FinTech Adoption and Corporate Greenwashing: A Technology Affordance Perspective

Abstract

Affordance theory suggests that technology offers certain opportunities or ‘affordances’ that can be exploited by users. In this context, we are exploring how FinTech adoption provides opportunities to address corporate greenwashing. Drawing on an affordance perspective, we assert that FinTech adoption effectively inhibits corporate greenwashing behaviour, primarily through facilitating green innovation and improving managerial efficiency. We also contend that the impact of FinTech adoption on reducing greenwashing behaviour is not uniform across all industries. It is more pronounced in heavy-polluting industries, indicating that FinTech has a greater effect in encouraging accurate disclosure of environmental information in environmentally sensitive sectors. Conversely, its impact is weaker in high-tech industries, which might already have strong environmental commitments. The findings contribute to the literature on sustainability, FinTech and governance.

Introduction

With the growing global emphasis on green transformation and sustainability, environmental performance has become a key factor for investors in assessing firm value (Lee and Raschke, 2023; Tang and Tang, 2018). Many companies are striving to project an eco-friendly image by disclosing their environmental efforts through annual or sustainability reports (Borgstedt et al., 2019; Schmuck, Matthes and Naderer, 2018). However, some firms engage in greenwashing, using misleading descriptions or avoiding full disclosure (Huang, 2022; Lee and Raschke, 2023; Siano et al., 2017). Greenwashing not only undermines the credibility of sustainability efforts but also slows progress towards a greener business environment (Delmas and Burbano, 2011). If unpunished, it could encourage other firms to follow suit (Hameed et al., 2021; Nygaard and Silkoset, 2022; Wang, Ma and Bai, 2019). Despite this, corporate greenwashing has not received sufficient attention in academia (Ruiz-Blanco, Romero and Fernandez-Feijoo, 2022; Seele and Gatti, 2017), making it a pressing issue.

FinTech, recognized for its role in reshaping financial services through technology (Financial Stability Board, 2017), encompasses a broad spectrum of activities, from payment systems to asset management and risk management (Ahlstrom, Cumming and Vismara, 2018; Haddad and Hornuf, 2019). Some studies suggest that FinTech can drive innovation and sustainability (Cumming et al., 2024; Cumming, Johan and Reardon, 2023; Gao and Jin, 2022; Yan et al., 2022), while others raise concerns about its potential to exacerbate information asymmetries (Ahlstrom, Cumming and Vismara, 2018). This raises the question: Does FinTech reduce or increase corporate greenwashing? There has been little research on how FinTech adoption affects corporate greenwashing (Luo et al., 2022; Yan et al., 2022), revealing a gap in understanding the mechanisms behind this relationship (Liu and Li, 2024; Nygaard and Silkoset, 2022; Si Mohammed et al., 2024; Xie et al., 2023).

Corporate greenwashing is influenced not only by FinTech adoption but also by the contextual factors in which these technologies are applied (Majchrzak et al., 2013; Orazalin, Ntim and Malagila, 2024). Ahlstrom, Cumming and Vismara (2018) call for further research on how governance mechanisms interact with financial innovations to impact firm performance. Since industries vary in their governance structures, it is important to study how FinTech adoption in specific industries may curb greenwashing, a topic that remains underexplored. To address this gap, we apply affordance theory to investigate the connection between FinTech and greenwashing. Affordance theory, which looks at how technology and contextual factors interact, is useful for explaining why FinTech has different effects on greenwashing across industries.

China provides a valuable context for studying FinTech and greenwashing due to its role as a global leader in FinTech innovation (Cumming et al., 2019). Over the last decade, China has seen rapid growth in FinTech, with cities like Beijing and Shanghai emerging as major hubs (Das, 2019). Additionally, China has long prioritized green development and tackled greenwashing, as evidenced by its release of a greenwashing list in 2009 (Guo et al., 2017). This ongoing commitment to environmental sustainability makes China an ideal setting to explore how FinTech adoption influences greenwashing (Cumming, Hou and Lee, 2016; Tang and Tang, 2018; Wang, Ma and Bai, 2019; Wu, Zhang and Xie, 2020; Zhang, 2022).

Our empirical analysis focuses on Chinese non-financial listed firms from 2011 to 2021. While FinTech emerged in the early twenty-first century, large-scale development in China has occurred mainly over the past decade. The availability of greenwashing data also makes this timeframe relevant. Our extended sample allows us to observe the evolution of FinTech and its influence on greenwashing. We argue that FinTech adoption curbs greenwashing by promoting green innovation and enhancing managerial efficiency. Additionally, we consider high-tech and heavy-polluting industries as key contextual affordances in our research framework. These industries interact with FinTech in unique ways, affecting how firms manage greenwashing.

Our study contributes to the literature in several ways. First, we apply affordance theory to FinTech and demonstrate how it can alleviate greenwashing, offering a new perspective that counters the view that FinTech merely amplifies information asymmetry (Ahlstrom, Cumming and Vismara, 2018). Instead, we support Cumming et al.’s (2024) argument that FinTech is a catalyst for sustainable business development. This research enriches both affordance theory and the FinTech literature by highlighting its role in promoting sustainability. Second, we address the largely overlooked issue of greenwashing within the sustainability literature. While previous research has focused on the positive aspects of sustainability and ESG in FinTech, such as crowdfunding (Cumming et al., 2024), we broaden the scope by investigating the inverse dimension of sustainability greenwashing. Our study reveals the mechanisms through which FinTech can improve transparency and reduce greenwashing. Third, we explore how the impact of FinTech varies across different governance mechanisms and industries. Prior studies have noted that technologies can have different effects depending on the context in which they are adopted (Ahlstrom, Cumming and Vismara, 2018; Huang, Meoli and Vismara, 2020; Liu et al., 2023). We expand this line of research by showing that FinTech's ability to curb greenwashing is stronger in heavy-polluting industries but weaker in high-tech industries, offering a nuanced understanding of how technological and contextual affordances interact.

In conclusion, our findings highlight the importance of context when assessing the impact of FinTech on corporate greenwashing. By examining the interplay between FinTech and industry-specific factors, we provide a deeper understanding of how FinTech can promote transparency and reduce deceptive environmental practices.

Theory and hypothesis development

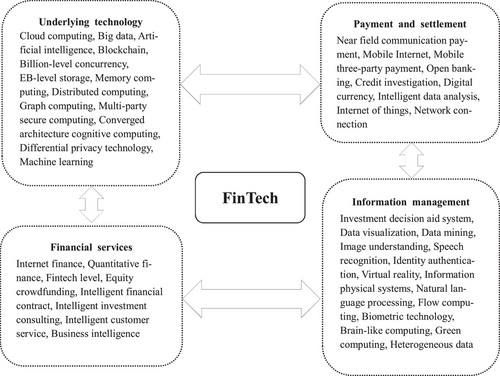

FinTech: Features and applications

FinTech is characterized by technology-driven financial innovation (Pan et al., 2018), differentiating itself from traditional finance through two key aspects: integration and precision. Integration refers to the combination of digital technology with traditional financial services, creating new business models (Borgstedt et al., 2019; Collevecchio et al., 2024). Precision focuses on matching financial services to user needs, enabling personalized solutions and improving business coverage and accuracy (Borgstedt et al., 2019). FinTech also enhances managerial efficiency by providing real-time access to internal information, allowing for better monitoring of operations (Luo et al., 2022).

Given these features, FinTech can play a pivotal role in advancing sustainable development and supporting green transformation. However, research on how FinTech influences firms’ sustainability outcomes remains limited. Corporate greenwashing, where firms deceive the market about their environmental practices due to incomplete information and market asymmetry, poses significant challenges to sustainability (Huang, 2022). Previous studies have examined internal organizational factors and external institutional factors like environmental regulation and media exposure in mitigating greenwashing (Kolbjørnsrud, Amico and Thomas, 2016; Li et al., 2023; Ruiz-Blanco, Romero and Fernandez-Feijoo, 2022; Wedari, Jubb and Moradi-Motlagh, 2021). However, the role of FinTech in reducing greenwashing remains underexplored. Investigating why some firms experience greater success in alleviating greenwashing despite using similar FinTech tools could uncover important insights into how firms and FinTech interact in diverse contexts (Huang, Meoli and Vismara, 2020; Liu et al., 2023; Piccoli, 2016).

The affordance perspective of FinTech adoption

Affordance theory, initially proposed by Gibson (1977), has been widely used to explore how individuals or organizations with specific perceptions and skills adopt technology (Hutchby, 2014; Juris, 2012). In organizational management research, it emphasizes both the material attributes of technology and the subjective nature of organizations (Hutchby, 2001). Technology affordance often focuses on the ability of the design and function of a specific technology to meet a specific need in theory, without considering the factors of the actual application environment or context (Majchrzak et al., 2013). Differently, contextual affordance is more focused on the actual use of the environment and context, referring to the ability of technology to meet a specific need in a specific environment or context (Liu et al., 2023). In fact, the actual effect of technology affordance is often limited by the context in which it is used. For example, a headset with advanced noise cancellation may be more functional in a noisy environment, but its noise cancellation effect may not be obvious in a quiet environment. In this paper, we employ technology affordance theory encompassing technology affordances and contextual affordances to explore the relationship between FinTech adoption and corporate greenwashing behaviour. By integrating technology attributes with seemingly unrelated factors (Gibson, 1977), technology affordance theory allows for a comprehensive understanding of the interaction between corporate subjects and FinTech.

Technology affordances of FinTech adoption

A trade-off between benefits and costs is a key driver of greenwashing (Lyon and Maxwell, 2011; Sutherland, 2018; Zhang, 2023). How FinTech adoption influences the costs and benefits of greenwashing can be observed as follows.

