Harnessing Hydrogen: A Comprehensive Literature Review on Strategic Launching Initiatives in the Global Energy Market

Abstract

In the transition towards sustainable energy sources, hydrogen has emerged as the predominant alternative after fossil fuels. This comprehensive literature review investigates into the evolving landscape of hydrogen launching strategies within the energy market. Numerous countries have strategically initiated efforts to introduce products based on hydrogen, highlighting the global acknowledgment of the potential inherent in hydrogen. Despite witnessing significant growth in the adoption of hydrogen energy worldwide, barriers to its widespread commercialization persist. This review identifies key barriers, including cost structures, technical complexities, and marketing challenges, hindering the establishment of a robust hydrogen energy market. The article critically examines the actions already undertaken to harness hydrogen energy for commercial purposes, looking at scientific insights and statistical data. By carefully examining the current state of hydrogen energy initiatives, the review highlights gaps in existing strategies that require thoughtful consideration. Insights derived from scientific and statistical analyses inform the identification of barriers and contribute to a nuanced understanding of the challenges faced in the journey towards hydrogen energy commercialization. Ultimately, the article presents a strategic proposal outlining marketing actions geared towards expediting the commercialization and widespread adoption of hydrogen energy. Grounded in a thorough review of existing literature and supported by scientific and statistical evidence, this comprehensive analysis offers valuable insights for stakeholders seeking to navigate the intricate landscape of hydrogen energy in the global energy market.

1. Introduction

1.1. Global Energy Challenge and Hydrogen

As industrialization spreads and living standards increase, energy demands continue to rise [1]. Currently, the majority of global power is produced by burning fossil fuels [2]. Despite its technological advancement, this method has a maximum efficiency of around 50%, contributes to nearly 35% of global greenhouse gas emissions, and has become more costly and less reliable due to recent fluctuations in oil prices. Therefore, ensuring a reliable energy supply and addressing climate change are two primary concerns for the future of the energy industry [3]. These concerns emphasize the necessity to find effective ways to reduce emissions while still meeting the energy needs essential for economic growth. [4]. Renewable energy sources, including wind, solar, microhydro, wave, geothermal, and biomass, offer potential solutions to the clean energy dilemma, although they present their own set of challenges [5, 6]. Using energy storage systems to store renewable energy can help incorporate these fluctuating, weather-dependent energy sources and maintain grid stability [7].

Hydrogen energy storage technology is proposed as an effective method to harness and utilize the world’s abundant yet intermittent renewable energy resources [8]. Hydrogen offers solutions to various important energy challenges. It provides a pathway to reduce carbon emissions in sectors like long-haul transport, chemicals, and iron and steel production, where significant emission reductions are challenging [8, 9]. Additionally, hydrogen contributes to improving air quality and enhancing energy security. Despite ambitious global climate targets, energy-related CO2 emissions hit a record high in 2018 [10]. Outdoor air pollution also continues to be a significant issue, causing approximately 3 million premature deaths annually [11, 12]. Hydrogen is a versatile energy carrier. Existing technologies allow hydrogen to be used for producing, storing, transporting, and utilizing energy in diverse ways. A variety of sources, including renewable energy, nuclear power, natural gas, coal, and oil, can produce hydrogen. It can be transported either as a gas through pipelines or in liquid form by ships, akin to liquefied natural gas (LNG) [10, 11]. Furthermore, hydrogen can be converted into electricity and methane to power homes and industries and into fuels for vehicles such as cars, trucks, ships, and planes [9, 13].

Hydrogen can significantly enhance the contribution of renewable energy sources. It is particularly useful in managing the variable output from renewable sources like solar photovoltaics (PV) and wind, which often do not align with energy demand. Hydrogen is a leading solution for storing renewable energy, and it is emerging as the most cost-effective option for long-term storage of electricity spanning days, weeks, or even months. Hydrogen and hydrogen-based fuels can also transport energy over long distances, from areas rich in solar and wind resources like Australia or Latin America to energy-intensive urban centers thousands of kilometers away. Today, hydrogen is primarily used in oil refining and fertilizer production. For hydrogen to significantly impact clean energy transitions, it must also be adopted in sectors where it is currently almost nonexistent, such as transportation, building heating, and power generation [9].

1.2. Role of Hydrogen in Transportation

To achieve full decarbonization of road transportation, it is imperative to prioritize the advancement of alternative, low-carbon fuels and more efficient propulsion systems in long-term strategies. Electric-drive vehicle options include pure battery electric vehicles (BEVs), fuel cell electric vehicles (FCEVs), and plug-in hybrid electric vehicles (PHEVs). BEVs rely on electricity stored in their batteries, while FCEVs utilize hydrogen stored onboard and converted into electricity via a fuel cell. PHEVs combine a battery system with either an internal combustion engine (ICE) or a fuel cell system [14]. Both BEVs and FCEVs, along with battery/fuel cell-based PHEVs, are acknowledged as genuine zero-emission vehicles, emitting no CO2 or local air pollutants during operation [14, 15]. A comparison of fuel cost between hydrogen and gasoline-based vehicles is outlined in Table 1. This study is based on the same models with a gasoline engine and a hybrid engine running for a 100-kilometer journey. A few models, i.e., Audi A2H2, Volkswagen Touran HyMotion 2004, Volkswagen Touran HyMotion 2007, KIA Borrego FCEV, KIA Sportage, Mazda, and Hyundai, have almost equal or lower costs of fuel, whether on gasoline or hydrogen. Once hydrogen is produced locally, assuming a 30% reduction in the price of production, the estimated cost of using hydrogen as a fuel is far lower than that of gasoline for any mentioned model.

| Vehicle manufacturer | Vehicle model | Distance with hydrogen fuel (km) | Fuel consumption with gasoline (l/100 km)a | Capacity of hydrogen storage (kg) | Gasoline cost (US$/100 km) | Hydrogen cost (US$/100 km) | Estimated cost with local hydrogen (US$/100 km)b |

|---|---|---|---|---|---|---|---|

| BMW | Hydrogen 7 (V12 6.0I ICE) | 201 | 13.9 | 8 | 13.43 | 19.90 | 13.93 |

| Audi | A2H2 | 220 | 5 | 1.8 | 4.83 | 4.09 | 2.86 |

| Toyota | FCHV bus | 690 | — | 6 | — | 4.35 | 3.04 |

| Volkswagen | Touran HyMotion 2004 | 160 | 7.2 | 1.9 | 6.96 | 5.94 | 4.16 |

| Volkswagen | Touran HyMotion 2007 | 230 | 6.5 | 3.2 | 6.28 | 6.96 | 4.87 |

| GM | Hydrogen Minivan | 270 | — | 3.1 | — | 5.74 | 4.02 |

| GM | H2H Hummer (V8 ICE) | 100 | 17 | 5.5 | 16.42 | 27.49 | 19.25 |

| KIA | Borrego FCEV | 690 | 13 | 7.9 | 12.56 | 5.72 | 4.01 |

| KIA | KIA Sportage | 400 | 8 | 3.5 | 7.73 | 4.37 | 3.06 |

| Honda | FCX Clarity | 430 | — | 2.7 | — | 3.14 | 2.20 |

| Mitsubishi | Lancer Evo IX Hydrogen | 110 | 8.7 | 2.2 | 8.40 | 10.00 | 7.00 |

| Peugeot | 207 Epure (ICE and FC) | 350 | 6.6 | 3 | 6.38 | 4.28 | 3.00 |

| Mazda | Premacy Hydrogen RE Hybrid | 200 | 11 | 2.4 | 10.63 | 6.00 | 4.20 |

| Daimler | B-Class F-Cell | 400 | 6 | 11.1 | 5.80 | 13.87 | 9.71 |

| Mercedes-Benz | F125 Concept | 1000 | — | 7.5 | — | 3.75 | 2.62 |

| Hyundai | Tucson FCEV | 650 | 7.5 | 5.6 | 7.25 | 4.31 | 3.01 |

- ICE: internal combustion engine; FC: fuel cell; FCEV: fuel cell electric vehicle. aBased on the same models with gasoline engines or the same vehicles with hybrid fuel consumption. bBased on a 30% reduction in the costs of production.

