Optimal Algebras and Novel Solutions of Time-Fractional (2 + 1) − D European Call Option Model

Abstract

In this article, we analyse the time-fractional (2 + 1) − D Black–Scholes model for European call options by employing Lie symmetry analysis. We derive the infinitesimal transformations and classify the optimal systems. Furthermore, under the geometric Brownian motion, we reduced the given model to ordinary differential equation (ODE) with integer order. We have obtained different ODEs for different correlation values. Then, we construct the power series solutions and established its convergence. Furthermore, the reduced ODE is simulated numerically and the solutions are illustrated graphically. Finally, we explicitly find the conserved vectors.

1. Introduction

In the present era, finance and financial economic encompassing balancing risk and return, investment in stocks, managing debt or optimizing corporate capitals, plays vital role. The nature of the financial markets is nonlinear phenomena as it involves volatility, correlation along with much more factors. This nonlinear phenomena can be well described and studied by mathematical models. Differential calculus dealing with derivatives is an efficient process to capture the rate of changes occurring in real life phenomena. For example, the Black–Scholes option pricing equation involving the derivative of option pricing is used for pricing European-style options [1].

This model helps in calculating the theoretical price of options by assuming that the underlying asset (e.g., a stock) has no dividends and that the market is frictionless with a constant risk-free interest rate. An empirical study was also conducted over the Black–Scholes model [2]. Several researchers have contributed to the development of the Black–Scholes model by studying using different techniques such as nonstandard finite difference method for American put option pricing in [3], dynamic calibration by Bayesian methods in [4], with help of orthogonal Gegenbauer polynomials in [5]. Even Lie symmetry has been utilised to Black–Scholes in different forms such as with time-dependent coefficients [6], bifractional under fractional G-Brownian motion [7] and (1 + 1) generalised Black–Scholes in [8].

On the other hand, it is not an easy task to construct an exact solution for a given fractional differential equation. Lie symmetry analysis is highly effective and simple approach to deal with such fractional PDEs [14–16]. This can be explored in different areas including biological [17], fluid dynamics [18, 19], and geophysical flows [20, 21]. Currently, the study is also advanced by including Nucci reduction, nonclassical solutions [22–25]. A symmetry of an FPDEs is a one-parameter Lie group of transformations that translates one solution to another while keeping the system invariant [26, 27]. Furthermore, the given FPDE may have infinite solutions and one must minimize the search for accurate solutions. Hence, the classification of optimal system of inequivalent subalgebra is needed [28, 29].

We organise this paper as follows: we perform symmetry analysis in Section 2 and we optimise the obtained subalgebras in Section 3. In Section 4, we construct an exact solution using power series, perform numerical simulation, and analyse multiple parameters with the help of graphs. We calculate the conserved vectors in Section 5. Finally, we conclude by a brief conclusion in Section 6.

2. Symmetry Analysis

Riemann–Liouville (R–L) fractional derivative.

3. Optimal Algebra

| ∗ | X1 | X2 | X3 | X4 |

|---|---|---|---|---|

| X1 | 0 | 0 | X1 | 0 |

| X2 | 0 | 0 | X2 | 0 |

| X3 | −X1 | −X2 | 0 | −X4 |

| X4 | 0 | 0 | X4 | 0 |

| Adj | X1 | X2 | X3 | X4 |

|---|---|---|---|---|

| X1 | X1 | X2 | X3 | X4 |

| X2 | X1 | X2 | X3 − εX2 | X4 |

| X3 | X3 | |||

| X4 | X1 | X2 | X3 − εX4 | X4 |

Using Table 1 and Table 2, we construct invariant function (ψ).

From the above system of equations, one can obtain the invariant function ψ = (f1, f2), which implies that the classified subalgebras will be isomorphic to the vector space spanned by X1 and X2. Furthermore, from adjoint action, we get ϰ3 = 0, which implies X3 itself is an one dimensional optimal algebra. Hence, we can span 2-dimensional algebra along with X3. Thus, we find 〈X1 ± X2, X3〉 as the optimal subalgebras.

