Pricing and Applications of Digital Installment Options

Abstract

For its theoretical interest and strong impact on financial markets, option valuation is considered one of the cornerstones of contemporary mathematical finance. This paper specifically studies the valuation of exotic options with digital payoff and flexible payment plan. By means of the Incomplete Fourier Transform, the pricing problem is solved in order to find integral representations of the upfront price for European call and put options. Several applications in the areas of corporate finance, insurance, and real options are discussed. Finally, a new type of digital derivative named supercash option is introduced and some payment schemes are also presented.

1. Introduction

Digital options, also referred to as binary options, are derivatives contracts whose value derives from the value of the so-called underlying asset (e.g., a financial index or a real estate asset). Digital options were first introduced in the 90s by Rubinstein and Reiner [1] and Turnbull [2], and since then their popularity has grown enormously in the derivatives market. In July 2008 they also reached the Chicago Board Options Exchange (CBOE), where digital option contracts on the S&P 500 Index and on the CBOE Volatility Index are traded. Given the peculiar payoff structure, they are embedded in many financial and insurance products and their valuation is crucial for corporate finance and real option problems as well.

In this paper we investigate the digital options world from a fresh perspective. In fact, in the literature, there are several articles devoted to digital options valuation, including [3–5], but none, as far as the authors know, has tried to solve the pricing problem considered here. Our aim is to recover pricing formulas for a wide variety of European installment derivatives with digital-type and path-independent payoffs. In contrast to the smooth payoff patterns of standard options, digital options have discontinuous payoffs, switched completely one way or the other depending on whether the terminal price of the underlying asset satisfies an exercise condition: if such condition occurs, the option pays out a predetermined amount dependent on the terms of the contract; otherwise, the option expires worthless. Furthermore, we consider that the premium can also be paid in installments over the contract lifetime and that the digital option can be lapsed at any payment date before maturity (for more details on the installment feature, see [6–9]).

The rest of the paper is organized as follows. In Section 2 a free boundary problem for the upfront price function and optimal stopping boundary is solved by the Fourier transform method. A general decomposition formula for European-style options with digital payoff structure and flexible payment plan is also derived. Using this approach, several applications in the areas of corporate finance, insurance, and real options are discussed in Section 3. In Section 4 the conclusions are drawn.

2. Problem Formulation

The Incomplete Fourier Transform (IFT) is used to solve the problem specified by (2.5)–(2.6) in order to obtain an integral representation of the upfront price for the class of European contingent claims with generic payoff and installment rate.

Theorem 2.1. Let v(x, τ) be the solution of the PDE (2.10) satisfying the initial and boundary conditions (2.9). Then, the initial premiums of the European installment call and put options with maturity date T, payoff h(x), and payment plan l(τ) are given, respectively, by:

-

For call options

() -

For put options

()

In Appendix A, it is shown how the free boundary problem defined by (2.9)–(2.10) can be solved with the aid of the IFT. Therefore, to price a European installment option for any given payoff pattern h(x) and payment plan l(τ), (2.14) must be solved using numerical methods to find the optimal stopping boundary. Once this is found, the function v(x, τ) can be evaluated via numerical integration. Existence and uniqueness of the solution to the pricing problem of European installment call and put options, as well as the regularity properties of the free boundary, are proved in [12, 13], respectively.

In order to enhance the mathematical tractability and economical meaning, we give a parametric representation of the European installment option price as function of the current asset price St and time to maturity τ. This allows to deal with a wide range of payoff structures and payment schemes.

Theorem 2.2. Let H : ℝ+ → [yH, ∞) be differentiable, except for at most a finite number of points, and let L : [0, T] → ℝ+ be piecewise continuous over [0, T]. Then, the initial premium functions C(St, τ) and P(St, τ) of the European installment call and put options can be expressed, respectively, as

Theorem 2.2, whose proof is reported in Appendix B, shows that the European installment option price can be divided into two parts: the value of an associated European option with the same characteristics (underlying asset, maturity, and payoff structure) and the DEPS component, which is the present value of all future installment payments along the optimal stopping boundary.

