Politically connected boards, value or cost: evidence from a natural experiment in China

Abstract

This study investigates the net effect of a politically connected board for a firm. Using a natural experiment in China – a regulatory change to forbid bureaucrats from sitting on the board of public firms – we address the causality of the net effect of a politically connected board by testing the market reaction of the shares of firm targeted by the regulatory change to the policy announcement. The stocks of firms with politically connected directors who are targeted by the regulatory change show on average a significantly positive abnormal return, which suggests that the agency cost effect of a politically connected director dominates the value effect. The result is robust to various model settings and to a matched sample using the propensity score methodology. Additionally, the announcement effect of the resignation of a politically connected director is significantly positive, and significantly higher than that of a non-connected director. Overall, our results suggest that the agency cost effect of a politically connected director dominates the value effect.

1 Introduction

A firm can acquire its political ties through various ways, such as a current or former bureaucrat CEO (Fan et al., 2007), any politically connected top officer or large shareholder (Faccio, 2006; Faccio et al., 2006) and former politicians sitting on the board (Goldman et al., 2009). Generally, most studies treat the political connection as a particular human capital of the firm. As Fan et al. (2007) argue, firms with politically connected CEOs underperform those without connected CEOs based on their post-IPO stock return in China stock market. And politically connected CEOs are more likely to hire politically connected directors on their boards. According to the ‘grabbing hand’ argument (Shleifer and Vishny, 1998) that bureaucrats/politicians extract resources from listed firms, we raise our question: Are these political connections helpful to the firms? As the current or formal bureaucrats/politicians are more likely to take a part-time position on boards, we focus on politically connected directors of the boards. And we address one main question: Does politically connected board add to firm value?

To answer this question, we will test two competing effects of a politically connected board: the value effect and agency cost effect. The value effect can come from outside directors who serve the firm by providing advice or monitoring (Adams et al., 2010). For a firm, it is more likely that politically connected outside directors are hired as a source of advice and counsel rather than monitoring. Many studies have shown that political connections do bring value in various ways, including preferential treatment by the government (Faccio et al., 2006)1 and government-controlled banks (Dinc, 2005; Khwaja and Mian, 2005), relaxed regulatory oversight (Berkman et al., 2010) and many others. On the other hand, politically connected directors may also cause agency problems. As Masulis and Mobbs (2014) argue, the incentive for an independent director to spend their time and energy is reputational benefits. However, this kind of benefit seems to not be attractive to politicians whose careers do not rely on their business reputation. These directors may be paid by some other sort of benefit from the management team for their service to the firm, or even worse, service to the managers only (Beetsman et al., 2000). Consequently, there would be agency conflicts among the politically connected directors, management team and shareholders. Our study is to determine which effect dominates the other: political connection value or agency cost?

The challenge of identifying the net effect of politically connected directors is same as that of all other kinds of directors: the board structure is endogenous with both selection bias and omitted variables problems (Adams et al., 2010). There is an optimal board structure after the coordination of shareholders, management team, directors and regulatory departments. Thus, it is difficult for us to evaluate the real value of a director on the board. To address these endogenous problems, one ideal experiment is that one randomly chosen group of firms face an exogenous shock to their board structure while the other group is not. Goldman et al. (2009) try to capture the net effect of politically connected boards using an exogenous event of US election. However, this event is not a shock to the board structure but to the ‘value’ of the politician directors who belong to the winning camp. The linkage between the election and the board structure is not so straightforward because the firms may have some other channels and links with the winning party. In our study, we use a regulatory shock targeted to the politically connected directors in China to address these endogenous issues and to establish a clear causality of politically connected director effect.

Due to anticorruption purposes, the Organization Department of the CPC Central Committee in China issued a file (termed hereafter as No. 18 File) to forbid some officials of the government or the Party from sitting in a position on all firm boards on 19 October 2013.2 Specifically, all officials of the government or the Party who are still in the position are debarred from sitting on all firms and those who are retired for <3 years are debarred from sitting on local firms.3 According to our sample, 255 politically connected directors and 119 non-connected directors of publicly listed firms in China resigned after the file issuing date (139 firms were affected), which indicates that this event is a huge shock to the board structure of firms.

However, it is necessary to emphasise that to identify which politically connected director is going to be made to resign is difficult because, in the No. 18 File, there still remains space for exceptions. For example, officials can apply for approval to sit on a firm's board if they have understandable reasons. To show robust results, we construct three treatment groups. The first treatment group we name as ‘Ex-Ante Affected’ and we sift through the 2013 fiscal year annual reports for all firms and identify every outside director as an affected director if and only if he (or she) is an official of the Chinese Communist Party (CCP) or the government, and being in the official position or retired for <3 years.4 Next, we construct the treatment group by including 139 firms which have at least one affected director sitting on the board. However, the first treatment group may include some officials who are approved to stay and may be missing some officials who have already resigned before the fiscal year end.5 Thus, we construct the second treatment group as ‘Ex-Post Affected’. Here, we identify a firm to be ex-post affected if and only if this firm had at least one politically connected director resign after the file issuing date (19 October 2013 to year-end of 2014). In other words, this group contains the firms who actually took action under the No. 18 File. And for the third treatment group, which we name as ‘Ex-Ante & Ex-Post’, we combine the previous two groups together. To answer the question of which effect dominates the other, political connection value or agency cost, we will test the market reaction of the treatment groups around the No. 18 File issuing date. We have two predictions: if the political connection value effect dominates the agency cost effect, the market reaction of the treatment groups will be negative compared to the control groups as those firms are going to lose their political connection value. On the other hand, if the agency cost effect dominates the political connection value effect, the market reaction of the treatment groups will be positive as excluding the politically connected directors can improve their governance.

