The Simple Microeconomics of Public-Private Partnerships

Elisabetta Iossa, University of Rome Tor Vergata, CEPR and IEFE-Bocconi, Rome, Italy ([email protected]). David Martimort, Paris School of Economics-EHESS, Paris, France ([email protected]).

This is a much revised and updated version of an earlier paper. For useful comments and discussions at different stages of this long-term project, we wish to thank the editor of this special issue Flavio Menezes as well as Malin Arve, John Bennett, Antonio Estache, Jérôme Pouyet, Yossi Spiegel, Emile Quinet, Zoe Moss, Wilfried Sand-Zantman, and seminar participants at ESNIE (Ajaccio), the Congrès de l'Association Française d'Economie (Paris-Sorbonne), and the UBC P3 Project (Vancouver). Elisabetta Iossa gratefully acknowledges financial support from the Ministry of Education, University and Research (PRIN 2008) while David Martimort thanks Agence Nationale de la Recherche (ANR).

Abstract

We build on the existing literature in public-private partnerships (PPP) to analyze the main incentive issues in PPPs and the shape of optimal contracts in those contexts. We present a basic model of procurement in a multitask environment in which a risk-averse firm chooses noncontractible efforts in cost reduction and quality improvement. We first consider the effect on incentives and risk transfer of bundling building and management stages into a single contract, allowing for different assumptions on feasible contracts and information available to the government. Then we extend the model in novel directions. We study the relationship between the operator and its financiers and the impact of private finance. We discuss the trade-off between incentive and flexibility in PPP agreements and the dynamics of PPPs, including cost overruns. We also consider how institutions, and specifically the risk of regulatory opportunism, affect contract design and incentives. The conclusion summarizes policy implications on the desirability of PPPs.

1. Introduction

Under a public-private partnership (hereafter abbreviated as PPP), a local authority or a central-government agency enters a long-term contract with a private supplier for the delivery of some services. The supplier takes responsibility for building infrastructure, financing the investment, and then managing and maintaining this facility.

PPPs are being used across Europe, Canada, the United States, and a number of developing countries as part of a general trend seeing an increasing involvement of the private sector in the provision of public services, under the form of privatization, deregulation, outsourcing, and downsizing of government.1 PPPs have traditionally been employed in transportation, energy, and water but their use has recently been extended to IT services, accommodation, leisure facilities, prisons, military training, waste management, schools, and hospitals.

In Europe, the PPP approach was pioneered by the private finance initiative (PFI) launched in 1992 in the United Kingdom.2 By 2009, approximately 800 PFI projects had been signed for a capital value of 64 billion (HL 2010).3 Other European countries have also invested in PPPs, especially France, Portugal, Spain, and Italy. Overall, more than 1300 PPP contracts have been signed in the EU from 1990 to 2009, representing a capital value of more than EUR 250 billion (EIB 2010). In the United States, PPPs are most common for projects involving highway and road transportation, rail, water supply, and waste water treatment (CBO 2007).4 In developing countries, PPP agreements have grown steadily since the 1990s. According to the World Bank's Private Participation in Infrastructure (PPI) database, between 2000 and 2010 twenty-nine countries in Latin America and the Caribbean implemented 688 infrastructure projects with private participation for capital value of US$191 billion. Between 2000 and 2010, 17 countries out of the 23 in East Asia and Pacific implemented 908 infrastructure projects with private participation for capital value of U.S. $154 billion. India is the largest market for PPI in the developing world.

Despite this worldwide growth, evidence on PPP performance remains mixed.5 On the one hand, PFI projects in the UK seem to be delivering cost saving compared to traditional procurement.6 Improvements in completion time and cost of delivery have also been achieved,7 and public bodies using private finance have shown satisfaction with the services provided by contractors.8

On the other hand, PPPs have resulted in higher water prices than traditional procurement in France.9 PPPs seem also unsuitable for fast-moving sectors; performance failures have been widespread in PPPs for specialized IT in the UK. Existing evidence also suggests that renegotiation has played a pervasive role in PPPs worldwide. In Latin American and Caribbean (LAC) countries, governments have sometimes failed to enforce contracts and projects have been abandoned.10 Adverse institutional conditions have also mattered. High transaction costs and unrealistic demand expectations have made PPPs in Central and Eastern Europe less successful than in other countries.11

These pieces of evidence not only question the values of PPPs but also call for a better understanding of the incentive issues in PPPs. This paper aims to build on previous works so as to identify circumstances in which the main characteristics of PPPs are suitable to provide adequate incentives for private contractors in infrastructure and public service provision. We also extensively describe the empirical evidence on PPPs and use our insights to derive clear policy implications.

- (i) Bundling. A PPP typically involves bundling design, building, finance, and operation of the project, which are all contracted out to a consortium of private firms. The consortium includes a construction company and a facility-management company and it is responsible for all aspects of services. The DBFO model (“Design,” “Build” “Finance,” and “Operate”), the BOT model (“Build,” “Operate,” and “Transfer”) or the BOO (“Build,” “Own,” and “Operate”) all account for bundling of building and operations but differ with regard to the ownership of the infrastructure at the end of the contract, which may either be retained by the private sector (e.g., as under BOO) or be transferred to the public sector (e.g., as under BOT).

- (ii) Risk transfer. Compared to traditional procurement, a PPP involves a greater transfer of risk and responsibility to the contractor. A system of output specifications is used: The government specifies the service and the basic standards, but leaves the consortium with control rights and responsibility over how to deliver the service and meet the pre-specified standards. So design, construction and operational risk are generally substantially transferred to the private-sector party.

- (iii) Long-term contracts. A PPP is a long-term contract lasting typically 20 to 35 years. The payments to the private-sector party for the use of the facility is made either by the government (as in the case of PFI projects) or by users of the facility (as in more standard concession contracts).

To capture those features, we present in Section 2. a simple model of procurement. Consistent with real-world evidence, our model features both aspects of the optimal contracting (the contractibility of some profit dimension and the need to share operating risk) and the property rights literatures. Moral hazard is key to investigate two issues that are pervasive in the economics of PPPs. The first one is the existing agency costs borne by governments when delegating to the private sector the task of providing a public service. The second one concerns risk-sharing between those parties. A key point of our analysis is to discuss the nature of agency costs and risk-sharing in a multitask environment where the agent not only manages assets necessary to provide the service but also may design, build, and finance these assets.12

Section 3. isolates conditions under which bundling of project phases (in particular building and operation) is optimal. An important distinction that we draw is between positive and negative externalities across different stages of production. Positive externality (resp. negative externality) refers to the case where a building innovation reduces (resp. increases) costs at the management stage. We show that when the externality across stages is positive, bundling then forces contractors to look at the long-term performances of the asset (the so called “whole life asset management”) and boosts the contractor's incentives to invest in asset quality. Importantly, bundling goes hand in hand with higher power incentives. Bundling and risk transfer to the private sector are two complementary features of PPPs. This explains the greater risk premium that is typically observed in PPPs compared to traditional procurement. Furthermore, we show that private ownership during the contract dominates public ownership from a social welfare perspective. Finally, the gains from bundling with private ownership are greater for generic facilities, such as leisure centers, accommodations, and public housing, than for specific facilities, such as prisons, hospitals, and schools which have limited use outside the public sector.

Once equipped with the rationale for bundling and risk transfer in PPPs, we develop our basic insights in more elaborated environments which have been viewed as particularly interesting both in the public debate and within recent academic research.

Section 4. studies another important characteristic of many PPPs, namely the use of private finance, focusing on the contracts between operators and financiers. This issue is of tantamount importance given the estimated size of investments in infrastructure for the next 20 years, and the role that infrastructure funds will play. Outside finance improves risk allocation if it helps alleviating moral hazard.