3. Valuation of Digital Installment Options

Now we consider some applications in order to illustrate the flexibility and generality of Theorem 2.2. They cover the fundamental class of digital-type and path-independent payoffs which form the building blocks for pricing a wide range of European derivative securities. In the subsequent propositions, which share a single proof given in Appendix C, we will provide explicit formulas for the initial premium and free boundary of the option corresponding to a certain digital payoff pattern and with a generic payment plan.

3.1. Cash-or-Nothing Payoff

Proposition 3.1. Let H : ℝ+ → [yH, ∞) be defined by (3.1). Then, the initial premiums CCoN(St, τ) and PCoN(St, τ) of the European cash-or-nothing installment call and put options are given, respectively, by

3.1.1. Application: Corporate Finance

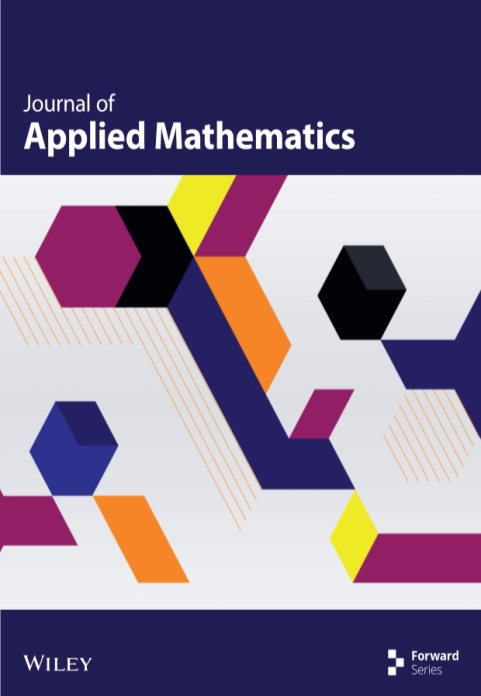

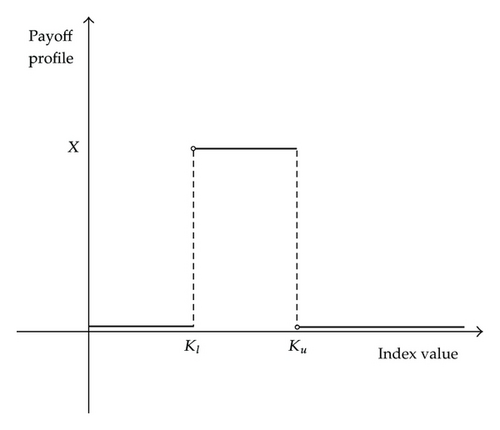

The cash-or-nothing payoff structure is very versatile and apt to represent a wide variety of situations, such as a very interesting corporate finance problem: the executive incentive compensation evaluation. Suppose that a company is considering to introduce an incentive program for its employees such that, if at the end of the year a given productivity index is greater or equal to a contractually specified threshold K, each employee will receive a monetary incentive X. The employee payoff profile as function of the final productivity index is shown in Figure 1. From the company′s perspective, it is very important to set K and X at the “right” level in terms of the cost benefit analysis. In order to perform such research, the valuation of the option given to the employees is crucial and to this extent the analysis here proposed can be very helpful.

3.2. Asset-or-Nothing Payoff

Proposition 3.2. Let H : ℝ+ → [yH, ∞) be defined by (3.5). Then, the initial premiums CAoN(St, τ) and PAoN(St, τ) of the European asset-or-nothing installment call and put options are given, respectively, by