The first main result of this article is that the portfolio of each of the three treatment groups has a significantly positive cumulative abnormal return (CAR) around the file issuing date. For example, for the Ex-Ante Affected group, the CAR of one day before the file issuing date to one day after is 1.08 percent. This result shows that the market believes that the future exclusion of politically connected directors is good news for the affected firms. In other words, we can conclude that the agency cost effect of politically connected directors dominates the political connection value effect. To better understand these two effects, we also split every treatment group into state-owned firms and non-state-owned firms. A firm is recognised as a state-owned firm if its actual controlling agent is the central government or local government.6 The results show that the non-state-owned treatment group has much higher CAR than that of the state-owned treatment group. For example, in the Ex-Ante Affected group, the non-state-owned firms have on average 1.44 percent abnormal return while the state-owned firms have only 0.836 percent. It is not a surprise that non-state-owned firms have a stronger effect. Firstly, the marginal agency cost of politically connected directors in a state-owned firm is lower than that in a non-state-owned firm. Usually in China, the state-owned firm has a much larger size; therefore, there is an equity effect such that the agency cost of a politically connected director is diluted by a larger amount of shares. Additionally, the conflict of interest among the management team, state ownership and other shareholders of a state-owned firm is higher than that of a non-state-owned firm (Xu and Wang, 1999; Megginson and Netter, 2001; Zhang et al., 2003); therefore, the marginal benefit of excluding politically connected directors for the state-owned firm is less. Secondly, the personal interest claimed by the politically connected director is higher for non-state-owned firms. Unlike state-owned firm, a non-state-owned firm is much weaker in terms of bargaining power when facing the regulator and government intervention especially in China where the property rights protection is weak. The rent seeking of politically connected directors in non-state-owned firm is more severe. As an exchange, the politically connected director may bring more value in terms of decreasing political discrimination to the firm. However, the bargaining power of politically connected directors is higher in facing the management team of a non-state-owned firm and they may claim higher personal interest. An even worse case is that the manager may seek their own interest from the politically connected director at the cost of all shareholders. Thirdly, the value of politically connected directors may be higher for state-owned firms. Generally, state-owned firms are more likely to be monopoly firms which rely on political environment to take advantage from political restrictions. After the privatisation of state-owned firms, political connection becomes more important for their operation. Losing political connections will force them to compete with non-state-owned firms without political priorities. Therefore, from the perspective of competition, excluding politically connected directors is harmful for state-owned firms’ monopoly business, but helpful for non-state-owned firms.

One challenge to our test is that the treatment group is not randomly assigned. There is still a potential selection bias problem regarding what kind of firm is more likely to be affected by the exogenous shock. To address this problem, we use a propensity score matching method. The first stage is a probit model with an industry fixed effect which shows that firms with larger size, lower ROA, higher cash flow, larger board size and higher outside director proportion are more likely to be assigned to the treatment group. To construct an overall matching sample, we pick the same number of firms as the treatment group within every industry by ranking the propensity score. The result shows that the difference of CAR between treatment group and control group remains significantly positive. For example, the difference of CAR of one day before the event to one day after the event is 0.810 percent.

Additional evidence is provided by assessing the announcement effect of the individual outside director's resignation. Generally, the announcement effect of a director's departure could be a combining effect if this departure is a voluntary resignation. Dewally and Peck (2010) argue that public resignations of outside directors are motivated by reputation concerns. They can act as a disciplining device for poor board performance. In other words, a voluntary resignation of an outside director could be a bad signal to the market. It is plausible that the announcement effect of a resignation could contain both a bad signal effect and the director's value effect. To obtain the net effect of director's value, we need to exclude the signal effect. An ideal experiment is that when the departure happens, the market believes this departure is caused by outside reasons which are not related to firm performance.

In our study, we examine the announcement effect of resignations of outside directors from 2012 to 2014 in the Chinese market. From 2012, the anticorruption actions in China had already begun. And before the No. 18 File issuing date, some politically connected directors already started to resign with a reason of ‘adopting new rules’ on the announcement. We believe that even before the file issuing date, the market would not be surprised by the resignation of politically connected directors and investors would only evaluate the value of them but not the signal behind it. On the other hand, after the file issuing date, the market already has the expectation of future resignations of politically connected directors. The announcement effect at that period should thus not be significant. Therefore, we split all resignation announcements into two groups: those before the file issuing date and those after. The results show that before the file issuing date, the CAR of resignation announcement effects for politically connected directors is significantly positive by 0.887 percent. And the CAR of a politically connected director's resignation is significantly higher than that of a non-connected director with a difference of 0.530 percent. After the file issuing date, the CAR of politically connected and non-connected directors are both insignificantly negative, but their difference is still positive. These results provide additional evidence that when politically connected directors resign, the market reaction is significantly more positive than that of non-connected directors’ resignation. We conclude that the agency cost effect of politically connected directors dominates the value effect.

This study contributes to a broader understanding of agency cost and the value of a politically connected board. Previous studies rarely avoid endogenous problems by comparing firm performance (Fan et al., 2007) or evaluating the market reaction of a self-selected political director nomination (Goldman et al., 2009). Our paper uses a regulatory shock targeting the politically connected directors to establish a clear causal relation between the politically connected board and firm value. The main result of our study is that the agency cost of politically connected directors dominates their value. This result differs from (Goldman et al., 2009) but is consistent with (Fan et al., 2007) and provides an alternative angle of evaluating the value and cost of political connections.

The rest of the article is organised as follows. Section 2 introduces the background of the Chinese stock market. Section 3 describes the data used in this paper. Section 4 presents the empirical analysis and the main results of the article. Section 5 concludes the paper.

2 Background

With the development of the Chinese stock market, the supervision department has gradually established a more effective system, including internal corporate governance mechanisms of the listed firms. Outside directors are considered an important corporate governance mechanism to improve the effectiveness of company decisions and to protect the interests of shareholders especially the minority group. On August 16, 2001, the China Securities Regulatory Commission (CSRC), the supervision department of the Chinese stock market, issued the ‘Guidance of the Establishment of an Independent Director System in Listed Firms’ (Independent Director Guidance). The guidance gave the standards for the qualification of independent directors, the power of the independent directors, and the responsibility of the independent directors among other aspects. The independent director guidance also requires that all the listed firms should hire at least one-third of their directors as independent directors by 30 June 2003. However, as there are many state-owned firms in the Chinese stock market, the government as the controlling shareholder tends to appoint politically connected persons as independent directors. On the other hand, to avoid political discrimination, private firms are prone to hire politically connected persons as their independent directors. In this context, many incumbent or retired politicians are appointed as the independent director (Fan et al., 2007). Indeed, 49.5 percent of our sample firms have at least one politically connected directors sitting on firm's board. However, as there are many problems in the corporate governance of Chinese listed firms, the independent directors who have not played their monitoring role are called ‘vase director’ by the mass media.

