FDI flows from the Global North compared to the Global South. While both are mainly attracted by the market potential that the African food market represents, investors from the Global North also value the availability of agricultural land, infrastructure, and democracy. The same pattern is observed for FDI in non-LDCs, which is not surprising considering that investors from the Global North invest more in the higher-income African countries. Tax incentives are only important for the investors from the Global South.

The results suggest that complementarities may exist between different types of investments and that policy-makers willing to attract food and beverages FDI should prioritize agricultural sector development. This can be achieved by providing more public investment to agriculture by the governments of the host countries, and by international donors. Essentially, however, policy-makers should also enhance private investment in agriculture by creating an appropriate enabling environment. In fact, private investment, especially by farmers themselves, remains by far the largest source of capital in agriculture in low- and middle-income countries, also in Africa (FAO, 2012; Kubik, 2021). While it is not part of the analysis in this paper, future research may look at the role of other forms of investments, for instance investment in the agricultural research and development.

On the other hand, the lack of evidence in case of the LDCs, where the agricultural sector performance is not significantly associated with the food and beverages FDI, is puzzling. This is also somewhat disappointing, especially considering the role that agricultural development often plays in the poverty reduction policies. LDCs receive much less FDI in the food and beverages sector while, at the same time, they could reap higher benefits of the foreign investment compared to more developed countries. Perhaps, for prospective foreign investors, there exist a certain threshold in the host country's level of development, as reflected by the income per capita and income growth, below which the investment decisions are solely driven by the host country's market potential. On the other hand, supply-side factors, like the agricultural sector performance in the case of this paper, are more likely to become a source of comparative advantage within more complex supply chains which, in turn, are more likely to be established in more developed countries. The paucity of data does not allow to investigate the structure and extent of the supply chains that foreign investors build in different groups of countries. Nevertheless, this could be a potential avenue for future research that could help explain FDI in LDCs in more detail.

The paper suffers from several important limitations. First, it looks at the planned—instead of implemented—FDI projects. Hence, the results with respect to specific variables should be interpreted in terms of the determinants of foreign investors’ perceptions of the host countries, rather than factors that actually bring real investment flows into the economy. Second, because of limited availability of yearly data for many countries in the sample, the selection of standard explanatory variables remains narrow compared with the literature. Third, the econometric specification employed in this paper does not eliminate all sources of endogeneity; in particular, the risk of the omitted variable bias. Nevertheless, the main results remain robust to alternative specifications.

ACKNOWLEDGMENTS

This study was developed in the context of the Program of Accompanying Research on Agricultural Innovation (PARI), supported by the Federal German Ministry for Economic Cooperation and Development (BMZ). Grant number 2014.0690.9. Open Access funding enabled and organized by Projekt DEAL.

APPENDIX:

| Variable name | Description | Source |

|---|---|---|

| Planned FDI (million US$) | FDI inflows in the food and beverages sector. In millions of constant 2010 US$. Planned investments. | fDi Markets, Financial Times (www.fdimarkets.com; accessed January 16, 2018) |

| Planned FDI deals (count) | FDI deals in the food and beverages sector. Number of projects. Planned investments. | fDi Markets, Financial Times |

| GDP pc (US$) | Gross domestic product per capita. In 2010 US$. | FAOSTAT |

| GDP pc growth (%) | Annual growth rate of gross domestic product per capita. In percent. | FAOSTAT |

| Population (million) | Population. In millions. | FAOSTAT |

| Agricultural land (km2) | Agricultural land (land area, i.e., arable, under permanent crops, and under permanent pastures). In km2. | World Development Indicators, WB |

| Electricity (% of population) | Percentage of population with access to electricity. | World Development Indicators, WB |

| Landlocked, dummy (1 = yes) | Dummy equal to 1 if a country is landlocked. | n.a. |

| Tax (% of profits) | Taxes and contributions (including profit tax, labor taxes and contributions, and other taxes and contributions) as a percentage of profits. | Doing Business, WB |

| Delivery quality (index) | Mean of government effectiveness, regulatory quality, and control of corruption indices. | Worldwide Governance Indicators, WB |

| Democratic quality (index) | Mean of voice and accountability, political stability, and rule of law. | Worldwide Governance Indicators, WB |

| Agricultural production | Gross production value. In millions of constant 2010 US$. | FAOSTAT |

| Agricultural value added | Value added in agriculture. In millions of constant 2010 US$. | FAOSTAT |

| Agricultural GFCF | Gross fixed capital formation in agriculture. In millions of constant 2010 US$. | FAOSTAT |

| Agricultural net capital stock | Net capital stock in agriculture. In millions of constant 2010 US$. | ESS-FAO |

| Government expenditure on agriculture | General government expenditure on agriculture. In millions of constant 2010 US$. | IMF COFOG, WEO, FAOSTAT and IFPRI SPEED |

| Agricultural ODA | Official development assistance (ODA) to agriculture. In millions of constant 2010 US$. | OECD |

- Abbreviations: FDI, foreign direct investment; GDP, gross domestic product; OECD, Organisation for Economic Co-operation and Development.