3.2.1. Application: Insurance

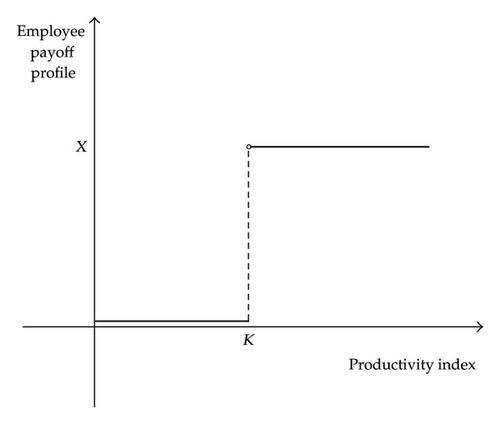

An insurance contract provides protection against loss for which periodically a premium is paid in exchange for a guarantee that there will be a compensation, under stipulated conditions, for a loss caused by a specified event. Given the nature of the risk insured and the payment structure, installment options are very suitable for valuation purposes and asset-or-nothing payoffs in particular are often embedded in insurance products. Let us consider for instance an earthquake insurance that provides a coverage proportional to the earthquake magnitude. Suppose that the insurance is provided only above a certain earthquake magnitude level K and that the resulting payoff grows linearly. The resulting insurance payoff as function of the earthquake magnitude is depicted in Figure 2.

3.3. Gap Payoff

Proposition 3.3. Let H : ℝ+ → [yH, ∞) be defined by (3.8). Then, the initial premiums CG(St, τ) and PG(St, τ) of the European gap installment call and put options are given, respectively, by

3.3.1. Application: Real Options

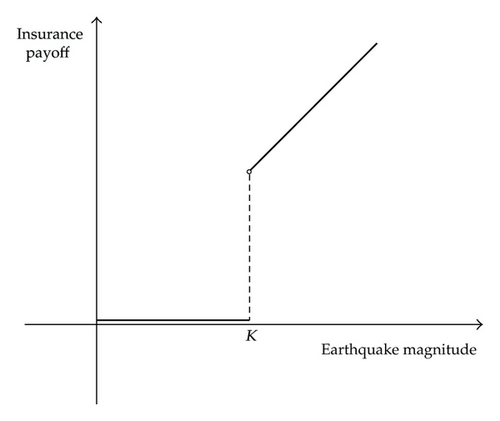

A rather common situation where gap option evaluation is relevant is the following real option case. Let us consider a request for tender by an agency for the supply of a given maximum quantity of goods of value K in exchange of a fixed amount of money X, with 0 < X < K. The quantity of goods supplied is a stochastic variable. It is known only at maturity and matches the demand at that date. Thus, the maximum quantity of goods is chosen by the agency large enough so that the demand does not exceed the level K. The cost of the goods is known, linear and independent from the quantity supplied (i.e., there are no economies of scale). The supplier′s profit and loss as function of the value of the goods supplied is represented in Figure 3. It is interesting to note that if the actual demand exceeds the level X, the supplier will incur in a loss, unlike most options final payoffs.

3.4. Range Binary Payoffs

So far we have considered options with payoffs having only one singularity. Range binary payoffs present two points of discontinuity in a given bounded interval within which must lie the terminal price of the underlying asset so that the option expires in-the-money. This feature makes range binary options cheaper than their plain vanilla counterpart.

Proposition 3.4. Let H : ℝ+ → [yH, ∞) be defined by (3.11). Then, the initial premiums CSS(St, τ) and PSS(St, τ) of the European supershare installment call and put options are given, respectively, by

Proposition 3.5. Let H : ℝ+ → [yH, ∞) be defined by (3.14). Then, the initial premium CSC(St, τ) of the European supercash installment call option is given by

3.4.1. Application: Structured Products

Range binary options are very attractive for creating structured financial products. In fact their peculiar payoff pattern allows to tailor made contracts meeting the expectations of the potential buyer. More importantly, by doing so it is possible to cut the costs relative to those scenarios that the buyer considers uninteresting. Therefore, the pricing framework of the range binary options is very useful for evaluation purposes in case of setting up investment strategies or when analyzing insurance products which are effective only within a certain range.

For instance, let us consider at time t ≥ 0 an individual investor who holds a risky portfolio and needs to withdraw a fixed amount of money X > 0 at a prespecified time T > t to meet an obligation. In this case, in order to hedge the market risk, the investor could buy a cash-or-nothing installment put option with maturity date T which pays the constant amount X if an appropriate index that mimics his/her portfolio value is below a certain threshold K. Alternatively, excluding some tail scenarios, he/she could choose a cheaper option, a supercash installment call option, that guarantees the same amount X if at maturity T the index value, as shown in Figure 4, lies within a certain range (Kl, Ku], with Ku = K. Furthermore, the installment feature allows the investor to drop the option as soon as the market conditions turn out to be reasonably favorable.

