Towards a Set of Design Principles for Executive Compensation Contracts

Abstract

Executive compensation has been controversial for many years. Controversies over executive pay have sparked outrage from some sectors and calls for increased regulation and reform. Yet others argue that knee-jerk reactions to perceived abuses of pay can lead to a host of unintended and inefficient outcomes. This paper argues that much of this controversy is due to executives being rewarded via contracts that have weaknesses in design. We argue that few stakeholders in firms would object to generous compensation for managers whose performance results in abnormally high long-term shareholder wealth creation. We state a set of principles, developed from a review of the extensive theoretical, regulatory, and empirical literature, that we offer as fundamental building blocks for designing executive remuneration systems in public firms, especially where ownership and control are separated. Our purpose is to generate broad debate and discussion leading to a consensus as to the principles that should be present in all executive compensation contracts such that the interests of shareholders and managers are more closely aligned.

CEO compensation is controversial. While some examples of CEO misbehaviour are quite recent and thus well-remembered, 1 Murphy (2013) demonstrates that CEO pay was controversial in the US even before the Great Depression of the 1930s, while Frydman and Sacks (2010) provide historical comparisons of median CEO pay relative to an average worker for the period 1936–2005.

CEOs of public companies are routinely perceived to be overpaid and their boards are perceived to provide poor monitoring and control of powerful executives. There are three elements to these complaints (Kaplan, 2013): (a) CEOs are overpaid and their pay keeps increasing; (b) CEO pay is not linked to performance; and (c) corporate boards are ineffective monitors. Bebchuk and Fried (2005, p. 2) claim that ‘flawed compensation arrangements have not been limited to a small number of “bad apples”; they have been widespread, persistent, and systemic’.

The US regulatory response to the Enron and WorldCom collapses (among many high profile failures) was to introduce far-reaching corporate governance reforms in the Sarbanes-Oxley legislation of 2002, while the Dodd-Frank legislation of 2010 followed the global financial crisis (GFC). Dodd-Frank requires that, among many other things, all public companies obtain an annual advisory shareholder vote on top executive pay. 2 The Australian response to perceived abuses of termination payments resulted in amendments to the Corporations Act 2001 that restrict giving benefits greater than one year's base salary on retirement from a board or managerial office, unless shareholders approve the benefit. Australian remuneration rules were also recently, and many argue controversially, amended to introduce the ‘two strikes’ rule, which became effective from 1 July 2011. 3 Under this rule, if 25% of shareholders at a company's annual general meeting (AGM) vote against the company's remuneration report the first time, directors are put on notice to review their remuneration policies. The second and final strike is delivered if, at the following year's AGM, 25% of shareholders again vote against the remuneration report. Further, if at least 50% of shareholders present at the meeting vote for a board spill, directors must face re-election within 90 days. 4 However, whether these regulatory reforms will achieve their intentions without severe unintended consequences remains somewhat clouded. A central theme of Murphy's (2013) paper is that the history of regulatory intervention in CEO pay in the US suggests that unintended consequences abound.

We argue that much of this controversy is due to executives being rewarded via contracts that have weaknesses in design. We argue that few stakeholders in firms would object to generous compensation for managers whose performance results in abnormally high long-term shareholder wealth creation. We state a set of principles, developed from a review of the extensive theoretical, regulatory, and empirical literature, that we suggest should be the fundamental building blocks for designing executive remuneration systems in public firms, especially where ownership and control is separated. Our purpose is to generate broad debate and discussion, hopefully leading to a consensus as to the principles that should be present in all executive compensation contracts such that the interests of shareholders and managers are better aligned.

Theories of Executive Compensation

There are two main ‘camps’ in relation to CEO compensation and it is quite clear that opinions are dramatically and sometimes heatedly divided. 5 One group of researchers, the efficient-contracting camp, argues and finds that CEO compensation is set in a competitive equilibrium with appropriate incentive structures to motivate managers to maximize shareholder wealth. The other dominant group, the managerial-power camp, argues that CEO compensation is set through managers exercising power over ineffective boards of directors. The two groups engage in robust debate, though occasionally this becomes somewhat inflamed.

Murphy (2013) suggests that any discussion of CEO compensation that ignores developments in government regulatory and tax policy in relation to the CEO pay controversy is likely to ignore an important aspect of the way in which executive pay, particularly in the US, has evolved. Thus a third aspect of executive compensation considers regulatory issues and, in particular, some of the unintended consequences of regulatory reform of CEO remuneration. Finally, CEOs are subject to the laws of the land, and these laws spell out the legal obligations of executives of corporations. It is interesting to note that both Australian and US corporations law 6 requires that directors and officers put the interests of the corporation before their own interests.

Efficient-contracting Theories

The efficient-contracting camp, with its theoretical roots in optimal-contracting theory, maintains that the ‘observed level and composition of compensation reflects a competitive equilibrium in the market for managerial talent, and that incentives are structured to optimize firm value’ (Murphy, 2013, p. 214). One often-discussed benefit of equity-based compensation is that it can reduce agency costs associated with the separation of ownership and control (see, Berle and Means (1932) and Jensen and Meckling (1976)) by better aligning the incentives of the CEO with those of the shareholders. Smith and Watts (1982) describe long-term incentive plans as a means whereby agency costs can be controlled, in particular, costs associated with a manager's risk aversion. Managers have a substantial portion of their wealth tied up in the firms they manage and hence they hold a portfolio with considerable exposure to firm-specific (idiosyncratic) risk. This may cause them to be risk averse in their investment and financing decisions for the firms they manage. Shareholders, on the other hand, can easily diversify away from such firm-specific risks and hence want to encourage managerial risk taking. One way in which this conflict can be reduced is to tie management compensation to firm performance, thus motivating managers to make shareholder value-increasing decisions and improving pay–performance sensitivity (see also, Hölmstrom, 1979; Harris and Raviv, 1979; Grossman and Hart, 1983; Smith and Stulz, 1985).

Hirshleifer and Suh (1992) argue that option-based managerial compensation can reduce agency costs associated with both risk aversion and incentives to reduce effort. Consequently, shareholders would prefer the composition of executive remuneration to contain more equity-linked payments than cash payments. However, it needs to be remembered that the value a CEO places on a share of restricted stock or the grant of an executive option ‘will be strictly less than the fair market value of the share’ (Murphy, 2013, p. 229).

Shleifer and Vishny (1997) argue that in the case of incomplete contracting where managers have more information than outsiders (i.e., analysts and shareholders) managers have residual control rights that provide incentives for self-interested behaviour. Long-term equity-based compensation offers one solution to this problem, so that firm performance is positively affected when managers are granted equity-based compensation.

Managerial-power Theories

The managerial-power camp argues that both the level and composition of CEO pay is determined through managers exercising their power over captive boards. A series of papers by Yermack (1995, 1997, 2006a, 2006b, 2009), Bebchuk and Fried (2003, 2004, 2006), Bebchuk et al. (2002, 2010) and Bebchuk and Grinstein (2005) exemplify this view. Yermack (1995) finds that few agency and financial contracting theories have explanatory power for patterns of CEO stock option awards, while Yermack (2006a) focuses on a CEO's personal use of corporate jets, finding that firms that disclose this managerial benefit underperform by more than 4% annually. An initial disclosure announcement share price effect of −1.1% is documented. Yermack (2006b) studies the severance pay of 179 CEOs who left Fortune 500 firms, showing that more than half receive severance pay worth on average $US5.4 million. A large majority of this severance pay is made on a discretionary basis by the board of directors, not in accord with the CEO's employment contract. Yermack (2009) samples 1,013 major gifts by CEOs to their family foundations between 2003 and 2005 and finds that CEOs make their gifts just before their stock price falls, maximizing their income tax refunds.

Bebchuk et al. (2002) and Bebchuk and Fried (2003) argue that managerial power and rent extraction are likely to have an important influence on the design of executive compensation contracts, while Bebchuk and Fried (2006) argue a similar case for managerial capture. Their 2006 book provides a ‘detailed account of how corporate boards have failed to negotiate with executives and how pay practices have decoupled compensation from performance, leading to practices that dilute manager incentives and hurt shareholders’ (Bebchuk and Fried, 2006, p. 2). They argue that making board decision making at arm's length from the power of CEOs is tortuous and that substantial additional corporate governance reform is necessary to give shareholders greater scrutiny over boards, and boards greater control over CEOs. Bebchuk and Fried (2004) show that US boards have been able to camouflage substantial amounts of executive remuneration through the use of payments made on retirement of executives.

Overall, our analysis provides support for the view that opportunistic timing practices reflect governance breakdowns and raise governance concerns. In particular, we find that: opportunistic timing was correlated with factors associated with greater CEO influence on corporate decision-making, such as a lack of a majority of independent directors or a long-serving CEO; grants to independent directors were also opportunistically timed, and this timing was not merely a byproduct of simultaneous awards to executives or of firms routinely timing all option grants; and lucky grants to independent directors were associated with more CEO luck and CEO compensation.

Bebchuk and Grinstein (2005) examine the growth of US executive pay during the period 1993−2003. They show that pay increased by substantially more than can be explained by changes in firm size, performance, and industry classification. Mean compensation in 2003 would have been only about half of its actual size had the relationships that existed in 1993 been maintained. Equity-based compensation increased considerably for both new-economy and old-economy firms; this growth was not accompanied by a reduction in non-equity rewards.