Section 5. analyzes incentives for investments over the length of a long-term contract. We start by considering the case of a public authority having a strong commitment power; the risk of unilateral changes of contract terms by governments being then minimal. We show that the optimal long-term contract entails increasing incentives over time to foster the renewal of investment. Cost-plus contracts arise in early periods whereas fixed-price agreements are expected close to the end of the contract.

Long-term contracts however suffer from being signed in contexts with pervasive uncertainty over future demands and costs. When estimates turn out to have been optimistic, renegotiation may occur, partially nullifying the incentive power of the initial contract. We then extend our analysis of the dynamics of PPPs by considering the distortions that are needed to prevent cost overruns. We show that incentives should be lower powered and less risk should be transferred at earlier stages of contracting. However, this nonstationarity of incentives does not necessarily undo the benefits of bundling.

Section 6. analyzes how the institutional environment, and most specifically the risk of regulatory opportunism, affects contract design and incentives. We consider thus settings where the risk of unilateral changes of contract terms by governments is significant. This typically might depict developing countries with low quality institutions but, beyond, the kind of political uncertainty that we have in mind certainly has some appeal also for developed countries subject to the political risk that electoral uncertainty generates. In weak institutional environments, less risk transfer should occur. This of course reduces the benefits of bundling without again coming to the conclusion that bundling should be given up.

Section 7. summarizes our conclusions and discusses the scope for future research.13

2. The General Framework

A government (sometimes referred to as G) relies on a private contractor (a firm or consortium) to provide a public service for society. Examples of such delegation include of course transportation, water production and sanitation, waste disposal, and so forth. In such settings, providing the service requires that a good quality infrastructure has been first designed and built. This delegation must thus be modeled as a multitask problem.14 The main feature of a PPP can then be viewed as the bundling of various phases of contracting.

Benefits and quality index. Benefits from the service are stochastic. Even when there is a reasonable level of confidence in forecasts, they can be dramatically affected by competition from substitutable services (in transport for instance, competition may come from untolled roads, ferries, buses; in the health sector competition may instead come from private health clinics etc.), changing user needs, and macroeconomic conditions. Benefits are also influenced both by the innate quality of the infrastructure and the operating effort.15

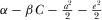

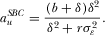

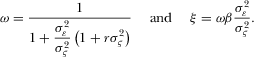

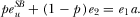

(1)

(1) and zero mean. The marginal benefit of efforts are positive (

and zero mean. The marginal benefit of efforts are positive ( ) and

) and  denotes some base level benefit that can be obtained even without any specific effort.

denotes some base level benefit that can be obtained even without any specific effort.We assume that, for services where users pay, the service provider extracts all their surplus.16 The firm then gets revenues worth B. We shall use B interchangeably to refer to social benefit or revenues, depending on the scenario.

Costs. The operating cost of providing one unit of service is also stochastic. Major maintenance and operational risks affect PPP projects. Operating costs depend also on the quality of the infrastructure, although the magnitude and sign of this externality varies across sectors and projects. In some cases, improving infrastructure reduces operational costs. For example, the design of a prison with better sight-lines for staff that improve security (i.e., social benefit) has the positive externality that the required number of security guards is reduced. In other cases, improving the quality of infrastructure increases operational costs. An innovative design of a hospital, using recently developed materials, may lead to improved lighting and air quality, and therefore better clinical outcomes, but may also increase maintenance costs.

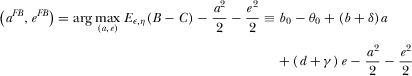

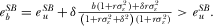

(2)

(2) and zero mean. θ0 is the base level cost of the service (linked to the underlying technology); γ is a positive parameter. The case

and zero mean. θ0 is the base level cost of the service (linked to the underlying technology); γ is a positive parameter. The case  corresponds to a positive externality where improving the quality of the infrastructure also reduces the costs. Instead,

corresponds to a positive externality where improving the quality of the infrastructure also reduces the costs. Instead,  arises for a negative externality. For simplicity, we normalize construction costs (other than a) to zero.

arises for a negative externality. For simplicity, we normalize construction costs (other than a) to zero.Efforts. For simplicity, quality-enhancing and operating efforts have quadratic monetary costs  and

and  respectively. Note that there are no (dis-) economies of scope between efforts so that bundling those tasks can only arise because agency costs have diseconomies of scope when both a and e are nonverifiable.

respectively. Note that there are no (dis-) economies of scope between efforts so that bundling those tasks can only arise because agency costs have diseconomies of scope when both a and e are nonverifiable.

Objectives. The risk-neutral government G maximizes consumer surplus net of the transfer(s) made to the contractor.17 We denote by t such payments. The contractor is risk-averse with a constant absolute degree of risk aversion  . This assumption captures the fact that a PPP project might represent a large share of the firm's activities so that it can hardly be viewed as being fully diversified.

. This assumption captures the fact that a PPP project might represent a large share of the firm's activities so that it can hardly be viewed as being fully diversified.

Relevant scenarios. In the rest of the paper, we develop our results by means of a main model but discuss their robustness to alternative contracting scenarios. To simplify exposition, these scenarios are assumed to be mutually exclusive although in practice they need not to be so.

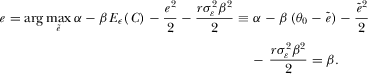

, where gross profits Π are equal to

, where gross profits Π are equal to  if users pay, and to

if users pay, and to  if users do not pay. The following three cases will be discussed:

if users do not pay. The following three cases will be discussed:

- Contractible profits. The contractor's gross profit

is observable and can be contracted upon. The firm also receives

is observable and can be contracted upon. The firm also receives  from G, where

from G, where  . Under this profit-sharing rule, the contractor obtains a net profit of:

. Under this profit-sharing rule, the contractor obtains a net profit of:  18 In the case

18 In the case  the contractor actually acts as an employee of the public sector who has no particular incentives to raise profits. Instead,

the contractor actually acts as an employee of the public sector who has no particular incentives to raise profits. Instead,  holds when the contractor bears profit risk. In the extreme case where

holds when the contractor bears profit risk. In the extreme case where  , all risks are transferred to the contractor. This scheme is typically used for complex transport projects where users pay for the service.

, all risks are transferred to the contractor. This scheme is typically used for complex transport projects where users pay for the service. - Contractible revenues. The revenues from the service B is observable and can be contracted upon whereas costs are not contractible. The payment mechanism takes the form

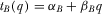

Under this revenue-sharing rule, the contractor obtains

Under this revenue-sharing rule, the contractor obtains  Revenue-sharing schemes are often used also in transport projects. A payment mechanism solely based on user charges corresponds to

Revenue-sharing schemes are often used also in transport projects. A payment mechanism solely based on user charges corresponds to  and

and  so that the contractor keeps all revenues and bears all demand risk. This is the case of PPP for leisure centres for example. A payment mechanism based on availability only, corresponds instead to

so that the contractor keeps all revenues and bears all demand risk. This is the case of PPP for leisure centres for example. A payment mechanism based on availability only, corresponds instead to  and

and  so that the contractor's reward is fixed and G retains all demand risk. This scheme is typically used for PPPs in hospitals, schools, and prisons (the so called PFI model) where users do not pay for the service. The revenues for the contractor then consist only of an “availability payment” α that G pays for making the service available to users.

so that the contractor's reward is fixed and G retains all demand risk. This scheme is typically used for PPPs in hospitals, schools, and prisons (the so called PFI model) where users do not pay for the service. The revenues for the contractor then consist only of an “availability payment” α that G pays for making the service available to users. - Contractible costs. The contractor receives no revenues from users, operating cost C is observable and contracted upon. The contractor is paid

and obtains

and obtains  . The case

. The case  corresponds to a cost-plus contract where the contractor is fully reimbursed for its own costs, whereas

corresponds to a cost-plus contract where the contractor is fully reimbursed for its own costs, whereas  holds for a fixed-price contract, where the contractor receives a fixed payment.

holds for a fixed-price contract, where the contractor receives a fixed payment.