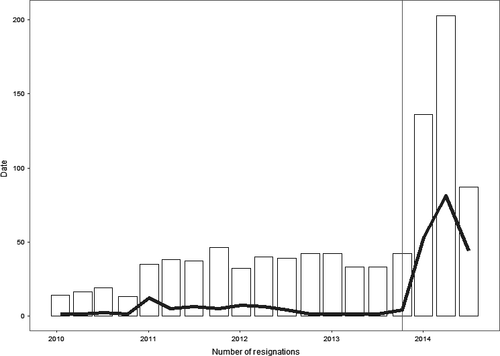

Starting from 2013, the Chinese government implemented comprehensive anticorruption actions from the institutional level. To regulate the power of officials in the government and the party, the Organization Department of the CPC Central Committee issued No. 18 File on 19 October 2013. Compared with other similar files issued, the No. 18 File made the unified and most strict standards for officials, who are currently on official position or retired within three years, to take part-time or full-time jobs in the firms. For example, if there is understandable reason for officials’ work in a firm, they should apply for this job and this job should not be more than one. As most of the official independent directors are not professionally related with the firm's business and are very busy with their government affairs, they cannot play their monitoring or counsel functions effectively. However, the firms should pay for the existence of official independent directors where agency costs would occur. The No. 18 File forced official independent directors to resign from listed firms, which provides us with an ideal experiment to study the net effect of official independent directors on firms’ value. Figure 1 shows the number of resignations of directors from 2010 to 2014. We can see that there are always director resignations due to all kinds of reasons over time. But before the new regulation, the politically connected directors rarely resigned. After the new regulation announced, both the number and the proportion of the resignations of politically connected directors increase dramatically.

In the Chinese context, the external legal environment and internal corporate governance mechanisms are relatively poor; thus, the principal–agent problem is severe in the listed firms. Therefore, we regard that the agency cost is high for the appointment of politically connected independent directors and the market will show a positive reaction to this event.

3 Data description

3.1 Firm data

The analysis in this paper utilises three types of data: firm-level data, director-level data and director resignation data. The firm-level data are drawn from the CSMAR database for the fiscal year of 2013. The sample contains Shanghai A listed firms and Shenzhen A listed firms. ST (special-treated; a firm will be special-treated if its profit continuously remains negative for 3 years) firms and financial firms are excluded. Panel B of Table 1 shows the summary statistics of the firm-level data. We can see that the firm-level sample contains 1759 observations. 49.5 percent of the firms have at least one politically connected director sitting on the board. But only 8.1 percent firms have at least one politically connected director to be strictly affected7 by the No. 18 File. Additionally, 8.5 percent firms have at least one politically connected director resignation after the file issuing date. 45.4 percent of the sample are recognised as state-owned firms.

