External auditor reliance on the work of the internal audit function in Jordanian listed companies

Abstract

This study investigates the factors that influence external auditor (EA) reliance on the work of the internal audit function (IAF) in Jordanian listed companies (JLCs). It evaluates the effect of internal auditor objectivity, competence and work performance as perceived by senior Jordanian EAs. The study employs a mixed method comprising a survey-based factorial experiment in addition to semi-structured interviews. The results, based on 35 fully-crossed factorial experiments and nine interviews with senior EAs and external audit managers, show that IAF objectivity has the greatest influence on the EA's decision to rely on the work of the IAF, followed closely by IAF competence and IAF work performance. Further, there was a significant interactive effect between objectivity and competence, indicating that the EAs do not consider the influence of individual factors in isolation. In interviews, the EAs put forward many reasons for the importance of all three of the independent variables. Our results have direct implications for organizations as well as for professional bodies and regulatory authorities charged with encouraging the development of IAFs.

1 INTRODUCTION

External auditor (EA) reliance on the work of internal audit is relevant to any organization seeking to secure increased value from its internal audit function (IAF). The literature indicates that EA reliance on internal audit work could produce significant cost savings through reduction of external audit time and fees (Brandon, 2010; Krishnamoorthy, 2002; Maletta & Kida, 1993; Mihret, 2010; Mihret & Admassu, 2011; Schneider, 2009). An EA's decision to rely on IAF's work depends largely on the strength of their client's IAF (Mat Zain, Zaman, & Mohamed, 2015). In particular, internal auditor (IA) objectivity, competence, and work performance can influence EA evaluations of EA decisions to rely on the work of internal audit. Further, Gramling, Maletta, Schneider, and Church (2004) suggested that the relative importance of an internal audit quality factor is likely to be contingent on the level of the other quality factors, thus recognizing the complexity in the relationship between IAs and EAs (Hay, 2013).

Decision-makers take into consideration their environment's risk factors using complex and systematic configural decision processes (Libby, Artman, & Willingham, 1985; Maletta & Kida, 1993). To improve decision-making, we need to understand how individuals make decisions and what role information plays in that process, and to recognize the influences of key cues on the judgment decision and their contributions towards outcomes (i.e., independence of outcomes or interaction with influence). According to Ganzach (1997), experienced decision-makers are more likely to consider decision cues configurally.1 In that regard, Desai, Roberts, and Srivastava (2010) report that IA objectivity, competence, and work performance are interdependent, such that EAs' judgments of the IAs remain high even if one of these factors is evaluated negatively; thus, further empirical verification is needed. Moreover, auditors seem to have relatively high levels of self-insight2 (Ashton, 1974; Gibbins & Swieringa, 1995; Solomon & Shields, 1995) as a result of the audit profession's auditing standards and consistency in auditor training (Libby, 1981; Pike, Sharp, & Kantor, 1988). It is important to gauge the level of self-insight so as to improve understanding of the learning process (Libby, 1981) and improve the accuracy of judgment (Hooper & Trotman, 1996).

The professional auditing standards provide guidance for EAs on the proper use of the internal audit work (Suwaidan & Qasim, 2010). International Auditing Standard 610, SAS 500 in the UK, SAS 128 (replacing SAS 65) in the USA, and ASA 610 in Australia state that EAs can rely on the work of IAs, and provide guidelines on EAs' considerations of IA work in the conduct of financial statement audits. However, these standards do not provide specific guidance for EAs regarding the degree of reliance on IAs' work (Reckers & Lee, 1997).

In light of the foregoing, this study sets out to examine (1) the relative importance of each factor (objectivity, competence, and work performance) in terms of both main and interactive effects, and thus the degree to which auditors evaluate these factors configurally, (2) the reported reasons for these factor effects, and (3) the degree of self-insight that the EAs had into their judgments.

This study contributes to the existing literature in several ways. First, we are not aware of any prior studies that investigate the degree of self-insight that EAs have when making their decision to rely on the work of IAs. In addition, several studies have investigated the relationship between reliance on the work of IAs and one or more of the three factors (i.e., objectivity, competence, and work performance), and these studies found that one or more of the three factors had a significant impact on reliance decisions. Few studies, however, specifically set out to rank all three of the factors. Additionally, it is possible that any or all of these factors, or their interactions, could influence the way in which companies, IAs, and EAs operate; hence the need for this study. As such, this study is the first research to measure the statistical effect (both direct and interactive) of all three factors on decisions to rely on the work of IAs.

