A Study on the Financial Health of Listed Real Estate Companies via Multicriteria Decision-Making Methods

Abstract

Under the influence of the pandemic and economic slowdown, real estate companies are facing severe financial risk, which has become a focal point of widespread concern. This study constructs a financial health evaluation model for real estate development enterprises on the basis of the entropy-VIKOR algorithm. Using China as a case study, this research selects real estate companies listed on the Shanghai and Shenzhen Stock Exchanges before the end of 2016 as the sample for empirical analysis. Sensitivity and validity analyses were conducted using 2020 data to ensure the robustness of the financial health evaluation model. The study identifies accounts receivable turnover and the interest coverage ratio as key secondary indicators of financial health in real estate companies, whereas operational capacity and debt repayment ability are critical primary indicators. The model is insensitive to weight perturbations, suggesting that its evaluation results are valid and predictive. Additionally, the pandemic and changes in the macroeconomic environment have negatively impacted corporate financial conditions, but internal adjustments and optimization strategies have contributed to the recovery of financial health. Finally, we analyze the research findings and provide targeted recommendations, with the aim of enabling real estate enterprises to respond better to macroeconomic and policy changes, thereby enhancing their financial health and market competitiveness.

1. Introduction

Since the market-oriented reform of the self-occupied housing sector, China’s real estate industry has experienced a period of rapid development. Real estate has shifted from merely a residential attribute to an investment attribute. The increasing property prices and increased demand for commercial housing from residents have led to the continuous growth and expansion of the real estate sector. In recent years, the real estate sector has accounted for approximately 7% of China’s GDP. However, since 2020, the global COVID-19 pandemic has spread, leading to a slowdown in economic development. The Chinese real estate industry has been severely impacted, with a decline in investment and financing and difficulty in enhancing corporate value. Despite the series of stimulus policies introduced by the government, resolving these issues within the real estate sector in a short period of time has been challenging. This situation inevitably results in varying degrees of financial risk for real estate enterprises. With frequent news reports of financial crises involving leading real estate companies such as China Evergrande Group, Country Garden Holdings, and Sunac China Holdings, the issue of financial risk in real estate enterprises has become one of the major and pressing concerns for policymakers, scholars, and practitioners in China. The article begins by elucidating the relevant aspects of financial risk. It identifies and evaluates the financial risks faced by real estate enterprises through an examination of their current status. The article then proposes methods and measures for financial risk prevention and control, aiming to mitigate funding, investment, and operational risks. The ultimate goal is to increase management awareness and attention to financial risk prevention in real estate enterprises.

Financial risk refers to the potential for an enterprise’s financial condition and health to be affected by internal and external factors under specific economic conditions, leading to risks such as economic loss, debt default, profit decline, or insolvency [1–5]. As early as the 1930s, international scholars began to study corporate financial risk from multiple perspectives, effectively optimizing and refining financial risk evaluation models. In the context of univariate models, individual financial indicators such as the shareholders’ equity ratio, debt-to-asset ratio, and current ratio are employed to evaluate financial health [6]. These models offer simplicity, ease of understanding, and implementation. However, univariate models are criticized for their arbitrariness and narrow focus, as they fail to represent the broader scope of financial risk. Consequently, their accuracy in reflecting overall financial health is limited. In the realm of multivariable models, the focus is primarily on the comprehensive analysis of various financial indicators, such as operational capacity, solvency, profitability, and asset utilization efficiency. These models integrate multiple financial variables to construct a robust financial risk assessment framework, examples of which include the Z-score model and the F-score model [7–9]. Although multivariate financial risk assessment models have advantages over univariate models, particularly in terms of higher predictive accuracy, they impose stringent requirements on sample data, which limits their applicability. In terms of hybrid models, multiple analytical methods are integrated into financial risk evaluation models. For example, techniques such as logistic regression, neural networks, deep learning, the entropy weight method, and the analytic hierarchy process (AHP) have been introduced into financial risk assessment models. This approach aims to increase the accuracy and reliability of financial risk forecasting by combining the strengths of different methodologies [10–13]. The hybrid financial evaluation model, through the integrated application of multiple perspectives and methods, enhances the accuracy and reliability of assessment results, offering greater practical value and theoretical significance. It has now become a critical research direction in the field of financial risk management.

- 1.

The complexity of the indicator system may lead to model overfitting, thereby affecting the accuracy of predictions.

- 2.

Most evaluation studies focus primarily on measuring and rating corporate financial risk, often utilizing a single evaluation method such as the AHP, principal component analysis (PCA), or machine learning techniques. However, these studies tend to prioritize the application of mathematical techniques over the evaluation of the methods’ inherent validity or the reliability of their outcomes as reference points. Therefore, it is crucial to adopt a comprehensive evaluation method for assessing corporate financial risk.

Therefore, constructing an effective financial health evaluation model for real estate development enterprises on the basis of publicly available financial data from listed companies is highly meaningful. The research results can provide valuable decision support for the healthy and orderly development of future real estate development enterprises.