Unintended Regulatory Consequences

Over the past 80 years, Congress has imposed tax policies, accounting rules, disclosure requirements, direct legislation, and myriad other rules to regulate executive pay. With few exceptions, the regulations have generally been either ineffective or counterproductive, typically increasing (rather than reducing) CEO pay and leading to a host of unintended consequences, including the explosion in perquisites in the 1970s, golden parachute plans in the 1980s, stock options in the 1990s, and restricted stock in the 2000s.

Legal Perspective

- make the judgement in good faith and for a proper purpose;

- not to have a material personal interest in the subject matter of the judgement;

- inform themselves about the subject matter of the judgement to the extent they reasonably believe to be appropriate;

- rationally believe that the judgement is in the best interests of the corporation.

In addition, directors and other officers of companies must exercise their powers and discharge their duties in good faith in the best interests of the corporation and for a proper purpose (s. 181). They are prohibited from improperly using their position to gain an advantage for themselves or someone else or to cause detriment to the corporation (s. 182) and are prohibited from using information obtained as a consequence of their role with the company to gain an advantage for themselves or someone else or to cause detriment to the corporation (s. 183). These last two provisions also apply to employees of the company.

The Corporations Act 2001 restricts giving benefits greater than one year's base salary on retirement from a board or managerial office, unless shareholders approve the benefit. 7 These restrictions cover anyone who has been a director of a company at any time during the three previous years and, for listed companies, key members of management and/or the five highest paid executives over the prior 12-month period. In addition, Australian Securities Exchange (ASX) Listing Rules in relation to termination payments apply to companies listed on the exchange. Specifically, a listed company is obliged to ensure that no officer will be entitled to a termination benefit if a change occurs in the shareholding control of the company (Listing rule 10.18) unless such termination payments are agreed by shareholders at a general meeting (Listing rule 10.19).

In essence the legal view is inconsistent with agency-based arguments derived from the economist's assumption of a ‘rational economic man’. Agency arguments are based on an assumption that executives will act in their own interests, though the parties they contract with are aware of these incentives and incorporate bonding and monitoring arrangements to control the potential conflict. The legal view, however, states that executives must not act in their own interests and must put the interests of the corporation first.

Global Trends in Executive Compensation

US Evidence

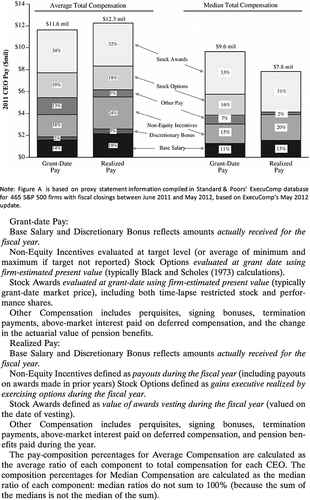

- Average total compensation is estimated at $11.6 million (based on grant date valuations) or $12.3 million, based on realized pay. Median compensations, reflecting the considerable skew in executive compensation, are $9.6 and $7.8 million respectively.

- The biggest component of executive compensation is associated with stock awards (both restricted stock and performance shares). Stock awards now comprise between 31% and 34% of total mean and median compensation for US CEOs.

- Base salary is between 14% and 18% of mean total compensation, and 11% to 13% of median total compensation.

- Stock options comprise 18% or 19% of mean total compensation, while options grants represent 16% of median grant-date total compensation.

- Non-equity incentive payments, which represent payouts during the current year for the current year and prior year awards, range between 18% and 24% of mean total compensation, and 15% to 20% of median total compensation.

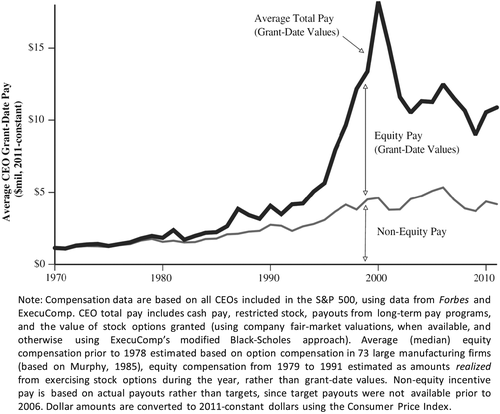

- Total pay increased from around $1.1 million in 1970 to $10.9 million in 2011, down from a peak of $18.2 million in 2000. Thus over this 42 year period CEO pay for S&P 500 firms outstripped inflation by a factor of approximately 10.

- Non-equity pay, which includes base salaries, payouts from short-term and long-term bonus plans, deferred compensation and other benefits, increased from around $1.1 million in 1970 to approximately $4.1 million in 2011. Thus non-equity pay increases outstripped CPI adjustments by a factor of approximately four.

- The growth in equity-linked pay, which includes the grant date values of stock options and restricted stock, is far more dramatic. In the period 1970 to 1978 total pay is almost entirely comprised of non-equity pay. However, by 2011 equity pay averages around $6.8 million or about two-thirds of average total pay.

- While it is not claimed to be causal, it is interesting to note that just a few years after Jensen and Meckling's (1976) paper on agency theory, the switch toward the use of equity pay as part of CEO compensation starts to emerge. By 1998 equity pay became the majority part of total executive compensation, and this is maintained in each year through to 2011.

- However, as noted by Kaplan (2013, p. 9), while CEOs ‘earn a great deal, they are not unique. Other groups with similar backgrounds—private company executives, corporate lawyers, hedge fund investors, private equity investors, and others—have seen significant pay increases where there is a competitive market for talent and managerial power problems are absent.’

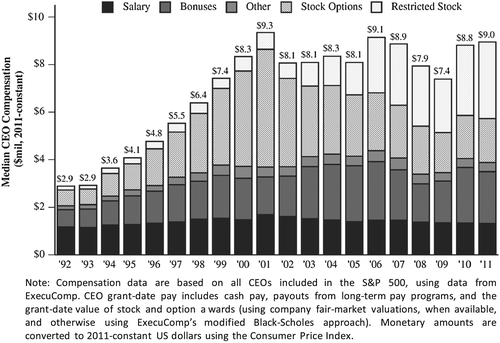

- Median total pay in Figure C in each year is significantly below mean pay, reflecting the skewness in pay distributions for US CEOs.

- Much of the growth in median total pay between 1992 and 2011 is due to an escalation in stock-option compensation between 1993 and 2001 coupled with a dramatic shift away from stock option grants towards restricted stock from between 2002 and 2011.

- In 1992 base salaries were about 41% of the $2.9 million median total CEO compensation package, while stock options accounted for about 25%. By 2001, base salaries are only about 18% of the median pay package, while options are more than 50%.

- In 2011 about two-thirds of median total pay is in the form of equity-based compensation.

International CEO Pay Trends

- When controls for only firm size and industry are considered, US CEOs earn substantially more than non-US CEOs. When additional controls for other firm characteristics, ownership, and board characteristics are included, US CEOs have effective parity in pay levels with other Anglo-Saxon nations (UK, Ireland, Australia, and Canada) as well as Germany, Italy, and Switzerland.

- When the results after risk adjustment using the Hall and Murphy (2002) approach are considered, again with controls for only firm size and industry, the US estimated pay using the ‘certainty equivalence’ approach is $2.1 million, and this is statistically higher than the non-US pay of $1.46 million. When additional controls are introduced the results show that US CEO pay is significantly less than in the UK and Australia, and insignificantly different to CEO pay in Canada, Italy, Ireland, and Switzerland.

Australian CEO Pay

-

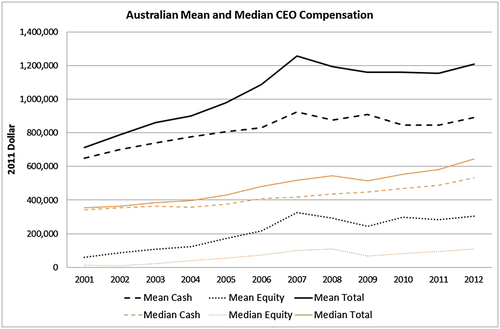

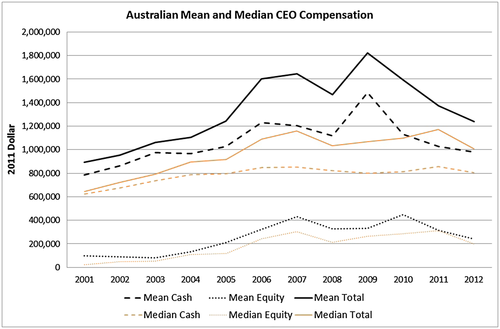

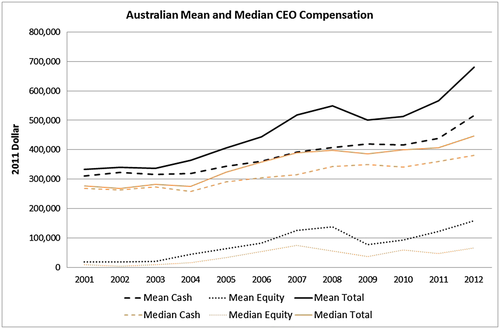

Mean (median) total compensation for the CEOs of all companies in Table 1 grew from $0.714 million to $1.210 million ($0.355 million to $0.644 million) between 2001 and 2012. Thus CEO pay has grown faster than the Australian CPI. There is a clear pattern of higher pay for the larger companies. The mean (median) average total compensation over the 12 years are as follows:

