The Value Relevance of Direct Cash Flows under International Financial Reporting Standards

Abstract

This study examines if there has been a change in the value relevance of direct cash flow components since the adoption of International Financial Reporting Standards (IFRS) in Australia. Our results show that for both industrial and extractive firms direct cash flow statements are value relevant under Australian Generally Accepted Accounting Principles (AGAAP) and remain so after the adoption of IFRS. In addition, for industrial firms there is a significant increase in the value relevance of direct cash flows after IFRS, along with an increase in the value relevance of accruals. These results are consistent with the proposition that direct cash flows play a reinforcing role that complements the more complex IFRS accounts. Consequently, if the International Accounting Standards Board (IASB) were to mandate direct cash flow statements it would, in all likelihood, provide users of accounts with a valuable incremental source of hard transaction information.

The International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) are currently proposing that direct cash flow statements become mandatory for all firms under their harmonized cash flow reporting requirements.1 If adopted, the IASB/FASB convergence project would mandate that all firms use the direct method coupled with an indirect reconciliation as part of the financial statement notes. Prior research has shown that direct cash flow statements provide useful information to users of financial accounts under local Generally Accepted Accounting Principles (GAAP) (e.g., Jones et al., 1995; Clinch et al., 2002; Goyal, 2004). Whilst these studies constitute strong evidence for the usefulness of direct cash flow statements, to date, no research has examined whether this relationship still holds under International Financial Reporting Standards (IFRS). We therefore investigate the value relevance of direct cash flow statements under IFRS in Australia and assess whether there has been a change in their value relevance since IFRS adoption.

For over 30 years, academics have strongly advocated the use of direct cash flow statements. It is of interest to note that the promotion of the direct method has been driven by a wide range of economic factors, such as liquidity problems (Ketz and Largay III, 1987), inflation and recession (Thomas, 1982), and the provision of clarity around insolvency (Trout et al., 1993).2 That is, in times of uncertainty, direct cash flow disclosures provide additional information to users of accounts, allowing an improved assessment of the financial position of the firm, despite opaque economic circumstances.

In addition to the academic evidence, there is support from financial account users for direct cash flows. For example, the joint FASB/IASB proposal received strong support in the 2009 Chartered Financial Analysis (CFA) Institute Member Poll: Cash Flow Survey. Of the 541 respondents, 63% either ‘agree’ or ‘strongly agree’ that the information provided in a direct cash flow statement improves financial forecasts. Further, 94% voted that information regarding cash receipts from customers, which is only found in direct cash flow statements, was the most important information reported under operating cash flows.3

Given the past evidence on the incremental usefulness of direct cash flow statements and the support for the direct method from standard setters, academics, and practitioners, it is important to examine whether direct cash flow statements provide relevant information in an IFRS reporting environment. There is a growing body of evidence that suggests countries that have adopted IFRS experienced an overall increase in financial reporting quality, comparability and general usefulness in the accounting information presented to investors (Daske and Gebhardt, 2006; Barth et al., 2008). Therefore, if IFRS has improved the financial reporting environment, it may be the case that direct cash flow disclosures are less relevant, as a result of the better information set provided by accounts prepared under IFRS. Consequently, the need for mandated direct cash flow statements becomes less clear given the implied cost of disclosure. However, the move to IFRS is likely to result in a large amount of uncertainty around any accounting numbers that are produced in the first few years of IFRS adoption, as investors will require time to adjust to the new accounting regime.4 Bissessur and Hodgson (2012), for example, show that post-IFRS, stock market synchronicity initially fell before increasing significantly. However, they caveat their results as IFRS may not have unequivocally increased financial reporting quality in Australia, noting that an increased reliance on industry level information may explain their findings. Direct cash flow statements may, therefore, become more relevant under IFRS, as historically operating cash flows have provided investors with a stable source of information during times of uncertainty (Thomas, 1982).

Using a sample of non-financial companies listed on the Australian Stock Exchange (ASX) 300 from 2000–2010 we examine whether there has been a change in the value relevance of direct cash flow statements under IFRS relative to Australian Generally Accepted Accounting Principles (AGAAP). Australia provides an ideal environment to test this question, as Australia was one of the few countries to mandate direct cash flow statements under local GAAP, and most firms still follow this approach under IFRS, despite Australia allowing firms to choose between the direct and the indirect method since 2008.5 In addition, early adoption of IFRS was prohibited and so IFRS reporting only came into effect for financial years beginning on or after 1 January 2005. We therefore have a distinct break point in the reporting environment that allows a clean test for changes in the value relevance of direct cash flow statements before and after IFRS.

Our results show that for both industrial and extractive firms direct cash flow statements are value relevant under AGAAP and remain so after the adoption of IFRS. In addition, for industrial firms there is a significant increase in the value relevance of direct cash flows after IFRS, along with an increase in the value relevance of accruals. These results are consistent with the proposition that direct cash flows play a reinforcing role that complements the more complex IFRS accounts. Consequently, if the IASB were to mandate direct cash flow statements it would likely provide users of accounts with a valuable incremental source of hard transaction information.

Literature Review

Usefulness of Reporting Direct Cash Flows

Debating the form of disclosure of operating cash flows has been central in the development of all cash flow reporting standards over the past three decades. At the heart of this debate has been whether to mandate or allow firms the choice of reporting operating cash flows using the indirect or direct method. Even before cash flow disclosures were standardized, several academics expressed a preference for the direct approach (e.g., Paton, 1963; Heath, 1978; Lee, 1981; Thomas, 1982; Ketz and Largay III, 1987). Moreover, even after indirect cash flow disclosure requirements became common in accounting regimes around the world, American and Australian surveys conducted on diverse groups of accounting academics and professionals indicated continuing support for the direct approach (e.g., Jones et al., 1995; McEnroe, 1996; Smith and Freeman, 1996; Jones and Ratnatunga, 1997; Jones and Widjaja, 1998; Goyal, 2004).

Although the IASB and FASB are currently advocating direct cash flow statements, few countries have previously done so;6 and critics of the direct method question whether the theoretical reporting benefits outweigh the cost of changing accounting systems to capture the required information.7 There is, however, a growing body of evidence that shows the inclusion of estimated or actual direct cash flow statement components significantly increases the explanatory power and accuracy of cash flow and earnings prediction models (e.g., Krishnan and Largay III, 2000; Arthur and Chuang, 2008; Cheng and Hollie, 2008; Orpurt and Zang, 2009; Arthur et al., 2010).

Moreover, there is also strong evidence for high value relevance of direct cash flows (e.g., Livnat and Zarowin, 1990; Clinch et al., 2002; Orpurt and Zang, 2009). Livnat and Zarowin (1990) examine the value relevance of estimated direct cash flow components and find a significant relationship between unexpected changes in estimated direct cash flows and annual abnormal stock returns. In addition, Clinch et al. (2002), using actual direct cash flow statements for a sample of Australian firms, show that direct cash flow components are value relevant and have a direct correlation in forecasting future cash flows and annual stock returns. Finally, Orpurt and Zang (2009) find that American firms that voluntarily report direct cash flows have a higher correlation between their stock prices and future earnings than firms using the indirect method.

