Effect of the ban on short selling on market prices and volatility

Abstract

We examine the effects of the short-selling ban, imposed by Australian regulators in the wake of the global financial crisis, on the trading of financial stocks. Our findings argue against commonly stated reasons for imposing short-sale bans. We find no evidence that short-sale restrictions provide support for stock prices or that they reduce volatility. Moreover, stocks subject to the short-selling ban suffered a severe degradation in market quality. Controlling for the adverse effects of the financial crisis on markets, we show that short-selling restrictions increase intraday volatility, reduce trading activity and increase bid–ask spreads.

1 Introduction

Financial markets remain unsettled in the wake of the global financial crisis of 2008. In an effort to calm markets and preserve confidence, regulators worldwide have resorted to and continue to resort to restrictions on short selling. As recently as 2011, France, Belgium, Spain and Italy imposed renewed restrictions on short selling. Other regulators continue to impose additional reporting requirements and guidelines to impede short sellers, and public opinion concurs with these decisions (Guardian, 2011). These measures have been taken in spite of research findings indicating that short-sale restrictions degrade market quality. In fact, regulators acknowledge those findings in the announcement of their decisions. For example, in 2009 the Australian Securities and Investment Commission (ASIC) press release stated ‘ASIC weighed up the continued volatility in global financial markets and potential damage from aggressive or predatory practices from short selling against the possible loss of some market efficiency or price discovery… [and decided that] the ban is justified given the current market circumstances’ (ASIC, 2009). Similarly, in a press release highlighting the objective to support prices, the Technical Committee of the International Organization of Securities Commissions states ‘in a context of a credit crisis where some entities face liquidity challenges, but are otherwise solvent, a decrease in their share price induced by short selling may lead to further credit tightening for these entities…’, but acknowledges the important role of short selling overall (IOSCO, 2008).

Although a number of recent academic papers (e.g. Hansson and Fors, 2009; Marsh and Payne, 2012) have confirmed a loss in market quality after the introduction of short-sale restrictions in 2008, much less consideration has been given to investigating whether the stated goals of regulators for imposing short-sale restrictions were achieved. In this paper, we address this gap in the literature. We consider whether a short-sale ban on financial stocks contributed to a calming of the market, that is whether banning short selling reduced market volatility, and whether the ban supported prices. To be consistent with related studies, we also test for the effects of the ban on market quality as measured by bid–ask spreads and trading activity. In a carefully matched sample of financial stocks, we find little support for the assertion that short-sale restrictions calm markets or increase market confidence.

Our data are drawn from two markets, Australia and Canada, with similar industry and regulatory characteristics. The crucial, for our study, difference between the markets is in the length of the short-sale restrictions. Australia imposed an extraordinarily long and comprehensive ban on short sales of financial stocks over a period of 8 months; Canada's ban lasted only 14 trading days. To isolate the effect of the shorting ban, we compare the banned Australian financial stocks to a control group of Canadian financial stocks. With this research design, we can examine the changes in intraday volatility, as well as bid–ask spreads and trading activity, before, during and after the shorting ban, and compare banned financial stocks to non-banned financial stocks. The effects are demonstrated with fixed-effect panel models. We use an event study to examine whether the ban on short selling supported prices.

2 History

On 18 September 2008, the Financial Services Authority (FSA) in the United Kingdom, the Securities and Exchange Commission (SEC) in the United States and the Ontario Securities Commission (OSC) in Canada surprised markets by implementing a temporary ban on short selling of selected financial stocks to mitigate the turmoil in financial markets. Several other countries including Australia, Germany, the Netherlands, France, Switzerland and Taiwan quickly followed suit, announcing similar policy changes before the opening of the markets on 22 September 2008 (Scannell, 2008). The ban in the USA was lifted on 8 October 2008, after a period of 14 trading days. The Canadian ban, implemented to prevent regulatory arbitrage in cross-listed stocks, was lifted at the same time (OSC, 2008). Australia initially imposed a 30 day ban on short selling for all Australian Stock exchange (ASX) listed stocks. This short-selling ban was extended until November 18, 2008, when it was lifted for all except financial stocks. The ban on short-selling financial stocks in Australia was extended multiple times until it was finally removed on 25 May 2009. The Australian financial stock short-selling ban interval encompassed both the turbulent period experienced in the financial markets at the end of 2008 and the milder period in 2009.

In our study, we focus on the day that the ban is lifted, rather than on the day it is imposed. As the Australian ban on short selling of financial stocks ended only in May of 2009, the market was much less noisy than at the time of other studies. Our results suggest that, at least for our extended ban period, the short-sale bans eroded confidence and therefore prices, rather than providing support. We then consider market volatility before, during and after Australia's protracted ban on short selling and compare the outcome to that of a control group of stocks over the same period. Our univariate and multivariate fixed-effect panel models provide rigorous empirical evidence of the impact of the short-selling ban. We use the same models to consider the impacts on market quality measured as trading activity and bid–ask spreads. Our specific hypotheses are outlined in the next paragraphs.1

3 Specific hypotheses

The findings of most empirical research, including non-US studies, are consistent with the overvaluation effect as hypothesised by Miller (1977), leading to our first hypothesis:

- H1: The ban on short selling causes stocks to be overvalued.

Advocates of short-selling constraints, including ASIC, refer to lower volatility as justification for such constraints. Yet the theoretical models of Abreu and Brunnermeier (2002) and Scheinkman and Xiong (2003) predict that making it more difficult for investors to sell securities short leads to a rise in volatility. Kraus and Rubin (2003) argue that the effect on volatility of short-sale constraints is dependent on the variability of news about final payoffs. Recent empirical work (Boehmer et al., 2009; Marsh and Payne, 2012) is consistent with the expectation that short-selling constraints increase intraday volatility. Sharif et al. (2014) find that volatility is reduced after the introduction of short selling for Chinese stocks. Therefore, our second hypothesis is as follows:

- H2: Implementation of the short-selling ban leads to a rise in intraday volatility.

The Investment and Financial Services Association (IFSA) in Australia estimates that short selling averaged approximately 15 percent of trading volume in the years prior the introduction of the shorting ban. The Diamond and Verrecchia (1987) model predicts a rise in bid–ask spreads when restrictions on short selling are present. Moreover, Boehmer et al. (2008) indicate that quantitative hedge funds are largely responsible for high frequency shorting activity. These funds have been supplying large amounts of liquidity to the market in recent years (Khandani and Lo, 2007). As these funds are not exempt from the shorting ban, we expect a sizeable decline in market liquidity, resulting in higher bid–ask spreads when the short-sale ban applies.

- H3: The ban on short selling decreases trading activity and market liquidity of short-sale constrained stocks.

