Should businesses keep consistent performance between channels? Empirical evidence from the impact of rating discrepancy on demand

Abstract

Consumers often search for and compare the online and offline performance of businesses, indicated by consumer ratings, before they make purchases. In this study, using empirical evidence from the restaurant industry, we examine the impact of consumer rating discrepancy between online and offline channels on online demand. We find that channel rating discrepancy for overall performance, products, and services negatively affects online demand. In addition, higher prices amplify the negative effect of channel rating discrepancy on consumer online purchase behavior. The negative discrepancy effect has heterogeneity that depends on the business's properties (i.e., chain vs. independent). Our findings suggest that companies should take an integrated approach to make cross-channel performance consistent. With consistent performance, companies can have a better overall performance that will attract consumer demand.

1 INTRODUCTION

In the online-to-offline (O2O) era, companies are operating in both online and offline channels to reach more consumers and increase their sales and profits (Li, Li, & Shi, 2019). Many businesses in various industries worldwide currently provide opportunities for consumers to rate online and offline performance separately. In the U.S. restaurant industry, DoorDash, Uber Eats, and Grubhub rate online food delivery, and Yelp and Tripadvisor rate offline dine-in services. In the U.S. legal industry, Justanswer.com rates online attorney services, and Avvo rates face-to-face attorney services. In the health care industry in China, Haodf.com rates online telehealth doctor consulting services, and hospitals have their own rating platforms for visits to the doctor's office. Also, in the education industry in China, EF.com rates online educational training, and EF Education rates face-to-face classes. Companies’ performance in one channel (either online or offline) can not only affect consumer demand in that channel, but also has an impact on demand for the other channel (Hwang & Kim, 2018). Efforts to improve performance include information management that uses decision support systems (Pan, Wu, & Olson, 2017), marketing efforts such as promotion and advertising (Zhang & Yao, 2020), and operational efforts such as pricing (He, Cheng, Dong, & Wang, 2016). However, many companies have limited resources and different priorities for online and offline channels, which may result in a performance gap between the two channels.

Consumers usually engage in intensive search behavior to gather all available information about a company's online and offline performance to increase their familiarity with the business and reduce their perceived risk of purchase (Chen, Hsiao, & Hsieh, 2019). It is found that more than half consumers visit a physical store first to experience the product before they purchase it online (Skrovan, 2017). In contrast, a significant number of consumers search for and compare products online first and then go to stores to make the purchase (Fraser, 2018). Consumers’ comparison behavior between online and offline channels may affect their purchase decisions. Previous studies have examined how consumers search for and compare information about brand effects (González-Benito, Martos-Partal, & San Martín, 2015), perceived risk (Herhausen, Binder, Schoegel, & Herrmann, 2015), price (Bodur, Klein, & Arora, 2015), shopping experience (Melis, Campo, Breugelmans, & Lamey, 2015), and technological requirements (Savastano, Bellini, D'Ascenzo, & De Marco, 2019). However, there is limited discussion on the effects of consumer rating discrepancy between online and offline channels, namely, the channel rating discrepancy (CRD), on a business's online demand.

To fill the above literature gap, our study aims to examine the impact of CRD on online demand. Correspondingly, we raise three research questions: First, given the common existence of CRD across two channels, we propose our first research question: How does CRD between online and offline channels affect online demand? Second, given the various prices offered by companies, we examine the impact of price on the relationship between CRD and demand and further evaluate whether consumers still care about CRD when their orders are less expensive. Thus, we propose our second research question: How does the impact of CRD on online demand differ by price? Third, we want to investigate the heterogeneity effects of CRD on consumer demand. Accordingly, our third research question is the following: How do companies’ properties (i.e., chain vs. independent) and competition intensity affect the influence of CRD on online demand?

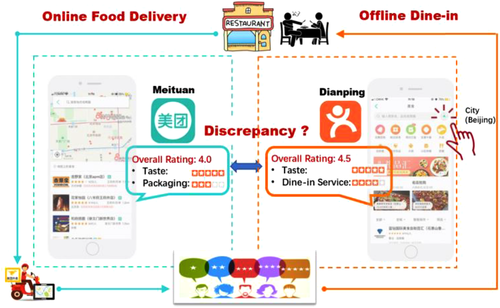

To answer these questions, we conduct empirical analysis based on the data collected from Meituan–Dianping. It is a platform company that is among the top-ten most valuable venture-backed private companies in the world, as listed by the Wall Street Journal (Chen et al., 2020). Meituan–Dianping consists of two platforms, including Meituan and Dianping. Meituan is an online food service platform where consumers can order food online from restaurants listed on Meituan and rate the restaurants there. Dianping is a counterpart platform where consumers can rate their dine-in experiences at restaurants. Most of the restaurants on Meituan–Dianping offer both online home delivery services and offline dine-in services; thus, they are listed on both Meituan and Dianping.

Our empirical results reveal that CRD in overall, product, and service ratings all negatively affects online demand. The negative discrepancy effect is amplified by higher prices and is heterogeneous depending on the properties of the business (i.e., chain vs. independent). Our results remain robust in a number of different model specifications. For instance, we use the instrumental variables (IV) estimation approach to solve for the endogeneity issue of price. In addition, we include the minimum and average ratings between online and offline channels to control for the potential spillover effect from offline to online channels. We also test the robustness of our results by using clustered standard errors. Moreover, we are able to show that CRD has a negative impact on online demand regardless of whether the online rating is higher or lower than the offline rating, which further proves the robustness of our results. Finally, we show that our results are not biased by the reverse causality issue. The contributions of this study lie mainly in the fact that this is the first study discussing the CRD effect on online consumer demand in the O2O context and its heterogeneity caused by price and the companies’ properties. Our findings suggest that companies should use an integrated approach to ensure consistent cross-channel performance.

The remainder of the study is organized as follows. We first elaborate the theoretical background and review the relevant literature. Then, we develop the hypotheses, conduct the data analytics, and present the results. Furthermore, we discuss the results and the theoretical and managerial implications. Last, we conclude this study and propose future research directions.

2 THEORETICAL BACKGROUND AND LITERATURE REVIEW

The theoretical background of this study lies mainly in a series of theories and their corresponding models, which are generated to model consumer behavior when the information is not consistent in different sources. In this section, we first elaborate on consumers’ behavior as they search for and compare information before a purchase, and then we examine two theories: the cue consistency theory (Maheswaran & Chaiken, 1991) and the multiple inference model (Reeder, Kumar, Hesson-McInnis, & Trafimow, 2002, 2004).

2.1 Information search and purchase behavior between online and offline channels

Consumer information search behavior is positively affected by the perceived ability and motivation to search (Schmidt & Spreng, 1996). Regarding perceived ability, digital platforms make searching for and comparing information only several-clicks of the mouse away (Chen et al., 2019). Thus, online consumers conduct intensive information search activities during their online shopping process (Bauer, Falk, & Hammerschmidt, 2006).

Regarding the motivation to search, the essential purpose of a search for information is to compare and process information from different sources (Wang, Guo, Zhang, Wei, & Chen, 2016). Individuals either use additive choice models by adding up the utilities of each attribute to compare the comprehensive performance of different merchants or channels, or they use conjunctive elimination-by-aspects models to compare the performance of each attribute from different merchants or channels (Payne, 1976). In this study, CRD indicates that the products and services offered by the same merchant maybe different between online and offline channels, which motivates consumers to search for information and make comparisons between channels.

