Venture Capital and Social Responsibility Behavior: An Evolutionary Game-Based Approach

Abstract

This study introduces a novel evolutionary game-based model to explore the dynamic interplay between venture capital (VC) institutions and their invested firms in adopting corporate social responsibility (CSR) practices, with a focus on the moderating role of government supervision. With CSR gaining prominence in VC-backed firm ecosystems, understanding these dynamics is critical. Verified through numerical simulations, the model examines system evolution under scenarios with and without government supervision. Key findings include the following: (1) VC-backed firms are more likely to adopt CSR practices when VCs prioritize long-term investment strategies, whereas short-term strategies centered on shareholder value hinder CSR efforts; (2) factors such as VC equity share, CSR costs, and benefits significantly influence CSR adoption; and (3) government incentives can promote CSR and accelerate convergence toward ideal outcomes, though with limited impact. This research advances the understanding of the VC-CSR relationship, offering theoretical insights and practical recommendations to foster responsible investment and business practices.

1. Introduction

With the increasing awareness of sustainable development, an expanding number of investors and entrepreneurs have realized the growing relevance of an active role in the assumption of social responsibility practices (SRPs) to achieve their goals for firms’ sustainable economic development [1–4]. Furthermore, as several countries are switching from speed-focused to quality-focused development model conception, higher requirements on social responsibility have been put on enterprises [5–7]; however, with China as an example, judging from SRP reports disclosed by Chinese A-share listed companies, until May 2021, only 30% of them carry out SRPs [8], demonstrating that further efforts are needed to fill the gap on firms involved on SRP, especially in developing countries.

After providing financial support to a firm, venture capital (VC) entities obtain capital appreciation by selling equity after the stage of accelerated growth. Unlike other financing methods, it often plays an active role in firm decisions at the operational and decision levels [9, 10]; consequently, it has a certain impact on firm SRP [11, 12].

Additionally, government policies and regulations also play a critical role in corporate SRP [13–15]. According to Douglass North’s institutional theory [16], institutional environments—including laws, regulations, and social norms—fundamentally shape economic performance and organizational behavior. For instance, in regions such as the European Union, stringent CSR regulations, such as the Nonfinancial Reporting Directive, mandate that companies disclose their environmental and social impacts. Under such regulatory frameworks, VCs are incentivized to actively oversee CSR practices in their portfolio companies to ensure compliance and mitigate potential risks. These regulatory constraints compel VC entities to integrate CSR considerations into their investment strategies, reinforcing their due diligence and engagement in CSR management. In China, by contrast, the government employs incentive mechanisms, such as tax reductions, financial rewards, and funding programs, to encourage CSR initiatives in areas such as environmental sustainability, poverty alleviation, and education. These incentives further motivate VCs to promote CSR practices within their portfolio firms. Therefore, in institutional environments characterized by either regulatory stringency or proactive incentives, VCs are not solely driven by financial returns but are also compelled to guide and monitor CSR implementation, thereby strengthening the link between VC involvement and CSR outcomes.

VC investors influence behavioral decisions on SRP for VC-supported start-ups [12], the government [13], its executives, and other influential groups as well [17]. However, since it is difficult for them to make completely rational decisions on whether to actively undertake SRP, traditional game modeling could not reflect group characteristics on corporate social responsibility (CSR) behavior decisions; nevertheless, as evolutionary game modeling assumes bounded rationality [18], it can systematically approach to the evolutionary laws and stable strategies behind the reality of social responsibility decisions of VC and VC-backed firms [19].

With the elements mentioned above, through the lens of an evolutionary game model, this study analyzed the stability of the SRP strategy on both sides of the game: VC entities and VC-backed firms, and discussed how the evolutionary stabilization strategy of the system differs depending on the level of government regulation or the involvement of VC entities. The empirical exercise for this analysis used numerical simulation in MathWorks MATLAB. Its results are intended to extend the theoretical basis and propose policy suggestions to effectively guide enterprises to actively undertake SRP.

The main contributions of this study are threefold: (1) The existing research primarily adopts empirical methods, using data from publicly listed companies to examine the impact of VC on CSR [11, 12, 20]. However, in reality, the influence of VC on CSR behavior is shaped by various factors, many of which lack corresponding data support, thereby limiting the scope of the current research. This study employs an evolutionary game model to analyze the intrinsic mechanisms by which VC influences CSR practices in startups, identifying key factors affecting CSR practices under VC support. By conducting numerical simulations using MATLAB, this study enriches the literature in the VC research domain. (2) While the existing literature discusses the impact of different types of VCs (e.g., state-owned, private, and corporate VC) on CSR [3, 12, 21], and some studies investigate the influence of VC equity share on CSR behavior [22], few have examined the critical role of government regulation in this relationship. Beyond analyzing the relationship between VC and CSR practices, this study further explores the effects of VC preferences, equity shareholding, and government regulation on their interactions. This provides valuable extensions to the research on the interplay between VCs and CSR behavior in startups. (3) This study highlights the positive impact of responsible investment on CSR practices, encouraging VC firms to reassess their investment strategies by incorporating environmental, social, and governance (ESG) factors into their decision-making frameworks. This shift can lead to a dual benefit of long-term financial returns and societal well-being. Additionally, the study reveals the active role of government regulation in promoting CSR, providing policymakers with scientific evidence that moderate regulatory measures can encourage enterprises to actively fulfill their social responsibilities and drive positive societal development. Finally, the findings offer significant insights into ESG investment and green finance, guiding capital toward environmentally friendly and carbon-reducing industries, thereby contributing to the achievement of carbon neutrality goals.

This paper proceeds with a review of the relevant literature, followed by the construction and analysis of the proposed model. Subsequently, numerical simulations are conducted to validate the model’s findings, and the study concludes with a discussion of the results and their implications.

2. Literature Review

This section reviews the existing literature on three sections: VC, CSR, and evolutionary game theory (EGT).

2.1. VC

Research on the VC influence on VC-backed firms generally focuses on three fields: (1) the distribution of management and control rights between VC entities and VC-VC-backed firms. The previous evidence has shown that VC support financially supports start-ups and partially controls the invested companies [23–26]. (2) The second field examines the impact of VC investment on a start-up’s initial public offering (IPO). In this case, some scholars have found that a lower market price in the initial offering may be conducive to shortening a supported firm’s time to go public, improving the reputation of the VC entity. In consequence, on facilitating further access to funds [27, 28], additional evidence also shows that VC-backed start-ups can present better IPO performance [29, 30]. (3) The third field of research explored the impact of VC on start-up performance, where previous studies found that VC support implies a certain degree of control of the start-up decision-making structure through professional training and talent recruiting, among other services while seeking performance improvements [25, 31–33].