1.3. Role of Hydrogen in Domestic Power

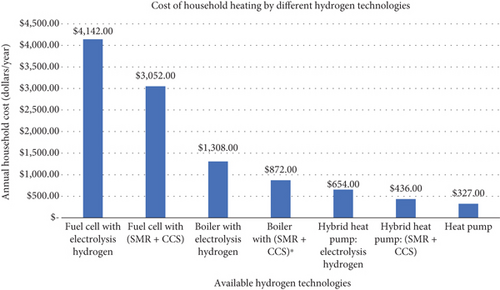

Fuel cell heaters, utilizing hydrogen as an energy source, represent an innovative approach to home heating. Unlike traditional heaters that combust gas or oil to produce heat, fuel cell heaters react hydrogen with oxygen, generating both electricity and heat [18]. This process does not involve burning hydrogen. An advantage of hydrogen-based heating is the potential to utilize the existing gas network for its transportation and leverage conventional technologies for storage [15, 18]. This approach is more cost-efficient, reducing the need for expensive new infrastructure for hydrogen transmission and distribution, and minimizes disruptions. Figure 1 presents a cost comparison of various hydrogen heating technologies for households.

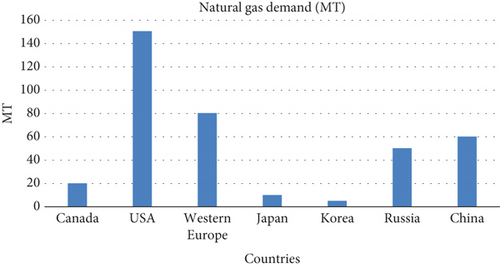

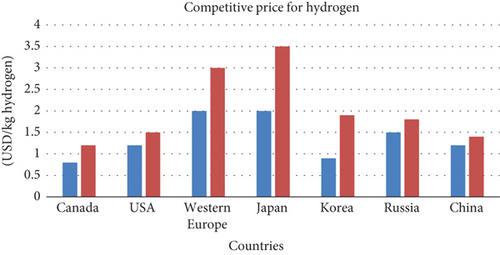

From Figure 1, it is clear that hydrogen produced by electrolysis in fuel cell is the costliest option for household heating, reaching about 4142 USD. Any technology when partnered with electrolysis bump up the cost while using the same technology with steam methane reforming and carbon capture reduces the expense. Table 2 illustrates the comparison between the current demand for natural gas and the theoretical demand for hydrogen (H2) for heating in buildings across seven countries. For hydrogen to replace natural gas in heating systems, its usage in current heating equipment must be practical, and its production, transmission, and distribution costs should be competitive with natural gas, the current standard for heating. This table projects natural gas demand for space heating and hot water production following improvements in building insulation as outlined in the Paris-compatible pathway. The “indicative demand” suggests the theoretical hydrogen demand, assuming that its production, transmission, and distribution are competitively priced. It also takes into account the typical lifespans of existing heating equipment, without considering premature equipment replacement. From this data, it is evident that hydrogen-based heating technologies still face significant challenges in competing with natural gas on a global scale, as the indicative demand for hydrogen is considerably lower than the current global demand for natural gas. Comparison between the demand for natural gas vs. theoretical hydrogen for domestic heating is depicted from Figures 2, 3, and 4 [13].

| Area of focus | Current role | Demand perspectives | Future deployment opportunities | Future deployment challenges |

|---|---|---|---|---|

| Flexible power generation | Limited adoption of commercial gas turbines operating with hydrogen-rich gases. Installed capacity: 363,000 fuel cell units (1,600 MW) | Transitioning 1% of global gas-fired power capacity to hydrogen by 2030 could generate 90 TWh of electricity and consume 4.5 Mt H2. |

|

|

| Back-up and off-grid power supply |

|

Increasing demand for reliable power supply, especially with the expansion of telecommunications. | Fuel cell systems in combination with storage as a cost-effective and less polluting alternative to diesel generators | (i) Higher initial investment compared to diesel generators |

| Long-term and large-scale energy storage | Three hydrogen salt cavern storage sites in the US and another three in the UK |

|

|

|

- Note: VRE: variable renewable energy.

1.4. Role of Hydrogen in Power Generation

Hydrogen and its derivatives are increasingly impacting the power generation sector. Their roles include enhancing flexibility in power generation, providing off-grid power solutions, and offering long-term energy storage. A table details these roles along with current and emerging demand sectors, plus the future potential or challenges in deployment. The primary challenges in implementing hydrogen-based products are the competition with other more adaptable and feasible power generation methods, substantial initial investments, and significant energy loss during storage conversion. However, future deployment opportunities such as integrating variable renewable energy into the power system, serving as an ecofriendly alternative to diesel generators, and offering low capital expenditure (CAPEX) for storage, position hydrogen and its derivatives as promising options in power generation. Table 2 summarizes these prospects, challenges, and opportunities in hydrogen for power generation.

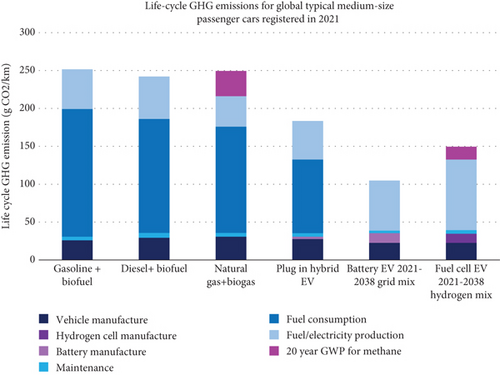

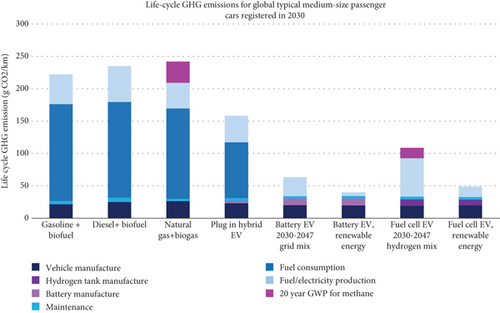

1.5. Role of Hydrogen in Reducing GHG Emissions

The charts depict the full lifecycle greenhouse gas (GHG) emissions of battery and fuel cell electric vehicles (EVs) registered in 2021 (Figure 5(a)), with a projected usage period of 15 to 18 years (Figure 5(b)). For battery EVs, GHG emissions from “fuel/electricity” production mainly arise from coal and natural gas used in power generation. This total also includes GHG emissions from manufacturing solar panels and wind turbines that generate renewable electricity for battery EVs, as well as losses in electricity transmission and EV charging. In the second chart, the increasing integration of renewable energy by 2030 significantly improves the lifetime climate performance of vehicles registered that year. Consequently, the life-cycle GHG emissions for both battery and hydrogen fuel cell EVs of 2030 models are substantially lower than those of 2021 models. In contrast, the GHG emissions from gasoline, diesel, and natural gas vehicles remain almost unchanged. Over time, the environmental advantages of using EVs compared to gasoline, diesel, and natural gas vehicles become more pronounced [19].

This paper discusses the current state and future projections of global hydrogen demand, evaluates global strategies for implementing hydrogen energy across various sectors, identifies key consumers of hydrogen based on different applications, discusses challenges faced in launching hydrogen initiatives, and proposes possible solutions. Additionally, it presents an approach for the commercial launching of hydrogen-based products, including marketing strategies and success metrics. By addressing these objectives, this review is aimed at providing insights into the pivotal role of hydrogen in the global energy transition and offering recommendations for effectively harnessing its potential for a sustainable future.

