Science Policy and Agricultural Biotechnology in Canada

Abstract

This paper examines Canadian science and technology (S&T) policies in the 1990s and the growth of the agriculture biotechnology sector. Drawing from several different data sources, we show that advances in biotechnology have made a substantive contribution to the agri-food landscape as evident by the growth in biotechnology companies, as well as the number of approved genetically modified field trials and canola biotechnology patents issued to inventors. We also show that Canadian inventors do not appear to have harvested a substantive number of enabling canola biotechnology patents as compared to U.S. and European inventors.

Canada has adopted science policy instruments such as intellectual property (IP) rights and public/private research networks to promote the development of closer government-research industry relations necessary for the commercialization of publicly funded research (Atkinson-Grosjean, House, and Fisher). Canada, a medium-sized country and exporter of primary and processed agri-food products, has a rich scientific tradition that extends to several fields of endeavor. Canada ranks sixth based on its scientists' contribution to the world's total number of publications in science, engineering, and medicine and seventh in the overall quality of research papers (May). While Canada accounts for a smaller proportion of publications worldwide, the impact of Canadian science has increased over the years based on the total number of papers judged to be citation all-stars (Strauss). This is evident, for example, in the field of molecular genetics, where Canadian researchers rank at the top internationally in terms of quality based on the average number of citations received from their scientific papers (Royal Society of Canada). Despite these positive attributes of the Canadian innovation system, there are few case studies undertaken to describe the changes in science policy and the agricultural biotechnology sector (Traoré and Rose).

The aim of this paper is to gain an understanding of the shifting trends in Canadian science and technology (S&T) policy and agriculture biotechnology. Drawing from several different data sources (e.g., Statistics Canada biotechnology surveys), this paper addresses several questions: (a) What is the quantum of the federal government research and development (R&D) investment in S&T and is this investment adequate to stimulate increased patenting? (b) How rapid has the growth of agriculture biotechnology been based on the number of approved field trials and the growth of biotechnology firms? (c) How does Canada's canola biotech patent activity compare with inventors from the United States and other countries? Answers to these questions will provide insights to the effectiveness of S&T policies, the success of public/private networks, the extent that molecular biology applications are being transformed into new products, and the types of canola biotechnology technologies Canadian inventors are pursuing relative to their major competitors.

The paper provides a brief overview of Canada's S&T policy, the growth pattern of agriculture biotechnology companies, and the share of field trials of genetically modified organisms. Canada's IP policy is described, followed by a discussion of trends in canola biotech patenting and the innovation characteristics of patents.

Science and Technology Policy in Canada

Recognizing the importance of a knowledge-based economy in the mid-1990s, the Government of Canada adopted a shift in S&T policy that identified the need for mechanisms to improve the management of science. This model of science policy emphasizes the need to manage S&T resources more strategically across federal-science departments and universities (Industry Canada 2002a). Underpinning this strategy were substantive federal investments made to enhance capacity building at universities and develop networks to integrate academic research with industry priorities to commercialize new inventions. Government mechanisms to improve public/private relationships and science investment efficiency resulted in the creation of the Canadian Foundation for Innovation and the Canadian Research Chairs at universities. This transformed model of science policy is anticipated not only to help leverage R&D resources from across federal-science departments, but to address national science priorities and take advantage of the basic science infrastructure in the university system.

These institutional changes and improved mechanisms in national science policy have resulted in the restructuring of federal-science departments to improve the governance of innovation policies and address economic, social, and environmental priorities. For example, Agriculture and Agri-food Canada (AAFC) has implemented the Agricultural Policy Framework (APF) to coordinate research and innovation efforts across provincial governments, industry, and public research institutions, and to maximize the return on science investments in priority research areas (Industry Canada 2003a).

Science and Technology Investments in Canada

The Canadian government's share in performing and funding R&D has shifted over the last decade. In 1990, the Government accounted for roughly 16% of R&D (Industry Canada 2003a), compared with about 9% in 2001 (table 1). This was attributed to the higher rates of increase in the performance of R&D by business enterprises and institutions of higher education. In 2001, the Canadian government funded about $3.7 billion (18%) of R&D, with almost $2 billion spent on intramural R&D. About $361 million went to business enterprises and $1.4 billion to universities to support extramural R&D activities (table 1).

