Financial misreporting and peer firms' operational efficiency

Abstract

We investigate the impact of financial misreporting on peer firms’ operational efficiency, defined as a firm’s efficiency in converting investments into revenues. We find that, on average, peers’ operational efficiency declines after rival firms misstate their financial performance. However, we also find that the impact of financial misreporting is not homogeneous across peer firms. The negative effect is mainly driven by non-misstating firms that had high performance. For firms that had lower past performance, the negative effect is significantly weaker, suggesting that the perceived competition induced by misreporting has a more positive effect. In addition, we document that the effect of misreporting is influenced by peer firms’ external financing need, industry leadership status and information environment.

1 Introduction

Theoretical studies have shown that a firm’s financial reporting can influence its peers’ operating and investment decisions (e.g., Gigler, 1994; Kumar and Langberg, 2009). Consistent with these theories, Beatty et al. (2013) empirically document a spillover effect of high-profile fraudulent financial reporting on peer firms’ capital expenditures during fraud periods. Li (2016) investigates further and finds that financial misreporting also induces peers to increase spending on other critical operating activities such as advertising and R&D. We investigate, in this study, two main research questions. First, what is the economic impact of financial misreporting for peer firms? More specifically, how does misreporting-induced spending impact the future operational efficiency of peer firms? We define operational efficiency as a firm’s efficiency in converting investment inputs, such as capital and R&D expenditures, into revenues.Our main construct – operational efficiency – differs from ‘investment efficiency’ in prior studies. Investment efficiency is often used to capture the degree to which a firm’s investments deviate from an optimal investment level (e.g., Biddle et al., 2009; Gao and Yu, 2018), whereas operational efficiency measures a firm’s ability to maximise revenues given a certain level of investments (e.g., Cheng et al., 2018). Second, is the impact homogeneous across peer firms?

Anecdotal evidence, on the one hand, suggests that a firm’s operational efficiency may decline when peer firms misreport. Peer misreporting often inflates financial numbers to paint a rosier picture of firm performance. Since current performance serves as a basis for the projection of future performance and market trends, firms may rely on overly optimistic information from their peers to make operating decisions that turn out to be suboptimal. As a result, the amount of sales generated per dollar invested declines. For example, during WorldCom’s fraudulent reporting period, executives at AT&T, Sprint and the Eastern Management Group explicitly stated that relying on WorldCom’s financial statements and its growth projections caused them to make inefficient operational decisions (Sidak, 2003; Sadka, 2006).Between 1999 and 2002, WorldCom inflated its earnings by more than $9 billion and made false and misleading projections about future Internet traffic. AT&T, Sprint and the Eastern Management Group claimed that, as a result of relying on WorldCom’s fraudulent financial reporting and intentionally misleading market projections, they made inefficient business decisions that resulted in significant losses.

However, we note that most incidences of financial misreporting are not of the same scale as WorldCom. It is plausible that, in less extreme cases, overstated performance may promote benign competition among peers, as managers facing competition will likely search for ways to improve performance or innovate (Barnett and Hansen, 1996). For example, the pressure of perceived competition may motivate firms who underperformed in the prior periods to increase its spending, cut slack, better manage inventory, or discontinue non-performing plants to improve resource utilisation. Further, prior research suggests that firms may not be investing at an optimal level due to principal-agent frictions. Managers have incentives to under-invest to avoid reporting lower earnings or missing analyst forecasts (e.g., Graham et al., 2005; Roychowdhury, 2006). The perceived competition may push firms to a more optimal level of spending. Thus, at the aggregate level, misreporting of a firm may have a nonnegative effect on its peers’ future operational efficiency.

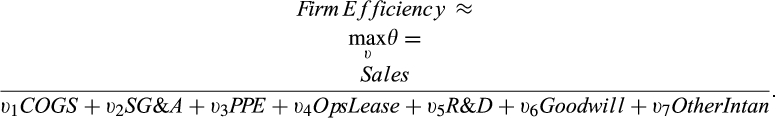

We test the research question by examining whether the operational efficiency of non-misstating firms is lower after peers misstate their financial performance. Following prior studies (e.g., Cheng et al., 2018), we use data envelopment analysis (DEA) to measure operational efficiency. The DEA approach estimates efficiency by calculating how efficiently a firm uses a set of inputs to convert into outputs (Demerjian et al., 2012). In the DEA model, we use revenues as the output and seven variables as inputs, including (i) net property, plant and equipment, (ii) capitalised R&D costs, (iii) purchased goodwill, (iv) capitalised operating leases, (v) cost of goods sold, (vi) selling, general and administrative expenses (SG&A) and (vii) other intangibles.Section 3.1 explains the details of the estimation method. We note that the list of inputs includes capital expenditures, SG&A expenses and R&D costs, all of which have been documented by prior studies as types of operating decisions that are influenced by peer misreporting. A higher operational efficiency measure indicates that the firm is able to generate more sales for every dollar invested.

We compare the future operational efficiency measure of firms in the peer-misreporting group with the measure of firms in the non-peer-misreporting group. A firm-year belongs to the peer-misreporting group if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. The non-misreporting group contains firm-years that do not have any misstatements by peers in year t. We identify misstatements as those that are classified as fraud or subject to Securities and Exchange Commission (SEC) investigation according to the Audit Analytics database. The sample period spans from 2000 to 2015, with 45,856 firm-year observations in our main test sample.

Using a regression model with year and industry fixed effects, we find that firms in the peer-misreporting group on average have lower future operational efficiency than firms in the non-peer-misreporting group. An alternative difference-in-differences model yields similar results. We also find that the negative impact of misreporting on peer firms’ future operational efficiency declines over time, from year t+1 to t+3. This set of results suggests that, on average, misreporting-induced expenditures documented in prior studies are an inefficient allocation of firm resources.