2. Existing and Projection of Hydrogen Demand

Hydrogen, as an energy carrier, has the potential to significantly impact the global energy landscape, both currently and in the future. Its application spans a diverse range of sectors, from transportation, where hydrogen fuel cell vehicles offer an alternative to fossil fuel-powered and battery electric vehicles, to industrial processes, particularly in refining and ammonia production where it is already extensively used [21, 22]. The push towards green hydrogen, produced through water electrolysis powered by renewable energy sources, highlights its role in decarbonizing sectors challenging to electrify, such as heavy industry and long-haul transportation [22]. However, challenges remain in the form of production costs, storage, and transport of hydrogen, as well as the need for substantial investment in infrastructure to support its widespread adoption. Future prospects for hydrogen utilization are vast and include blending into natural gas pipelines to reduce carbon intensity, in power generation for grid balancing and storage, and as a raw material in the production of synthetic fuels and chemicals, thereby further extending its applicability across the energy system. Nevertheless, the criticality of ensuring a sustainable and environmentally beneficial hydrogen economy cannot be overstated. This involves addressing the environmental impact of current hydrogen production methods predominantly from fossil fuels and ensuring that the shift towards green hydrogen production scales up in tandem with the expansion of renewable energy capacities [22, 23]. The development of international standards and policies supporting hydrogen’s integration into the energy system, alongside technological innovation and cost reduction in electrolysis and other production methods, are imperative for realizing hydrogen’s full potential. As such, hydrogen stands at the cusp of transforming from a niche energy carrier to a central pillar of a sustainable, low-carbon energy future, provided that the challenges in its path are effectively navigated [24, 25].

2.1. Existing Global Hydrogen Demand

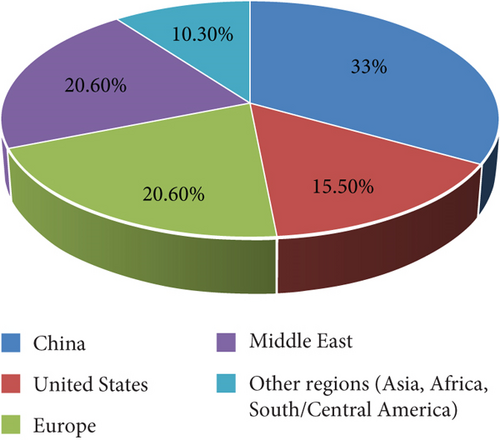

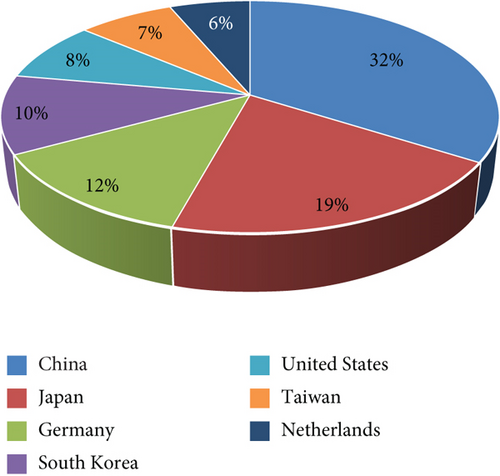

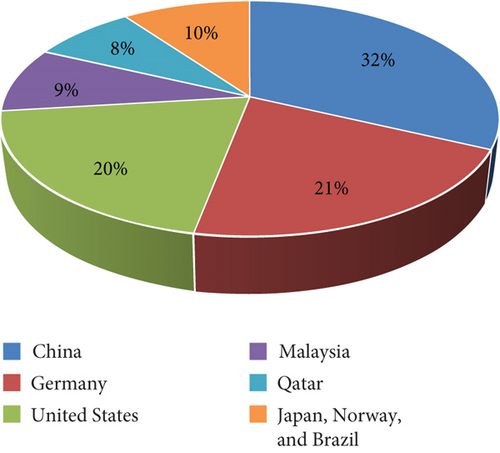

Hydrogen is becoming more and more important for clean and efficient energy solutions as countries worldwide try to tackle climate change and reduce their use of fossil fuels. It is used in many industries, like transportation and manufacturing, to help cut down on pollution and make energy supplies more secure. With the urgent need to address climate change, hydrogen is seen as a crucial part of shifting to cleaner energy sources. Figures 6(a), 6(b), and 6(c) provide a comprehensive overview of the global hydrogen market, showing the geographic distribution of hydrogen consumption in 2020 (a), the top importers of hydrogen in 2021 (b), and the leading exporters of hydrogen in 2021 (c).

In Figure 6(a), we see a breakdown of where hydrogen was consumed around the world in the year 2020. China stands out as the largest consumer, using 33% of the total hydrogen consumed globally. Following closely behind are the Middle East and Europe, each accounting for approximately 20.6% of the consumption. The United States also plays a significant role, accounting for 15.5% of the total consumption. Other regions, including Asia, Africa, and South/Central America, collectively make up 10.3% of the global hydrogen consumption. This distribution of hydrogen consumption provides insights into its versatile usage across regions globally. It highlights regions where hydrogen plays a critical role in various industries, facilitating strategic planning and investment in hydrogen infrastructure for its continued growth and development worldwide. Figure 6(b) describes the top importers of hydrogen in 2021. China remains a significant trader, with 32% of imports. Japan (19%) and Germany (12%) are other major importers, followed by South Korea (10%), the United States (8%), and Taiwan (7%). The Netherlands also appears on the list with 6%. Figure 6(c) outlines the top exporters of hydrogen in 2021. The United States emerges as a key exporter with 20% of the market share, closely followed by Germany at 21%. China’s exports account for 32%, which is substantial but not surprising given its leading role in imports as well. Japan, Norway, and Brazil represent 10% of exports together, with Malaysia at 9% and Qatar at 8%. These charts collectively imply that China is a central figure in the global hydrogen market, with significant stakes in all three trade sectors: consumption, importing, and exporting. European countries and the United States also play vital roles, indicating a diverse and global spread of hydrogen energy commerce. The data establishes the strategic importance of hydrogen as an energy source in these economies and predicts a growing trend in the shift towards alternative energy sources. Overall, these observations highlight the pivotal role of hydrogen in the transition to cleaner energy and highlighting the importance of continued investment in hydrogen infrastructure for its global expansion and development.

2.2. Projection of Hydrogen Demand (2030-2050)

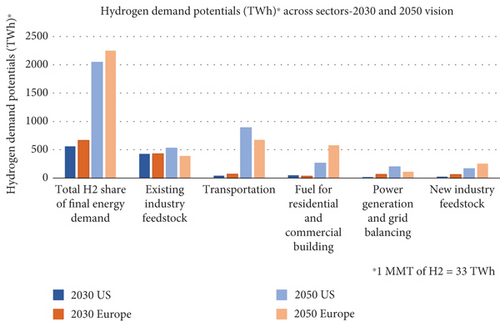

As we explore the future landscape of hydrogen utilization, it is important to examine the projected demand trends. Figure 4 shows the hydrogen demand potential in terawatt-hours (TWh) across various sectors for 2030 and 2050 in the US and Europe. It indicates significant growth in the total hydrogen share of final energy demand by 2050, particularly in Europe. The existing industry feedstock stays stable across the years. The transportation sector sees an increase in hydrogen demand, indicating a shift towards hydrogen-fueled transport. Hydrogen use for residential and commercial buildings is projected to rise, although it remains relatively small compared to other sectors. For power generation and grid balancing, the demand is expected to increase, reflecting hydrogen’s role in energy storage and managing intermittent renewable energy supplies. New industry feedstock shows moderate growth, and the suggested new applications for hydrogen in the future are depicted in Figure 7 [27, 28].

