Genetic Modification Technology and Producer Returns: The Impacts of Productivity, Preferences, and Technology Uptake

Abstract

Modern biotechnology can produce genetically modified crops that are more productive or provide qualities some consumers might prefer. This article presents a partial equilibrium model of international agricultural commodity trade, which is used to examine the effects on producer returns of productivity, consumer preferences, and uptake rates of genetically modified crops. Both first- and second-generation genetically modified crops are considered. The analysis focuses on gross returns to agricultural producers in Australia, the European Union, New Zealand, and the United States. Results suggest that these regions are affected differently by productivity changes and consumer reactions to genetically modified crops.

Modern biotechnology can produce genetically modified (GM) crops with many different characteristics. The major commercial GM crops to date have been field crops modified for herbicide tolerance and insect resistance (James 2003, 2005). These input-oriented crops are considered the first generation of GM crops, but the second generation promises modified output characteristics that consumers may find desirable (Anderson, Jackson, and Nielsen; Shoemaker et al.). Second-generation crops may include better-tasting tomatoes, crisper carrots, and more nutritious strawberries (BIO).

These different types of crop modification can have different impacts on agricultural producers. Input-oriented modifications affect farm profitability by changing how crops are produced and with what inputs (Commission of the European Communities; Runge and Ryan). They further have the potential to affect gross farm receipts if there is a difference in productivity or a price differential between GM crops and non-GM crops (Miranowski et al.). Output-oriented modifications are intended to increase demand by creating more useful or desirable products (Krueger). For these crops, the impact should be an increase in farm gross receipts. It is also possible that these products will affect production costs. Thus, both input- and output-oriented GM crops can affect both supply and demand, with the net effect on agriculture income uncertain.

International trade in agricultural commodities compounds this uncertainty. Countries have varied in their regulatory approval of GM crops and food (Kaye-Blake et al.), such as in the food labeling requirements or in the GM cultivars authorized for production. These requirements have affected the rates of uptake of GM crops, which vary significantly across the world (James 2003, 2005). They also affect where specific crops can be sold. However, the divisions between GM-sensitive and GM-indifferent countries as well as sensitive and indifferent uses within the same country (e.g., direct consumption versus use for processing or industrial purposes) has meant that consumers have generally been able to source the product they want while producers have been able to sell their crops (Parcell and Kalaitzandonakes; Shoemaker et al.; USDA 2001).

Because the net effects of changes in productivity, preferences for non-GM crops, levels of uptake, and potential preferences for second-generation GM crops are uncertain, particularly when the potential for trade is considered, a partial equilibrium model of international trade in agricultural commodities was developed to analyze the market for GM crops. In particular, this analysis focused on the types of GM crops that would be most advantageous to agricultural producers and the conditions under which producers would benefit.

This article is organized as follows. The next section reviews prior GM research on crop productivity, consumer preferences, and trade impacts. This research then informs the following section, which presents the structure and inputs for the trade model. The next section analyses the impacts of several different scenarios regarding GM crops and food, and this leads to a discussion of the results. A concluding section finishes the paper.

Prior Research

GM crops and food have been researched and discussed from a number of perspectives. The following presents some main findings from this literature that will underpin the trade modeling. This section in particular covers trade modeling, productivity impacts, and consumer responses.

Trade Modeling

The trade modeling literature focused on GM crops has examined a number of scenarios using different types of models. Frisvold, Sullivan, and Raneses used a partial equilibrium model similar to the one used here to assess productivity gains. They demonstrated that genetic improvements in U.S. crops could lead to substantial increases in total welfare, larger than the improvements calculated with other methods. These gains were largely the result of increases in consumer surpluses. Producers tended to experience decreases in their welfare, with the exception of those in the United States, whose increased production was large enough to offset price declines. This distribution of effects between consumers and producers is to be expected because of the price-inelastic nature of demand for agricultural commodities. It is also similar to the findings of Moschini, Lapan, and Sobolevsky in their modeling of the soybean sector. Importantly, they found that U.S. farmers fared worse when GM technology was made available to other countries and when the technology increased yields as opposed to simply reducing costs. In a later model, Lapan and Moschini demonstrated that the introduction of GM technology can have uneven impacts on social welfare, depending on consumers' preferences, and that the net welfare impact may be negative or positive.

Computable general equilibrium (CGE) trade models have also been used to analyze the impact of GM crops on international trade (Anderson and Nielsen; Anderson, Nielsen, and Robinson; Stone, Matysek, and Dolling; Anderson, Damania, and Jackson; Anderson and Jackson; Anderson, Jackson, and Nielsen). The most basic finding of this research was that GM crops, by using the factors of production more efficiently, reduced prices and improved total social welfare. Countries that adopted GM crops extensively gained by increasing their productivity. They also increased their market share relative to nonadopting countries. Importing countries improved their welfare, too, because of lower commodity prices and reallocation of agricultural resources.