Impact of Reporting Under IFRS

Investigating the impact of early adoption of IFRS, Barth et al. (2008) and Daske and Gebhardt (2006) both find a significant improvement in financial reporting quality of those firms that switched from local GAAP to IFRS. Notably, Barth et al. (2008) found increased value relevance of earnings under IFRS, whilst Daske and Gebhardt (2006) observed that users perceived IFRS financial statements to be of significantly higher quality than those prepared under local GAAP. Although these early studies provide evidence for increased financial reporting quality, it was only after the 2005 mandatory adoption of IFRS by the European Union (EU) and Australia that the impact of reporting under IFRS could be further examined by using richer data sets.

Daske et al. (2008) provide evidence on the economic benefits of IFRS adoption, with a general decline in cost of capital and an increase in Tobin's Q in the pre-adoption year, followed by an increase in capital market liquidity post-adoption. However, increased market liquidity under IFRS only occurred in countries with strong reporting incentives and legal enforcement of the standards. This result is consistent with the views of Ball (2006) and Soderstrom and Sun (2007), who postulate that the perceived benefits associated with the global mandatory adoption of IFRS, would be dependent upon the effectiveness of the enforcement of IFRS. The findings of Byard et al. (2011) further emphasize the important role of effective enforcement; with a reported significant decline in analyst forecast errors following the mandatory adoption of IFRS in Europe, but only for firms in countries with a strong legal environment.

Adoption of IFRS by Australia

Australia provides a unique setting to examine the impact of reporting under IFRS since there is a regime of high quality accounting enforcement coupled with low manipulation incentives (Cotter et al., 2012) and, unlike the EU, Australia prohibited the early adoption of IFRS. Consequently, any empirical results on the impact of IFRS adoption are free from early adoption bias. In addition, Australian standard setters have been on a process of IFRS convergence since 1996 (Tarca, 2004), although by the time firms adopted the Australian equivalent of IFRS there were still some noteworthy differences between the two standards.8 If these differences were insignificant then the mandatory adoption of IFRS would cause very little or no change in the value relevance of accounting information (Aharony et al., 2010). In fact recent studies specifically examining Australian firms have found that there has been a significant change in the value relevance of accounting information subsequent to adopting IFRS, evidenced by an increased accuracy of analysts' earnings forecasts (Bissessur and Hodgson, 2012; Cotter et al., 2012).

Hypotheses Development

Cotter et al. (2012) and Bissessur and Hodgson (2012) both attribute their findings to a post-IFRS improvement in accounting information. However, an important question generally left unanswered by the extant literature is what specific accounting information under IFRS has improved the quality of accounting information and resulted in an overall improvement in earnings' forecasts? Prior to the adoption of IFRS, Ernst and Young (2005) anticipated that the remaining differences between AGAAP and IFRS would lead to an overall 6% increase in profits, and a 15% decrease in net assets because of the changes brought about by the new standards. The most significant change under IFRS was the abolition of capitalising certain internally generated intangible assets, and the introduction of assessing goodwill for annual impairment, rather than amortizing goodwill. Prior to IFRS, Matolcsy and Wyatt (2006) found a significant positive/(negative) association between firms that capitalized intangible assets and analyst following/(forecast errors). Further, subsequent to Australia's adoption of IFRS, Chalmers et al. (2012) found significantly higher analyst forecast errors for firms reporting lower levels of internally generated capitalized intangible assets. Taken together, these findings imply that the IASB's changes to intangibles in Australia may have resulted in a loss of value relevant information.

IFRS is also hypothesized to increase earnings volatility because of the application of fair value accounting. Although Ball (2006) notes that increased earnings volatility is not necessarily a problem, it becomes a problem when it is caused by ‘estimation noise’ or ‘management manipulation’. Earnings volatility may, therefore, be an issue under IFRS given the increased reliance on managerial discretion that fair value measurement requires. Moreover, as Ball (2006) notes, the recognition of both future gains and losses in the current reporting period is one of the most significant problems associated with fair value accounting, and this approach is contrary to the conservative accounting approach of deferring expected future profits until realized.

In addition, since AASB 107 mandated that all firms use the direct method of reporting cash flows until 2007, we also disaggregate operating cash flows and examine the value relevance of direct cash flow components under IFRS. Given the perceived benefits of direct cash flow statements as a source of useful information for users of accounts, and the belief by analysts that components such as cash receipts from customers are useful informational disclosures, we therefore analyse both ‘core’ and ‘non-core’ direct cash flow disclosures. Prior research has shown that ‘core’ direct cash flows have been found to be more useful in forecasting future cash flows than either ‘non-core’ or aggregate operating cash flows alone (Cheng and Hollie, 2008).9

Model Development and Data

Model Construction

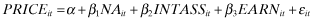

Price levels models are often used to provide standard setters with insights into the value relevance of specific accounting information (Barth et al., 2001). To examine the value relevance of operating cash flows and the direct cash flow components pre- and post-IFRS we compare the coefficients generated by the price levels models (1) to (5) below, before and after 1 January 2005.10 By pooling the regressions for the entire sample period and including dummy variables interacting between our explanatory variables and the post-IFRS adoption period, we determine whether there has been a significant change in the value relevance of operating cash flows and direct cash flow components after the adoption of IFRS.11 These models are derivations of the Ohlson model (Feltham and Ohlson, 1995; Ohlson, 1995), and are estimated using pooled cross sectional regressions in which all variables are deflated by the number of common shares outstanding to mitigate the effects of heteroscedasticity (Barth and Clinch, 2009).

(1)

(1) (2)

(2) (3)

(3) (4)

(4) (5)

(5)Sample Construction and Descriptive Statistics

Our initial sample consists of 652 firms representing companies listed on the ASX 300 index at the end of each of the ten years from 2000–2010.12 From this list, financials and utilities, firms with a primary listing other than the ASX and firms missing key financial information are removed.13 We also remove all firms that subsequently chose to report their cash flows under the indirect method.14 Only eight firms in our sample chose to switch from the direct to the indirect method. The low uptake of the indirect method by Australian companies is likely a result of Australian firms having already invested in the information systems needed to capture the requisite information reported in a direct cash flow statement (Bond et al., 2012). Accordingly, there is no added cost for Australian firms to continue reporting direct cash flows since this is effectively a sunk cost. In addition, the removal of this information may be viewed as a negative signal as the firm would be disclosing less information than previously, and so firms are not willing to switch. Consequently, if firms are disclosing direct cash flow components, they are likely to continue doing so, even when given the option to switch.

Our final sample of 459 firms shown in Table 1 Panel A represents, on average, one third of market capitalization of all domestic firms listed on the ASX throughout our sample period. This specifically includes mining and natural resources exploration companies and, in line with Clinch et al. (2002), we treat mining and natural resources exploration companies as a unique group of ‘extractive’ firms. All remaining firms are classified as a sample of ‘industrial’ firms. All financial data is obtained from the Aspect Huntley database, which provides a detailed breakdown of the direct cash flow components that are otherwise unavailable elsewhere.

