Improved corporate governance and Chinese seasoned equity offering announcement effects

Abstract

Corporate governance and thus overall investor protection in China improved after the Split Share Structure Reform and the release of the new company law in 2005. This study examines the impact of improved corporate governance and investor protection on the market's reaction to seasoned equity offering (SEO) announcements in China. The market reacts to post-2005 SEOs positively, while it reacts to pre-2005 SEOs negatively. The different market reactions are attributed to the market's different perceptions of firms' intentions behind SEO decisions – that is, investors are more optimistic and have more trust in SEO issuers when they believe they are better protected.

1 Introduction

This study provides a Chinese example of the importance of a sound investor protection mechanism by examining the impact of a systematic improvement in corporate governance on the market's reaction to announcements of seasoned equity offerings (SEOs). Corporate governance is a set of mechanisms that protect outside investors from being expropriated by insiders, including mangers and controlling shareholders (La Porta et al., 2000), and they are institutions that can be altered through reforms (see Shleifer and Vishny, 1997). The Split Share Structure Reform was initiated in 2005 and the new company law was released around same time, with the aim to improve the corporate governance and overall investor protection in China. The current paper explores the changes in the market's reactions to SEO announcements, when investors particularly the minority investors are better protected in China, and the causes behind such changes. The findings of the current paper imply that an improved corporate governance mechanism increases investors' confidence – that is, investors are more optimistic when they are better protected despite the existence of information asymmetry.

With over 20 years' development, the Chinese stock market is among the largest stock markets in the world (see WFE, 2014). While well known for its rapid development, the investor protection in China is still unsound. Being aware of the importance of investor protection to the development of financial market and real economy, the Chinese government and regulators are taking measures to improve investor protection in China. Among them, the Split Share Structure Reform and the release of the new company law have far-reaching significance for the improvement of corporate governance and therefore investor protection in China.

The Split Share Structure Reform was initiated in 2005 and aligned the large and minority shareholders through eliminating the division between tradable and nontradable shares (see Firth et al., 2010; Chen, 2014). Such improvement in corporate governance is systematic as almost all the public companies are involved in the reform. In addition, the legal protection on investors has also improved after 2005 with the release of the new company law in October 2005. The new law came into force on 1 January 2006, and it protects shareholders more effectively. Therefore, the Chinese corporate governance mechanism and thus investor protection experienced a significant improvement in 2005. By studying the SEO announcement effects prior to and post-2005, this paper provides an example of the impact of an improved investor protection mechanism on behaviours of stock market participants.

The literature on SEO announcement effects is well established. Significant share price reduction has been observed at the announcement of SEOs in developed financial markets (see Asquith and Mullins, 1986; Masulis and Korwar, 1986; Mikkelson and Partch, 1986; Huh and Subrahmanyam, 2005). In addition, a small body of literature has been established to investigate the equity issuances in China (see Wang et al., 2006; Chen and Chen, 2007; Shahid et al., 2010). Shahid et al. (2010) focus on rights offering and public offerings from 1998 to 2008. They observed negative announcement effects for public offerings and positive announcements for rights offering. Chen and Chen (2007) study rights issues from 1999 to 2001 and observed negative market reactions. Wang et al. (2006) examine the market reaction to rights offerings on the ex-rights date but found positive market reactions to rights offerings in China. Unlike previous studies on Chinese SEOs, the current study covers all SEO types, including rights offering, public offering and private placement, from 1999 to 2010. Besides, the special institutions of China as well as the major institutional changes occurred during the sample period – that is, the 2005 Split Share Structure Reform and the release of the new company law are also taken into account. More importantly, the current study corrects for sample selection bias and focuses on the private information behind SEO decisions.

A main stream of explanation proposed in the literature for the negative market reaction following SEO announcements is attributed to information asymmetry between managers and outsiders. Because of information asymmetry between insiders and outsiders, the market believes that SEO decisions are made based on managers' private information with embedded ‘bad intentions’ from the perspective of the outside investors. In Myers and Majluf (1984)'s model, managers have superior information about the value of the firm and tend to act in the best interests of existing shareholders at the cost of new shareholders. Therefore, the market perceives SEOs negatively. In addition, Miller and Rock (1985) consider financing announcements, equity issuances included, as negative dividends that send a negative signal about the issuers' prospects. Furthermore, Ross (1977) proposes that a company's leverage is positively associated with firm value because leverage level embeds managers' private information about the prospects of a company. Thus, leverage-decreasing events such as SEOs cause share price to decline. The essence of this literature is as follows: first, market reacts to the private information implied by SEO decisions rather than SEO decisions themselves; second, whatever the private information is, the market believes that its ultimate implication is that SEOs are not made for the benefit of new shareholders.

An alternative stream of explanation for the negative announcement effect is called the price pressure hypothesis developed by Scholes (1972). The price pressure hypothesis relates share price to the number of shares traded in the market, that is increased supply of shares as a result of an equity issuance creates pressure on share price. This explanation is based on a downward sloping demand curve and the non-substitution feature of a company's shares (see Asquith and Mullins, 1986). However, the hypothesis is in contrast to the widely accepted views that share price is solely determined by future underlying cash flows and any risk–return combination of a specific share is replicable by an appropriate portfolio construction (Asquith and Mullins, 1986).

Consistent with the previous literature, negative market reaction to SEO announcements is observed in China before the initiation of the Split Share Structure Reform and the release of the new company law in 2005. However, positive market reaction is observed after that. Yet, the existence of sample selection bias has to be considered – that is, I may be focusing on firms self-selecting into issuing equities, rather than a random sample. Heckman (1979)'s sample selection model not only corrects potential sample selection bias but also facilitates the test of the impact of private information (Li and Prabhala, 2007). After controlling for private information by applying the Heckman's sample selection model, the price effects at SEO announcement entirely disappear. The results indicate the following: first, Chinese firms self-select into SEO issuances and the abnormal returns following SEO announcements are attributed to the private information behind the announcements; second, it is the differences between the market's perceptions of the intentions behind SEO announcements that cause the different market reactions to SEO announcements after 2005. The findings imply that the market now believes that firms issue new shares for good reasons, while it used to believe firms issue new shares for bad reasons. Therefore, improved investor protection mechanism leads to improved investors' faith in public companies.

This study also tests the relation between the level of information asymmetry and SEO announcement effects in China. The theoretical literature has established information asymmetry as an important determinant behind market reactions to capital structure adjusting activities such as SEOs (see Ross, 1977; Myers and Majluf, 1984; Miller and Rock, 1985). If there is no information asymmetry, there is no private information. Empirical evidence has also been found. Dierkens (1991) examines the relation between information asymmetry and equity issuances in US and confirms a positive relation between the extent of price drop at a SEO announcement and the extent of information asymmetry. In general, the current paper finds some evidence for the negative effect of information asymmetry when information asymmetry is measured by firm age. However, an opposite effect of information asymmetry before 2005 is observed when information asymmetry is measured by proximity to financial centres.

The remainder of the paper is organised as follows: Section 2 provides an overview of corporate governance and the recent improvement in China. Section 3 presents the methodology used. Section 4 describes the sample and data sources. Section 5 presents the empirical results, and Section 6 summarises the paper.

