Effects of COVID-19 on U.S. Aquaculture Farms

Editor in charge: Craig Gundersen

Abstract

The U.S. aquaculture industry has experienced disruptions due to the global COVID-19 pandemic. Responses from 537 U.S. aquaculture farms and businesses, collected through an online survey, revealed that the primary impact has been the disruption of traditional marketing channels. This has resulted in a cascade of effects, including the loss of revenue, consequences for farm labor, difficulty securing production inputs and services, and management challenges from on-farm inventory of unsold fish/shellfish. Results from the Quarter 1 survey confirm that COVID-19 has, and will continue to, negatively affect U.S. aquaculture for the duration of 2020, and possibly longer.

1 INTRODUCTION

On January 20, 2020, the United States of America (U.S.) reported its first confirmed case of the novel coronavirus disease 2019n-CoV (COVID-19) (Holshue et al., 2020). The declaration of a national emergency on March 13 by the U.S. government triggered a cascade of actions and measures that spread across the nation, as citizens and governments responded to protect public health (CDC, 2020; Office of the Federal Register, 2020). A critical element of this response was the closure of non-essential business and the implementation of social distancing policies to prevent the further spread of COVID-19 (Prem et al., 2020). Agriculture and food production, including aquaculture, were formally defined as essential services by the Department of Homeland Security (DHS), and the operation of farms could continue (DHS, 2020). Reports have begun to emerge on the effects of COVID-19 on various sectors of agriculture, including various grain crops, forestry and wood products, and the meat processing industry, among others (Lusk et al., 2020). Most of these reports have relied on analyses of ongoing data series compiled by USDA and other agencies. There are no equivalent data reporting systems in place for U.S. aquaculture. Moreover, aquaculture is unique because it produces aquatic animals that must be handled and treated differently during production, transportation, and sales. Despite the continuation of operations, the U.S. aquaculture industry has suffered economic hardships because of the COVID-19 pandemic, primarily from the loss of major market channels and the interruption of other related economic sectors. In response to troubling communications from industry members, a formal investigation was launched to document and assess the effects and impacts of COVID-19 on the U.S. aquaculture and aquaponics industry. This paper summarizes the effects reported by U.S. aquaculture producers through a national survey and discusses the implications of these effects on the industry. This study will continue to collect data from producers quarterly throughout 2020; the results summarized and discussed here are from the first quarter survey, covering the period from January 1 to March 23, 2020 (van Senten et al., 2020a, 2020b, 2020c).

Globally about half of all seafood is produced by aquaculture, estimated to be 114.5 million metric tons live weight and $263.3 billion in farm gate value in 2018 (FAO, 2020). In 2017 the U.S. was ranked 17th among global aquaculture producing countries, having produced 284 thousand metric tons of marine and freshwater products (NMFS, 2020). U.S. aquaculture production had an estimated value of $1.46 billion in 2017, accounting for 21% of total U.S. seafood production value (NMFS, 2020). Although considered to be only a minor producer, the U.S. was the largest importer of seafood products in 2017, with approximately 90% of all seafood consumed, by weight, imported from abroad (NOAA, 2020). The U.S. aquaculture industry is highly diverse, encompassing the production of aquatic animals (and plants) for human consumption, recreation, conservation, ornamental purposes, and research. Aquaculture also supports the U.S. commercial fishing industry, with approximately 40% of all salmon caught in Alaska and 80–90% of Pacific Northwest salmon originating from hatcheries (NOAA, 2020). The primary segments of U.S. freshwater aquaculture are catfish, crawfish, and trout; whereas mollusks (oysters, clams, mussels) account for the largest segment of marine aquaculture production. Notably, the majority of U.S. aquaculture consists of family owned and operated farms that are classified as small business entities. One factor responsible for much of the economic hardship experienced by producers because of COVID-19 is that the majority of seafood (68%) in the U.S. is consumed outside of the home (NMFS, 2018). According to the 2018 USDA Census of Aquaculture, most segments of U.S aquaculture demonstrated low percentages of product sold directly to consumers; as was the case for foodfish (2%), sportfish (3%), and mollusks (4%) (USDA, 2019). Therefore, the closure of restaurants and food service establishments has had severe consequences for the U.S. aquaculture industry. The structure of market channels for aquaculture is an area that warrants further investigation to identify specific vulnerabilities and opportunities for improved resiliency and risk reduction in light of the COVID-19 pandemic.