Further, several research studies examined the drivers of EA reliance on IAs in developed countries, such as the USA and the UK. Nonetheless, these studies might not be completely applicable to the case of Jordan, a developing country in the Middle East, with its high-context culture,3 smaller companies with family groups as majority shareholders, widespread public perception of nepotism and corruption, and a context of economic instability and fraud, even within its bigger companies (Abdullatif & Al-Khadash, 2010). One study, by Suwaidan and Qasim (2010), examined the impact of the three factors on the EA's decision to rely on IAs work in Jordan. Yet their study did not test for the interaction of the three factors, nor did they factor the self-insight of EAs. Moreover, in countries like Jordan, where the law does not require companies to have IAFs (Rahahleh, 2010), shareholders and management might require a convincing argument or business case for developing an IAF, hence justifying this study.

We employ a mixed method comparing a survey-based factorial experiment in addition to semi-structured interviews. The first method measures the influence of the three factors; the second helps confirm and explain the influence. The analysis of the quantitative data from the factorial experiment considers both the main and interactive effects of the three independent factors. Further, the quantitative analysis compares EAs' stated beliefs about the influence of each of the independent factors to the weights revealed by the factorial experiment in order to gauge the accuracy of self-insight of the EAs. The analysis of the qualitative data from the semi-structured interviews provides contextual depth to the quantitative results and, through triangulation, enhances the validity of the study.

The rest of the paper is structured as follows. Section 2 presents a brief history of auditing and its related regulations in Jordan; this is followed by the literature review in Section 3. Section 4 lays out the research design and methodology, while Section 5 discusses the results. Section 6 concludes the paper.

2 AUDITING IN JORDAN

The accounting profession in Jordan was greatly influenced by British rules and principles. During the 1920s and 1930s only British auditors were employed, and the audit profession was mainly located at the office of one firm: Russell & Co (Al-Shiab, 2003; Mardini, Crawford, & Power, 2012; Obaidat, 2007). Although several accounting and auditing firms were opened in Jordan during the 1950s, the accounting and auditing practices were unregulated until the early 1960s (Abdullatif & Al-Khadash, 2010).

During 1961–2003, the government issued three laws to regulate the local external auditing profession. In 1961, the Auditing Profession Practice Law No. 10 of 1961 was issued as the first law governing the audit profession in Jordan. Although this law was very limited in scope, it was necessary to establish the fundamental conditions and rules that all individuals licensed to practice audit must fulfill. Moreover, the auditing law No. 10 of 1961 was amended by the Auditing Profession Practice Law No. 12 of 1964, which includes the statement that all accounts for public companies must be audited (Abdullah, 1982).

During the period between the first law and the 1970s, a second generation of auditing thinking and practice was dominant, which was known as the “systems approach” or the “analytical auditing approach” (Swift, Humphrey, & Gor, 2000). By 1978, The Institute of Internal Auditors (IIA) officially adopted standards of professional practice for internal audit, with the aim of achieving global recognition of the IA profession (Rahahleh, 2010).

Meanwhile, in the public sector, the AB of Jordan was established in 1952 under the Audit Bureau's Law no. 28 of 1952, which had been issued in accordance with the Jordan constitution. Article 119 of the Jordan constitution stipulates that the “Audit Bureau act has been set to audit the revenues and expenditures of the state and ways of expenditure.” It was only in early 1980s that the AB took responsibility for controlling entry into the auditing profession in Jordan (Suwaidan, 1997).

Given the limitations of the earlier laws, as well as the needs of modern business, economic developments in Jordan, and the establishment of public shareholding companies in record numbers, there was a need for better laws governing the auditing profession, and eventually another law was issued: the Auditing Profession Law No. 32 of 1985. Among the provisions of the 1985 law was a revision of the required qualifications for EAs, revised to require at least a community college degree in accounting and the passing of an exam administered by the High Council of the Accounting Profession (Abdullatif & Al-Khadash, 2010). Note that the 1985 law did not establish requirements for IAs. It also did not identify the nature of the responsibilities, tasks, and the essential authorizations that are needed to perform their responsibilities (Rahahleh, 2010).

The 1985 law established the Jordanian Association of Certified Public Accountants (JACPA), and therefore set up the first accounting association in Jordan. Currently, the AB is still responsible for supervising the financial matters of the government and the public accounting profession. Private accountancy firms are monitored by JACPA.

In 1989, JACPA adopted the international accounting standards. However, JACPA did not have the legal power to force Jordanian companies to follow its recommendations. The New Company Law of 1997 required that the accounting standards to be adopted internationally and used as the basis for Jordanian accounting practices. Furthermore, the Securities Commission Law 1997 adopted international accounting, auditing, and performance evaluation standards for all entities falling under the supervision of the Securities Commission (Al-Akra, Ali, & Marashdeh, 2009).

Owing to the significant role an auditor plays in a company's affairs and in modern business, the Jordanian legislature enacted several provisions in order to formalize the EA's rights and duties. The legislature carved out in more detail a special section in the Company Legislation No. 22 of 1997 to deal with matters such as election of an EA, contents of EA reports, their attendance at the general assembly meetings, and prohibitions placed on EAs.