4 Methods and data

To test these hypotheses, we employ a matching procedure in conjunction with a fixed-effect panel methodology. It is commonly believed that financial stocks are affected differently by financial crises than non-financial stocks. As all Australian financial firms were subject to the shorting ban in Australia, we chose Canadian financial stocks, traded on the Toronto Stock Exchange (TSX), for our control group.

We use TSX-listed financial stocks as our control group because of the similarities between the two markets. Both the ASX and the TSX are fully automated order-driven continuous auction markets based on price–time priority.2 Measures of market quality, including transaction costs (the trade-weighted relative effective spread), exchange charges and taxes, have been similar for the two exchanges in recent years (Swan and Westerholm, 2008). The two countries also have similar levels of short interest.3 The Standard & Poor's and Moody's the rankings of Canadian financial institutions are similar to the rankings of Australian financial firms; both countries have a strong financial system with domestic banks solidly within Moody's Aa debt rating band. A key difference between the markets, and the one that matters for our purposes, is that the short-selling ban in Canada applied only to those financial stocks that are cross-listed in the US equity market, and only for a period of 14 trading days, while the shorting ban in Australia was much longer lived.

4.1 Data

The transaction data are from Reuters DataScope Tick History (RDTH). RDTH contains all executed trades, time-stamped to the nearest hundredth of a second. As the transaction data do not contain the prevalent bid and ask prices at the time the trades occur, the data are supplemented with Reuters’ market depth data which contains bid and ask prices, time-stamped to the nearest hundredth of a second. Each trade is matched with the best bid and ask prices that are prevalent in the market immediately prior the transaction. The Reuters RDTH database is also our source for daily data on the S&P/TSX Composite Index and S&P/ASX All Ordinaries Index as well as the Australian Dollar/Canadian Dollar exchange rate.

We select our sample of Australian stocks with the following criteria: to be included, over the sample interval from 22 September 2008 to 25 May 2009, stocks must be continuously listed, be affected by the short-selling ban (primarily financial firms), have at least one trade and one quote for each trading day, and not experience a stock split. Applying these criteria to the universe of Australian stocks leads to a sample of 45 Australian stocks.

(1)

(1)where  and

and  are the market capitalisation (measured in Australian dollars) for the Australian stock and the Canadian stock, respectively.

are the market capitalisation (measured in Australian dollars) for the Australian stock and the Canadian stock, respectively.

The Australian treatment and Canadian control pairs are well matched. The GICS sector, ‘Financials’ is an exact match for all but one of the 45 pairs. The GICS industry is a perfect match for 32 pairs; for the remaining 13 pairs we use a firm from a related GICS industry. All company pairs, with one exception, meet the size matching condition specified in Equation 1. The closest match for the exception, Wesfarmers, is TSX-listed SNC – Lavalin Group Inc. – with a much smaller market capitalisation (A$10 billion vs. A$27 billion on 21 January 2008). We retain this pair in the sample on the belief that the benefits of keeping it outweigh the disadvantages of an imperfect match, as argued by Davies and Kim (2009). Seven of the Canadian financial institutions in the sample are subject to the 14 day short-sale ban. These stocks allow an analysis of whether there are analogous changes in trading attributes between the affected control stocks and base stocks during this period with this subset of stocks.

4.2 Descriptive statistics

Table 1 provides summary statistics for the Australian treatment stocks and the Canadian control stocks. For each group, we estimate a time-series average over the entire sample period to then calculate a cross-sectional mean. Because we are comparing stocks from different countries, we focus on relative, and therefore unit-free, measures.

| Variable | Obs | Australian base stocks | Canadian control stocks | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. dev. | Skewness | Kurtosis | Mean | Std. dev. | Skewness | Kurtosis | ||

| Market Cap. (AUD million) | 45 | 12,140 | 18,793 | 2.281 | 7.566 | 12,670 | 19,799 | 1.946 | 5.747 |

| Return | 16,335 | −0.0024 | 0.0568 | −1.782 | 59.875 | −0.0006 | 0.0337 | 0.073 | 8.915 |

| Price (AUD) | 16,380 | 8.37 | 12.01 | 1.940 | 6.344 | 30.65 | 44.41 | 5.710 | 38.110 |

| Trade Volume (million) | 16,380 | 6.669 | 11.608 | 8.359 | 139.143 | 0.835 | 1.639 | 4.535 | 33.445 |

| Dollar Turnover (AUD million) | 16,380 | 37.588 | 71.164 | 3.403 | 19.615 | 29.285 | 61.857 | 4.035 | 29.989 |

| Share of market turnover | 16,380 | 0.0077 | 0.0138 | 2.666 | 11.363 | 0.0055 | 0.0111 | 3.104 | 15.610 |

| VWRSP | 16,380 | 0.0071 | 0.0091 | 3.948 | 33.401 | 0.0031 | 0.0024 | 4.296 | 43.622 |

| TWRSP | 16,380 | 0.0068 | 0.0081 | 2.451 | 9.973 | 0.0030 | 0.0024 | 3.313 | 32.492 |

| RASP | 16,380 | 0.0222 | 0.0236 | 2.844 | 16.732 | 0.0072 | 0.0078 | 3.803 | 31.080 |

| HLVOL | 16,380 | 0.0593 | 0.0468 | 3.055 | 18.602 | 0.0427 | 0.0308 | 2.560 | 14.813 |

| RVOL10 | 16,380 | 0.0022 | 0.0067 | 11.265 | 186.145 | 0.0006 | 0.0010 | 8.200 | 120.608 |

- This table reports summary statistics for the base group and the control group for the entire sample from 22 January 2008 to 24 July 2009. The statistics are calculated using all observations. Market capitalisation is determined as the number of shares outstanding as at 22 January 2008 multiplied by the closing share price on this date for each stock. Market capitalisation of the Canadian control stocks is converted to Australian dollars using the exchange rate prevalent on 21 January 2008. Price refers to closing prices where Canadian stock prices are converted to Australian dollars using the exchange rate prevalent on the given day. Trade volume, dollar turnover and share of market turnover refer to trading activity where trade volume is the number of shares traded per day and dollar turnover is the daily turnover measured in Australian dollars. VWRSP stands for volume-weighted relative effective spread; TWRSP stands for time-weighted relative spread; RASP stands for relative average spreads; HLVOL is the high–low intraday volatility measure; RVOL10 is the ten minute realised volatility.

We matched stocks based on market capitalisation, so those characteristics are very similar, but mean share prices are very different, at A$8.37 for Australian stocks compared to A$30.65 for Canadian stocks. This share price differential explains the large difference in the number of shares traded between the two groups. Other measures of trading activity, such as dollar turnover and share of market turnover, are similar between the two samples. On average, the Australian stocks exhibit larger spreads and higher intraday volatility than the control Canadian stocks. Most measures of trading activity and market quality are positively skewed. Accordingly, we calculate medians as well as means, and we use the logarithm of the mean measures in later parts of this study.

