A Quasi-Variational Approach for the Dynamic Oligopolistic Market Equilibrium Problem

Abstract

The paper is concerned with the dynamic oligopolistic market equilibrium problem in the realistic case in which we allow the presence of capacity constraints and production excesses and, moreover, we assume that the production function depends not only on the time but also on the equilibrium distribution. As a consequence, we introduce the generalized dynamic Cournot-Nash principle in the elastic case and prove the equivalence between this equilibrium definition and a suitable evolutionary quasi-variational inequality. For completeness we make the analysis of existence, regularity, and sensitivity of the solution. In the end, a numerical example is provided.

1. Introduction

The aim of the paper is to improve the results obtained in [1] concerning the dynamic oligopolistic market equilibrium problem in presence of production excesses by introducing the dependence on the equilibrium commodity shipment in the production function (see 𝕂*(x*) in (4)) and, as a consequence, studying the so-called elastic model. This is a more realistic situation since it is reasonable to think that the production function is influenced not only by the time, but also by the evaluation of the amount of commodity shipment, namely, the forecasted equilibrium solution. The presence of production excesses may be well justified in periods of economic crisis, so it is possible that some of the amounts of the commodity available are sold out whereas for a part of the products, an excess of production can occur.

In the last decade a lot of problems considering a feasible set depending on equilibrium solutions have been studied (see, e.g., [2–4]). It is well known that the equilibrium models with fixed constraint sets may be expressed in terms of evolutionary variational inequalities, while models with elastic constraint sets are expressed by evolutionary quasi-variational inequalities. Moreover, the dependence on time leads to considering variational and quasi-variational inequalities in an infinite dimensional setting, for example, a Lebesgue space.

Let us remember that a dynamic oligopolistic market equilibrium problem is the problem of finding a trade equilibrium in a supply-demand market between a finite number of spatially separated firms producing homogeneous goods in a fixed time interval. Moreover, the firms act in a noncooperative behavior. This problem has its origin with Cournot [5]. He considered only two firms and for this reason it was called the duopoly problem. Later, Nash [6, 7] extended Cournot′s duopoly problem to n agents. A more complete and efficient study was done by Nagurney et al. in [8–11], but the problem was still faced in a static case through a finite dimensional variational approach. Finally, in [12] the time dependence was considered in the model. It allows to explore the change of behavior of equilibrium states for the oligopolistic market models over a finite time interval of interest. As Beckmann and Wallace stressed, for the first time, in [13], “the time-dependent formulation of equilibrium problems allows one to explore the dynamics of adjustment processes in which a delay on time response is operating.” Of course a delay on time response always happens because the processes do not have an infinite speed. Usually, such adjustment processes can be represented by means of a memory term which depends on previous equilibrium solutions according to the Volterra operator (see, e.g., [14, 15]).

Furthermore, in [16] the authors describe the behavior of the market by using the Lagrange multipliers of the infinite dimensional duality theory developed in [17–21]. Such results make use of the notion of tangent cone, normal cone, and quasi-relative interior of sets (see [22, 23]), important tools to overcome the difficulty of the emptiness of the topological interior of the ordering cone which defines constraints of several infinite dimensional problems (see [24, 25]). Moreover, a sensitivity result has been obtained which states that, under additional assumptions, small changes of the solution happen in correspondence with small changes of the profit function.

Lately, in [1, 26], the model presented in [12] has been improved with the addition of production excesses and both production and demand excesses, respectively. Another important question is to find some regularity properties for the solution. In [1, 26], the continuity of solution is proved under suitable assumptions, and it results to be very helpful in order to introduce numerical schemes to compute equilibrium solutions (see [27, 28]).

In [29, 30], the authors abandon the study of the problem from a producer′s point of view whose purpose is to maximize his own profit and focus their attention on the policy-maker′s perspective whose aim is to control the commodity exportations by means of the imposition of taxes or incentives and formulate the resulting optimization problem as an inverse variational inequality.

