Can Futures and Options Markets Hold the Milk Price Safety Net? Policy Conflicts and Market Failures in Dairy Hedging

Abstract

U.S. Department of Agriculture's Dairy Options Pilot Program promoted hedging by producers, and was a test case for similar programs in other agricultural industries. Rapidly shifting milk pricing policies impeded quantitative hedging evaluations while the program was active. Hedging appears capable of reducing price variance by 50–60% in most regions, and favors large, sophisticated producers in heavy cheese manufacturing regions. Forward contracting or price insurance products may offer lower transaction costs and attract more small-scale producers. Ballooning milk deficiency payments and milk's prominent role in trade-distorting payments suggest an ongoing need to promote private price risk management tools.

Got Options?

That was the question posed by a solemn-looking cow on the U.S. Department of Agriculture (USDA) Risk Management Agency poster promoting the Dairy Options Pilot Program (DOPP). The innovative educational program was designed to empower producers with hedging skills that could protect them from downside price risk. Four rounds of DOPP were held between 1999 and 2002, and by Round IV, producers in 300 counties were eligible to buy heavily subsidized put options through the program.

DOPP was based on the untested premise that milk hedging is effective. If so, futures and options markets might partially replace publicly funded safety nets, a welcome prospect given that the dairy industry is responsible for the largest portion of World Trade Organization (WTO) “amber box” payments and has received billions of dollars in federal deficiency payments since 2002. Now that sufficient data have accumulated to allow quantitative analysis, this study evaluated the risk management potential of private milk hedging. The objectives were to estimate hedging effectiveness, to evaluate whether hedging was equally effective over diverse regions and farm sizes, and to compare the merits of individual hedging to those of alternative price risk management strategies.

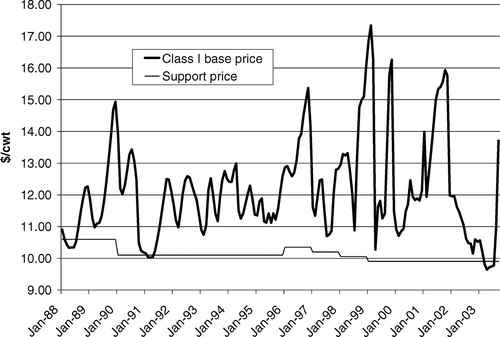

When the Basic Formula Price (BFP) that previously drove farm-level milk prices dropped 37% between January and February 1999, milk producers might have been expected to embrace hedging programs in droves. By the time this and similar price crashes occurred, policy actions dating back to the 1980s had reduced federal price supports to levels that rarely exceeded market prices. DOPP was authorized under the 1996 Federal Agriculture Improvement and Reform (FAIR) Act at a time when price supports were expected to be phased out entirely (they have since been extended through 2007). Figure 1 illustrates the substantial milk price variation experienced between 1996 and 2002. The coefficient of variation (CV) in the primary milk reference price rose from 9% during 1988–95 to 18% during 1996–2002. By comparison, the CV of Dodge City 7–8 hundredweight feeder cattle prices over a similar period was 13%, while the CV of Iowa hog prices was 26%.

The dairy industry was a promising candidate for an options pilot program for several reasons. Milk ranked high among U.S. agricultural products in 1999 value of production, behind cattle but exceeding corn, soybeans, broilers, and hogs. Dairy product futures markets have existed since 1993, and milk futures and options contracts have been available on the Chicago Mercantile Exchange since 1997. Milk prices were relatively volatile, and other private risk management tools such as forward contracting were rarely used except within cooperatives. Dairy producers relied instead on publicly funded risk management tools vulnerable to political challenges. In addition to federal price supports, producers received more than $850 million in market loss assistance payments in 1999 and 2000. The 2002 Farm Bill added a target price/deficiency payment program that cost in excess of $1 billion in its first fourteen months. Dairy payments were the largest component of trade-distorting “amber box” payments that are limited under WTO regulations (Harris). DOPP was a timely policy innovation that, if successful, could be extended to other commodities.