Consumers search for and compare information across channels to accumulate product knowledge and alleviate uncertainties so that they can choose one channel to make a purchase (Gao & Su, 2017). Therefore, businesses need to share product knowledge and strive to perform consistently across channels. Conflicting information and performances, such as the CRD in this study, can cause consumer frustration and weaken purchase intentions (Brynjolfsson, Hu, & Rahman, 2013). Gao and Su (2017) examined how information structures affect consumers’ channel choice. Saghiri, Wilding, Mena, and Bourlakis (2017) found that retailers strive to make product and service information consistent across online and offline channels to make the information appear more uniform to consumers and motivate them to choose multiple channels, rather than sticking to one channel only. The efforts to unify consumers’ online and offline experiences through technology also facilitate consumers’ switching between channels (Larke, Kilgour, & O'Connor, 2018). Because of the physical distance between the consumer and the merchant, the transaction and the fulfillment processes are separated, and the products cannot be inspected before delivery. Thus, consumers perceive high risk when dealing with unfamiliar merchants, products, and services (Hong, 2015), which increases their need to search for information about the merchants from various sources.

2.2 Cue consistency theory

Cue consistency theory posits that multiple information sources are more useful when they offer corroborating information than when they provide disparate conclusions (Maheswaran & Chaiken, 1991). In such cases, attitudes are derived by integrating the value of that information (Miyazaki, Grewal, & Goodstein, 2005). When cues are consistent, consumers are more likely to use them jointly to evaluate information (Anderson, 1981). Consistent cues can enhance consumer trust, but disparate cues can reduce trust (Hu, Wu, Wu, & Zhang, 2010). When cues are not consistent, negative cues play a more important role in affecting consumer perceptions (Ahluwalia, 2002). In this study, the two cue sources are online and offline ratings. When these ratings are consistent, the information is corroborated. If online and offline ratings have gaps, then the cues are disparate. When the level of information inconsistency is significant, consumers’ attitudes are formed from both their positive and negative evaluations, and they are spontaneously motivated to make sense of those inconsistencies for the purpose of making an integrated evaluation (Srull & Wyer, 1989). Thus, the exposure to inconsistencies causes consumers to increase efforts to reconcile the inconsistent sets of information, which amplifies the amount of information processing (Maheswaran & Chaiken, 1991) and weakens their intent to purchase (Sengupta & Johar, 2002).

Online and offline ratings serve as cues that illuminate a providers’ performance, based on which consumers generate general judgments through the cue-interaction and aggregation-based learning models (Kardes, Posavac, & Cronley, 2004). These judgments are referred to as “comparative judgments” in previous studies (e.g., Qiu & Yeung, 2008). The foundation of a comparative judgment is feature-matching conceptualization (Houston & Sherman, 1995), which shows that consumers often compare the features of alternatives. In these comparisons, consumers tend to focus on the discrepancy between the two information sources, rather than commonality (Wang & Wyer, 2002).

2.3 Multiple inference model

According to the multiple inference model, consumers generate judgments through inferences that are formed through the generation of if–then links between information and conclusions (Reeder, 2009a, 2009b; Reeder et al., 2002, 2004). The information functions as cues, heuristics, arguments, and knowledge, and the conclusions include the consumer perceptions, appraisal, and behavior (Kardes et al., 2004). The information used as a basis for inference is situationally available; namely, consumers encounter information online and form inferences. Based on the multiple inference model, consumer appraisal and behavior are formed in the activation–validation inference process (Gawronski, 2009). The activation is formed from inference-relevant cues, which activate the corresponding concepts consumers form through the spreading activation process (Collins & Loftus, 1975). Consumers then validate the activated information. The information inconsistency, as shown by CRD in this study, between the activation and validation processes triggers consumers to expend more cognitive efforts and posit possible explanations for the inconsistency (Roese & Sherman, 2007).

According to the multiple inference model, consumers consider multiple motives, situational factors, and prior knowledge about the merchants when integrating inferences into one coherent impression to interpret a target (Kim & Kim, 2020; Reeder, 2009a, 2009b; Reeder et al., 2002, 2004; Verlegh, Ryu, Tuk, & Feick, 2013). Regarding motives, they reflect the intentions of merchants. Perceivers (i.e., consumers in this study) integrate inferences of motives to judge merchants (Verlegh et al., 2013). Therefore, motives affect consumers’ behavior (Kim & Kim, 2020; Verlegh et al., 2013). In this study, price is considered as a type of motive-related information because pricing incorporates multiple motives of the merchants, based on which consumers judge and infer. High price can result from the business's desire for consumers to infer the high quality of a product or service, and low price can result from the business's desire to promote the product or service (Gijsbrechts, 1993). Consumers search for and compare information to infer the motives behind the pricing. Prior knowledge about the business affects consumer inferences by serving as evidence that helps them judge whether new inferences and cues are in line with their prior knowledge (Trope, 1986). In terms of prior knowledge, because chain stores often have more standard operations and brand effects than independent stores, consumers have more prior knowledge of chain stores, which influences their inferences. For the situational factors, they reflect the level of constraints on individuals when implementing their behavior (Reeder, Monroe, & Pryor, 2008). Situational information affects the consumers’ capability to search. In this study, we thus examine the competition intensity of merchants. Higher competition intensity means that it is easier for consumers to choose products because there are more options, which alleviates their information search constraints (Ailawadi & Farris, 2017).

3 HYPOTHESIS DEVELOPMENT

3.1 Impact of CRD on consumer online purchase behavior

The CRD represents information inconsistency from different sources. Consumers often search, gather, and compare information from different sources to make judgments about the information consistency (Chen et al., 2019). The discrepancy increases the mismatch costs for consumers, which indicates the actual products and services consumers receive may not meet their expectations (Sun, 2012). Thus, consumers generate negative judgments and perceive higher risks, which have a negative impact on their purchase intentions and behavior (Hong, 2015). According to the cue consistency theory (Maheswaran & Chaiken, 1991) and the multiple inference model (Reeder et al., 2002, 2004), CRD offers inconsistent cues for consumers to compare, which reduces their purchase intentions.

In addition, ratings can be viewed as an intangible asset for the merchant because they are formed through the long-term accumulation of reviews (Xu, Munson, & Zeng, 2017). Positive ratings also indicate consumer satisfaction (Gao, Greenwood, Agarwal, & McCullough, 2015). Depending on what is being evaluated, ratings can be categorized as overall ratings and attribute-level ratings. The overall ratings reflect consumer perceptions toward the consumption experience and thus shows consumer overall satisfaction (Mittal, Ross, & Baldasare, 1998). The attribute-level ratings show consumer perceptions toward a particular attribute, such as product or service (Jiang & Rosenbloom, 2005). In this study, we focus on CRD in both overall and attribute-level ratings and propose the following hypothesis:

- H1: CRD in overall ratings (H1a), product-attribute ratings (H1b), and service-attribute ratings (H1c) negatively affects online consumer demand.

3.2 Role of pricing in the effect of CRD

According to the multiple inference model, merchants’ motives are an important factor for consumers in their judgments (Reeder, 2009a, 2009b; Reeder et al., 2002, 2004). Businesses can have multiple motives for determining their pricing strategies. The pricing of various products among different merchants is often divergent, which causes consumers to search for and compare information to form a more coherent impression (Bodur et al., 2015).