The relationship between VC and corporate green innovation has also garnered significant academic attention. Mrkajic et al. [34] examined whether being born-to-be-green sends a credible signal to potential VC investors. Their findings suggest that this signal is only reliable when entrepreneurs engage in activities based on green technologies or products while simultaneously positioning their companies within green industries. Bellucci et al. [35] explored the role of green innovation in attracting VC financing, finding that, compared to other equity financing methods, firms engaging in green innovation are more likely to secure VC funding. Furthermore, the larger the share of green patents in a company’s patent portfolio relative to nongreen patents, the higher the likelihood of obtaining VC investment. Maiti [36], through empirical research, demonstrated that the growth of VC investment positively impacts environment-related technological innovations and the share of renewable energy supply by reducing debt-related financial burdens and mitigating firms’ tendencies to take excessive risks. Similarly, Lin and Xie [37] indicated that VC significantly enhances the green technological innovation performance of Chinese renewable energy firms by increasing monetary capital, alleviating financing constraints, and strengthening corporate R&D investments; VC indirectly promotes green technological innovation.

Likewise, the concept of green venture capital (GVC) has gained widespread attention. GVC refers to VC investments that focus on environmental protection, particularly in sectors such as clean technology, sustainable entrepreneurship, technological innovation, green innovation, and sustainability [38]. Wei et al. [39] clarified the role of GVC by providing empirical evidence of its impact on the adoption of renewable energy in the clean technology sector, proposing that GVC can effectively drive green innovation. Dong et al. [40] examined the relationship between the green innovation parameters of environmentally friendly enterprises and the practical efficiency of GVC. Dhayal et al. [41] further explored why GVC can serve as a catalyst for achieving the United Nations’ 2030 Sustainable Development Goals, highlighting the transition of VC research toward GVC, as well as its connections with clean technology, sustainability, and policy-driven green finance initiatives. Bocken [42] provided an in-depth analysis of how venture capitalists contribute to the success of sustainable enterprises by examining their roles, motivations, investment rationales, and the barriers and enablers for achieving sustainability.

The relationship between VC and CSR behavior has been widely discussed in recent studies [9, 11, 12, 20, 21]. However, there remains no clear consensus on whether VC investment promotes or inhibits CSR behavior in VC-backed firms. One strand of research suggests that VC involvement negatively impacts CSR performance, with studies indicating that start-ups backed by VC investors tend to have lower social responsibility scores. For instance, the authors in [22] found that VC participation may reduce CSR performance in portfolio companies, particularly small- and medium-sized enterprises (SMEs). Their study also identified internal control quality (ICQ) as a key mechanism through which VC influences CSR outcomes.

Conversely, another line of research argues that VC investment can positively influence CSR behavior in supported firms [12]. For example, Li et al. [12] and Cheng et al. [10] suggest that VCs provide a resource endowment, equipping portfolio firms with financial and strategic support that enhances their CSR engagement. Their findings indicate that VC-backed start-ups may experience sustained CSR performance, particularly when investors emphasize long-term value creation, reputation-building, and sustainable business practices.

2.2. CSR

CSR extends the field of decision responsibility beyond the shareholder interest by also considering society, the environment, employees, suppliers, and customers while generating a value [43]. The research on CSR focuses on the enterprise’s motivation to undertake SRP and the factors affecting its practice.

Existing studies have shown that active involvement in SRP may be conducive to enterprise rent-seeking [44], legitimacy gain [45], competitive advantage [46–48], consumer buying willingness [49], and may promote growth and innovation [50]; among other benefits stimulated by government regulations, firms may undertake SRP also to access government subsidies [51] and tax relief measures [52], among other preferential policies.

On the impact of the external environment on CSR, some scholars found that market competition level, national development, and economic openness may impact CSR behavior [53]. Additional evidence also found that other social-related factors may influence CSR attitudes and behavior, such as family upbringing [54] and religious beliefs [55].

Empirical studies have studied the impact of internal governance on CSR behavior, finding that factors such as corporate equity structure [56, 57], management compensation structure, institutional investor shareholding [58], and board composition [59] may constitute influencing factors. Some researchers have indicated that institutional investors can promote CSR [60] and inhibit excessive investment in CSR and self-interested management behavior [61].

2.3. EGT

Originally used by genetic ecologists to analyze the game between cooperative and conflicting behavior among animals [62], EGT’s field of action also extended to economics, sociology, and management, among other fields. Scholars also applied it to study the decision-making process in VC-related areas; for instance, Zheng et al. [63] used EGT to analyze the evolutionary process of VC strategy selection, assuming a framework of limited rationality and exploring the applications of the EGT to the problem of adverse selection. In addition, Chen and Bian [64] used a three-party evolutionary game method to develop a noncooperative evolutionary game model, including VC entities, start-ups, and the government, to study the effect of the government’s direct subsidy policy on VC entities.

Other scholars applied EGT while studying CSR strategy selection [65–67]; for instance, Li and Lai [68] constructed an EGT-based theoretical model for CSR realization in the energy industry, finding that cooperation constitutes a key premise to achieve CRS sustainability and stability. In another study, Nie et al. [69] combined an EGT-based model with system dynamics to perform a simulation analysis to study the dynamic processes between local government, mining enterprises, and the local community.

2.4. Research Gap and Contributions of This Study

- 1.

First, existing studies on VC used empirical research methods to validate the relationship between VC and CSR behavior of the VC-backed firms by examining the data of listed companies [11, 12, 21], but the differences of the data samples still bring over different research conclusions. From the system theory perspective, this study complements the actual research by defining VC and a VC-backed firm’s CSR behavior as a dynamic system, bringing EGT as a framework to explore the key influencing factors of CSR behavior in VC-supported environments.

- 2.

Secondly, as existing research focused on the relationship between VC and CSR by exploring elements such as background [11] and investment philosophy [21], there is a need for more evidence that considers the impact of government regulation given the importance of official policies in the promotion of VC as a tool for national development; to address this gap, this study compared the differences between scenarios with and without government regulation.

3. Basic Assumptions and Model Construction

Given the limitations of the hypothesis-driven empirical research and static game models under the assumption of complete rationality, EGT provides a robust framework for depicting the strategic evolution processes among multiple stakeholders, including VC entities, VC-backed firms, and government regulatory agencies, under conditions of bounded rationality and information asymmetry. This approach offers strong theoretical explanatory power in analyzing the dynamic interactions between VC entities and VC-backed firms in CSR engagement, particularly in response to external regulatory interventions.

Furthermore, EGT enables numerical simulations to explore strategy equilibria under varying levels of government supervision and policy interventions, providing quantitative insights for optimizing regulatory design. This, in turn, offers theoretical guidance for improving government regulatory efficiency and encouraging firms to actively engage in CSR practices.

Additionally, the fundamental framework of EGT—comprising strategy sets, payoff functions, and replicator dynamics—is highly generalizable and adaptable to different industries and regulatory environments. By adjusting model parameters and assumptions, this approach can be readily applied to other VC investment scenarios or CSR-related contexts, ensuring replicability and transferability. Therefore, this study employs EGT to dynamically analyze the relationship between VC entities and VC-backed firms in CSR engagement.

