Global production sharing: Exploring Australia's competitive edge

Abstract

Cross-border dispersion of production processes within vertically integrated global industries (“global production sharing”) has been an increasingly important structural feature of economic globalisation in the recent decades. This paper examines patterns and determinants of global production sharing with an emphasis on how Australian manufacturing fits into global production networks (GPNs). Though Australia is a minor player in GPNs, there is evidence that Australian manufacturing has a distinct competitive edge in specialised, skill-intensive tasks in several industries such as aircraft, medical devices, machine tools, measuring and scientific equipment and photographic equipment. Specialisation in high-value-to-weight components and final goods within GPNs, which are suitable for air transport, helps Australian manufacturing to overcome the “tyranny of distance” in world trade. Being predominantly “relationship specific,” Australian GPN exports are not significantly susceptible to real exchange rate appreciation.

1 Introduction

Cross-border dispersion of production processes within vertically integrated global industries, which we label “global production sharing” in this paper,1 has been an increasingly important structural feature of economic globalisation in recent decades. This process of international division of labour opens up opportunities for countries to specialise in different slices (tasks) of the production process in line with their relative cost advantages. As the production processes are finely sliced across a wide range of industries, new opportunities for specialisation within global production networks (GPNs) are created. Given this structural shift in global production, the conventional approach to analysing trade patterns, which treats international trade as an exchange of goods produced from beginning to end in a given trading partner, is rapidly losing its relevance (Helpman, 2011; Jones & Kierzkowski, 2004).

The 787 Dreamliner “produced” by the Boeing Corporation, USA, has become an eye-catching illustrative case of how countries are engaging in an intricate web of production-sharing arrangements (Grapper, 2007). Offshore production accounts for 70% of the many thousands of parts used in assembling the jet. Boeing itself is responsible for only about 10% by value of the aircraft, tail fin and final assembly, but holds rights to the 787 technology. There are 43 parts and component suppliers spread over 135 production sites around the world. The wings are produced in Japan, the engines in the United Kingdom and the United States, the flaps and ailerons in Australia and Canada, the fuselage in Japan, Italy and the United States, the horizontal stabiliser in Italy, the landing gear in France and the doors in Sweden and France. This pattern of outsourced production around the world is in sharp contrast to the Boeing's parochial emphasis on procuring components domestically: only about 1% of the Boeing 707 was built outside the USA in the 1950s. Boeing is now focusing on its own specific advantages—design, supply chain management, marketing and branding—rather than on areas where others are bound to make inroads. Airbus, Boeing's competitor, followed Boeing's lead for its A350 jet. It has closed down some component-producing plants in Europe and is outsourcing work to China and elsewhere in producing this wide-body jet, which is positioned to compete with Boeing 787.

The purpose of this paper is to examine the patterns and determinants of global production sharing with an emphasis on the implications for the performance and structural change in Australian manufacturing. The study is motivated by the growing emphasis in the contemporary policy debate in Australia on the country's manufacturing future in the aftermaths of the cessation of the commodity boom (ACOLA 2015, CEDA 2014, PC 2014; Withers, Gupta, Curtis, & Larkins, 2015). Notwithstanding this policy emphasis, the implications of the ongoing process of global production sharing for effective integration of domestic manufacturing into global manufacturing networks and the related policy issues have not been systematically explored. Given this information gap, the Australian mindset has not changed to accommodate current and emerging global trends in manufacturing. For instance, according to a survey of 450 top business executives and 700 public servants conducted by the Australian Council of Learned Academies (ACOLA), neither business leaders nor public servants identified global production sharing as an issue of strategic importance for Australia (Withers et al., 2015). The data from the Annual Survey of Business Characteristics conducted by the Australian Bureau of Statistics (ABS 2015) are consistent with this findings: only 1.8% of all manufacturing firms on average were engaged in integrated supply chains during the period from 2005–06 to 2013–14 (ABS 2015).

The paper is structured as follows: Section 2 provides a stage-setting overview of the process of global production sharing and emerging opportunities for countries to specialise in line with their relative cost advantage. The procedure followed in separating data on trade taking place within global production networks (“GPN trade”) from the standard trade data are discussed in Section 3. Section 4 provides a comparative analysis of Australia's engagement in global production sharing. An econometric analysis is undertaken in Section 4 using the standard gravity modelling framework to examine the determinants of intercountry differences in the degree of involvement in global production sharing. Section 5 summarises the key findings and draws policy inferences.

2 Global production sharing

Global production sharing is not a new phenomenon. There is ample anecdotal evidence of evolving trade in parts and components within the branch networks of multinational enterprises (MNEs) dating back to the early twentieth century (Wilkins, 1970). What is unprecedented about the contemporary process of global production sharing is its wider and ever increasing product coverage, and its rapid spread from mature industrial countries to developing countries. Over the past four decades, production networks have gradually evolved encompassing many countries and spreading to many industries such as sport footwear, automobile, televisions and radio receivers, sewing machines, office equipment, electrical machinery, machine tools, cameras, watches, light emitting diodes, solar panels and surgical and medical devices.

The expansion of global production sharing has been driven by three mutually reinforcing developments (Helpman, 2011; Jones & Kierzkowski, 2004; Yi, 2003). First, rapid advancements in production technology have enabled the industry to slice up the value chain into finer, “portable” components. Second, technological innovations in communication and transportation have shrunk the distance that once separated the world's nations, and improved speed, efficiency and economy of coordinating geographically dispersed production processes. This has facilitated, and reduced the cost of, establishing “service links” needed to combine various fragments of the production process across countries in a timely and cost-efficient manner. Third, liberalisation policy reforms across the world over the past four decades have considerably removed barriers to trade and foreign direct investment. Trade liberalisation is far more important for the expansion of GPN trade compared to the conventional horizontal trade. This is because, since a given slice/task of the production chain operates with a smaller price–cost margin, the profitability could be erased by even a small tariff.

Factor intensities of a given tasks/segments of the production process and the prices of the required factor inputs in comparison with their productivity jointly determine which country produces what tasks with a production network. It may be that workers in a given country tend to have different skills from those in other countries, and the skills required in each production block differ so that a dispersion of activity could lower marginal production cost. Alternatively, it may be that the production blocks differ from each other in the proportion of different factors required, enabling firms to locate labour-intensive production blocks in countries where productivity-adjusted labour cost is relatively low.

However, successful participation in global production sharing will occur only if the costs of “service links” associated with production sharing outweigh the gain from the lower costs of the activity abroad. Here the term service links refers to arrangements for connecting/coordinating activities into a smooth sequence for the production of the final good. Service link cost relates to transportation, communication and other related tasks involved in coordinating the activity in a given country with what is done in other countries within the production network. The policy regime and the domestic investment climate also need to be conducive for involvement in production sharing. This is because supply disruptions in a given overseas location could disrupt the entire production chain. Such disruptions could be the product of shipping delays, political disturbances or labour disputes (in addition, of course, to natural disasters). In many instances, it is not possible to fully offset these risks by writing complete contracts (Spenser, 2005).