Consumer reactions to GM crops have also been included in these models. The exact impact on consumer welfare (and therefore total welfare) depended on how the consumer reaction was modeled. In addition, consumer reactions were sometimes modeled at the same time as policy responses (e.g., Stone, Matysek, and Dolling), so their separate impacts can be difficult to discern. Anderson, Nielsen, and Robinson modeled European consumer reluctance toward GM crops as a costless preference shift. In that case, total world welfare declined somewhat, but mostly because of a decline in European consumer surplus. That is, Europeans bore most of the cost of the preference shift. When European reaction was modeled as a trade restriction on GM crops, total world welfare was more than halved, but again it was the Europeans who bore the burden of the (much larger) decline in welfare (Anderson, Nielson, and Robinson). Further research extended this analysis to show that, while total European welfare might decline, European producers gained as a result of the ban on GM imports (Anderson and Nielsen; Anderson, Damania, and Jackson). Interestingly, producers in exporting countries with low adoption rates of GM crops (Australia, New Zealand) also gained from the ban. Anderson and Jackson specifically examined the impacts on Australia and New Zealand, and found that these exporting countries were significantly affected by consumer reactions in importing countries. Greater European resistance to the crops leads to welfare losses instead of gains from GM crops.

However, these calculations of total welfare and consumer welfare did not take into account that consumers surplus might be increased by providing greater access to non-GM commodities. Anderson, Damania, and Jackson stated this explicitly, noting that if EU citizens were willing to pay just $9 per capita per year, the welfare impact of a GM ban would be positive.

Modeling work on second-generation GM crops for which consumers have positive preferences appears to be less frequent. One example is Saunders and Cagatay, which included scenarios in which consumers preferred certain GM products. As industry and government look toward future impacts of GM technologies, estimating the impact of second-generation products will require modeling of such preferences.

Productivity

The contribution of GM technology to farm productivity is a key consideration in modeling the impacts of the technology on trade. In CGE modeling, a range of increases in factor productivity has been used, from 2% to 10% (Anderson and Nielsen; Anderson, Nielsen, and Robinson; Stone, Matysek, and Dolling; Jackson and Anderson). Moschini, Lapan, and Sobolevsky used several assumptions to test the sensitivity of their partial equilibrium model results, including costs reductions of 10% to 30%, and a yield gain of either 0% or 5%. These different productivity assumptions indicate a lack of consensus about the actual impacts of GM technology on farm productivity.

Unfortunately, the literature on actual on-farm productivity increases provides little guidance. Estimates of production, input use, and profitability for GM food crops vary depending on the crop analyzed, the year, and the particular study (Kaye-Blake et al.). There is even disagreement over whether the net impact on farmers has been positive or negative. Marra, Pardey, and Alston presented results from a number of studies that suggest positive impacts, but Fernandez-Cornejo and McBride conducted an analysis on USDA data that found no positive impact on farm finances. Marra, Pardey, and Alston raised the issue of comparability of farms in various studies, including those by the USDA. Their concern was that lack of comparability was obscuring the true extent of benefits of GM crops to adopting farmers.

Consumer Preferences

Another issue confronting modelers is the extent and permanence of consumer reactions. Many studies have estimated consumers' willingness to pay for either GM or non-GM food, and they cover several countries: Australia (James and Burton), China (Hu; Li et al.), Japan (Hu; McCluskey et al.), the United Kingdom (Burton, Rigby, and Young; Rigby and Burton), the United States (Hossain and Onyango; Lusk et al.; Rousu et al.), and New Zealand (Kassardjian, Gamble, and Gunson; Kaye-Blake, Bicknell, and Saunders). They indicate, first, that reactions to GM food vary by country. They also suggest wide variation within each country, such that some people are willing to pay more for GM food, while others are not willing to buy it at all. As a consequence of these consumer reactions, price premiums for non-GM products in international markets began to appear in 1999 with two-tiered pricing structures developing in some markets, such as Japan, Korea, and Europe (Commission of the European Communities; Parcell; Parcell and Kalaitzandonakes).

The willingness of consumers to pay a premium for second-generation GM products has also been explored in this literature. For example, Rousu et al. used an auction experiment to examine willingness to pay for GM cigarettes, and found that information affected the willingness to pay for the low-nicotine cigarettes. Kaye-Blake, Bicknell, and Saunders conducted a choice modeling survey that examined willingness to pay for GM apples with health benefits. Respondents in their sample were willing to pay for more antioxidants, but not when the antioxidant level was enhanced through GM technology. Finally, O'Connor et al. found that an enhanced GM dairy spread would achieve acceptance by a niche market.