3.5. Flexible Payment Plans

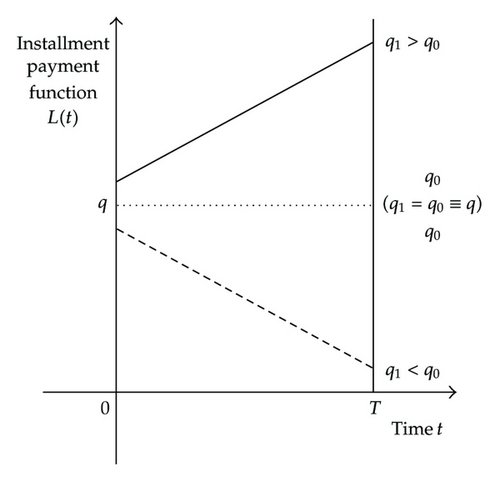

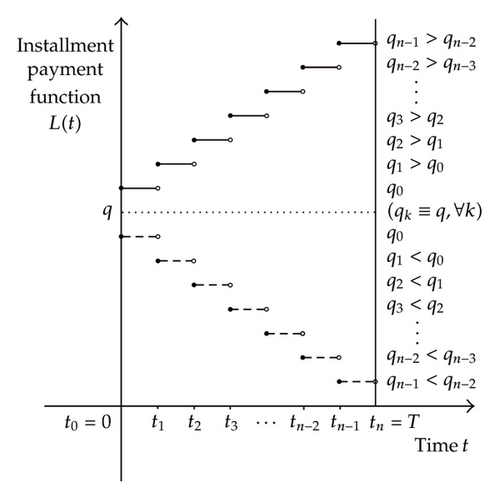

In this paragraph, we analyze in greater detail the wide class of time-varying payment schemes, specifying two different functional forms of the installment rate L(t) and focusing on the DEPS representation for call options.

4. Conclusions

In this paper, we have studied the valuation of exotic options with digital payoff and flexible payment plan. Taking the free boundary problem formulation, we have used the Fourier transform method to solve the inhomogeneous Black-Scholes-Merton equation subject to the appropriate boundary and terminal conditions. An integral representation of the upfront price and its decomposition formula has been proposed.

The class of path-independent options with discontinuous payoffs forms the building blocks for pricing a wide range of securities such as barrier options, structured convertible bonds, and mortgage-backed securities. This framework has been usefully applied to solve problems in different areas, including corporate finance, insurance, and real options.

Appendices

A. Proof of Theorem 2.1

Similarly, for put options, by expressing PDE (2.10) and (2.9) in terms of the newly defined auxiliary function y(x, τ) : = exv(x, τ), we are able to apply the IFT (since the required condition lim x→−∞ y(x, τ) = 0 is fulfilled) and then obtain the solution for the resulting ODE. Taking the inverse Fourier transform of this solution in conjunction with the Convolution Theorem and then recovering the original function v(x, τ), we derive the integral representation (2.13) for the initial premium v(x, τ) of the European installment put option.

Now, applying the second condition in (2.9), that is, imposing that the function v(x, τ) is equal to zero as x tends to the optimal stopping boundary, we get (2.14) which completes the proof.

B. Proof of Theorem 2.2

Substituting the expressions of v1(x, τ) and v2(x, τ) into (2.12) and reverting back to the original variable via St = ex, we obtain (2.15) in conjunction with the expressions (2.17) and (2.19) defining and ΛC(St, τ; a(·)), respectively. Finally, because the early stopping decision is optimal when St = aτ, by applying the value matching condition (2.14), we get (2.21).

C. Proof of Propositions 3.1–3.5

Propositions 3.4-3.5 are easily proved using (C.12) since the in-the-money region is the bounded interval (Kl, Ku]. Plugging {(ϕ0 = 0)∧(ϕ1 = 1/Kl)} into (C.12), we have the explicit expression for and substituting it into (2.15) yields (3.12). Similarly, setting {(ϕ0 = X)∧(ϕ1 = 0)} in (C.12) and substituting the resulting expression into (2.15), we get (3.15).