First, FinTech adoption has greatly increased the cost and risk of corporate greenwashing. Firms and investors can leverage FinTech to store environment-related data, thereby enhancing the credibility and immutability of data, and improving the objectivity of environmental performance. This makes costly any attempt to conceal negative environmental information (i.e. greenwashing) through false data (Gai, Qiu and Sun, 2018). It means that firms will face huge cover-up costs, and there is also a high possibility of facing legal litigation and high fines (Erel and Liebersohn, 2022; Petersen and Rajan, 2002), thereby augmenting the difficulty of greenwashing. Second, FinTech adoption has compressed the potential benefits of greenwashing. Investors utilize big data analysis techniques and algorithms to analyse firms’ production and operation (Liu and Li, 2024; Si Mohammed et al., 2024), including energy consumption, emissions and other environmental issues. This encourages firms to engage in green production, energy conservation and emission reduction, in order to attract funds. This improvement in substantive action makes firms’ unsustainable behaviour like greenwashing unnecessary (Liu and Li, 2024; Xie et al., 2023).

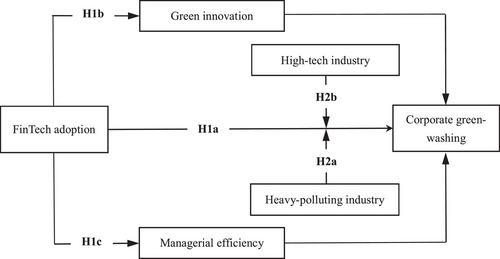

- H1a: With more FinTech adoption, it can inhibit corporate greenwashing.

Mechanism of green innovation

The first important mechanism through which FinTech adoption mitigates greenwashing behaviour is by facilitating firms’ green innovation. Green innovation refers to environmentally friendly innovations that effectively alleviate environmental impacts through developing new products and processes (Huang et al., 2023). It involves a ‘green walk’ with substantive actions (Walker and Wan, 2012). We argue that the integration and precision offered by FinTech play a crucial role in facilitating green innovation, thereby suppressing corporate greenwashing behaviour.

First, FinTech can be applied to accurately identify the quality of corporate innovation (Metawa, Dogan and Taskin, 2022; Qu, Shao and Shi, 2020). By using complex algorithms and modelling techniques, precise project selection can be identified. Especially in the construction industry, this precise identification can assess the environmental impact of projects, improve their energy efficiency and environmental performance and capture green projects with high-quality potential (Dangelico, Pujari and Pontrandolfo, 2017), thereby enhancing the overall quality of firms’ green innovation efforts. This not only ensures investment returns but also realizes the sustainability of green projects (Cao, Cumming and Zhou, 2020; Seele and Gatti, 2017). Second, FinTech can be adopted to address the funding needs for corporate green innovation while ensuring stability and transparency (Ayyagari, Demirgüç-Kunt and Maksimovic, 2011; Gull et al., 2023). As aforementioned, a distributed ledger through blockchain reduces the possibility of capital misappropriation and ensures that funds are allocated to high-quality green innovation projects. Currently, some well-known Chinese firms, such as JD.com and Huawei, are actively applying solutions based on smart contracts and digital currency. This application greatly contributes to the openness and transparency of the fund usage process, guaranteeing the quality of green innovation within firms.

- H1b: FinTech adoption can inhibit corporate greenwashing by facilitating its green innovation.

Mechanism of managerial efficiency

The second important mechanism through which FinTech can reduce corporate greenwashing resides in elevating managerial efficiency (Park, 2018; Zhang, Yang and Bi, 2011). Managerial efficiency pertains to a firm's capacity to proficiently employ and orchestrate its resources for production and operational activities (Cui, Li and Li, 2020; Krasnikov and Jayachandran, 2008). Given that the trade-off between cost and benefit constitutes a crucial incentive for corporate greenwashing, we contend that FinTech's role can effectively enhance managerial efficiency and curtail operating costs, thereby further alleviating greenwashing.

FinTech can augment the managerial efficiency of FinTech-adopting firms by streamlining transaction processes. For example, transaction parties can bypass transfer banks and directly undertake peer-to-peer rapid and cost-effective payments via employing distributed ledger technology, thus enhancing transaction efficiency. Meanwhile, firms leverage FinTech to achieve data integration and sharing among internal departments, enabling top-down visualization. This assists firms in making efficient decisions and improving their business processing efficiency (Begenau, Farboodi and Veldkamp, 2018), which reduces the opportunities for individual departments to falsify information (Luo et al., 2022). Besides, thanks to the observable and recordable big data platforms supported by FinTech, some firms monitor and analyse real-time fund usage and balance related to processes such as procurement, production, inventory and sales. This enables firms to improve the efficiency of fund utilization (Begenau, Farboodi and Veldkamp, 2018; Bollaert, Lopez-de-Silanes and Schwienbacher, 2021).

- H1c: FinTech adoption can inhibit corporate greenwashing by improving its managerial efficiency.

Contextual affordances of heavy-polluting industry and high-tech industry

Majchrzak et al. (2013) found that the same or similar technologies may produce diverse application effects among technology application subjects due to differences in context. We argue that FinTech adoption's effect on corporate greenwashing is not only closely related to technology affordances, but also largely depends on contextual affordances, such as the industrial contexts where firms operate. Obviously, heavy-polluting industries and high-tech industries are two industrial contexts that are highly relevant to corporate sustainability. Therefore, this research examines the important contextual affordances of heavy-polluting industries and high-tech industries to determine their influence on the adoption of FinTech in corporate greenwashing.

Heavy-polluting industry

Heavy-polluting industries are the first contextual factor to be examined in this paper. According to the Guidelines for Environmental Information Disclosure of Listed Firms issued by the Ministry of Environmental Protection of China, heavy-polluting industries cover 16 specific industries, including thermal power, iron and steel, coal, metallurgy and mining, and so on. Heavy-polluting industries are characterized by significant environmental pollution and high energy consumption (Petersen and Rajan, 2002), and face greater challenges in adjusting the industrial structure and undergoing a green transformation. Firms in heavy-polluting industries often have limited technological capabilities and high costs of transformation (Petersen and Rajan, 2002), making it difficult to meet stricter environmental regulations and invest in green technologies and processes (Gu et al., 2021).

- H2a: In heavy-polluting industries, FinTech adoption strengthens the inhibitory effect on corporate greenwashing.

High-tech industry

Technological development is a key driving force for achieving green transformation and can inhibit corporate greenwashing. The high-tech industry involves the production of cutting-edge technological products in areas such as information technology, bioengineering and new materials (Pan et al., 2018).

- H2b: In high-tech industries, FinTech adoption weakens the inhibitory effect on corporate greenwashing.

Based on the above arguments, we build the conceptual framework of this study (see Figure 1).

Methodology

Sample and data

Considering the data availability, the sample used in this paper is Chinese firms listed on the Shanghai and Shenzhen Stock Exchanges between 2011 and 2021. Data related to financial and other information were obtained from reputable sources: China Stock Market & Accounting Research (CSMAR) Database and China Research Data Service (CNRDS) Platform. These databases are widely recognized as authoritative sources of information on publicly listed firms in China. To ensure the quality and relevance of the sample, certain criteria were applied during the selection process. First, firms belonging to financial industries that are supervised by the China Banking Regulatory Commission and the China Securities Regulatory Commission were excluded; second, observations with insufficient information to evaluate greenwashing behaviour were excluded; third, observations with other missing data were also excluded. Ultimately, a final sample of 25,985 observations was generated, including 2991 listed firms from 79 non-financial industries. Table 1 provides information on sample firms by ownership and location.

| Province | Number of firms | State-owned enterprises | Non-state-owned enterprises |

|---|---|---|---|

| Guangdong | 496 | 87 | 409 |

| Zhejiang | 386 | 31 | 355 |

| Jiangsu | 351 | 50 | 301 |

| Beijing | 258 | 103 | 155 |

| Shanghai | 220 | 63 | 157 |

| Shandong | 186 | 54 | 132 |

| Fujian | 109 | 27 | 82 |

| Sichuan | 107 | 38 | 69 |

| Anhui | 95 | 37 | 58 |

| Hunan | 87 | 35 | 52 |

| Hubei | 75 | 28 | 47 |

| Henan | 67 | 27 | 40 |

| Liaoning | 53 | 17 | 36 |

| Hebei | 50 | 22 | 28 |

| Jiangxi | 46 | 22 | 24 |

| Tianjin | 44 | 22 | 22 |

| Shaanxi | 43 | 26 | 17 |

| Chongqing | 40 | 14 | 26 |

| Xinjiang | 38 | 22 | 16 |

| Shanxi | 29 | 18 | 11 |

| Jilin | 28 | 16 | 12 |

| Gansu | 27 | 12 | 15 |

| Yunnan | 26 | 15 | 11 |

| Guizhou | 25 | 13 | 12 |

| Heilongjiang | 25 | 11 | 14 |

| Guangxi | 24 | 12 | 12 |

| Inner Mongolia | 20 | 7 | 13 |

| Hainan | 17 | 6 | 11 |

| Ningxia | 11 | 6 | 5 |

| Qinghai | 8 | 2 | 6 |

| Total | 2991 | 843 | 2148 |

Variable measurement

Dependent variable

Lyon and Maxwell (2011, p. 9) define greenwashing as the ‘selective disclosure of positive information about a company's environmental or social performance, without full disclosure of negative information on these dimensions, so as to create an overly positive corporate image’, while Walker and Wan (2012, p. 231) view greenwashing as ‘symbolic information emanating from within an organization without substantive actions’ or the ‘discrepancy between symbolic and substantive actions’. In this paper, we focus on environmental greenwashing, and hence the environmental dimension of information disclosure. We see both selective information disclosure and symbolic information disclosure as representative forms of corporate greenwashing, as they involve the intentional distortion of environmental information disclosure to create a falsely positive corporate image to a large extent.

