The Effect of Aggregation Bias: An NTB-modelling Analysis of Turkey's Agro-food Trade with the EU

Abstract

We explore how different data aggregation levels affect the gravity estimates of non-tariff barriers (NTBs) in the agro-food sector, and we examine their related impacts on policy simulations of an expansion to the European Union (EU) that would include Turkey. We calculate two sets of ad valorem equivalents (AVEs) of NTBs using the gravity approach to disaggregated and aggregated Central Product Classification data for 15 Global Trade Analysis Project (GTAP) agro-food sectors. We find that the AVEs of NTBs vary substantially across products and that using aggregated data primarily results in greater effects of NTBs. In a second step, we incorporate the AVEs of NTBs into the GTAP model to evaluate Turkey's EU membership and conclude that aggregation bias has considerable effects on both the estimation of NTBs and the general equilibrium simulation results. Utilising different data aggregation levels leads to a great variability of trade costs of NTBs and, hence, to misleading trade and welfare effects.

1 Introduction

Multilateral negotiations on trade liberalisation and the increasing number of economic integration agreements have led to a low level of tariffs worldwide. Consequently, the number and importance of non-tariff barriers (NTBs) to trade has risen, and the plethora of different NTBs makes their regulation at the multilateral level almost impossible. Another potential framework to negotiate the reduction in NTBs might be bilateral and regional trade agreements (RTAs). Thus, a reduction in NTBs needs to be taken into account, particularly in the analysis of RTAs. Recent literature shows that NTB reduction has a greater impact on welfare results than reduced tariffs in most RTAs (e.g. Lejour et al., 2001; Engelbert et al., 2014).

Regional trade agreements are negotiated at a very detailed product level, whereas most empirical studies only consider the aggregated sector level. Against this background, this paper analyses the effects of different aggregation levels on econometric estimates of the trade costs of NTBs and their related impact on the policy simulations of Turkey's potential membership to the European Union (EU). In our analysis, we consider the importance of the food and agricultural trade between Turkey and the EU and the high NTBs imposed on this sector.

We calculate two sets of ad valorem equivalents (AVEs) of NTBs using the gravity approach to disaggregated and aggregated Central Product Classification (CPC) data for 15 Global Trade Analysis Project (GTAP) agro-food sectors. We compare the disaggregated CPC-pooled gravity results with the aggregated gravity results to reveal the impact of the level of data aggregation on the magnitude of trade costs caused by NTBs. Subsequently, we incorporate the AVEs of NTBs estimated at different aggregation levels into the GTAP model to simulate the EU's expansion to include Turkey. We run two experiments, which differ in terms of the NTBs resulting from the different gravity aggregation estimates, to show the impact of aggregation bias on the simulation results.

Aggregation bias is well recognised and apparent in the gravity literature. Anderson and van Wincoop (2004) provide a thorough study on aggregation bias in gravity estimations. They also discuss the reasons leading to the direction of bias and conclude that there is no theoretical presumption. While Agostino et al. (2007) and Anderson (2009) find an upward bias of using aggregated data in gravity estimations, Anderson and Yotov (2010, 2011), Raimondi and Olper (2011), and French (2012) show that aggregated data lead to underestimation. Although there is a missing consensus of direction and magnitude of aggregation bias, the overall recommendation is to disaggregate the data as much as possible to reduce aggregation bias. Still most studies on agricultural sector apply aggregated data and thereby possibly accept biased results for further analysis. One exception is Jensen and Yotov (2011) who examine data aggregation issues for four agricultural sectors. The importance of using different data aggregation levels in CGE models and its related effect on simulation results are also acknowledged by several authors (e.g. Grant et al., 2007, 2008; Charteris and Winchester, 2010; Alexeeva-Talebi et al., 2012; Brockmeier and Bektasoglu, 2014). Considering NTBs for the policy analysis of RTAs are predominantly done by conducting two-stage analysis; first, the effects of NTBs are estimated using the gravity approach, and then, they are implemented in CGE or partial equilibrium models (e.g. Andriamananjara et al., 2004; Philippidis and Sanjuán, 2006, 2007; Fugazza and Maur, 2008; Rau and van Tongeren, 2009; Winchester, 2009; Chang and Hayakawa, 2010). However, to the best of our knowledge, none of the existing studies offer gravity estimates at our very detailed agro-food product level, nor do existing studies offer econometric estimates of NTBs at different aggregation levels used in a CGE model. Thus, in this paper we add to the literature by expounding the effect of using different data aggregation levels to estimate NTBs for trade policy analysis.

Our analysis is divided into two parts. In the first part, we use the gravity approach to estimate the AVEs of NTBs using disaggregated and aggregated data. In the second part, we incorporate these AVEs, which are calculated at different aggregation levels, into the GTAP framework to expose the aggregation bias that is transferred from the gravity estimates to the CGE analysis. We focus on the extent of aggregation bias and the differences between the results of experiments that are either run using the AVEs of NTBs from the disaggregated gravity estimates or those from the aggregated gravity estimates.

2 Gravity Modelling

The measurement of the effects of NTBs at different levels of aggregation is based on an ex post study using the gravity approach. The gravity model has become a useful empirical tool for analysing patterns of trade flows, regional agreements and the effects of trade frictions. Due to its broad theoretical justification and strong explanatory power, it is also recognised as a useful tool for identifying and quantifying the trade costs of NTBs.1 In its basic formulation, the gravity model explains trade between two countries by the economic output of the exporting country and importing country and by the bilateral trade barriers. Anderson and van Wincoop (2003) advocate considering multilateral resistance terms because trade between two countries is lowered by bilateral trade barriers relative to multilateral trade barriers. This theoretical advancement allows accounting for general equilibrium effects. The multilateral resistance terms are econometrically captured by country-specific dummies (Anderson and van Wincoop, 2003, 2004; Feenstra, 2004).2 Bilateral trade barriers are unobservable, but they can be approximated by a trade cost function using observable trade cost proxies.

2.1 Identification Strategy and Data

There are several strategies to directly estimate trade costs of NTBs in the framework of the gravity approach. They are differentiated by incorporating explicit or implicit measures of NTBs into the gravity equation (Chen and Novy, 2012). Studies using explicit measures apply distinct figures such as count of the number of NTBs (e.g. Czubala et al., 2009), notification data from the WTO (e.g. Disdier et al., 2008) and indices of NTBs whose calculation is based on literature review, case studies and interviews with experts (e.g. Winchester et al., 2012). In contrast, studies applying implicit measures mainly use indicators such as regional agreements to identify non-tariff policy measures within a region that can be reduced or eliminated in the course of trade negotiations (e.g. Egger et al., 2011). Following a similar concept, it is also possible to apply the border-effect approach to derive estimates for NTBs (e.g. Anderson and van Wincoop, 2003; Winchester, 2009; Engelbert et al., 2014). Furthermore, surveys (e.g. Maskus et al., 2005) and case studies dealing with specific factors such as maximum residue levels (e.g. Drogué and DeMaria, 2012; Wieck et al., 2012) also can be used to implicitly estimate the effects of NTBs.