This paper is structured as follows. In Section 2 we present the dynamic oligopolistic market equilibrium problem with the elastic production function and after that we give the definition of equilibrium according to the generalized Cournot-Nash principle. Moreover, we prove the equivalence with a suitable evolutionary quasi-variational inequality. Section 3 is devoted to prove a result of existence of the solution, while in Section 4 Kuratowski′s set convergence will be a preliminary property in order to prove the continuity of the equilibrium solution. In Section 5 we establish a sensitivity result that shows how the equilibrium solution can change if the data have been perturbed. In Section 6 a numerical example is provided to make the theoretical model presented in the previous sections more clearer.

2. Quasi-Variational Inequalities in Dynamic Oligopolistic Markets

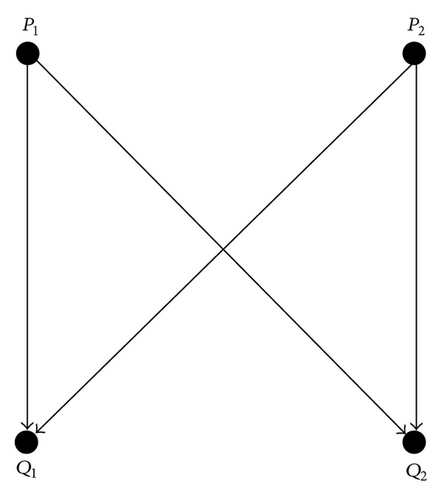

Let us consider m firms Pi, i = 1, …, m, that produce a homogeneous commodity and n demand markets Qj, j = 1, …, n, that are generally spatially separated. Assume that the homogeneous commodity, produced by the m firms and consumed by the n markets, is involved during a time interval [0, T], T > 0.

Let xij(t), i = 1, …, m and j = 1, …, n, denote the nonnegative commodity shipment between the supply market Pi and the demand market Qj at the time t ∈ [0, T]. In particular, let us set the vector xi(t) = (xi1(t), …, xin(t)), i = 1, …, m and t ∈ [0, T], as the strategy vector for the firm Pi.

Now, let us introduce the production excesses. Let ϵi(t), i = 1, …, m, be the nonnegative production excess for the commodity of the firm Pi at the time t ∈ [0, T]. Let us group the production excess into a vector function and let us assume that ϵ ∈ L2([0, T], ℝm).

- (i)

vi(t, x(t)) is continuously differentiable for each i = 1, …, m, a.e. in [0, T],

- (ii)

is a Carathéodory function, such that

() - (iii)

vi(t, x(t)) is pseudoconcave with respect to the variables xi, i = 1, …, m, a.e. in [0, T].

Now, let us consider the dynamic oligopolistic market, in which the m firms supply the commodity in a noncooperative fashion, each one trying to maximize its own profit at the time t ∈ [0, T]. We seek to determine a nonnegative commodity distribution matrix function x* for which the m firms and the n demand markets will be in a state of equilibrium according to the dynamic Cournot-Nash principle.

Definition 1. x* ∈ 𝕂(x*) is a dynamic oligopolistic market equilibrium in presence of production excesses if and only if for each i = 1, …, m and a.e. in [0, T]

Definition 1 states that each firm Pi maximizes its own profit, at the time t ∈ [0, T], considering the given optimal strategy of the other firms.

Theorem 2. Suppose that assumptions (i), (ii), and (iii) are satisfied. Then, x* ∈ 𝕂(x*) is a dynamic oligopolistic market equilibrium according to Definition 1 if and only if it satisfies the evolutionary quasi-variational inequality

Proof. First of all, let us prove that the evolutionary quasi-variational inequality (20), that we can write as follows:

So the equivalence between the evolutionary quasi-variational inequalities (20) and (22) is proved.

Let us prove, now, the equivalence between the dynamic Cournot-Nash principle and the evolutionary quasi-variational inequality (20).

Let us suppose that x* ∈ 𝕂(x*) is an equilibrium point according to Definition 1; namely,

Vice versa, let us suppose that x*(t) is a solution to evolutionary quasi-variational inequality (20), but not an equilibrium solution according to the dynamic Cournot-Nash principle, namely, ∃I⊆[0, T] with m(I) > 0, and such that

3. An Existence Theorem for Equilibrium Solutions

Now, we prove an existence result for the equilibrium solution to the dynamic elastic oligopolistic market equilibrium problem. To this aim, we recall a general existence result for solutions to quasi-variational inequalities in topological linear locally convex Hausdorff spaces due to Tan [32].