To measure greenwashing, following Huang and Huang (2020) and Li et al. (2023), we employed a two-step approach for content analysis. In the first step, we constructed an environmental information disclosure indicator system. Two of the authors independently coded all the reports, including annual reports and corporate social responsibility reports. The coding process was iterative until the coders could no longer identify any additional distinct and meaningful indicators. A comparison of the constructs indicates a high and satisfactory inter-coder rate (k = 0.86), and any disagreements were resolved through extensive discussions between all the authors. Ultimately, we obtained four key indicators1 and 37 sub-indicators to capture a firm's environmental performance and actions. Table 2 provides detailed coding information about the environmental information disclosure indicator system of firms.

| First-level indicator | Second-level indicator |

|---|---|

| Green debt and governance | Description of wastewater discharges |

| Description of waste gas (ozone-depleting substances, nitrogen-oxides) emissions | |

| Description of sulphur oxide gas emissions | |

| Description of greenhouse gas emissions | |

| Description of dust and smoke emissions | |

| Description of industrial solid waste generation | |

| Description of reduction and control of wastewater discharges | |

| Description of reduction and control of waste gas (ozone-depleting substances, nitrogen-oxides) emission | |

| Description of control of dust and smoke emissions | |

| Description of utilization and disposal of solid waste | |

| Description of control of noise, light pollution and radiation | |

| Description of cleaner production implementation | |

| Environmental investment expenditures or borrowings | |

| Environmental protection tax and pollutant discharge fee | |

| Emergency expenditures for major environmental issues | |

| Green effectiveness and benefits | Description of the benefits of reducing pollution |

| Description of wastage utilization revenue | |

| Description of environmental grants, subsidies, exemptions and incentive incomes | |

| Measures and results of energy conservation | |

| Description of environmental measures and improvements | |

| Attainment of the type and quantity of pollutant discharges | |

| Green regulation and certification | Description of key pollution monitoring |

| Description of pollutant discharge attainment | |

| Description of the environmental emergency matters | |

| Description of environmental violations | |

| Description of environmental petition cases | |

| Description of whether the firm has been certified by ISO14001 Environmental Management System | |

| Description of whether the firm has been certified by ISO9001 Quality Management System | |

| Green management | Description of corporate environmental protection concept and policy, green organizational structure, green development model, etc. |

| Achievement of past environmental targets and description of future environmental targets | |

| Descriptions of environmental management system, regulations and responsibilities, etc. | |

| Description of environmental education and training | |

| Description of social welfare activities, such as special environmental protection activities | |

| Descriptions of emergency response mechanisms for major environment-related emergencies, emergency measures and the treatment of pollutants | |

| Description of environmental honours or awards | |

| Description of the ‘three simultaneous’ systema | |

| Independent Social Responsibility Sustainability Report and Independent Environmental Report |

- Source: Authors’ own elaboration.

- a The ‘three simultaneous’ system is a fundamental environmental management system for construction projects in China. It requires that environmental protection facilities be designed, constructed and put into operation simultaneously with the main construction project. This ensures that environmental considerations are embedded throughout the entire project lifecycle.

If an indicator item in Table 2 is disclosed in a firm's report, then the corresponding indicator item is assigned the value 1, otherwise 0. Among the disclosed items, if the description is quantitative, a value of 0 is assigned; otherwise 1. Take China Railway Construction as an example. Its 2018 Social Responsibility Report did not cover the description regarding the matter of industrial solid waste generation, thus this item was assigned the value 0; meanwhile, the firm claimed that it had engaged in environmental education and training, it did not disclose quantitative data such as the number of trainees, therefore it was seen as a qualitative disclosure in the disclosed matters, and assigned the value 1.

Independent variables

- 1

Standardize the original data. The original data are normalized to eliminate the influence of dimension on index construction. The selected indicators are all positive indicators, thus the following equation is applied for data standardization:

(4)

- 2

Calculate the variation degree:

(5)

- 3

Calculate entropy:

(6)

- 4

Calculate the weight of each index using information entropy:

(7)

- 5

Synthesize the first-level index using the weighted values:

(8)

For example, to obtain the level of FinTech adoption of Shenzhen Energy in 2020, we combined ‘Shenzhen Energy’ with FinTech keywords for each dimension in the advanced search of Baidu News and summarized the number of webpages retrieved by each dimension keyword in 2020 (13,071, 594, 1987 and 9268 pages, respectively), and performed logarithmic transformation to obtain the keyword webpage frequency in the four dimensions. After entropy weighting, we integrated the keyword webpage frequencies of Shenzhen Energy in four dimensions and obtained its level of FinTech adoption.

Moderating variables

Heavy-polluting industry is a dummy variable that takes the value 1 if the firm belongs to an industry categorized as a heavy-polluting industry, and 0 otherwise. The classification of heavy-polluting industries is based on the Guidelines for the Classification of Listed Firms issued by the China Securities Regulatory Commission in 2012. The specific industry codes associated with heavy-polluting industries are B06, B07, B08, B09, C17, C19, C22, C25, C26, C28, C29, C30, C31, C32, C33 and D44.

High-tech industry is also a dummy variable that takes the value 1 if the firm belongs to the high-tech industry sector, and 0 otherwise. The classification of high-tech firms is based on the directory of listed high-tech firms available in the CSMAR database.

Mediating variables

Green innovation refers to the innovative activities and achievements focused on environmental sustainability. It represents a firm's efforts in developing and implementing innovative technologies with positive environmental impacts (de Rassenfosse and Jaffe, 2018). To measure green innovation, Bakker et al. (2016) and Huang et al. (2023) suggest using the number of times a firm's green innovation patent has been cited by others. The rationale behind this approach is that a higher number of citations suggests greater recognition and influence of a firm's green innovation within the field. Therefore, this paper uses the number of green innovation patent citations in a firm in a given year to measure green innovation.

Control variables

First, this paper includes several financial variables, corporate governance variables, R&D variables and location variables as controls to account for their potential effects on FinTech adoption and corporate greenwashing (Delmas and Burbano, 2011; Huang, Meoli and Vismara, 2020; Ruiz-Blanco, Romero and Fernandez-Feijoo, 2022). Table 3 shows the measurement of variables and their data sources.

| Variable type | Variable name | Measurement | Data source |

|---|---|---|---|

| Dependent variable | Corporate greenwashing | See Equation (3) | Various official reports of a firm |

| Independent variable | FinTech adoption | FinTech adoption index | Authors’ own |

| Moderating variables | Heavy-polluting industry | Valued 1 if a firm belongs to a heavy-polluting industry; otherwise, 0 | CSMAR |

| High-tech industry | Valued 1 if a firm belongs to a high-tech industry; otherwise, 0 | ||

| Mediating variables | Green innovation quality | Number of green innovation patent citations | CNRDS |

| Managerial efficiency | See Equation (9) | CSMAR | |

| Control variables | Return on investment | Measured by return on total assets, calculated through current investment income/(long-term equity investment current period end value + holding to maturity investment current period end value + trading financial assets current period end value + available for sale financial assets current period end value + derivative financial assets current period end value) | |

| Cash flow ratio | Net cash flow from operating activities/total assets | ||

| Total asset turnover | Operating income/total average assets | ||

| Growth rate | Current year's operating income/previous year's operating income − 1 | ||

| Loss | Valued 1 if the net profit is less than 0; otherwise, 0 | ||

| Board members | The natural logarithm of the number of board members | ||

| Independent director ratio | The number of independent directors divided by the number of directors | ||

| CEO duality | Valued 1 if the chairman and CEO are the same person; otherwise, 0 | ||

| Equity balance | The sum of the proportion of shares held by the second to the fifth major shareholders divided by the proportion of shares held by the largest shareholder | ||

| State ownership | Valued 1 if a firm is state owned; otherwise, 0 | ||

| Firm listing age | The logarithm of the number of years that a firm has listed on the stock market | ||

| Sales expenses | The natural logarithm of sales expenses | ||

| R&D investment ratio | R&D expenditure divided by a firm's annual operating income | ||

| Environmental rewards | Valued 1 if a firm has received environmental rewards; otherwise, 0 | CNRDS | |

| Environmental punishment | Valued 1 if a firm has received environmental punishments; otherwise, 0 | ||

| Population density | Ratio of the number of permanent resident population in a province to the total area (square kilometre) of the province | China National Bureau of Statistics | |

| Per capita education years | The average number of years of education (including primary education, secondary education and higher education, etc.) received by the population in the province where a firm is located |

Model settings

Empirical results

Descriptive statistics and correlation

Table 4 presents descriptive statistics for each variable. The results show that the maximum degree of corporate greenwashing is 98.32 and the minimum 25.82, suggesting a significant disparity in greenwashing practices among firms. The maximum value of FinTech adoption is 10.32, while the minimum value is 4.737, and the average value is 7.194. The uneven distribution of FinTech adoption, indicated by the large difference between the maximum and minimum values, indicates that different firms have varying degrees of engagement with FinTech adoption. The wide ranges between the maximum and minimum values across all financial variables suggest significant variations in the financial performance of the sampled firms.