3.1. Basic Assumptions

Assumption 1. Players and Strategic Choices. The game consists of two players: (1) the VC entity (Player A) and (2) the VC-backed firm (Player B). The strategic options available for the VC entity are either to support SRP or withhold support, denoted as A = (Support SRP, Withhold Support). Conversely, the VC-backed firm can either perform SRP or withhold participation, represented as B = (Perform SRP, Withhold Participation).

More specifically, each player has two respective choices: A VC entity supports SRP when it utilizes its financial resources, expertise, networks, or other assets to encourage the VC-backed firm’s engagement in CSR activities. Alternatively, a VC entity withholds support by choosing not to provide resources or actively discouraging SRP implementation. From the VC-backed firm’s perspective, performing SRP involves engaging in activities that benefit employees, shareholders, consumers, suppliers, and society at large, while withholding participation in SRP includes actions such as neglecting stakeholder interests, contributing to environmental degradation, or remaining passive on CSR issues.

Assumption 2. Probability of Strategy Selection. The probability of a VC entity supporting SRP is denoted as x, while the probability of withholding support is 1 − x. Similarly, the probability of a VC-backed firm performing SRP is y, and 1 − y represents the probability of withholding SRP participation.

Assumption 3. Investment and Return Cycles. Let T represent the investment cycle of the VC entity and t denote the return cycle of CSR investments. If T > t, the VC entity remains involved long enough to benefit from SRP outcomes. However, if T ≤ t, the VC entity exits before realizing the returns associated with CSR investments. Consequently, a VC entity that prioritizes long-term benefits will follow a strategy where T > t, whereas a VC entity focused on a short-term shareholder value will prefer T ≤ t.

Assumption 4. Payoffs, Excess Returns, and Cost Allocation. Let R1 and R2 denote the initial payoffs of Player A (VC entity) and Player B (VC-backed firm) when SRP is neither supported nor performed. ∆R represents the excess returns generated by the VC-backed firm when the VC entity supports CSR activities, excluding government-derived benefits such as subsidies and tax incentives. The VC entity’s shareholding ratio in the VC-backed firm is denoted as α, meaning that its share of the excess return (∆R) is α∆R, while the VC-backed firm receives (1 − α)∆R.

The cost of implementing SRP is represented by C, which is borne by both the VC entity and the VC-backed firm. Assuming a cost-sharing coefficient β, the cost assumed by the VC entity is βC, while the cost borne by the VC- backed firm is (1 − β)C.

Assumption 5. Free-Rider Behavior and Its Impact. Due to differences in resource availability and CSR objectives between the two players, their incentives for engaging in SRP may diverge. If the VC entity supports SRP, but the VC-backed firm withholds participation, this results in a “free-rider” problem, where the VC-backed firm benefits from the VC entity’s support without making its own CSR investments. This scenario reduces the VC entity’s overall return, while the VC-backed firm experiences an inconsistent increase in its payoff.

Conversely, if the VC entity withholds support, but the VC-backed firm performs SRP, a reverse free-rider problem arises, where CSR benefits accrue disproportionately to the VC entity while reducing the VC-backed firm’s immediate profits. If a free-rider scenario emerges, the variable L represents the magnitude of CSR-related gains or losses for both players.

Assumption 6. Government Regulation and Incentives. In China, the government serves as an active promoter of CSR practices. When implementing regulatory measures, it introduces a combination of rewards, penalties, and financial incentives to encourage CSR engagement. Firms that actively practice CSR may receive government support in the form of tax incentives, financial subsidies, or other policy-driven benefits.

The additional benefits provided by the government to both players are denoted by H, with the VC entity receiving αH and the VC-backed firm receiving (1 − α)H, where α represents the VC entity’s shareholding ratio, determining its proportion of government incentives relative to its ownership and influence over the VC-backed firm.

3.1.1. The Regulatory Role of the Government

In the Chinese environment, the government is an active promoter of SRP, and evidence of its participation appears in regulations that reflect the importance given to CSR; this regulatory mechanism takes the form of incentives and penalties in the sectors where Players A and B are involved. Firms actively promoting and performing SRP can access tax deductions, subsidies, and other benefits; H represents the additional income from these benefits as Players A and B receive αH and (1 − α)H.

A synthesis of the notations described in this section is available in Table 1 as follows.

| Notation | Definition |

|---|---|

| Player A | VC entity |

| Player B | VC-backed firm |

| x; (1 − x) | The probability of the VC entity supporting or withholding support for SRP |

| y; (1 − y) | The probability of the VC-backed firm performing or withholding participation in SRP |

| T | Investment cycle of the VC entity |

| t | ROI cycle for social responsibility practices (SRP) |

| R1 | VC entity’s profits when it withholds support for SRP and the VC-backed firm does not perform SRP |

| R2 | VC-backed firm’s profits when the VC entity withholds support for SRP and the VC-backed firm does not perform SRP |

| ∆R | Excess returns obtained by the VC-backed firm when the VC entity actively supports SRP and the firm actively practices CSR, excluding benefits derived from government incentives |

| α | VC entity’s shareholding ratio in the VC-backed firm |

| β | Allocation coefficient for SRP costs |

| C | Additional cost for the VC entity to support SRP in the VC-backed firm |

| L | Increase (or decrease) in SRP benefits for both players when “free-rider” behavior occurs |

| H | Government incentives provided to companies engaging in SRP |

| S1 | Evolutionary game system without government supervision |

| S2 | Evolutionary game system under government supervision |

3.2. Model Construction

3.2.1. Evolutionary Game Model Without Government Intervention

Based on the assumptions described in the previous section, the evolutionary game return matrix of the VC entity and the VC-backed firm can be shown in Table 2 as follows.

| VC-backed firm (Player B) | |||

|---|---|---|---|

| Perform SRP (y) | Withhold Participation (1 − y) | ||

| VC entity (Player A) | Support SRP (x) |

|

|

| Withhold Support (1 − x) |

|

|

|

3.2.1.1. Evolutionary Stability Analysis: VC Entity Strategy

Then, y = (βC + L)/α∆R and F(x) = 0 can be calculated, and the system will be in a stable state for any value of x; otherwise, when y ≠ (βC + L)/α∆R, then for F(x) = 0, x = 0 and x = 1 can be the steady state of x. According to the stability theorem of differential equations, when , then x∗ is the evolutionary stable strategy; in combination with equation (10) being possible to affirm that since α∆R > 0, the stable strategy of VC depends on y when y < (βC + L)/α∆R due to dF(x)/dx|x=0 < 0, dF(x)/dx|x=1 > 0; therefore, x = 0 can be defined as an evolutionary stable strategy.