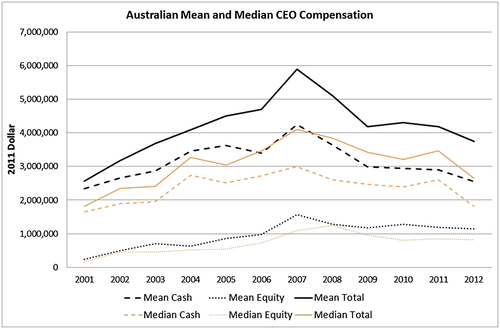

- top 100 firms (large firms in Table 2) $4.180 million and $3.080 million;

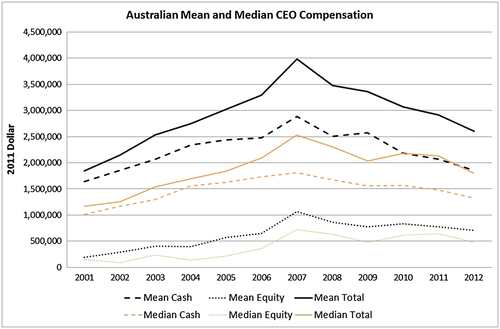

- top 200 firms (Table 3) $2.916 million and $1.818 million;

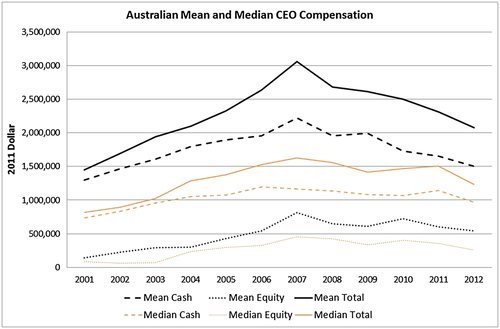

- top 300 firms (Table 4) $2.282 million and $1.281 million;

- top 101–300 firms (medium size firms in Table 5) $1.333 million and $0.927 million; and

- firms ranked 301 and higher (small firms in Table 6) $0.460 million and $0.341 million.

-

Equity-based compensation for all firms in Table 1 is 20.2% of mean total compensation and 12.2% of median total compensation over all sample years 2001–2012. Again there is a very clear pattern in relation to firm size, with the proportion of total compensation paid in the form of equity rising as firm size increases. The mean and median proportions of equity compensation to total compensation are as follows from Tables 2-6:

- the largest firms (top 100)—mean proportion 23.0%, median 23.4%;

- the largest 200 firms—mean proportion 21.5%, median 18.1%;

- the largest 300 firms—mean proportion 21.4%, median 20.0%;

- medium-sized firms (top 101–300)—mean proportion 18.9%, median 16.9%

- small firms (301 and up)—mean proportion 17.4 percent, median 10.0%.

| Year | NOB | Mean | Median | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | ||

| All Years | 11,282 | 817,514 | 78.5% | 210,460 | 20.2% | 1,041,461 | 410,714 | 87.8% | 57,228 | 12.2% | 467,942 | ||

| 2001 | 881 | 648,519 | 90.8% | 61,092 | 8.6% | 714,343 | 341,181 | 96.1% | 13,958 | 3.9% | 355,140 | ||

| 2002 | 903 | 701,938 | 88.9% | 86,480 | 11.0% | 789,604 | 10.5% | 355,333 | 97.7% | 8,414 | 2.3% | 363,747 | 2.4% |

| 2003 | 914 | 739,514 | 85.8% | 109,340 | 12.7% | 862,358 | 9.2% | 362,324 | 94.4% | 21,385 | 5.6% | 383,709 | 5.5% |

| 2004 | 974 | 775,085 | 86.2% | 122,884 | 13.7% | 899,062 | 4.3% | 357,455 | 89.8% | 40,650 | 10.2% | 398,105 | 3.8% |

| 2005 | 1,006 | 805,358 | 82.2% | 172,032 | 17.6% | 979,186 | 8.9% | 376,226 | 87.2% | 55,133 | 12.8% | 431,359 | 8.4% |

| 2006 | 1,020 | 829,540 | 76.2% | 217,094 | 19.9% | 1,088,945 | 11.2% | 409,182 | 84.7% | 73,707 | 15.3% | 482,888 | 11.9% |

| 2007 | 1,030 | 924,135 | 73.4% | 325,896 | 25.9% | 1,258,379 | 15.6% | 417,678 | 80.5% | 100,946 | 19.5% | 518,624 | 7.4% |

| 2008 | 991 | 876,693 | 73.4% | 292,323 | 24.5% | 1,194,480 | –5.1% | 436,681 | 79.9% | 109,597 | 20.1% | 546,278 | 5.3% |

| 2009 | 961 | 909,694 | 78.4% | 244,783 | 21.1% | 1,160,065 | –2.9% | 448,710 | 87.0% | 67,167 | 13.0% | 515,877 | –5.6% |

| 2010 | 921 | 844,823 | 72.8% | 298,773 | 25.8% | 1,159,731 | 0.0% | 470,389 | 85.0% | 82,784 | 15.0% | 553,173 | 7.2% |

| 2011 | 890 | 846,664 | 73.3% | 283,934 | 24.6% | 1,155,101 | –0.4% | 487,491 | 83.7% | 94,874 | 16.3% | 582,365 | 5.3% |

| 2012 | 791 | 890,532 | 73.6% | 303,287 | 25.1% | 1,209,961 | 4.7% | 533,598 | 82.8% | 110,724 | 17.2% | 644,322 | 10.6% |

- Notes: Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

| Year | NOB | Mean | Median | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | ||

| All Years | 1,200 | 3,135,036 | 75.0% | 963,287 | 23.0% | 4,180,499 | 2,358,037 | 76.6% | 721,731 | 23.4% | 3,079,769 | ||

| 2001 | 100 | 2,333,923 | 90.8% | 234,287 | 9.1% | 2,569,813 | 1,659,105 | 91.0% | 163,307 | 9.0% | 1,822,413 | ||

| 2002 | 100 | 2,663,347 | 84.1% | 494,395 | 15.6% | 3,168,454 | 23.3% | 1,887,424 | 80.3% | 463,369 | 19.7% | 2,350,792 | 29.0% |

| 2003 | 100 | 2,867,706 | 77.7% | 708,625 | 19.2% | 3,689,757 | 16.5% | 1,952,863 | 81.0% | 457,727 | 19.0% | 2,410,590 | 2.5% |

| 2004 | 100 | 3,458,661 | 84.4% | 636,293 | 15.5% | 4,095,924 | 11.0% | 2,745,374 | 84.0% | 524,813 | 16.0% | 3,270,187 | 35.7% |

| 2005 | 100 | 3,623,498 | 80.6% | 864,354 | 19.2% | 4,495,180 | 9.7% | 2,507,077 | 82.2% | 543,278 | 17.8% | 3,050,356 | –6.7% |

| 2006 | 100 | 3,404,534 | 72.4% | 973,717 | 20.7% | 4,703,288 | 4.6% | 2,728,890 | 78.8% | 732,984 | 21.2% | 3,461,874 | 13.5% |

| 2007 | 100 | 4,252,072 | 72.2% | 1,573,407 | 26.7% | 5,889,643 | 25.2% | 3,001,960 | 73.3% | 1,094,308 | 26.7% | 4,096,268 | 18.3% |

| 2008 | 100 | 3,636,509 | 71.1% | 1,288,573 | 25.2% | 5,114,690 | –13.2% | 2,608,688 | 67.7% | 1,243,240 | 32.3% | 3,851,928 | –6.0% |

| 2009 | 100 | 2,996,897 | 71.5% | 1,178,963 | 28.1% | 4,192,006 | –18.0% | 2,470,031 | 72.1% | 955,587 | 27.9% | 3,425,618 | –11.1% |

| 2010 | 100 | 2,938,895 | 68.2% | 1,283,889 | 29.8% | 4,312,291 | 2.9% | 2,396,190 | 74.7% | 812,166 | 25.3% | 3,208,356 | –6.3% |

| 2011 | 100 | 2,900,287 | 69.2% | 1,183,582 | 28.2% | 4,190,639 | –2.8% | 2,611,368 | 75.5% | 848,309 | 24.5% | 3,459,677 | 7.8% |

| 2012 | 100 | 2,544,108 | 67.9% | 1,139,360 | 30.4% | 3,744,298 | –10.7% | 1,822,967 | 68.8% | 826,889 | 31.2% | 2,649,856 | –23.4% |