Why should policymakers pay particular attention to global production sharing as part of the outward-oriented development strategy? First, participation in GPNs is likely to have a favourable “atmosphere creation” effect for domestic manufacturing. Engaging in global production sharing is an effective way of linking domestic manufacturing to dynamic global industries of electronics, electrical goods, medical devices and transport equipment, which are the incubators of new technology and managerial skills. The very nature of these industries is the continuous shaking-up of the production processes, the emergence of new products and production processes in place of old ones. Thus, joining GPNs has the potential to yield growth externalities (spillover effects) through the transfer of technology and managerial know-how. Second, as GPN trade accounts for a large and increasing share of world manufacturing trade, there can be considerable gains from economies of scale and scope that arise in wider markets. Third, specialisation in parts and components within production networks has the potential to help overcome “tyranny of distance,” trade cost disadvantage arising from the geographical distance to the major markets. The process global production sharing opens up opportunities to specialise in high-value-to-weight components and specialised final assembly in the value chain for which air shipment is the major mode of transport (Hummels 2009). The second and third considerations are particularly important for Australia. The performance of Australian manufacturing has historically been constrained by the small size of the domestic market and distance-related trade cost (Hutchinson, 2014).

3 Compilation of trade data

A prerequisite for analysing patterns and determinants of GPN trade is the systematic delineation of parts and components and final assembly from the standard (Customs records based) trade data. Following the seminal paper by Yeats (2001), it has become common practice to use data on parts and components to measure GPN trade. However, there has been a remarkable expansion of production sharing from parts and component to encompass final assembly. Moreover, the relative importance of these two tasks within production networks varies among countries and over time in a given country, making it problematic to use data on the parts and component trade as a general indicator of the trends and patterns of GPN trade over time and across countries. In this study, we define network trade to incorporate both components and final (assembled) goods exchanged within the production networks.

The data used in this study for all countries except Taiwan are compiled from the UN Comtrade database, based on Revision 3 of the Standard International Trade Classification (SITC Rev. 3). The data for Taiwan (a country which is not covered in the UN trade data reporting system) come from the database of the Council of Economic Planning and Development, Taipei.

Parts and components are delineated from the reported trade data using a list compiled by mapping parts and components in the intermediate products subcategory of the UN Broad Economic Classification with the SITC at the five-digit level of commodity disaggregation.2 It is important to note that parts and components, as defined here, are only a subset of intermediate goods, even though the two terms have been widely used interchangeably in the recent literature on global production sharing. Parts and components unlike the standard intermediate inputs, such as iron and steel, industrial chemicals and coal, are “relationship-specific” intermediate inputs; in most cases, they do not have reference prices, and are not sold on exchanges and are more demanding on the contractual environment (Hummels, 2002; Nunn, 2007). Most (if not all) of parts and components also do not have a “commercial life” on their own unless they are embodied in a final product. Mixing the two is particularly problematic for trade data analysis for Australia because the standard intermediate goods historically account for a large share of total manufactured exports.

There is no hard and fast rule for delineating final goods assembled within GPNs from the standard trade data. The only practical way of doing this is to focus on the specific product categories in which GPN trade is heavily concentrated. Once these product categories are identified, trade in final assembly can be approximately estimated as the difference between parts and components, which are directly identified based on our list, and the total trade of these product categories (Krugman, 1995).

Guided by the available literature on production sharing, we identified seven product categories: office machines and automatic data processing machines (SITC 75), telecommunication and sound recording equipment (SITC 76), electrical machinery (SITC 77), road vehicles (SITC 78), other transport equipment (SITC 79), professional and scientific equipment (SITC 87) and photographic apparatus (SITC 88). It is quite reasonable to assume that these product categories contain virtually no products produced from start to finish in a given country. The difference between the value of total exports and parts and components of these categories was treated as the value of final assembly.3

4 Australian manufacturing in global production networks

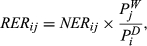

Data on manufacturing exports from Australia, disaggregated into components, final assembly and total GPN exports, are plotted in Figure 1. Between 1988/89 and 2000/01, total manufacturing exports recorded a fivefold increase, from A$5.6bn to 28.3bn, and the share of manufacturing in total merchandise trade increased from 13.4% to 23.1%. During the ensuing years, exports slowed, with greater degree of volatility. By 2013/14, the share of manufacturing in total merchandise export had declined to 12.4%. Interestingly, exports of GPN products, however, remained less volatile during this period and have contributed disproportionately to export expansion in recent years. The share of these products in total manufacturing exports increased from 43.8% to 47.5% between 2009/10 and 2013/14. Within the GPN category, parts and component exports have increased at a faster rate compared to final assembly. In summary, GPN exports, in particular exports of parts and components, seem to have been remarkably resilient to the Dutch Disease effect, the adverse impact of exchange rate appreciation, during the commodity boom.

Source: Data compiled from UN Comtrade database.

This pattern is consistent with the postulate that trade within production networks, in particular parts and component trade, has some structural peculiarities that could weaken the impact of real exchange rate (RER, relative price) changes (Arndt & Huemer, 2007; Athukorala & Khan, 2016; Burstein, Kurz, & Tesar, 2008). First, production units of the value chain located in different countries normally specialise in specific tasks. Therefore, the substitutability of parts and components sourced from various sources is rather limited. Second, setting up of overseas production bases and establishing the services links entail high fixed costs. Once such fixed costs are incurred, relative price/cost changes become less important in business decision-making. Third, when a firm in a given country is engaged in a particular slice of production process, its export profitability depends not only on external demand and the domestic cost of production, but also on supply conditions in the countries supplying parts and components, the bilateral exchange rates between them and magnitude of the share of import content in exported goods. Changes in exchange rates also have offsetting effects on imports and exports, and thus, the net effect of exchange rate changes on exports within production networks would tend to be weaker than in the standard case of producing the entire product in the given country.