When y > (βC + L)/α∆R due to dF(x)/dx|x=0 > 0, then dF(x)/dx|x=1 < 0; therefore, x = 1 can also be defined an evolutionary stable strategy.

3.2.1.2. Evolutionary Stability Analysis: VC-Backed Firm Strategy

When x = [(1 − β)C + L]/[(1 − α)∆R], then F(y) = 0 can be calculated, and the system will be in a stable state for any value of y; on the other hand, when x ≠ [(1 − β)C + L]/[(1 − α)∆R], for F(y) = 0, then y = 0 and y = 1 can be the steady state of y, and according to the stability theorem of differential equations, when , then y∗ is the evolutionary stable strategy that in combination with equation (11) being possible to define the stable strategy as follows:

When [(1 − β)C + L]/[(1 − α)∆R] > 0, the stable strategy of VC (VC) depends on x; when x < [(1 − β)C + L]/[(1 − α)∆R], due to dF(y)/dy|y=1 > 0, then dF(y)/dy|y=0 < 0; therefore, y = 0 can be defined as an evolutionary stable strategy.

When x > [(1 − β)C + L]/[(1 − α)∆R], due to dF(y)/dy|y=1 > 0, then dF(y)/dy|y=0 > 0; therefore, y = 1 is also an evolutionary stable strategy.

3.2.1.3. Evolutionary Stability Analysis for the System S1

This analysis will consider two scenarios, the first when T > t and the second when T < t.

3.2.1.3.1. When T > t

- i.

- ii.

tr(j) = C11 + C22 < 0

Based on the Jacobian matrix local stability analysis, the values (negative or positive) of det(j) and tr(j) allow the stability identification for each of the five equilibrium points, as shown in Table 3.

| Equilibrium point | det(j) | tr(j) | Stability |

|---|---|---|---|

| A(0, 0) | > 0 (+) | < 0 (−) | ESS |

| B(1, 0) | > 0 (+) | > 0 (+) | Unstable |

| C(1, 1) | > 0 (+) | < 0 (−) | ESS |

| D(0, 1) | > 0 (+) | > 0 (+) | Unstable |

| O(a, b) | < 0 (−) | = 0 (0) | Saddle point |

As shown in Table 3, the equilibrium points, where det(j) > 0 and tr(j) < 0, satisfy the conditions for the system to reach a stable equilibrium. These correspond to two Pareto-optimal strategies: (Withhold Support, Withhold Participation) and (Support SRP, Perform SRP). The remaining points represent unstable states, indicating that the strategies (Withhold Support, Perform SRP) and (Support SRP, Withhold Participation) cannot lead to a stable system equilibrium. As a result, the system undergoes dynamic adjustments until it converges toward one of the two stable equilibrium points (A or B). Additionally, O points serve as saddle points, representing critical states in EGT that determine the system’s trajectory.

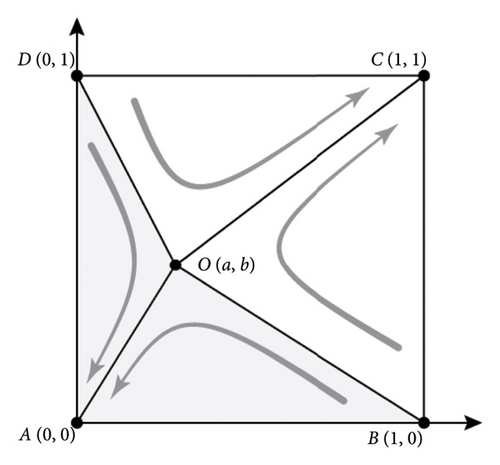

Figure 1 presents the phase diagram of the system’s evolution in the absence of government regulation, illustrating how the system evolves when VC entities favor long-term or responsible investment strategies.

As shown in Figure 1, the segments connecting points B, O, and D form the critical trajectory that determines the system’s convergence toward one of two stable equilibrium states. The prevalence of the lower-left region (SABOD) may drive the system toward the stable equilibrium A(0, 0), where both players ultimately adopt the strategy (Withhold Support, Withhold Participation). Conversely, the dominance of the upper-right region (SBCDO) may lead the system to converge toward the stable equilibrium C(1, 1), where both players adopt the strategy (Support SRP, Perform SRP).

Thus, the final state of the evolutionary game between the VC entity and the VC-backed firm depends on the relative sizes of SABOD and SBCDO. A larger SABOD area increases the probability of both players converging toward (Withhold Support, Withhold Participation), while a larger SBCDO area corresponds to a higher likelihood of (Support SRP, Perform SRP) convergence.

- 1.

Excess return ∆R

-

The derivative of ∆R through the formula of the area for SABOD results in a monotonic subtractive function of d∆R:

() -

Any increase in ∆R implies a decrease in SABOD, the respective increase in SBCDO and the probability that both players evolve into (Support SRP, Perform SRP). In contrast, any decrease in ∆R will be related to an increase in SABOD, a decrease in SBCDO, and the increase in the probability that the game scenario evolves to the SRP negative setting (Withhold Support, Withhold Participation). Then, the increase in excess returns can effectively promote VC to actively support the VC-backed firm in their CSR activities boosting any related initiative that may emerge within the start-up.

- 2.

SRP cost C

-

The derivative of C through the formula of the area for SABOD results in a monotonically increasing function for DC:

() -

In other words, an increase in C implies an expansion of the area SABOD; thus, the corresponding reduction of SBCDO and the probability that the game will evolve into the (Withhold Support, Withhold Participation) setting. On the other hand, in the opposite scenario, a decrease in C will reduce the area SABOD, increasing the corresponding area for SBCDO, increasing the probability for the game players to evolve into the (Support, Perform SRP) setting; thus, to seek this scenario, the VC-backed firm should effectively control the cost of SRP.

- 3.

VC shareholding ratio α

-

The derivative of α through the formula of the area for SABOD results in a nonmonotonic function for dα:

() -

Nevertheless, the quadratic derivative for α does result in a monotonically increasing function:

() -

Therefore, SABOD is a concave function of α with a specific point where SABOD can be minimized, maximizing the probability of the system evolving into (Support, Perform SRP) setting.

-

Furthermore, when

() -

then,

() -

In this case, the probability of the players reaching the ideal evolution state is the largest. Therefore, there is an optimal VC shareholding ratio able to maximize the possibility of the game achieving the (Support, Perform SRP) strategy.

- (4)

Variation of SRP benefits when there is “free rider” behavior L

-

The derivative of L through the formula of the area for SABOD results in a monotonically increasing function for dL:

()

It means that an increase for L will be subsequently linked to an increase for SABOD; thus, to decrease the area for SBCDO as well as the probability of both players evolving to (Withhold Support, Withhold Participation). In contrast, a decrease for L will imply a reduction in SABOD, an increase in SBCDO, and the subsequent probability for the game to evolve into (Support, Perform SRP) strategy.