- Notes: Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

| Year | NOB | Mean | Median | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | ||

| All Years | 2,400 | 2,241,826 | 76.9% | 627,240 | 21.5% | 2,916,199 | 1,489,273 | 81.9% | 328,253 | 18.1% | 1,817,526 | ||

| 2001 | 200 | 1,640,914 | 89.1% | 193,858 | 10.5% | 1,842,285 | 1,015,393 | 87.2% | 149,579 | 12.8% | 1,164,972 | ||

| 2002 | 200 | 1,852,749 | 86.2% | 290,161 | 13.5% | 2,148,266 | 16.6% | 1,166,278 | 92.7% | 92,154 | 7.3% | 1,258,432 | 8.0% |

| 2003 | 200 | 2,064,860 | 81.6% | 409,900 | 16.2% | 2,531,540 | 17.8% | 1,297,066 | 84.5% | 237,756 | 15.5% | 1,534,821 | 22.0% |

| 2004 | 200 | 2,343,696 | 85.4% | 398,949 | 14.5% | 2,745,960 | 8.5% | 1,554,318 | 91.6% | 142,934 | 8.4% | 1,697,252 | 10.6% |

| 2005 | 200 | 2,440,173 | 80.8% | 574,346 | 19.0% | 3,021,027 | 10.0% | 1,628,186 | 88.3% | 214,806 | 11.7% | 1,842,992 | 8.6% |

| 2006 | 200 | 2,480,314 | 75.3% | 648,602 | 19.7% | 3,293,075 | 9.0% | 1,731,568 | 82.6% | 365,363 | 17.4% | 2,096,931 | 13.8% |

| 2007 | 200 | 2,881,771 | 72.4% | 1,064,460 | 26.7% | 3,982,271 | 20.9% | 1,812,121 | 71.5% | 721,247 | 28.5% | 2,533,369 | 20.8% |

| 2008 | 200 | 2,505,782 | 72.0% | 867,355 | 24.9% | 3,480,240 | –12.6% | 1,671,378 | 72.6% | 630,405 | 27.4% | 2,301,783 | –9.1% |

| 2009 | 200 | 2,576,046 | 76.7% | 771,156 | 23.0% | 3,358,419 | –3.5% | 1,554,304 | 76.3% | 482,855 | 23.7% | 2,037,159 | –11.5% |

| 2010 | 200 | 2,185,658 | 71.1% | 832,632 | 27.1% | 3,072,018 | –8.5% | 1,565,365 | 71.9% | 611,972 | 28.1% | 2,177,337 | 6.9% |

| 2011 | 200 | 2,071,825 | 71.1% | 771,881 | 26.5% | 2,914,515 | –5.1% | 1,481,272 | 69.6% | 647,142 | 30.4% | 2,128,414 | –2.2% |

| 2012 | 200 | 1,858,121 | 71.3% | 703,579 | 27.0% | 2,604,775 | –10.6% | 1,323,633 | 73.5% | 476,189 | 26.5% | 1,799,822 | –15.4% |

- * Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

| Year | NOB | Mean | Median | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | ||

| All Years | 3,600 | 1,756,038 | 76.9% | 489,265 | 21.4% | 2,282,457 | 1,024,675 | 80.0% | 255,833 | 20.0% | 1,280,508 | ||

| 2001 | 300 | 1,302,150 | 89.6% | 142,175 | 9.8% | 1,453,272 | 736,123 | 90.0% | 82,209 | 10.0% | 818,333 | ||

| 2002 | 300 | 1,464,261 | 86.6% | 223,828 | 13.2% | 1,691,659 | 16.4% | 832,458 | 93.3% | 59,794 | 6.7% | 892,251 | 9.0% |

| 2003 | 300 | 1,606,836 | 82.9% | 291,155 | 15.0% | 1,939,025 | 14.6% | 953,794 | 93.4% | 67,758 | 6.6% | 1,021,552 | 14.5% |

| 2004 | 300 | 1,797,454 | 85.5% | 300,729 | 14.3% | 2,101,774 | 8.4% | 1,055,795 | 81.8% | 234,249 | 18.2% | 1,290,044 | 26.3% |

| 2005 | 300 | 1,893,347 | 81.4% | 428,442 | 18.4% | 2,327,229 | 10.7% | 1,079,181 | 78.4% | 297,651 | 21.6% | 1,376,832 | 6.7% |

| 2006 | 300 | 1,954,341 | 74.2% | 539,941 | 20.5% | 2,635,639 | 13.3% | 1,196,698 | 78.4% | 329,565 | 21.6% | 1,526,263 | 10.9% |

| 2007 | 300 | 2,219,489 | 72.5% | 813,053 | 26.6% | 3,059,856 | 16.1% | 1,167,066 | 71.9% | 456,917 | 28.1% | 1,623,983 | 6.4% |

| 2008 | 300 | 1,958,537 | 73.0% | 647,056 | 24.1% | 2,682,101 | –12.3% | 1,133,935 | 72.6% | 428,406 | 27.4% | 1,562,341 | –3.8% |

| 2009 | 300 | 1,990,537 | 76.2% | 613,256 | 23.5% | 2,613,107 | –2.6% | 1,085,633 | 76.5% | 333,256 | 23.5% | 1,418,889 | –9.2% |

| 2010 | 300 | 1,732,574 | 69.3% | 726,788 | 29.1% | 2,499,055 | –4.4% | 1,064,996 | 72.6% | 401,627 | 27.4% | 1,466,623 | 3.4% |

| 2011 | 300 | 1,650,721 | 71.4% | 603,577 | 26.1% | 2,311,992 | –7.5% | 1,144,030 | 76.1% | 359,916 | 23.9% | 1,503,946 | 2.5% |

| 2012 | 300 | 1,502,209 | 72.4% | 541,179 | 26.1% | 2,074,778 | –10.3% | 973,203 | 78.8% | 261,887 | 21.2% | 1,235,091 | –17.9% |

- Notes: Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

| Year | NOB | Mean | Median | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | ||

| All Years | 2,400 | 1,066,539 | 80.0% | 252,254 | 18.9% | 1,333,437 | 769,856 | 83.1% | 156,780 | 16.9% | 926,636 | ||

| 2001 | 200 | 786,263 | 87.9% | 96,119 | 10.7% | 895,002 | 622,100 | 96.7% | 21,099 | 3.3% | 643,199 | ||

| 2002 | 200 | 864,718 | 90.7% | 88,544 | 9.3% | 953,262 | 6.5% | 674,713 | 93.5% | 47,179 | 6.5% | 721,892 | 12.2% |

| 2003 | 200 | 976,401 | 91.8% | 82,420 | 7.7% | 1,063,658 | 11.6% | 735,399 | 93.1% | 54,177 | 6.9% | 789,576 | 9.4% |

| 2004 | 200 | 966,851 | 87.5% | 132,947 | 12.0% | 1,104,699 | 3.9% | 786,197 | 87.6% | 110,821 | 12.4% | 897,018 | 13.6% |

| 2005 | 200 | 1,028,272 | 82.7% | 210,486 | 16.9% | 1,243,254 | 12.5% | 796,085 | 86.9% | 119,531 | 13.1% | 915,617 | 2.1% |

| 2006 | 200 | 1,229,245 | 76.7% | 323,053 | 20.2% | 1,601,814 | 28.8% | 847,945 | 77.7% | 243,628 | 22.3% | 1,091,573 | 19.2% |

| 2007 | 200 | 1,203,197 | 73.1% | 432,876 | 26.3% | 1,644,962 | 2.7% | 852,197 | 73.6% | 305,108 | 26.4% | 1,157,306 | 6.0% |

| 2008 | 200 | 1,119,550 | 76.4% | 326,298 | 22.3% | 1,465,807 | –10.9% | 820,979 | 79.3% | 214,300 | 20.7% | 1,035,279 | –10.5% |

| 2009 | 200 | 1,487,358 | 81.6% | 330,403 | 18.1% | 1,823,658 | 24.4% | 801,670 | 75.1% | 266,230 | 24.9% | 1,067,900 | 3.2% |

| 2010 | 200 | 1,129,414 | 70.9% | 448,238 | 28.1% | 1,592,437 | –12.7% | 813,124 | 74.1% | 284,919 | 25.9% | 1,098,042 | 2.8% |

| 2011 | 200 | 1,025,938 | 74.7% | 313,574 | 22.8% | 1,372,669 | –13.8% | 857,561 | 73.3% | 312,691 | 26.7% | 1,170,252 | 6.6% |

| 2012 | 200 | 981,260 | 79.1% | 242,088 | 19.5% | 1,240,017 | –9.7% | 806,288 | 80.2% | 199,413 | 19.8% | 1,005,701 | –14.1% |

- Notes: Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

| Mean | Median | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | NOB | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | Cash comp. | Cash ratio | Equity comp. | Equity ratio | Total comp. | Change in total comp. From t–1 | |

| All Years | 7,682 | 377,638 | 82.1% | 79,804 | 17.4% | 459,819 | 307,142 | 90.0% | 33,958 | 10.0% | 341,100 | |||

| 2001 | 581 | 311,015 | 93.5% | 19,226 | 5.8% | 332,797 | 269,132 | 97.0% | 8,439 | 3.0% | 277,570 | |||

| 2002 | 603 | 322,673 | 94.7% | 18,147 | 5.3% | 340,821 | 2.4% | 263,871 | 98.3% | 4,490 | 1.7% | 268,360 | –3.3% | |

| 2003 | 614 | 315,742 | 93.9% | 20,506 | 6.1% | 336,299 | –1.3% | 273,175 | 96.7% | 9,380 | 3.3% | 282,555 | 5.3% | |

| 2004 | 674 | 320,025 | 88.0% | 43,724 | 12.0% | 363,731 | 8.2% | 258,322 | 93.9% | 16,636 | 6.1% | 274,958 | –2.7% | |

| 2005 | 706 | 343,040 | 84.4% | 63,075 | 15.5% | 406,364 | 11.7% | 290,557 | 89.6% | 33,732 | 10.4% | 324,289 | 17.9% | |

| 2006 | 720 | 360,873 | 81.2% | 82,574 | 18.6% | 444,489 | 9.4% | 303,974 | 85.0% | 53,449 | 15.0% | 357,424 | 10.2% | |

| 2007 | 730 | 391,799 | 75.6% | 125,694 | 24.3% | 518,045 | 16.5% | 315,039 | 80.8% | 74,647 | 19.2% | 389,686 | 9.0% | |

| 2008 | 691 | 407,007 | 74.2% | 138,315 | 25.2% | 548,624 | 5.9% | 341,774 | 85.8% | 56,547 | 14.2% | 398,321 | 2.2% | |

| 2009 | 661 | 419,145 | 83.7% | 77,549 | 15.5% | 500,591 | –8.8% | 349,839 | 90.6% | 36,421 | 9.4% | 386,259 | –3.0% | |

| 2010 | 621 | 415,958 | 81.1% | 92,002 | 17.9% | 512,714 | 2.4% | 340,549 | 85.2% | 59,221 | 14.8% | 399,770 | 3.5% | |

| 2011 | 590 | 437,822 | 77.2% | 121,404 | 21.4% | 566,851 | 10.6% | 359,734 | 88.3% | 47,447 | 11.7% | 407,181 | 1.9% | |

| 2012 | 491 | 516,035 | 75.8% | 157,936 | 23.2% | 680,482 | 20.0% | 379,981 | 85.2% | 65,796 | 14.8% | 445,777 | 9.5% | |

- Notes: Small differences between total compensation and the sum of cash compensation and equity compensation are caused by small amounts of other compensation.

