EARLY WITHDRAWALS FROM RETIREMENT ACCOUNTS DURING THE GREAT RECESSION

Abstract

Early withdrawals from retirement accounts are a double-edged sword, because withdrawals reduce retirement resources, but they also allow individuals to smooth consumption when they experience demographic and economic shocks. Using tax data, we show that preretirement withdrawals increased between 2004 and 2010, especially after 2007, but early withdrawal rates are substantial (relative to new contributions) in all those years. Early withdrawal events are strongly correlated with shocks to income and marital status, and lower-income taxpayers are more likely to experience the types of shocks associated with early withdrawals and more likely to have a taxable withdrawal when they experience a given shock. (JEL G23, H24, H31)

ABBREVIATIONS

-

- AGI

-

- Adjusted Gross Income

-

- DB

-

- Defined Benefit

-

- DC

-

- Defined Contribution

-

- IRAs

-

- Individual Retirement Accounts

-

- SCF

-

- Survey of Consumer Finances

-

- SOI

-

- Statistics of Income

I. INTRODUCTION

Defined contribution (DC) pensions have rapidly become the dominant form of employer-sponsored retirement plan in the private sector, and they are becoming increasingly important in the public sector as well.1 Since the onset of the Great Recession and the subsequent period of slow economic growth, the fraction of working-age families with evidence of self-directed retirement accounts and the typical balances for those families with such accounts have declined. Those trends are potentially attributable to loss of employer-sponsored pension coverage at job separation, depressed participation rates for those offered coverage, lower contribution rates by employers and employees, and poor investment returns. Another crucial behavioral decision affecting self-directed retirement accounts, and the subject here, is the potential for increased “leakage” from retirement accounts that occurs when participants take early withdrawals.

Early withdrawals from retirement accounts are a double-edged sword. On the one hand, early withdrawals directly reduce retirement resources, and that may be contributing to the recent declines in self-directed coverage and account balances. However, early withdrawals allow individuals to smooth over demographic and economic shocks, and many younger people would not voluntarily contribute to retirement accounts in the first place if they knew they would be unable to access their funds in an emergency. This tradeoff underlies a key provision in the rules governing early withdrawals from retirement accounts. Funds are generally accessible for early withdrawal, but a 10% penalty in addition to the regular income tax liability applies for most withdrawals made by taxpayers younger than 59½.

The issue of early withdrawals from retirement accounts (in particular, the failure to rollover pension distributions at job change) has been addressed in previous papers.2 However, the importance of preretirement withdrawals is underscored by recent economic turmoil. The Great Recession was associated with significant shocks to employment, household balance sheets, and incomes, and the subsequent economic recovery has been slow and incomplete. For single individuals younger than 55, and for couples where the older of the head or spouse is younger than 55, data from the Survey of Consumer Finances (SCF) show a substantial decline in real retirement account balances between 2007 and 2010.3 Also, both the SCF and Statistics of Income (SOI) indicate that fewer younger families are participating in any type of current employer-sponsored pension or have balances carried forward from previous employer-sponsored coverage or individual retirement account (IRA) contributions.

The first set of questions motivating this paper concern whether early withdrawal behavior changed substantially in the period during and following the Great Recession. To study this, we use SOI cross-sections for 2004 through 2010. We find that among taxpayers who have evidence of pension coverage, the fraction that experienced gross distributions did increase between 2004 and 2010. Also, the ratio of taxable to gross distributions increased, but both trends are modest relative to the withdrawal rates observed in every year during that period. In an important sense, the lack of a prodigious trend in early withdrawal activity between 2004 and 2010 only serves to underscore the fact that early withdrawals are substantial in every year between 2004 and 2010.

The second set of questions motivating this article concern the possible factors associated with early withdrawals, in particular, the effects that demographic and economic shocks have on the probability of observing a taxable withdrawal. Two particular shocks are considered here. First, a taxpayer is said to have experienced a marital shock if they are a nonjoint filer who was a joint filer within the past 2 years, or a joint filer who had a different co-filer in one of the past 2 years. Second, a taxpayer is said to have experienced an income shock if their nonpension income (adjusted gross income [AGI], less taxable pensions, per-capita to adjust for shifts between joint and single filing) fell by more than 10% from the prior year value. In the period we study, about 6% of taxpayers under age 55 with evidence of pension coverage or retirement accounts experienced a negative marital shock, and just over 20% experienced an income shock.

Marital and income shocks both increase the likelihood of observing taxable withdrawals, even after controlling for age, filing status, presence of children, and the level of income itself. The effects of the shocks are significant in various logistic regressions, and the results indicate that income shocks are particularly noteworthy in terms of distributional consequences. That is, lower income taxpayers with evidence of pension coverage or retirement accounts are much more likely to have experienced income shocks, and more likely to have a taxable withdrawal given that they experience the shock. That combination suggests that for any given contribution rate, lower-income families are more likely to experience leakage along the way.

The Great Recession raised the visibility of early withdrawals from retirement accounts as a potential public policy issue, but the circumstances also serve to remind us that preretirement withdrawals may be playing an important role in terms of offsetting economic and demographic shocks.4 Indeed, prior research has shown that the possibility of withdrawals is an important consideration underlying the decision to participate in a retirement plan in the first place, and how much to contribute given participation.5 Thus, it is important to keep in mind that the alternative to allowing preretirement withdrawals is not necessarily higher overall retirement account balances, because contributions may well have been lower in that counterfactual world in which access to retirement accounts would be more limited.6

II. BACKGROUND ON EARLY RETIREMENT ACCOUNT WITHDRAWALS

Self-directed DC retirement accounts became widespread during the past few decades. Most contributions to self-directed accounts occur through 401(k) and other types of workplace saving plans, but distributions from employer-sponsored plans are often rolled directly into IRAs at job separation. Thus, there are three main routes through which preretirement leakage can occur. The first route is in-service withdrawals from active DC plans, the second route is failure to rollover distributions from qualified plans at job separation, and the third route is withdrawals from IRAs or other qualified accounts that are associated with some past job, individual contributions, or rollover.

There are several variants of tax-exempt (or “qualified”) retirement plans that account for the early withdrawals analyzed here. The most common type of self-directed plan is the ubiquitous private sector 401(k) arrangement, in which employers and/or employees make contributions, and the worker has the legal claim to accumulated balances.7 Other variants include public and nonprofit sector 403(b) plans, which are similar to 401(k)s, and various types of employer-sponsored IRA or other saving arrangements. Also, although traditional defined benefit (DB) pension promises are not self-directed accounts per se, many separating employees with vested DB benefits take a lump-sum payout in lieu of receiving benefits later. From a tax perspective, lump-sum payouts from DB plans are effectively the same as DC distributions.