The Empirical Model

In the present research, a partial equilibrium model was used to quantify the price, supply, demand, and net trade effects of productivity impacts, consumer preferences, and uptake rates. The model focused on the agricultural sector, and did not include linkages between the agricultural sector and other industries, factor markets or the macroeconomy. The model was based on SWOPSIM (Frisvold, Sullivan, and Raneses; Roningen 1986), later VORSIM (Roningen 2007), and was further modified according to Saunders and Cagatay. The model incorporated prior research on agricultural markets and price and income elasticities in order to estimate the model equations, and was thus synthetic.

A partial framework was preferred in this study because of the level of commodity disaggregation that the framework allowed. Furthermore, the VORSIM base model was flexible and transparent, and allowed the impact of exogenous shocks to be traced through the model. Finally, the extensions in Saunders and Cagatay included detailed, disaggregated modeling of the dairy sector, a commodity sector significantly affected by trade policies and significant for some of the countries in the model.

Nine countries and sixteen agricultural commodities were included in the model (see Appendix table A1 for a list). In each country, production and consumption were functions of price, the relevant elasticities, and government policies. Domestic production and consumption then led to excess supply or excess demand, which spilled over into the world market to determine international prices. The model solution was achieved by finding the world commodity price that resulted in an equilibrium between total excess supply and total excess demand; this solution was found using a nonlinear optimization algorithm.

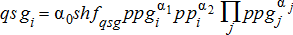

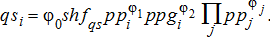

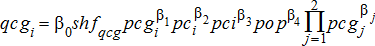

Production and consumption in all countries were split into GM and non-GM components, so that effectively thirty-two products were modeled. The GM and non-GM components of a commodity were assumed have identical supply, demand, stock, and price functions, similar to the approach used by Nielsen, Robinson, and Thierfelder and by Barkley. The separate equations could then be modified in order to model the different scenarios.

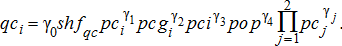

(1)

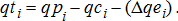

(1) (2)

(2) (3)

(3) (4)

(4) (5)

(5)Presentation of Model Scenarios

The literature discussed above was used to inform the model scenarios. Scenarios were built around three key parameters: the productivity changes from GM crops, the level of consumer preferences for GM and non-GM products, and the level of uptake or adoption of GM crops in each country and sector. The values for these key parameters are discussed below, and are summarized in table 1.

| GM Productivity Increase | ||||

|---|---|---|---|---|

| Lower Adoption Rates | Higher Adoption Rates | |||

| Consumer Preference | No change | Increase | No change | Increase |

| None | Base | ScenarioA2 | Base | ScenarioB2 |

| Low non-GM preference | Scenario A3 | Scenario A4 | Scenario B3 | Scenario B4 |

| High non-GM preference | Scenario A5 | Scenario A6 | Scenario B5 | Scenario B6 |

| GM preference | Scenario A7 | Scenario A8 | Scenario B7 | Scenario B8 |

Productivity Increases

The effects of GM adoption were simulated with two alternative scenarios on the supply side. In the first one, the adoption was assumed to yield no productivity increase in either the commodities or countries. In the second one, a 10% increase in the productivity of GM crops was assumed. To model the productivity increase, the shift parameter was increased by 10%, to shfqsg = 1.10, which yielded a pivotal downward shift in supply curve. This increase is based on the findings of Qaim and Traxler with regard to herbicide-tolerant soybeans. While literature on the impacts of GM cultivars has found a range of productivity impacts, Qaim and Traxler provided a recent estimate from a farm-level survey. The shift was applied to most commodities in the model (apples and kiwifruit are not affected) and to all countries. A 10% shift was large enough to determine the impact of productivity changes, and could be compared to no-shift scenarios to understand the impacts of changes in consumption preferences and uptake levels when placed alongside productivity shifts.

Consumer Preferences

Alternative demand responses were simulated to analyze the effects of consumer preferences on GM and non-GM commodities. Initially, GM technology was assumed to have no impact on consumer preferences for agricultural commodities, so that the consumption shift variable was equal to one for both GM and non-GM products, shfqcg = shfqc = 1. Three other consumption responses were modeled. In one response, consumers weakly preferred non-GM commodities. The strength of this preference varied by country, as suggested by the willingness-to-pay literature discussed above. The preference shifts are given by country in the appendix in table A2. A second response considered even stronger consumer reactions against GM food. These values (presented in table A2) also varied by country. The final response considered was a preference for GM food, corresponding to a second-generation GM crop for which consumers were prepared to pay a premium. The values for these preferences were the same as those used in the weak consumer preference scenario above, but were applied such that GM food is preferred to non-GM.

