Bank Failure, Mark-to-market and the Financial Crisis

Abstract

This paper is concerned with the allegation that fair value accounting rules have contributed significantly to the recent financial crisis. It focuses on one particular channel for that contribution: the impact of fair value on the actual or potential failure of banks. The paper compares four criteria for failure: one economic, two legal and one regulatory. It is clear from this comparison that balance sheet valuations of assets are, in two cases, crucial in these definitions, and so the choice between ‘fair value’ or other valuations can be decisive in whether a bank fails; but in two cases fair value is irrelevant. Bank failures might arise despite capital adequacy and balance sheet solvency due to sudden shocks to liquidity positions. Two of the most prominent bank failures cannot, at first sight, be attributed to fair value accounting: we show that Northern Rock was balance sheet solvent, even on a fair value basis, as was Lehman Brothers. The case study evidence is augmented by econometric tests that suggest that mark-to-market accounting has had only a very limited influence on the perceived failure risk of banks.

There are two sides on the balance sheet.

The left side of the balance sheet has nothing right

and the right side has nothing left.

But they are equal to each other.

So accounting-wise we are fine.

Jacob Frenkel, VC of AIG

This paper investigates the allegation that fair value accounting rules contributed significantly to the recent financial crisis. It focuses on one particular channel for that contribution: the impact of fair value on the actual or potential failure of banks.1

In analyzing the financial crisis, distinguished commentators have attributed part of the blame to the financial reporting regime—in particular the use of mark-to-market (M2M) ‘fair values’ in reporting financial instruments in bank balance sheets. Anatole Kaletsky of the London Times wrote: ‘Much of the damage in the financial crisis was caused by forcing banks to use mark to market accounting rules …’ (Kaletsky, 2009). And Bill Janeway writes of ‘The Accountants’ Doomsday Machine' (Janeway, 2008).

Economic policymakers have joined the condemnation. For example, European Commissioner McCreevy announced, ‘there is growing concern among Finance Ministers at the perceived slowness of the International Accounting Standards Board in responding to the systemic crisis we have endured … many Ministers have complained about what they see as an “over-academic” approach to standard setting, which many see as “out of touch” with today's reality’.2 And the communiqué from the April 2009 summit (G20, 2009) joined the implicit criticism with a call (paragraph 15) to the accounting standard setters to work urgently with supervisors and regulators to improve standards on valuation and provisioning.

The principal accounting regulators, the International Accounting Standards Board (IASB) and the Financial Standards Board (FASB) have—not always enthusiastically—introduced modifications to the fair value accounting regime. In October 2008, the IASB issued amendments to IAS 39 Financial Instruments: Recognition and Measurement and IAS 7 Statement of Cash Flows to permit reclassifications of some financial instruments (so that they did not have to be recorded at current (depressed) market value); and later that month issued guidance on measurement when markets become inactive, relaxing requirements to use current market prices (IASB, 2008). The issue continues to be contentious for the regulators: the IASB and FASB are divided on the extent to which M2M valuations should be adopted in bank balance sheets.3

The role of fair value accounting in the recent financial crisis is also widely debated in the academic literature. Cifuentes et al. (2005), Allen and Carletti (2008) and Plantin et al. (2008) show analytically that M2M accounting might, during financial crises, lead to pro-cyclical selling, depress asset prices, further causing so-called feedback effects, and thus exacerbate contagion among financial institutions. Laux and Leuz (2010) and Barth and Landsman (2010), on the other hand, argue that the analytical models assume a full fair value regime, in which all assets are marked to market prices and fully recognized by prudential regulators in their assessment of capital ratios, which is inconsistent with current regulatory practice. They argue that there is no systematic empirical evidence confirming the results of the analytical models. In fact, Badertscher et al. (2012), in a recent study, provide evidence that M2M accounting had little effect on regulatory capital and that market price pressure did not result in economically significant selling of affected assets by financial institutions.

In this paper we focus on the potential impact of fair value accounting on bank failures. We analyze theoretically when fair values become crucial in deciding whether a bank has failed and examine empirically whether they actually precipitated bank failures in the recent financial crisis.

Bank failure can play several major roles in financial crises. For the bank's stakeholders, it brings deadweight bankruptcy costs incurred by courts, administrators and liquidators (Altman, 1984), destroys organizational capital (Lev et al., 2009), depresses trading activity (Andrade and Kaplan, 1998) and leads to capital losses from the fire sales of assets (Pulvino, 1998). For the system there are potential externalities and contagion. One bank's fire sales may depress asset valuations across markets, and with M2M accounting, shrink other banks' reported balance sheets. Failure can eliminate financial claims, undermining counterparties' trust that their claims on other banks will be honoured: spreads may widen, and, in the extreme, markets will freeze. And a heightened fear of failure may cause banks to scale back lending, curtailing potentially profitable economic activity. Two landmark bank failures of the 2007 financial crisis illustrate the unwelcome options confronting policymakers when banks are distressed. In the U.K., Northern Rock, target of Britain's first bank run since 1861, was an early beneficiary of a government bailout programme for banks—but one that dramatically increased the indebtedness of the public sector, constraining macroeconomic policy for many years. On the other hand, in the U.S., in 2008, Lehman Brothers was denied government bailout funds, but its failure is associated with violent disruption across the world's financial markets.

In this paper we analyze the role of M2M accounting in these individual failures and in market-wide developments. Recognizing the complexity of the processes at work, we use a range of disciplines and methodologies. First, we review four different conditions for a bank failure, from economics, from bankruptcy law, and from prudential regulation, and we relate them to accounting regulation—to identify which of the four failure conditions might be triggered by M2M accounting. Second, we analyze the financial statements of the two landmark bank failures in the light of those failure conditions, to identify the role of M2M accounting in their demise. And, third, we assess econometrically the impact on bank failure risk of two sources of M2M perturbation: market prices and the accounting standards governing the role of current market prices in the financial statements used in some failure conditions. We analyze two types of market price change in financial instruments—regular daily prices and exceptional fire sale prices—and two shifts in accounting regulation, one governing the scope of M2M, the other the circumstances in which M2M rules could be relaxed.

The diversity of the failure criteria we indentify has several implications for the efficiency of the failure mechanism, particularly in periods of financial crises. First, none of the legal or regulatory criteria are usually aligned with the economic criterion for exit: viable banks may fail, whilst neither the legal nor the banking regulators' mechanisms can be relied upon to eliminate a bank that is economically ‘unfit’. Second, the legal constraints that eliminate banks and other businesses depend on prevailing economic circumstances: other things equal, a bank may survive in deep and liquid markets yet fail in less active markets. Third, we show that fair values in the balance sheet are potentially critical in two of these four failure triggers (one legal and the other regulatory), but not directly relevant in two of them (the economic and the other legal one). We therefore explore whether they have actually been important in the current crisis.

From our analysis of the financial statements of the two most notorious bank failures of the crisis, Northern Rock and Lehman Brothers, we conclude that the failure of these banks cannot be attributed to M2M accounting. When measured at fair value, and without any of the relaxations of fair value rules that were subsequently introduced, neither bank was balance sheet insolvent—usually the primary legal criterion for failure in the relevant jurisdictions; nor did they break the regulators' capital adequacy rules in relation to their balance sheets. Their demise is instead attributable to cash flow insolvency, a condition that is of little consequence in normal times when markets are deep and liquid.