To provide more granularity to the average effect of misreporting, we further assess whether the impact is heterogeneous across different types of peer firms. We predict that the impact of misreporting differs depending on peer firms’ incentives. For example, a top performer in the industry will likely respond differently to a perceived threat than would a poorly performing firm who strives to improve its competitiveness. Therefore, we assess how past operational and financial performance of peer firms influence the relation between misreporting and operational efficiency. We find that the negative effect of peer misreporting is primarily driven by non-misstating firms that had high operational (asset turnover) or financial (sales growth) performance. The negative effect of misreporting is much weaker for non-misstating firms that had lower operational or financial performance. Taken together, our results suggest that while misreporting has a negative impact on peers’ resource allocation decisions on average, the magnitude of the effect is not uniform across all types of firms. Misreporting increases the perceived threat and motivates underperforming firms to allocate their resources efficiently.

As a supplementary analysis, we use a second outcome measure – research and development efficiency – to test the impact of misreporting-induced spending. The R&D efficiency measure estimates a firm’s ability to turn research and development expenditures into revenues (Knott, 2008). Consistent with results from using the operational efficiency measure, we find that financial misreporting has a negative impact on peer firms’ R&D efficiency.

To lend credence to our main results, we further investigate and provide evidence on how variations in firm characteristics impact the relation between financial misreporting and peer firms’ operational efficiency. Specifically, we predict that the effect of peer misreporting varies with the following three firm characteristics: degree of reliance on external financing, industry leadership status and information environment. Our cross-sectional tests yield the following insights. First, we find that the effect of peer misreporting is stronger for firms that rely more on external financing. This finding suggests that, facing higher performance pressure, firms may be more likely to respond to peers’ inflated financial information by over-investing, possibly leading to poorer operational efficiency. Second, the results show that the effect of peer misreporting is weaker when the non-misstating firm is an industry leader. As shown in Leary and Roberts (2014), industry leaders are less likely to mimic the financial policy of less successful firms because they are insensitive to the stock returns of smaller peers. Third, we document that the effect of misreporting is also weaker when non-misstating firms have higher analysts following, our proxy for better information environment.

Our paper makes several contributions to the literature. Prior studies (e.g., Beatty et al., 2013; Li, 2016) investigate whether financial misreporting impacts peer firms’ operating and investing activities such as advertising, capital expenditure and R&D. They find that firms respond to peers’ inflated financial numbers by increasing expenditures in those activities. In essence, prior studies focus on the effect of financial misreporting on the inputs of the revenue-generating process. While increased spending by peers may imply suboptimal allocation of resources to some extent, no study has directly documented its economic consequences – the impact on the output.Li (2016) does not test whether misstatement-induced spending is optimal. Beatty et al.(2013) provide some indirect evidence that the misstatement-induced spending may be suboptimal. They find that the positive relation between capital expenditures and future cash flows is weaker during peers’ misreporting periods. However, neither study identifies conditions under which misreporting may have a nonnegative effect. Our study provides direct evidence that, on average, financial misreporting lowers peers’ revenue generating efficiency. Interestingly, our results also reveal that misreporting does not have a homogeneous effect on all peer firms. For the subset of managers that made inefficient decisions in the past, the additional competition from peer misreporting appears to have a positive effect. In short, our results complement the findings in the extant literature; together they paint a more complete and granular picture of the externalities of financial misreporting.

We also contribute to the literature by documenting another factor that has an impact on operational efficiency. For example, Cheng et al.(2018) document that a firm’s internal control quality can affect operational efficiency through its internal information environment. Our results suggest that peer financial reporting can also have an impact on operational efficiency via the spillover effect. Furthermore, Baik et al. (2013) find that changes in operational efficiency are useful for predicting future firm profitability. Therefore, identifying the determinants of operational efficiency has important implications for firm valuation and analyst forecasting.

The remainder of the paper is organised as follows: Section 2 reviews related literature and develops empirical predictions; Section 3 outlines our research design; Section 4 presents our empirical results; and Section 5 draws our conclusion.

2 Related literature and hypotheses development

2.1 Corporate decisions and imitation among peers

Imitation and learning are common practices among businesses as they compete in environments characterised by uncertainty and ambiguity (Lieberman and Asaba, 2006). Empirical studies have documented that firms can influence peers on business decisions such as corporate capital structure and financial policies (Bertrand and Schoar, 2003; Leary and Roberts, 2014), stock repurchases (Massa et al., 2007), mergers and acquisitions (Bizjak et al., 2009), tax avoidance (Li et al., 2014) and capital expenditures (Foucault and Fresard, 2014).

Two broad categories of economic theories are often used to explain managers’ decisions to imitate (Banerjee, 1992; Deephouse, 1999; Lieberman and Asaba, 2006). The first is the information-based theories, which posit that managers follow peers because they believe that peers may have superior information about investment opportunities or growth prospects. Under business environments filled with uncertainty, managers cannot fully predict the investment outcomes, nor can they untangle all the causal relationships between different factors. Therefore, they are more likely to incorporate information that is implicit in peers’ actions. Managers also have an incentive to herd to reduce the probability of failure and, in the case of failure, to avoid reputation damage arising from deviation from the norm.

The second category of theories is the rivalry-based theories, which conjecture that firms imitate each other to maintain their competitive position and, in a highly competitively environment, to limit the impact of rivalry or minimise risk. Under a competitive environment, managers face pressure to protect sales and the profit margin. To alleviate pressure, managers can adopt either a homogeneous or differentiation strategy. Managers that adopt the differentiation strategy, if they succeed, can avoid engaging in destructive price wars. However, differentiation strategies are inherently riskier and more difficult to implement. Therefore, some managers may choose to adopt the homogeneous strategies that mimic those of their peers to lessen the competition and reduce risk.

2.2 Hypotheses development

2.2.1 Effects of financial misreporting on peers’ investments

One of the primary channels through which firms can learn from peers is through peers’ financial disclosures, which reveal a firm’s cost structure, capital investments, R&D expenditures and other strategic actions. Prior studies argue and demonstrate that managers incorporate peers’ financial information in their investment decisions (Moon and Bates, 1993). For example, Bushman and Smith (2001) posit that ‘managers can identify promising new investment opportunities on the basis of the high profit margins reported by other firms.’ Guilding’s (1999) survey study finds that managers incorporate peer firms’ sales, profits and market shares in their decisions. Gao and Sidhu (2018) document that the positive financial reporting externality can be magnified when financial disclosures are based on a common set of accounting standards.