2 METHODS

University-imposed restrictions on travel and research activities with the public, meant that the only viable option for disseminating a national survey in an accelerated time frame was to use an online distribution method. The survey instrument was developed in Qualtrics® (Seattle, Washington) and distributed via e-mail in collaboration with national, regional, and species-specific aquaculture industry associations and Extension agents. Respondents self-selected for participation, and there was no probabilistic sampling method used due to time constraints and challenges with establishing contact lists of producers nationwide. The survey instrument underwent a development and review process to ensure that it was “respondent friendly,” contained a welcome screen with instructions for respondents, presented questions in a conventional format, limited the length of questions, provided specific instructions on how to answer each question, and adhered to other guidelines as set forth by Dillman et al. (1998). Although on an accelerated timeline, the survey instrument did undergo a process of expert review, pretesting and revision, and IRB review (IRB#20–294). The survey instrument did not capture any personally identifiable information, and all individual responses were treated as confidential. The Quarter 1 survey covered the period from January 1 to March 23, 2020; the day the survey instrument was launched. Dissemination of the survey took place primarily via e-mail. The study was also advertised on social media platforms (including LinkedIn, Facebook, and Twitter). Following the initial announcement of the survey, two reminder notices were disseminated using the same distribution channels; the first reminder about halfway through the data collection period, the final reminder 2 days before termination of the survey on April 10. Survey responses were exported from Qualtrics® to Microsoft Excel® for further analysis and manipulation. Responses were screened, coded, and summarized using Microsoft Excel®.

The United States Department of Agriculture (USDA) announced the Coronavirus Food Assistance Program (CFAP) on April 17, 2020, following the closure of the survey. Given that no industry average price indexes are available for U.S. aquaculture, USDA published a request for “information in order to evaluate whether additional commodities suffered losses that should result in eligibility for CFAP” in the Federal Register on May 22, 2020 (Federal Register Notice 85 FR 31062–31,065). Aquaculture was included in this request for additional information. Industry stakeholders, led by the National Aquaculture Association, contacted the research team to see if survey responses could be used to estimate losses on aquaculture farms. Quarter 1 survey respondents had reported both lost sales due to the business closures during the shutdown and average total annual sales. To estimate the loss in value to aquaculture producers from COVID-19, the total lost sales reported by each individual observation in each species group category were divided by the total annual sales reported by that respondent. Given that the survey question requested ranges of values for both lost sales and total annual sales, the midpoint value for each range was used in the calculations. The percent losses in sales were then averaged across all observations within that species group. Because the USDA CFAP program was announced after the Quarter 1 survey had closed, respondents had no reason to believe their responses would influence policy or government payments.

3 RESULTS

3.1 General findings and characteristics of respondents

There were 652 recorded responses to the first quarter survey. After thorough examination of all responses, 537 were sufficiently complete to be usable for further analysis. This represented approximately 18% of the 2,932 U.S. aquaculture producers reporting on the 2018 Census of Aquaculture (USDA, 2019). Survey results not included in tables can be found either in van Senten et al. (2020a) or one of the 13 species or regional reports available at www.arec.vaes.vt.edu/arec/virginia-seafood/research/Impacts_of_COVID19.html. Ninety percent of survey respondents indicated that their farm or business had been impacted by the COVID-19 pandemic (van Senten et al., 2020c). Respondents represented all the major groups of U.S. aquaculture, with mollusk (41%) and foodfish (21%) producers making up most of the respondents (Table 1). Survey respondents included all scales of production, from less than $1,000 to more than $1 million, with most size ranges represented in similar proportions to those of the 2018 Census of Aquaculture (USDA, 2019), with the exception of a relatively greater proportion of respondents that sold more than $1 million (22% as compared to 9% in this size category in the census). The survey also included proportionately fewer respondents at the smallest production scale, those with sales less than $25,000 (13% as compared to 36% in the census). By geographic USDA aquaculture region, the percentages of survey respondents in the western, north central, and tropical/subtropical regions mirrored those in the census but appear to be somewhat over represented from the northeast region (26% in the survey compared to 18% in the census) and somewhat under represented in the southern region (49% in the survey as compared to 59% in the census). Respondents were also asked to identify the first point of sale for their products. Supply chains vary widely among segments of aquaculture due to the nature of the products and business models. Overall, 31% of respondents reported sales to distributors as their first point of sale, followed by 18% who reported direct to consumer sales, 16% to processors, 11% directly to restaurants, 8% to other producers, and 3% of respondents reported selling directly to grocery stores/supermarkets. As with other food supply chains, product sold from farms to either distributors or processors is further sold either to retail grocery stores/supermarkets or to the restaurant food-service sector. As expected, there was variability amongst the responding segments of U.S. aquaculture. Seventy-six percent of catfish respondents sold to processors, whereas only 14% of trout producers sold to processors. Mollusk (50%), ornamental (39%), and trout (36%) producers tended to sell more often to distributors, whereas sportfish (52%), aquaponics (43%), tilapia (39%), and ornamental (39%) producers tended to sell directly to consumers. The key findings that will be addressed further by this paper are the disruption of traditional marketing channels, challenges with farm labor, and challenges with obtaining goods and services from other related businesses.