| Statistic | N | Mean | SD | Pctl (25) | Median | Pctl (75) |

|---|---|---|---|---|---|---|

| Panel A: Director level | ||||||

| Politically Connected | 7,026 | 0.185 | 0.388 | 0 | 0 | 0 |

| Affected | 7,026 | 0.022 | 0.146 | 0 | 0 | 0 |

| Female | 7,026 | 0.152 | 0.359 | 0 | 0 | 0 |

| Age | 7,026 | 54.453 | 9.573 | 48 | 52 | 61 |

| Salary | 6,958 | 59.897 | 42.951 | 38.125 | 56.000 | 80.000 |

| Scholar | 7,026 | 0.434 | 0.496 | 0 | 0 | 1 |

| Accountant | 7,026 | 0.243 | 0.429 | 0 | 0 | 0 |

| Financial | 7,026 | 0.079 | 0.270 | 0 | 0 | 0 |

| Lawyer | 7,026 | 0.120 | 0.326 | 0 | 0 | 0 |

| In.Position | 7,026 | 0.008 | 0.088 | 0 | 0 | 0 |

| Retire ≤ 3 | 7,026 | 0.014 | 0.118 | 0 | 0 | 0 |

| Retire > 3 | 7,026 | 0.163 | 0.370 | 0 | 0 | 0 |

| Industry.poli | 7,026 | 0.156 | 0.363 | 0 | 0 | 0 |

| Congress | 7,026 | 0.010 | 0.099 | 0 | 0 | 0 |

| Panel B: Firm level | ||||||

| Political.Board | 1,759 | 0.495 | 0.500 | 0 | 0 | 1 |

| Political.Size | 1,759 | 0.738 | 0.924 | 0 | 0 | 1 |

| Firm.Affected | 1,759 | 0.081 | 0.272 | 0 | 0 | 0 |

| Board.Size | 1,759 | 8.924 | 1.825 | 8 | 9 | 9 |

| ID.Size | 1,759 | 3.297 | 0.689 | 3 | 3 | 4 |

| ID.Propotion | 1,759 | 0.374 | 0.056 | 0.333 | 0.333 | 0.408 |

| State.owned | 1,759 | 0.454 | 0.498 | 0 | 0 | 1 |

| Firm.Resign | 1,759 | 0.085 | 0.279 | 0 | 0 | 0 |

| Log(AT) | 1,759 | 22.189 | 1.279 | 21.311 | 21.976 | 22.875 |

| Log(MV) | 1,736 | 15.321 | 0.923 | 14.670 | 15.151 | 15.788 |

| ROA | 1,758 | 0.061 | 0.055 | 0.030 | 0.053 | 0.084 |

| Cashholding | 1,757 | 0.153 | 0.118 | 0.071 | 0.119 | 0.200 |

| Investment | 1,759 | 0.308 | 0.480 | 0.091 | 0.192 | 0.366 |

| Cashflow | 1,758 | 0.166 | 0.162 | 0.079 | 0.134 | 0.212 |

| Panel C: Resign level | ||||||

| Before.file | 618 | 0.348 | 0.477 | 0 | 0 | 1 |

| Adoption | 618 | 0.293 | 0.455 | 0 | 0 | 1 |

| Politically Connected | 618 | 0.432 | 0.496 | 0 | 0 | 1 |

| Accountant | 618 | 0.231 | 0.422 | 0 | 0 | 0 |

| Financial | 618 | 0.126 | 0.332 | 0 | 0 | 0 |

| Lawyer | 618 | 0.104 | 0.305 | 0 | 0 | 0 |

- This table reports the means, medians, standard deviations and quarter values of director-level, firm-level and resign-level variables. For director level and firm level, the sample includes all public firms listed on Shanghai A Stock Exchange and Shenzhen A Stock Exchange excluding ST (special-treated) and financial firms in the fiscal year 2013. It includes 7,026 observations at the director level (outside directors) and 1,759 observations at the firm level. For the resign level, the sample has 618 observations from 2012 to 2014. The firm-level accounting variables are winsored at 1 and 99 percent. Definition of all variables can be found in Appendix I.

3.2 Director data

To retrieve director-level data, we draw the independent director data from the CSMAR database, which includes name, gender, age, salary, shareholdings, education background and other biographical information. We hand-collect the information of the director's official position by going through their biographies provided by the CSMAR database and from searching online through platforms such as google.com, baidu.com and sina.com. We identify each outside director for several dummy variables: Politically Connected, Affected, In.Position, Retire < 3, Retire > 3, Congress, Scholar, Accountant, Financial and Lawyer. The definition of these variables can be found in Appendix I. Panel A of Table 1 shows the summary statistics of the director-level data. We can see in total we have 7026 outside directors for the 1759 firms in our sample. 18.5 percent of the directors are politically connected. 2.2 percent of them are affected by the No. 18 File. 43.4 percent of them are scholars. 24.3 percent of them are accountants. 7.9 percent of them are from financial systems (commercial banks or the central bank) and 12 percent of them are lawyers.

3.3 Director's resignation data

The director's resignation data is hand-collected by going through all public announcement files of all listed firms from 2012 to 2014. Overall, we have 618 announcements of outside director resignations. Panel C of Table 1 describes the summary statistics of the resignation data. 34.8 percent of the resignations happened before the file issuing data. 29.3 percent of the resignations provide the reason of ‘adopting the new rule’. 43.2 percent of the resignations are of politically connected directors.

3.4 Stock return data

The stock return data is obtained from the CSMAR database. The sample period is from 2012 to 2014 and the frequency is daily.

In this paper, we report three kinds of abnormal returns. The first kind of abnormal return is adjusted by the CAPM. The estimation period is from 300 trading days to 60 trading days before the event. And we report cumulative abnormal returns (CARs) for three time windows: 1 trading day before to 1 trading day after (e.g. (−1,+1)), 1 trading day before to 3 trading days after (e.g. (−1,+3)) and 1 trading day before to 5 trading days after (e.g. (−1,+5)). The second kind of abnormal return is the stock return minus the market return directly. The CARs time windows are same to the previous one.

4 Empirical analysis

The empirical analysis consists of three parts. The first part evaluates the market reaction to the No. 18 File. The second part constructs a matched sample by the use of propensity score matching and examines the difference in the abnormal stock returns of the two groups. The third part provides additional evidence by evaluating the announcement effect for outside director resignations.

Unless specified, all abnormal returns are adjusted by the CAPM. The estimation period is from 300 trading days to 60 trading days before the event, while the test period is from 1 day before the event to 5 days after that. We aggregate the CARs of all individual firms by constructing equally weighted and value-weighted portfolios. The standard deviation of the portfolio CAR is obtained by assuming independence of the error term across time and firms.

4.1 CAR around file issuing date

On 19 October 2013, the Organization Department of the CPC Central Committee in China issued the No. 18 File to forbid some officials of the government or the Party to sit on a position in listed firms. To be specific, officials who are currently in the official position or retired for <3 years are involved in this file action. To show the robustness of our results, we construct three treatment groups. The first treatment group, named Ex-Ante Affected, contains all firms which have at least one official who is currently in official position or retired for <3 years sitting on the board. The second treatment group, named Ex-Post Affected, contains firms that actually had politically connected director resignations after the file issuing date. The third treatment group, named Ex-Ante & Ex-Post, is the combination of the previous two treatment groups.

Table 2 reports the CAR around the file issuing date for the three treatment groups. The result shows that, for Ex-Ante Affected group, the equally weighted CAR from the CAPM for the event window (−1,+1) is 1.083 percent which is statistically significant, and robust for other event windows, which suggests that the market believes the exclusion of politically connected directors is good news for the firm. According to our predictions, as the abnormal returns of the firms which have politically connected directors (affected by the No. 18 File) are significantly positive, we believe that agency cost of politically connected directors is higher than their value.

| Equally weighted | Value-weighted | ||||||

|---|---|---|---|---|---|---|---|

| Adjusted by CAPM | Adjusted by CAPM | ||||||

| Boards type | N | (−1,+1) | (−1,+3) | (−1,+5) | (−1,+1) | (−1,+3) | (−1,+5) |

| Ex-Ante affected | 139 | 1.083*** | 1.009*** | 1.008*** | 0.123 | −0.443 | −0.197 |

| (3.889) | (2.807) | (2.370) | (0.222) | (−0.621) | (−0.234) | ||

| Non-state owned | 57 | 1.440*** | 1.504*** | 1.293* | 1.712** | 1.121 | 1.426 |

| (3.121) | (2.523) | (1.834) | (2.065) | (1.048) | (1.125) | ||

| State owned | 82 | 0.836*** | 0.665 | 0.810 | (0.176) | (0.737) | (0.503) |

| (2.412) | (1.489) | (1.532) | (−0.277) | (−0.897) | (−0.517) | ||

| Ex-post affected | 140 | 0.789*** | 0.757** | 0.520 | 0.077 | 1.228* | 0.212 |

| (2.794) | (2.077) | (1.206) | (0.150) | (1.864) | (0.272) | ||

| Non-state owned | 56 | 1.642*** | 1.177* | 1.462** | 1.556* | 3.112*** | 4.505*** |

