Aggregation bias and its drivers in large-scale flood loss estimation: A Massachusetts case study

Funding information: Boston University; U.S. Department of Energy, Office of Science, Biological and Environmental Research Program, Earth and Environmental Systems Modeling, MultiSector Dynamics, Grant/Award Numbers: DE-SC0016162, DE-SC0022141

Abstract

Large-scale estimations of flood losses are often based on spatially aggregated inputs. This makes risk assessments vulnerable to aggregation bias, a well-studied, sometimes substantial outcome in analyses that model fine-grained spatial phenomena at coarse spatial units. To evaluate this potential in the context of large-scale flood risk assessments, we use data from a high-resolution flood hazard model and structure inventory for over 1.3 million properties in Massachusetts and examine how prominent data aggregation approaches affect the magnitude and spatial distribution of flood loss estimates. All considered aggregation approaches rely on aggregate structure inventories but differ in whether flood hazard is also aggregated. We find that aggregating only structure inventories slightly underestimates overall losses (−10% bias), and when flood hazard data is spatially aggregated to even relatively small spatial units (census block), statewide aggregation bias can reach +366%. All aggregation-based procedures fail to capture the spatial covariation of inputs distributions in the upper tails that disproportionately generate total expected losses. Our findings are robust to several key assumptions, add important context to published risk assessments and highlight opportunities to improve flood loss estimation uncertainty quantification.

1 INTRODUCTION

Flood loss estimates are fundamental to flood risk research (Czajkowski et al., 2013; Kousky & Walls, 2014; Montgomery & Kunreuther, 2018; Narayan et al., 2017; Reguero et al., 2018; Tate et al., 2016; Wing et al., 2018) and management practice—for example, the U.S. Federal Emergency Management Agency (FEMA) Risk Rating 2.0 (RR 2.0), and National Risk Index (NRI) (FEMA, 2021a; Zuzak et al., 2020). Prospective loss calculations combine flood hazard projections with structure inventories (the characteristics, values, and locations of structures at risk), two separate sets of data that can often differ markedly in their accuracy, spatial resolution, and geographic coverage (de Moel et al., 2015; Merz et al., 2010).

The use of high-resolution hazard and structure inputs are generally preferred for flood loss estimation because inundation depths are highly heterogeneous (First Street Foundation, 2020; Wing et al., 2017) and their relationship to losses can vary substantially at fine spatial resolutions (Rözer et al., 2019; Schröter et al., 2014; Wing et al., 2020). However, such loss estimation procedures—which incorporate inundation depth grids, and buildings' structural characteristics and values on horizontal scales of tens of meters—have heretofore been rare, with applications limited to a few thousand single-family homes (Kousky & Walls, 2014; Tate et al., 2016). By contrast, in large-scale analyses (i.e., over a broader spatial domain), loss estimation relies on spatially aggregated representations of hazards, structures, or both (Aerts et al., 2013; Aznar-Siguan & Bresch, 2019; Czajkowski et al., 2013; FEMA, 2021a; Johnson et al., 2020; Montgomery & Kunreuther, 2018; Narayan et al., 2017; Reguero et al., 2018; Remo et al., 2016; Wing et al., 2018; Zuzak et al., 2020). This is in part due to limited access to high-resolution data (de Moel et al., 2015; Nolte, 2020; Nolte et al., 2021). Recent efforts to develop high-resolution flood hazard estimates over large scales for noncommercial use (First Street Foundation, 2020) have the potential to change this practice and have resulted in notable exceptions (Armal et al., 2020; Wing et al., 2022; Wobus et al., 2021). However, these exceptions often rely on restricted access structure inventories to enable loss estimation over their large scales (Wing et al., 2022; Wobus et al., 2021), and such hazard and structure inventories implicitly require analysts to accept the full set of modeling assumptions chosen by the producers of such data (Cooper et al., 2022). Thus, analysts that seek to better understand drivers of flood loss, predict flood losses, and robustly assess the benefits of risk mitigation strategies over large scales may not be able to avoid working with input data aggregated to coarser spatial units.

To generate more accurate loss estimates over aggregate scales, procedures that rely on aggregate inputs must preserve the potentially long tails and covariation of flood loss drivers, which may vary substantially over space (Atreya & Czajkowski, 2019; Beltrán et al., 2018; Bin et al., 2008; Merz et al., 2010; Pollack & Kaufmann, 2022). Flood depths vary substantially at ~10 m horizontal spatial resolution (Tate et al., 2015), the distributions of both modeled flood depths and observed structure values are long-tailed (de Moel et al., 2014; Tate et al., 2015), and the functions that relate depth to damage can be highly nonlinear, implying substantially different patterns of variation of loss with depth for different types of structures (FEMA, 2011; USACE, 2015; Wing et al., 2020). High-resolution studies find the resulting distribution of losses to be highly skewed, driven by the highest depth exposures and most valuable structures (Kousky & Walls, 2014; Tate et al., 2016). Thus, loss estimation using aggregated inputs may be subject to aggregation bias (Clark & Avery, 1976; Holt et al., 1996; Jelinski & Wu, 1996).

