Nonpecuniary Benefits to Farming: Implications for Supply Response to Decoupled Payments

Abstract

We develop a household model wherein farmers allocate labor to maximize utility from leisure, consumption, and nonpecuniary benefits from farming. The model shows that farmers with decreasing marginal utility of income respond to higher decoupled payments by decreasing off-farm labor and increasing farm labor, resulting in greater agricultural output. We then estimate the difference between farm and off-farm returns to labor using data from three nationally representative farm household surveys. The finding of a large on-farm/off-farm wage differential provides compelling evidence of substantial nonpecuniary benefits from farming.

Agricultural policy reforms, beginning in the United States with the 1996 Federal Agricultural Improvement and Reform (FAIR) Act, have attempted to minimize production distortions by giving farmers lump-sum payments that are not tied to production decisions or prices. How these “decoupled” payments affect production is an important question in the context of international trade because farm payments can be considered “green box”—that is, exempt from World Trade Organization limits—if, among other things, they have “no, or at most minimal, trade distorting effects of effects on production” (WTO 1999). Theoretical insights or empirical evidence concerning how decoupled payments influence production could play an important role in future trade negotiations and disputes.

Within the academic literature, a great deal of uncertainty remains about how decoupled lump-sum (DLS) payments influence production.1 In a partial equilibrium framework with complete and perfect markets, economic theory suggests that DLS payments would not affect production. However, these payments might influence production when there are market imperfections, such as incomplete labor markets, transactions costs, or credit constraints (e.g., Roe, Somwaru, and Diao 2003). Chau and de Gorter (2001) suggested that payments might increase the number of producers who are able to meet their fixed costs and therefore remain in production. They argued that even though DLS payments may not affect firm-level output decisions, the payments could influence aggregate output by altering incentives to exit the industry.

Hennessy (1998) provided a widely cited rationale for production distortions from decoupled payments that has served as the basis for several policy simulations (e.g., Young and Westcott 2000; Mullen, de Gorter, and Gloy 2001). He showed that with declining absolute risk aversion (DARA) DLS payments raise income and therefore reduce risk aversion, resulting in greater output. Studies finding an income effect on crop allocation decisions have been interpreted as evidence of DARA preferences (Chavas and Holt 1990). However, DARA preferences alone are unlikely to result in a large income effect because the magnitude of this effect depends on the third derivative of the utility function—that is, how the concavity (the second derivative) of the utility function changes with a change in income (Just, forthcoming).2

In this article, we propose a new way DLS payments could have a substantial positive effect on production via an income effect.3 The income effect we describe does not stem from uncertainty or standard market failures but instead results when farm operators derive nonpecuniary benefits from farming—that is, when operators prefer on-farm work to off-farm work, given the same wage. The intuition is as follows: at low payment levels, farmers have a high marginal utility of income—they work off-farm at a higher wage to earn enough to satisfy their consumer needs. An increase in government payments lowers their marginal utility of income, which makes the nonpecuniary benefits that come with working on-farm relatively more desirable. Hence, with the higher income from payments, farmers can “afford” to work more on-farm, and output increases.

The model developed in the next two sections formalizes this intuition. It shows that farmers allocate their labor to equate marginal utility from labor (labor provides income and nonpecuniary benefits) in on-farm and off-farm work. Higher DLS payments (which farmers receive regardless of their labor allocation) lower the marginal utility of income but do not reduce the marginal utility of nonpecuniary benefits from farming. Farmers respond by shifting labor from off-farm to on-farm, which raises the marginal utility of income and lowers the marginal utility of nonpecuniary benefits, restoring equilibrium. Since output is increasing in labor, an increase in decoupled payments results in greater production.

That nonpecuniary benefits associated with particular jobs can help explain pecuniary wage differentials has long been recognized.4 In the labor economics literature, a “compensating differential” refers to the additional income that the same (or identical) worker must be offered as compensation to accept a less pleasant job compared to a more pleasant job. One can also speak of the compensating differential for an especially desirable job, in which case the differential would be negative—that is, a given worker would be willing to accept a lower wage for an especially desirable job, relative to other jobs. Here we use the term “positive nonpecuniary benefit” instead of “negative compensating differential,” though both appear in the literature (e.g., Hamilton 2000; Miller 2004).

There exists some empirical support for positive nonpecuniary benefits to farming relative to off-farm work. Summary statistics for farm income have, for many years, shown that a substantial portion of farmers report negative returns from farming (e.g., Hoppe and Banker 2006). The fact that farmers appear to earn less on-farm than they could earn in an alternative off-farm occupation is consistent with nonpecuniary benefits to farming. Some studies suggests that attributes associated with farming—such as autonomy over farm management decisions, independence, sense of responsibility, and pride associated with business ownership—are valuable to hog farmers (Gillespie and Eidman 1998; Gillespie, Davis, and Rahelizatovo 2004; Key 2005). In an agricultural household model framework, some studies have found the value marginal product of on-farm labor substantially below the market wage (e.g., Elhorst 1994; Fall and Magnac 2004). Outside of agriculture, studies have compared the well-being of the self-employed to paid employees and generally found that the self-employed express greater satisfaction with their jobs (Eden 1973; Katz 1993; Vandenheuvel and Wooden 1997). One influential study found substantial nonmonetary benefits to self-employment: individuals were willing to give up about 35% of their income in order to be self-employed rather than to be paid employees (Hamilton 2000).

Using data from three annual nationally representative surveys of farm households, the second part of the article provides evidence of nonpecuniary benefits from farming by comparing on-farm and off-farm returns to labor for farm households. Some past empirical studies compared returns to nonfarm labor for separate samples of self-employed or paid workers (Brock and Evans 1986; Rees and Shah 1986, Borjas and Bronars 1989; Hamilton 2000). Here we compare returns to labor for on-farm and off-farm work for the same households, which controls for all household effects—both observable and unobservable. This provides a compelling estimate of the nonpecuniary benefits to farming for those farm households with members who work off-farm. To estimate the on-farm/off-farm wage differential for the entire farm population, we use a Heckman sample selection model that accounts for unobserved differences between those households that supply labor off-farm and those that do not. We also show that the results are not sensitive to the assumption of unitary household labor by estimating the wage differential for the farm operator alone, rather than the household. The finding of a substantial differential between wages on and off the farm provides empirical support for positive nonpecuniary benefits from farming—a necessary condition for decoupled payments to increase on-farm labor supply, and therefore output.