-

There is a clear upward trend in the use of equity-based compensation, with mean (median) proportions in Table 1 for all firms in 2001 being 8.6% (3.9%), with these rising to 25.1 (17.2)% by 2012, respectively. This growth in the use of equity-based compensation is more pronounced for the larger firms than smaller ones. Specifically Tables 2-6 show that between 2001 and 2012 equity forms of compensation as a proportion of total compensation has increased as follows:

- Table 2 (the largest firms) the growth is from 9.1% to 30.4%;

- Table 3 (top 200 firms) the growth is from 10.5% to 27.0%;

- Table 4 (top 300 firms) the growth is from 9.8% to 26.1%;

- Table 5 (medium-sized firms) the growth is from 10.7% to 19.5%; and

- Table 6 (small firms) the growth in equity-based compensation as a proportion of total compensation between 2001 and 2012 is from 5.8% to 23.2%. These proportions are however somewhat misleading because the average equity based payment in 2001 to small firms is only $19,226 per firm, and this rose to $157,936 per firm by 2012. Among the top 100 firms equity-based compensation dwarfs these values with mean equity-based compensation rising from an average of $234,287 in 2001 to $1,139,360 by 2012.

- Yearly growth figures show that mean and median CEO compensation for all firms in Table 1 grew quite strongly over 2001–2007, but the GFC has stopped this trend, resulting in mean CEO compensation in 2012 at approximately the same level as in 2007. Median CEO pay has continued to show modest growth from 2007 to 2012. The levels of pay for the top 100 firms have, however, declined quite dramatically between 2007 (where the average total compensation for a CEO of a top 100 firm was $5.890 million) and 2012 (where the average pay was $3.744 million). On average a top 100 CEO in Australia is about $2 million worse off in 2012 than he/she was in 2007. Among the top 200 firms the drop in average pay between 2007 and 2012 is $1.378 million, for the top 300 firms it is $0.985 million and for medium size firms the average CEO salary drops by $0.404 million. Small firm CEO total compensation bucks this trend, rising from $0.518 million in 2007 to $0.680 million in 2012.

- Irrespective of the groupings we form, Australian CEO total compensation (both means and medians) have outstripped the CPI over the 12 years we summarize. These trends are clearly evident in each of the figures we provide. The increase is largely attributable to equity compensation in each group. For example, average equity compensation in top 100 firms rises by $905,073 meaning that top 100 firms' total compensation outstrips inflation by almost one million dollars.

Empirical Evidence on Executive Compensation

There is an extensive literature on CEO compensation with a particular focus on US public firms (see, for example, review articles by Frydman and Jenter (2010), Murphy (1999, 2013), Jensen and Murphy (2004), Kaplan (2013), and Ferrarini et al. (2009). We do not intend to fully canvass this voluminous work. Rather we attempt to draw out broad trends that emerge from review papers that involve time series and cross sectional examinations, and then provide a comprehensive review on the Australian-based evidence.

The Increase in CEO Compensation

The dramatic increase in CEO compensation of US publicly traded corporations over the past three decades has attracted extensive attention in academic research. Most studies rely on either the efficient-contracting theories or managerial-power theories in an attempt to explain the increase. However, as argued by Murphy (2013), any compelling theory must not only explain the increased level of CEO pay, but should also explain the explosion in option grants to lower-level executives and employees, the leveling of CEO pay after 2001 and the emerging dominance of restricted stock in the early 2000s.

In the efficient-contracting camp, several general equilibrium models are recently developed by accommodating the shift in the relative importance of general ‘managerial capital’ or the marginal product of managerial ability as a function of firm size. One important change in the CEO labour market over the past several decades is the increased prevalence of newly appointed CEOs being hired externally, jumping from 15% in the 1970s to nearly one-third in the late 1990s (Murphy and Zabojnik, 2007). Murphy and Zabojnik (2007) and Frydman (2007) therefore argue that the nature of the CEO job market has changed gradually over recent years and that the demand for CEOs has shifted away from firm-specific capital (reflecting skills, knowledge, and experience valuable only within the organization) towards more general managerial skills. Both papers offer general equilibrium models and attribute the increase in CEO wages to the increased prevalence of outside hiring and the intensified competition among firms for managerial talent. The above argument is further supported by the comparable rise in pay for top talent in other sectors with active and mobile labour markets, such as athletes, lawyers, investment bankers, and hedge fund managers during the same period (Kaplan and Rauh, 2010).

On the other hand, Gabaix and Landier (2008) build an equilibrium model and argue that in equilibrium the most skilled CEOs should be employed by the largest companies, as managerial talent has greatest effect in larger firms. Accordingly, any shift in the size distribution of firms will lead to a proportional change in CEO pay. They show that the dramatic rise in US CEO pay since 1980 can be fully explained by the simultaneous growth in firm size.

However, as Murphy (2013) argues, while the efficient-contracting theories provide important insights on the rise in CEO pay, they cannot explain why stock options were once the preferred form of equity incentives, and why this shifted to restricted stock after 2001. More importantly, the extensive option grants to employees well below the executive suite are also contradictory to efficient-contracting theories.

Compared to the efficient-contracting camp, the managerial-power hypothesis is even less successful in explaining the increase in CEO pay. Under this hypothesis, CEOs in firms with weak corporate governance and acquiescent boards are able to (at least partly) determine their compensation, resulting in inefficiently high levels of compensation. This argument is inconsistent with improved board independence in US firms during the 1990s, as evidenced by the increasingly higher percentage of outside directors serving on the board and the CEO being the sole insider in about half of all firms (Murphy, 2013). In fact, it is well documented that most aspects of corporate governance in US firms have improved since the 1970s, which in turn largely weakens the influence of CEOs over board members (Hölmstrom and Kaplan, 2001).

In attempting to offer a managerial-power explanation, Bebchuk and Grinstein (2005) argue that the ‘outrage constraint’ on managerial power largely depends on stock market conditions and sentiment. The stock market boom in the 1990s weakened outrage and led to a dramatic increase in CEO pay over that decade. Conversely, outrage strengthened in the bearish market during 2000–2002, resulting in a reduction in CEO pay and the use of stock options. However, as Murphy (2013) argues, a fundamental problem with the managerial-power hypothesis, as well as the Bebchuk and Grinstein (2005) explanation, is that ‘there is no principled way to refute any trend in pay given the authors’ flexible (and unmeasurable) definition of both the “outrage constraint” and its importance’ (Murphy, 2013, p. 334).

Besides the efficient-contracting and managerial-power theories, recent research also offers several explanations, with some success, to understand the increase in CEO pay from other perspectives, such as perceived costs of options, disclosure requirements, tax policies, and non-market mechanisms. Hall and Murphy (2002) argue that the greater use of stock options in the 1990s reflects the fact that many directors and top executives perceived options to be costless and did not understand their true economic cost for shareholders. The SEC disclosure rules in place during that period and the pre-2003 NYSE listing requirement also contributed to the ‘perceived cost’ problem, as the costs of options to be granted were not required to be disclosed or approved by shareholders. The perceived cost view may also explain the decreased use of options since 2002, as many firms voluntarily expensed options since early 2003 under FAS 123R, which was mandated in 2006 (Murphy, 2013). In addition, Rose and Wolfram (2002) claim that the tax laws enacted in 1994 effectively made stock options less expensive than cash pay and this partly contributed to the explosion in stock options.

Piketty and Saez (2003, 2006) propose an explanation based on non-market mechanisms, such as social norms or labour market institutions. They document evidence of a U-shape pattern over the course of the twentieth century for the pay of those at the very top of the income distribution. They therefore argue that the shift in social norms towards the acceptability of extreme pay since the 1970s contributed to the increase in CEO compensation.

Most empirical studies on CEO compensation limit their samples to the post-1990 period, when the Execucomp data are readily available for US firms. Frydman and Saks (2010), however, offer a unique long-term perspective by hand-collecting and examining CEO pay in the top 100 (in terms of sales) US firms over the period 1936 to 2005. In line with Piketty and Saez (2003, 2006), Frydman and Jenter (2010) show that CEO compensation between the end of World War II and before the mid-1970s is characterized by low levels of pay, little dispersion across top managers, moderate pay–performance sensitivities, and a weak relation between pay and firm size. From the mid-1970s to the early 2000s, compensation levels grew dramatically, differences in pay among CEOs widened, and equity incentives tied managers' wealth closer to firm performance and firm size. The long-term perspective presented in Frydman and Saks (2010) therefore reveals that the recent theoretical advances fail to explain the trend in CEO pay in the pre-1970 period.