- Source: Author's own elaboration.

| Mean | Standard deviation | |

|---|---|---|

| (1) | (2) | |

| Planned FDI (million US$) | 60.15 | 244.04 |

| Planned FDI (million US$) North | 33.80 | 143.41 |

| Planned FDI (million US$) South | 26.35 | 188.2 |

| GDP pc growth (%) | 0.20 | 0.08 |

| GDP pc (US$) | 2413.70 | 3472.91 |

| Population (million) | 18.51 | 26.64 |

| Electricity (% of population) | 40.69 | 29.202 |

| Landlocked, dummy (1 = yes) | 0.26 | 0.44 |

| Tax (% of profits) | 45.74 | 15.86 |

| Democratic quality (index) | −0.64 | 0.69 |

| Delivery quality (index) | −0.70 | 0.59 |

| Agricultural land (km2) | 193,586.30 | 208,316.90 |

| Ag. VA (million US$) | 4914.70 | 11,281.88 |

| Ag. prod. (million US$) | 5681.16 | 8053.53 |

| Ag. GFCF (million US$) | 315.87 | 610.82 |

| Ag. net capital stock (million US$) | 4146.93 | 7504.67 |

| Ag. gov. expenditure (million US$) | 261.50 | 460.24 |

| Ag. ODA (million US$) | 52.71 | 80.28 |

| Number of observations | 682 |

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. gov. expenditure, government expenditure on agriculture; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. prod., agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment; GDP, gross domestic product.

- Source: Author's own elaboration.

| Test for multiple breaks at unknown break dates | ||||

|---|---|---|---|---|

| Ditzen et al. (2021) | ||||

| H0: no break(s) versus H1: 1 < = s < = 3 break(s) | ||||

| Panel A | Planned FDI (million US$) | |||

| Bai & Perron critical values | ||||

| Test statistic | 1% critical value | 5% critical value | 10% critical value | |

| W(τ) | 6.4 | 12.37 | 8.88 | 7.46 |

| Estimated breakpoints: 2010 & 2012 | ||||

| Panel B | Planned FDI deals (count) | |||

| Bai & Perron critical values | ||||

| Test statistic | 1% critical value | 5% critical value | 10% critical value | |

| W(τ) | 17.34 | 12.37 | 8.88 | 7.46 |

| Estimated breakpoints: 2007 | ||||

- Abbreviation: FDI, foreign direct investment.

- Source: Author's own elaboration.

| Planned FDI (million US$), log (total) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| GDP pc growth (%) | 2.076 | 2.822** | 2.269 | 3.136** | 2.403 | 1.580 |

| (1.292) | (1.239) | (1.417) | (1.259) | (1.565) | (1.226) | |

| GDP pc (US$), log | 0.0457 | 0.230 | −0.128 | −0.0668 | −0.0854 | 0.0760 |

| (0.220) | (0.245) | (0.226) | (0.208) | (0.280) | (0.262) | |

| Population (million) | 0.0251*** | 0.0279*** | 0.0255*** | 0.0239*** | 0.0334*** | 0.0359*** |

| (0.00721) | (0.00896) | (0.00629) | (0.00653) | (0.00626) | (0.00675) | |

| Electricity (% of population) | 0.0116 | 0.00408 | 0.0117 | 0.00691 | 0.00862 | 0.0129 |

| (0.00733) | (0.00870) | (0.00744) | (0.00685) | (0.0100) | (0.00809) | |

| Landlocked, dummy (1 = yes) | 0.0762 | −0.299 | −0.0613 | −0.335 | −0.333 | −0.0661 |

| (0.316) | (0.379) | (0.313) | (0.314) | (0.381) | (0.331) | |

| Tax (% of profits) | −0.00148 | −0.000962 | −0.00215* | −0.00269*** | −0.00118 | −0.00140 |

| −0.00148 | −0.000962 | −0.00215* | −0.00269*** | −0.00118 | −0.00140 | |

| Democratic quality (index) | 0.595** | 0.350 | 0.485 | 0.392 | 0.316 | 0.403 |

| (0.289) | (0.332) | (0.302) | (0.297) | (0.342) | (0.275) | |

| Delivery quality (index) | −0.154 | 0.106 | −0.135 | 0.00534 | 0.0833 | −0.0330 |