| Variable | N | Mean | SD | Min | Max | VIF |

|---|---|---|---|---|---|---|

| Corporate greenwashing | 25,895 | 84.55 | 14.72 | 25.82 | 98.32 | |

| FinTech adoption | 25,894 | 7.194 | 0.593 | 4.737 | 10.32 | 1.39 |

| Return on investment | 21,113 | 0.332 | 1.254 | −1.091 | 17.70 | 1.00 |

| Cash flow ratio | 25,895 | 0.050 | 0.070 | −0.742 | 0.726 | 1.14 |

| Total asset turnover | 25,894 | 0.640 | 0.442 | −0.048 | 12.37 | 1.15 |

| Growth rate | 25,371 | 0.155 | 0.290 | −0.490 | 2.077 | 1.10 |

| Loss | 25,895 | 0.097 | 0.296 | 0.000 | 1.000 | 1.11 |

| Board members | 25,893 | 2.125 | 0.199 | 1.099 | 2.890 | 1.61 |

| Independent director ratio | 25,893 | 0.376 | 0.056 | 0.143 | 0.800 | 1.47 |

| CEO duality | 25,895 | 0.293 | 0.455 | 0.000 | 1.000 | 1.14 |

| Equity balance | 25,894 | 0.369 | 0.287 | 0.001 | 1.000 | 1.06 |

| State ownership | 25,895 | 0.328 | 0.470 | 0.000 | 1.000 | 1.46 |

| Firm listing age | 25,895 | 2.013 | 0.891 | 0.000 | 3.434 | 1.35 |

| R&D investment ratio | 23,183 | 0.050 | 0.057 | 0.000 | 2.516 | 1.16 |

| Sales expenses | 25,602 | 18.04 | 2.390 | 0.000 | 25.03 | 1.27 |

| Environmental rewards | 25,895 | 0.032 | 0.176 | 0.000 | 1.000 | 1.02 |

| Environmental punishment | 25,895 | 0.001 | 0.037 | 0.000 | 1.000 | 1.00 |

| Population density | 25,484 | 6.295 | 0.915 | 2.683 | 8.275 | 1.58 |

| Per capita education years | 25,895 | 9.645 | 1.060 | 7.474 | 12.78 | 1.67 |

| Heavy-polluting industry | 25,895 | 0.287 | 0.452 | 0.000 | 1.000 | |

| High-tech industry | 25,895 | 0.657 | 0.475 | 0.000 | 1.000 |

To assess multicollinearity, this paper calculates the variance inflation factor (VIF) of variables, with the highest value of 1.67, which is below the commonly used threshold of 2.5, indicating that multicollinearity is not a serious problem.

Table 5 presents the correlation matrix of variables. The maximum correlation coefficient is 0.598. This indicates a low level of multicollinearity among the variables, which supports reasonable variable selection. Meanwhile, the correlation coefficient between FinTech and corporate greenwashing is significantly negative (−0.343), implying that there is a certain degree of greenwashing alleviation with FinTech adoption.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Corporate greenwashing | 1.000 | |||||||

| FinTech adoption | −0.343*** | 1.000 | ||||||

| Return on investment | 0.028*** | −0.028*** | 1.000 | |||||

| Cash flow ratio | −0.150*** | 0.275*** | −0.004 | 1.000 | ||||

| Total asset turnover | −0.111*** | 0.124*** | 0.015** | 0.104*** | 1.000 | |||

| Growth rate | 0.021*** | 0.118*** | 0.001 | 0.024*** | 0.133*** | 1.000 | ||

| Loss | 0.035*** | −0.064*** | −0.015** | −0.184*** | −0.108*** | −0.202*** | 1.000 | |

| Board members | −0.153*** | 0.159*** | −0.020*** | 0.050*** | 0.014** | −0.030*** | −0.026*** | 1.000 |

| Independent director ratio | 0.022*** | 0.013** | 0.002 | −0.005 | −0.018*** | 0.000 | 0.018*** | −0.546*** |

| CEO duality | 0.103*** | −0.090*** | 0.013* | −0.018*** | −0.034*** | 0.048*** | −0.020*** | −0.175*** |

| Equity balance | 0.029*** | −0.023*** | 0.001 | −0.015** | −0.060*** | 0.037*** | 0.000 | 0.008 |

| State ownership | −0.191*** | 0.184*** | −0.032*** | 0.008 | 0.020*** | −0.103*** | 0.041*** | 0.280*** |

| Firm listing age | −0.224*** | 0.198*** | −0.052*** | 0.017*** | −0.004 | −0.104*** | 0.147*** | 0.140*** |

| R&D investment ratio | 0.169*** | −0.114*** | −0.011 | −0.042*** | −0.234*** | −0.009 | 0.044*** | −0.104*** |

| Sales expenses | −0.196*** | 0.299*** | −0.008 | 0.112*** | 0.204*** | 0.014** | −0.037*** | 0.057*** |

| Environmental rewards | −0.038*** | −0.004 | 0.004 | 0.014** | 0.013** | −0.025*** | 0.020*** | 0.061*** |

| Environmental punishment | −0.012* | −0.009 | −0.004 | −0.006 | 0.002 | −0.014** | 0.023*** | 0.008 |

| Population density | 0.065*** | 0.034*** | −0.004 | 0.010 | 0.062*** | 0.015** | −0.044*** | −0.085*** |

| Per capita education years | 0.022*** | 0.131*** | −0.014** | −0.012* | −0.032*** | 0.025*** | −0.001 | −0.062*** |

| (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | |

|---|---|---|---|---|---|---|---|---|

| Board members | ||||||||

| Independent director ratio | 1.000 | |||||||

| CEO duality | 0.099*** | 1.000 | ||||||

| Equity balance | −0.017*** | 0.050*** | 1.000 | |||||

| State ownership | −0.051*** | −0.304*** | −0.212*** | 1.000 | ||||

| Firm listing age | −0.015** | −0.242*** | −0.132*** | 0.441*** | 1.000 | |||

| R&D investment ratio | 0.043*** | 0.129*** | 0.104*** | −0.178*** | −0.151*** | 1.000 | ||

| Sales expenses | 0.013** | 0.001 | −0.008 | 0.015** | 0.120*** | −0.044*** | 1.000 | |

| Environmental rewards | −0.027*** | −0.046*** | −0.038*** | 0.068*** | 0.023*** | −0.071*** | −0.002 | 1.000 |

| Environmental punishment | −0.007 | −0.006 | −0.004 | 0.018*** | 0.012* | −0.014** | 0.009 | 0.029*** |

| Population density | 0.033*** | 0.097*** | 0.042*** | −0.112*** | −0.130*** | 0.117*** | 0.033*** | −0.046*** |

| Per capita education years | 0.064*** | 0.047*** | 0.014** | 0.016** | −0.010* | 0.162*** | 0.069*** | −0.064*** |

| (17) | (18) | (19) | |

|---|---|---|---|

| Environmental punishment | 1.000 | ||

| Population density | −0.007 | 1.000 | |

| Per capita education years | −0.014** | 0.598*** | 1.000 |

- Note: ***p < 0.01; **p < 0.05; *p < 0.10.

Hypothesis testing

We performed the Hausman test to select an appropriate model. The p-value obtained (p < 0.05) suggests that a fixed-effect model is more appropriate than a random-effect model. Table 6 presents the empirical results, where model (1) and model (2) represent the results without controlling firm, year and province fixed effects, model (3) represents the result without control variables and model (4) includes control variables. Both models consistently show significant negative correlations between FinTech adoption and corporate greenwashing behaviour. The results confirm H1a, indicating that FinTech adoption is likely to alleviate the greenwashing behaviour of firms.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| FinTech adoption | −8.507*** | −6.259*** | −7.283*** | −5.130*** | −4.263*** | −5.666*** |

| (−58.77) | (−31.34) | (−51.08) | (−25.80) | (−18.97) | (−19.40) | |

| Heavy-polluting industry | 3.689 | |||||

| (1.47) | ||||||

| High-tech industry | −4.710* | |||||

| (−1.91) | ||||||

| FinTech adoption × heavy-polluting industry | −1.400*** | |||||

| (−4.09) | ||||||

| FinTech adoption × high-tech industry | 0.866** | |||||

| (2.55) | ||||||

| Return on investment | 0.193** | 0.232*** | 0.203*** | 0.229*** | ||

| (2.41) | (3.14) | (2.79) | (3.09) | |||

| Cash flow ratio | −16.015*** | −9.617*** | −9.142*** | −9.253*** | ||

| (−9.69) | (−6.06) | (−5.87) | (−5.83) | |||

| Total asset turnover | −1.466*** | −1.391*** | −0.971*** | −1.462*** | ||

| (−5.92) | (−5.90) | (−4.19) | (−6.20) | |||

| Growth rate | 2.579*** | 2.667*** | 2.379*** | 2.617*** | ||

| (6.93) | (7.58) | (6.89) | (7.44) | |||

| Loss | 1.111*** | 1.728*** | 1.877*** | 1.714*** | ||

| (3.04) | (5.07) | (5.60) | (5.03) | |||

| Board members | −5.479*** | −7.796*** | −7.220*** | −7.831*** | ||

| (−8.43) | (−12.67) | (−11.95) | (−12.74) | |||

| Independent director ratio | −5.984*** | −12.006*** | −11.640*** | −11.767*** | ||

| (−2.74) | (−5.88) | (−5.81) | (−5.77) | |||

| CEO duality | 0.244 | 0.457** | 0.405* | 0.446** | ||

| (1.02) | (2.05) | (1.85) | (2.01) | |||

| Equity balance | −1.088*** | −0.508 | −0.682** | −0.523 | ||

| (−2.96) | (−1.47) | (−2.01) | (−1.52) | |||

| State ownership | −2.148*** | −3.569*** | −3.317*** | −3.575*** | ||

| (−8.10) | (−13.77) | (−13.03) | (−13.79) | |||

| Firm listing age | −2.074*** | −1.324*** | −1.210*** | −1.336*** | ||

| (−14.29) | (−9.42) | (−8.76) | (−9.51) | |||

| R&D investment ratio | 22.149*** | 13.884*** | 7.647*** | 12.827*** | ||

| (11.55) | (7.06) | (3.93) | (6.49) | |||

| Sales expenses | −0.595*** | −0.450*** | −0.712*** | −0.459*** | ||

| (−9.27) | (−6.95) | (−11.05) | (−7.08) | |||

| Environmental rewards | −0.880 | −2.521*** | −1.546*** | −2.509*** | ||

| (−1.45) | (−4.37) | (−2.72) | (−4.35) | |||

| Environmental punishment | −2.404 | −3.151 | −2.186 | −3.204 | ||

| (−0.93) | (−1.31) | (−0.93) | (−1.33) | |||

| Population density | 0.486*** | 11.679** | 12.509*** | 11.902** | ||

| (3.36) | (2.51) | (2.74) | (2.56) | |||

| Per capita education years | 0.566*** | 0.388 | 0.391 | 0.387 | ||

| (4.63) | (0.54) | (0.55) | (0.54) | |||

| Constant | 145.746*** | 150.464*** | 136.940*** | 76.314** | 69.825** | 78.004** |