The consumer preferences were applied by moving the GM and non-GM shifters in opposite directions. Thus, a 10% preference for non-GM food was modeled by setting the non-GM shift parameter equal to 1.05 and the GM shift parameter equal to 0.95. There were theoretical and practical reasons for this approach. The theoretical concern was that the literature was not clear whether a change in consumer preference applies as a discount for one type of produce or as a premium for the other. Some research estimated the willingness to pay more for non-GM food, while other considered the discount for GM food. The practical concern was that the partial equilibrium model examined agricultural production and consumption in isolation, so that the total size of the sector could increase without countervailing pressure from other industries or budget constraints. By splitting the consumption impact between the two shifters, the total size of the sector was roughly maintained. Increased returns from one type of commodity came at the expense of reduced returns for the other.

Uptake of GM Crops

Production of all commodities in all countries was assumed to be segregated into GM and non-GM varieties. For apples and kiwifruit, essentially no GM production was modeled (minimal amounts were included to allow the trade model to solve). For all other commodities, two sets of adoption percentages were modeled. The first set was based on data regarding actual uptake of GM crops, given the current regulatory environment. U.S. adoption rates were based on USDA figures for 2004 (USDA 2007). Adoption rates for Argentina, Australia, Canada, the EU, Mexico, and the Rest of the World (RW) were calculated from the number of hectares in GM crops (James 2005) and the total number of hectares in maize, soybeans, cotton, and rapeseed (Food and Agriculture Organisation). Adoption rates for wheat and coarse grains were set equal to those for maize, in order to recognize that such products as glyphosate-tolerant wheat have been developed and could be commercially released. Japan and New Zealand were modeled as having essentially no GM production. These calculated rates were also compared to other research (Schnepf, Dohlman, and Bolling; Dargie; Miles; Stone, Matysek, and Dolling) for validation.

Adoption rates of GM crops are affected by not only the costs and benefits of the technology per se, but also by the regulatory environment in each country. To the extent that regulation is slowing uptake of GM cultivars, the full potential impacts of the technology are not being realized. Adoption rates were therefore also set at a second, higher level to model the impact of reducing regulatory hurdles to uptake of GM crops in countries with low uptake and consider the separate impacts of technology and regulation. These second adoption rates were set at a modest level between the highest and lowest levels currently observed. The rates are given in tables A3 and A4.

One wrinkle in public policy and modeling around GM is how to define GM food; this applies particularly to GM meat and dairy products. If the meat animal has not been genetically modified, but has eaten GM grain, then the meat may or may not be considered GM by consumers or regulators. The model in effect created two segregated production streams, so that animals fed GM crops were considered GM products. This is consistent with a labeling regime that was proposed in Europe (Mitchell) but not the final rules (Food Standards Agency), and is consistent with marketing practices in which meat producers advertise their use of non-GM feed (Kaye-Blake et al.). Meat and dairy adoption rates were therefore set equal to the rates for oilseeds.

Results of Empirical Analysis

The empirical analysis consisted of the model scenarios summarized in table 1, which combined different levels of productivity impacts, consumer willingness to pay, and technology adoption. For each scenario, total producer returns (producer price multiplied by quantity produced) were calculated for the United States, EU, Australia, and New Zealand1 and for several commodities in each country. Producer returns for each scenario were compared to the base model levels and the change in producer returns was calculated. The percentage changes in producer returns given the lower adoption rates are presented in table 2; results given higher adoption rates are presented in table 3.