In most qualified retirement plans, contributions are subtracted from current year earned income for purposes of computing current-year income tax, and current-year investment returns are excluded. Later withdrawals from qualified plans, which include both the original contributions and accumulated investment returns, are fully taxable to the participant in the year during which those withdrawals occur. This pattern of deductions and taxes effectively provides consumption-tax treatment on qualified retirement accounts. The exception to the general rule about qualified retirement plans is Roth-type qualified plans. Contributions to Roth plans are not deductible, but withdrawals are not taxed, and that combination provides (ex ante) the economically equivalent consumption-tax treatment as more traditional deductible plans.

Early withdrawals from qualified retirement plans, defined as withdrawals that occur before age 59½, are generally subject to a 10% penalty in addition to the income tax that applies in any year during which a withdrawal occurs. The penalty does not apply in many cases, however, and thus many early withdrawal events are not penalized. The most important exception is for employees age 55 or older who take a withdrawal when they separate from an employer. That situation is likely to be met by many taxpayers taking withdrawals between ages 55 and 59½, and thus, in the empirical work here, we focus on employees who are younger than 55 when they receive the distribution. 8

Many taxpayers younger than 55 receiving withdrawals are exempt from the 10% penalty for other reasons. Taxpayers can get an exemption from the penalty if they take withdrawals for hardship reasons, home purchase, post-secondary education, and even in cases where the taxpayer simply agrees to take “substantially equal” withdrawals for a fixed period of time of at least 5 years. There are also (sometimes inexplicable) differences in the rules that apply to the various types of accounts. For example, if an employee younger than 55 separates from their employer and takes a withdrawal from a qualified 401(k) plan, they will pay the penalty, even if they use the proceeds for (say) education expenses. However, if the same taxpayer first rolls the qualified plan distribution into an IRA (a nontaxable and nonpenalized event) and then subsequently takes withdrawals from that IRA for education expenses, those withdrawals are not subject to penalty.

In short, whether or not a penalty applies to the early withdrawal depends on factors that may or may not be indicative of the “leakage” concept we are trying to capture. Thus, in the empirical work, we consider both taxable withdrawals and penalized withdrawals as alternative measures. Penalized withdrawals are generally about half of taxable withdrawals for the population we study, and the time patterns and estimated effects of income and marital shocks on withdrawals are qualitatively the same for the two measures.

III. MEASURING EARLY WITHDRAWALS FROM RETIREMENT ACCOUNTS

There is no single data source well-suited for studying flows into and out of retirement accounts, and data for measuring early withdrawals is particularly problematic.9 The best survey data source for studying household-level DC retirement plan contributions and retirement account balances in the United States is the triennial Survey of Consumer Finances (SCF), and the SCF also does a good job tracking “regular” pension income from DB plans.10 However, the relatively low frequency of early withdrawal activity means that studying the dominant form of leakage (the failure to roll over “cash settlements” from prior jobs) with the relatively few observations in the SCF involves substantial sampling variability. Also, potential problems with respondent recall and/or interpretation about the meaning of pension distributions leads to reported gross and taxable distributions for preretirees that are below values found in the SOI tax data.

The primary data used here to analyze early withdrawals come from the SOI cross-section data files for the period 2004 to 2010. In order to capture and properly characterize retirement plan distributions, we match information returns associated with retirement plan distributions (Form 1099R) and contributions to IRAs (Form 5498) to the main SOI Form 1040 dataset. We also link prior year 1040s for each observation in the individual SOI cross-sections for 2004 through 2010, in order to construct the income and marital shock variables used to analyze changes in withdrawal behavior over time.11

In principle, if taxpayers always filled in Form 1040 properly, the information returns are not necessary, because the key distinctions for what follows are whether a given gross distribution is ultimately taxable, and if it is taxable, whether it is also penalized. In practice, based on Form 1099R information returns, taxpayers under the age of 55 fail to record about 20% of gross distributions in any given year on Form 1040.12 Most of that nonreporting is inconsequential from a tax perspective, because (for example) a direct rollover to another qualified account has no implications for current-year taxes.

Tracking gross distributions for a given year is the starting point for the analysis of early withdrawals below (Table 1). In 2010, $1,246 billion was paid out of qualified retirement plans, of which, $230 billion went to taxpayers under age 55. Not surprisingly, the lion's share of pension distributions went to people over the age of 55, and most of those distributions (93% of returns and 66% of dollars) are taxable in the current year. Those distributions include payments from traditional DB plans and withdrawals from IRAs or employer-sponsored accounts, so this measure is effectively capturing all forms of qualified retirement income.

| All Returns | Age < 55 | Ages 55+ | ||||

|---|---|---|---|---|---|---|

| Millions of Returns | Billions of Dollars | Millions of Returns | Billions of Dollars | Millions of Returns | Billions of Dollars | |

| Gross distributions | 38.2 | $1,246 | 12.2 | $230 | 26.0 | $1,016 |

| Nontaxable distributions and conversions | 17.7 | 484 | 6.2 | 135 | 11.5 | 349 |

| Direct rollovers to other qualified accounts | 4.0 | 292 | 2.3 | 92 | 1.7 | 199 |

| Indirect rollovers to other qualified accounts | 0.6 | 41 | 0.3 | 12 | 0.2 | 29 |

| Nontaxable distributions from Roth accounts | 0.3 | 4 | 0.1 | 0 | 0.2 | 4 |

| Return of after-tax contributions to qualified accounts | 9.1 | 57 | 1.4 | 11 | 7.7 | 46 |

| Section 1035 exchanges | 0.3 | 22 | 0.1 | 3 | 0.2 | 20 |

| Roth conversions | 0.5 | 41 | 0.2 | 11 | 0.3 | 31 |

| Other nontaxable distributions | 1.1 | 27 | 0.2 | 6 | 0.9 | 21 |

| Net taxable distributions | 32.2 | 762 | 7.9 | 95 | 24.3 | 667 |

| Nonpenalized | 28.9 | 704 | 5.0 | 48 | 23.9 | 656 |

| Penalized | 5.7 | 58 | 4.9 | 47 | 0.8 | 10 |

| Addendum | ||||||

| Taxable as a percent of gross (%) | 84 | 61 | 65 | 41 | 93 | 66 |

| Penalized as a percent of gross (%) | 15 | 5 | 40 | 21 | 3 | 1 |

Note that the concept of early withdrawals focused on here excludes conversions from qualified before-tax IRAs and pensions into Roth accounts. Those types of conversions surged in 2010 after Congress changed the income limits and method for allocating the tax liability over multiple years. Roth conversions are of course taxable events, but they do not represent what one thinks of as “leakage” from retirement accounts. As Table 1 shows, Roth conversions are concentrated among relatively few taxpayers, most of whom have large accounts. In what follows, the concept of taxable withdrawals less Roth conversions is referred to as “net taxable” withdrawals.