Various motives can lead businesses to raise prices. A high price can be a reflection of the high quality of the product or service and its incorporated brand value, or of the premium that may be charged to consumers because of unique features or competitive advantages (Anselmsson, Johansson, & Persson, 2007). The high price can also be caused by the high cost incurred in each step of the manufacturing or service process, or by the business's attempts to earn a higher marginal profit. The various motives urge consumers to gather information to acquire an integrated impression (Kim & Kim, 2020). When the price is high, consumers are more sensitive to CRD, and they perceive more uncertainties about the reasons for CRD and the motives for the high price (Hui, Yoo, & Tam, 2008). The high price increases consumers’ perceived risk, which can result in more monetary losses for the consumers and their reduced purchase intentions and behavior (Forsythe & Shi, 2003). This is particularly true for online shopping, which amplifies consumers’ concerns about the risk because of the physical distance between consumers and providers, preventing face-to-face communication. The perceived risk is also caused by the separate processes of payment and fulfillment; consumers cannot receive a product or service immediately upon payment (Bauer et al., 2006).

High prices increase consumers’ desire to acquire high utility and quality (Lim & Dubinsky, 2004). High quality can be measured by consistent performance, which drives consistent cues or inferences (Carlsson, 1993). Therefore, when CRD exists for higher-priced merchants, consumers are more likely to generate negative perceptions, such as disappointment and anxiety, when their expectations of high quality are not met (Zeelenberg & Pieters, 2004). In this way, consumers have more difficulties integrating these conflicted inferences to form a coherent judgment about the business (Verlegh et al., 2013). This has a negative impact on their purchase intentions and behavior. Thus, we propose the following hypothesis:

- H2: Higher prices increase the negative effect of CRD on online consumer demand.

3.3 Heterogeneity of effects of CRD

In the multiple inference model, one of the most important elements of consumers’ decisions to search for and compare information is their prior knowledge of the business (Reeder, 2009a, 2009b; Reeder et al., 2002, 2004). Stores can belong to a chain or can be independent, so “chain” and “independent” are two key properties of the business (Wenzel, 2011). Consumers have more existing knowledge of chain stores because of their standardized operations and brand effect, which are favored by many consumers (Mallapragada & Srinivasan, 2017). When CRD exists for chain stores, consumers perceive lower credibility, believing that the quality and operations are not standardized as expected and do not meet the franchise's standards and policies (O'Neill, Mattila, & Xiao, 2006). This negatively affects their purchase intentions and behavior (Jiang, Balasubramanian, & Lambert, 2015). Because chain stores usually have well-known brands, consumer expectations are raised (Lee & Kwon, 2011). Therefore, consumers are more likely to feel disappointed or dissatisfied if CRD exists. This reduces their future purchase intentions and behavior (Oliver, 1980).

However, for independent stores, one of the core competencies is being different than their competitors through the provision of unique and customized products and services (Markides & Williamson, 1994). Independent stores often have irreplaceable competitive advantages, which usually provide heterogeneous products and services (Chang, 1991). Consumers often favor the unique characteristics of independent stores (Wu, Lu, Wu, & Fu, 2012) and are more tolerant of CRD. Thus, we hypothesize the following:

- H3: CRD has a higher negative effect on online consumer demand at chain stores than at independent stores.

According to the multiple inference model, consumers’ decision to search for and compare information is also modified by situational factors, which may be soft or hard constraints, depending on the choices available to them (Reeder, 2009a, 2009b; Reeder, Vonk, Ronk, Ham, & Lawrence, 2004). In this study, we use the number of competitors to reflect the situational factor. A higher number of competitors alleviates the constraints on the ability of consumers to search for and compare information because more information is available, which amplifies the role of negative information—CRD in this study in reducing their purchase intention (Lee, Park, & Han, 2008).

More competition also increases the availability of service providers, which gives consumers more purchase choices. These increased choices thus alleviate the constraints and barriers that might prevent them from searching for information and switching between merchants (Jones, Mothersbaugh, & Beatty, 2000). Consumers become less loyal because of their ability to switch to other merchants (Yang & Peterson, 2004). Thus, CRD triggers consumers’ incentive to leave the merchants that were originally under their consideration and try alternatives (Li et al., 2018). Higher competition intensity also motivates businesses to invest more efforts into enhancing quality and attracting consumers, so businesses with inconsistent quality—as indicated by CRD—are more likely to be viewed with disfavor (Hegner, Fetscherin, & van Delzen, 2017). Therefore, we propose the following hypothesis:

- H4: CRD has a higher negative effect on online consumer demand for stores with higher competition intensity than for stores with lower competition intensity.

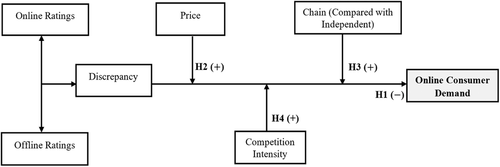

We present the theoretical framework of this study in Figure 1.

4 DATA ANALYTICS

4.1 Data collection

We obtain our data from Meituan–Dianping, a leading company in China that offers diversified services to consumers, such as catering, food delivery, hotel accommodations, and travel services. The company owns two platforms, Meituan and Dianping. Meituan provides online food delivery services. Consumers can order online from restaurants listed on the platform, receive the food, and then rate the restaurants on Meituan. In contrast, Dianping is a platform letting consumers rate restaurants regarding their dine-in experiences. Most restaurants are listed on both Meituan and Dianping. As shown in Figure 2, the overall and attribute ratings on Meituan and Dianping for a given restaurant can differ, indicating the presence of CRD.

Evaluations of merchants on Meituan include overall ratings and two separate ratings for taste and packaging, whereas evaluations of merchants on Dianping include overall ratings and separate ratings for taste and dine-in services. Taste is the common attribute on both the online and offline channels, and it is the core attribute of food quality (Namkung & Jang, 2008). Thus, in this study, we refer to the rating of taste as the “product rating” to represent consumers’ evaluation of the quality attribute. Packaging is the core service attribute of online food ordering because it is directly related to the experience of food consumption upon delivery (Moussal, Eliasl, & Soliman, 2012), and dine-in service is the core service attribute of the dine-in experience (June & Smith, 1987). Thus, in this study, the “service rating” reflects the ratings of packaging on Meituan and of the dine-in services on Dianping.

Consumers do not need to search both platforms to find the respective ratings of a restaurant on the two platforms. Instead, restaurant ratings on Dianping are also posted on Meituan, as shown in Figure 3. In this way, consumers who order online from a restaurant on Meituan can find the ratings for that restaurant on Dianping on the same webpage. This information is presented on the webpage before consumers place an order, and thus viewing this information serves as a prerequisite for the purchase decision. Therefore, the search cost of the CRD information is negligible for online consumers, which facilitates the consumers’ comparison of ratings for restaurants’ online and offline performance.

In this study, we collect a cross sectional dataset on September 14, 2019. It contains detailed information including monthly aggregated demand and monthly average ratings of 15,569 restaurants that are located in Beijing, China during the period from August 15th to September 14, 2019. Meituan identifies nine cuisine categories for selection, such as Southeast Asian cuisines, Western foods, and Chinese dishes. Referring to previous studies (e.g., Liang, Schuckert, Law, & Chen, 2017), we limit our data collection to a single city to control the potential effects of different cities on demand.