| Panel A: Sampling process | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Firms | |||||||||||||

| Initial sample of firms identified on the respective index for fiscal years from 2000 to 2009 | 652 | ||||||||||||

| Less: Foreign with a primary listing other than the ASX | (17) | ||||||||||||

| Less: Financial firms | (137) | ||||||||||||

| Less: Utility firms | (14) | ||||||||||||

| Less: Firms switching to the indirect method of reporting cash flows | (8) | ||||||||||||

| Less: Firms with missing data requirements | (17) | ||||||||||||

| Final sample | 459 | ||||||||||||

| Panel B: Sample distribution by industry sector and fiscal year | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Industry | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | Firm Years | Total Firms |

| Basic materials | 9 | 7 | 8 | 9 | 9 | 9 | 10 | 10 | 8 | 7 | 6 | 92 | 11 |

| Consumer goods and services | 70 | 71 | 71 | 69 | 75 | 73 | 75 | 72 | 65 | 60 | 60 | 761 | 102 |

| Extractive | 83 | 85 | 90 | 92 | 108 | 118 | 136 | 138 | 125 | 123 | 113 | 1,211 | 171 |

| Healthcare | 26 | 31 | 30 | 31 | 31 | 31 | 31 | 28 | 26 | 19 | 15 | 299 | 37 |

| Industrials | 59 | 60 | 57 | 61 | 60 | 60 | 61 | 58 | 57 | 57 | 54 | 644 | 82 |

| Technology | 34 | 33 | 31 | 25 | 25 | 23 | 26 | 24 | 19 | 18 | 20 | 278 | 41 |

| Telecommunications | 10 | 11 | 10 | 8 | 7 | 7 | 8 | 9 | 9 | 9 | 8 | 96 | 15 |

| Total | 291 | 298 | 297 | 295 | 315 | 321 | 347 | 339 | 309 | 293 | 276 | 3,381 | 459 |

| Panel C: Size of sample firms | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Industrial firms Variable | Full sample | Pre-IFRS | Post-IFRS | ||||||

| (2,170 firm years) | (1,038 firm years) | (1,132 firm years) | |||||||

| Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | |

| A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | |

| Market capitalization | 1,510.00 | 303.00 | 4,750.00 | 1,180.00 | 238.00 | 4,850.00 | 1,820.00 | 401.00 | 4,640.00 |

| Net assets | 629.00 | 142.00 | 1,400.00 | 486.00 | 113.00 | 1,260.00 | 759.00 | 184.00 | 1,500.00 |

| Total assets | 1,430.00 | 298.00 | 3,540.00 | 1,080.00 | 205.00 | 3,040.00 | 1,760.00 | 406.00 | 3,910.00 |

| Earnings | 82.50 | 16.30 | 322.00 | 59.50 | 11.50 | 304.00 | 104.00 | 22.40 | 336.00 |

| Operating cash flow | 142.00 | 23.00 | 618.00 | 107.00 | 15.80 | 516.00 | 175.00 | 31.00 | 697.00 |

| Revenue | 1,320.00 | 268.00 | 3,850.00 | 1,050.00 | 204.00 | 3,110.00 | 1,570.00 | 377.00 | 4,410.00 |

| Extractive firms Variable | (1,211 firm years) | (458 firm years) | (753 firm years) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | |

| A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | A$ Mill | |

| Market capitalization | 934.00 | 171.00 | 3,740.00 | 476.00 | 72.20 | 1,220.00 | 1,210.00 | 257.00 | 4,620.00 |

| Net assets | 350.00 | 76.30 | 788.00 | 285.00 | 42.60 | 671.00 | 390.00 | 102.00 | 850.00 |

| Total assets | 622.00 | 124.00 | 1,440.00 | 562.00 | 71.10 | 1,370.00 | 659.00 | 148.00 | 1,480.00 |

| Earnings | 31.40 | (0.61) | 114.00 | 25.30 | 0.15 | 86.70 | 35.20 | (1.22) | 127.00 |

| Operating cash flow | 62.90 | 0.95 | 198.00 | 61.10 | 3.77 | 177.00 | 64.10 | (0.33) | 210.00 |

| Revenue | 452.00 | 24.40 | 1,780.00 | 405.00 | 27.90 | 1,340.00 | 480.00 | 19.80 | 2,000.00 |

- The sample consists of 459 publicly traded Australian firms included on the ASX 300 index between January 2000 and December 2010. ‘Market capitalization’ is measured three months after the end of each financial year. ‘Earnings’ are measured as earnings after taxation before extraordinary items. All other accounting variables are as reported in the annual financial statements for each firm. Using the Industry Classification Benchmark (ICB) code, all firms included in the three ICB sector codes 0530, 1750 and 1770 are classified as ‘extractive’ firms whilst all remaining companies are included under ‘industrial’ firms. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005.

Table 1 Panel B presents the distribution of our sample by industry classification and firm year. It shows that the number of extractive firms has grown considerably over the sample period from 83 in 2000 to 113 in 2010, which represents 41% of total firms. The distribution across other industry groups remains relatively stable over the sample period, with the exception of the healthcare and technology industries, which see a decline in numbers by the end of 2010. Although our group of industrial firms is not dominated by a single sector, consumer goods and services and industrials combined comprise 64% of firms in this sample.

Summary descriptive statistics reported in Table 1 Panel C present the market capitalization, net assets, total assets, earnings, operating cash flows and revenue of the pooled sample of industrial and extractive firms as well as the pre- and post-IFRS periods. Consistent with Clinch et al. (2002), all variables are positively skewed for both industrial and extractive firms. The means and medians for most industrial variables are consistently about twice as large as variables for extractive firms, with the medians for earnings, operating cash flows and revenue of extractive firms less than 10% of those for industrial firms.15 This is most likely due to the nature of the industry, which requires a lengthy start-up period of exploration before revenue generation begins. Finally, we observe a significant increase in means and medians of all variables after the adoption of IFRS, with the exception of median earnings, operating cash flow and revenue for extractive firms.

Table 2 provides summary descriptive statistics of the variables used in our regression analyses, standardized by common shares outstanding at the financial year-end to mitigate potential scale effects (Barth and Clinch, 2009). Consistent with the unscaled variables in Table 1 Panel C the deflated variables in Table 2 Panel A are positively skewed with average share price, net assets, earnings and operating cash flows per share being larger for industrial than extractive firms. Further, the mean value per share of each variable increases in the post-IFRS period. Overall, the summary statistics in Table 2 Panel A are in line with those in Clinch et al. (2002).

| Panel A: Descriptive statistics of variables used in the regression analysis | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Industrial firms Variable | Full sample | Pre-IFRS | Post-IFRS | ||||||

| (2,170 firm years) | (1,038 firm years) | (1,132 firm years) | |||||||

| Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | |

| PRICE | 4.22 | 2.16 | 7.22 | 3.37 | 1.90 | 4.81 | 5.00 | 2.49 | 8.80 |

| NETASS | 1.75 | 1.05 | 2.06 | 1.53 | 0.93 | 1.79 | 1.95 | 1.20 | 2.26 |

| INTASS | 0.94 | 0.25 | 1.66 | 0.64 | 0.17 | 1.25 | 1.21 | 0.37 | 1.92 |

| CSHRC | 4.55 | 1.95 | 6.93 | 3.94 | 1.60 | 6.20 | 5.11 | 2.26 | 7.50 |

| CSHPS | (4.06) | (1.60) | 6.42 | (3.51) | (1.27) | 5.76 | (4.56) | (1.82) | 6.94 |

| CORE_OCF | 0.49 | 0.25 | 0.99 | 0.43 | 0.21 | 1.00 | 0.55 | 0.29 | 0.97 |

| TXP | (0.08) | (0.04) | 0.13 | (0.07) | (0.03) | 0.10 | (0.10) | (0.04) | 0.15 |

| INTP | (0.07) | (0.02) | 0.11 | (0.06) | (0.02) | 0.09 | (0.08) | (0.03) | 0.13 |

| CSHOTH | (0.02) | 0.01 | 0.71 | (0.04) | 0.01 | 0.82 | 0.00 | 0.01 | 0.59 |

| OCF | 0.32 | 0.18 | 0.54 | 0.27 | 0.14 | 0.47 | 0.37 | 0.21 | 0.59 |

| ACC | (0.12) | (0.05) | 0.34 | (0.11) | (0.04) | 0.34 | (0.12) | (0.05) | 0.35 |

| EARN | 0.21 | 0.12 | 0.35 | 0.15 | 0.10 | 0.25 | 0.25 | 0.15 | 0.41 |

| Extractive firms Variable | (1,211 firm years) | (458 firm years) | (753 firm years) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | |

| PRICE | 2.24 | 0.76 | 5.12 | 1.23 | 0.52 | 2.04 | 2.85 | 0.97 | 6.21 |

| NETASS | 0.84 | 0.34 | 1.33 | 0.77 | 0.28 | 1.12 | 0.88 | 0.38 | 1.44 |

| INTASS | 0.05 | 0.00 | 0.21 | 0.04 | 0.00 | 0.18 | 0.05 | 0.00 | 0.23 |

| CSHRC | 1.32 | 0.08 | 6.43 | 1.22 | 0.16 | 4.45 | 1.37 | 0.04 | 7.39 |

| CSHPS | (1.13) | (0.07) | 6.19 | (1.03) | (0.10) | 4.25 | (1.18) | (0.06) | 7.11 |

| CORE_OCF | 0.19 | 0.01 | 0.46 | 0.19 | 0.03 | 0.36 | 0.19 | (0.00) | 0.51 |

| TXP | (0.03) | 0.00 | 0.09 | (0.02) | 0.00 | 0.07 | (0.03) | 0.00 | 0.10 |

| INTP | (0.02) | (0.00) | 0.04 | (0.02) | (0.00) | 0.04 | (0.02) | (0.00) | 0.04 |

| CSHOTH | 0.00 | 0.00 | 0.15 | 0.00 | 0.00 | 0.05 | (0.00) | 0.00 | 0.19 |

| OCF | 0.15 | 0.00 | 0.41 | 0.15 | 0.02 | 0.30 | 0.14 | (0.00) | 0.47 |

| ACC | (0.07) | (0.02) | 0.25 | (0.09) | (0.02) | 0.17 | (0.06) | (0.01) | 0.28 |

| EARN | 0.07 | (0.00) | 0.25 | 0.06 | 0.00 | 0.17 | 0.08 | (0.00) | 0.28 |

| Panel B: Industrial firms (below the diagonal) and Extractive firms (above the diagonal) Pearson correlations of variables used in the regression analysis | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | PRICE_L03 | NETASS | INTASS | CSHRC | CSHPS | CSHRAP | TXP | INTP | CSHOTH | OCF | ACC | EARN |

| PRICE_L03 | 0.506 | 0.087 | 0.249 | −0.225 | 0.465 | −0.355 | −0.361 | −0.189 | 0.329 | −0.099 | 0.449 | |

| NETASS | 0.629 | 0.282 | 0.641 | −0.606 | 0.814 | −0.640 | −0.630 | 0.042‡ | 0.708 | −0.462 | 0.713 | |

| INTASS | 0.413 | 0.667 | 0.193 | −0.186 | 0.187 | −0.174 | −0.250 | 0.033‡ | 0.154 | −0.062 | 0.194 | |

| CSHRC | 0.540 | 0.669 | 0.375 | −0.998 | 0.569 | −0.567 | −0.540 | 0.032‡ | 0.459 | −0.269 | 0.493 | |

| CSHPS | −0.500 | −0.646 | −0.347 | −0.992 | −0.518 | 0.535 | 0.520 | −0.030‡ | −0.410 | 0.234 | −0.448 | |

| CSHRAP | 0.541 | 0.496 | 0.370 | 0.568 | −0.459 | −0.730 | −0.562 | 0.049‡ | 0.904 | −0.620 | 0.881 | |

| TXP | −0.740 | −0.644 | −0.440 | −0.674 | 0.635 | −0.598 | 0.375 | −0.047‡ | −0.561 | 0.282 | −0.651 | |

| INTP | −0.392 | −0.670 | −0.489 | −0.545 | 0.526 | −0.405 | 0.455 | 0.276 | −0.333 | 0.144 | −0.410 | |

| CSHOTH | −0.026‡ | 0.024‡ | −0.054 | −0.074 | −0.030‡ | −0.710 | 0.056 | −0.037‡ | 0.436 | −0.610 | 0.111 | |

| OCF | 0.699 | 0.648 | 0.402 | 0.671 | −0.621 | 0.674 | −0.688 | −0.479 | 0.020‡ | −0.832 | 0.828 | |

| ACC | −0.260 | −0.296 | −0.176 | −0.402 | 0.366 | −0.440 | 0.253 | 0.242 | −0.056 | −0.773 | −0.377 | |

| EARN | 0.822 | 0.707 | 0.446 | 0.638 | −0.596 | 0.605 | −0.812 | −0.499 | −0.025‡ | 0.778 | −0.203 | |

| Variable Definitions: | |

| PRICE | = closing unadjusted share price three months after the financial year-end; |

| NETASS | = reported net assets at the financial year-end; |

| INTASS | = reported net intangible assets at the financial year-end; |

| CSHRC | = cash receipts from customers; |

| CSHPS | = cash payments to suppliers and employees; |

| CORE_OCF | = core operating cash flows calculated as net CSHRC and CSHPS; |

| TXP | = net taxes paid or tax refunds received; |

| INTP | = interest paid; |

| CSHOTH | = all other operating cash flows |

| OCF | = net operating cash flow for the year; |

| ACC | = accruals calculated as EARN minus OCF; |

| EARN | = earnings after taxation before extraordinary items. |

- The sample consists of 459 publicly traded Australian firms, including 2,170 industrial firm year observations and 1,211 extractive firm year observations, included on the ASX 300 index between January 2000 and December 2010. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. All variables are deflated by the issued number of ordinary shares at the financial year-end. In Panel B, insignificant correlations (two tailed p-value < 0.05), are shown by ‡.

From Table 2 Panel A cash receipts from customers (CSHRC) and cash payments to suppliers and employees (CSHPS) represent the greatest proportion of operating cash flows and have the highest standard deviation amongst all the cash flow components. This shows that the perceived importance of these amounts over and above the other cash flow components is supported and justifies their classification by Cheng and Hollie (2008) as ‘core’ operating cash flows. Moreover, consistent with the extant literature, the correlations reported in Table 2 Panel B reveal a very high correlation between CSHRC and CSHPS suggesting that one dollar per share of cash receipts from customers explains more than 98 cents per share of cash paid to suppliers and employees. Due to this high correlation, we choose to examine the net ‘core’ operating cash flows in a separate model to prevent findings from being unduly influenced by this high correlation.

Table 2 Panel A also shows that mean operating cash flows are consistently larger than accruals for both industrial and extractive firms consistent with comparable descriptive statistics reported by Clinch et al. (2002). Further, subsequent to adopting IFRS there has only been a slight increase in the ratio of operating cash flows to accruals revealing little change after IFRS. In contrast, there has been a significant increase in the ratio of mean/(median) intangible assets to net assets for industrial firms from 42% (18%) to 62 % (30%). For extractive firms, however, intangible assets consistently comprise around 5% of net assets pre- and post-IFRS. The change in the magnitude of intangible assets between AGAAP and IFRS supports the separate treatment of intangible assets within our latter models, as there has clearly been a large change in the amount of intangible assets in the balance sheet of the average industrial firm.

Empirical Results

To ensure our results are not unduly influenced by extreme observations, we follow the approach of Francis and Schipper (1999) and Clinch et al. (2002) by removing all observations with an absolute student residual greater than 3.0. Moreover, we use the Newey and West (1987) correction procedure to adjust standard errors to mitigate against potential problems associated with heteroscedasticity and first-order serial correlation. Finally, Variance Inflation Factors (VIF) are reported in Tables 3 to 6(b)b to identify potential problems of multicollinearity.16

| PRICEit = α + β1NETASSit + β2EARNit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.797*** (0.000) |

0.474*** (0.000) |

0.830*** (0.000) |

0.301*** (0.000) |

0.773*** (0.000) |

0.294*** (0.000) |

| NETASS |

0.661*** (0.000) |

0.462*** (0.000) |

0.570*** (0.000) |

0.696*** (0.000) |

1.514*** (0.000) |

0.850*** (0.000) |

| EARN |

8.272*** (0.000) |

13.131*** (0.000) |

9.223*** (0.000) |

3.902*** (0.000) |

3.773*** (0.000) |

4.151*** (0.000) |

| D_Intercept |

−0.347** (0.017) |

0.452*** (0.006) |

||||

| D_NETASS |

−0.149 (0.291) |

0.674** (0.016) |

||||

| D_EARN |

4.254*** (0.000) |

−0.394 (0.715) |

||||

| VIF Max | 2.01 | 2.03 | 1.82 | 2.02 | ||

| VIF Mean | 2.01 | 2.03 | 1.82 | 2.02 | ||

| n | 1,019 | 1,111 | 2,133 | 449 | 744 | 1,200 |

| Adjusted R2 | 0.715 | 0.800 | 0.781 | 0.752 | 0.647 | 0.666 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre-and post-IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

Value Relevance

Tables 3 to 8 summarize the results from regression models (1) to (5) before and after the adoption of IFRS for both industrial and extractive firms. The tables present the estimated coefficients, two tailed t-statistics, and adjusted R2 values for the pre-IFRS period (from January 2000 to December 2004), the post-IFRS period (from January 2005 to December 2010), and pooled regressions (from January 2000 to December 2010) as well as robust regressions for each post-IFRS year. Interactive dummy variables are included in the pooled regressions to test whether there is a significant change in the value relevance of the mean coefficients post-IFRS.17

Value Relevance of Earnings and Net Assets

Table 3 presents the results for our benchmark model (equation 1), which tests the value relevance of earnings and net assets pre- and post-IFRS. The earnings coefficients for both samples of industrial and extractive firms are positive and significant under both AGAAP and IFRS. Further, results from the pooled regression of industrial firms report a significant and positive mean coefficient of 4.25 for the interactive earnings dummy variable D_EARN. Earnings for industrial firms have therefore significantly increased in value relevance since the adoption of IFRS. Results for the industrial sample are similar to those found by Aharony et al. (2010), who find a significant increase in the value relevance of earnings after the adoption of IFRS in the EU.

There is a contrast in results between industrial and extractive firms—emphasized by the fact that there is a significant rise in the value relevance of net assets under IFRS for extractive firms but not so for industrial firms. In summary, initial tests show that the changes brought about by IFRS adoption are strongest in earnings of industrial firms and net assets of extractive firms.

Descriptive statistics in Table 2 Panel A reveal intangible assets comprise a relatively small proportion of net assets for extractive firms, whilst representing more than 50% of industrial firms. Thus, if the IASB's changes to intangible accounting led to a loss of valuable information, we would expect a greater impact for the sample of industrial firms. Investigating this further, Table 4 disaggregates net assets by removing intangible assets and treating this as a separate explanatory variable in equation 2. As predicted for industrial firms, a significant decline in the value relevance of intangible assets is observed, whilst intangible assets in extractive firms lose their significance after IFRS adoption. IFRS, therefore, is associated with a significant loss of value relevant information from the balance sheet for industrial firms driven by intangible assets. Earnings for industrial firms remain significantly value relevant, as do net assets for extractive firms after the introduction of IFRS. These findings corroborate Matolcsy and Wyatt (2006) and recent findings by Chalmers et al. (2012), which reveal that the accounting changes to intangible assets are associated with a loss of useful financial information.

| PRICEit = α + β1NAit + β2INTASSit + β3EARNit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.843*** (0.000) |

0.473*** (0.000) |

0.852*** (0.000) |

0.301*** (0.000) |

0.725*** (0.000) |

0.298*** (0.000) |

| NA |

0.411*** (0.001) |

0.447*** (0.000) |

0.359*** (0.005) |

0.695*** (0.000) |

1.683*** (0.000) |

0.867*** (0.000) |

| INTASS |

0.794*** (0.000) |

0.472*** (0.000) |

0.727*** (0.000) |

0.721*** (0.004) |

0.127 (0.764) |

0.480** (0.027) |

| EARN |

8.775*** (0.000) |

13.132*** (0.000) |

9.627*** (0.000) |

3.904*** (0.000) |

3.857*** (0.000) |

4.120*** (0.000) |

| D_Intercept |

−0.372*** (0.009) |

0.404*** (0.007) |

||||

| D_NA |

0.025 (0.881) |

0.828*** (0.003) |

||||

| D_INTASS |

−0.283* (0.057) |

−0.256 (0.583) |

||||

| D_EARN |

3.856*** (0.001) |

−0.484 (0.648) |

||||

| VIF Max | 2.08 | 2.03 | 1.83 | 2.10 | ||

| VIF Mean | 1.76 | 1.90 | 1.55 | 1.73 | ||

| n | 1,020 | 1,111 | 2,133 | 449 | 745 | 1,199 |

| Adjusted R2 | 0.719 | 0.800 | 0.784 | 0.751 | 0.673 | 0.679 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre- and post-IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. NA equals NETASS minus INTASS. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

Disaggregating Earnings

By disaggregating earnings into its constituent parts, Tables 5 to 8 present results for testing H1 and H2 by investigating the value relevance of accruals, operating cash flows and direct cash flow components pre- and post-IFRS. Table 5 presents the results of equation 3, which disaggregates earnings into operating cash flows and accruals. In line with the significant increase in value relevance of earnings for industrial firms, we find support for H1 as we observe a correspondingly significant rise in the value relevance of operating cash flows for industrial firms. The post-IFRS coefficient on operating cash flows is higher, and in the pooled regression, the post-IFRS dummy reveals a significant increase in the level of operating cash flows in explaining firm value. Likewise, accruals, which are significantly positive under AGAAP and IFRS, also significantly increase in value relevance for industrial firms after IFRS.

| PRICEit = α + β1NAit + β2INTASSit + β3OCFit + β4ACCit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.798*** (0.000) |

0.362*** (0.001) |

0.857*** (0.000) |

0.297*** (0.000) |

0.789*** (0.000) |

0.294*** (0.000) |

| NA |

0.416*** (0.000) |

0.351*** (0.001) |

0.334*** (0.006) |

0.656*** (0.000) |

1.576*** (0.000) |

0.833*** (0.000) |

| INTASS |

0.785*** (0.000) |

0.382*** (0.000) |

0.762*** (0.000) |

0.668*** (0.007) |

0.227 (0.576) |

0.433* (0.063) |

| OCF |

8.489*** (0.000) |

12.961*** (0.000) |

8.677*** (0.000) |

3.840*** (0.000) |

3.728*** (0.000) |

4.077*** (0.000) |

| ACC |

7.582*** (0.000) |

10.166*** (0.000) |

7.775*** (0.000) |

3.403*** (0.001) |

3.887*** (0.001) |

3.698*** (0.003) |

| D_Intercept |

−0.495*** (0.000) |

0.479*** (0.001) |

||||

| D_NA |

0.018 (0.913) |

0.745*** (0.006) |

||||

| D_INTASS |

−0.381*** (0.008) |

−0.163 (0.721) |

||||

| D_OCF |

4.283*** (0.000) |

−0.182 (0.868) |

||||

| D_ACC |

2.391** (0.041) |

0.738 (0.652) |

||||

| VIF Max | 7.74 | 4.42 | 6.07 | 4.25 | ||

| VIF Mean | 4.14 | 2.71 | 3.47 | 2.58 | ||

| n | 1,019 | 1,109 | 2,133 | 449 | 743 | 1,197 |

| Adjusted R2 | 0.731 | 0.819 | 0.794 | 0.752 | 0.655 | 0.668 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre- and post-IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

For extractive firms there is no significant change in the value relevance of operating cash flows, but the significant increase in the value relevance of net assets under IFRS remains. The fact that we do not observe an increase in the value relevance of operating cash flow needs to be interpreted carefully. Operating cash flows remains significant in the IFRS period, and so the disclosure of operating cash flow still provides value relevant information for extractive firms. This may also be driven by the rise in the number of extractive firms compared with industrial firms in our post-IFRS sample period.18 Consequently, and as noted previously, firms within this industry often experience a lengthy period with little or no operating cash flows whilst they are still in the exploration phase of their business cycle. Moreover, we observe a large rise in the number of extractive firms reporting negative operating cash flows post-IFRS, up from 40% under AGAAP to 51% under IFRS. The increased number of new extractive firms post-IFRS with very low and negative cash flows may therefore explain why there is no increase in value relevance of operating cash flows. Alternatively, however, net assets reported under IFRS may capture incremental information, which is reflected in prices for extractive firms, as the assets of these firms give an indication of future profitability once they are in the extraction phase.

In sum, these results present evidence that operating cash flows are value relevant pre- and post-IFRS and that there is a significant increase in the value relevance of operating cash flows for industrial firms. We can therefore accept our first hypothesis H1, for our sample of industrial firms that the value relevance of operating cash flows increases under IFRS.

Disaggregating Cash Flows

Testing our second hypothesis H2, equation 4 further disaggregates operating cash flows into ‘core’ and ‘non-core’ direct cash flows.19 Table 6(a) presents findings consistent with the more parsimonious model used in Table 5, showing a significant increase in value relevance of both ‘core’ and ‘non-core’ operating cash flows under IFRS for our sample of industrial firms. Further, for extractive firms, core operating cash flows remain value relevant although there is a significant decline in the value relevance of non-core operating cash flows under IFRS. Other than the decline in relevance of non-core operating cash flows for extractive firms, these findings are in line with our observations made for net operating cash flows in Table 5. Overall, however, these findings should be treated cautiously given the high multicollinearity reported for industrial firms, as the VIF is greater than 10.

| PRICEit = α + β1NAit + β2INTASSit + β3CORE_OCFit + β4NCORE_OCFit + β5ACCit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.782*** (0.000) |

0.354*** (0.001) |

0.841*** (0.000) |

0.269*** (0.000) |

0.793*** (0.000) |

0.281*** (0.000) |

| NA |

0.432*** (0.000) |

0.360*** (0.001) |

0.350*** (0.004) |

0.812*** (0.000) |

1.556*** (0.000) |

0.955*** (0.000) |

| INTASS |

0.773*** (0.000) |

0.372*** (0.000) |

0.749*** (0.000) |

0.723*** (0.001) |

0.204 (0.629) |

0.532*** (0.006) |

| CORE_OCF |

8.220*** (0.000) |

12.793*** (0.000) |

8.423*** (0.000) |

3.667*** (0.000) |

3.665*** (0.000) |

4.124*** (0.000) |

| NCORE_OCF |

7.967*** (0.000) |

12.459*** (0.000) |

8.170*** (0.000) |

5.426*** (0.000) |

3.185 (0.119) |

6.067*** (0.000) |

| ACC |

7.237*** (0.000) |

10.038*** (0.000) |

7.447*** (0.000) |

3.210*** (0.001) |

3.826*** (0.000) |

3.848*** (0.002) |

| D_Intercept |

−0.486*** (0.000) |

0.458*** (0.001) |

||||

| D_NA |

0.010 (0.949) |

0.606** (0.037) |

||||

| D_INTASS |

−0.377*** (0.008) |

−0.289 (0.539) |

||||

| D_CORE_OCF |

4.371*** (0.000) |

−0.755 (0.491) |

||||

| D_NCORE_OCF |

4.289*** (0.000) |

−4.987** (0.025) |

||||

| D_ACC |

2.590** (0.025) |

0.152 (0.922) |

||||

| VIF Max | 40.74 | 15.61 | 8.75 | 6.84 | ||

| VIF Mean | 16.67 | 6.42 | 3.91 | 3.27 | ||

| n | 1,019 | 1,109 | 2,133 | 450 | 743 | 1,195 |

| Adjusted R2 | 0.735 | 0.820 | 0.795 | 0.754 | 0.655 | 0.683 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre- and post-IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. NCORE_OCF is the accumulation of non-core operating cash flows calculated as the difference between OCF and CORE_OCF. All other variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

To address the problem of high multicollinearity reported in Table 6(a), we follow a remedial measure recommended by Gujarati (1999) by re-estimating equation 4 after dropping non-core operating cash flows, one of the collinear variables. We choose non-core cash flow as the variable to be dropped as the focus of our research question is on core cash flow, which can only be obtained from a direct cash flow statement. Table 6(b) reports the results for the more restricted model and the VIF are now less than 10, thus mitigating the problem with high multicollinearity reported in Table 6(a). Moreover, while the magnitude of the coefficients for core direct cash flows and accruals are lower than those reported in Table 6(a), the findings presented in Table 6(b) remain consistent with those reported in Table 6(a).

| PRICEit = α + β1NAit + β2INTASSit + β3CORE_OCFit + β4ACCit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.651*** (0.000) |

0.467*** (0.000) |

0.670*** (0.000) |

0.278*** (0.000) |

0.790*** (0.000) |

0.269*** (0.000) |

| NA |

1.285*** (0.000) |

0.826*** (0.000) |

1.312*** (0.000) |

0.634*** (0.000) |

1.518*** (0.000) |

0.895*** (0.000) |

| INTASS |

1.307*** (0.000) |

0.506*** (0.000) |

1.394*** (0.000) |

0.639* (0.050) |

0.156 (0.718) |

0.432 (0.161) |

| CORE_OCF |

0.943** (0.031) |

6.166*** (0.000) |

0.740*** (0.000) |

2.231*** (0.000) |

2.880*** (0.000) |

2.063*** (0.010) |

| ACC |

−0.120 (0.790) |

3.582*** (0.000) |

−0.302 (0.409) |

1.360* (0.076) |

3.044*** (0.005) |

1.387 (0.250) |

| D_Intercept |

−0.245 (0.118) |

0.467*** (0.001) |

||||

| D_NA |

−0.431** (0.016) |

0.656** (0.028) |

||||

| D_INTASS |

−0.878*** (0.000) |

−0.205 (0.698) |

||||

| D_CORE_OCF |

5.367*** (0.000) |

1.040 (0.280) |

||||

| D_ACC |

3.659*** (0.000) |

2.353 (0.127) |

||||

| VIF Max | 1.64 | 3.25 | 6.12 | 4.24 | ||

| VIF Mean | 1.39 | 2.17 | 3.42 | 2.58 | ||

| n | 1,019 | 1,119 | 2,141 | 448 | 743 | 1,195 |

| Adjusted R2 | 0.630 | 0.740 | 0.716 | 0.716 | 0.651 | 0.676 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre- and post-IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

Pooling data from different post-IFRS adoption years in Tables 3 to 6 may mask what could be a temporary change in value relevance. Accordingly, equation 4, restricted to exclude non-core operating cash flows to control for multicollinearity, is re-estimated on an annual basis for both industrial and extractive firms, and the results reported in Table 7. Consistent with a post-IFRS increase in value relevance for core direct cash flows, there is a significant and sustained increase in the magnitude of the coefficients for CORE_OCF for industrial firms for each year post-IFRS. Moreover, the findings for extractive firms confirm an increase in value relevance of net assets post-IFRS as evidenced by a significant increase in the interactive dummy variable NA in four out of the six years between 2005 and 2010. These findings confirm our earlier results, that the observed post-IFRS change in value relevance is significant and, moreover, is persistent across the sample period analysed.

| Variable | Industrial firms | Extractive firms | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | Pre-IFRS | |

| Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | Vs. | |

| FY2005 | FY2006 | FY2007 | FY2008 | FY2009 | FY2010 | FY2005 | FY2006 | FY2007 | FY2008 | FY2009 | FY2010 | |

| Intercept |

0.651*** (0.000) |

0.660*** (0.000) |

0.626*** (0.000) |

0.616*** (0.000) |

0.660*** (0.000) |

0.660*** (0.000) |

0.268*** (0.000) |

0.231*** (0.000) |

0.251*** (0.000) |

0.231*** (0.000) |

0.269*** (0.000) |

0.268*** (0.000) |

| NA |

1.285*** (0.000) |

1.277*** (0.000) |

1.354*** (0.000) |

1.327*** (0.000) |

1.277*** (0.000) |

1.277*** (0.000) |

0.772*** (0.000) |

0.838*** (0.000) |

0.862*** (0.000) |

0.838*** (0.000) |

0.895*** (0.000) |

0.772*** (0.000) |

| INTASS |

1.307*** (0.000) |

1.322*** (0.000) |

1.399*** (0.000) |

1.366*** (0.000) |

1.322*** (0.000) |

1.322*** (0.000) |

0.648** (0.043) |

0.577* (0.059) |

0.521* (0.088) |

0.577* (0.060) |

0.432 (0.163) |

0.648** (0.043) |

| CORE_OCF |

0.943** (0.031) |

0.949** (0.032) |

0.713*** (0.000) |

0.911** (0.031) |

0.949** (0.032) |

0.949** (0.032) |

1.966*** (0.000) |

2.254*** (0.005) |

2.155*** (0.008) |

2.254*** (0.005) |

2.063** (0.010) |

1.966*** (0.000) |

| ACC |

−0.120 (0.790) |

−0.089 (0.844) |

−0.297 (0.376) |

−0.101 (0.817) |

−0.089 (0.844) |

−0.089 (0.844) |

1.459* (0.061) |

1.870 (0.104) |

1.662 (0.154) |

1.870 (0.104) |

1.387 (0.253) |

1.459* (0.061) |

| D_Intercept |

0.158 (0.444) |

−0.177 (0.450) |

−0.388 (0.178) |

−0.605** (0.015) |

−0.550** (0.024) |

−0.822*** (0.001) |

0.276*** (0.010) |

0.516*** (0.002) |

0.777*** (0.000) |

−0.114 (0.451) |

0.549** (0.022) |

0.071 (0.583) |

| D_NA |

−0.666** (0.016) |

−0.906*** (0.000) |

−0.560* (0.056) |

−0.851*** (0.000) |

−0.547** (0.032) |

−0.387* (0.093) |

0.886*** (0.006) |

0.506 (0.238) |

0.845** (0.021) |

1.019*** (0.004) |

0.475 (0.248) |

0.882*** (0.008) |

| D_INTASS |

−0.528** (0.010) |

−0.771*** (0.001) |

−0.978*** (0.000) |

−1.375*** (0.000) |

−1.098*** (0.000) |

−1.029*** (0.000) |

0.834 (0.433) |

−0.170 (0.815) |

−0.285 (0.651) |

−0.064 (0.885) |

−0.220 (0.768) |

−0.437 (0.649) |

| D_CORE_OCF |

4.043*** (0.000) |

7.203*** (0.000) |

8.612*** (0.000) |

7.089*** (0.000) |

7.257*** (0.000) |

7.902*** (0.000) |

1.178 (0.211) |

0.996 (0.477) |

0.162 (0.869) |

−1.172 (0.307) |

1.736 (0.205) |

1.366 (0.451) |

| D_ACC |

1.834 (0.129) |

5.520*** (0.000) |

2.931 (0.161) |

5.472*** (0.000) |

8.521*** (0.000) |

8.911*** (0.000) |

3.458** (0.042) |

1.696 (0.470) |

−1.346 (0.573) |

0.014 (0.994) |

5.071** (0.018) |

1.828 (0.368) |

| n | 1,219 | 1,227 | 1,212 | 1,199 | 1,187 | 1,181 | 563 | 581 | 584 | 570 | 570 | 558 |

| Adjusted R2 | 0.673 | 0.688 | 0.711 | 0.691 | 0.705 | 0.711 | 0.783 | 0.754 | 0.798 | 0.632 | 0.742 | 0.724 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004. ‘Pooled’ regressions include all firms spanning both the pre- and post-IFRS period. When estimating the coefficients' standard errors for the pooled regressions, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post-IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

Overall, the findings from Tables 6 and 7 provide strong initial support for the value relevance of direct cash flows statements under IFRS across all industries. Moreover, post-IFRS adoption, while remaining value relevant across all industries, core direct cash flows significantly increase in value relevance for industrial firms. Further, for industrial firms, non-core direct cash flow information, which would be available in an indirect cash flow statement, is significantly more value relevant under IFRS than AGAAP. Core direct cash flows evidently capture the rich information set reflected in prices for both industrial and extractive firms, but more so under IFRS for industrial firms

Finally, Table 8 presents the results for equation 5, which has the highest level of cash flow disaggregation. Given equation 5 has by design two highly collinear variables, CSHRC and CSHPS, this final model naturally suffers from high multicollinearity. However, for completeness, and in order to be consistent with Clinch et al. (2002), we report the results of equation 5. Results show that direct cash flow components, with the exception of tax (TXP), are value relevant both pre- and post-IFRS for industrial firms. Moreover, the mean coefficients for the interactive dummy variables show a significant increase in the value relevance of the two ‘core’ direct cash flow measures, namely, cash receipts from customers (CSHRC) and payments to suppliers and employees (CSHPS). Interest paid (INTP) and other operating cash flows (CSHOTH) increase in value relevance under IFRS. Accruals (ACC) are also value relevant for industrial and extractive firms under both AGAAP and IFRS, but there is no increase in relevance since the adoption of IFRS.

| PRICEit = α + β1NAit + β2INTASSit + β3CSHRCit + β4CSHPSit + β5INTPit + β6TXPit + β7CSHOTHit + β8ACCit + εit | ||||||

|---|---|---|---|---|---|---|

| Variable | Industrial firms | Extractive firms | ||||

| Pre-IFRS | Post-IFRS | Pooled | Pre-IFRS | Post-IFRS | Pooled | |

| Intercept |

0.740*** (0.000) |

0.376*** (0.000) |

0.796*** (0.000) |

0.280*** (0.000) |

0.468*** (0.000) |

0.304*** (0.000) |

| NA |

0.416*** (0.000) |

0.373*** (0.003) |

0.323*** (0.009) |

0.832*** (0.000) |

2.341*** (0.000) |

0.975*** (0.000) |

| INTASS |

0.745*** (0.000) |

0.413*** (0.000) |

0.689*** (0.000) |

0.740*** (0.000) |

0.777* (0.052) |

0.479** (0.022) |

| CSHRC |

7.518*** (0.000) |

9.693*** (0.000) |

7.424*** (0.000) |

3.666*** (0.000) |

3.538*** (0.000) |

3.911*** (0.000) |

| CSHPS |

7.512*** (0.000) |

9.664*** (0.000) |

7.415*** (0.000) |

3.682*** (0.000) |

3.695*** (0.000) |

3.887*** (0.000) |

| INTP |

7.999*** (0.000) |

12.795*** (0.000) |

8.188*** (0.000) |

6.596*** (0.002) |

8.243* (0.098) |

9.809*** (0.000) |

| TXP |

4.031** (0.028) |

−0.043 (0.987) |

2.491 (0.301) |

3.632*** (0.000) |

1.533 (0.592) |

4.366*** (0.002) |

| CSHOTH |

7.321*** (0.000) |

9.478*** (0.000) |

7.249*** (0.000) |

5.962*** (0.000) |

−4.674*** (0.001) |

7.446*** (0.000) |

| ACC |

6.566*** (0.000) |

7.516*** (0.000) |

6.610*** (0.000) |

3.454*** (0.000) |

4.619*** (0.000) |

3.606*** (0.001) |

| D_Intercept |

−0.443*** (0.000) |

0.209* (0.078) |

||||

| D_NA |

−0.030 (0.857) |

1.202*** (0.000) |

||||

| D_INTASS |

−0.334** (0.023) |

0.216 (0.626) |

||||

| D_CSHRC |

2.818** (0.016) |

−0.599 (0.568) |

||||

| D_CSHPS |

2.797** (0.018) |

−0.428 (0.682) |

||||

| D_INTP |

4.317* (0.077) |

−4.447 (0.401) |

||||

| D_TXP |

−1.663 (0.624) |

−4.019 (0.172) |

||||

| D_CSHOTH |

2.787** (0.019) |

−11.967*** (0.000) |

||||

| D_ACC |

1.532 (0.208) |

0.896 (0.550) |

||||

| n | 1,020 | 1,113 | 2,130 | 450 | 745 | 1,200 |

| Adjusted R2 | 0.734 | 0.827 | 0.808 | 0.755 | 0.763 | 0.752 |

- All explanatory variables are deflated by the issued number of ordinary shares at the financial year-end. ‘Pre-IFRS’ includes all firms with financial years ending up to and including 31 December 2004, whereas ‘Post-IFRS’ incorporates all firms with financial years ending on or after 1 January 2005. ‘Pooled’ regressions include all firms spanning both the pre- and post IFRS period. When estimating the coefficients' standard errors, we use the Newey and West (1987) robust estimator to correct standard errors for both heteroscedasticity and first-order serial correlation. Variable definitions are as reported in Table 2. Dummy variables are prefixed by ‘D’, taking on the value of their respective explanatory variable post IFRS, and zero otherwise. Two-tailed p-values are presented in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

Much like industrial firms, the direct cash flow components for our sample of extractive firms all reveal a strong association with the share price under both AGAAP and IFRS, with the exception of INTP and TXP, which are insignificant at levels less than 5% post-IFRS. However, in contrast to the findings for industrial firms, adopting IFRS has only resulted in a significant change in the value relevance of CSHOTH. Consistent with a rise in the number of extractive firms, as shown in Table 2, reporting positive other operating cash flows (CSHOTH) pre-IFRS, but negative CSHOTH under IFRS, we observe a change in signs of our coefficient for net other operating cash flows.

Taken as a whole, these findings provide strong evidence of direct cash flows reported under IFRS capturing the richer information set reflected in the stock prices. Specifically, ‘core’ cash flows that are unavailable under indirect cash flow statements are value relevant and reflected in share price across all industries. Further, ‘core’ direct cash flows at the very least remain value relevant after the move to IFRS, and for industrial firms they are shown to significantly increase in value relevance under IFRS. We can therefore accept our second hypothesis H2, that there will be a rise in the value relevance of direct cash flow components under IFRS.

Robustness Tests

Although Australian firms were prohibited from full early voluntary adoption of IFRS, they were required to report on the impact of adopting IFRS in their 2005 financial statements. To account for the release of this information to investors in 2005, we included firm year observations from this year as part of our post-IFRS sample period. However, as a robustness test we dropped all 2005 firm year observations following Jones and Finley (2011). We found largely unchanged and consistent results for all models. In addition, we re-estimated by including industry level dummies in all models to control for unobserved industry group effects. Results of the analysis remained qualitatively similar. Finally, we also used Wald tests to examine the change in value relevance of direct cash flow disclosures and again results are consistent.

Conclusion and Discussion

Currently, the IASB and FASB are proposing that direct cash flow statements become mandatory for all companies under their harmonized cash flow reporting joint project. While there is consistent academic evidence to support the mandating of direct cash flow statements given their usefulness to users of accounts (e.g., Jones et al., 1995; Clinch et al., 2002; Goyal, 2004), there are a number of critics citing the high cost of additional preparation and disclosure (Hales and Orpurt, 2012). We therefore analyse whether direct cash flow disclosures remain value relevant for a sample of Australian firms, to test whether direct cash flow statements continue to capture the rich information set reflected in stock prices in an IFRS reporting environment.

Our results provide strong evidence that direct cash flow statements are value relevant under AGAAP and remain value relevant for both industrial and extractive firms after IFRS adoption. Moreover, for industrial firms we report an increase in the value relevance of direct cash flows since the adoption of IFRS, and additionally find that ‘core’ and ‘non-core’ cash flow disclosures increase in value relevance for industrial firms under IFRS. Consequently, if the IASB were to mandate direct cash flow statements it would likely provide users of accounts with a valuable incremental source of information.

The observed increase in value relevance for industrial firms under IFRS is also consistent with increased uncertainty around the accounting numbers that are being disclosed. Based upon the evidence of Bissessur and Hodgson (2012), the move to IFRS created a degree of uncertainty in the accounting numbers being disclosed. In particular, and consistent with Chalmers et al. (2012), for industrial firms we find evidence that IFRS has resulted in a loss of value relevant information regarding intangibles. In addition, our sample period also includes one of the biggest periods of uncertainty in recent times, namely the global financial crisis, and so a continued reliance on direct cash flow numbers would not be surprising. Ultimately, whether the increased value relevance of direct cash flow numbers persists beyond the current market turmoil and the loss of information from the prohibition of internally generated intangibles merits further investigation. Regardless of this, we present strong evidence that direct cash flow disclosures are a value relevant source of information in an IFRS reporting environment.