[Retracted] Core Technology Optimization of Intelligent Financial Technology Based on Collaborative Filtering Algorithm in Big Data Environment

Abstract

With the improvement of people’s economic level, people pay more attention to financial investment. At present, the financial industry provides customers with a variety of investment services, but it has always been unable to provide targeted services for customers. Based on this, this paper studies the optimization of intelligent financial technology core technology based on collaborative filtering algorithm in the big data environment. On the basis of a simple analysis of the application of financial core technology and the research status of collaborative filtering algorithm, this paper constructs an application model of intelligent financial collaborative filtering algorithm. In view of the shortcomings of collaborative filtering algorithm, it uses user-based clustering algorithm to improve the collaborative filtering algorithm. According to the frequency of customers’ access to financial products, the attention model is established and simulated. The results show that the collaborative filtering optimization algorithm used in this paper can reduce the absolute error of recommendation and improve the accuracy.

1. Introduction

With the development of information technology, various financial products are emerging. In addition to common banking products, other financial products have also attracted the attention of many investors [1]. The core business of the financial industry includes the following three aspects: (1) liability business refers to the business that forms the source of funds, and its funds mainly come from its own funds and foreign investment; (2) asset business refers to the business in which the bank uses the funds raised through liability business; (3) intermediary business refers to the business in which a bank does not need to use its own funds but only undertakes entrusted matters such as payment on behalf of customers and charges corresponding handling charges. In the core business of the financial industry, in addition to the traditional deposit business, the sales of financial products have also become one of the core businesses [2, 3]. However, the quality of a wide variety of products in the financial industry is not exactly the same. It is also accompanied by many financial risks. How to avoid risks is crucial to the development of the financial industry. Improving the accuracy of product recommendation is a good way. In financial product recommendation, collaborative filtering algorithm is widely used at present. It can recommend corresponding financial products according to the characteristics of users [4]. However, this collaborative filtering algorithm only recommends according to the scoring data in the application, and the accuracy is not particularly high. There is a cold start problem in the application of the algorithm. There are missing values when analyzing the user matrix. Whether it is deleted directly or the average value will affect the accuracy of the results.

Based on this background, this paper studies and analyzes the optimization of the core technology of intelligent financial technology based on collaborative filtering algorithm in the big data environment, which is mainly divided into four chapters. The first chapter briefly introduces the recommendation status of financial core business and the chapter arrangement of this study. Chapter 2 introduces the application of recommendation algorithm and collaborative filtering algorithm at home and abroad and the research status of improved algorithms and summarizes the shortcomings of the current research. In Chapter 3, the optimization model of intelligent financial technology core technology based on collaborative filtering algorithm in big data environment is constructed. Aiming at the shortcomings of collaborative filtering algorithm, cluster analysis algorithm is used to improve it. The improved collaborative filtering algorithm only focuses on the shortcomings of user scoring, improves the accuracy of algorithm recommendation, and reduces errors. In Chapter 4, the optimization model of collaborative filtering algorithm constructed in this paper is simulated and analyzed to measure the performance of the algorithm under different number of clusters and nearest neighbors. The experimental results show that when the number of clusters is 25, the performance of the algorithm is the best. Compared with the traditional collaborative filtering algorithm, the accuracy and product diversity have been significantly improved.

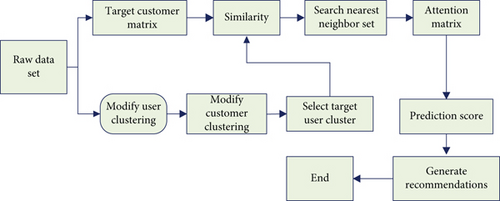

The main point of this paper is the improvement of collaborative filtering algorithm. In the improvement of collaborative filtering algorithm, generally only based on the user rating data, using clustering to improve also has this problem. In this paper, the clustering analysis is carried out from the two aspects of initial class center and distance. After improving the clustering algorithm, the collaborative filtering algorithm is used to achieve product recommendation and improve the quality of recommendation.