Given that managers rely on peer firms’ financial information to draw inferences about their strategy actions and to guide their operational decisions, peer firms’ inflated financial performance may stimulate firms to spend more to gain or maintain competitive advantage. Kumar and Langberg (2013) show that managers increase their investment level in response to peers’ inflated productivity reports. In their rational expectations model, the leading firm has incentives to inflate their productivity report to attract investments. The false reporting of their performance raises market participants’ expectation about the future prospects of the industry and induces investments by new market entrants. A number of empirical studies have also documented the impact of financial misreporting on peer firms’ investments. For example, Beatty et al.(2013) investigate how 35 high-profile accounting frauds impacted peer firms’ investments. They find that managers increase their capital expenditures during peer firms’ fraudulent reporting periods. Li (2016) shows that the impact is not limited to capital expenditures; it extends to other operating decisions such as R&D expenditure, advertising plans and pricing policies.

2.2.2 Effects of financial misreporting on peers’ operational efficiency

The preceding discussion naturally raises the question of whether operational decisions, influenced by peers’ inflated performance, are indeed inefficient. A firm is said to have higher operational efficiency when it generates a higher amount of sales for a given level of spending.Detailed calculation of operational efficiency is provided in Section 3.1. The estimation model yields a ratio of sales over the sum of (weighted) inputs such as advertising, R&D and capital expenditures. As a simplified example with only one input: a firm that generates $100 in sales and spends $10 in advertising (a ratio of 10) has a higher operational efficiency than a firm that generates $150 in sales and spends $20 in advertising (a ratio of 7.5). One possible outcome is that misreporting leads to a lower operational efficiency. Conceptually, assume that a firm, absent peer misreporting, is at the optimal level of spending. Then an additional dollar of spending induced by misreporting would be a deviation from the optimal allocation of resources. Although the additional spending may generate more sales, it will likely result in lower sales per dollar invested. While there is no direct empirical evidence documenting the relationship, anecdotally, peers of WorldCom claimed that WorldCom’s financial reporting scandal caused them to make suboptimal investment decisions.WorldCom utilised its proprietary information to make false Internet traffic projections. As a result of relying on WorldCom’s financial performance and market prediction, the Eastern Management Group claimed that a significant percentage of the $90 billion invested by carriers in the long-haul industry was misallocated. AT&T and Sprint drew similar conclusions regarding the impact of WorldCom’s fraud on the outcome of their operating and investment decisions.

However, prior research suggests plausible reasons for how firm misreporting may not have a negative effect on its peers’ operational efficiency. First, prior studies have shown that spending more on advertising (Kim and McAlister, 2011), R&D (Ehie and Olibe, 2010) and capital expenditures (McConnell and Muscarella, 1985) can have a positive effect on future sales. Thus, even if such expenditures are induced by peers’ inflated information, they will likely increase firms’ sales. Therefore, the question of whether expenditures increase the sales-per-dollar-invested ratio (operational efficiency) can depend on various other complex factors, such as principal-agent frictions, within the firm. For example, it is well documented that principal-agent frictions can cause firms to deviate from an optimal level of investment. Facing capital market pressure to perform in the short term, managers have incentives to under-invest because investments in areas such as R&D and advertising must be expensed, and therefore have a negative impact on current period profits (e.g., Roychowdhury, 2006; Zang, 2012). In a survey study, Graham et al.(2005) find that 80 percent of chief financial officers (CFOs) state that they would forgo R&D, advertising and maintenance expenditures to meet short-term earnings targets. This line of research calls into question the assumption that most firms maintain an optimal level of spending. In this context, inflated performance by peers may push the average firm to invest at a more optimal level. Given that most misreporting incidents are of a much lower magnitude compared to WorldCom, the misreporting-induced expenditures may not generate any less sales for every dollar invested.

Second, firms may not rely solely on peers’ financial reporting to determine the amount and type of investment. For example, Foucault and Fresard (2014) find a positive relation between peers’ stock prices and managers’ capital expenditures, suggesting that managers use information contained in their peers’ valuation to guide their operating and investment decisions. In addition to firm-specific performance information, its peers’ stock prices reflect industry trends and market outlook. Since a firm’s investment strategy may draw upon different sources of information, the investment decisions may be guided by rational expectations rather than being completely misled by misstating peers.

H1: A firm’s future operational efficiency is associated with its peers’ financial misreporting.

H2a: The effect of financial misreporting on peer firms’ future operational efficiency is influenced by peer firms’ previous level of operational performance.

H2b: The effect of financial misreporting on peer firms’ future operational efficiency is influenced by peer firms’ previous level of financial performance.

In addition to the main hypotheses, we also predict that the effect of misreporting on operational efficiency will vary with a peer firm’s degree of reliance on external financing, industry leadership status and information environment. We discuss each of these predictions in the following sub-section.

2.2.3 Effects of external financing, industry leadership and information environment

Effect of external financing

H3a: The effect of financial misreporting on peer firms’ operational efficiency is stronger when peer firms have a greater reliance on external financing.

Effect of industry leadership status

H3b: The effect of financial misreporting on peer firms’ operational efficiency is weaker when peer firms are industry leaders.

Effect of peer firms’ information environment

As information intermediaries, analysts help to narrow information asymmetry between firm managers and shareholders. Ceteris paribus, firms with fewer analysts following have greater information asymmetry, and firms that have great information asymmetry are more likely to suffer from unfavourable misevaluation (Myers and Majluf, 1984). Given the pressure to correct or prevent firm undervaluation, firms with fewer analysts following are more likely to react to their peers’ inflated financial reporting by over-investing.Our focus on the number of analysts following non-misreporting firms differs from that of Beatty et al.(2013) and Li (2016). The former examines the effect of the number of overlapping analysts who cover both misstating and non-misstating firms, while the latter investigates the effect of the number of analysts following the misreporting firms. Therefore, our prediction differs from those of these other two studies. Therefore, we hypothesise that: H3c: The effect of financial misreporting on peer firms’ operational efficiency is weaker when peer firms have more analysts following.