As seen in the function, the emergency of a free-riding behavior is not conducive for the system to evolve into the ideal stable state, meaning that to make the system converge into the (Support, Perform SRP) stable state, it is necessary to formulate scientific and reasonable measures that may reduce the occurrence of “free riding” behavior.

3.2.1.3.2. When T < t

In this situation, VC cannot perceive the returns of CSR activities in its investment cycle. Without the effect of government supervision, the system stability solutions with their corresponding det(j) and tr(j) values (negative or positive) for each one of the four equilibrium points are shown in Table 4 as follows:

| Equilibrium point | det(j) | tr(j) | Stability |

|---|---|---|---|

| A(0, 0) | > 0 (+) | < 0 (−) | ESS |

| B(1, 0) | < 0 (−) | Saddle point | |

| C(1, 1) | > 0 (+) | > 0 (+) | Unstable |

| D(0, 1) | < 0 (−) | Saddle point |

As shown in Table 4, the equilibrium point A(0, 0) satisfies the conditions for a stable equilibrium, as its det(j) is greater than 0 and tr(j) is less than 0. This means that A(0, 0) represents a stable equilibrium strategy for the system, corresponding to the (Withhold Support, Withhold Participation) strategy adopted by both players.

On the other hand, C(1, 1) is unstable, meaning that the strategies (Withhold Support, Perform SRP) and (Support SRP, Withhold Participation) do not lead the system to stability. This indicates that when the VC entity operates under a short investment cycle, it becomes unable to perceive the long-term returns of CSR engagement by the VC-backed firm. As a result, both players are more likely to evolve toward the (Withhold Support, Withhold Participation) equilibrium state.

3.2.2. CSR Evolutionary Game Model Under Government Supervision

Based on the assumptions in the previous section, the evolutionary game return matrix for each player in the scenario with government supervision is shown in Table 5 as follows:

| VC-backed firm | |||

|---|---|---|---|

| Perform SRP (y) | Withhold Participation (1 − y) | ||

| VC entity | Support SRP (x) |

|

|

| Withhold Support (1 − x) |

|

|

|

From this step, it is possible to determine the five equilibrium points corresponding to the system S2:

With these calculations, the local stability of the investment on CSR strategy evolution in a system under government supervision S2 is discussed for two scenarios: when T > t and when T < t.

3.2.2.1. When T > t

The local stability for this specific case is shown in Table 6, displaying two stable points for the system S2 corresponding to the Pareto optimal solutions (Withhold Support, Withhold Participation) and (Support SRP, Perform SRP). F(1, 0) and H(0, 1) are unstable system points, and P(a1, b1) represent the corresponding saddle point.

| Equilibrium point | det(j) | tr(j) | Stability |

|---|---|---|---|

| E(0, 0) | > 0 (+) | < 0 (−) | ESS |

| F(1, 0) | > 0 (+) | > 0 (+) | Unstable |

| G(1, 1) | > 0 (+) | < 0 (−) | ESS |

| H(0, 1) | > 0 (+) | > 0 (+) | Unstable |

| P(a1, b1) | < 0 (−) | = 0 (0) | Saddle point |

As shown in Table 6, the equilibrium points E(0, 0) and G(1, 1) satisfy the conditions for a stable equilibrium, as their det(j) values are greater than 0 and tr(j) values are less than 0. This means that these two points serve as the system’s stable equilibrium states, corresponding to two Pareto-optimal strategies: (Withhold Support, Withhold Participation) and (Support SRP, Perform SRP).

Conversely, F(1, 0) and H(0, 1) are unstable points, indicating that the strategies (Withhold Support, Perform SRP) and (Support SRP, Withhold Participation) do not lead the system to stability. In such cases, the system will continue dynamic adjustments until it eventually converges to the stable equilibrium points E or G. Additionally, P(a1, b1) functions as a saddle point, representing a critical threshold in the evolutionary game where the system’s trajectory is highly sensitive to initial conditions.

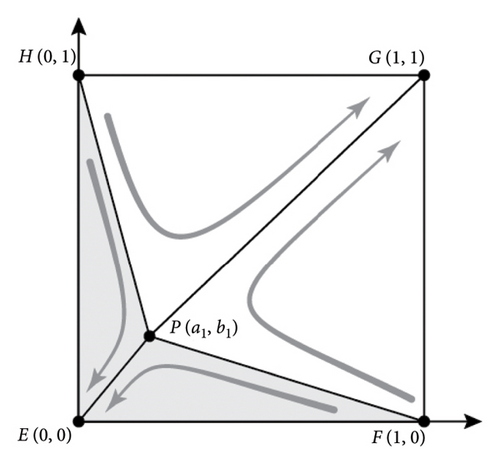

Similarly, based on these findings, the phase diagram of the evolutionary game between VC entities and VC-backed firms under government supervision can be derived, as illustrated in Figure 2.

As shown in Figure 2, the line connecting points H, P, and F forms the critical boundary that determines the system’s convergence toward one of the two stable equilibrium states. In the lower-left region (SEFPH), the system converges toward equilibrium point E(0, 0), where both players ultimately adopt the strategy (Withhold Support, Withhold Participation). Conversely, in the upper-right region (SHPFG), the system converges toward equilibrium point G(1, 1), where both players eventually adopt the strategy (Support SRP, Perform SRP).

By comparing Figure 2 with Figure 1, it is evident that SBCDO < SHPFG. The primary reason for this difference lies in the role of government supervision. Compared to the system without government supervision (S1) and its saddle point O(a, b), the system under government supervision (S2) introduces the incentive factor H, which determines the location of the saddle point P(a1, b1). As a result, the presence of government incentives alters the evolutionary dynamics, increasing the probability that both players will ultimately adopt (Support SRP, Perform SRP).

Therefore, the impact of government supervision on the evolutionary game strategy can be analyzed by examining the effect of H on the system’s equilibrium states. This highlights the regulatory role of government intervention in influencing CSR engagement within VC-backed firms and shaping long-term investment strategies for VC entities.

The introduction of government supervision leads to SABOD > SEFPH which reduces the likelihood of the system evolving toward the (Withhold Support, Withhold Participation) equilibrium. Instead, the system becomes more likely to converge toward the alternative stable solution (Support SRP, Perform SRP). This indicates that as the government’s incentive (H) for firms actively engaging in CSR increases, the probability of both players adopting (Support SRP, Perform SRP) also rises.

3.2.2.2. When T < t

It is assumed that the government rewards firms actively involved in CSR activities. However, their role is usually limited to a guiding position, and the amount of this reward is often smaller than the cost assumed by VC to stimulate the VC-backed firm to perform SRP, implying that αH < βC; (1 − α)H < (1 − β)H.