Australia is a small player in world manufacturing trade (Table 1). Its share in total world manufacturing remained around 0.28% during the period under study without showing any trend. However, Australia's share in world exports of GPN products increased from 0.22% to 0.25% between 1990/01 and 2012/13, underpinned by an increase in the share of parts and components, from 0.24% to 0.28%. Australia's share of total manufacturing exports of OECD countries increased from 0.35% to 0.54% between these years, with the share of GPN exports increasing from 0.27% to 0.36%.

| Total manufacturing | Parts and components | Final assembly | GPN products | Other manufacturing | |

|---|---|---|---|---|---|

| OECD share in world exports (%) | |||||

| 1990/01 | 78.3 | 81.3 | 81.7 | 81.5 | 74.9 |

| 2000/01 | 66.6 | 64.7 | 72.5 | 67.6 | 65.2 |

| 2005/06 | 59.8 | 56.0 | 63.3 | 58.9 | 61.0 |

| 2012/13 | 48.2 | 45.6 | 48.8 | 47.0 | 49.4 |

| Australia's share in world exports (%) | |||||

| 1990/01 | 0.27 | 0.24 | 0.19 | 0.22 | 0.33 |

| 2000/01 | 0.33 | 0.27 | 0.38 | 0.31 | 0.35 |

| 2005/06 | 0.28 | 0.23 | 0.31 | 0.25 | 0.32 |

| 2012/13 | 0.26 | 0.28 | 0.23 | 0.25 | 0.28 |

| Australia's share in OECD exports | |||||

| 1990/01 | 0.35 | 0.30 | 0.24 | 0.27 | 0.44 |

| 2000/01 | 0.49 | 0.31 | 0.26 | 0.29 | 0.48 |

| 2005/06 | 0.47 | 0.33 | 0.29 | 0.31 | 0.52 |

| 2012/13 | 0.54 | 0.38 | 0.33 | 0.36 | 0.58 |

| OECD export composition (%) | |||||

| 1990/01 | 100 | 30.3 | 23.4 | 53.7 | 46.3 |

| 2000/01 | 100 | 34.5 | 23.1 | 57.6 | 42.4 |

| 2005/06 | 100 | 31.1 | 22.6 | 53.7 | 46.3 |

| 2012/13 | 100 | 25.4 | 21.8 | 47.3 | 52.7 |

| Australia's export composition (%) | |||||

| 1990/01 | 100 | 26.0 | 15.9 | 41.9 | 58.1 |

| 2000/01 | 100 | 29.3 | 24.8 | 54.1 | 45.9 |

| 2005/06 | 100 | 25.5 | 23.2 | 48.8 | 51.2 |

| 2012/13 | 100 | 27.2 | 18.7 | 45.9 | 54.1 |

Notes

- Countries which became OECD member before 1990.

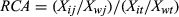

The data on the commodity profile of parts and components, and final assembly exports from Australian manufacturing exports are summarised in Tables 2 and 3, in terms of three indicators: percentage composition, share in world trade and the revealed comparative advantage (RCA) index. The RCA index measures Australia's export performance in a given product compared to its category's overall performance in world trade.4

| SITC code | Product description | Composition (%) | World market share (%) | RCA index | |||

|---|---|---|---|---|---|---|---|

| 2000/01 | 2012/13 | 2000/01 | 2012/13 | 2000/01 | 2012/13 | ||

| 7929 | Aircraft parts (excluding electrical parts) | 7.6 | 13.3 | 1.0 | 1.7 | 2.9 | 5.8 |

| 7843 | Motor vehicle parts other than bodies | 10.8 | 8.8 | 0.4 | 0.2 | 1 | 0.7 |

| 7239 | Parts of earth moving machines | 2.8 | 8.6 | 0.8 | 1.4 | 2.4 | 4.7 |

| 7599 | Parts of data processing/storage machines | 13.5 | 7.1 | 0.4 | 0.6 | 1.3 | 2.2 |

| 7643 | Transmission apparatus for radio-telephony | 2.0 | 3.7 | 0.1 | 0.2 | 0.4 | 0.6 |

| 7283 | Parts of machines for mineral processing | 1.3 | 2.9 | 2.7 | 3 | 7.8 | 10.3 |

| 7132 | Engines for propelling vehicles | 4.6 | 2.4 | 0.6 | 0.3 | 1.8 | 1 |

| 7429 | Parts of pumps and liquid elevators | 0.8 | 2.2 | 0.7 | 1.1 | 2.1 | 3.9 |

| 7725 | Electrical apparatus for electrical circuits | 3.8 | 2.0 | 0.5 | 0.2 | 1.3 | 0.7 |

| 6956 | Plates, sticks and tips for tools | 0.9 | 1.8 | 0.3 | 0.4 | 0.9 | 1.5 |

| 7285 | Parts of specialised industrial machinery | 2.0 | 1.8 | 0.6 | 0.4 | 1.8 | 1.3 |

| 7726 | Boards and panels for electrical control | 0.5 | 1.7 | 0.2 | 0.3 | 0.6 | 1.0 |

| 7139 | Parts for internal combustion engines | 1.9 | 1.6 | 0.3 | 0.2 | 1.0 | 0.7 |

| 7724 | Reciprocating positive displacement pumps | 1.0 | 1.6 | 1.3 | 1.3 | 3.7 | 4.6 |

| 7478 | Taps/cocks/valves | 0.5 | 1.6 | 0.2 | 0.3 | 0.5 | 0.9 |

| 7919 | Railway or tramway track fixtures and fittings | 0.3 | 1.3 | 0.3 | 0.9 | 1 | 2.9 |

| 7523 | Parts of digital processing units | 1.3 | 1.2 | 0.2 | 0.2 | 0.5 | 0.6 |

| 7783 | Accessories of motor vehicles except bodies | 0.6 | 1.2 | 0.2 | 0.2 | 0.6 | 0.8 |

| 7449 | Parts for lifting and loading machinery | 0.8 | 1.2 | 0.5 | 0.5 | 1.3 | 1.7 |

| 7529 | Parts of data processing equipment | 1.2 | 1.0 | 0.3 | 0.4 | 0.9 | 1.2 |

| 7649 | Parts of sound recording equipment | 2.7 | 0.9 | 0.3 | 0.1 | 0.8 | 0.5 |

| 7763 | Semiconductor devices | 0.6 | 0.9 | 0.1 | 0.1 | 0.3 | 0.3 |

| 7788 | Parts of electrical machinery | 1.3 | 0.9 | 0.5 | 0.2 | 1.4 | 0.8 |

| 7731 | Insulated wire, cable electric conductors | 2.2 | 0.9 | 0.3 | 0.1 | 0.8 | 0.4 |

| 7484 | Gears and gearing and other speed changer | 0.1 | 0.9 | 0.1 | 0.4 | 0.2 | 1.3 |

| 7189 | Engines/motors for electric rotary converters | 0.1 | 0.8 | 0.5 | 1.0 | 1.5 | 3.5 |

| 6648 | Vehicle rear-view mirror | 0.9 | 0.8 | 4.2 | 2.1 | 12.3 | 7.2 |

| 7728 | Parts suitable for electrical apparatus | 0.6 | 0.8 | 0.2 | 0.2 | 0.6 | 0.7 |

| 7489 | Parts of Gear/flywheel/clutches | 0.3 | 0.7 | 0.5 | 0.6 | 1.6 | 2.2 |

| 7526 | Input/output units for data processing machines | 0.6 | 0.7 | 0.1 | 0.2 | 0.2 | 0.8 |