Price variation in the Class I base price since 1988 justifies price risk management

Although DOPP was motivated by the presumption that milk hedging was effective, no supporting analysis existed. As a result, only a small portion of eligible producers (apparently fewer than 4%) purchased options through the heavily subsidized program. USDA's Risk Management Agency commissioned an evaluation of DOPP in 2002, partly to decide whether to extend the options pilot program model within the dairy industry or to other agricultural commodities.

The purpose of this article is to explain forces affecting the opportunities and challenges producers face in hedging milk price. As shown, the shifting nature of highly regulated milk pricing complicated hedging. The interaction of pricing policy, industry structure, and available futures contracts led to higher hedging effectiveness in regions where cheese production dominated, and small commercial dairies faced fewer incentives to hedge. Milk hedging by individual producers is growing, and serves the needs of some producers well. However, expanded use of forward contracting and price insurance products are potentially superior alternatives for a large portion of dairy producers.

Data from both futures and options markets were used in the analysis to broaden its applicability beyond the DOPP experience. DOPP required use of options, but futures markets are more heavily traded, the underlying concepts are easier to communicate, and the most salient issues apply to both futures and options. The study period begins in January 2000, when Federal Milk Marketing Order (FMMO) reform initiated major changes in farm-level milk pricing policy. Given the diverse regional structure of the dairy industry, data were collected from thirteen regions that captured the full range of milk usage patterns and production environments. The University of Wisconsin Dairy Marketing and Risk Management Program provided daily futures and options prices and monthly mailbox prices (i.e., regional estimates of typical producer prices) used in this analysis. All other data were obtained from annual FMMO statistics (U.S. Department of Agriculture, Agricultural Marketing Service, 1995–2002). Table 1 contains descriptive statistics for regional mailbox price and basis, calculated as mailbox prices minus Class III futures prices at expiration.

| Mailbox Price ($/cwt) | Basis ($/cwt) | |||

|---|---|---|---|---|

| Region | Median | SD | Median | SD |

| Northeast | 12.91 | 1.61 | 2.05 | 0.92 |

| Florida | 16.00 | 1.42 | 5.18 | 1.28 |

| Ohio Valley | 12.47 | 1.65 | 1.76 | 0.82 |

| Kentucky | 14.04 | 1.53 | 3.15 | 1.21 |

| Southeast | 13.41 | 1.84 | 2.53 | 1.00 |

| Michigan | 12.44 | 1.58 | 1.73 | 0.88 |

| Wisconsin | 12.41 | 1.80 | 1.63 | 0.55 |

| Iowa | 12.12 | 1.72 | 1.42 | 0.61 |

| Texas | 12.30 | 1.68 | 1.81 | 0.77 |

| Idaho | 11.22 | 1.71 | 0.59 | 0.59 |

| New Mexico | 12.08 | 1.44 | 1.38 | 1.05 |

| Pacific NW | 12.17 | 1.51 | 1.42 | 0.87 |

| California | 12.01 | 1.57 | 1.18 | 0.94 |

The remainder of the paper begins with background on milk pricing policy and then demonstrates how such policies fail to provide clear incentives to hedge. Hedging effectiveness is shown to be regionally diverse and arguably modest, with thin futures markets and large contract sizes providing further disincentives to hedge. Forward contracting is described as a potentially superior alternative to individual hedging, and the paper concludes with policy recommendations.

A Quick Primer on Milk Pricing

U.S. dairy policy relies on marketing orders and classified pricing, which sets minimum prices for milk depending on whether it is used to make fluid products (Class I), soft-manufactured products (Class II), cheese (Class III), or butter (Class IV). FMMO's regulate milk marketing in virtually every major U.S. milk producing region except California, which operates its own state marketing order. From May 1995 through December 1999, the Basic Formula Price was the foundation for all milk prices in federal marketing orders. Since January 2000, however, the Class I base price for beverage milk is the higher of the “advanced” Class III or Class IV price determined during the prior month. This important element of milk pricing is known as the “higher-of rule,” and its impact on basis risk is discussed shortly.