The focus of this article is on early withdrawals, so we concentrate on the group of taxpayers younger than 55. Of the $230 billion we estimate that was paid out in gross distributions in 2010, 41% was (net) taxable in the current year, and 21% was subject to penalty. The gap between the taxable and penalized amounts arises because there are situations in which taxpayers under the age of 55 can access funds without penalty, including certain hardship situations, new home purchase, and education. However, we cannot rule out the possibility that some of these distributions are from DB plans, inherited accounts, or other situations where penalties would not apply.

Among the 12.2 million taxpayers younger than 55 who received gross distributions in 2010, 6.2 million had nontaxable distributions, and 7.9 million had net taxable distributions. The sum of taxable and nontaxable returns (14.1 million) exceeds the number of returns with gross distributions, but that is because many returns have partially taxable distributions. Given receipt of a gross distribution, many taxpayers chose to rollover part of the balance, but also to cash-out part of the distribution.

Are these early withdrawal rates quantitatively important? In order to benchmark the withdrawal rates we focus on the group of taxpayers for whom early withdrawals is even an option, the reference group referred to throughout this article as “having evidence of pension coverage” either past or present. In the SOI tax data, evidence of coverage comes from the presence of gross distributions on Form 1099-R or Form 1040, checking of the “pension coverage” box on Form W2, and IRA contributions on Form 5498. Given that definition, the SOI shows that 54% of taxpayers under the age of 55 had evidence of coverage or retirement account balances of some kind in 2010.

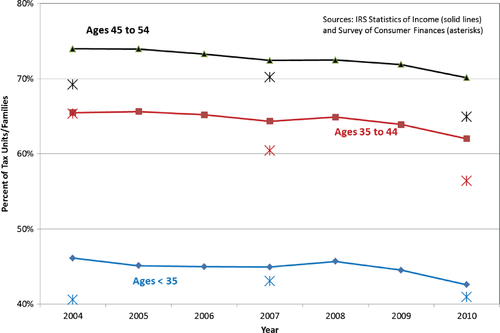

One can construct a comparable measure of pension evidence using the SCF. Families are flagged as having evidence of pension coverage if they carry a balance in an IRA account, if they reported a withdrawal from a current or future pension plan including 401ks and IRAs, reported a cash settlement in the survey year or the year prior, if the household reports current pension coverage, or if the household reports receiving income from a pension plan. In 2010, the SCF shows that 53% of families under age 55 had evidence of coverage. Indeed, the patterns of coverage in the SOI and SCF are comparable across age subgroups (less than 35, 35–44, and 45–54) and over the 6-year period 2004 to 2010 (Figure 1).

In 2010, the SOI tax data show that about one-fourth of the taxpayers younger than 55 who had evidence of current pension coverage or retirement balances from past contributions experienced a gross distribution. Among those taxpayers experiencing a gross distribution, two-thirds of the taxpayers had a net taxable distribution, and 40% had a penalized distribution. In terms of dollars, 41% of the gross distribution amounts were net taxable in 2010, and 21% of the gross distributions were penalized.

Using the ratio of net taxable to gross distributions as a measure of early withdrawal propensity, one can say that in 2010 about two-thirds of taxpayers experiencing a gross distribution received at least some of the available funds as an early withdrawal, and just over 40% of gross distribution amounts leaked out of retirement accounts. These results are consistent with the existing literature in the sense that the SOI shows at least some leakage for most taxpayers when a gross distribution event occurs but at the same time most dollars are preserved (rolled over to another qualified account) when a gross distribution event occurs.

IV. EARLY WITHDRAWALS IN THE ERA OF THE GREAT RECESSION

According to both SOI and SCF data, evidence of current pension coverage and/or retirement account balances for the population younger than 55 has trended down in recent years (Figure 1). This trend is potentially attributable to factors such as the loss of employer-sponsored pension coverage at job separation, depressed participation rates for those who are offered coverage, lower contribution rates by employers and employees who choose to participate, and poor returns on investments. The results of the last section suggest that early withdrawals may also be a quantitatively important part of the story. In this section, we consider trends in early withdrawals across the period leading up to, during, and subsequent to the Great Recession, using data from 2004 through 2010. Although there is evidence of increased early withdrawal activity over time, the dominant impression is a moderate trend on top of generally substantial early withdrawal activity throughout the entire period.

There are two distinct channels of causality that may have led to an increase in early withdrawal activity. Early withdrawals might have risen because the opportunity for access to funds expanded if increased job separations in the latter period led to an increase in the incidence of gross distributions. Or, early withdrawals may have risen because the propensity to cash-out a given gross distribution or take a withdrawal increased. Evidence for the first possibility would generally show up as an increase in gross distributions, and evidence for the second possibility would generally show up as an increase in the ratio of taxable to gross distributions.

Early withdrawal activity trended upwards in the 2004 to 2010 period, and there is evidence for both increased opportunity to take withdrawals and increased propensity to access funds given the opportunity (Tables 2 and 3). Both increases are best described as modest, however, and the increases in gross distributions are slow and steady over the 6-year period, which is not consistent with changing economic circumstances after the onset of the Great Recession. There is some evidence that the propensity to cash out a given gross distribution did increase after 2007, however.

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|

| Number of tax units | 89.8 | 90.8 | 92.4 | 95.3 | 94.3 | 93.1 | 95.3 |

| Tax units with evidence of retirement accounts or pension coverage | 52.4 | 52.7 | 53.1 | 54.2 | 54.0 | 52.3 | 51.7 |

| Percent of all tax units (%) | 58.4 | 58.0 | 57.5 | 56.9 | 57.2 | 56.2 | 54.3 |

| Tax units with gross distributions | 11.0 | 10.9 | 11.4 | 11.9 | 12.1 | 11.9 | 12.2 |

| Percent of all tax units (%) | 12.2 | 12.0 | 12.4 | 12.4 | 12.8 | 12.8 | 12.8 |

| Percent of tax units with retirement accounts or pension coverage (%) | 20.9 | 20.6 | 21.5 | 21.9 | 22.4 | 22.8 | 23.6 |

| Tax units with net taxable distributions | 7.0 | 6.9 | 7.1 | 7.4 | 7.4 | 7.5 | 7.9 |

| Percent of all tax units (%) | 7.8 | 7.6 | 7.6 | 7.8 | 7.8 | 8.1 | 8.3 |

| Percent of tax units with retirement accounts or pension coverage (%) | 13.3 | 13.2 | 13.3 | 13.7 | 13.6 | 14.4 | 15.4 |

| Percent of tax units with gross distributions (%) | 63.7 | 63.8 | 61.7 | 62.7 | 60.8 | 63.0 | 64.9 |

| Tax units with penalized distributions | 4.2 | 4.1 | 4.3 | 4.6 | 4.6 | 4.8 | 4.9 |

| Percent of all tax units (%) | 4.7 | 4.5 | 4.6 | 4.8 | 4.9 | 5.1 | 5.1 |

| Percent of tax units with retirement accounts or pension coverage (%) | 8.0 | 7.7 | 8.0 | 8.4 | 8.6 | 9.2 | 9.4 |

| Percent of tax units with gross distributions (%) | 38.2 | 37.3 | 37.2 | 38.4 | 38.4 | 40.2 | 39.7 |