2 Corporate governance and investor protection in China

Shleifer and Vishny (1997) define corporate governance as a mechanism designed to ensure that suppliers of finance get a proper return on their investment. Denis and McConnell (2003) further point out that corporate governance is ‘the set of mechanisms – both institutional and market-based – that induce the self-interested controllers of a company (those that make decisions regarding how the company will be operated) to make decisions that maximize the value of the company to its owners (the suppliers of capital)’. Thus, controller–owner conflicts of interests – the conflicts of interests between mangers and shareholders (for example, see Jensen and Meckling, 1976), and the conflicts of interests between large shareholders and the minority shareholders (for example, see Djankov et al., 2008) – are the key issues.

In countries with concentrated ownership, the large–minority shareholders agency problem is the central problem (Jiang et al., 2010). This is the case for China – the ownership of Chinese companies is concentrated with the state as the largest shareholder (see Branstetter, 2007), and evidence is found for expropriation of the minority shareholders by large shareholders in China, particularly before 2006.1

The Split Share Structure in China was an important cause of the serious large–minority shareholders agency problem in China. The trading restrictions on nontradable shares created serious conflicts of interests between large and the minority shareholders (see Huang and Fung, 2005; Firth et al., 2010; Green et al., 2010; Chen et al., 2011; Hou et al., 2012; Chen, 2014). The privatisation process of state-owned enterprises (SOEs) in China is defined as partial privatisation with the state still holding vast interests (Sun and Tong, 2003). To ensure the state retains its control over SEOs, the majority of shares were unable to be freely traded in the share market and were controlled directly or indirectly by the state (see Branstetter, 2007). Around 70 percent of all listed shares were nontradable shares and were mainly made up by state shares owned by the state, and legal person shares owned by domestic legal persons such as enterprises and institutions, which in many cases were connected to the government (see Branstetter, 2007). While the cash rights and voting rights attached to tradable and nontradable shares were same (Li et al., 2011), nontradable shareholders were unable to benefit from the capital gains in the secondary market (Wei and Xiao, 2009). State shares were nontradable and non-transferable (Branstetter, 2007). However, legal person shares sometimes could be traded through auctions or private placements with government approval but at very high discount due to illiquidity, sometimes as high as 85.59 percent discount, and price in the share market had little effect on the price of such transactions (see Chen and Xiong, 2001; Branstetter, 2007). Chen et al. (2008) point out that the transfer price of nontradable shares was generally related to the net asset of the company, rather than the market price. Therefore, the strict public trading restrictions on nontradable shares and the price differential between tradable and nontradable shares led to the insensitivity of nontradable shareholders to share price in the share market and therefore conflicts of interests between large shareholders and minority shareholders.

On 29 April 2005, the Chinese government started the Split Share Structure Reform aiming at eliminating the division between nontradable and tradable shares and making all shares freely tradable in the share market. The reform aimed to improve the corporate governance by aligning large shareholders with the minority (see Firth et al., 2010; Zhang and Liao, 2010). The reform involves the negotiation of a compensation plan between nontradable and tradable shareholders with tradable shareholders being compensated for potential adverse effects on share prices due to substantial increases in the supply side of the share market, and sharing idiosyncratic risk with nontradable shareholders (see Li et al., 2011). Nearly all companies finished the reform by the end of 2007 (see Li et al., 2011).

Improvement of corporate government in China after the reform has been proved empirically. Liao et al. (2008) find positive effects of the Split Share Structure Reform on corporate governance, which is measured by constructing a corporate governance index. Tseng (2012) finds evidence for the positive impact of the Split Share Structure Reform on agency problems in Chinese public firms. Hou et al. (2012) find that the Split Share Structure has improved the corporate transparency of Chinese listed firms by increasing their share price informativeness, which represents an improvement in corporate governance after the reform aligned incentives of large and minority shareholders. They further argue that improved transparency reduces the cost of equity capital and the reformed companies will be less dependent on government financial support. Green et al. (2010) construct a mandatory transparency score, a voluntary transparency score and an overall score to test the impact of the Split Share Structure Reform on corporate financial transparency of Chinese companies. They find that mandatory, voluntary and overall disclosures of reformed companies have all improved after the reform. Besides, they also find that voluntary disclosure increased more significantly than mandatory disclosure with significant improvement also observed in mandatory disclosure. Zhang and Liao (2010) find that the Split Share Structure Reform improved voluntary disclosure, particularly non-financial information disclosure. They attribute such improvement to the improved corporate governance as a result of the alignment of shareholder incentives after the reform.

Concentrated ownership and legal protection are two common approaches of corporate governance, and they are supplementary to each other (Shleifer and Vishny, 1997). The alignment of large and minority shareholders (outcome of the Split Share Structure Reform) has significantly improved Chinese corporate governance. In addition, the government also took measures to improve legal protection on investors by amending the company law, with the new law that came into force on 1 January 2006. The first Chinese company law was released and came into force in July 1994. I use La Porta et al. (1998)'s method and find none of the six shareholder rights2 was defined in 1994 Company Law and two rights3 of six shareholder rights were defined in the current Company Law in force, that is the 2006 Company Law. Therefore, the laws protect investors more effectively from 2006.

3 Methodology

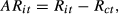

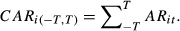

3.1 Abnormal returns and cumulative abnormal returns

To determine the significance of the abnormal returns and cumulative abnormal returns, the following two tests are performed:

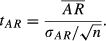

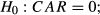

3.2 Sample selection bias and the Heckman's sample selection model

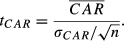

This study takes into account the sample selection bias, that is equity issuing firms might self-select into an equity issue and might not constitute a random sample. Firms may choose to issue SEOs according to their own situations, and SEO issuers might differ from nonissuers in a number of firm characteristics – that is, SEO issuers may share common features. Firms might have their own private intentions behind their SEO decisions. Therefore, a random firm making a similar SEO announcement might not receive the similar market reaction. Potential sample selection bias has to be corrected for before concluding about the market's perception of SEO issuances in China. Therefore, I refer to Heckman (1979) and adopt Heckman's sample selection model to correct sample selection bias. Heckman's sample selection model is a two-step model.

(1)

(1)The same probit model was employed by Chen (2014) to investigate the determinants behind Chinese companies' SEO decisions. This paper studies the announcement effects of SEOs in China and thus focuses on the second step of the Heckman's model. EIi,t is equal to 1 if a firm i makes an equity issue announcement at time t and is 0 otherwise. X is a vector of observable determinants of a SEO decision used in Chen (2014), which differentiates SEO issuers from nonissuers. These set of variables are also used by Chen and Ling (2015) to study Chinese SEO issuers' capital structure. INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is an industry dummy, which is 1 if the company is a machine or equipment manufacturer. LnS is the natural log of total sales. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is 1 if the state or the state-owned enterprises is the ultimate controlling shareholder. ALLC is a corporate governance indicator, which is 1 if all shares can be freely traded in the share market. AR is the regional development level dummy, which is 1 if the company is registered in the developed area. SHSZ is the stock exchange indicator, which is 1 if the company is listed on the Shanghai Stock Exchange. The variables in X are discussed in detail in Chen (2014).

Based on the first step of the Heckman's model, the inverse mill ratio (λE,i) can be derived. According to Heckman (1979), λE,i = f(Zi)/F(−Zi), where f( ) and F( ) are the probability density function and the cumulative distribution function for a standard normal variable, respectively, and Zi = −(Xδ/σ). According to Li and Prabhala (2007), λE,i represents the sample selection error as well as the private information behind firm's selection. Therefore, λE enables us to correct the sample selection bias and test the private information underlying SEO decisions at the same time.