Market-wide pooling pays farmers a minimum weighted average price based on the end uses of milk purchased in the farmer's marketing order. The percentage of milk purchased for each end use (Classes I–IV) is referred to as “class utilization.” Regional differences in class utilization are substantial, and influence basis risk.

A producer's mailbox price can be represented as the sum of three components: (1) the Class III base price that applies to all marketing orders; (2) the producer price differential (PPD) that applies to all producers within a given marketing order; and (3) the producer-specific price adjustments. The Class III base price is calculated from National Agricultural Statistics Service (NASS) surveys of cheddar cheese, butter, dry whey, and nonfat dry milk prices. The other class prices are also ultimately tied to the price of these four manufactured dairy products. The PPD reflects a marketing order's class utilization and the value of Classes I, II, and IV milk relative to the value of Class III milk. Thus, for example, a high Class I utilization area such as Florida will usually have a higher PPD than a high Class III utilization area such as Wisconsin, because Class I milk is more valuable than Class III milk. On top of the Class III price and the PPD, producer-specific adjustments to the mailbox price include quality premiums, volume premiums, over-order premiums negotiated by cooperatives, cooperative dividends or retains, and hauling charges.

Dairy policies that reduce the need for hedging include a price support program and, since December 2001, deficiency payments. The Dairy Price Support Program (DPSP) is a Commodity Credit Corporation open offer to purchase cheese, butter, and nonfat dry milk at predetermined prices. The 2002 Farm Security and Rural Investment Act also authorized the nationwide Milk Income Loss Contract (MILC) Program. When the Class I base price falls below $13.69/hundredweight, farmers are paid 45% of the difference. Payments apply to production from December 2001 through September 2005, and are subject to a production cap of 2.4 million pounds per fiscal year.

How the Milk Pricing System Influences Regional Basis Patterns

DOPP participants were instructed to seize hedging opportunities when the expected net price, which equals the current futures price plus the expected basis, reached an adequately profitable level. Basis was conventionally defined as the producer's mailbox price minus the Class III price (i.e., basis equals the PPD plus producer-specific price adjustments). By hedging, the producer replaces price risk with basis risk. As long as basis risk is lower than price risk, hedging reduces net risk.

When marketing order reform took effect in January 2000, it had two major impacts on basis patterns. First, reform changed milk pricing dramatically enough that it rendered prior information largely obsolete, leaving little historical information from which to form basis expectations. Second, during the period examined, Class I prices were often based on the Class IV price under the higher-of rule, but Class IV futures contracts were too illiquid to be useful hedging tools. Downside basis risk increased because of the possibility that the Class III/Class IV price spread would narrow while the Class IV price remained higher.

Recall that mailbox price can be represented as the sum of the Class III price, the PPD, and the producer-specific price adjustments. Thraen contended that mailbox price elements other than the Class III price are not hedgable, and that producers should focus only on hedging the portion of mailbox price represented by Class III price at standard component levels. However, mailbox prices are less volatile than Class III prices in all regions of the country, suggesting that the PPD and producer-specific price components are negatively correlated with the Class III price. This negative correlation provides a partial natural hedge against Class III price volatility. Focusing exclusively on the Class III component of one's mailbox price would overstate the need for hedging.