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|

| Total gross distributions | $170.0 | $183.0 | $206.4 | $218.6 | $209.6 | $181.4 | $229.8 |

| Percent of total adjusted gross income (%) | 3.6 | 3.7 | 3.9 | 3.9 | 3.8 | 3.6 | 4.3 |

| Total net taxable distributions | $64.8 | $66.9 | $72.9 | $77.9 | $81.0 | $81.0 | $94.8 |

| Percent of total adjusted gross income (%) | 1.4 | 1.3 | 1.4 | 1.4 | 1.5 | 1.6 | 1.8 |

| Percent of gross distributions (%) | 38.1 | 36.6 | 35.3 | 35.6 | 38.6 | 44.7 | 41.3 |

| Total penalized distributions | $29.7 | $30.9 | $35.2 | $39.9 | $42.4 | $42.3 | $47.3 |

| Percent of total adjusted gross income (%) | 0.6 | 0.6 | 0.7 | 0.7 | 0.8 | 0.8 | 0.9 |

| Percent of gross distributions (%) | 17.5 | 16.9 | 17.0 | 18.2 | 20.2 | 23.3 | 20.6 |

- Notes: All tax unit counts are reported in millions, age based on older of primary or secondary for joint returns, excludes dependent filers. Net taxable distributions are all taxable distributions less Roth conversions.

- Source: IRS SOI.

In 2004, 20.9% of taxpayers younger than 55 with evidence of pension coverage or retirement account balances experienced a gross distribution, and that fraction grew to 23.6% in 2010 (Table 2). The increase was slow and steady over the period, however, with 21.9% of taxpayers in the relevant group experiencing a gross distribution in 2007, the last calendar year before the Great Recession. In terms of dollars, the ratio of gross distributions to AGI grew from 3.6% in 2004 to 4.3% in 2010, but again, almost half of that increase occurred before the recession began (Table 3).

The time pattern of net taxable withdrawals is different, however, especially when benchmarked against gross distributions in order to characterize how behavior with respect to accessible funds might have changed. In 2004, 63.7% of taxpayers failed to preserve at least part of their gross distribution in qualified accounts, and 37.0% of the dollars were net taxable. Both of those ratios fell modestly between 2004 and 2007, by which time only 62.7% of taxpayers with gross distributions took at least some of the money in net taxable form, and 38.1% of the dollars were net taxable. Both ratios then increased with the onset of the recession, and by 2010, the ratios of net taxable to gross distributions were 64.9% for the number of returns, and 41.3% for the amount in dollars.

The time patterns for incidence and amounts of penalized withdrawals largely mirror that of net taxable withdrawals, with penalized generally running about half net taxable in terms of both numbers of returns and dollars in every year. Penalized withdrawals exhibit a somewhat steadier upward trend over the entire 7-year period from 2004 to 2011, however, and thus the trends in the periods before and after 2007 do not appear quite as different.

V. FACTORS ASSOCIATED WITH EARLY WITHDRAWALS

The uptick in early withdrawals from retirement accounts between 2004 and 2010 suggests that economic shocks may be playing some role in the decision by younger families to tap into their retirement resources. In this section, we investigate that proposition directly, by constructing a measure of micro-level “income shocks,” and showing that measure is strongly associated with early withdrawals. We also construct a measure of negative “marital shocks,” and show that too has a quantitatively important (but much smaller) effect on taxable withdrawals. These effects hold even after controlling for the level of income and basic demographics. Interactions between the shocks, income levels, and heterogeneous effects of shocks (by income) on taxable withdrawals come together to help to explain why lower-income families are less likely to ultimately accumulate retirement balances for any given level of contributions.13

Constructing measures of income and marital shocks obviously requires changes over time, and we adopt a novel empirical strategy for measuring those changes using tax data. We begin with the same SOI cross-section data used to study trends in the last section, and then access IRS population data in order to get the lagged values for incomes and other variables needed to construct the shocks for the taxpayers in the sample. Advantages of this pooled cross-section approach (relative to building a panel and tracking a fixed group of taxpayers over time) include maintaining representative cross-sections and being able to look at changes over time from the perspective of both the primary and (on joint returns) secondary filers. The sample we use has roughly 806,000 observations for the relevant (under 55 and has evidence of pension coverage or retirement account) population.

The specific income shock measure constructed for these experiments is a decline in (nonpension) AGI by 10% or more between 2009 and 2010.14 Because we are working with a population that has some single filers and some joint filers, we construct a per-capita (actually, per-filer) income measure for the purpose of computing changes. The per-capita income measure excludes taxable pensions, because we want to capture the event that triggers a taxable withdrawal. In the SOI data in a typical year during our sample period, something like 20% of the less than 55 population with evidence of pension coverage or retirement accounts experienced the income shock generated by these criteria.15

The specific marital shock measure used in this analysis is constructed to capture recent divorce, separation, or widowing, which we think of as “negative” marital shocks, because the taxpayer is likely to have experienced a net reduction in resources. Nonjoint filers in each year who filed jointly in the 2 years prior, and joint filers who filed with a different co-filer in the 2 years prior, are characterized as having experienced a negative marital shock. Using those criteria, we find that just under 6% of the population we are studying experienced a negative marital shock in the 2004 through 2010 period.16

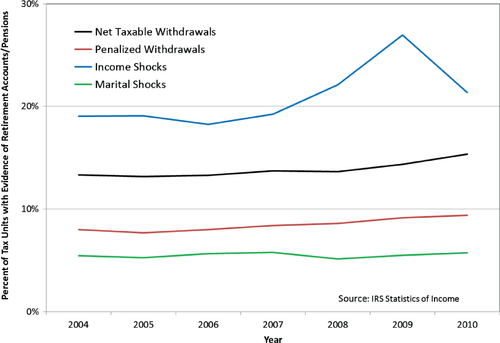

Not surprisingly, the income shock measure constructed using lagged Form 1040 data has a strong cyclical component, while the marital shock measure does not (Figure 2). The overall rates of net taxable and penalized withdrawals are reproduced from Table 2, and both show the modest upward trends as described above. The incidence of marital shocks is effectively flat across the 7-year period. The incidence of income shocks is the one substantially cyclical variable shown in Figure 2, rising dramatically in 2008 and peaking in 2009, before declining again in 2010 but remaining above prerecession levels.

