When cointegration is interrupted: Price transmission analysis in the Italian dairy-feed industry

Luca Cattivelli and Federico Antonioli contributed equally to this manuscript.

Abstract

We analyze price transmission dynamics in the under-investigated feed supply chain, applying a special case of the Threshold Vector Error Correction model where the cointegrating relationship is interrupted. Weekly Italian dairy feed and corn prices are used, finding evidence of asymmetric price transmission when the feed industry's margins are squeezed and highly volatile. The proposed Interrupted Threshold Cointegration model represents a valid complement to existing threshold and regime-switching techniques, allowing for the application of an agile nonstructural error correction model when standard cointegration tests fail to detect any long-run relationship between price series. [EconLit Citations: Q11, Q13, C24].

Abbreviations

-

- ADF

-

- Augmented Dickey-Fuller

-

- ECT

-

- error correction term

-

- F-ADF

-

- Fourier ADF

-

- F-LM

-

- Fourier LM

-

- ITC

-

- interrupted threshold cointegration

-

- MEC

-

- Markov error correction

-

- OLS

-

- ordinary least square

-

- POs

-

- Producers' Organizations

-

- PP

-

- Phillips–Perron

-

- PT

-

- price transmission

-

- STC

-

- smooth transition cointegration

-

- TAR

-

- threshold autoregressive

-

- TVECM

-

- Threshold Vector Error Correction Model

-

- ZA

-

- Zivot–Andrews

1 INTRODUCTION

The analysis of price transmission (PT) dynamics in the field of agricultural economics relies on a long and rich literature of empirical applications (Lloyd, 2017; von Cramon-Taubadel & Goodwin, 2021). Cointegration represent the mostly applied econometric strategy for detecting the existence of a long-run equilibrium between prices, often under the assumption of uninterrupted linkage over time. Nevertheless, such assumption may result hazardous: trade costs (Beghin & Schweizer, 2021; Lence et al., 2018), transaction, processing, and storage costs (Santeramo, 2022; von Cramon-Taubadel & Goodwin, 2021), and/or changes in policies and economic scenarios (for instance consumers preferences) may generate periods in which movements toward a long-run equilibrium do not occur (Psaradakis et al., 2004). For instance, depending on opening and closing borders policies, prices of the same agricultural commodity in different geographical areas may alternate periods of comovement with periods of isolation (Esposti & Listorti, 2018). Likewise, substitution effects may hinder the relationship between commodities of the same nature but with different quality cues (Antonioli et al., 2019). We present a more flexible technique, relaxing the rigid assumption of an uninterrupted long-term linkage between prices and building on the unrestricted two-regime threshold autoregressive (TAR) model with an autoregressive unit root developed by Caner and Hansen (2001). Relying on Kim's (2003) “segmented cointegration” and the subsequent “interrupted cointegration” approach of Martins and Gabriel (2014), a particular case of two-regimes Threshold Vector Error Correction Model (TVECM) where one of the two regimes is not cointegrated is described, allowing for several interruption in the long-run relationship. We refer to this specification as the interrupted threshold cointegration (ITC) model, in which cointegration may occur in just one of the two external regimes. To the best of the authors' knowledge, this is the first time that the Caner and Hansen (2001) cointegration test is applied in agricultural economics. The widely applied band-TVECM, developed by Balke and Fomby (1997) and Lo and Zivot (2001), determines three regimes—hence two thresholds—in which the between-regime, the “band,” is not cointegrated. However, this model is suitable only when the long-run equilibrium adjustments disappear near the equilibrium.1 The ITC considers a two-regime system in which the cointegration relationship is activated and deactivated according to a transition variable driving the system, hence only when the threshold is overcome cointegration exists. Therefore, the ITC does not restrict the cointegration relationship to be inactive within-the-band and near the long-run equilibrium. The regime-switching Markov error-correction (MEC) model is another widely used technique in PT analysis, defined as a two-regime Markov switching VECM in which one regime is not cointegrated (Martins & Gabriel, 2014; Psaradakis et al., 2004). Although similar, the ITC differs in terms of the transition variable: while the MEC is driven by a hidden, nonmeasurable, Markov chain, the ITC permits the researcher to freely choose the transition variable defining the regimes, embracing climate-, economic- or policy-related elements, alongside the most commonly used marketing margin.

