Overcoming the blockchain technology credibility gap

Abstract

Blockchain technology has been designed to improve the transmission of transparent information across a variety of industries and products. Yet, consumers tend to perceive product information provided by blockchain technology (vs. humans) as less credible. As this may not apply to all consumers, it becomes critical for companies to understand how to improve blockchain perceived credibility. This work investigates how individual differences and marketing actions shape consumer responses to product information provided by blockchain technology (vs. humans). Four controlled experiments demonstrate that consumers perceive the information provided by blockchain technology (vs. humans) as having less credibility, which in turn decreases word-of-mouth and intention to share information about the product on social media (Study 1). This effect is stronger for consumers with lower need for cognition (Study 2a), which in turn affects willingness to buy and actual behavior (Study 2b). Providing social proof—that is, the number of satisfied customers who recommend blockchain technology—increases blockchain perceived credibility (Study 3). These insights deepen the understanding of how individual differences shape consumer's responses to product information provided by blockchain technology and offer actionable insights on how to boost technology credibility.

1 INTRODUCTION

Blockchain technology is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network (Tan & Saraniemi, 2022). It has been shown to create an “Internet of trust” by guaranteeing information integrity (Peres et al., 2022; Tan & Salo, 2023). As such, blockchain technology has meaningful implications for information search (i.e., the retrieval of knowledge from external sources) that occurs early in consumer decision-making (Gleim & Stevens, 2021). Consumers often collect (in a somewhat random order) product information from a variety of sources, including other humans and technologies (Branco et al., 2012). However, consumers often question the credibility of this information, especially when it comes from technological sources (Schimmelpfennig & Hunt, 2020), which in turn shapes a variety of marketing outcomes, including electronic word-of-mouth (Giakoumaki & Krepapa, 2020; Lim et al., 2022), intention to follow the recommendation (Flavián et al., 2023), intention to share information on social media (Kulkarni et al., 2020), purchase intention (Baek et al., 2010; Flavián et al., 2023), and actual behavior (Gaczek et al., 2023). Therefore, revealing new ways of increasing information credibility, especially that provided by technology, seems to be of pivotal importance for both business and consumers.

In this vein, blockchain technology could potentially increase the credibility of shared product information by recording the origin and reporting the authenticity of product components throughout the value chain (Joo et al., 2023; Kumar, 2018). In this way, consumers can easily check where a product or its components have come from, who has handled it, whether it is legitimate or fake, and so forth (Tan & Salo, 2023). However, previous research suggests that consumers generally tend to rely more on human as opposed to technological sources of information (Castelo et al., 2019; Longoni et al., 2019). But does this apply to blockchain technology and do all consumers perceive blockchain technology as a less credible source of information? And if so, what can companies do to improve blockchain technology credibility and thereby enhance the return on investment from adopting this technology?

According to the Elaboration Likelihood Model, which describes different ways of processing information presented in support of an advocacy (Petty & Briñol, 2011), consumer tendency to elaborate information either through the central or the peripheral route affects their perceptions of source credibility (Balabanis & Chatzopoulou, 2019; Lee & Koo, 2016). Against this backdrop, we examine whether individual differences, which are believed to influence information processing, may shape consumer perceptions of blockchain technology credibility. Specifically, we examine the role of need for cognition—that is, individual tendency to engage in and enjoy effortful cognitive activity (Lord & Putrevu, 2006)—in shaping consumer responses to blockchain technology. We suggest that individuals who are less likely to engage in and enjoy effortful cognitive activity will perceive blockchain technology as a less credible source of information, which will in turn affect purchase intention and actual behavior. Finally, building on social influence literature (Risselada et al., 2014; Senecal & Nantel, 2004), we propose that providing social proof—that is, a psychological phenomenon whereby people conform to the feedback or actions of others under the assumption that such actions reflect correct behavior (Cialdini, 2007), can enhance blockchain technology credibility.

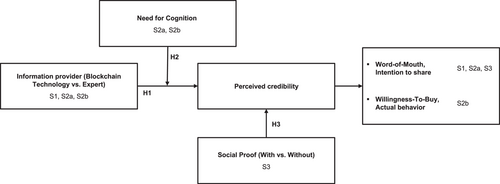

Four sequential controlled experiments test these possibilities. Study 1 provides evidence for the lower perceived credibility of product information provided by blockchain technology (vs. human expert). Studies 2a and 2b test the role of need for cognition in shaping perceived credibility of product information provided by blockchain technology (vs. human expert). Study 3 examines whether the use of social proof can help companies enhance blockchain technology credibility.

This work makes three main contributions. First, we contribute to the research on consumer responses to information provided by technology (Castelo et al., 2019; Davenport et al., 2020; Puntoni et al., 2021) by studying the perceived credibility of product information provided by blockchain technology (vs. humans). This is a particularly important topic, as companies are increasingly interested in boosting the credibility of the product-related information provided by technology.

Second, we contribute to the literature on individual differences in technological acceptance (Dietvorst et al., 2018; Gill, 2020; Longoni et al., 2019). Prior research has studied technology adoption by analyzing differential effects due to individual traits such as identity motives (Leung et al., 2018), need for uniqueness (Granulo et al., 2021; Longoni et al., 2019), attachment style (Pozharliev, Rossi, et al., 2021), and need for social interaction (Belanche et al., 2021) (see Table 1). To the best of our knowledge, no previous research has studied the role of need for cognition, an important individual trait affecting information processing (Brennan & Bahn, 2006; Martin et al., 2005; Nan, 2009), in technological acceptance.

| Paper | Method | Individual factors | Key findings |

|---|---|---|---|

| Belanche et al. (2021) | Online experiment |

|

Perceived warmth influences relational expectations (i.e., emotional value) and this effect is more pronounced for customers with a low (vs. high) need for social interaction. |

| Blut and Wang (2020) | Meta-analysis |

|

Age is negatively correlated with technology readiness motivators (innovativeness, optimism), while education and experience are positively correlated with motivators. In contrast, inhibitors (insecurity, discomfort) demonstrate the opposite effect. |

|

|||

|

|||

|

|||

| Faraji-Rad et al. (2017) | Online experiment |

|

When desire for control is high—as an individual trait as well as a situational state—consumers are less willing to accept new (vs. traditional) products. |

| Granulo et al. (2021) | Online survey |

|

Consumers prefer human (vs. robotic) labor more for products with higher (vs. lower) symbolic value. Individual differences in need for uniqueness moderate the interaction between production mode and symbolic motives. |

| Leung et al. (2018) | Online survey/lab experiment |

|

People who strongly identify with a particular social category resist automated features that hinder the attribution of identity-relevant consumption outcomes to themselves. |