| 7439 | Parts of centrifuges and purifying machines | 0.3 | 0.7 | 0.3 | 0.4 | 0.9 | 1.4 |

| 8741 | Parts of surveying and navigating instruments | 0.3 | 0.7 | 0.8 | 1.0 | 2.5 | 3.4 |

| 7479 | Parts of valves, taps and cocks | 0.4 | 0.7 | 0.4 | 0.4 | 1.3 | 1.2 |

| 7527 | Data storage units | 0.3 | 0.7 | 0 | 0.1 | 0.1 | 0.3 |

| 7415 | Air conditioner parts | 1.0 | 0.6 | 0.4 | 0.2 | 1.3 | 0.7 |

| 7853 | Parts and accessories of cycles | 0.3 | 0.6 | 0.2 | 0.3 | 0.6 | 1.0 |

| 7219 | Parts of agricultural machinery | 0.5 | 0.5 | 0.7 | 0.4 | 1.9 | 1.2 |

| Otherb | 28.5 | 19.3 | 0.2 | 0.2 | 0.7 | 0.3 | |

| Total | 100 | 100 | 0.3 | 0.3 | 0.82 | 1.01 | |

Notes

- aProducts are listed by ascending order based on export shares for 2012/13. Figures are 2-year averages.

- bFour-digit items, each of which accounts for <0.5% of the total value.

| SITC code | Product description | Composition (%) | World market share (%) | RCA index | |||

|---|---|---|---|---|---|---|---|

| 2000/01 | 2012/13 | 2000/01 | 2012/13 | 2000/01 | 2012/13 | ||

| 7821 | Motor vehicles for the transport of goods | 29.2 | 28.9 | 0.4 | 0.3 | 1.2 | 0.9 |

| 7812 | Passenger motor vehicles | 28.3 | 25.3 | 0.5 | 0.3 | 1.4 | 0.9 |

| 8723 | Mechanotherapy appliancesb | 0.8 | 7.3 | 1.4 | 5.5 | 4.1 | 18.7 |

| 8722 | Medical, surgical or veterinary instruments | 3.4 | 5.6 | 0.8 | 0.6 | 2.3 | 1.9 |

| 7921/2 | Aircraft <2,000 kg | 1.4 | 3.6 | 1.2 | 2.4 | 3.6 | 8 |

| 8744 | Instruments/apparatus for chemical analysis | 2.1 | 3.1 | 1 | 0.6 | 2.8 | 2.2 |

| 7522 | Digital automatic data processing machines | 0.6 | 2.1 | 0.1 | 0.1 | 0.3 | 0.3 |

| 7788 | Electrical machinery and equipment | 1.3 | 2 | 0.4 | 0.3 | 1.2 | 1.1 |

| 8742 | Drawing or mathematical calculating instruments | 0.6 | 1.6 | 0.3 | 0.4 | 0.8 | 1.3 |

| 8741 | Meteorological/geophysical instruments | 0.8 | 1.6 | 0.8 | 1 | 2.2 | 3.4 |

| 7931 | Yachts and other sport vessels | 1.7 | 1.4 | 1.6 | 0.9 | 4.8 | 3.1 |

| 7638 | Sound recording/reproducing apparatus | 0.4 | 1.1 | 0.1 | 0.2 | 0.2 | 0.5 |

| 7648 | Telecommunications equipment | 0.3 | 0.9 | 0.3 | 0.4 | 1 | 1.3 |

| 8745 | Measuring, controlling and scientific instruments | 0.2 | 0.9 | 0.3 | 0.7 | 0.9 | 2.5 |

| 8746 | Automatic regulating or controlling instruments | 0.3 | 0.8 | 0.2 | 0.3 | 0.5 | 0.9 |

| 7932 | Ships, boats and other vessels | 4 | 0.8 | 0.7 | 0.1 | 1.9 | 0.2 |

| 7758 | Electro-thermic appliances | 0.4 | 0.8 | 0.2 | 0.2 | 0.5 | 0.5 |

| 7741 | Electro-diagnostic (except radiological) apparatus | 0.4 | 0.7 | 0.3 | 0.3 | 0.8 | 0.9 |

| 7712 | Microphones and stands therefor | 0.4 | 0.7 | 0.1 | 0.1 | 0.4 | 0.4 |

| 7642 | Wrist watches | 0.3 | 0.7 | 0.2 | 0.2 | 0.4 | 0.7 |

| 7832 | Semi-trailer tractors | 0.4 | 0.6 | 0.1 | 0.1 | 0.4 | 0.3 |

| 8743 | Lenses, prisms, mirrors and other optical elements | 0.2 | 0.6 | 0.2 | 0.3 | 0.7 | 1 |

| 8747 | Oscilloscopes, spectrum analyser instruments | 1.2 | 0.6 | 0.6 | 0.3 | 1.7 | 0.9 |

| 7822 | Special-purpose motor vehicles | 0.3 | 0.5 | 0.4 | 0.3 | 1.1 | 0.9 |

| Other | 20.6 | 7.3 | 0.6 | 0.2 | 1.6 | 0.8 | |

| Total | 100 | 100 | 0.4 | 0.3 | 1.2 | 0.8 | |

Notes

- a Products are listed by ascending order based on export shares for 2012/13. Figures are 2-year averages.

- b Four-digit items, each of which accounts for <0.5% of the total value.

Among the parts and component exports, aircraft parts and components (SITC 7929) stand out for its impressive growth performance. Its share in Australia's total parts and component exports increased from 8.2% in 2000/01 to 13.4% in 2012/13 (Table 2). In 2012/13, Australia accounted for 1.7% of total world exports of aircraft components, compared to 0.6% in 2000/01. As measured by the RCA index, in 2012/13 Australia's share of world exports of aircraft parts and components was almost six times of the Australian share in world manufacturing exports, compared to 2.1 times in 1990/91. The emergence of aircraft components as a new dynamic item in Australia's export composition has been underpinned by the consolidation of the presence of Boeing and Airbus, the world's two major aircraft producers in the world, in Australian manufacturing. Australia is well placed to benefit from the rapid global expansion of aircraft production networks given the skill base and managerial talent developed over the past century, and a successful public–private collaborative effort to gain a global niche in the production of carbon fibre composite materials over the past two decades (Athukorala & Talgaswatta, 2016).

The other products that have indicated notable increases in exports shares are parts of earth moving machines (SITC 7239), transmission apparatus for radio-telephony (SITC 7643), mineral processing machines (SITC83) and various machine tools (SITC 7429). Automobile parts (SITC 7843) account for the second largest share in exports after aircraft parts, but this share has declined from 10.8% to 8.8% between 2000/01 and 2012/13.