To identify the effects of NTBs in this study, we use an implicit measure that we integrate into our trade cost function. RTA variables serve as instruments to isolate the effects of the elimination of unnecessary and restrictive non-tariff measures, the reduction in regulatory divergence and the harmonisation of standards or regulations within a region on average. In the analysis of Turkey's potential accession to the EU, we apply a variable to the EU trade bloc to quantify the positive effects of regulatory convergence and the reduction in NTBs that occur in the integration process.3 We compare existing trade levels under the European economic integration to a hypothesised, counterfactual trade level in the absence of the EU. We draw inferences about the trade costs of NTBs using the theoretical model structure based on the missing trade in the absence of the EU. Applying this approach allows us to calculate a consistently aggregated measure that identifies all NTB-induced trade costs at the sector or product level, which can be realistically eliminated within the EU integration process.

We use a panel data framework to obtain the most reliable estimate of the average expected effect of the European integration process (Baier and Bergstrand, 2007; Magee, 2008; Raimondi et al., 2012), but there are different specifications of the panel gravity equation (compare Egger and Pfaffermayr, 2003; Micco et al., 2003; Baldwin and Taglioni, 2006; Stack, 2009; Sun and Reed, 2010). For our analysis, we choose the panel structure with time-fixed and bilateral fixed effects. Accordingly, we use a panel data estimation strategy in which all time-invariant country-pair factors, such as distance, sharing a common border or common language, a colonial relationship, and other ties that are constant over time, are captured by the country-pair individual heterogeneity term. The intercept is also absorbed, so it has to be removed from the equation. Hence, only time-variant characteristics enter the fixed-effects model. As controls, we include several variables to capture changes in economic and political characteristics as well as trade policies. We use the Poisson fixed-effects model to estimate the gravity equation (Palmgren, 1981; Hausman et al., 1984). This estimation is accomplished through a multiplicative form incorporating trade flows in levels, and we thereby address the problem of zero bilateral trade flows. This problem is especially prominent when using disaggregated data. The more disaggregated the data, the greater the proportion of zero trade flows. Hence, using standard log-linear specification of the gravity model would lead to a loss in information and hence misleading estimation results. Studies show that ignoring zero trade flows as a consequence of log-linearisation results in overestimation of parameters (e.g. Engelbert et al., 2014).

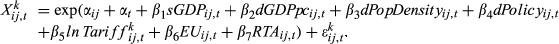

(1)

(1)The variable  represents imports to country i from country j. Following Stack (2009) and Stack and Pentecost (2011), the determinants GDP, GDP per capita, population density and political structure do not enter the equation separately for each country, but in a joint form. The similarity in the terms for economic size (sGDPij,t) for each country pair is derived from the two countries’ share of GDP,5 and the difference in terms of relative factor endowments (dGDPpcij,t) for each country pair is derived from the absolute difference in the GDP per capita6 (Helpman, 1987; Stack, 2009; Stack and Pentecost, 2011). In the same way, differences in population density (dPopDensityij,t) and political structure (dPolicyij,t) are obtained. The variable

represents imports to country i from country j. Following Stack (2009) and Stack and Pentecost (2011), the determinants GDP, GDP per capita, population density and political structure do not enter the equation separately for each country, but in a joint form. The similarity in the terms for economic size (sGDPij,t) for each country pair is derived from the two countries’ share of GDP,5 and the difference in terms of relative factor endowments (dGDPpcij,t) for each country pair is derived from the absolute difference in the GDP per capita6 (Helpman, 1987; Stack, 2009; Stack and Pentecost, 2011). In the same way, differences in population density (dPopDensityij,t) and political structure (dPolicyij,t) are obtained. The variable  is equal to one plus the ad valorem tariff equivalent of country i on the exports of country j in year t and sector k. The variable EUij,t is equal to one if countries i and j are both members of the EU and zero otherwise. The dummy variable RTAij,t is set to unity if both countries belong to the same RTA and to zero otherwise. The EU and RTA dummies account for the regional non-tariff preferences.7 The corresponding regression parameters are denoted by β1–β7, and the fixed-effects control for time-invariant bilateral factors (αij) and time-specific macroeconomic shocks affecting global trade flows (αt). Finally,

is equal to one plus the ad valorem tariff equivalent of country i on the exports of country j in year t and sector k. The variable EUij,t is equal to one if countries i and j are both members of the EU and zero otherwise. The dummy variable RTAij,t is set to unity if both countries belong to the same RTA and to zero otherwise. The EU and RTA dummies account for the regional non-tariff preferences.7 The corresponding regression parameters are denoted by β1–β7, and the fixed-effects control for time-invariant bilateral factors (αij) and time-specific macroeconomic shocks affecting global trade flows (αt). Finally,  is an error term. Following the structure of the theoretical gravity model, the parameters of the economic integration variables are interpreted as β6 = (σ − 1)lnbEU and β7 = (σ − 1)lnbEU, where σ (= β5 + 1) is the elasticity of substitution between goods and bEU − 1 and bRTA − 1 are the tariff cost equivalents of the EU NTBs and a typical RTA.

is an error term. Following the structure of the theoretical gravity model, the parameters of the economic integration variables are interpreted as β6 = (σ − 1)lnbEU and β7 = (σ − 1)lnbEU, where σ (= β5 + 1) is the elasticity of substitution between goods and bEU − 1 and bRTA − 1 are the tariff cost equivalents of the EU NTBs and a typical RTA.

To estimate equation 1 and to compute the tariff cost equivalent of NTBs, we source annual data on bilateral trade flows for 157 CPC products8 at the most disaggregated level from the United Nations Commodity Trade Statistics (UN COMTRADE) database.9 Bilateral tariffs come from the UNCTAD TRAINS database using the World Integrated Trade Solution application software. Information on GDP and GDP per capita is taken from the World Bank. To calculate population density, we use data for population and land area that is also taken from the World Bank. The source of the political variable is the Polity IV project (CSP 2014).10 Finally, the binary RTA variable is taken from de Sousa (2014). Our panel set covers the period from 1988 to 2011. The most important parameters of our analysis are the ones for tariffs and EU membership. What expectation do we have according to the estimates and how is it influenced? We expect tariffs to have a negative effect on trade and EU membership to have a trade-enhancing effect. In the CPC product-level regressions, we anticipate high variation in the effects of tariffs and economic integration across products. The higher the variation at the product level, the higher the aggregation bias using aggregated data. In terms of tariffs, aggregate values tend to mask high-tariff components due to the aggregation method, and hence, we expect an underestimation of the effect. In addition, the elasticity of substitution between goods decreases the wider the product differentiation or the more aggregated product bundles are. Hence, we expect that our estimated tariff elasticity will be lower at the aggregated level. With respect to the positive trade effects of economic integration variables, we anticipate the contrary effect. The effect might be overstated the higher the data aggregation because of the fact that not all individual products are included in economic integration processes. But we expect this effect to be offset at the aggregate level. According to the theoretical derivation of AVEs of NTBs, we anticipate that the combination of lower elasticity of substitution and higher trade effect of economic integration at the aggregated data level leads to overestimation of trade costs of NTBs. The calculation of the tariff equivalents of NTBs is highly sensitive to the value of the substitution elasticity. On this account, we expect our estimates to show that a decreasing elasticity of substitution leads to a disproportionate high increase in the tariff cost equivalents of NTBs.