Having included the government supervision effect in the game system S2, the system stability solutions from the corresponding det(j) and tr(j) values are shown in Table 7 as follows:

| Equilibrium point | det(j) | tr(j) | Stability |

|---|---|---|---|

| E(0, 0) | > 0 (+) | < 0 (−) | ESS |

| F(1, 0) | < 0 (−) | Saddle point | |

| G(1, 1) | > 0 (+) | > 0 (+) | Unstable |

| H(0, 1) | < 0 (−) | Saddle point |

As shown in Table 7, the equilibrium point E(0, 0) satisfies the conditions for a stable equilibrium, as its det(j) is greater than 0 and tr(j) is less than 0. This means that E(0, 0) serves as the system’s stable equilibrium state, corresponding to the strategy (Withhold Support, Withhold Participation) adopted by both players.

Conversely, F(1, 0) and H(0, 1) are saddle points, indicating that the strategies (Withhold Support, Perform SRP) and (Support SRP, Withhold Participation) do not lead the system to stability. This suggests that, regardless of government support, the evolutionary trajectory remains unchanged compared to the system without government supervision (S1). In other words, even if the government provides incentives for CSR engagement and if the VC entity operates under a short investment cycle that prevents it from realizing the benefits of supporting SRP, the system will still evolve toward (Withhold Support, Withhold Participation).

4. Numerical Simulation

Discussion about the specific effects is available in the following sections.

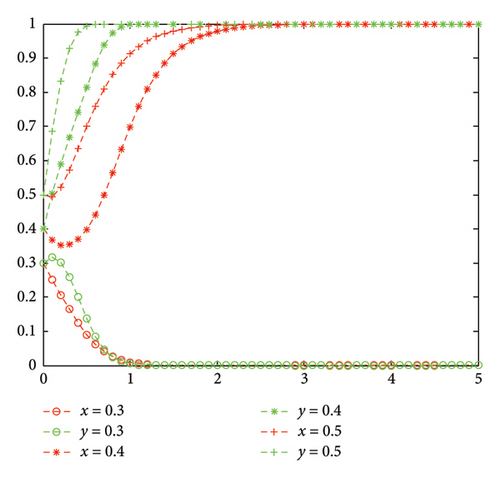

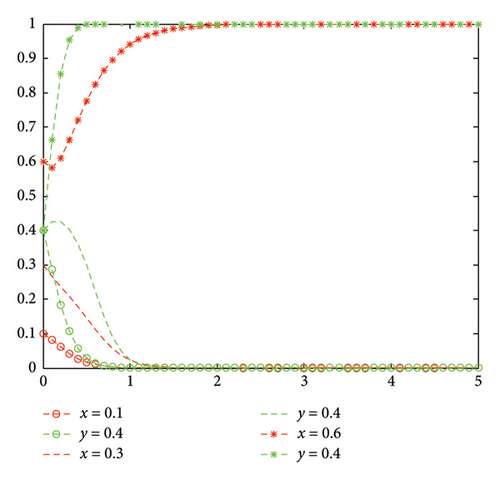

4.1. Effect of Players’ Initial CSR Preference on the System Evolution

The influence of the players’ initial willingness to undertake SRP on the evolution of a system without government supervision (H = 0) is illustrated in Figure 3 below. In the figure, VC entities are represented by red lines, while VC-backed firms are represented by green lines.

Keeping the above parameters unchanged, we assume that the initial willingness of both the VC entity and the VC-backed firm to undertake CSR is the same.

The results displayed in Figure 3 indicate that when both players have a low initial preference for SRP (below 0.3 in this case), the system tends to evolve toward (0, 0), meaning (Withhold Support, Withhold Participation). However, as the initial preference increases (up to 0.4 in this case), the system’s evolutionary trend shifts. While the VC-backed firm’s willingness to engage in SRP steadily increases, the VC entity’s willingness to support SRP initially declines before stabilizing, ultimately leading the system to converge toward (1, 1) or (Support SRP, Perform SRP). Furthermore, as initial preferences increase further, the system converges toward the (1, 1) stable state at a faster rate.

The primary reason for this behavior is that in the system, the VC entity primarily provides capital, management, and resource support, while the VC-backed firm is responsible for implementing SRP. Since CSR investment incurs immediate costs for the VC-backed firm while offering delayed returns, its willingness to engage in CSR is relatively low in the early stages, especially when it faces financial constraints and long CSR investment cycles. However, as the VC entity becomes involved and influences the VC-backed firm through its investment philosophy, the firm’s CSR willingness is affected accordingly. If the VC entity does not support SRP, the VC-backed firm’s motivation for CSR diminishes, leading the system to evolve toward (Withhold Support, Withhold Participation). Conversely, if the VC entity actively provides financial and resource support, the VC-backed firm’s willingness to undertake CSR gradually strengthens, driving the system toward (Support SRP, Perform SRP).

These findings demonstrate that VC support plays a crucial role in influencing the willingness of VC-backed firms to engage in CSR. Financial and resource assistance enhances a firm’s motivation and capacity, encouraging it to adopt more proactive CSR practices.

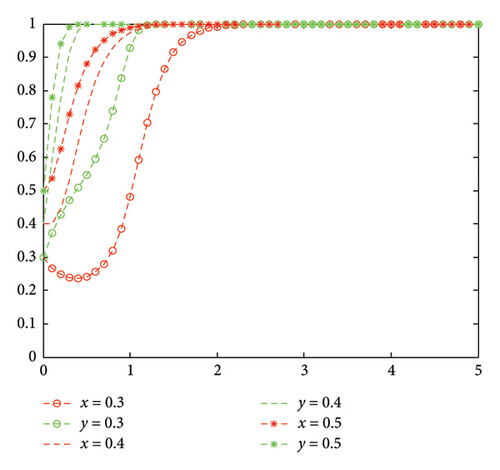

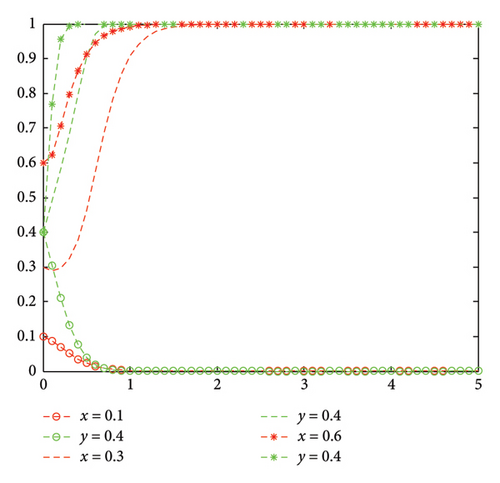

Figure 4 shows the simulation results by including government supervision (H > 0) in the evolutionary system.

As shown in Figure 4, in comparison with Figure 3, it becomes evident that when both players have a low initial preference for CSR (0.3, 0.3), government supervision effectively stimulates the system, increasing the players’ willingness to engage in SRP to a level that drives the system toward the stable state (Support SRP, Perform SRP). On the other hand, when the initial CSR preference is relatively high (above 0.4), the presence of government supervision accelerates the system’s convergence toward the optimal equilibrium (1, 1).