| Segment of aquaculture | Percent of survey respondents | Percent on 2018 USDA Census |

|---|---|---|

| Mollusks | 41% | 30% |

| Foodfish | 21% | 37% |

| Other | 9% | 6% |

| Ornamental fish | 7% | 9% |

| Aquaponics | 6% | (not reported separately) |

| Sportfish | 6% | 9% |

| Allied business | 3% | (not reported) |

| Crustaceans | 3% | 19% |

| Baitfish | 1% | 6% |

| Seaweed | 1% | (not reported separately) |

| Aquatic plants | <1% | (not reported separately) |

| No response | 1% | - |

3.2 Disruption of traditional marketing channels

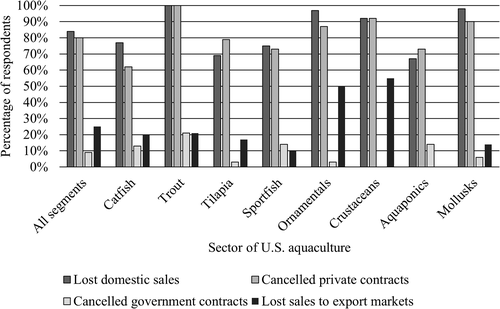

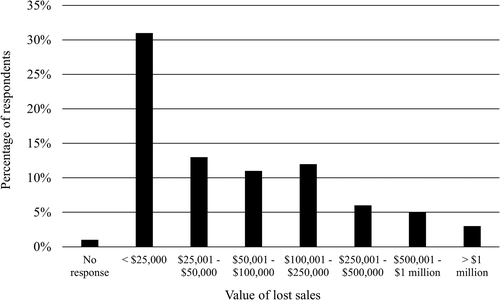

Eighty-four percent of respondents reported having experienced lost sales as a result of the COVID-19 pandemic during the first quarter of 2020 (Figure 1). Respondents reported lost sales to domestic markets, cancellations of private contracts, cancellations of government contracts, and lost sales to international export markets in varying degrees across the segments of U.S. aquaculture. In a few instances, individual respondents reported lost sales to be greater than $1 million for the first quarter of 2020 (Figure 2). Eighty-six percent of respondents indicated that they expect to experience further lost sales due to the COVID-19 pandemic in 2020. Other impacts of the lost sales include social effects related to the cultural importance of the supply of live fish products (such as hybrid striped bass, largemouth bass foodfish, red drum, carp, and tilapia sold as foodfish) to various ethnic groups.

A cross tabulation of respondent primary marketing channels and their reported impacts to marketing channels (lost sales and canceled contracts) is reported in Table 2. Greater percentages of respondents who sold to distributors and restaurants reported being impacted by COVID-19 than those who sold to other market channels. In addition, those who sold to distributors and restaurants also reported greater lost domestic sales and more canceled private contracts. Most foodfish supply chains involve sales from farms to processing plants that then sell to distributors and food service companies, who then sell to either retail grocery stores/supermarkets or to restaurants. Few respondents sold to grocery stores/supermarkets as a first point of sale. Lost sales very quickly rippled down from processors to farms who then reported high rates of lost sales. Interestingly, although there have been general reports of increased sales in grocery stores/supermarkets, these survey results showed that aquaculture respondents who sold directly to grocery stores/supermarket were also impacted strongly by the shutdowns (83% were impacted by COVID-19), although the percentage of those reported being impacted was greater for those respondents who sold primarily to other channels (99% to distributors, 96% to restaurants, and 86% to processors). Of these impacts, a smaller percentage of those who sold to grocery stores/supermarkets reported losses of domestic sales (67% as compared to 74% to 100% of respondents who sold to other categories) and also losses in terms of canceled private contracts (80% as compared to 83% to 94%). Respondents reported difficulties in pivoting to retail grocery/supermarket sales in the form of existing contractual obligations, trucking quotas, packaging and inspection requirements, and other constraints to increasing or pivoting sales to retail groceries/supermarkets.