2.2 Empirical Results

We apply the two-way fixed-effects Poisson model to the trade data of 157 CPC products for 15 GTAP agro-food sectors at the aggregated and pooled levels.11 In both implementations, we use the disaggregated data at CPC product level. To obtain sectoral estimates, we either sum up product-level values according to the GTAP sectors (aggregated) or we pool the data by keeping the disaggregated structure (pooled). In addition, we obtain estimates at each CPC product level to compare product line estimates to sector estimates and thus reveal the aggregation differences in the estimates. Table 1 shows the parameter estimates for the vegetables, fruits and nuts sector.12 We only present and discuss the results of this sector in detail for two reasons. First, fruits, vegetables and nuts are important to the trade between the EU and Turkey. They compose the greatest share of Turkey's total exports to the EU within the agro-food sector by 2.68 per cent (GTAP database, Version 8). While Turkey is listed as the top supplier of fruits to the EU, it ranked third in exporting vegetables to the EU (European Commission 2012). Second, vegetables, fruits and nuts are highly affected by sanitary and phytosanitary measures and other food safety standards to which consumers are very sensitive. Accordingly, most frequent NTBs on agro-food trade between Turkey and the EU are imposed on the vegetables, fruits and nuts sector (Önen, 2008; Özdemir, 2008, RASFF 2013; European Commission 2014a; Teknik Engel, 2016).

| Sector Level | Product Level | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

| Vegetables, Fruits, Nuts Agg | Vegetables, Fruits, Nuts Disagg | Potatoes | Dried Leguminous Vegetables | Other Vegetables, Fresh or Chilled | Edible Roots and Tubers | Dates, Figs, Bananas, Coconuts, etc. | Citrus Fruit, Fresh or Dried | Grapes, Fresh or Dried | Other Fruit, Fresh | Other Fruit, Dried | Other Nuts | |

| lnTariff | −3.091*** | −2.279** | −0.811*** | −0.954*** | −4.490*** | −4.620* | −3.705*** | −4.823*** | −1.941*** | −4.064*** | −3.573*** | −4.073** |

| (1.168) | (1.045) | (0.163) | (0.192) | (0.788) | (2.413) | (0.637) | (1.632) | (0.593) | (1.064) | (1.041) | (1.681) | |

| EU | 1.617*** | 1.072*** | 0.591* | −0.178 | 1.570*** | 0.629 | 2.882*** | 0.790*** | 1.304*** | 1.309*** | 1.161*** | 0.824*** |

| (0.135) | (0.120) | (0.321) | (0.357) | (0.168) | (0.738) | (0.279) | (0.191) | (0.161) | (0.179) | (0.312) | (0.241) | |

| RTA | 0.765*** | 0.539*** | 0.381** | 0.215* | 0.709*** | 0.489* | 0.447*** | 0.311** | 0.635*** | 0.661*** | 0.417*** | 0.0732 |

| (0.0751) | (0.0666) | (0.183) | (0.125) | (0.113) | (0.271) | (0.0834) | (0.142) | (0.0960) | (0.0763) | (0.122) | (0.227) | |

| sGDP | 0.135 | −0.127 | −0.140 | −0.320 | 0.221 | −1.099*** | 0.242 | 0.239 | −0.490** | −0.193 | −0.126 | 0.121 |

| (0.124) | (0.128) | (0.333) | (0.224) | (0.166) | (0.335) | (0.198) | (0.248) | (0.235) | (0.162) | (0.159) | (0.232) | |

| dGDPpc | −0.599*** | −0.660*** | −0.660** | −0.705*** | −0.567*** | −1.245*** | −0.139 | −0.331* | −0.870*** | −0.751*** | −0.901*** | −0.630** |

| (0.104) | (0.107) | (0.321) | (0.172) | (0.126) | (0.233) | (0.193) | (0.184) | (0.192) | (0.128) | (0.176) | (0.288) | |

| dPopDensity | −0.459 | −0.598* | −0.580 | −0.714 | −1.329** | −7.831*** | −0.452 | 0.957 | 0.979 | −0.762 | −0.885 | 0.683 |

| (0.374) | (0.332) | (1.090) | (0.776) | (0.590) | (2.715) | (0.437) | (0.762) | (0.850) | (0.540) | (0.737) | (0.895) | |

| dPolicy | −0.0539*** | −0.0322*** | −0.0299 | −0.0252** | −0.0334** | −0.0193 | −0.0433*** | −0.0282 | −0.0635*** | −0.0167 | 0.00408 | −0.0155 |

| (0.0120) | (0.0107) | (0.0316) | (0.0117) | (0.0156) | (0.0155) | (0.0116) | (0.0286) | (0.0207) | (0.0186) | (0.0101) | (0.0173) | |

| Obs. | 91,094 | 251,572 | 11,686 | 27,812 | 36,525 | 10,213 | 38,078 | 20,785 | 19,229 | 34,708 | 21,059 | 22,310 |

| AVEs of NTBs (%) | 68.73 | 60.06 | 107.24 | 25.28 | 41.86 | 11.16 | 117.68 | 17.8 | 95.78 | 38.0 | 38.39 | 22.42 |

Notes

- (i) Standard errors are reported in parentheses.

- (ii) AVE, ad valorem equivalents; NTB, non-tariff barriers.

- (iii) Asterisks (*), (**) and (***) denote significance at the 10%, 5% and 1% levels, respectively.

- Source: Authors’ calculation.

Column (1) shows the estimates for the vegetables, fruits and nuts sector at the aggregated level, and column (2) shows the estimates from the disaggregated CPC-pooled gravity regression. The subsequent columns display the gravity results for the corresponding individual CPC products. Thereby, columns (3)–(6) represent vegetables, and columns (7)–(12) represent fruits.