4. Exact Solution

Under the geometric Brownian motion, α1 = α2 = α and σ1 = σ2 = σ, we consider the following three cases.

Case 1. For ρ = 1.

4.1. Convergence Analysis of (25)

First, we shall prove (26) is majorant of (22) and then (26) has positive finite radius of convergence.

Clearly, from the above equation, we see G(0, v0) = 0 and G′(0, v0) ≠ 0 proving that V(ξ) is convergent in a neighbourhood of the point (0, s0) using implicit function theorem.

Hence, we can conclude that (25) is convergent.

Case: 2. For ρ = −1.

Similarly, if we consider (26), we can prove the convergence of (30).

Case 3. For ρ = 0.

When ρ = 0, with the help of ansatz u = f(t), the governing equation gets simplified into with a trivial solution given as u = c1tμ−1.

4.2. Numerical Simulation

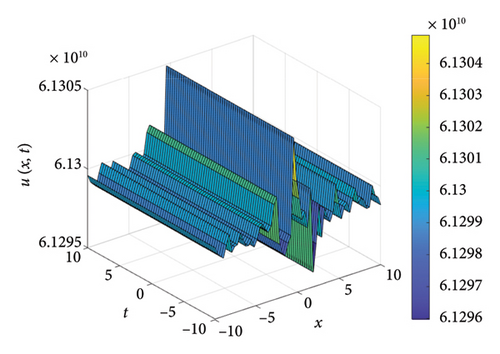

For the numerical simulation, we consider a situation when the stock price is translated to the initial state at the opening bell, that is, u(x, y, 0) = 0, with invariant condition U(ξ) = 0 in (21) and discuss the behaviour of option price using the finite collocation method.

5. Results and Discussion

- •

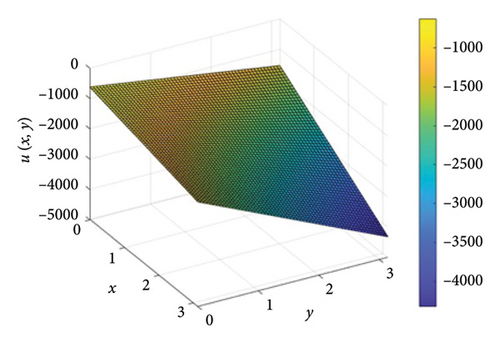

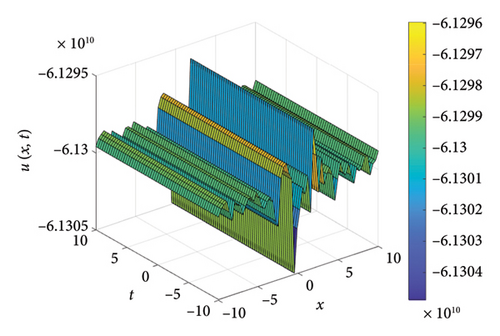

From Figure 1, it is observed that at a fixed time, for a basket of two positively correlated assets, the price of call options declines linearly. Furthermore, when the stock price is fixed for one asset and as time progresses, the option pricing oscillates giving the rogue waves and dark soliton type solution, which is presented in Figure 2.