| Logg et al. (2019) | Online experiment |

|

People readily rely on algorithmic advice regardless of their age and gender. |

|

|||

| Longoni et al. (2019) | Online survey |

|

Uniqueness neglect drives consumer resistance to medical AI, with the sense of uniqueness as a key moderator. Resistance to medical AI is stronger for consumers who perceive themselves to be more unique. |

| Lourenço et al. (2020) | Online survey |

|

Older people are less satisfied and have less trust in the algorithmic interaction than younger people. In addition, compared to males, females are on average clearly less satisfied with their interaction with the advisor algorithm. |

|

|||

| Pozharliev, Rossi, et al. (2021) | Online experiment |

|

Customers with low (vs. high) scores on anxious attachment style respond more negatively to frontline service robot (vs. frontline human agent). |

| Yang and Hu (2022) | Online experiment |

|

Consumers prefer AI-enabled customer service when the brand personality is competence and human-staffed service when the brand personality is sincerity. The positive effects of the alignment between brand personality and service emerge for high-involvement consumers, but not for low-involvement consumers. |

| Zhu et al. (2007) | Computer-based experiment |

|

The interactive effects of self-service technologies (SSTs) features are moderated by a customer discomfort with technology and experience. Novice customers or those that are highly technology ready allot a sizable portion of their cognitive resources to the SST task. |

|

|||

| Current research | Online experiment |

|

Need for cognition moderated consumer responses to blockchain technology. Individuals with lower levels in need for cognition show lower perceived credibility and therefore lower intention to share product related information provided by blockchain technology (vs. human expert). |

Third, we contribute to the literature on social influence (Risselada et al., 2014; Senecal & Nantel, 2004) by showing that social proof can enhance the credibility of product information provided by blockchain technology. Finally, our results provide practical insights in terms of how segmentation and communication can be used to improve blockchain technology acceptance.

2 THEORETICAL DEVELOPMENT

2.1 Consumer perspectives of blockchain technology

New technologies often have inherently conflicting and even opposing properties that make their complete diffusion and adoption complicated (Frank et al., 2023). For instance, blockchain technology can improve the transmission of transparent information across a variety of industries and products, but not all consumers tend to perceive it as trustworthy and credible (Dupuis et al., 2021). This paradox of technology poses a challenge for marketers because as functional benefits increase, so do perceived risks for consumers in using the technology (Li & Choudhury, 2021), preventing its adoption.

While the use of blockchain technology remains low due to perceived high risks (Albayati et al., 2020), most people show a lack of trust in blockchain technology (Tan & Saraniemi, 2022). In fact, trust, which is intrinsically related to credibility, is the main factor influencing consumer behavioral intention and the actual use of blockchain technology, and its full adoption is hindered in the absence of trust (Dupuis et al., 2021). Consumers feel more confident about blockchain technology and the information it provides when, for example, they have a positive attitude toward the technology and information about the system and its quality (Dupuis et al., 2021). Since trust is conceptually embedded in the broader notion of credibility (Ohanian, 1990), we focus on this aspect to investigate consumer attitudes to information provided by blockchain technology and the comparison with human beings.

2.2 Credibility

The perceived credibility of an information source—that is, the extent to which a source is perceived as possessing expertise relevant to the communication topic and can be trusted to give an objective opinion on the subject (Ohanian, 1990)—is of great importance to consumers (Schimmelpfennig & Hunt, 2020). The question of credibility is pivotal because consumers are less persuaded by product information when they perceive that a source is not credible (Flavián et al., 2023; Pornpitakpan, 2004). Flavián et al. (2023) showed that the influence of recommendations on behavioral intentions is mediated by consumer perceptions of their credibility. Schimmelpfennig and Hunt (2020) identified several consequences of perceived source credibility, including some related to consumers such as satisfaction and word-of-mouth. Word-of-mouth, linked to the intention to share on social media (Giakoumaki & Krepapa, 2020), is a commonly researched credibility outcome (Jin & Phua, 2014; Pozharliev et al., 2022). It is a critical resource for companies because it has higher credibility than traditional media (Giakoumaki & Krepapa, 2020). Indeed, most consumers refer to the opinions of other people when assessing product information or before making final purchase decisions (Babić Rosario et al., 2016).

Although blockchain technology has largely been linked to financial services, researchers and practitioners have demonstrated that the benefits of this technology have a broader scope (Eckhardt et al., 2019). Indeed, blockchain technology has the potential to transform a variety of business industries such as food and electronics by offering new ways of collecting, handling, and retrieving product information (Joo et al., 2023). As such, blockchain technology has the potential to significantly improve the credibility of shared data by providing relevant information about location tracking, component origin, and changes in ownership rights across the supply chain (Tan & Salo, 2023). Consequently, business should seek to better understand consumer responses to product information provided by blockchain technology.

Previous research on consumer responses to information provided by technology (Dietvorst et al., 2018; Longoni et al., 2019) has highlighted individuals' general reluctance to follow advice given by an artificial intelligence, algorithm, or robot (Castelo et al., 2019; Longoni et al., 2019; Puntoni et al., 2021). This is mainly because people perceive technology as a less credible source of information than human sources (Longoni et al., 2019). However, is the low credibility of artificial intelligence, mathematical algorithms, and robots applicable to blockchain technology? Despite the huge potential of blockchain technology in improving the credibility of information exchanges (Völter et al., 2023), there has been scant attention to how consumers respond to information provided by blockchain technology. Building on the above, we hypothesize that:

H1.Consumers perceive product information shared by blockchain technology (vs. humans) as less credible, which in turn reduces positive word-of-mouth and the intention to share product information on social media.

2.3 Need for cognition

Previous research suggests that the effect of perceived source credibility could be contingent upon an array of individual factors, such as identity motives (Leung et al., 2018), the need for uniqueness (Granulo et al., 2021; Longoni et al., 2019), attachment style (Pozharliev, De Angelis, et al., 2021), the need for social interaction (Belanche et al., 2021), and involvement with the message and product (Schimmelpfennig & Hunt, 2020). However, little is known about how individual differences affect the perceived credibility of product information provided by blockchain technology (vs. humans).

One factor that affects information processing and could lead to an increase or decrease in perceived credibility is the individual need for cognition (Areni et al., 2000; Suri & Monroe, 2001). Need for cognition—a stable individual difference in people's tendency to engage in and enjoy effortful cognitive activity—has been identified as a significant determinant of the type of information processing approach a consumer will adopt (Brennan & Bahn, 2006; Martin et al., 2005). Need for cognition is associated with the amount of thought that goes into making a decision, such as sharing product-related information. Individuals high in need for cognition tend to search and reflect on information to make sense of stimuli and events (Lord & Putrevu, 2006; Suri & Monroe, 2001). They make their decisions based on multiple sources of information and evidence. Consumers high in need for cognition are more likely to form their attitudes (e.g., perceived credibility) by paying close attention to relevant arguments (Diamantopoulos et al., 2020). In contrast, consumers low in need for cognition will put less effort into information processing (i.e., they process peripherally) due to a higher reliance on heuristics (Chatterjee et al., 2005).