Some studies have directly estimated the effect of payments on labor supply (El-Osta, Mishra, and Ahearn 2004; Ahearn, El-Osta, and Dewbre 2006). These studies found that decoupled (and coupled) payments tended to increase the hours operators work on their farm and decrease the hours they work off-farm. The finding that decoupled payments increase on-farm labor supply is inconsistent with the standard household model, which predicts that lump-sum payments have no effect on on-farm labor. While Ahearn, El-Osta, and Dewbre discuss several possible explanations for this apparently inconsistent result, this article provides a theoretical model consistent with their findings, as well as empirical support for a critical component of the model.

The article describes a novel mechanism through which decoupled payment could affect labor supply and agricultural supply. While the predictions of the model are consistent with existing empirical evidence on the labor supply response to payments, we are not aware of any research that tests the link between decoupled payments, on-farm labor supply, and agricultural output. Such research is needed to confirm the validity of the mechanism described herein but is beyond the scope of the current article.

Theoretical Model

There is an established literature considering the allocation of farm household labor (e.g., Lee 1965; Gronau 1977; Sumner 1982; Lopez 1984; Singh, Squire, and Strauss 1986). In the basic model, farm households choose between leisure and labor on and off-farm to maximize utility—workers are indifferent between working on and off-farm at the same wage rate.

In the context of the basic household model, an increase in income from a decoupled lump-sum payment induces an increase in the consumption of leisure and a reduction in total work time. However, the household, behaving like a profit maximizing firm, chooses the optimal quantity of farm labor to equate the value marginal product of labor and the wage rate, regardless of its income. Hence, for households that work both on and off the farm, a DLS payment reduces the supply of labor off-farm, but has no effect on the quantity of labor supplied on-farm and therefore has no effect on farm output.

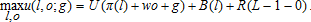

(1)

(1)As usual, assume that farm profits are increasing in farm labor at a diminishing rate (π′ > 0, π′ < 0). Importantly, government payments are assumed to be lump-sum in that g is fixed: g does not depend on the farmer's labor allocation, agricultural output, or any other decision or outcome.

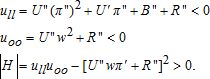

(2)

(2) (3)

(3) (4)

(4) (5)

(5)The numerator in equation (5) is positive because, at the optimum, it follows from the first-order conditions that wages exceed marginal profits. Thus, with nonpecuniary benefits from farming, when there is an interior solution, an increase in decoupled payments causes an increase in on-farm labor. This contrasts with the standard model (no nonpecuniary benefits) where a lump sump income transfer has no effect on farm labor when there is an interior solution.5

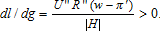

(6)

(6)A critical simplifying assumption in this theoretical framework is the additive separability of consumption, nonpecuniary benefits, and leisure in the utility function. Without this assumption, the comparative statics are considerably more complex and fail to give unambiguous predictions. Ambiguity stems from the inability to sign a priori the cross-partial derivatives of the direct utility function: ucl, ucr, ulr. Additive separability implicitly sets these cross-partial derivatives to zero. Thus, a positive effect of lump-sum payments is consistent with a plausible theoretical model, but we cannot rule out a negative effect in a more general framework.

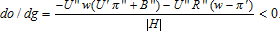

A Graphical Illustration

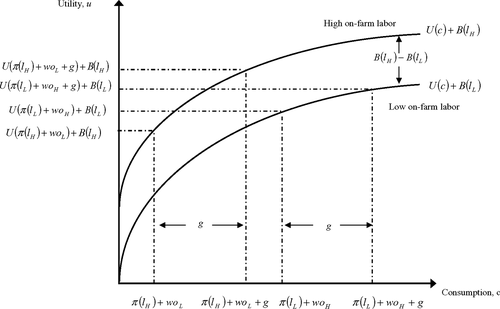

The result that a household will increase its farm labor supply in response to a decoupled lump-sum payment can be illustrated graphically. Figure 1 illustrates two possible labor allocations: (a) low on-farm labor, high off-farm labor (lL, oH) and (b) high on-farm labor, low off-farm labor (lH, oL), such that lL < lH and oL < oH. For clarity, leisure is assumed zero (or constant). The two curves map utility as a function of consumption, for two different levels of on-farm labor. The lower utility curve reflects lower nonpecuniary benefits from the lower level of on-farm labor B(lL). The higher utility curve reflects the higher nonpecuniary benefits B(lH) obtained when more labor is applied on-farm. Without the lump-sum transfer g, utility is higher when less time is spent on-farm and more spent off-farm: U(π(lL) + woH) + B(lL) > U(π(lH) + woL) + B(lH). With the lump transfer, utility is higher when working more on-farm and less off-farm: U(π(lL) + woH + g) + B(lL) < U(π(lH) + woL + g) + B(lH). Hence, receipt of decoupled payments, g, causes the household to reallocate labor from off-farm to on-farm work—that is, increase on-farm labor from lL to lH and decrease off-farm labor from oH to oL.

The figure illustrates the importance of the curvature of the utility function (risk aversion) to the farm labor response. This assumption of diminishing marginal utility is less restrictive than declining absolute risk aversion, which is necessary for an increase in DLS payments to cause an increase in output in some models (e.g., Hennessy).

Utility with two different allocations of labor, with and without lump-sum decoupled payments

Estimating Nonpecuniary Benefits to Farming

Outside of agriculture, several studies have compared earnings of employees and self-employed workers (analogous to off-farm and on-farm employment). Some studies have found that the potential wages of entrepreneurs are not significantly different from the wages of paid employees (although growth trajectories of their wages differ) (Brock and Evans 1986; Rees and Shah 1986; Borjas and Bronars 1989). Hamilton (2000) points out that these studies generally suffer from two shortcomings. First, mean earnings are strongly influenced by high-income entrepreneurial “superstars,” so mean earnings may not characterize the self-employment returns of most business owners. Second, measures of self-employment income used in past studies tend to underestimate true entrepreneurial income because individuals had an incentive to underreport these earnings. Hamilton addresses these shortcomings and finds self-employment offers substantial nonpecuniary benefits for many workers. His comparison of median earnings showed that paid employment offers both higher initial earnings and greater earnings growth. After ten years in business, median entrepreneurial earnings are 35% less than the predicted alternative wage for a paid job of the same duration.