| Performing Sectors | ||||||||

|---|---|---|---|---|---|---|---|---|

| Funding Sectors | Federal Government | Provincial Government | PROsa | Business Enterprises | Higher Education | PNPsa | Total | Distribution (%) |

| $CDN million | ||||||||

| Federal government | 1,907 | 0 | 2 | 361 | 1,431 | 31 | 3,732 | 18 |

| Provincial governments | 2 | 181 | 42 | 370 | 635 | 22 | 952 | 5 |

| PROs | 0 | 0 | 3 | 30 | 0 | 0 | 3 | 0 |

| Business enterprises | 44 | 0 | 22 | 38,078 | 603 | 23 | 8,770 | 42 |

| Higher education | 0 | 0 | 0 | 30 | 3,609 | 0 | 3,609 | 17 |

| PNPs | 0 | 0 | 0 | 30 | 462 | 103 | 565 | 3 |

| Foreign | 0 | 0 | 4 | 33,147 | 75 | 14 | 3,240 | 15 |

| Total ($CDN millions) | 1,953 | 181 | 73 | 311,656 | 6,815 | 193 | 20,871 | 100 |

| Share of total (%) | 9 | 1 | 0 | 356 | 33 | 1 | 100 | |

- a PROs and PNPs refer to provincial research organizations and private nonprofit organizations, respectively. Source:Industry Canada (2002c).

The government's efforts to strengthen academic research capacity have resulted in universities being more successful than federal-science-based departments in harvesting patents and generating licensing revenue (table 2). Between 1999 and 2001, the total number of patents held by federal-science departments decreased from 1,946 to 1,407, while university patents jumped from 1,826 to 1,994. In addition, royalties from patents earned by federal-science departments and universities increased by about 45% and 135% to reach $17.4 million and $44.4 million in 2001. Universities also created a larger number of spin-off companies which implies a significant effort being made to commercialize publicly funded university research.

| Federal-Science Departmentsa | Universitiesb | |||

|---|---|---|---|---|

| Resources for IP Management | 1999 | 2001P | 1999 | 2001 |

| Full-time equivalent (FTE) for IP management | 66 | 61.4 | 169 | 202 |

| Expenditures on IP ($CDN millions) | 8.5 | 13.3 | 21.0 | 25.7 |

| Invention reports (disclosed) | 113 | 340 | 829 | 1,005 |

| Patents issued | ||||

| Canada (%) | 20.2% | 24.8% | 12.0% | 19.2% |

| United States (%) | 59.6% | 48.6% | 51.7% | 57.2% |

| Other foreign (%) | 20.2% | 26.6% | 34.3% | 13.8% |

| Unspecified (%) | 0.0% | 0.0% | 2.0% | 9.7% |

| Total patents (number) | 89 | 109 | 325 | 339 |

| Total patents (held) in force | 1,946 | 1,407 | 1,826 | 1,994 |

| New licenses | ||||

| Canadian (%) | 84.3% | 67.9% | 50.0% | 41.6% |

| U.S. and foreign (%) | 15.7% | 21.6% | 39.4% | 37.2% |

| Unspecified (%) | 0.0% | 10.4% | 10.6% | 21.3% |

| Total new licenses (number) | 191 | 134 | 218 | 320 |

| Royalties | ||||

| Canadian (%) | 39.2% | 46.6% | 31.5% | 24.9% |

| Foreign (%) | 22.5% | 39.4% | 47% | 48.1% |

| Unspecified (%) | 38.3% | 14.0% | 21.5% | 26.9% |

| Total ($CDN millions)P | 12.0 | 17.4 | 18.9 | 44.4 |

| Spin-off companiesc (Total historical reported) | 48 | 29 | 454 | 655 |

- a Includes science-based departments such as Agriculture and Agri-food Canada, Atomic Energy of Canada Limited, Canada Food Inspection Agency, Canada Space Agency, Communications Research Centre (Industry Canada), Department of Fisheries and Oceans, Department of National Defence, Environment Canada, Health Canada, National Research Council, and Natural Resources Canada.

- b The number of universities in the survey were 84 in 1999 and 85 in 2001.

- c Some of the spin-off companies reported in 2001 for universities were created prior to 1999.

- P Preliminary Sources:Statistics Canada. Nov. 2002. Statistics Canada. 2003a.

Characteristics of Agri-Food Biotechnology Firms

Plant biotechnology in Canada had its early beginnings in the 1980s, with a number of companies adopting biotechnology processes (i.e, genome maps, cell fusion, genetic recombination) to reduce the average time required to develop canola varieties with important economic characteristics (Phillips, Canadian Biotechnology Advisory Committee Special Report 2002b).

Canada's biotechnology sector comprises more than 400 companies employing 62,000 individuals. It ranks second in the world, after the United States, in terms of number of firms, and third after the United States and the United Kingdom in generating revenues. The largest concentration of biotechnology companies lies in the therapeutics sector (57%), followed by agriculture (15%) (Canadian Biotechnology Advisory Committee Annual Report 2002a).