4.3 Univariate analysis

As a first investigation of hypotheses 2 and 3, we consider a graphical illustration of the changes in market attributes over the sample period, comparing the treatment group, 45 Australian stocks, to the 45 matched Canadian control stocks. We split our sample into four periods:

- the period before 22 September 2008 called the pre-ban period;

- the period from 22 September 2008 to 8 October 2008 called the common ban period;

- the period from 9 October 2008 to 24 May 2009 called the ban period; and

- the period from 25 May 2008 to 24 July 2009 called the post-ban period.

During the pre-ban period, none of the stocks in the sample were prohibited from being sold short. For the 13 trading day4 common ban period, the shorting ban was in place in Australia and for seven of the Canadian stocks. The main period of interest is the ban period during which only the Australian stocks are subject to a ban on short selling. This period extends over several months and it is over this interval we test whether the shorting ban achieved its goals of calming markets and preventing unwarranted price falls. The post-ban period refers to the time immediately after the shorting ban in Australia. In addition to exploring the patterns of the variables under investigation, we analyse the changes in the differences in the market attributes measures between the treatment group and the control group over the sample period.

4.4 Multivariate analysis: fixed-effect panel regression

(2)

(2)In summary, the effect of the shorting ban on a particular quantity Y is identified by comparing base stocks to matching control stocks during the pre-ban period versus the common ban period, the ban period and the post-ban period. This panel regression, a differences-in-differences methodology, examines the change in the volatility or market quality differential between the matching stocks over the various time intervals in the sample after controlling for other factors.

(3)

(3)Matched-pair fixed effects are part of the control variables. Including these allows for 45 different intercepts, one for each matched pair. These intercepts can be thought of as a set of binary variables that absorb the influences of omitted variables that are different between the matched pairs but are constant over time. In other words, the matched-pair fixed effects removes any discrepancy between the paired stocks even during the pre-ban period, or alternatively, the matched-pair fixed effects removes the idiosyncratic differences between the two stocks over the sampling period. This approach is related to Boehmer et al. (2009).

In addition to pair fixed effects, other control variables are incorporated in some of our panel regression models. These control variables differ slightly depending on the dependent variable. Generally, the additional variables control for differences in number of shares traded, dollar turnover, intraday volatility, bid–ask spread and stock price.

All control variables are measured in difference terms, that is quantity for the Australian firm less the quantity for its matched Canadian counterpart. Consistent with the specifications of Gajewski and Gresse (2007), who use fixed-effect panel regressions in conjunction with matched pairs to examine impacts on market quality, we use control variables as defined in the Appendix. These control variables control for other factors, for example unexpected company announcements, that affect the dependent variable in addition to the short-sale ban. The control variables capture these influences and ensure that these events do not have a potentially misleading effect on the results. We estimate the correlation matrix of the control variables and determine that multicollinearity is not a problem in this methodology.6 We report robust standard errors because we fail to reject homoscedasticity in the models, perhaps due to the presence of cross-sectional dependence of regression residuals across firms (Gagnon and Witmer, 2009).

Several studies employ a matched sample setting to analyse divergences in market quality measures.7 Others, including Boehmer et al. (2009), Clifton and Snape (2009), Marsh and Payne (2012) and Gagnon and Witmer (2009), specifically analyse the effects of the 2008 shorting ban. However, there are several features that make our methodology unique. We match stocks from two different countries by GICS sector, GICS industry and market capitalisation. Boehmer et al. (2009), Marsh and Payne (2012) and Clifton and Snape (2009) use stocks from different industries as their control stocks while matching on the same exchange. Gagnon and Witmer (2009) consider US and Canadian stocks which are listed on both exchanges, including non-financials in their control group. The inclusion of non-financial stocks, Gagnon and Witmer (2009) state, ‘may make it more difficult to compare behaviour between the two groups’ (p. 21). One would expect the originators of the global financial meltdown, that is financial firms, to behave differently during this era than non-financial firms. Our study examines the effects of the September 2008 shorting ban on volatility and market quality by comparing banned financial firms to non-banned financial firms. Although the stocks come from two different countries, they portray similar characteristics and trading attributes during normal economies. Moreover, the fixed-effects regression setting and the analysis of the changes in differences between these groups mitigates the problems of matching stocks across markets.

Our study incorporates a significantly longer sample period (and ban period) than other studies that focused on the 2008 shorting ban and it incorporates a relatively calm period in financial markets as well as the period of the crisis. Others generally investigate stocks in the USA or in the UK, where the shorting ban was in effect for 14 trading days or for three and a half months, respectively. The sample period for those studies generally extends over less than 6 months, covering the period from mid-2008 to the end of 2008. This period encompasses the height of the financial crisis including the collapse of Lehman Brothers in September 2008, Merrill Lynch's hasty sale to the Bank of America and the US Federal Reserve seizure of the global insurance giant American International Group (AIG). The peculiarity of this period may potentially act as caveat to these studies. Assessing causality during these extraordinary times can be difficult because it is ambiguous what would have happened if the shorting ban did not occur (Flatley, 2009). In contrast, the shorting ban in Australia was in effect for over 8 months, including both the turbulent period at the end of 2008 and the calmer, more normal period in 2009. Our results provide evidence on how a shorting ban impacts market volatility and market prices in the absence of a crisis.

Another unique feature of this study is the calculation of potentially more informative variables. To analyse the effect of the short-sale ban on trading activity, we calculate dollar turnover and share of market turnover. Share of market turnover is a relative measure that has not been used previously for this purpose. Variations in overall market values such as turnover and trade volume are likely to occur during times of global financial turbulence – with or without a ban on short selling. Relative measures tend to be more stable. Thus, using share of total market turnover as a key proxy for trading activity should provide more reliable results.

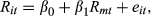

4.5 Event study

One of the stated reasons for banning short selling is to support stock prices. To test the efficacy of this procedure, we use an event study. If Miller's (1977) price optimism model holds, then stock prices will be too high during a short-selling ban and will fall when it is lifted. The empirical results of Chang et al. (2012), based on an event study of Hong Kong stocks, suggest that short-sale constraints result in lower cost of capital, and therefore higher prices. In either case, the termination of the shorting ban on financial stocks would manifest itself as negative abnormal returns for these stocks. In contrast, Lim's (2011) model suggests that short-sale bans over a prolonged period would be considered by investors and therefore would not affect prices.

Our approach is somewhat different to that of other studies (e.g. Boehmer et al., 2009 and Boulton and Braga-Alves, 2010) in that we choose the day that the short-selling bans are lifted as our event day zero. Other studies consider the day the new emergency regulations on short selling are put in place as event day zero and measure the market reaction by examining the abnormal returns over the event window. While this approach is natural, in this case the assumptions of the technique may be violated. An event study assumes that there are no other events during the event window which affect the stocks under investigation. This assumption is unlikely to hold for the short-selling ban. Short-selling restrictions were introduced in many countries around 19 September 2008. In addition, the period is marked by several other market-shaking events including the collapse of Lehman Brothers on 15 September 2008 and the announcement by the Federal Reserve to take control over AIG on 16 September 2008. Moreover, as initially all ASX-listed stocks were subject to the short-selling ban, centring on the first day of the ban would make it difficult to isolate the price impact on financial stocks. We choose the end of the short-selling ban on financial stocks, 25 May 2009, as our event day zero. This day represents a much less unusual period in global stock markets. The event window covers 10 days prior and 10 days past the event day.