Using the framework of the agricultural household model, some studies have estimated farm household profit functions, allowing for a comparison of the value marginal product of on-farm labor to the market wage rate (Elhorst 1994; Fall and Magnac 2004). With data on Dutch dairy farms, Elhorst found that the on-farm implicit wage was substantially smaller than the market wage implying the utility of on-farm work was higher than that of off-farm work. In their empirical approach, Fall and Magnac explicitly model a “taste for working on-farm” and estimate a lower bound for this parameter. Combining two surveys of French farm households, they found that the implicit on-farm wage was below the off-farm wage for both spouses in the farm household. They interpret their results as implying a significant taste for working on-farm in Europe.

In this article, we estimate the difference between the implicit on-farm wage and the off-farm wage using the difference between the average income on-farm and the average income off-farm. With diminishing returns to labor on-farm, the average on-farm wage overestimates the value marginal product of on-farm labor, so the average income differential provides a conservative estimate of the “true” marginal wage differential. In addition to enhanced transparency, this approach offers several practical advantages over the profit function approach, as we discuss later in the empirical results section. While nonpecuniary benefits offer a plausible explanation for the wage differential, we discuss several alternative explanations at the conclusion of the results section.

Empirical Model

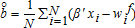

(7)

(7)This expression can be interpreted as the utility of an hour of on-farm work relative to an hour of leisure (Fall and Magnac). Since the wage is the opportunity cost of an hour of leisure, it follows that the implicit wage differential (w − π′) is equivalent to the monetary value of the nonpecuniary benefits of an hour of on-farm work. Hence, our empirical efforts focus on estimating this wage differential.

. If farm profits increase at a decreasing rate, then average profits are greater than marginal profits at the optimum labor allocation. Hence, b provides a conservative estimate of the wage differential

. If farm profits increase at a decreasing rate, then average profits are greater than marginal profits at the optimum labor allocation. Hence, b provides a conservative estimate of the wage differential

(8)

(8) (9)

(9) (10)

(10) (11)

(11)We do not observe OFF*i, rather we observe an indicator: OFFi = 1 if OFF*i > 0, and OFFi = 0 otherwise. We observe equation (11) only if OFFi = 1.

(12)

(12)Equation (12) shows that if the correlation of the errors (ρ) is nonzero, then least squares regression on the subset of farms with off-farm labor produces biased and inconsistent estimates of β for the population. For example, if ρ is positive, OLS will underestimate off-farm wages and consequently underestimate nonpecuniary benefits to farming.

(13)

(13)For identification, the sample selection model relies on the assumption of a joint normal distribution of the errors of the selection and outcome equations (10) and (11). The Heckman approach does not require variables to be excluded from the outcome equation. This is advantageous, since we do not have available an instrument that is correlated with the decision to work off-farm, but does not also directly affect the off-farm hourly wage.

Data

Data for the analysis are from the 2002, 2003, and 2004 Agricultural Resource Management Study (ARMS)—the USDA's primary vehicle for collecting data about the financial conditions of U.S. farms. ARMS collects detailed information about the farm business and the farm operator household, including income, expenses, debt, assets, land operated, crop production, and the allocation of household labor on and off the farm.7

Because operator household data are not defined for nonfamily farms, we consider only family farms—farms that are not operated by a hired manager and that are organized as proprietorships, partnerships or family corporations. Family farms represented approximately 98% of all operations.

In 2002, 2003, and 2004, ARMS collected information about the hours of labor worked on-farm and off-farm for both the operator and the operator's spouse, but information is not available about on-farm labor time for other family members. Consequently, on-farm labor is defined as the total annual hours the principal operator and spouse worked on-farm (paid and unpaid) and to be consistent, off-farm labor is defined as the total annual hours the operator and spouse worked off-farm. An online appendix describes in more detail the construction of the key variables using the ARMS data (Key and Roberts 2008).

The on-farm labor income (on-farm income attributable to farm household labor) is defined as the household income from farming minus farmland rental income. Household labor income includes wages paid to the operator and household members by the farm business. Farmland rental income is not included in our measure of on-farm labor income because rental income is not attributable to farm labor. On-farm labor income may overestimate returns to farm labor (and hence underestimate nonpecuniary benefits) because farm business income includes government payments, which to some degree are decoupled from production and do not depend on farm labor. We explore this in more detail in the next section.

To some degree our measure of farm labor income is biased upward. ARMS uses an accounting-based measure of income that captures net cash flow minus reported depreciation. The income measure therefore includes returns to owned land and capital used on-farm, in addition to labor.8 As a result, we overestimate the implicit on-farm wage and therefore underestimate the nonpecuniary benefits to farming. An alternative measure of farm labor income could be obtained by subtracting an estimate of the opportunity costs of the owned capital and land used on-farm, but this would introduce a new set of assumptions (e.g., Mishra and Morehart 2001). For the purpose of this article, we prefer to report a conservative estimate of the wage differential.

Off-farm labor income is defined as all off-farm income attributable to off-farm work (including off-farm wages, salaries, and off-farm business income). Off-farm labor income does not include components of off-farm income not attributable to labor, such as interest, dividends, capital gains, social security, and public assistance.

Because the measures of on-farm and off-farm labor income include wages from all household members, these measures overestimate returns to operator and spouse labor. We can investigate the extent of the overestimate using data from the 2001 survey because in that year it is possible to distinguish the contributions to off-farm labor income by the operator, spouse, and other family members. Of the total average household off-farm income of $33,626, operators earned $20,644 (61%), spouses earned $11,924 (35%), and other family members earned $1,058 (3%). Hence, the contribution of other family members to household off-farm wages is small. If other family members contributed nothing to on-farm wages, this would only minimally bias our estimate of nonpecuniary benefits upward. On the other hand, if other family members contribute more to on-farm wages than off-farm wages, this would have the effect of biasing our estimate of nonpecuniary benefits down. In the next section, we separately consider the subsample of households with only two members and show that the results do not differ substantially from the full sample.

Table 1 summarizes the key labor, income, and wage variables used in the study for each of the three survey years. In general, the median income and wage estimates were more stable over time than the mean values. The average on-farm labor income was substantially higher in 2004 compared to 2002 or 2003. Despite this, both the average and median wage differentials were only slightly lower in 2004 compared to 2002. Estimates of the median wage differential (for those farms where the operator or spouse worked off-farm) were stable across the three surveys—varying from $21.08 to $24.85 per hour.