(2)

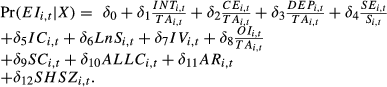

(2)The following t-test is performed on α0 and α1:

Negative announcement effects are found empirically in the literature (see Asquith and Mullins, 1986; Masulis and Korwar, 1986; Mikkelson and Partch, 1986). A significantly negative α0 confirms that CAR is significantly negative even after the sample selection bias is taken into account, which implies that an equity issue announcement decreases an issuing firm's value and a random firm announces a SEO will on average have significantly negative post-announcement abnormal returns. A significant α0 also implies significant market reactions even though private information is controlled for. A significant α1 indicates the existence of sample selection bias. In addition, a significant α1 implies that market reacts to the private information implied by a SEO announcement.

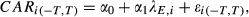

3.3 Determinants of the market reaction at announcement

A considerable amount of prior literature holds the view that the announcement effect of an equity issuance is attributed to the level of information asymmetry between insiders and outsiders (see Ross, 1977; Myers and Majluf, 1984; Miller and Rock, 1985). The current paper tests this relation by employing two information asymmetry proxies: FirmAge which is defined as the number of days since a firm goes public, and MTTFC which is defined as the minimum time needed to drive from a firm's registering address to one of the three financial centres in China (Shanghai, Beijing and Shenzhen). Firm age has been widely used as a proxy for information asymmetry (see Barry and Brown, 1984; Scherr and Hulburt, 2001; Wu, 2004; Zhang, 2006). In addition, I expect that firms closer to the financial centres have less severe information asymmetry problems. In China, most brokage firms, investment consulting firms and fund managements firms are located in three cities, that is Shanghai, Beijing and Shenzhen. Thus, I expect that the majority of analysts are located in these cities. Analysts who are closer to an analysed company provide more accurate forecasts (Malloy, 2005; Bae et al., 2008).

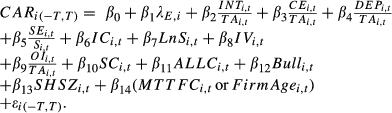

(3)

(3)Where λE,i is the inverse mill ratio, which represents private information. εi(−T,T) is the error term. Explanatory variables used in Equation 1 are employed here except for the regional development indicator AR. In addition, MTTFC and FirmAge are employed as the information asymmetry proxies. Bull is the market condition indicator defined in Chen and Ling (2015).4

4 Data

4.1 SEO issuers and their benchmarks

This paper employs the same SEO issuances sample as in Chen (2014). The sample covers rights issue, public offering and private placement announcements occurring from 1999 to 2010, subject to the sample criteria as specified in Chen (2014). I also use the same matching nonissuers sample as constructed in Chen (2014) in this paper. The sample selection process for the issuers' sample and the matching nonissuers' sample are illustrated in detail in Chen (2014).

However, there are only 631 issuers and 631 nonissuers in the current sample, which are slightly fewer than 642 issuers and 642 nonissuers in Chen (2014) due to the availability of the stock return data.

4.2 Data sources

The definition of a large number of variables in this paper overlaps with those used in Chen (2014) and Chen and Ling (2015). For those variables, I use the same set of data sources and data collection process as Chen (2014) and Chen and Ling (2015).

The SEO announcements are acquired from the CCER rights issue and CCER SEO databases. Financial statement data are acquired from the CSMAR China Stock Market Financial Statements Database. The CSRC industry classification data are sourced from CCER and GTA databases. The ultimate controlling shareholder data are available from the GTA China Listed Firm's Shareholders Research Database. The completion dates of the Split Share Structure Reform are derived from the GTA China Stock Market Equity Division Reform Research Database. Stock return data for issuers and their matching nonissuers are sourced from the CSMAR China Stock Market Trading Database. The minimum driving time from the city where a company is registered to Shanghai, Shenzhen or Beijing is manually collected from the Google map. Companies' registration addresses are collected from the CCER database or hand collected from the stock exchange websites if unavailable in the CCER Database. Listing dates of issuers are collected from the CSMAR China Stock Market Trading Database. The difference between the listing date and the announcement date is a firm's firm age.

5 Empirical results

5.1 SEO announcement effects

Table 1 shows the market's reaction to SEO announcements from 1999 to 2010. Panel A reports the average abnormal returns within ±10 trading days around SEO announcements over the period.5 Chinese SEO issuers outperform their nonissuing peers of similar size and same industry by around 0.6 percent on the announcement day and the day before the announcement, in contrast to the negative announcement effects found in the empirical literature. Panel B reports the average CARs over the different windows within ±30 days around SEO announcements. Similar to the results in Panel A, SEO issuers on average outperform their benchmarks over all event windows, from [0, 0] to [−30, +30]. The average CAR increases with the expansion of event window. It increases up to 4.9 percent for the window of [−30, +30].

| Panel A: Average abnormal returns within ±10 days around SEO announcements: 1999–2010 | |||

|---|---|---|---|

| Trading days | Average AR | N | t |

| −10 | −0.0006 | 610 | −0.45 |

| −9 | 0.0012 | 612 | 0.82 |

| −8 | 0.0023* | 614 | 1.67 |

| −7 | 0.0021 | 615 | 1.49 |

| −6 | 0.0005 | 616 | 0.39 |

| −5 | −0.0005 | 618 | −0.38 |

| −4 | 0.0012 | 619 | 0.93 |

| −3 | −0.0009 | 619 | −0.64 |

| −2 | 0.0011 | 620 | 0.78 |

| −1 | 0.0066*** | 621 | 4.29 |

| 0 | 0.0061*** | 511 | 2.63 |

| 1 | 0.0173 | 630 | 1.58 |

| 2 | 0.0008 | 627 | 0.52 |

| 3 | 0.0012 | 626 | 0.74 |

| 4 | 0.0007 | 626 | 0.48 |

| 5 | 0.0006 | 626 | 0.44 |

| 6 | 0.0000 | 625 | 0.02 |

| 7 | 0.0006 | 620 | 0.47 |

| 8 | −0.0005 | 620 | −0.40 |

| 9 | 0.0028** | 619 | 1.99 |

| 10 | −0.0003 | 617 | −0.21 |

| Panel B: Average cumulative abnormal returns around SEO announcements: 1999–2010 | |||

|---|---|---|---|

| Event window | Average CAR | T-statistics | N |

| [−30, +30] | 0.0487*** | 3.24 | 631 |

| [−20, +20] | 0.0416*** | 3.03 | 631 |

| [−10, +10] | 0.0408*** | 3.20 | 631 |

| [−5, +5] | 0.0329*** | 2.68 | 631 |

| [−1,+1] | 0.0286*** | 2.57 | 631 |

| [0, 0] | 0.0061*** | 2.63 | 511 |

- Day 0 is the announcement date. Day −t is the tth day before the announcement date. Day t is the tth day after the announcement date. N is the sample size. t is t-statistics.

- *p < 0.1, **p < 0.05, ***p < 0.01.