CEO Incentives and Pay–Performance Sensitivity

Equity-based compensation is used to align the interests of shareholders and managers (Jensen and Meckling, 1976) because decisions that increase shareholders' wealth also increase managers' wealth. To measure CEO incentives, pay–performance sensitivity is often utilized, which indicates how much compensation depends on how well the company performs. Jensen and Murphy (1990) conceptualize pay–performance sensitivity as the dollar change in executive wealth associated with each dollar change in shareholder wealth. They document that for between 1974 and 1986 the average CEO experiences a change in wealth of $3.25 for each $1,000 change in firm value, and the pay–performance sensitivity decreases in firm size. The results therefore indicate that CEO incentives are low on average, particularly in large firms.

The insensitivity of CEO wealth to performance documented in Jensen and Murphy (1990) is questioned by subsequent research, and alternative measures of pay–performance sensitivity are proposed (see Hall and Liebman, 1998; Aggarwal and Samwick, 1999; Edmans and Gabaix, 2009). For example, Hall and Liebman (1998) argue that the dollar changes in CEO wealth due to typical changes in firm value are, in fact, not small. They measure CEO incentives as the dollar change in CEO wealth for a percentage change in firm value. Murphy (1985) and Kaplan (1994) recommend the use of the elasticity of CEO wealth to shareholder value, which indicates the percentage change in CEO wealth for a percentage change in firm value. Edmans and Gabaix (2009) and Frydman and Jenter (2010) discuss the advantages and disadvantages of different incentive measures. They suggest that they are all important and should be considered independently due to the heterogeneity of corporate activities CEOs engage in and CEO utility. 2

Overall, research on US firms suggests that the pay–performance sensitivity of CEOs' wealth surged during the 1990s, mostly due to the use of executive options (Frydman and Jenter, 2010). Between 1990 and 2011, CEOs were rewarded for good performance, and penalized for poor performance (Kaplan, 2013). However, the fractional ownership of most US CEOs in the firms they manage remains low, and it is even lower today than it was in the 1930s (Frydman and Jenter, 2010).

CEO Pay, Firm Performance, and Corporate Actions

The issue of whether CEO incentives affect firm performance has been quite controversial and there is no theoretical and empirical consensus in the literature. In a seminal study, Morck et al. (1988) document a nonlinear, cross-sectional relation between managerial ownership and firm valuation. They find that firm performance increases in managerial ownership for ownership lower than 5% or greater than 25%, but decreases in ownership between 5% and 25%. While the results in Morck et al. (1988) imply that greater CEO incentives are not always better-aligned and tend to be worse in the 5% to 25% ownership range, subsequent studies present mixed evidence on the effect of different aspects of CEO equity incentives on firm performance (see McConnell and Servaes, 1990; Mehran, 1995; Habib and Ljungqvist, 2005).

In contrast, Demsetz and Lehn (1985) and Himmelberg et al. (1999) argue that observed levels of managerial ownership represent an equilibrium solution to agency problems. As the complex process of compensation arrangements involves the CEO, the compensation committee and consultants, the boards, and the external labour market of executives, the level of compensation and incentives is/are determined by a large number of observable and unobservable firm and CEO characteristics. Therefore, the cross-sectional relation between managerial ownership and firm value is spurious. To control for the alleged endogeneity problem, studies by Demsetz and Lehn (1985), Loderer and Martin (1997), Cho (1998), Himmelberg et al. (1999), Palia (2001), and Villalonga and Amit (2006) either utilize simultaneous equations models or employ instrumental variables so as to identify the causal effects of managerial incentives on firm value. In addition, Coles et al. (2012) estimate a structural model and show that the documented hump-shaped relation between managerial ownership and firm value (McConnell and Servaes, 1990) is the outcome of firms having different productivity from physical assets and managerial inputs. To assess the effectiveness of standard econometric approaches to the well-known endogeneity problem, they conclude that fixed effects and instrumental variables do not generally provide reliable solutions to simultaneity bias in testing the effect of managerial ownership on firm performance.

Given the difficulty of convincingly identifying the causal effects of managerial incentives on firm value, recent research endeavours to connect executive incentives to a wide variety of corporate decisions and outcomes. The idea behind this is that incentives influence the decisions managers make, which in turn impact firm value. For example, Core and Larcker (2002) examine a sample of firms adopting ‘target ownership plans’ and find that the required increases in managerial ownership lead to improvements in the firm's operating performance. Fenn and Liang (2001) and Brown et al. (2007) find that executives with higher ownership are more likely to increase dividends, but Fenn and Liang (2001) also show that management stock options are negatively (positively) related to dividends (repurchases). Denis et al. (1997) suggest that managerial ownership creates incentives for managers to pursue value-increasing investments and therefore constrains business diversification and avoids value destruction.

With respect to managerial risk taking, recent studies recognize the differential theoretical predictions regarding the relationship between firm risk and the sensitivity of executives' wealth to firm risk (vega) and to changes in stock price (delta). Coles et al. (2006) and Low (2009) document a positive relationship between vega and firm risk, but provide mixed evidence for delta. Evidence on CEO pay and takeovers is also mixed. Consistent with efficient contracting, Datta et al. (2001) document a strong positive relation between acquiring managers' equity-based compensation and merger performance. In contrast, Harford and Li (2007) compare compensation policies implemented in firms that undertake either acquisitions or capital expenditures (external vs. internal investment). Consistent with managerial-power explanations, Harford and Li (2007) find that CEOs are financially better off from making acquisition decisions, even though these decisions typically destroy shareholder value (see also Bliss and Rosen, 2001).

Overall, there is ample but often mixed evidence between CEO incentives and a variety of corporate policies and actions. While one may interpret this evidence as empirical validity of the widespread misuse of CEO compensation, an alternative is that the endogeneity of compensation arrangements makes it extremely difficult to interpret any observed relation between CEO compensation and corporate outcomes as evidence of a causal effect. A response to such a challenge in recent research is to identify a natural experiment, such as a regulatory change and unexpected ‘shock’ to the economy (see, for example, Brown et al., 2007; Gormley et al., 2013).

Australian Evidence

The level of CEO pay and its determinants

Early research (before 1999) on Australian CEO compensation typically examines the association between the level of CEO cash-based compensation and firm size and performance. This is largely due to disclosure requirements in Australia before 1998, when information about component parts of remuneration is absent and unavailable for research. In addition, early research tends to rely on a small sample of Australian firms and/or a relatively short sample period, which makes the hand-collection of CEO compensation data from annual reports feasible and cost-effective. The sample size in these studies is typically less than 100, with the only exception being Merhebi et al. (2006). 3 Although early research on Australian CEO pay generally documents a positive association between the level of CEO cash-based compensation and firm size, it typically reports that cash-based compensation and its components are not significantly associated with prior-year or current-year firm performance measured by either accounting return (such as ROA or ROE) or stock return of the firm. Table 7 provides a summary of Australian empirical studies on the level of CEO compensation.

| Authors | Year | Sample/Sources | Sample year | Pay measures | Size | Prior-year performance | Current-year performance | Other determinants | Key findings |

|---|---|---|---|---|---|---|---|---|---|

| Capezio, Shields, and O'Donnell | 2011 | 663 (4,456) firms (firm-yeras) from ASX top 500, source unknown | 1998–2006 | Total cash-based compensation and its components | + | Current stock return(X) | Incoming CEO(−), board independence(X) | Board structural independence does not affect the relation between CEO pay and performance. The results contradict both efficient-contracting and managerial-power theories | |

| Chalmers, Koh, and Stapledon | 2006 | 133 (532) firms (firm-years) for ASX top 200, annual reports | 1999–2002 | Total compensation, salary, bonus, shares, and options | + | Past ROA(+), past return(X) | Board size(+), CEO ownership(−), firm risk(+) | Fixed salary and share-based components of compensation are consistent with efficient-contracting explanations, while bonuses and option grants are found to be consistent with rent extraction. | |

| Coulton and Taylor | 2002 | 258 ASX firms, annual report | 2000 | Executive stock option | + | Prior stock return(+) | Current ROA(−) | CEO ownership(−), insider ownership(−) | The ratio of options over total pay is positively associated with firm size and prior-year return, but negatively related to current-year ROA, CEO ownership and insider ownership. The results indicate that firms with weak corporate governance are likely to use stock options excessively. |

| Cybinski and Windsor | 2013 | 143 ASX300 firms | 2001 | Total cash pay, and CEO bonus | Prior-year ROA(X) | The relation between CEO cash pay and prior-year performance is only significant in the largest 50 firms among ASX300 with an independent remuneration committee. | |||

| Doucouliagos, Haman, and Askary | 2007 | 10 Australian banks, 149 firm-years, annual report | 1992–2005 | Total compensation | + | Prior bank performance(+), prior-year stock return(+) | Institutional ownership(+), board size(−) | CEO pay is positively related to firm size, prior-year bank performance, prior-year stock return, and institutional ownership, but negatively associated with board size. | |

| Heaney, Tawani, and Goodwin | 2010 | 1,144 listed Australian firms, annual report | 2006 | Total compensation | + | Prior ROA(X),prior stock return(X), | Current ROA(X), current stock return(X), | Board size(+), growth option(+), CEO duality(−) | The level of CEO compensation is found to be positively related to size, board size, growth options, and the separation of CEO and Chairman roles in the board. However, there is no evidence of a significant relation between CEO pay and firm performance (either accounting or market performance) in the prior year or future year. |

| Holland, Dowling, and Innes | 2001 | 26 (312) Australian firms (firm-years) | 1988–1999 | Total compensation | + | Current stock return(+ weak) | A weak positive relationship between CEO compensation and current period market performance, and a strong positive association between CEO pay and firm size, which has decreased over the sample period. | ||