The third and current effective law is the Law of Organizing the Practice of the Public Accounting Profession Law (No. 73 of 2003), which was composed based on some amendments to the Auditing Profession Practice Law (1985). Moreover, this law addresses a contemporary basis for practicing the public accounting profession to “guarantee” the reliability of the financial statements presented by companies and other institutions. This law (No. 73 of 2003) aimed to achieve the following: organizing the practice of the external auditing profession; ensuring compliance by Jordanian companies and EAs to international accounting and auditing standards; developing the technical and educational levels to be achieved by Jordanian auditors; ensuring compliance of the EAs with the code of professional ethics; and enhancing auditors' integrity and independence (Abdullatif & Al-Khadash, 2010; Mardini et al., 2012).

Although auditing profession requirements were still the same as in the previous law, the 2003 act included two major amendments affecting the accountancy profession. The first amendment was that JACPA became a self-funded and administratively independent organization (JACPA Law 2002 Article 7), while the second amendment required that JACPA join the High Council of the Accounting Profession. This gave JACPA new powers that include responsibility to draft its regulations, disciplinary authority over its own members, and the right to inspect its members' working permits (Abdullatif & Al-Khadash, 2010; Obaidat, 2007).

At this point in time, few laws and regulations have a direct application to the work of IAs in Jordan. IAs simply need to satisfy their employers' requirements for employment. There are no required qualifications for IAs or any other type of nonpublic accountant. The World Bank (2004, p. 12) report stated that, in Jordan, “the quality of some audits is materially affected by management attitudes in client companies, and severe competition between audit firms. It is observed that the quality of many audits is affected by management … attitude [which results in] low audit fees. Thus the degree of compliance with the applicable auditing standards varies between large and small firms.”

3 LITERATURE REVIEW

“Relying on the work of IAs” refers to using their work in preparing for and conducting an external audit. This work can include past reports and documentation produced by IAs as well as using IAs as assistants or advisors for the EAs. For example, EAs could use IAs' knowledge (i.e., by consulting them) or parts of their previous or new work to benefit from the IAs' “insider knowledge” and their continuous monitoring of the organization's internal control systems (Edge & Farley, 1991, p. 70), potentially improving the quality of the external audit. In such cases, the work of the IAs would contribute to the planning and/or the content of the external audit. Alternatively, EAs could directly use some of the work of IAs in order to reduce duplication of work and the required time and cost, as well as reducing the audit's disruption of the organization's operations (NAO, 2000, p. 4).

Several research studies examined the degree of reliance of EAs on the work of IAs, particularly in relation to IA objectivity, competence, and work performance. These studies ranked the three factors in order of importance (e.g., Brown, 1983; Desai et al., 2010; Krishnamoorthy, 2002; Maletta, 1993; Messier, Reynolds, Kenneth, Chad, & Wood, 2011; Messier & Schneider, 1988; Schneider, 1984, 1985a, 1985b; Suwaidan & Qasim, 2010). Overall, these studies have shown that competence, objectivity, and work performance are important for EAs to make a decision in regard to reliance on an IA's work, even though there are differences in their order of importance between the various studies. Table 1 summarizes the ranking of the three factors as found in the studies covered in the literature review.

| Researcher | Scope/country | Objectivity | Competence | Work performance |

|---|---|---|---|---|

| Abdel-Khalik, Snowball, and Wragge (1983) | CPA firms, Canada | A | — | B |

| Schneider (1984) | CPA firms, Columbus, OH, USA | C | B | A |

| Schneider (1985a) | CPA firms, Columbus, OHo, USA | B | A | A |

| Schneider (1985b) | CPA firms, Atlanta, GA, USA | C | B | A |

| Messier and Schneider (1988) | USA | B | A | C |

| Edge and Farley (1991) | Australia | C | A | B |

| Maletta (1993) | Big 6 accounting firm, USA | B | A | C |

| Obeid (2007) | Banking sector, Sudan | B | C | A |

| Suwaidan and Qasim (2010) | Jordan | A | B | C |

| Al-Matarneh (2011) | Banking sector, Jordan | C | B | A |

| 2 A, 4 B, 4 C | 4 A, 4 B, 1 C | 5 A, 2 B, 3 C |

- A is the most significant factor, B is the second most significant factor, and C is the third most significant factor.

Table 1 shows that most studies place emphasis on work performance as the most significant factor (Margheim, 1986; Schneider, 1984, 1985a, 1985b). On the other hand, Messier and Schneider (1988), Edge and Farley (1991), and Maletta (1993) all found competence to be the most significant factor. Only one study, conducted by Abdel-Khalik et al. (1983), claimed that objectivity was the most significant factor. In the case of Abdel-Khalik et al., the study investigated five different factors4 but did not include the competence factor.