2. State of the Art

The financial industry has the characteristics of customer intensive, so it is inevitable to use data mining technology in financial institutions. As an important part of the financial industry, banks have added many investment products in addition to time deposits in their core business. Accurately recommending products for customers plays a great role in the development of banks. At present, the core technology of the financial industry has widely used intelligent algorithms to mine information. In their research and analysis, Shang et al. determined the frequent fuzzy option set through fuzzy clustering method, parallel rules, and parallel mining algorithm, so as to obtain the fuzzy association rules that meet the minimum fuzzy reliability and analyze the financial risk [5]. In the bank telemarketing analysis, Moro et al. used data-based sensitivity analysis to extract feature correlation and also used expert evaluation to decompose and describe the telemarketing contact to sell bank deposits [6]. Tang et al. used the method of fuzzy subset selection in their research to characterize the relevant indicators that have a great impact on the trading history, automatically customize the indicators of different financial products in different markets, and the selection algorithm runs in the frequency domain to identify and match the peak value and technical indicators in the key patterns and trading volume [7]. Collaborative filtering algorithm is widely used in financial product recommendation. This algorithm has also been improved in different fields in recent years. In their research, Yu et al. proposed a cross domain collaborative filtering algorithm to expand the user and project features through the potential factor space of the auxiliary domain. The recommendation problem is described as a classification problem in the target domain. Taking the user and project location as the feature vector, funk SVD decomposition is used to extract additional user and project features from the user and project side auxiliary domains, respectively, so as to expand the two-dimensional location feature vector [8]. Pan et al. proposed an improved collaborative filtering algorithm, which uses the confidence coefficient to distinguish the reliability of the score. The program recommends items by comprehensively considering the predicted score and predictability of the items and converts the program into a 0-1 knapsack problem, so as to select the optimized recommendation list [9]. Li et al. proposed the collaborative filtering algorithm based on category priority K-means (cpckcf) and proposed the definition of user item category preference ratio (uicpr) to calculate the uicpr matrix [10].

To sum up, it can be seen that the application of intelligent algorithms in the core businesses of the financial industry has been relatively common at present. It can mine and analyze data and improve the efficiency. However, the intelligent core technology also has its own limitations. With the increasing data, it has been unable to meet the development needs of customers. On the other hand, there are many improvements in the recommendation algorithm, but there are not many research results applied to the financial industry. Therefore, it is of great significance to carry out the research on the optimization of the core technology of intelligent finance based on collaborative filtering algorithm in the big data environment.

3. Methodology

3.1. Intelligent Financial Technology Core Recommendation System

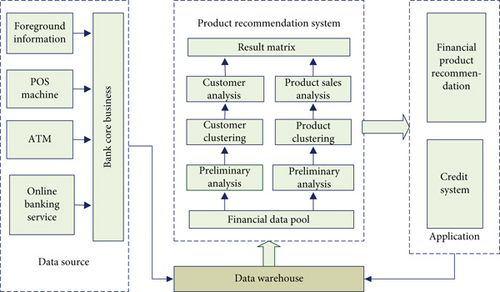

Among the core technologies of science and technology in the financial industry, product sales and financial risk technology are the core technologies. Collaborative filtering algorithm is widely used in product sales. As a recommendation system, collaborative filtering algorithm has many similarities with other recommendation systems. It is to find potential customers and provide personalized product sales services to improve customer satisfaction [11]. Compared with other recommendation algorithms, collaborative filtering algorithm mines information according to the association between users and products, not just users themselves. In application, it has low requirements for data and does not need to extract text information. In recommendation, it can mine many similar products according to the calculation of user similarity, with simple technical operation and strong scalability [12]. Collaborative filtering algorithm is widely used in various fields of customer recommendation, as shown in Figure 1.

In the field of financial product sales, collaborative filtering algorithm is established in the unified processing, storage, and analysis of various financial systems. In customer analysis, it is necessary to make a detailed mining of customer basic information, product information, and historical transactions [13]. The financial database needs to store the product-related data extracted from the core system and data and also covers the basic information of users, product information, and so on. In the data mining module, the data mining algorithm is used to classify customers and realize cluster analysis. In the data analysis module, products are combined and classified to provide customers with corresponding product services.

When providing users with personalized products and services, collaborative filtering method has many advantages compared with other algorithms, such as filtering the content that is difficult to analyze by the machine, summarizing the previous experience, avoiding inaccurate analysis, and filtering some complex content [14]. Collaborative filtering algorithm has the ability of recommendation information, can provide users with completely unknown information, and can realize automatic recommendation and improve efficiency. However, collaborative filtering algorithm also found many deficiencies in the application. In the collaborative filtering algorithm, there is basically no evaluation of customers, so it is impossible to accurately analyze customers’ preferences and realize accurate recommendation [15]. With the increase of user scale, the number of items and products is increasing sharply, but the user score is always sparse. In this case, the collaborative filtering algorithm is difficult to provide users with more recommendation information and will affect the accuracy of the algorithm [16]. From the perspective of data analysis, collaborative filtering algorithm only uses part of the information to mine, and the recommendation accuracy and scalability are not completely solved. Therefore, it is necessary to optimize the collaborative filtering algorithm.