3 3. Research design

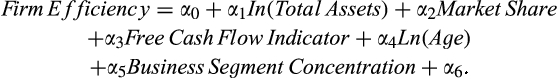

3.1 Measure of operational efficiency

Consistent with prior studies (e.g., Berk and Green, 2004; Berk and Stanton, 2007; Cheng et al., 2018), we rely on frontier analysis – data envelopment analysis (DEA) – to estimate operational efficiency.We obtain the DEA measure of efficiency from Professor Peter Demerjian’s website: http://faculty.washington.edu/pdemerj/data.html. The DEA is a statistical approach that can be used to estimate the efficiency of a firm in converting a set of inputs to outputs. Similar to the concept of ratio-based efficiency measures such as return on assets, the DEA approach scales outputs by inputs to estimate efficiency. However, unlike the ratio-based measures, which take into account only one input (total assets, as in the case of return on assets) and has an explicit weight, the DEA approach incorporates a set of inputs and allows the weight structure of inputs to vary across firms.

) of each input:

) of each input:

()

() ()

()The residuals from Equation (2) represent our main construct: operational efficiency.Chen et al. (2018) show that using residuals as the dependent variable may introduce bias. Thus, as a robustness check we also use an operational efficiency in a non-residual form. Specifically, we estimate Equation (1), use the scores obtained as the measure of operational efficiency, and then control for the firm characteristic variables in a regression model. Our results (untabulated) remain qualitatively the same.

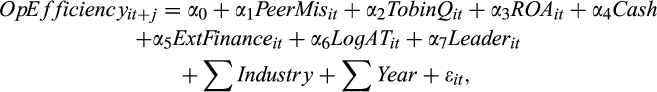

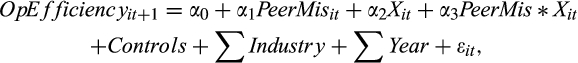

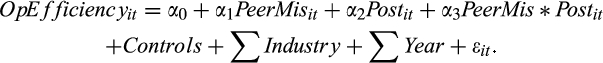

3.2 Regression models

()

()One of the challenges in examining peer spillover effects is identifying a comparable set of firms that share similar firm characteristics and whose investment decisions can serve as a reference to the peer firms. Matching a firm on multiple dimensions will be impractical as the reference group will consist of too few firms. Albuquerque (2009) shows that a parsimonious set of matching criteria – industry and size – captures many of the firm characteristics.In the context of relative performance evaluation in CEO compensation, Albuquerque (2009) argues that using a misspecified peer group is the reason for finding mixed evidence in prior studies. The study shows that matching on both industry and size yields results consistent with theoretical predictions. Therefore, we define peers as firms in the same industry (according to the Fama and French 48 industry classification) and size quartile (using market value) in which firm i operates.

In regard to control variables, we note that in estimating the operational efficiency measure (Equation (2)), the model has taken into account many firm characteristics such as firm size, business segment concentration, market dominance, cash availability, firm life cycle and international presence. In addition, in Equation (3), we control for other key firm characteristics that may be correlated with operational efficiency and investment decisions. Following Li (2016), we include Tobin’s Q (TobinQ) as a proxy for firm investment opportunities. We include return on assets (ROA) and firm size (LogAT) because larger, more profitable firms may be more likely to invest or hire managers who can generate higher operational efficiency. We include cash availability (Cash) because firms with more cash reserves face fewer investment constraints. We also include firm-level external financing (ExtFinance) as higher performance pressure may exacerbate the need for managers to react to rivals’ inflated financial information. We also take into account whether a non-misreporting firm is a leader (Leader) in the industry, as leaders are more likely to be insensitive to peers’ actions (Leary and Roberts, 2014). More detailed definitions of these variables are presented in the Appendix. Since operational efficiency likely varies across industries, we include industry fixed effects using the Fama and French 48 industry classification in all our models. We also include year fixed effects to control for time-specific trends. Note that we do not include firm fixed effects in our empirical models because it would be inappropriate for tests that are designed to capture cross-sectional variations across firms.Consistent with Li (2016), we do not include firm fixed effects in our models for several reasons. First, our main variable of interest, PeerMis, is an industry-level measure, and therefore it is less susceptible to firm-specific correlated omitted variable problems. Second, we are interested in both within-firm variations and across-firm variations, i.e., firms in misreporting industries versus firms in non-misreporting industries. Thus, adding firm fixed effects is inappropriate because it would prevent us from testing the cross-sectional variations.In all our tests, we cluster the standard errors by firm.

()

() ()

()4 Sample and empirical results

4.1 Sample and descriptive statistics

The sample selection steps are listed in Panel A of Table 1. First, we require all firm-year observations to have financial data available from the Compustat database through the period from 2000 to 2015. Then, consistent with prior studies, we exclude firm-years in the financial, utilities and telecommunication industries. We exclude firms in the financial industry because of the uniqueness of their asset structure and earnings-generating process, and we exclude firms in the utilities and telecommunication industries due to their industry-specific regulations. We also exclude firm-years that have missing operational efficiency measures and firm-years that have financial misreporting. The final sample contains 45,856 firm-year observations, or 6,386 unique firms.