2. Research Methods and Evaluation Indicators

2.1. Research Methods

Multicriteria decision-making compromise methods, such as entropy-TOPSIS and VIKOR, are advantageous over traditional single methods because of their intuitive analysis and ease of computation [14]. It has been widely applied in areas such as urban industrial competitiveness, regional system development, enterprise evaluation, supplier selection, and project selection [15–18]. The entropy-VIKOR method, which integrates the entropy-weighting method with VIKOR, provides a more effective means of assessing the uncertainty of indicators. It leverages the original indicator data to calculate the proximity to an ideal sample without losing valuable information. On the basis of this calculation, the method produces an evaluation score for each sample, thereby improving the precision and objectivity of the assessment [19]. Therefore, this study employs the entropy-VIKOR method to determine the weight of each indicator within the evaluation system and to calculate the comprehensive scores of the respective enterprises.

The steps of the entropy-VIKOR algorithm [20] used in this study are as follows.

2.1.1. Dimensionless Processing

2.1.2. The Entropy-Weighting Method to Find Weights

2.1.3. VIKOR Method

The VIKOR method ranks the advantages and disadvantages of the options to be evaluated on the basis of a comparison of the group utility value, the regret value, and the combined utility value in the ranking process, and the preferred option obtained via this method is the closest to the ideal option [22]. The calculation process is as follows.

2.2. Selection of Evaluation Indicators

The scientific validity of financial risk assessment for real estate enterprises depends on whether it accurately reflects the true financial condition of these enterprises. The selection of financial evaluation indicators is crucial, as it determines the extent to which the assessment can objectively represent the real financial status of the company. Therefore, the selection of indicators should adhere to the following three principles: predictive capability, availability, and scientific validity. Guided by the aforementioned principles, this study draws extensively from both domestic and international research [23–26] and considers the characteristics and conditions specific to financial crises in real estate companies. These include the following: First, cash flow issues, where cash shortages lead to delays in payments to suppliers and employees; second, high debt ratios, with significant increases in liabilities due to extensive borrowing; third, project stagnation and delays, with construction halts and delivery delays caused by funding shortages; fourth, worsening balance sheets, characterized by poor asset liquidity and severe asset impairment during market downturns; fifth, financing difficulties, with rising financing costs and restricted financing channels due to declining credit ratings; sixth, declining market confidence, leading to falling stock prices and weakened buyer confidence; and finally, legal and regulatory risks, including debt defaults and increased regulatory pressures. A financial risk indicator system for real estate enterprises is constructed from five aspects: profitability, operational capability, growth capability, solvency, and cash flow capability, as shown in Table 1. The indicators are classified into positive and moderate types. Most indicators are positive, meaning that as their values increase, they better reflect the financial health of the enterprise. Some indicators related to debt repayment capacity are moderate indicators, which should be maintained within an appropriate range. For example, a higher debt-to-equity ratio indicates greater debt levels and an increased risk of financial distress, whereas a lower ratio may suggest poor investment and financing capabilities, which could restrict growth. Therefore, this ratio should be maintained within a moderate range.

| Objective layer | Primary indicator | Secondary indicators | Indicator interpretation |

|---|---|---|---|

| Financial risk indicator system for real estate enterprises | Profitability | Return on assets | (Total profit + financial expenses)/total assets |

| Net profit margin on total assets | Net profit/total asset balance | ||

| Return on equity | Net profit/average balance of owner’s equity | ||

| Net profit margin | Net profit/operating revenue | ||

| Operational capability | Total asset turnover ratio | Operating revenue/total assets at the end of the period | |

| Inventory turnover ratio | Cost of goods sold/ending inventory balance | ||

| Accounts receivable turnover ratio | Operating revenue/ending balance of accounts receivable | ||

| Current asset turnover ratio | Main business revenue/closing balance of current assets | ||

| Growth capability | Total asset growth rate | (Ending total assets-beginning total assets)/beginning total assets | |

| Net profit growth rate | (Net profit of the current year-net profit of the previous year)/net profit of the previous year | ||

| Revenue growth rate | (Current period operating revenue-previous period operating revenue)/previous period operating revenue | ||

| Solvency | Current ratio | Current assets/current liabilities | |

| Quick ratio | (Current assets-Inventory)/current liabilities | ||

| Cash ratio | Cash and cash equivalents/current liabilities | ||

| Debt-to-assets ratio | Total liabilities/total assets | ||

| Interest coverage ratio | (Net profit + income tax expense + financial expenses)/financial expenses | ||

| Cash capability | Cash content of operating revenue | Net cash flow from operating activities/operating revenue | |

| Total asset cash recovery ratio | Net cash flow from operating activities/total assets at the end of the period |

3. Analysis of Empirical Research

3.1. Sample Selection and Data Sources

The classification of listed real estate companies in this study is based on the industry categories established by the China Securities Regulatory Commission (CSRC). To ensure the continuity, comparability, and accuracy of the data, 42 real estate companies listed on the Shanghai and Shenzhen Stock Exchanges, whose data for the past four years, up to the end of 2020, were complete, were selected. The sample companies are shown in Table 2. The data for the indicators are sourced from the annual reports of the sample enterprises and obtained through the WIND database, and the data are detailed in the Supporting table A.