The literature review brings to light variations in the definitions of the factors used in these studies. In particular, competence and work performance might look, at first glance, to be very similar. A study by Margheim (1986), examining the reliance of EAs on the work of the IAF, does offer an insight into why competence is sometimes combined with work performance or not included at all. Margheim elected to combine competence and work performance in his study in order to avoid “unrealistic combinations,” such as low competence and high work performance.

This study is based on four theories that help create context for the relationships between the variables in this study; namely, agency theory, informational asymmetry theory, certification theory, and resource dependency theory.

3.1 Research hypothesis

The way in which multiple variables interact to influence judgments has been examined in previous research into judgmental decision-making in auditing (e.g., Ashton, 1974; Brown & Solomon, 1990, 1991; Hofstedt & Hughes, 19777; Hooper & Trotman, 1996; Trotman, 1996). Configurality is a related term that refers to cases in which “the analyst's interpretation of an item of information varies depending on the nature of other available information” (Slovic, 1972, p. 786). Additionally, configural information processing is “cognition in which the pattern (or configuration) of stimuli is important to the subsequent judgement/ decision” (Brown & Solomon, 1990, p. 19). Extensive research has been undertaken into configural assessment of information in financial valuation and advice (e.g., Mear & Firth, 1987, 1990; Slovic, 1969; Slovic et al., 1972).

In a similar vein, we believe that configural information processing is influential to EAs when they use material prepared by IAs. Hence, the study hypothesizes that EAs' judgment decision-making regarding their reliance on IA work is configural; EAs look for and take into consideration both the individual (i.e., main effect) and interactive effects of the three independent variables when evaluating their reliance on IA work.

The hypothesis of this study can be stated as follows.

H1.EAs assess decision-making information configurally when considering the influence of IAF objectivity, competence, and work performance when relying on IA work.

3.2 Research questions

- RQ1

What are the relative main and interactive weights of:

- the objectivity of the IAF,

- the competence of the IAF, and

- the work performance of the IAF

- RQ2

What degree of self-insight do EAs demonstrate in their assessments of the influence of IAF objectivity, competence, and work performance on their decisions on the degree of reliance on the work of the IAF?

- RQ3

How and why do:

- the objectivity of the IAF,

- the competence of the IAF, and

- the work performance of the IAF

influence EA decision-making regarding the ability to rely upon the work of the IAF?

4 RESEARCH DESIGN AND METHODOLOGY

The first phase of the study uses an experimental technique adapted from the early works of Slovic and others (Slovic, 1969; Slovic et al., 1972; Trotman, 1996) to measure the influence of the three independent variables on the two dependent variables.

Given the stated importance of all three factors in auditing standards, the current study includes all three. To test the hypotheses, a fully crossed 2 × 2 × 2 within-subject experiment is employed. Furthermore, the issue of avoiding “unrealistic combinations” is not truly a factor in our study since our focus is on EA perceptions and judgments based on a wide range of combinations. We reduce confusion among EAs participating in our study by setting out a clear definition for each of the three factors. Moreover, we avoid creating an artificial relationship between any of the three factors by ensuring that their definitions do not overlap (i.e., they are distinctly different and none of the factors used to measure any one of the three factors can be confused with any other factor used to measure any other factor).

As mentioned earlier, the study examines, through an experimental technique, the main and interactive effects of the three factors on EA judgments regarding their willingness to rely on the work of the IAF. The experiment also examines EAs' self-insight into the influence of the three factors on their judgments regarding their reliance decision.

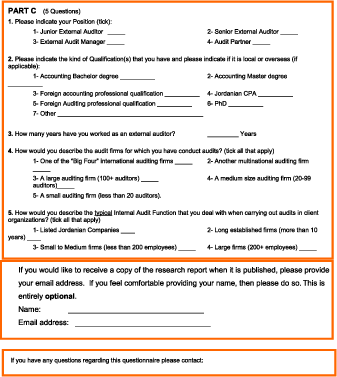

4.1 Participants

A total of 35 usable surveys were received; four other incomplete surveys were excluded. Other EAs did not return their surveys and were thus considered as declining to participate. The response rate was 43.3%,5 which is not unexpected in a profession concerned with confidentiality; this is acceptable, especially given that EAs are likely to react somewhat similarly given the existence of standards of auditing (see Note 5). The respondent rate was also relatively high in comparison with other key studies (e.g., Dezoort, 19988; Laswad & Roush, 1996). The number of completed surveys (i.e., 35) also compares very well with Coolican's (1994) recommended range for experimental designs with homogeneous respondents, coming right at the top end of the range. See Tables 2 and 3 for the demographics and experience of the respondents.