| Description | Firm-years |

|---|---|

| Panel A: Sample selection | |

| Available firm-year observations with necessary Compustat data over the period 2000–2015 | 65,946 |

| Less: firm-year observations belong to utility, telecommunication, and financial industry (SIC from 4400 to 5000, and SIC from 6000 to 7000) | (7,766) |

| Less: firm-year observations with missing operational efficiency data | (11,090) |

| Less: firm-years in which firms misreported financial statements | (1,234) |

| Final sample | 45,856 |

| Industry | No. of firm-year observations | % of full sample |

|---|---|---|

| Panel B: Sample distribution by industry | ||

| Personal and business services | 7,924 | 17.3 |

| Business equipment | 7,256 | 15.8 |

| Healthcare, medical equipment, pharmaceutical products | 6,750 | 14.7 |

| Retail | 2,759 | 6.0 |

| Petroleum and natural gas | 2,315 | 5.0 |

| Fabricated products and machinery | 2,046 | 4.5 |

| Wholesale | 1,847 | 4.0 |

| Construction and construction materials | 1,515 | 3.3 |

| Everything else | 1,345 | 2.9 |

| Food products | 1,285 | 2.8 |

| Recreation | 1,234 | 2.7 |

| Chemicals | 1,195 | 2.6 |

| Restaurants, hotels, motels | 1,058 | 2.3 |

| Electrical equipment | 1,015 | 2.2 |

| Automobiles and trucks | 837 | 1.8 |

| Consumer goods | 792 | 1.7 |

| Apparel | 790 | 1.7 |

| Business supplies and shipping containers | 769 | 1.7 |

| Transportation | 674 | 1.5 |

| Steel works and others | 659 | 1.4 |

| Printing and publishing | 486 | 1.1 |

| Aircraft, ships and railroad equipment | 397 | 0.9 |

| Precious metals, non-metallic and industrial metal mining | 319 | 0.7 |

| Textiles | 209 | 0.5 |

| Beer and liquor | 183 | 0.4 |

| Coal | 141 | 0.3 |

| Tobacco products | 56 | 0.1 |

| Total | 45,856 | 100.0 |

- Panel A describes the sample selection process and Panel B shows the sample distribution across different industries (Fama–French 30 industry classification). Firms in the financial, utilities and telecommunication industries are excluded from the full sample.

Panel B of Table 1 shows the sample distribution by industry (according to the Fama–French 30 industry classification). The top three industries with the most observations are the personal and business services industry, the business equipment industry, and the healthcare industry. The sum of the three industries constitutes about 50 percent of the full sample. The rest of the observations, absent the financial, utilities and telecommunication industries, are divided among the remaining 24 industries.

We acquire accounting data from the Compustat database and analyst forecast information from the Institutional Brokers Estimate Systems (IBES) database. We rely on Audit Analytics to identify firm-years that have financial misreporting. Our sample period spans from 2000 to 2015, with 45,856 firm-year observations in our main test sample. It starts in the year 2000 because Audit Analytics begins tracking all financial restatements in 2000. The sample includes two groups of firms: firm-years that have at least one misstating peer and firm-years that have zero misstating peers. We delete firm-years that have misreported financial information from the sample.

Panel A of Table 2 shows the descriptive statistics for our main test sample. The distribution of the dependent variable, OpEfficiency, is similar to the distribution documented in prior studies (e.g., Demerjian et al., 2012). The mean and median values are −0.003 and −0.02, respectively. The mean of PeerMis, which indicates firm-years that have at least one peer misstatement in the peer group (industry-size quartile), is about 50 percent, indicating that about half of the observations in our sample belong to the treatment group and the other half belong to the control group. A median firm-year in the sample has total assets of $207 million, ROA of 2.6 percent, a cash balance of 9.7 percent of total assets, and raises debt and equity that is equal to 3.8 percent of total assets.

| Variable | Mean | SD | Q1 | Median | Q3 | N |

|---|---|---|---|---|---|---|

| Panel A: Descriptive statistics of main variables | ||||||

| OpEfficiencyt +1 | −0.003 | 0.109 | −0.065 | −0.020 | 0.032 | 45,856 |

| PeerMis | 0.500 | 0.500 | 0.000 | 1.000 | 1.000 | 45,856 |

| TobinQ | 1.623 | 2.038 | 0.552 | 1.007 | 1.859 | 45,856 |

| ROA | −0.069 | 0.314 | −0.087 | 0.026 | 0.077 | 45,856 |

| Cash | 0.177 | 0.230 | 0.032 | 0.097 | 0.227 | 45,856 |

| ExtFinance | 0.237 | 0.713 | −0.028 | 0.038 | 0.182 | 45,856 |

| AT | 1,801 | 5,205 | 39.46 | 207.1 | 985.7 | 45,856 |

| Leader | 0.535 | 0.499 | 0.000 | 1.000 | 1.000 | 45,856 |

| R&D_Efficiencyt +1 | 0.163 | 0.027 | 0.145 | 0.163 | 0.183 | 20,606 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel B: Pearson correlations | ||||||||||

| 1 | OpEfficiencyt +1 | 1.00 | 0.14 | 0.19 | 0.10 | 0.10 | −0.02 | 0.06 | 0.08 | −0.08 |

| 2 | PeerMis | 1.00 | 0.08 | −0.06 | 0.13 | 0.05 | −0.04 | 0.01 | −0.15 | |

| 3 | TobinQ | 1.00 | −0.35 | 0.27 | 0.36 | −0.19 | −0.10 | −0.09 | ||

| 4 | ROA | 1.00 | −0.14 | −0.49 | 0.43 | 0.34 | 0.17 | |||

| 5 | Cash | 1.00 | 0.48 | −0.21 | −0.17 | −0.09 | ||||

| 6 | ExtFinance | 1.00 | −0.18 | −0.16 | −0.10 | |||||

| 7 | LogAT | 1.00 | 0.72 | 0.10 | ||||||

| 8 | Leader | 1.00 | 0.01 | |||||||

| 9 | R&D_Efficiencyt +1 | 1.00 | ||||||||

- Panel A presents descriptive statistics for a sample of 45,856 observations from 6,386 unique firms during 2000–2015. For ease of interpretation, total assets (AT) is presented in dollar value rather than log form. Misreporting firm-years are excluded from the full sample. Panel B reports Pearson correlations between variables in the main sample. Bold indicates significance at a p-value of < 0.01. All variables are defined in the Appendix.

Panel B of Table 2 represents the Pearson correlation matrix for the key variables in the main test sample. OpEfficiency is positively correlated with firm characteristics such as TobinQ, ROA, Cash, LogAT and Leader, suggesting that firms that have better investment opportunities, higher profits and higher cash reserves have higher operational efficiency. Larger firms and industry leaders also seem to have higher values of operational efficiency. The positive correlation between operational efficiency and firm characteristics further justifies the need to include those variables as controls in our regression models.