Before investigating the role of income and marital shocks in explaining taxable withdrawals, it is useful to first look at how the shocks vary with income levels. The first column in each panel of Table 4 shows the incidence of income and marital shocks by current (per-capita, nonpension) income. The incidence of income shocks is greatly skewed towards the bottom, which makes sense, because taxpayers who experienced a large reduction in (nonpension) income during the past year are obviously more likely to show up at the bottom of the current (nonpension) income distribution, even if they offset their reduced income by taking a taxable withdrawal. The incidence of marital shocks is much more evenly distributed across income groups.

| Percent with Income Shocks | Percent with Marital Shocks | |||

|---|---|---|---|---|

| Income Decile | Tax Units Sorted by Current Year Income (%) | Tax Units Sorted by 3-Year Average Income (%) | Tax Units Sorted by Current Year Income (%) | Tax Units Sorted by 3-Year Average Income (%) |

| 1 | 55.6 | 31.3 | 6.4 | 5.2 |

| 2 | 32.1 | 25.4 | 5.6 | 5.7 |

| 3 | 23.3 | 22.6 | 5.4 | 5.9 |

| 4 | 19.0 | 20.5 | 5.5 | 6.1 |

| 5 | 15.9 | 18.9 | 5.3 | 5.7 |

| 6 | 13.3 | 17.5 | 5.2 | 5.7 |

| 7 | 12.3 | 16.3 | 5.5 | 5.4 |

| 8 | 11.7 | 16.3 | 5.2 | 5.2 |

| 9 | 11.2 | 17.2 | 5.7 | 5.5 |

| 10 | 14.1 | 22.5 | 5.4 | 4.6 |

| All | 20.8 | 20.8 | 5.5 | 5.5 |

- Notes: Income shocks and income for sorting based on per capita AGI less taxable pensions. Population is all tax units with evidence of pension coverage or retirement accounts. Income shock is defined as a decline of 10% or more below the previous year value. Marital shock is defined as a movement from joint to nonjoint filing or filing with a different co-filer within past 2 years.

- Source: IRS SOI.

The correlation between income shock and current-year income level motivates an alternative income classifier for both looking at the distribution of shocks and to use as the primary control variable for income levels in the withdrawal equations estimated below. The alternative measure is a 3-year average of income (same per-capita nonpension measure) including the current year and two lag values. As when measuring income change, the 3-year average accounts for changes in within-person filing status by dividing any joint return values by two. For example, a single person in, for example, 2010 with AGI of $25,000 who was married in 2009 and had AGI of $50,000 would show up in this measure as having experienced no income change.

As expected, the average income classifier does shift more of the income shock incidence away from the bottom of the distribution, but it is still clear that lower-income families are more likely to have experienced income shocks than the middle of the distribution, by a factor of almost two to one. Interestingly, the incidence of negative income shocks for the highest income decile exceeds the incidence in the middle of the distribution, especially when taxpayers are classified using the 3-year average income. The distribution of marital shocks across income groups changes only slightly under the new classifier.

These observations about the relationship between incidence of shocks and income levels are important for two reasons. First, if experiencing income and/or marital shocks leads to increased early withdrawal activity, and shocks are more likely to be experienced by particular income groups, that will help explain why taxable withdrawals differ across income groups. Second, it is possible there is an additional correlation between the probability of shock response and income level given that a shock occurs, for example, lower-income taxpayers may be more likely than higher-income taxpayers to respond to a given shock by accessing their retirement accounts. Exploring both possibilities requires clarity about the income classifier being used to make the inference.

The framework used to disentangle the possible inter-relationships between income levels and the various shocks is a logistic regression of net taxable (or penalized) withdrawal incidence on some basic controls, income levels, and income interacted with both types of shocks. The population is, as above, taxpayers under the age of 55 with evidence of pension coverage or retirement account balances. The basic controls are six dummies for age and filing status (less than 35, 35 to 44, and 45 to 54, interacted with joint and nonjoint filing), presence of kids (home and away from home separately), and a full set of interactions between dummies for the 10 income deciles and the two shocks. Finally, all of the equations include year dummies for 2005 through 2010, to capture residual changes over time. The regressions are estimated first using the current income concept, and then again using the 3-year average measure.

The coefficients for the four logistic early withdrawal equations are shown in Table 5. Virtually all of the estimated coefficients are statistically significant at the 1% level, so only the two exceptions (where the coefficients are essentially zero) are flagged as insignificant in the table. Coefficients are all of the expected signs—for example, the presence of children increases the likelihood of withdrawals, all else constant. However, the interaction terms used to capture shock-response heterogeneity means that computing the marginal effect of experiencing, for example, an income shock, varies by income level itself, and thus requires (for all but the omitted income group) summing two coefficients. That is, the total response is the sum of the income shock coefficient and the income shock interaction term for that particular income decile.

| Dependent Variable and Income Classifier | ||||

|---|---|---|---|---|

| Net Taxable Withdrawals | Penalized Withdrawals | |||

| Independent Variables (Dummies) | Current Income | 3-Year Average Income | Current Income | 3-Year Average Income |