Most control variables have the expected signs and are statistically significant. As expected, differences between countries in terms of factor endowments, population density and policies, as identified by the variables dGDPpcij,t, dPopDensityij,t and dPolicyij,t, respectively, tend to decrease bilateral trade. Instead, the estimates of similarity in economic size, as captured by the variable sGDPij,t, are mixed in terms of having the correct sign. When the parameter shows the correct sign, it is not significant. In contrast, the effects of tariffs are consistent with our expectations and are highly significant. If the tariff increases by 1 per cent, the trade of vegetables, fruits and nuts decreases by 3.1 per cent in the aggregated version and by 2.3 per cent in the disaggregated version. Considering the results from the product-level gravity approach, the tariff elasticity varies greatly from 0.8 to 4.8 per cent.13

Economic integration agreements have a positive effect on trade. Trade between two countries that join the same RTA is expected to increase by 114.9 per cent with the aggregated data and by 71.4 per cent with the disaggregated data. In terms of the product-level results, trade is expected to increase somewhere between 23.4 per cent (dried leguminous vegetables) and 103.2 per cent (other vegetables, fresh or chilled).14 As expected, deeper trade integration increases trade even more, and EU membership is expected to increase the trade of vegetables, fruits and nuts by 403.8 per cent if considering the aggregated data and by 192.1 per cent if considering the disaggregated data. In the product-level estimations, the positive trade effects of EU membership are greater for some products (e.g. dates, figs, bananas, coconuts, Brazil and cashew nuts, pineapples, and avocados (1.7 per cent)) and lower for others (e.g. potatoes (80.6 per cent)). In two sectors (shelled, dried leguminous vegetables and edible roots and tubers with high starch or inulin content), EU membership does not have a significant effect on trade.

In terms of aggregation bias, the effect of EU membership is significantly lower using disaggregated data compared to the result using aggregated data. This notion is not applicable to all regressions and trade policy variables because there is an overlap between the confidence intervals of the disaggregated gravity and aggregated gravity results. Nonetheless, we can conclude that for some sectors (vegetables, fruits, and nuts, crops; dairy; other food products; beverages and tobacco), there is a significant overestimation of trade policy effects using aggregated data. This result is in accordance with those of other authors using aggregated data in gravity modelling (e.g. Hillberry, 2002; French, 2012). Also, in line with our prior assumptions, the tariff elasticity is mostly higher when using disaggregated data attributable to the aggregation method of tariffs and reflecting the greater elasticity of substitution for disaggregated products.

The last row of Table 1 displays the tariff cost equivalents of NTBs. According to the theoretical derivation, we calculate the tariff cost equivalents of NTBs as AVEsEU = exp(b6/(σ − 1)) − 1.15,16 In terms of the aggregated gravity result, EU membership leads to a reduction in NTBs or regulatory divergence in vegetables, fruits and nuts equivalent to a 68.7 per cent tariff for both countries. Considering the CPC-pooled regression results, the trade-enhancing effect for the vegetables, fruits and nuts sector that results from Turkey's membership in the EU amounts to only 60.1 per cent. This reflects the overestimation effect of using highly aggregated data to estimate the effects of NTBs.

The results of the CPC product-level gravity approach reveals that the most regulatory convergence occurs in the dates, figs, bananas, coconuts, Brazil and cashew nuts, pineapples, and avocados sector (117.7 per cent). The least regulatory compliance occurs in the edible roots and tubers with high starch or inulin content sector (11.2 per cent). The results on AVEs of NTBs are very sensitive to the elasticity of substitution (e.g. Obstfeld and Rogoff, 2001; Raimondi and Olper, 2011). In general, the lower the estimated elasticity of substitution, the greater the estimated AVEs of NTBs will be. This issue also applies to our estimates of tariff elasticity and explains the high AVEs of NTBs for some disaggregated CPC-level products.

To compare the CPC product-level results to the sector-level results, we aggregate the results of the product-level gravity approach on AVEs to the sector level and weight them by their relative importance using trade quantities as weights.17 Specifically, we utilise the weights according to the bilateral trade structure of the EU and Turkey for each sector. This approach leads to asymmetric AVEs of NTBs for the EU and Turkey.

Table 2 exhibits the AVEs of NTBs that the EU and Turkey are expected to decrease during the process of Turkey's integration into the EU. They are differentiated according to the data approach in the econometric part. Aggregated AVEs result from estimations using aggregated data, and disaggregated AVEs are the result of the pooled estimation. In the third approach, we run the gravity model at product level, and then, we aggregated the estimates of trade costs to the sector level for comparison reasons. We refer to these AVEs as re-aggregated AVEs. In addition, we present the number of CPC sectors mapped to each GTAP-level sector and the variation coefficient of AVEs of NTBs from the CPC product-level gravity regressions. In the wheat and processed rice sectors, there is only one corresponding CPC sector leading to equal AVEs of NTBs for all gravity versions. Consequently, there is also no variation at the CPC level across products. In line with other studies (e.g. Anderson and van Wincoop, 2004), there is high variation across products. We observe high variation coefficients in the sectors of other meat, other animal products and plant-based fibres with variation coefficients of 188 per cent, 130 per cent and 122 per cent, respectively. The lowest variation is found in the oil seeds (22 per cent), sugar (50 per cent), and vegetable oils and fats (64 per cent) sectors. Turning to the results of the aggregated gravity approach (AGG) to estimate the AVEs of NTBs, the trade of plant-based fibres is expected to face relatively low non-tariff compliance. The very high trade costs caused by NTBs are expected to decrease in beverages and tobacco, wheat and cereal grains. The order is similar when considering the pooled CPC-disaggregated gravity regression results on AVEs of NTBs, although the magnitude is much lower. The EU and Turkey are assumed to only marginally reduce trade costs in the crop and sugar sectors. Instead, the two parties are expected to achieve the most regulatory compliance in the wheat, beverages and tobacco, other food products and cereal grains sectors. With one exception, namely, other food products, all gravity results on the AVEs of NTBs using aggregated data are higher than those obtained using disaggregated data. This result again confirms our previous assumption that estimates from aggregated data regressions will overestimate the effect of EU membership.

| Sector | CPC Sectors | Variation Coefficient | Aggregated Estimation | Pooled Estimation | Product-level Estimation | |

|---|---|---|---|---|---|---|

| Aggregated AVEs | Disaggregated AVEs | Re-aggregated AVEs | ||||

| (No.) | (%) | EU/TUR | EU/TUR | TUR→EU | EU→TUR | |

| Wheat | 1 | – | 315.17 | 315.17 | 315.17 | 315.17 |

| Cereal grain | 4 | 76.75 | 291.89 | 140.94 | 98.08 | 86.15 |

| Vegetables, fruits and nuts | 10 | 77.01 | 68.73 | 60.06 | 47.07 | 47.75 |

| Oil seeds | 5 | 22.32 | 40.86 | 26.64 | 17.75 | 19.42 |

| Plant-based fibers | 3 | 122.45 | 8.52 | 0.00 | 0.00 | 0.03 |

| Crops | 14 | 113.51 | 101.77 | 13.86 | 43.34 | 32.75 |

| Other animal products | 10 | 130.14 | 122.28 | 78.38 | 13.45 | 1.41 |

| Cattle meat | 9 | 91.41 | 88.62 | 35.02 | 127.25 | 48.01 |

| Other meat | 9 | 188.00 | 116.95 | 104.62 | 21.39 | 19.52 |

| Vegetables oils and fats | 11 | 64.08 | 52.66 | 29.95 | 30.62 | 29.35 |

| Dairy | 11 | 113.91 | 84.14 | 56.98 | 102.70 | 137.30 |

| Processed rice | 1 | – | 50.14 | 50.14 | 50.14 | 50.14 |

| Sugar | 4 | 49.58 | 42.52 | 28.96 | 125.00 | 135.73 |

| Other food products | 52 | 95.19 | 49.26 | 148.99 | 41.49 | 37.52 |

| Beverages and tobacco | 13 | 113.15 | 541.97 | 156.00 | 60.56 | 183.96 |

Notes

- AVE, ad valorem equivalents; NTB, non-tariff barriers.