| (139.48) | (63.00) | (133.12) | (2.51) | (2.34) | (2.57) | |

| Firm FE | No | No | Yes | Yes | Yes | Yes |

| Year FE | No | No | Yes | Yes | Yes | Yes |

| Province FE | No | No | Yes | Yes | Yes | Yes |

| Observations | 25,894 | 18,081 | 25,894 | 18,080 | 18,080 | 18,080 |

| R-squared | 0.118 | 0.190 | 0.253 | 0.309 | 0.334 | 0.310 |

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

To understand the mechanisms through which FinTech adoption affects corporate greenwashing behaviour, Table 7 demonstrates the results of the mediating effects. This paper examines two mediating variables: green innovation and managerial efficiency. Model (2) shows that FinTech adoption is positively and significantly correlated with green innovation (β = 0.525, p < 0.01). This implies that higher levels of FinTech adoption led to stronger green innovation of firms. The results in model (3) show that both FinTech adoption and green innovation have inhibitory effects on corporate greenwashing (β = −4.781, p < 0.01; β = −0.665, p < 0.01, respectively). Compared to model (1), the mediation effect size in model (3) is −0.349 (−0.665 × 0.525), accounting for 6.80% of the overall explanatory effect of FinTech adoption on corporate greenwashing. These findings support H1b that improving green innovation is an important channel for reducing corporate greenwashing through FinTech adoption.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | Corporate greenwashing | Green innovation quality | Corporate greenwashing | Managerial efficiency | Corporate greenwashing |

| Green innovation quality | −0.665*** | ||||

| (−7.83) | |||||

| Managerial efficiency | −11.641*** | ||||

| (−11.86) | |||||

| FinTech adoption | −5.130*** | 0.525*** | −4.781*** | 0.038*** | −4.684*** |

| (−25.80) | (30.13) | (−23.50) | (25.45) | (−23.24) | |

| Return on investment | 0.232*** | −0.025*** | 0.216*** | −0.001** | 0.218*** |

| (3.14) | (−3.91) | (2.91) | (−2.28) | (2.94) | |

| Cash flow ratio | −9.617*** | −1.596*** | −10.677*** | −0.072*** | −10.453*** |

| (−6.06) | (−11.46) | (−6.71) | (−5.98) | (−6.60) | |

| Total asset turnover | −1.391*** | −0.010 | −1.397*** | 0.076*** | −0.511** |

| (−5.90) | (−0.46) | (−5.94) | (42.40) | (−2.08) | |

| Growth rate | 2.667*** | 0.088*** | 2.725*** | 0.011*** | 2.792*** |

| (7.58) | (2.84) | (7.76) | (4.03) | (7.97) | |

| Loss | 1.728*** | −0.133*** | 1.640*** | −0.053*** | 1.110*** |

| (5.07) | (−4.44) | (4.81) | (−20.57) | (3.23) | |

| Board members | −7.796*** | 0.381*** | −7.542*** | 0.018*** | −7.580*** |

| (−12.67) | (7.06) | (−12.27) | (3.97) | (−12.37) | |

| Independent director ratio | −12.006*** | 1.207*** | −11.204*** | 0.038** | −11.563*** |

| (−5.88) | (6.75) | (−5.49) | (2.47) | (−5.69) | |

| CEO duality | 0.457** | 0.023 | 0.472** | −0.001 | 0.446** |

| (2.05) | (1.16) | (2.12) | (−0.57) | (2.01) | |

| Equity balance | −0.508 | −0.002 | −0.509 | −0.006** | −0.578* |

| (−1.47) | (−0.06) | (−1.48) | (−2.31) | (−1.68) | |

| State ownership | −3.569*** | 0.208*** | −3.431*** | 0.034*** | −3.168*** |

| (−13.77) | (9.13) | (−13.23) | (17.59) | (−12.17) | |

| Firm listing age | −1.324*** | 0.071*** | −1.277*** | −0.001 | −1.330*** |

| (−9.42) | (5.79) | (−9.09) | (−0.52) | (−9.50) | |

| R&D investment ratio | 13.884*** | 1.848*** | 15.113*** | −0.734*** | 5.342** |

| (7.06) | (10.72) | (7.67) | (−49.33) | (2.56) | |

| Sales expenses | −0.450*** | 0.115*** | −0.374*** | −0.023*** | −0.716*** |

| (−6.95) | (20.21) | (−5.71) | (−46.55) | (−10.47) | |

| Environmental rewards | −2.521*** | −0.017 | −2.532*** | 0.025*** | −2.225*** |

| (−4.37) | (−0.34) | (−4.40) | (5.82) | (−3.87) | |

| Environmental punishment | −3.151 | 0.226 | −3.001 | 0.032* | −2.782 |

| (−1.31) | (1.07) | (−1.25) | (1.74) | (−1.16) | |

| Population density | 11.679** | −0.164 | 11.570** | 0.053 | 12.295*** |

| (2.51) | (−0.40) | (2.49) | (1.51) | (2.66) | |

| Per capita education years | 0.388 | −0.068 | 0.343 | 0.006 | 0.464 |

| (0.54) | (−1.08) | (0.48) | (1.20) | (0.65) | |

| Constant | 76.314** | −4.925* | 73.041** | 0.498** | 82.116*** |

| (2.51) | (−1.85) | (2.41) | (2.17) | (2.71) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 18,080 | 18,080 | 18,080 | 18,080 | 18,080 |

| R-squared | 0.309 | 0.268 | 0.311 | 0.448 | 0.315 |

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

Meanwhile, the results in model (4) indicate a significant and positive relationship between FinTech adoption and managerial efficiency (β = 0.038, p < 0.01). This implies that higher levels of FinTech adoption are associated with increased managerial efficiency in firms. Model (5) shows that both FinTech adoption and managerial efficiency have inhibitory effects on corporate greenwashing (β = −5.130, p < 0.01; β = −11.641, p < 0.01, respectively). When compared to model (1), the mediating effect size in model (5) is −0.442 (−11.641 × 0.038), accounting for 8.62% of the overall explanatory effect of FinTech adoption. These findings suggest that by improving managerial efficiency, FinTech adoption can reduce corporate greenwashing. Thus, H1c is confirmed. In addition, the Sobel test results confirm the presence of partial mediating effects, verifying that FinTech adoption can alleviate corporate greenwashing behaviour by enhancing both green innovation and managerial efficiency.

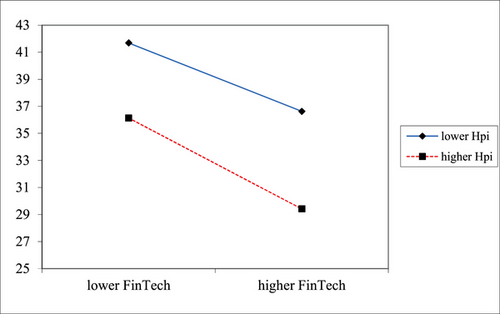

To further investigate the effect of FinTech adoption on corporate greenwashing behaviour in different industrial contexts, this paper introduces moderating variables into the regression model, namely heavy-polluting industry and high-tech industry, along with their interaction terms. In model (5) of Table 6, the coefficient of FinTech adoption remains significantly negative (β = −4.263, p < 0.01), and the coefficient of heavy-polluting industry is positive (β = 3.689). Notably, the regression coefficient of the interaction term FinTech adoption × heavy-polluting industry in model (5) of Table 6 is significantly negative (β = −1.400, p < 0.01). This means that the inhibitory effect of FinTech adoption on corporate greenwashing behaviour becomes stronger in heavy-polluting industries. Thus, H2a is confirmed.

Figure 2 visually depicts the moderating role of heavy-polluting industry in the relationship between FinTech adoption and corporate greenwashing behaviour. The solid line labelled ‘lower Hpi’ illustrates a slightly negative relationship between FinTech adoption and greenwashing behaviour for firms in non-heavy-polluting industries. By contrast, the dotted line labelled ‘higher Hpi’ appears to demonstrate an explicit negative relationship between FinTech adoption and greenwashing behaviour for those firms in heavy-polluting industries. These findings are consistent with H1a, which suggests that FinTech adoption shows a significant inhibitory effect on corporate greenwashing. However, the presence of heavy-polluting industry offsets this inhibitory effect of FinTech adoption on corporate greenwashing. Therefore, the results support H2a once again.

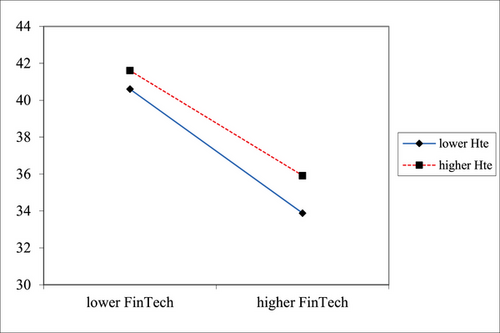

Model (6) in Table 6 shows that the regression coefficients of both FinTech adoption and high-tech industry are significantly negative (β = −5.666, p < 0.01; β = −4.710, respectively), indicating that both FinTech adoption and being in a high-tech industry benefit the reduction of corporate greenwashing. Furthermore, the regression coefficient of the interaction term FinTech adoption × high-tech industry in model (6) of Table 6 is significantly positive (β = 0.866, p < 0.5). This indicates a certain substitution effect between these two restraining forces, namely FinTech adoption and high-tech industry, on corporate greenwashing.