Among the final assembly exports, motor vehicles (SITC 7821: goods transport vehicles and 7812: passenger cars) still accounts for over a half of the total assembly exports, but their share has declined in recent years. Also the RCA index of automobile is less than unity (Table 3). This evidence suggests that export performance of automotive industry is predominantly driven by industry assistance provided by the government.5 However, Australian automotive industry seems to have a competitive edge in some specialised automotive parts such as parts of trucks for short-distance transport (SITC 7441), vehicle rear-view mirrors (SITC 6648), engine parts (SITC 7189) and valves (SITC 7429).

The most notable export share gains are associated with medical equipment and measuring instruments. Between 1990/01 and 2012/13, the shares of mechanotherapy exports increased from 0.3% to 7.3%, and that of medical and surgical instruments increased from 2.5% to 5.6%. In 2012/13, Australia accounted for 5.5% of the total world exports of mechanotherapy appliances, up from 0.3% in 1990/91. The share of light aircraft (<2,000 kg) accounted for 3.6% of total final goods exports, compared to 1.2% in 1990/91. Australia's share in world light aircraft exports increased from 1.1% to 3.6% between 1990/91 and 2012/13. Various categories of measuring, scientific and medical/surgical equipment have recorded increases in their shares in total GPN final exports from Australia as well as in total world exports.

5 Determinants of exports

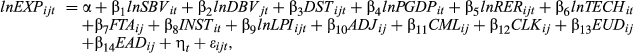

In this section, we undertake an econometric analysis of the determinants of manufacturing exports, distinguishing among parts and components, final assembly and conventional (horizontal) products. The analysis is undertaken within the standard gravity modelling framework, which has now become the “workhorse” for modelling bilateral trade flows.6 We estimate the export equation separately for total manufacturing and the three product categories by including intercept and slope dummy variables to examine how Australian performance differs from that of the other countries. This approach is equivalent to estimating separate regressions for Australia, but it has the added advantage of providing a direct test of the statistical significance of the differences between the estimated coefficients.

5.1 The model

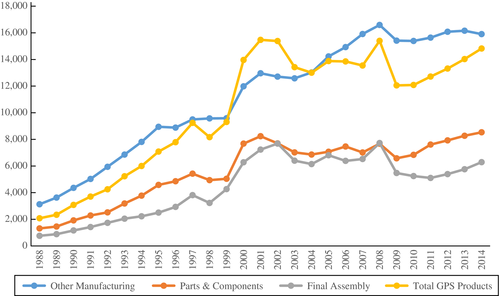

EXP, bilateral exports; SBV, supply-base variable: real manufacturing output (RMF) for parts and components and GDP for final assembly and total exports of country i (+); DBV, demand-base variable: RMF for parts and components and GDP for final assembly and total exports of country j (+); DST, the distance between the economic centres of i and j (−); PGDP, real per capita GDP of country i and j (+ or −); RER, real bilateral exchange rate between i and j (+); TECH, technological capabilities of i measured by resident patent registrations (+); INST, institutional quality of country i (+); FTA, a binary dummy which is unity if both i and j belong to the same regional trade agreements and 0 otherwise (+); LPI, quality of trade-related logistics of country i and j (+); ADJ, a binary dummy variable which takes the value one if i and j share a common land border and zero otherwise (+); CML, a dummy variable which takes the value one if i and j have a common language (a measure of cultural affinity) and zero otherwise (+); CLK, colonial economic link dummy which takes the value one for country pairs with colonial links and zero otherwise (+); EUD, a dummy variable for the European Union member countries (which takes the value one for EU member countries and zero for the other countries); EAD, a dummy variable for the countries in East Asia (which takes the value one for the East Asian countries and zero for the other countries); α, a constant term; ηt, a set of time dummy variables to capture year-specific “fixed” effects; ε, a stochastic error term, representing the omitted influences on bilateral trade.

The three variables, SBV, DBV and DST, are the key gravity model variables. In the standard formulation of the model, the real GDP of the reporting and partner countries is used to represent SBV and DBV. The GDP of the exporting country is used to represent its supply capacity, whereas that of the destination nation represents the capacity to absorb: the larger countries have more variety to offer and absorb in international trade than smaller countries (Tinbergen, 1962). The use of these variables in the trade equation is also consistent with the theory of global production sharing, which predicts that the optimal degree of fragmentation depends on the size of the market (Grossman & Rossi-Hansberg, 2013; Jones & Kierzkowski, 2004). However, for modelling trade in parts and components, which are mostly inputs in the production process, the use of GDP to represent supply and demand is less appropriate (Baldwin & Taglioni, 2011). For this reason, we use the RMF of the reporting and partner countries as the proxies for SBV and DBV in the part and component equation.

The geographic distance (DST) is a proxy measure of transport (shipping) costs and other costs associated with time lags in transportation including spoilage. Technological advances during the post-war era have sharply reduced international communication costs. However, there is evidence that geographical “distance” is still a key factor in determining international transport costs, in particular shipping costs. Transport cost could also be a much more important influence on GPN trade than on the conventional horizontal trade, because of multiple border crossing involved, meeting delivery requirements for just-in-time production and the requirements for movement of managerial and technical manpower within GPNs (Hummels, 2007).

Relative per capita GDP (RPGDP) is a good surrogate variable for intercountry differences in the capital–labour ratio (Helpman, 1987). There are also reasons to believe that relative GDP per capita has a positive effect on GPN trade because as countries grow richer, the scale and composition of industrial output could become more conducive to production sharing. More developed countries also have better trade-related infrastructure that facilitate production sharing by reducing the cost of maintaining “services links.”

Real exchange rate, measured as the domestic currency price of trading partner currency adjusted for relative prices of the two countries, is included to capture the impact of international competitiveness of tradable goods production on export performance. In the standard trade flow modelling, this variable is expected to have a positive impact on bilateral trade flows. However, as discussed (Section 3), we hypothesise this impact to be weaker (or even zero) for GPN trade.

Technological capabilities (TECH) is a key determinant of a country's ability to move from low-value assembly activities to high-value upstream and down-street activities within global production chains. The free trade agreement dummy variable (FTA) is included to capture the impact of tariff concessions offered under these agreements. In theory, GPN trade is considered to be relatively more sensitive to tariff changes (under an FTA or otherwise) compared to the conventional horizontal trade because normally a tariff is incurred each time a good in process crosses a border (Yi, 2003). However, in reality, the trade effect of any FTA would depend very much on the nature of the rules of origin (ROOs) built into it and resultant increase in transaction costs involved in FTA implementation (Krishna, 2006). Moreover, the process of global production sharing is characterised by the continuous emergence of new products, which could lead to administrative delays and the tweaking of rules as a means of disguised protection.