| Marketing channel | Impacted by COVID-19 | Lost domestic sales | Lost international sales | Canceled private contracts | Canceled government contracts |

|---|---|---|---|---|---|

| Direct to consumer | 81% | 79% | 17% | 75% | 15% |

| Processor | 86% | 79% | 19% | 72% | 7% |

| Distributor | 99% | 100% | 31% | 94% | 7% |

| Restaurants | 96% | 96% | 11% | 83% | 4% |

| Grocery stores/ supermarkets | 83% | 67% | 38% | 80% | 10% |

| To other producers | 91% | 74% | 48% | 88% | 13% |

| Other | 90% | 58% | 28% | 67% | 7% |

Lost sales were tabulated as a percent of total annual sales by aquaculture segment. Based on these estimates, tilapia suffered the greatest lost sales as a percent of total annual sales (38%), followed by crustaceans (29%), ornamentals (24%), finfish sold as live foodfish (21%), trout sold for foodfish (19%), trout sold for recreational fishing (13%), and sportfish (13%). For many sectors of U.S. aquaculture, such as mollusks, trout, sportfish, and baitfish, spring is the peak marketing period when many producers obtain the best prices for their products. The months leading up to Lent (Quarter 1) are some of the most important sales months of the year. Thus, the sales lost in Quarter 1 due to the pandemic constitute a proportionately greater percentage of total annual sales than if the losses had occurred at a different time of the year.

Hatcheries/seedstock suppliers were also impacted by the economic shutdowns, particularly through disruption of supply chain logistics such as air freight and other transportation sector limitations. Hatchery/seedstock suppliers in the aquaculture industry sell eggs, fingerlings, and other seedstock without which foodfish producers would not be able to supply customers. Disruptions to these businesses will have consequences for the future supply of seedstock to growout farms.

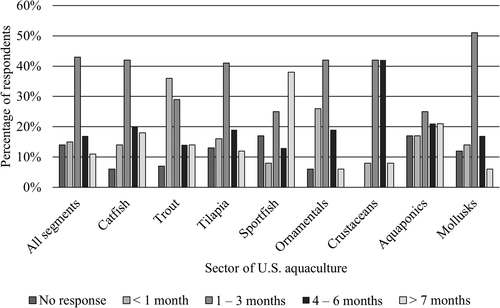

Respondents were also asked how long their business could survive without sales before suffering longer term cash flow effects. Forty-three percent of survey respondents indicated that they could survive a period of no sales for 1 to 3 months before suffering long term cash flow effects; but, there was variability across the responding segments of aquaculture (Figure 3).

3.3 Challenges with farm labor

U.S. aquaculture respondents also reported challenges with labor, including temporary loss of employees due to shelter at home orders, illness, furloughs, and permanent loss of employees due to terminations forced by the lack of revenue resulting from marketing channel disruptions. Thirty-three percent of respondents to the Quarter 1 survey indicated that their farm or business had terminated employees, with 26% of respondents indicating they would have to soon (Table 3). Most respondents (56%) stated that this affected one to three employees, but within some segments of U.S. aquaculture, respondents indicated that over 100 employees had been terminated. When asked about the potential for future terminations as a result of the COVID-19 pandemic, the majority of respondents (54%) indicated that they had between 1 and 3 weeks to make a decision about additional terminations. The exception to this was sportfish, for which the majority (67%) indicated having between 4 and 6 weeks to decide. The number of employees this would affect was also requested, with the majority (62%) of responding aquaculture farms and businesses indicating it would affect between one and three employees. The exception to this was crustaceans, for which the responses (33%) were equally divided among 4 and 6, 7 and 10, and greater than 20 employees.