| Frequency | % | |

|---|---|---|

| Auditor position | ||

| 1. Junior external auditor | 7 | 20.0 |

| 2. Senior external auditor | 22 | 62.9 |

| 3. External audit manager | 3 | 8.6 |

| 4. Audit partner | 3 | 8.6 |

| Descriptive qualification statistics of respondents | ||

| 1. Accounting bachelor's degree | 35 | 50.0 |

| 2. Accounting master's degree | 10 | 14.3 |

| 3. Foreign accounting professional qualification | 6 | 8.6 |

| 4. Jordanian certified public accountant | 12 | 17.1 |

| 5. Foreign auditing professional qualification | 3 | 4.3 |

| 6. PhD | 3 | 4.3 |

| 7. Other | 1 | 1.4 |

| Experience statistic | Years of external audit experience |

|---|---|

| Mean | 7.55 |

| Median | 7.0 |

| Minimum | 4.0 |

| Maximum | 17.0 |

| Standard deviation | 3.046 |

4.2 The survey (experimental treatments)

To address these questions, we employ a mixed method comprising a survey-based factorial experiment as well as semi-structured interviews. The first measures the influence of the three factors on the reliance decision; the second helps explain the influence. The analysis of the quantitative data from the factorial experiment considers both the main and interactive effects of the three factors on the reliance decision. Further quantitative analysis compares EAs' stated beliefs about the influence of each of the three factors, on the one hand, with the weights revealed by the factorial experiment, on the other hand, in order to gauge the accuracy of self-insight of the EAs.6 The analysis of the qualitative data from the semi-structured interviews provides some contextual depth to the quantitative results and, through triangulation, enhances the validity of the study.

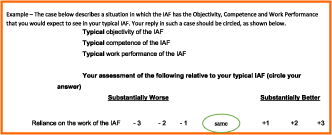

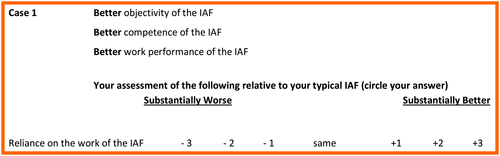

To achieve the objectives of the study, we followed a factorial design for the survey-based quantitative experiment (an example of treatment presentation is depicted in Figure 1)7 and used SPSS to analyze the data. There were three variants of the survey instrument, varying the case order to mitigate practice and carryover effects (Keppel, 1982; Trotman, 1996). The case order for each of the three variants was assigned randomly. The experimental treatments were presented to subjects as a series of case scenarios. Subjects were presented with eight cases (see Appendix for an example of the eight cases from the experimental survey), comprising a fully crossed design of three factors. To facilitate understanding of the exercise and assist subjects in conceptualizing a typical benchmark case, the instrument introduction included an example layout containing neutral content. Subjects were instructed to indicate, on a discrete scale with common intervals, their assessment of the reliance decision in each combination, relative to their assessment of a typical benchmark audit client (i.e., the typical IAF in Jordanian listed companies, according to their own experience). The participants were also asked to indicate the relative importance of each of the three factors on their judgments regarding the reliance decision. The study uses a relative measure because there is no absolute measure of the variables, the differences can be very small, and relative measures are easier for respondents to interpret and calculate. These subjective weights enabled us to collect data on the participants' self-insight regarding their judgment decision-making.

4.3 In-depth interviews

In the second stage of this study, data collection was through semi-structured interviews, a method appropriate for theory-informed research (Flick, 2002). Research participants were selected through the judgment sampling technique, also known as purposive sampling, as it is the most productive sample to answer the research questions (Marshall, 1996). The interview structure adopted in the current study is similar to that of Creswell (1998). Each interview was for a duration varying from 40 min to more than 1 hr length and was audio recorded after obtaining each participant's consent. Through this approach, the researcher could identify and investigate the variables that are most important to decisions regarding reliance on the work of the IAF, as perceived by EAs.

4.4 Sample of external auditors

The population studied is EAs employed in the biggest audit firms located in Jordan. According to Naser and Nuseibeh (2007) and Abdullatif (2013), these large audit firms are estimated to undertake the majority of audit work for Jordanian listed companies. Since we focused on the judgment of EAs in decisions regarding reliance on the work of the IAF in Jordanian listed companies, we sought EAs of sufficient seniority to have meaningful experience with a wide range of companies and in making such decisions; that is, supervisors, senior auditors, managers, executives, and so on. Interviewees were selected through a snowball sampling technique. All the selected EAs were located in Amman, which is by far the largest city in Jordan and the location of the head offices of the majority of audit firms in Jordan. As Heberlein and Baumgartner (1978) advise, we did not exercise any form of direct or indirect pressure, including financial incentives, on any of the selected EAs in order to obtain their participation. Seeking to obtain a survey participant from each of the major auditing firms, we contacted 90 EAs and obtained 35 usable survey responses and nine interviews. Despite the small sample size, Coolican (1994) argues that a sample size of 25–30 is desirable for an experimental design if subjects are expected to react in the same way to similar cues.