The remaining variables represent various aspects of the cost of “service links” involved in connecting production blocks/tasks within the GPNs. The institutional quality index (INST) captures various aspects of governance that directly affect property rights, political instability, policy continuity and other factors which have a bearing on the ability to carry out business transaction. The logistic performance index (LPI) measures the quality of trade-related logistic provisions. Adjacency (ADJ) and common business language (CML), and colonial links (CLK) can facilitate trade by reducing transaction cost and through better understanding of each other's culture and legal systems. The European Union dummy (EUD) is expected to capture the possible implications of economic integration for trade patterns. The East Asia dummy (EAD) is included to test whether the importance of the region as a centre of regional production network's still holds after controlling for the other relevant variables.

5.2 Data and the estimation method

The model is estimated using annual data compiled from the exporter records in the UN trade data system (Comtrade database) during the period 1996–2013. The data set covers 44 countries each of which accounted for 0.01% or more of total world manufacturing exports in 2005. These countries account for over 98% of total world manufacturing exports. The trade data in nominal US$ are converted into real terms using US import price indices extracted from the US Bureau of Labour Statistics database. Information on the data sources and the construction of the explanatory variables is summarised in Table 4.

| Label | Definition | Data source/variable construction |

|---|---|---|

| EXP |

Bilateral exports in US$ measured at constant (2000) price, for 44 countries: Argentina, Australia, Belgium, Bangladesh, Brazil, Canada, Switzerland, China, Costa Rica, Czech Republic, Germany, Denmark, Spain, Finland, France, United Kingdom, Hong Kong, China HKG, Hungary, Indonesia, India, Ireland, Israel, Italy, Japan, Rep. of Korea, Sri Lanka, Mexico, Malaysia, the Netherlands, Norway, Pakistan, the Philippines, Poland, Portugal, Russian Federation, Singapore, Slovakia, Slovenia, South Africa, Sweden, Thailand, Turkey, United States, USA and Vietnam |

Exports (at CIF price, US$): compiled from UN COMTRADE database Exports values are deflated by US import price indices extracted from the US Bureau of Labour Statistics data base (http://www.bls.gov/ppi/home.htm) |

| GDP, RMF, PGDP | GDP, manufacturing output and per capita GDP (at 2,000 price) | World Bank: World development Indicators |

| DST | Weighted distance measure of the French Institute for Research on the International Economy (CEPII), which measures the bilateral great-circle distance between major cities of each country | French Institute for Research on the International Economy (CEPII) database |

| RER | Real exchange rate: where NER is the nominal bilateral exchange rate index (value of country j's currency in terms of country i's currency), PW is price level of country j measured by the producer price index and PD is the domestic price index of country i measured by the GDP deflator. An increase (decrease) in RERij indicates improvement (deterioration) in country's international competitiveness relative to country j | Constructed using data from World Bank, World development Indicators database |

| TECH | Technological capability proxied by patent applications by the residents of a given country | World Bank: World Development Indicators |

| FTA | A binary dummy variable which is unity if both country i and country j are signatories to a given regional trading agreement | CEPII database |

| INS | Institutional (governance) quality (by political stability and absence of violence) measured on a scale of −2.5 (worst performance) to 2.5 (best performance) | World Bank: worldwide-governance-indicators |

| LPI | World Bank Logistic Performance Index: logistic quality of a country assessed on a scale of 1 (worst performance) to 5 (best performance), based on six indicators: (1) efficiency of the clearance process by customs and other border agencies; (2) quality of transport and information technology infrastructure; (3) ease and affordability of arranging international shipments; (4) competence of the local logistics industry; (5) ability to track and trace international shipments; (6) domestic logistic costs; and (7) timeliness of shipment in reaching destination | World Bank: http://lpi.worldbank.org/ |

| ADJ | A binary dummy variable which is unity if country i and country j share a common land border and 0 otherwise | CEPII database |

| CML | A dummy variable which is unity if country i and country j have a common language and zero otherwise | CEPII database |

| CLK | A dummy variable which is unity for country pairs with colonial links and zero otherwise | CEPII database |

Of the three standard panel data estimation methods (pooled OLS, random-effects and fixed-effects estimators), the fixed-effects estimator is not appropriate for estimating the model because it contains a number of time-invariant explanatory variables, which are central to our analysis. In experimental runs, we used both pooled OLS estimator and random-effects estimator (REE). The Breusch–Pagan Lagrange multiplier test favoured the use of RE over the OLS counterpart. However, RE estimator can yield biased and inconsistent coefficient estimates if one or more explanatory variables are endogenous (i.e., if they are jointly determined together with the dependent variable). Given these concerns, we re-estimated the model by the instrumental variable estimator proposed by Hausman and Taylor (1981) (henceforth HTE). The HTE redresses the endogeneity problem using instruments derived exclusively from inside the model to capture various dimensions of the data. Its superiority of HTE over REE in generating consistent coefficient estimates of the gravity model has been demonstrated by a number of recent studies.7

5.3 Results

The preferred Hausman and Taylor estimator estimates of the trade equation are reported in Table 5.8 The coefficient estimates for Australia derived from the overall regression are given in Table 6. We first discuss the findings generally applicable to all countries followed by Australia-specific findings.

| Variables | Total manufacturing | Parts and components | Final assembly | Conventional (horizontal) exports |

|---|---|---|---|---|

| Ln real GDP (RGDP), reporter | 1.23*** | 1.81*** | 1.03*** | |

| (0.03) | (0.06) | (0.03) | ||

| Ln real GDP (RGDP), partner | 1.38*** | 2.14*** | 1.19*** | |

| (0.03) | (0.06) | (0.03) | ||

| Ln real manufacturing output (RMF), reporter | 1.39*** | |||

| (0.03) | ||||

| Ln RMF, partner | 1.10*** | |||

| (0.03) | ||||

| Ln Distance (DST) | −0.86*** | −0.81*** | −1.09*** | −0.95*** |

| (0.06) | (0.10) | (0.10) | (0.05) | |

| Ln relative per capital GDP (RPGDP) | −0.00** | −0.01*** | 0.01*** | −0.01*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Ln bilateral real exchange rate (RER) | 0.01*** | −0.01 | −0.01* | 0.01*** |

| (0.00) | (0.00) | (0.01) | (0.00) | |

| Ln technology base, reporter (TECH) | 0.07*** | 0.22*** | 0.05*** | 0.09*** |

| (0.01) | (0.01) | (0.02) | (0.01) | |

| FTA membership dummy (FTA) | 0.34*** | 0.47*** | 0.69*** | 0.22*** |

| (0.02) | (0.04) | (0.05) | (0.02) | |

| Institutional quality (INST), reporter | −0.06*** | 0.04** | −0.05** | −0.05*** |