4.2 Test results

Table 3 reports the regression results for our main effect test. The coefficients of our main variable of interest, PeerMis, are negative in all columns (year t+1 to t+3) and statistically significant at the 5 percent level. The results suggest that financial misreporting of rival firms has a negative impact on peer firms’ future operational efficiency. Interestingly, the negative impact is strongest at year t+1 and dissipates as time progresses. In regard to the control variables, the regression results show that firm characteristics such as TobinQ, ROA, Cash and Leader are positively associated with OpEfficiency, while ExtFinance and LogAT are negatively correlated with OpEfficiency.

| Dependent variable | OpEfficiencyt+1 (1) | OpEfficiencyt+2 (2) | OpEfficiencyt+3 (3) | ||||

|---|---|---|---|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat | Coefficient | t-stat | Coefficient | t-stat |

| Intercept | ? | −0.0906 | −21.13*** | −0.0937 | −20.42*** | −0.0918 | −18.67*** |

| PeerMis | +/− | −0.0049 | −4.1*** | −0.0034 | −2.7*** | −0.0032 | −2.3** |

| TobinQ | + | 0.0095 | 35.73*** | 0.0083 | 28.63*** | 0.0074 | 23.5*** |

| ROA | + | 0.0519 | 25.82*** | 0.0380 | 17.35*** | 0.0315 | 12.9*** |

| Cash | + | 0.0230 | 9.25*** | 0.0222 | 8.23*** | 0.0249 | 8.55*** |

| ExtFinance | − | −0.0076 | −9.03*** | −0.0070 | −7.63*** | −0.0081 | −7.95*** |

| LogAT | + | 0.0013 | 3.68*** | 0.0026 | 6.89*** | 0.0032 | 7.66*** |

| Leader | + | 0.0036 | 2.44** | 0.0004 | 0.27 | 0.0011 | 0.62 |

| Industry fixed effects | Yes | Yes | Yes | ||||

| Year fixed effects | Yes | Yes | Yes | ||||

| N | 45,856 | 39,926 | 34,749 | ||||

| Adj. R2 | 12.05% | 11.43% | 11.21% | ||||

- This table reports the effect of financial misreporting on peer firms’ future operational efficiency. OpEfficiency is the operational efficiency measure. PeerMis is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

Table 4 presents the results of the test that examines the effect of past levels of operational performance on the relation between misreporting and a peer firm’s future operational efficiency. We find a positive coefficient (0.0043, t = 3.14) for the indicator variable LowAssetTurnover, suggesting a mean reversion in revenue-generating efficiency; if a firm had a low average asset turnover in the past three years, its future operational efficiency improves as a result of competition and its survival need. We also find that the negative effect of peer misreporting is primarily driven by firms that had high asset turnover, as indicated by the negative coefficient on PeerMis (−0.0057, t = −3.70). In contrast, we find a much weaker negative effect of peer misreporting for firms that had low asset turnover, as represented by the sum of coefficients on PeerMis and PeerMis * LowAssetTurnover (−0.0010 = −0.0057 + 0.0047). The results suggest that, relative to firms that had high operational performance, firms that had low operational performance spend more efficiently when they face heightened competition.

| Dependent variable: ∆OpEfficiency | ||||

|---|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat | |

| Intercept | ? | 0.0007 | 0.15 | |

| PeerMis | +/− | −0.0057 | −3.7*** | |

| LowAssetTurnover | + | 0.0043 | 3.14*** | |

| PeerMis* LowAssetTurnover | + | 0.0047 | 2.4** | |

| TobinQ | + | 0.0027 | 8.79*** | |

| ROA | + | −0.0231 | −9.38*** | |

| Cash | + | −0.0007 | −0.24 | |

| ExtFinance | − | −0.0148 | −12.8*** | |

| LogAT | + | −0.0014 | −3.76*** | |

| Leader | + | 0.0076 | 5.08*** | |

| Industry fixed effects | Yes | |||

| Year fixed effects | Yes | |||

| N | 42,070 | |||

| Adj. R2 | 1.24% | |||

- This table reports results of the test that examines the effect of past level of operational performance on the relation between misreporting and future operational efficiency. ∆OpEfficiency is the change in operational efficiency from year t−1 to year t+1. PeerMis is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. LowAssetTurnover is an indicator variable equal to one if, in a given year, a firm’s average asset turnover ratio over the past 3 years is below the industry median. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

Similarly, in Table 5 we find a negative coefficient on PeerMis (−0.0052, t = −3.37), indicating that peer misreporting has a negative effect on operational efficiency for firms that had high sales growth. The negative effect of misreporting is significantly weaker for firms that had low sales growth, as indicated by the sum of coefficients on PeerMis and PeerMis * LowSalesGrowth (−0.0008 = −0.0052 + 0.0044). The results suggest that, relative to firms that had high sales growth, firms that had low sales growth are more efficient in allocating resources when perceived competition increases.

| Dependent variable: ∆OpEfficiency | ||||

|---|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat | |

| Intercept | ? | −0.0054 | −1.22 | |

| PeerMis | +/− | −0.0052 | −3.37*** | |

| LowSalesGrowth | + | 0.0075 | 5.57*** | |

| PeerMis* LowSalesGrowth | + | 0.0044 | 2.24** | |

| TobinQ | + | 0.0031 | 10.01*** | |

| ROA | + | −0.0262 | −10.91*** | |

| Cash | + | 0.0009 | 0.32 | |

| ExtFinance | − | −0.0146 | −12.63*** | |

| LogAT | + | −0.0007 | −1.93* | |

| Leader | + | 0.0061 | 4.14*** | |

| Industry fixed effects | Yes | |||

| Year fixed effects | Yes | |||

| N | 42,070 | |||

| Adj. R2 | 1.36% | |||

- This table reports results of the test that examines the effect of past level of financial performance on the relation between misreporting and future operational efficiency. ∆OpEfficiency is the change in operational efficiency from year t−1 to year t+1. PeerMis is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. LowSalesGrowth is an indicator variable equal to one if, in a given year, a firm’s average asset turnover ratio over the past 3 years is below the industry median. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