We therefore assess other evidence that might reveal a pernicious role for fair values in the crisis. We attempt formally to test whether M2M risk (the likelihood of write-downs due to falling market prices) increased the bankruptcy risk of financial institutions during the financial crisis. More specifically, in time-series regressions we test whether daily changes in the ABX.HE index increased the perceived risk of bankruptcy reflected in spreads on credit default swaps. We do not find evidence suggesting this in our tests. Instead we find some explanatory power in the spread between LIBOR and Overnight Index Swaps (OIS), which measures counterparty risk for borrowings with very short maturities, confirming our theoretical argument that cash flow insolvency becomes the binding failure condition during financial crises.

Changes in the fair value regime offer another opportunity to assess the role of M2M in bank failure. During the crisis the accounting regulators twice introduced relaxation in the fair value regime. First, we consider the amendment of IAS 39 in 2008—allowing banks to re-classify certain financial instruments from the trading category (which requires continuous marking to market) to the loan category (which is measured at cost). We reason that, even though it does not affect their underlying legal solvency or economic viability, this partial suspension of fair value accounting may, for some banks, have reduced the probability of regulatory failure with all its attendant costs; and such a benefit would show in share prices. At first sight this benefit for the banking sector's market valuation does seem to have accompanied the IASB announcement.

A second relaxation of the fair value regime introduced by the IASB and the FASB concerns the fair values to be used where the markets in which the relevant instruments are to be priced have become very thin. This relaxation responds to the fear of externalities and vicious circles, where one bank's distress sale of an instrument in an illiquid market determines the prices at which equivalent or comparable instruments are recorded, for legal or regulatory purposes, in other banks' balance sheets. To assess this relaxation we measure share price changes in the banking sector—again as an indicator of changed failure risk—in response to a notorious example of a financial instrument being sold in large quantity at a massive discount: Merrill Lynch's sale of its ABS CDO portfolio with a face value of US$30.6 billion at a price of US$6.7 billion in the summer of 2008. Despite a negative short-term effect on share prices for the banking sector overall at the time of the announcement, the results do not indicate that the market expected this distress sale to have an adverse impact on other banks' balance sheets. However, we do find some evidence that the subsequent relaxation of the accounting regime concerning such market prices did relieve our indicator of bankruptcy risk.

To our knowledge no single publication has addressed the specific issue we analyze in this paper. However, some of the literature has contributed material on which we rely, and in turn the paper aims to contribute to the literature. This study synthesizes elements of each of the literature on law, economics and accounting. In the area of law and economics it demonstrates previously unrecognized conflicts between failure criteria in the different disciplines. In relation to the accounting literature it provides new evidence on the impact of M2M accounting on failure prospects both of individual banks and across the system. In relation to the economic literature it informs the discussion of contagion via accounting valuations in bank balance sheets for fair value accounting.

Literature Review and Hypotheses Development

Prior Literature

The corporate finance literature identifies and quantifies the costs resulting from business failure. Altman (1984) enumerates the direct costs of bankruptcy totalling around 3% of firm value. Andrade and Kaplan (1998) extend the calculation to indirect costs—notably business forgone on account of financial distress—and estimate these to fall between 10% and 25% of firm value. The direct costs alone have been estimated as US$350 million for United Airlines, US$1 billion for Enron, and US$2.4 billion so far for Lehman Brothers.

On the other hand, one strand of the microeconomic literature identifies the benefits of corporate failure in enhancing the efficiency of the economic system. This is for the Darwinian reasons famously developed by Friedman (1953): elimination of the ‘unfit’. As the last Governor of the Bank of England emphasized (George, E., ‘The Pursuit of Financial Stability’, lecture given at London School of Economics in 1993, quoted in SRM, 2009, p. 6): ‘The possibility of failure is necessary to the health of the financial system, as it is to the efficiency of all other economic activity’. And he cited Bagehot on moral hazard: ‘Any aid to a present bad bank is the surest mode of preventing the establishment of a future good bank’. This was the basis for the presumption that prevailed at the start of the 2007 crisis against bailing out distressed banks. In the U.K. there were 31 bank failures in the period from the secondary banking crisis of 1973–76 until 2009; and in only four of these cases did the Bank of England consider that government support was warranted (SRM, 2009, para. 137).

One qualification to this microeconomic view of failure as a benign ‘culling’ process comes from macroeconomic analysis exploring the role in some failures of unpredicted or unpredictable macroeconomic shocks (sometimes the unintended consequences of government policy), which force otherwise healthy firms into bankruptcy (Goudie and Meeks, 1991, 1998).

A second qualification to the optimistic microeconomic ‘survival of the fittest’ argument focuses on externalities, or contagion. The interaction of macroeconomic forces with M2M accounting has been analyzed in a series of papers on contagion. Plantin et al. (2005, 2008) analytically investigate the financial stability implications of the use of market prices for the valuation of loans. They argue that although the emergence of surrogate prices via innovative derivatives markets for previously illiquid assets allows these assets to be marked to market, this may not be desirable due to the magnifying role of prices on financial intermediaries' actions during financial crises. Changes in asset prices are found to be a major channel of contagion among financial institutions (Cifuentes et al., 2005); and particularly during financial crises these changes might predominantly be reflective of the overall liquidity of the market—its ability to absorb large asset sales (Adrian and Shin, 2008; Gorton and Huang, 2004; Schnabel and Shin, 2004). Under these circumstances the liquidity shortages and distressed asset sales may lead to systemic failures in the banking system, as highlighted in Diamond and Rajan (2005).

The law and economics literature has identified circumstances where, from an economic standpoint, the bankruptcy process administered by lawyers has been dysfunctional. Jackson (1982) and Webb (1991) analyze cases in which, on legal grounds, companies are liable to fail, but on economic grounds the assets would best remain employed in the present business: the business is worth more as a going concern than if it is liquidated. Under a creditor-oriented legal system (such as the U.K.'s), the incentive system may induce destructive creditor races, and economically undesirable exit. On the other hand, there are firms which, on economic grounds should be disbanded, but are not compelled to by the legal system. Such companies are the focus of Jensen's (1986) analysis of cash-rich firms free to squander shareholders' money because of agency problems; and of his prescription of raising their leverage, thus compelling them to return some cash flow to wealth-holders every year in the form of interest payments: unless their performance improves they will ultimately be driven into the insolvency net, with the prospect of law intervening to part executives from their under-performing assets. A related case analyzed by Stiglitz (1972) (see also White, 1992) has managers continuing in business under the protection of Chapter 11, gambling with stockholders' money, even though liquidation is warranted on economic grounds (see the related analysis of Eastern Airlines by Weiss and Wruck, 1998).

In the accounting literature, Meeks and Meeks (2009) explore the fragility of balance sheet valuations: legal failure often depends on M2M valuations, which themselves depend on the probability of failure. But in the particular case of the crisis and the regulatory failure of banks, Laux and Leuz (2010) argue that changes in the value of the majority of debt securities were not determined by M2M, and so did not affect the critical regulatory capital measures under the Basel regime. Badertscher et al. (2012) empirically investigate the effects of fair value losses on bank regulatory capital and on the selling behaviour of commercial banks. They find no evidence that other-than-temporary fair value impairment charges significantly depleted bank regulatory capital or that they caused pro-cyclical selling behaviour. Bhat et al. (2011), on the other hand, examine the selling behaviour of banks induced by declines in market values of mortgage-backed securities (MBS) and feedback effects on market prices of MBS before and after the FASB's guidance on fair value measurements in April 2009. The study finds a positive association between changes in MBS holdings and changes in prices consistent with the existence of feedback effects, but that this relation weakened after the rule clarification.

Hypotheses

- P1: The change in balance sheet valuations from cost to M2M alters the outcome of decision rules determining whether a bank fails.

