Lattice Methods for Pricing American Strangles with Two-Dimensional Stochastic Volatility Models

Abstract

The aim of this paper is to extend the lattice method proposed by Ritchken and Trevor (1999) for pricing American options with one-dimensional stochastic volatility models to the two-dimensional cases with strangle payoff. This proposed method is compared with the least square Monte-Carlo method via numerical examples.

1. Introduction

Calculating American style options under geometric Brownian motion is far from the realistic financial market. It is more valuable to price American style options under stochastic models. In general the valuation of American options with stochastic volatility models has no closed-form solution except very few cases (see, e.g., Heston [1]). Therefore numerical methods or simulation methods are developed to price financial derivatives with stochastic volatility, among which the lattice methods receive much more attention. Ritchken and Trevor [2] proposed an efficient lattice method for pricing American options under GARCH models. Later the idea was further developed and applied by several papers, for example, Cakici and Topyan [3] and Wu [4], and recently the convergence of the method was proved by Akyildirim et al. [5].

All the abovementioned references focused on the development of lattice methods for pricing American options with one underlying asset and single stochastic volatility model. To the best of our knowledge, there are no papers studying the lattice methods for options with many underlying assets and multidimensional stochastic volatility models. Indeed there are many papers in developing lattice methods for pricing options with many underlying assets, for example, Boyle [6], Boyle et al. [7], Chen et al. [8], Gamba and Trigeorgis [9], and Moon et al. [10]. However it is not seen for lattice methods for multidimensional stochastic volatility models.

In this paper we give an attempt to this challenging topic by studying an American style option with strangle payoff, which was previously investigated by Chiarella and Ziogas [11] and Moraux [12] for single asset and constant volatility. We develop the lattice methods of Ritchken and Trevor [2] to the American strangle options with many underlying assets and multidimensional stochastic volatility GARCH models. We compare the lattice methods with the least square Monte-Carlo methods via several numerical examples.

2. Two-Dimensional Stochastic Volatility Models of American Strangles

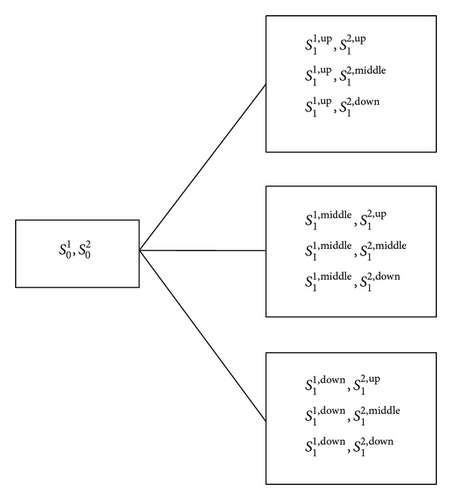

3. Lattice Algorithms

| , |

|---|

| , |

| , |

| , |

| , |

| , |

| , |

| , |

| , |

4. Numerical Examples

In this section, several examples are implemented using the lattice method in this paper and least square Monte-Carlo method (LSM) developed by Longstaff and Schwartz [14].

In Examples 1, 2, and 3, we focus on the single asset American strangle options under GARCH model where the convergence with respect to n and K are studied, respectively, in the first two examples, and the optimal exercise boundaries are drawn for the third example. In Examples 4 and 5, we compute the two-dimensional assets American strangle options.

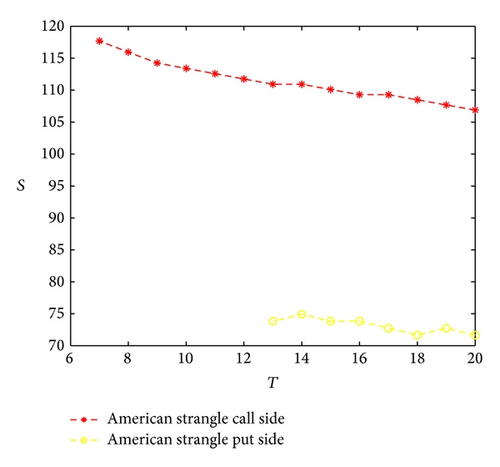

In Tables 2 and 3, the prices of the options using LSM with 5,000 paths are calculated and the intervals that the true prices fall into are provided. From the comparisons we confirm that the lattice methods developed in this paper are correct and reliable. Furthermore from Table 2 we observe that the lattice method converges as n goes larger and from Table 3 the lattice method converges as K goes larger. Figure 2 shows exercise and holding regions: the middle part is the holding region and the top and bottom parts are the exercise regions.