We provide an empirical application of the ITC, investigating the interaction between Italian feed and corn prices. The feed industry represents a compelling case study, both for its strong dependence on raw agricultural commodities and its economic importance in agricultural production. The Italian milk-cow feed industry represents an important market, accruing for 8% of the overall agrifood industry's turnover, with feed costs accounting for more than 50% of the operational expenses for an average Italian milk producer (European Commission, 2018). Italian feed prices strongly depend on corn, which represents 60% of the overall raw inputs used in the feed formula (Assalzoo, 2021; FEFAC, 2021; ISTAT, 2021). Both the volatility and levels of the equilibrium error, the marketing margin—have been used as transition variables in the attempt to capture the market forces driving the vertical linkage between corn and feed producers. We describe how the application of standard cointegration tests would fail to reject the null of no cointegration, preventing the application of related error correction models. On the contrary, the ITC allows to detect for an (interrupted) cointegrating relationship between the two price series, where the equilibrium error is mean-reverting in one regime and contains a unit-root in the other. Results unveil the presence of asymmetric behavior, as only when margins are squeezed or highly volatile the feed industry responds to corn price dynamics. We contribute on both the modeling and economic side by applying a special case of TVECM that allows for interruptions in the long-run relationship and considering an under-investigated agrifood sector. Despite a fair number of applications cemented the close correlation between corn and feed prices—primarily because of the competition between ethanol and feed production (Hanif et al., 2021; Koirala et al., 2015; Tejeda & Goodwin, 2011)—, research efforts devoted to understand the functioning of the feed markets are scant. Exceptions are represented by the study of Schulte and Musshoff (2018) on the horizontal transmission of feed prices across North-Western Germany regions, and that of Ben-Kaabia et al. (2005), using feed prices to investigate the vertical price transmission for the Spanish poultry sector. The remainder of the paper is the following: Section 2 provides the reader with a general but updated background on PT analysis in agricultural markets; Section 3 describes the main features of the Italian feed supply chain and its agents, motivating the use of the ITC model; Section 4 presents the ITC modeling technique; Section 5 explains the data used and the first preliminary statistical results on the price series; Section 6 implements the ITC model to the price transmission process in the Italian feed industry, presenting its empirical results; finally, Section 7 concludes and draws final remarks.

2 PRICE TRANSMISSION ANALYSIS IN THE AGRICULTURAL SECTOR

The analysis of both horizontal (i.e., same commodities in different geographical areas) and vertical (i.e., between different agents of the same product's supply chain) PT process has a long history in the agricultural economic field—see the recent works of Kouyaté and von Cramon-Taubadel (2016), Lloyd (2017), and von Cramon-Taubadel and Goodwin (2021). The last 20 years marked a tumultuous run for the agrifood sector, with mergers and acquisitions and vertical integration dynamics raising worries about concentration levels (Hirsch et al., 2021; Sexton, 2013; Sexton & Xia, 2018), especially in light of the low bargaining power of primary producers (Bonanno et al., 2018). Moreover, crises and policy reforms narrowed the interest of researchers in understanding how such events influence the functioning of markets and their efficiency (Antonioli & Santeramo, 2021; Penone et al., 2022; Ramsey et al., 2021). Quoting Lloyd (2017), the analysis of price transmission dynamics “[…] gives us a yardstick with which to measure the functioning of markets” (p. 17), and “measuring the degree of vertical price transmission […] helps to identify potential market failures” (European Commission, 2009a, p. 5). Market efficiency presupposes that in a competitive market with perfect information, price differentials reflect the cost of marketing services, and shocks are instantaneously transmitted between agents, hence PT should be symmetric (Abdulai, 2002; Goodwin & Schroeder, 1991).2 Nevertheless, the literature concludes on the significant gap between empirical results and the theoretical economic background, suggesting asymmetries as the rule rather than the exception (Bakucs et al., 2014; Meyer & Cramon-Taubadel, 2004; Peltzman, 2000; Rezitis & Tsionas, 2019). The vertical dimension of price transmission often represents highly complex relationships with vertical integration processes not visible to the researcher (Adjemian et al., 2016; Lan et al., 2022; von Cramon-Taubadel & Goodwin, 2021). The increasing use of nonlinear models—particularly representing regime changes—provide for the effect of such nonobservable mechanisms, especially under the form of transaction and processing costs, with significant nonlinear price dynamics turning as an indicator for market inefficiencies (Cakir, 2021; Mai et al., 2018). Despite the traditional focus on market power (McCorriston et al., 2001; Yu & Gould, 2019), the PT literature endeavors to offer further economic insights explaining food chains' inefficiencies, like the presence of adjustment costs (Chavas & Mehta, 2004), policy interventions (Brummer et al., 2009; Santeramo & Cioffi, 2012), the degree of perishability and storability of the products concerned (Santeramo, 2015; Santeramo & von Cramon-Taubadel, 2016) or product differentiation (Antonioli et al., 2019; Livat et al., 2019), among others. Policy analysis is witnessing an increasing interest by nonlinear PT applications: Mofya-Mukuka and Abdulai (2013) employ a threshold cointegration to disentangle the impact of policy reforms on the PT between the world and domestic coffee market prices in Zambia and Tanzania; Wang and Wei (2021), study how China's soybean price policy shapes both domestic and global soybean prices, thus their effect on welfare; Götz et al. (2016) apply a smooth transition cointegration (STC) model to study the effects of export controls on the domestic Ukraine wheat price; and, in a similar fashion, Antonioli and Santeramo (2021) explain how the Common Agricultural Policy reform of 2003 shaped price transmission dynamics in the Italian dairy market.3 Climate-change-related research questions are also entering the PT literature: Hatzenbuehler et al. (2021) study how different growing conditions and planted areas influence the United States chickpea price changes, modeling regime shifts in the linear fashion of Gregory and Hansen (1996); Baffes et al. (2019) investigate the role of variables related to harvest cycles, weather anomalies, and trade policies on Tanzanian corn price using the standard ECM; Hatzenbuehler et al. (2020) how Nigerian grain prices transmit under different anomalous-weather periods; Zamani et al. (2021) disentangle the role of different temperatures on price transmission dynamics in the Iranian poultry value chain. Finally, other scholars attempt to disentangle the role of different variables on the behavior of PT, for which the application of the ITC model may be beneficial for allowing interruptions along the long-run relationship between prices and for spotting different regimes according to the trigger. Lundberg et al. (2021) investigate the relationship between oil and agricultural commodity prices accounting for heterogeneity across time horizons, while Chavas and Pan (2020) study dynamic linkages between farm and retail pork prices in China, disentangling how consumer income and feed costs shape the price relationship.