Panel A of Table 6 reports the regression results for testing the effect of firms’ external financing, a proxy for performance pressure. Facing higher performance pressure, managers are more likely to react to the fraudulent peers’ inflated information. Consistent with Hypothesis 3a, we find that the coefficient on the interaction term, PeerMis * ExtFinance, is negative (−0.003, t = −2.00). The result suggests that the negative effect of financial misreporting on peer firms’ operational efficiency is stronger when they have a greater reliance on external financing.

| Dependent Variable: OpEfficiencyt+1 | |||

|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat |

| Panel A: Effect of external financing | |||

| Intercept | ? | −0.0916 | −21.54*** |

| PeerMis | +/− | −0.0042 | −3.43*** |

| ExtFinance | − | −0.0072 | −6.36*** |

| PeerMis × ExtFinance | − | −0.0032 | −2.00** |

| Controls | Included | ||

| Industry fixed effects | Yes | ||

| Year fixed effects | Yes | ||

| N | 45,856 | ||

| Adj. R2 | 12.38% | ||

| Panel B: Effect of industry leadership status | |||

| Intercept | ? | −0.0878 | −20.58*** |

| PeerMis | +/− | −0.0134 | −8.51*** |

| Leader | + | −0.0049 | −2.79*** |

| PeerMis × Leader | + | 0.0160 | 8.17*** |

| Controls | Included | ||

| Industry fixed effects | Yes | ||

| Year fixed effects | Yes | ||

| N | 45,856 | ||

| Adj. R2 | 12.50% | ||

| Panel C: Effect of peer firms’ information environment | |||

| Intercept | ? | −0.1403 | −23.56*** |

| PeerMis | +/− | −0.0091 | −5.15*** |

| HighAnalyst | + | 0.0073 | 3.45*** |

| PeerMis × HighAnalyst | + | 0.0210 | 8.00*** |

| Controls | Included | ||

| Industry fixed effects | Yes | ||

| Year fixed effects | Yes | ||

| N | 31,787 | ||

| Adj. R2 | 18.12% | ||

- This table reports results of cross-sectional tests that examine the effect of external financing (Panel A), industry leadership status (Panel B), and peer firms’ information environment (Panel C) on the relation between misreporting and future operational efficiency. OpEfficiency is the operational efficiency measure. PeerMis is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. ExtFinance is firms’ external financing, calculated as the sum of equity issues and debt issues in year t divided by total assets in year t. Leader is an indicator equal to one if a firm’s market share is above the industry median and zero otherwise. HighAnalyst is equal to one if, within an industry-year, the decile ranking of number of analysts following the non-misstating firm falls in the top tercile. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

Panel B of Table 6 shows the regression results for testing the effect of the leadership status of non-misreporting firms among their peers. Consistent with the main effect results in Table 3, the coefficient on PeerMis is negative (−0.0134, t = −8.51). The coefficient captures the main effect of financial misreporting on the operational efficiency of peers who are not leaders in the industry (Leader = 0). The negative coefficient indicates that financial misreporting decreases peer firms’ operational efficiency. However, the coefficient on the interaction term, PeerMis * Leader, is positive (0.016, t = 8.17), suggesting that being an industry leader mitigates the negative impact of financial misreporting by rival firms. In fact, the positive coefficient on PeerMis * Leader offsets the negative coefficient on PeerMis. The results support Hypothesis 3b and suggest that industry leaders are immune to the actions of misreporting firms.

Panel C of Table 6 presents the regression results for testing the effect of non-misreporting firms’ information environment. The coefficient on PeerMis * HighAnalyst is positive and significant (0.021, t = 8.00), suggesting that the negative effect of financial misreporting on peer firms’ operational efficiency is weaker when they have a higher analysts following. The result supports our prediction that the effect of misreporting by rivals is weaker when non-misstating firms have lower information asymmetry between managers and outside shareholders.

4.3 Robustness test: alternative model specification

()

()The DiD model allows us to compare the difference in operational efficiency between the treatment and control firms before and after the misreporting event. Post is an indicator variable that is equal to 1 in the post-misreporting period. We present the results from the DiD test in Table 7. Consistent with our previous regression model using longitudinal data and fixed effects, the DiD test yields the same inference. The coefficient on PeerMIS is indistinguishable from zero, indicating that in the pre-misreporting period, there is no difference in operational efficiency between treatment and control firms. After the misreporting event, firms that were exposed to peer misreporting experience a decline in their operational efficiency, as indicated by the negative coefficient on the interaction term, Treatment * Post (−0.0176, t = −1.72).

| Dependent variable: OpEfficiency | ||||

|---|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat | |

| Intercept | ? | −0.0756 | −1.44 | |

| Treatment | +/− | 0.0121 | 1.53 | |

| Post | ? | −0.0013 | −0.25 | |

| Treatment × Post | − | −0.0176 | −1.72* | |

| TobinQ | + | 0.0100 | 6.82*** | |

| ROA | + | 0.1179 | 9.42*** | |

| Cash | + | 0.0013 | 0.1 | |

| ExtFinance | − | −0.0016 | −0.25 | |

| LogAT | + | −0.0010 | −0.59 | |

| Leader | + | −0.0083 | −1.26 | |

| Industry fixed effects | Yes | |||

| Year fixed effects | Yes | |||

| N | 1,866 | |||

| Adj. R2 | 22.55% | |||

- This table reports results from a difference-in-differences test. Treatment is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. Post is an indicator equal to one if a firm-year is after the misreporting period. OpEfficiency is the operational efficiency measure. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

The DiD model specification significantly mitigates the endogeneity concerns arising from potential omitted variable bias. However, we note that using the model dramatically decreases our sample size to 1,866 firm-year observations due to sample selection requirements. More specifically, we exclude all firm-year observations that had any peer misreporting in a 3-year window around the event period to avoid cross-period contamination. Due to the sample size, we rely on the panel regression as our main model.