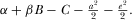

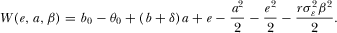

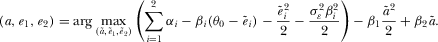

and

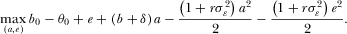

and  that maximize the overall expected surplus:

that maximize the overall expected surplus:

(3)

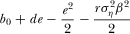

(3)The first-best quality-enhancing effort  trades off the marginal social value of that effort, including its impact on operating costs (δ) and on the social value of the service (b), with its marginal cost (a). We assume

trades off the marginal social value of that effort, including its impact on operating costs (δ) and on the social value of the service (b), with its marginal cost (a). We assume  so that

so that  is always positive. The operating cost-reducing effort

is always positive. The operating cost-reducing effort  trades off the marginal benefit of raising social benefit (d) and lowering those operating costs (γ) with its marginal monetary disutility (e).

trades off the marginal benefit of raising social benefit (d) and lowering those operating costs (γ) with its marginal monetary disutility (e).

3. Bundling or Unbundling?

We now provide a rationale for relying on PPPs rather than adopting more traditional procurement contracts. With such contracts, G first buys the infrastructure from a given builder and then selects an operator. We thus investigate whether the two tasks of designing/building and then operating assets should be bundled and performed by the same contractor (a consortium) or instead be unbundled and undertaken by two separate firms (a builder and a separate operator).19

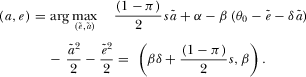

, let

, let  in the benefit function and focus on the case where B is deterministic, so that social benefits reduce to

in the benefit function and focus on the case where B is deterministic, so that social benefits reduce to

3.1. Pure Agency Considerations: Bundling Dominates

, while the builder gets only a fixed payment

, while the builder gets only a fixed payment  .21 With such payment unrelated to his own effort, the builder does not exert any effort:

.21 With such payment unrelated to his own effort, the builder does not exert any effort:

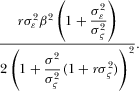

(4)

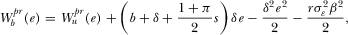

(4) (5)

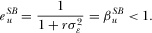

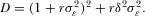

(5)An increase in the incentive power β, the share of the profit risk borne by the operator, boosts its cost-reducing effort. However, as more operational risk is transferred to the operator, the risk premium  also increases which is at the core of a standard moral hazard trade-off between incentives and insurance.

also increases which is at the core of a standard moral hazard trade-off between incentives and insurance.

and the operator α so as to extract all their surplus. The principal's payoff then coincides with the expected value of the project net of the risk premium, that is,

and the operator α so as to extract all their surplus. The principal's payoff then coincides with the expected value of the project net of the risk premium, that is,

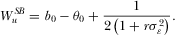

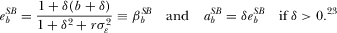

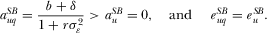

while taking into account the incentive constraints 4 and 5 that hold under unbundling yields the following expressions of the second-best operating effort and the share of the risk borne by the operator:

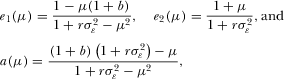

while taking into account the incentive constraints 4 and 5 that hold under unbundling yields the following expressions of the second-best operating effort and the share of the risk borne by the operator:

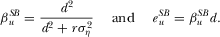

(6)

(6) larger) also tilts the trade-off between insurance and incentives toward low powered incentives.22 G's expected payoff is then

larger) also tilts the trade-off between insurance and incentives toward low powered incentives.22 G's expected payoff is then

(7)

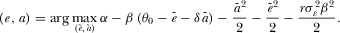

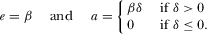

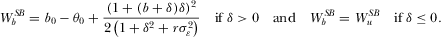

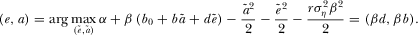

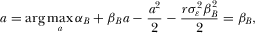

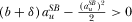

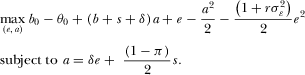

(7) ) chooses the effort levels so as to maximize the sum of its profit at both the building and operational stages and thus internalizes the impact of the design stage on the operational costs. The corresponding effort levels thus solve

) chooses the effort levels so as to maximize the sum of its profit at both the building and operational stages and thus internalizes the impact of the design stage on the operational costs. The corresponding effort levels thus solve

we obtain the following incentive constraints:

we obtain the following incentive constraints:

(8)

(8) ), those effort levels just replicate those found under unbundling. Instead, with a positive externality (

), those effort levels just replicate those found under unbundling. Instead, with a positive externality ( ), the first-stage effort is positive because now the firm at least partially takes into account the impact of this first stage on costs.

), the first-stage effort is positive because now the firm at least partially takes into account the impact of this first stage on costs.As before, the fixed fee α is adjusted by G so that to extract all surplus from the consortium. Now, G's maximization problem consists in maximizing  subject to the incentive constraints in 8.

subject to the incentive constraints in 8.

PROPOSITION 1.Bundling is strictly desirable in the presence of positive externality and there is an indifference between organizational forms otherwise.

When  the consortium never performs any quality-enhancing effort because it is not rewarded for doing so. This replicates the case of unbundling. With a negative externality, investment a is already at a minimum under unbundling (the builder having no incentives to invest), and the internalization of the negative externality under bundling cannot depress these incentives further. Investment a remains at a minimum under both organizational forms which yield the same expected benefits to the principal.

the consortium never performs any quality-enhancing effort because it is not rewarded for doing so. This replicates the case of unbundling. With a negative externality, investment a is already at a minimum under unbundling (the builder having no incentives to invest), and the internalization of the negative externality under bundling cannot depress these incentives further. Investment a remains at a minimum under both organizational forms which yield the same expected benefits to the principal.

When  , a consortium anticipates how a high-quality infrastructure also reduces costs. Bundling then induces the consortium to internalize the positive externality generated by its quality-enhancing effort a on the fraction of costs that it bears at the operational stage. This unambiguously raises welfare as it reduces the underinvestment problem during the building stage, raising quality-enhancing effort.24 Quality-enhancing effort however remains suboptimal: the consortium only internalizes the effect of a on the fraction of costs that it bears (this effect is measured by

, a consortium anticipates how a high-quality infrastructure also reduces costs. Bundling then induces the consortium to internalize the positive externality generated by its quality-enhancing effort a on the fraction of costs that it bears at the operational stage. This unambiguously raises welfare as it reduces the underinvestment problem during the building stage, raising quality-enhancing effort.24 Quality-enhancing effort however remains suboptimal: the consortium only internalizes the effect of a on the fraction of costs that it bears (this effect is measured by  and thus not the total effect on costs (measured by

and thus not the total effect on costs (measured by  ), and also it does not internalize the effect on social benefits (measured by

), and also it does not internalize the effect on social benefits (measured by  ).

).