3 THE ITALIAN FEED INDUSTRY

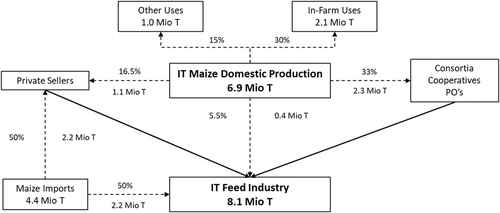

The Italian feed industry represents a vital sector within the agrifood industry, with an estimated turnover, in 2020, of about 8 billion euros and a whole output of more than 15 million tonnes of compound feed, of which 2.5 Mio tonnes of feed destined to milk cows, relying upon 420 production units (Assalzoo, 2021). Compound feed is defined by the European Commission (2009b) as “a mixture of at least two feed materials in the form of complete or complementary feed,” representing the primary feedstuff used for feeding dairy cattle. The latter represents 40% of the sectorial turnover, and 23% of the overall Italian feed production (Assalzoo, 2021). Within the EU-27, Italy represents the fifth cow-feed and total feed producer with shares of 8% (3.4 Mio tonnes) and 10% (14.5 Mio tonnes), respectively (FEFAC, 2021).4 In Europe, livestock is the most important outlet for EU-cereals: 61% of total production goes to animal feeding, of which 28% to the feed industry, and 33% to on-farm feed use. In Italy, corn represents 43% of the whole cereal category, and 71% of total available corn on the Italian territory (i.e., domestic production and imports, excluding exports) is destined to compound feed production (Assalzoo, 2021; ISTAT, 2021). Considering also the corn directly used as a simple feedstuff, then 90% of harvested corn in Italy is destined for cattle feeding (USDA, 2012). The northern Italian regions of Emilia-Romagna, Lombardy, Veneto, and Piedmont accrue for 77% and 67% of both volume and feed production units, respectively (Assalzoo, 2021), gathering about 80% of corn producers and 82% of the entire Italian corn production (ISTAT, 2021). Feed costs are particularly relevant for farmers: the European Commission (2018) estimates that, for the average Italian milk-producing unit, 52% of total operational costs are represented by purchases of compound feed, while home-grown feed represents only 15% of total feeding costs. The Italian feed supply chain is composed of three main steps (Serra, 2009), as described in Figure 1. The first step is the agricultural production of corn, with 100,000 producers distributed on a surface of 590,000 hectares (ISTAT, 2021). According to ISMEA (2021), one-third of corn volume is used in farm, mainly for animal feeding. Over the total domestic production, around 30% is sold to operators, whom store the production and eventually resell it to feed producers (these operators also market half of the imported corn). Consortia, cooperatives, and producers' organizations (POs) collect the major share of corn production, 60%, for later deliver it to the feed industry. The feed industry buys 10% of corn volume directly from farmers and about half of the total imports.

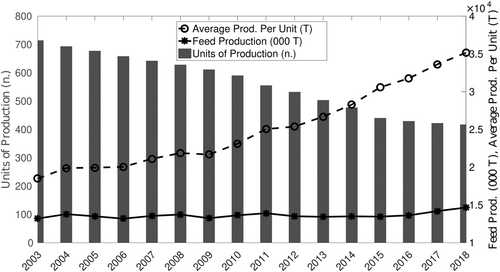

According to latest data available, the first six industrial feed producers gather 42% of both total volume and value (Mambriani, 2009). The first company, Veronesi, accrues nowadays a market share of 22% (Veronesi, 2020), being the eighth largest feed producer in Europe with a final output of more than 3 million tonnes in 2009 (Wesseler et al., 2015). Following the European trend, the Italian feed industry is witnessing a decrease in units of production, with −30% for the period 2010–2020 (Assalzoo, 2011, 2021; FEFAC, 2021) and a stable volume of production, pointing to an increasing concentration (see Figure 2).