Initial public offerings (IPOs) and SEOs were suspended after the initiation of the Split Share Structure Reform in 2005 and were not resumed until mid 2006. During this period, the new company law was also released and came into force. The reform and the new company law improved corporate governance and thus the investor protection mechanism in China. The market might react differently to a SEO issuance when the external institutional environment changes. To investigate the impact of improved corporate governance and investor protection on market's perception of the announcement of a SEO, I examine the market reactions to pre-2005 and post-2005 SEO announcements separately.

Table 2 presents the announcement effects of SEOs from 1999 to 2005. Panel A reports the average abnormal returns ±10 trading days around SEO announcements over this period. Before 2005, SEO issuers underperform their benchmarks by 1.21 percent on the announcement day. Panel B reports the average CARs over different windows within ±30 days around SEO announcements before 2005. Seasoned equity offering issuers on average underperform their benchmarks over the event windows ranging from [0, 0] to [−10, +10]. The issuers on average underperform their benchmarks by as much as 2 percent over the [−5, +5] window. The results indicate that the market perceives SEO announcements negatively before 2005, which is consistent with the literature.

| Panel A: Average abnormal returns within ±10 days around SEO Announcements: 1999–2005 | |||

|---|---|---|---|

| Trading days | Average AR | N | t |

| −10 | 0.0031* | 211 | 1.65 |

| −9 | −0.0007 | 211 | −0.35 |

| −8 | −0.0039* | 213 | −1.94 |

| −7 | 0.0003 | 214 | 0.15 |

| −6 | 0.0013 | 215 | 0.67 |

| −5 | 0.0010 | 215 | 0.50 |

| −4 | 0.0016 | 215 | 0.95 |

| −3 | −0.0026 | 215 | −1.29 |

| −2 | −0.0027 | 215 | −1.28 |

| −1 | 0.0009 | 215 | 0.46 |

| 0 | −0.0121*** | 165 | −4.19 |

| 1 | −0.0036 | 215 | −1.61 |

| 2 | −0.0020 | 215 | −0.89 |

| 3 | −0.0013 | 215 | −0.44 |

| 4 | −0.0012 | 215 | −0.54 |

| 5 | −0.0007 | 215 | −0.34 |

| 6 | 0.0026 | 215 | 1.36 |

| 7 | 0.0008 | 212 | 0.43 |

| 8 | −0.0042** | 212 | −2.32 |

| 9 | 0.0031 | 211 | 1.55 |

| 10 | 0.0011 | 211 | 0.55 |

| Panel B: Average cumulative abnormal returns around SEO announcements: 1999–2005 | |||

|---|---|---|---|

| Event window | Average CAR | T-statistics | N |

| [−30, +30] | 0.0069 | 0.52 | 215 |

| [−20, +20] | −0.0019 | −0.16 | 215 |

| [−10, +10] | −0.0163** | −2.00 | 215 |

| [−5, +5] | −0.0197*** | −2.74 | 215 |

| [−1,+1] | −0.0119*** | −3.23 | 215 |

| [0, 0] | −0.0121*** | −4.19 | 165 |

- Day 0 is the announcement date. Day −t is the tth day before the announcement date. Day t is the tth day after the announcement date. N is the sample size. t is t-statistics.

- *p < 0.1, **p < 0.05, ***p < 0.01.

In contrast, the market reactions are entirely different after the reform and the release of the new company law. Table 3 shows the market reactions to SEO announcements from 2006 to 2010. Panel A reports the average abnormal returns within ±10 trading days around announcement day over this period. The issuers outperform the nonissuers of similar size and same industry by around 1 percent on the day before the announcement and around 1.5 percent on the announcement day. Panel B reports the average CARs over different windows within ±30 days of SEO announcements from 2006 to 2010. The issuers on average significantly outperform their matching nonissuers over all event windows, from [0, 0] to [−30, +30]. Over the [−5, +5] window period, the issuers on average outperform their benchmarks by 6 percent. Over the [−10, +10] window period, the issuers on average outperform their benchmarks by as much as 7 percent. The results imply that the market perceives SEO announcements positively after 2005. The opposite market reactions to pre-2005 and post-2005 SEO announcements might be attributed to the changes in institutional environment in 2005 – improvement in investor protection.

| Panel A: Average abnormal returns within ±10 days around SEO announcements: 2006–2010 | |||

|---|---|---|---|

| Trading days | Average AR | N | t |

| −10 | −0.0026 | 399 | −1.40 |

| −9 | 0.0021 | 401 | 1.13 |

| −8 | 0.0056*** | 401 | 3.11 |

| −7 | 0.0031 | 401 | 1.60 |

| −6 | 0.0001 | 401 | 0.06 |

| −5 | −0.0013 | 403 | −0.73 |

| −4 | 0.0009 | 404 | 0.54 |

| −3 | 0.0000 | 404 | −0.02 |

| −2 | 0.0031* | 405 | 1.65 |

| −1 | 0.0096*** | 406 | 4.62 |

| 0 | 0.0147*** | 346 | 4.90 |

| 1 | 0.0281* | 415 | 1.70 |

| 2 | 0.0023 | 412 | 1.07 |

| 3 | 0.0025 | 411 | 1.23 |

| 4 | 0.0017 | 411 | 0.86 |

| 5 | 0.0013 | 411 | 0.70 |

| 6 | −0.0013 | 410 | −0.66 |

| 7 | 0.0005 | 408 | 0.31 |

| 8 | 0.0014 | 408 | 0.83 |

| 9 | 0.0026 | 408 | 1.41 |

| 10 | −0.0010 | 406 | −0.57 |

| Panel B: Average cumulative abnormal returns around SEO announcements: 2006–2010 | |||

|---|---|---|---|

| Event window | Average CAR | T-statistics | N |

| [−30, +30] | 0.0703*** | 3.25 | 416 |

| [−20, +20] | 0.0641*** | 3.22 | 416 |

| [−10, +10] | 0.0703*** | 3.75 | 416 |

| [−5, +5] | 0.0600*** | 3.31 | 416 |

| [−1,+1] | 0.0496*** | 2.96 | 416 |

| [0, 0] | 0.0147*** | 4.90 | 346 |

- Day 0 is the announcement date. Day −t is the tth day before the announcement date. Day t is the tth day after the announcement date. N is the sample size. t is t-statistics.

- *p < 0.1, **p < 0.05, ***p < 0.01.

5.2 SEO announcement effects after private information is controlled for

However, sample selection bias need to be considered. In addition, the literature suggests that market reacts to private information underlying SEO decisions – that is, managers' intentions, rather than SEO decisions themselves (see Ross, 1977; Myers and Majluf, 1984; Miller and Rock, 1985). I refer to Heckman (1979) and employ the Heckman's sample selection model to correct for potential sample selection bias and test the effect of private information at the same time. CARs over the [−10, 10] window around SEO announcements are tested here.