| (3.456) | (1.918) | (2.014) | (1.712) | (2.653) | (3.248) | ||

| State owned | 84 | 0.220 | 0.477 | −0.108 | −0.478 | 0.521 | −1.399 |

| (0.632) | (1.062) | (−0.204) | (−0.778) | (0.658) | (−1.494) | ||

| Ex-Ante & Ex-Post | 250 | 0.864*** | 0.758*** | 0.553* | 0.047 | 0.005 | −0.178 |

| (4.117) | (2.800) | (1.726) | (0.109) | (0.009) | (−0.272) | ||

| Non-state owned | 106 | 1.482*** | 1.219*** | 1.180** | 1.461*** | 2.000*** | 2.876*** |

| (4.345) | (2.769) | (2.266) | (2.285) | (2.424) | (2.947) | ||

| State owned | 144 | 0.409 | 0.419 | 0.091 | −0.308 | −0.495 | −0.944 |

| (1.549) | (1.230) | (0.227) | (−0.600) | (−0.748) | (−1.204) | ||

| General political | 834 | 0.739*** | 0.444*** | 0.145 | 0.208 | −0.009 | −0.408 |

| (6.413) | (2.985) | (0.827) | (0.832) | (−0.027) | (−1.069) | ||

| Non-state owned | 399 | 1.148*** | 0.771*** | 0.561** | 1.047*** | 0.273 | 0.392 |

| (6.454) | (3.358) | (2.067) | (3.376) | (0.683) | (0.828) | ||

| State owned | 435 | 0.364*** | 0.144 | −0.236 | −0.060 | −0.099 | −0.663 |

| (2.444) | (0.750) | (−1.037) | (−0.193) | (−0.243) | (−1.382) | ||

- This table shows the cumulative abnormal returns around the file issuing date. Ex-Ante Affected is the subsample of firms with at least one politically connected outside director that being identified strictly affected by the NO. 18 File (e.g. in the position currently or retired <3 years) according to the 2013 fiscal year annual report. Ex-Post Affected is the subsample of firms with at least one politically connected outside director actually resigned after the file issued. Ex-Ante & Ex-Post is the combination of the previous two subsamples. General Political is the subsample of firms with at least one politically connected outside director. State-owned are firms controlled by national government or local government. Non-State-owned are firms controlled by other kinds of shareholders. Abnormal returns are adjusted by CAPM. The estimation period is from 300 trading days to 60 trading days before the file issuing date, while the test period is from 1 day before the file issuing date to 5 days after that. The standard deviations of CAR are aggregated by assuming independent of error term across time and firms. t-Values are reported in parentheses. *, ** and *** denote the significance at 10, 5 and 1 percent respectively.

Furthermore, when we split the Ex-Ante Affected group into non-state-owned firms and state-owned firms, we can see that CAR of non-state-owned firms for (−1,+1) is 1.388 percent, which is statistically significant, and higher than that of state-owned firms (0.396 percent). This result shows that agency cost effect is much stronger for non-state-owned firms, which suggests that the politically connected director is more costly for non-state firms. We also report the CARs for the general political group, which contains all firms with any kinds of politically connected directors (affected or not) sitting on the board. The result indicates that the market also gives a positive reaction to this group, but is less and short-lived. The value-weighted CARs are not significant for all three treatment groups, but they are significant for the non-state-owned subgroups. This is because the state-owned firms usually have much bigger size than non-state-owned firms. Further, some extremely large state-owned firms like China National Petroleum Corporation and Sinopec have no reaction to this event.

In conclusion, the results in this analysis suggest that the cost of politically connected directors is more than their value for the firms. Their abnormal stock returns are positive and statistically significant around the file issuing date, and this effect is stronger for non-state-owned firms.

We also try to evaluate the value of politically connected directors. We construct three variables to proxy the value of a politically connected director. The first variable is ‘Industry.poli’, which is a dummy variable to show whether the director is an official of a department related to the industry of the firm. We use this variable to proxy the director's value of consulting. The second variable is ‘Rank’, which describes how high the rank of the official is. We take this variable as an indicator of their monitoring and management ability. The third factor is ‘Financial’, which is a dummy variable to show whether the director has experience in the financial system. We use this variable to describe if the director can bring financial resource to the firm. However, we do not find any significance of these variables to the market reaction of a firm. Therefore, there is no strong evidence of the value effect of politically connected directors according to our findings.

4.2 Propensity score matching

One weakness of the natural experiment design in this paper is that the treatment group is not randomly assigned. In this analysis, we will construct a matching sample for the treatment group by propensity score matching.

Table 3 reports the probit model of the likelihood to be in the treatment group. We include the firm-level characteristics of Log(AT), leverage, ROA, cash holding, investment, cash flow, state.owned, board size, independent director proportion and industry fixed effect in the probit regression. The result shows that firms with larger size, lower ROA, state controlling ownership, higher cash flow, larger board size and higher independent director proportion are more likely to be affected by the No. 18 File.