In the context of Internet information search, Amichai-Hamburger et al. (2007) found that people high in need for cognition tended to consider the informational attributes (e.g., verbal information) as more critical to a website's persuasiveness than other non-informational attributes (e.g., visual information). This substantiates Heckler et al.'s (1993) previous finding that people high in need for cognition demonstrate a preference for verbal processing versus visual processing.

In light of prior research (Areni et al., 2000; Diamantopoulos et al., 2020; Martin et al., 2005) we expect that individuals high in need for cognition will perceive the product information provided by blockchain technology (vs. a human expert) as equally credible so long as the verbal information (e.g., product characteristics, origin, and quality of the components, etc.) provided by each source is the same. Conversely, individuals low in need for cognition may make inferences about the source credibility by engaging in heuristic processing based on other, possibly visual, contextual cues (Heckler et al., 1993; Richard & Chebat, 2016), such as the visual image of a human expert, which might signal credibility (especially when compared to technology). By extension, we expect that the lack of human reference for information provided by blockchain technology will negatively affect its credibility for individuals low in need for cognition. Moreover, past research suggests that enhancing perceived credibility can increase purchase intention (Baek et al., 2010) and actual behavior toward the recommended product (Gaczek et al., 2023; Huang et al., 2023). Building on the above, we hypothesize that:

H2.Decrease in need for cognition leads to a decrease in perceived credibility of information provided by blockchain technology (vs. a human), which in turn decreases positive word-of-mouth, intention to share, willingness to buy, and actual behavior.

2.4 Social proof

Along with finding out whether negative perceptions about blockchain technology may be subject to individual differences in information processing, businesses also need to determine the actions they can take to improve blockchain technology credibility. While previous studies have suggested several tactics for reducing consumer negative responses to technology-based recommendations (Castelo et al., 2019; Longoni et al., 2019), there has been less attention to business solutions that could enhance blockchain technology credibility. For example, Castelo et al. (2019) found that showing real examples of AI technology with affective abilities could improve trust in the information. Dietvorst et al. (2018) demonstrated that allowing people to slightly change the output of an algorithm makes them feel more confident with the reported results. Finally, Longoni et al. (2019) revealed that including human support can increase trust in the information provided by AI technology.

While all these tactics can be useful in alleviating concerns about information provided by technology, there is no better way to gain someone's confidence than by showing them that others find the information trustworthy and reliable (Hyken, 2020). Building on the social influence literature (Risselada et al., 2014; Senecal & Nantel, 2004), we suggest that providing social proof can improve blockchain technology credibility. The efficacy of social proof on consumer trust toward products and services has been demonstrated in both the adoption of high-tech products (Risselada et al., 2014) and in other business contexts, including financial services (Rao et al., 2001), online shopping (Senecal & Nantel, 2004), and traditional retailing (Salmon et al., 2015). This evidence suggests that showing decision-makers that they are making the right choice could be an appropriate tactic for boosting perceived credibility (Hyken, 2020). The same may be true for enhancing the credibility of blockchain technology (Cialdini, 2007).

One way to harness social proof is to highlight people's positive responses and showcase real-time statistics (e.g., number of satisfied customers) derived from current customers (Amblee & Bui, 2011). Hence, we employed the phrase, “9 out 10 previous customers were extremely satisfied with the certification and would recommend it to friends and relatives.” Thus, we hypothesize that:

H3.Social proof enhances the perceived credibility of information provided by blockchain technology, which in turn increases positive word-of-mouth and intention to share.

Please, refer to Figure 1 for the full conceptual framework showing studies' contribution in relation to the hypotheses.

3 STUDY 1: BLOCKCHAIN TECHNOLOGY CREDIBILITY, WORD-OF-MOUTH, AND INTENTION TO SHARE

In Study 1, we explore consumer responses (e.g., perceived credibility, word-of-mouth, intention to share) to product information provided by blockchain technology (vs. a human expert). We used the experimental vignette method in this and subsequent studies. Vignettes are designed to explore participants' attitudes, judgments, or behaviors by presenting a hypothetical, but realistic scenario where key variables are intentionally modified, but the rest of the vignette content remains the same (Belanche et al., 2021).

3.1 Methods

3.1.1 Participants

Two hundred (Mage = 26.39 years, SD = 8.58, 56.5% male) individuals from the US and UK were recruited via Prolific and participated in the study in exchange for payment. At the end of the experiment, all participants were informed that the product and the displayed information used in the study were fictitious.

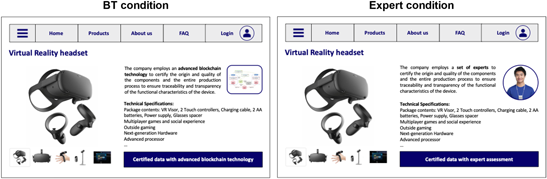

3.1.2 Procedure

The study utilized a between-subject design. After receiving a brief introduction to the experiment, respondents were randomly exposed to one of the two experimental conditions—blockchain technology (N = 100) and human expert (N = 100), being instructed as to which of the two sources provided them with the information. At the beginning of the study, participants were presented with the experimental stimulus (see Table 2). Subsequently, they were asked to express their level of agreement with a set of items that measured (1) the perceived credibility of the source, (2) their willingness to create word-of-mouth, and (3) their intention to share the information about the product on their personal social media accounts (see Web Appendix A Table A1).

| Study | Stimuli |

|---|---|

| Study 1 |  |

| Study 2a |  |

| Study 2b |  |

| Study 3 |  |

3.1.3 Data acquisition

Perceived credibility was assessed using a 7-point semantic differential scale, previously tested by Ohanian (1990). Word-of-mouth was assessed using a 7-point Likert scale (1 = strongly disagree; 7 = strongly agree) (Lim et al., 2017). Intention to share was measured with a dichotomous question (“Would you like to share information about the product seen previously through your social media?”).

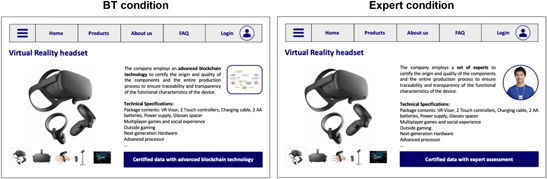

3.1.4 Stimuli

The stimuli used in the experiment were inspired by Media Markt, a German retail chain specializing in electronics and consumer appliances (MediaMarkt, 2022). The interface and graphics were slightly changed for the purposes of the study (see Table 2). The subjects saw an image displaying a product sheet about a virtual reality headset, which informed respondents that the origin and quality of the components, as well as the entire production process, were certified by an advanced blockchain technology (vs. a human expert) to ensure the traceability and transparency of the device's functional characteristics.