- P2: In the two pivotal bank failures of the 2007–2008 crisis, failure can be attributed to the use of M2M valuations rather than traditional cost measures.

We investigate the evidence of stock returns in a portfolio of 588 banks for a negative effect from the notorious fire sale by Merrill Lynch of a US$30 billion ABS CDO portfolio at a discount of almost 80%, and for positive effects from the subsequent relaxation of M2M rules on such transactions.

What triggers bank failure?4

One Legal Criterion for Company Failure: Balance Sheet Insolvency (BSI)

()

()where A is the value of the firm's assets (we leave the valuation basis undefined at this stage: this is a critical issue later in the paper) and L is the value of the firm's liabilities (debts). Referring to this inequality the U.S. bankruptcy code of 1978 states: ‘“Insolvent” means, in relation to an entity, that … the sum of such entity's debts is greater than all of such entity's property, at a fair valuation …’5

Similarly, one component of the U.K. Insolvency Act (1986, 2.123) has an equivalent balance sheet test:

‘A company is also deemed unable to pay its debts if it is proved to the satisfaction of the court that the value of the company's assets is less than the amount of its liabilities …’

In general the courts will adopt generally accepted accounting practice in valuing the assets and liabilities in this calculation; so the accounting standard setters play a powerful role in this process: in a falling market a bank might be deemed solvent if its assets are valued at cost, but insolvent if they are recorded at a fair value based on current market price.

The Economic Criterion for Company Failure (EF)

()

()where Apv is the present discounted value of net future cash flows generated by the company's assets if they are retained in their existing use, and Anrv is the net realizable value of the assets if they are sold for an alternative use. In other words, economic efficiency would be enhanced if a company discontinued, once its assets could yield higher returns in an alternative use. It does not depend on whether to record assets at fair value or historical cost but involves comparing two sets of potential cash flows.6 It also does not take account of the company's legal insolvency, since no comparison is made between assets and liabilities. Hence it may be economically desirable for a business to continue even where it fails on legal grounds.7

Regulatory Failure (RF)

()

()-

- K =

-

- regulatory capital

-

- q =

-

- leverage multiplier

-

- A =

-

- assets

RF can be measured in different ways depending on varying definitions of regulatory capital and assets. Regulatory capital is defined more broadly compared to traditional measures of capital (assets minus liabilities); it comprises capital that is able to absorb losses and is junior to claims from senior creditors and deposit insurers, for example, the government (Berger et al., 1995). It may include equity capital, hybrid capital such as preference shares, and more complex capital innovations, as well as subordinated debt and general reserves—capital that is considered to be perpetual, junior and able to reduce moral hazard incentives. The definition of assets for regulatory purposes can vary from un-weighted to more complex and dynamic risk-weighted variations, such as the one implemented under Basel capital regulations. Although a breach of the minimum capital requirements does not simultaneously and immediately constitute legal or economic insolvency, it is usually, however, accompanied by reprimanding and intervening actions by the regulator on the bank's financial activities.8 The amount of regulatory capital to be held by financial institutions has to be set by regulators in relation to the risk (and hence possible losses) it should be able to absorb. A risk-based capital ratio allows the minimum capital held as protection against bankruptcy to adjust to the variability in the net worth of the bank (Bradley et al., 1991; Avery and Berger, 1991). The Basel capital adequacy rules require all banks to hold a minimum of 8% of total (regulatory) capital to risk-weighted assets. The risk weights are designed to take into account the bank's exposure to the credit risk of the counterparty within its banking book activities, for example, traditional banking activities such as borrowing and lending. Banks' trading activities require additional capital provisions for exposure to market risk usually based on more complex techniques such as value-at-risk calculations.

()

()Since W is always positive, it is obvious that the regulatory conditions are breached before the financial firm reaches legal insolvency based on BSI. These more stringent failure conditions for financial firms are justified by the regulators on the grounds of the systemic importance of financial companies for the economic system and for confidence in capital markets.

A Second Legal Criterion: Cash Flow Insolvency (CFI)

- (1) A person is solvent if, and only if, the person is able to pay all the person's debts, as and when they fall due and payable.

- (2) A person who is not solvent is insolvent.

- {c} … the company is unable to pay its debts as they fall due.

- A company is also deemed unable to pay its debts if it is proved to the satisfaction of the court that the value of the company's assets is less than the amount of its liabilities …

()

()-

- CI(t) =

-

- cash in (initial liquid assets, plus cash receipts) during period t

-

- CO(t) =

-

- immediate obligations to pay, plus fresh obligations to pay in period t

Comparing BSI and CFI

Does this mean that balance sheet insolvency is irrelevant in these other jurisdictions? We would argue that if markets are deep and liquid BSI is the binding condition even if the law is framed in terms of CFI, and that it is CFI that is irrelevant. Suppose an Australian company (in that cash flow bankruptcy regime) has encountered a cash flow difficulty and does not have cash in the bank with which to pay a ‘debt due and payable’. What happens next? Managers (and equity holders) have strong incentives to avoid the legal process of failure, since it entails bankruptcy costs (see Altman, 1984; Andrade and Kaplan, 1998 above), and would typically deprive equity holders of their wealth, and managers of their control and their income. They can therefore be expected to seek cash with which to meet the debt. They could do this by selling off any non-cash assets that are not required for operations (surplus inventories, real estate or equipment). Or, if there were no such surplus assets, they could borrow against the assets they wished to continue operating. For example, in the case of real estate they could construct a mortgage or a sale and lease-back arrangement; in the case of inventories they could follow common practice and use these as collateral for short-term bank borrowing; and in the case of receivables, they could adopt factoring to ‘turn them into cash’ ahead of the due payment day.

What is the limit on such borrowing? For a credit-worthy company operating in deep and liquid capital markets, the limit will be set by its potential collateral. In other words, the question will be: does it have more assets than liabilities? CFI will only matter, therefore, if it is accompanied by balance sheet insolvency: A < L. Otherwise the rational manager will solve the problem of CFI with some form of re-financing package. This is the analogue of the standard Modigliani–Miller proposition that stockholders will, in certain circumstances, be indifferent between dividends—cash flows—and retained earnings. This is because, for listed companies, retained earnings, which are equity, can readily be transformed into cash via financial markets: stockholders can ‘declare their own dividend’ by selling some stock. Similarly, in our context, with deep and liquid financial markets, the executive faced with CFI can sell assets or raise finance against collateral, provided there is positive equity, that is, balance sheet solvency.

Mark-To-Market Accounting and The Different Concepts of Bank Failure

Mark-to-market and Economic Failure

The notion of marking to market under a fair value accounting regime is based on the relevance and reliability of market prices in approximating economic or fundamental value (Whittington, 2008). This concept relies on exit prices to reflect the equilibrium state of demand and supply (Chambers, 1966).9 Measurement of the economic failure condition is therefore inherently connected to the notion of fair value. In perfect and complete markets prices are readily available for all assets and the economic failure condition can easily be assessed by comparing observable exit prices (net realizable values) with the value in use of all assets of a business.10 However, when markets are less than perfect and are incomplete the exit price might no longer serve as a good approximation for economic value. Yet, this does not necessarily alter decisions for going concerns based on the economic failure condition. If, for instance, during financial crises markets become illiquid and prices reflect investors' demand for liquidity rather than expected future cash flows (Allen and Carletti, 2008; Plantin et al., 2008), realizable values will fall substantially below values in use as market participants will require a premium to give up liquidity and hold the illiquid asset. Consequently, the economic failure condition will not be breached—the surplus of present value over net realizable value will actually be increased, reducing failure risk—and assets will remain in their current use. Marking assets to market does therefore not influence rational decisions under pure economic failure conditions.