| Response | All segments | Catfish | Trout | Sportfish | Tilapia | Ornamental | Crustaceans | Aquaponics | Mollusks |

|---|---|---|---|---|---|---|---|---|---|

| No response | 1% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Laid off employees | 33% | 16% | 43% | 32% | 21% | 30% | 25% | 27% | 42% |

| Not laid off employees | 40% | 56% | 14% | 55% | 55% | 30% | 50% | 55% | 34% |

| Will have to soon | 26% | 29% | 43% | 14% | 24% | 40% | 25% | 18% | 24% |

| Number of employees | All segments | Catfish | Trout | Sportfish | Tilapia | Ornamental | Crustaceans | Aquaponics | Mollusks |

| 1 to 3 employees | 56% | 43% | 83% | 71% | 33% | 33% | 67% | 50% | 56% |

| 4 to 6 employees | 19% | 29% | 0% | 14% | 17% | 22% | 0% | 17% | 20% |

| 7 to 10 employees | 7% | 14% | 0% | 0% | 17% | 11% | 0% | 0% | 4% |

| 11 to 15 employees | 7% | 0% | 17% | 0% | 17% | 0% | 33% | 17% | 11% |

| 16 to 20 employees | 3% | 14% | 0% | 14% | 0% | 0% | 0% | 0% | 3% |

| > 20 employees | 6% | 0% | 0% | 0% | 17% | 33% | 0% | 17% | 7% |

3.4 Challenges with inputs, goods, and services

U.S. aquaculture respondents to the Quarter 1 survey indicated and commented on a variety of challenges related to production inputs, goods, and services that they relied on for successful operation of their farms. U.S. aquaculture farms and businesses noted difficulties with obtaining critical production inputs such as feed for finfish and juvenile mollusks for planting. Survey respondents also noted difficulties resulting from unavailable services such as veterinary services, repair, maintenance, and construction. Forty-three percent of survey respondents indicated they had difficulties acquiring production inputs, whereas 32% reported challenges with repair, construction, and engineering services; and 29% experienced difficulties with financial services; these challenges did vary by segment of U.S. aquaculture (Table 4).

| Challenges experienced | All segments | Catfish | Trout | Sportfish | Tilapia | Ornamental | Crustaceans | Aquaponics | Mollusks |

|---|---|---|---|---|---|---|---|---|---|

| Production inputs | 43% | 42% | 63% | 46% | 44% | 64% | 50% | 21% | 22% |

| Repair, construction, consultant, engineering services | 32% | 17% | 50% | 31% | 39% | 36% | 25% | 43% | 36% |

| Financial services | 29% | 29% | 63% | 8% | 22% | 29% | 25% | 14% | 31% |

| Other challenges | 30% | 25% | 25% | 15% | 11% | 7% | 0% | 21% | 46% |

| Cannot identify at this time | 22% | 42% | 13% | 38% | 11% | 21% | 25% | 14% | 17% |

3.5 Management challenges from holding market-ready aquaculture product on farms

In contrast to some other types of agriculture, the live aquatic animals produced in aquaculture do not leave the farm until purchased by a buyer, and farms do not have separate storage facilities for their animals. Thus, when not sold as anticipated, the live fish or shellfish remain on the farm and remain in the same units (ponds, raceways, tanks) as used for production. Sixty percent of survey respondents indicated that holding market-ready product on farm, because of lost sales, would make it less marketable. Unlike other animals, fish continue to grow throughout their lives. Therefore, holding product for an additional length of time results in fish/shellfish growing past the ideal marketing size, and the price per pound decreases as a result. An additional complication is that the equipment used in processing plants cannot easily be re-set to accommodate larger fish that must be processed by hand at a greater cost.

Respondents to the survey also expressed concerns over the increased risks associated with holding high volumes and biomasses of market-sized fish and shellfish, particularly because the pandemic occurred at the time when the next crop was to be planted. Holding market-sized inventory increases the cost per unit of production with additional feed costs and slower growth rates from the higher biomasses in production units. Higher biomasses also result in greater risk of low oxygen levels that require additional aeration (and additional cost) and increases the risk of disease outbreaks due to the added physical stress from the accompanying water quality problems. The risk of additional mortality from predation and weather events further increases the longer the fish/shellfish are in the production unit.

4 CONCLUSION

The critical need to obtain information on how aquaculture was being affected by COVID-19 necessitated an online, self-selection process for survey administration. Although every effort was made to distribute the survey widely across U.S. aquaculture, it is possible that the findings of this study are skewed toward farms and businesses that have been affected more negatively by COVID-19; results should be interpreted accordingly. However, there were a few respondents (3%) who had not been affected by the COVID-19 pandemic. Given the high dependence of aquaculture products generally on restaurant and other in-dining establishments, it is plausible that non-respondents experienced similar impacts, in terms of the disruption of traditional marketing channels; challenges with farm labor; and challenges with inputs, goods, services, and management of increased inventories of unsold market-ready product.