There were 51,429 total observations for the three years of data. Limiting the sample to those households where the operator or spouse worked on farm resulted in 51,396 farms. Of these, 40,177 respondents provided information about how much they worked on-farm (they did not refuse to provide this information). Dropping observations located in regions with missing information on county wages or land quality reduced the total sample to 39,899. Of these, there were 22,388 households where either the operator or spouse worked off-farm and 17,511 where the operator and spouse worked only on-farm.

| Mean | Median | |||||

|---|---|---|---|---|---|---|

| 2002 | 2003 | 2004 | 2002 | 2003 | 2004 | |

| On-farm hours (operator) | 1,370 | 1,416 | 1,720 | 1,050 | 1,113 | 1,495 |

| On-farm hours (spouse) | 264 | 326 | 353 | 0 | 0 | 0 |

| On-farm hours (operator and spouse) | 1,635 | 1,743 | 2,073 | 1,250 | 1,300 | 1,690 |

| On-farm labor income ($/year) | 3,534 | 7,235 | 25,028 | −2,454 | −2,077 | 850 |

| On-farm wage ($/hour) | 1.57 | 2.84 | 12.55 | −2.7 | −2.11 | 0.84 |

| Off-farm hours (operator)a | 1,458 | 1,507 | 1,325 | 2,000 | 2,000 | 1,785 |

| Off-farm hours (spouse)a | 1,141 | 1,179 | 1,256 | 1,400 | 1,440 | 1,560 |

| Off-farm hours (operator and spouse)a | 2,599 | 2,686 | 2,581 | 2340 | 2340 | 2,250 |

| Off-farm labor income ($/year)a | 68,290 | 67,845 | 72,264 | 47,251 | 49,684 | 53,750 |

| Off-farm wage (op. and sp.) ($/hour)a | 49.28 | 33.59 | 54.53 | 19.63 | 19.17 | 20.27 |

| Wage differential (off-farm-on-farm) ($/hour)a | 51.23 | 34.02 | 45.78 | 24.85 | 23.8 | 21.08 |

| Observations | 11,495 | 16,805 | 11,599 | 11,495 | 16,805 | 11,599 |

| Observationsa | 6,478 | 9,304 | 6,606 | 6,478 | 9,304 | 6,606 |

- a These statistics are for operations where the operator or spouse works off-farm.

Empirical Results

Table 2 reports the mean and median on-farm and off-farm hourly wages and wage differentials for households in which the operator or spouse worked off-farm. The table also reports a t-test of the null hypothesis that the difference between on-farm and off-farm hourly wages is zero. Assuming unitary household labor, the estimates of wage differentials in table 2 do not suffer from sample selection bias because we observe on-farm and off-farm wages for each household.

Statistics in the first row in the table are for all households in the sample where the operator or spouse worked off-farm—a group that represents about 56% of all farms and which produces about 32% of the total value of agricultural production. Results indicate that for those farms where either the operator or spouse works off-farm, the median household receives $24.00 per hour more working off-farm compared to on-farm.

| Samples | Obs. | Mean On-Farm Wage ($/Hour) | Mean Off-Farm Wage ($/Hour) | Mean Wage Differential ($/Hour) | Median Wage Differential ($/Hour) | Paired t-Stat |

|---|---|---|---|---|---|---|

| 1. All farms where operator or spouse works some time off-farm | 22,388 | 0.06 | 43.30 | 43.25 | 24.00 | −7.11*** |

| 2. Exclude wage outliers | 21,222 | −1.59 | 28.37 | 29.96 | 23.89 | −103.79*** |

| 3. Exclude wage outliers and farms where spouse and operator works less than 480 hours off-farm and less than 480 hours on-farm | 17,886 | −1.14 | 25.70 | 26.84 | 22.39 | −103.85*** |

| 4. Exclude wage outliers and farms with operators 65 years and older | 19,154 | −1.58 | 27.78 | 29.36 | 24.01 | −99.37*** |

| 5. Exclude wage outliers and households with more than two members | 9,905 | −1.80 | 29.53 | 31.32 | 24.37 | −71.42*** |

| 6. Exclude wage outliers and farms producing less than $100,000 of output | 10,243 | 15.76 | 28.45 | 12.69 | 9.26 | −25.07*** |

| 7. Exclude wage outliers and farms producing less than $250,000 of output | 6,358 | 21.98 | 28.79 | 6.81 | 5.38 | −9.88*** |

- a Note: Triple asterisks (***) indicate that paired t-statistics have a p-value < 0.0001. The paired t statistic associated with the test of the null hypothesis that the paired difference (di = off-farm wagei – on-farm wagei) is zero is defined:

, where

, where  is the sample mean of the paired differences, sd is the sample variance of the paired differences, and n is sample size.

is the sample mean of the paired differences, sd is the sample variance of the paired differences, and n is sample size.

To explore the robustness of this result, table 2 reports the estimated nonpecuniary benefits for several subsamples. The second row excludes households in the top and bottom 1% of on-farm and off-farm wages. This limits the sample to households earning between negative $105.58 (financial losses) and $207.20 per hour on-farm, and between $1.68 and $360.95 per hour off-farm. Row 3 removes the wage outliers and farms where the operator and spouse spent less than 480 hours working on-farm and 480 hours off-farm (480 hours is approximately a quarter of standard full-time employment for an individual). Row 4 removes the wage outliers and farms with operators over 64 years old. Row 5 excludes wage outliers and farms with more than two members. For all five samples the median wage differentials are consistent—with values between $22.39 and $24.37 per hour.

Rows 6 and 7 in table 2 limit the sample by farm size. Row 6 removes the wage outliers and farms with a total value of production less than $100,000. Row 7 removes the wage outliers and farms with production worth less than $250,000. Not surprisingly, the larger farms are more profitable on average, so have a higher on-farm hourly wage. Because the off-farm hourly wage is about the same for the larger farms, the mean and median hourly wage differentials are smaller. However, even for farms with a value of production of at least $250,000, the wage differential is substantial: with a mean value of $6.81 per hour and a median of $5.38 per hour.