4.2 Measurements

In Table 1, we summarize the descriptive statistics of the key variables used in this study. For the dependent variable, we use the natural logarithm of Meituan restaurant sales during the one-month study period (i.e., Ln(Demand)) to reduce the skewness shown in previous studies (Ye, Law, & Gu, 2009; Ye, Law, Gu, & Chen, 2011; Zhang, Ye, Law, & Li, 2010). Table 1 shows that the average demand is 743 orders during our study period.

| Variable | Mean | SD | Min | Max |

|---|---|---|---|---|

| Demand | 743.07 | 1058.42 | 1.00 | 12,403.00 |

| Diff_rating_overall | 0.68 | 0.42 | 0.00 | 2.60 |

| Rating_overall | 4.47 | 0.34 | 1.70 | 5.00 |

| Diff_rating_product | 0.60 | 0.35 | 0.00 | 2.10 |

| Rating_product | 4.51 | 0.33 | 1.70 | 5.00 |

| Diff_rating_service | 0.69 | 0.36 | 0.00 | 1.85 |

| Rating_service | 4.60 | 0.30 | 1.90 | 5.00 |

| Price | 68.41 | 42.42 | 16.75 | 1247.00 |

| Tenure | 2.02 | 1.32 | 0.00 | 5.45 |

| Competition | 31.29 | 28.37 | 1.00 | 176.00 |

| GDPPC | 6.14 | 1.46 | 3.66 | 7.82 |

| Population | 2.37 | 1.05 | 0.33 | 3.61 |

- Note. Price is measured in RMB; Tenure is measured in years; GDPPC is measured in 10,000 RMB; and Population is measured in millions.

Our main independent variable is the CRD between Meituan and Dianping. To calculate the CRD for each restaurant, we first obtain each restaurant's overall ratings, product ratings, and service ratings on Meituan and Dianping separately. Each rating reflects a value from 1 to 5, with higher values indicating higher satisfaction. Then, referring to previous studies (e.g., Hambrick, 1981; Teas, 1993), we measure discrepancy in overall ratings (Diff_rating_overall), product-attribute ratings (Diff_rating_product), and service-attribute ratings (Diff_rating_service) by the absolute value of the difference in ratings between Meituan and Dianping. We do not use the normal difference because an increase in the normal difference (e.g., from –1 to 1) does not necessarily indicate a larger extent of discrepancy.

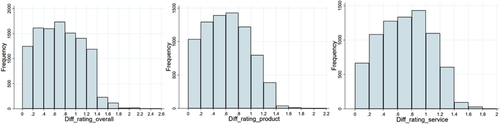

Table 1 shows that the key independent variables (the discrepancy of overall, product, and service ratings) have a relatively high variation. To visually present the distribution of CRD, we generate Figure 4. As Figure 4 shows, the CRD of the majority of restaurants is between 0 and 1.4, and the proportions of Diff_rating_overall, Diff_rating_product, and Diff_rating_service that have a value between 0 and 1.4 are 96%, 99%, and 98%, respectively. Figure 4 and Table 1 also show that the maximum values of Diff_rating_overall, Diff_rating_product, and Diff_rating_service are 2.6, 2.1, and 1.85, respectively. The possible reason for this is that some merchants, namely, restaurants in this study, pursue the channel management strategy of setting a high priority for one channel (either online or offline) by allocating more resources for that channel, rather than focus on developing both channels (Xiao & Shi, 2016). This is particularly true for restaurants that are limited in size and resources to invest (Mun & Jang, 2015). Thus, some restaurants, such as pizza and dumpling providers, focus on developing the online channel by hiring more drivers and improving packaging and delivery services but allocate limited space and servers for dine-in consumers (Yeo, Goh, & Rezaei, 2017). However, restaurants that serve traditional Chinese cuisine and restaurants with creative menus focus on using their long-established history or unique features to attract dine-in consumers through their restaurants’ special atmosphere and dine-in services.

In addition, we add the overall ratings of the restaurant (Rating_overall), the product attribute ratings (Rating_product), and the service attribute ratings (Rating_service) on Meituan as control variables. Seiler, Yao, and Wang (2017) found that consumer ratings, as credible information, serve as electronic word-of-mouth effect to influence consumers’ perceptions and purchase behaviors. Table 1 shows that the averages for Rating_overall, Rating_product, and Rating_service are 4.47, 4.51, and 4.60, respectively. We also control for the Price at each restaurant, which is measured by the average price of the food of the restaurant. Following Sorenson and Sørensen's study (2001), we include the number of years the restaurant has been operating (Tenure) as a control variable to control for the impact of tenure on demand.

The competition level of each restaurant shows the availability of providers consumers can choose from, which affects consumer choice and demand (Kumar, Qiu, & Kumar, 2019). Thus, we use the competition level of each restaurant (Competition) as a control variable. Following De Silva, Elliott, and Simmons (2013) and Kumar et al. (2019), we measure competition by the number of restaurants in the same district and the cuisine category as the focal restaurant. We identify districts based on the algorithm implemented by Meituan, which divides Beijing into 197 districts. The algorithm adopted by Meituan considers comprehensive factors, including delivery capacity, the restaurants’ geographical locations, and the local market size. Statistically, the average size of each district is around 28 square kilometers (i.e., 11 square miles).

Furthermore, we add market demand variables, including GDP per capita (GDPPC) and population size (Population) as control variables to capture the impact of income level and market size on consumer demand (De Silva et al., 2013). We obtain demographic characteristics on Beijing's twelve administrative divisions, including GDPPC and Population, from the 2019 Beijing Statistical Yearbook (Beijing Statistics Bureau, 2020). We then measure GDPPC and Population by the GDP per capita and the population size of the administrative division in which the focal restaurant locates, respectively.

5 EMPIRICAL ANALYSIS

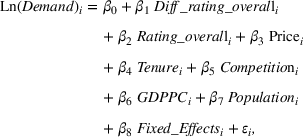

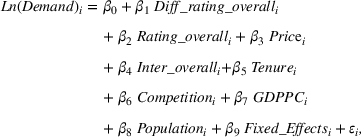

5.1 Impact of CRD on online demand

(1)

(1) represents restaurants, the vector Fixed_Effectsi includes cuisine category fixed effects and district fixed effects, and

represents restaurants, the vector Fixed_Effectsi includes cuisine category fixed effects and district fixed effects, and  is the error term, and all other variables are measured as mentioned in the previous section. Equation (1) can be reestimated if we change the rating-related variables from overall ratings to product ratings or service ratings.

is the error term, and all other variables are measured as mentioned in the previous section. Equation (1) can be reestimated if we change the rating-related variables from overall ratings to product ratings or service ratings.Competition in Equation (1) may be endogenous. For instance, the level of competition is correlated with the population size and income level in the restaurant's district; thus, the effect of competition on demand may reflect the effect of market size. It is also possible that competition may be higher for some cuisine categories, and the coefficient for competition may pick up the effect of the cuisine category. To account for the endogeneity of Competition, we adopt two strategies. First, following Igami and Yang's study (2016), we include the district and the cuisine category fixed effects, which control for unobserved market demand factors. In addition, we include demographic variables such as GDP per capita and population size as control variables, which can also help alleviate the endogeneity of competition (De Silva et al., 2013). We think the endogeneity issue resulting from omitted variables can be alleviated, to a large extent, by adding an extensive set of control variables, which was a common strategy used by previous studies (Fiorini & Keane, 2014; Todd & Wolpin, 2003).