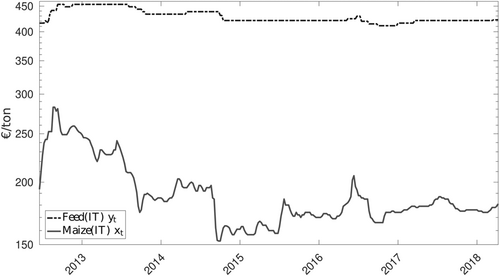

Figure 3 shows a quite flat price series for feedstuff, with some peaks occurring when the price of corn features significant upwards spikes.5 Under the methodological point of view, this may resemble a first challenging issue for standard cointegration models, as tests would fail to reject the null of no long-run relationship, hindering the possibility to use PT models; second, such a price system could be better described by an interrupted cointegration dynamic, where feed and corn price series comove during certain time windows, followed by periods in which they move independently the one to the other. As one of the characteristics of the ITC model is that of using a trigger variable to define the regimes, we rely on profit margins, both in levels and volatility measure. Indeed, as far as the magnitude of price transmission coefficients cannot be generally attached to the existence (or absence) of market power—and more generally other market inefficiencies—whether margins are significantly affected by supply or demand shifters is first evidence of inefficient market mechanisms (Kinnucan & Zhang, 2015; Lloyd et al., 2006; von Cramon-Taubadel & Goodwin, 2021; Weldegebriel, 2004).

4 INTERRUPTED THRESHOLD COINTEGRATION

4.1 Testing procedure

The standard approach for testing for threshold cointegration would consist in the following methodological steps: (i) preliminary testing for the presence of unit-root in both price series; (ii) when both price series contain a unit-root (series are nonstationary), test for (linear) cointegration (e.g., the Johansen test); (iii) if series are cointegrated, determine whether such a relationship is nonlinear and of threshold-type; (iv) if linearity is rejected, a bivariate TVECM can be specified and estimated. Nevertheless, when the dynamics of the ECT, , does not follow a simple autoregressive process, standard unit-root tests as the augmented Dickey-Fuller (ADF) test may fail to differentiate a pure unit-root process from a TAR process with one of the two regimes (potentially) nonstationary (Gonzalo & Gonzalez, 1997). Following Caner and Hansen (2001), we propose an alternative methodology not requiring a preliminary test of linear cointegration, and allowing to describe a case in which the equilibrium term is characterized by nonstationary behavior in one of the two outer regimes; accordingly, different unit-root tests are proposed to better define the nature of the ECT,9 and that do not suffer from reduced power nested in unit-root tests when nonlinearity is present in the data generating process—contrary to the test strategy followed by Balke and Fomby (1997) for threshold cointegration and Hansen and Seo (2002) for nonlinearity. The proposed different methodology hinges on the main following steps: (i) preliminary testing for the presence of unit-root in both price series; (ii) when both price series contain a unit-root (series are nonstationary), test for nonlinearity; (iii) if nonlinear price dynamics are found, testing whether prices are threshold cointegrated and whether such long-run relationship is interrupted.

4.1.1 Nonlinearity test

Under the null hypothesis of no threshold effect, the parameter is not identified, resulting in a nonstandard testing problem. Caner and Hansen (2001) showed, via Monte Carlo simulations, that the best way to obtain the critical values of their test statistics is the residual bootstrap procedure, which outperforms first-order asymptotic techniques. For this reason, we adopt a bootstrap approximation to the asymptotic distribution of for the calculation of critical values and p values (see Appendix A for more details).

4.1.2 Cointegration test

To distinguish between the null and the alternative hypothesis, the one-sided Wald test statistic is proposed11: , where and are obtained from OLS regression of Equation (5) as statistics of and and is the indicator function. In such a way, one can easily understand whether the data-generating process follows or not. When is significant, can be rejected, although and are not yet distinguishable. Caner and Hansen (2001) solve the problem by examining the individual t statistics and : when only one of the two statistics is significant there is discontinuity in the cointegration relation (i.e., ), while when both significant, the system follows the standard threshold cointegration process (i.e., ). Critical values for , and can be calculated under the null of no cointegration in both regimes via a residual bootstrap procedure (see Appendix A for further details). The interesting advantage of this cointegration test strategy is that it can be performed independently from the result of standard linear-cointegration tests, in contrast with methodological steps presented in Balke and Fomby (1997), Hansen and Seo (2002), and Lo and Zivot (2001).