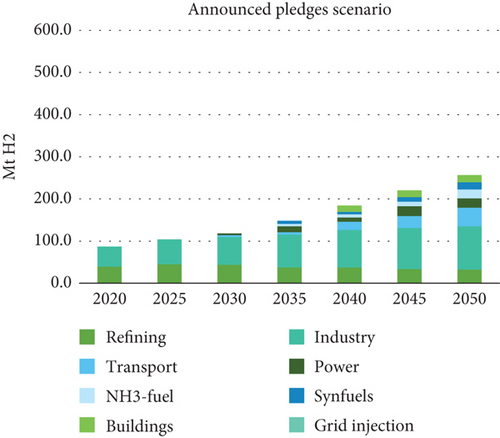

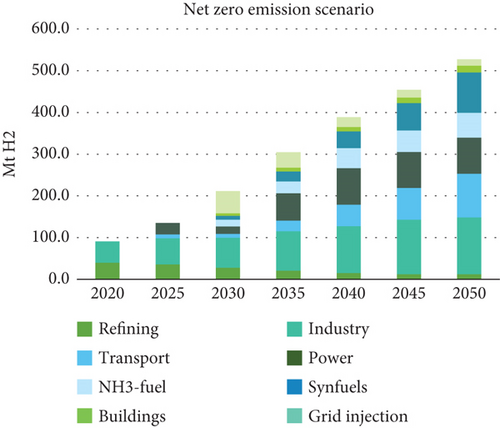

The US shows a significant anticipated increase in hydrogen demand for existing industry feedstock by 2050 compared to Europe. Europe seems to place a greater emphasis on hydrogen for transportation and power generation by 2050, likely reflecting more aggressive policies towards decarbonization and renewable energy integration. By 2050, both Europe and the United States expect a significant increase in the amount of hydrogen required across numerous industries. This indicates that developing a cleaner energy system is important to both regions, and hydrogen is one of them. It indicates that awareness of the significance of hydrogen for the transition to a greener future is beginning to spread. Both regions are preparing for the widespread use of hydrogen in various applications, including manufacturing, power plants, and automobiles. This aligns with global efforts being made by nations to combat climate change and promote sustainability. This suggests that hydrogen has the potential to significantly improve both the health of our planet and the strength of our economies. Variations in hydrogen demand over time and between countries are influenced by a number of factors, including economic situations, technological breakthroughs, government regulations, and the degree to which each region is committed to addressing climate change. Variations in demand trends point to the need for a planned response to environmental problems, energy security, and the viability of hydrogen production and use. It implies that areas are meticulously organized to tackle environmental issues, meet their energy requirements, and assess the viability of producing and utilizing hydrogen. These changes in consumer demand demonstrate a deliberate attempt to adopt greener energy sources and progress towards a more sustainable future. Figure 8(a) presents the global hydrogen demand by sector from 2020 to 2050 under the announced pledges scenario. The demand rises gradually, with the industry and transport sectors showing the most significant increase. This scenario likely reflects the current pledges by countries for hydrogen use, indicating a consistent gradual adoption with their stated goals. Figure 8(b) illustrates the global hydrogen demand by sector from 2020 to 2050 under the net-zero emission scenario [29]. Compared to the announced pledges scenario, this one shows a more obvious growth, especially after 2030, as efforts to reduce emissions intensify. The most substantial increases are observed in power and transport sectors, with significant demand in grid injection for energy storage, reflecting an ambitious drive towards a carbon-neutral future.

These figures highlight the growing role of hydrogen as an energy carrier across multiple sectors, with significant increases anticipated in response to climate goals and the transition towards low-carbon energy systems. The different divergent paths demonstrate the significant impact of current policy decisions and commitments on the global integration of hydrogen into our energy mix. The disparities highlight the crucial role that present-day policy choices will play in shaping the future energy landscape.

3. Global Strategies to Implement Hydrogen Energy

Tables 3, 4, and 5 present a comprehensive overview of national hydrogen strategies across various countries, indicating their commitment to developing hydrogen as an energy source for various sectors including industry, refining, transport, building, electricity, exports, mining, shipping, and aviation. From the details provided, it is clear that the United Kingdom, Czech Republic, Norway, and Hungary have the latest strategies in place. Meanwhile, Germany, France, Japan, and the European Union are highlighted for their significant financial commitments to advancing hydrogen energy production.

| Country | Document, year | Deployment targets (2030) | Production | Public investment committed |

|---|---|---|---|---|

| Australia | National Hydrogen Strategy, 2019 | None specified |

|

AUD 1.3 bln (~USD 0.9 bln) |

| Canada | Hydrogen Strategy for Canada, 2020 | Total use: 4 Mt H2/yr |

|

USD 19 mil by 2026 |

| Chile | National Green Hydrogen Strategy, 2020 | 25 GW electrolysis | Electrolysis (renewable) | USD 50 mln for 2021 |

| Hungary | National Hydrogen Strategy, 2021 |

|

Electrolysis fossil fuels with CCUS | n.a |

| Japan | Green Growth Strategy, 2020, 2021 | 420 kt low-carbon H2 800000 FCEVs | Electrolysis fossil fuels with CCUS | 2030 (~USD 6.5 bln) |

| Russia | Hydrogen roadmap 2020 | Exports: 2 Mt H2 | Electrolysis natural gas with CCUS | n.a |

| Norway | Hydrogen Roadmap, 2021 | n.a. |

|

for 2021 (~USD 21 mln) |

- Sectors of use: building, electricity, exports, industry, mining, shipping, and transport [13].

| Country | Document, year | Deployment targets (2030) | Production | Public investment committed |

|---|---|---|---|---|

| Czech Republic | Hydrogen Strategy, 2021 | Low-carbon demand: 97 kt H2/yr | Electrolysis | n.a |

| European Union | EU Hydrogen Strategy, 2020 | 40 GW electrolysis |

|

By 2030 (~USD 4.3 bln) |

| Korea | Hydrogen Economy Roadmap, 2019 |

|

|

In 2020 (~USD 2.2 bln) |

| France | National Strategy for Decarbonized Hydrogen Development, 2020 |

|

Electrolysis | By 2030 (~USD 8.2 bln) |

- Sectors of use: industry, refining, and transport [13].

| Country | Document, year | Deployment targets (2030) | Production | Public investment committed |

|---|---|---|---|---|

| Germany | National Hydrogen Strategy, 2020 | 5 GW electrolysis | Electrolysis (renewable) | By 2030 (~USD 10.3 bln) |

| Netherlands | Government Strategy on Hydrogen, 2020 | 3-4 GW electrolysis 300000 FC cars 3000 FC HDVs |

|

~USD 80 mln/yr |

| Spain | National Hydrogen Roadmap, 2020 | 4 GW electrolysis 25% industrial H2 decarbonized | Electrolysis (renewables) | ~USD 1.8 bln |

| United Kingdom | UK Hydrogen Strategy, 2021 | 5 GW low-carbon production capacity | Natural gas with CCUS Electrolysis | ~USD 1.3 bln |

- Sectors of use: building, electricity, exports, industry, mining, shipping, transport, and aviation [13].

A notable trend among these countries is the move towards sustainable hydrogen production. Germany, the Netherlands, Spain, the European Union, Chile, and Australia are particularly focused on generating hydrogen from renewable resources. This aligns with global efforts to decarbonize energy sources to mitigate climate change impacts. Other countries appear to rely more on carbon capture and storage (CCUS) technologies, which are used in conjunction with fossil fuel-based hydrogen production to reduce carbon emissions. Different strategies taken by different countries are summarized in Tables 3, 4, and 5.

4. Consumers of Hydrogen Based on Applications

Figure 9 is an overview of hydrogen energy logistics. It categorizes hydrogen production into four types: blue hydrogen (from natural gas with CO2 storage), green hydrogen (from renewables with no emissions), brown hydrogen (from coal with high emissions), and grey hydrogen (from natural gas with high emissions). Transport varies by distance and state of hydrogen, from gas in tube trailers to liquid in ships for international delivery. Storage options include cooling hydrogen to a liquid state, compressing it for vehicles, or using chemicals like ammonia for larger quantities. Consumers use hydrogen for transportation, heating homes, industrial processes, and exporting it overseas in liquefied form.