5.2.1 Entire sample period: 1999–2010

Table 4 reports the market reactions to SEO announcements occurred between 1999 and 2010 after I control for private information using the Heckman's sample selection model. Panel A of Table 4 reports the results of the first step of the Heckman's model – Equation 1. Capital expenditure, Ln(SALES) and operating income are positively associated with the probability of conducting a SEO. Selling expenses and state ownership are negatively associated with the probability of a SEO.

| Panel A: First step: a probit regression for issues over the period 1999–2010 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Issuer = 1 Nonissuer = 0 | INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln(SALES) | IV | OI/TA | SC | ALLC | AR | SHSZ | Intercept | Pseudo R2 | N |

| −0.493 | 1.704*** | −2.280 | −1.015** | 0.010 | 0.071** | −0.0003 | 2.592*** | −0.179** | 0.067 | 0.050 | −0.105 | −0.483** | 0.0416 | 1262 | |

| (−0.61) | (2.87) | (−0.89) | (−2.03) | (0.13) | (2.28) | (−0.39) | (4.43) | (−2.29) | (0.78) | (0.61) | (−1.42) | (−2.16) | |||

| [0.804] | [0.593] | [2.549] | [0.501] | [0.079] | [0.031] | [0.0008] | [0.585] | [0.078] | [0.086] | [0.082] | [0.074] | [0.224] | |||

| Panel B: Second step: Chinese SEO announcement effects and the determinants after controlling for private information: 1999–2010 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln (SALES) | IV | OI/TA | SC | ALLC | BULL | SHSZ | MTTFC | FirmAge | Lambda | Intercept | Adjusted R2 | N | |

| (1) | 0.323 | −0.206 | 0.0275 | 631 | ||||||||||||||

| (1.57) | (−1.40) | |||||||||||||||||

| [0.206] | [0.147] | |||||||||||||||||

| (2) | −0.183 | 1.380 | −2.221 | −1.162 | −0.003 | 0.065 | −0.0002 | 1.608 | −0.227 | 0.059 | −0.034 | −0.113 | 0.0004 | 1.577 | −1.498 | 0.0464 | 631 | |

| (−0.47) | (0.83) | (−0.88) | (−0.97) | (−0.15) | (0.80) | (−0.50) | (0.77) | (−1.04) | (1.47) | (−1.09) | (−0.89) | (0.26) | (0.94) | (−0.85) | ||||

| [0.390] | [1.657] | [2.516] | [1.193] | [0.019] | [0.081] | [0.0004] | [2.098] | [0.218] | [0.041] | [0.031] | [0.128] | [0.001] | [1.685] | [1.753] | ||||

| (3) | 0.370 | −0.256 | 0.236 | −0.116 | −0.015 | −0.006 | 0.0001 | −1.032 | −0.052 | −0.006 | −0.036 | −0.013 | 0.002 | 0.200* | 0.0408 | 631 | ||

| (1.03) | (−1.50) | (0.32) | (−0.77) | (−0.74) | (−0.58) | (0.82) | (−1.24) | (−1.38) | (−0.12) | (−1.09) | (−0.44) | (1.32) | (1.90) | |||||

| [0.358] | [0.171] | [0.744] | [0.149] | [0.020] | [0.011] | [0.0001] | [0.830] | [0.038] | [0.048] | [0.033] | [0.030] | [0.002] | [0.105] | |||||

| (4) | −0.281 | 1.406 | −2.026 | −1.127 | −0.003 | 0.053 | −0.0002 | 1.605 | −0.221 | 0.037 | −0.030 | −0.111 | 0.00002*** | 1.504 | −1.425 | 0.0543 | 631 | |

| (−0.83) | (0.94) | (−0.89) | (−1.03) | (−0.16) | (0.72) | (−0.54) | (0.88) | (−1.10) | (1.04) | (−0.99) | (−0.94) | (3.04) | (0.99) | (−0.89) | ||||

| [0.339] | [1.499] | [2.268] | [1.091] | [0.019] | [0.074] | [0.0004] | [1.827] | [0.202] | [0.035] | [0.030 | [0.118] | [0.000008] | [1.526] | [1.592] | ||||

| (5) | 0.234 | −0.154 | 0.370 | −0.132 | −0.017 | −0.016 | 0.00008 | −0.911 | −0.052 | −0.029 | −0.034 | −0.018 | 0.00003*** | 0.215* | 0.0475 | 631 | ||

| (0.69) | (−0.94) | (0.50) | (−0.88) | (−0.81) | (−1.57) | (0.59) | (−1.12) | (−1.43) | (−0.55) | (−1.01) | (−0.57) | (3.03) | (1.95) | |||||

| [0.342] | [0.164] | [0.742] | [0.149] | [0.021] | [0.010] | [0.0001] | [0.811] | [0.036] | [0.053] | [0.034] | [0.032] | [0.000009] | [0.110] | |||||

- Panel A: This table presents the estimation results of the first step of the Heckman's sample selection model, which is a probit regression. Chen (2014) used the same probit regression to study the determinants behind Chinese SEO decisions. This set of variables is also used by Chen and Ling (2015) to study Chinese SEO issuers' capital structure. The definitions of the variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, which is 1 if the company is a machine or equipment manufacturer, and is 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises and 0 otherwise. ALLC is the corporate governance indicator, which is 1 if all of the company's shares are fully tradable in the share market and 0 otherwise. AR is the regional development level indicator, which is 1 if the company is registered in developed area and 0 otherwise. SHSZ is the stock exchange indicator, which is 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange.

- Panel B: This table reports the estimation results of the second step of the Heckman's sample selection model, which examines the SEO announcement effects and the determinants behind the announcement effects after we take into account the sample selection bias. The dependent variable is CAR over the [−10, +10] window. Except for MTTFC, FirmAge and Lambda, the definitions of the explanatory variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, which is 1 if the company is a machine or equipment manufacturer, and is 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises, and 0 otherwise. ALLC is the corporate governance indicator, which is 1 if all of the company's shares are fully tradable in the share market and 0 otherwise. BULL is the market condition indicator, which is 1 if it is bull market and 0 otherwise. SHSZ is the stock exchange indicator, which is 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange. MTTFC is a measure for information asymmetry and is the minimum time needed to drive from a firm's registration address to one of the three main financial centres, that is Beijing, Shenzhen and Shanghai. FirmAge is another measure for information asymmetry and is measured as the number of days since a firm's IPO. Lambda represents the sample selection error as well as the private information and is derived from the first step of the Heckman's model.

- t-Statistics in parentheses ( ).

- Standard error in parentheses [ ].

- *p < 0.1, **p < 0.05, ***p < 0.01.

Panel B of Table 4 reports the results of Equations 2 and 3 over the period 1999–2010. λE (the inverse mills ratio), which represents sample selection error as well as private information, is derived from the results of first step of the Heckman's model. By including λE, private information is controlled for, with sample selection bias corrected at the same time. The first regression estimates Equation 2. The coefficient of Lambda is positive but insignificant with t statistics that equals 1.57, which does not provide any direct evidence of market's reaction to private information behind SEO announcements. However, the insignificant intercept indicates that the positive market reaction disappears after private information is controlled for. It can be considered as indirect evidence for the impact of private information on market's reaction to SEO announcements. The positive market reactions to SEO announcements, which vanish after private information is controlled for, are attributed to the implied private information – that is, the market reacts positively to SEO announcements because it perceives the intentions behind positively.

The second regression of Panel B of Table 4 examines the determinants of the market reaction to a SEO announcement from 1999 to 2010 after private information is controlled for (the results of Eqn 3), with MTTFC used as the proxy for information asymmetry. No variable is significant here, including λE and the intercept.

Furthermore, I also run a regression of Equation 3 with λE excluded from the model – that is, without controlling for private information, which is the regression (3) of Panel B of Table 4. There is still no variable observed to affect the market reaction to a SEO announcement. However, the intercept becomes significantly positive again when private information is ignored.