| (0.01) | (0.02) | (0.02) | (0.01) | |

| Ln logistic quality (LPI), reporter | 0.93*** | 1.02*** | 1.16*** | 0.79*** |

| (0.12) | (0.18) | (0.24) | (0.13) | |

| Contiguity dummy (ADJ) | −0.03 | −0.44 | −0.60* | 0.11 |

| (0.21) | (0.35) | (0.36) | (0.18) | |

| Common language dummy (CML) | 0.38*** | 0.70*** | 0.15 | 0.48*** |

| (0.13) | (0.23) | (0.22) | (0.11) | |

| Colony dummy (CLK) | −0.32 | 0.12 | −0.93** | 0.01 |

| (0.22) | (0.37) | (0.39) | (0.20) | |

| European Union dummy (EU) | −0.13 | 0.40 | −0.30 | −0.17 |

| (0.15) | (0.24) | (0.27) | (0.14) | |

| East Asia dummy (EAS) | 1.68*** | 1.97*** | 1.79*** | 1.37*** |

| (0.18) | (0.31) | (0.32) | (0.16) | |

| Constant | −51.47*** | −47.06*** | −87.70*** | −40.77*** |

| (1.18) | (1.31) | (2.23) | (1.17) | |

| Australia dummy (AD) variables | ||||

| AD × RGDP, Australia | −0.03 | −1.22** | 0.14 | |

| (0.32) | (0.62) | (0.33) | ||

| AD × RGDP, partner | −0.22 | −1.24*** | 0.09 | |

| (0.24) | (0.47) | (0.25) | ||

| AD × RMF, reporter | 1.09 | |||

| (1.48) | ||||

| AD × RMF partner | −0.23 | |||

| (0.21) | ||||

| AD × RPGDP | −0.00 | 0.04*** | 0.00 | −0.01 |

| (0.01) | (0.01) | (0.02) | (0.01) | |

| AD × RER | 0.05* | 0.09** | 0.06 | 0.07*** |

| (0.03) | (0.04) | (0.05) | (0.03) | |

| AD × TECH | 0.17 | 0.67 | 1.27** | 0.40 |

| (0.26) | (0.50) | (0.50) | (0.27) | |

| AD × FTA | −0.56*** | −0.53*** | −0.97*** | −0.53*** |

| (0.15) | (0.20) | (0.29) | (0.15) | |

| AD × INST | 0.27 | 0.94*** | 0.32 | 0.14 |

| (0.18) | (0.28) | (0.35) | (0.19) | |

| AD × LPI | 1.29 | −2.78 | 7.36 | 3.45 |

| (3.23) | (5.12) | (6.36) | (3.40) | |

| AD × CML | 0.26 | 0.41 | 0.88 | 0.08 |

| (0.60) | (1.03) | (1.05) | (0.53) | |

| AD × CLK | 0.70 | 0.90 | 1.41 | 0.36 |

| (1.74) | (2.72) | (3.06) | (1.56) | |

| AD | 26.91*** | −14.42 | 53.94*** | 16.80* |

| (10.42) | (33.24) | (19.63) | (10.30) | |

| Observations | 30,570 | 24,546 | 30,100 | 30,060 |

| Number of country pairs | 1,845 | 1,672 | 1,843 | 1,838 |

Notes

- Heteroscedasticity-corrected standard errors are given in parentheses.

- The statistical significance of regression coefficients denoted as: ***p < .01, **p < .05, *p < .1.

| Variables | Total manufacturing | Parts and components | Final assembly | Conventional (horizontal) exports |

|---|---|---|---|---|

| Ln real GDP (RGDP), Australia | 1.20*** | 0.60*** | 1.16*** | |

| (0.32) | (0.22) | (0.33) | ||

| Ln real GDP (RGDP), partner | 1.17*** | 0.90* | 1.28*** | |

| (0.24) | (0.46) | (0.24) | ||

| Ln real manufacturing output (RMF), Australia | 2.49 | |||

| (1.49) | ||||

| Ln RMF, partner | 0.86*** | |||

| (0.21) | ||||

| Ln distance (DST) | −3.52*** | −1.94 | −2.05* | −4.30*** |

| (0.73) | (1.17) | (1.29) | (0.66) | |

| Ln relative per capital GDP (RPGDP) | −0.01 | 0.03*** | 0.01 | −0.02 |

| (0.01) | (0.01) | (0.02) | (0.01) | |

| Ln bilateral real exchange rate (RER) | 0.06*** | 0.07* | 0.04 | 0.08*** |

| (0.02) | (0.04) | (0.05) | (0.03) | |

| Ln technology base, reporter (TECH) | 0.14*** | 0.43*** | 0.10*** | 0.18*** |

| (0.02) | (0.03) | (0.04) | (0.01) | |

| FTA membership dummy (FTA) | −0.22 | −0.06 | −0.28 | −0.30* |

| (0.15) | (0.20) | (0.29) | (0.15) | |

| Institutional quality (INST), Australia | 0.22 | 0.98*** | 0.27 | 0.09 |

| (0.18) | (0.28) | (0.35) | (0.19) | |

| Ln logistic quality (LPI), reporter | 2.22 | −1.76 | 8.52 | 4.23 |

| (3.22) | (5.11) | (6.35) | (3.39) | |

| Common language dummy (CML) | 0.64 | 1.12 | 1.02 | 0.56 |

| (0.59) | (1.01) | (1.03) | (0.52) | |

| Colony dummy (CLK) | 0.38 | 1.03 | 0.48 | 0.37 |

| (1.73) | (2.70) | (3.04) | (1.55) |

Notes

- The results reported in this table are derived from the overall regressions reported in Table 6. The coefficients are the linear combinations of each of the base coefficient and the coefficient of the Australia dummy. The standards errors (derived from the covariance of the two coefficients) are given in parentheses.

- The statistical significance of the regression coefficients is denoted as ***p < .01, **p < .05, *p < .10.

The coefficients of the standard gravity variables (SBV, DBV and DST) are statistically significant with the expected signs in all equations. The magnitude of the coefficient of the distance, DST (between −.81 and −1.09), is consistent with the results of previous gravity model applications to modelling trade flows (Head & Mayer, 2014).

The result for the relative per capita income variable (RPGDP) is mixed. The coefficient is statistically significant with the negative sign in the parts and component equation, suggesting a relative labour intensity bias associated with export expansion. The reverse impact seems to apply for final assembly, but the estimated impact is small in both cases (.01).

The results for the RER variable support our hypothesis that global production sharing weakens the link between international price changes and trade flows. The coefficient of RER is not statistically different from zero in the equation of parts and components. It is marginally significant in the equation for final assembly with the perverse sign. By contrast, the estimated effect of RER on horizontal exports (and hence on total exports) is highly significant with the expected (positive) sign.