When both the VC entity and the VC-backed firm initially have a low willingness to undertake CSR, such as at x = 0.3 and y = 0.3, the introduction of government supervision gradually strengthens their motivation to engage in CSR practices. Consequently, the system ultimately evolves toward the ideal stable state (1, 1), corresponding to (Support SRP, Perform SRP). A comparative analysis of Figures 3 and 4 indicates that when both players have a higher initial CSR preference, government supervision accelerates the system’s evolution toward the optimal equilibrium (1, 1).

These findings demonstrate that government regulatory policies—such as reward and penalty mechanisms, financial subsidies, and other incentive structures—can significantly influence stakeholders’ strategic choices. By guiding investment behavior, such policies encourage both VC entities and firms to adopt strategies that support and implement CSR. This highlights the crucial role of institutional environments in shaping CSR engagement and suggests that well-designed regulatory incentives and constraints can effectively promote responsible behavior in both firms and capital markets.

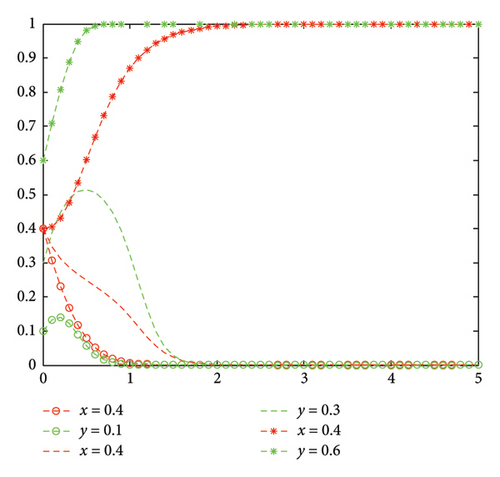

4.2. The Influence of VC Preference Variations on the System Evolution

Keeping other parameters unchanged, Figures 5 and 6 illustrate the evolutionary path of the VC-backed firm’s CSR engagement under two scenarios: with and without government supervision, when the VC entity’s preference for CSR practices changes.

As shown in Figure 5, under the evolutionary game scenario without government supervision, the VC-backed firm’s initial willingness (y) to undertake SRP is set at a fixed value (y0 = 0.4). To evaluate the influence of different levels of the VC entity’s initial preference for CSR on the system’s final convergence, the simulation considers three different values: x0 = 0.1, x0 = 0.3, and x0 = 0.6.

When the VC entity’s preference for supporting SRP is extremely low (e.g., x = 0.1), the system evolves toward (0, 0), meaning (Withhold Support, Withhold Participation). However, as x increases, the VC-backed firm’s willingness to engage in SRP also strengthens. For instance, when the initial x-value is set to 0.3, the firm’s willingness (y) first increases, but as x gradually declines, y also decreases until reaching zero. This indicates that the VC entity, as a resource allocator, plays a crucial role in guiding CSR engagement. Without external support, firms may abandon CSR initiatives due to resource constraints or cost-benefit considerations.

Conversely, when the VC entity demonstrates a stronger preference for CSR (e.g., x = 0.6), the VC-backed firm’s CSR engagement (y) steadily increases and approaches 1. Meanwhile, x initially declines but later increases again, leading the system to ultimately evolve toward (1, 1), representing (Support SRP, Perform SRP).

These results demonstrate that the VC entity’s CSR preference significantly influences the CSR engagement of VC-backed firms. The relationship between VC support and corporate CSR behavior forms a positive feedback loop—proactive investment in CSR encourages firms to engage in socially responsible practices, and in turn, firms’ active CSR participation strengthens their collaboration with VC entities.

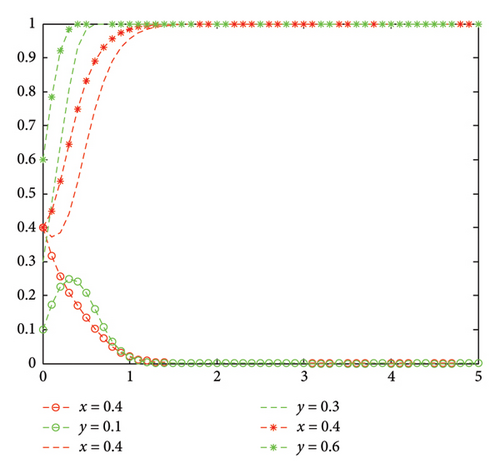

As shown in Figure 6, when government supervision is introduced, the system’s evolutionary speed significantly increases compared to the scenario without government regulation. Additionally, when the initial values of x and y remain the same, the probability of the system converging to (1, 1) is higher under government supervision.

For instance, when the VC entity’s willingness to support CSR is relatively low (x = 0.3), the system no longer evolves toward the (0, 0) stable state, as observed in the absence of government supervision. Instead, it gradually converges to (1, 1), representing (Support SRP, Perform SRP). This reinforces the idea that government supervision plays a guiding role in encouraging CSR engagement, promoting VC entities to actively support CSR implementation in VC-backed firms. Even if a VC entity initially exhibits a low willingness to support CSR, government incentives and regulatory guidance can gradually drive it toward a more proactive CSR approach. In response, the VC-backed firm’s willingness to engage in CSR also increases, ultimately leading the system to stabilize at (Support SRP, Perform SRP).

However, when the VC entity’s initial willingness to support CSR is extremely low (e.g., x = 0.1), the VC-backed firm eventually chooses not to engage in CSR (y = 0). This suggests that while government supervision can encourage CSR adoption among firms and investors, its influence has limitations. If a VC entity completely lacks the willingness to support CSR, government incentives and penalties alone may be insufficient to alter the system’s evolutionary trajectory. To prevent the system from falling into the undesirable (0, 0) equilibrium, policy design should focus on enhancing VC entities’ willingness to support CSR, ensuring a more robust and sustainable CSR ecosystem.

4.3. The Influence of Start-Up Preference Variations on the System Evolution

Figures 7 and 8 illustrate the evolutionary path of strategy selection for both players under two scenarios—with and without government supervision—when the initial willingness (y) of the VC-backed firm to undertake CSR varies, while keeping other parameters unchanged.

The simulation results in Figure 7 indicate that when the VC entity’s initial willingness to support CSR remains unchanged, the absence of government supervision leads to varied system evolution outcomes. Even when the VC entity has a moderate initial preference for supporting CSR (x = 0.4), if the VC-backed firm’s willingness to undertake CSR is low (e.g., y = 0.1 or y = 0.3), the system still evolves toward the (Withhold Support, Withhold Participation) stable state. However, when the VC-backed firm’s initial willingness to engage in CSR is relatively high (e.g., y = 0.6), the system converges toward the ideal equilibrium (Support SRP, Perform SRP).