To select an appropriate product, we first performed a pretest aimed at analyzing how consumers perceive and classify technology products according to the Search-Experience-Credence attributes (SEC) (Roy & Naidoo, 2021). The objective was to provide the respondents with an experience product—that is, an item whose information could not be known until tried or used (Girard & Dion, 2010)—thus making it necessary to search for information. The pretest was administered to 80 individuals from the US and UK who were recruited via Prolific in exchange for payment. The respondents were provided with the definition of SEC products, according to Girard and Dion (2010), and then asked to assign 10 products to one of the SEC classes (“Please, according to the definitions previously read, indicate which category the above products fall into:…”). Based on participants' classifications, the most frequently cited experience product was a “virtual reality headset” (see Web Appendix A Table A2).

We conducted a second pretest to select an appropriate human expert (e.g., professor, industry expert, engineer, system analyst). First, we recruited 60 participants from the US and UK via Prolific in exchange for payment. Respondents then assessed the perceived credibility (Ohanian, 1990) of different professionals in the field of technology (see Web Appendix A Table A3). Because no statistical differences emerged between the proposed characters, we interviewed five graduate researchers who declared a unanimous preference for the industry expert over the other options.

3.2 Results

3.2.1 Perceived credibility

We assessed differences in the perceived credibility of blockchain technology (vs. a human expert) using a one-way analysis of variance (ANOVA). An ANOVA with the information provider (blockchain technology vs. human expert) as the independent variable and perceived credibility as the dependent variable revealed a significant effect of the information provider (Mblockchain technology = 4.76, SD = 0.915 vs. Mhuman = 5.20, SD = 0.867, F(1, 199) = 12.30, p < 0.001).

3.2.2 Mediation

We conducted a regression analysis with the information provider (blockchain technology = 1; human expert = 0) as the independent variable, intention to share as the dependent variable, and perceived credibility and word-of-mouth as the mediators. The regression was conducted via PROCESS macro SPSS (Model 6) (Hayes, 2017).

The regression analysis revealed a significant effect of the information provider on perceived credibility (b = −0.442, p < 0.001), and a significant effect of credibility on word-of-mouth (b = 0.755, p < 0.001), which in turn significantly affected the intention to share (b = 1.315, p < 0.001). Taken together, these results suggest that the lower perceived credibility of blockchain technology (vs. a human) explains participants' lower willingness to spread word-of-mouth and share product information on social media for blockchain technology (vs. a human).

3.3 Discussion

The results of Study 1 provide support for H1 (see Table 3). We found that blockchain technology (vs. a human expert) is perceived as less credible, which in turn affects word-of-mouth and the intention to share product information on social media. Such evidence lends further support to the common consumer aversion to technology, illustrating how this reluctance extends beyond innovations such as artificial intelligence (Longoni & Cian, 2022) to blockchain technology.

| Hypothesis | Study | Result |

|---|---|---|

| H1: Consumers perceive product information shared by blockchain technology (vs. a human) as less credible, which in turn reduces positive word-of-mouth and the intention to share product information on social media. | Study 1 | Validated |

| H2: Decrease in need for cognition leads to a decrease in perceived credibility of information provided by blockchain technology (vs. a human), which in turn decreases positive word-of-mouth, intention to share, willingness to buy, and actual behavior. | Study 2 | Validated |

| H3: Social proof enhances perceived credibility of information provided by blockchain technology, which in turn increases positive word-of-mouth and the intention to share. | Study 3 | Validated |

4 STUDY 2A: NEED FOR COGNITION AND CREDIBILITY

Study 2a replicates the findings of Study 1 and extends them by deepening the understanding of the role of individual differences in shaping information processing and perceived credibility of information provided by blockchain technology (vs. human expert). Specifically, Study 2a contributes to the conceptual model by investigating how one such individual trait, namely need for cognition, affects the perceived credibility of blockchain technology (vs. human expert), word-of-mouth, and intention to share the information about the product on personal social media accounts.

4.1 Study 2a methods

4.1.1 Participants

Two-hundred and thirty (Mage = 27.6 years, SD = 7.6, 54.3% male) individuals from the US and UK were recruited via Prolific to participate in this study in exchange for payment. At the end of the experiment, all participants were informed that the product and the displayed information used in the study were fictitious.

4.1.2 Procedure

The study employed a between-subject design. After receiving a brief introduction to the experiment, respondents were randomly exposed to one of the two experimental conditions that differed in the information provider: blockchain technology (N = 116) and human expert (N = 114). At the beginning of the study, participants were presented with the experimental stimulus (see Table 2). Subsequently, they were asked to express their level of agreement with a set of items measuring (1) the perceived credibility of the source, (2) their willingness to create word-of-mouth, (3) their intention to share the information about the product on their personal social media accounts, and (4) their need for cognition (see Web Appendix A Table A1).

4.1.3 Data acquisition

Perceived credibility (Ohanian, 1990), word-of-mouth (Lim et al., 2017), and intention to share were measured using the scales and items adopted in Study 1. Need for cognition (Cacioppo et al., 1984), introduced here, was measured using a 7-point Likert scale (1 = strongly disagree; 7 = strongly agree).

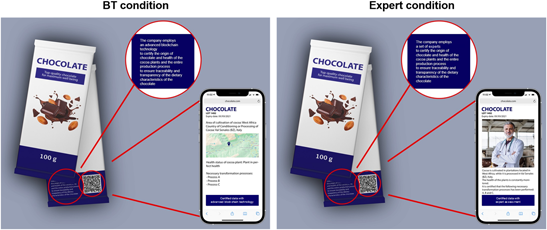

4.1.4 Stimuli

In Study 2a, we replaced the technological product with a food one to offer generalizability of our results and show they are not contingent to a specific product category. Specifically, the stimuli used in the experiment were inspired by an existing chocolate package. The design and graphics were slightly changed for the purposes of the study (see Table 2). The subjects saw an image displaying chocolate packaging that contained information on the origin and quality of the cocoa plants, as well as the entire production process. All information was certified either by blockchain technology or a human expert to ensure the traceability and transparency of the dietary characteristics of the chocolate. Furthermore, the package displayed a QR Code, through which consumers could access the online retailer and see an enlarged version of the product information.