Mark-to-market and Legal Failure

Previously we introduced two legal definitions of failure, BSI and CFI, and concluded that in functioning markets CFI is irrelevant since assets can be turned into cash by pledging them as collateral as long as the entity is balance sheet solvent, that is, the value of the assets exceeds the value of the liabilities. Under these legal conditions the valuation of assets becomes crucial. When assets are continuously marked to market creditors are able to verify asset valuations instantaneously. In an environment of falling asset prices debtors will receive collateral calls asking them to pledge a larger volume of assets for the same value of liabilities. Again, as long as A exceeds L even on a M2M basis the debtor is able to continue with ordinary business although it will prove to be more costly. Ceteris paribus, if asset prices drop fast and deep enough the value of A will fall below L and the business will be declared insolvent. Under an historical cost regime the drop in asset values (and hence insolvency) will only feed through to the balance sheet if asset prices remain impaired for a sustained period of time and the business is not able to refinance itself through earnings during this period. Consequently, the legal failure condition may not be breached under historical cost accounting as opposed to under a fair value regime.11

However, assuming prices come under enough pressure (which by definition is a feature of financial crises), irrespective of balance sheet valuations creditors will demand more collateral since expectations of defaults have increased. Ad extremum, creditors may not be willing to hold non-cash collateral in anticipation that the value of these assets will drop further (even though they are still held at cost on the balance sheets). The cash flow constraint becomes binding. As liquidity dries up in markets, creditors demand liquid assets or charge higher premia to hold illiquid assets as collateral, forcing debtors to turn assets into cash with a substantial discount (Gorton and Metrick, 2009). Short-term funding in wholesale markets freezes. This may result in pro-cyclical adjustments of balance sheets with negative feedback effects as explained in Adrian and Shin (2010). If creditors anticipate each other's moves, they will all demand cash almost simultaneously as everyone tries to pre-empt the other's move even though collectively it might prove beneficial to forbear (Epstein and Henderson, 2009). Now cash flows, not balance sheet values, become crucial. Hence, CFI overrides BSI and balance sheet valuations become irrelevant. These circumstances are tantamount to a bank run and caused the demise of Northern Rock and Lehman Brothers.

Mark-to-market and Regulatory Failure

So far we have illustrated that legal failure might be triggered even when the business should continue on economic grounds, and that under certain extreme market conditions cash flow insolvency becomes the decisive factor in failure irrespective of the prevailing accounting regime.

Although we argue here that the accounting convention does not change the fundamental value of the assets, and that investors and creditors see through mere accounting numbers, fair value accounting might introduce feedback loops when market prices are used as inputs for valuation models. Once markdowns occur under M2M accounting these might amplify downward movements in asset prices if they artificially induce balance sheet de-leveraging. We argue that these feedback effects do not automatically occur due to economic or legal insolvency conditions as explained above, but rather are introduced through regulatory channels. If balance sheet variables are marked to market, vicious circles can develop in falling markets as banks seek to comply with capital adequacy regulation and shrink their balance sheets to avert failure. This can intensify the cycle and create externalities when, in thin markets, banks decide to trade assets or liabilities. Owing to the dual role of market prices under fair value accounting one bank's market transaction might affect the valuations in another bank's balance sheet.

Consider a bank with equity of 10 and a 10% regulatory capital ratio under three different regulatory systems, one crude leverage constraint and two risk-based capital rules, one static (Basel 1) and one dynamic (Basel 2). Assume that under each regime the bank is required to hold a minimum of 8% equity to regulatory capital. Further assume that the average risk weights of the assets under the risk-based regimes Basel 1 and Basel 2 are 50%. Also assume that all loans are marked to market and due to a deterioration of economic conditions are worth only 97 cents in the dollar.

First, consider the change in the banks' balance sheet under the regime with the crude leverage constraint as under the Federal Deposit Insurance Corporation Improvement Act 1991 (FDICIA). Initially, the bank made loans valued at 100 (10 equity with a capital ratio of 10%). These loans are marked down 3% and are now worth 97 since equity is reduced by three, and the bank now has a capital ratio of (10 – 3)/0.97*100 = 7.2%. If no capital can be raised the bank has to reduce its balance sheet by 97 – (7/0.08) = 9.5 to reach the minimum capital ratio requirement of 8%.

Now consider the case for a bank operating under Basel 1. Because the average risk weight of assets is 50% the bank can now make 200 in loans in order to have a 10% capital ratio to risk-weighted assets. After a 3% write-down the assets are now worth 194, and equity is reduced by six. The new risk-weighted capital ratio is now only (10 – 6)/(0.5*194) = 4.1%. Hence, the bank has to reduce its balance sheet by 194 – (4/0.5*0.08) = 94 to be able to maintain a minimum risk-weighted capital ratio of 8%.

Recall that Basel 2 differs from Basel 1 in as much as the risk-weights are not static but depend on (external or internal) credit ratings of the loans. It is likely that, owing to the deterioration of the economic conditions, default probabilities increase such that the risk-weights under dynamic risk-based capital rules such as Basel 2 increase. Assume for simplicity that average risk weights have increased from 0.5 to 0.6. Although the bank has incurred the same loss of six and holds loans worth 194, it now must raise 194 – (4/0.6*0.08) = 110.7, that is, almost 20% more than under Basel 1.

This simple example illustrates that the main pro-cyclical downward pressure results from the risk-based regulatory regime (Basel 1), which is further magnified in the dynamic version (Basel 2). Compared to the crude leverage constraint regime, almost 10 times worth more loans have to be sold under risk-based capital adequacy rules. Consequently, Laux and Leuz (2009) argue that measures against contagion and procyclicality in bank balance sheets should be implemented by changes in prudential regulation rather than changes in accounting standards.

Plantin et al. (2008) show analytically that M2M accounting is inefficient for non-standardized illiquid and long-term assets such as loans. However, the current accounting regime acknowledges this since loans are predominantly required to be measured at amortised cost on bank balance sheets. Laux and Leuz (2010) argue that fair value changes of the majority of debt securities do not affect regulatory capital since these—at the time of the financial crisis—fell under the held-to-maturity or available-for-sale category for which temporary fair value losses were not recognized in income and tier 1 capital. And of course, if the loans had not to be marked to market initially, no write-off would be necessary at all (although this might change if the loans are deemed impaired in the long-term). The discussion here provides simple simulations suggesting that risk-based capital adequacy rules reinforce strains on equity capital beyond losses incurred due to M2M accounting.

Summary

- the use of M2M in a falling market could be sufficient to tip into balance sheet insolvency, our first legal criterion, a bank that was solvent on a traditional, historic cost accounting basis;

- M2M could likewise be sufficient to make a bank breach its capital adequacy ratios and suffer regulatory failure under a regime such as Basel 2;

- neither balance sheet insolvency nor regulatory failure is necessary for a bank to fail, as we will see in the cases of Northern Rock and Lehman Brothers: failure may be precipitated by cash flow insolvency when markets are not deep and liquid.

| Failure type | Formula | Affected by balance sheet valuation method? |

|---|---|---|

| Legal – BSI | A < L | Yes |

| Legal – CFI | CI < CO | No |

| Economic – EF | Apv < Anrv | No |

| Regulatory – RF |

|

Yes |

- This table summarizes the failure criteria and their relation to the balance sheet valuation method.