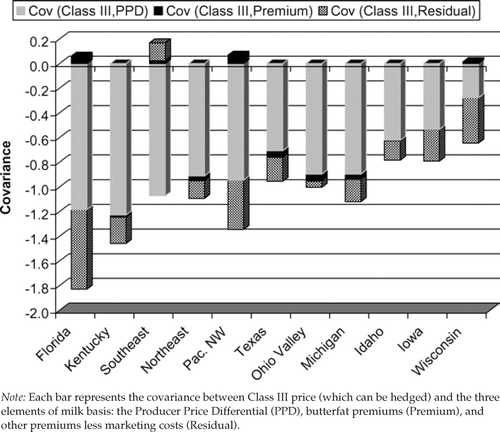

Variance decomposition was used to identify the source of the partial natural hedge provided by postreform milk pricing policies. Mailbox price consists of the sum of the Class III price and the two main elements of basis: the PPD and producer-specific adjustments. Given that butterfat test statistics are available for all marketing orders, and that they vary substantially across months and regions, the producer-specific component of mailbox price was further categorized into butterfat premiums and a “residual” made up of other premiums and marketing cost deductions. Mailbox price variance was decomposed using the general relationship var(X + Y) = var(X) + var(Y) + 2cov(X, Y).

Figure 2 shows the regional covariance between Class III price and each element of basis. In every region except Wisconsin, the PPD is the predominant source of negative covariance between the Class III price and the basis. The regions are presented in increasing order of Class III utilization to illustrate that the magnitude of the natural hedge tends to fall as Class III utilization increases. This pattern can be understood by thinking of the PPD as a weighted sum of class price deviations from the Class III price, with the weights being utilization rates for Classes I, II, and IV milk. Other things being equal, a rise in the Class III price will reduce the PPD, appearing in figure 2 as negative covariance. Moreover, the extent of this reduction will be greater in cases where low Class III utilization causes the weights to be higher. Figure 2 illustrates how the interaction of pricing policy and regional milk use patterns affect the partial natural hedge facing producers. The implications are that producers in different regions face different incentives to hedge, and producers in high Class III utilization areas have the greatest incentives to hedge.

Regional Disparities in Hedging Effectiveness: Follow the Cheese

A hedge ratio relates the quantity of milk hedged in futures or options markets to the quantity of milk actually marketed. For example, a hedge ratio of −0.5 implies that the futures position (e.g., one 200,000-pound futures contract) will be 50% of the size of the cash position (e.g., 400,000 pounds of milk production). The negative sign indicates that the hedger holds opposite positions in cash and futures markets (in this case, long in cash, short in futures). Following Lien and Tse, minimum semi-variance futures and options hedge ratios were estimated. Specifically, the semi-variance measure was calculated in the same manner as variance, but only outcomes lower than the mean were included.

The Producer Price Differential (PPD) is the dominant source of a partial natural hedge

Note: Each bar represents the covariance between Class III price (which can be hedged) and the three elements of milk basis: the Producer Price Differential (PPD), butterfat premiums (Premium), and other premiums less marketing costs (Residual).

Semi-variance was used for two reasons: (1) it is necessary to accommodate the asymmetric payout structure of option hedges and (2) it recognizes that producers and policy makers are more concerned with reducing downside than upside risk. For the purpose of individual decision making, note that optimal (as opposed to minimum semi-variance) hedge ratio estimation would be appropriate because it accounts for the degree of risk aversion and the tradeoff between risk and return. For the purpose of a policy discussion regarding safety nets, though, we were interested in identifying the maximum attainable downside risk reduction, and this methodological choice does not affect the qualitative regional relationships or policy implications.

The simplest method of obtaining minimum-variance futures hedge ratios is to divide the covariance of mailbox and futures price changes by the variance of futures price changes (Stoll and Whaley, p. 54). For nonstorable products such as milk, mailbox price change must be replaced by deviation from expected mailbox price. Myers and Thompson suggested a regression approach that accounts for conditional information available at the time the hedging decision is made. Numerical methods, however, are required to estimate options hedge ratios. In the interest of using a comparable approach for both futures and options hedges, a grid search method was used to identify hedge ratios that minimized downside semi-variance in each region during the postreform study period from January 2000 to February 2003. In the case of options hedges, the strike price closest to being $0.25/hundredweight out-of-the-money was selected on or about the 20th day of each month. Futures hedges were also assumed to be set on or about the 20th of each month. A four-month hedging interval was assumed, reflecting a concern that longer hedging intervals would be plagued by excessively thin markets.