Table 3 compares characteristics of farm households where the operator and spouse do not work off-farm to households where the operator or spouse does work off-farm. There are significant differences between these types of households for most variables. In households where the operator and spouse do not work off-farm, both the operator and spouse work significantly more on-farm, so they earn higher on-farm labor income. They also earn higher hourly wages. The operators of farms where there is no off-farm labor participation are substantially older on average, and substantially less educated. Farm households that supply no labor off-farm are significantly smaller on average, having 2.3 versus 3.0 members, but possess significantly greater net worth. These farms produce more output, even though they are more likely to be located in areas with substantially lower land quality. Farms where the operator and spouse do not work off-farm are more likely to be located in the “Fruitful Rim” or “Mississippi Portal” and less likely to be located in the “Heartland,” the “Northern Crescent,” or “Eastern Uplands” regions.

The comparison in table 3 shows that many farm household characteristics differ substantially according to the labor market participation decisions of the operator and spouse. Since observable household characteristics differ substantially it is reasonable to assume that unobservable characteristics that affect off-farm labor participation and off-farm wages also differ. To address this possibility, we estimate a Heckman sample selection model using the maximum likelihood approach, the results of which are presented in table 4. To reduce the influence of outliers, farms with the lowest and highest 1% of off-farm and on-farm hourly income were dropped from the sample.

| (1) No Off-Farm Labor (Mean) | (2) Some Off-Farm Labor (Mean) | (3) t-Stat | |

|---|---|---|---|

| On-farm hours (operator) | 1,648 | 1,331 | 26.53*** |

| On-farm hours (spouse) | 337 | 285 | 7.67*** |

| On-farm hours (operator and spouse) | 1,985 | 1,616 | 23.43*** |

| On-farm labor income ($/year) | 18,138 | 2,893 | 10.93*** |

| On-farm wage ($/hour) | 10.63 | 0.06 | 9.21*** |

| Off-farm hours (operator) | 0 | 1,462 | − |

| Off-farm hours (spouse) | 0 | 1,172 | − |

| Off-farm hours (operator and spouse) | 0 | 2,634 | − |

| Off-farm labor income ($/year) | 6,968 | 68,608 | −67.72*** |

| Off-farm wage (op. and sp.) ($/hour) | – | 43.30 | − |

| Wage differential ($/hour) | − | 43.25 | − |

| Operator age | 64.93 | 51.12 | 109.16*** |

| Operator educ.—less than high school | 0.19 | 0.06 | 40.06*** |

| Operator educ.—high school | 0.44 | 0.41 | 5.91*** |

| Operator educ.—some college | 0.21 | 0.28 | −16.56*** |

| Operator educ.—four-year college | 0.11 | 0.17 | −14.73*** |

| Operator educ.—graduate school | 0.05 | 0.08 | −10.56*** |

| Operator has spouse | 0.64 | 0.86 | −52.42*** |

| Household size | 2.28 | 2.95 | −45.98*** |

| Household net worth | 802,553 | 555,327 | 19.18*** |

| Total value of agric. production | 136,047 | 63,452 | 13.85*** |

| Local land quality (share type I or II) | 0.43 | 0.44 | −3.87*** |

| County wage (BEA 2003) | 27,282 | 27,291 | −0.15 |

| ARMS Region—Heartland | 0.20 | 0.24 | −8.1*** |

| ARMS Region—Northern Crescent | 0.13 | 0.14 | −2.85** |

| ARMS Region—Northern Great Plains | 0.05 | 0.04 | 2.52* |

| ARMS Region—Prairie Gateway | 0.15 | 0.15 | 1.13 |

| ARMS Region—Eastern Uplands | 0.13 | 0.15 | −3.06** |

| ARMS Region—Southern Seaboard | 0.11 | 0.11 | 1.21 |

| ARMS Region—Fruitful Rim | 0.13 | 0.11 | 8.07*** |

| ARMS Region—Basin and Range | 0.04 | 0.04 | 1.59 |

| ARMS Region—Mississippi Portal | 0.05 | 0.03 | 6.71*** |

| Observations | 17,511 | 22,388 |

- a Note: Triple asterisks (***) indicates p-value < 0.0001; double asterisks (**) < 0.001; single asterisk (*) < 0.01. The t-stat is the statistic associated with the null hypothesis that the difference between the means of the two samples is zero:

, where s is the pooled sample variance.

, where s is the pooled sample variance.

The top of table 4 reports the estimated coefficients associated with the decision to work off-farm. Results are generally consistent with the summary statistics presented in table 3.9 Older operators, particularly those 55 years and over, are less likely to work off-farm, while better educated operators are more likely to. The likelihood of working off-farm also decreases with the net worth of the operation, and increases if the operator is married (has a spouse). The average wage in the county has a small positive effect on the likelihood of working off-farm.