3.2. Optimization Design of Collaborative Filtering Algorithm

4. Result Analysis and Discussion

4.1. Simulation Analysis of Optimized Collaborative Filtering Algorithm

The financial product database is used for simulation analysis. These data are from stock information. The file covers the scoring records of more than 6000 users on stocks, and the stock information covers hundreds of kinds. The data were randomly divided into two groups, 60% of which were used as test data and 40% as training set. The average absolute error MAE commonly used in the recommendation algorithm is used for scoring. The smaller the value, the better the classification effect. The average absolute error of collaborative filtering algorithm does not change significantly with K value. The average absolute error of the improved algorithm first decreases and then increases with K value. When K value is 25, the average absolute error is the smallest. The improved algorithm is better than the collaborative filtering algorithm.

In the improvement of the algorithm, the K-means clustering algorithm is used to classify users, so the K value is changed to discuss the impact on the algorithm. The K value determines the size of the search space of the target user, and the appropriate number of classifications can get higher similarity. In the simulation, the number of nearest neighbors is 40, and the size of the number of clusters K is changed. The measurement results are shown in Figure 3. From the data changes in the figure, it can be seen that the error decreases continuously and the accuracy is improved at 5 ~ 25. When it continues to increase, the change is not obvious. At this time, because K is small, the distinction is obvious, and the difference is large. It is impossible to accurately analyze the nearest neighbors. The number of users’ nearest neighbors is too large, and the analysis of users’ nearest neighbors is not necessarily accurate. Therefore, the value of K is 25.

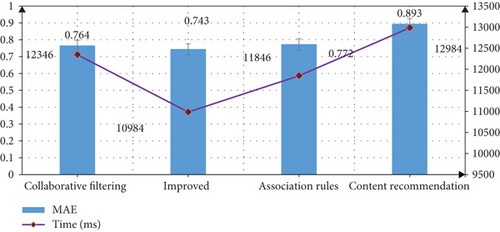

Analyze the impact of the improved algorithm on the effectiveness of the financial product recommendation algorithm. The nearest neighbor value is 40, and the number of clusters is 25. The traditional algorithm and the improved collaborative filtering algorithm are used for simulation analysis. The measurement results are shown in Figure 4. It can be seen from the data changes in the figure that the improved algorithm has significantly improved the recommendation efficiency and shortened the running time.

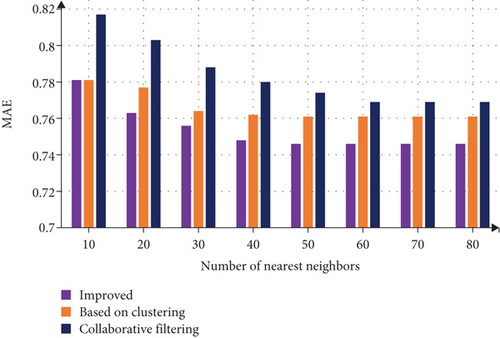

By comparing and analyzing the accuracy of the algorithm, change the number of nearest neighbors and take the value of K as 25. The measurement results are shown in Figure 5. It can be seen from the figure that the accuracy has been improved with the increase of the number of nearest neighbors. In comparison, the accuracy of the algorithm proposed in this paper is higher.

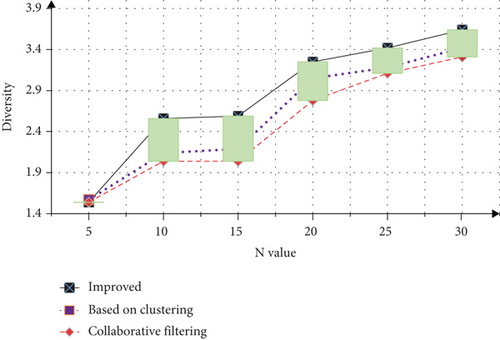

There are many types of financial products. When providing products to customers, we need to ensure the diversity of products. Therefore, we also need to consider the diversity of different algorithms. The measurement results are shown in Figure 6. It can be seen from the data in the figure that with the increase of parameter values, the diversity is increasing. In comparison, the diversity of the algorithm proposed in this paper is richer.