The number of Canadian agri-food biotechnology companies increased by 53% from 74 in 1997 to 113 companies in 2001 (table 3). This corresponded to a 157% increase in biotechnology revenues from $322 million in 1997 to $826 million in 2001. The food processing sector earned $581 million in biotechnology revenues, compared with $245 million for agriculture. Revenue generation has become critical since external financing dwindled in the early 2000s.

| Agriculture and Food Processinga | ||||

|---|---|---|---|---|

| 1997 | 1999 | 2001 | % Change (1997–2001) | |

| No. of companies | 74 | 119 | 113 | 53 |

| Total revenues ($CDN mil.) | 9,792 | 7,153 | 12,998 | 33 |

| Biotechnology revenues ($CDN million) | 322 | 709 | 826 | 157 |

| Total R&D expenditures ($CDN million) | 93 | 124 | 318 | 242 |

| Biotechnology R&Db expenditures ($CDN million) | 53 | 73 | 107 | 102 |

| Exports ($CDN million) | 101 | 284 | N/A | - |

| Imports ($CDN million) | N/A | 48 | N/A | - |

| Total employees | 10,671 | 31,392 | 22,332 | 109 |

| No. of biotech employees | 1,542 | 1,323 | 2,264 | 47 |

| Biotechnology R&D as a % of biotech revenue | 16 | 10 | 13 | −19 |

| Biotechnology R&D per employee ($CDN) | 34,371 | 55,178 | 47,261 | 38 |

| Biotechnology R&D per company ($CDN) | 716,216 | 613,445 | 946,903 | 32 |

- a Includes components of plant biotechnology, animal biotechnology, biofertilizers, biopesticides, bioherbicides, biological feed additives, microbial pest control, nonfood applications of agricultural products, bioprocessing, functional foods/nutraceuticals.

- b Total spending in biotechnology R&D includes payments made to outside organizations for R&D purposes. N/A indicates data are not available. Sources: McNiven; Traoré; McNiven, Raoub, and Traoré.

The separation of the Statistics Canada survey data beginning in 1999 into food processing and agriculture firms marked important changes in the structure of the agriculture biotech industry. Indicators, such as biotechnology R&D as a percent of biotech revenue, reveal that agriculture and food processing have become attractive opportunities for biotechnology R&D investment. In 2001, biotechnology R&D investment by food processing and agriculture firms accounted for 8.3% and 24.1% of biotech revenues, respectively. In general, small and medium-sized enterprises (SMEs) tend to allocate a large share of their total R&D investment to research in biotechnology, since they are less diversified and more concentrated in biotechnology activities (McNiven, Raoub, and Traoré).

The total number of new products/processes that will be commercialized by firms is another measure that reflects the economic potential of the biotech sector. Surveyed agri-food firms reported more than 6,000 products/processes in the product pipeline with over 50% in the R&D stage and 23% in the regulatory phase (McNiven, Raoub, and Traoré). The world market for biotechnology-based products is anticipated to increase from $20 billion in 1995 to $50 billion in 2005 (Canadian Biotechnology Advisory Committee 2002a). Therefore, there is a greater need for SMEs to establish alliances, since many of them producing transgenic varieties for overseas markets have encountered barriers in merchandising their products (Niosi).

The majority of agriculture biotechnology firms in Canada are located in Saskatchewan. This geographic location of biotechnology firms augurs well for technology transfer and cooperative research arrangements. Successful biotech start-up companies tend to concentrate in geographic locations with adequate university infrastructure facilities, since geographic proximity captures research spillover effects and reduces the transaction cost in exploiting patentable innovation (Xia and Buccola). The trend to have clusters in strategic locations is consistent with the internationalization of S&T associated with the expansion of multinational corporations and the establishment of scientific alliances.

Federal Government Expenditure on Biotechnology

One of the major inputs in developing a vibrant biotechnology sector is a strong commitment by public R&D to developing partnerships with industry and universities. Federal government S&T expenditures devoted to biotechnology have increased over the last few years. In 2001–2002, the federal government S&T expenditures on biotechnology totaled $513 million of which $494 million was devoted to R&D. Intramural and higher education account for the bulk of government S&T biotechnology expenditures (table 4). Among federal-science departments, Agriculture and Agri-food Canada biotechnology S&T expenditures averaged roughly $56 million per year over 1998–2002 or 16% of total S&T expenditures devoted to agriculture.