Figure 3 depicts the moderating effect of high-tech industry in the relationship between FinTech adoption and greenwashing behaviour of firms. A negative relationship between FinTech adoption and greenwashing is observed, which supports H1a once again. The solid line labelled ‘lower Hte’ displays a steeper negative slope, indicating a strong negative relationship between FinTech adoption and corporate greenwashing in non-high-tech industries. On the other hand, the dotted line labelled ‘higher Hte’ demonstrates a less steep slope, indicating a weaker negative relationship between FinTech adoption and corporate greenwashing in high-tech industries. This implies that in high-tech industries, the inhibitory effect of FinTech adoption on corporate greenwashing is weakened to some extent. Thus, H2b is confirmed once again.

Endogeneity and robustness tests

Corporate greenwashing behaviour is affected by many factors, and the problem of missing variables occurs inevitably in the regression. Meanwhile, a reverse causality may exist since corporate greenwashing behaviour might be forced to transform due to governmental regulation or social monitoring, thereby increasing the demand for financial services and affecting FinTech adoption. Therefore, to solve the endogeneity problem and potential reverse causality, this paper introduces IVs in a two-stage least squares (2SLS) regression. Two IVs are introduced to overcome the issues.

The first IV used is the penetration rate of higher education (Pro_edu) of each province, obtained from the National Bureau of Statistics of China from 2011 to 2021. Pro_edu is considered an appropriate IV for two reasons. First, the development of higher education is crucial for the rapid growth of FinTech. In general, FinTech is more accessible in regions with a higher level of higher education penetration rate. Second, historical higher education penetration rate is unlikely to have a direct impact on current corporate greenwashing, ensuring both relevance and exogeneity conditions are met. The second IV used is the 1-year lagged form of FinTech adoption (L.FinTech). Table 8 presents the results. In the first-stage regression, present in models (1), (3) and (5), the coefficients are significantly positive, satisfying the correlation conditions between the IVs and the endogenous variable. Meanwhile, the Kleibergen–Paap rk LM statistics reject under-identified IVs at the 1% significance level, the Kleibergen–Paap rk Wald F statistics are higher than the Stock–Yogo weak ID test critical values, rejecting weak IVs, and the Hansen J statistic rejects over-identified IVs. In the second-stage regression results present in models (2), (4) and (6), the coefficients remain significantly negative, generating similar results to those mentioned previously.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| First stage | Second stage | First stage | Second stage | First stage | Second stage | Time trend | |

| (Pro_edu) | (Pro_edu) | (L.Fintech) | (L.Fintech) | (All) | (All) | ||

| Variable | FinTech adoption | Corporate greenwashing | FinTech adoption | Corporate greenwashing | FinTech adoption | Corporate greenwashing | Corporate greenwashing |

| FinTech adoption | −32.381*** | −8.313*** | −8.491*** | −2.695*** | |||

| (−8.39) | (−26.80) | (−27.43) | (−7.04) | ||||

| Pro_edu | 1.398*** | 0.968*** | |||||

| (9.72) | (8.62) | ||||||

| L.FinTech | 0.691*** | 0.689*** | |||||

| (117.19) | (116.96) | ||||||

| Time trend | 3.043*** | ||||||

| (7.52) | |||||||

| FinTech adoption × time trend | −0.402*** | ||||||

| (−7.43) | |||||||

| Return on investment | −0.007** | 0.010 | −0.003 | 0.178** | −0.003 | 0.176** | 0.232*** |

| (−2.33) | (0.09) | (−1.15) | (2.06) | (−1.18) | (2.04) | (3.14) | |

| Cash flow ratio | 2.004*** | 36.774*** | 0.981*** | −11.440*** | 0.973*** | −11.073*** | −9.739*** |

| (33.64) | (4.53) | (20.59) | (−6.30) | (20.45) | (−6.10) | (−6.14) | |

| Total asset turnover | 0.018* | −1.036*** | 0.015** | −1.540*** | 0.016** | −1.538*** | −1.367*** |

| (1.93) | (−2.95) | (2.15) | (−5.94) | (2.28) | (−5.93) | (−5.79) | |

| Growth rate | 0.265*** | 9.519*** | 0.312*** | 3.082*** | 0.312*** | 3.132*** | 2.627*** |

| (19.40) | (8.30) | (29.55) | (7.83) | (29.59) | (7.95) | (7.48) | |

| Loss | −0.036*** | 0.168 | 0.158*** | 1.152*** | 0.158*** | 1.145*** | 1.516*** |

| (-2.63) | (0.32) | (15.03) | (3.05) | (15.05) | (3.03) | (4.44) | |

| Board members | 0.376*** | 4.306** | 0.101*** | −5.178*** | 0.103*** | −5.113*** | −7.773*** |

| (15.67) | (2.53) | (5.36) | (−7.51) | (5.46) | (−7.41) | (−12.66) | |

| Independent director ratio | 1.026*** | 20.070*** | 0.331*** | −4.672** | 0.353*** | −4.493* | −11.831*** |

| (12.67) | (4.09) | (5.24) | (−2.02) | (5.59) | (−1.94) | (−5.80) | |

| CEO duality | −0.024*** | −0.425 | −0.006 | 0.223 | −0.005 | 0.218 | 0.506** |

| (−2.72) | (−1.22) | (−0.81) | (0.89) | (−0.68) | (0.87) | (2.28) | |

| Equity balance | 0.039*** | −0.117 | 0.025** | −0.871** | 0.026** | −0.864** | −0.477 |

| (2.85) | (−0.22) | (2.35) | (−2.26) | (2.48) | (−2.24) | (−1.39) | |

| State ownership | 0.092*** | 0.168 | 0.020*** | −2.041*** | 0.022*** | −2.026*** | −3.471*** |

| (9.31) | (0.33) | (2.58) | (−7.28) | (2.87) | (−7.22) | (−13.24) | |

| Firm listing age | 0.058*** | −0.534* | 0.043*** | −1.883*** | 0.043*** | −1.868*** | −1.563*** |

| (10.82) | (−1.76) | (8.95) | (−10.64) | (8.84) | (−10.55) | (−7.64) | |

| R&D investment ratio | −0.849*** | −0.050 | −0.208*** | 20.941*** | −0.211*** | 20.797*** | 13.785*** |

| (−11.96) | (−0.01) | (−3.78) | (10.42) | (−3.83) | (10.34) | (7.02) | |

| Sales expenses | 0.101*** | 2.060*** | 0.030*** | −0.395*** | 0.030*** | −0.376*** | −0.455*** |

| (44.71) | (5.13) | (15.79) | (−5.42) | (15.77) | (−5.17) | (−7.01) | |

| Environmental rewards | −0.070*** | −2.927*** | −0.054*** | −1.188* | −0.048*** | −1.203* | −2.593*** |

| (−3.08) | (−3.25) | (−3.06) | (−1.84) | (−2.73) | (−1.86) | (−4.50) | |

| Environmental punishment | −0.194** | −7.215* | −0.083 | −2.638 | −0.089 | −2.667 | −3.017 |

| (−2.01) | (−1.96) | (−1.13) | (−0.99) | (−1.22) | (−1.00) | (−1.26) | |

| Population density | −0.009* | 0.017 | −0.013*** | 0.428*** | −0.007* | 0.425*** | 0.021*** |

| (−1.71) | (0.08) | (−3.19) | (2.85) | (−1.76) | (2.82) | (3.20) | |

| Per capita education years | −0.053*** | 2.679*** | 0.031*** | 0.829*** | −0.061*** | 0.843*** | 0.206 |

| (−3.64) | (7.55) | (8.95) | (6.44) | (−5.42) | (6.54) | (0.28) | |

| Constant | 4.249*** | 235.922*** | 0.951*** | 157.520*** | 1.640*** | 158.087*** | 117.411*** |

| (32.22) | (18.11) | (13.73) | (60.27) | (15.52) | (60.48) | (13.35) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 18,081 | 18,081 | 16,727 | 16,727 | 16,727 | 16,727 | 18,080 |

| R-squared | 0.284 | 0.184 | 0.607 | 0.185 | 0.609 | 0.185 | 0.311 |

| Kleibergen–Paap rk LM statistic | 12.517*** | 528.360*** | 538.332*** | ||||

| Kleibergen–Paap rk Wald F statistic | 12.589 | 657.171 | 335.679 | ||||

| Hansen J statistic | 0.000 | 0.000 | 6.989*** | ||||

| First-stage F statistic | 96.57 | 126.24 | 126.30 | ||||

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

In addition, considering that the relationship between FinTech adoption and greenwashing may change over time, we introduce the time trend variable into the regression, and the results of model (7) show that the ‘de-greenwashing’ effect of FinTech adoption increases over time.