5 RESULTS

The study was successful in measuring both the relative main and interactive effects of the independent variables using objective and subjective techniques. The objectives measure revealed that objectivity of the IA had the greatest effect on EA reliance on the work of the IAF, accounting for 35.31% of the total effect size after allocation of the interaction terms. The second most influential factor was competence of the IAs, at 34.05%. The least influential factor affecting reliance on the work of IAs was work performance, accounting for 30.70% of effect size (see Tables 4 and 5). The results also revealed one large and statistically significant interaction (Objectivity × Competence), which accounted for 7.3% of the total effect size.

| Importance in relation to EAs' decisions to rely on the work of the IAF of: | ||||

|---|---|---|---|---|

| Objectivity | Competence | Work performance | ||

| Self-reported weights | ||||

| Mean (%)a | 39.51 | 30.52 | 29.97 | 100 |

| SD (%) | 8.603558 | 4.39071 | 8 | |

| Range order (%) | 20–60 | 20–40 | 10–60 | |

| N = 35 | ||||

| Rank | 1 | 2 | 3 | |

| Effect sizeb | ||||

| Main effects (%) | 30.49 | 30.26 | 29.25 | 89.04 |

| Interactions (%)c,d | 4.82 | 3.79 | 1.45 | 10.06e |

| Combined effects (%) | 35.31 | 34.05 | 30.70 | 100 |

| N = 35 | ||||

| Rank order | 1 | 2 | 3 | |

- a The difference in judgment means across treatments (Slovic, 1969).

- b Effect size is measured by partial eta squared.

- c Interaction effects are assigned to factors weighted by the size of main effect for that factor.

- d Combined effects = Main effects + Interactions.

- e Interaction effect percentage = Total interactions effects/Sum of effect size.

| Factor | Effect sizea | p value | Observed power |

|---|---|---|---|

| Main effects | |||

| Objectivity | 0.918 | .000* | 1.00b |

| Competence | 0.913 | .000* | 1.00b |

| Work performance | 0.881 | .000* | 1.00b |

| Total main effects | 2.712 | ||

| Interactions effects | |||

| Objectivity × Competence | 0.215 | .004* | .843 |

| Objectivity × Work performance | 0.074 | .108 | .362 |

| Competence × Work performance | 0.008 | .595 | .082 |

| Objectivity × Competence × Work performance | 0.005 | .809 | .056 |

| Total interactions effects | 0.303 | — | — |

| Sum of effect size | 3.015 | — | — |

This study is the first investigation of the degree of self-insight among Jordanian EAs. Gauging self-insight is important because it helps improve understanding of the learning process and the accuracy of judgment. The study showed a high degree of self-insight into the decision-making processes of EAs, given that the rankings of the self-reported weights were the same as the rankings according to effect sizes, and the weights and effect sizes were very close. This degree of self-insight demonstrated by Jordanian EAs is consistent with other studies in other countries using EAs, accountants (Savich, 1977; Solomon & Shields, 1995), and professional managers (Gibbins & Swieringa, 1995; Wood, 2002), all revealing relatively high degrees of self-insight among research subjects.

Ascertaining how and why the three independent variables influence EA willingness to rely on the work of the IAF requires consideration of the extant literature in conjunction with the presented objective effects data and individual EA explanations of what mattered to them as they made their decisions.

With respect to the objectivity of IAs, it can be argued that auditors, whether internal or external, can never be totally independent and free of bias or other considerations (Duska, Duska, & Ragatz, 2011). Auditors, however, are required by international audit standards to be free enough such that their ability to express an unbiased audit opinion is not significantly compromised (McGrath, Siegel, Dunfee, Glazer, & Jaenicke, 2001). Guidelines drawing the broad outlines of what is meant by not having a significantly compromised ability to express an unbiased audit opinion are included within international audit standards.

According to the subjective self-weightings reported by the participating EAs, objectivity was the most influential factor when it came to the degree that EAs could rely on the work of IAs. Objectivity was also ranked as the most influential factor according to the objective: effect size data generated by the experiment. The interviews revealed several themes regarding the importance of objectivity in decisions to rely on the work of the IAF, including the importance of freedom from bias, reducing the need for supervision when relying on objective IAs, the essential duty of all auditors to be objective and independent, and the importance of freedom from management interference. Countering these themes is the suggestion that, in Jordan, there were frequently reasons to suspect that IAs were often not as independent/objective as they should be despite the difficulty identifying those biases or omissions purely from a review of their work.

With respect to the competence of IAs, the study used the definition of IAF competence provided by the Standards for the Professional Practice of Internal Auditing (SPPIA) and IIA standard number 1210. SPPIA defined competence as “whether the internal auditors have adequate technical training and proficiency as internal auditors” (Para. 9 ISA 610, 2009, p. 630). The IIA standards defined competence of IAF under section no. 1210 “Proficiency,” stating that “Internal auditors must possess the knowledge, skills, and other competencies needed to perform their individual responsibilities. The internal audit activity collectively must possess or obtain the knowledge, skills, and other competencies needed to perform its responsibilities” (The IIA, 2011, p. 5).