Table 2 lists the regression results of the impact of CRD on consumer online demand. To test hypotheses 1a, 1b, and 1c, columns 1, 2, and 3 include CRD in overall ratings (Diff_rating_overall), product ratings (Diff_rating_product), and service ratings (Diff_rating_service), respectively. Columns 4, 5, and 6 include category and district fixed effects. The results are quite consistent, which suggests that CRD in overall, product, and service ratings negatively affects online demand. We also find that higher online overall, product, and service ratings increase online demand. These findings align with studies by Luca (2016) and Anderson and Magruder (2012), who used the regression discontinuity design method and established a causal relationship between ratings and online demand. Table 2 also suggests that higher prices reduce consumer demand, but longer tenure has a positive impact on consumer demand. After controlling for category and district fixed effects, competition and population become insignificant, indicating that their effects may have been absorbed by category and district fixed effects.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Overall | Product | Service | Overall | Product | Service | |

| No FEs | No FEs | No FEs | FEs | FEs | FEs | |

| Diff_rating_overall | −0.557*** | −0.563*** | ||||

| (0.028) | (0.028) | |||||

| Rating_overall | 0.646*** | 0.659*** | ||||

| (0.032) | (0.032) | |||||

| Diff_rating_product | −0.849*** | −0.882*** | ||||

| (0.042) | (0.043) | |||||

| Rating_product | 0.828*** | 0.854*** | ||||

| (0.043) | (0.043) | |||||

| Diff_rating_service | −0.685*** | −0.709*** | ||||

| (0.041) | (0.043) | |||||

| Rating_service | 0.907*** | 0.936*** | ||||

| (0.047) | (0.048) | |||||

| Price | −0.010*** | −0.011*** | −0.011*** | −0.008*** | −0.009*** | −0.009*** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | |

| Tenure | 0.242*** | 0.251*** | 0.267*** | 0.234*** | 0.245*** | 0.260*** |

| (0.008) | (0.009) | (0.009) | (0.008) | (0.009) | (0.010) | |

| Competition | 0.002*** | 0.002*** | 0.002*** | −0.001 | −0.001 | −0.001 |

| (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.001) | |

| GDPPC | −0.006 | 0.002 | 0.009 | 0.189 | −0.025 | −0.014 |

| (0.008) | (0.010) | (0.010) | (0.142) | (0.117) | (0.118) | |

| Population | 0.052*** | 0.045*** | 0.043*** | 0.080 | 0.113 | 0.128 |

| (0.011) | (0.013) | (0.013) | (0.076) | (0.097) | (0.098) | |

| Constant | 3.777*** | 3.057*** | 2.519*** | 1.472 | 2.160*** | 1.476* |

| (0.146) | (0.188) | (0.209) | (0.981) | (0.764) | (0.775) | |

| Category fixed effects | No | No | No | Yes | Yes | Yes |

| District fixed effects | No | No | No | Yes | Yes | Yes |

| R2 | 0.167 | 0.183 | 0.173 | 0.222 | 0.244 | 0.234 |

- Note. Numbers in parentheses are standard errors. “FE” represents fixed effects.

- *p < 0.1.

- ***p < 0.01.

A possible problem with the regressions in Table 2 is the endogeneity of Price, which might be correlated with unobserved demand factors in the error term. To solve this problem, we use the instrumental variables (IV) estimation approach (Davidson & MacKinnon, 2004). We instrument for Price with the average commercial real estate rent data in the focal restaurant's district (Rent), showing the restaurant's fixed costs. We collect rent data from Lianjia (formerly named Homelink), one of the largest real estate agencies in China. To be a valid instrument, rent must meet two conditions. The first is that it needs to be correlated with price, and the second is that it needs to be uncorrelated with the error term in Equation (1) so that the rent only influences demand through price. We verify the first condition by examining the first-stage regression of the IV estimation approach, and we find that rent is positively correlated with price (p < 0.05). To verify the second condition, following previous studies (e.g., Acemoglu, Johnson, & Robinson, 2001; Kumar et al., 2019), we test the exclusion restriction by including rent in Equation (1). The results show that the coefficient of rent is not statistically significant, indicating that rent does not have a direct impact on demand once price has been controlled for in the model. In addition, rent may be influenced by locations of high demand, but online demand may not be correlated with such factors. The results of the IV estimation approach are presented in column 1 of Table 3. Note that, for all the following robustness checks in this section, we only present the results of the key attribute, Diff_rating_product. Consistent with our previous estimation, the IV estimation approach shows that CRD of the product negatively affects online demand.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Main model | Min_rating | Avg_rating | Cluster:district | Cluster:division | Rating relation | |

| Diff_rating_product | −1.663*** | −0.441*** | −0.698*** | −0.882*** | −0.882*** | −0.465*** |

| (0.379) | (0.129) | (0.066) | (0.051) | (0.069) | (0.152) | |

| Rating_product | 1.564*** | 0.482*** | 0.482*** | 0.854*** | 0.854*** | |

| (0.340) | (0.111) | (0.111) | (0.041) | (0.044) | ||

| Min_rating_product | 0.513*** | |||||

| (0.141) | ||||||

| Avg_rating_product | 0.513*** | 0.977*** | ||||

| (0.141) | (0.058) | |||||

| Relation_product | 0.324*** | |||||

| (0.066) | ||||||

| Diff_rating × Relation | −0.054 | |||||

| (0.156) | ||||||

| Price | −0.056** | −0.010*** | −0.010*** | −0.009*** | −0.009*** | −0.010*** |

| (0.022) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Tenure | 0.260*** | 0.247*** | 0.247*** | 0.245*** | 0.245*** | 0.245*** |

| (0.015) | (0.009) | (0.009) | (0.011) | (0.011) | (0.009) | |

| Competition | 0.000 | −0.001 | −0.001 | −0.001* | −0.001* | −0.001 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| GDPPC | 0.079* | −0.032 | −0.032 | −0.025*** | −0.025*** | −0.028 |

| (0.045) | (0.117) | (0.117) | (0.005) | (0.006) | (0.117) | |

| Population | 0.024 | 0.110 | 0.110 | 0.113*** | 0.113*** | 0.104 |

| (0.021) | (0.097) | (0.097) | (0.008) | (0.007) | (0.097) | |

| Constant | 3.641*** | 1.638** | 1.638** | 2.160*** | 2.160*** | 1.423* |

| (0.637) | (0.777) | (0.777) | (0.183) | (0.317) | (0.777) | |

| No. of clusters | — | — | — | 197 | 12 | — |

| Category fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| District fixed effects | — | Yes | Yes | Yes | Yes | Yes |

| R2 | — | 0.245 | 0.245 | 0.244 | 0.244 | 0.248 |

- Note. Numbers in parentheses are standard errors.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01.