| Serial number | Company abbreviation |

|---|---|

| 1 | Shenzhen Zhenye (Group) |

| 2 | Rongan Property |

| 3 | China Vanke |

| 4 | Seazen Holdings |

| 5 | Cosmos Group |

| 6 | Nanjing Gaoke Company |

| 7 | Gemdale Corporation |

| 8 | Shanghai Shimao |

| 9 | Poly Developments and Holdings Group |

| 10 | Financial Street Holdings |

| 11 | Dongguan Winnerway Industry Zone |

| 12 | Bright Real Estate Group |

| 13 | Hubei Fuxing Science and Technology |

| 14 | Zhuhai Huafa Properties |

| 15 | Shanghai Jinqiao Export Processing Zone Development |

| 16 | Suning Universal |

| 17 | Everbright Jiabao |

| 18 | Metro Land Corporation |

| 19 | Hangzhou Binjiang Real Estate Group |

| 20 | Shanghai New Huang Pu industrial Group |

| 21 | Shenzhen New Nanshan Holding (Group) |

| 22 | Quzhou Xin’An Development |

| 23 | Greenland Holdings Corporation |

| 24 | China Enterprise Company |

| 25 | Dima Holdings |

| 26 | Guangzhou Pearl River Development Group |

| 27 | Cinda Real Estate |

| 28 | Vantone Neo Development Group |

| 29 | Aoyuan Beauty Valley Technology |

| 30 | Shenzhen Heungkong Holding |

| 31 | Myhome Real Estate Development Group |

| 32 | Chongqing Yukaifa |

| 33 | Citychamp Dartong |

| 34 | Suzhou New District Hi-Tech Industrial |

| 35 | Shahe Industrial |

| 36 | Grandjoy Holdings group |

| 37 | Sichuan Languang Development |

| 38 | Yango Group |

| 39 | Jinke Property Group |

| 40 | Yunnan Metropolitan Real Estate Development |

| 41 | Tibet Urban Development and Investment |

| 42 | Beijing North Star Company |

3.2. Corporate Financial Health Assessment

In accordance with the introduction of the entropy-VIKOR method in Section 2.1, the data are first normalized via equations (1) to (3). Next, the information entropy for each indicator is calculated via equation (4) (as shown in the fifth column of Table 3), and the coefficient of variation is subsequently determined (as shown in the sixth column of Table 3). Third, the weights of the secondary indicators are derived via equation (5) (as presented in the seventh column of Table 3). Finally, the weights of the primary indicators are calculated, with the weight of each primary indicator being equal to the sum of the weights of its corresponding secondary indicators. For example, the weight of the primary indicator “profitability” is calculated as 0.0158 + 0.0153 + 0.0016 + 0.0053 = 0.038. The calculated weights of all the indicators are shown in Table 3.

| Objective layer | Primary indicator | Weights | Secondary indicators | Information entropy | gj | Weights |

|---|---|---|---|---|---|---|

| Financial risk indicator system for real estate enterprises | Profitability | 0.038 | Return on assets | 0.9972 | 0.0028 | 0.0158 |

| Net profit margin on total assets | 0.9834 | 0.0166 | 0.0153 | |||

| Return on equity | 0.9718 | 0.0282 | 0.0016 | |||

| Net profit margin | 0.9575 | 0.0425 | 0.0053 | |||

| Operational capability | 0.4641 | Total asset turnover ratio | 0.9962 | 0.0038 | 0.0315 | |

| Inventory turnover ratio | 0.9761 | 0.0239 | 0.0338 | |||

| Accounts receivable turnover ratio | 0.9773 | 0.0227 | 0.3655 | |||

| Current asset turnover ratio | 0.9757 | 0.0243 | 0.0333 | |||

| Growth capability | 0.0664 | Total asset growth rate | 0.7373 | 0.2627 | 0.0392 | |

| Net profit growth rate | 0.9962 | 0.0038 | 0.0040 | |||

| Revenue growth rate | 0.9988 | 0.0012 | 0.0232 | |||

| Solvency | 0.4093 | Current ratio | 0.9890 | 0.0110 | 0.0135 | |

| Quick ratio | 0.7887 | 0.2113 | 0.0092 | |||

| Cash ratio | 0.9887 | 0.0113 | 0.0592 | |||

| Debt-to-assets ratio | 0.9878 | 0.0122 | 0.0333 | |||

| Interest coverage ratio | 0.9760 | 0.0240 | 0.2941 | |||

| Cash capability | 0.0222 | Cash content of operating revenue | 0.9903 | 0.0097 | 0.0052 | |