(4)

(4)

(5)

(5)5 Results

5.1 Event study: end of shorting ban on financial stocks

After extending the shorting ban on financial stocks on 21 October 2008, 21 January 2009 and 5 March 2009, ASCI announced that the ban would finally be lifted on 31 May 2009. To the surprise of the market the ban was lifted 1 week earlier on Monday, 25 May 2009. This provides a natural setting for an event study as the end date of the shorting ban is unexpected and there does not appear to be any other significant market news during the event window. As the ban was implemented to support prices, we would expect negative returns following the lifting of the ban.

The results of the event study are displayed in Figure 1. On event day zero, the day the short-selling ban on financial stock is removed, the average abnormal return (AAR) is −1.80 percent. This AAR is, however, statistically indistinguishable from zero. For the following 7 days (i.e. event days +1 to +7) abnormal returns on financial stocks are positive, accumulating over 10 percent of abnormal returns and a positive cumulative average abnormal return (CAAR) over the event window. This development in AARs following the termination of the shorting ban is a challenge to the conjecture that the short-sale restrictions achieved price support or alternatively led to prices above fundamental value. Instead, it seems possible that the lifting of the ban resulted in positive returns for the affected stocks. These results are consistent with Do et al. (2012), who find that relative prices of Australian stocks identified as close substitutes for one another (‘pairs’) do not diverge persistently over the short-selling ban period.

5.2 Univariate analysis

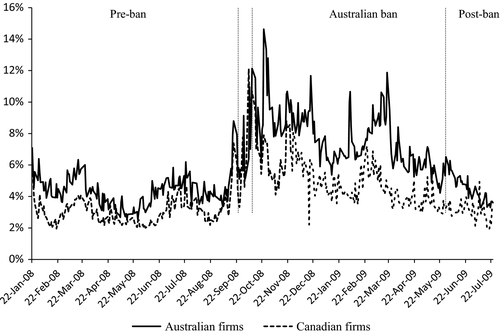

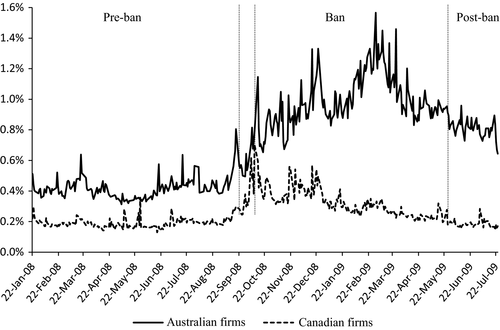

We illustrate the results of the univariate tests with graphs in which we compare our measures of volatility and market quality for the two markets, Australia and Canada, over the four intervals, pre-ban, common ban, (Australia only) ban and post-ban. We are particularly interested in how the relation between the Australian and Canadian volatility measures changes when only the Australian stocks are subject to a short-selling ban.

Figure 2 provides details on intraday volatility for the Australian base stocks and the Canadian control stocks. We focus on the range-based high–low intraday volatility measure; the results for the realised volatility measure are analogous.8 A key advantage of the range-based volatility measure is that it is robust to the effects of bid–ask bounce (Bandi and Russell, 2006). During the pre-ban period, average high–low volatility for base stocks is 4.4 percent, exceeding the average high–low volatility of 3.1 percent for control stocks. Although the magnitude of the average volatility is different between the two groups, the two series appear to move in tandem and the pairwise correlation coefficient between the two series is a strikingly high 0.89 during the pre-ban.9

Volatility for both groups rises in early September 2008, and it continues to increase during the common ban period, that is from 22 September 2008 to 8 October 2008. On average, volatility for both groups is almost twice as high during the common ban period as during the pre-ban period. The pattern of the volatility series for the two groups exhibits a break just after the common ban period. Volatility for the Canadian control stocks falls from early October 2008 to early November 2008, almost reaching pre-ban levels. Volatility for the banned Australian financial stocks, on the other hand, stays relatively high throughout the ban period. The average volatility differential increases from 1.3 percent during the pre-ban period to 2.8 percent during the ban period. This evidence suggests that short-sale bans do not ‘calm markets’ as intended. Rather, our results support the proposition that in the absence of short sellers and under the resulting low levels of liquidity, intraday volatility increases. The developments in the post-ban period strengthen this argument. Average volatility for the treatment group and the control group is 4.6 and 3.1 percent, respectively, very similar to the numbers in the pre-ban period. The test for the difference in average volatility differentials between the pre-ban and the ban period yields a statistically significant t-statistic of 2.80. On the other hand, a test for the difference in average volatility differentials between the pre-ban and the post-ban period yields an insignificant t-statistic of 0.34. Only during the (Australian only) ban period did the volatility differentials diverge significantly.

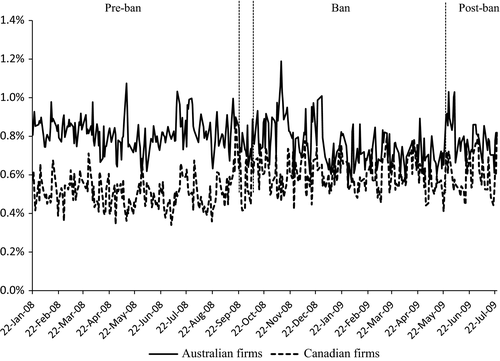

To illustrate the low levels of liquidity, Figure 3 shows the behaviour of volume-weighted relative effective bid–ask spreads for the base group and the control group for the time interval around the shorting ban. The time-weighted relative effective bid–ask spread series and the average relative bid–ask spread series exhibit very similar patterns, so our discussion will focus on the volume-weighted relative effective bid–ask spread values (VWRSP). Before the ban, the differential in VWRSP between the treatment group and the control group is relatively small in magnitude at about 22 basis points. The spread series of the Australian treatment stocks and the Canadian control stocks appear to follow a similar pattern during this time, an observation corroborated by the pairwise correlation coefficient of 0.50.10

Figure 3 shows that for both countries, bid–ask spreads increase during early September 2008. There appears to be a break in the pattern of the two series just after the common ban period, that is early October 2008. Bid–ask spreads for the Canadian control stocks reach a high on 10 October 2008, the day after the shorting ban in Canada is lifted, and subsequently return to prior, pre-ban levels. Bid–ask spreads for treatment stocks remain relatively high throughout the ban period. The average VWRSP for the treatment stocks is 0.99 percent during the ban period, more than twice as high as the average spread during the pre-ban period (0.42 percent). For comparison, the VWRSP for the control stocks is 0.32 percent during the ban period compared to 0.20 percent over the pre-ban period. The bid–ask spread differential between the two groups fluctuates around a much wider band during the ban period than during the pre-ban period. The average spread differential increases from 22 basis points during the pre-ban period to 67 basis points during the ban period, indicating a much larger drop in liquidity for treatment stocks relative to control stocks. The difference-in-means test results in a highly significant t-statistic of 15.31. In the post-ban period, the spread differential is slightly lower at 61 basis points but remains high. The lack of complete reversal in the spread differential after the ban period could be explained by trading strategies not being immediately adjusted upon termination of the ban. Note also that the pairwise correlation in the VWRSP series between the treatment group and the control group drops substantially from 0.50 before the ban to 0.03 during the ban period, and then rises to 0.08 during the post-ban period.