Similar to effects described on other sectors of agriculture, lost sales and canceled contracts experienced by the U.S. aquaculture industry were primarily the result of disrupted traditional marketing channels due to closures of restaurants and food service establishments. Disruptions at seafood processors, due to fears of COVID-19 outbreaks, likely also played a role in reduced farm sales. With the majority of U.S. seafood consumption occurring outside the home (NMFS, 2018), the magnitude of the reported lost sales during the peak sales period of the year is not surprising. Moreover, the cascading effects of market channel disruptions and the resulting loss of revenues during Quarter 1 of 2020 are therefore likely to present the U.S. aquaculture industry with continued challenges for the duration of 2020. Continued Extension and outreach communications with aquaculture producers during the second quarter have revealed that several farms and businesses are in the process of establishing new direct-to-consumer marketing channels. Future iterations of the survey instrument will inquire about adaptations and the implementation of new marketing channels.

Farm labor impacts were driven primarily by the resulting loss of revenue from marketing channel disruptions. In addition to terminations and temporary loss of employees, respondents also reported salary cuts for owners and management positions. Several respondents raised concerns about the loss of specialized and skilled labor, describing an inability to manage production or processing activities because of a reduced labor force. Survey respondents also expressed concern about the health and well-being of their employees, noting efforts to implement revised protocols to allow for social distancing and purchasing additional COVID-19 related personal protective equipment. Unless revenue generation at the farm level improves, it is unlikely that the employment outlook for U.S. aquaculture will improve. Survey respondents (26%) have already indicated potential additional terminations, and the effects of reduced employment are likely to cause additional operation and management challenges for production and marketing.

Beyond the challenges already experienced by U.S. aquaculture producers, 47% of respondents also indicated that they expected to experience further production-related challenges in 2020 due to COVID-19. In comments provided by survey respondents, farms noted that holding inventory of market-ready products will interfere with their ability to start production of future crops. This would suggest that the disruptions caused by the COVID-19 pandemic may result in reduced product availability of U.S. aquaculture products beyond 2020, as some crops take multiple years to reach market size. Due to the high degree of variability in the U.S. aquaculture industry, the specific challenges faced by respondents vary across the different segments of aquaculture and marketing channels. However, it is evident that the closures of other businesses (deemed non-essential) have and will continue to have an impact on U.S. aquaculture producers.

This survey was conducted before the CARES Act and other relief programs were implemented. At the time this paper was written, the extent of the benefits deriving from the CARES Act were unknown. The Quarter 2 follow-up survey will elicit information on the extent to which U.S. aquaculture producers were able to participate in relief programs and to what extent they were helpful.

The highly diverse nature of the U.S. aquaculture industry results in a large variety of specific challenges and impacts resulting from the COVID-19 pandemic and the related response measures implemented to protect public health. These impacts and effects can be summarized into the four categories discussed in this paper: (1) the disruption of traditional marketing channels and resulting losses in revenue; (2) effects on farm labor; (3) challenges with inputs, goods, and services provided by other sectors of the U.S. economy; and (4) management challenges from holding market-ready aquaculture products on farm. Thirteen percent of Quarter 1 survey respondents indicated that their farm or business would not survive 3 months without external intervention, increasing to 32% when the term was increased to 6 months without external intervention. The findings of the Quarter 1 survey have confirmed the need to carry forward this assessment for the duration of 2020. Although this study was initiated with the intent to assess the short and medium-term implications for U.S. aquaculture, these data may also be of value in assessing vulnerabilities and opportunities for adaptation to reduce risk and improve the resiliency of U.S. aquaculture. Given what we have learned about the impacts of COVID-19 in Quarter 1 of 2020, it is safe to conclude that there will be longer term economic effects for the U.S aquaculture industry.

ACKNOWLEDGEMENTS

We thank the many producers who responded to the survey as well as the many aquaculture associations and extension specialists who assisted with dissemination of information on the survey to encourage participation.

Biography

Jonathan van Senten is the Assistant Director of the Virginia Seafood Agricultural Research and Extension Center (AREC), an Assistant Professor and Extension Specialist in the Department of Agricultural and Applied Economics, and affiliate faculty in the Center for Coastal Studies at Virginia Tech.