| Total asset cash recovery ratio | 0.9934 | 0.0066 | 0.0170 |

Table 3 shows that the weight of the secondary indicator, the receivable turnover ratio, is the highest at 0.3655. This finding indicates that the accounts receivable turnover ratio is a crucial metric for evaluating the financial health of real estate development enterprises. In general, the higher the accounts receivable turnover ratio is, the better. A high turnover rate indicates a fast accounts receivable collection speed, a shorter average collection period, minimal bad debt losses, rapid asset liquidity, and strong short-term solvency [27]. Moreover, a higher turnover rate also reflects the implementation of a stringent credit policy by the company, which contributes to maintaining a strong credit rating, enhancing financing capacity, and improving the company’s profitability. The secondary indicator “interest coverage ratio” has a weight of 0.2941, ranking second in importance, which indicates that this metric is also crucial to financial health. A higher interest coverage ratio indicates a stronger ability of a company to meet its interest obligations, reflecting its solid long-term solvency [28]. In the capital-intensive real estate industry, the interest coverage ratio reflects not only a company’s profitability but also its commitment to repaying creditors on time and in full. The higher the interest coverage ratio is, the stronger the company’s ability to meet its debt obligations, thereby increasing its likelihood of securing financing.

The weight of the operational capability indicator among the primary indicators is the highest at 0.4641, indicating that operational capability has the greatest impact on the financial health of real estate development enterprises. It affects the turnover rate of capital, cash flow management, and the progress and returns of projects, ensuring that the enterprise maintains a stable source of revenue and enhances its financial health. High operational efficiency can improve asset turnover, reduce financial costs, and increase profitability, thereby strengthening financial health and credit ratings [29]. The second most significant factor is debt repayment ability, with a weight of 0.4093, ranking second in importance. Debt repayment ability refers to a company’s capacity to meet its debt obligations when they become due. A stronger ability to repay debt can enhance a company’s credit rating and reduce financing costs. Adequate debt servicing capacity ensures that a firm has sufficient funds to navigate crises during macroeconomic fluctuations or changes in market demand [30]. These findings indicate that operational and debt-servicing capacities are crucial indicators for evaluating the financial health of real estate development enterprises, which is consistent with the conclusions drawn in reference [31]. This alignment suggests that the evaluation model developed in this study is relatively credible.

The positive and negative ideal solutions for each indicator are determined, the VIKOR composite indicator Q is calculated, the advantages and disadvantages are ranked, and the rankings of the Q values for each year are shown in Table 4. As shown in Table 4, in the financial health evaluation of 2017–2020, the four enterprises of Zhuhai Huafa Properties, Shahe Industrial, Gemdale Corporation, and Shenzhen Zhenye (Group) are ranked in the top 10, indicating that these four enterprises are in better financial condition, whereas the three enterprises of Hubei Fuxing Science and Technology, Yunnan Metropolitan Real Estate Development, and Tibet Urban Development and Investment are ranked in the bottom 10, indicating that these three enterprises are in poorer financial condition.

| Company | Year | ||||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | ||

| Rankings | Q | Rankings | |||

| Shenzhen Zhenye (Group) | 10 | 6 | 4 | 0.5860 | 6 |

| Rongan Property | 14 | 21 | 7 | 0.5692 | 5 |

| China Vanke | 19 | 11 | 18 | 0.6529 | 8 |

| Seazen Holdings | 4 | 4 | 22 | 0.5379 | 4 |

| Cosmos Group | 11 | 15 | 12 | 0.6624 | 9 |

| Nanjing Gaoke Company | 39 | 40 | 17 | 0.8466 | 29 |

| Gemdale Corporation | 5 | 3 | 9 | 0.5343 | 3 |

| Shanghai Shimao | 6 | 30 | 3 | 0.7209 | 14 |

| Poly Developments and Holdings Group | 23 | 16 | 5 | 0.6897 | 10 |

| Financial Street Holdings | 36 | 24 | 34 | 0.9237 | 39 |

| Dongguan Winnerway Industry Zone | 29 | 9 | 15 | 0.8299 | 24 |

| Bright Real Estate Group | 25 | 36 | 37 | 0.9045 | 38 |

| Hubei Fuxing Science and Technology | 33 | 39 | 36 | 0.9274 | 40 |

| Zhuhai Huafa Properties | 1 | 1 | 2 | 0.0000 | 1 |

| Shanghai Jinqiao Export Processing Zone Development | 40 | 31 | 6 | 0.8026 | 20 |