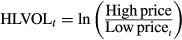

Finally, in Figure 4, we analyse the patterns in the share of market turnover. The share of market turnover is a relative measure and is thought to be fairly stable, especially during times when overall market trading values seem to behave erratically. During the pre-ban period, turnover of Australian treatment stocks represents, on average, 0.82 percent of total market turnover. Share of market turnover for control stocks is 0.51 percent, a differential of 0.31 percent between the two groups.11 This differential decreases substantially during the ban period to 0.15 percent. After the ban period, the gap widens again to 0.19 percent. The Canadian group's share of market turnover remains relatively constant over ban and post-ban periods; the share of market turnover for the Australian group increases after the ban is lifted. The pattern in share of market turnover suggests that the ban on short selling substantially lowered the trading activity in the affected stocks.

These conclusions are supported by the average turnover metrics. The average turnover of Australian financial stocks during the ban period is A$28 million, a decrease of over 40 percent relative to the pre-ban period. The difference-in-means test between the two periods results in a t-statistic of 14.16. Average turnover of Canadian control stocks remains relatively constant at A$33 million, confirmed by the insignificant t-statistics of the difference-in-means test. These divergent trends suggest that the shorting ban significantly lowers trading activity of Australian financial stocks. Moreover, when the shorting ban ends on 25 May 2009, turnover of the Australian financial stocks rises sharply and remains significantly higher over the following 2 months, further evidence that the ban reduces trading in the affected stocks.

5.3 Multivariate analysis

In this section, we discuss the results of the fixed-effect panel regression. These regressions test the impact of the short-sale ban on intraday volatility, as well as bid–ask spreads and turnover. Throughout the section we refer to Tables 2–4 in which the multivariate regression results are reported.

| Panel A: ΔHLVOL | Panel B: ΔRVOL10 | |||

|---|---|---|---|---|

| (1) | (2) | (1) | (2) | |

| Common Ban × Bothbanned | 0.0056* | 0.0024 | 0.0001 | −0.0002 |

| (1.74) | (0.74) | (0.45) | (−1.20) | |

| Common Ban × (1-Bothbanned) | −0.0065*** | −0.0059*** | 0.0002 | 0.0004 |

| (−3.03) | (−2.74) | (0.75) | (1.57) | |

| Ban | 0.0124 *** | 0.0017 *** | ||

| (17.49) | (12.91) | |||

| Post-Ban | −0.0057*** | −0.0011*** | ||

| (−7.12) | (−7.62) | |||

| Ban × Bothbanned | 0.0045*** | 0.0003*** | ||

| (4.66) | (3.16) | |||

| Ban × (1-Bothbanned) | 0.0141*** | 0.0020*** | ||

| (17.20) | (13.09) | |||

| Post-Ban × Bothbanned | −0.0040*** | −0.0007*** | ||

| (−4.19) | (−9.34) | |||

| Post-Ban × (1-Bothbanned) | −0.0057*** | −0.0011*** | ||

| (−6.12) | (−6.73) | |||

| Δln(Volume) | 0.0045** | 0.0046*** | 0.0003 | 0.0003 |

| (2.56) | (2.62) | (1.16) | (1.23) | |

| Δln(Dollar Turnover) | 0.0071*** | 0.0070*** | 0.0004 | 0.0004 |

| (4.12) | (4.05) | (1.34) | (1.276) | |

| Δln(Price) | −0.0199*** | −0.0191*** | −0.0029*** | −0.0028*** |

| (−10.18) | (−9.72) | (−6.89) | (−6.56) | |

| Observations | 16380 | 16380 | 16380 | 16380 |

| Adjusted R-squared | 0.31 | 0.31 | 0.10 | 0.10 |

- This table reports the results of two-way fixed-effects panel regressions for the 90 stocks (45 pairs) in our sample. In Panel A, the dependent variable is the difference in the range-based high–low volatility measure between the base stock and its match. In Panel B, the dependent variable is the difference in realised volatility between the base stock and the control stock. Model (1) corresponds to Equation 2 in the text; Model (2) corresponds to Equation 3. Robust t-statistics are presented in parentheses. *, ** and *** denote significance at the 10, 5 and 1 percent level, respectively. Coefficients associated with the ban period (i.e. coefficients of interest) are reported in bold.