4.2. Simulation Analysis on Core Technology of Financial Product Recommendation

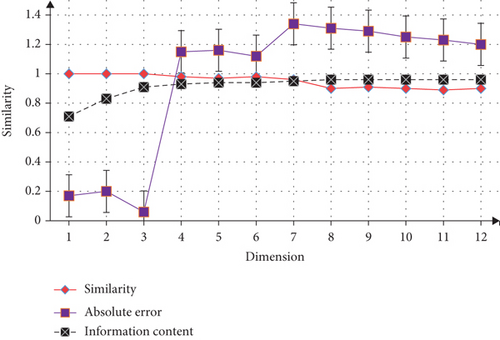

Taking the stock recommendation of financial products as an example, the simulation analysis is carried out. The original data covers the stock code, recent trading date, rise and fall range, turnover rate, closing price, and other data of thousands of Shanghai stock exchanges. In order to facilitate the calculation, the missing value of stocks is supplemented by inserting the average value. Convert the data into values of the same dimension for comparative analysis. The stock data is sorted and normalized. Considering the high complexity of data and inconvenient for rapid processing, dimensionality reduction is needed. PCA is used as the dimensionality reduction scheme to retain the amount of information, and the information can be concentrated in the first few dimensions. Calculate the cosine similarity of data after dimension reduction. Figure 7 shows the results of data cosine similarity, absolute error, and retained information. From the data in the figure, we can see that the similarity range is 0.9 ~ 1.1, the similarity is very high, and the average absolute error does not exceed 1.5%.

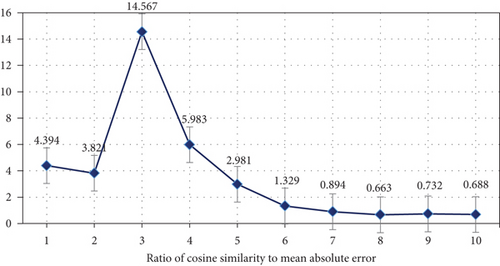

Calculate the cosine similarity and average absolute error ratio of the data. The measurement results are shown in Figure 8. It can be seen from the figure that this value is constantly changing. When the dimension is 3, the ratio reaches the maximum. Therefore, the financial data indicators can be reduced to 3 dimensions for analysis, which can retain more information and reduce the amount of information processing. The similarity and average absolute error are both small.

5. Conclusion

The average absolute error of collaborative filtering algorithm does not change significantly with K value. The average absolute error of the improved algorithm first decreases and then increases with K value. When K value is 25, the average absolute error is the smallest. The improved algorithm is better than the collaborative filtering algorithm. The K-means clustering algorithm is used to classify users, so change the K value to discuss the impact on the algorithm. The value of K is 25. The improved algorithm significantly improves the recommendation efficiency and shortens the running time. The accuracy increases with the increase of the number of nearest neighbors. The accuracy of the algorithm proposed in this paper is higher. The results of data cosine similarity, absolute error, and retained information show that the similarity range is 0.9 ~ 1.1, the similarity is very high, and the average absolute error is not more than 1.5%. Calculate the cosine similarity and average absolute error ratio of the data. When the dimension is 3, the ratio reaches the maximum.

With the development of the era of big data, in the core technology of finance, information recommendation algorithm has become one of the necessary application technologies for the main business. As the most commonly used big data mining algorithm, collaborative filtering algorithm shows a lot of value in application and also finds many deficiencies. Based on this, this paper studies the optimization of the core technology of intelligent financial technology based on collaborative filtering algorithm in the big data environment, improves the existing recommendation model of the financial industry, and uses the improved clustering algorithm to optimize the recommendation algorithm. The number of clusters is optimized through simulation test, which shows superiority in accuracy, diversity, and error of product recommendation. In view of the huge amount of financial data and the difficulty of processing, the dimension reduction processing is carried out in the simulation, which reduces the complexity of data processing. It should be pointed out that there are many factors affecting the clustering effect. In addition to the number of clusters proposed in this simulation, there is also the degree of fuzziness. With the increase of data scale, the cold start problem is still not well solved, and it may also affect the running time of the algorithm. These need to be further studied.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Acknowledgments

The authors would like to express sincere thanks to the contributors of the techniques used in this research. This work was supported by the Sichuan Vocational College of Finance and Economic: an empirical study on the impact of the availability of financial services on rural household consumption.

Open Research

Data Availability

The figures used to support the findings of this study are included in the article.