| Suning Universal | 8 | 38 | 11 | 0.7865 | 19 |

| Everbright Jiabao | 9 | 13 | 28 | 0.8903 | 37 |

| Metro Land Corporation | 28 | 28 | 40 | 0.8155 | 22 |

| Hangzhou Binjiang Real Estate Group | 13 | 17 | 23 | 0.8138 | 21 |

| Shanghai New Huang Pu Industrial Group | 3 | 14 | 41 | 0.8191 | 23 |

| Shenzhen New Nanshan Holding (Group) | 12 | 25 | 31 | 0.8605 | 32 |

| Quzhou Xin’An Development | 16 | 34 | 39 | 0.6207 | 7 |

| Greenland Holdings Corporation | 31 | 37 | 21 | 0.8575 | 31 |

| China Enterprise Company | 18 | 5 | 8 | 0.7136 | 13 |

| Dima Holdings | 30 | 22 | 10 | 0.7661 | 17 |

| Guangzhou Pearl River Development Group | 2 | 7 | 27 | 0.8345 | 26 |

| Cinda Real Estate | 34 | 20 | 32 | 0.8357 | 27 |

| Vantone Neo Development Group | 17 | 12 | 25 | 0.8299 | 24 |

| Aoyuan Beauty Valley Technology | 15 | 33 | 33 | 0.9277 | 41 |

| Shenzhen Heungkong Holding | 21 | 29 | 30 | 0.7779 | 18 |

| Myhome Real Estate Development Group | 22 | 35 | 38 | 0.8437 | 28 |

| Chongqing Yukaifa | 20 | 23 | 14 | 0.8526 | 30 |

| Citychamp Dartong | 24 | 18 | 26 | 0.8609 | 33 |

| Suzhou New District Hi-Tech Industrial | 26 | 32 | 29 | 0.8813 | 36 |

| Shahe Industrial | 7 | 2 | 1 | 0.5199 | 2 |

| Grandjoy Holdings Group | 38 | 26 | 20 | 0.7348 | 15 |

| Sichuan Languang Development | 32 | 27 | 16 | 0.8660 | 34 |

| Yango Group | 37 | 19 | 19 | 0.7383 | 16 |

| Jinke Property Group | 35 | 8 | 13 | 0.7030 | 12 |

| Yunnan Metropolitan Real Estate Development | 41 | 42 | 42 | 0.9826 | 42 |

| Tibet Urban Development and Investment | 42 | 41 | 36 | 0.8708 | 35 |

| Beijing North Star Company | 27 | 10 | 24 | 0.6912 | 11 |

To compare the reliability of the models, this study also applies factor analysis to assess the financial health of enterprises in 2020. The evaluation results are presented in Table 5.

| Company | Score | Rankings |

|---|---|---|

| Shenzhen Zhenye (Group) | −2.8866 | 35 |

| Rongan Property | 9.3113 | 10 |

| China Vanke | 5.3452 | 23 |

| Seazen Holdings | 7.2455 | 15 |

| Cosmos Group | 6.1517 | 18 |

| Nanjing Gaoke Company | 1.4486 | 31 |

| Gemdale Corporation | 5.8172 | 21 |

| Shanghai Shimao | 7.7564 | 13 |

| Poly Developments and Holdings Group | 5.9738 | 20 |

| Financial Street Holdings | 4.8666 | 24 |

| Dongguan Winnerway Industry Zone | −9.6723 | 38 |

| Bright Real Estate Group | 3.1308 | 28 |

| Hubei Fuxing Science and Technology | 5.7798 | 22 |

| Zhuhai Huafa Properties | −0.8421 | 34 |

| Shanghai Jinqiao Export Processing Zone Development | 15.6962 | 4 |

| Suning Universal | 3.5137 | 26 |

| Everbright Jiabao | 6.0076 | 19 |

| Metro Land Corporation | 50.0454 | 1 |

| Hangzhou Binjiang Real Estate Group | 8.5854 | 12 |

| Shanghai New Huang Pu Industrial Group | 22.5422 | 2 |

| Shenzhen New Nanshan Holding(Group) | 20.7157 | 3 |

| Quzhou Xin’An Development | 2.1054 | 29 |

| Greenland Holdings Corporation | 9.3990 | 9 |

| China Enterprise Company | 0.9751 | 32 |

| Dima Holdings | 9.7938 | 8 |

| Guangzhou Pearl River Development Group | −14.7279 | 39 |

| Cinda Real Estate | 7.5759 | 14 |

| Vantone Neo Development Group | 7.0691 | 16 |

| Aoyuan Beauty Valley Technology | −56.0834 | 42 |

| Shenzhen Heungkong Holding | 1.7596 | 30 |

| Myhome Real Estate Development Group | 4.7116 | 25 |

| Chongqing Yukaifa | −22.0145 | 40 |

| Citychamp Dartong | 3.4435 | 27 |

| Suzhou New District Hi-Tech Industrial | 8.7308 | 11 |

| Shahe Industrial | −8.3696 | 37 |

| Grandjoy Holdings Group | −0.4311 | 33 |

| Sichuan Languang Development | 6.8824 | 17 |

| Yango Group | 13.2119 | 6 |

| Jinke Property Group | 13.8800 | 5 |

| Yunnan Metropolitan Real Estate Development | −22.3142 | 41 |

| Tibet Urban Development and Investment | 11.4009 | 7 |

| Beijing North Star Company | −6.2282 | 36 |

3.3. Sensitivity Analysis

When we objectively assign weights to the evaluation criteria, variations in these weights may significantly affect the results of the model’s evaluation. Through sensitivity analysis, it is possible to identify how potential variations in the weights of evaluation criteria can lead to deviations in the assessment results. This is crucial for the effective utilization of models and the implementation of quantitative decision-making [32]. This paper, which uses the year 2020 as an example, employs perturbation methods to conduct a sensitivity analysis of the evaluation criteria weights. Specifically, the analysis examines how the financial evaluation results vary in response to minor perturbations in the weights of the model’s evaluation criteria.