Like in Study 1, we conducted a pretest to select a human expert (e.g., professor, industry expert, agronomist, farmer). Eighty participants from the US and UK were recruited via Prolific in exchange for payment; they assessed the perceived credibility (Ohanian, 1990) of different professionals in the field of food (see Web Appendix A Table A4). Once again, we observed no statistical difference between the proposed characters, and thus interviewed five graduate researchers who all reported a preference for the industry expert.

4.2 Study 2a results

4.2.1 Perceived credibility

We assessed differences in the perceived credibility of blockchain technology (vs. a human expert) using a one-way ANOVA. An ANOVA with the information provider (blockchain technology vs. human expert) as the independent variable and perceived credibility as the dependent variable which revealed a significant effect of the information provider (Mblockchain technology = 5.16 SD = 1.024 vs. Mhuman = 5.49, SD = 0.782, F(1, 229) = 7.33, p = 0.007).

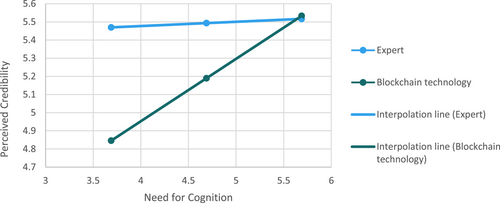

4.2.2 Moderation

To assess the effect of need for cognition on perceived credibility, we conducted a regression analysis with the information provider (blockchain technology = 1; human expert = 0) as the independent variable, need for cognition as the moderator, and perceived credibility as the dependent variable. The regression was conducted via PROCESS macro SPSS (Model 1) (Hayes, 2017).

As expected, there was a significant interaction (Figure 2) between the information provider and need for cognition on perceived credibility (b = 0.320; p = 0.009). The cut-off value of the moderator was determined through the Johnson−Neyman analysis, conducted in Hayes' Process. The cut-off for the need for cognition score equals 4.89, meaning that the mediation is significant for participants whose need for cognition score is 4.89 or lower. We set the low, moderate, and high levels of need for cognition as −1SD, mean, and +1SD, respectively. Participants perceived the information provider as less credible when it was the blockchain technology (vs. human expert) for both low (Mblockchain technology = 4.84 vs. Mhuman = 5.47, b = −0.624, p < 0.001) and moderate levels of need for cognition (Mblockchain technology = 5.19 vs. Mhuman = 5.49, b = −0.304, p < 0.010). However, we found no significant difference in perceived credibility for participants with high (p = 0.923) levels of need for cognition.

4.3 Moderated mediation

To assess the overall indirect effect of blockchain technology (vs. a human expert) on the intention to share, we conducted a regression analysis with the information provider (blockchain technology = 1; human expert = 0) as the independent variable and need for cognition as the moderator of the former's effect on perceived credibility. Perceived credibility and word-of-mouth were the mediators, while intention to share was the dependent variable. The regression was conducted via PROCESS macro SPSS (Model 83) (Hayes, 2017). Model 83 was used to assess the overall indirect effect of blockchain technology (vs. a human expert) on the intention to share, in tandem with the double mediation of perceived credibility and word-of-mouth, and the moderation of need for cognition.

We observed a significant index of moderated mediation through perceived credibility and word-of-mouth (b = 0.242; LCI = 0.021; UCI = 0.532). In particular, the results showed that the indirect effect of the information provider on the intention to share the product information through perceived credibility and word-of-mouth was not significant for participants scoring high (b = 0.012; LCI = −0.282; UCI = 0.326) on need for cognition, indicating that this group perceived no differences between blockchain technology and the human expert. However, the indirect effect became significant as need for cognition decreased to both low (b = −0.472; LCI = −0.896; UCI = −0.170) and moderate (b = −0.230; LCI = −0.464; UCI = −0.052) levels. Specifically, people scoring below 4.89 on need for cognition showed a decreased intention to share the product information provided by blockchain technology.

4.4 Study 2a discussion

The results of Study 2a confirmed our findings from Study 1 and extended them by deepening the understanding of how individual differences shape consumer responses to product information provided by blockchain technology. Specifically, we found that need for cognition moderates perceived credibility, which in turn affects willingness to spread word-of-mouth and intention to share information about the product on social media thus providing support for H2 (see Table 3).

4.5 Study 2b methods

Study 2a replicates the findings of Study 2b and extends them by showing that the moderating effect of need for cognition on perceived credibility affects not only willingness to spread word-of-mouth and intention to share information about the product on social media, but also willingness to buy and actual behavior.

4.5.1 Participants

Three-hundred (Mage = 33.8 years, SD = 10.1, 60.3% male) individuals from the US and UK were recruited via Prolific to participate in this study in exchange for payment. At the end of the experiment, all participants were informed that the product and the displayed information used in the study were fictitious.

4.5.2 Procedure

The study employed a between-subject design. After receiving a brief introduction to the experiment, respondents were randomly exposed to one of the two experimental conditions that differed in the information provider: blockchain technology (N = 150) and human expert (N = 150). At the beginning of the study, participants were presented with the experimental stimulus (see Table 2). Subsequently, they were asked to express their level of agreement with a set of items measuring (1) the perceived credibility of the source, (2) their willingness to buy the product, and (3) need for cognition (see Web Appendix A Table A1). Finally, we recorded their actual behavior.

4.5.3 Data acquisition

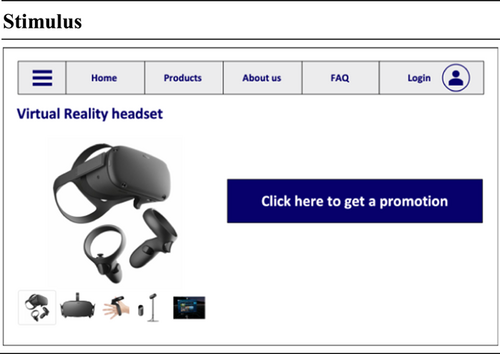

Perceived credibility (Ohanian, 1990) and need for cognition (Cacioppo et al., 1984) were measured using the scales and items adopted in Study 2a. Willingness to buy (Sweeney et al., 1999), was measured using a 7-point Likert scale (1 = strongly disagree; 7 = strongly agree). The actual behavior was measured by asking respondents to press a button if they were interested in receiving a promotion, or to move on with the survey if they were not interested (“Please, click on the blue button below if you want to receive a promotion on the product you have seen. Then, tap the arrow. Otherwise, if you do not want a promotion, proceed directly by tapping the arrow.”).

4.5.4 Stimuli

The stimuli used in the experiment were the same as Study 1. In addition, we also designed another stimulus to measure respondents' actual behavior. Specifically, the subjects saw an image displaying the virtual reality headset and a button with the text “Click here to get a promotion” at the top (Figure 3).