Motivated by this susceptibility, the common use of aggregated inputs in large-scale loss estimation procedures, and the difficulties in overcoming data limitations, key questions are (i) what are the impacts of input aggregation on flood loss estimates, (ii) what phenomena drive these effects, and (iii) how much inaccuracy is introduced by different degrees of aggregation? These questions have been partially addressed in the flood loss uncertainty literature (Apel et al., 2004, 2008; de Moel & Aerts, 2011; de Moel et al., 2014; Saint-Geours et al., 2015; Tate et al., 2015), and, so far as we are aware, not over broad geographic domains. For example, Tate et al.’s (2015) sensitivity analysis of HAZUS-MH flood loss estimates over a city-scale area quantifies the effects of varying hazard model resolutions (5 m to roughly 30 m) and structure inventories (tax records versus the HAZUS-MH default structure inventory). They report that losses based on the combination of lowest resolution inputs are 35% lower than those based on the combination of the highest resolution inputs, but do not detail specific outcomes from other input combinations or how different combinations interact to generate divergent loss estimates.

Aggregation biases might be highly consequential. In the case of RR 2.0, the goal of ensuring solvency of the National Flood Insurance Program (NFIP) is undermined if the overall magnitude of loss payouts is underestimated, while mischaracterization of the distribution of losses across households hinders progress toward setting actuarially fair premiums based on individual risk (FEMA, 2020b). The latter also implies an inaccurate picture of the spatial distribution of risk (Wing et al., 2018), reducing losses' usefulness as a guide for where mitigation or adaptation measures might be most beneficial (Johnson et al., 2020; Narayan et al., 2017; Reguero et al., 2018). In the case of risk or vulnerability indexes like the NRI, inaccuracies in the rank ordering of losses across communities at different scales can potentially bias the index and lead to misallocation of resources for planning, emergency management and education (Remo et al., 2016; Zuzak et al., 2020).

This study characterizes the sign, magnitude, and drivers of aggregation bias introduced by procedures that are commonly used to aggregate data inputs for large-scale flood risk estimation, using a case study of 1.3 million single-family homes in the U.S. state of Massachusetts. Our sample of single-family properties exhibits a wide range of structure values and characteristics, as well as heterogeneous exposures to pluvial, fluvial, and coastal flood hazards. We focus on single-family homes as they exhibit comparatively low heterogeneity in losses for a given hazard exposure are well represented in assessor records over our study domain and are the asset category commonly assessed in the flood loss estimation literature (Merz et al., 2010).

Following Tate et al. (2015), we first construct benchmark loss estimates by combining a high-resolution hazard layer with data on individual properties' locations, characteristics, and values. We then assess the impact on aggregated losses of aggregation techniques commonly seen in practice, highlighting biases relative to the benchmark in expected annual losses (EALs) and their rank ordering at the spatial unit of aggregation. For robustness, we consider uncertainty in flood loss estimation that is expected to influence aggregation bias results such as first-floor elevation (FFE) assumptions and how low-depth exposures translate into damages. Other sources of uncertainty, such as the accuracy of flood hazard estimates and structure inventory data we rely on are likely influential on loss estimates (de Moel & Aerts, 2011; de Moel et al., 2014; Tate et al., 2015) but beyond the scope of illustrating aggregation bias as encountered in common practice because all procedures we implement rely on the same underlying data.

The rest of the article is organized as follows. In Section 2, we describe the data inputs, flood loss estimation framework, and the aggregation procedures. Section 3 presents the aggregation bias incurred from common estimation procedures, its drivers, and the degree to which our findings are robust to key assumptions. Our discussion in Section 4 highlights the likely presence of aggregation bias in published flood risk assessments and implications on conclusions. It closes with caveats and a discussion on the relative magnitude of aggregation bias to other sources of uncertainty. Section 5 concludes with a brief summary and priorities for future research to increase the accuracy and reliability of flood loss estimates.

2 DATA AND METHODS

2.1 Structure locations, characteristics, and value

We base our analysis on a publicly available digital parcel map for 2,340,303 tax parcels in Massachusetts (MassGIS, 2019), excluding Suffolk County (the City of Boston), for which we use a commercial digital map of 127,203 tax parcels, provided by Regrid. Parcels are linked to the ZTRAX nationwide tax assessor and transaction database (Zillow, 2021), as well as a dataset for flood hazards open to researchers (First Street Foundation, 2020) and other open-source datasets (for details, see, Table S2). These inputs were harmonized to the parcel level using the Private-Land Conservation Evidence System (PLACES) database (Nolte, 2020) to yield our dataset of 1.3 million single family homes.