| Variable | (1) Coefficient | (2) Robust Standard Error | (3) z-Statistic |

|---|---|---|---|

| Dependent Variable: Work Off-Farm (1/0) | |||

| 35 < = Operator age < = 44 | 0.029 | 0.087 | 0.34 |

| 45 < = Operator age < = 54 | −0.116 | 0.087 | −1.34 |

| 55 < = Operator age < = 64 | −0.467 | 0.087 | −5.36*** |

| 65 < = Operator age | −1.598 | 0.091 | −17.51*** |

| Operator educ.—high school | 0.363 | 0.065 | 5.54*** |

| Operator educ.—some college | 0.505 | 0.069 | 7.34*** |

| Operator educ.—four-year college | 0.628 | 0.073 | 8.65*** |

| Operator educ.—graduate school | 0.811 | 0.087 | 9.3*** |

| Year = 2003 | −0.046 | 0.038 | −1.22 |

| Year = 2004 | −0.190 | 0.035 | −5.42*** |

| Household net worth | −0.00023 | 0.000020 | −11.29*** |

| County wage (BEA 2003) | 0.0088 | 0.0039 | 2.28* |

| Household size | −0.004 | 0.013 | −0.34 |

| Local land quality (Share type I or II) | −0.061 | 0.078 | −0.79 |

| Spouse | 0.764 | 0.046 | 16.46*** |

| ARMS Regions (categorical variables) | yes | ||

| Constant | 0.082 | 0.157 | 0.52 |

| Dependent Variable: Off-Farm Wage | |||

| 35 < = Operator age < = 44 | 3.27 | 1.31 | 2.49* |

| 45 < = Operator age < = 54 | 3.57 | 1.17 | 3.06** |

| 55 < = Operator age < = 64 | 5.11 | 1.27 | 4.03*** |

| 65 < = Operator age | 8.06 | 2.05 | 3.94*** |

| Operator educ. – High school | −0.16 | 1.63 | −0.1 |

| Operator educ. – Some college | 1.69 | 1.78 | 0.95 |

| Operator educ. – four-year college | 7.96 | 1.95 | 4.08*** |

| Operator educ. – Graduate school | 18.54 | 2.84 | 6.52*** |

| Year = 2003 | −2.69 | 0.95 | −2.82** |

| Year = 2004 | −1.71 | 1.00 | −1.7 |

| Household net worth | 0.009 | 0.001 | 9.52*** |

| County wage (BEA 2003) | 0.216 | 0.097 | 2.23* |

| Spouse | −4.77 | 1.15 | −4.14*** |

| Constant | 14.23 | 3.37 | 4.22*** |

| ARMS Regions (categorical variables) | Yes | ||

| ρ | −0.018 | 0.011 | −1.61 |

| σ | 3.44 | 0.04 | 96.51*** |

| Observations | 37,702 |

- a Note: Triple asterisks (***) indicates p-value < 0.001; double asterisks (**) < 0.01; single asterisk (*) < 0.05. The Wald test of model significance has p-value <0.0001. The Wald test of independent equations (ρ = 0)) has p-value = 0.106. 16,480 censored observations, and 21,222 uncensored observations. Missing categories: operator age < 35; operator educ. less than high school; year = 2002.

The bottom of table 4 reports the coefficients associated with the off-farm hourly wage equation. Results indicate that older and better-educated operators earn higher hourly wages off-farm. In addition, the farm household's net worth is positively associated with higher off-farm earnings, as is the local county wage. If the operator is married, the hourly wage for off-farm work is lower on average. The estimated correlation between the equations (ρ) is negative, but is not significantly different from zero at the 10% level. A negative ρ might result because unobserved skills, such as entrepreneurial ability, were better rewarded on-farm than off-farm. If this were the case, more entrepreneurial farmers would be less likely to work off-farm, ceteris paribus.

Table 5 presents the estimated hourly off-farm and on-farm wages and the wage differential based on the results of the sample selection model. Results indicate off-farm work would command a higher hourly wage on farms where neither the operator nor spouse works off-farm. This result seems somewhat counterintuitive since one would expect the likelihood of working off-farm to be positively associated with a higher off-farm wage. However, farms where the operator and spouse work off-farm are quite different from those that do not. We have seen that farms where the operator or spouse works off-farm have much younger operators, and younger operators earn significantly less than older operators. In addition, the operator or spouse is more likely to work off-farm if the operator is married, and if the operator is married, the hourly wage is likely to be lower. These effects cause a lower estimated off-farm hourly wage for farms where the operator or spouse works off-farm. Counterbalancing this is the fact that farms with off-farm workers tend to have better-educated operators, and better educated workers earn higher wages on average.

Subtracting the mean observed hourly on-farm income from the estimated hourly off-farm income gives the estimated wage differential. Results indicate that farms where the operator or spouse works off-farm have slightly higher wage differential compared to farms where the spouse and operator work exclusively on-farm. We estimate that for all farm households, the average labor wage differential is $29.51 per hour. However, as we saw in table 2 in rows 6 and 7, larger-scale operations received a higher on-farm wage, and consequently, experienced a smaller wage differential. One way of characterizing the wage differential associated with farm output is to weight each observation by the value of production of the operation. As shown at the bottom of table 5, the production-weighted average on-farm wage is much higher ($23.91 per hour), causing the estimated wage differential to be substantially smaller ($12.96 per hour).

| Household Labor Allocation | Mean | Standard Error | Obs. |

|---|---|---|---|

| Some off-farm labor | |||

| Estimated off-farm wage ($/hour) | 28.59 | 0.07 | 21,222 |

| Observed on-farm wage ($/hour) | −1.59 | 0.18 | |

| Estimated wage differential ($/hour) | 30.18 | 0.19 | |

| No off-farm labor | |||

| Estimated off-farm wage ($/hour) | 33.08 | 0.13 | 16,480 |

| Observed on-farm wage ($/hour) | 4.91 | 0.23 | |

| Estimated wage differential ($/hour) | 28.17 | 0.26 | |

| All farms | |||

| Estimated off-farm wage ($/hour) | 30.09 | 0.07 | 37,702 |

| Observed on-farm wage ($/hour) | 0.57 | 0.14 | |

| Estimated wage differential ($/hour) | 29.51 | 0.15 | |

| All Farms, Weighted by Value of Production | |||

| Estimated off-farm wage ($/hour) | 36.87 | 0.18 | 37,702 |

| Observed on-farm wage ($/hour) | 23.91 | 0.24 | |

| Estimated wage differential ($/hour) | 12.96 | 0.29 |

- a Note: Estimates for sample that excludes wage outliers (top and bottom 1% of the off-farm wage and the on-farm wage).

Operator Wage Differential

In the basic model presented in the theory section, household labor is unitary—no distinction is made between labor provided by different household members. In fact, the operator and spouse likely have different skills, education, and training, implying they would command different wages off-farm and would contribute differently to farm production. For example, it is plausible that the ratio of the implicit on-farm wage to the off-farm wage is higher for operators than for spouses (operators have selected agriculture as an occupation, so they might be relatively more productive in this work). In households where the operator works only on-farm and the spouse works only off-farm, the wage differential is the difference in wages of two different individuals. In this case, the wage differential may not reflect the nonpecuniary benefits from on-farm labor for the operator, but instead may reflect differences in human capital endowments between the operator and spouse. This is potentially a problem whenever operator and spouse labor is disproportionately allocated on and off-farm.

Fall and Magnac (2004) account for different labor endowments (and preferences) among household members by estimating a profit function that allows for separate contributions by the operator and spouse to farm profits. This approach allows for a separate estimation of the value marginal productivity of the operator and spouse, which can then be compared separately to the off-farm wages of the operator and spouse. This approach also allows for separate wage differentials (nonpecuniary benefits) for the operator and spouse, which the unitary household model does not.