Theorem 3. Let X be a topological linear locally convex Hausdorff space and let D be a convex compact nonempty subset of X. Let be an upper semicontinuous multivalued mapping with C(x), x ∈ D, convex compact nonempty, let 𝕂 : D → 2D be a closed lower semicontinuous multivalued mapping with 𝕂(x), x ∈ D, convex compact nonempty, and let φ : D → ℝ be a proper convex lower semicontinuous function. Then, there exists x* ∈ D such that:

- (i)

x* ∈ 𝕂(x*),

- (ii)

there exists y* ∈ 𝕂(x*) for which

()

Now, we are able to prove our main result.

Theorem 4. Let v : [0, T] → ℝm and p : [0, T] → ℝm be two vector functions such that assumptions (i) and (iii) are satisfied and

- (I)

∇Dv(t, x) is measurable in t, for all , continuous in x, a.e. in [0, T], such that ∃γ ∈ L2([0, T]) : ∥∇Dv(t, x)∥ ≤ γ(t) + ∥x∥, for all , a.e. in [0, T];

- (II)

p(t, x) is measurable in t, for all , continuous in x, a.e. in [0, T], such that ∃ϕ ∈ L1([0, T]) : ∥p(t, x)∥ ≤ ϕ(t) + ∥x∥2, for all , a.e. in [0, T];

- (III)

∃ν(t) ≥ 0, a.e. in [0, T], η ∈ L∞([0, T]) such that

()

Proof. At first, observe that under the hypotheses (I) and (II) and if ,

Now, in order to show that 𝕂(x*) is a closed multifunction, we prove that the following condition holds. For every two arbitrary sequences {xk} k∈ℕ and {yk} k∈ℕ such that xk → x and yk → y in L2([0, T], ℝmn), with yk ∈ 𝕂(xk), ∀n ∈ ℕ, then y ∈ 𝕂(x). To this aim, let us consider two arbitrary convergent sequences in L2([0, T], ℝmn), {xk} k∈ℕ and {yk} k∈ℕ to x and y, respectively. Since yk ∈ 𝕂(xk), , for i = 1, …, m, j = 1, …, n, and a.e. in [0, T], and the convergence of the sequence {yk} k∈ℕ in L2([0, T], ℝmn) implies that also y satisfies the capacity constraints.

Moreover, the following relationship holds:

Now, let us show the lower semicontinuity of the multifunction 𝕂. To this aim it suffices to prove that for every {xk} k∈ℕ such that xk → x, in L2([0, T], ℝmn), and for every y ∈ 𝕂(x), there exists a sequence {yk} k∈ℕ such that yk → y, in L2([0, T], ℝmn), with yk ∈ 𝕂(xk), for all k ∈ ℕ.

Let {xk} k∈ℕ be an arbitrary sequence such that xk → x, in L2([0, T], ℝmn), and let y ∈ 𝕂(x). Let us note that, for i = 1, …, m and j = 1, …, n, and if

- (i)

for k > ν, for all i = 1, …, m, for all j = 1, …, n,

() - (ii)

for k ≤ ν, for all i = 1, …, m, for all j = 1, …, n,

()

It is easy to verify that if k ≤ ν, for (47), yk ∈ 𝕂(xk). Instead, for k > ν, since for (45), , for all i = 1, …, m, for all j = 1, …, n, a.e. in [0, T],

Let us prove now the convergence of {yk} k∈ℕ to y in L2([0, T], ℝmn). Let us observe that

4. Regularity Results for Equilibrium Solutions

In this section, we study the assumptions under which the continuity of solutions to evolutionary quasi-variational inequality, which expresses the equilibrium condition for the dynamic elastic oligopolistic market equilibrium problem in presence of production excesses, is ensured.