| Panel A: ΔVWRSP | Panel B: ΔTWRSP | |||

|---|---|---|---|---|

| (1) | (2) | (1) | (2) | |

| Common Ban × Bothbanned | 0.0001 | −0.0001 | −0.0001 | −0.0003* |

| (0.44) | (−1.61) | (−0.39) | (−1.81) | |

| Common Ban × (1-Bothbanned) | 0.00002 | 0.0002 | −0.0002 | −0.0002 |

| (0.08) | (0.74) | (−1.52) | (−1.12) | |

| Ban | 0.0014 *** | 0.0011 *** | ||

| (13.78) | (17.51) | |||

| Post-Ban | 0.0010*** | 0.0009*** | ||

| (7.39) | (8.73) | |||

| Ban × Bothbanned | 0.0001 | 0.0000 | ||

| (1.49) | (0.74) | |||

| Ban × (1-Bothbanned) | 0.0017*** | 0.0015*** | ||

| (14.64) | (18.01) | |||

| Post-Ban × Bothbanned | −0.0010*** | −0.0008*** | ||

| (−9.49) | (−10.36) | |||

| Post-Ban × (1-Bothbanned) | 0.0013*** | 0.0014*** | ||

| (9.12) | (10.18) | |||

| ΔVolatility | 0.0221*** | 0.0219*** | 0.0208*** | 0.0203*** |

| (13.24) | (13.11) | (15.27) | (15.18) | |

| Δln(Volume) | 0.0003 | 0.0003 | −0.0004** | −0.0004** |

| (0.67) | (0.70) | (−2.35) | (−2.26) | |

| Δln(Dollar Turnover) | −0.0004 | −0.0004 | 0.0000 | 0.0000 |

| (−0.95) | (−0.96) | (0.04) | (0.01) | |

| Δln(Price) | −0.0062*** | −0.0061*** | −0.0067*** | −0.0066*** |

| (15.41) | (−14.87) | (−25.07) | (−24.02) | |

| Observations | 16380 | 16380 | 16380 | 16380 |

| Adjusted R-squared | 0.58 | 0.58 | 0.70 | 0.70 |

- This table reports the results of two-way fixed-effects panel regressions for the 90 stocks (45 pairs) in our sample. In Panel A, the dependent variable is the difference in trade volume-weighted relative effective spreads between the base stock and its match (ΔVWRSP). In Panel B, the dependent variable is the difference in time-weighted relative spreads (ΔTWRSP). Model (1) corresponds to Equation 2 in the text; Model (2) corresponds to Equation 3. Robust t-statistics are presented in parentheses. *, ** and *** denote significance at the 10, 5 and 1 percent level, respectively. Note that coefficients associated with the ban period (i.e. coefficients of interest) are reported in bold.

| Panel A: Δ share of market turnover | Panel B: Δ dollar turnover | |||

|---|---|---|---|---|

| (1) | (2) | (1) | (2) | |

| Common Ban × Bothbanned | −56.33*** | −73.05*** | −0.0005 | −0.0024 |

| (−4.28) | (−5.45) | (−0.34) | (−1.60) | |

| Common Ban × (1-Bothbanned) | −14.62*** | −11.58*** | −0.0012*** | −0.0009*** |

| (−10.87) | (−8.93) | (−6.17) | (−4.64) | |

| Ban | −18.26*** | −0.0019*** | ||

| (−22.07) | (−14.16) | |||

| Post-Ban | −5.94*** | −0.0013*** | ||

| (−5.34) | (−6.54) | |||

| Ban × Bothbanned | −56.19*** | −0.0058*** | ||

| (−14.07) | (−8.93) | |||

| Ban × (1-Bothbanned) | −10.26*** | −0.0011*** | ||

| (−21.77) | (−12.90) | |||

| Post-Ban × Bothbanned | −6.40 | −0.0028** | ||

| (−1.08) | (−2.53) | |||

| Post-Ban × (1-Bothbanned) | −5.15*** | −0.0010*** | ||

| (−8.41) | (−8.79) | |||

| ΔVolatility | 96.21*** | 90.11*** | 0.0148*** | 0.0139*** |

| (16.18) | (14.83) | (14.71) | (13.89) | |

| ΔBid-Ask Spread | 130.51*** | 86.70** | 0.0254*** | 0.0090 |

| (5.31) | (2.21) | (3.20) | (1.18) | |

| Observations | 16380 | 16380 | 16380 | 16380 |

| Adjusted R-squared | 0.36 | 0.38 | 0.47 | 0.48 |

- This table reports the results of two-way fixed-effects panel regressions for the 90 stocks (45 pairs) in our sample. In Panel A, the dependent variable is the difference in share of market turnover between the base stock and the control stock. In Panel B, the dependent variable is the difference in dollar turnover (measured in millions of Australian dollars) between the base stock and its match. Model (1) corresponds to Equation 2 in the text; Model (2) corresponds to Equation 3. Robust t-statistics are presented in parentheses. *, ** and *** denote significance at the 10, 5 and 1 percent level, respectively. Note that coefficients associated with the ban period (i.e. coefficients of interest) are reported in bold.

5.3.1 Volatility

Table 2 illustrates how the short-sale ban affected intraday volatility. Panel A of Table 2 reports the results of the panel regressions when the high–low volatility differential is used as the dependent variable. As a robustness test, we run similar panel regressions using the differential in 10 min realised volatility as the dependent variable and report the results Panel B. Other studies that examine intraday volatility under a fixed-effect panel regression setting often control for trading activity and price (Eom et al., 2007). We follow a similar procedure, including Δln(Volume), Δln(Dollar Turnover) and Δln(Price) as additional control variables. The coefficients on the control variables are statistically significant at the 5 percent level and have the expected signs. An increase in the number of shares traded in the Australian base stocks relative to their matched control stocks (i.e. an increase in the volume differential) is associated with an increase in the volatility differential. The coefficients on Δln(Dollar Turnover) have a similar interpretation. Price coefficients are negative and highly significant suggesting that price differentials partially explain the volatility differentials. For robustness, we estimated the models without the control variables; our conclusions are unaffected.12

All of the evidence suggests that volatility increased for the affected stocks during the short-sale ban. The coefficient of Ban, with a highly significant t-statistic of 17.49, means that during the ban period, volatility of Australian stocks subject to the ban increases by 1.24 percent more than their non-banned counterparts, after controlling for differences in trading activity and price. The coefficient on Post-Ban indicates that the volatility differential drops considerably after the short-sale ban in Australia is lifted. The volatility differential is even lower in the post-ban period relative to the pre-ban period, strong evidence that the short-sale ban led to an increase in volatility of affected stocks. Rather than calming markets, short-sale bans seem to agitate them.

Model (2) differs from Model (1) in that it allows for different behaviour between ‘both-banned’ pairs and ‘not-both-banned’ pairs. The coefficients on Ban*Bothbanned and Ban*(1-Bothbanned) are 0.0045 and 0.0141, respectively. Both coefficients are positive and highly significant indicating that the volatility differential for both groups of pairs is higher during the ban period compared to the pre-ban period. The coefficients on Post-Ban*Bothbanned and Post-Ban*(1-Bothbanned), on the other hand, are significantly lower at −0.0040 and −0.0057, respectively. This implies that the volatility differential for both groups of pairs decreases considerably after the termination of the short-sale ban in Australia. Thus, the conclusion that the shorting ban had an adverse effect on volatility remains unchanged even when distinguishing between larger (and therefore subject to the 14 day ban in Canada) and smaller firms.

Panel B reports the results of the same regressions using the 10-min realised volatility as the proxy for price volatility instead of the range-based high–low volatility measure used in the previous section. The implications are the same. The magnitude of the coefficients changes but the sign and the statistical significance of the variables of interest do not change noticeably. The volatility differentials generally increase in the ban period and decrease during the post-ban period. Our finding that the shorting ban had an adverse effect on volatility is robust to model specification and to the inclusion of trading activity and price control variables. The short-sale ban in Australia did not calm markets and thus failed to accomplish the stated goal of the regulators.