| Izan, Sidhu, and Taylor | 1998 | 99 (488) Australian firms (firm-years) with available financial and price data, annual reports | 1987–1992 | Total cash compensation | + | Prior ROE(X), prior stock return(X) | Current ROE(X),current stock return(X), | They find no evidence of a linkage between CEO cash pay and current period performance, as well as prior-year performance. Firm size is positively related to CEO pay. Australian CEOs have had, at least compared to US CEOs, a relatively small proportion of total (cash) compensation ‘at risk’. | |

| Lee | 2009 | 66 Australian firms, 47 performance-improving and 19 declining, annual reports | 2003 | Performance-based pay, namely bonus and equity pay | + | Change in ROE(+) | CEO duality(+), CEO change(−), board independence (X) | CEO performance-based pay is positively linked to change in financial performance, firm size, and CEO duality, and is likely to reduce in case of a CEO change. There is no evidence of an association between performance-based pay and board independence. | |

| Matolcsy | 2000 | 100 randomly selected Australian firms, 900 firm-years, annual reports | 1987–1995 | Changes in total cash-based compensation | Changes in financial performance (mixed) | The relationship between changes in CEO cash compensation and changes in financial performance is positive during economic growth, but is flat during an economic downturn. | |||

| Matolcsy and Wright | 2006 | 696 firm-years from top 500 Australian firms, Sirca Limited | 1999–2001 | Total compensation | + | Current stock return(+) | Firm complexity(+) | Levels of Australian CEO compensation are associated with the firm's underlying economic characteristics, with a positive relation to firm size, firm complexity, and current stock price performance. | |

| Matolcsy and Wright | 2007 | 696 firm-years from top 500 Australian firms, Sirca Limited | 1999–2001 | Total compensation, cash, and equity-based pay | + | Finds 34% firm-years with only cash pay and 66% firm-years where a combination of cash- and equity-based compensation is paid. CEO pay is highest in the banking and finance sector, but the pay levels are much lower than US CEOs. | |||

| Merhebi, Pattenden, Swan and Zhou | 2006 | 722 (2,574) firms (firm-years) from the Top 500 firms listed in Business Review Weekly, annual reports | 1990–1999 | Total cash compensation | + | Current ROA(X), current stock return(X), | CEO pay is positively related to firm size, but is not related to contemporaneous accounting and market performance. | ||

| O'Neill and Iob | 1999 | 49 firms from top 150 Australian firms, annual reports | 1997 | Salary and total pay | + | Accounting performance(X) | CEO age(X), CEO service years(X) | The level of CEO base salary and total pay is positively related to size, but is not associated with firm performance, CEO age, and the number of CEO service years. | |

| Schultz, Tian, and Twite | 2013 | 8,594 firm-years with available compensation data, Boardroom | 2000–2010 | Total compensation, known pay, cash bonus, and long-term at-risk pay | + | Current ROA(+) | Tobin Q(+), leverage(−), Board size(+), CEO duality(−), the ratio of nonexecutive directors (+), the existence of remuneration committee(+), CEO serving the remuneration committee(−) | There is no evidence of a consistent relationship between the effectiveness of board monitoring activity and levels of CEO compensation. Results also highlight the role of blockholders (outside and inside) in affecting the pay-performance sensitivity. | |

| Walker | 2010 | 50 randomly selected ‘high-growth’ and 50 ‘low-growth’ firms, annual reports | 2005–2006 | Performance-based pay and equity pay | + | Current ROA(X) | Growth(+), CEO ownership(X), CEO duality(X) | Performance-based pay is positively related to firm size and growth, but is not significantly associated with ROA, CEO ownership and CEO duality. |

For example, Izan et al. (1998) examine the relation between cash-based compensation, accounting and share price performance, and firm size for a sample of 99 Australian firms with available financial and price data from 1987 to 1992. They find no evidence of a linkage between CEO cash pay and current period performance, as well as prior-year performance. They discuss several alternative explanations and conclude that Australian CEOs have had, at least compared to US CEOs, a relatively small proportion of total (cash) compensation ‘at risk’. O'Neill and Iob (1999) examine 49 large Australian firms in 1997. They find that the level of CEO base salary and aggregate pay is positively related to firm size, but there is no significant relation between CEO pay and firm performance, CEO age, and the number of CEO service years.

Merhebi et al. (2006) conduct a large sample study on CEO cash pay for the Top 500 Australian public firms (based on reported profits) for the period 1990–1999. 4 They find that: (a) CEO pay is statistically positively related to firm size (CEO pay increases by 2.74% for a 10% increase in firm size, measured as revenue); and (b) CEO pay is insignificantly related to contemporaneous measures of performance (return on assets, return on equity, and share price performance).

Two exceptions in early research are studies by Matolcsy (2000) and Holland et al. (2001), which report either mixed or weak evidence on the relationship between CEO cash pay and firm performance. Holland et al. (2001) examine a sample of 26 Australian companies over 1989–1999 and find a weak positive relationship between CEO compensation and current period market performance (no statistics are presented). Matolcsy (2000) tests how business cycles affect the association between changes in CEO pay and changes in firm performance. Using a sample of 100 randomly selected Australian firms over 1987–1995, Matolcsy first shows that, on average, CEO cash-based compensation increased by 13.24% over the sample period. The average growth rate is higher during periods of ‘Steady growth’ (15%) and ‘Soft landing’ (24%), and lower for periods of ‘Flat recovery’ (9%) and ‘Recession’ (11%). The results show that the relationship between changes in CEO cash compensation and changes in financial performance is positive during economic growth, but flat during an economic downturn.

Australian regulations and disclosure requirements in relation to executive and director pay were amended by the Company Law Review Act 1998 (CLRA) as part of the Corporate Law Economic Reform Program (CLERP). The CLRA amended provisions of the Corporations Law deal with financial reporting and auditing for accounting periods ending on or after 1 July 1998. Since then, Australian public companies have been required, in their directors' report, to provide detailed information and discussion on the nature, amount, and rationale of each element of the compensation paid to senior executives and board directors, including equity-based compensation. The regulation was further amended in 2004, including the issuance of an accounting standard (AASB 1046 Director and Executive Disclosures by Disclosing Entities) prescribing detailed disclosure of executive and director remuneration components, and the CLERP (Audit Reform and Corporate Disclosure) Act 2004 (CLERP9) introducing a number of amendments in relation to executive compensation.

Following the introduction of increased disclosure regulations that came into effect on 1 July 1998, Matolcsy and Wright (2007) provide descriptive evidence on the structure of Australian CEO pay for the period of 1999–2001. Using firms in the Top 500 with available data, they find 238 firm-years (34%) where only cash is paid to the CEO and 458 firm-years (66%) where a combination of cash- and equity-based compensation is paid. CEO compensation is highest in the cash and equity-based compensation group of the banking and finance sector where the mean (median) compensation for the equity-based group is $1.865 million ($1.153 million). These pay levels are much lower than in the US where Murphy (1999) reports median CEO compensation of $US4.582 million for 1996.

Coulton and Taylor (2002) present the first Australian examination on executive stock options for a sample of 258 Australian firms in 2000. They find that large firms with better prior-year market performance are more likely to grant stock options to their CEOs. The percentage of stock options over total compensation is positively associated with firm size and prior-year stock return, but negatively related to current-year accounting performance (ROA), CEO ownership, and insider ownership. They conclude that the results are more consistent with the notion that firms with weak corporate governance are likely to use stock options excessively.

As information about equity-based compensation became more publicly available, recent research re-examines the association between firm performance and CEO pay, using total compensation as well as four different components (salary, bonus, shares, and options). Evidence suggests that the level of CEO compensation is positively related to current-year ROA (Schultz et al., 2013), changes in ROE (Lee, 2009), and current-year stock return (Matolcsy and Wright, 2006), as well as past-year accounting performance (Chalmers et al., 2006; Doucouliagos et al., 2007). For example, Doucouliagos et al. (2007) explore the relationship between CEO pay and performance in 10 Australian banks during 1992–2005. They find that CEO pay is positively related to firm size, prior-year bank performance, prior-year stock return, and institutional ownership, but negatively associated with board size.

However, evidence on CEO pay and firm performance is somewhat inconclusive. A number of studies, particularly those examining CEO pay in one particular year or over a short sample period, report an insignificant association between CEO pay and firm performance (Capezio et al., 2011; Cybinski and Windsor, 2013; Heaney et al., 2010; Walker, 2010). Walker (2010) randomly selected 50 ‘high-growth’ and 50 ‘low-growth’ Australian firms. She found that performance-based pay is positively related to firm size and growth, but not significantly associated with current-year ROA, CEO ownership and CEO duality. Heaney et al. (2010) analyze 1,144 listed Australian firms in 2006, following the adoption of International Financial Reporting Standards (IFRS) that resulted in more detailed disclosure on executive compensation. They find no evidence of any significant relation between CEO pay and firm performance (either accounting or market performance) in the prior, current, or future year.

Matolcsy et al. (2009) note that prior evidence on the association between market-based measures of performance and stock and option-based compensation reveals both positive and negative effects, and thus they seek to explain these contradictory empirical results. They suggest that stock-based compensation can be used as a reward for past performance (in which case the market will view the grant as an expense) and as an incentive for future performance (in contrast, the market will view the grant as an asset). If stock-based compensation is a reward for past performance, a negative relationship is expected; whereas a positive relationship is expected if these payments are made to provide incentives for future performance. They use 259 firm-year observations for 1999–2004 disclosures and divide these into ‘reward’ and ‘incentive’ groups using firm prior period return characteristics and the degree of ‘at-the-money’ of the granted options. An instrumental variables approach is used to control for the mechanical relationship between the value of a share and the value of an option. After controlling for endogeneity, the results show a statistically positive association for the ‘incentive’ group; however, the ‘reward’ group is statistically insignificant.