| Joint return, Age < 35 | −2.559 | −2.521 | −3.148 | −3.126 |

| Single return, Age < 35 | −2.931 | −2.880 | −3.489 | −3.454 |

| Joint return, Age 35–44 | −2.285 | −2.272 | −3.027 | −3.027 |

| Single return, Age 35–44 | −2.514 | −2.486 | −3.179 | −3.168 |

| Joint return, Age 45–54 | −1.998 | −1.983 | −3.169 | −3.166 |

| Single return, Age 45–54 | −2.211 | −2.174 | −3.227 | −3.207 |

| Kids at home | 0.042 | 0.037 | 0.171 | 0.169 |

| Kids away | 0.244 | 0.226 | 0.259 | 0.244 |

| Income shock | 0.286 | 0.568 | 0.103 | 0.493 |

| Marital shock | 0.424 | 0.337 | 0.473 | 0.398 |

| Income × Marital shock | −0.208 | −0.179 | −0.129 | −0.156 |

| Income decile 1 | 0.499 | 0.285 | 0.577 | 0.397 |

| Income decile 2 | 0.198 | 0.127 | 0.481 | 0.424 |

| Income decile 3 | 0.222 | 0.222 | 0.532 | 0.552 |

| Income decile 4 | 0.280 | 0.256 | 0.606 | 0.603 |

| Income decile 5 | 0.232 | 0.205 | 0.555 | 0.545 |

| Income decile 6 | 0.229 | 0.234 | 0.543 | 0.550 |

| Income decile 7 | 0.163 | 0.151 | 0.429 | 0.445 |

| Income decile 8 | 0.095 | 0.121 | 0.356 | 0.383 |

| Income decile 9 | 0.074 | 0.044 | 0.261 | 0.242 |

| Income decile 1 × Income shock | 0.798 | 0.388 | 0.797 | 0.272 |

| Income decile 2 × Income shock | 0.871 | 0.672 | 0.940 | 0.559 |

| Income decile 3 × Income shock | 0.864 | 0.622 | 0.899 | 0.516 |

| Income decile 4 × Income shock | 0.769 | 0.605 | 0.701 | 0.446 |

| Income decile 5 × Income shock | 0.754 | 0.672 | 0.680 | 0.491 |

| Income decile 6 × Income shock | 0.739 | 0.615 | 0.720 | 0.435 |

| Income decile 7 × Income shock | 0.652 | 0.670 | 0.587 | 0.483 |

| Income decile 8 × Income shock | 0.642 | 0.510 | 0.563 | 0.375 |

| Income decile 9 × Income shock | 0.517 | 0.538 | 0.455 | 0.369 |

| Income decile 1 × Marital shock | −0.113 | −0.093 | −0.362 | −0.362 |

| Income decile 2 × Marital shock | −0.121 | −0.029 | −0.341 | −0.288 |

| Income decile 3 × Marital shock | −0.162 | −0.152 | −0.358 | −0.272 |

| Income decile 4 × Marital shock | −0.141 | −0.056 | −0.302 | −0.266 |

| Income decile 5 × Marital shock | −0.269 | 0.000* | −0.277 | −0.135 |

| Income decile 6 × Marital shock | −0.276 | −0.241 | −0.498 | −0.308 |

| Income decile 7 × Marital shock | −0.155 | −0.082 | −0.266 | −0.141 |

| Income decile 8 × Marital shock | −0.034 | 0.049 | −0.051 | −0.034 |

| Income decile 9 × Marital shock | −0.062 | −0.008 | −0.093 | −0.098 |

| Year = 2005 | −0.017 | −0.018 | −0.042 | −0.045 |

| Year = 2006 | 0.009 | 0.009 | 0.014 | 0.013 |

| Year = 2007 | 0.041 | 0.038 | 0.064 | 0.061 |

| Year = 2008 | 0.006 | −0.001* | 0.067 | 0.061 |

| Year = 2009 | 0.007 | −0.006 | 0.087 | 0.076 |

| Year = 2010 | 0.153 | 0.148 | 0.168 | 0.163 |

| Pseudo R2 | 0.056 | 0.053 | 0.033 | 0.032 |

- Notes: Authors' estimates based on 2004 through 2010 SOI data. Net taxable withdrawals exclude Roth conversions. Population is taxpayers younger than 55 with evidence of pension coverage, as defined in text, N = 805,956. All reported coefficients significant at greater than the 1% level, except * indicates not significantly different from zero at the 10% level.

Rather than focus directly on estimated coefficients, the approach here for describing the results is to compute and compare predicted withdrawal rates by income decile across various combinations of income and marital shocks (Tables 6, 7, and 8). The logistic withdrawal equations are essentially a type of reduced-form tabular analysis, because all of the independent variables are dummies. Thus, we compute predicted withdrawal rates for every unique cell as defined by the dummy variables, and then compute weighted averages of the predicted probabilities for the aggregated groups of interest.

| Income Decile | All Tax Units (%) | Neither Income or Marital Shock (%) | Just Income Shock (%) | Just Marital Shock (%) | Both Income and Marital Shocks (%) |

|---|---|---|---|---|---|

| 1 | 23 | 12 | 31 | 16 | 31 |

| 2 | 15 | 10 | 26 | 12 | 26 |

| 3 | 14 | 10 | 28 | 11 | 26 |

| 4 | 14 | 11 | 28 | 13 | 26 |

| 5 | 13 | 11 | 27 | 11 | 23 |

| 6 | 13 | 11 | 27 | 11 | 22 |

| 7 | 12 | 11 | 24 | 12 | 23 |

| 8 | 12 | 10 | 23 | 13 | 24 |

| 9 | 11 | 10 | 21 | 12 | 21 |

| 10 | 11 | 10 | 13 | 13 | 14 |

| All | 13 | 10 | 23 | 11 | 22 |

- Notes: Income shocks and income for sorting based on per capita AGI less taxable pensions. Population is all tax units with evidence of pension coverage or retirement accounts. Income shock is defined as a decline of 10% or more relative to the prior year value. Marital shock is defined as a movement from joint to nonjoint filing or joint filing with a different co-filer within past 2 years. Withdrawal rates shown are based on a logistic equation controlling for age, filing status, presence of children, dummies for income deciles, full interactions between income and marital shocks and income decile dummies, and year dummies. Estimated parameters are shown in Table 5.

- Source: IRS SOI.

| Income Decile | All Tax Units | Neither Income or Marital Shock | Just Income Shock | Just Marital Shock | Both Income and Marital Shocks |

|---|---|---|---|---|---|

| 1 | 14 | 10 | 24 | 12 | 24 |

| 2 | 13 | 9 | 26 | 11 | 27 |

| 3 | 14 | 10 | 28 | 11 | 26 |

| 4 | 15 | 11 | 29 | 13 | 29 |

| 5 | 15 | 11 | 30 | 13 | 31 |

| 6 | 15 | 11 | 30 | 11 | 25 |

| 7 | 14 | 11 | 30 | 12 | 28 |

| 8 | 13 | 11 | 27 | 13 | 28 |

| 9 | 13 | 10 | 26 | 12 | 26 |

| 10 | 12 | 10 | 17 | 12 | 18 |

| All | 13 | 9 | 25 | 11 | 24 |

- Notes: Income shocks and income for sorting based on per capita AGI less taxable pensions. Population is all tax units with evidence of pension coverage or retirement accounts. Income shock is defined as a decline of 10% or more relative to the prior year value. Marital shock is defined as a movement from joint to nonjoint filing or joint filing with a different co-filer within past 2 years. Withdrawal rates shown are based on a logistic equation controlling for age, filing status, presence of children, dummies for income deciles, full interactions between income and marital shocks and income decile dummies, and year dummies. Estimated parameters are shown in Table 5.