The coefficient of TECH suggests that the domestic technology base is an important determinant of manufacturing export performance in general. However, the coefficient of this variable for parts and components (.22) is much larger compared to that of final assembly (.05), supporting the hypothesis that specialisation in parts and components within GPNs is generally more technology intensive compared to final assembly.

The coefficient of the free trade agreement variable (FTA) is statistically significant in all four equations, but it is larger in magnitude in the two GPN exports equations. This result is consistent with the fact that tariffs on final electrical and transport equipment still remain high in most countries. The coefficient of this variable for parts and components is smaller (.47) compared to that for final assembly (.69). This difference is consistent with the fact that almost all countries permit duty-free entry of parts and components as part of their export promotion policy.

Institutionally quality (INST)9 seems to have a positive and statistically significant effect only on parts and component exports. This is plausible because institutional quality is closely associated with the service link costs involved in global production sharing. Timely delivery of parts and components is vital for the smooth functioning of closely knit tasks within the value chain.

The coefficient of the logistic performance variable (LPI) is statistically significant in all four equations. The magnitude of the coefficient of this variable for parts and components (1.02) and final assembly (1.16) is larger than that of conventional (horizontal) exports (.79). This difference (which is statistically significant) is consistent with the view that the quality of trade-related logistics is a much more important for a country's success in expanding GNP trade.

The common language (CML) seems to have a highly significant impact on parts and component exports. The use of a common language generally reduces service link cost. Surprisingly, the coefficient of this variable is not statistically significant in the equation for final assembly export. This presumably reflects China's dominance in the world final assembly trade.

Finally, the coefficient of the East Asia dummy (EAS) is highly significant with the expected sign in all four regressions. The coefficient EAS in the two GPN equations is much larger than that in the horizontal export equation, indicating a strong in intraregional bias in East Asian GPN trade. The results for the EU dummy suggest that there is distinct intraregional bias in EU trade only in the case of parts and component exports.

Turing to Australia-specific results (Table 6), the coefficients of most of the dummy interaction variables are not statistically significant. This suggests that the above inferences relating to these variables are generally applicable to exports from Australia as well.

A notable Australia-specific finding is that “tyranny of distance” is a much more binding constraint on exports of conventional (horizontal) goods and hence on total manufacturing exports. The coefficient of DST in the equations for horizontal goods (−4.30) and total manufacturing (−3.52) is highly significant and it is more than three times larger in magnitude compared to the all-country coefficient (−.95 and −.86, respectively). By contrast, the coefficient of DST in the equations for parts and components is not statistically significant, suggesting that distance does not place Australia at a specific disadvantage in exporting parts and components compared to the all-country experience. The coefficient of DST related to final assembly exports is marginally significant (at the 10% level) presumably because shipping is the only mode of transport for some final assembly products such as motor vehicles and agricultural machinery. However, overall, it seems that fitting into GPNs help Australian manufacturing to circumvent the “tyranny of distance” by specialising in high-value-to-weight components, which are suitable for air transport.

The coefficient of RGDP is statistically significant with the positive sign only in the parts and component regression. This finding is consistent with the view that Australia has comparative advantage in the production of relatively more capital parts and components within production networks compared to the other countries.

The coefficient of the RER variable in the final goods equation is not statistically different from zero. It is marginally statistically significant (at the 10% level) for components with the expected (positive) sign, but the magnitude of the coefficient is small (.07). Thus, overall, the results are consistent with our postulate that relative price competitiveness is not a major determinant of GPN trade.

The domestic technology base seems to give an edge to Australian manufacturing in exports of both parts and components and final assembly. The estimated Australian coefficient of TECH is statistically significant and its magnitude is much larger compared to the all-country coefficients. The coefficient of the parts and comments equation (.43) is four times of that of the final assembly equation (.10). This is consistent with the greater technology intensity of parts and component production compared to final assembly. Overall, the Australian results relating to TECH variables are consistent with the patterns revealed in our RCA analysis. The results for the FTA variable suggest that FTA membership10 has not so far helped expansion of Australian manufacturing exports over and above the other determinants of trade flows.

Institution quality (INST) seems to give Australian manufacturing a distinct competitive edge in parts and component exports over the other countries. The coefficient of INST for Australia in the equation for parts and components is as large as .98 compared to the all-country coefficient of a mere .04.

6 Concluding remarks

Global production sharing has become an integral part of the global economic landscape over the past few decades. Australia is still a minor player in global production sharing, but at the disaggregated levels we can observe a number of promising signs. There are, however, early signs of Australian manufacturing joining the GPNs, specifically focusing on specialised tasks which are generally consistent with the country's comparative advantage in skill-intensive production. Australia's share of total OECD exports of GPN products has doubled over the past decade.

Australia seems to have a distinct competitive edge in parts and component specialisation in several product categories: aircraft and associated equipment, parts of earth moving and mineral processing machines and specialised automotive parts. Among final assembly products, Australia seems to have a competitive edge in medical and surgical equipment, light aircraft, measuring and scientific equipment and instruments for chemical analysis. In summary, the ongoing process of global production sharing has opened up opportunities for Australia to specialise in high-value-to-weight parts and components, and final assembly, which are not generally subject to the tyranny of distance in world trade because the main mode of transport is air shipment.

Overall, our findings are consistent with the view that “[R]umours of the death of manufacturing in Australia, perpetuated by the media's constant reporting of factory closures, and large multinationals exiting manufacturing, is generally exaggerated” (CEDA 2014).

There is evidence that domestic technological capabilities are relatively more important compared to the average global experience in determining components exports from Australia. Relative price competitiveness (captured in our analysis by the RER) does not seem to be an important determinant of GPN exports. These exports are predominantly “relationship specific” and are based on long-term supplier–producer relationship. This evidence suggests that reaping gains from Australia's comparative advantage in primary commodity (resource-based) trade and from specialisation in knowledge-intensive tasks within GPNs are not conflicting policy goals for Australia.

Finally, the ongoing process of global production sharing calls for a change in national data reporting systems, and analytical and statistical tools we use to measure and understand world trade and the trade–industry nexus. Linking trade data at the firm/establishment level with production data is vital for clearly identifying the niche areas of specialisation within global production systems and monitoring the achievement of the manufacturing industry in those areas. It is also important to improve/restructure the national data reporting system in order to better capture the growing importance of the role of services in manufacturing.

where Xij denotes country i's exports of commodity j, Xwj is world exports of commodity j, Xit is country i's total exports, and Xwt is total world exports. When the value of RCA exceeds (is below) unity, country i is said to have a RCA (comparative disadvantage) in commodity j.

where Xij denotes country i's exports of commodity j, Xwj is world exports of commodity j, Xit is country i's total exports, and Xwt is total world exports. When the value of RCA exceeds (is below) unity, country i is said to have a RCA (comparative disadvantage) in commodity j.