5. Challenges Faced in Hydrogen Launching and Possible Solutions

5.1. Production Costs

Reducing hydrogen production costs is critical for its emergence as a viable energy alternative. In Japan, the cost of generating power solely from hydrogen is around yen 97.3/kWh and yen 20.9/kWh for a 10% hydrogen blend with regasified LNG [30]. However, hydrogen imports in Japan, regardless of their production method (gray, blue, or green), are not expected to be cost-competitive with LNG or coal for power generation in the near future, considering the forecasted prices up to 2035. In the US, producing hydrogen from renewable sources is currently around $5 per kilogram, influenced mainly by the costs of renewable power equipment, electrolyzers, and hydrogen compressors. The US Department of Energy (DOE) aims to reduce hydrogen costs by 80% to $1 per kilogram, to expand its market, including in sectors like steel manufacturing and heavy-duty trucks. Technological advances and economies of scale could make hydrogen from solar photovoltaic (PV) competitive with that from natural gas, as per the IEA’s Roadmap to net zero by 2050. This roadmap suggests a scenario where hydrogen from renewables could drop to $1.30 per kilogram by 2030 in regions with rich renewable resources and to $1 per kilogram in longer term, making it competitive even without carbon capture and sequestration (CCUS). Furthermore, the costs of automotive fuel cells and electrolyzers are expected to decrease significantly, although a short-term rise in costs is possible due to high demand outpacing supply [30].

To mitigate the high production costs of hydrogen and make it more competitive, efforts focus on technological advancements and economies of scale. Strategies include investing in research and development to improve the efficiency of renewable power equipment, electrolyzers, and hydrogen compressors. Additionally, initiatives are aimed at increasing the deployment of renewable energy sources like solar photovoltaic (PV) to reduce the overall cost of producing hydrogen. These measures, along with anticipated reductions in the costs of automotive fuel cells and electrolyzers over time, are expected to contribute to making hydrogen a cost-competitive energy alternative.

5.2. Infrastructure

One of the major barriers to widespread adoption of green (and blue) hydrogen in the US is the slow development of low-carbon hydrogen infrastructure [31]. While large megaprojects are underway in Australia, the Middle East, the UK, Europe, and Africa, the US is lagging, despite having significant potential for production and consumption. Hydrogen prices for consumers depend on the availability and usage of refueling stations, as well as the competition from other fuels and the growing market share of battery electrification, particularly suited for personal vehicles [32]. Coordinated efforts involving federal, state, and local governments; industry; and investors are needed to address this. Achieving the Biden administration’s green hydrogen targets would necessitate substantial investments in renewable energy and power grid infrastructure to connect renewable power sources to green hydrogen production facilities.

As was previously said, there are logistical issues with the growing production of clean hydrogen for the transportation system, particularly in Europe. Several European countries are thinking of using their current gas pipelines for the transportation of hydrogen as a solution to this problem. Even though hydrogen may shorten the lifespan of pipelines, it is still possible to repurpose current infrastructure as long as pressure swings are controlled, and operating pressures are maintained within safe bounds. There are financial benefits to using existing pipelines for hydrogen transport; nevertheless, careful evaluations are required to ascertain whether a certain pipeline is suitable for hydrogen use. Careful consideration must be given to a number of aspects, such as the likelihood of leaks, detection techniques, the impact of hydrogen on pipeline integrity and end users, corrosion hazards, maintenance requirements, and precise gas flow metering. Utilizing existing infrastructure is predicted to result in significant cost savings compared to building new pipes. Although dedicated pipelines for the transportation of hydrogen are viable for moderate amounts and short distances, their implementation can be expensive. In an effort to cut costs and solve the difficulties related to the production and transportation of hydrogen, a number of research projects and continuing research activities are investigating ways to make the most of the infrastructure that already exists. These projects include integrating hydrogen into the natural gas infrastructure and repurposing pipes that are not being used for the transportation of hydrogen, with a special emphasis on parallel or disused pipelines that present excellent repurposing options [33–35].

5.3. Scaling Up to Industrial Applications

Scaling up is a major challenge for any new technology, including green hydrogen. Transitioning from small-scale demonstrations to large-scale industrial applications involves overcoming scientific, technological, logistical, economic, and sometimes political challenges. A 2020 Material Economics report highlighted that grid expansion significantly impacts the adoption speed of green hydrogen. Investment reluctance due to the unproven nature of the technology is a concern, particularly regarding capital expenditure (capex) and operational expenditure (opex). Europe, with a political climate more conducive to green hydrogen projects, is making strides in this area, supported by initiatives like the European Battery Alliance and the Clean Hydrogen Alliance. The EGHAC, backed by Breakthrough Energy and Bill Gates, offers financial and reputational support, potentially accelerating the adoption of green hydrogen in often a conservative energy industry.

To overcome the challenge of scaling up green hydrogen technology, strategies include fostering supportive political environments, increasing investment confidence, and investing in research and development to improve efficiency and affordability. Collaboration through initiatives like public-private partnerships and industry alliances is key to accelerating the widespread adoption of green hydrogen.

5.4. Regulatory

The absence of specific regulations and incentives is currently hindering the development of a clean hydrogen industry in the US. To foster growth, collaboration between the government and industry is necessary to ensure regulations do not hamper investment. The US lacks defined standards for labeling hydrogen as green or setting acceptable carbon limits for blue or “low-carbon” hydrogen. Developers, therefore, must be cautious to not exclude themselves from markets inadvertently. This situation increases engineering time and costs and could reduce operational efficiency, making hydrogen more expensive for consumers. Ideally, the US should collaborate with the European Union and Asian countries to establish global standards for hydrogen, facilitating a traded market similar to crude oil and LNG. Intending to mitigate the regulatory barriers that obstruct the clean hydrogen industry in the US, collaboration between government and industry is essential to establish clear standards and incentives. International cooperation can further facilitate the development of global hydrogen standards, promoting investment and market efficiency.

5.5. Attracting Investors

Despite the shared goal of promoting renewable energy, there are concerns that widespread adoption of green hydrogen might inefficiently divert resources from direct electricity generation. The International Renewable Energy Agency estimates that achieving a green hydrogen-driven energy mix would require increasing green hydrogen production by up to 158.3 million tons per year. This effort would necessitate building 2,243 GW of onshore wind capacity annually, over four times the existing global capacity. This raises efficiency concerns at a continental scale: the logic of investing in renewables for green hydrogen versus direct investment in renewable energy sources. Currently, there is no established market for green hydrogen in the US or elsewhere, and developers face challenges in managing market risk exposure. For green hydrogen projects to be bankable, they typically need long-term, fixed-price offtake contracts with reliable off-takers, structured on a take-or-pay basis, akin to early LNG projects [30].

To alleviate concerns about resource diversion from direct electricity generation, it is crucial to balance investments in green hydrogen and renewable energy sources while attracting investors. Collaborative efforts are needed to establish a reliable market for green hydrogen, offering long-term, fixed-price contracts to mitigate market risks and attract investors. Prioritizing the development of renewable energy infrastructure can further bolster investor confidence and support the growth of both sectors simultaneously.

6. An Approach to Commercial Launching of Hydrogen-Based Products

This section will further analyze the probable approach of advertising and commercializing hydrogen-based products in the market [21, 36].

6.1. Core Aspects of Hydrogen Marketing

While hydrogen holds considerable promise, there are substantial challenges in commercialization and marketing that must be tackled for it to fully realize its potential in powering humanity. After overcoming the technological obstacles, it is crucial to prepare and develop the market for hydrogen. Our suggestion is to implement a dual approach of market push and demand-pull strategies concurrently. In order to effectively meet market demand, a push-pull strategy involving both proactive and reactive measures is being implemented in the hydrogen supply chain and marketing. While the pull strategy focuses on meeting customer demand, the push strategy pushes products into the market. Here is how to build up a hydrogen push-pull strategy:

6.1.1. Push Strategy in Hydrogen Development

- (i)

Determining what laws are in place now and what needs to be covered in gaps

- (ii)

Encourage widespread production and blending of green hydrogen by granting tax exemptions

- (iii)

Include green hydrogen in the carbon intensity estimates of refineries

- (iv)

Establish a guarantee of origin certification program for renewable hydrogen-based system (RHS) electricity and green hydrogen

- (v)

RHS subsidies in the building and residential sectors

- (i)

Establishing and coordinating rules, codes, and standards (RCS)

- (ii)

The creation of dependable sensors and standardized metering protocols for use in residential and commercial buildings’ small spaces

- (iii)

Safety procedures for handling hydrogen at high pressure

- (iv)

Removing large RHS plants from storage areas to prevent the spread of explosions and deflagration

- (v)

The specification of safety parameters and guidelines for certain stationary uses

The push strategy is aimed at advancing hydrogen technology through strategic investments and collaborations to enhance production, infrastructure, and research. While promising, potential counterarguments include concerns about resource diversion, reliance on government support, feasibility of cost reductions, and effectiveness of collaborations. Addressing these concerns is crucial for ensuring a balanced and sustainable approach to hydrogen development.