| Dependent variable: | |||

|---|---|---|---|

| Combine.Affected | |||

| (1) | (2) | (3) | |

| Log(AT) | 0.030*** | 0.030*** | 0.023** |

| (0.008) | (0.009) | (0.009) | |

| Leverage | 0.019 | 0.016 | 0.020 |

| (0.054) | (0.057) | (0.057) | |

| ROA | −0.340* | −0.327* | −0.303 |

| (0.188) | (0.193) | (0.192) | |

| Cashholding | 0.123 | 0.118 | 0.111 |

| (0.079) | (0.083) | (0.082) | |

| Investment | 0.011 | 0.012 | 0.011 |

| (0.018) | (0.018) | (0.018) | |

| State.owned | 0.033* | 0.030 | 0.025 |

| (0.019) | (0.019) | (0.019) | |

| Cashflow | 0.162*** | 0.136* | 0.135* |

| (0.062) | (0.070) | (0.070) | |

| Board.Size | 0.015*** | ||

| (0.005) | |||

| ID.Propotion | 0.463*** | ||

| (0.164) | |||

| Constant | −0.580*** | −0.667*** | −0.807*** |

| (0.172) | (0.186) | (0.192) | |

| Industry fixed effect | Yes | Yes | Yes |

| Observations | 1,756 | 1,756 | 1,756 |

| Log Likelihood | −647.857 | −641.015 | −635.287 |

| Akaike Inf. Crit. | 1,311.715 | 1,320.030 | 1,312.574 |

- This table reports the probit model of firms being affected. The dependent variable Combine.Affected is a dummy variable which equals 1 if the firm has a politically connected outside director being affected by the file (e.g. in the position currently or retired <3 years) according to 2013 annual report, or happens at least one politically connected outside director resigning after the file issuing date. Log(AT) is log of total asset of the firm. Leverage is total debt scaled by total asset. ROA is EBITDA scaled by total asset. Cashholding is cash and cash equivalent scaled by total asset. Investment is capital expenditure scaled by total asset. State.owned is a dummy variable which equals 1 if the firm is controlled by national government or local government. Cashflow is EBITDA scaled by fixed asset. Board.Size is the number of all directors of the firm. ID.Proportion is the proportion of outside directors in the board. Definition of all variables definition can be found in Appendix I. Standard errors are reported in parentheses. *, ** and *** denote the significance at 10, 5 and 1 percent respectively.

To construct the matching sample group, we pick the same number of firms to the treatment sample within every industry to guarantee that the matching sample has the same industry distribution with the treatment sample as we include the industry fix effect in the probit model. Matching firms are chosen by ranking their propensity score from regression (3) of Table 3. Table 4 reports the comparison of summary statistics of the treatment group and the control group. We can see that the control group has a smaller number of politically connected directors sitting on the board, a slightly larger board size and a higher proportion of state-owned firms. All other variables’ values are close, although some differences between them are statistically significant.

| Statistic | Treatment group | Control group | t | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| N | Mean | SD | Pctl(25) | Median | Pctl(75) | N | Mean | SD | Pctl(25) | Median | Pctl(75) | ||

| Combine.Affected | 249 | 1.000 | 0.000 | 1 | 1 | 1 | 249 | 0.000 | 0.000 | 0 | 0 | 0 | |

| Political.Size | 249 | 1.674 | 1.085 | 1 | 1 | 2 | 249 | 0.806 | 0.917 | 0 | 1 | 1 | 9.814*** |

| Board.Size | 249 | 9.318 | 2.130 | 8 | 9 | 11 | 249 | 10.523 | 2.333 | 9 | 11 | 12 | −6.129*** |

| State.owned | 249 | 0.566 | 0.497 | 0 | 1 | 1 | 249 | 0.795 | 0.405 | 1 | 1 | 1 | −5.733*** |

| Log(AT) | 249 | 22.578 | 1.460 | 21.477 | 22.193 | 23.414 | 249 | 23.544 | 1.310 | 22.640 | 23.464 | 24.484 | −7.909*** |

| Log(MV) | 249 | 15.597 | 1.063 | 14.900 | 15.386 | 16.026 | 249 | 16.137 | 1.004 | 15.372 | 16.093 | 16.787 | 0.070 |

| Cashholding | 249 | 0.154 | 0.117 | 0.065 | 0.122 | 0.213 | 249 | 0.153 | 0.130 | 0.065 | 0.115 | 0.200 | −1.344 |

| Investment | 249 | 0.324 | 0.591 | 0.092 | 0.190 | 0.355 | 249 | 0.401 | 0.705 | 0.085 | 0.185 | 0.380 | −0.530 |

| Cashflow | 249 | 0.190 | 0.187 | 0.080 | 0.137 | 0.234 | 249 | 0.199 | 0.195 | 0.078 | 0.139 | 0.250 | −5.733*** |

| ROA | 249 | 0.060 | 0.058 | 0.031 | 0.052 | 0.081 | 249 | 0.055 | 0.048 | 0.026 | 0.047 | 0.073 | −0.698 |

| ID.Propotion | 249 | 0.380 | 0.062 | 0.333 | 0.364 | 0.429 | 249 | 0.403 | 0.077 | 0.359 | 0.364 | 0.444 | −10.061*** |

- This table reports the summary statistics of treatment group and control group. The treatment group is the subsample of firms that have a politically connected outside director being affected by the file (e.g. in the position currently or retired <3 years) according to 2013 annual report, or happen at least one politically connected outside director resigning after the file issuing date. The control group is selected according to the propensity score (fitted value of regression (3) in Table 3). Within every industry, the control group picks the same number of firms as the treatment group by ranking the propensity score. *, ** and *** denote the significance at 10, 5 and 1 percent respectively.

Table 5 reports the results of the difference of CARs between the treatment group and the control group. We denote the treatment group as A, the non-state-owned firms in the treatment group as B, the state-owned firms in the treatment group as C, the control group as D, the non-state-owned firms in the control group as E, and the state-owned firms in the control group as F. The CARs reported in Table 5 are all for equally weighted portfolios, and we provide CARs from the CAPM and the raw return. From the table, we can see that the CARs for the control group are not positively significant and some of them are even negative. The differences between the treatment group and the control group are always significantly positive. Specifically, for the event window (−1,+1), the difference of CAR between the treatment group and the control group (A–D) is 0.81 percent, the difference between the non-state subgroups (B–E) is 0.78 percent, and the difference between the state-owned subgroups (C–F) is 0.54 percent. All other differences of CARs are robust. The result suggests that controlling by matching sample, the abnormal stock return of the firms with politically connected directors affected by the No. 18 File is positive, which indicates that the agency cost effect of politically connected directors dominates the value effect.