- Source: IRS SOI.

| Income Decile | All Tax Units (%) | Neither Income or Marital Shock (%) | Just Income Shock (%) | Just Marital Shock (%) | Both Income and Marital Shocks (%) |

|---|---|---|---|---|---|

| 1 | 8 | 6 | 12 | 6 | 11 |

| 2 | 9 | 6 | 17 | 7 | 15 |

| 3 | 10 | 7 | 18 | 8 | 17 |

| 4 | 10 | 8 | 18 | 8 | 17 |

| 5 | 10 | 8 | 18 | 9 | 18 |

| 6 | 9 | 8 | 17 | 8 | 15 |

| 7 | 9 | 7 | 17 | 8 | 17 |

| 8 | 8 | 7 | 15 | 9 | 16 |

| 9 | 7 | 6 | 13 | 7 | 14 |

| 10 | 5 | 5 | 8 | 6 | 9 |

| All | 8 | 6 | 14 | 7 | 14 |

- Notes: Income shocks and income for sorting based on per capita AGI less taxable pensions. Population is all tax units with evidence of pension coverage or retirement accounts. Income shock is defined as a decline of 10% or more relative to the prior year value. Marital shock is defined as a movement from joint to nonjoint filing or joint filing with a different co-filer within past 2 years. Withdrawal rates shown are based on a logistic equation controlling for age, filing status, presence of children, dummies for income deciles, full interactions between income and marital shocks and income decile dummies, and year dummies. Estimated parameters are shown in Table 5.

- Source: IRS SOI.

The income and marital shock measures are strongly correlated with the probability of a net taxable withdrawal. Between 2004 and 2010, 13% of tax units overall in the population being studied had net taxable withdrawals (bottom row of Table 6), but among those experiencing neither a marital or income shock, the predicted incidence from the logistic equation based on the current income classifier is 10%. Among those experiencing just the income shock, the predicted incidence of early withdrawal is 23%, and among those experiencing just the marital shock, the overall predicted incidence is 11%. The predicted incidence for taxpayers experiencing both income and marital shocks is 22%, suggesting a slight negative correlation in the responses.

The goal of interacting the shock measures with income is to allow for heterogeneous responses across income groups. Absent any shocks, taxpayers in the lowest income decile are more likely than others to take an early withdrawal, at a predicted incidence of 12% (relative to 10% for the entire population). The lowest income group is also more likely than other income groups to take a net taxable withdrawal when they experience an income shock, at 31%. However, the effect of income shocks is large and consistent across all income groups, with the predicted incidence of net taxable withdrawals more than doubling when income shocks occur (seen by computing the ratio of the “just income” shock column to the “no shock” column) for every group except the highest income decile.

Although marital shocks also raise the probability of withdrawal, the overall effect is smaller, and the relative effects across income groups are more similar. Marital shocks alone generally raise withdrawal probabilities by about 20%. The effect of concurrent income and marital shocks is dominated by the income shock, and thus the joint-shocks column looks much like the “just income” shock column.

The results are more muted when looking at withdrawal responses across taxpayers classified by the 3-year average income measure (Table 7). Predicted withdrawals absent any shocks are much flatter across income deciles, with a slight hump-shape of higher withdrawal rates in the middle income groups. This carries through to the shock-response columns. As before, the relative effects of the shocks is similar across income groups, with income shocks more than doubling withdrawal probabilities and marital shocks raising probabilities by about 20%. Also, as with the current income classifier, the top income decile is the least responsive to shocks, which is expected given that taxable withdrawals are being used to fund current purchases, and higher-income families are less likely to need retirement funds to meet those needs.

The results for penalized withdrawals are essentially the same as for net taxable withdrawals, but the predicted withdrawal rates are about half the values for net taxable across average income groups and shock incidence (Table 8). The dominant impression is again a slight hump-shape in predicted withdrawals across 3-year average income deciles, a rough doubling of penalized withdrawal rates when taxpayers experience income shocks (though again with a muted effect for the highest income decile) and a roughly 20% increase in withdrawal rates when taxpayers experience marital shocks.

Unexplained differences in withdrawal activity across the years 2004 through 2010 are captured by the year dummies, and in general these are statistically significant, but relatively small when compared to the effects of control variables of interest (Table 5). For net taxable withdrawals, the two outlier years are 2007 and 2010, with the dummy for 2010 in particular indicating higher overall unexplained withdrawal rates. But even the 2010 year dummy coefficient (approximately 0.15 and consistent across the two specifications) is small relative to the total-marginal coefficient associated with income shocks in the middle of the distribution, which is something like 1.0 to 1.2 after summing the two relevant coefficients.17 This observation about the relative magnitude of income shock effects and residual year dummies has a clear connection back to Figure 2, because the incidence of income shocks fell between 2009 and 2010, yet the incidence of net taxable withdrawals went up.18

Though relatively small, these findings about residual year dummies are suggestive that some other unobserved business cycle or trend effects are affecting early withdrawal rates over time. Interestingly, those unexplained increases in residual effects occur for the year (2007) just prior to the onset of the Great Recession, and for the first year (2010) that labor markets had begun to recover. The relatively lower unexplained withdrawal rates in 2008 and 2009 may be attributable to poor investment returns, if, for example, taxpayers experiencing financial losses on their retirement accounts are more averse to taking withdrawals. This is obviously an area for future research, but the well-known connection between job change and retirement account withdrawals offers one clue worth pursuing. When job turnover slowed dramatically in 2008 and 2009, normal access to retirement accounts at job change was necessarily diminished, and that may explain why unexplained early withdrawal propensities declined.

VI. NET CONTRIBUTIONS TO RETIREMENT ACCOUNTS IN THE ERA OF THE GREAT RECESSION

The size of the increase in early withdrawal activity between 2004 and 2010 reported above does not seem particularly large relative to the average withdrawal rates in any given year during the period. There is an upward trend, but the dominant impression one sees is that early withdrawal rates and early withdrawal amounts are substantial in every year, and not just a phenomenon associated with the shocks to economic activity that occurred after 2007. This seems somewhat contradictory to the premise motivating this paper, that an increase in early withdrawals because of economic shocks may be an important factor for explaining observed decreases in retirement account balances during the 2007 to 2010 period.