Besides firm size and performance, research studies also endeavour to identify a variety of firm characteristics, CEO characteristics, and corporate governance variables that explain the level of CEO compensation in Australia. The rationale behind this is that the determination of compensation arrangements is a jointly-determined process involving the CEO, the compensation committee and its consultants, the board of directors, and the external labour market.

For firm characteristics, the level of CEO compensation is found to be positively related to firm size, the idiosyncratic risk of the firm (Chalmers et al., 2006), growth opportunities (Heaney et al., 2010; Walker, 2010), Tobin's Q (Schultz et al., 2013), and business complexity (Matolcsy and Wright, 2006), and negatively related to financial leverage (Schultz et al., 2013). For instance, Matolcsy and Wright (2006) examine the relation between CEO compensation and firm characteristics for a sample of about 250 Australian firms among the ‘Top 500’ during 1999–2001. Consistent with efficient-contracting theories, they find that levels of Australian CEO compensation are associated with the firm's underlying economic characteristics, which explain around 41.5% of cross-sectional variation in the levels of CEO pay. The level of CEO compensation is found to be positively related to firm size, firm complexity (measured by the number of subsidiaries), and current stock price performance.

With respect to CEO characteristics and governance variables, the level of CEO compensation is found to be positively related to board size (Chalmers et al., 2006; Heaney et al., 2010; Schultz et al., 2013) and institutional ownership (Doucouliagos et al., 2007), and negatively related to a CEO change (Capezio et al., 2011; Lee, 2009), CEO ownership (Coulton and Taylor, 2002; Chalmers et al., 2006), and insider ownership (Coulton and Taylor, 2002). There is mixed evidence on the relation between CEO pay and CEO duality. Heaney et al. (2010) and Schultz et al. (2013) report a negative relationship, while Lee (2009) and Walker (2010) document a positive or insignificant association. O'Neill and Iob (1999) find no significant relation between CEO cash pay and CEO age and the number of CEO service year.

Importantly, prior research finds that the effectiveness of board monitoring is not significantly related to the level of CEO compensation (Lee, 2009; Capezio et al., 2011; Schultz et al., 2013). For example, Schultz et al. (2013) do not find a consistent relationship between the effectiveness of board monitoring activity and CEO compensation. The proportion of nonexecutive directors and the existence of a remuneration committee are both positively related to CEO pay, which is at odds with the notion that greater monitoring afforded by these characteristics would lower CEO pay. Inconsistent with the incentive effect, there is a negative impact of CEO duality and a CEO serving on the remuneration committee on CEO pay.

Capezio et al. (2011) use the top 500 ASX firms for the period 1998–2006 and examine whether board structural independence is an important boundary condition for the enforcement of CEO pay-for-performance. Employing a system Generalized Method of Moments (GMM), they find that the pay–performance relation is not significantly different in firms in which the boards are chaired by non-executives and dominated by non-executive directors (at both the full board and compensation committee levels). They also find that the level of CEO cash compensation is influenced by firm size, but not firm performance. They therefore conclude that the results contradict both efficient-contracting and managerial-power theories, and argue that policy makers' faith in incentive plans and the moderating influence of structural independence per se may be misplaced.

On the other hand, Chalmers et al. (2006) use the enhanced executive remuneration disclosure regulations introduced in Australia on 1 July 1998 to examine firm attributes that are associated with, and explain differences in, CEO pay levels, and whether CEO compensation and performance relationships are consistent with labour demand theory (efficient contracting) or rent extraction (managerial power). Total compensation is found to be significantly positively related to size, ROA, the idiosyncratic risk of the firm, and board size, while a significant negative relationship is found for CEO ownership. When considering different components of CEO pay, they find the fixed salary and share-based components of compensation are consistent with efficient-contracting explanations, while bonuses and option grants are found to be consistent with rent extraction (particularly for smaller firms and for firms with above average performance). The rent extraction is statistically significant, though it is economically negligible and short-lived, in contrast to US evidence where, according to Core et al. (1999), rent extraction is wide-spread, persistent, and economically substantial.

The trend of Australian CEO pay

In its report on executive remuneration, the Productivity Commission (2009, p. 41) notes that from 1993 to 2009, average compensation of ASX100 CEOs increased in real terms at an average rate of 6–7%, equivalent to an increase from 17 times average earnings in Australia in 1993 to 42 times in 2009. The rate of increase is significantly stronger in the 1990s (12%), with slower but still positive growth from 2000–2007.

Pottenger and Leigh (2015) present a long-term perspective of executive compensation for BHP, the resources giant and one of the largest companies in Australia, over the period 1887–2013. Similar to the pattern in US CEO compensation and Australian top incomes, they find the trend in director remuneration (relative to average earnings) follows a U-shape. Specifically, the pay to executives and directors of BHP increased from the 1880s to the 1910s, trended downwards through the 1920s and into the 1930s, rose briefly during World War II and fell again from the 1940s until the 1980s. However, director pay subsequently has increased dramatically, consistent with the trend in executive compensation in the largest Australian firms. They therefore suggest that Australia experienced a ‘great compression’ in executive salaries during the post-war era, followed by the recent ‘great divergence’ in the late 20th century. The documented pattern is similar to the long-term analysis of US CEO pay and the US evidence on managerial labour market in Frydman and Saks (2010) and Piketty and Saez (2003).

Matolcsy et al. (2012) consider a unique setting where Australian companies have changed from cash bonus to equity-based compensation, and examine determinants and performance consequences of changes in CEO compensation structure. According to efficient-contracting theory, they argue that the change to equity-based compensation is driven by changes in firm characteristics and by CEO turnover, the latter providing a less costly opportunity for such change. Using a sample of 2,288 firm-years over 2001–2009, they find larger firms with more business segments and higher investment opportunities are more likely to change their compensation structure. The likelihood is also higher when there is a change of CEO. They also document a significant negative association between changes in compensation structure and the firm's financial and stock price performance in the following year, even after controlling for CEO turnover and poor governance environment. They suggest that the initial change to equity-based compensation is part of an error learning process made by firms that leads them towards efficient CEO compensation contracts.

Hill et al. (2011) present an insightful comparison in CEO employment contracts between Australia and the US. They create pairs of US and Australian firms matched on firm size, industry, and contract starting date. They find that Australian CEOs have significantly greater base salaries than their US counterparts, but are less likely to be compensated with restricted stock and stock options. Interestingly, the employment contracts for Australian CEOs tend to be shorter than US contracts and have more restrictions on CEO actions. In contrast, employment contracts for US CEOs are more likely to have arbitration provisions, change-in-control provisions, tax gross ups, do not compete clauses, and supplementary executive retirement plans (SERPs). Hill et al. (2011) suggest that some of the differences reflect underlying differences in the legal, regulatory, and cultural environment. For example, the relative infrequency of change-in-control provisions in Australian contracts may be due to the more stringent ASX listing requirements, while vast differences in arbitration provisions may reflect cultural differences. However, a better understanding of institutional differences, such as tax codes, takeover protection, and corporate governance practice is still needed to help explain remaining differences in CEO contracts between Australia and the US.

CEO pay–performance sensitivity

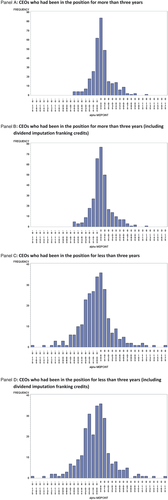

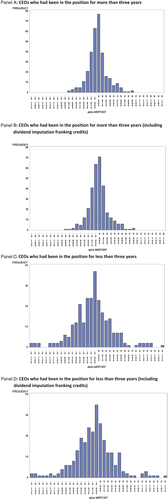

Early research on CEO pay–performance sensitivity in Australia presents mixed evidence, partly due to the fact that these studies use total cash-based compensation and do not include equity-based pay (because disclosure was not required during these sample periods). Izan et al. (1998) present preliminary evidence on an insignificant and close to zero pay–performance sensitivity for total cash compensation over 1987–1992. Merhebi et al. (2006) study the Top 500 firms over 1990–1999, and report evidence consistent with efficient-contracting explanations. They find that: (a) changes in CEO cash pay is positively associated with the change in current and lagged period shareholder wealth (a CEO receives a 1.16% increase in pay for a 10% increase in shareholder wealth); and (b) CEO pay sensitivity decreases as the riskiness of the firm increases. Table 8 provides a summary of Australian evidence on the CEO pay–performance sensitivity.

| Authors | Year | Sample/Sources | Sample year | Pay measures | Pay–performance sensitivity | Key findings |

|---|---|---|---|---|---|---|

| Clarkson, Walker, and Nicholls | 2011 | 240 (2,160) firms (firm-years) available in each year of 2001–2009, annual report | 2001–2009 | Total compensation, salary, bonus, and equity pay | A general improvement in pay-performance sensitivity over 2001–2009. The sensitivity increase is primarily related to enhanced remuneration disclosure and the non-binding shareholder vote on the remuneration report. | Enhanced oversight over executive remuneration arrangements resulting from regulatory change has a positive impact on the process of executive compensation arrangement by strengthening pay–performance sensitivity |