| Activity/Performer | Intramural | Business Enterprise | Higher Education | Other Performersb | Foreign Performers | Total |

|---|---|---|---|---|---|---|

| Thousands of CDN dollars | ||||||

| 2001–2002 | ||||||

| Research and development (R&D) | 221,637 | 32,881 | 156,i518 | 79,121 | 3,785 | 493,942 |

| Related scientific activities (RSA) | 9,728 | 576 | 7,311 | 766 | 581 | 18,962 |

| Total expenditures | 231,365 | 33,457 | 163,829 | 79,887 | 4,366 | 512,904 |

| 2000–2001 | ||||||

| Research and development (R&D) | 184,133 | 25,957 | 165,236 | 2,693 | 528 | 378,546 |

| Related scientific activities (RSA) | 8,682 | 6,628 | 4,528 | 88 | 323 | 20,249 |

| Total expenditures | 192,815 | 32,585 | 169,764 | 2,781 | 851 | 398,795 |

| 1999–2000 | ||||||

| Research and development (R&D) | 177,855 | 34,577 | 164,521 | 1,922 | 628 | 379,503 |

| Related scientific activities (RSAs) | 6,696 | 922 | 4,638 | 0 | 250 | 12,506 |

| Total expenditures | 184,551 | 35,499 | 169,159 | 1,922 | 878 | 392,009 |

- a S&T expenditures include R&D plus related scientific activities (RSA) such as education support and technical surveys.

- b Other includes Canadian nonprofit institutions and provincial and municipal governments. Source:Statistics Canada (2003b).

Because federal government investment in R&D at federal-science departments did not grow substantively in real terms in the 1990s, there has been a shift to greater public-private collaboration as an avenue for private companies to leverage government resources. To bolster public/private sector cooperation in R&D, the Canadian government has implemented commercialization policies to allow, for example, universities to take title to intellectual property arising from federally funded research (Industry Canada 1999). A large amount of university research is basic and, therefore, it is necessary to have policy incentives to translate this research into marketable products.

Transgenic Field Trials and Canola Adoption Rates

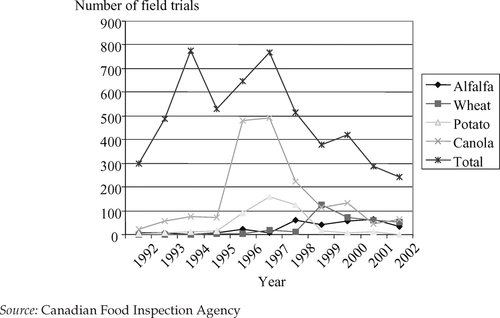

Genetically modified varieties in Canada are required to satisfy health, safety, and environmental requirements before commercialization. Evidence of biotechnology activities devoted to the development of new crops with novel traits can be gleaned from the number of approved field trials conducted over the last decade (figure 1). The total number of approved field trials peaked in 1997 and has continued to decline. This may be due to a reduction in private R&D devoted to plant biotechnology, explained in part by consumer resistance, reforms to government regulation of confined field trials, and the rising cost of commercializing new products (Huang et al.,Yarrow).

In 2002, there were 241 approved field trials, with the largest concentrated in canola (64), wheat (53), corn (39), alfalfa (34), and flax (20) (Canadian Food Inspection Agency). Field trials in Canada are conducted by both public research organizations (e.g., universities) and multinational firms.1 Because of the ease of breeding improved traits most of the biotechnology research work conducted by private companies on canola has concentrated on Argentine (Brassica napus) rather than on Polish varieties (Brassica rapa). The combination of small Canadian acreages and disease resistance problems have resulted in very little biotechnology research effort devoted to Polish canola varieties by multinational firms (Raine). To date, there are sixty Argentine canola varieties registered in Canada, compared to a dozen Polish. Of the sixty Argentine varieties, forty are herbicide tolerant and a dozen are hybrids.

Transgenic crop field trials, 1992–2002

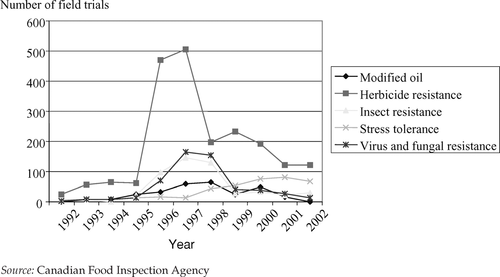

The traits that plant breeders are exploiting in genetically transformed plants have varied widely. Figure 2 shows the majority of approved field trials in Canada were devoted to traits such as herbicide tolerance, followed by insect, and virus and fungal resistance.

The advent of Plant Breeders' Rights (PBR) in 1990 and the approval by Agriculture and Agri-food Canada of herbicide tolerant canola and soybeans in 1995 have facilitated large investments in plant breeding, which increased by 179% from $33.2 million in 1987 to $92.5 million in 2001 (Canadian Seed Trade Association). Investment increases for specific crops were the largest for canola (329%), soybeans (257%), and special crops (214%). Plant Breeder's rights in Canada has also facilitated increased access to foreign varieties and has permitted domestic plant breeding companies to build research alliances with multinational companies.