| Percentage Change in Producer Returns from Base Scenario | |||||||

|---|---|---|---|---|---|---|---|

| Scenario | |||||||

| Country and Industry | A2 | A3 | A4 | A5 | A6 | A7 | A8 |

| New Zealand | |||||||

| Dairy | −0.29 | 4.04 | 3.78 | 30.67 | 30.54 | −3.05 | −3.37 |

| Beef | −0.04 | 3.41 | 3.36 | 24.00 | 23.96 | −3.38 | −3.42 |

| Sheep | −0.41 | 2.27 | 1.87 | 21.30 | 20.96 | −2.37 | −2.78 |

| Totala | −0.22 | 3.75 | 3.54 | 29.09 | 28.95 | −3.08 | −3.31 |

| United States | |||||||

| Dairy | −13.78 | −6.53 | −19.06 | −32.10 | −39.04 | 7.21 | −7.92 |

| Beef | −3.59 | −1.35 | −4.88 | −9.03 | −12.14 | 0.93 | −2.71 |

| Sheep | −12.53 | −3.01 | −15.15 | −13.76 | −24.23 | −2.34 | −14.59 |

| Oilseeds | −13.71 | −1.10 | −14.64 | −5.66 | −18.38 | −0.82 | −14.43 |

| Maize | −4.68 | 0.38 | −4.26 | 1.48 | −2.77 | 0.01 | −4.72 |

| Totala | −7.52 | −1.37 | −8.64 | −7.25 | −13.07 | 1.18 | −6.58 |

| Europe | |||||||

| Dairy | −0.17 | 5.75 | 5.59 | 33.46 | 33.37 | −5.32 | −5.51 |

| Beef | −0.03 | 2.93 | 2.90 | 20.56 | 20.53 | −2.92 | −2.96 |

| Sheep | −0.17 | 1.77 | 1.60 | 16.25 | 16.10 | −1.85 | −2.02 |

| Oilseeds | −0.28 | 3.66 | 3.37 | 12.28 | 12.04 | 1.08 | 0.80 |

| Maize | −0.17 | 1.19 | 1.03 | 8.36 | 8.20 | −0.81 | −0.98 |

| Totala | −0.12 | 3.89 | 3.76 | 25.21 | 25.12 | −3.39 | −3.52 |

| Australia | |||||||

| Dairy | −0.20 | 4.55 | 4.36 | 35.44 | 35.34 | −4.05 | −4.28 |

| Beef | −0.05 | 3.29 | 3.24 | 23.27 | 23.23 | −3.27 | −3.31 |

| Sheep | −0.25 | 2.15 | 1.90 | 20.02 | 19.81 | −2.24 | −2.49 |

| Oilseeds | −0.29 | 3.73 | 3.43 | 13.81 | 13.55 | 0.81 | 0.52 |

| Maize | −0.22 | 1.58 | 1.36 | 10.49 | 10.27 | −0.96 | −1.18 |

| Totala | −0.15 | 3.42 | 3.28 | 27.42 | 27.31 | −2.99 | −3.14 |

- a Includes all commodities, including ones not listed specifically herein.

| Percentage Change in Producer Returns from Base Scenario | |||||||

|---|---|---|---|---|---|---|---|

| Scenario | |||||||

| Country and Industry | B2 | B3 | B4 | B5 | B6 | B7 | B8 |

| New Zealand | |||||||

| Dairy | −2.25 | 2.50 | 0.56 | 23.56 | 22.53 | −2.11 | −4.85 |

| Beef | −0.42 | 2.87 | 2.46 | 20.69 | 20.34 | −2.85 | −3.28 |

| Sheep | −2.22 | 1.87 | −0.33 | 17.48 | 15.63 | −1.87 | −4.09 |

| Totala | −1.46 | 2.79 | 1.45 | 24.19 | 23.28 | −2.61 | −4.22 |

| United States | |||||||

| Dairy | −14.21 | −7.20 | −19.81 | −34.13 | −40.87 | 7.93 | −7.57 |

| Beef | −3.40 | −1.28 | −4.62 | −9.26 | −12.17 | 1.27 | −2.14 |

| Sheep | −8.15 | −0.81 | −8.90 | −11.05 | −18.07 | 0.73 | −7.32 |

| Oilseeds | −13.33 | −0.24 | −13.53 | −4.43 | −17.21 | 0.51 | −13.38 |

| Maize | −4.59 | 0.03 | −4.53 | 0.71 | −3.33 | −0.16 | −4.56 |

| Totala | −7.38 | −1.49 | −8.56 | −7.80 | −13.40 | 1.62 | −6.04 |

| Europe | |||||||

| Dairy | −1.75 | 4.21 | 2.64 | 25.58 | 24.77 | −4.03 | −5.85 |

| Beef | −0.30 | 2.46 | 2.17 | 17.62 | 17.36 | −2.45 | −2.75 |

| Sheep | −0.79 | 1.46 | 0.67 | 13.32 | 12.62 | −1.47 | −2.25 |

| Oilseeds | −1.53 | 1.03 | −0.50 | 8.70 | 7.19 | −0.99 | −2.62 |

| Maize | −0.87 | 0.72 | −0.15 | 6.32 | 5.53 | −0.75 | −1.58 |

| Totala | −0.97 | 2.98 | 2.06 | 20.68 | 20.01 | −2.91 | −3.89 |

| Australia | |||||||

| Dairy | −4.32 | 4.60 | 4.41 | 35.51 | 35.41 | −4.00 | −4.23 |

| Beef | −1.08 | 4.39 | 4.34 | 24.58 | 24.54 | −2.24 | −2.29 |

| Sheep | −2.89 | −4.88 | −5.11 | 11.77 | 11.57 | −8.96 | −9.20 |

| Oilseeds | −4.18 | 1.31 | 1.02 | 11.16 | 10.90 | −1.54 | −1.82 |

| Maize | −3.03 | 0.52 | 0.30 | 9.33 | 9.12 | −1.99 | −2.21 |

| Totala | −2.83 | 2.62 | 2.48 | 26.43 | 26.33 | −3.74 | −3.89 |

- a Includes all commodities, including ones not listed specifically herein.