- •

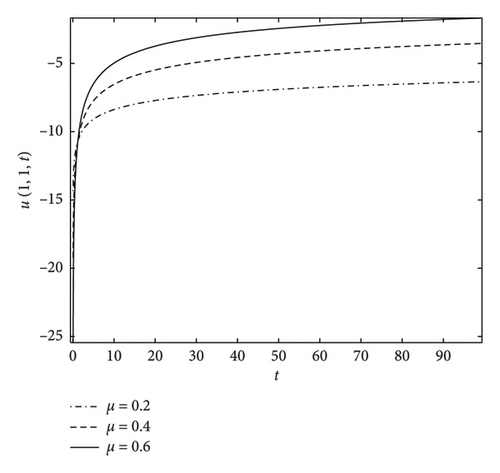

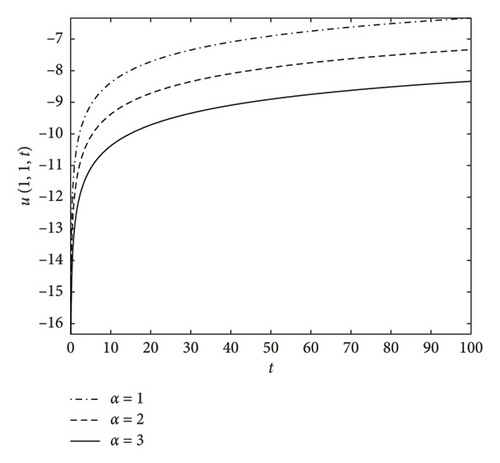

If the stock price of basket of assets is fixed for a long time, it is trivial that it does not affect the decision of buyers. Therefore, the option call pricing decays significantly. Furthermore, as the fractional order μ increases, the rate of call option pricing attains at-the-money state faster, which is noticed in Figure 3.

- •

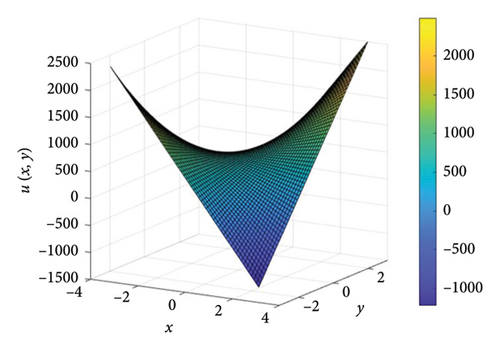

If the two assets are negatively correlated, for a given fixed time, then the price of call options are inversely proportional to each other and it is observed in Figure 4. Furthermore, it is noticed that when the stock price is fixed for one asset, then the option pricing gives rogue waves and bright soliton as time progresses, which is shown in Figure 5.

- •

In Figure 6, we fluctuate the expected rate of return (α) and observe its influence on option call pricing. We notice that, as the expected rate of return increases, investors tend to hold the stocks and as a result, the option call price gets lowered. This movement is very gradual.

- •

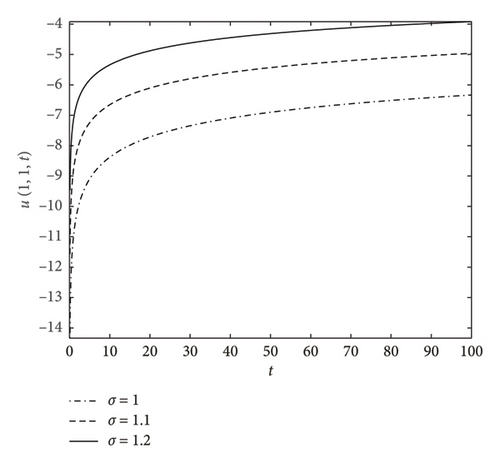

Furthermore, increase in volatility rate (σ) attracts more traders; as a result, the option call pricing increases. This movement is very sensitive, which is illustrated in Figure 7.

- •

Figure 8 clearly indicates that the option call pricing profile is decreasing in an extended run, showing that the option call pricing becomes stable. Furthermore, the critical point which diminishes the initial peak is crucial for selling, that is, exiting.

6. Conservation Laws

The conservation laws provide physical interpretation of the model and are due to [31].

For X1:

For X2:

For X3:

7. Conclusion

In this work, we have analysed a (2 + 1) -D time-fractional Black–Scholes equation through the lens of Lie symmetry. Using the Lie group, we have reduced our governing equation into an ODE with integer order and, successively, we have constructed some power series solutions. We established the convergence of power series solutions and also simulated the reduced ODE numerically. Furthermore, we have obtained the conserved vectors to delve into physical properties. From our study, we conclude that hedging is a smart stock market practice; if the expected rate of return is high, investors tend to hold it for long term, resulting in a stable price. Thus, the stock trading movement becomes slow and increase in fractional order μ, making the stock price attain “at the money” state quickly.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

The authors did not receive any specific funding for this work.

Open Research

Data Availability Statement

No new data were generated in this work.