Table 2 shows minimum semi-variance futures and options hedge ratios. In most regions, these ratios ranged from −0.56 to −0.72. Assuming production of 19,000 lb/cow/year, the hedge ratios imply that herd sizes of 175–225 cows are needed to hedge using one 200,000-pound futures contract per month. Nationally, about 10% of dairy operations are this large.

| Futures Hedge | Options Hedge | |||

|---|---|---|---|---|

| Region | Hedge Ratio | Hedging Effectiveness (%) | Hedge Ratio | Hedging Effectiveness (%) |

| Florida | −0.45 | 24 | −0.23 | 7 |

| Kentucky | −0.59 | 47 | −0.61 | 29 |

| Southeast | −0.72 | 36 | −1.13 | 22 |

| Northeast | −0.66 | 53 | −0.68 | 30 |

| Pacific NW | −0.65 | 52 | −0.62 | 36 |

| Texas | −0.63 | 59 | −0.56 | 42 |

| New Mexico | −0.58 | 45 | −0.59 | 19 |

| Ohio Valley | −0.68 | 59 | −0.75 | 41 |

| Michigan | −0.62 | 58 | −0.64 | 43 |

| California | −0.68 | 54 | −0.70 | 32 |

| Idaho | −0.50 | 52 | −0.46 | 35 |

| Iowa | −0.65 | 58 | −0.57 | 44 |

| Wisconsin | −0.63 | 58 | −0.72 | 42 |

- Note: Hedging effectiveness refers to the percentage of mailbox price semi-variance avoided by hedging.

Hedging effectiveness, also reported in table 2, was determined by first calculating monthly net mailbox prices that would have occurred during the study period if the minimum semi-variance hedge ratios were applied. Net mailbox price equals the mailbox price plus the gain or loss from the futures or options position, weighted by the appropriate hedge ratio. Semi-variances of the hedged and unhedged outcomes were calculated for each region, and hedging effectiveness was then calculated as the ratio of semi-variance reduction over unhedged mailbox price semi-variance.

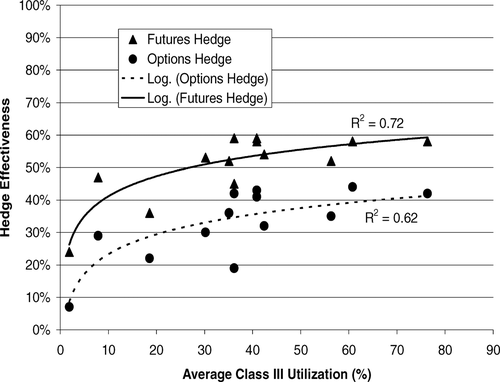

Hedging effectiveness represents the portion of price risk that was avoided by hedging. Futures hedging effectiveness ranged from 24% in Florida to 58–59% in several midwestern regions. Options hedging effectiveness averaged 18% lower, ranging from 7% in Florida to 44% in Iowa. Lower hedging effectiveness was expected for options, as the hedger accepts additional downside risk in return for retaining upside potential. Regional disparities were modest, with the exceptions of New Mexico and the low Class III utilization regions of Florida, Kentucky, and the Southeast. Figure 3 illustrates that a logarithmic function of Class III utilization explained much of the regional variation in hedging effectiveness.

The advent of Milk Income Loss Contracts with the 2002 Farm Bill has the potential to substantially reduce the need for hedging on farms' first 2.4 million pounds of annual milk production, because it eliminates 45% of downside minimum Class I price movements whenever the Class I base price is below $13.69/hundredweight. Mailbox prices were simulated as if MILC had been in effect for the entire postreform period, and as if a producer's entire production were eligible for MILC (unlikely for herds larger than 120 cows of average productivity). Minimum-variance futures hedge ratios were re-estimated for each region.