None of the legal or regulatory criteria coincide—except by unlikely chance—with the condition for economically efficient exit. These failure conditions may drive out of existence a bank that should continue on economic grounds, and may allow a bank that should exit to survive.

Bank Failure During The Financial Crisis

Northern Rock

Northern Rock provided a milestone in the crisis. It experienced the first bank run in Britain since the 19th century; and it had to be bailed out by the U.K. government.

- Northern Rock was not balance sheet insolvent: assets exceeded liabilities and the margin between the two was only slightly below the corresponding value a year earlier;

- the bank comfortably exceeded the tier 1 and overall capital ratios stipulated by Basel 2.

| PANEL A: NORTHERN ROCK KEY BALANCE SHEET ITEMS | |

|---|---|

| Northern Rock balance sheet items (31 December 2007) | |

| £ billion | |

| Assets | 109.3 (2006: 101.0) |

| Liabilities | 106.6 (2006: 97.8) |

| Risk-weighted assets | 20.7 |

| Basel 2 Ratios | % |

| Tier 1 ratio | 7.7 |

| Total capital | 14.4 |

| Source: Northern Rock, Annual Report and Accounts, 2007. | |

| PANEL B: LEHMAN BROTHERS KEY BALANCE SHEET ITEMS | |

|---|---|

| Lehman Brothers balance sheet items Q2, 2008 (31 August 2008) | |

| £ billion | |

| Assets | 600.0 (2007: 659.2) |

| Liabilities | 571.6 (2007: 637.5) |

| Tangible equity capital | 29.3 |

| Leverage Ratios | |

| Total leverage | 21.1x |

| Net leverage | 10.6x |

- This table presents abbreviated snapshots of the most recent financial data available from the balance sheets of Northern Rock (Panel A) and Lehman Brothers (Panel B) before their bankruptcy announcements.

- Source: Lehman Brothers, Form 8-k, filed 10 September 2008.

So it failed neither on the legal, balance sheet test, nor on the capital adequacy test of Basel 2. Northern Rock complied fully with the fair value requirements of the accounting regulations; and these measurements predate the relaxation of fair value accounting rules in 2008. Moreover, the auditors did not make a going concern qualification for these accounts. This assessment is confirmed by a High Court Judgement in 2009 (SRM and The Commissioners of Her Majesty's Treasury), paragraph 82(b): ‘At all relevant times the assets of Northern Rock exceeded its liabilities. It was solvent on a balance sheet basis’.

In normal times, when markets are orderly, the bank could have turned positive equity into cash via the short-term lending markets. However, in Northern Rock's case, ‘on August 9, 2007, the short-term market and interbank lending all but froze’ (Shin, 2009, p. 102). Northern Rock was unable to renew its short- and medium-term paper: as Shin's analysis shows, by the December 2007 balance sheet, the funding from this wholesale market had shrunk to £11.4 billion, from £26.7 billion a year earlier. When news of the bank's request to the central bank for substitute funding leaked, in the following month, the famous run developed: the retail deposits market also became inaccessible for Northern Rock, and these liabilities fell by a similar sum to the shrinkage of wholesale sources—some £14 billion over the year to December 2007. Northern Rock became cash flow insolvent.

Lehman Brothers

- Lehman Brothers was not balance sheet insolvent: assets exceeded liabilities by US$28 billion;

- the bank had a market capitalization of more than US$20 billion; and

- the bank exceeded the minimum net capital requirements for broker-dealers under SEC rules by US$2.1 billion.12

In addition, according to Bloomberg, the company had already announced total write-downs of US$13.8 billion and at the same time raised US$13.9 billion of equity in 2008.

Similar to the Northern Rock case, Lehman Brothers fell victim to the capital and term structure of its balance sheet. Lehman was extremely reliant on short-term funding and high levels of leverage (Zingales, 2008). As opposed to commercial banks, Lehman Brothers as a broker–dealer had no access to retail deposits and only limited access to liquidity from the Federal Reserve Bank but relied heavily on the repo market. In the immediate days before the bankruptcy filing, Lehman faced collateral calls on its secured loans and was denied access to wholesale funds. Even though Lehman's assets exceeded its liabilities based on fair values, the collateral value of these mostly illiquid and hard-to-value assets pledged for liquidity in repo markets required steep haircuts. Owing to the uncertainty surrounding the value of the collateral in highly volatile markets, lenders generally demanded higher haircuts for all types of non-cash collateral—in the extreme case of up to 100% for mortgage-related assets, that is, these assets were not accepted as collateral at all any more (Gorton and Metrick, 2009). Liquidity previously accessible in abundance froze almost instantaneously as haircuts on assets used as collateral became prohibitive and suitable collateral became scarce (Morris and Shin, 2008; Brunnermeier, 2009).13 Lehman Brothers, too, became cash flow insolvent.

The cases of Northern Rock and Lehman Brothers highlight that bank failures might arise despite capital adequacy and balance sheet solvency due to sudden shocks to liquidity positions (see also Alexander, 2009, p. 81; Alexander et al., 2007). And M2M accounting cannot be held responsible for their collapse.

Econometric Analysis

Here we test our three hypotheses, analyzing larger sets of data for statistical tendencies. We focus on the question whether fair value accounting and the use of market values in bank balance sheets per se increased default expectations for banks during the financial crisis and whether it led to contagious effects in the markets.

Sample Selection

| TIER1 | Ratio of regulatory tier 1 capital to regulatory risk-weighted assets |

| LEV | Ratio of total assets to total shareholder's equity |

| FVASSETS | Ratio of assets held at fair value to total assets |

| AFSLOSS | Ratio of unrealized fair value losses to total shareholder's equity |

| IASB | Indicator variable which equals one during a three-day period around the IASB announcement of a relaxation of IAS39 allowing reclassification of certain assets, and zero otherwise |

| MER | Indicator variable which equals one during a three-day period around the announcement by Merrill Lynch of the sale of a large portfolio of mortgage-backed securities, and zero otherwise |

| MM | Momentum factor retrieved from Kenneth French's website |

| HML | Fama–French factor mimicking portfolio of returns on high minus low book-to-market firms retrieved from Kenneth French's website |

| SMB | Fama–French factor mimicking portfolio of returns on small minus big firms retrieved from Kenneth French's website |

| ΔLOIS | Daily change in the LIBOR-OIS spread. LIBOR represents the funding rate for banks in the interbank market over a period of three months and OIS is the overnight index swap rate |

| ΔABX | Daily change in the on-the-run ABX.HE index of 20 equally weighted subprime mortgage-backed securities |

| ΔCDS | Daily change in credit default swap spreads on financial firms |

| ΔVIX | Daily change in the VIX index, which measures the implied volatility of S&P 500 index options |

| ΔSPXF | Daily returns on the S&P financials index |

| MRP | Market risk premium Rmt − Rft |

| N | mean | p25 | median | p75 | min | max | |

|---|---|---|---|---|---|---|---|

| Market value (US$ million) | 519 | 2,094.3 | 63.7 | 142.4 | 403.9 | 8.8 | 183,107 |

| Total assets (US$ million) | 519 | 22,042.3 | 573.7 | 1,208.8 | 3,377.6 | 88.2 | 2,950,316 |

| Total liabilities (US$ million) | 519 | 20,448.5 | 523.1 | 1,069.1 | 3,083.6 | 79.3 | 2,894,144 |

| Common equity (US$ million) | 519 | 1,544.0 | 55.8 | 112.6 | 335.5 | 6.0 | 142,394 |

| Tier 1 capital ratio (%) | 519 | 11.1 | 9.2 | 10.3 | 12.4 | 5.4 | 26.0 |

| Leverage (total assets to equity) | 519 | 11.2 | 9.2 | 10.8 | 12.9 | 3.2 | 42.7 |

- This table presents summary statistics of a sample of 519 financial institutions drawn from the Compustat North America and Compustat Bank files with SIC codes 6020, 6035 and 6211. To be included in the sample the banks must have positive assets and positive equity. The table describes the number of firms, mean, standard deviation, median and first and third quartiles, and the minimum and maximum of the main firm characteristics.