In addition, to test the robustness of our results, we analyze whether consumers are affected by the minimum and the average of ratings on Meituan and Dianping, in addition to the CRD. In specific, we add the minimum ratings (Min_rating_product) and the average ratings (Avg_rating_product) of the product between Meituan and Dianping in columns 2 and 3 in Table 3, respectively. Note that the minimum ratings and the average ratings cannot be included together because of the perfect multicollinearity issue. The results show that the impact of CRD in product on online demand remains significantly negative. We also observe that if the minimum ratings or average ratings of the product increase, online demand also increases. Note that models (2) and (3) present lower CRD effects than the main model (1) because the potential spillover effects are controlled by minimum and average ratings, which further proves the robustness of our results in terms of direction and significance.

However, the error terms in Equation (1) might be spatially correlated, and failure to control for within-cluster error correlations may understate the true standard errors (Cameron, Gelbach, & Miller, 2008). Referring to previous studies (Kumar et al., 2019), we report clustered standard errors at the district level and the administrative division level in Beijing, with the number of clusters being 197 and 12, respectively. The corresponding results are shown in columns 4 and 5 of Table 3, which are consistent with previous estimation.

Furthermore, because we measure CRD by absolute values, it is possible that the effects on demand are different between a positive or a negative difference between online and offline ratings. For instance, holding online rating fixed (as we control for online rating in our model), if the online rating is higher than the offline rating, a higher CRD indicates a lower offline rating; if the online rating is lower than the offline rating, a higher CRD indicates a higher offline rating. We want to show that CRD has a negative impact on online demand in both of the above two cases. To test the robustness of our results, we include a dummy variable named Relation_product in our analysis. Specifically, we set Relation_product = 1 if the restaurant's online rating is higher than its corresponding offline rating; otherwise, Relation_product = 0. We also include the interaction term between Relation_product and Diff_rating_product (i.e., Diff_rating × Relation). In addition, we use the average ratings of the restaurant's two channels instead of its online ratings as a control variable because the average ratings can serve as a measure for quality. The results are presented in column 6 of Table 3. The results show that the coefficient of CRD remains negative and significant, but its interaction term with Relation_product is insignificant, indicating that CRD has a negative impact on online demand, regardless of whether the online rating is higher or lower than the offline rating.

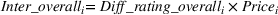

5.2 Moderating effect of price

(2)

(2)where  . Equation (2) can be reestimated if we change the rating-related variables from overall ratings to product ratings or service ratings, and the interaction terms between price and CRD in product and service are defined as

. Equation (2) can be reestimated if we change the rating-related variables from overall ratings to product ratings or service ratings, and the interaction terms between price and CRD in product and service are defined as  and

and  , respectively. Accordingly, we run three regression models separately, and for each model, we add only one rating-related variable and its associated interaction term.

, respectively. Accordingly, we run three regression models separately, and for each model, we add only one rating-related variable and its associated interaction term.

In each model, because Price and its interaction term with CRD are endogenous, we adopt the IV estimation approach and use Rent and its interaction term with CRD as instruments. Following previous studies (Afshartous & Preston, 2011; Williams, 2015), we center price, CRD variables, and the instrument (i.e., Rent) by subtracting their means and generate interaction terms based on centered variables, which does not change the meaning of the model but enhances the interpretability of the coefficients. The results from these three regressions are presented in column 1 of Table 4, which shows that the coefficients of Inter_overall and Inter_product are negative and significant, indicating that the negative impact of overall and product rating discrepancy on sales increases with price.

| (1) | (2) | (3) | |

|---|---|---|---|

| Interaction effect | High price | Low price | |

| Overall | |||

| Diff_rating_overall | −1.364*** | −0.578*** | −0.551*** |

| (0.290) | (0.046) | (0.038) | |

| Rating_overall | 1.028*** | 0.376*** | 0.804*** |

| (0.238) | (0.049) | (0.045) | |

| Inter_overall | −0.040* | ||

| (0.023) | |||

| Product | |||

| Diff_rating_product | −1.669*** | −1.105*** | −0.701*** |

| (0.372) | (0.066) | (0.059) | |

| Rating_product | 1.397*** | 0.679*** | 0.879*** |

| (0.333) | (0.064) | (0.060) | |

| Inter_product | −0.036** | ||

| (0.016) | |||

| Service | |||

| Diff_rating_service | −1.506*** | −0.839*** | −0.578*** |

| (0.427) | (0.064) | (0.059) | |

| Rating_service | 1.722*** | 0.811*** | 0.916*** |

| (0.473) | (0.071) | (0.066) | |

| Inter_service | −0.020 | ||

| (0.018) |

- Note. Numbers in parentheses are standard errors. Control variables in column 1 include Price, Tenure, Competition, GDPPC, and Population, as well as cuisine category fixed effects. Column 1 is estimated by the IV estimation approach with Rent and its interaction term with CRD as instruments. Control variables in columns 2 and 3 are the same as in column 1 except for Price, which is not included in columns 2 and 3 because it is used as the classification criterion. The results of control variables are omitted because of space limitations.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01.

In addition, to provide more evidence that the impact of CRD increases with price, we adopt an additional strategy described in Stock and Watson (2007) by splitting our sample based on Price, which also reflects whether consumers still care about CRD when they order lower-priced meals. Specifically, if the average price at the restaurant is higher than the sample average of 68 RMB (i.e., around $10), we define the restaurant as higher-priced; otherwise, it is considered a lower-priced restaurant. The estimation results of the higher-priced group and the lower-priced group are presented in columns 2 and 3, respectively, in Table 4. We further observe that, even for lower-priced restaurants, CRD in all three attributes (i.e., Diff_rating_overall, Diff_rating_product, and Diff_rating_service) continue to have a significantly negative impact on online demand. To test whether the coefficients of CRD are statistically different between lower-priced restaurants and higher-priced restaurants, referring to previous studies (e.g., Mize, Doan, & Long, 2019; Weesie, 1999), we adopt a cross-model Wald test that computes the cross-model covariance. The null hypotheses that the coefficients of CRD in product and service are the same between the two subgroups are rejected (p < 0.01), indicating that the negative impact of CRD in product and service is larger in higher-priced restaurants.

5.3 Heterogeneity analysis

In this section, we further analyze whether the impact of CRD on online demand changes with restaurants’ properties (i.e., chain vs. independent) and the competition level a restaurant faces (i.e., high vs. low). Specifically, we set Chain = 1 if a restaurant belongs to a chain; otherwise, Chain = 0. In addition, we use CI to represent competition intensity. We define CI = 1 as a high competition intensity if the number of restaurants in the same category and district with the focal restaurant is larger than the average number of restaurants by category and district, which is 31; otherwise, CI = 0. We generate interaction terms between CRD with Chain and CI, respectively, and include them in our analysis.