- Source: Authors' calculation.

According to the trade-weighted re-aggregated results (two right-most columns in Table 2), the EU and Turkey show the greatest deviation in the effects from harmonisation of regulatory systems in the beverages and tobacco, dairy and sugar sectors, in which Turkey's integration into the EU is expected to translate into higher price effects for Turkey than for the EU. Additionally, in the cattle meat, other animal products, cereal grains and crops sectors, there are large deviations. Here, Turkey's membership in the EU is expected to lead to higher price effects for the EU than for Turkey.

Not shown in Table 2, but important nonetheless, is the average AVE of NTBs across all 15 sectors, which decreases greatly from the aggregated version (131.7 per cent) to the disaggregated version (83.1 per cent) and even more in the re-aggregated version (72.9 per cent for the EU and 76.3 per cent for Turkey). Hence, the overestimation effect ranges between 60 and 80 percentage points. Considering the sectoral differences between the aggregated and disaggregated gravity estimation results, there is a bias of between 11 and 635 percentage points. In the same way, the variation in the average AVEs of NTBs across sectors decreases substantially.

3 Simulations with the Global Trade Analysis Project Framework

We analyse the effects of the aggregation bias of the gravity estimates on the policy simulation results with the help of the GTAP model, which is a comparative, static, multiregion general equilibrium model. The standard GTAP model provides a detailed representation of the economy, including the linkages between the farming, agribusiness, industrial and service sectors. The use of the non-homothetic, constant difference of elasticity to handle private household preferences, the explicit treatment of international trade and transport margins and the inclusion of the global banking sector are innovative features of the GTAP model. Trade is represented by bilateral matrices based on the Armington assumption. Additional features of the standard GTAP model are in perfect competition in all markets and the profit and utility-maximising behaviour of producers and consumers. All policy interventions are represented by price wedges. The framework of the standard GTAP model is well-documented in Hertel (1997) and is available on the Internet (see https://www.gtap.org).

3.1 Incorporation of NTBs into the GTAP Model

Non-tariff barriers are not considered in the standard GTAP model. However, they can be modelled using several methods, namely, as export taxes or import tariffs or as efficiency losses depending on the policies with which they are related. In the cases in which trade barriers generate rents, they can be implemented into the CGE model as import tariffs or export taxes. When NTBs only cause efficiency losses and thus increase the cost of production, an efficiency approach can be used (compare Francois, 1999, 2001). Several authors employ a combination of both NTB-modelling approaches to account for the different effects of trade barriers (Andriamananjara et al., 2003, 2004; Fox et al., 2003; Walkenhorst and Yasui, 2005; Fugazza and Maur, 2008; CEPR 2013). With the efficiency approach, the removal of trade costs is reflected as an increase in technology by introducing an additional effective import price that is a function of the observed import price and an exogenous unobserved technical coefficient (Francois, 1999, 2001; Hertel et al., 2001, p. 13). The efficiency approach to modelling NTBs is also referred to as the ‘sand in the wheels’ of trade or the ‘iceberg cost approach’. Alternatively, rent-creating NTBs are incorporated into the GTAP model using the import-tariff or export-tax approach. Hence, a change in import tariffs or export taxes is simulated to account for the protection effect of NTBs. The ‘Altertax’ program in the GTAP model enables users to implement NTBs as additional duties to the initial GTAP duties. Therefore, the partial or complete removal of import tariffs and/or export taxes reflects the effects of trade costs (Andriamananjara et al., 2003; Fox et al., 2003; Walkenhorst and Yasui, 2005).

3.2 Experimental Design

In this paper, we employ version 8 of the GTAP database. We combine the original 134 countries and regions and the original 57 sectors into a 23-sector, 10-region aggregation. We keep food and agricultural sectors separate and group non-food sectors into extraction, manufacturing and services. In the regional mapping, we single out the main country groups. Our sector and region aggregations are highlighted in Table A1 in the Appendix.

The base year in version 8 of the GTAP database is 2007. We move the GTAP framework to 2020 because we assume that Turkey's membership in the EU will be concluded by then. Croatia's membership in the EU is established after 2007. With the help of a pre-experiment, we model the enlargement of the EU to include Croatia, and we include exogenous projections of GDP, population, technical progress and growth in factor endowments to incorporate economic developments until 2020. We source the data for the corresponding shocks from the Centre d’Études Prospectives et d'Informations Internationales, the UN and the World Bank. We disregard Turkey's free trade agreements (FTAs) after 2007 since Turkey would have to withdraw from any FTAs with third-party nations on its membership in the EU (European Commission 2016; Turkish Ministry of Economy 2016).

We then run two experiments using the AVEs of NTBs, which are calculated at different aggregation levels, namely using the AVEs of NTBs from the AGG and those from the disaggregated gravity approach (DIS).18 We consider the bilateral import tariffs and export subsidies between Turkey and the EU and Turkey's adaptation of the EU Customs Union's tariff level after becoming an EU member. In modelling the NTBs, we take the predominance of technical NTBs in the food and agricultural sectors into account by assuming that 75 per cent of NTBs to the agro-food trade are technical NTBs. Hence, we model them using the efficiency approach.19 The remaining 25 per cent are assumed to be rent-creating NTBs, so they are implemented in the GTAP model by employing the import tariff modelling technique.20 We also assume 1 per cent of trade facilitation in non-food sectors (Francois, 2007; Engelbert et al., 2014).21 In our GTAP model, we swap the original GTAP substitution elasticities with the substitution elasticities calculated with the help of the econometric tariff elasticities.22 This approach is chosen to obtain consistency between the econometric estimates and the GTAP simulations.

3.3 Simulation Results: Welfare and Trade Effects

This section discusses the results of two experiments, AGG and DIS, and we focus on the welfare and trade balance effects. We use the NTBs estimated with the gravity approach based either on aggregated data or disaggregated data to reveal the effect of different data aggregation levels on the policy simulation results. We present our results in millions of 2007 US$. GEMPACK (Version 11.0) and RunGTAP (Harrison and Pearson, 1996) are used to perform the simulations. We adopt a fixed trade balance as macroeconomic closure in the enlargement simulations.