The fourth regression of Panel B of Table 4 estimates Equation 3 over 1999–2010, with FirmAge used as the proxy for information asymmetry. Neither the intercept nor the Lambda is significant. FirmAge is positively correlated to the announcement effect, which implies that a SEO made by a firm with a long history is perceived more positively because the information asymmetry problem is less severe in a firm with a long history. The results confirm the negative impact of information asymmetry on the market reaction to a SEO. The results suggest that information asymmetry is the only factor that affects market's reaction to a SEO in China, over the period of 1999–2010, after I control for private information and correct sample selection bias.

The last regression of Panel B of Table 4 is the estimation of Equation 3, with λE excluded from the model. Without controlling for sample selection bias, the intercept becomes significantly positive again. Furthermore, although some coefficient signs change, FirmAge still maintains its positive and significant effect.

The results of Table 4 suggest that the positive SEO announcement effects observed from 1999 to 2010 disappear after private information is controlled for. Information asymmetry is the only factor that affects the market reaction to a SEO announcement, regardless of the control of private information or not.

5.2.2 Before the reform and the release of the new company law: 1999–2005

Table 5 reports the market reaction to a SEO announcement before the Split Share Structure Reform and the release of the new company law (from 1999 to 2005), after controlling for private information and sample selection bias. Panel A of Table 5 reports the first step of the Heckman's sample selection model – Equation 1. Capital expenditure, Ln(SALES) and operating income show a positive correlation with the probability of conducting a SEO. State ownership and Shanghai Stock Exchange listing negatively affect the decision to issue a SEO.

| Panel A: First step: A probit regression for SEOs over the period 1999–2005 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Issuer = 1 Nonissuer = 0 | INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln(SALES) | IV | OI/TA | SC | AR | SHSZ | Intercept | Pseudo R2 | N |

| 2.348 | 2.712*** | −2.132 | 0.122 | 0.131 | 0.174** | −0.001 | 11.347*** | −0.305* | 0.085 | −0.359*** | −1.607*** | 0.1939 | 430 | |

| (1.21) | (2.86) | (−0.38) | (0.12) | (0.84) | (2.53) | (−0.25) | (6.63) | (−1.86) | (0.59) | (−2.61) | (−3.43) | |||

| [1.942] | [0.948] | [5.583] | [0.995] | [0.156] | [0.069] | [0.002] | [1.710] | [0.164] | [0.145] | [0.138] | [0.468] | |||

| Panel B: Second step: Chinese SEO announcement effects and the determinants after controlling for private information: 1999–2005 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln(SALES) | IV | OI/TA | SC | BULL | SHSZ | MTTFC | FirmAge | Lambda | Intercept | Adjusted R2 | N | |

| (1) | 0.013 | −0.024 | −0.0038 | 215 | |||||||||||||

| (0.45) | (−1.23) | ||||||||||||||||

| [0.028] | [0.020] | ||||||||||||||||

| (2) | −0.316 | −0.343 | 0.038 | 0.046 | −0.034 | −0.048*** | 0.0001 | −1.872** | 0.089*** | −0.027 | 0.087** | 0.003*** | −0.345** | 0.589** | 0.0419 | 215 | |

| (−1.11) | (−1.33) | (0.06) | (0.39) | (−1.57) | (−2.85) | (0.43) | (−2.03) | (2.72) | (−1.46) | (2.46) | (2.87) | (−2.21) | (2.28) | ||||

| [0.285] | [0.259] | [0.660] | [0.120] | [0.022] | [0.017] | [0.0003] | [0.923] | [0.033] | [0.018] | [0.035] | [0.001] | [0.156] | [0.258] | ||||

| (3) | 0.118 | 0.154 | −0.233 | 0.076 | −0.008 | −0.016* | 0.00001 | 0.089 | 0.030 | −0.029 | 0.018 | 0.002** | 0.040 | 0.0235 | 215 | ||

| (0.56) | (1.19) | (−0.36) | (0.63) | (−0.41) | (−1.85) | (0.05) | (0.35) | (1.57) | (−1.57) | (1.08) | (2.20) | (0.58) | |||||

| [0.208] | [0.129] | [0.655] | [0.120] | [0.018] | [0.009] | [0.0003] | [0.253] | [0.019] | [0.019] | [0.017] | [0.001] | [0.069] | |||||

| (4) | −0.178 | −0.120 | −0.009 | 0.078 | −0.024 | −0.039** | 0.00004 | −1.067 | 0.067** | −0.024 | 0.049 | 0.00001 | −0.201 | 0.390 | 0.0080 | 215 | |

| (−0.62) | (−0.47) | (−0.01) | (0.64) | (−1.11) | (−2.31) | (0.14) | (−1.20) | (2.07) | (−1.21) | (1.47) | (1.05) | (−1.34) | (1.55) | ||||

| [0.288] | [0.252] | [0.671] | [0.122] | [0.022] | [0.017] | [0.0003] | [0.888] | [0.032] | [0.020] | [0.033] | [0.00001] | [0.149] | [0.252] | ||||

| (5) | 0.080 | 0.168 | −0.179 | 0.092 | −0.009 | −0.020** | −0.00001 | 0.077 | 0.032* | −0.026 | 0.011 | 0.00001 | 0.065 | 0.0040 | 215 | ||

| (0.38) | (1.25) | (−0.27) | (0.76) | (−0.47) | (−2.25) | (−0.06) | (0.30) | (1.66) | (−1.29) | (0.62) | (0.89) | (0.94) | |||||

| [0.214] | [0.134] | [0.661] | [0.121] | [0.019] | [0.009] | [0.0003] | [0.256] | [0.019] | [0.020] | [0.017] | [0.00001] | [0.069] | |||||

- Panel A: This table presents the estimation results of the first step of the Heckman's sample selection model, which is a probit regression. Chen (2014) used the same probit regression to study the determinants behind Chinese SEO decisions. This set of variables are also used by Chen and Ling (2015) to study Chinese SEO issuers' capital structure. The definitions of the variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, equalling 1 if the company is a machine or equipment manufacturer, and 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, equalling 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises and 0 otherwise. AR is the regional development level indicator, equalling 1 if the company is registered in developed area and 0 otherwise. SHSZ is the stock exchange indicator, which is equal to 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange.

- Panel B: This table reports the estimation results of the second step of the Heckman's sample selection model, which examines the SEO announcement effects and the determinants behind the announcement effects after we take into account the sample selection bias. The dependent variable is CAR over the [−10, +10] window. Except for MTTFC, FirmAge and Lambda, the definitions of the explanatory variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, equalling 1 if the company is a machine or equipment manufacturer, and 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is equal to 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises and 0 otherwise. BULL is the market condition indicator, which is equal to 1 if it is bull market and 0 otherwise. SHSZ is the stock exchange indicator, which is equal to 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange. MTTFC is a measure for information asymmetry and is the minimum time needed to drive from a firm's registration address to one of the three main financial centres, that is. Beijing, Shenzhen and Shanghai. FirmAge is another measure for information asymmetry and is measured as the number of days since a firm's IPO. Lambda represents the sample selection error as well as the private information and is derived from the first step of the Heckman's model.

- t-Statistics in parentheses ( ).