Because we have three rating attributes, we analyze three separate regression models. In each model, Price is included as a control variable and is endogenous; thus, we adopt the IV estimation approach using Rent as the instrument. In addition, to control for the heterogeneous effect of market size on chain versus independent stores, we interact the market size variables (Population and GDPPC) with Chain as additional control variables. Moreover, we include the number of restaurants in the chain as a control variable. The results are presented in Table 5. From Table 5, we find that CRD in all three attributes remains negative and significant. In addition, we find that the interaction terms between CRD and Chain are also negative and significant, but not for the interaction terms between CRD and CI, indicating that the negative impact of CRD on online demand is larger in chain restaurants compared with independent restaurants.

| (1) | (2) | (3) | |

|---|---|---|---|

| Overall | Product | Service | |

| Diff_rating_overall | −1.106*** | ||

| (0.277) | |||

| Diff_rating_overall × Chain | −0.412*** | ||

| (0.151) | |||

| Diff_rating_overall × CI | 0.009 | ||

| (0.093) | |||

| Diff_rating_product | −1.451*** | ||

| (0.359) | |||

| Diff_rating_product × Chain | −0.408** | ||

| (0.172) | |||

| Diff_rating_product × CI | 0.084 | ||

| (0.109) | |||

| Diff_rating_service | −1.393*** | ||

| (0.439) | |||

| Diff_rating_service × Chain | −0.341** | ||

| (0.159) | |||

| Diff_rating_service × CI | 0.007 | ||

| (0.108) | |||

- Note. Numbers in parentheses are standard errors. Control variables include the corresponding online ratings, Price, Tenure, GDPPC, Population, Chain, CI, the number of restaurants in the chain, the interaction term between GDPPC and Chain, and the interaction term between Population and Chain, as well as cuisine category fixed effects, which are omitted for presentation because of space limitations. Because Price is endogenous in each regression, the IV estimation approach is adopted with Rent as the instrument.

- **p < 0.05.

- ***p < 0.01.

5.4 Investigation of reverse causality

Although our research design of examining the impact of average ratings on demand during the same time period can be supported by previous studies (Clemons, Gao, & Hitt, 2006; Sun, 2012; Ye et al., 2009, 2011), it is possible that a reverse causality from demand to rating may exist and create endogeneity issues (Lee, Lee, & Oh, 2015). For instance, a higher demand leads to more comments, which further affects the ratings of the restaurant. However, due to the rating calculation mechanisms in Meituan–Dianping, we think the impact of the reverse causality issue is limited in our study. A merchant's rating on Meituan–Dianping each day is long-term accumulated, which is based on its long-term performance starting from its launch date. Thus, the daily rating is relatively stable and has not been much affected by the corresponding one-day's performance. In addition, the rating of a merchant on Meituan–Dianping is generated by a complex algorithm based on a series of comprehensive factors. It is not only determined by consumer ratings, but also from other merchant-related factors, such as the authenticity of the information posted by the merchants, the merchant's credibility of paying the predetermined commission to the platform on-time, as well as complaints about the merchant, which further mitigates the reverse causality issue.

To deal with the potential reverse causality issue and prove the robustness of our results, following previous studies (e.g., Davidson & MacKinnon, 2004; Stock & Watson, 2007), we employ an IV estimation approach. We instrument for ratings with the complaint ratio of each restaurant during our study period. According to the rating calculation mechanism of Meituan–Dianping, the ratings of each restaurant on Meituan–Dianping is directly affected by the complaints about the merchant received by the platform (Meituan–Dianping, 2020). The complaints made through phone calls are recorded by the platform, which, once verified, can affect the ratings of the corresponding merchant. However, the complaint ratio cannot directly affect demand because consumers cannot observe the complaints information on the platform when they place orders. In addition, the IV is not correlated with demand because it is measured by a ratio. Moreover, complaints come from deliverymen, who complain about the merchant for reasons such as an unreasonable revenue allocation or the inaccurate delivery information provided by the merchant. Thus, the complaints influence the credibility and ratings of the merchants, but are not influenced by consumer experiences.

To verify the validity of complaint ratio as an instrument, following previous studies (e.g., Acemoglu et al., 2001; Kumar et al., 2019), we check the first stage estimation results and the exclusion restrictions. We find that the complaint ratio negatively affects ratings (p < 0.05), but it does not directly affect demand once ratings have been controlled for, which validate the strength of our instrument variable. The estimation results are presented in Table 6. The findings in Table 6 suggest that CRD in all three attributes remains negative and significant, which is highly consistent with previous estimation results.

| (1) | (2) | (3) | |

|---|---|---|---|

| Overall | Product | Service | |

| Diff_rating_overall | –0.579*** | ||

| (0.112) | |||

| Rating_overall | 0.714* | ||

| (0.369) | |||

| Diff_rating_product | –0.872*** | ||

| (0.228) | |||

| Rating_product | 0.833* | ||

| (0.476) | |||

| Diff_rating_service | –0.604*** | ||

| (0.223) | |||

| Rating_service | 0.699 | ||

| (0.496) |

- Note. Numbers in parentheses are standard errors. Control variables include Price, Tenure, Competition, GDPPC, and Population, as well as district and cuisine category fixed effects. The results of control variables are omitted because of space limitations.

- *p < 0.1.

- ***p < 0.01.

6 DISCUSSION

6.1 Effect of CRD on online demand

Regression results in Table 2 indicate that CRD in overall performance, products, and services has a significant and negative effect on online demand, which fully supports hypotheses 1(a) through 1(c). This should drive businesses to consider how to allocate their resources for online and offline channels to enhance online consumer demand. Although devoting all efforts to enhancing online consumer ratings would positively affect online consumer demand, this positive effect would be largely offset by the negative effect of CRD.

For an example based on column 4 of Table 2, we assume that merchants have extra resources to allocate to the two channels, and if they allocate all those resources to one channel, consumers’ overall ratings for that channel would increase by 2. If the merchant allocates all those resources to the online channel, the positive effect of the increased online ratings would bring in an additional 2 × 65.9% = 131.8% of demand, offset by the 2 × 56.3% = 112.6% reduction attributable to the CRD. Thus, the demand would only increase by 19.2%. Even worse, if the merchant allocates all its extra resources to the offline channel, the online ratings would not change, but the offline ratings would increase by 2. As a result, online demand would drop by 112.6% because of the CRD. The optimal approach would be to allocate extra resources and sales efforts using an integrated approach between online and offline channels, which prevents discrepancy by increasing the ratings in both channels by one. This way, online demand would increase by 65.9%. This is an example of multihoming where merchants extend their channels both online and offline instead of focusing on one channel exclusively.

6.2 Role of pricing in the impact of CRD on demand

The findings support hypothesis 2, as shown by the results of the regressions in Table 4. A higher price increases the negative effect of CRD on online purchase behavior. The higher monetary cost of purchases causes consumers to perceive a greater risk. When CRD exists, the perceived risk is even more amplified, making consumers more hesitant to purchase goods. In addition, higher prices make consumers’ perceptions of the merchants’ motives more complex and prevent consumers from forming a coherent judgment of the provider when CRD exists. Moreover, higher prices also increase consumers’ expectations of the product and service, thus increasing the likelihood that they will be disappointed by the existence of CRD, which will discourage them from making the purchase.

6.3 Heterogeneity effects

Our results support hypothesis 3. As shown in Table 5, we find that chain store status amplifies the negative impact of CRD on consumer demand. Chain stores usually have standardized operations and brand effects, and consumers have more familiarity and clearer expectations of them. Thus, when chain stores show high performance discrepancy between online and offline channels, it is more unexpected, which reduces consumer purchase intention and behavior more so than with independent stores. Because of the unique and customized products and services offered by independent stores, they are more difficult to be replaced and thus are valued more by consumers even though the ratings are not consistent online and offline.