4.6 Study 2b results

4.6.1 Perceived credibility

We assessed differences in the perceived credibility of blockchain technology (vs. a human expert) using a one-way ANOVA. An ANOVA with the information provider (blockchain technology vs. human expert) as the independent variable and perceived credibility as the dependent variable revealed a significant effect of the information provider (Mblockchain technology = 4.64, SD = 1.018 vs. Mhuman = 5.06, SD = 0.808, F(1, 299) = 15.78, p < 0.001).

4.6.2 Moderation

To assess the effect of need for cognition on perceived credibility, we conducted a regression analysis with the information provider (blockchain technology = 1; human expert = 0) as the independent variable, need for cognition as the moderator, and perceived credibility as the dependent variable. The regression was conducted via PROCESS macro SPSS (Model 1) (Hayes, 2017).

As expected, there was a significant interaction between the information provider and need for cognition on perceived credibility (b = 0.574; p < 0.001). The cut-off value of the moderator was determined through the Johnson−Neyman analysis, conducted in Hayes' Process. The cut-off for the need for cognition score equal 5.16, meaning that the mediation is significant for participants whose need for cognition score is lower than 5.16. We set the low, moderate, and high levels of need for cognition as −1SD, mean, and +1SD, respectively. Participants perceived the information provider as less credible when it was the blockchain technology (vs. human expert) for both low (Mblockchain technology = 4.11 vs. Mhuman = 5.11, b = −1.000, p < 0.001) and moderate levels of need for cognition (Mblockchain technology = 4.61 vs. Mhuman = 5.05, b = −0.445, p < 0.001). However, we found no significant difference in perceived credibility for participants with high (p = 0.427) levels of need for cognition.

4.6.3 Moderated mediation

To assess the overall indirect effect of blockchain technology (vs. a human expert) on actual consumer behavior, we conducted a regression analysis with the information provider (blockchain technology = 1; human expert = 0) as the independent variable and need for cognition as the moderator of the former's effect on perceived credibility. Perceived credibility and willingness to buy were the mediators, while the actual behavior was the dependent variable (click = 1; no click = 0). The regression was conducted via PROCESS macro SPSS (Model 83) (Hayes, 2017). Model 83 was used to assess the overall indirect effect of blockchain technology (vs. a human expert) on the actual behavior, in conjunction with the double mediation of perceived credibility and willingness to buy, and the moderation of need for cognition.

We observed a significant index of moderated mediation through perceived credibility and willingness to buy (b = 0.091; LCI = 0.006; UCI = 0.201). In particular, the results showed that the indirect effect of the information provider on the actual behavior through perceived credibility and willingness to buy was not significant for participants scoring high (b = 0.018; LCI = −0.029; UCI = 0.074) on need for cognition, indicating that this group perceived no difference between the blockchain technology and human expert. However, the indirect effect became significant as need for cognition decreased to both low (b = −0.159; LCI = −0.345; UCI = −0.012) and moderate (b = −0.071; LCI = −0.162; UCI = −0.005) levels.

4.6.4 Study 2b discussion

The results of Study 2b confirmed our findings from Study 2a and thus provided support for H2. Moreover, Study 2b complements Study 2a by showing that the moderating effect of need for cognition on perceived credibility affects not only willingness to spread word-of-mouth and intention to share information about the product on social media, but also willingness to buy and actual behavior.

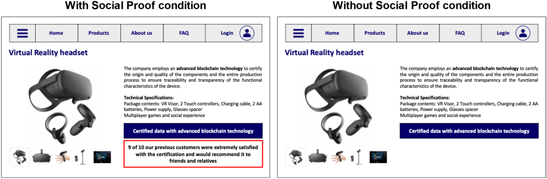

5 STUDY 3: SOCIAL PROOF

Study 3 contributes to the previous studies by providing actionable insights for boosting blockchain technology credibility. Specifically, we explored the effect of including social proof (e.g., “9 out 10 previous customers were extremely satisfied with the certification and would recommend it to friends and relatives”) on the perceived credibility of blockchain technology, word-of-mouth, and the intention to share the product information on social media.

5.1 Methods

5.1.1 Participants

Two hundred (Mage = 32.4 years, SD = 9.8, 57.7% male) individuals from the US and UK were recruited via Prolific to participate in the study in exchange for payment. At the end of the experiment, all participants were informed that the product and the displayed information used in the study were fictitious.

5.1.2 Procedure

The study employed a between-subject design. After receiving a brief introduction to the experiment, respondents were randomly exposed to one of the two experimental conditions: with social proof (N = 100) and without social proof (N = 100). First, participants were presented with the experimental stimulus. Subsequently, they were asked to express their level of agreement with a set of items measuring (1) the perceived credibility of the source, (2) their willingness to generate word-of-mouth, and (3) their intention to share the information about the product on their personal social media accounts (see Web Appendix A Table A1).

5.1.3 Data acquisition

We measured perceived credibility (Ohanian, 1990), word-of-mouth (Lim et al., 2017), and intention to share using the scales and items adopted in Study 1 and Study 2.

5.1.4 Stimuli

The stimuli used in the experiment were drawn from Study 1 and modified for the purposes of the current study with (or without) the social proof (see Table 2). In the scenario without social proof, participants were exposed to the same stimulus from Study 1. In the scenario with social proof, the stimulus was modified by adding the following social proof statement: “9 out 10 previous customers were extremely satisfied with the certification and would recommend it to friends and relatives.”

5.2 Results

5.2.1 Perceived credibility

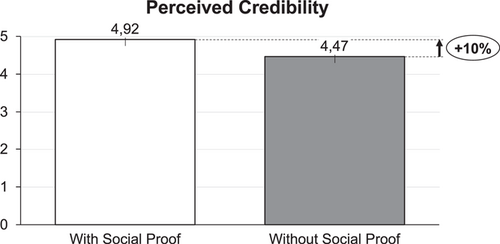

We assessed differences in the perceived credibility of blockchain technology with social proof (vs. without social proof) using a one-way ANOVA. An ANOVA—with social proof (vs. without social proof) as the independent variable and perceived credibility as the dependent variable—revealed a significant effect (Figure 4) of the social proof (Mwithsocialproof = 4.92, SD = 1.240 vs. Mwithoutsocialproof = 4.47, SD = 1.386, F(1, 199) = 6.28, p = 0.008).

5.2.2 Mediation

To assess the overall indirect effect of the product information with social proof (vs. without social proof) on the intention to share, we conducted a regression analysis with the Condition (with social proof = 1; without social proof = 0) as the independent variable, the perceived credibility and word-of-mouth as the mediators, and the intention to share as the dependent variable. The regression was conducted via PROCESS macro SPSS (Model 6) (Hayes, 2017). Model 6 was used to assess the overall indirect effect of the product information with social proof (vs. without social proof) on the intention to share, with the double mediation of perceived credibility and word-of-mouth.