Class III utilization explains most regional variation in hedging effectiveness

Table 3 shows the impacts of hedging and MILC on net price risk, as measured by downside coefficient of variation (i.e., the square root of downside semi-variance divided by the mean net mailbox price). MILC alone, and hedging alone, were similarly effective at reducing price risk if a producer's entire production were eligible for MILC payments. In six regions, however, average annual production per farm exceeded the 2.4 million pound cap, and the prorated parenthetical values in table 3 show that MILC's influence on the average producer's price risk was limited in those regions. Combining MILC with hedging further reduced net price risk to modest levels. Note that if MILC had been in effect since 2000, higher production would almost certainly have occurred. This leads to speculation about what would have happened to prices, but if increased supply pinned prices near support levels and reduced price volatility, hedging benefits would have been lower than table 3 suggests.

| CV without MILC | CV with MILC | |||

|---|---|---|---|---|

| Not Hedged | Hedged | Not Hedged | Hedged | |

| Florida | 6.6 | 5.7 | 4.4 (6.1) | 4.0 (5.3) |

| Kentucky | 9.1 | 6.4 | 5.4 | 4.0 |

| Southeast | 8.8 | 6.8 | 6.5 | 5.0 |

| Northeast | 8.9 | 5.9 | 5.3 | 3.9 |

| Pacific NW | 8.6 | 5.7 | 5.2 (7.5) | 3.6 (5.0) |

| Texas | 8.4 | 5.2 | 5.7 (7.8) | 4.1 (5.0) |

| New Mexico | 9.0 | 6.5 | 6.0 (8.4) | 4.7 (6.1) |

| Ohio Valley | 8.4 | 5.2 | 5.3 | 3.6 |

| Michigan | 8.8 | 5.5 | 5.3 | 3.8 |

| California | 9.8 | 6.4 | 6.1 (9.3) | 4.1 (5.8) |

| Idaho | 9.1 | 6.1 | 6.6 (8.3) | 5.0 (5.7) |

| Iowa | 8.6 | 5.4 | 6.1 | 4.2 |

| Wisconsin | 9.1 | 5.7 | 6.6 | 4.8 |

- Notes: All values represent price risk as measured by downside coefficient of variation = (square root of downside semi-variance)/(mean), expressed as percentages. The “With MILC” scenario assumes MILC was in effect throughout the entire study period, and producers' production fell within the 2.4 million lb. annual limit. Values in parentheses are a weighted average of “With MILC” and “Without MILC” values, with weights based on 2.4 million lb/average annual production per farm. Regions without parenthetical values are those with average annual production per farm under 2.4 million lb.

Blank, Carter, and McDonald provided a useful taxonomy for evaluating the results, based on two important distinctions. First, risk (in which outcomes vary according to known probabilities) is distinct from uncertainty (in which probability distributions are unknown). Second, market failure (the under-provision of goods by private markets) may be due to missing markets or incomplete markets. Missing markets are those in which no exchange occurs between buyers and sellers (picture a supply curve that always lies above the demand curve). If risk is the cause of a missing market, government subsidies can raise the demand curve to encourage purchase of the good. USDA followed this approach with its 80% subsidy of DOPP premiums.

Under uncertainty, however, it may not be possible to define a demand curve for hedging, in which case a market may remain missing despite government subsidies. Widespread uncertainty is a likely contributor to low DOPP participation and producer-level milk hedging in general. Even if an objective milk price distribution exists, producers who are unaware of that distribution will behave as if they face uncertainty. Furthermore, all producers are subject to uncertainty caused by FMMO reform, the advent of MILC payments, and an ongoing host of minor policy changes.

The alternative to a missing market is an incomplete market, which would occur if many producers viewed the hedging effectiveness results in tables 2 and 3 as too modest to justify hedging. Hedging effectiveness is limited because all producers must cross-hedge mailbox prices with Class III futures and options, and because large contract sizes make it difficult to attain desired hedge ratios. Perhaps more importantly, by effectively providing free put options through price supports and MILC, current dairy policy contributes to incomplete markets for milk hedging.