- Standard error in parentheses [ ].

- *p < 0.1, **p < 0.05, ***p < 0.01.

Panel B of Table 5 reports the results of Equations 2 and 3 over from 1999 to 2005. The first regression results are from the estimation of Equation 2. Coefficient of Lambda is still insignificant, which provides no direct evidence for the impact of private information. However, an insignificantly negative intercept is observed here, which implies that the negative announcement effect before 2006 disappears after I control for the private information. It implies that private information does affect the market's perception of SEO announcements before 2005.

The second regression of Panel B of Table 5 estimates Equation 3 from 1999 to 2005, with MTTFC used as proxy for information asymmetry. The intercept is significantly positive. Lambda becomes significantly negative. The results strongly confirm the impact of private information – that is, the market perceives the private information underlying the SEO announcement negatively, which consequently contributes to the negative announcement effects of SEOs before 2006. Furthermore, Ln(SALES) and operating income are negatively correlated with the announcement effect. State control and the Shanghai Stock Exchange listing show positive effects. However, MTTFC is positively related to the announcement effects – that is, firms located further away from major financial centres outperform firms located closer to financial centres, in contrast to the information asymmetry hypothesis of SEOs. A potential explanation is associated with the partial price adjustments as a consequence of the small percentage of tradable shares prior to the Split Share Structure Reform, particularly for firms exposed to a lower level of analyst coverage.

The third regression of Panel B of Table 5 estimates Equation 3 from 1999 to 2005, with Lambda excluded and MTTFC as the proxy for information asymmetry. The intercept becomes insignificantly positive when private information is excluded from the model. Ln(SALES) still maintains its negative effect and MTTFC still maintains its positive effect while operating income, state control and the Shanghai Stock Exchange become insignificant.

The fourth regression results of Panel B of Table 5 are from the estimation of Equation 3 from 1999 to 2005, with FirmAge used as the proxy for information asymmetry. Lambda is insignificant and negative. Ln(SALES) and state control still maintain their negative and positive effects, respectively. However, FirmAge is insignificant.

The last regression results of Panel B of Table 5 are from the estimation of Equation 3, with Lambda excluded and FirmAge used as the proxy for information asymmetry. Although changes in some coefficient signs are observed, Ln(SALES) and state ownership still maintain their negative and positive effects, respectively. FirmAge is still insignificant.

In general, evidence is found for the market's negative perception of privation information behind SEO announcements, which contributes to the negative announcement effects following a SEO announcement before 2005. Firm size and state control are also factors that influence SEO announcement effects before 2005.

5.2.3 After the reform and the release of the new company law: 2006–2010

Table 6 shows the market reaction to a SEO announcement after the Split Share Structure Reform and the release of the new company law (from 2006 to 2010), after controlling for private information and correcting sample selection bias. Panel A of Table 6 presents the results of the first step of the Heckman's sample selection model – Equation 1. Selling expenses and state ownership affect a firm's decision to issue SEO negatively. Ln(SALES) is positively associated with the probability of announcing a SEO.

| Panel A: First step: a probit regression for SEOs over the period 2006–2010 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Issuer = 1 Nonissuer = 0 | INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln(SALES) | IV | OI/TA | SC | ALLC | AR | SHSZ | Intercept | Pseudo R2 | N |

| −0.959 | 1.009 | −3.613 | −1.317** | −0.026 | 0.070* | 0.0001 | 0.712 | −0.208** | 0.071 | 0.025 | −0.044 | −0.292 | 0.0195 | 832 | |

| (−1.04) | (1.28) | (−1.22) | (−2.19) | (−0.27) | (1.82) | (0.10) | (1.04) | (−2.13) | (0.76) | (0.24) | (−0.48) | (−1.00) | |||

| [0.921] | [0.785] | [2.972] | [0.601] | [0.096] | [0.039] | [0.001] | [0.684] | [0.098] | [0.094] | [0.104] | [0.092] | [0.292] | |||

| Panel B: Second step: Chinese SEO announcement effects and the determinants after controlling for private information: 2006–2010 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| INT/TA | CE/TA | DEP/TA | SE/S | IC | Ln(SALES) | IV | OI/TA | SC | ALLC | BULL | SHSZ | MTTFC | FirmAge | Lambda | Intercept | Adjusted R2 | N | |

| (1) | 0.333 | −0.190 | 0.0101 | 416 | ||||||||||||||

| (1.60) | (−1.28) | |||||||||||||||||

| [0.208] | [0.148] | |||||||||||||||||

| (2) | 0.557 | −0.621 | 0.490 | −0.128 | −0.016 | −0.016 | 0.0001 | −1.107 | −0.045 | −0.048 | −0.050 | −0.030 | 0.002 | −0.122 | 0.435 | 0.0363 | 416 | |

| (0.45) | (−0.49) | (0.10) | (−0.07) | (−0.37) | (−0.17) | (0.47) | (−0.98) | (−0.16) | (−0.52) | (−0.99) | (−0.39) | (0.88) | (−0.06) | (0.23) | ||||

| [1.245] | [1.266] | [4.789] | [1.786] | [0.045] | [0.094] | [0.0002] | [1.128] | [0.287] | [0.092] | [0.051] | [0.077] | [0.003] | [2.017] | [1.933] | ||||

| (3) | 0.481 | −0.543* | 0.203 | −0.235 | −0.018 | −0.011 | 0.0001 | −1.050 | −0.062 | −0.042 | −0.050 | −0.033 | 0.002 | 0.317** | 0.0387 | 416 | ||

| (0.87) | (−1.88) | (0.20) | (−1.03) | (−0.67) | (−0.61) | (0.60) | (−1.10) | (−1.09) | (−0.77) | (−0.98) | (−0.69) | (0.85) | (2.35) | |||||

| [0.551] | [0.288] | [1.038] | [0.228] | [0.027] | [0.018] | [0.0002] | [0.958] | [0.056] | [0.055] | [0.051] | [0.048] | [0.003] | [0.135] | |||||

| (4) | 0.053 | −0.096 | −0.811 | −0.714 | −0.027 | 0.005 | 0.0001 | −0.719 | −0.134 | −0.033 | −0.052 | −0.049 | 0.00002** | 0.515 | −0.180 | 0.0401 | 416 | |

| (0.05) | (−0.08) | (−0.17) | (−0.38) | (−0.57) | (0.05) | (0.63) | (−0.87) | (−0.44) | (−0.43) | (−0.98) | (−0.53) | (2.15) | (0.25) | (−0.09) | ||||

| [1.077] | [1.218] | [4.721] | [1.865] | [0.047] | [0.101] | [0.0002] | [0.822] | [0.308] | [0.077] | [0.053] | [0.091] | [0.00001] | [2.070] | [1.977] | ||||

| (5) | 0.373 | −0.425 | 0.403 | −0.266 | −0.019 | −0.018 | 0.00009 | −0.960 | −0.066 | −0.056 | −0.053 | −0.035 | 0.00002** | 0.322** | 0.0423 | 416 | ||

| (0.71) | (−1.50) | (0.39) | (−1.15) | (−0.68) | (−1.09) | (0.44) | (−1.02) | (−1.23) | (−0.94) | (−0.97) | (−0.69) | (2.13) | (2.34) | |||||

| [0.528] | [0.283] | [1.033] | [0.231] | [0.028] | [0.017] | [0.0002] | [0.942] | [0.053] | [0.060] | [0.055] | [0.050] | [0.00001] | [0.137] | |||||

- Panel A: This table presents the estimation results of the first step of the Heckman's sample selection model, which is a probit regression. Chen (2014) used the same probit regression to study the determinants behind Chinese SEO decisions. This set of variables is also used by Chen and Ling (2015) to study Chinese SEO issuers' capital structure. The definitions of the variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, which is equal to 1 if the company is a machine or equipment manufacturer, and 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is equal to 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises, and 0 otherwise. ALLC is the corporate governance indicator, which is equal to 1 if all of the company's shares are fully tradable in the share market and 0 otherwise. AR is the regional development level indicator, which is equal to 1 if the company is registered in developed area and 0 otherwise. SHSZ is the stock exchange indicator, which is equal to 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange.