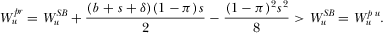

Moving from traditional procurement to PPP changes cost-reimbursement rules. Bundling shifts more risk to the operator ( and increases incentives to invest in asset quality. This is intuitive: Transferring more operational risk (through higher values of β) induces the operator to exert higher cost-reducing effort but it brings the cost of a higher risk premium. Under bundling, the transfer of operational risk brings the additional benefit of also inducing quality-enhancing effort. This justifies transferring more operational risk. Thus, bundling and fixed-price contracts go hand in hand under PPP whereas unbundling and cost-plus contracts are more likely under traditional procurement. This is in lines with existing evidence that PPPs are characterized by more risk transfer and thus greater risk premium than traditional procurement.

and increases incentives to invest in asset quality. This is intuitive: Transferring more operational risk (through higher values of β) induces the operator to exert higher cost-reducing effort but it brings the cost of a higher risk premium. Under bundling, the transfer of operational risk brings the additional benefit of also inducing quality-enhancing effort. This justifies transferring more operational risk. Thus, bundling and fixed-price contracts go hand in hand under PPP whereas unbundling and cost-plus contracts are more likely under traditional procurement. This is in lines with existing evidence that PPPs are characterized by more risk transfer and thus greater risk premium than traditional procurement.

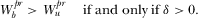

small enough. In this case, it is immediate that the builder obtains no benefit from raising operational revenues under unbundling and thus

small enough. In this case, it is immediate that the builder obtains no benefit from raising operational revenues under unbundling and thus  . At the same time, the operator chooses

. At the same time, the operator chooses

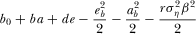

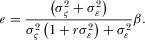

(9)

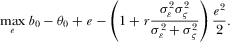

(9) its expected payoff

its expected payoff

(10)

(10)

(11)

(11) (12)

(12)

and

and  25

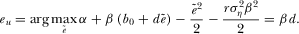

25Intuitively, the consortium anticipates that increasing a raises revenues B. The greater the share β of revenues kept by the consortium, the greater the incentives to increase a. Since the builder under unbundling gets no revenues, incentives are there absent. As with verifiable costs, bundling boosts effort at the building stage. This unambiguously raises welfare and the stronger the effect of infrastructure quality on revenues (higher b) the greater the benefits of bundling. Furthermore, since higher risk transfer (higher β) raises both e and a, bundling again comes with more risk transfer:  . Finally, comparative statics on

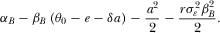

. Finally, comparative statics on  characterizes the optimal allocation of demand risk under a PPP. The optimal payment mechanism trades off incentives and insurance: transferring demand risk to the contractor gives it incentives to boost demand (a increases) and raises consumer surplus (B increases) but it costs the government a higher risk premium (

characterizes the optimal allocation of demand risk under a PPP. The optimal payment mechanism trades off incentives and insurance: transferring demand risk to the contractor gives it incentives to boost demand (a increases) and raises consumer surplus (B increases) but it costs the government a higher risk premium ( ). Thus, the more demand levels are affected by the contractor's action (higher b), the lower the demand risk (lower

). Thus, the more demand levels are affected by the contractor's action (higher b), the lower the demand risk (lower  ) or the risk aversion of the contractor (r), the more demand risk should be borne by the contractor.

) or the risk aversion of the contractor (r), the more demand risk should be borne by the contractor.

In PPP projects such as prisons, users do not pay, and government policies determine most of demand changes. Since the contractor's effort has little impact on demand levels (b small), not transferring demand risk to the contractor ( ) is indeed optimal. With financially free-standing projects, such as leisure centres, the contractor recoups its initial investment through charges to final users. Here, revenue risk lies entirely with the contractor (

) is indeed optimal. With financially free-standing projects, such as leisure centres, the contractor recoups its initial investment through charges to final users. Here, revenue risk lies entirely with the contractor ( ) since the contractor's effort has large impact on demand levels (b high). Transport projects instead typically fall in the intermediate case, where there is some revenue sharing between the contractor and the public authority.26

) since the contractor's effort has large impact on demand levels (b high). Transport projects instead typically fall in the intermediate case, where there is some revenue sharing between the contractor and the public authority.26

3.2. More Complete Contracting

As a robustness check of our previous findings, we now envision the consequences of allowing more complete contracts. This may be by making the builder's payment depend on costs under unbundling or on a quality index for the infrastructure. We focus on the case of positive externality under the contractible-cost scenario.

3.2.1. Costs incentives

. If the builder is risk-averse (assuming the same degree of risk aversion as the operator) such payment comes with an extra risk premium worth

. If the builder is risk-averse (assuming the same degree of risk aversion as the operator) such payment comes with an extra risk premium worth  to induce the builder's participation. This premium quickly increases when the positive externality is small enough, i.e., when the noisy observable does not track so easily the builder's effort. The builder then maximizes

to induce the builder's participation. This premium quickly increases when the positive externality is small enough, i.e., when the noisy observable does not track so easily the builder's effort. The builder then maximizes

(13)

(13)Other scenarios. The insights from this robustness check carry over when profit-sharing or revenue-sharing rules can be used. When profits or revenues are verifiable, G can reward the builder when higher profits or revenues are observed. With  this induces higher quality-enhancing effort under unbundling. However, with a positive externality bundling still strictly dominates unbundling, since the incentive scheme at the operating stage (the profit sharing or revenue-sharing rule) helps to incentivize both efforts at building and operating stages.

this induces higher quality-enhancing effort under unbundling. However, with a positive externality bundling still strictly dominates unbundling, since the incentive scheme at the operating stage (the profit sharing or revenue-sharing rule) helps to incentivize both efforts at building and operating stages.

3.2.2. Quality incentives

is a random variable which is assumed to be normally distributed with (for simplicity) variance

is a random variable which is assumed to be normally distributed with (for simplicity) variance  and zero mean. For simplicity, we keep the same variance of noise on this quality index and on the operating costs. This assumption is particularly relevant when q stems for an earlier realization of operating costs in a context where the investment consists of complementary and renewed assets. The builder's incentive scheme is now of the form

and zero mean. For simplicity, we keep the same variance of noise on this quality index and on the operating costs. This assumption is particularly relevant when q stems for an earlier realization of operating costs in a context where the investment consists of complementary and renewed assets. The builder's incentive scheme is now of the form  .

. (14)

(14) (15)

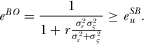

(15)By making the firm's payment depend on the quality index, the cost reimbursement rule is made more powerful and welfare increases.

PROPOSITION 2.Bundling strictly dominates unbundling when complete contracts on both operating costs and a quality index are feasible and the externality is positive.

Even if using a quality index eases agency problems under unbundling, bundling remains preferable whenever this index remains imperfect as the nature of the agency problem remains unchanged.

Robustness check. It can be shown that when the quality index is on the service quality rather than infrastructure quality, the main insights of this section continue to hold. Since a service quality index is positively affected by a, via the effect that a has on social benefits B, a payment system that rewards the builder for higher service quality eases the agency problem under unbundling. Bundling however remains preferable whenever the firm is risk-averse.

3.3. Residual Value and Ownership

Proposition 1 told us that bundling always weakly dominates unbundling. We now show that, when instead the builder has some incentives to invest under unbundling and the externality is negative, unbundling may become the preferred mode of provision.27

To tackle the issue of ownership, we now identify PPP as an organizational form where there is bundling of the design and operation phases but also private ownership of the assets over the whole length of the contract. Traditional contracting corresponds instead to the case where G buys an asset built by the private sector and delegates operations to a second firm.

When contracts allocate rights and duties and there are no unforeseen contingencies, ownership matters only to the extent that assets have some residual value at the end of the contract. Ownership entitles the owner with the market value of these assets. This residual value provides incentives to invest in asset quality. Of course, that residual value will depend on assets specificity. In the case of generic facilities (such as, leisure centers, office accommodation, general IT systems, and land use), there is demand from users other than the government, so that the public and private residual value do not differ significantly. This is of course different for specific facilities, such as hospitals, prisons, and schools.