Transgenic field trials by breeding objective, 1992–2002

Since 1995, most growers in Western Canada have adopted transgenic canola varieties and have planted them on approximately 55% of the 12 million canola acres (Canola Council of Canada). Herbicide-tolerant canola and varieties qualifying for PBR occupy a large share of the seeded area in Manitoba (Carew and Devadoss). The share of seeded acres devoted to herbicide-tolerant canola in Manitoba went from less than 11% in 1995 to at least 85% by 2002. In contrast, the share of canola acres qualifying for PBR has declined since 2000 likely because plant breeding companies have strengthened their IP protection through biological means, such as combing herbicide-tolerant resistance with hybrid traits. Bayer Crop Science, Pioneer Hi-Bred, and Monsanto Canada were the major companies developing herbicide-tolerant canola varieties for Manitoba growers and acquiring patent-like PBR protection.

Intellectual Property Rights in Canada

Intellectual property policy in Canada comprises a number of policy instruments combined with other innovation measures (e.g., R&D tax incentives) to protect IP and promote commercialization of technologies. Canada's first Patent Act2 was dated in 1869. Intellectual property laws in Canada were strengthened with the modification of the Patent Act in 1989 and amendments to the Plant Breeders' Rights Act in 1999. The changes to the Patent Act include: a first-to-file system that provides greater certainty in the determination of patent rights; publication of patent applications eighteen months after date of filing to foster early diffusion of new technology; an exemption for the use of patented inventions for research; and a patent term of twenty years from date of filing (Industry Canada 2003b).

In Canada, for an invention to be patentable, it must satisfy the following criteria of novelty, nonobviousness, and utility (i.e., has the potential for commercialization). A patent can be defined as a monopoly right granted to an inventor for a fixed period of time in exchange for public disclosure of the invention, thereby ensuring widespread applicability of the technology when the patent expires. There are institutional differences in the U.S. and Canadian patent regimes. Unlike the U.S. system that has a first-to-invent principle, for example, Canada has a first-to-file priority rule, requiring patents to be published eighteen months after the filing date. Plants and animals are not eligible for patenting.3

Unlike the PBR system, Canada's Patent Act has a much narrower research use exemption designed to balance the patent holder's commercialization efforts with those of society to foster further R&D (Industry Canada 1998a). An experimental exemption permits use of someone's patented invention for noncommercial purposes. In Canada, this experimental use exemption has been applied in a few cases with limited success, partly because biotechnology blurs the balance between commercial and noncommercial research; thus increasing the potential risks of infringing on someone's research tools (Hope). There is no general research exemption either in Australia or the United States for allowing a person to use another's patented technologies (Nottenburg, Pardey, and Wright).

In general, most inventors in Canada seek patents first in the United States because U.S. standards for patentability are much more stringent (Trajtenberg 2000).

Patents as Indicators of Innovation: A Brief Review

Patents are an important business strategy for agricultural biotechnology firms to protect their intellectual property and provide a valuable source of information on the temporal, geographic, and technological composition of inventions (Archibugi). It is well known that patents are a reasonable measure of scientific success resulting from research investments in science and technology. The number of successful patent applications and the quantum of R&D investment levels are measures of a firm's success compared to its stock performance, products in development, and employment growth (Zucker and Darby).

Because simple patent counts are not considered a precise measure of the economic value of a patent, citations (i.e., references to prior patents) have gained prominence in the literature as a more precise indicator of the technological importance of an invention (Trajtenberg 1990). Patent citations perform an important legal function, since they delimit the scope of the property rights by identifying previous cited patents or “prior art” that can be considered the building block of the citing patent. Moreover, patents of relatively higher economic value are likely to be cited more frequently than those of low value (Harhoff et al.). The frequency with which a given country's inventors cite another nation's patents provides some measure of the knowledge flows between countries. However, there are some disadvantages of using them to indicate inventions and knowledge flows across institutional and geographic boundaries (Jaffe, Trajtenberg, and Fogarty).