7 THEORETICAL AND MANAGERIAL IMPLICATIONS

7.1 Theoretical implications

The findings of this study support the cue consistency theory (Maheswaran & Chaiken, 1991) and the multiple inference model (Reeder et al., 2002, 2004), confirming that inconsistent cues and multiple inferences have negative influences on consumer purchase behavior. The findings support the claim that inconsistent information impairs the activation–validation process, thus generating negative perceptions and reducing consumer purchase behavior.

In addition, the findings of this study extend and contribute to the cue consistency theory and the multiple inference model in two respects: first, we specify the two sources of information as consumer ratings from the two channels. These ratings reflect the business's online and offline performance, respectively. The negative impact of CRD shows that consumers care about consistency in a business's online and offline performance, and they integrate the dual channels’ performance when evaluating businesses, which affects their purchase behavior. Second, we contribute to the multiple inference model by discussing the influence of three essential elements—motives, consumer prior knowledge of the business, and situational factors—on consumers’ abilities to form a coherent impression of the business's performance. The selected variables of price and chain stores amplify the impact of CRD on consumer purchase behavior, which supports the multiple inference model.

7.2 Managerial implications

In the O2O era, businesses are striving to improve the performance in both their online and offline channels. However, given their limited resources, many businesses place a higher priority on developing one channel over the other. The findings of this study suggest businesses to take an integrated approach to allocate resources to both online and offline channels to make cross-channel performance consistent.

The CRD negatively influences consumer purchase behavior. Consumers often search for and compare merchants’ online and offline product and service quality before making a purchase, so consistent performance both online and offline causes consumers to perceive products and services as more reliable, and they trust the merchant more. The reputation and brand of the merchants are built by their comprehensive performance in both channels rather than in a single channel.

The core takeaway from our findings is that managers should understand the “bucket effect.” That is, the capacity of a bucket depends on the shortest board rather than the longest board. Lower performance in one channel negatively influences consumer perceptions of the merchant's reputation, reducing their purchase intention. Thus, in the O2O era, because of the interactive influence of demand and consumer perception between channels, businesses should carefully consider the consequences of focusing their efforts on only one channel. Distributing resources and efforts using an integrated approach to enhance product and service performance in both channels is more helpful for generating positive consumer perceptions and demand than placing a higher priority on a certain channel or even focusing on one channel exclusively.

In particular, consumers perceive higher risks when merchants sell higher-priced products or services. Thus, offering consistent, high-quality performance, both online and offline, is more important for enhancing consumers’ trust, causing them to perceive higher utility and benefits from the purchase. Consumers thus have more incentive to build and maintain relationships with merchants and increase their own purchase intentions and behavior (Hayne, Wang, & Wang, 2015). Businesses in a chain need to ensure consistent performance between online and offline channels because consumers are more likely to walk away from these businesses when CRD exists. Enhancing competitive advantages, such as customization and improving core competencies to create unique features, can help businesses perform better in the market.

8 CONCLUDING REMARKS

Using empirical evidence from the Meituan–Dianping platforms, we analyze the influence of CRD on online consumer demand. We find that CRD in overall, product, and service ratings all negatively affects consumer online purchasing behavior. Moreover, higher price amplifies the negative effect of CRD on online consumer demand. The negative effect of CRD is heterogeneous, depending on the properties of the business (i.e., chain vs. independent).

Therefore, this study shows that improving the sales efforts and performance in a single channel (either online or offline) without addressing the other channel cannot achieve an expected sales increase for that channel directly. Only when businesses have consistent online and offline performance, can they build a positive image and goodwill, and thus attract more online demand. That is, making direct efforts to enhance one channel's performance while ignoring the other is only a piecemeal solution. Instead, we recommend the development of an overall plan for the fundamental enhancement of both channels.

Our research examines the impact of CRD on online consumer demand, which opens several new directions for future research. First, in this study, we consider how consumer ratings reflect business performance and how CRD indicates inconsistent performance between online and offline channels. However, it is also possible that the ratings on different channels are affected by online and offline consumer differences in perception, preference, and demographics. For example, online consumers can be more critical than those offline. Wei, Xu, and Zhu (2019) found consumers can become more critical when they complain about the restaurant's online service quality even though the problem, such as the surge pricing of delivery, was caused by the digital platform. However, it is also possible that consumers are more tolerant of restaurants’ online channel performance because they have lower expectations that the food ordered online will be warm or fresh. In addition, consumers’ perceptions of quality and their evaluation of the providers may also be affected by the design, layout, and operations of different platforms.

The above possibilities may lead to the existence of systemic differences between online and offline consumers, and thus CRD may have the measurement error issue. Measurement error in the explanatory variable causes an attenuation bias, which means that the coefficient is biased toward zero (Wooldridge, 2010). As a result, the actual negative impact of CRD could be larger than our estimates. However, we believe the measurement error caused by the above systematic differences between online consumers and offline consumers may not be significant in this study for the following two reasons. First, from the perspective of the restaurant industry, the number of online consumers is growing rapidly along with the increasing popularity of the Internet and the development of information technology, which means that online and offline consumers are interrelated. Second, both the Meituan and Dianping platforms are operated by the same company. Thus, the design, information layout, and rating systems of the two platforms are quite similar. These all reduce potential systemic differences. Future studies could examine the commonalities and differences of online and offline consumer demographics and perceptions toward the providers through surveys or experiments and analyze alternative explanations for CRD.

In addition, in our study, we examine the impact of CRD on online demand. Future research could explore its impact on offline demand—a comparative study might be interesting. Moreover, the impact of CRD on consumer demand could be analyzed in more depth when more data become available. For instance, future studies could better capture the market demand situation by collecting data about income and population size within a certain radius of each restaurant (Seim, 2006). As a final note, with new channels for mobiles and tablets emerging and developing, future research on the impact of these new channels on consumer behavior still has plenty of potential.

ACKNOWLEDGMENTS

This research is supported by the National Natural Science Foundation of China (Grant Nos. 71872200 and 71903024) and Beijing Natural Science Foundation(9192021).

Biographies

Nina Yan is currently working as a full professor in Business School, Central University of Finance and Economics, Beijing, China. She received her PhD in management science from Northeastern University in March 2007. Her current research interests include supply chain finance, operations management, platform economics, etc. She has published over 20 papers in such journals as European Journal of Operational Research, Omega, International Journal of Production Economics, International Journal of Production Research, etc.

Xun Xu holds a PhD in operations management from the Washington State University. He is currently a tenured associate professor in the Department of Management, Operations, and Marketing in College of Business Administration at the California State University, Stanislaus in the United States. He teaches operations management and management science related courses. His research interests include service operations management, supply chain management and coordination, sustainability, e-commerce, data and text mining, and the interface of hospitality and operations management. He has published over 40 papers in such journals as Annals of Tourism Research, Computers and Industrial Engineering, Decision Support Systems, European Journal of Operational Research, Journal of Business Research, Journal of the Operational Research Society, Journal of Travel Research, International Journal of Hospitality Management, International Journal of Contemporary Hospitality Management, International Journal of Information Management, International Journal of Production Economics, and International Journal of Production Research, along with others.

Tingting Tong is an associate professor in Dongbei University of Finance and Economics, China. She received her PhD in economics from Georgia Institute of Technology in August 2016. Her research focuses on operations management, labor economics, and applied econometrics. Her articles have been published by journals such as International Journal of Production Economics, China Economic Review, and Journal of Transport Geography.