Following Nolte et al. (2021), we identify residential buildings as those with corresponding ZTRAX building codes (RR101, RR102, RR000, and RR999) and at most two building footprints linked to a parcel. Remotely sensed building footprint data can omit buildings that are under tree cover or newly constructed. We include properties without building footprints if a building valuation is recorded by the tax assessor and assume that the building is located at the centroid of the parcel. Properties with more than two building footprints are assumed to exhibit too much uncertainty in structures' locations. Building geocodes are used to identify whether a property is in a FEMA flood zone and for linking properties to high-resolution flood hazard datasets (Section 2.2, below).

Accurate calculation of losses necessitates information on the values and characteristics of flood-affected structures, a variable which tends to be unreported or heuristic and unvalidated (for details, see, Supporting Information). For properties with recorded sales, we impute the structure value by multiplying each property's deflated ZTRAX sale price (FHFA, 2020) by the ratio of the assessed value of the building to the assessed value of the property (i.e., building and land). Where sales data are missing, the assessed value of the building is used. Assignment of characteristics to structures is based on architectural characteristics recorded in ZTRAX. For the remainder, we use the universe of OpenFEMA NFIP Redacted Policies dataset to define spatially varying probabilities of structure (FEMA, 2019), similar to the approach in Aerts et al. (2014). (For details, see, Supporting Information).

2.2 Flood hazards

Our flood hazard estimates are based on 30 m horizontal resolution modeled spatial distributions of inundation depths on 2, 5, 10, 50, 75, 100, 200, 250, and 500 years return periods, developed by First Street Foundation (2020). These incorporate fluvial and pluvial processes inland (Wing et al., 2017), and fluvial, pluvial, and coastal processes within 100 km from coastlines (Mandli & Dawson, 2014). In areas with no surge or tidal hazard, the model selects the maximum of fluvial and pluvial depth. A one-dimensional hydraulic model is used to capture fluvial processes (Bates et al., 2021), distinct from two-dimensional (2D) approaches employed to generate recent flood insurance rate maps (FIRMs; FEMA, 2020a), and with further potential differences in stream geometry (Bates et al., 2021; Benjankar et al., 2015; FEMA, 2020a). In coastal zones, surge, fluvial and pluvial hazards are modeled individually and then jointly to identify joint effects of each source of hazard on flooding (First Street Foundation, 2020). We use the 2020 mid-likelihood depth and link the flood hazard estimates to our parcel data using spatial joins of the lowest point of a building footprint or, where no footprint is available, the parcel centroid.

2.3 Depth-damage functions and property-level inundation exposures

We utilize physical depth-damage functions (DDFs) that specify fractional loss in the value of a structure resulting from different flood depth exposures. Our DDFs are taken from the US Army Corps of Engineers' (USACE) North Atlantic Coast Comprehensive Study–NACCS (USACE, 2015). In contrast to the more widely used HAZUS-MH functions (FEMA, 2021b), NACCS DDFs specify “minimum,” “most likely,” and “maximum” damage curves for different building archetypes. NACCS DDFs are further stratified according to building archetypes whose characteristics determine vulnerability to inundation: the type of foundation (including the presence of a basement), the height of the FFE, and the age of the structure. (See, Table S3). Each home in our sample is assigned to an archetype, based on the presence of a basement, the number of stories, and the structure's age. We calculate damage using DDFs for one-story and two or more story single-family residences, with and without basements (Figure S1). Where the basement and/or number of stories are unknown, we calculate losses using damage curves for every archetype, weighting the outcome by the fraction of houses corresponding to each archetype in the property's flood zone, tract, or county, similar to Aerts et al. (2014). (For details, see, Supporting Information).

A crucial uncertainty is that nonzero depth above grade at the building centroid may or may not translate into damage. The literature contains scant guidance on how to deal with such situations (FEMA, 2021b; USACE, 2015). Our approach is to subtract the archetypical value of the FFE assigned to each building from the depth given by the hazard layer to obtain an “effective depth” that is used as input to the appropriate DDF for that building. For basement homes in particular, damages can occur at negative depths relative to grade. To assess the sensitivity of losses to our algorithm, we augment our default model (“Benchmark”) with illustrative alternative specifications (“Damage Scenarios”) that illustrate the impact of FFE adjustments and the choice of damage curves (“minimum,” “most likely,” or “maximum”) within each building archetype (Table S3).