In the literature, researchers have assessed the internationalization of biotechnology R&D by examining biotechnology patents and citations. Some of these studies have focused on U.S. biotechnology patent citations and spillover relationships between businesses and university ag-biotech patents, while others have looked at the contribution of public science to biotechnology. Barham, Foltz, and Kim examined trends in U.S. university ag-biotech for patents belonging to the U.S. classification scheme. They found that Land Grant universities accounted for most of the U.S. ag-biotech patents and that university ag-biotech patents were cited more frequently than the average university patent. McMillan, Narin, and Deeds found that the biotechnology sector is more reliant on public science than the pharmaceutical industry. In addition, the country of origin for the cited papers had a stronger national bias in biotechnology than for other U.S. industries. Kim, Foltz, and Barham found that there were significant synergies between scientific articles and biotech patents at U.S. Land Grant universities. Since the few published biotechnology studies have focused primarily on patenting activity by U.S. universities and biotech companies, they may not reveal the peculiarities associated with patenting practices in Canada, a country with access to smaller levels of R&D and venture capital resources.

Trends in Canadian Canola Biotechnology Patenting

By using patent-based measures of innovation (e.g., patent citations), we investigate knowledge flows between Canada and the United States, and the linkage between biotechnology patents and scientific references. The approach adopted in this paper builds on that of Trajtenberg (2000), who compared Canadian industrial innovation patterns to several countries. We focus specifically on canola biotechnology patents and related plant species.

Canola biotech patents issued in the United States to Canadian and other inventors were extracted from the U.S. Patent and Trademark Office (USPTO) for 1991–2001. Patent data statistics covered the country of residence of the inventor and assignee, application and grant dates, technology composition of the invention, number of claims, and the identity of the previous citations listed in the patent references.

Ownership Structure of Canola Biotechnology Patents

Table 5 shows the number of canola biotechnology patents granted to Canadian, U.S., and European inventors. Most canola biotechnology patents belonged to the International Patent Classification (IPC) codes: A01H, C12N, and C07K. The number of patents granted to Canadian inventors4 totaled seventy-seven, while U.S. and European inventors accounted for 656 and 260 patents, respectively. Patent rates for U.S. patents increased substantively in the 1990s likely due to improvements in the management of R&D (Kortum and Lerner). Studies have shown that the comparatively low filing rate by Canadian biotech companies may be attributed to the better capitalization and more advanced stage of industrial maturity of U.S. firms (Heller). Low Canadian patent numbers were also evident for industrial products and may be a cause for concern because Canada is not able to generate more innovations relative to the G7 countries (Trajtenberg 2000).

| Local | ||||||

|---|---|---|---|---|---|---|

| Country | No. of Patents | Unassigned | Foreign | Agr. Depta | University/Research Institute | Firms |

| CDN | 77 | 2 | 27 | 15 | 13 | 20 |

| U.S. | 656 | 21 | 35 | 9 | 156 | 435 |

| Europe | 260 | 10 | 38 | 1 | 14 | 197 |

| JPN | 62 | 1 | 1 | 0 | 1 | 59 |

| ROW | 22 | 1 | 11 | 1 | 7 | 2 |

| Total | 1,077 | 35 | 112 | 26 | 191 | 713 |

- a Includes Agriculture and Agri-food Canada. Source: U.S. Patent and Trademark Office.

About one-third of Canadian canola biotechnology patents are owned or assigned to foreign private companies (table 5). For example, in the early 1990s, Pioneer Hi-Bred funded canola germplasm-related activities that were undertaken by the University of Guelph, Ontario. The ownership of most of the patents resulting from this research effort now resides in the United States. The country of domicile of the patent holder is an important economic factor, since it influences subsequent investments to commercialize biotechnology products (Trajtenberg 2000). Apart from patents granted to foreign assignees, canola patents were also awarded to AAFC, Canadian universities, and domestic firms. Among U.S. canola biotech patents, domestic firms and universities accounted for 66% and 24%, respectively. These differences in U.S. and Canadian patenting activity may be due to differences in the financial conditions that impact incentives for venture capitalists. There is the perception in Canada that federal-science departments and universities may not be capitalizing on their research capabilities, and thereby not attracting enough venture capital to commercialize publicly funded research knowledge.

Trajtenberg (2001) argues that for a country to develop its high-tech sector, it has to achieve a critical mass in significant elements of infrastructure, skills development, managerial experience, testing facilities, and financial institutions. Therefore, if we take the absolute number of canola patents and the level of R&D expenditures as indicative of the absolute size of the Canadian agricultural biotechnology sector, Canada needs to develop its research capacity in upstream technologies by investing in science and using its IP assets to procure research tools and forge closer linkages with private companies.