5 DATA AND PRELIMINARY RESULTS

The econometric analysis hinges on two series of Italian corn () and feed price for milk-cows () (Figure 3). We retrieved the price series from the Chamber of Commerce of Bologna and the Chamber of Commerce of Forlì-Cesena for corn and milk-cow feed prices, respectively. Both Chambers are located in the Emilia-Romagna region, representing one of the most representative territories regarding both feed and corn production, as described in Section 3. Our data set consists of nearly 6 years of weekly data (303 observations), from the 25th week of 2012 to the 15th week of 2018 for the Italian feed and corn prices.12

All series are expressed in logarithms to mitigate price fluctuations, to increase the likelihood of stationarity after first differencing, and to interpret results in percentage change terms (Ben-Kaabia & Gil, 2007). Three different (standard) unit-root tests are employed: the ADF, the PP test proposed by Phillips and Perron (1988) and the KPSS test proposed by Kwiatkowski et al. (1992), all clearly indicating that both price series are I(1) as shown in Table 1. To exclude the presence of structural breaks in the price series, we consider unit root test with structural breaks: the Zivot and Andrews (1992) test (ZA), the LM test of Lee and Strazicich (2013), and, finally the Fourier ADF (F-ADF) and Fourier LM (F-LM) test of Enders and Lee (2012). Excepted for the ZA test for the feed price series and the LM test for the corn price series, all tests indicate the absence of any structural break in both price series (Table 1).

| Variable | ADF | PP | KPSS | ZA | LM | F-ADF | F-LM |

|---|---|---|---|---|---|---|---|

| Corn prices | >0.10 | >0.10 | <0.01*** | >0.05 | <0.01*** | >0.10 | >0.10 |

| Feed prices | >0.10 | >0.10 | <0.01*** | <0.01*** | >0.10 | >0.10 | >0.10 |

- Note: The stationary alternative hypothesis specifications include the intercept for all but KPSS test. Trends are not included as the price series have none (see Figure 3). Significance level: ***1%.

- Source: Authors' elaboration.

Testing for Granger causality (Granger, 1969) leads to the conclusion that the corn price Granger-causes the feed price.13 We investigate the relationship between the two series by applying the more standard cointegration analysis, that is, we test for the presence of cointegration between the two series adopting both Engle–Granger and Johansen tests. The Engle and Granger test, with both the ADF and PP statistics, fails to reject the null of noncointegration at the 5% level, independently of the order of the price variables in the cointegration relationship.14 The Johansen test delivers similar results, with the noncointegration hypothesis failed to be rejected at the 5% level. In conclusion, the two series appear to be noncointegrated according to the most commonly used standard (linear) cointegration tests. Nevertheless, as both cointegration tests may be invalidated by the presence of structural breaks, additional and different approaches are applied. First, the Gregory and Hansen (1996) approach allows for the detection of a cointegrating relationship where the null hypothesis is non-cointegration against an alternative of cointegration with one structural break at an unknown point in time. This test considers three model's specifications: (i) model C that includes a level-shift in the relationship of cointegration; (ii) model C/T that is as model C plus a linear trend; (iii) finally, model C/S that adds to model C/T the possibility of a shift in the slope coefficient. The critical values of the ADF, Zt, and Zα test statistics are taken from Gregory and Hansen (1996) considering the case with 300 and a number of lags selected with a downward-t procedure15 (Table 2).

| Gregory and Hansen (1996) test | ADF | ||

|---|---|---|---|

| C (level-shift in the relationship of cointegration) | −5.36* | −4.37 | −27.98 |

| Critical values 5% | −5.28 | −5.28 | −53.58 |

| Critical values 1% | −5.77 | −5.77 | −63.64 |

| C/T (model C plus a linear trend) | −5.87 | −4.44 | −27.86 |

| Critical values 5% | −5.57 | −5.57 | −59.76 |

| Critical values 1% | −6.05 | −6.05 | −70.27 |

| C/S (model C/T plus a shift in the slope coefficient) | −5.49 | −4.32 | −27.37 |

| Critical values 5% | −6.00 | −6.00 | −68.94 |

| Critical values 1% | −6.51 | −6.51 | −80.15 |

- Note: The null hypothesis consists of no-cointegration against the alternative of cointegration with one structural break at an unknown date. Significance level: *10%.

- Source: Authors' elaboration.

The ADF test fails to reject the null for all but model C, for which the null is rejected at the 5% level. However, given that the ADF test suffers from size distortions that leads to over-rejection of the null, we conclude that there are no evidence of a regime shift in the cointegrating relationship. To test for the presence of more than one regime shift in the cointegrating relationship, the Gregory and Hansen (1996) approach is extended to allow for two breaks, which corresponds to the Hatemi-J (2008) test.16 Again, the test fails to reject the null of no cointegration for all three model specifications (Table 3). Therefore, recalling that the application of the standard TVECM requires the system to be cointegrated, the latter approach could not be estimated for the current price system.

| Hatemi-J (2008) test statistics | ADF | ||

|---|---|---|---|

| C/S | −6.53 | −5.53 | −36.48 |

| Critical values 5% | −7.35 | −7.35 | −104.86 |

| Critical values 1% | −7.83 | −7.83 | −118.58 |

- Note: The null hypothesis consists of no-cointegration against the alternative of cointegration with two structural breaks at an unknown date.