6.1.2. Pull Strategy in Hydrogen Development

The pull strategy for hydrogen development focuses on creating market demand and increasing public and industry awareness of hydrogen energy’s potential. A central component of this strategy is initiating a comprehensive hydrogen marketing campaign on a national scale. The campaign is aimed at highlighting the benefits of hydrogen across various industries, including transportation, power generation, and domestic heating. By collaborating with media outlets, trade associations, and environmental organizations, the strategy seeks to enhance public knowledge about the environmental, economic, and energy security benefits of hydrogen.

- (i)

Promote the benefits of hydrogen and hybridization

- (ii)

Development of a clear, understandable legal framework and RCS

- (iii)

Instruction, data, conversation, and experience to increase end users’ consciousness and understanding

- (iv)

Include users in the creation of RHS

- (v)

Assist RHS with domestic needs

- (vi)

Teach end users how to utilize RCS and secure network of hydrogen

Targeted marketing is another crucial element of the pull strategy. This involves identifying key sectors such as transportation, manufacturing, and power generation where hydrogen can have a significant impact. Partnerships and alliances play a vital role in this strategy. The plan includes collaborating with a diverse range of stakeholders to create a national network for hydrogen distribution and fueling. Strategic alliances will be formed with businesses that can benefit from hydrogen use, such as automakers and energy providers. The aim is to generate demand for hydrogen and attract customers through competitive pricing and convenient access.

- (i)

Widespread application of RHS to reduce greenhouse gas emissions and prevent acidification linked to the production of hydrogen and energy from fossil fuels

- (ii)

Hydrogen-RES hybridization to lower the amount of land used for RES

- (iii)

Encourage the use of hydrogen storage since it has a smaller environmental impact than batteries, compressed air systems, or pumped hydro

- (iv)

Recover water from evaporation columns that was produced during FC operation

- (v)

Utilize wastewater treatment plants’ regenerate water. Establish clear guidelines for appropriate water management

Government incentive programs are also a key component of the pull strategy. This includes providing tax breaks, subsidies, or other financial incentives to encourage customers and businesses to invest in hydrogen-based products. By providing examples of effective hydrogen use in various industries and regions across the US, along with customer testimonials and case studies, the strategy is aimed at demonstrating the feasibility and practicality of hydrogen technology to potential clients. Finally, responsive supply chain management is integral to the pull strategy. This involves adapting production and distribution processes to create market demand.

There are doubts about whether marketing campaigns can truly alter energy consumption habits. Additionally, there is uncertainty regarding the feasibility of establishing a unified national hydrogen brand. Concerns have been raised about the long-term sustainability of relying solely on government incentives. Moreover, challenges exist in forming partnerships with key stakeholders. Furthermore, supply chains may struggle to quickly adjust to changes in the market.

6.2. The AIDA Model for Hydrogen

The AIDA model, an established marketing tool, is effectively use to understand effect of an action which may range from awareness to behavioral change (buying behavior). The first step, attention, involves highlighting hydrogen’s potential, introducing stakeholders and end user about the concept of sustainable energy solutions. Next, the interest phase focuses on presenting detailed strategies and initiatives from various countries and industries, thereby creating an informative and engaging narrative. In the desire phase, the model emphasizes the economic, environmental, and technological benefits of hydrogen, clarifying its advantages and promoting its adoption. Finally, the action phase involves a clear call for participation from global entities in the hydrogen initiative, underscoring the role of hydrogen in shaping a sustainable energy future. Overall, the AIDA model, seamlessly applied to hydrogen, catalyzes awareness, engagement, and enthusiastic participation in the quest for a sustainable energy in the future. Figure 10 shows the general schematic of an AIDA model.

The AIDA model for hydrogen is analyzed and elaborated in Table 6.

| Awareness |

|

| Interest |

|

| Desire |

|

| Action |

|

- (i)

Target the audience: tailor the message to resonate with specific groups like policymakers, businesses, or individual consumers

- (ii)

Use positive and persuasive language: focus on the benefits and opportunities that hydrogen presents

- (iii)

Be transparent and informative: address challenges openly and provide factual information

In the lagged effect, sometimes, consumers do not act immediately after receiving a message. It delayed the response to a marketing communication campaign. It usually takes several exposures before a consumer completely processes the message. This delay sometimes complicates the measurement of a campaign’s current impact. For a novel product like hydrogen, this phenomenon can be common. However, the campaign should focus on involving more stakeholders and addressing the public perception that hydrogen is a safe and cost-effective energy source. Significant perceived concerns about hydrogen need to be uncovered. Focus groups could be used as a starting point. For example, reactions to hydrogen might be unfavorable since individuals might be concerned about the flammability or explosiveness of hydrogen. An educational campaign might need to be developed to reduce these fears if they are unwarranted or overstated. As a third step, marketing research will need to be conducted periodically to keep consumers moving through the AIDA steps. It is suggested that governments might work to fund and otherwise support this research, as it will be ongoing and take several years and resources.

6.3. Developing Marketing Strategies for Hydrogen Business

Developing effective marketing strategies for hydrogen business ventures is very important. By following a structured approach, businesses can navigate the complexities of the market and position themselves strategically for success. The journey begins with defining the business’s overarching mission and objectives, aligning them with the broader vision of promoting hydrogen-based solutions. Subsequently, a thorough situation analysis, employing SWOT (strengths, weaknesses, opportunities, and threats) methodology, enables businesses to gain a comprehensive understanding of their internal capabilities and external market dynamics. Armed with this insight, the next step involves identifying opportunities within the market landscape, pinpointing areas where the business can capitalize and differentiate itself effectively. Through these strategic steps, businesses can lay a solid foundation for crafting shaped marketing strategies that resonate with target audiences and drive growth in the growing hydrogen sector.

6.3.1. Business, Mission, and Objective

The business mission objective of hydrogen production can vary. Below are few vital objectives of hydrogen harness.

(1) Environmental sustainability: Reduce dependence on fossil fuels: this is a primary goal that seeks to produce hydrogen, a fuel with no emissions at the point of use, to contribute to a greener energy future. The primary goal is to achieve net-zero emissions (NZE) by 2050.

(2) Develop green hydrogen production methods: Businesses may concentrate on electrolysis to create clean (green) hydrogen utilizing sustainable energy sources like solar or wind power.

(3) Economic profitability: Drive down production costs: achieving cost parity between hydrogen generation and conventional techniques is important for its extensive implementation. To do this, businesses may concentrate on economies of scale or technology developments.

(4) Become a major supplier of hydrogen: This goal is to take the lead in the market and secure a sizeable portion of the expanding hydrogen economy.

(5) Technological advancement: Develop efficient hydrogen production methods: this can entail developing and applying fresh electrolysis techniques or refining currently used techniques for obtaining hydrogen from various sources.

(6) Contribute to infrastructure development: To develop a strong hydrogen ecosystem, certain businesses may concentrate on constructing hydrogen production facilities, storage options, or filling stations.

(7) Scalability: Scalability in hydrogen production is a goal in light of the expanding need for clean energy in a number of industries and sectors, such as transportation, manufacturing, and power generation. Companies might concentrate on creating infrastructure and scalable production technologies that can support extensive networks for the production and distribution of hydrogen.