2.4 Loss estimation: the benchmark procedure

2.5 Aggregation procedures and bias quantification

2.5.1 Aggregate structures (AS)

This approach is broadly similar to RR 2.0, which combines explicit structure locations with county, state, or uniform imputations of home values and structural attributes (FEMA, 2021a). However, we differ from newer studies (Johnson et al., 2020; Wing et al., 2018) that rely on the National Structure Inventory (NSI). Given the marked differences between the NSI and tax assessor data (Shultz, 2021), we eschew the use of that data product because of its potential to introduce additional changes in EAL that obscure the true effect of aggregation bias.

2.5.2 Aggregate structures and hazard (ASH)

This procedure pairs the AS structure inventory with a stylized aggregate representation of flood exposure indicative of 100 m to 5 km horizontal resolution hazard layers used by Narayan et al. (2017) and Reguero et al. (2018). To maximize consistency with the spatial unit of asset aggregation, we coarsen the hazard to the census block level (land area of 2–5320 m2 for the study domain with a median of 154 m2 and interquartile range of 103–303 m2). Our aggregation takes the mean depth across properties as representative of the depth exposure of all properties in that block.

Importantly, block-level implies that unexposed properties () can be assigned nonzero depths and are included in the loss aggregation in Equation (4c).

2.5.3 Aggregate structures and hazard, filtered (ASHF)

2.6 Aggregation bias metrics and drivers

It is extremely challenging to predict the a priori net impact that each of our procedures could have on EAL—either in aggregate, or in terms of the distribution of losses across spatial units. First, Equations (1a), (3a), (4a), and (5a) highlight that losses increase linearly with the value of affected assets. The fact that distributions of building values tend to be long-tailed (Tate et al., 2015) suggests that upper tail property values will account for a large proportion of losses (Kousky & Walls, 2014; Tate et al., 2016). To the extent that, all three aggregation procedures underestimate these tail values the resulting EAL bias would be negative.

Second, this seemingly straightforward effect is complicated by the influence of fine spatial scale topographic heterogeneity. On one hand, naïve aggregation of flood hazards that ignores the possibility that some properties have zero depth exposure will erroneously apply damage to valuable structures that are in fact undamaged, biasing aggregate EAL upward. But on the other hand, the calculation of the aggregated hazard will include these zero-depth observations, imparting a downward bias to aggregated depths, and, for damaged properties, percentage losses, leading to underestimation of EAL. The degree to which the error in one or the other direction dominates, or the two fortuitously cancel out (Merz et al., 2010), depends on the relative numbers of properties that are undamaged and erroneously identified as exposed versus those truly at risk, the distribution of depths faced by the latter (which are likely to also exhibit long tails—(Tate et al., 2015)), and the convexity of the damage function.

Third, further complications arise from the potential for aggregation to alter DDFs' shapes and change the relationship between DDFs and structure values. Aggregating over structures can lead to biases in the assignment and/or weighting of structural archetypes—and their damage susceptibility (Figure S2). The direction of this effect is highly uncertain. Moreover, structural characteristics and values are likely both highly correlated with one another, and jointly correlated with depth exposure (Beltrán et al., 2018; Pollack & Kaufmann, 2022). To the extent that aggregation procedures fail to preserve such correlations, they may underestimate EAL by failing to capture high-value homes that incur substantial damage from extreme depth exposures on long return periods.

The ultimate goal is to rigorously evaluate the importance of these factors in the context of global sensitivity approaches of the kind used by Tate et al. (2015). However, given the complexity and computational cost of undertaking such an analysis with large-scale data, we settle here for the more modest interim step of elucidating the potential pitfalls of input aggregation that capture in a stylized way the essence of procedures commonly seen in practice.

To quantify the overall severity of bias we compute summary statistics of the fine-scale agreement between aggregated and benchmark EAL: the root mean square error (RMSE), a common accuracy metric, which is strictly positive, and bias per home at risk, an accuracy metric which also indicates the direction of estimation error. To quantify the impact of aggregation on the distribution of EAL, we calculate the agreement in the rank ordering of losses via the standard error of rank order bias (see below, Equation 8). All three metrics are computed at the property level and for loss aggregated to the census tract, the finest scale at which analyses utilizing aggregation procedures cited in Table S1 present their results. We also compute our metrics at the county level, to test whether bias cancels out over larger units of aggregation.

We also elucidate the potential drivers of bias. First, we inspect the spatial patterns of depth and structure value for aggregation-based procedures compared to the benchmark. We then capture the overall influence of the shape of the input distributions by computing how the joint and marginal densities of depth and building value under each procedure shift with respect the benchmark. Finally, we demonstrate how aggregation-induced errors in the number of properties at risk, property value, and the damage function interact with uncertainty in the structural archetypes—particularly in the tails of the distributions of depth and value.