In Table 3, we present the welfare results of Turkey's potential membership in the EU relative to the baseline. The simulation results in the first part of the table are based on the experiment using the aggregated data in the gravity estimation, whereas the second part of Table 3 displays the simulation results using the disaggregated data in the gravity estimation. The welfare results are also differentiated according to the gains that result from the reduction in NTBs or the removal of tariffs. We decomposed the total effect of the shock into separate contribution of each shocked variable by programming subtotals in RunGtap.23 We consider our first experiment, AGG, as our reference situation. In the third part of the table, we therefore present the absolute and percentage deviations of DIS from AGG. The percentage deviations are denoted in parentheses.

| Turkey | EU | MENA | Asia | NorthAm | LatinAm | Oceania | SSA | ROW | |

|---|---|---|---|---|---|---|---|---|---|

| AGG | |||||||||

| NTBs from aggregated gravity estimates | |||||||||

| Total | 6,548 | 5,867 | 629 | −329 | −468 | −247 | 8 | 306 | 502 |

| Tariffs | 893 | 622 | 705 | −422 | 179 | 358 | 36 | 187 | 749 |

| NTBs | 5,655 | 5,245 | −262 | 247 | −255 | −356 | −46 | −27 | −349 |

| DIS | |||||||||

| NTBs from disaggregated gravity estimates | |||||||||

| Total | 5,200 | 5,485 | 452 | −117 | −221 | −44 | 28 | 210 | 442 |

| Tariffs | 898 | 484 | 630 | −33 | 255 | 200 | 53 | 157 | 755 |

| NTBs | 4,302 | 5,001 | −359 | 249 | −86 | −292 | −53 | −63 | −404 |

| AGG–DIS | |||||||||

| Total | 1,348 | 382 | 177 | −212 | −247 | −203 | −20 | 96 | 60 |

| (21) | (7) | (28) | (64) | (53) | (82) | (−250) | (31) | (12) | |

| Tariffs | −5 | 138 | 75 | −389 | −76 | 158 | −17 | 30 | −6 |

| (−1) | (22) | (11) | (92) | (−42) | (44) | (−47) | (16) | (−1) | |

| NTBs | 1,353 | 244 | 97 | −2 | −169 | −64 | 7 | 36 | 55 |

| (24) | (5) | (−37) | (−1) | (66) | (18) | (−15) | (−133) | (−16) | |

Notes

- (i) AGG, aggregated gravity approach; DIS, disaggregated gravity approach; MENA, Middle East and North Africa; NTB, non-tariff barriers; ROW, rest of the world.

- (ii) The numbers in brackets are the percentage deviations of AGG from DIS. For instance, the percentage change in Turkey's total welfare level between AGG and DIS is equal to 21 per cent.

- Source: Authors' calculation.

As expected, Turkey's inclusion in the EU results in unambiguous gains for both Turkey and the EU in both experiments. Turkey's total welfare gain amounts to US$6.55 billion in the first experiment whereas US$5.87 billion accrue to the EU. In DIS, in which NTBs from the disaggregated gravity estimates are used, the welfare gains for Turkey and the EU are more limited but remain considerable (US$5.20 billion and US$5.49 billion, respectively). In AGG, US$0.89 billion of welfare gain accrue to Turkey due to the bilateral removal of import tariffs between Turkey and the EU, and Turkey's adaptation of the EU Customs Union's tariff level after becoming an EU member. The remaining US$5.66 billion stem from the reduction in NTBs. The greater welfare effects through the elimination of NTBs, as opposed to the abolition of tariffs, also applies to the EU (US$5.25 billion vs. US$0.62 billion). Similar welfare effects are observed in DIS, in which the gains stemming from NTB reduction outweigh the gains resulting from bilateral tariff removal. Hence, the welfare effect of the removal of NTBs amounts to US$4.30 billion for Turkey and US$5.00 billion for the EU. Including Turkey in the EU also has welfare impacts on other countries. Asia in AGG and Latin America in DIS experience welfare losses due to the decrease in their agro-food imports to the EU. In both experiments, the overall welfare level of the Middle East and North Africa (MENA) and the rest of the world (ROW) increase considerably. In both cases, those welfare gains can be predominantly traced to Turkey's adaptation of the EU Customs Union's tariff level.

As presented in Table 3, the transfer of aggregation bias from the econometric estimations to the GTAP-level simulations creates differences between the welfare results of the two experiments. Using gravity estimates based on aggregated data results in higher welfare gains for both Turkey and the EU. However, especially for Turkey, deviations across experiments are higher (US$6.55 billion vs. US$5.20 billion for Turkey and US$5.87 billion vs. US$5.49 billion for the EU). Higher differences between AGG and DIS for Turkey can be traced back to the predominance of the higher AVEs of NTBs in the gravity estimates using aggregated data (compare Table 1 and Table 2). Using AGG as our reference situation, total welfare effects deviate by 21 per cent for Turkey and by 7 per cent for the EU. For Turkey, the deviation across experiments that resulted from the reduction in NTBs (24 per cent) is higher than the deviation due to the removal of tariffs (−1 per cent). In contrast, the difference in welfare gains between AGG and DIS caused by NTB reduction for the EU is not highly pronounced (5 per cent).

In Table 4, we present the impact of Turkey's membership in the EU focusing on the trade balance of the total agro-food sector and the 16 individual food and agricultural products. The first part of the table shows changes in the trade balance when NTBs stem from gravity estimates using aggregated data (AGG). The second part demonstrates the effects of tariff and NTB reduction between Turkey and the EU when NTBs from the disaggregated gravity estimates are used (DIS). The third part exhibits the absolute and percentage changes of DIS from the reference situation, AGG.

| AGG | DIS | AGG–DIS | |||||||

|---|---|---|---|---|---|---|---|---|---|

| NTBs from Aggregated Gravity Estimates | NTBs from Disaggregated Gravity Estimates | ||||||||

| Turkey | EU | ROWa | Turkey | EU | ROW | Turkey | EU | ROW | |

| Food and agricultural products | 1,598 | −2,350 | −911 | −162 | −1,856 | 897 | 1,760 | −494 | −1,808 |

| (110) | (21) | (198) | |||||||

| Wheat | −596 | 308 | 249 | −559 | 277 | 245 | −37 | 31 | 4 |

| (6) | (10) | (2) | |||||||

| Cereal grain | −478 | 306 | 136 | −481 | 260 | 186 | 3 | 46 | −50 |

| (−1) | (15) | (−37) | |||||||

| Paddy rice | −1 | −10 | 10 | −1 | −10 | 11 | 0 | 0 | −1 |

| (0) | (0) | (−10) | |||||||

| Vegetables, fruit and nuts | 2,412 | −2,621 | −188 | 1,838 | −1,808 | −287 | 574 | −813 | 99 |

| (24) | (31) | (−53) | |||||||

| Oilseeds | −44 | 438 | −408 | −45 | 324 | −293 | 1 | 114 | −115 |

| (−2) | (26) | (28) | |||||||

| Plant-based fibres | 119 | −8 | −105 | 45 | 8 | −54 | 74 | −16 | −51 |

| (62) | (200) | (49) | |||||||

| Crops | −32 | 45 | −71 | −578 | −104 | 572 | 546 | 149 | −643 |

| (−1,706) | (331) | (906) | |||||||

| Other animal products | −272 | 332 | −87 | −195 | 254 | −80 | −77 | 78 | −7 |

| (28) | (23) | (8) | |||||||

| Vegetable oils and fats | 117 | −444 | 229 | −55 | −466 | 412 | 172 | 22 | −183 |