| T | n | Option prices with lattice | Option prices and intervals with LSM |

|---|---|---|---|

| 1 | 0.014987254820724 |

|

|

| 2 | 0.030190542190626 | ||

| 5 | 4 | 0.030393224336490 | |

| 7 | 0.030981333835160 | ||

| 10 | 0.031863879158063 | ||

| 1 | 0.068487810335143 |

|

|

| 2 | 0.081254039347033 | ||

| 7 | 4 | 0.083605936631716 | |

| 7 | 0.081680163494625 | ||

| 10 | 0.080301350887482 | ||

| 1 | 0.178948896057298 |

|

|

| 2 | 0.192329465764766 | ||

| 10 | 4 | 0.195314383716280 | |

| 7 | 0.199868029599249 | ||

| 10 | 0.193058780881166 | ||

| T | K | Option prices with lattice | Option prices and intervals with LSM |

|---|---|---|---|

| 5 | 2 | 0.028187456298155 |

|

| 4 | 0.029090524706680 | ||

| 6 | 0.029930565933099 | ||

| 10 | 0.030190542190626 | ||

| 20 | 0.029391074539888 | ||

| 40 | 0.029489977773055 | ||

| 10 | 2 | 0.197070210662258 |

|

| 4 | 0.195700639175277 | ||

| 6 | 0.196465071653130 | ||

| 10 | 0.192329465764766 | ||

| 20 | 0.193696054251151 | ||

| 40 | 0.194423204241922 | ||

| 30 | 2 | 1.182560819901510 |

|

| 4 | 1.197816540629624 | ||

| 6 | 1.200350772727828 | ||

| 10 | 1.202714267674711 | ||

| 20 | 1.203407511987706 | ||

| 40 | 1.203545193979154 | ||

Example 1. Consider single asset GARCH model with parameters rf = 5%, q = 10%, β0 = 6.575 × 10−6, β1 = 0.9, β2 = 0.04, S0 = 100, h0 = 0.0001096, K1 = 105, K2 = 95, γ = h0, and c* = 0. Fixing K = 20, we investigate the convergence behavior as n increases.

Example 2. Consider single asset GARCH model with the same parameters as Example 1. In this example, n = 5 and the sensitivity to the volatility space parameter, K, is explored.

Example 3. Consider single asset GARCH model with the same parameters as Example 1. Draw the figure of the optimal exercise boundaries for American strangle.

In Examples 4 and 5, we examine the stochastic lattice methods for pricing American strangle options under multiasset under stochastic volatility model where the convergence with n and K are studied. From the numerics in Tables 4 and 5, we confirm that the lattice methods for two-dimensional models are correct and reliable and the convergence of the lattice methods with respect to n and K is observed.

| T | n | Option prices with lattice | Option prices and interval with LSM |

|---|---|---|---|

| 3 | 1 | 0.005974297 |

|

| 2 | 0.004223692 | ||

| 3 | 0.004502351 | ||

| 4 | 0.005530355 | ||

| 5 | 0.005040507 | ||

| 4 | 1 | 0.014427788 |

|

| 2 | 0.014590056 | ||

| 3 | 0.013984718 | ||

| 4 | 0.017223364 | ||

| 5 | 0.015988485 | ||

| 5 | 1 | 0.022129134 |

|

| 2 | 0.030507636 | ||

| 3 | 0.030853276 | ||

| 4 | 0.035594538 | ||

| 5 | 0.034694665 | ||

| T | K | Option prices with lattice | Option prices and intervals with LSM |

|---|---|---|---|

| 3 | 2 | 0.005974297 |

|

| 4 | 0.005974297 | ||

| 6 | 0.005974297 | ||

| 8 | 0.005974297 | ||

| 10 | 0.005974297 | ||

| 4 | 2 | 0.014427788 |

|

| 4 | 0.014427788 | ||

| 6 | 0.014427788 | ||

| 8 | 0.014427788 | ||

| 10 | 0.014427788 | ||

| 5 | 2 | 0.02194509 |

|

| 4 | 0.022129134 | ||

| 6 | 0.022164226 | ||

| 8 | 0.024355984 | ||

| 10 | 0.024276964 | ||

Example 4. Consider two-asset American strangles with parameters rf = 5%, q1 = q2 = 10%, , , , , , K1 = 105, K2 = 95, , and c*,1 = c*,2 = 0. Fixing K = 4, we investigate the convergence behavior as n increases.

Example 5. Consider the two-dimensional GARCH model with the same parameters as Example 4. Fixing n = 1, we study the sensitivity to the volatility space parameter K.

5. Conclusions

In this paper we studied pricing methods for stochastic volatility models of the American strangles with single asset and multiassets. Both lattice methods and LSM methods are developed and implemented. To the best of our knowledge, there are no results on the lattice methods for multidimensional stochastic volatility models. We first extended the stochastic lattice methods invented by Ritchken and Trevor [2] which are for one-dimensional GARCH models of American call to the multidimensional GARCH models of American strangles. Numerical examples confirm the correctness and reliability of the lattice methods. Future challenging works include the development of the lattice methods for multidimensional volatility models with correlations and recently developed models (e.g., [15]). One possible solution to the case of correlation is to adopt the idea (using moment-generating function) in [7]. However it needs to develop new techniques when the stochastic volatility models are involved. Furthermore, a dimensional-reduction technique should be developed to reduce the computational cost.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.

Acknowledgment

The work was supported by the Fundamental Research Funds for the Central Universities (Grant no. JBK130401).