3 RESULTS

3.1 Total aggregation bias and its spatial distribution

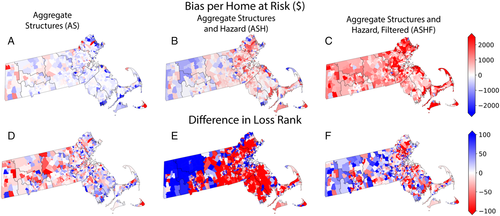

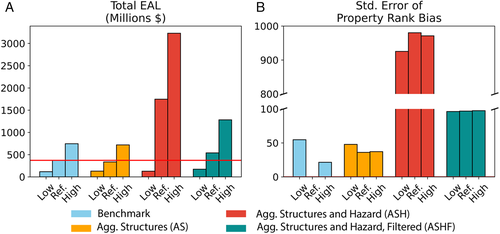

We find that all data aggregation procedures introduce biases in the estimation of expected annual flood losses (Figure 1). Our benchmark derived from all high-resolution data (hazard and structures) estimates that 139,836 single family homes in Massachusetts are exposed to flood risk, giving rise to a total EAL of $374 million (Figure 1, Table S4). Relative to this benchmark, aggregating structures to the block group (AS) underestimates total EAL by 17% (Figure 1a); it also leads to a slight overestimation of the number of properties at risk (+1%) (Figure 1b), mainly due to differences in the applied DDFs and the resulting extent to which structures are estimated to incur losses at low depth. By contrast, additionally aggregating hazard to the census block without removing not-at-risk properties (ASH) leads to a substantial overestimation of the number of properties estimated to be at risk (by a factor of 4.5) as well as total EAL (by a factor of 3.7; Figure 1a,b). When properties not at risk are removed prior to aggregation of structures and hazard (ASHF), this bias in total EAL is reduced to +44% relative to the benchmark (Figure 1a), a substantial reduction when compared to the ASH procedure, but still a large overestimate.

None of the aggregation procedures succeed in accurately capturing the distribution of expected flood losses across Massachusetts single-family homes (Figures 1 and 2). At the property level, RMSE exceeds benchmark EAL per home at risk regardless of procedure (Figure 1a,d) and procedures based off aggregate inputs generally fail to capture the rank ordering of losses (Figure 1g). At the level of census tracts, we observe the largest biases—a RMSE and standard error of rank order bias of $1,948,066 and 4.5, respectively—when aggregating both structure and hazards without removing not-at-risk properties (ASH) (Figure 1e,h). Tract-level bias is reduced by a factor of over 6 to an RMSE of $308,668 and a rank order discrepancy of 1.8 when properties not at risk are removed (ASHF). Aggregating structures only (AS) leads to the lowest errors in spatial distribution: a RMSE and standard error of rank order bias of $129,016 and 1.1, respectively. However, even in this latter case, biases for individual census tracts can be large. Furthermore, over- and underestimations are clustered in space (Figure 2). These biases and errors in rank ordering persist even when loss estimates are aggregated to coarser spatial units, such as the census tract or county (Figures 1, 2, and S5), illustrating that errors observed at small spatial scales do not necessarily cancel out when aggregating to larger spatial scales.