Let thus sa ( ) denote the value of the assets at the end of the contract when these assets are used by the government for public service provision. Let also

) denote the value of the assets at the end of the contract when these assets are used by the government for public service provision. Let also  with

with  denote their value for private use. Consistent with the incomplete contracts literature, the residual value of these assets cannot be specified ex ante in a contract although it is ex post observable and can be bargained upon at that date.28 The parameter π captures the degree of asset specificity, with π being higher the less specific is the facility.29 Since

denote their value for private use. Consistent with the incomplete contracts literature, the residual value of these assets cannot be specified ex ante in a contract although it is ex post observable and can be bargained upon at that date.28 The parameter π captures the degree of asset specificity, with π being higher the less specific is the facility.29 Since  public ownership is always optimal at the end of the contract.30

public ownership is always optimal at the end of the contract.30

Public Ownership. Suppose that assets are publicly owned throughout the contract. Since a is not contractible and there is no sale of the facility once the contract expires, the builder cannot be incentivized. Whether bundling or unbundling is chosen, efforts and welfare with public ownership remain the same as before. Public ownership has no impact on incentives. Whether bundling strictly dominates depends only on the sign of the externality as in Section 3.1..

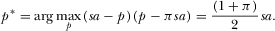

at which ownership is transferred results from Nash bargaining (assuming equal bargaining powers):

at which ownership is transferred results from Nash bargaining (assuming equal bargaining powers):

boosts his incentives to enhance assets quality if he is a builder.31 The owner's incentives to invest are also greater with less specific assets. Indeed, asset specificity reduces the status quo payoff if ownership is not transferred to the public sector. This exacerbates the hold-up problem that occurs through ex post bargaining and dampens the private owner's incentives.

boosts his incentives to enhance assets quality if he is a builder.31 The owner's incentives to invest are also greater with less specific assets. Indeed, asset specificity reduces the status quo payoff if ownership is not transferred to the public sector. This exacerbates the hold-up problem that occurs through ex post bargaining and dampens the private owner's incentives. (16)

(16) (17)

(17) (18)

(18)Comparing public and private ownerships, we immediately obtain:

PROPOSITION 3.Private ownership always dominates public ownership. The gain from private ownership is nonincreasing in the level of asset specificity.

Comparing now PPPs and traditional procurement, we get:

PROPOSITION 4.PPPs, i.e., private ownership and bundling, strictly dominates traditional contracting, i.e., private ownership and unbundling, with a positive externality:

Compared to public ownership, under private ownership bundling implements strictly lower efforts than unbundling if the externality is negative. Ownership gives to the builder some incentives to invest in asset quality. These incentives are depressed if the builder internalizes the negative externality that quality exerts on costs.

3.4. Related Literature

Our baseline model has merged two strands of the literature on PPPs which have both emphasized the multitask nature of the procurement problem when building and managing assets matter. Using the property rights approach, Hart (2003) provided a model where the sole source of incentives is ownership. A builder can perform two kinds of investment (productive and unproductive) which may both reduce costs, although only the productive investment raises also benefits. Under traditional procurement, the builder cannot internalize the impact of his effort neither on benefits nor on costs. He implements too little of the productive investment but the right amount of the unproductive one. Under PPP, the builder somewhat internalizes the impact of his productive investment whereas he also exerts too much of the unproductive one. Francesconi and Muthoo (2011) and King and Pitchford (2001) considered the case of impure public goods and showed that shared authority can be optimal when the parties' investments are comparable. Bennett and Iossa (2006) studied the desirability of bundling project phases and of giving ownership to the investor. Innovations are noncontractible ex ante but verifiable ex post. Ownership gives control right to the owner to decide whether to implement quality enhancing or cost-reducing innovations proposed by the investor. The hold-up problem is less severe under PPP, compared with traditional procurement, when there is a positive externality between the building and managing stages, and vice versa when the externality is negative. Public ownership acts as a commitment for the government to renegotiate and share with the investor the surplus from implementing the innovation. Private ownership is nevertheless optimal for generic facilities with high residual value. Chen and Chiu (2010) extend Bennett and Iossa (2006) to the case of interdependent tasks and show that complementarity between tasks favors unbundling.

In a complete contracting framework, Martimort and Pouyet (2006) built a model where both the quality of the infrastructure and operating costs are contractible. Incentives and welfare are higher under a PPP when there is a positive externality between building and managing assets compared to traditional procurement.33 Ownership aligns incentives but, to a large extent, the important issue is not who owns the asset but instead whether tasks are bundled or not. That insight is developed in various extensions of their basic model allowing for risk-sharing as a motive for forming consortia, or for political economy. In the same spirit, Iossa and Martimort (2011) built an agency model where operating costs are noncontractible but both the quality of the infrastructure and the demand for the service are contractible. They focus on how bundling affects incentives to raise demand, and the optimal allocation of demand risk. Our baseline model borrows a lot from these principal-agent models: a common theme is that PPP comes with higher powered incentives.

Taking also a complete-contract approach, Benz, Grout, and Halonen (2001) showed that the government should buy services (as in PFI) rather than facilities (as in traditional procurement) if the building and service delivery costs are low.34 Hoppe and Schmitz (2013) focused instead on the incentives to gather information about future costs to adapt the service provision to changing circumstances. They showed that whether bundling or unbundling is better for information gathering depends on the costs of efforts in innovation and in information gathering, and on the degree to which effort is contractible. Finally, Iossa and Martimort (2012a) considered a dynamic multitask moral hazard environment where the mapping between effort and performance is ex ante uncertain but information may come along during operations. In that context, compounding of asymmetric information ex post plus moral hazard and renegotiation may generate diseconomies of scope in agency costs which, for high operational risk, can make unbundling optimal also with positive externalities.

3.5. Implications

Our results suggest that PPPs deliver efficiency gains when a whole-life cost approach to the project yields significant cost savings and when risk is effectively transferred to the private operator. Transferring design, construction, and operating risks to the contractor provides incentives for keeping project costs down and efficiently providing the service. A report commissioned by the Treasury Taskforce estimated saving on a sample of PFI projects equal to 17%, compared to traditional procurement.35 Significant cost savings were realized in the prison sector. The National Audit Office (NAO 2003a) reported that innovative designs helped to reduce the level of staffing needed to ensure security and this resulted in an overall cost reduction by approximately 30%. Conclusive evidence is however still to be found. Blanc-Brude, Goldsmith, and Välilä (2009) studied a sample of road projects financed by the EIB between 1990 and 2005 in all EU-15 countries plus Norway. They found that ex ante construction costs (i.e., costs before construction actually starts) are some 20% higher for PPP roads than for traditionally procured roads.36

Our results also suggest that, when a higher asset quality increases social benefit but has a negative impact on whole-life cost, the scope for PPP might be limited. Evidence of negative externalities is more difficult to find. However, a report by the Audit Commission (see PPP Focus, Education 2, 2004) noted that the quality of many early PFI school buildings was disappointing. School quality has a direct positive impact on pupil behavior and educational achievement. Local education authorities now anticipate this problem and include more detailed output specifications in the contract. As a result the quality of school buildings has improved.

Our results also shed some light on the current approach to facility ownership. Under PPP, ownership during the contract length goes to the consortium, but ownership once the contract expires varies depending on the circumstances. Assets tend to revert to the public sector either when they have no obvious alternative use or when they are required to continue the service after contract ends (for example, schools, prisons, and hospitals). For generic facilities with an alternative use outside the public sector and no clear long-term public sector needs, ownership is retained by the private sector.