- Source: Authors' elaboration.

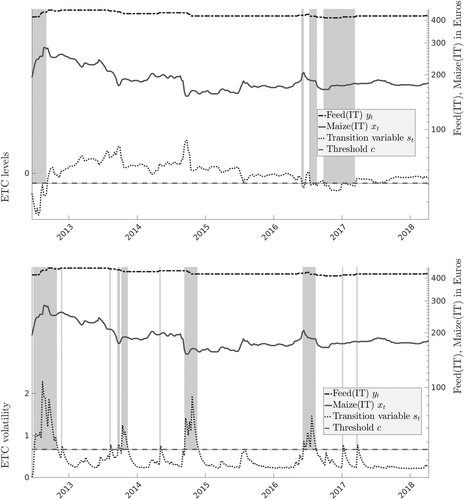

6 THE ITC MODEL FOR THE FEED–CORN RELATIONSHIP

At this point, the researcher would conclude the two prices are not cointegrated, preventing the use of error correction model approaches and switching to different approaches such as vector autoregressive models. Nevertheless, the ITC approach, as detailed in Section 4, does not depend on the standard cointegration tests that would lead to the rejection of the hypothesis of a (continuous) long-run relationship between Italian feed and corn prices. We then follow the methodological steps outlined in Sections 4 and 4.1 and eventually estimate an ITC model as in (3). As detailed above, the researcher is free to choose any trigger variable she believes able to drive the price dynamics. Latter studies on PT analysis were sceptical regarding the magnitude of price transmission coefficients as a reliable indicator of the existence (or absence) of market inefficiencies, suggesting that the extent to which margins are affected by supply or demand shifters is a first signal of inefficiencies (Kinnucan & Zhang, 2015; von Cramon-Taubadel & Goodwin, 2021). Therefore, the ECT is used as the transition variable, both in its levels () and volatility (). The latter has been estimated through a GARCH(1,1) process , where Representing the marketing margin, using both levels and the volatility measure of ECT allows accounting for both endogenous and exogenous market factors and see how the agents of the supply chain react. The level of ECT, as usually done in the relevant literature (Ben-Kaabia & Gil, 2007; Lo & Zivot, 2001), describes different regimes depending on the size of the marketing margins of the feed industry, giving insights on the potential exertion of market power. The volatility of the ECT (Ganneval, 2016) helps in understanding the effect that margins' uncertainty and risk play in the PT dynamics, with price cycles influenced by exogenous shocks such as climate and environmental events, altering both supply and demand of corn and feed. For both transition variables the W test rejects the null of linearity, hence one can proceed to testing for cointegration in each regime (Table 4). Whenever the null of non-cointegration is rejected for one regime only, the system features an interrupted-cointegration: price series share a common stochastic trend only when the transition variable is above (the upper regime) or below (the lower regime) the estimated threshold value. Whenever the test rejects the null for both regimes, the system can be modeled via a standard threshold cointegration model. The usual battery of test on residuals is performed (Table 4), showing that no autocorrelation (Ljung–Box test) or heteroscedasticity (ARCH test) is present, while the null hypothesis of normal distribution is strongly rejected. Nevertheless, although the nonnormality of residuals may bring doubts about the efficiency of OLS estimators, it does not affect its consistency properties. All in all, the results on residuals are satisfactory.

| ECT volatility | ECT levels | |

|---|---|---|

| Number of lags (BIC) | 1 | 5 |

| Threshold: c | 0.663 | −0.017 |

| % observations in the lower regime (l) | 83.50 | 15.18 |

| Linearity test: p-val of W | 0.029** | 0.048** |

| Cointegration test: p-val of R | 0.001*** | 0.000*** |

| Cointegration test: p-val of | 0.923 | 0.000*** |

| for feed prices | −0.072*** | |

| for corn prices | −0.110 | |

| Cointegration test: p-val of | 0.001*** | 0.718 |

| for feed prices | −0.194*** | |

| for corn prices | 0.040 | |

| Tests on residuals | ||

| Ljung-Box (lag = 1) for feed prices | 0.475 | 0.156 |

| Ljung-Box (lag = 1) for corn prices | 0.510 | 0.623 |

| Ljung-Box (lag = 52) for feed prices | 0.596 | 0.325 |

| Ljung-Box (lag = 52) for corn prices | 0.824 | 0.370 |

| ARCH (lag = 1) for feed prices | 0.638 | 0.235 |

| ARCH (lag = 1) for corn prices | 0.452 | 0.759 |

| ARCH (lag = 52) for feed prices | 0.376 | 1.000 |

| ARCH (lag = 52) for corn prices | 1.000 | 0.999 |

| Jarque–Bera for feed prices | <0.01*** | <0.01*** |

| Jarque–Bera for corn prices | <0.01*** | <0.01*** |

- Note: The coefficients are not displayed when the corresponding cointegration t-test fails the rejection of the null at the 5% level. For the definition of c, see (5); for see (7); the Linearity test statistics is defined in (9); while the cointegration test statistics in (11). The Ljung-Box, ARCH, and Jarque-Bera tests are conducted on the residuals of Equation (3).