| (147) | (−5) | (−80) | |||||||

| Dairy | −2,354 | 1,617 | 593 | −1,526 | 963 | 465 | −828 | 654 | 128 |

| (35) | (40) | (22) | |||||||

| Processed rice | −140 | 144 | −21 | −131 | 131 | −17 | −9 | 13 | −4 |

| (6) | (9) | (19) | |||||||

| Sugar | 1,712 | −1,085 | −669 | 1,505 | −894 | −659 | 207 | −191 | −10 |

| (12) | (18) | (1) | |||||||

| Other food products | 2,156 | −2,180 | −688 | 1,358 | −1,389 | −257 | 798 | −791 | −431 |

| (37) | (36) | (63) | |||||||

| Beverages and tobacco | −553 | 545 | −68 | −377 | 390 | −70 | −176 | 155 | 2 |

| (32) | (28) | (−3) | |||||||

| Cattle meat | −287 | 103 | 185 | −864 | 120 | 720 | 577 | −17 | −535 |

| (−201) | (−17) | (−289) | |||||||

| Other meat | −161 | 160 | −8 | −96 | 88 | 3 | −65 | 72 | −11 |

| (40) | (45) | (138) | |||||||

Notes

- (i) AGG, aggregated gravity approach; DIS, disaggregated gravity approach; NTB, non-tariff barriers; ROW, rest of the world.

- (ii) The numbers in brackets are the percentage deviations of AGG from DIS. For instance, the percentage change difference in Turkey's agro-food trade balance between AGG and DIS is equal to 110 per cent.

- (iii) aOriginally, we differentiated between Switzerland, Norway, Croatia, rest of EFTA, rest of Eastern Europe, rest of Europe, Belarus, Russian Federation, Ukraine, Kazakhstan, Kyrgyzstan, Armenia, Azerbaijan, rest of Former Soviet Union and rest of the world (compare Table A1 in the Appendix). To simplify, we aggregated all regions other than Turkey and the EU to ROW to present the results.

- Source: Authors' calculation.

The aggregation level used to estimate NTBs with the gravity approach has different trade balance effects on Turkey, the EU, and the ROW. For instance, the results of AGG indicate that Turkey's membership in the EU causes an increase in Turkey's agro-food trade balance by US$1.60 billion when the aggregated gravity estimates are used to estimate the AVEs of NTBs. However, Turkey's agro-food trade balance decreases by US$0.16 billion according to the results of DIS. Hence, the deviation between AGG and DIS amounts to 110 per cent. The same effect of aggregation bias, and thus a deviation of 21 per cent, is also observed for the EU agro-food trade balance. EU agro-food imports relative to exports decrease by US$2.35 billion in AGG, whereas this decrease is smaller and is equal to US$1.86 billion in DIS. As expected, Turkey's inclusion in the EU also has effects on other economies, but the direction and magnitude of the effect again differ according to the aggregation level that is used to estimate the AVEs of NTBs. For example, Turkey's membership to the EU has a negative effect on the ROW agro-food trade balance when NTBs from aggregated gravity estimates are used. However, the ROW trade balance in the food and agricultural sector increases when NTBs from gravity estimates using disaggregated data are input in the GTAP model. Here, the deviation amounts to 198 per cent.

At the product level, the greatest changes to Turkey's and EU's agro-food trade balance are observed in the vegetables, fruits and nuts, dairy and other food products sectors in both experiments. The changes in the trade balance of the separate food and agricultural sectors also drive the results for the total trade of food and agricultural products. This is particularly true for vegetables, fruits and nuts as well as other food products, which are highly exported from Turkey to the EU (GTAP database, version 8); NTBs are most frequently imposed in these sectors (Önen, 2008; Özdemir, 2008, RASFF 2013; European Commission 2014a; Teknik Engel, 2016). Following Turkey's membership in the EU, the imports of dairy products from the EU to Turkey increase and result in a rise in the EU dairy trade balance.

For AGG, the largest increase, US$2.41 billion, in Turkey's agro-food trade balance occurs in the vegetables, fruits and nuts sector. Remarkably, the increase in other food exports from Turkey is relative to its imports by US$2.16 billion. In accordance with the relative increase in Turkey's exports of vegetables, fruits and nuts as well as other food products in AGG, the EU trade balance in these sectors decreases by US$2.62 billion and US$2.18 billion, respectively. For the EU, the highest increase in the agro-food trade balance occurs in dairy products (US$1.16 billion) accompanied by a decrease in Turkey's trade balance (US$2.35 billion). However, using the NTBs from the disaggregated gravity estimates leads to lower changes in the trade balances of Turkey and the EU for the vegetables, fruits and nuts, dairy and other food products sectors. In DIS, Turkey's trade balance of the vegetables, fruits and nuts sector increases by only US$1.83 billion, which corresponds to a deviation of 24 per cent from the results of AGG. The increase in the trade balance in other food products amounts to US$1.36 billion for Turkey in DIS, so the deviation between AGG and DIS equals 37 per cent. For dairy products, we calculate the EU trade balance changes in DIS to be equal to US$0.96 billion, resulting in a deviation of 40 per cent between AGG and DIS. These differences clearly reveal the effects of aggregation bias, which stems from the econometric estimates of trade costs at different data aggregation levels and is particularly prominent in those two sectors. For instance, the AVE of NTBs for dairy products is estimated to be 84.14 per cent with the aggregated gravity estimates, whereas the number equals 56.98 per cent when disaggregated gravity estimates are used (compare Table 2). We also observe similar differences in the AVEs of NTBs for the vegetables, fruits and nuts sector (68.73 per cent in AGG vs. 60.06 per cent in DIS). The only exception occurs in the other food products sector, in which the estimated AVE of NTBs is lower in the gravity estimates using aggregated data, but the reduction in the NTBs in this sector results in higher changes in the trade balance in DIS.

The predominant assumption of aggregation bias in the CGE analysis is that a higher degree of sector disaggregation results in larger trade and welfare effects in the simulations performed with CGE models (e.g. Grant et al., 2007, 2008; Charteris and Winchester, 2010; Narayanan et al., 2010a, 2010b; Brockmeier and Bektasoglu, 2014). However, in previous studies, NTBs are not considered, and the AVEs of NTBs that are calculated at different aggregation levels are not compared. In our analysis, the overestimation of the CGE model traces back to the aggregation bias occurring in the estimates of AVEs of NTBs. As demonstrated by several authors, it is common to observe the overestimation effects of gravity estimates on trade costs using aggregated data (e.g. Hillberry, 2002; Hillberry and Hummels, 2003; French, 2012). Because we use the exact same structure of the GTAP database in both experiments and only change the implemented AVEs of NTBs between our experiments, we observe the pure effects of aggregation bias from the gravity estimates in our results. Hence, our analysis is not comparable to existing studies analysing the effect of data aggregation levels in CGE models.