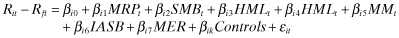

Research Design

Here we attempt to assess the impact of M2M risk on the perceived bankruptcy likelihood of financial institutions. First, we focus on the spreads of credit default swaps for banks as a proxy for default risk as perceived by the market. We use the daily average spread on a basket of 125 financial institutions for which credit default swap (CDS) data was available on Bloomberg from January 2007 to September 2009. We regress the daily change in average CDS spreads (ΔCDS) on a set of variables that proxy different risks. As a proxy for the risk of M2M losses on asset-backed securities we use the on-the-run ABX.HE index, which reflects the price of 20 equally weighted residential mortgage-backed securities (RMBS).14 Specifically, we use the price for the sub-index of AAA-rated tranches of these securities. These are representative of the most secure securities based on sub-prime mortgages and are the last to be affected by mortgage defaults but rather bear market risk.15 We use asset-backed securities based on sub-prime mortgages since these were the most contentious assets on bank balance sheets during the initial phases of the financial crisis. Fair value accounting requires financial institutions to mark all asset-backed securities, not held to maturity, to market, for which indicative fair values are usually estimated using a market index such as the ABX.

Following Gorton and Metrick (2009) we choose the LIBOR-OIS spread (LOIS) as a proxy for illiquidity risk in the repo market. LIBOR represents the funding rate for banks in the interbank market over a period of three months, and OIS is the overnight index swap rate, which is a fixed-to-floating interest rate swap based on an overnight reference rate such as the Fed funds rate. Since the OIS has virtually no counterparty risk—there is no principal payment and the interest rate differential between the fixed and the floating rate is paid at maturity—the LIBOR-OIS spread mainly reflects counterparty risk for the lender. A spread widening indicates a greater reluctance of lenders in the interbank market to provide short-term liquidity.

()

()If potential M2M write-downs on asset-backed securities were expected to increase the risk of default for banks, the coefficient of ΔABX should be positive and significant controlling for other market risk proxies. The regression is estimated using three different estimation methods: Prais–Winston-FGLS, OLS with autocorrelation robust standard errors, and an ARCH model.

Results

| (1) | (2) | (3) | |

|---|---|---|---|

| ΔLOISt |

0.055 (1.65) |

0.049 (1.68)* |

0.054 (1.93)* |

| ΔLOISt−1 |

0.161 (5.31)*** |

0.161 (5.91)*** |

0.157 (5.99)*** |

| ΔLOISt−2 |

0.031 (1.43) |

0.03 (1.96)** |

0.016 (1.00) |

| ΔABXt |

0.019 (0.11) |

0.005 (0.03) |

0.011 (0.03) |

| ΔABXt−1 |

0.017 (0.1) |

0.038 (0.24) |

0.04 (0.12) |

| ΔABXt−2 |

0.138 (0.82) |

0.13 (0.78) |

0.103 (0.3) |

| ΔVIXt |

0.054 (1.47) |

0.057 (1.97)** |

0.054 (1.70)* |

| ΔSPXFt |

–0.008 (–0.16) |

–0.002 (–0.05) |

–0.001 (–0.01) |

| ΔCDSt−1 |

0.167 (4.35)*** |

||

| Constant |

0.003 (1.39) |

0.003 (1.26) |

0.002 (1.04) |

| Observations | 391 | 391 | 391 |

| R-squared | 0.09 |

- This table presents coefficients and t-statistics of time-series regressions of the daily average change of an index of credit default swap spreads of 125 banks on daily changes of LIBOR-OIS spreads (ΔLOIS) and its two lags, daily changes of the price of the ABX.HE AAA tranche index ΔABX and its two lags, daily changes in the VIX index ΔVIX and on daily returns on the S&P financials index ΔSPXF. The regression is run from January 2007 to September 2009. Model (1) uses Prais–Winston FGLS estimation for serially correlated errors, model (2) estimates the regression with OLS and autocorrelation robust standard errors based on the Newey–West method, and model (3) includes a lag for the dependent variable ΔCDS as regressor and is estimated with an ARCH model. T-statistics are calculated using heteroscedasticity robust standard errors where appropriate. ***, **, * denote statistical significance at the 0.01, 0.05 and 0.10 levels, respectively.

Research Design

The risk of balance sheet insolvency and regulatory failure of banks should also be reflected in stock prices as investors face failure costs (FC)—at best a reduction in the return on equity as balance sheets are restructured, and at worst, expropriation in the case of bankruptcy or nationalization of troubled institutions.

- i) the business (bank) continues as a going concern (probability (1-p)), outcome PV1 (present value of net future cash flows from trading);

- ii) the business fails (probability p), FC are incurred, control passes to other managers who then also generate PV1 from trading.

The economic value of the business is then (1-p)PV1 + p(PV1 – FC). Ceteris paribus the value declines as p, the probability of failure, increases.

Hence, an increase in bankruptcy risk is generally associated with negative stock returns, and in our remaining analyses we use stock returns as a proxy for bankruptcy risk and risk of contagion. Related research similarly uses stock returns in general, and stock price reactions to policy changes in particular, as measures of increased risk of regulatory intervention or as proxy for pro-cyclical contagion among financial institutions (e.g., Cornett et al., 1996; Bowen et al., 2010).

We first investigate abnormal stock returns around the IASB's announcement of an amendment to IAS 39. The amendment allowed banks to re-classify certain financial instruments from the trading category (which requires continuous marking to market) to the loan category (which is measured at cost). This effectively allowed banks to measure securities that were previously held for trading purposes at amortized cost and can be viewed as a partial suspension of fair value accounting for certain assets.16 If investors regarded M2M accounting as one of the main reasons for the increased threat of regulatory intervention or potential bankruptcy of financial institutions, the overall market reaction to the announcement of this amendment should be positive. More specifically, the reaction should be more favourable for those firms that are more likely to have been adversely affected by the M2M rules, that is, banks with more assets accounted for at fair value (FVASSETS) and with higher unrealized fair value losses (AFSLOSS), and also more favourable for those firms that are more likely to have been threatened by regulatory intervention, that is, with a lower tier 1 capital ratio (TIER1) and higher leverage (LEV).

We further investigate abnormal stock returns around a major market transaction in July 2008 in the, until then, frozen market for asset-backed securities. In July 2008 Merrill Lynch announced the sale of its ABS CDO portfolio with a face value of US$30.6 billion at a price of US$6.7 billion to the private equity fund Lone Star. This sale constituted one of the few market transactions in these assets and hence could have served as a reference for other financial institutions to mark similar assets at equally high discounts with profound effects on balance sheet valuations and write-downs.17 If investors feared that the prevailing price in this single transaction would have had an impact on fair values of similar assets on other banks' balance sheets due to the application of M2M accounting, this would have caused a general decline in share prices of financial institutions at the announcement of the transaction, and more so for those firms with a lower tier 1 ratio (TIER1), higher leverage (LEV), more assets measured at fair value (FVASSETS), and higher unrealized fair value losses (AFSLOSS).18

We acknowledge that stock prices of financial firms during our particular sample period will most likely be affected by the release of a multitude of other market-relevant information related to the profitability and financial health of banks. Therefore, we limit this analysis to a three-day window around the event dates. Longer event windows will not enable us to isolate the market reaction to the events in question. Additionally, we conduct a news search on Factiva during our three-day event windows to uncover other value relevant information releases in order to detect other confounding, firm-specific events.