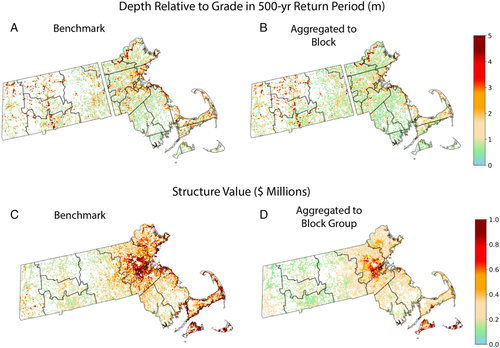

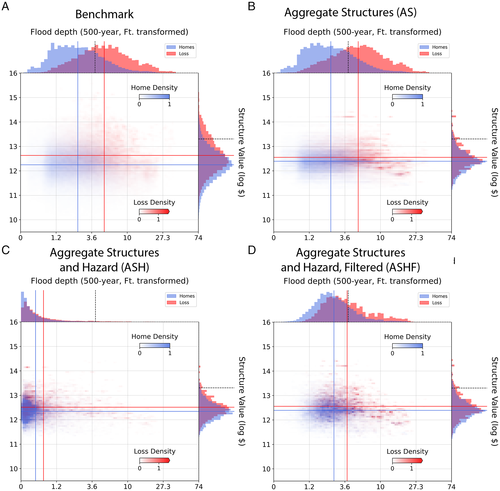

3.2 Aggregation fails to capture joint long-tailed distributions of hazard and structure value

A key driver of the observed aggregation biases is the joint distribution of estimated flood hazard (depth) and structure values. In Massachusetts, these distributions are both positively skewed, and the long upper tails are spatially correlated with each other. For example, many of the highest-value homes are clustered along much of the coast, which coincide with locations facing relatively high depths (Figure 3a,c). This correlation of high-value and high-hazard homes drives results in overall loss estimation as illustrated by 8.5% of total EAL in the benchmark procedure composed of only 0.6% of properties that are in the top 10% percentiles of both value and hazard distributions. This crucial interaction is largely lost when input data is aggregated along either dimension (Figure 4). The joint distributions of all observations versus loss-weighted observations (Figure 4a) are substantially reduced through aggregation of structures (Figure 4b–d) and hazard (Figure 4c,d). Importantly, average flood depths in the ASH procedure are considerably lower than in other procedures since they include homes not at-risk within each block. Adjusting for this overinclusion with a filter for homes at-risk (ASHF) improves the representation of average depth, but the misrepresented marginal and joint distributions still lead to substantial bias (Figures 1c, 2c, and 4d). Finally, the AS procedure generates marginal distributions for structure value based off all observations and loss-weighted observations that is narrower than under the high-resolution benchmark. As a result, even though average structure value is roughly captured, the joint distributions in the upper tails of depth and structure value are not, with a greater density of observations closer to the means of depth and structure value. This explains the overall underestimation of losses from this procedure (Figure 1c), and prominent underestimations of loss in high-valued coastal areas (Figure 2a).

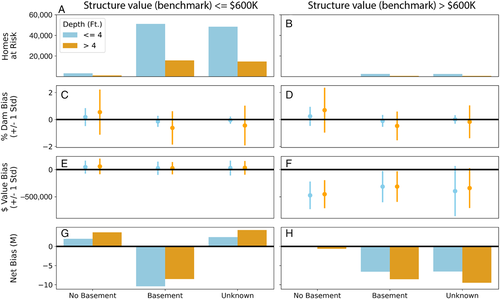

3.3 Aggregation of structure characteristics can introduce additional bidirectional biases

In addition to the observed loss of long-tailed distributions through aggregation, we observe that the aggregation of structural characteristics can introduce additional over and underestimations of loss, because the convexity of DDFs varies by structure type and depth. This rather complex relationship can be illustrated by decomposing overall bias in our best-performing aggregation procedure—the aggregation of structures (AS)—by depth, value, and a key structural characteristic, namely whether a home has a basement (Figure 5). We find that bias in the estimation of fractional damage (i.e., % of structure value) increases with estimated hazard (flood depth), as does the standard deviation of estimation errors (Figure 5c,d). These biases are bidirectional: on average, percentage damage is underestimated for homes with basements and overestimated for homes without basements or no (i.e., imputed) basement information; this is the case both for the tail of highest-value structures (>$600K) as well as the remainder. However, because estimated fractional damage interacts (i.e., is multiplied) with bias in structure value (Figure 5e,f) and the total number of properties (Figure 5a,b), overall bias in the EAL estimation varies among subgroups in directions other than one might assume when considering only the observed biases in the estimation of fractional damage. For instance, although homes with unknown basement type have a negative average bias in fractional damage, their estimated EAL is overestimated on net when highest-value structures are excluded (Figure 5g). Conversely, in the case of highest-value structures, the large negative bias in the aggregation of structure value prevails over the bias in fractional damage (Figure 5f), leading to an underestimate of EALs across all structure types. This illustration highlights that interactions between flood hazard, structure characteristics, and structure value can give rise to net biases that can be difficult to predict and correct for ex-ante when an analyst only has access to aggregated data. Importantly, the relationships observed in the case of Massachusetts might look different in other locations.

3.4 Benchmark losses are highly uncertain

Finally, we find that estimates of EAL can be highly sensitive to key assumptions analysts have to make with respect to unobserved structural characteristics, notably the FFE of homes relative to grade and the shape of DDFs. Differences between benchmark estimates based on “low damage,” “reference,” and “high damage” assumptions are an order of magnitude larger than biases introduced through the aggregation of structures (AS) or through the aggregation of structures and hazards when properties not at risk are removed (ASHF) (Figure 6). Similarly, differences in the distribution of property-level EAL estimates are of similar magnitude as those introduced through data aggregation (Figure 6).

4 DISCUSSION

4.1 Accurate flood loss estimation requires high-resolution data on hazards and structures

Our results reveal the potential for substantial aggregation bias in the estimation of flood loss when input data on hazard and structures are aggregated to even relatively small spatial units (census blocks). This threat appears to be particularly high if the distributions of flood hazard and structural value are positively skewed and their tails are correlated in space. Due to complex interactions between flood hazards, structure values, and structure characteristics, there is no easy remedy to control for this bias when high-resolution data is not available for large-scale estimation tasks.