(8) Market penetration and adoption: This might be working with industry stakeholders in partnerships, taking part in advocacy and educational initiatives, and showcasing the benefits of hydrogen in a variety of applications. One potential research gap could be the need for further exploration and development of strategies to ensure the sustainability and environmental impact of hydrogen production, especially focusing on renewable energy sources. While the mission emphasizes domestic manufacturing of electrolyzers and production of hydrogen, there may be a gap in addressing the environmental sustainability aspect, such as reducing carbon emissions throughout the entire hydrogen production process. Additionally, more specific details regarding the identification and development of regions capable of supporting large-scale hydrogen production include considerations for infrastructure, resource availability, and environmental impacts. Further research could focus on optimizing the selection criteria for these regions to maximize efficiency and minimize negative environmental consequences.

6.3.2. Situation Analysis (SWOT)

SWOT stands for strengths, weaknesses, opportunities, and threats. It is a useful tool for businesses to assess their current situation and make informed decisions about their strategies. Table 7 shows the SWOT analysis for developing marketing strategies for hydrogen business.

| Strengths |

|

| Weakness |

|

| Opportunities |

|

| Threats |

|

In this table, we identify the internal factors (within the control of the business) such as strengths and weaknesses and external factors (outside the control of the business) such as opportunities and threats. This analysis helps businesses to capitalize on their strengths, address their weaknesses, seize opportunities, and mitigate threats effectively in the competitive market landscape.

However, this analysis of hydrogen businesses shows some areas where more research is needed. One gap is the absence of clear rules and standards in the industry. This could slow down the adoption of hydrogen and make it harder for businesses to follow the rules. Another gap is the lack of detailed studies on what people want and need when it comes to hydrogen energy in the EU. Having more information about what customers want could help businesses make better decisions and succeed in the market. So, more research is needed to fill these gaps and help the hydrogen industry grow better.

6.3.3. Identify Opportunities

In the process of developing marketing strategies for hydrogen-based businesses, identifying opportunities involves not only analyzing the market landscape but also incorporating segmentation, targeting, and positioning (STP) strategies. This complex approach allows businesses to tailor their offerings to specific market segments, effectively reach their target audience, and strategically position themselves for success in the dynamic hydrogen sector. Let us explore how businesses can leverage segmentation, targeting, and positioning to identify and capitalize on opportunities in the market. Table 8 shows the three key parts of identifying opportunities in the market landscape.

| Segmentation | Targeting | Positioning |

|---|---|---|

|

|

|

6.4. Market Segmentation Analysis

Market segmentation analysis provides valuable insights into the diverse factors shaping the global hydrogen market. By categorizing market dynamics based on various criteria, businesses can identify growth opportunities and tailor their strategies to meet evolving consumer demands.

6.4.1. By Technology

The worldwide hydrogen market is divided into four main segments by technology: steam methane reforming (SMR), electrolysis, coal gasification, and others. SMR holds the largest share, propelled by rising crude oil demand, supportive government policies, ongoing research to improve SMR technology, and a well-established methane supply chain. On the other hand, electrolysis is experiencing rapid growth due to the demand for renewable energy sources, government incentives, and decreasing costs of electrolyzer equipment.

6.4.2. By Sector

The demand for hydrogen is divided into five key sectors: existing industrial applications, transportation, power generation, heating for buildings and industries, and emerging industrial uses. The mobility sector is projected to experience significant expansion in the foreseeable future, driven by heightened investments in fuel cell technology, the rollout of fuel cell vehicles, the establishment of additional hydrogen refueling infrastructure, and efforts to reduce carbon emissions in transportation.

6.4.3. By Source

There are three primary classifications for hydrogen production: low carbon, renewable, and gray. At the moment, grey hydrogen—which comes from fossil fuels—has the biggest market share. But there is a growing expectation that the generation of low-carbon hydrogen and green hydrogen from renewable sources will increase significantly. The increase in the production of renewable hydrogen is ascribed to the worldwide movement towards sustainable energy practices and the acknowledged durability of this production technique in the long run. Simultaneously, a number of businesses’ efforts to reduce carbon emissions are driving up demand for low-carbon hydrogen.

6.4.4. By Region

Several regions are considered in the analysis of the global hydrogen market, including Asia Pacific, North America, and Europe. Asia Pacific is the region with the fastest rate of growth in the global hydrogen market out of all of them. Its impressive rise can be ascribed to a number of things, such as the growing demand for sustainable energy solutions, the notable presence of refineries in important countries like China and India, policies that are supportive of the industry, the increased demand for hydrogen in the production of electricity, investments made to expand the infrastructure for hydrogen refueling, and the adoption of alternative transportation options like electric cars and automated buses.

Market segmentation analysis serves as a vital tool for understanding the complex dynamics of the global hydrogen market. By examining the market through various lenses, businesses can identify strategic opportunities, mitigate risks, and position themselves for success in this rapidly evolving industry. While the market segmentation analysis provides valuable insights into the global hydrogen market, there are still some research gaps to be addressed. These include understanding the integration of different market segments, exploring emerging technologies’ impact, focusing into regional variances within key markets, examining market access and distribution channels, and investigating consumer behavior and preferences. Addressing these gaps could lead to a more comprehensive understanding of the market dynamics and inform strategic decision-making for businesses and policymakers involved in the transition to a hydrogen-based economy.

6.5. Global Hydrogen Market Dynamics

Understanding the dynamics driving the global hydrogen market is essential for stakeholders seeking to capitalize on emerging opportunities and navigate challenges. This section explores the key growth drivers, challenges, and trends shaping the landscape of the hydrogen market on a global scale.

6.5.1. Growth Drivers

The global hydrogen market is experiencing robust growth due to increasing demand for hydrogen across various industries, favorable government policies and incentives, the need for decarbonization and achieving net-zero emission goals, and the rise of hydrogen as a sustainable alternative to fossil fuels. Commitments by major economies to achieve net-zero emissions by 2050, declining costs of renewable energy sources like solar and wind, and emerging applications of hydrogen in sectors like steel manufacturing are contributing to higher hydrogen consumption.

6.5.2. Challenges

Challenges to the market’s growth include energy conversion losses associated with hydrogen production cost with existing technology, production in sustainable manner, and competition from alternative technologies. Storing hydrogen in gaseous form (low energy density) leads to inherent energy loss during compression, liquefaction, and solid-state storage, which accounts for a significant portion of the total energy content. Establishing a robust infrastructure for hydrogen distribution is another challenge. Other than that, the most common way to produce hydrogen today is from natural gas (grey hydrogen). While the hydrogen itself burns clean, this process releases greenhouse gases. Blue hydrogen captures these emissions, but the technology is still developing.

6.5.3. Market Trends

Emerging trends in the hydrogen market include the increasing adoption of hydrogen fuel cells, a growing number of hydrogen projects, decreasing distribution costs, the use of green hydrogen, a focus on achieving net-zero emissions targets, and ongoing technological advancements in hydrogen generation. Major corporations and organizations are initiating hydrogen projects to boost production and consumption, creating new business opportunities and investment prospects.

In summary, the dynamic interplay of growth drivers, challenges, and trends is crucial for stakeholders to navigate the global hydrogen market. By staying informed about market dynamics, businesses can identify strategic opportunities, address challenges effectively, and position themselves for success in this evolving landscape. While understanding the dynamics of the global hydrogen market is crucial, there are still research gaps to be addressed. These include exploring the efficiency of hydrogen production, investment cost, storage technique, and mass people awareness (about why hydrogen) and assessing their environmental impacts. Additionally, more research is needed to overcome the economic barrier and social implications of transitioning to a hydrogen-based economy. By addressing these gaps, stakeholders can make more informed decisions in navigating the hydrogen market landscape.

6.6. 5 P’s Strategy in Business Area

6.6.1. Product

Hydrogen is recognized for its innovative role in energy storage from renewable sources. Its versatility extends to transportation and power generation, offering a low-cost alternative to traditional fuels. The development of hydrogen-based products reflects a growing trend towards sustainable and efficient energy solutions.