()

()The regression coefficients are estimated using generalized least squares (GLS). All variables are described in Table 3. Under the null hypothesis that the announcements had no impact on stock returns the parameters on the dummy variables will be equal to zero.

Results

Table 6 summarizes cumulative abnormal returns for a three-day period around the IASB announcement (left column) and the Merrill Lynch CDO sale (right column). Results for the entire sample are given in the first row and further conditioned on prior year firm characteristics into the highest and lowest quintile. The table shows a statistically and economically significant increase in abnormal stock returns around the IASB announcement (CAR = 3.15%, p-value < 0.01). The evidence points towards the market's perception of a reduction in bankruptcy risk resulting from the relaxation of the fair value accounting rules. However, the investigation of the sub-samples shows no significant differences in the stock price reaction of firms based on differences in TIER1, LEV, FVASSETS and AFSLOSS. Furthermore, we do not find a significant reaction to the Merrill Lynch sale announcement (CAR 0.40%). More specifically, and contrary to the suggestion that M2M accounting will have negative effects for other banks using the sale price as the benchmark market price for their own valuations, we do not find larger negative reactions for banks with low TIER1, high LEV, high FVASSETS and high AFSLOSS. Rather to the contrary, the evidence suggests significantly higher abnormal returns for the banks that are presumably more vulnerable to M2M accounting.

| IASB amendment | Merrill CDO sale | ||||

|---|---|---|---|---|---|

| Mean | t-stat | Mean | t-stat | ||

| All | 3.15% | 4.149*** | 0.40% | 0.753 | |

| TIER1 | High | 0.72% | 0.69 | 1.05% | 2.011** |

| Low | 0.50% | 0.351 | 2.55% | 4.037*** | |

| Diff | 0.22% | 0.124 | –1.49% | –1.821** | |

| LEV | High | 0.03% | 0.021 | 0.98% | 1.567* |

| Low | 0.56% | 0.481 | 1.11% | 1.579* | |

| Diff | –0.53% | –0.276 | –0.12% | –0.13 | |

| FVASSETS | High | 1.08% | 1.431* | 1.22% | 3.106*** |

| Low | 1.08% | 1.441* | 0.76% | 1.794** | |

| Diff | 0.00% | 0 | 0.47% | –0.808 | |

| AFSLOSS | High | 0.54% | 0.461 | 2.06% | 3.241*** |

| Low | 1.56% | 1.194 | –0.44% | –0.632 | |

| Diff | –1.02% | –0.586 | 2.51% | 2.649*** | |

- This table presents cumulative abnormal returns for the portfolio of sample firms around two pivotal events during the financial crisis. The first event is the IASB announcement of amendments to IAS 39 (reclassification of financial instruments) and the second event is the announcement of a sale of a large portfolio of mortgage-backed securities by Merrill Lynch. All financial institutions are aggregated into a single portfolio in event time, and abnormal returns are calculated on the portfolio level. Abnormal returns are calculated using the Fama–French three-factor model plus a momentum factor. As proxy for the market portfolio the CRSP value-weighted index is used. Re-estimation with the equally weighted index does not change the results significantly. Model parameters are estimated over a 255-day estimation period ending 45 days before the event date. The sample firms are further sorted into top and bottom quintiles based on their regulatory tier 1 capital ratio (TIER1), leverage (LEV), the ratio of assets measured at fair value to total assets (FVASSETS), and the ratio of unrealized losses on available-for-sale assets to total equity. *, **, *** denote significance at the 10%, 5% and 1% levels, respectively.

Table 7 provides more robust evidence on the effect of these events and the sensitivity of different banks in cross-sectional regressions. The evidence re-affirms the mixed results of the event study. The coefficients on the IASB announcement are positive and significant confirming our previous results of the event study (0.014, p < 0.001 in columns (1) and (2)). The coefficients on the Merrill Lynch announcement are also positive, albeit somewhat weaker statistically (around 0.002, p-value < 0.05–0.1). Consistent with expectations the results in column (2) show that banks with a higher tier 1 capital ratio (TIER1) and lower leverage (LEV) experience higher excess returns during the sample period as these are deemed more conservative and thus safer institutions during periods of distress. The results presented in the first two columns of Table 7 do not provide consistent, sustained evidence of investors perceiving increased risk of externalities and feedback loops in bank balance sheet valuations due to M2M accounting although they indicate that the relaxation of the fair value rules did have an impact. Column (3) further shows the results of the extended regression that includes interaction effects between the bank characteristics and the event dates. The interaction coefficients with IASB suggest that banks with a lower tier 1 capital ratio and with more assets valued at fair value experienced a relatively higher market reaction to the announcement (IASB*TIER1 = −0.003, p-value < 0.001; IASB*FVASSETS = 0.211, p-value < 0.001), consistent with the notion that the more vulnerable firms from the market's perspective benefited most from the relaxation of the rules. In contrast, the coefficient on the interaction effect with LEV does not paint the same picture. Firms with higher leverage show lower excess returns during the announcement (IASB*LEV = −0.002, p-value < 0.001). Moreover, the results on the interaction effects with MER refute the hypothesis that firms more vulnerable to fair value accounting experienced lower abnormal returns during the Merrill Lynch CDO sale announcement. In fact, the coefficients on MER*TIER1 and MER*AFSLOSS show the opposite (–0.001 and 0.256, respectively). The regression results do not point towards possible feedback effects from the Merrill Lynch sale announcement.