We have focused on the benefits of bundling that may come from inducing the contractor to take a long-term approach to the project. However, bundling also brings other benefits. First, PPPs are characterized by a longer procurement process and by higher costs of bidding than traditional procurement. Albeit with differences between sectors, it has been estimated that PPP tendering periods last an average of 34 months (NAO 2007) and that procurement costs can reach 5%–10% of the capital cost of a project (Yescombe 2007). These transaction costs are also to a large extent independent of the size of a project, which suffices to make PPP unsuitable for low capital value projects.37

Second, bundling of different phases of the project increases project complexity and limits participation of small construction companies that do not have the necessary financial resources to sustain the costs and risks of bidding for PPP contracts. Albeit with differences across sectors, in the United Kingdom, there is an average of four bidders per PPP contract. This is problematic, as collusion among bidders is certainly more likely if the number of participants is small.38

In our basic model, we have only focused on “build” and “operate.” In practice, the realization of a project comprises a wider variety of tasks. Services in the operational stage for example include “soft” facility-management services (e.g., cleaning, catering, security) and “hard” facility-management services (e.g., routine and/or life-cycle maintenance of buildings and equipment). The arguments set up in Section 3. apply to hard services where asset quality matters and externalities are significant but less so to soft services where asset quality plays a limited role and externalities are relatively small. Whether to include soft services in PPPs should then follow other considerations. On the one hand, their inclusion creates a single point of responsibility within the private sector in charge of service provision and allows to internalize the externalities. On the other hand, unbundling helps to employ short-term contracts for soft services and thus to benefit from more competitive pressure. Separate tendering for soft services also favors the participation of small firms. There are no uniform experiences across countries regarding service unbundling and the HM Treasury (2006) currently advises against their inclusion.

4. Bundling Financing and Operating Tasks

4.1. The Benefits of Outside Finance

So far we have focused on the effects of bundling building and operation in a single contract with a single agent. PPPs however are often also characterized by the private sector financing a substantial part, or all of, the project (the “F” in the DBFO model). The firm then recoups its initial investment through charges to final users or from government availability payments, that is, government contributions for making the service (e.g., prison services) available. In this section, we briefly study the rationale for private finance in PPPs.

The relationship between investment and their financing is particularly critical for privately financed infrastructure. On the one hand, an often heard benefit of PPPs is that they might bring in the expertise of outside financiers in evaluating risks. In this respect, bundling the task of looking for outside finance (be it through outside equity or debt) and operating assets could improve on the more traditional mode of procurement where the cost of investment is paid through taxation and investment is not backed up by such level of expertise within the public sphere. On the other hand, private finance adds an additional layer of contracting, the one between the consortium and the financier, and this could have perverse effects on incentives.

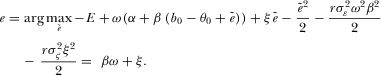

so that, there are no benefit of building a better infrastructure. All the benefits of having private finance, if any, are thus due to the reduced agency costs that it might bring. For simplicity we also let

so that, there are no benefit of building a better infrastructure. All the benefits of having private finance, if any, are thus due to the reduced agency costs that it might bring. For simplicity we also let  ,

,  , so that the profit function is given by

, so that the profit function is given by

(19)

(19) (20)

(20) and zero mean. Such informative signal may be quite useful to provide cheaper incentives.

and zero mean. Such informative signal may be quite useful to provide cheaper incentives.We investigate in turn the case of public finance where the investment is financed by taxation and the case of outside private finance. We assume throughout that financiers operate in a perfectly competitive financial market.

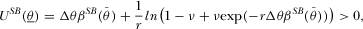

Public finance. The government itself provides funds to cover an investment I. It does not observe the informative signal y and implements only the second-best effort  .

.

Outside finance. The operator has now full control over his access to the financial market on top of control over operations. To fix ideas, suppose that only profits are verifiable, so that the firm operates under a linear scheme  and therefore keeps a gross payoff of

and therefore keeps a gross payoff of  . The operator and its financiers agree on how to share the remaining risk induced by such a contract.

. The operator and its financiers agree on how to share the remaining risk induced by such a contract.

that is kept by the operator. Because outside financiers can condition the firm's repayment on the extra signal y, a linear repayment scheme that share risk between the operator and its financiers is given by

that is kept by the operator. Because outside financiers can condition the firm's repayment on the extra signal y, a linear repayment scheme that share risk between the operator and its financiers is given by

(

( ) is a bonus in case the signal on the firm's effort is positive and a punishment otherwise. Since financiers are competitive, the fixed payment E is the price of equity they hold in the project net of the investment cost I.

) is a bonus in case the signal on the firm's effort is positive and a punishment otherwise. Since financiers are competitive, the fixed payment E is the price of equity they hold in the project net of the investment cost I. (21)

(21) (22)

(22)

(23)

(23)Notice that this effort level converges toward β when  goes to zero. When financiers have a very informative signal on the firm's effort, there is no further dilution of incentives within their coalitional agreement: Effort is efficiently set within the firm/financiers coalition. Instead, when

goes to zero. When financiers have a very informative signal on the firm's effort, there is no further dilution of incentives within their coalitional agreement: Effort is efficiently set within the firm/financiers coalition. Instead, when  converges toward infinity, the effort level converges toward

converges toward infinity, the effort level converges toward  , which captures the fact that part of the incentives given by G are dissipated through further risk-sharing with financiers.

, which captures the fact that part of the incentives given by G are dissipated through further risk-sharing with financiers.

Comparing with public finance, private finance unambiguously raises incentives and comes closer to the first-best.

PROPOSITION 5.Bundling private finance and operation is optimal when outside financiers have access to some informative signal on the operator's effort level. The power of incentives unambiguously raises and aggregate welfare improves with respect to public finance.

Relying on outside finance brings two contrasting effects. On the one hand, it adds a new layer of contracting, which may exacerbate moral hazard by introducing further risk-sharing. On the other hand, the financial contract is made under a better information structure, which improves incentives. This trade-off is resolved in favor of outside finance because financiers are competitive, so that everything happens as if the government itself was enjoying the financiers' expertise to provide funds at a cheaper cost.

Remark 1.When financiers are specialized in infrastructure risk, they might have some market power. It is unlikely that, in such an environment, the government can recoup all benefits from the financiers' expertise. A double-marginalization problem might occur with both the government and financiers willing to reduce the firm's effort. There would be a trade-off between the benefits of the financiers' expertise and the extra distortions that financial contracts might bring.

4.2. Related Literature

Engel, Fisher, and Galetovic (2006) were the first to study the rationale for private finance in PPPs. They showed that private finance cannot save on distortionary taxation. Any additional $1 invested by the contractor saves society some distortionary taxes but the concessionaire must be compensated for the additional investment through a longer contract term. This costs society future distortionary taxes equal to the initial tax saving. De Bettignies and Ross (2009) also discussed the benefit of private finance in PPPs. In their model, information is symmetric but private finance may lead to the efficient termination of bad projects, while public developers may sustain such projects for political reasons. On a related line, Auriol and Picard (2009, 2013) showed that the cost of public funds may actually justify outsourcing activities through PPPs in more incomplete contracting environments. The model of this section bears some similarities with Iossa and Martimort (2012a). In that paper, like here, the financier has better information than the government, though the information refers to operational risk rather than operational effort.

4.3. Implications

Our analysis has shown that outside finance improves risk allocation if it helps alleviate moral hazard. In practice, the use of private finance has been made also because it has allowed the public sector to finance the construction of infrastructure “off the balance sheet” and to accelerate delivery of projects.39 The accounting treatment of PPPs stream of payments can vary and it can often make the government budget look healthier than it is, thereby undervaluing the cost of PPP-financed infrastructure. This not only biases decisions in favor of PPPs as opposed to more traditional procurement arrangements but it can make PPPs a means to unduly transfer costs from current to future generations.40 There is no economic justification for PPPs being promoted for allowing investment off the balance sheet. To ensure homogeneity across member states and limit accounting tricks made to comply with the rules of the Stability and Growth Pact, Eurostat made a decision (news release 18/2004) on the accounting of PPPs which clarified and made the process of accounting true PPPs more transparent. However, the temptation to adopt PPPs as a tool to window dress budget deficits has not been fully removed.41

5. Contractual Dynamics

PPPs are typically long-term projects which might cover 20 to 35 years. Over such a long period the quality of durable assets and infrastructure may significantly depreciate. An important issue concerns the extent to which contractors are willing to invest to improve the stock of existing infrastructure or whether they prefer to choose management strategies that maintain costs low in the short-run.