6.6.2. Price

Maintaining a competitive price for hydrogen is crucial. This involves not just the raw cost of production but also considers long-term savings and environmental benefits. Subsidies and incentives, as seen in initiatives like Germany’s publicly accessible hydrogen network and Australia’s national hydrogen strategy, play a vital role in making hydrogen cost-competitive.

6.6.3. Promotion

Targeted training programs are essential to increase awareness and adoption among local transport and power generation companies. Seasonal discounts, customer loyalty programs, and government-organized seminars and fairs can effectively promote hydrogen technologies. Public-private partnerships, like the EU’s Fuel Cells and Hydrogen Joint Undertaking, have been instrumental in advancing hydrogen technologies through coordinated efforts.

6.6.4. Place

Building a robust distribution network ensures hydrogen is accessible where and when needed. This includes strategically located hydrogen production facilities and refueling stations, optimized to integrate with existing transit systems. The focus on developing infrastructure, as seen in regions like the US and EU, is crucial for the widespread adoption of hydrogen energy.

6.6.5. People

Skilled personnel trained in hydrogen technology can enhance customer service and effectively communicate the benefits of hydrogen. Hiring local, community-friendly staff can also help in establishing a strong connection with the customer base and foster adoption. The emphasis is on building a knowledgeable team that can navigate the complexities of hydrogen energy and communicate its advantages effectively. The 5 P’s strategy for hydrogen energy, enhanced with recent market insights, underlines the need for innovation, competitive pricing, strategic promotion, effective distribution, and skilled personnel. The changing nature of the hydrogen market presents unique opportunities and challenges that need to be addressed through a comprehensive and adaptive marketing strategy. This approach is critical to accelerating the transition to a sustainable hydrogen economy. Research in the area of the 5 P’s strategy in the hydrogen business reveals several gaps. Firstly, there is a need for more studies examining the effectiveness of different pricing strategies for hydrogen, considering factors like production costs, environmental benefits, and consumer behavior. Secondly, further research is necessary to assess the impact of various promotion techniques, such as training programs and government incentives, on increasing adoption rates of hydrogen technologies. Additionally, studies exploring the optimal placement of hydrogen production facilities and refueling stations, particularly in regions with limited infrastructure, are essential to facilitate widespread accessibility. Lastly, more research on the role of skilled personnel in promoting hydrogen adoption and the effectiveness of hiring strategies in building a knowledgeable workforce can provide valuable insights for businesses and policymakers aiming to promote hydrogen energy.

6.7. Planning and Measuring Success of Hydrogen Business

Before diving into the specifics of planning and measuring success in the hydrogen business, it is crucial to establish the goals and objectives that guide these efforts. This section outlines the strategic understanding of desired outcomes and sets the stage for discussing short-term and long-term goals.

6.7.1. Goals

The overarching goal of hydrogen businesses is to strategically understand and achieve desired outcomes. In the short term, efforts are focused on increasing customer inquiries about hydrogen products and enhancing awareness of product safety. Looking ahead, long-term objectives include boosting sales of hydrogen-based products, expanding the market share of hydrogen in the energy sector, and fostering customer loyalty towards transitioning energy usage to hydrogen. These goals provide a roadmap for guiding business strategies and initiatives, ensuring alignment with broader objectives in the dynamic hydrogen market.

6.7.2. Measuring Success Using Marketing Metrics

Once the budget for marketing communication and its campaign is developed and implemented, it is necessary to measure the success of the campaign using various marketing metrics. While measuring the promotional effectiveness of the hydrogen market, the “lagged effect” must be considered. It may take several exposures before consumers shift to hydrogen energy from traditional fuel-based energy.

(1) Traditional Media Metrics. When and how often have consumers been exposed to marketing communication? The measurement can be done by calculating the “frequency” of exposure. Frequency states how often the audience is exposed to communication within a specific period of time. The other method is “reach” which states the percentage of the target population exposed to specific marketing communication, such as advertisements.

Gross rating points (GRP): GRP = “reach” × “frequency”. If 50% of the targeted population is reached by 7 advertisements, then GRP = 350.

(2) Web-Based Media Metrics. This includes paid search, display ads, email, and sponsorship. While the percentage change in digital ad spending to total spending is slowing, the absolute level of spending and relative share of digital marketing is still increasing. Effective planning and measurement are integral to the success of hydrogen businesses in the competitive market landscape. By setting clear goals and utilizing appropriate marketing metrics, businesses can optimize their strategies, maximize ROI, and drive sustainable growth in the hydrogen sector. Research gaps in planning and measuring success in the hydrogen business include the need for comprehensive studies on effective marketing metrics, understanding long-term effects of marketing campaigns, optimal allocation of marketing budgets, and exploring consumer perceptions and attitudes towards hydrogen energy.

7. Conclusion

In conclusion, this comprehensive literature review on hydrogen launching strategies in energy market highlights the complexity inherent in transitioning to a new fuel model. The complex character of this shift is evident in the various strategies implemented by nations worldwide to incorporate hydrogen-based products into the energy market. Recognizing hydrogen as a crucial alternative to traditional fuels, the review emphasizes its significance for environmental sustainability, future energy supply, and cost-effectiveness. The challenges associated with this paradigm shift are not to be underestimated, as evidenced by the barriers of cost structures, technical difficulties, and marketing challenges. Nevertheless, the necessity to adopt hydrogen as a fundamental element of the energy blend cannot be emphasized enough. Beyond its role in mitigating environmental impact, hydrogen holds immense promise for securing future energy supplies and maintaining lower costs in the long run. As the global community faces the complications of this transition, the findings of this literature review shed light on existing gaps in strategies that necessitate careful consideration. The analysis shows the importance of a dual push-pull strategy in marketing hydrogen-based products, emphasizing initiatives like investing in technology, expanding infrastructure, and strategic promotion. The 5 P’s strategy further highlights innovation, competitive pricing, and skilled personnel as critical factors. However, research gaps remain in areas like pricing strategies and consumer perceptions. Effective planning and measurement, guided by clear goals and metrics, are crucial for sustainable growth. The proposal for marketing actions presented in this article serves as a guide for accelerating the commercialization and widespread adoption of hydrogen energy. Adopting hydrogen is not merely an option; it is a crucial step towards a sustainable and resilient energy future. Finding the right balance between technology, money, and taking care of nature is key to making hydrogen work well for energy. A cohesive marketing strategy is essential for navigating the dynamic hydrogen market and driving the transition to a sustainable energy future. The statistical and scientific analyses presented here can serve as a foundation for practical, implementable actions aimed at overcoming existing barriers to hydrogen energy commercialization. For instance, the identified cost structures, technical complexities, and marketing challenges can be addressed through specific policy recommendations, technological advancements, and strategic marketing plans. By emphasizing a targeted push-pull strategy in marketing hydrogen technologies, advocating for the development of supportive legislative frameworks, and fostering the adoption of innovative production and storage solutions, this study is aimed at equipping policymakers, industry leaders, and energy providers with the necessary tools to accelerate the adoption of hydrogen as a sustainable energy source. The transition to hydrogen-powered public transportation systems, as seen in pilot projects involving hydrogen buses and trains in regions like California and Germany, demonstrates the feasibility and environmental benefits of adopting hydrogen as a cleaner energy source. Furthermore, the deployment of hydrogen fuel cell technology in sectors such as logistics and warehousing, evidenced by companies like Amazon and Walmart adopting fuel cell forklifts, illustrates the efficiency gains and emission reductions achievable with hydrogen energy. These cases show hydrogen’s viability as an energy source and suggest ways stakeholders can integrate hydrogen technologies for efficiency and sustainability.

Disclosure

We acknowledge that this manuscript was initially submitted as a preprint.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Acknowledgments

We extend our gratitude to the preprint platform for facilitating early dissemination and feedback that have significantly contributed to the final version of this manuscript [37].

Open Research

Data Availability

No underlying data was collected or produced in this study. This is a narrative review article. The numeric numbers and figures are drawn from online available literature which has been cited inside the article.