5.3.2 Bid-Ask spread

We analyse the impact of the short-sale ban on bid–ask spreads in Table 3. Panel A of Table 3 reports the results of the fixed-effect panel regressions when the differential in volume-weighted relative effective spread is used as the dependent variable. Panel B provides a robustness test and reports the regression results when the differential in time-weighted relative spread is used as the dependent variable. Gajewski and Gresse (2007), Stoll (2000) and Huang and Stoll (1996) argue that relevant determinants of the spread series comprise volatility, trading frequency, turnover and price. Therefore, we include ΔVolatility, Δln(Volume), Δln(Dollar Turnover) and Δln(Price) as additional control variables. Consistent with theory, volatility coefficients are significantly positive, suggesting that larger volatility differentials are associated with larger spread differentials. The differences in volume and dollar turnover do not significantly impact the spread differentials. Price coefficients are significantly negative, which indicates that the differences in stock price partially explain the differential spreads.

In Model (1), the positive and statistically significant coefficient of Ban indicates a 14 basis point increase in volume-weighted relative effective bid–ask spreads for Australian banned stocks relative to their Canadian matches, signifying a decline in market liquidity for the affected stocks. The coefficient on Post-Ban is lower than that of Ban and statistically significant, suggesting that the increase in the spread differential dissipates somewhat in the post-ban period. The time-weighted relative spread coefficients reported in Panel B are very similar.

In Model (2), we interact all three time indicator variables (i.e. Common Ban, Ban and Post-Ban) with Bothbanned and (1-Bothbanned). In this model, the interaction variables Ban*Bothbanned and Ban*(1-Bothbanned) are the variables of interest in the experiment. Both coefficients have the expected sign but only the coefficient on Ban*(1-Bothbanned) is statistically significant. During the ban period in which only Australian base stocks are subject to the short-sale ban, the spread differential for ‘not-both-banned’ pairs increases by 17 basis points13 relative to the pre-ban period. The spread differential for ‘both-banned’ pairs does not change significantly over this period. We might conclude that the short-sale ban did not have a significant impact on the spread differential of these pairs which include the largest Canadian and the largest Australian stocks in the sample. However, the developments in the post-ban period lead to a different conclusion. The coefficient on Post-Ban*Bothbanned in Model (2) shows that when the short-sale ban is lifted in Australia the spread differential of these pairs drops significantly – indicating that liquidity of the Australian stocks increased much more than that of their Canadian counterparts. Yet again, we have evidence that the short-sale ban had an adverse effect on liquidity. Moreover, the coefficients of two interaction terms Common Ban*Bothbanned and Common Ban*(1-Bothbanned) are predominantly insignificant, suggesting that there was no change in the spread differential for the pairs during the relatively short common ban period.

5.3.3 Trading activity

Table 4 illustrates the effect of the short-sale ban on trading activity, measured as share of market turnover in Panel A and as dollar turnover in Panel B. As with the univariate results, we focus on explaining the change in the share of market turnover. We include two control variables, ΔVolatility and ΔBid-Ask Spread. The first control variable controls for differences in volatility between the matching stocks; the second one controls for the potential influence of liquidity shifts. The inclusion of these two control variables is advocated by Lo and Wang (2000), who argue that liquidity shifts and changes in price volatility can have an effect on turnover.14 In Model (1), we include the three indicator variables Common Ban, Ban and Post-Ban, which are equal to one if the observation falls into the respective time interval, and to zero on all other days. The indicator variable Common Ban is also interacted with the indicator variables Bothbanned and (1-Bothbanned) to allow for different behaviour between ‘both-banned’ pairs and ‘not-both-banned’ pairs in the common ban period. Recall that for seven pairs in the sample the Australian firm as well as the Canadian counterpart are prohibited from being sold short during the short common ban period. These pairs are referred to as ‘both-banned’ pairs. They are expected to behave differently during the common ban period than the other 38 (‘not-both-banned’) pairs in the sample. The interaction terms capture this difference.

The variable Ban is the primary variable of interest in the experiment. The coefficient of Ban measures by how much the turnover differential between the two groups changes from the pre-ban period to the ban period. Under the null hypothesis that the shorting ban has no impact on trading activity, the coefficient would be statistically indistinguishable from zero. In Model (1) of Table 4, the coefficient associated with Ban is statistically significant at the 1 percent level,15 indicating that during the Australian ban period the differential share of market turnover for the affected stocks decreased significantly relative to the Canadian matched stocks.

The coefficients of the interaction terms β1 and β2 are also quite interesting. These coefficients capture the impact on the differentials during the common ban period for the seven Canadian stocks that were affected by the 14 day short-selling ban and for the balance of Canadian stocks that were never affected, respectively. Both coefficients are negative and statistically significant at the 1 percent level, indicating that the turnover differential decreased while short-selling bans were imposed in both countries, regardless of whether the control stocks were subject to the ban. The negative and significant sign of β1 suggests that stocks subject to the shorting ban in Australia suffered a larger decrease in turnover than stocks subject to the ban in Canada, perhaps because there were more short sellers in the Australian market than in the Canadian one during the pre-ban period.

In Model (2) of Table 4, the interaction variables Ban*Bothbanned and Ban*(1-Bothbanned) are the variables of interest. The coefficients associated with these variables, β5 and β6, are negative and highly statistically significant, showing that the turnover differential decreases during the Australian ban. The difference in magnitude between the two coefficients can be attributed to the fact that ‘both-banned’ pairs16 are the largest stocks in the sample and therefore have a greater share of trading activity than the others. After the Australian ban period the turnover differentials are lower than before the ban, but higher, for the larger stocks, than during the ban period. We conclude that the change in the turnover differentials is mainly attributable to the shorting ban rather than to other factors.

6 Conclusion

We conduct a comprehensive analysis of ASIC's emergency ban on short selling of stocks on the ASX. Unlike in other countries, the ban on financial stocks lasted for over 8 months. The focus of this study is whether the ban on short selling of financial stocks achieved the goals of the regulators. Statements by the regulators indicate that the restrictions on short selling were imposed to calm markets and to preserve confidence by mitigating opportunities for price manipulation. With an event study, we find no evidence that the ban on short-selling financial stocks supported prices. Then, using a matching procedure to compare stocks affected by the ban to otherwise similar stocks that are unaffected, we consider whether volatility was impacted by the short-sale bans. We explore the patterns of intraday volatility, as well as of trading activity and bid–ask spreads, with a univariate analysis. Differences in these measures between base stocks and control stocks are examined and compared over the pre-ban, ban and post-ban period.

We formally test the impact of the shorting ban with fixed-effect panel regressions. This setting enables us to the control for other firm specific variables that are not directly included in the matching procedure but may explain the observed changes in variable differentials. We find strong evidence that stocks subject to the short-sale ban in Australia suffered an increase in volatility, as well as a severe degradation in market quality, as measured by trading activity and bid–ask spreads. We conclude that the stated goal of calming the market was not achieved with the ban. On the contrary, the short-sale ban significantly increased the volatility of affected stocks. Our findings are robust to a variety of variable and model specifications and tests. Our conclusions are based on a sample which extends over 18 months including an 8 month ban period. This period covers the turbulent era in the financial markets at the end of 2008 as well as the more settled markets in 2009. Hence, this study overcomes the criticism that other studies on the 2008 shorting ban often encounter regarding the peculiarity of their ban period. Contrary to the opinions of ASIC, it appears that the shorting ban in Australia generated much higher costs than benefits. Similarly, Chuang and Lee (2010) argue that removing short-sale constraints in the Taiwanese market benefits retail investors. Our findings clearly illustrate that the shorting ban had substantially negative effects on the ASX market, resulting in larger price volatility and lower liquidity, and no positive effects.