- Significance level: ***1%, **5%, and *10%.

- Source: Authors' elaboration.

6.1 ECT volatility

First, we investigate whether the margin's volatility bears any impact on the price transmission dynamics between corn and feed prices.17 The W test rejects the null of linearity at the 5% level, and the R test rejects the null of noncointegration hypothesis at the 1% level: the upper regime is cointegrated as per the significance of the coefficient α (i.e., the ECT term is stationary in the upper regime, while nonstationary in the lower regime). In other words, cow-feed, and corn prices share a long-run relationship with interruptions, comoving only when the volatility of the feed industry's margin is high—that is, above the threshold value c. The average value of the margin's volatility is 0.45, with a standard deviation of 0.35; being the threshold value 0.66, it reveals how prices comove when volatility is relatively high. Moreover, the ECT coefficient for the upper regime is significant only in the feed equation, signaling that the feed price is the one reverting the system towards the equilibrium. With a coefficient of −0.19, roughly 20% of the shock is absorbed each period, with the system reaching the equilibrium again after 5 weeks approximately. Results describe how feed producers accommodate their selling price when the system is affected by high volatility. Therefore, when the market turns more uncertain and risky, feed operators prefer to attach their clearing market price to that of their main input, corn, probably fearing spikes in corn price. Indeed, Figure 4 clearly suggests how the system results cointegrated when cereal price spikes occur.

6.2 ECT levels

When considering the level of ECT—the marketing margin of feed producers—again both the W and the R tests reject the null of linearity and noncointegration, respectively, with the lower regime showing stationarity, hence cointegration (Table 4). The average value of the transition variable is close to zero and the threshold coincides with the (negative) standard deviation of the ECT, clearly defining how cointegration is activated only when deviations from the equilibrium margins are largely negative. The ICT delivers significant and negative estimates for the ECT in the feed equation, with a coefficient of −0.07: only when margins are too low, the feed price tends to adjust back to the equilibrium at a rate of 7% per period, in line with results of Ben-Kaabia and Gil (2007) regarding poultry feed price in Spain. Such price behavior reflects the well-known “rocket and feather” dynamic described in Peltzman (2000): when margins are shrinking the system adjusts to the long-run equilibrium, lingering for about 14 weeks after the shock. This behavior can be explained by the increasing concentration in the Italian feed industry, with feed producers using their market power to maintain high margins for longer periods. Indeed, it is clear from the price patterns of Figure 3, how feed price increases are more pronounced than decreases, especially after a peak in the price of corn.

Overall, results point to the exogeneity of corn prices—they do not adjust to the steady-state when a shock occurs—while feed prices respond and bring back the system to its equilibrium when changes in the economic margins and their volatility occur.

7 CONCLUSIONS

We present the ITC model, a special case of TVECM with two regimes and where the cointegrating relationship is interrupted, hence active only in one of the two regimes. The Caner and Hansen (2001) approach is applied for the first time in agricultural economics, allowing to test for cointegration when the ECT follows a TAR process with an autoregressive unit root. Price transmission dynamics between corn and feed prices in the Italian market are investigated, proving the usefulness of the ITC technique. The scant literature on price transmission in the feed industry probably originates from the nature of price data: as often observed by researchers for consumer prices, feed prices smooth over large periods, adjusting to upper stages of the supply chain (corn producers) only when price changes are large. We proved how conventional cointegration tests—that is, Johansen, Engle–Granger, Gregory–Hansen, and Hatemi—would have failed in finding any long-run dynamics between price series, whereas the ITC model offers the opportunity to rigorously address the issue, allowing to detect a long-run relationship hence offering new evidence on asymmetries and market inefficiencies in the feed sector. First, a discontinuous long-run relationship between Italian corn and feed prices is found, with the feed price leading the relationship, hence bringing the system back to the equilibrium after a shock occurs. Second, the ITC spots asymmetries in the price dynamics that could be related to feed producers' market power: only when margins of the feed industry are squeezed and when highly volatile, the feed industry triggers a significant response, following the corn price dynamics. This behavior is consistent with the highly-fragmented Italian agricultural sector, opposite to a well-concentrated feed industry able to steer the market to their favor. However, as consistently argued by von Cramon-Taubadel and Goodwin (2021), latest empirical works on price transmission are highly context-specific, with vertical maneuvers (contracts, coordination) turning spot markets very thin and with researchers unable to observe such hidden information. This prevents any useful comparison with studies on similar but structurally different markets or sectors. Nevertheless, the exertion of market power seems having left a signature on price data, identifying in the Italian feed industry a case for which a closer scrutiny of the competent antitrust authority is deserved. All in all, the ITC approach allows for the application of an agile nonstructural error correction model for those economic systems that appear exempted of any long-run relationship according to linear cointegration tests, complementing existing threshold and regime-switching techniques. We offer an informative tool to study markets with incomplete price information, as often happens for price transmission analysis in developing and least developed countries, and for seasonal markets as fruits and vegetables (see among others, Hamulczuk et al., 2019; Reziti & Panagopoulos, 2008; Santeramo, 2015; Santeramo & von Cramon-Taubadel, 2016). In other words, the ITC disentangles how the cointegrating space behaves under different regimes triggered by transition variables the researcher chooses to use, serving also as a statistical tool to test for the significance of different triggers' role in the investigated economic system. However, this line of research is not exempt of limitations. First, the addition of one more regime would provide more insights into the impact of the triggers. Second, short-run dynamics, that is, impulse response functions, should be investigated to deepen the understanding on how the market behaves in the short-term according to the trigger variables. Finally, the development of the ITC using a different estimator, as the maximum-likelihood in the fashion of Johansen (1991), would undoubtedly offer a more powerful methodology for investigating PT dynamics.