- Panel B: This table reports the estimation results of the second step of the Heckman's sample selection model, which examines the SEO announcement effects and the determinants behind the announcement effects after we take into account the sample selection bias. The dependent variable is CAR over the [−10, +10] window. Except for MTTFC, FirmAge and Lambda, the definitions of the explanatory variables here are the same as those in Chen (2014) and Chen and Ling (2015). INT/TA is the ratio of intangible assets to total assets. CE/TA is the ratio of capital expenditure to total assets. DEP/TA is the ratio of depreciation to total assets. SE/S is the ratio of selling expenses to total sales. IC is the industry dummy, which is equal to 1 if the company is a machine or equipment manufacturer, and 0 otherwise. IV is income volatility, which is the standard deviation of the percentage change in operating income. OI/TA is the ratio of operating income to total assets. SC is the state control indicator, which is equal to 1 if the ultimate controlling shareholder of the company is the state or state-owned enterprises, and 0 otherwise. ALLC is the corporate governance indicator, which is equal to 1 if all of the company's shares are fully tradable in the share market and 0 otherwise. BULL is the market condition indicator, which is equal to 1 if it is a bull market and 0 otherwise. SHSZ is the stock exchange indicator, which is equal to 1 if the company is listed on the Shanghai Stock Exchange and 0 if the company is listed on the Shenzhen Stock Exchange. MTTFC is a measure for information asymmetry and is the minimum time needed to drive from a firm's registration address to one of the three main financial centres, that is Beijing, Shenzhen and Shanghai. FirmAge is another measure for information asymmetry and is measured as the number of days since a firm's IPO. Lambda represents the sample selection error as well as the private information and is derived from the first step of the Heckman's model.

- t-Statistics in parentheses ( ).

- Standard error in parentheses [ ].

- *p < 0.1, **p < 0.05, ***p < 0.01.

Panel B of Table 6 reports the estimation results of Equations 2 and 3 from 2006 to 2010. The first regression results are from the estimation of Equation 2. Lambda is positive but insignificant with a t statistics equal to 1.6, which does not provide any direct evidence for the impact of private information. However, the insignificantly negative intercept again implies the vanishing of the positive market reaction after I control for private information, which confirms the impact of private information.

The second regression in Panel B of Table 6 estimates Equation 3 from 2006 to 2010, with MTTFC used as a measure for information asymmetry. None of the variables shows significant effects.

The third regression in Panel B of Table 6 estimates Equation 3 from 2006 to 2010, with Lambda excluded and MTTFC used as proxy for information asymmetry. Without controlling for private information, the intercept becomes significantly positive. In addition, capital expenditure becomes significantly negative.

The fourth regression results of Panel B Table 6 are form the estimation of Equation 3 from 2006 to 2010, with FirmAge used as the proxy for information asymmetry. The intercept and the Lambda remain insignificant. When using FirmAge as proxy for information asymmetry, the effects of information asymmetry on the market reaction to a SEO are observed. FirmAge is positively correlated to the announcement effects of a SEO, the longer a firm's history is, the more positive the market reaction is to the SEO announcement, which support a negative relation between the level of information asymmetry and the market reaction to a SEO.

The last regression results of Panel B of Table 6 are from the estimation of Equation 3 from 2006 to 2010, with Lambda excluded and FirmAge used as the proxy for information asymmetry. Without correcting for sample selection bias, the intercept becomes significantly positive and some coefficient signs also change. However, information asymmetry still remains as an influential factor to the market reaction to announcement as FirmAge maintains its significant and positive coefficient.

The results in Table 6 suggest that the positive announcement effects of SEO announcements from 2006 to 2010 disappear after I control for private information. In addition, information asymmetry is found to affect the market reaction to a SEO announcement when FirmAge is used as the proxy for information asymmetry, regardless of controlling for private information or not. State control is no longer significant after 2005, implying a weakening governance influence on the Chinese financial market.

Furthermore, the difference between the market reactions to pre-2005 and post-2005 SEO announcements vanishes after private information is controlled. Therefore, the different market reactions to pre-2005 and post-2005 SEOs are attributed to the different perceptions of private information behind SEO decisions– that is, the market reacts differently to SEO announcements because it perceives intentions behind SEO decisions differently before and after 2005. Investors are more optimistic and have more confidence in SEO issuers after 2005 when they are better protected.

6 Conclusion

The Split Share Structure Reform initiated in 2005 and the release of the new company law (effective form 1 January 2006) improved the corporate governance mechanism and thus the investor protection in China after 2005. Before I take into account the sample selection bias and control for private information, significant SEO announcement effects are observed in China. The market reacts negatively to SEO announcements before 2005 and reacts positively after 2005 when the overall corporate governance and investor protection environment improved.

However, after I control for private information, the announcement effects vanish and the apparent difference between pre-2005 and post-2005 market reactions disappears. Chinese companies self-select into SEOs according to their own situations, and they have their intentions behind their selection. Despite the fact that I did not observe direct evidence for the impact of private information by consistently observing significant coefficient for Lambda that represents private information behind SEOs, the notable difference between pre-correction and post-correction results implies the impact of private information. The disappearance of the announcement effects after private information is controlled for implies that it is the market's perception of SEO issuers' intentions that contribute to the significant market reactions to SEO announcements. A random firm making SEO announcement does not receive a similar market reaction.

The regression results indicate that the different market reactions to a SEO announcement after 2005 are due to the market's different perceptions of issuers' intentions after 2005. The low levels of investor protection and corporate governance before 2005 facilitate the expropriation of minority shareholders through issuing equity; thus, SEO announcements are perceived negatively by the market before 2005. The better corporate governance and investor protection after 2005 protect the minority shareholders better, and fewer ‘expropriators’ are believed to issue SEOs; thus, SEO announcements are perceived positively by the market. Therefore, the quality of investor protection mechanism influences investors' perception of firm financing activities in the financial markets and therefore their activities. In a safer environment, investors are more optimistic and grant more trust to SEO issuers even with information asymmetry in place.

Some evidence is found to support the negative impacts of information asymmetry on market's reaction to SEO announcements when information asymmetry is measured by firm age. However, before 2005, a positive impact of information asymmetry is observed when information asymmetry is measured by a company's proximity to financial centres, which contradicts with the theoretical and empirical literature.

Furthermore, before 2005, state ownership is found to have positive effects on the market reaction to a SEO announcement. Such a positive effect vanishes after 2005, which implies the weakening of government influence in the Chinese financial market.