For the evaluation criterion weights wj, when different parameters η are perturbed, the corresponding evaluation results are obtained.

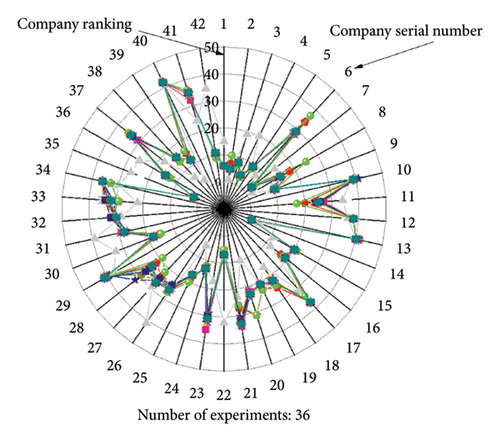

The perturbation method was applied to the 18 evaluation indicators used in this study, with the parameter η set to 1/2 and 1/3 in sequence, resulting in a total of 36 experiments. The financial evaluation results for the year 2020 are shown in Figure 1. As shown in Figure 1, the top-ranked enterprise secured the first position in 34 out of 36 experiments (94.44%). The second-ranked enterprise consistently ranked second in 34 out of 36 experiments (94.44%). The lowest-ranked enterprise maintained the last position in all 36 experiments (100%). Additionally, enterprises consistently ranked within the top 5 in 34 out of 36 experiments (94.44%), whereas those consistently ranked within the bottom 5 appeared 35 times (97.22%). In summary, the ranking consistency rate exceeds 90%, indicating that the evaluation model in this study is not sensitive to weight perturbations.

3.4. Effectiveness Analysis

The validation of model effectiveness refers to the process of using specific statistical or analytical methods to verify whether a model can accurately reflect real-world conditions and predict outcomes. One commonly used method is consistency testing, which involves evaluating the same object via different assessment methods or models and comparing the consistency of the results. If the evaluation outcomes are similar across different methods, the results are considered reliable. William Beaver [34], in summarizing previous research, indicated that univariate models can effectively analyze financial risk predictions. On the basis of his calculations and observations of corporate financial conditions, he found that the best predictive indicator is the debt protection ratio, followed by the debt-to-asset ratio. Moreover, the closer the indicator is to the occurrence of a financial crisis, the more accurate the prediction becomes. Therefore, this study selects the debt coverage ratio and the debt-to-asset ratio for efficacy testing. Table 6 shows that the debt coverage ratio and debt-to-asset ratio of the top 30% of enterprises according to the entropy-VIKOR method are superior to those in the bottom 30%. This indicates that the model’s evaluation results are reliable. The results obtained via factor analysis indicate that the debt coverage ratios in the top 30% outperform those in the bottom 30%, whereas the asset–liability ratios in the top 30% are not superior to those in the bottom 30%. This finding indirectly suggests that the evaluation results of the entropy-VIKOR method are superior to those derived from factor analysis, further demonstrating the reliability of the evaluation model proposed in this study.

| Debt coverage ratio | Debt-to-asset ratio | Debt coverage ratio | Debt-to-asset ratio | |||

|---|---|---|---|---|---|---|

| Entropy-VIKOR | Top 30% | 0.0197 | 74.12 | Bottom 30% | 0.0048 | 75.67 |

| Factor analysis | Top 30% | 0.0510 | 77.96 | Bottom 30% | 0.0081 | 69.4 |

4. Discussion

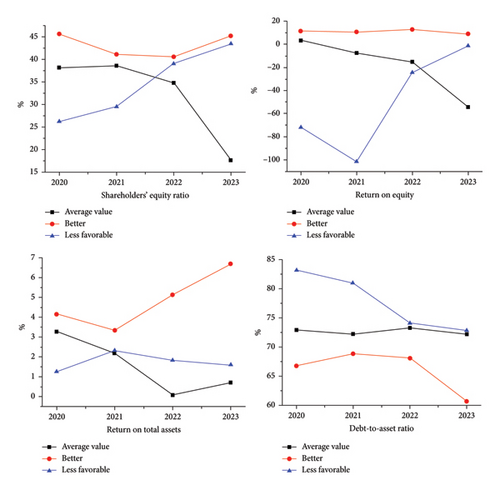

Since 2020, the global COVID-19 pandemic has led to a slowdown in economic growth, significantly impacting the real estate sector in China. Investment and financing activities have diminished, making it challenging for companies to increase their value, thereby exposing real estate enterprises to varying degrees of financial risk. This study uses financial health evaluation results from 2020 to analyze financial health status and corresponding measures for the period from 2021 to 2023. Referencing the literature [6, 34, 35], a comparative analysis is conducted using indicators such as return on equity (ROE), the shareholders’ equity ratio, the return on total assets (ROA), and the debt-to-asset ratio. As shown in Table 4, in the financial health evaluations from 2017 to 2020, four companies—Zhuhai Huafa Properties, Shahe Industrial, Gemdale Corporation, and Shenzhen Zhenye (Group)—consistently ranked within the top 10 and are thus classified as having relatively good financial health. In contrast, Hubei Fuxing Science and Technology, Yunnan Metropolitan Real Estate Development, and Tibet Urban Development and Investment consistently ranked within the bottom 10 and are defined as having relatively poor financial health. The financial indicators of enterprises with good financial conditions, those with poor financial conditions, and the average of all enterprises are compared, as shown in Figure 2.