5.1. The Trade-Off between Investment and Maintenance

To analyze the trade-off between investment and maintenance, we consider a twice-repeated and slightly modified version of our basic model with contractible costs. To focus on the operator's incentives to invest, we assume that the firm gets a basic stock of infrastructure to run off public service at date  . Improving this stock requires some extra investment which costs

. Improving this stock requires some extra investment which costs  today but it lowers operating costs at date

today but it lowers operating costs at date  by an amount a. Another strategy would be to avoid incurring any initial investment and then cutting operating costs with more maintenance.

by an amount a. Another strategy would be to avoid incurring any initial investment and then cutting operating costs with more maintenance.

are normally distributed with zero mean and variance σ2, and

are normally distributed with zero mean and variance σ2, and  is the maintenance effort undertaken at date i.42

is the maintenance effort undertaken at date i.42Investing increases accounting costs in the short run but, because of a positive externality between design and operation, reduces the long-run cost of the service.43 Implicit in our formulation is the fact that the cost of investment is noncontractible, e.g., because it is (at least partly) aggregated with other costs, noticeably the first-period operating costs, in the firm's book.44

Consistently with Section 3., we assume that the stock of new investment has a social value  with

with  . In practice, this simply means that there is a difference between the social and the private returns on investment. Assuming that investment is verifiable, its first-best level is

. In practice, this simply means that there is a difference between the social and the private returns on investment. Assuming that investment is verifiable, its first-best level is  whereas

whereas  would be privately optimal.

would be privately optimal.

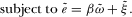

Noncontractible investment. Suppose that the investment a is noncontractible and must be induced by designing adequate incentives. Denote by  the cost-reimbursement rule used at date i.45 The firm's gross profit is thus

the cost-reimbursement rule used at date i.45 The firm's gross profit is thus  . Let us first consider the case where G can commit himself to such a two-period contract

. Let us first consider the case where G can commit himself to such a two-period contract  .

.

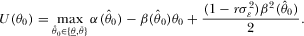

to maximize the certainty equivalent of its intertemporal payoff:

to maximize the certainty equivalent of its intertemporal payoff:

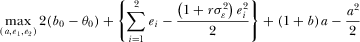

(24)

(24)An interesting benchmark is obtained when G offers the stationary contract with slope  , i.e., the contract that would be optimal without any concern on the renewal of the infrastructure. This contract induces a stationary effort

, i.e., the contract that would be optimal without any concern on the renewal of the infrastructure. This contract induces a stationary effort  and an investment level,

and an investment level,  , which is privately optimal but not socially so when

, which is privately optimal but not socially so when  . There is too little investment in renewing infrastructure with such stationary contract. Raising investment requires modifying the intertemporal pattern of incentives.

. There is too little investment in renewing infrastructure with such stationary contract. Raising investment requires modifying the intertemporal pattern of incentives.

PROPOSITION 6.Assuming full commitment, the optimal long-term contract entails higher powered incentives toward the end of the contract than at the beginning and an inefficient level of investment:

To boost incentives to undertake a nonverifiable investment, G must let  bear less of the costs and enjoy most of the benefits associated to that investment. This is best achieved by offering cost-plus contracts in the earlier periods and fixed-price contracts toward the end of the relationship.46 Still, this is not enough to align the private incentives to invest with the socially optimal ones and underinvestment follows.

bear less of the costs and enjoy most of the benefits associated to that investment. This is best achieved by offering cost-plus contracts in the earlier periods and fixed-price contracts toward the end of the relationship.46 Still, this is not enough to align the private incentives to invest with the socially optimal ones and underinvestment follows.

Remark 2.History-dependent contracts. Let us suppose now that G can commit to two-period history dependent contract  where

where  and

and  The benefit of considering this larger class of incentive schemes is well-known since Rogerson (1985), pushing part of the rewards (and punishments) for a good first-period cost toward the second period improves the first-period trade-off between insurance and incentives. To then check the robustness of our earlier results, observe first that, given the history-dependent contract above, the agent chooses his effort array

The benefit of considering this larger class of incentive schemes is well-known since Rogerson (1985), pushing part of the rewards (and punishments) for a good first-period cost toward the second period improves the first-period trade-off between insurance and incentives. To then check the robustness of our earlier results, observe first that, given the history-dependent contract above, the agent chooses his effort array  so that

so that

(25)

(25) . Everything happens as if the first-period variance on costs was lowered by one half. This implies high-powered incentives to reduce costs in the first period and an unambiguously increase in welfare. But, it has a detrimental impact on investment which becomes less attractive than improved maintenance.

. Everything happens as if the first-period variance on costs was lowered by one half. This implies high-powered incentives to reduce costs in the first period and an unambiguously increase in welfare. But, it has a detrimental impact on investment which becomes less attractive than improved maintenance.

Other scenarios. In the case of verifiable profits or of verifiable revenues, the optimal long-term contract also calls for low-powered incentives in the earlier periods of the contract and high-powered incentives toward the end of the relationship. By offering greater profit or revenue shares to the firm toward the end of the contract than at the beginning, G makes  bear less of the costs and enjoy most of the benefits associated to its noncontractible investment.47

bear less of the costs and enjoy most of the benefits associated to its noncontractible investment.47

5.2. Cost Overruns

As we already stressed, long-term contracting takes place under significant uncertainty on the realizations of future costs and demand. In infrastructure projects, and maybe due to competitive pressures in awarding projects, contractors are often overly optimistic in estimating future costs.48 Following costs overruns, long-term contracting may be subject to renegotiation. Firms may obtain a tariff increase or an increase in the number of cost components passed through tariffs, a reduction in their payment to the public sector and delays and reduction in investments.

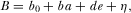

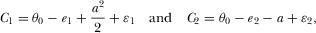

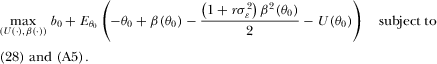

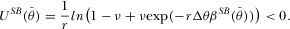

(26)

(26) with probability

with probability  or low,

or low,  with probability ν (denote

with probability ν (denote  ).

). stipulating a fixed fee

stipulating a fixed fee  and a share

and a share  of the cost borne by the firm as a function of its report

of the cost borne by the firm as a function of its report  on its innate base cost level. Since, for any slope of the incentive scheme

on its innate base cost level. Since, for any slope of the incentive scheme  , the firm always choose an effort level given by

, the firm always choose an effort level given by  , we define the certainty equivalent of the firm's expected utility when knowing θ0 as

, we define the certainty equivalent of the firm's expected utility when knowing θ0 as

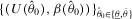

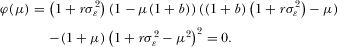

(27)

(27) as the true primitives of our problem allows to write the truthtelling constraint for an efficient firm as49

as the true primitives of our problem allows to write the truthtelling constraint for an efficient firm as49

(28)

(28)The contract consisting in offering a rent/effort profile given by  and

and  that would be offered had θ0 been contractible can no longer be implemented under asymmetric information because an efficient firm would strategically inflate its costs. Cost overruns arise for such badly designed contracts.

that would be offered had θ0 been contractible can no longer be implemented under asymmetric information because an efficient firm would strategically inflate its costs. Cost overruns arise for such badly designed contracts.