According to the subjective self-weightings reported by the participating EAs, competence was the second most influential factor that EAs used to rely on the work of IAs. Competence also ranked as the second most influential factor according to the objective, effect size data. The interviews revealed several themes regarding the importance of competence, including the need for relevant or specific types of audit knowledge, the impact of knowledge on auditors' ability to work in accordance with auditing standards, the impact of knowledge on auditors' ability to work with EAs, and the impact of knowledge regarding the client company. On the other hand, the procedure followed and the information technology limitations seem to reduce EA reliance on the IAF. Further, relying on EA fraud specialists, in situations in which fraud is suspected, is an issue that has been raised by EAs and is thought to reduce their reliance on IAF work.

Finally, with respect to the work performance of IAs, this study adopted the definition provided by the SPPIA and IIA standard number 2240. SPPIA defined work performance as “due professional care,” stating “Internal auditors must apply the care and skill expected of a reasonably prudent and competent internal auditor.” According to IIA standard number 2240 (Engagement Work Program), “internal auditors must develop and document working programs that achieve the engagement objectives” (The IIA, 2010, p. 13).

According to the subjective self-weightings reported by the participating EAs, work performance was the least influential decision factor. Likewise, the objective effect size data also ranked work performance as the least influential factor influencing EAs' reliance on the work of IAs. The interviews revealed several themes regarding the importance of work performance in decisions to rely on the work of the IAF; these include: the importance of planning, execution and documentation in decisions to reduce audit scope, the importance of the ability to work in accordance with auditing standards, the impact of high work performance on the effectiveness, and thus the value added of the IA to the audit, and professional conduct reducing the likelihood of audit errors.

The interviews revealed other factors impacting an EA's decision to rely on the IAF. These include the level of communication between IAs and EAs, prior cases of fraud or significant financial misstatement identified, expectation of future strategic financial transactions (e.g., merger), and the degree of cooperation between IAs and EAs. On examination, some of the suggested factors can be considered factors that increase the risk of the external audit (e.g., prior cases of fraud, future mergers) and might, conceivably, change the way EAs make judgments (Sarens & Beelde, 2006; Spira & Page, 2003; Walker, Shenkir, & Barton, 2003). Interestingly, the first suggested factor, communication between IAs and EAs, is not stipulated in the international standards on auditing whereas it is stipulated in the Australian auditing standards, an issue that should be noted by regulators both locally and internationally.

6 CONCLUSION

The primary aim of the study is to understand how audit quality factors influence EA decisions to rely on IAs and the work of the IAF. This aim reflects a concern regarding auditing; that is, increasing EA reliance on IAs and the work of the IAF in order to achieve potential benefits such as more timely internal and external audits, lower audit costs, and improved knowledge transfer between IAs and EAs. Identifying statistically significant positive relationships between the three factors and reliance on IAs and the work of IAFs is evidence that the three factors simultaneously drive EA reliance on IAs and the work of the IAFs. The presence of statistically significant interactions between the three factors suggests that models of EA reliance on IAs and the work of the IAF would be incomplete and less accurate if they did not include all three factors.

The results of the study show that the three hypothesized factors have a statistically significant influence on decisions to rely on the work of the IAF. Objectivity was found to be the most influential factor in decisions to rely on the work of IAs and the IAF. Competence was found to be the second most influential factor, while work performance ranked last. One large and statistically significant interaction was identified, namely Objectivity × Competence. This interaction accounted for approximately 7% of the total effect size. Overall, each of the factors accounted for more than 25% of the total effect size and so are substantial influences of the EA's decision to rely on the work of the IAF.

Furthermore, the finding that EAs employ configural decision-making supports the suggestion of Gramling et al. (2004) that the relative importance of two of the factors is contingent on the level of the other factor. Regarding the ranking of the three factors, very few studies have set out to identify the relative importance of the three factors, and this study helps fill this gap. Finally, as the findings are relatively consistent with those of studies in advanced economies, it would appear that advice to carefully consider IA objectivity, competence, and work performance when deciding their degree of reliance on the IAF is sound advice for EAs across the developed economy–less-developed economy continuum.

The study has several implications. For managers, an approach focusing on closing deficiencies in IAF objectivity, competence, and work performance should increase EA reliance on the IAF and, consequently, reduce budgeted audit hours and cost since EAs can depend on the prior work of the IAF, thus reducing the scope of audits and the number of EAs needed to accomplish tasks within a certain time frame. Company regulators and related professional bodies can use this study's findings to better plan future internal audit regulations and improve the requirements and training for IAs. The configurability of EA decision-making regarding IAF reliance also suggests that regulators and professional bodies should take into consideration all three factors when looking to increase EA reliance on the work of the IAF. Further, the identification of other factors impacting the EA's decision to rely on the IAF, particularly communication between IAs and EAs, should be noted by regulators contemplating revamping auditing legislation.