| Adjusted by CAPM | Return | ||||||

|---|---|---|---|---|---|---|---|

| Boards type | N | (−1,+1) | (−1,+3) | (−1,+5) | (−1,+1) | (−1,+3) | (−1,+5) |

| Treatment (A) | 249 | 0.819*** | 0.647*** | 0.433** | 2.245*** | −0.641*** | −2.418*** |

| (5.814) | (3.561) | (2.013) | (7.847) | (−1.751) | (−5.588) | ||

| Non-state (B) | 106 | 1.388*** | 1.039*** | 0.971*** | 3.049*** | −0.134 | −1.654*** |

| (6.105) | (3.538) | (2.794) | (6.135) | (−0.247) | (−2.840) | ||

| State (C) | 143 | 0.396*** | 0.357 | 0.034 | 1.625*** | −1.032** | −3.006*** |

| (2.226) | (1.554) | (0.124) | (5.019) | (−2.087) | (−4.864) | ||

| Control (D) | 249 | 0.008 | −0.295* | −0.677*** | 1.539*** | −1.347*** | −3.369*** |

| (0.062) | (−1.751) | (−3.392) | (5.633) | (−3.805) | (−8.859) | ||

| Non-state (E) | 53 | 0.602* | −0.103 | −1.038** | 2.728*** | −0.546 | −2.892*** |

| (1.913) | (−0.254) | (−2.157) | (4.784) | (−0.829) | (−3.904) | ||

| State (F) | 196 | −0.143 | −0.344* | −0.585*** | 1.227*** | −1.557*** | −3.495*** |

| (−1.004) | (−1.866) | (−2.679) | (3.988) | (−3.784) | (−7.952) | ||

| A–D | 0.810*** | 0.942*** | 1.109*** | 0.705* | 0.705 | 0.952* | |

| (8.440) | (7.600) | (7.562) | (1.783) | (1.385) | (1.653) | ||

| B–E | 0.786*** | 1.142*** | 2.009*** | 0.321 | 0.411 | 1.238 | |

| (4.260) | (4.794) | (7.124) | (0.425) | (0.482) | (1.314) | ||

| C–F | 0.540*** | 0.701*** | 0.618*** | 0.397 | 0.525 | 0.488 | |

| (4.837) | (4.865) | (3.628) | (0.890) | (0.817) | (0.644) | ||

- This table compares the cumulative abnormal returns around the file issuing date between treatment group and control group. The treatment group is the subsample of firms that have a politically connected outside director being affected by the file (e.g. in the position currently or retired <3 years) according to 2013 annual report, or happen at least one politically connected outside director resigning after the file issuing date. The control group is selected according to the propensity score (fitted value of regression (3) in Table 3). Within every industry, the control group picks the same number of firms as the treatment group by ranking the propensity score. State owned are firms controlled by national government or local government. Non-State owned are firms controlled by other kinds of shareholders. Abnormal returns are adjusted by CAPM. The estimation period is from 300 trading days to 60 trading days before the file issuing date, while the test period is from 1 day before the file issuing date to 5 days after that. The standard deviations of CAR are aggregated by assuming independent of error term across time and firms. t-Values are reported in parentheses. *, ** and *** denote the significance at 10, 5 and 1 percent respectively.

4.3 Announcement effect of director's resignation

The previous test provides evidence by a difference-in-difference design. It compares the market reaction of the treatment group and control group to a major event. To avoid accident driven results, we provide an additional test to show the robustness of our results by evaluating the announcement effect of a director's resignation. Generally, the announcement effect of an outside director's resignation is a combination of the signal effect and the value effect. As Dewally and Peck (2010) argue, the public resignations may indicate poor board performance. Thus, the signal effect of the director's resignation is negative. If we assume that the director is valuable for the firm, the value effect of the director resignation should also predict a negative market reaction. Therefore, a positive result of market reaction will give us confidence that the value of a politically connected director is negative as it is opposite to both of the previous predictions. In our study, we evaluate the announcement effect of all outside directors’ resignations except for those retiring.8 And we split all 540 resignations into two groups: the ones before the file issuing date and the ones after. We also evaluate the difference between the resignation of a politically connected outside director and that of a non-connected outside director.

Table 6 reports the results of the abnormal stock return for the announcement effect of outside director resignations. We can see that before the file issuing date, the CAR for a politically connected director resignation is significantly positive (0.887 percent), while that of a non-connected director's resignation is not significant. This result contradicts with the predictions of both the signal effect and the value effect, which suggests that the net effect of politically connected outside directors is negative. In fact, the anticorruption actions have already begun since 2012; thus, the resignations are unlikely to be a surprise to investors. When we survey the announcement file, some politically connected directors address the reason of their resignations as ‘adopting new rules’. Thus, it is reasonable to assume that the resignation of a politically connected director does not carry any information about firm performance. Regardless, we can conclude that the effect of their resignation is positive. Furthermore, the difference between the politically connected director's resignation and the non-connected director resignation (A–B) is consistently positive and statistically significant, which confirms the positive effect for a politically connected director's resignation with a benchmark.

| Equally weighted | Value-weighted | ||||||

|---|---|---|---|---|---|---|---|

| Adjusted by CAPM | Adjusted by CAPM | ||||||

| Panel A: Outside directors departure before file issuing date | |||||||

| Directors type | N | (−1,+1) | (−1,+3) | (−1,+5) | (−1,+1) | (−1,+3) | (−1,+5) |

| Politically connected (A) | 63 | 0.887*** | 0.512 | 0.989** | 1.604*** | 1.081* | 1.265* |

| (3.091) | (1.382 | (2.261) | (3.281) | (1.713) | (1.700) | ||

| Non-connected (B) | 103 | 0.358 | 0.510* | 0.49 | 0.316 | 0.601* | 0.789* |

| (1.619) | (1.787) | (1.451) | (1.156) | (1.705) | (1.890) | ||

| A–B | 0.530*** | 0.002 | 0.500* | 1.289*** | 0.48 | 0.476 | |

| (3.025) | (0.010) | (1.869) | (5.129) | (1.481) | (1.242) | ||

| Panel B : Outside directors departure after file issuing date | |||||||

| Politically connected (C) | 255 | −0.084 | −0.24 | −0.133 | −0.562* | −0.245 | −0.064 |