These findings have important implications for applications that rely on the estimation of flood risk over large scales, like calculating flood insurance premiums. For instance, we find that the aggregation of data on structures (AS)—with which we sought to emulate the aggregation procedures inherent in RR 2.0—underestimates total EAL by 17% in our case study. Although this bias is smaller than those introduced through the aggregation of flood hazard (ASH and ASHF), or through potentially erroneous imputation of key missing data, such as FFE, it could negatively affect the solvency of an insurance scheme that relied on this strategy for the computation of premiums.

Similarly, our results demonstrate that flood loss estimation procedures that rely on aggregate input data will find it challenging to accurately reproduce the spatial distribution of flood risks across individual properties and broader spatial scales (Figures 1, 2, and S5). As a result, such procedures are unlikely to be suitable for the identification of actuarially fair flood insurance premiums (RR 2.0), or for the efficient allocation of flood mitigation funding to different communities (Johnson et al., 2020; Narayan et al., 2017; Reguero et al., 2018). In the case of the NRI, the reliance on flood zone boundaries to identify properties at risk, and their exposure, likely introduces additional substantial errors in terms of overall bias and rank ordering of units at risk because flood zones include homes not at risk, exclude homes at risk, and do not capture fine-scaled heterogeneities of exposure and vulnerability (Czajkowski et al., 2013; Wing et al., 2018; Figure S6). However, an underlying issue we do not address is the differences between the hydraulic modeling approaches employed by the First Street Foundation and FEMA, and their potentially divergent effects on inundation depths and extents—a question that is a key area for future research. More generally, high-resolution estimation of flood losses draws attention to situations in which the majority of flood losses, and thus the majority of benefits of flood mitigation, are likely captured by the highest-value homes, thus shedding light on potential equity issues in the allocation of federal and state funding if based on procedures subject to aggregation bias.

4.2 Missing data is a substantial source of potential bias that remains largely unmitigated

In addition to the issue of aggregation bias, our results draw attention to key uncertainties in the estimation of expected flood losses that cannot be easily resolved using the property-level datasets commonly available to flood researchers (e.g., tax assessor data). Although joint observation of building footprints and terrain elevation is now feasible and continuously improving (Hawker et al., 2022), missing data on other key characteristics—such as FFE and the presence of basements—remains a major source of uncertainty and potential bias in the estimation of flood losses (Figure 6). To shed further light on the relative importance of different data imputation assumptions, flood loss estimation analyses and products need to acknowledge more fully, and attempt to model, these sources of biases and uncertainties inherent in estimation strategies, including relevant uncertainties in the underlying flood hazard model (Tate et al., 2015). Crucially, uncertainty analyses need to explicitly account for the possibility that errors in data imputation can be correlated in space (Saint-Geours et al., 2015; Tate et al., 2015). Similar error correlations can also be introduced through assumptions inherent in estimation procedures that rely on the depth-damage paradigm. For example, the linear relationship between damage and structure value could easily be violated if owners of high-value homes are more likely to invest in structural defenses to reduce flood losses, or if defended homes command a premium in the market from knowledgeable buyers (Pollack & Kaufmann, 2022). Following the logic of Equation (1a), this effect would make the damage function systematically less convex for the highest value properties, leading to an overstatement of aggregation bias at the highest depths and structure values. A dearth of systematically available property-level information on structural defenses makes it difficult to test these assumptions explicitly.

More rigorous empirical assessments of observable relationships between modeled flood depths, actual flood inundations and observed flood damages across different realized flood events and heterogeneous structure inventories could assist with the development of empirical DDFs and best-practices for prospective loss estimation (Rözer et al., 2019; Schröter et al., 2014; Wing et al., 2020). Our uniform perturbation of FFE and its effect on depth-damage relationships is a crude first step toward characterization of the relevant uncertainties. The fundamental challenges are to, first, understand how such relationships might be distributed among different property types and locations at high resolution, and second, assess the aggregate consequences of hundreds of thousands of property-level perturbations in a computationally efficient manner. With large-scale datasets of the kind used here, such an undertaking is at the forefront of uncertainty quantification research (Tate et al., 2015; Wing et al., 2022).

5 CONCLUSION

Our case study of single-family homes in Massachusetts shows that aggregation bias can be a substantial concern in the estimation of flood losses. We surmise that such biases might be widespread across existing academic analyses and data products that use aggregated data inputs to inform flood insurance and mitigation policy, such as RR 2.0 and NRI. This raises concern about the validity of inferences drawn from risk estimates derived from aggregated data inputs. Unfortunately, our analysis also suggests that there might be no simple way to correct for this aggregation bias, as the interactions between flood hazard, structure value, and structural characteristics are complex and difficult to anticipate where large-scale property-level data is unavailable.