To avoid cost overruns, the truthtelling constraint 28 must be binding at the optimum. This imposes some extra risk on the firm and an extra risk premium that society bears to induce the firm's participation. Reducing this risk premium requires to distort downward  below its complete information value, which is obtained by giving to an inefficient firm a low-powered cost-plus contract.

below its complete information value, which is obtained by giving to an inefficient firm a low-powered cost-plus contract.

PROPOSITION 7.With ex post asymmetric information, strategic cost overruns are a concern. The optimal menu of incentive contracts that prevents cost overruns is such that the less efficient firm produces under low powered incentives whereas the firm receives incomplete insurance against the realizations of innate cost:

Remark 3.Cost overruns and bundling. With low-powered incentives needed to avoid strategic cost overruns, it becomes less valuable to bundle construction and management in an extended multitask version of the model along the lines of Section 2.. This does not implies that bundling is no longer optimal. Indeed, cost overruns also occur with the more traditional mode of contracting and would shift the power of incentives the same way. We conjecture that a priori, a positive externality between construction and management would still be conductive to bundling even with ex post asymmetric information.

Remark 4.Cost overruns, renegotiation and the soft budget constraint. The optimal contract found above is not renegotiation-proof once θ0 is known. Indeed, to induce revelation information, this contract requires that an inefficient firm runs a loss. This creates incentives for the least efficient firm to stop the ongoing project if its innate costs are high. Anticipating this outcome, G may not refrain from instilling more subsidy to ensure that even the worst firms breaks even; another instance of the soft budget constraint fallacy. Such renegotiation is akin to assuming that the firm is protected by a pair of interim participation constraints ensuring it indeed always breaks even:

(29)

(29) obtains now a positive expected payoff and the corresponding distortion needed to induce truthtelling are exacerbated leading to a large effort distortion.

obtains now a positive expected payoff and the corresponding distortion needed to induce truthtelling are exacerbated leading to a large effort distortion.

5.3. Related Literature

Laffont and Tirole (1993, chapter 8) proposed an adverse selection model with repeated auctions of incentive contracts which shares many features of our model, most noticeably the shift toward higher powered incentives over time. An incumbent invests in period 1 but, because of contract renewal, may lose the benefits of its investment if it is not granted the new contract for date 2. They particularly focused on the necessary bias toward the incumbent as an incentive tool to secure investment. Our pure moral hazard model can be viewed as providing a simplified version of the same insight. Dewatripont and Legros (2005) argued that ex ante competition between potential consortia may limit the extent of cost overruns and that introducing a third-party (typically outside shareholders or creditors) in a PPP contract may improve monitoring which limits cost overruns as well.50

5.4. Implications

Empirical evidence on effort allocation in long-term projects shows that effort rises over time. Projects within firms often run beyond deadlines and most resources are increased toward the final stages as in Marshall and Meckling (1962) and Mansfield, Schnee, and Wagner (1995). Actual costs often significantly exceed cost estimates used to decide whether public projects should be built. PPPs are not immune to cost overruns, though no clear evidence exists as to whether cost overruns under PPPs are more or less likely than under traditional procurement. In the United Kingdom, with traditionally procured contracts in 73% of central government's construction projects, the price to the public sector had exceeded the contractors' tender price and the project ran over budget; actual costs were between 2% and 14% above estimates. The equivalent figure with PFI was 22% although that was due to the private companies bearing the cost increase rather than the cost increase not occurring (NAO 2003b). Examples of cost overruns under PPP also include the disastrous case of Metronet, the private tube contractor for London Underground, whose cost overruns led it to bankruptcy.

While risk allocation in PPPs generally forces the contractor to bear a significant part of the construction and operational risks, the actual risk allocation may differ from what was originally planned. Governments are providers of last resort and contractors are aware that public authorities cannot afford prolonged service disruption. The re-tendering of a PPP contact is a long and costly process. Also, as the case of London Underground points out, a market for secondary contracts may not always exist. In fact very few PPP contracts have been prematurely terminated. The Channel Tunnel Raillink is one example of the government bailing out the PPP contractor. More generally, empirical evidence supports that risk allocation in practice often departs from what is laid out in theory (see, e.g., Lobina and Hall 2003). As stressed by The World Bank, “whether PPPs perform better than full provision by state-owned enterprises depends in particular on whether performance risk is effectively shifted from taxpayers to the private shareholders of the company that enters into a concession-type arrangement.” 51

6. The Role of Institutions: Regulatory and Political Risks

6.1. Under-Investment and Opportunistic Governments

The nonstationary path of incentives described in Proposition 6 is highly dependent of G's ability to commit to increase subsidies in the second period to reward  's initial investment. Assume now that such commitment power is absent and that renegotiation takes place at date

's initial investment. Assume now that such commitment power is absent and that renegotiation takes place at date  with G still having all bargaining power at that stage and extracting all surplus that

with G still having all bargaining power at that stage and extracting all surplus that  could withdraw from renegotiation.

could withdraw from renegotiation.

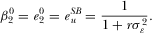

's investment a0 is sunk and the second-period cost reimbursement rule is renegotiated to reach the optimal trade-off between maintenance effort and risk that would arise in a static context, i.e., conditionally on the investment level a0.52 This yields the standard expressions for the second period maintenance effort and the slope of the renegotiated incentive scheme:

's investment a0 is sunk and the second-period cost reimbursement rule is renegotiated to reach the optimal trade-off between maintenance effort and risk that would arise in a static context, i.e., conditionally on the investment level a0.52 This yields the standard expressions for the second period maintenance effort and the slope of the renegotiated incentive scheme:

chooses his investment so that

chooses his investment so that

(30)

(30)With an opportunistic government, welfare is obviously lower than with full commitment. The second-period contract also entails lower powered incentives because, at date 2, G does not take into account the impact of the second-period contract the first-period investment. Since  , 30 implies that

, 30 implies that  enjoys less of the benefits of its investment. To maintain incentives,

enjoys less of the benefits of its investment. To maintain incentives,  must be even more reimbursed for its first-period costs than under full commitment. This tilts first-period incentives even further toward cost-plus contracts.

must be even more reimbursed for its first-period costs than under full commitment. This tilts first-period incentives even further toward cost-plus contracts.

PROPOSITION 8.With an opportunistic government, investment is lower and cost-reimbursement rules are even more tilted toward cost-plus contracts than under full commitment:

Regulatory risk. Assume now that renegotiation takes place at date 2 only with probability p. This parameter is a measure of institutional quality, with higher values of p meaning weaker enforcement. For instance, the government may change between dates 1 and 2 with some probability due to elections or renegotiation takes place due to exogenous events. In some cases, PPP contract clauses indeed seek to insure the private operator against aggregate risks, but episodes have occurred where governments have reneged on these clauses when a severe macroeconomic crisis occurred. The assumption of limited commitment also fits quite well the case of developing countries with weak enforcement power.

's investment a0 is sunk and with probability p the second period cost reimbursement rule is renegotiated to implement the conditionally optimal maintenance effort

's investment a0 is sunk and with probability p the second period cost reimbursement rule is renegotiated to implement the conditionally optimal maintenance effort  through an incentive scheme having slope

through an incentive scheme having slope  . This leads to the following expression of

. This leads to the following expression of  's incentive constraint:

's incentive constraint:

(31)

(31)Other scenarios. In the case of contractible profits or of contractible revenues, where infrastructure-improving investment in the first period enhances second period's quality and service demand, similar insights are obtained. With an opportunistic government, investment is lower and incentives are even less high-powered in both periods than under full commitment.53

6.2. Related Literature

In a pure adverse selection framework, Aubert and Laffont (2002) analyzed the mechanism through which a government can affect future contracting by distorting regulatory requirements to take into account possible political changes and renegotiation. Assuming that the current contract binds all future governments, imperfect commitment implies that the amount information revealed in the first period is strategically determined to affect the beliefs of the future governments.