Overall, the mean values of financially healthier enterprises are consistently greater than those of financially weaker enterprises, and they also surpass the average of all enterprises. This finding indicates that companies maintaining strong financial health are likely to continue doing so in the coming years. The mean of financially weaker enterprises does not significantly deviate from the mean of all enterprises, which is reasonable. Enterprises with poorer financial health often implement corrective measures for improvement. The above findings demonstrate that the evaluation results of the model used in this study are reliable and have predictive value for the coming years.

From the perspective of various indicators, the overall ROE and shareholder equity ratio of the sample enterprises have been declining, whereas the debt-to-asset ratio has remained relatively stable. The ROA initially decreased but then increased, indicating that the real estate sector has been adversely affected by the pandemic and macroeconomic policy environment. The shareholders’ equity ratio and ROA of financially sound enterprises initially decreased and then increased, whereas the ROE remained stable. The debt-to-asset ratio initially increased but then decreased. This trend is attributed primarily to the impact of the pandemic in 2021 and 2022, which caused a decline, followed by a recovery in 2023 with the end of the pandemic. Enterprises with deteriorating financial conditions exhibit a progressively increasing equity ratio, which surpassed the mean of all enterprises in 2022. The ROE initially declined but subsequently increased, surpassing the mean of all enterprises in 2023. The return on assets initially increased but then decreased, eventually exceeding the mean of all enterprises. The debt-to-assets ratio exhibited a gradual decline and increasingly converged with the mean of all enterprises. This indicates that measures taken to address financial health risks in these enterprises have been effective and have yielded significant results.

- 1.

Changes in the market environment: In 2021, the real estate market faced significant pressure due to the impact of the COVID-19 pandemic and increased uncertainty in the macroeconomic environment. Additionally, the implementation of stricter real estate regulation policies, such as the “three red lines” policy, led to financing difficulties for real estate enterprises, decreased sales, and deteriorating balance sheets, which in turn affected shareholder equity ratios. In 2022 and 2023, as pandemic control measures gradually relaxed and the economy began to recover, market confidence improved, and real estate market demand experienced some recovery. The government introduced several moderately supportive policies, such as lowering loan interest rates and relaxing purchase and loan restrictions, to help enterprises improve their cash flow and gradually restore their financial health.

- 2.

Adjustments and optimizations by the enterprise itself: In response to the challenges faced in 2021, real estate enterprises undertook internal adjustments and optimizations, including accelerating inventory reduction, lowering leverage, and adjusting business structures. Although these measures may have led to a decline in financial health in the short term, they are expected to enhance enterprises’ financial health and sustainability in the medium- to long-term. By 2022 and 2023, adjusted enterprises gradually regained stability, with improvements in asset quality and reductions in debt levels, leading to a recovery in financial health.

- 3.

Policy support and improvements in market expectations: In 2022 and 2023, the government implemented several measures aimed at stabilizing the economy and promoting growth, leading to an improvement in market expectations for the real estate sector. In particular, state-controlled enterprises are often perceived as key vehicles for policy implementation and thus receive relatively more policy support, such as credit support and debt restructuring. This has contributed to the gradual recovery of the financial health of state-controlled enterprises between 2022 and 2023.

5. Conclusions and Recommendations

- 1.

The accounts receivable turnover ratio (weight 0.3655) and the interest coverage ratio (weight 0.2941) are key secondary indicators for assessing the financial health of real estate development enterprises, reflecting the importance of liquidity, cash flow management, and debt servicing ability. Among the primary indicators, operational efficiency (weight 0.4641) and debt-paying ability (weight 0.4093) have a significant effect on the financial health of enterprises, highlighting the need to maintain financial stability and market competitiveness in an industry characterized by high capital expenditures and long development cycles.

- 2.

The financial health evaluation model for real estate development enterprises based on the entropy-VIKOR algorithm is not sensitive to weight perturbation, and the evaluation results are valid, reliable, and superior to those obtained via the factor analysis method.

- 3.

In the financial health evaluations from 2017 to 2020, Huafa Industrial, Shahe Shares, Gemdale Group, and Shenzhen Investment Ltd. consistently ranked among the top 10, whereas Fuxing Shares, Yunnan Metropolitan Real Estate, and Tibet Urban Investment consistently ranked among the bottom 10.

- 4.

From 2020 to 2023, enterprises with better financial conditions outperformed those with poorer financial conditions, as well as the overall average, across all financial indicators. These findings suggest that these enterprises are likely to maintain stable financial health in the coming years, demonstrating the reliability and predictive capacity of the model used for evaluation.

- 5.