Innovation Indicators for Canola Biotech Patents

Multiple innovation indicators were constructed for canola biotechnology patents according to seven technology clusters (table 6), including transformation methods, specific trait technologies, and germplasm and cultivar development. Patents describing gene and gene traits to improve plant metabolism and production efficiency accounted for roughly one-third of patents in the sample. The technology category (gene/gene traits to modify plant parts) can be considered very broad, since it includes sub-technologies comprising novel proteins, modified starches, enzymes, and plant peptides. The number of canola patents awarded to Canadian, U.S., and European inventors varied between technology clusters. The largest number of Canadian patents were awarded in the technology fields of gene/gene traits to improve plant performance (e.g., modification of starch and protein content) and germplasm and cultivar development. Fewer patents were awarded to Canadian inventors in technology categories where genes were employed in plants to confer insect, disease, and herbicide tolerance.

| Country | No. of Patents | Approval Time/Patent (Days) | No. of Classes/Patent (e.g., C12N) | No. of Claims/Patent | Backward Citation/Patent (U.S.) | Backward Citation/Patent (Foreign) | Forward Citation/Patent | Scientific References/Patent |

|---|---|---|---|---|---|---|---|---|

| Transformation Methods | ||||||||

| CDN | 12 | 1,081 | 2.1 | 25.7 | 2.8 | 2.5 | 0.2 | 33.3 |

| U.S. | 99 | 1,162.1 | 1.9 | 20.3 | 3.8 | 2.9 | 0.6 | 28.1 |

| Europe | 44 | 1,031.6 | 2 | 17.2 | 2 | 3.8 | 1.6 | 21.9 |

| JPN | 6 | 1,050.8 | 2.1 | 24.3 | 2.6 | 6.8 | 3 | 24.5 |

| ROW | 2 | 807.5 | 1 | 11.5 | 6.5 | 1 | 0 | 61.5 |

| Genetic Modification: Oil/Fatty Acid | ||||||||

| CDN | 8 | 1,259.7 | 1.5 | 20.4 | 7.1 | 4.1 | 0.2 | 24.4 |

| U.S. | 98 | 1,042.6 | 1.8 | 17.8 | 4.2 | 3.7 | 2.2 | 28.9 |

| Europe | 13 | 879.1 | 2.2 | 13.3 | 1.4 | 4 | 1.1 | 11.1 |

| JPN | 2 | 846.5 | 2.5 | 11 | 1.5 | 4 | 0.5 | 9 |

| ROW | 2 | 969 | 2.5 | 20.5 | 2.5 | 3.5 | 1.5 | 20.5 |

| Gene/Genetic Traits: Improve Yield, Protein | ||||||||

| CDN | 27 | 904.5 | 2 | 27.4 | 2.3 | 1.9 | 0.3 | 30.4 |

| U.S. | 159 | 1,026 | 2.1 | 18.4 | 4.4 | 4.5 | 1 | 32.8 |

| Europe | 85 | 1,008.3 | 1.9 | 22.1 | 2.5 | 4.1 | 1 | 14.4 |

| JPN | 42 | 866.8 | 1.9 | 12.3 | 2.8 | 6.3 | 0.7 | 8 |

| ROW | 6 | 900.6 | 1.9 | 34.3 | 0.8 | 1.2 | 0 | 24.5 |

| Genetic Modification: Insect Resistance | ||||||||

| CDN | 2 | 1,182.5 | 2 | 13.5 | 0 | 1 | 0 | 5 |

| U.S. | 79 | 1,045.7 | 2 | 16.8 | 7.2 | 4.7 | 2 | 18.9 |

| Europe | 24 | 920.2 | 2.4 | 15.3 | 2.3 | 7.4 | 0.3 | 21.3 |

| JPN | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ROW | 4 | 922.7 | 1.9 | 15.7 | 1.9 | 7.2 | 0 | 28 |

| Genetic Modification: Disease Resistance | ||||||||

| CDN | 1 | 938 | 2 | 37 | 6 | 0 | 0 | 21 |

| U.S. | 74 | 1,023.3 | 2 | 17.2 | 6.1 | 6.6 | 0.9 | 40.1 |

| Europe | 59 | 1,115.4 | 2 | 15.3 | 2.9 | 2.5 | 0.7 | 11.8 |

| JPN | 2 | 712 | 2.5 | 11 | 4 | 7.5 | 0 | 2.5 |

| ROW | 1 | 691 | 1 | 1 | 1 | 0 | 0 | 9 |

| Genetic Modification: Herbicide Tolerance | ||||||||

| CDN | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| U.S. | 39 | 973.5 | 1.8 | 26.3 | 5.7 | 4 | 1.1 | 44.8 |

| Europe | 8 | 996.4 | 1.8 | 17.5 | 2.6 | 6.4 | 1 | 58.6 |

| JPN | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ROW | 1 | 1,594 | 2 | 6 | 1 | 3 | 3 | 17 |

| Breeding/Germplasm | ||||||||

| CDN | 17 | 1,213.7 | 1.7 | 11.3 | 2 | 7.4 | 0 | 39.9 |

| U.S. | 34 | 950.7 | 1.8 | 18.1 | 4.6 | 3.8 | 0.2 | 28.1 |

| Europe | 12 | 1,021.5 | 1.8 | 30.6 | 1.6 | 3 | 0.5 | 9.7 |

| JPN | 3 | 1,174 | 1.5 | 6.8 | 1 | 3.8 | 0.3 | 5.3 |

| ROW | 5 | 705.4 | 1.8 | 16.6 | 5.2 | 0.2 | 0 | 17.2 |

- Source: U.S. Patent and Trademark Office.