Every study has its limitations, and our study is no different. In regard to the experimental survey technique, one limitation is that, unless present during the process, the researcher cannot confirm that the survey is completed by the selected participant, reducing by that the sample size. In addition, the researcher elected to provide the participants with high-level definitions for all the variables used in the study. In cases where the researcher was not present, the researcher could not confirm that the participants took note of the definitions as described in the questionnaires.

A related limitation was the decision to confine the values the three factors in the hypothetical cases to two possible values: lower or higher. This limitation was imposed by the researcher to keep the survey to a reasonable size. Even allowing the three independent variables to take one more possible value would result in an experiment with 27 scenarios, dramatically increasing the time required to complete the survey and, quite likely, increasing the possibility that fewer auditors would submit fully completed surveys. Two-level factorial experiments are commonly used in research and reported to be effective (Hopkins, 2009; Teoh & Lim, 1996; Wood & Ross, 2006).

As mentioned earlier, EAs were requested to suggest other IA-related variables that might be useful in evaluating decisions to rely on the work of IAs. The variables suggested by the respondents could become the basis for further research, resulting in a more comprehensive understanding of EA decisions to rely on the work of IAs.

This study demonstrated that objectivity, competence, and work performance, independently and in combination, all have a substantial impact on EAs' evaluations of the decisions to rely on the work of IAs. Research can be conducted to assess the current state of IAs' objectivity, competence, and work performance and determine the costs and benefits of various approaches to improving these characteristics at both the organization and national levels. Further research could also be conducted on how to improve the relationship between IAs and EAs, particularly in terms of trust, cooperation, and reliance, while simultaneously protecting the best interests of shareholders and other stakeholders.

ENDNOTES

- 1 Configural information processing is defined by Brown and Solomon (1990, p. 19) as “cognition in which the pattern of stimuli is important to the subsequent judgment/decision.”

- 2 Self-insight, in the context of this study, refers to how aware an auditor is of their own judgment formation processes.

- 3 High-context culture refers to “a culture's tendency to use high context messages over low context messages in routine communication” (Hall, 1976). In a higher context culture, many things are left unsaid, letting the culture explain. Words and word choice become very important in higher context communication, since a few words can communicate a complex message very effectively to an in-group (but less effectively outside that group), while in a low-context culture, the communicator needs to be much more explicit and the value of a single word is less important.

- 4 The Abdel-Khalik et al. (1983) study employed five different factors: (1) integrated test facility, (2) test data, (3) generalized audit software, (4) the level to which the internal auditing department reports (representing the independence and objectivity of IAF), and (5) the IA's level of responsibility in reviewing changes in application programs.

- 5 Ninety auditors from 17 audit firms were selected from the list provided by JACPA (39/90 = 43.3%).

- 6 Self-insight is investigated by correlating and matching the objective outcomes obtained from cue usage (the eight scenarios of the factorial experimental questionnaire) against the subjective weightings that have also been gathered from the participants via the same instrument.

- 7 We used a simple seven-point scale from −3 (substantially lower effectiveness) to +3 (substantially higher effectiveness), with a central neutral point of reference labelled “Same” (i.e., same as in a typical IAF) (Dillman, 2000).

APPENDIX 1: DATA COLLECTION: EXPERIMENTAL SURVEY

Evaluating the efficiency and effectiveness of the internal audit function in Jordanian listed companies

This questionnaire is part of study evaluating the effectiveness of the Internal Audit Function in Jordanian listed companies, as judged by professional external auditors.

Your views will contribute greatly to the level and quality of information being gathered. Please complete all three parts of the questionnaire yourself and without discussion with colleagues.

PART A - The Exercise (8 cases).

Thank you, your input is greatly appreciated

Biographies

Ashraf Al-sukker holds a PhD in auditing from the Australian Catholic University. He taught several accounting and auditing subjects both at the undergraduate and postgraduate levels. His research interests are in auditing and assurance standards, auditing functions, corporate governance, and forensic accounting.

Donald Ross, BBA, MBA, PhD, has a substantial breadth of university teaching expertise, having taught across many topic areas in finance and investments at the undergraduate, postgraduate, executive, and doctoral levels. His professional career in finance has involved financing large capital projects across the globe and advising government agencies. He has also written leading professional texts in both Canada and Australia to guide managers in their export finance activities.

Waleed Abdel-Qader holds a PhD in auditing from the University of Western Sydney. He has a vast experience in teaching accounting and auditing subjects, at undergraduate and postgraduate levels, and supervises research students both at the masters and PhD levels. He has publications in conferences and refereed journals and he is a member of CPA.

Mahmoud Al-Akra holds a PhD in accounting from the University of New England, Australia. He published at international conferences, and his publications have appeared in international refereed academic journals. He has worked in several positions, both professional and academic, and he is a member of a number of professional associations (CPA, IPA, and CMA).