Pandemic and changes in the macroeconomic environment have had a significant effect on the financial condition of real estate enterprises. In 2021, under the dual influence of the pandemic and regulatory policies, the ROE and equity ratio declined across the sector, whereas the ROA exhibited a “decline followed by recovery” trend. Enterprises with relatively sound financial conditions experience a gradual restoration of financial health through internal adjustments and policy support, exhibiting a trend of initial decline followed by subsequent recovery. Enterprises with initially poor financial conditions gradually improve and approach the industry average. Simultaneously, an analysis from the perspective of ownership structure reveals that state-controlled enterprises experience notable recovery in their financial conditions under risk management and policy support.

This study has several limitations. Although the entropy-VIKOR model can integrate multiple indicators to assess financial health, its static-weighting mechanism struggles to capture the dynamic characteristics of financial markets, potentially leading to biases under structural changes or unexpected events (e.g., political instability and economic shocks). Additionally, the VIKOR method’s reliance on the ideal solution limits its ability to handle uncertainty and fuzziness. Future research could incorporate dynamic weight adjustment methods (e.g., time-varying entropy weight) and fuzzy decision-making approaches to enhance model adaptability. Moreover, expanding the research scope to a global scale and focusing on the impact of digitalization, smart city development, and sustainability on the financial stability of real estate enterprises would provide deeper insights. By analyzing regional differences in adaptability, this study can reveal the mechanisms through which technological innovation and sustainability enhance market transparency, operational efficiency, and asset value, thereby providing more universal decision-making support for financial risk management in the global real estate sector. Despite these limitations, the research findings contribute to enhancing the financial risk management capabilities of enterprises, providing decision-making support for the orderly development of financial health in real estate companies.

On the basis of the analysis presented, the following strategic recommendations are proposed from both macroeconomic and microeconomic perspectives:

Macroeconomic perspective: (1) Focus on policy orientation and establish robust strategic development goals. It is essential to stay informed about the latest policies introduced by both national and local governments and to conduct objective assessments in advance regarding the impact these policies may have on the financial performance and cash flow of real estate projects. (2) Departing from traditional industry pathways and seeking new growth opportunities within the real estate sector can involve exploring emerging avenues such as urban renewal projects, smart city initiatives, industrial–urban integration, a dual emphasis on renting and purchasing, and property management services. These areas present fresh development potential for the industry.

Microeconomic perspective: (1) Reasonably control the financial risk of investment projects, enhance profitability, optimize development costs, strictly control operating expenses, improve product quality, expand project promotion efforts, increase project returns, and accelerate sales and cash recovery. (2) Focus on the development and improvement of corporate operations and governance to avoid reckless investments, maintain a prudent investment strategy, ensure financial stability, optimize the proportion of long-term to short-term borrowings, sustain an appropriate interest coverage ratio, and enhance debt repayment capacity. (3) To approach enterprises from a long-term strategic perspective, it is crucial to define their development goals clearly and enhance their profitability and operational efficiency. Moreover, it is necessary to balance current growth demands with future growth potential to achieve sustainable return distribution. On the basis of this foundation, enterprises should enhance comprehensive financial risk management, particularly by improving sales performance, strengthening accounts receivable management, and increasing asset turnover efficiency, to ensure the sustained growth and stability of cash flow. These measures not only contribute to enhancing the financial health of the enterprise but also bolster its ability to navigate market fluctuations. (4) Emphasize internal adjustment and optimization strategies while enhancing risk management capabilities. Enterprises should adjust their business strategies and financial management measures in a timely manner according to changes in the external environment. They should enhance their financial management systems, optimize their asset–liability structure, and improve the financial stability of the organization. State-controlled enterprises exhibit strong risk management capabilities, and other companies can learn from their risk mitigation strategies under policy support. (5) Developing an effective financial health evaluation model. Enterprises can use the financial health evaluation model of the entropy-VIKOR algorithm proposed in this study to analyze the existing financial situation, make predictions on the future financial situation, and adjust the investment, financing, and operation plans in a timely and scientific manner to reduce financial risk.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Conceptualization, Wenbao Wang; methodology, Wenbao Wang and Wenhe Lin; software, Enhao Chen; project administration, Wenhe Lin and Zhizhuan Zheng; data curation, Enhao Chen and Zhizhuan Zheng; writing – original draft preparation, Wenbao Wang; writing – review and editing, Wenhe Lin; and funding acquisition, Wenbao Wang. All authors have read and agreed to the published version of the manuscript. No further changes to authorship after this point.

Funding

This project was supported by the Research Initiation Fund (RIF) project (Grant No.: FZYKJRCQD202402).

Acknowledgments

This project was supported by the Research Initiation Fund (RIF) project (Grant No.: FZYKJRCQD202402).

Supporting Information

Supporting table A: The raw data required for the paper.

Table A1: Original data of indicators in 2017.

Table A2: Original data of indicators in 2018.

Table A3: Original data of indicators in 2019.

Table A4: Original data of indicators in 2020.

Table A5: Original data of indicators in 2020–2023.

Open Research

Data Availability Statement

Data can be made available upon request.