Unfortunately, substantial empirical problems arise in implementing this approach. First, the farm profit function is difficult to estimate in practice because in many households (56.4% in our sample) the spouse does not work on-farm. Fall and Magnac estimated the profit function only for those households where both the operator and spouse work on-farm, but did not control for the accompanying sample selection issues in extending this estimate to the population. Second, except for one year, the data do not disaggregate total off-farm income into the contributions from the spouse and operator. Data limitations required Fall and Magnac to estimate a relationship between observable household characteristics and the off-farm wage using information in a second survey, and then use the estimated relationship to predict off-farm wages for the sample for which they had on-farm income. Third, there is a fundamental endogeneity problem involved with estimating a production function from a regression of outputs on inputs. The problem is that such a regression contains no explanation for what drives input variation across farms, and no explanation for the model error that is plausibly exogenous to input choices. Particularly in a cross-sectional regression (which presumably contains little price variation—a clear theoretical driver of inputs and outputs), one must worry that unobserved factors specific to each farm and its location (the model error) drive both input use and output. In other words, such a regression requires the questionable assumption that observed cross-sectional input-to-output associations are causal.

Since the purpose of this article is to explore the evidence for nonpecuniary benefits that might affect the farm operator's household labor supply decisions, we take a different approach to address the potential empirical problems resulting from a nonunitary household. Rather than trying to estimate separate wage differentials for the operator and spouse, we instead estimate the wage differential for the farm operator alone. Since the operator provides 82.5% of total on-farm family labor, it is plausible that the operator derives the bulk of any nonpecuniary benefits that may exist. First, we directly measure the operator's wage differential in those households where the operator works off-farm and the spouse does not work. Second, we estimate operator's wage differential in households with any off-farm workers by controlling for the share of off-farm labor and on-farm labor that is provided by the operator's spouse. In the second case, the idea is to directly control for possible systematic differences in human capital endowments between the operator and spouse.

For the 2002–2004 surveys, households where the operator works off-farm and the spouse does not work represent 8.6% of the sample, or 3,259 farms. For these farm households, the mean wage differential of the operator is $38.89 and the median value is $29.68. These values are similar to those obtained for the entire sample.

Next, we consider, as before, the sample of households where either the spouse or operator worked off-farm. We can estimate the operators' wage differential by controlling for the share of total off-farm labor provided by the spouse and the share of on-farm labor provided by the spouse. The first column in table 6 shows the results of this basic model. Because the intercept is the estimated value of the dependent variable when the independent variables are zero, the intercept provides an estimate of the average wage differential for the operator: $37.41 per hour. The negative coefficient associated with spouse's share of off-farm labor implies that spouses earn less than the operator off-farm, so if the spouse works relatively more off-farm, the off-farm wage is lower, and the wage differential is lower. The positive coefficient associated with the spouse's on-farm labor share implies that the operator also earns a higher implicit wage on-farm, so if the spouse works relatively more on-farm, the aggregate on-farm wage is lower, and the wage differential is greater.

Column 2 adds additional controls for the operator's age and education (the spouse's age and education are not observed), household net worth, county wage, and geographic region. All controls are interacted with the spouse's on-farm and off-farm labor shares to allow for different characteristics of the spouse or operator to alter how the spouses share in labor supply affect the wage differential—that is, to allow for different human capital attributes. With this specification the intercept again can be interpreted as the average wage differential for operators: $37.76 per hour.

| Variable | (1) OLS | (2) OLS Coefficient (Standard Error) | (3) Heckman MLE |

|---|---|---|---|

| Dep. Var.: Operator Wage Differential | |||

| Constant | 37.41*** | 37.76*** | 37.93*** |

| (0.48) | (0.47) | (1.50) | |

| Spouse share off-farm labor | −20.29*** | −24.51*** | −24.35*** |

| (0.76) | (4.97) | (8.54) | |

| Spouse share on-farm labor | 12.25*** | 52.31*** | 52.55** |

| (1.48) | (13.09) | (24.24) | |

| Spouse share off-farm labor * hh net worth | −3.8 × 10−7 | −3.4 × 10−7 | |

| (7.9 × 10−7) | (1.3 × 10−6) | ||

| Spouse share on-farm labor * hh net worth | 1.6 × 10−5*** | 1.6 × 10−5*** | |

| (2.4 × 10−6) | (4.6 × 10−6) | ||

| Spouse share off-farm labor * county wage | 8.4 × 10−4*** | 8.4 × 10−4*** | |

| (1.1 × 10−4) | (1.8 × 10−4) | ||

| Spouse share on-farm labor * county wage | −2.6 × 10−4 | −2.6 × 10−4 | |

| (2.8 × 10−4) | (5.5 × 10−4) | ||

| Spouse share off-farm labor * operator age cat. | Yes | Yes | |

| Spouse share on-farm labor * operator age cat. | Yes | Yes | |

| Spouse share off-farm labor * operator educ. cat. | Yes | Yes | |

| Spouse share on-farm labor * operator educ. cat. | Yes | Yes | |

| Spouse share off-farm labor * farm region | Yes | Yes | |

| Spouse share on-farm labor * farm region | Yes | Yes | |

| ρ | − | − | −0.0084 |

| (0.041) | |||

| σ | − | − | 40.51*** |

| (0.96) | |||

| R2 | 0.04 | 0.07 | − |

| Obs. | 21,226 | 21,226 | 21,226 |

- a Note: Triple asterisks (***) indicates p-value < 0.001; double asterisks (**) < 0.01; single asterisk (*) < 0.05.

Finally, column 3 displays the results of the second stage of a Heckman selection model that accounts for the fact that households providing labor off-farm might differ from the farm population resulting in sample selection bias. The first stage of the Heckman model is the same as that presented in table 4. The intercept again provides an estimate of the average operator wage differential: $37.93 per hour.

In sum, controlling for the amount and quality of time the spouse works on and off the farm provides estimates of the operator's wage differential that are similar to the estimates for the average household wage differential. Consequently, the assumptions associated with of the unitary household model do not appear to be driving results reported earlier.

Interpreting the Wage Differential

The finding of a large on-farm/off-farm wage differential suggests the possibility of substantial nonpecuniary benefits to farming. Assuming that all of the wage differential can be attributed to nonpecuniary benefits, an average household (where the spouse and farmer together work 1,758 hours per year on-farm) derives nonpecuniary benefits worth $51,879 per year (from table 5). Operators and spouses of larger operations typically earn higher farm wages, so enjoy smaller hourly nonpecuniary benefits to farming, but they also typically work more on-farm. The production-weighted average on-farm labor allocation of 3,331 hours implies total production-weighted nonpecuniary benefits worth $43,170 per year.