Why Many Milk Producers May Lack Enthusiasm for Hedging

Round III of DOPP produced the most active total participation, with 763 producers purchasing options (U.S. Department of Agriculture, Risk Management Agency). Based on accessible reports of county-level dairy farm numbers, the active Round III participation rate among eligible milk producers was approximately 3% in Wisconsin, 4% in Minnesota, 2% in Iowa, 1.5% in Michigan, and 1% in Kentucky. California and New York, ranked first and third in national milk production, combined for only 23 active Round III DOPP participants. Any evaluation of hedging as a price safety net must address the question of why participation rates were so low, especially in light of the program's 80% premium subsidy.

Feedback obtained during DOPP training sessions provided several clues that warrant consideration. First, producers consistently asked, “How much of my production should I hedge?” (i.e., hedge ratios) and “How much will it lower my risk?” (i.e., hedging effectiveness). No detailed studies of hedging performance had yet been performed, however, leaving the producers' questions unanswered. Committing scarce time to learning how to hedge is a form of irreversible investment, and producers might rationally delay that investment until uncertainty about hedging effectiveness is resolved.

Second, DOPP was intended to be useful for both small and large operations, but the 200,000-pound size of milk futures and options contracts clearly favored large operations. Although 50,000 pound and 100,000 pound Class III European options also existed, they were traded too thinly to be viable hedging tools. A producer using a hedge ratio of −0.7, producing 19,000 lb/cow/year (or 1,583 lb/cow/month), would require 180 cows to justify hedging one month's production with a single futures contract (i.e., 200,000 lb/0.7/1583 lb/cow = 180 cows). In 2001, only 21% of U.S. dairy herds contained more than 100 cows, and only 8% contained more than 200 cows (U.S. Department of Agriculture, National Agricultural Statistics Service).

Third, transaction costs exist beyond the explicit costs of trading. Hedging requires devoting scarce managerial time to following the futures market, devising a hedging strategy, and evaluating its performance. Producers routinely expressed wariness about choosing and working with a broker. Hedging in thin milk markets requires price concessions to get orders filled, often combined with delayed fills, that render hedging more costly than an analysis of closing prices suggests.

Fourth, hedging is psychologically demanding (see, e.g., Stasko, pp. 29–32). Unlike relying on public policies or one's cooperative for risk management, when a producer hedges and the outcome is poor, the producer has no one to blame but him/herself. Despite academics' emphasis on hedging as downside risk management, producers often became frustrated in training simulations when they hedged and output prices later rose.

Fifth, some producers argued that hedging is unnecessary because milk is a flow good, suggesting that they either perceive risk over a long horizon, or are insufficiently risk averse to justify hedging. Finally, the presence of support prices, market loss assistance payments, and MILC blunt the need for privately funded risk management.

Forward Contracting as an Alternative to Hedging

Forward contracting offers a price risk management alternative to individual hedging. Its greatest drawback is limited availability. Forward contracting with regulated milk handlers is problematic because minimum class prices fluctuate and might exceed previously negotiated contract prices. Use of forward contracting has expanded since the USDA began administering the Dairy Forward Pricing Pilot Program (DFPPP), which became active in August 2000 and ran through December 31, 2004. Under the program, regulated milk handlers are allowed to contract for future deliveries of milk at prices exempt from minimum class prices (U.S. Department of Agriculture, Agricultural Marketing Service, 2002). The minimum price exemption applies only to milk used for nonfluid purposes. Fixed price contracts are the most commonly offered type of forward contract. After committing to fixed price contracts, handlers or cooperatives hedge by selling Class III futures contracts.