4.1. Set Convergence

First of all, we recall the notion of Kuratowski′s set convergence that has an important role in order to establish regularity results. The classical notion of convergence for subsets of a given metric space (X, d) is introduced in the 1950s by Kuratowski (see [33]; see also [34, 35]).

In the following, we recall Kuratowski′s set convergence.

Definition 5. We say that {𝕂n} converges to some subset 𝕂⊆X in Kuratowski′s sense and we briefly write 𝕂n → 𝕂, if . Thus, in order to verify that 𝕂n → 𝕂, it suffices to check that

- (i)

, that is, for any sequence {xn} n∈ℕ frequently in 𝕂n such that for some x ∈ S, then x ∈ 𝕂;

- (ii)

, that is, for any x ∈ 𝕂 there exists a sequence {xn} n∈ℕ eventually in 𝕂n such that .

The below lemma establishes that the feasible set 𝕂 of the dynamic elastic oligopolistic market equilibrium problem in the presence of production excesses satisfies the property of Kuratowski′s set convergence.

Lemma 6. Let , let be such that

Proof. Firstly, we prove condition (K1). Let {tk} k∈ℕ be a sequence such that tk → t, with t ∈ [0, T] as k → +∞. Making use of the continuity assumptions on , , and p, we get , , and p(tk, y) → p(t, y) as k → +∞, respectively. Furthermore,

Let x(t) ∈ 𝕂(t, x*) be fixed and let us note that, for i = 1, …, m and j = 1, …, n, and if

- (i)

for k > ν, for all i = 1, …, m, for all j = 1, …, n,

() - (ii)

for k ≤ ν, for all i = 1, …, m, for all j = 1, …, n,

()

Obviously if k ≤ ν, for (64) we have x(tk) ∈ 𝕂(tk, x*). Instead, for k > ν, since for (62), , for all i = 1, …, m, for all j = 1, …, n, we get

Let us prove, now, condition (K2). Let {tk} k∈ℕ be a sequence such that tk → t, with t ∈ [0, T], as k → +∞. Let {x(tk)} k∈ℕ be a sequence, such that x(tk) ∈ 𝕂(tk, x*), for all k ∈ ℕ, and converging to x(t), as k → +∞. We have to prove that x(t) ∈ 𝕂(t, x*).

Since x(tk) ∈ 𝕂(tk, x*), for all k ∈ ℕ,

As a consequence,

4.2. Continuity of Solutions to Weighted Quasi-Variational Inequalities

In [2, 36–39] some continuity results for variational and quasi-variational inequalities in infinite dimensional spaces have been obtained. It is worth remarking that similar results have been proved for weighted variational and quasi-variational inequalities in nonpivot Hilbert spaces (see [4, 40]).

Now, we show a continuity result for equilibrium solutions to the dynamic elastic oligopolistic market equilibrium problem in presence of production excesses.

Theorem 7. Let , and let be such that

5. A Sensitivity Result

In this section a theorem about the sensitivity of solution is presented. The following result establishes that a small change in profit function produces a small change in equilibrium distribution.

Theorem 8. Assume that the profit function changes from v(·) to the perturbed function and denote by x* and the correspondent solutions of the following quasi-variational inequalities:

6. A Numerical Example

This section is devoted to provide a numerical example of the theoretical achievements presented.

7. Conclusions

In [1] the dynamic oligopolistic market equilibrium problem was studied by introducing production excesses, and the dynamic Cournot-Nash equilibrium was characterized as a solution to a suitable evolutionary variational inequality. In this paper, in order to have a model closer to reality, it was supposed that the production function depends on the equilibrium commodity shipment. Hence, an elastic formulation was introduced that leads to an equivalent formulation by means of a suitable evolutionary quasi-variational inequality. By means of this mathematical formulation, results of existence and regularity of solutions were proved. Furthermore, a sensitivity analysis is provided. At last a numerical example was provided in order to clarify the theoretical results. In future work, it is possible to consider also demand excesses and elastic demand function, in order to have a more complete and realistic model.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.

Acknowledgment

This work has been partially supported by F.A.R.O. 2012 “Metodi matematici per la modellizzazione di fenomeni naturali.”