| (0.376) | (0.411) | (0.334) | (0.358) | (0.460) | (0.372) | |

| Ag. VA (million US$), log | 0.387*** | |||||

| (0.113) | ||||||

| Ag. prod. (million US$), log | 0.423*** | |||||

| (0.131) | ||||||

| Ag. GFCF (million US$), log | 0.405*** | |||||

| (0.0888) | ||||||

| Ag. net capital stock (million US$), log | 0.435*** | |||||

| (0.0768) | ||||||

| Ag. gov. expenditure (million US$), log | 1.120 | |||||

| (0.719) | ||||||

| Ag. ODA (million US$), log | 0.171*** | |||||

| (0.0647) | ||||||

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −3.002 | −5.416 | 0.327 | −1.326 | 1.774 | −1.451 |

| (3.113) | (3.692) | (3.169) | (2.899) | (3.784) | (3.574) | |

| Number of observations | 682 | 682 | 682 | 682 | 682 | 682 |

- Note: Standard errors in parentheses.

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. gov. expenditure, government expenditure on agriculture; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. prod., agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment; GDP, gross domestic product.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author's own calculations. Random effects model with cluster-robust standard errors. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: total planned FDI in the food and beverages sector.

| Subsector | Planned FDI (million US$, total 2003-2017) | Share (%) | |

|---|---|---|---|

| Panel A: LDCs | |||

| 1 | Pesticide, fertilizers and other agricultural chemicals | 8913.41 | 52.00 |

| 2 | Breweries and distilleries | 1927.13 | 11.24 |

| 3 | Crop production | 1229.60 | 7.17 |

| 4 | Sugar and confectionary products | 974.77 | 5.69 |

| 5 | Soft drinks and ice | 711.53 | 4.15 |

| 6 | Grains and oilseed | 480.20 | 2.80 |

| 7 | Coffee and tea | 385.60 | 2.25 |

| 8 | Animal slaughtering and processing | 380.26 | 2.22 |

| 9 | Dairy products | 374.77 | 2.19 |

| 10 | Tobacco | 265.80 | 1.55 |

| No. of observations | 416 | ||

| Panel B: non-LDCs | |||

| 1 | Pesticide, fertilizers and other agricultural chemicals | 12,411.24 | 38.58 |

| 2 | Crop production | 3854.37 | 11.98 |

| 3 | Sugar and confectionary products | 3128.81 | 9.73 |

| 4 | Breweries and distilleries | 2478.65 | 7.71 |

| 5 | Soft drinks and ice | 1598.91 | 4.97 |

| 6 | Alumina and aluminum production and processing | 892.66 | 2.78 |

| 7 | Snack food | 784.85 | 2.44 |

| 8 | Dairy products | 723.02 | 2.25 |

| 9 | Grains and oilseed | 654.15 | 2.03 |

| 10 | Paints, coatings, additives, and adhesives | 582.00 | 1.81 |

| No. of observations | 266 |

- Source: Author's own elaboration. Panel A: least developed countries (LDCs). Panel B: non-LDCs. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. LDCs: Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Congo Dem. Rep., Djibouti, Ethiopia, The Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Sudan, Sudan, Tanzania, Togo, Uganda, and Zambia.

| LDCs | Non-LDCs | |||

|---|---|---|---|---|

| Mean | Standard deviation | Mean | Standard deviation | |

| (1) | (2) | (3) | (4) | |

| Planned FDI (million US$) | 35.16 | 227.01 | 96.51 | 263.02 |

| Agricultural land (sq. km.) | 180,382.20 | 177,458.60 | 212,975.00 | 24,5678.00 |

| Ag. VA (million US$) | 2350.18 | 3309.81 | 8586.63 | 16,470.90 |

| Ag. prod. (million US$) | 3246.43 | 2901.37 | 8656.94 | 10,858.79 |

| Ag. GFCF (million US$) | 142.76 | 240.50 | 545.17 | 836.38 |

| Ag. net capital stock (million US$) | 1664.73 | 2478.68 | 7456.52 | 10,207.29 |

| Ag. gov. expenditure (million US$) | 134.22 | 149.94 | 402.92 | 620.24 |

| Ag. ODA (million US$) | 56.59 | 77.09 | 47.50 | 84.50 |

| Number of observations | 416 | 266 | ||

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. gov. expenditure, government expenditure on agriculture; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. prod., agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment.