Notes

Appendix A

Definitions of dependent and independent variables employed in Models (1) and (2), which are Equations 2 and 3, respectively.

| Independent variable | Type | Definition |

|---|---|---|

| Common Ban × Bothbanned | Dummy (interaction) | For the interval when this variable is equal to 1, short-sale constraints are in place in both Australia and Canada, and the Canadian matched stock is subject to the constraints |

| Common Ban × (1-Bothbanned) | Indicator (interaction) | For the interval when this variable is equal to 1, short-sale constraints are in place in both Australia and Canada, and the Canadian matched stock is NOT subject to the constraints |

| Ban | Indicator | For the interval when this variable is equal to 1, Australian stocks are subject to short-sale constraints; Canadian stocks are no longer subject to constraints |

| Post-Ban | Indicator | For the interval when this variable is equal to 1, Australian stocks are no longer subject to short-sale constraints |

| Ban × Bothbanned | Indicator (interaction) | For the interval when this variable is equal to 1, short-sale constraints are in place in Australia and are no longer in place in Canada, and the Canadian matched stock had been subject to the constraints |

| Ban × (1-Bothbanned) | Indicator (interaction) | For the interval when this variable is equal to 1, short-sale constraints are in place in Australia and are no longer in place in Canada, and the Canadian matched stock had NEVER been subject to the constraints |

| Post-Ban × Bothbanned | Indicator (interaction) | For the interval when this variable is equal to 1, short-sale constraints are no longer in place in Australia (and Canada), and the Canadian matched stock had been subject to the constraints |

| Post-Ban × (1-Bothbanned) | Indicator (interaction) | For the interval when this variable is equal to 1, short-sale constraints are no longer in place in Australia (and Canada), and the Canadian matched stock had NEVER been subject to the constraints |

| Δln(Volume) | Control (continuous) | ln(Volumebase stock) – ln(Volumecontrol stock), where Volume is the number of shares traded per day measured in millions |

| Δln(Dollar Turnover) | Control (continuous) | ln(Dollar Turnoverbase stock) – ln(Dollar Turnovercontrol stock), where Dollar Turnover is measured in millions of Australian dollars |

| Δln(Price) | Control (continuous) | ln(Pricebase stock) – ln(Pricecontrol stock), where Price denotes the closing price measured in Australian dollars |

| ΔVolatility | Control (continuous) | Volatilitybase stock – Volatilitycontrol stock, where Volatility is proxied by the range-based high–low volatility |

| ΔBid-Ask Spread | Control (continuous) | Bid-Ask Spreadbase stock – Bid-Ask Spreadcontrol stock, where Bid-Ask Spread is proxied by the volume-weighted relative effective spread |

| Matched-pair fixed effects | Control (unique to each pair) | These intercepts can be thought of as a set of binary variables that absorb the influences of omitted variables that are different between the matched pairs but are constant over time. In other words, the matched-pair fixed effects removes any discrepancy between the paired stocks even during the pre-constraints period, or alternatively, the matched-pair fixed effects removes the idiosyncratic differences between the two stocks over the sampling period. |

The control variables, excepting the fixed effects, are measured in difference terms, that is quantity for the Australian firm (‘base stock’) less the quantity for its matched Canadian counterpart (‘control stock’). We use the natural logarithm of Volume, Dollar Turnover and Price as these variables are always greater than zero and their distributions are considerably skewed to the right. These control variables control for other factors, for example unexpected company announcements, that affect the dependent variable in addition to the short-sale ban. The control variables capture these influences and ensure that these events do not have a potentially misleading effect on the results. We estimate the correlation matrix of the control variables and determine that multicollinearity is not a problem in this methodology.

| Dependent variable (ΔYit) | Definition |

|---|---|

| ΔHLVOL | The difference in the range-based high–low volatility measure between the Australian stock and its Canadian match. |

The intraday volatility measure for each country is estimated as the natural logarithm of the daily high price over the daily low prices (Alizadeh et al., 2002):  |

|

| ΔRVOL10 | The difference in realised volatility between the Australian stock and its Canadian match. |

The realised volatility measure for each country is calculated as the sum of the squared returns between the bid–ask mid-point prices taken every ten minutes during the trading day, that is:  |

|

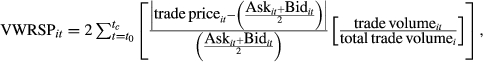

| ΔVWRSP | The difference in trade volume-weighted relative effective spreads between the Australian stock and its Canadian match. For each stock in the sample, the trade volume-weighted relative effective spread is calculated as:  where t0 is the time when regular trading commences during a trading day, t is the time when a trade is executed, and tc is the time when trading ceases for the day. Trade volume refers to the number of shares traded rather than the traded value of firm i. The conventional doubling of the effective spread on a single trade is followed to compute the ‘round-trip’ cost. where t0 is the time when regular trading commences during a trading day, t is the time when a trade is executed, and tc is the time when trading ceases for the day. Trade volume refers to the number of shares traded rather than the traded value of firm i. The conventional doubling of the effective spread on a single trade is followed to compute the ‘round-trip’ cost. |

| ΔTWRSP | The difference in time-weighted relative effective spreads between the Australian stock and its Canadian match. |

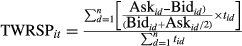

The formula used to calculate the time-weighted relative bid–ask spread measure for each stock for each day is as follows:  where ti is the amount of time the proportional bid–ask spread d was alive during the day for firm i. where ti is the amount of time the proportional bid–ask spread d was alive during the day for firm i. |

|

| Δ Share of Market Turnover | The difference in share of market turnover between the Australian stock and its Canadian match. |

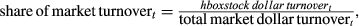

Share of market turnover is the fraction of total market turnover that a firm's turnover makes up on a given day. It is calculated as:  where Stock dollar turnover is the number of shares traded in the stock times the volume-weighted average price for day t. Total market dollar turnover is defined as the sum of dollar turnover for all stocks in the market index on the particular day. where Stock dollar turnover is the number of shares traded in the stock times the volume-weighted average price for day t. Total market dollar turnover is defined as the sum of dollar turnover for all stocks in the market index on the particular day. |

|

| Δ Dollar Turnover | The difference in dollar turnover (measured in millions of Australian dollars) between the Australian stock and its Canadian match. |

| The daily dollar turnover for Canadian control stocks is converted to Australian dollars using the closing exchange rate on the given day |