Model results are presented as changes to producer returns, rather than impacts on producer welfare or total social welfare. Prior research has found that GM technology can produce net social benefit while reducing producer welfare. The present analysis thus focused on how the agricultural sector might be affected by GM technology. The focus on returns rather than welfare provided important information for regions dependent on agriculture for income. For example, New Zealand is export-focused, agriculturally based country (Ministry of Agriculture and Forestry), and depends on agriculture for much of its export earnings. In the United States, recent research on Midwestern regional economic development has focused on total county income (Monchuk et al.), and producer returns would be an important component of that income.

The results for Australia, the European Union, and New Zealand with the lower adoption rates were all similar, because of the similar assumptions for the scenarios. All three countries had low adoption rates, equal productivity impacts, and similar consumer preferences. With an increase in productivity from GM cultivars and no changes to the demand equations (A2, B2), these countries all had a small decrease in producer returns. When consumers preferred non-GM products, the countries that specialized in non-GM cultivars had increases in producer returns (A3, A5; B3, B5). Two different demand shifts were modeled, and the larger demand shift (A5, B5) led to larger increases in producer returns. Finally, when GM commodities were preferred, the countries with low adoption rates saw their agricultural income fall (A7, B7).

The results of the scenarios mixing productivity, consumption, and uptake changes provided more information. Combining a productivity increase from GM cultivars with a premium for non-GM commodities led to larger producer returns for these countries (A4, A6; B4, B6), although slightly less than without the productivity increases. When GM cultivars were both more productive and preferred by consumers, these nonadopting countries had their largest fall in producer returns. Finally, the impact of moving from the current, low level of adoption of GM crops in these countries to higher rates was demonstrated by the difference between the scenarios in set A and those in set B.

Increases in productivity without any change to the demand equations resulted in falls in producer returns when these countries had larger adoption rates, as seen in the difference between A2 and B2. Gains from consumer willingness to pay for non-GM food were not as large (A3 versus B3). However, losses when consumers preferred GM commodities were not as large (A7 versus B7).

The changes in U.S. producer returns were quite different. Because the United States had high rates of adoption of GM crops, it was also more exposed to the impacts of GM technology than the other countries. As crop productivity rose, gross producer returns fell (A2, B2). With consumer preferences running against GM commodities, producer returns decreased (A3, A5, B3, B5). However, the country did stand to gain when GM products were preferred by consumers (A7, B7).

The scenarios with combinations of changes also provided different results for the United States than for other countries. For example, in scenarios A4 and B4, a low consumer premium for non-GM products was set alongside a productivity increase for GM crops. The wedge between GM and non-GM prices reduced producer returns, and then the productivity increase reduced returns even more. Scenarios A7 and B7 indicated the impacts of a consumer premium for GM products; the United States, as a large producer of these products, naturally gained. However, when these same GM cultivars were also more productive, the net result was a drop in producer returns. For the scenarios in sets A and B, the U.S. adoption rates were not changed; the differences between the sets were the result of changes in other countries and the resultant impacts on trade.

The results in tables 2 and 3 include figures for several commodities in each country. For each scenario, there was a general trend as indicated by the total impact on producer returns, and some commodity-specific impacts. Results for the dairy sector were often more extreme than those for other sectors, especially for scenarios with high consumer preference shifts (A5, A7; B5, B7). Maize had some of the lowest changes across the board, and even in conditions of high preferences tended to have only single-digit changes. The differences between results for maize and for other products are perhaps most pronounced in the United States, and are a function of the different uptake rates of GM crops in maize versus oilseeds.

Discussion

The analysis has calculated the impact that several types of changes had on producer returns. The results of modeling suggested several points that characterize the impacts of GM technology on producer returns. One change was consumer preference for non-GM products, modeled as shifts in the demand curves. As consumers were willing to pay more for these products, the countries that specialized in non-GM production—New Zealand, Australia, and the EU—gained at the expense of those countries focusing on GM production. In the low-premium cases, the shift in the demand curves was 0, 5, or 10%, depending on the country. The shifts led to increases of less than 4% (in set A scenarios), reflecting the inelastic demand for agricultural commodities. Other scenarios examined the impacts of consumer preferences by modeling a preference for GM products. In those cases, countries without much GM production lost producer returns, while the United States gained from the consumer preference.

A second impact of GM technology modeled was increased productivity. Across the board, increased productivity of GM crops led to reduced producer returns. Technology that makes it easier or cheaper to produce commodities, whether by increasing yields or reducing cost of inputs, reduces the cost to supply the commodity, increasing the quantity supplied and reducing its price. Demand for agricultural commodities tends to be inelastic, so total revenue falls as the price falls and quantity increases. The impact of reduced producer returns was uneven across the countries in the model, and varied according to the adoption rates of GM cultivars. Thus, the United States had the largest losses because of increased GM productivity.