To ensure the robustness of the empirical results, this paper conducts regression analysis using alternative dependent variables: selective information disclosure and symbolic information disclosure. Table 9 shows the results of robustness tests, which are consistent with the results discussed earlier. This consistency provides further support for the hypotheses put forward in the study.

| Selective information disclosure | Symbolic information disclosure | |||||

|---|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

| FinTech adoption | −6.561*** | −5.809*** | −7.108*** | −2.808*** | −1.975*** | −3.185*** |

| (−26.42) | (−20.64) | (−19.48) | (−16.48) | (−10.19) | (−12.72) | |

| Heavy-polluting industry | −1.640 | 8.324*** | ||||

| (−0.52) | (3.85) | |||||

| High-tech industry | −4.388 | −3.740* | ||||

| (−1.42) | (−1.77) | |||||

| FinTech adoption × heavy-polluting industry | −0.822* | −1.733*** | ||||

| (−1.92) | (−5.87) | |||||

| FinTech adoption × high-tech industry | 0.887** | 0.604** | ||||

| (2.09) | (2.07) | |||||

| Return on investment | 0.278*** | 0.246*** | 0.274*** | 0.158** | 0.136** | 0.156** |

| (3.00) | (2.70) | (2.97) | (2.49) | (2.17) | (2.46) | |

| Cash flow ratio | −12.111*** | −11.647*** | −11.649*** | −5.610*** | −5.206*** | −5.448*** |

| (−6.11) | (−5.97) | (−5.87) | (−4.12) | (−3.87) | (−4.00) | |

| Total asset turnover | −1.556*** | −1.045*** | −1.643*** | −0.969*** | −0.712*** | −1.006*** |

| (−5.29) | (−3.60) | (−5.58) | (−4.80) | (−3.55) | (−4.97) | |

| Growth rate | 3.396*** | 3.046*** | 3.335*** | 1.641*** | 1.462*** | 1.616*** |

| (7.73) | (7.04) | (7.59) | (5.45) | (4.91) | (5.36) | |

| Loss | 2.406*** | 2.593*** | 2.389*** | 0.701** | 0.787*** | 0.694** |

| (5.65) | (6.18) | (5.61) | (2.40) | (2.72) | (2.38) | |

| Board members | −9.349*** | −8.678*** | −9.396*** | −5.042*** | −4.659*** | −5.057*** |

| (−12.17) | (−11.47) | (−12.24) | (−9.57) | (−8.94) | (−9.59) | |

| Independent director ratio | −14.018*** | −13.587*** | −13.754*** | −8.402*** | −8.161*** | −8.254*** |

| (−5.50) | (−5.41) | (−5.40) | (−4.80) | (−4.72) | (−4.72) | |

| CEO duality | 0.646** | 0.588** | 0.636** | 0.166 | 0.129 | 0.158 |

| (2.33) | (2.15) | (2.29) | (0.87) | (0.69) | (0.83) | |

| Equity balance | −0.711* | −0.932** | −0.732* | −0.118 | −0.217 | −0.123 |

| (−1.65) | (−2.20) | (−1.70) | (−0.40) | (−0.74) | (−0.42) | |

| State ownership | −4.465*** | −4.168*** | −4.478*** | −2.146*** | −1.981*** | −2.142*** |

| (−13.79) | (−13.07) | (−13.83) | (−9.66) | (−9.02) | (−9.64) | |

| Firm listing age | −1.783*** | −1.653*** | −1.795*** | −0.609*** | −0.529*** | −0.619*** |

| (−10.15) | (−9.56) | (−10.22) | (−5.06) | (−4.44) | (−5.13) | |

| R&D investment ratio | 17.301*** | 9.941*** | 15.927*** | 8.632*** | 4.563*** | 8.193*** |

| (7.04) | (4.08) | (6.45) | (5.12) | (2.72) | (4.83) | |

| Sales expenses | −0.545*** | −0.847*** | −0.555*** | −0.286*** | −0.463*** | −0.290*** |

| (−6.72) | (−10.50) | (−6.85) | (−5.14) | (−8.33) | (−5.22) | |

| Environmental rewards | −3.252*** | −2.072*** | −3.224*** | −1.298*** | −0.690 | −1.306*** |

| (−4.51) | (−2.91) | (−4.47) | (−2.62) | (−1.41) | (−2.64) | |

| Environmental punishment | −4.267 | −3.097 | −4.326 | −1.543 | −0.944 | −1.574 |

| (−1.42) | (−1.05) | (−1.44) | (−0.75) | (−0.46) | (−0.76) | |

| Population density | 19.250*** | 20.414*** | 19.502*** | 0.887 | 1.247 | 1.020 |

| (3.32) | (3.57) | (3.36) | (0.22) | (0.32) | (0.26) | |

| Per capita education years | 0.239 | 0.265 | 0.235 | 0.548 | 0.526 | 0.549 |

| (0.27) | (0.30) | (0.26) | (0.89) | (0.87) | (0.89) | |

| Constant | 38.945 | 31.747 | 40.298 | 124.311*** | 119.626*** | 125.881*** |

| (1.03) | (0.85) | (1.06) | (4.77) | (4.64) | (4.83) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 18,080 | 18,080 | 18,080 | 18,080 | 18,080 | 18,080 |

| R-squared | 0.322 | 0.343 | 0.323 | 0.169 | 0.188 | 0.169 |

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

Further analysis

This paper further examines the mediating effect of green innovation and managerial efficiency on the relationship between FinTech adoption and corporate greenwashing behaviour in heavy-polluting industries. The result in model (1) of Table 10 shows a significant and strong alleviation effect of FinTech adoption on greenwashing in heavy-polluting industries (β = −4.711, p < 0.01), which verifies H2a. The results displayed in models (2) to (5) suggest that green innovation and managerial efficiency account for 12.10% and 16.17%, respectively, of the overall explanatory effect of FinTech adoption on corporate greenwashing behaviour in heavy-polluting industries. In comparison to the effect sizes of green innovation and managerial efficiency (6.80% and 8.62%, respectively) observed in the entire sample, the results indicate that when firms in heavy-polluting industries adopt FinTech, improving their managerial efficiency might be more effective at alleviating greenwashing compared to enhancing green innovation.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | Corporate greenwashing | Green innovation quality | Corporate greenwashing | Managerial efficiency | Corporate greenwashing |

| Green innovation quality | −1.397*** | ||||

| (−6.25) | |||||

| Managerial efficiency | −31.753*** | ||||

| (−11.02) | |||||

| FinTech adoption | −4.711*** | 0.408*** | −4.142*** | 0.024*** | −3.963*** |

| (−10.83) | (14.79) | (−9.35) | (11.10) | (−9.11) | |

| Return on investment | 0.429*** | −0.001 | 0.428*** | 0.000 | 0.435*** |

| (2.61) | (−0.12) | (2.61) | (0.21) | (2.67) | |

| Cash flow ratio | −10.844*** | −1.033*** | −12.286*** | −0.017 | −11.375*** |

| (−3.09) | (−4.64) | (−3.51) | (−0.98) | (−3.28) | |

| Total asset turnover | −1.903*** | 0.008 | −1.892*** | 0.056*** | −0.121 |

| (−3.89) | (0.25) | (−3.89) | (23.55) | (−0.24) | |

| Growth rate | 3.438*** | 0.144*** | 3.638*** | 0.017*** | 3.973*** |

| (4.05) | (2.67) | (4.30) | (4.07) | (4.73) | |

| Loss | 2.306*** | −0.098** | 2.169*** | −0.046*** | 0.855 |

| (3.06) | (−2.05) | (2.89) | (−12.45) | (1.13) | |

| Board members | −11.032*** | 0.399*** | −10.474*** | 0.029*** | −10.113*** |

| (−8.19) | (4.68) | (−7.79) | (4.40) | (−7.59) | |

| Independent director ratio | −0.381 | 0.808*** | 0.748 | 0.038* | 0.841 |

| (−0.08) | (2.67) | (0.16) | (1.65) | (0.18) | |

| CEO duality | 0.644 | −0.130*** | 0.462 | −0.011*** | 0.281 |

| (1.21) | (−3.85) | (0.87) | (−4.40) | (0.53) | |

| Equity balance | 0.181 | 0.001 | 0.183 | 0.001 | 0.197 |

| (0.22) | (0.03) | (0.23) | (0.13) | (0.25) | |

| State ownership | −4.967*** | 0.199*** | −4.688*** | 0.012*** | −4.589*** |

| (−8.40) | (5.32) | (−7.94) | (4.13) | (−7.84) | |

| Firm listing age | −1.603*** | 0.010 | −1.589*** | 0.006*** | −1.426*** |

| (−4.65) | (0.46) | (−4.62) | (3.32) | (−4.18) | |

| R&D investment ratio | 59.332*** | 3.273*** | 63.903*** | −0.635*** | 39.182*** |

| (5.30) | (4.61) | (5.72) | (−11.62) | (3.49) | |

| Sales expenses | −0.477*** | 0.087*** | −0.356** | −0.013*** | −0.902*** |

| (−3.38) | (9.68) | (−2.51) | (−19.47) | (−6.24) | |

| Environmental rewards | −2.006** | −0.144** | −2.207** | −0.001 | −2.032** |

| (−2.15) | (−2.43) | (−2.37) | (−0.18) | (−2.20) | |

| Environmental punishment | −3.450 | 0.567** | −2.657 | 0.025 | −2.651 |

| (−0.92) | (2.39) | (−0.71) | (1.38) | (−0.72) | |

| Population density | 25.651** | 0.751 | 26.700** | −0.070 | 23.429** |

| (2.27) | (1.05) | (2.37) | (−1.27) | (2.10) | |

| Per capita education years | 1.072 | −0.099 | 0.933 | 0.008 | 1.339 |

| (0.64) | (−0.94) | (0.56) | (1.03) | (0.81) | |

| Constant | −20.285 | −8.907* | −32.727 | 1.173*** | 16.964 |

| (−0.28) | (−1.95) | (−0.46) | (3.34) | (0.24) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 5013 | 5013 | 5013 | 5013 | 5013 |