In our view, these findings point toward a substantial potential problem for the reproducibility and transparency of large-scale flood loss estimation research. In the United States, as in many other countries, the aggregation of large-scale property data is the domain of commercial endeavors, which has historically limited access to such data to well-funded institutions and research groups, with only few notable exceptions (Nolte et al., 2021). Recent efforts to make property-level flood risk estimates more widely available for the purpose of noncommercial research (e.g., by the First Street Foundation) are therefore laudable initiatives. However, as we have shown, data releases of single point estimates of flood loss can mask substantial uncertainties and potential biases inherent in flood loss estimation. Furthermore, if established practice for the related problem of property value estimation offers any indication, analyses and data releases have heretofore only rarely been accompanied by information on prediction uncertainties (Krause et al., 2020). Wing et al.'s (2022) large-scale Monte Carlo assessment of flood loss uncertainty goes a considerable way toward remedying this state of affairs, but more needs to be done to highlight the implications of key modeling assumptions and data imputation steps. Our hope is that the present study can help to point the way forward by illustrating approaches to better quantify the extent to which inputs aggregated to various degrees on the same underlying data drive uncertainties in estimated losses, and transparently identify the pathways through which those effects manifest.

There are several courses of action that may help analysts mitigate the problem of aggregation bias, and uncertainty in loss estimation with high-resolution inputs, in academic studies and data products that inform flood risk management in the United States. First, minimal standards for state and local governments who manage cadastral and building records could be set. These include ensuring that structure locations, characteristics and values are recorded, linkable to each other, and openly accessible. An exemplifying example is the property appraiser database for Monroe County, Florida that meets this standard and includes structural characteristics like household elevation on stilts. Second, model outputs and data collected by FEMA in its administration of the NFIP and other programs could be released or used to support their analyses and decision-making. For example, FFE are recorded in the processing of elevation certificates. Similarly, high-resolution 2D hydraulic analyses are used in the development of flood zone boundaries and could be released in their disaggregated form. Further, FEMA maintains databases on observed damages and flood extents for a large range of events. Releasing these could enable comparisons of modeled outputs to real-world estimates from flood events and the actual damages observed at high-resolution and with detailed structural characteristics. In turn, these can be used to validate high-resolution flood hazard models, loss estimation outputs based on them, and quantify aggregation bias and uncertainty in practice. Finally, barring releases of high-resolution data for privacy or proprietary concerns, data providers may release statistics on the distributions of flood loss drivers and their correlations, which could enable analysts to faithfully replicate aggregate loss estimates that would be obtained from property level information with appropriate sampling techniques (de Moel et al., 2014).

ACKNOWLEDGMENTS

The authors gratefully acknowledge the provision of free-of-charge datasets by Zillow and First Street. Data provided by Zillow through the Zillow Transaction and Assessment Dataset (ZTRAX). More information on accessing the data can be found at http://www.zillow.com/ztrax. The results and opinions are those of the author(s) and do not reflect the position of Zillow Group. This work was supported by the U.S. Department of Energy, Office of Science, Biological and Environmental Research Program, Earth and Environmental Systems Modeling, MultiSector Dynamics, Contract No. DE-SC0016162. This work was also supported by the Department of Earth and Environment and a Research Incubation Award from the Hariri Institute for Computing and Computational Science, both at Boston University. We thank Sanjib Sharma for reading and providing comments on a revised manuscript. Finally, we thank two editors and two anonymous reviewers for The Journal of Flood Risk Management, who helped clarify our thinking and pointed out issues in early drafts.

Open Research

DATA AVAILABILITY STATEMENT

Our illustration of aggregation bias is only made possible due to licenses for limited-access datasets. Thus, we are limited in our ability to share the full set of data that composes our analysis. Property-level losses under the reference damage scenario across all procedures are made available for all properties in our sample since they are a unique transformed quantity of the underlying licensed data. These are available at https://dataverse.harvard.edu/dataverse/places;Open NFIP Policy data is available at: https://www.fema.gov/openfema-data-page/fima-nfip-redacted-policies-v1;FHFA Housing Price Indices: https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index-Datasets.aspx;A link to information on access to PLACES: https://placeslab.org/get-access/;The structure inventory is made available by ZTRAX, but new licenses are no longer available to researchers, and those currently with access will lose it September 30, 2023. (https://www.zillow.com/research/ztrax/);The flood hazard model is made available by the First Street Foundation, and licenses are available for non-commercial purposes: https://firststreet.org/data-access/public-access/; All code is stored in a private GitHub repository, and code can be made available upon request.