The conclusion that there are large nonpecuniary benefits to farming should be qualified by discussing additional factors that could explain some of the wage differential. First, our estimates of nonpecuniary benefits are biased upward to the extent that the estimates of net farm income derived from the USDA Agricultural Resource Management Survey are biased downward. It has been recognized that farm income is generally underreported to the IRS, though estimates of the extent of underreporting vary widely depending on the methodology used. An IRS study using random audits found that only 68% of net farm income was reported to the IRS in 1988, almost exactly the same rate as nonfarm proprietary income (IRS 1996). Using data on charitable giving, Feldman and Slemrod (2007) estimated that only 26–34% of net farm income was reported to the IRS (p. 347).

Unlike for IRS tax documents, farmers are not required to report net farm income for the USDA-ARMS. Instead, farmers report components of gross income and expenses, which are then aggregated by the USDA to estimate net farm income. While there might be incentives for households to underreport net farm income to the IRS, it is not clear whether there are incentives to underreport the components of gross income or over-report the components of expenses to the USDA. USDA net farm income figures have been consistently higher than IRS figures (GAO, p. 10).10 For 1996, Durst and Monke (2001, p. 3) analyzed this discrepancy by sales category and found that IRS tax data indicate substantially lower average net farm income than comparable USDA data: $111 versus $7,906 for all farm proprietors; $16,914 versus $25,708 for family farms with sales between $100,000 and $250,000; and $31,572 versus $93,513 for family farms with sales above $250,000. A GAO study found that a primary reason for the difference between IRS and USDA net farm income figures is that tax filers underreport their farm income to the IRS (GAO 1993).

The relevant issue for this analysis is the extent to which farm income is underestimated relative to off-farm income using the ARMS data. Unfortunately, this is not observed. However, even assuming that all off-farm income is accounted for by the survey, farm income would have to be underestimated by an implausibly large degree to explain the entire wage differential. For example, estimates of net farm income for an average farm (table 5) would need to be fifty-three times larger for the wage differential to disappear.

A second possible explanation for the wage differential stems from differences in job experience and the earning-experience profiles across sectors (Lazear 1981; Lazear and Moore 1984). As Hamilton (2000) discusses, investment and agency models predict an “overtaking behavior” in wages—individuals earn less initially as entrepreneurs (farmers), but as they gain experience, their earnings increase faster than do paid employees (off-farm work). This could explain the observed wage differential if individuals are relatively inexperienced at farming compared to off-farm work (causing them to have relatively low current farm earnings, but higher earnings in the future). Hamilton found no evidence that job experience is related to the difference between paid and self-employed earnings, and therefore finds little support for these theories. Unfortunately, our survey data do not include information about experience in off-farm occupations, so we are unable to make a similar assessment.

Third, it is plausible that there are benefits or costs to labor that are not adequately accounted for. For example, it is plausible that some capital and land appreciation could be attributed to farm labor, which causes us to underestimate the returns to farm labor and overestimate nonpecuniary benefits. Unfortunately, we cannot estimate these returns to on-farm labor because we do not have information about how much labor used for maintaining or improving land and capital assets, nor do we observe the value of land or capital appreciation in the year of the survey. On the other hand, as discussed in the Data section, our methods attribute all returns from farming (except income generated from land or capital that is rented out) to labor and none to land or capital. This overestimates the returns to labor and underestimates nonpecuniary benefits to farming.

There may also be nonwage costs associated with working off-farm, including transportation costs, the opportunity cost of time spent commuting, and away-from-home meal expenses. Accounting for these costs would reduce the effective off-farm wage, and therefore reduce the estimated nonpecuniary benefits to farming. On the other hand, there could be substantial nonwage benefits to off-farm work, including retirement and health insurance benefits, and paid vacation and sick time. Accounting for these benefits would raise the effective off-farm wage and nonpecuniary benefits. Unfortunately, the data do not allow us to measure these nonwage costs and benefits.

Conclusions

Using farm household data from the United States, this study compares the returns to household labor on-farm and off-farm. The average wage differential can be measured directly for farms where the operator or spouse works off-farm. To estimate the wage differential for the entire farm population we use a sample-selection model that controls for observable and unobservable differences between households with members who work off-farm and households without members who work off-farm. To account for possible systematic differences in human capital endowments between the operator and spouse, we also estimate the wage differential of the farm operator alone by controlling for the share of off-farm and on-farm labor provided by the operator's spouse and differences in operator and spouse skills. While other factors, such as the underestimating net farm income or unobserved benefits and costs to on-farm and off-farm labor, could help explain the observed wage differential, the findings provide compelling evidence of substantial nonpecuniary benefits to farming.

Using an agricultural household model, we show that lump-sum payments increase farm labor supply under two key assumptions: (1) farmers prefer working on-farm to off-farm given the same wage and (2) declining marginal utility of income. The finding of a large on-farm/off-farm wage differential provides empirical support for the first assumption. The second assumption, though not empirically examined here, is plausible and generally supported by experimental evidence. For large commodity-crop farmers, payments might be large enough to have a significant influence on the marginal utility of income, and consequently substantial production effects. The income effect modeled does not rely, as do other mechanisms, on market imperfections or changes in the third derivative of the utility function, which are probably small. While this article focuses on the production effects of lump-sum decoupled payments, “coupled” payments—that are tied to production or prices—would also raise household income. Hence, with nonpecuniary benefits to farming we expect a similar income effect for coupled payments as the one considered in this article.

Though the theoretical question of how decoupled lump-sum payments influence supply remains unresolved, some recent research has sought to econometrically estimate the link between post-FAIR Act payments and production. Although these payments may not be truly decoupled and the econometric estimations might be confounded by nonpayment factors, the studies generally find a positive association between these payments and production (Adams et al. 2001; Goodwin and Mishra 2005; Goodwin and Mishra 2006), and sometimes the link is strong (Key, Lubowski, and Roberts 2005).11 This article provides a theory and supporting empirical evidence that could help explain the findings of a strong link between participation in largely decoupled agricultural programs and production, as well as the somewhat puzzling result that PFC payments under the 1996 FAIR Act are not entirely capitalized into rents and land values (Roberts, Kirwan, and Hopkins 2003; Kirwan 2005). The theory also provides an explanation for recent empirical findings that decoupled (and coupled) payments increase the hours operators work on-farm and decrease the hours they work off-farm (El-Osta, Mishra, and Ahearn 2004; Ahearn, El-Osta, and Dewbre 2006).