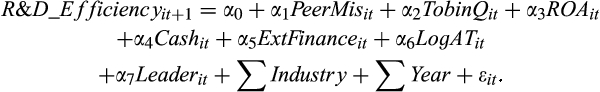

4.4 Robustness test: alternative measure of revenue-generating efficiency

We also test the economic consequence of financial misreporting using another output efficiency measure, R&D_Efficiency. The estimation model uses a 10-year window rolling regression which regresses revenues on lagged R&D and a set of other inputs and firm characteristics (Knott, 2008). The resulting measure represents the percentage increase in revenues corresponding to a one percentage increase in R&D, holding other inputs and elasticities constant. In other words, R&D_Efficiency captures a firm’s efficiency in converting R&D expenditures (input) into sales revenues (output). This measure has two key differences that distinguishes it from our primary measure of operational efficiency. First, R&D_Efficiency uses linear regression, rather than a frontier analysis – data envelopment analysis (DEA) – to estimate an efficiency measure. Second, the measure does not use the residuals of a regression model. While the differences do not necessarily translate to a better measure, they mitigate the concern of potential measurement bias in the construct that may be associated with the operational efficiency measure.

()

()As reported in Table 8, the coefficient on PeerMis is negative and statistically significant (−0.0016, t = −4.16). The results indicate that peer firms’ efficiency in converting R&D expenditures into sales declines after rivals present misleading financial performance, a finding that is consistent with our prior documented results.

| Dependent variable: R&D_Efficiencyt+1 | |||

|---|---|---|---|

| Parameter | Predicted sign | Coefficient | t-stat |

| Intercept | ? | 0.1552 | 103*** |

| PeerMis | +/− | −0.0016 | −4.16*** |

| TobinQ | + | 0.0000 | 0.45 |

| ROA | + | 0.0109 | 17.56*** |

| Cash | + | −0.0048 | −6.48*** |

| ExtFinance | − | 0.0005 | 1.51 |

| LogAT | + | −0.0005 | −4.99*** |

| Leader | + | −0.0011 | −2.39** |

| Industry fixed effects | Yes | ||

| Year fixed effects | Yes | ||

| N | 20,606 | ||

| Adj. R2 | 36.36% | ||

- This table reports results of the test that examines the effect of financial misreporting on peer firms’ future R&D efficiency. R&D_Efficiency is the research and development efficiency measure, which is calculated as the percentage increase in future revenues given a one percentage increase in R&D expenditure. PeerMis is an indicator equal to one if the industry and size quartile in which firm i operates has one or more misstatements by peers in year t. All other variables are defined in the Appendix. The standard errors are clustered by firm. ***, ** and * indicate statistical significance at the 1, 5 and 10 percent levels, respectively.

5 Conclusion

A firm’s financial misreporting can have a spillover effect on the business decisions of its peers. Prior studies document that firms increase expenditures in operating and investing activities such as advertising, capital acquisition and R&D when industry peers inflate their financial performance. However, extant literature has not provided direct evidence on whether misreporting-induced expenditures are indeed inefficient, i.e., whether they generate less sales for every dollar invested. Despite the anecdotal evidence suggesting a negative impact of peer misreporting, we believe the relation is more complex than it initially appears, as it can be influenced by many factors such as firms’ past performance, external financing need, industry leadership status and information environment. Therefore, it is important to evaluate the impact of peer misreporting from a more holistic view.

We begin our analysis by testing the relation between peer misreporting and rival firms’ operational efficiency at the aggregate level. Using two measures of revenue-generating efficiency, we provide evidence confirming that financial misreporting by rivals leads peer firms to make inefficient resource allocation decisions. In spite of the average effect, we also find that the negative impact of misreporting is heterogeneous across different types of peer firms. The negative impact of misreporting is mainly driven by non-misstating firms that had high operational or financial performance. In contrast, the negative effect is much weaker for non-misstating firms that had low operational or financial performance. Taken together, the results suggest that for the subset of managers who had lacklustre performance in the past, the additional competition from peer misreporting can have a positive effect.

We then evaluate how the impact of misreporting varies with the degree of a firm’s reliance on external financing, its industry leadership status and its information environment. We predict and find that the negative effect of misreporting is stronger when peer firms rely more on external financing – a proxy for performance pressure. The negative effect is weaker when peers are industry leaders or when they have a more transparent information environment. Collectively, the results further our understanding of the externalities of financial misreporting.

Appendix

| Variable | Definition |

|---|---|

| OpEfficiency | Manager operational efficiency measure, estimated based on the data envelopment analysis. First, the model estimates firm-level operational efficiency by using sales revenue as output and seven inputs: net PP&E, cost of goods sold, SG&A expenses, capitalised operating leases, capitalised R&D expenditures, purchased goodwill, and other intangibles. Then the firm-level efficiency score is regressed on a set of firm characteristics. The residuals from the model represents manager operational efficiency. The measures are obtained from Professor Peter Demerjian’s faculty webpage: http://faculty.washington.edu/pdemerj/data.html. Details of the estimation steps are explained in Section 3.1 |

| R&D_Efficiency | A measure of R&D efficiency, which is calculated as the percentage increase in future revenues given a one percentage increase in R&D expenditure (Knott, 2008) |

| PeerMIS | Equal to one if the industry (Fama–French 48 industry classification) and size quartile (using market value) in which firm i operates has one or more misstatements by peers in year t. Misstatements are those classified as fraud or subject to SEC investigation according to the Audit Analytics database |

| TobinQ | Market value of assets divided by book value of assets |

| ROA | Income before extraordinary items divided by average assets |

| Cash | Cash holding scaled by lagged total assets |

| ExtFinance | Firms’ external financing, calculated as the sum of equity issues and debt issues in year t divided by total assets in year t |

| LogAT | Natural log of firm total assets |

| Leader | Equal to one if a firm’s market shares are above the industry median and zero otherwise |

| HighAnalyst | Equal to one if, within an industry-year, the decile ranking of number of analysts following the non-misstating firm falls in the top tercile |

| LowSalesGrowth | An indicator variable which equals one if, in a given year, a firm’s average sales growth rate over the past 3 years is below the industry median |

| LowAssetTurnover | An indicator variable which equals one if, in a given year, a firm’s average asset turnover ratio over the past 3 years is below the industry median |

References

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12