The third change modeled was the rate of adoption of GM technology. One set of scenarios analyzed productivity and consumer preference impacts at the current level of uptake, while a second set of scenarios analyzed impacts with higher adoption rates. With the higher adoption rates, countries had larger losses because of productivity enhancements and lower gains from consumer preferences of non-GM products. However, even at the higher rates modeled, New Zealand, the EU, and Australia still had losses when consumers preferred GM products; those losses increased when the products were not only preferred but also more productive.

The most interesting use of a model is to analyze the impact of several changes at once. Two scenarios, A8 and B8, examined the impact of increasing the productivity of GM crops at the same time as assuming a consumer preference for these crops—the case of a second-generation GM product. For all countries, the net impact was negative. The wedge between GM and non-GM preferences led to a fall in producer returns for all countries but the United States, as seen in scenarios A7 and B7, and increasing the productivity of the GM crops reinforced that fall. The increased productivity even led to losses in the United States, which had registered a gain when the consumer preference was considered in isolation. Finally, changing the uptake rates in New Zealand, the EU, and Australia had little impact on these results. At the adoption levels modeled, both the current and higher levels, the premium GM crop did not produce any net benefit for these countries.

These modeling results suggest that agricultural producers can improve their returns under specific conditions. First, if consumers prefer non-GM products, then producers can increase their revenues by supplying those products. If, on the other hand, new GM products can be developed that appeal to consumers and for which consumers are willing to pay a premium, then producers can increase their revenues by growing these new crops. Finally, productivity increases are not likely to improve farm revenues. Increasing the productivity of commodities with inelastic demand leads to a decline in producer returns. This impact in the modeling results is consistent with supply-demand theory, and prior analysis of the impacts of biotechnology on dairy production has found similar results (Foltz and Chang).

Conclusion

This article examined the impact on agricultural producer returns from different types of GM crops—ones that increase productivity, ones that provoke negative consumer reactions, and ones that are quality-enhanced to be preferred by consumers. The results of a partial equilibrium model of international trade in agricultural commodities showed that increasing productivity of GM crops harms producers in countries that adopt GM crops, and that the higher the adoption, the greater the harm. Consumer preferences were more significant in affecting producer returns than were changes in productivity. Countries increased their producer returns by producing what consumers preferred, whether that was GM or non-GM commodities. Furthermore, countries that concentrated on producing consumer-preferred non-GM commodities maintained these increases even in the face of increasing productivity of GM crops.

These results do reflect basic economic theory and experience relating to increases in productivity especially for agricultural products. Agricultural commodities tend to have an inelastic demand so that the price fall required for the extra supply to be sold is proportionally greater than revenue from the extra supply itself. This inelasticity also means that consumers are willing to pay relatively more for the agricultural products that they prefer.

The results of this analysis shed some light on national interests. Since, at the moment, any existing preference is for non-GM products, then identifying GM products through labeling and the associated segregation or production moratoria is clearly in the interests of low adopters of GM crops, such as Europe, Australia, and New Zealand. On the other hand, the United States has no interest in being able to identify GM from non-GM commodities. For its part, the United States seems to be following a strategy of increased productivity. Although this strategy will reduce returns for the sector as a whole, the present analysis cannot address the issue of distribution of gains and losses within the sector. However, other literature suggests a first-mover advantage, and biotechnology firms producing innovations have clearly been able to capture returns (Falck-Zepeda, Traxler, and Nelson). However, U.S. regulation allows products to be identified as genetically modified, so the option exists for positively identified GM products with quality enhancements in order to attract consumer premia. Finally, countries with any GM production would be concerned about issues of market access. The model assumes that coexistence acceptable to consumers is possible and that both GM and non-GM crops have market access. The policies of New Zealand and Australia (at the Federal level) are thus quite understandable: they are pursuing GM technologies on the grounds that gains are possible, especially by producing quality-enhanced GM crops, and are advocating open market access so that no products are shut out of any markets.

One drawback to the way the GM issue has been modeled here is the treatment of segregation or identity preservation. The modeling assumed that it is possible for countries to produce both GM and non-GM commodities and sell into both markets in a way acceptable to consumers. This assumption is counter to the possibility that GM could be segregated on the basis of country of origin, which has been modeled elsewhere (Anderson, Nielsen, and Robinson). The modeling did not include segregation costs, which have also been examined elsewhere. However, the increases in producer returns do give some indication as to the size of segregation costs that the non-GM market could bear. Thus, segregation or labeling policies whose costs amount to just a few percentage points of total producer returns, under assumptions of low consumer willingness to pay for non-GM products, will likely have little effect on producer returns in countries that produce most non-GM products.2

A second issue with this modeling effort is the universal imposition of productivity shifts. Using these results as a baseline, future modeling can examine the impact of assuming different impacts in different markets, commodities, and countries.