| R-squared | 0.277 | 0.289 | 0.283 | 0.441 | 0.294 |

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

Meanwhile, this paper explores the mediating effect of green innovation and managerial efficiency on the relationship between FinTech adoption and corporate greenwashing behaviour in high-tech industries. The result in model (1) of Table 11 suggests that the greenwashing reduction effect of FinTech adoption is weakened in high-tech industries (β = −3.943, p < 0.01), verifying H2b. The results displayed in models (2) to (5) indicate that green innovation and managerial efficiency explain 6.26% and 4.43%, respectively, of the overall effect of FinTech adoption on corporate greenwashing behaviour in high-tech industries. Comparatively, when firms in high-tech industries adopt FinTech, improving green innovation appears to be a slightly more effective channel for reducing their greenwashing behaviour compared to enhancing managerial efficiency.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | Corporate greenwashing | Green innovation quality | Corporate greenwashing | Managerial efficiency | Corporate greenwashing |

| Green innovation quality | −0.576*** | ||||

| (−6.00) | |||||

| Managerial efficiency | −13.423*** | ||||

| (−11.78) | |||||

| FinTech adoption | −3.943*** | 0.429*** | −3.696*** | 0.013*** | −3.122*** |

| (−15.44) | (18.14) | (−14.31) | (6.61) | (−11.86) | |

| Return on investment | 0.104 | −0.024*** | 0.090 | −0.001 | 0.079 |

| (1.20) | (−3.02) | (1.04) | (−1.46) | (0.92) | |

| Cash flow ratio | −12.128*** | −1.645*** | −13.076*** | −0.098*** | −13.154*** |

| (−6.41) | (−9.39) | (−6.89) | (−6.01) | (−6.98) | |

| Total asset turnover | −2.668*** | −0.070*** | −2.709*** | 0.059*** | −1.702*** |

| (−9.84) | (−2.79) | (−10.00) | (25.55) | (−6.04) | |

| Growth rate | 2.761*** | 0.128*** | 2.834*** | 0.015*** | 2.842*** |

| (6.77) | (3.39) | (6.95) | (4.34) | (7.00) | |

| Loss | 1.463*** | −0.126*** | 1.391*** | −0.047*** | 0.741* |

| (3.70) | (−3.45) | (3.52) | (−13.83) | (1.86) | |

| Board members | −8.159*** | 0.385*** | −7.937*** | 0.002 | −7.689*** |

| (−11.19) | (5.71) | (−10.89) | (0.26) | (−10.59) | |

| Independent director ratio | −12.664*** | 1.202*** | −11.971*** | −0.009 | −11.944*** |

| (−5.12) | (5.24) | (−4.84) | (−0.42) | (−4.85) | |

| CEO duality | 0.490* | 0.026 | 0.505** | −0.002 | 0.510** |

| (1.94) | (1.10) | (2.00) | (−1.06) | (2.03) | |

| Equity balance | 0.279 | 0.041 | 0.303 | −0.009** | 0.190 |

| (0.69) | (1.10) | (0.75) | (−2.46) | (0.47) | |

| State ownership | −3.042*** | 0.224*** | −2.913*** | 0.046*** | −2.447*** |

| (−9.77) | (7.78) | (−9.35) | (17.28) | (−7.80) | |

| Firm listing age | −1.101*** | 0.064*** | −1.064*** | −0.013*** | −1.045*** |

| (−6.45) | (4.07) | (−6.24) | (−9.03) | (−6.16) | |

| R&D investment ratio | 8.646*** | 1.575*** | 9.553*** | −0.758*** | −1.056 |

| (4.29) | (8.44) | (4.73) | (−43.82) | (−0.49) | |

| Sales expenses | −0.984*** | 0.205*** | −0.865*** | −0.040*** | −1.514*** |

| (−10.20) | (23.00) | (−8.80) | (−12.71) | (−14.28) | |

| Environmental rewards | −2.290*** | 0.039 | −2.268*** | 0.036*** | −1.785** |

| (−3.19) | (0.58) | (−3.16) | (5.79) | (−2.49) | |

| Environmental punishment | −5.399* | 0.245 | −5.258* | 0.043* | −4.604* |

| (−1.93) | (0.95) | (−1.89) | (1.78) | (−1.66) | |

| Population density | 15.976*** | −0.945* | 15.431*** | 0.000 | 16.884*** |

| (2.99) | (−1.91) | (2.89) | (1.11) | (3.17) | |

| Per capita education years | 1.415* | −0.056 | 1.383 | 0.001 | 1.441* |

| (1.67) | (−0.71) | (1.63) | (0.11) | (1.71) | |

| Constant | 41.506 | −0.970 | 40.947 | 0.684*** | 48.831 |

| (1.18) | (−0.30) | (1.17) | (8.08) | (1.40) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Province FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 12,698 | 12,698 | 12,698 | 12,698 | 12,698 |

| R-squared | 0.316 | 0.256 | 0.318 | 0.393 | 0.323 |

- Note: Unstandardized regression coefficients are shown with t values in parentheses. ***p < 0.01; **p < 0.05; *p < 0.10.

Discussion and conclusion

Using panel data of Chinese listed firms in non-financial industries during 2011 and 2021, this paper explores the influence of FinTech adoption on corporate greenwashing for the first time, which provides a novel perspective for FinTech research. The empirical findings reveal that FinTech adoption by non-financial firms significantly inhibits corporate greenwashing, indicating that it offers technology affordances and helps reduce information asymmetry in the Chinese markets. Furthermore, this research demonstrates that FinTech adoption promotes green innovation and enhances managerial efficiency, thus contributing to the reduction of corporate greenwashing behaviour. The contextual analysis also explores the moderating effects of heavy-polluting industries and high-tech industries. It finds a stronger inhibitory effect of FinTech adoption on corporate greenwashing behaviour in heavy-polluting industries. Conversely, in high-tech industries, there is a substitution effect, where the inhibitory effect of FinTech adoption on corporate greenwashing is significantly weakened for firms operating in this sector.

Theoretical implications

First, the research contributes to the emerging literature on FinTech by focusing on its role in addressing corporate greenwashing issues (Zhang et al., 2022). While prior literature has debated the role of FinTech on information asymmetry, the findings present contrasting conclusions (Vismara, 2016). Most existing research contends that the adoption of FinTech mitigates information asymmetry. For instance, Du et al. (2020) construct a new type of supply chain financial platform which facilitates the information flow by using blockchain technology. Of course, some literature realizes that the emergence of FinTech may amplify information asymmetries between insiders and outsiders (Vismara, 2016). For instance, Zhou and Chen (2021) argue that the virtual nature of FinTech innovation aggravates the information asymmetries faced by regulators, and DeFusco, Tang and Yannelis (2022) suggest that welfare losses arise from information asymmetry in China's FinTech lending market. We elaborate on this discussion and uncover the specific effect of FinTech in the phenomenon of corporate greenwashing. Drawing upon affordance theory, we find that the adoption of FinTech is not readily employed to aggravate information asymmetry, but rather enhances the difficulty and cost of environmental information manipulation by firms through improving transparency. Our contribution lies in systematically exploring, for the first time, how the integration and precision features of FinTech compress the profit margin of corporate greenwashing behaviour, thus not only hindering the manipulation of environmental information disclosure, but also encouraging substantial environmental action and positive environmental performance. The findings highlight the alleviating effect of FinTech adoption for non-financial firms on artificially created information asymmetry. These observations raise scholars’ attention on the positive and negative effects of FinTech adoption in terms of information asymmetry and contribute to FinTech research by complementing the positive effect of FinTech adoption from the perspective of corporate greenwashing.

Second, our findings contribute to the sustainability literature by addressing the previously neglected greenwashing in corporate sustainability. While prior studies have largely discussed the antecedents and mechanisms of corporate sustainability, the exploration of a reverse perspective of sustainability (i.e. corporate greenwashing alleviation) remains in its infancy (Hameed et al., 2021; Wang, Ma and Bai, 2019; Wedari, Jubb and Moradi-Motlagh, 2021). Recent studies have explored and advanced how to curb corporate greenwashing from multiple perspectives, such as external institutional factors like environmental regulation and media coverage (Li et al., 2023; Ruiz-Blanco, Romero and Fernandez-Feijoo, 2022). However, to the best of our knowledge, a dearth of prior literature has been devoted to addressing the intrinsic power of technology affordance on greenwashing alleviation. In accordance with this, by focusing on the practice of FinTech adoption in Chinese non-financial firms, this research fills the gap by systematically revealing the unique role and mechanisms of FinTech in alleviating greenwashing. Drawing on the technology affordance perspective, we argue that the affordances offered by FinTech can enhance green innovation and managerial efficiency, and further reduce greenwashing. Taken together, the role of FinTech and the two mechanisms we identified contribute to explaining the greenwashing alleviation outcome, thus enriching the theoretical framework of corporate sustainability literature.

Third, we contribute to the literature on governance by understanding how the greenwashing alleviation effect of FinTech adoption varies in different industrial contexts. Prior research recognizes that the effect of technology adoption can vary in different contexts (Majchrzak et al., 2013). Ahlstrom, Cumming and Vismara (2018) suggest that governance through different legal and institutional conditions has played a pronounced role in shaping FinTech development, providing great opportunities for firms to improve their chances of success. For instance, since blockchain could reverse existing information asymmetries in the seafood industry, such innovation faces greater resistance and implementation challenges (Thompson and Rust, 2023). We add a new dimension to the governance literature by arguing that the governance in different industrial conditions and its intersection with FinTech provides a contextual affordance and significantly influences the possible outcome of FinTech adoption. We find that firms in heavy-polluting industries face stricter environmental supervision and higher pressure of green transformation and are more likely to reduce greenwashing from adopting FinTech, while the governance in high-tech firms supplements this effect of FinTech adoption due to their advanced governance structure and innovation capability. These findings provide implications for firms in other industrial contexts and conditions to address the governance challenges of FinTech and environmental information disclosure. The investigation regarding the interaction between technology affordance of FinTech and contextual affordances of different industries on corporate greenwashing contributes to a nuanced understanding of similar research on FinTech adoption in other industries and provides valuable solutions for addressing sustainability governance concerns faced by firms in various contexts.

Practical implications