| (1) | (2) | (3) | |

|---|---|---|---|

| Rm-Rf |

0.588 (117.23)*** |

0.515 (92.79)*** |

0.515 (92.81)*** |

| SMB |

0.495 (43.82)*** |

0.519 (41.56)*** |

0.519 (41.57)*** |

| HML |

0.511 (36.29)*** |

0.560 (35.89)*** |

0.560 (35.90)*** |

| MM |

–0.211 (–24.06)*** |

–0.203 (–20.97)*** |

–0.203 (–20.97)*** |

| IASB |

0.014 (13.39)*** |

0.014 (12.45)*** |

0.077 (10.35)*** |

| MER |

0.002 (1.85)* |

0.003 (2.26)** |

0.017 (2.26)** |

| TIER1 |

0.0006 (2.01)** |

0.0009 (2.83)*** |

|

| LEV |

–0.0006 (–2.00)** |

–0.0003 (–1.39) |

|

| FVASSETS |

–0.003 (–0.79) |

–0.004 (–1.02) |

|

| AFSLOSS |

0.013 (1.54) |

0.011 (1.24) |

|

| IASB*TIER1 |

–0.003 (–8.60)*** |

||

| MER*TIER1 |

–0.001 (–2.14)** |

||

| IASB*LEV |

–0.002 (–6.24)*** |

||

| MER*LEV |

–0.001 (–1.53) |

||

| IASB*FVASSETS |

0.211 (4.09)*** |

||

| MER*FVASSETS |

–0.052 (–1.00) |

||

| IASB*AFSLOSS |

0.163 (1.47) |

||

| MER*AFSLOSS |

0.256 (2.31)** |

||

| Constant |

–0.000 (–5.41)*** |

–0.001 (–1.10) |

–0.001 (–1.89)* |

| Observations | 284386 | 238165 | 238165 |

| R-squared | 0.123 | 0.106 | 0.106 |

- This table presents coefficients and z-statistics of cross-sectional time-series regressions of daily excess stock returns of the sample of financial institutions from January 2007 to December 2008 on dummy variables representing the IASB's announcement of amendments to IAS 39 (IASB) and Merrill Lynch's announcement of the sales of their ABS portfolio (MER). The common asset pricing factors are included as control variables, where Rmt − Rft is the market risk premium, SMB is the Fama–French factor mimicking portfolio of returns on small minus big firms, HML is the Fama–French factor mimicking portfolio of returns on high minus low book-to-market firms and MM is the momentum factor; all retrieved from Kenneth French's website. IASB and MER represent indicator variables, which equal 1 during a three-day period around the event announcement and 0 otherwise for the two announcements (IASB announcement and Merrill Lynch announcement). Regression (2) further includes a set of prior-year bank-level characteristics such as the regulatory tier 1 capital ratio (TIER1), leverage (LEV), the ratio of assets measured at fair value to total assets (FVASSETS), and the ratio of unrealized losses on available-for-sale assets to total equity as further control variables. Regression (3) includes the interaction effects of the firm-level characteristics with the event indicators. All variables are defined in Appendix A. Regression coefficients are estimated using GLS. Absolute values of the z-statistic are given in parentheses. *, **, *** denote significance at the 10%, 5% and 1% levels, respectively.

Overall, the results of the econometric analysis suggest that M2M accounting has had only a very limited influence on the perceived failure risk of banks and on potential feedback and contagion effects. We do not find any correlation between changes in default swap spreads of financial institutions and changes in market prices of sub-prime mortgage-backed securities. We find, however, that the regulatory relaxation of the M2M rules has had positive effects on stock returns. Finally, we do not find that the market sale of one bank's mortgage-backed securities portfolio at substantial discount has had an effect on stock prices of other institutions.

Summary, Conclusions and Implications

Summary of results

We first analyze whether the change from cost to M2M alters the decision rules determining whether a bank fails. We analyze four sets of failure criteria, one economic, two legal and one (Basel) regulatory. We show that these rules are not aligned with one another. In two cases M2M in a falling market does not raise the probability of failure; in two cases it does. Which case dominates will depend on the economic context and circumstances of the individual bank.

We then investigate whether in the two landmark bank failures of the 2007 crisis, failure can be attributed to the use of M2M valuations rather than traditional cost measures. We find that M2M did not make a decisive difference in these cases.

Following the theoretical discussion and case evidence we turn to the econometric evidence. We ask whether increased risk of M2M losses on asset-backed securities raised the perceived risk of bankruptcy reflected in spreads on credit default swaps. We do not find evidence of such a link with balance sheet valuations. But we do find that constraints in the interbank lending market—associated with cash flow insolvency—may have increased the perceived risk of bankruptcy. For further evidence on the effects of M2M accounting on the potential failure of banks we investigate two pivotal events during the crisis. First, whether the amendment of IAS 39 in 2008 allowing banks to depart from M2M and report higher (cost-based) valuations of some assets reduced the probability of failure as reflected in share prices. And second, if the distress sale of assets by one bank depresses the share price of other banks in the sector (because the discount on the market transaction adversely affects, via M2M, other banks' balance sheets, and hence their risk of failure). We do not find evidence of a sustained negative effect from the transaction, but we do find evidence of a positive effect from the announcement of a relaxation of the M2M regime consistent with the market imputing a lower risk of costly (regulatory) failure.

Conclusions and Potential Extensions

In relation to failure criteria then, the measurement basis for assets and liabilities—whether to mark to market—is irrelevant to economic failure and to legal cash flow insolvency. It is, however, relevant to legal balance sheet insolvency, but we argue that cash flow insolvency dominated balance sheet insolvency in the crisis (with deep and liquid markets the roles should be reversed). M2M is likely, therefore, to have been most powerful during the crisis because of its role in (Basel) regulatory failure.

In the two landmark bank failures we argue that both Northern Rock and Lehman Brothers were balance sheet solvent and regulatory compliant on a M2M basis. Cash flow insolvency was the culprit: M2M did not play a decisive role.

The econometric analysis took several steps in the search for evidence of a role for M2M in altering the risk of bank failure. It failed to find a significant sustained role for a key market price index, or for the heavily discounted prices in a massive distress sale. But the evidence suggests that changes in the regime of accounting regulation—altering the scope of M2M in balance sheets—did sway investors' perception of bankruptcy risk.

This is not the last word on the econometric approach. Further work might consider alternative proxies for bankruptcy risk and other sources of relevant market price data. The time profile of any M2M impact might warrant further work: we did find an initial response to the prices in the distress sale, but this was short-lived. Perhaps there was uncertainty in the turmoil of the crisis over whether that price information might be overtaken by other price movements, and whether the accounting regulators or the prudential regulators would relent over the application of M2M rules (as did the accounting regulators).

Implications for Accounting Standards

Against the background of a polarized debate on the merits of M2M in bank balance sheets, it would be easy to draw unsound partial inferences from our discussion. For example, those hostile to fair values might conclude that if fair value was irrelevant to the failure of Northern Rock and Lehman Brothers, why go to all the trouble of fair values: why not instead revert to cost? Or critics of fair value might find comfort in our evidence that the stock market prices of banks changed when fair value procedures were relaxed, even though there was no change in the banks' underlying economic position: fair value induces artificial valuation changes, it might be argued.

We take a more complex view. For example, we accept that, for many decisions, cost may be a more important measure of an asset than current market price—for example, if the asset is to be held to maturity, if the bank is sure to survive to its maturity, and if the market for that asset is currently frozen. Then, we agree that if fair values are relied upon for valuing bank assets, pro-cyclical tendencies may be reinforced as collateral recorded at fair value swells and shrinks over the cycle. We also recognize the problems caused under the present legal and regulatory regimes if one bank's distress sale of an asset at a huge discount requires a reduction in the carrying value of corresponding assets in another bank's balance sheet, which the second bank has no intention of liquidating before maturity.

But these concerns do not lead us to support a retreat to cost in place of fair value. On the contrary, our analysis reinforces the case for reporting market values, especially in circumstances of financial crisis.20 First, we have argued that it is precisely at times of crisis that cash flow insolvency comes to dominate balance sheet insolvency; and so the liquidation values of assets become crucial in decisions on whether a bank should continue to operate, and whether it is a reliable counter party. This is the case even if the bank would ordinarily choose to hold these assets until maturity: in the extraordinary circumstances of crisis it may not have that option! One might argue that cash flow insolvency only becomes binding because of uncertain valuations on the balance sheet, that is, because of the fear of balance sheet insolvency. But this would actually call for more transparency and increased use of more relevant market values. However, liquidation values alone are not appropriate in such circumstances: stakeholders and regulators reading the accounts also need to know the valuation of the asset relevant if the bank continues in business and holds the asset to maturity—that valuation will often be amortized cost.

Second, we have argued that neither the legal triggers for failure nor the regulators' rules for capital adequacy are aligned with the economic decision for equity-holders whether to continue or to close a business such as a bank. That decision requires a comparison of value in use of the business assets with their realizable value in the best alternative use.21 In the case we have been considering, the bank would compare holding the asset to maturity (where cost might be appropriate) or selling now, for whatever it would fetch on the market (M2M version of fair value). To conclude, much of the debate on whether to opt for fair value or cost is redundant: we need both valuations to be disclosed and to be incorporated in regulators' assessments.