The regression analysis revealed a significant effect of the Condition on perceived credibility (b = 0.502, p = 0.008), a significant effect of perceived credibility on word-of-mouth (b = 0.875, p < 0.001), and a significant effect of word-of-mouth on the intention to share (b = 1.759, p < 0.001).

5.3 Discussion

The results of Study 3 provide support for H3 (see Table 3). Moreover, they complement the previous studies by offering actionable insights for marketers on how to improve blockchain technology credibility. Specifically, the results indicate that providing social proof boosts blockchain technology credibility, which in turn affects word-of-mouth and intention to share product information on social media.

6 GENERAL DISCUSSION

While there has been a great deal of recent interest in consumer responses to information provided by artificial intelligence and service robots, less is known about how people react to product information provided by blockchain technology. Furthermore, consumers often question the credibility of product information, so business and brands are striving to understand how to improve their credibility—a relevant managerial challenge in the context of exponentially increasing investments in blockchain technology.

In addition to investigating these issues, this study considered whether individual differences and business actions can impact credibility. We conducted three experiments to assess how consumer characteristics and communication tactics shape people's responses to product information provided by blockchain technology (vs. a human expert).

First, our results indicate that consumers find the product information provided by blockchain technology as less credible compared to a human expert (Study 1). The results further underscore the casual impact of credibility, which increases consumer positive word-of-mouth and actual intention to share information about the product on social media, confirming that such outcomes are potential consequences of perceived source credibility (Flavián et al., 2023; Giakoumaki & Krepapa, 2020; Schimmelpfennig & Hunt, 2020).

Second, the results shed light on the underlying individual differences that shape this effect (Study 2). Consumers who are less prone to engaging in cognitive activity when evaluating product information perceive blockchain technology (vs. a human expert) as less credible and are therefore less likely to engage in positive word-of-mouth and share the product information on social media (Study 2a). Thus, our results add to previous research on the individual differences affecting perceived credibility of information (Belanche et al., 2021; Granulo et al., 2021; Leung et al., 2018). Moreover, the results of Study 2b reveal that the above-mentioned effects extend to purchase intentions and actual behavior, as suggested by past research (Baek et al., 2010; Gaczek et al., 2023; Huang et al., 2023).

Finally, we then offer a practical business solution that companies can adopt to boost blockchain technology credibility (Study 3). Based on the view that one's trust can be earned by proving that other people find the information trustworthy and reliable (Hyken, 2020) and building on the literature on social influence (Risselada et al., 2014; Senecal & Nantel, 2004), we explored the effect of social proof on the credibility of blockchain technology. Providing an expression of social proof—“9 out 10 previous customers were extremely satisfied with the certification and would recommend it to friends and relatives”—improved blockchain technology credibility and, by extension, encouraged consumers to engage in positive word-of-mouth and share product information on social media.

6.1 Theoretical implications

The present research makes three primary theoretical contributions. First, while research on people's reluctance to adopt new technologies has mainly focused on artificial intelligence (Longoni & Cian, 2022), service robots (Granulo et al., 2021; Mende et al., 2019), augmented reality and virtual reality (Flavián et al., 2021), there has been less attention on consumer resistance toward information provided by blockchain technology. We contribute to this emerging area by demonstrating that the low confidence in product information and recommendations provided by other technologies also extends to blockchain technology. Given that consumer decisions to purchase a product (Jin & Phua, 2014) or share information about it (Babić Rosario et al., 2016) largely depend on the credibility of the product information, boosting credibility in the information source is particularly important for influencing the balance of consumer decision-making process.

Second, we contribute to the literature on consumer characteristics that shape responses to technology. While prior research has studied individual differences like identity motives (Leung et al., 2018), need for uniqueness (Granulo et al., 2021; Longoni et al., 2019), attachment style (Pozharliev, Rossi, et al., 2021), and need for social interaction (Belanche et al., 2021), there has been less attention to the individual traits that can affect information processing and thus perceived source credibility, especially when this information is delivered through blockchain technology. Our research complements this work by demonstrating how one such individual difference, namely the need for cognition, shapes blockchain technology credibility. We establish that consumers who are less likely to engage in and enjoy effortful cognitive activity perceive product information provided by blockchain technology (vs. a human expert) as less credible. In doing so, this work adds to the growing literature on how individual differences shape information processing, perceptions, and responses to new technologies.

Third, we contribute to the literature on social influence. While prior work has studied different strategies for reducing consumer resistance to technology-based recommendations (Castelo et al., 2019; Dietvorst et al., 2018; Longoni et al., 2019), we illustrate how social proof affects blockchain technology credibility. Previous research has demonstrated that social proof can improve consumer trust of financial services (Rao et al., 2001), online shopping (Senecal & Nantel, 2004), and traditional retailing (Salmon et al., 2015). Our work adds that social proof can boost blockchain technology credibility and, by extension, consumer willingness to share product information on social media.

6.2 Managerial implications

Our findings should be of great interest to firms looking to invest in blockchain technology. Consumers are increasingly subject to massive information overload, which heightens the difficulty of understanding which sources and data to rely on. As a result, consumers are unable to easily verify where a product has come from, who has handled it, whether it is legitimate or fake, and so forth. Blockchain technology can mitigate this problem by offering a digital record-keeping system that decentralizes the management of various transactions and makes complex information easier to find and digest. Consequently, the global blockchain technology market is expected to grow at a CAGR of 48% during the next decade. Of the worldwide blockchain technology expenditure, 20% is currently devoted to verifying the origin and authenticity of a product while moving along the value chain, especially in discrete manufacturing (e.g., in the production of technology products such as smartphones and computers) and process manufacturing (e.g., foods and beverages; IDC, 2021). However, there is one glaring problem: Our data suggest that blockchain technology is perceived as less credible than human experts. Consequently, marketers and practitioners are challenged to improve their knowledge about the individual differences that moderate consumer responses to blockchain technology and the actions they should take to increase the perceived credibility of information provided by blockchain technology. To this end, our research has actionable implications for (1) segmenting customers, (2) tailoring offerings toward specific segments, and (3) designing custom-made marketing communication for the selected segments.

First, our results identified a critical psychological barrier that consumers and business organizations will need to overcome to fully embrace the benefits of blockchain technology. Specifically, we found that consumers who are less likely to engage in and enjoy effortful cognitive activity perceive the information provided by blockchain technology as less credible, which in turn affects the willingness to buy the promoted product and actual behavior. Our findings suggest that marketers might therefore consider need for cognition as a segmentation criterion for better segmenting their target market (Gaczek et al., 2023). For instance, marketers can look at pre-existing segments in a specific product category, survey consumers from each of these segments to derive need for cognition scores and discover how these segments vary in terms of need for cognition. Managers can then use this information to produce more tailored communication.