Whereas the 200,000-pound size of milk futures and options contracts is too large for many producers, forward contracting offers scale-neutral benefits. Margin deposits are typically maintained by the handler or cooperative, thereby reducing cash flow concerns. Forward contracts offer administrative simplicity relative to individual hedging. Producers do not need to use a broker, some cooperatives offer automatic transaction accounting through a single payment system, and forward contracting demands less time than other risk management tools. A single price can often be locked in for an entire year, smoothing cash flow and eliminating the need to hedge each month's production separately. Finally, forward contracting offers a credible means of assuring lenders that future prices are established, especially for smaller producers.

Policy Implications

Shifting responsibility for dairy price risk management from the public to the private sector has important potential economic and political benefits. The dairy industry is the largest contributor to WTO amber box payments (Harris), which the administration appears willing to reduce (U.S. Department of Agriculture, Office of Communications). In just one year, the estimated cost of MILC deficiency payments has grown from $1.3 billion to the $3–4 billion range (Dairy Foods). A future policy debate about restructuring the publicly funded safety net appears inevitable.

The main contribution of this analysis is the finding that hedging by individual milk producers can eliminate 50–60% of price variance in most regions, but it does not offer risk protection that is equally accessible to producers at all scales and at all locations. As a partial replacement for federal risk reduction policies, independent hedging appears best-suited for relatively sophisticated managers of large operations in high Class III utilization areas.

In the most active round of DOPP, producers in Wisconsin and Minnesota purchased 56% of options. These two states contained about 23% of the nation's dairy herds. Not coincidentally, the Upper Midwest was the region in which milk hedging was most effective, due to its high Class III utilization. While hedging effectiveness explains a portion of regional variation in DOPP participation, the larger issue is that over 96% of eligible producers did not take advantage of USDA's 80% premium subsidy. The average 2001 subsidy per producer was over $3,500 (U.S. Department of Agriculture, Risk Management Agency), a seemingly ample return for a day's worth of training and filling out forms. Important disincentives seem to be large contract sizes and transaction costs.

Private hedging requires that each individual producer absorb the full transaction costs of designing and implementing a hedging strategy. Alternative program structures that retain DOPP's emphasis on market-oriented risk management tools, but centralize transaction costs, might induce higher participation rates. In addition to economies of scale, pooling the price risk of many producers could remove the barrier that large futures contract size poses for small producers.

The Risk Management Agency's Livestock Risk Protection (LRP) program is a market-oriented example in which producer transaction costs are limited. Participating hog producers select a coverage price, and pay premiums derived from Chicago Mercantile Exchange prices. If the two-day average of the USDA Agricultural Marketing Service cash price index falls below a producer's chosen coverage price, the producer receives an indemnity payment. The LRP program is offered through a private insurer, and reinsured by USDA.

The current reliance on deficiency payments creates a vicious cycle. Expectations of recurring government payments discourage private hedging activity, which contributes to illiquid futures and options markets. Illiquid futures and options markets reduce hedging effectiveness, which increases the perceived need for deficiency payments.

In other commodities, merchandisers who offer forward pricing contracts to producers generate much of the hedging volume in futures contracts. Such contracts are attractive to producers largely because they shift transaction costs onto the merchandiser. If forward pricing becomes more widely used in the dairy industry, milk futures and options liquidity might improve considerably, but only by sacrificing a portion of the benefits of minimum classified pricing, which evolved over decades to meet unique aspects of milk marketing.

A dominant theme of this article was a series of conflicts between dairy marketing policies and producer hedging incentives. Shifting pricing policies complicated basis calculations, the classified pricing system contributed to disparate regional hedging effectiveness and difficulty in designing forward contracts, and government payment programs likely contributed to thin milk futures and options markets. Successfully promoting a large-scale shift from public to private management of dairy price risk will require ingenuity in structuring programs that recognize and work around these conflicts.

Acknowledgments

This study was supported through cooperative agreement with the USDA Economic Research Service. The authors wish to thank, without implicating, Monte Vandeveer, Dick Heifner, and two anonymous reviewers for helpful comments.