SOI tax data are useful for studying early withdrawals, but the data are limited in terms of studying contributions and account balances, so we turn to the SCF in order to help put the early withdrawal trends in perspective.19 The SCF collects data on both employer and employee contributions to DC-type pension plans, and overall balances and gross contribution amounts in the SCF micro data benchmark quite well against available aggregate control totals (Form 5500, federal TSP, and other sources). There are three SCF surveys that overlap the SOI data period, in 2004, 2007, and 2010. Thus, we can construct a measure of “net contributions” in each year using the aggregated contribution amounts from the SCF and the aggregated taxable withdrawal amounts from the SOI.20

On the basis of the SCF data for 2010, the early withdrawals reported above amount to roughly 1.3% of total labor income for the younger than 55 age group (Table 9).21 When thinking about changes in balances, however, it also helps to benchmark early withdrawals against the value of total new gross contributions for the same age group. Based on the SCF, total new contributions amounted to 3.2% of total labor income for the younger than 55 age group in 2010. Thus, for every dollar that was contributed, roughly 40 cents (1.3% of labor income relative to 3.2% of labor income) flowed back out of accounts through early distributions. In addition, total early withdrawals amounted to just under 3% of account balances in 2010. Thus, at least in 2010, early withdrawals are quantitatively important in terms of the effect on the overall retirement account accumulation process.

| 2004 | 2007 | 2010 | |

|---|---|---|---|

| All tax units/Families Age < 55 | |||

| Retirement contributions as a fraction of labor income | 3.5% | 3.4% | 3.2% |

| Taxable distributions as a fraction of labor income | 1.0% | 1.1% | 1.3% |

| Net contributions as a fraction of labor income | 2.5% | 2.3% | 1.8% |

| Tax units/Families age 45–54 | |||

| Retirement contributions as a fraction of labor income | 3.8% | 3.8% | 3.6% |

| Taxable distributions as a fraction of labor income | 1.0% | 1.1% | 1.3% |

| Net contributions as a fraction of labor income | 2.8% | 2.7% | 2.3% |

| Tax units/Families age 35–44 | |||

| Retirement contributions as a fraction of labor income | 3.6% | 3.4% | 3.1% |

| Taxable distributions as a fraction of labor income | 1.5% | 1.6% | 2.0% |

| Net contributions as a fraction of labor income | 2.1% | 1.8% | 1.1% |

| Tax units/Families age < 35 | |||

| Retirement contributions as a fraction of labor income | 2.9% | 2.6% | 2.4% |

| Taxable distributions as a fraction of labor income | 0.8% | 0.9% | 1.1% |

| Net contributions as a fraction of labor income | 2.1% | 1.7% | 1.4% |

- Notes: Age based on older of primary or secondary for joint returns, excludes dependent filers.

- Source: IRS SOI and SCF.

The net contribution to self-directed retirement accounts is the gap between gross contributions and early withdrawals, and that measure fell substantially for all age groups younger than 55 in the 2004 to 2010 period, with much of the decline coming after 2007 (Table 9). The overall net retirement contribution rate for the less than 55 age group fell from 2.5% of labor income in 2004 to 2.3% in 2007 before reaching 1.8% in 2010. As noted above, early withdrawals are roughly 40% of new contributions in 2010, and less than 30% in 2004, so there has been an increase in the withdrawal to contributions ratio. In summary, the overall decline in net contributions is attributable to both lower contributions and increased early withdrawals, with most of the change occurring between 2007 and 2010.

VII. CONCLUSIONS

Early withdrawals from retirement accounts increased during the Great Recession and its aftermath, but to some extent the trend seems modest in perspective, because early withdrawal activity was substantial in every year between 2004 and 2010. In 2004, about 13.3% of taxpayers under age 55 with evidence of pension coverage or retirement account balances experienced a taxable retirement account distribution, and early withdrawals amounted to 1.4% of AGI for that group. The fraction with early withdrawals rose to 15.4% in 2010, and the dollar values to 1.8% in 2010. These trends in rising early withdrawals were reinforced by declining contributions and poor investment returns, and as a result, average retirement account balances fell.

Lifecycle theory suggests that rational agents will access accumulated asset balances when they experience particular types of income or demographic shocks, and the analysis here confirms that both principles are important. For example, the buffer-stock saving model suggested by Carroll (1997) predicts that negative income shocks will lead a rational agent to draw down assets and smooth consumption. The demographically rich lifecycle model suggested by Scholz, Seshadri, and Khitatrakun (2006) emphasizes the role of household composition in wealth accumulation. The SOI tax data clearly show that negative income and marital shocks both lead to increases in early withdrawals from retirement accounts.

The analysis here of factors associated with early withdrawals also shows that propensities to receive cash-outs or to take taxable withdrawals is higher for lower-income families, because lower-income families are much more likely to experience the sorts of shocks that lead to withdrawals, and more likely to take a withdrawal when they experience those shocks. These findings may help to explain why the observed cross-section distribution of retirement account balances—even within the covered population, and relative to contributions—is skewed towards higher-income families. For example, the highest quartile of families in the 2010 SCF, when ranked by permanent or “normal” income, account for 66% of retirement account contributions, but 73% of balances. The analysis here shows that differential propensities to take early withdrawals may help explain some of that gap.

APPENDIX A: SCF AND SOI DATA SOURCES USED IN THIS STUDY

Measuring the extent to which preretirement withdrawals may be affecting self-directed retirement accounts is challenging because of data limitations. Surveys like the SCF are good at capturing the flow of contributions to pensions and the balances in 401(k)-type pensions and IRAs, and also for measuring “regular” pension income, such as the life annuities traditionally paid out by DB plans. However, events like rollovers, cash-outs, and early withdrawals are relatively rare, so analysis with a limited number of observations comes with substantial sampling variability.

Analyzing early withdrawals using Form 1040 and tax information returns comes with other complications, however. The Form 1099R information return shows all distributions from qualified retirement accounts, and the various distribution codes make it possible to broadly characterize the distribution event, but there are some limitations. For example, one type of event not captured in tax reporting is a job separation where the employee leaves the funds in their former employer's qualified plan.

In addition to using Forms 1099R and Form 1040, we also use Form 5498, which tracks contributions to IRAs, makes it possible to observe when taxpayers receive a (potentially taxable) distribution, but then avoid the tax and early withdrawal consequences by rolling the money directly into another qualified account within 60 days. That is, the 1099R will indicate the distribution is a “normal taxable” event, but if there is a matching contribution to an IRA we know the taxpayer executed what we refer to (see Table 1) as an “indirect” rollover.

Unfortunately there is no direct indicator in the information returns about whether a given pension distribution is actually “regular” income from a DB plan, as opposed to what we are trying to measure, which is early withdrawals. Sabelhaus and Weiner (1999) attempt to overcome the problem of distinguishing regular payments from lump sum distributions using the Form 1099R code for “full” versus “partial” distribution. However, that approach breaks down when an early withdrawal is made that does not exhaust an account, such as a partial IRA withdrawal. In the data used here, something like half of the distributions are “partial,” which is much too high to be the non-DB share of distributions. Given the inability to directly separate withdrawals and cash out of lump-sum distributions from regular pension income, the analysis here is focused on age groups less than 55, for whom regular DB payments are likely to be only a small fraction of total distributions.

Finally, there are other representative household survey datasets available, in particular the Survey of Income and Program Participation (SIPP), for studying retirement account inflows, outflows, and balances. Although the SIPP offers larger sample sizes than the SCF, failure to account for the top of the wealth distribution and differences in question wording and/or question placement leads to dramatic under-reporting relative to aggregates. For example, Burman, Coe, and Gale (1999) estimate that 70% of withdrawals are not captured by the SIPP.