4 Concluding Remarks

In this paper, we focus on the importance of NTBs in the analysis of RTAs and the effect of aggregation bias on the estimation of the AVEs of NTBs. We explore the impact of different data aggregation levels on the estimation of the trade costs of NTBs. In addition, we reveal how the aggregation bias from the econometric estimates is transferred to the GTAP framework and thus affects the results of policy simulations analysing Turkey's membership to the EU. In our analysis, we focus on food and agriculture. First, we infer the trade costs of NTBs for 15 aggregated GTAP sectors using the gravity approach and state-of-the-art econometrics. We apply the gravity model to aggregated and disaggregated data. We choose a model specification in which we capture all policy measures that reduce regulatory divergence and eliminate unnecessary restrictive NTBs in the European integration using a binary variable. We convert the missing trade in the absence of EU membership into a tariff equivalent using the theoretical model structure.

Our results show that AVEs of NTBs vary substantially across sectors and products, particularly when using disaggregated data. The higher the variation at the disaggregated level, the greater is the aggregation bias using aggregated data. In line, the AVEs of NTBs are significantly higher for some sectors when using aggregated data, indicating the overestimation effect of applying trade policies at the aggregated level. Considering average values, the AVEs of NTBs resulting from aggregated gravity estimations are approximately 60 percentage points higher than the AVEs of NTBs resulting from disaggregated gravity estimations. In terms of sectoral differences, the overestimation ranges from 11 to 635 percentage points.

Second, we incorporate the estimated AVEs of NTBs into the GTAP framework using the efficiency and import-tariff modelling approaches. In our experiments, we use both the disaggregated and the aggregated gravity estimates to reveal the extent to which the policy simulation results differ when different aggregation levels are used to estimate the AVEs of NTBs. The results of our two experiments show that Turkey's membership in the EU results in unambiguous welfare gains for both Turkey and the EU in both experiments. However, there are considerable differences between the experiments using NTBs from either aggregated gravity estimates (AGG) or from disaggregated gravity estimates (DIS). The deviations of DIS from AGG amount to 21 per cent and 7 per cent for Turkey's and the EU's welfare gains, respectively. Similar effects of aggregation bias are also observed in the trade balance results. The deviations between experiments for the agro-food trade balance of Turkey and the EU are equal to 110 per cent and 21 per cent, respectively. At the product level, the greatest differences between the results of the two experiments are observed in the trade balance of the vegetables, fruits and nuts, dairy and other food products sectors. This effect of aggregation bias clearly results from the predominance of higher levels of AVEs of NTBs obtained using aggregated data to the gravity approach. Therefore, using highly aggregated data to estimate the effects of NTBs predominantly results in an overestimation of trade costs. The effect of aggregation bias that already occurs in gravity estimations is then transferred to CGE simulations. Hence, we also obtain deviating results in the policy simulation conducted with the GTAP framework, which is especially observed at the sector level when different data aggregation levels are used to estimate the AVEs of NTBs.

In this paper, we are able to confirm the importance of NTBs in the analysis of RTAs. Our results show that the welfare gains from the reduction in NTBs outweigh the gains from the elimination of import tariffs and export subsidies. Hence, the consideration of NTBs in trade policy analysis should not be disregarded. Second, we conclude that the aggregation level of the data influences the outcome of the estimation of the AVEs of NTBs considerably. The implementation of different values of estimated trade costs into the GTAP model directly affects policy simulation results. Consequently, researchers and policymakers should be aware of aggregation bias in the in-depth analysis of trade policies and be cautious when finding a compromise between spending resources to gather disaggregated data and inaccurate results.

Appendix A:

| Regions | Sectors |

|---|---|

| 1 Turkey | 1 Paddy rice |

| 2 European Union | 2 Wheat |

| Austria, Belgium, Denmark, Finland, France, Germany, Ireland, United Kingdom, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, Czech Republic, Hungary, Malta, Poland, Slovakia, Slovenia, Estonia, Latvia, Lithuania, Cyprus, Romania, Bulgaria | |

| 3 Croatia | 3 Cereal grains |

| 4 Middle East and North Africa | 4 Vegetables and fruits |

| Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Egypt, Morocco, Tunisia, Islamic Republic of Iran, Israel, rest of North Africa, rest of Western Asia | |

| 5 Asia | 5 Oil seeds |

| China, Hong Kong, Japan, Korea, Mongolia, Taiwan, Cambodia, Indonesia, People's Democratic Republic of Lao, Malaysia, Philippines, Singapore, Thailand, Viet Nam, Bangladesh, India, Nepal, Pakistan, Sri Lanka, rest of South Asia, rest of Southeast Asia | |

| 6 North America | 6 Sugar cane, sugar beet |

| Canada, United States of America, Mexico, rest of North America | |

| 7 Latin America | 7 Plant-based fibres |

| Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela, Costa Rica, Guatemala, Honduras, Nicaragua, Panama, El Salvador, Caribbean, rest of South America, rest of Central America | |

| 8 Oceania | 8 Crops |

| Australia, New Zealand, rest of Oceania | |

| 9 Sub-Saharan Africa | 9 Cattle |

| Cameroon, Ivory Coast, Ghana, Nigeria, Senegal, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Mozambique, Tanzania, Uganda, Zambia, Zimbabwe, Botswana, Namibia, South Africa, rest of African Customs Union, South Central Africa, rest of Eastern Africa, rest of Western Africa, Central Africa | |

| 10 Rest of the World | 10 Other animal products |

| Switzerland, Norway, Croatia, rest of EFTA, rest of Eastern Europe, rest of Europe, Belarus, Russian Federation, Ukraine, Kazakhstan, Kyrgyzstan, Armenia, Azerbaijan, rest of Former Soviet Union, rest of the world | |

| 11 Raw milk | |

| 12 Wool | |

| 13 Sugar | |

| 14 Processed rice | |

| 15 Dairy | |

| 16 Cattle meat | |

| 17 Other meat | |

| 18 Vegetable oils and fats | |

| 19 Other food products | |

| 20 Beverages and tobacco | |

| 21 Extraction | |

| Forestry, fishing, coal, oil, gas, minerals not elsewhere specified (nec) | |

| 22 Manufacturing | |

| Textiles, wearing apparel, leather products, wood products, paper products, publishing, metal products, motor vehicles and parts, transport equipment nec, petroleum, coal products, chemical, rubber, plastic products, mineral products nec, ferrous metals, metals nec., electronic equipment, machinery and equipment nec | |

| 23 Services | |

| Electricity, gas manufacture, distribution, water, construction, trade, transport nec, sea transport, air transport, communication, financial services nec, insurance, business services nec, recreation and other services, PubAdmin/Defence/Health/Educat, dwellings |