Second, in terms of targeting consumers, marketing managers intending to use blockchain technology to promote products should focus only on consumers who are more likely to engage in and enjoy effortful cognitive activity, namely those scoring high on need for cognition. These consumers might respond more favorably to information provided by blockchain technology (vs. human expert). Specifically, our results reveal that, due to their high need for cognition, such consumers respond almost in the same way when processing information from blockchain technology and from human expert. On the contrary, consumers scoring low on need for cognition find the information provided by blockchain technology as less credible, which can then affect their behavioral intentions and actual choices. Therefore, we recommend that consumers who are less likely to engage in and enjoy effortful cognitive activity when processing product information, should be targeted at a later stage of the technology adoption lifecycle when blockchain technology has become the standard for offering product information.

Finally, our results apply to marketing communication decisions. Our research suggests that social proof can be a highly effective tool used to build trust in blockchain technology and boost consumer intentions. Specifically, by socially validating the accuracy of the product information, managers can enhance their firms' perceived credibility and boost consumer willingness to adopt blockchain technology-based product recommendations. One practical way to do this is by adding new features to the blockchain technology application that can give consumers real-time information on the number of satisfied customers who trust the information source and recommend the product or the service (e.g., “90% of all previous clients were extremely satisfied by the certification of product provenance through blockchain technology and would share this information with friends and relatives”).

6.3 Limitations and future research

Our results provide insights into how companies can enhance the credibility of product information provided by blockchain technology, thus maximizing the effectiveness of their investments in this technology. At the same time, our research has some limitations which provide opportunities for further investigation.

First, we tested the effect of need for cognition as an individual characteristic that may moderate consumer responses to product information provided by blockchain technology. However, previous literature suggests that other individual characteristics—such as technology involvement (Kim et al., 2009) and technology usage motivation (Dong et al., 2008)—might also affect consumer responses to blockchain technology. Therefore, further investigations into influential individual traits could refine our theoretical understanding of blockchain technology acceptance.

Second, we examined consumer responses to blockchain technology (vs. a human expert) by focusing on product information about virtual reality games in Study 1 and 3, and on chocolate in Study 2. It would be interesting to see whether our results extend to other domains. For example, further research could explore whether our findings apply to consumer responses to blockchain technology that provides service information (e.g., shops, restaurants, and spa centers). Services have unique characteristics such as intangibility, heterogeneity, inseparability, and perishability, which may generate a different level of need for information. Thus, it could be that the credibility gap between blockchain technology and human experts is more pronounced for services compared to products.

Finally, our results show that the differential responses to blockchain technology (vs. a human expert) may be partially driven by the presence (vs. absence) of a human picture, especially for consumers low in need for cognition. Future research could examine how different levels of anthropomorphism affect consumer responses to blockchain technology. It could be that making the interface of the blockchain technology more human-like enhances its credibility. For example, adding a human voice reading the product information could positively affect credibility and thus galvanize various consumer behaviors.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflict of interest.

APPENDIX A

| # | Items | M | SD | ⍺ |

|---|---|---|---|---|

| Perceived credibility (Ohanian, 1990) | ||||

| CR 1 | Dependable/undependable | 5.04 | 1.22 | 0.914 |

| CR 2 | Honest/dishonest | 5.25 | 1.22 | |

| CR 3 | Reliable/unreliable | 5.30 | 1.16 | |

| CR 4 | Sincere/insincere | 5.04 | 1.30 | |

| CR 5 | Trustworthy/untrustworthy | 5.29 | 1.24 | |

| CR 6 | Expert/not an expert | 5.57 | 1.19 | |

| CR 7 | Experienced/inexperienced | 5.24 | 1.33 | |

| CR 8 | Knowledgeable/unknowledgeable | 5.39 | 1.25 | |

| CR 9 | Qualified/unqualified | 5.58 | 1.18 | |

| CR 10 | Skilled/unskilled | 5.60 | 1.08 | |

| Word-of-mouth (Lim et al., 2017) | ||||

| WOM 1 | I will spread positive word-of-mouth about the product. | 5.04 | 1.27 | 0.942 |

| WOM 2 | I will recommend the product to my friends. | 5.01 | 1.31 | |

| WOM 3 | I will encourage my friends to buy the product. | 4.67 | 1.41 | |

| Need for cognition (Cacioppo et al., 1984) | ||||

| NFC 1 | I would prefer complex to simple problems. | 4.50 | 1.38 | 0.807 |

| NFC 2 | I like to have the responsibility of handling a situation that requires a lot of thinking. | 4.84 | 1.38 | |

| NFC 3 | I would rather do something that requires little thought than something that is sure to challenge my thinking abilities. | 4.92 | 1.53 | |

| NFC 4 | I really enjoy a task that involves coming up with new solutions to problems. | 4.30 | 1.52 | |

| NFC 5 | I would prefer a task that is intellectual, difficult, and important to one that is somewhat important but does not require much thought. | 5.27 | 1.22 | |

| Willingness to buy (Sweeney et al., 1999) | ||||

| WTB 1 | There is a strong likelihood that I will buy the product I just saw. | 3.74 | 1.54 | 0.936 |

| WTB 2 | I would consider buying the product I just saw. | 4.29 | 1.51 | |

| WTB 3 | I will purchase the product I just saw. | 3.53 | 1.53 |

| Search | Frequency | Experience | Frequency | Credence | Frequency |

|---|---|---|---|---|---|

| Notebook | 46 | Virtual reality headset | 57 | Revitalizing and firming device | 32 |

| Speaker bluetooth | 46 | Digital camera | 39 | Ionic air purifier | 28 |

| Smartwatch | 45 | Videogames | 39 | ||

| Phone | 44 | ||||

| Alarm system | 34 |

| Character | Mean | p Value |

|---|---|---|

| Professor | 5.64 | 0.269 |

| Industry expert | 5.50 | 0.959 |

| Engineer | 5.58 | 0.544 |

| System analyst | 5.44 | 0.701 |

- Note: The median of the means of the characters was adopted as the reference test value (5.49)

| Character | Mean | p Value |

|---|---|---|

| Professor | 5.20 | 0.182 |

| Industry expert | 5.33 | 0.829 |

| Agronomist | 5.50 | 0.170 |

| Farmer | 5.44 | 0.860 |

- Note: The median of the means of the characters was adopted as the reference test value (5.35)

Open Research

DATA AVAILABILITY STATEMENT

Research data are not shared.