- Source: Author's own elaboration. Columns 1–2: least developed countries (LDCs). Columns 3-4: non-LDCs. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. LDCs: Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Congo Dem. Rep., Djibouti, Ethiopia, The Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Sudan, Sudan, Tanzania, Togo, Uganda, and Zambia.

| Food and beverages | ||||

|---|---|---|---|---|

| Benchmark | Excluding fertilizer | SIC | Deals | |

| Planned FDI (total) (million US$, log) | ||||

| (1) | (2) | (3) | (4) | |

| Ag. VA (million US$), log | 0.387*** | 0.325*** | 0.256*** | 0.761** |

| (0.113) | (0.0972) | (0.0953) | (0.349) | |

| Ag. prod. (million US$), log | 0.423*** | 0.379*** | 0.302** | 0.662 |

| (0.131) | (0.116) | (0.118) | (0.412) | |

| Ag. GFCF (million US$), log | 0.405*** | 0.367*** | 0.292*** | 0.594 |

| (0.0888) | (0.0855) | (0.0790) | (0.453) | |

| Ag. net capital stock (million US$), log | 0.435*** | 0.420*** | 0.354*** | 0.841*** |

| (0.0768) | (0.0716) | (0.0732) | (0.120) | |

| Ag. gov. expenditure (million US$), log | 1.120 | 1.044 | 0.780 | 0.389 |

| (0.719) | (0.745) | (0.712) | (0.270) | |

| Ag. ODA (million US$), log | 0.171*** | 0.135* | 0.0937 | 0.155 |

| (0.0647) | (0.0694) | (0.0608) | (0.136) | |

| Control variables | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Number of observations | 682 | 682 | 682 | 682 |

- Note: Standard errors in parentheses.

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. gov. expenditure, government expenditure on agriculture; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. prod., agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment; SIC, standard industrial classification.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author’ sown calculations. Random effects model with cluster-robust standard errors in columns 1–3. Poisson panel regression model in column 4; coefficients are reported. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Column 1: total FDI as defined in the data section. Column 2: total FDI excluding fertilizer sector. Column 3: total FDI in the food and beverages sector as defined by the SIC. Column 4: total number of FDI deals. Control variables included and specified as in Table 1.

| Planned FDI (million US$, log) | |||

|---|---|---|---|

| Total | North | South | |

| (1) | (2) | (3) | |

| Ag. VA (million US$), log | 0.809*** | 0.654*** | 0.408*** |

| (0.207) | (0.181) | (0.142) | |

| Ag. prod. (million US$), log | 0.521 | 0.626** | 0.390 |

| (0.343) | (0.233) | (0.285) | |

| Ag. GFCF (million US$), log | 0.751*** | 0.587*** | 0.449*** |

| (0.182) | (0.176) | (0.136) | |

| Ag. net capital stock (million US$), log | 0.885*** | 0.703*** | 0.476*** |

| (0.188) | (0.154) | (0.118) | |

| Ag. gov. expenditure (million US$), log | 1.806* | 1.839* | 0.886 |

| (1.060) | (1.078) | (1.071) | |

| Ag. ODA (million US$), log | 0.713*** | 0.519*** | 0.518** |

| (0.207) | (0.190) | (0.216) | |

| Control variables | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

| Number of observations | 192 | 192 | 192 |

| Number of groups | 49 | 49 | 49 |

| Number of instruments | 20 | 20 | 20 |

| Hansen test of overidentification restrictions (p value) | 0.257 | 0.311 | 0.547 |

- Note: Standard errors in parentheses.

- Abbreviations: Ag. GFCF, agricultural gross fixed capital formation; Ag. gov. expenditure, government expenditure on agriculture; Ag. net capital stock, agricultural net capital stock; Ag. ODI, official development assistance to agriculture; Ag. prod., agricultural production; Ag. VA, agricultural value added; FDI, foreign direct investment; GMM, generalized method of moments.

- * p < 0.10

- ** p < 0.05

- *** p < 0.01.

- Source: Author's own calculations. One-step system-GMM model with cluster-robust standard errors. All estimations based on data aggregated over 3-year periods. The sample includes all African countries except for Eritrea, Libya, Niger, Seychelles, and Somalia. Dependent variable: planned FDI in the food and beverages sector. Column 1: total FDI. Column 2: FDI originating from the Global North. Column 3: FDI originating from the Global South. Control variables included and specified as in Table 1.

Biography

Zaneta Kubik is a development economist. She obtained her PhD from the University of Paris 1 Panthéon Sorbonne. Currently, she works as a senior researcher at the Center for Development Research (ZEF), University of Bonn.

Open Research

DATA AVAILABILITY STATEMENT