These findings suggest that even if the VC entity’s initial willingness to support CSR is moderate, a strong intrinsic motivation from the VC-backed firm can drive the system toward the positive evolution. This implies that VC-backed firms must exhibit sufficient proactive engagement in CSR from the early stages to fully leverage the support provided by VC entities. When such synergistic interactions occur, they create a reinforcing feedback loop that drives the system toward the optimal stable state (Support SRP, Perform SRP).

The simulation results in Figure 8 indicate that under government supervision, the VC-backed firm’s willingness to engage in CSR gradually increases. Although in cases where the initial willingness is extremely low (e.g., y = 0.1), the system still ultimately evolves toward (0, 0), the probability of reaching the (1, 1) stable state increases compared to the scenario without regulation.

By comparing the results of Figures 7 and 8, it becomes evident that when the VC-backed firm’s initial willingness to undertake CSR is relatively low (e.g., y = 0.3), the system without supervision is more likely to fall into the undesirable equilibrium (0, 0). However, when government supervision is introduced, the system tends to evolve toward the optimal stable state (1, 1). This demonstrates that government incentive mechanisms, such as rewards, penalties, and subsidies, can help firms overcome the initial lack of motivation for CSR, thereby enhancing the overall stability of the system.

However, when the initial willingness is extremely low (e.g., y = 0.1), the system may still remain at (0, 0) despite government intervention. This reflects a threshold effect in government regulation—if the VC-backed firm’s initial willingness to engage in CSR falls below a critical level, regulatory measures may not be sufficient to completely alter the system’s evolutionary trajectory.

These simulation results highlight the long-term positive effects of government supervision in promoting CSR engagement across the system. By guiding VC-backed firms toward active CSR participation, government supervision not only improves short-term evolutionary trends but also establishes a foundation for long-term sustainable development.

5. Conclusions

Based on EGT and bounded rationality, this study offers an evolutionary game-based model that displays the dynamics of SRP engagement in the relationship between VC institutions and their VC-backed firms. This proposal enriches our understanding of the factors impacting SRP and the evolution of this system across different VC investment cycles. By using MathWorks MATLAB for numerical simulations, this study investigated the impact of each player’s CSR preferences and the role of government supervision in guiding the system toward the ideal stable state. These findings offer important implications for both theory and practice.

From the perspective of VC entities, investment cycles and CSR investment philosophies are critical factors influencing their preference for supporting or withholding support for SRP in VC-backed firms. This conclusion aligns with the findings of Alakent et al. [11] and provides a theoretical foundation for their study. When VC entities prioritize long-term value investments and CSR initiatives, they can significantly influence the system to evolve toward a stable state characterized by active SRP engagement. Conversely, shorter investment cycles or a diminished emphasis on CSR may drive the system toward withholding support and disengaging from SRP. Meanwhile, VC-backed firms’ decisions regarding SRP are shaped by factors such as SRP costs, expected returns, the VC entity’s shareholding ratio, and the extent of VC entity influence on their CSR strategies. This broadened perspective offers valuable insights for advancing theoretical discussion in this domain.

From an external perspective, the impact of government supervision is contingent on the initial SRP preferences of VC institutions and start-ups. In favorable initial conditions, government supervision can expedite the system’s evolution toward active SRP engagement. In conditions of uncertainty, government supervision can potentially reverse negative momentum and favor the convergence of the system toward the ideal stable state. Therefore, governments should consider rewarding mechanisms to incentivize active SRP engagement, such as public procurement opportunities, tax relief, and recognitions, while recognizing their role as facilitators rather than enforcers.

6. Practical Implications

For policymakers, the government should focus on reducing the initial costs of corporate CSR engagement through policy design while providing sufficient incentives to encourage firms to take the first step. For instance, offering more attractive tax incentives, financial subsidies, and other supportive policies can help lower the barriers to CSR adoption. Additionally, enhancing CSR awareness through education and public campaigns can improve firms’ recognition and commitment to social responsibility. Encouraging VC-backed firms to strengthen their intrinsic motivation for CSR in the early stages—for example, through training programs, awareness campaigns, or incentive-based policies—can further promote CSR engagement. Moreover, policy design should aim to increase VC entities’ willingness to support CSR initiatives. This can be achieved through stronger financial and tax incentives, preferential policies, or CSR performance ratings for investment institutions, encouraging VC entities to actively participate in supporting CSR practices within the firms they invest in. Furthermore, fostering stronger collaboration between VC entities and VC-backed firms can help both parties jointly address CSR challenges.

For VC investors, a long-term perspective should be adopted, integrating CSR into investment decision-making frameworks as a key factor for enhancing both investment returns and social value. VC entities can also support CSR by leveraging resource integration, strategic support, and governance optimization, thereby improving the CSR capabilities of VC-backed firms. Providing technological, managerial, and resource-based support can accelerate the evolution of VC-backed firms toward active CSR engagement. Additionally, VC entities should pay close attention to government regulations and incentive policies, recognizing them as powerful tools for encouraging CSR adoption. With government-provided tax benefits and financial subsidies, VC entities can adjust their investment strategies to align with policy incentives, forming synergistic efforts with the government to achieve both economic and social values.

For VC-backed firms, recognizing the long-term benefits of CSR is essential for enhancing competitiveness and market reputation. Actively collaborating with VC entities can help leverage investment resources and support to strengthen CSR implementation. By utilizing the resources and strategic guidance of VC entities, firms can improve their capacity, execution ability, and overall impact in CSR initiatives. Furthermore, actively engaging with government reward-and-penalty mechanisms and subsidy programs can help firms lower the initial costs of CSR implementation through policy support, ultimately enhancing their sustainable development capabilities.

7. Limitations and Future Research

This study serves as a significant theoretical exploration of the relationship between VC institutions and start-ups. However, we recognize its inherent limitations, specifically the lack of empirical testing to fully validate the proposed model. It is important to note that extensive corporate data availability is necessary for performing these tests with the required reliability and representativeness.

Despite this limitation, our model adds value to the scholarly community by providing a robust framework for understanding the relationship between VC institutions and start-ups. We hope our work will serve as a catalyst for other researchers who may have access to different corporate datasets.

Future research could investigate the influence of VC institutions on their VC-backed firms, specifically in areas such as environmental, shareholder, and employee responsibility, among others; this would enrich our understanding of this complex relationship and offer opportunities to validate or refine our theoretical model empirically.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

This research was supported by the 2023 Youth Fund for Humanities and Social Sciences Research of the Ministry of Education, Project number 23YJC630128.

Open Research

Data Availability Statement

All results presented in this study are derived solely from numerical simulations performed with MathWorks MATLAB. The simulation framework, including MATLAB scripts, numerical outputs, and supplementary documentation, is fully self-contained and can be used to replicate the findings reported herein. These materials are available from the authors upon reasonable request. No external empirical datasets were employed in this research.