From the innovation indicators shown in table 6, the average number of IPC classes per patent did not show much variation for patents of different technology clusters. For most technology categories, Canadian, U.S., and European inventors had an average of two IPC classes per patent. Employing the IPC classification as a proxy for patent scope, Lerner found that patents with a larger number of IPC classes had a significant impact on the value of biotech firms. Canadian patents had a larger average number of claims per patent in the technology fields of transformation methods, genetic modification to enhance oil/fatty acid, and genetic improvements to enhance plant performance. Canada had a lower number of claims per patent in the technology field of germplasm and cultivar development.

Canadian canola patents relied more on U.S. patent references, especially for technologies to genetically modify oil/fatty acid. The mean patent citation per patent for the genetic modification of oil/fatty acids was 7.1 for Canada, 4.2 for the United States, and 1.4 for European inventors. The relatively larger number of backward citations for Canadian canola patents for oil/fatty acid technologies may be due to the combination of new biotechnology methods and renewed market interest in speciality oils that have triggered greater oil-based research for canola (Phillips). U.S. patents for insect-resistance technologies cited a relatively higher number of prior U.S. patent references than European or Canadian inventors, implying that there is a strong linkage between U.S. science and biotechnology development in the United States.

Our analyses also shows that canola biotech patents are relying on scientific references for supportive research effort. Technologies such as transformation methods had more than twenty scientific references per patent. U.S. patents in technology fields, such as disease resistance and herbicide tolerance, had greater than forty scientific references per patent. Future research should explore the country of origin of cited scientific references to determine the contribution that Canadian public science is making towards applied biotechnology research. The application-to-grant lag for most canola biotech patents varied from 2.5 to 3.5 years. For technologies where Canada had a fair number of patents, there were no significant differences in the application-to-grant lag time.

Research and development in agricultural biotechnology relies heavily on access to research tools such as transformation methods, which are necessary to develop plants with genetically modified traits. These tools are subject to proprietary rights stemming from the proliferation of strong IP laws among developed countries. Because research tools are subject to numerous overlapping proprietary claims, public research agencies face high transaction costs in obtaining the freedom to research and commercialize the results of their research effort (Hope). High transactional costs are attributed to the cost and uncertainty of discovering who holds the rights to various technologies, and obtaining the freedom to operate under those rights through various licensing arrangements (Bennett et al.). In Canada, commercialization opportunities in the plant biotechnology sector are hindered by large transaction costs involved in procuring the rights to use fundamental technologies controlled by non-Canadian firms (Industry Canada 1998b). This concern was also raised by the Auditor General Report, which indicated that the acquisition of research tools and the management of IP should be reviewed by Agriculture and Agri-food Canada in providing innovations to the agriculture sector. There are several options public research agencies can employ to acquire research tools, including establishing public/private partnerships, cross-licensing, patent pooling, and developing market segmentation strategies (Nottenburg, Pardey, and Wright).

Concluding Comments

Despite little increase in R&D investment in federal-science-based departments (e.g., AAFC) over the last decade, Canada has made great strides in implementing an integrated science-based policy and developing a biotechnology industry that has attracted foreign investment, created employment, and exported products to the world. However, there are challenges ahead to ensure that Canada's patent laws are consistent with major competitors and the World Trade Organization standards of reciprocity. The recent Supreme Court of Canada's decision to prevent the patenting of higher life forms distinguished Canada from the United States, Europe, and Japan, and made it one of the few industrialized countries that does not allow the patenting of higher life forms.

There is a strong need for Canada to develop mechanisms to provide public seed capital, and attract more venture capital devoted to R&D through collaborative arrangements, which can contribute to local ownership of IP and develop marketable products from research knowledge. Apart from measures to attract more R&D investment, incentives are necessary to hasten the speed of biotech patenting and focus on research tools that can contribute to the development of plants with important economic characteristics. A knowledge of what patents and their multiple claims are owned by universities and federal- science departments is necessary for public institutions to leverage their IP and access research tools owned by others.

Acknowledgments

The author acknowledges the constructive comments provided by two anonymous reviewers. The views expressed in this article do not necessarily reflect the views of Agriculture and Agri-food Canada.