| (−0.552) | (−1.227) | (−0.572) | (−1.969) | (−0.665) | (−0.147) | ||

| Non-connected (D) | 119 | −0.143 | −0.415 | −0.749** | −0.146 | −2.177*** | −2.404*** |

| (−0.654) | (−1.469) | (−2.238) | (−0.319) | (−3.678) | (−3.434) | ||

| C–D | 0.059 | 0.175 | 0.616*** | −0.416* | 1.932*** | 2.340*** | |

| (0.475) | (1.086) | (3.234) | (−1.710) | (6.158) | (6.308) | ||

- This table shows the cumulative abnormal returns around the outside director departure announcement date. Panel A tests the announcement effect of outside director departures from 2012 to the file issuing date (19/10/2013), while panel B tests that after the file issuing date. Politically Connected refers to the departure of a politically connected outside director. Non-connected refers to the departure of all other categories of outside directors. A–B and C–B report the difference between Politically Connected and Non-connected. Abnormal returns are adjusted by CAPM. The estimation period is from 300 trading days to 60 trading days before the file issuing date, while the test period is from 1 day before the file issuing date to 5 days after that. The standard deviations of CAR are aggregated by assuming independent of error term across time and firms. t-Values are reported in parentheses. *, ** and *** denote the significance at 10, 5 and 1 percent respectively.

The CARs for the resignation after the file issuing date are not significant, which is reasonable because investors already expect these resignations. Further, the market has already reacted around the file issuing date. Despite this, we can see that the difference in CARs between the politically connected group and non-connected group (C–D) is still positive.

5 Conclusion

This study shows that politically connected boards have a higher agency cost than the value added to the firm. Using an exogenous event – a regulatory change to forbid some officials sitting on the board – we design a nature experiment to address the causality of the politically connected outside directors’ effect.

Firstly, we hand-collect all outside directors’ characters to construct the sample of firms that would be affected by the exogenous shock. The abnormal stock returns for these firms around the file issuing date are significantly positive, which suggests that the agency cost effect of the politically connected directors dominates their value effect. Furthermore, the difference between the treatment group and the control group, constructed by propensity score matching, is significantly positive.

Secondly, following the announcement of the resignation of a politically connected outside director before the file issuing date, there is on average a positive and significant abnormal stock return. This abnormal return is significantly higher than that of the resignation of a non-connected outside director. These announcement effects provide additional evidence for our argument.

In conclusion, the evidence presented in this article supports the argument that the agency cost effect of the politically connected board dominates its value effect.

Notes

Appendix A: Definition of variables

| Variables | Definition |

|---|---|

| Politically Connected | Equals 1 if the outside director is an official of the Chinese Communist Party (CCP) or the Chinese government. (Not includes the representatives of the National People's Congress and members of the National Committee of the Chinese People's Political Consultative Conference.) Source: Hand-collected. |

| Affected | Equals 1 if the outside director is strictly affected by the NO.18 File. (Officials in the position or retired less than 3 years.) Source: Hand-collected. |

| Female | Equals 1 if the outside director is a female. Source: CSMAR. |

| Age | Age of the outside director. Source: CSMAR. |

| Salary | Salary of the outside director. (Thousand yuan) Source: CSMAR. |

| Scholar | Equals 1 if the outside director is a scholar at a university. Source: Hand-collected. |

| Accountant | Equals 1 if the outside director is an accountant. Source: Hand-collected. |

| Financial | Equals 1 if the outside director is an officer of financial companies. Source: Hand-collected. |

| Lawyer | Equals 1 if the outside director is a lawyer. Source: Hand-collected. |

| In.Position | Equals 1 if the outside director is an official and is in the position. Source: Hand-collected. |

| Retire ≤ 3 | Equals 1 if the outside director is an official and is retired less than 3 years. Source: Hand-collected. |

| Retire > 3 | Equals 1 if the outside director is an official and is retired more than 3 years. Source: Hand-collected. |

| Industry.poli | Equals 1 if the director is an official of a department related to the industry of the firm. |

| Congress | Equals 1 if the outside director is a representative of the National People's Congress or a member of the National Committee of the Chinese People's Political Consultative Conference. Source: Hand-collected. |

| Political.Board | Equals 1 if there is at least one politically connected outside director in the board. Source: Hand-collected. |

| Political.Size | The number of politically connected outside directors in the board. Source: Hand-collected. |

| Firm.Affected | Affected by the NO.18 File (Officials in the position or retired less than 3 years.) Source: Hand-collected. |

| Board.Size | Number of all directors in the board. Source: CSMAR. |

| ID.Size | Number of all outside directors in the board. Source: CSMAR. |

| ID.Proportion | Proportion of outside directors in the board. Source: CSMAR. |

| State.owned | Equals 1 if the controlling shareholder is the national government or local government. Source: CSMAR. |

| Firm.Resign | Equals 1 if there is at least one official outside directors resigned after the file issuing date (19/10/2013). Source: Hand-collected. |

| Log(AT) | Log of total asset of the firm. Source: CSMAR. |

| Log(MV) | Log of market value of the firm. Source: CSMAR. |

| ROA | EBITDA scaled by total asset. Source: CSMAR. |

| Leverage | Total debt scaled by total asset. Source: CSMAR. |

| Cashholding | Cash and cash equivalent scaled by total asset. Source: CSMAR. |

| Investment | Capital expenditure scaled by fixed asset. Source: CSMAR. |

| Cashflow | EBITDA scaled by fixed asset. Source: CSMAR. |

| Before.File | Equals 1 if the outside director resigned from 2012 to the file issuing date (19/10/2013). Source: Hand-collected. |

| Adoption | Equals 1 if the statement of resign reason is adopting the file. Source: Hand-collected. |

| Retire | Equals 1 if the resign reason is retire after regular tenure (4 years). Source: Hand-collected. |

| Ex-Ante | Affected Subsample of firms which Firm.Affected equals 1. |

| Ex-Post | Affected Subsample of firms which Firm.Resign equals 1. |

| Ex-Ante& Ex-Post | A combination of Ex-Ante Affected and Ex-Post Affected. |

| Combine.Affected | Equals 1 if Firm.Affected equals 1 or Firm.Resign equals 1. |