ACKNOWLEDGMENT

The authors would like to thank Prof. José M. Gil and Prof. Marco Zuppiroli for constructive comments. All errors remain our own.

CONFLICT OF INTEREST

The authors declare no conflict of interest.

DISCLAIMER

The authors are solely responsible for the content of the paper. The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of the European Commission.

Biographies

Luca Cattivelli graduated in Physics from the University of Parma and holds a Ph.D. in mathematical finance at Scuola Normale Superiore, Italy. His research interests are focused mainly on financial/agricultural econometrics and “random walks on graphs.” He works for international companies about data science projects.

Federico Antonioli is a Project Officer at the Joint Research Centre of Seville, Spain. He holds a doctorate in Agricultural Economics from the University of Ferrara. His research focuses mainly on food policy and their influence on the functioning of agrifood supply chains, particularly sustainable consumption patterns and trends, agricultural price transmission analysis, immigrant agricultural workforce and farms' performance, and farms' productivity.

Open Research

DATA AVAILABILITY STATEMENT

Due to the private nature of the data they cannot be shared publicly, so supporting data is not available.

REFERENCES

- 1 For an excellent critique on the band-TVECM, particularly concerning PT in trade analysis, see Lence et al. (2018).

- 2 This logic is also valid for horizontal PT analysis and the law of one price: price differentials between different geographical areas should reflect the transaction cost to move the product between these two locations (Goodwin et al., 1990).

- 3 See also Goetz and von Cramon_Taubadel (2008), Greb et al. (2013), and Traorè and Diop (2021) for recent reviews and nonlinear applications for horizontal price transmission analysis.

- 4 The first four feed producers are Spain (25.4 Mio tonnes), Germany (24 Mio tonnes), France (20.8 Mio tonnes), and the Netherlands (14.7 Mio tonnes) (FEFAC, 2021).

- 5 It is worth to note that Singerman et al. (2014) offer an interesting approach to cointegration in which a new specification for a jump process is applied. However, we believe that the ITC is more flexible and easy to interpret. Since comparison between the two approaches goes beyond the scope of this article, we left it to future research.

- 6 The mathematical definition of the Caner and Hansen (2001) specification will be given in Equation (5), which specifies the alternative hypothesis of cointegration test.

- 7 See Balke and Fomby (1997) for the relationship between TAR and TVECM parameters.

- 8 If the equilibrium error satisfies the “α mixing” conditions (assumption 2.1 in Phillips, 1987), then the least squares estimate of is super-consistent (Balke & Fomby, 1997). A sufficient condition for the TAR models with one nonstationary regime to be “α mixing” is the Markovianity of the transition variable (Gonzalo & Gonzalez, 1997).

- 9 Critical values for each statistics is retrieved via simulation using 20,000 replications.

- 10 The same test has been considered also in Lo and Zivot (2001).

- 11 The proposed Wald statistic is one-sided because it focuses only on the negative values of u and l.

- 12 Please, note that feed prices for milk-cow are no longer accessible.

- 13 Results available upon request.

- 14 Having considered a cointegration regression of the form , the Engle–Granger test fails to reject the null hypothesis. Moreover, for robustness check, we also switched the position of the two variables in the cointegration regression () performing a second Engle–Granger test failing to reject the null at the 10% level.

- 15 The maximum number of lags that we consider is 4, given that Table 1 of Gregory and Hansen (1996) gives the critical values only for 1,2,3, and 4 lags. The selected number of lags by the downward-t procedure is equal to 3.

- 16 The selected number of lags with the Hatemi procedure is equal to 3.

- 17 We estimate a GARCH as: , where the t-stats are, in order, 5.735, 14.642, and 6.869, respectively.