A final issue, raised by one reviewer, was the assumption of static demand elasticities at a time when there is increasing demand for animal feed, biofuel feedstock, and food for human consumption. Unfortunately, it is in the nature of this type of model to have fixed elasticities. These can be argued to hold over the short to medium term, in keeping with the notion of fixed tastes and preferences. However, it would be very useful to expand this research to include sensitivity analysis on the elasticity assumptions.

These issues do suggest that more modeling could be done in order to understand international trade in GM commodities. However, the results presented here suggest that agricultural producers in general do not tend to benefit from crop productivity increases but rather tend to benefit from commodities that consumers find desirable.

Acknowledgment

The authors gratefully acknowledge the helpful comments of two anonymous reviewers.

Endnotes

Appendices

| Countries | Argentina-AR |

| Australia-AU | |

| Canada-CN | |

| European Union (15)-EU | |

| Japan-JP | |

| Mexico-MX | |

| New Zealand-NZ | |

| United States of America-USA | |

| Rest of World-RW | |

| Commoditiesa | Wheat |

| Coarse grains | |

| Maize | |

| Beef and veal | |

| Sheepmeat | |

| Oilseeds | |

| Oilseed meals | |

| Oils | |

| Raw milk | |

| Liquid milk | |

| Butter | |

| Cheese | |

| Whole milk powder | |

| Skim milk powder | |

| Kiwifruit |

- a Each commodity is included as GM and non-GM components.

| Low Preference | High Preference | ||||

|---|---|---|---|---|---|

| Country | Base | Preferred Product | Non-Preferred Product | Preferred Product | Non-Preferred Product |

| Argentina-AR | 1.000 | 1.000 | 1.000 | 1.050 | 0.950 |

| Australia-AU | 1.000 | 1.025 | 0.975 | 1.250 | 0.750 |

| Canada-CA | 1.000 | 1.025 | 0.975 | 1.150 | 0.850 |

| European Union (15)-EU | 1.000 | 1.050 | 0.950 | 1.150 | 0.750 |

| Japan-JP | 1.000 | 1.050 | 0.950 | 1.250 | 0.750 |

| Mexico-MX | 1.000 | 1.025 | 0.975 | 1.150 | 0.850 |

| New Zealand-NZ | 1.000 | 1.050 | 0.950 | 1.250 | 0.750 |

| United States of America-US | 1.000 | 1.025 | 0.975 | 1.150 | 0.850 |

| Rest of World-RW | 1.000 | 1.00 | 1.000 | 1.050 | 0.950 |

| Commodity | AR | AU | CN | EU | JP | MX | NZ | US | RW |

|---|---|---|---|---|---|---|---|---|---|

| Wheat | 0.90 | 0.01 | 0.55 | 0.01 | 0.01 | 0.01 | 0.01 | 0.45 | 0.10 |

| Coarse grains | 0.90 | 0.01 | 0.55 | 0.01 | 0.01 | 0.01 | 0.01 | 0.45 | 0.10 |

| Maize | 0.90 | 0.01 | 0.55 | 0.01 | 0.01 | 0.01 | 0.01 | 0.45 | 0.10 |

| Oilseeds | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Oilseed meals | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Oils | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Raw milk | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Liquid milk | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Butter | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Cheese | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Whole milk powder | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Skim milk powder | 0.90 | 0.01 | 0.80 | 0.01 | 0.01 | 0.50 | 0.01 | 0.85 | 0.25 |

| Apples | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Kiwifruit | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Commodity | AR | AU | CN | EU | JP | MX | NZ | US | RW |

|---|---|---|---|---|---|---|---|---|---|

| Wheat | 0.90 | 0.25 | 0.55 | 0.10 | 0.10 | 0.45 | 0.10 | 0.45 | 0.10 |

| Coarse grains | 0.90 | 0.25 | 0.55 | 0.10 | 0.10 | 0.45 | 0.10 | 0.45 | 0.10 |

| Maize | 0.90 | 0.25 | 0.55 | 0.10 | 0.10 | 0.45 | 0.10 | 0.45 | 0.10 |

| Oilseeds | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Oilseed meals | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Oils | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Raw milk | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Liquid milk | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Butter | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Cheese | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Whole milk powder | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Skim milk powder | 0.90 | 0.25 | 0.80 | 0.10 | 0.10 | 0.85 | 0.10 | 0.85 | 0.25 |

| Apples | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Kiwifruit | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |