Economic Decline and Ecological Impact: What Future for European Fur Farming?

Déclin économique et impact écologique : quel avenir pour l’élevage d'animaux à fourrure en Europe ?

Wirtschaftlicher Niedergang und ökologische Auswirkungen: Was bringt die Zukunft für die europäische Pelztierzucht?

Summary

enThe economic, ecological and animal welfare impacts of fur farming in the European Union have been debated for decades, culminating in proposals for an EU-wide ban on keeping animals solely for fur production. The Covid-19 pandemic further intensified these discussions, particularly within individual Member States.

This study analyses the economic trends, environmental consequences and disease risks associated with fur farming, providing insights to inform political and societal debate. Our findings indicate that, even before the pandemic, fur exports and consumer demand were in steady decline. This trend has been driven by shifting consumer preferences, major fashion brands phasing out fur, and growing concerns over animal welfare and sustainability. Additionally, the industry has been linked to biodiversity threats, zoonotic disease transmission, and negative environmental impacts, including a high carbon footprint.

While concerns remain over the relocation of fur farming to regions with weaker regulations, the industry requires a strategic transition. Supporting fur farmers in shifting to alternative activities, for example, through training, targeted subsidies, compensation and other policy incentives, can help repurpose land and employment towards viable and sustainable alternatives.

Abstract

frLes impacts économiques, écologiques et sur le bien-être animal de l’élevage d'animaux à fourrure dans l'Union européenne (UE) font l'objet de débats depuis des décennies, aboutissant à des propositions visant à interdire, à l’échelle de l'UE, l’élevage d'animaux uniquement destinés à la production de fourrure. La pandémie de Covid-19 a encore intensifié ces discussions, en particulier au sein des États membres.

Cette étude analyse les tendances économiques, les conséquences environnementales et les risques de maladies associés à l’élevage d'animaux à fourrure, fournissant des informations pour éclairer le débat politique et sociétal. Nos résultats indiquent que, même avant la pandémie, les exportations de fourrure et la demande des consommateurs étaient en baisse constante. Cette tendance a été alimentée par l’évolution des préférences des consommateurs, l’élimination progressive de la fourrure par les grandes marques de mode et les préoccupations croissantes concernant le bien-être animal et la durabilité. En outre, l'industrie a été associée à des menaces pour la biodiversité, à la transmission de maladies zoonotiques et à des impacts environnementaux négatifs, notamment une empreinte carbone élevée.

Bien que des inquiétudes subsistent quant à la délocalisation de l’élevage d'animaux à fourrure vers des régions où la réglementation est plus faible, l'industrie a besoin d'une transition stratégique. Aider les éleveurs d'animaux à fourrure à se tourner vers des activités alternatives, par exemple par le biais de formations, de subventions ciblées, d'indemnisations et d'autres incitations par les politiques, peut aider à réorienter les terres et les emplois vers des alternatives viables et durables.

Abstract

deDie wirtschaftlichen, ökologischen und tierschutzrelevanten Aspekte der Pelztierzucht in der Europäischen Union werden seit Jahrzehnten diskutiert und gipfelten in Vorschlägen für ein EU-weites Verbot der Haltung von Tieren ausschließlich zur Pelzgewinnung. Die Covid-19-Pandemie hat diese Diskussionen weiter verschärft, insbesondere in einzelnen Mitgliedstaaten.

Diese Studie analysiert die wirtschaftlichen Trends, die Umweltauswirkungen und die mit der Pelztierhaltung verbundenen Krankheitsrisiken und liefert Erkenntnisse für die politische und gesellschaftliche Debatte. Unsere Ergebnisse zeigen, dass bereits vor der Pandemie die Pelzexporte und die Konsumnachfrage stetig zurückgingen. Dieser Trend wurde durch veränderte Konsumpräferenzen, den Ausstieg großer Modemarken aus der Pelzproduktion und wachsende Bedenken hinsichtlich des Tierschutzes und der Nachhaltigkeit vorangetrieben. Darüber hinaus wird die Pelzindustrie mit der Bedrohung der biologischen Vielfalt, der Übertragung von Zoonosen und negativen Umweltauswirkungen, einschließlich eines großen CO2-Fußabdrucks, in Verbindung gebracht.

Auch wenn die Verlagerung der Pelztierzucht in Regionen mit weniger strengen Vorschriften weiterhin für Bedenken sorgt, muss sich die Branche strategisch neu aufstellen. Die Unterstützung von Pelztierzuchtbetrieben bei der Umstellung auf alternative Tätigkeiten, z. B. durch Schulungen, gezielte Subventionen, Entschädigungen und andere politische Anreize, kann dazu beitragen, dass Nutzflächen und Arbeitsplätze auf tragfähige und nachhaltige Alternativen umgestellt werden.

Introduction

The practice of using animals for fur, deeply rooted in ancient cultures, has evolved from the provision of necessities to a form of luxury, status and high-street fashion. The fur production industry involves the extraction of fur from both farmed (85–95 per cent) and wild (5–15 per cent) animals from a variety of species (Bijleveld et al., 2011). Like other animal-based agricultural practices, fur farming faces challenges related to breeding, veterinary care and disease control. Issues such as insufficient genetic diversity, poor animal welfare and the potential role of fur farming in disease transmission remain subjects of concern.

The European Union (EU) is currently engaged in a significant debate on fur farming, culminating in the Fur Free Europe Citizens’ Initiative, submitted to the European Commission in June 2023 with the support of over 1.5 million signatories. This initiative calls for an EU-wide ban on keeping and killing animals solely for fur production, marking a pivotal moment in the ongoing discourse. In response, the European Commission is assessing the need for and feasibility of such a ban, with plans to announce by March 2026 whether it will move forward with a proposal, potentially including a transition period.

Amid the growing criticism, the fur industry has responded by pledging to improve animal welfare standards and promote sustainable practices, such as through the development of a circular economy. A circular economy replaces the linear ‘take-make-dispose’ model with a system that prioritises sharing, reusing, repairing and recycling to minimise waste and maximise resource value, keeping materials in use for as long as possible. Initiatives like the WelFur inspection and certification programme – designed to harmonise standards across European fur farms and with the aim to ensure that best practices are applied to animal welfare in the fur supply chain – are part of the industry's efforts to address these concerns.

To contribute to an informed decision-making process, this study analyses the ecological and economic impacts of fur farming in Europe, focusing on raw furskins. We present data and a review of literature from academic publications, private and public sector reports, business and legal documents, offering insights into the fur industry's opportunities, risks and trends. Our research aims to provide an unbiased assessment of the sector's ecological and economic implications and trends, assisting policymakers at both the EU and Member-State levels in navigating this complex and contentious issue.

Background information: A declining industry

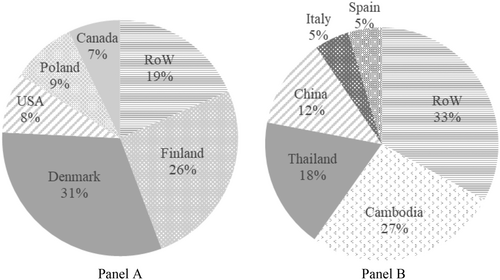

Before 2020, more than half of global fur farms – accounting for over 70 per cent of the world's raw furskin exports – were spread across 22 European countries. Finland and Denmark led this market and, as of 2023 data, continue to do so, holding over 50 per cent of the total share (Figure 1, panel A; Hansen, 2021). Meanwhile, Asian countries, notably Cambodia, Thailand and China, dominated the exported value of tanned or dressed furskins (Figure 1, panel B). However, a decade before the onset of the Covid-19 pandemic, the European fur industry had already begun to experience a steady decline in both export volume and value (Hansen, 2021) as well as in consumer demand. The status-signalling value of fur garments is increasingly challenged by animal rights organisations in several European countries. This trend is driven by growing animal welfare concerns among EU consumers, the success of anti-fur consumption movements that have stigmatised real fur in fashion, and technological advancements that enable the production of high-quality synthetic alternatives, commonly known as faux fur, which now closely resemble real fur (EC, 2023; Shin and Jin, 2021).

Panel A: Percentage share of world exports of raw furskins (HS 4301). Panel B: Percentage share of world exports of tanned or dressed furskins (HS 4302). Figures are based on average annual values from 2019 to 2023

Notes: The total world export value of raw furskins and tanned furskins during the period 2019–2023 averaged 1,057,893 thousand euros and 980,844 thousand euros annually, respectively.

Source: Authors’ elaboration based on data from ITC Trade Map, 2025 (www.trademap.org). Last accessed: 17.02.2025.

Even before 2020, several European fur-producing countries had already begun implementing diverse legislative and regulatory measures to address public health, animal welfare and sustainability concerns (Figure 2). Some countries, such as the UK, Austria and North Macedonia, imposed complete bans on fur farming, while others opted for partial bans or stringent welfare standards. For example, Italy introduced a total ban on fur farming at the end of 2021, offering compensation to farms for transitioning to alternative industries. Similarly, in March 2022, Ireland amended its Animal Health and Welfare Bill to prohibit fur farming and established a training fund to assist redundant workers. Other countries adopted partial bans targeting specific species, such as Sweden, which prohibited the farming of foxes and chinchillas while maintaining mink farming until the Covid-19 pandemic. Germany and Switzerland did not officially ban fur farming but set such high welfare standards that such activity became economically unviable. Figure 2 provides an overview of the legislative landscape surrounding fur farming bans and restrictions across Europe.

Map of fur farm legislation in Europe as of March 2023

Notes: Up-to-date information on fur farming legislation is also provided by the Fur Free Alliance: www.furfreealliance.com/fur-bans.

Source: Authors’ elaboration based on a review of country-specific legislation and documents.

Emerging challenges in European fur farming: Environmental, health and economic dimensions

Our analysis identifies primary areas of concern within European fur farming. We group these under three, often interconnected, categories: Environmental impacts, Disease and parasite spread and Economic trends.

Environmental impacts

The introduction of exotic, non-native species via farms, gardens or zoological collections, poses significant threats to biodiversity. Invasive species, intentionally or unintentionally released into the wild, can disrupt ecosystems, endangering native flora and fauna.

One well-documented example is the connection between feral American mink (Neogale vison) populations and fur farms, which has been associated with the decline of local European mink (Mustela lutreola), the endangerment of water voles (Arvicola terrestris) and nesting failure in various bird species. Other farmed species like nutria (Myocastor coypus) and muskrats (Ondatra zibethicus) have caused habitat destruction and damage to infrastructure, such as riverbed collapse and weakening of railroads and dams.

Environmental impact studies on fur farms reveal significant negative effects throughout the fur production cycle, processing and transportation. These include water depletion, marine and freshwater toxicology, eutrophication, terrestrial acidification, and particulate matter formation (Bijleveld et al., 2011). Animal feed contributes to over 80 per cent of the cycle’s ecotoxicology and eutrophication.

A life cycle assessment (LCA) of fur production identifies chicken offal and wheat-based feed as major contributors to pollution, accounting for approximately 50 per cent and 45 per cent, respectively, of water-source depletion. The same study also highlights that producing 1 kg of mink fur requires over 11 animals and approximately 563 kg of feed, more than 60 per cent of which is sourced from chicken offal. Additionally, fur production has a significant carbon footprint, with some studies suggesting that mink fur generates five times the carbon emissions of wool (Bijleveld et al., 2011). These environmental costs may be exacerbated by the outsourcing of fur processing to regions with potentially lower environmental regulatory standards.

In the context of the EU Green Deal, the European Commission has proposed new measures to reduce the environmental and climate footprint of the agricultural sector and improve animal welfare. These actions include financial incentives for circular agricultural practices. Several related strategies and funding schemes, such as the EU Farm to Fork Strategy and the European Agricultural Fund for Rural Development (EAFRD), are well-suited to small, family-run enterprises. These programmes could provide viable opportunities for fur farm owners seeking to transition to more environmentally and economically sustainable practices in the future.

Disease and parasite spread

Fur farms, with their high-density animal populations, create ideal conditions for pathogen spillover. Farmed animals, acting as reservoirs for various pathogens, may transmit such pathogens to humans, either through direct contact or intermediary hosts such as cats, dogs and rats (Keen, 2022). This can also facilitate the spread of ectoparasites (11 species of fleas and lice) and endoparasites (32 species of nematodes and trematodes).

Farmed animals, particularly Neovale vison, are well-documented carriers and transmitters of various zoonotic diseases. These include Chlamydia abortus, Aleutian mink disease virus (AMDV), canine distemper virus (CDV), Mink enteritis virus (MEV), and human and animal influenza viruses with pandemic potential. These diseases can be highly infectious and sometimes challenging to treat, and there are historic records of hospitalisation of farm staff and nearby residents (EFSA, 2021; Keen, 2022). Despite the long existence of these diseases in Europe, the introduction of new fur species increases the number of vectors, elevating the risk and rate of spread.

The most striking example of this risk occurred in 2020 during the global Covid-19 pandemic. By the end of 2020, 214 cases of mink-to-human infection were recorded in Denmark alone. As a result, over 17 million animals were culled by Carbon Monoxide (CO) gassing and their carcasses burned or buried. As of January 2023, SARS-CoV-2 virus had been detected in 447 mink farms for fur production in nine countries in the EU/EEA, namely 290 farms in Denmark, 69 in the Netherlands, 25 in Greece, 19 in Spain, 17 in Lithuania, 13 in Sweden, 12 in Poland, 2 in Italy, and 1 in France (EFSA et al., 2021).

Biosafety measures, including human and animal testing, disinfection, personal protective equipment (PPE) use, and reduced personnel on-site, have been implemented in functioning farms. Yet, studies continue to highlight the risks associated with fur farming practices, including mink's hyper-susceptibility to SARS-CoV-2 infection, spill-over and spill-back interactions between humans and farmed mink, escaped mink acting as reservoirs, and mink mutations evading human vaccines (Keen, 2022).

Zoonotic viral outbreaks are appearing at an increasing rate, with fewer years between outbreaks and a wider geographic spread (EFSA, 2021). This emphasises the need for primary prevention measures on fur farms, including regular viral surveillance through testing and quarantine, and wildlife trade adherence to international agreements and standards.

Economic trends

This section focuses on the economic trends related to heads, tails, paws and other suitable pieces or cuttings for furriery (henceforth referred to as raw furskins), excluding raw hides and skins of bovine, equine animals, sheep or lambs.

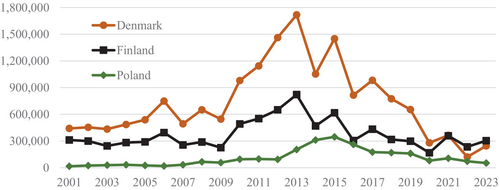

If we look at export and market trends, the European fur farming sector has traditionally been dominated by two main players: Denmark and Finland. Over the past decade, with few exceptions, European exporters of raw fur skins have seen declining export values (Figure 3). This decline is evident for both mink and fox fur skins, the two most common species in EU fur farms (authors’ calculations based on ITC Trade Map data).

Exported value (EUR thousand) in the top 3 European fur-producing countries of raw furskins

Note: Harmonized System (HS) product code: 4301.

Source: Authors’ elaboration based on data from ITC Trade Map, 2025 (www.trademap.org). Last accessed: 18.02.2025.

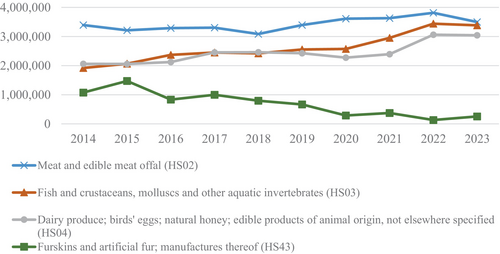

European Fur farms often engage in activities beyond fur production, including the cultivation of agricultural crops, electricity generation and farm-related food services. On average, fur farms employ between 10–15 workers, with three to five directly involved in fur-related activities, while the remainder work in other operations (FiFur, 2022). Before the Covid-19 pandemic, European fur farms produced approximately 43 million furskins, accounting for about 50 per cent of global production (EFSA, 2021). In Finland, annual revenue from wholesale skin sales reached €10 million in 2021, with an additional €5 million from retail sales of fur clothing. To put this into context, the total export value of raw fur skins was estimated at €362 million, constituting only 0.5 per cent of Finland's total export value that year (FiFur, 2022). Similarly, despite Denmark being Europe's and the world's largest mink fur exporter, fur represents only a small fraction of its total annual exports of animal-related agricultural products (Figure 4).

Source: Authors’ elaboration based on data from ITC Trade Map, 2025 (www.trademap.org). Last accessed: 18.02.2025.

Notably, the decline in European fur production has not resulted in a proportional increase in fur products exports from other countries. Trade data indicate a significant decrease in global fur product imports as well (Hansen, 2021). Between 2014 and 2023, the value of imported raw furskins continued to decline worldwide. The global import value of raw furskins in 2023 is estimated at €947 million, marking a drop of over 70 per cent from 2014, when it stood at approximately €3.268 billion (authors’ calculation based on ITC Trade Map data, 2025).

The fashion industry remains the primary consumer in the fur value chain, but over the past decade, demand for natural fur products has shifted significantly. Many high-profile fashion houses and high-street brands have discontinued the use of natural fur mainly due to buyer pressures and ethical concerns from animal welfare groups. Brands that have phased out natural fur include: Gruppo Giorgio Armani (since 2016), H&M (since 2016), North Face (since 2017), Gucci (since 2018), Prada (since 2020), Adidas (since 2021), Dolce & Gabbana (since 2022), Canada Goose (2021) and Max Mara Fashion Group (2024), among many others. Similarly, major high-street retailers and department stores have followed suit, responding to both regulatory pressures and evolving consumer sentiment. The outbreak of SARS-CoV-2 strains in mink farms exacerbated the decline, causing substantial economic losses and placing the industry in the global spotlight, sparking public debate and policy scrutiny. Additionally, Russia, historically one of the largest fur markets, has seen a drop in demand due to economic sanctions imposed in 2022 in response to the war in Ukraine. These restrictions have disrupted trade flows and reduced purchasing power, further constraining the market. The increasing number of fashion brands phasing out fur reflects a declining role for traditional fur products in fashion and a broader industry shift towards ethical and sustainable alternatives. A 2023 study commissioned by the European Commission explored public opinion on animal welfare across the EU. Findings indicate that 57 per cent of Europeans support a strict ban on fur farming, while 32 per cent believe fur farming should continue but with improved EU-wide welfare standards (EC, 2023).

Looking at more local economic impacts, specific studies on the effect of fur farming on nearby housing prices are limited. However, unpublished research in Poland has assessed its impact on property values and the housing market. Findings suggest that residential properties and agricultural land within 1 km of a fur farm experienced significant depreciation. Although the industry claims substantial community support, surveys indicate that neighbouring residents express dissatisfaction with fur farming, citing concerns such as unpleasant odours, increased insect populations and escaped animals (Marcinkowski and Urbański, 2018).

Public data on the costs of eradicating invasive species that have escaped from fur farms are scarce but suggest that efforts are often expensive and not always successful, even after decades of control attempts. For example, removing American mink from 1,000 km2 of Hiiumaa Island, Estonia, cost an estimated €70,000–€100,000 over two years, while a similar campaign in the Scottish Outer Hebrides cost £1.65 million over five years. These costs stem from labour-intensive efforts, specialised equipment and ongoing monitoring to prevent reinvasion. For a comprehensive review of scientific literature on American mink management programmes worldwide (1992–2022), see Lopez et al. (2023).

Conclusion and recommendations

The European fur farming industry continues to be the subject of ongoing debates regarding its economic, environmental and animal welfare impacts. This study provides a review of academic literature, policy and legal frameworks, public and private sector reports, and data analysis to offer insights into the complexities and trends of the sector. While data availability varies and consistency is lacking, discernible trends and recommendations can still be identified with caution.

Recognising the industry's economic decline and falling consumer demand over the past decade, exacerbated by the Covid-19 pandemic, this study highlights the need for a strategic shift. Ceasing fur farming activities and converting land and employment opportunities towards other farming activities or economic sectors should be considered a viable long-term opportunity. Governments face growing pressure to support a sector that is already in economic decline, necessitating collaboration with the private sector. Compensation schemes alone may not ensure social sustainability or facilitate a smooth transition to alternative economic activities.

New education and training opportunities for former fur farmers must align with emerging legislation. Businesses should invest in skilling, upskilling and reskilling programmes for their workforces and communities. However, transitioning to alternative activities presents challenges, including financial viability, market access and the need for specialised training. Moreover, alternative livestock farming, such as sheep production, has its own environmental impact, including greenhouse gas emissions, biodiversity loss, and risks of contagious disease outbreaks. Policy tools such as targeted subsidies, advisory services and market incentives will be essential in supporting a sustainable transition that balances economic, environmental and animal welfare considerations.

It is crucial that the decline in fur farming in Europe is accompanied by a reduction in global demand. Without progress towards more sustainable fashion and consumption patterns, production may shift to countries with lower social and environmental standards, increasing leakage risks. A European Citizens’ Initiative, which received over 1.5 million statements of support in 2023, has urged the European Commission to ban the keeping and killing of animals for the sole or main purpose of fur production and the placement of farmed animal fur, and products containing such fur, on the EU market. This initiative is a good example of the push for demand reduction in Europe and sends a strong signal to other producing countries to start developing alternatives to the fur industry.

Finally, this review underscores the need for further rigorous academic research on the environmental impacts, economic trends and consumer preferences in the fur farming industry. Discussions on the sector's future are often polarised and rely heavily on non-academic, unpublished sources. A more evidence-based approach is essential to support balanced policymaking and public debate, ensuring that decisions are grounded in robust scientific and economic analysis.

Further Reading

With economic decline, shifting consumer demand, and the ‘Fur Free Europe’ Initiative backed by 1.5 million signatories, European fur farming stands at a crossroads.

Avec le déclin économique, l’évolution de la demande des consommateurs et l'initiative ‘Pas de fourrure en Europe’ soutenue par 1.5 million de signataires, l’élevage européen d'animaux à fourrure se trouve à la croisée des chemins.

Angesichts des wirtschaftlichen Abschwungs, der sich ändernden Konsumnachfrage und der Initiative ‘Pelzfreies Europa’ die von 1.5 Millionen Unterzeichnenden unterstützt wird, steht die europäische Pelztierzucht am Scheideweg.

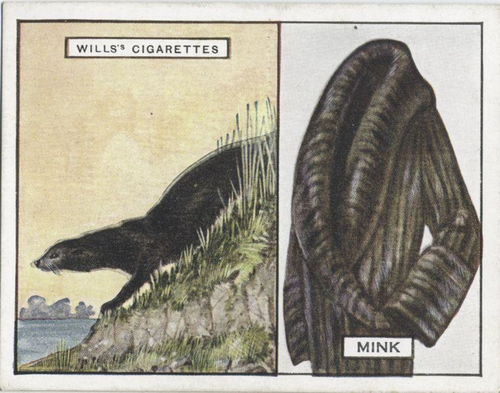

Lithograph from the collection “Animals and Their Furs: A Series of 25 (Wills's Cigarettes), 1850–1959”. Once a symbol of status, the use of real fur in fashion is now often challenged or even stigmatised among European consumers © George Arents Collection, The New York Public Library. Digital Collection Accessed March 7, 2025. https://digitalcollections.nypl.org/items/510d47da-9dbe-a3d9-e040-e00a18064a99