Social Impact Business Angels as New Impact Investors

Abstract

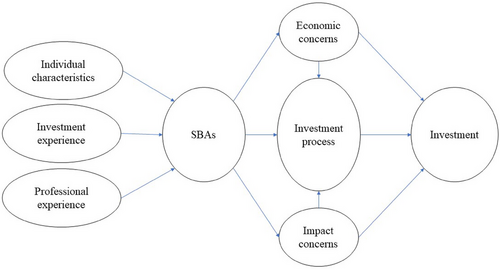

This study aims to understand how business angels (BAs) who intentionally prioritize investments in start-ups with a significant social impact (i.e. social impact business angels, SBAs) differ in their characteristics from non-social BAs. We also examine which features of the investment process of SBAs differ from those of non-social BAs, and whether social impact considerations are included in investors’ decision-making. The study also proposes a conceptual model that integrates the relationships between individual characteristics, the likelihood of acting as an SBA, and management of the investment process with the inclusion of both economic and impact concerns. Our analyses are based on a sample of 212 surveyed BAs and on follow-up interviews with 10 SBAs. We find that certain investor characteristics can explain how SBAs differ from non-social angels. SBAs follow a similar investment process to other BAs, but they conduct additional evaluations focused on the impact potential of the opportunities.

Introduction

Social impact start-ups – ventures that generate social, environmental, and economic impact through innovative solutions without disregarding financial returns – have been playing an increasingly dominant role in addressing social, environmental, and economic challenges over the last decade (Bacq and Lumpkin, 2021; Bhatt, 2022; Cojoianu et al., 2020; Pache and Santos, 2013). The search for financial resources to improve the growth aspirations of a business is one of the key problems faced by start-ups. This problem is even more relevant for social impact entrepreneurs (Arena et al., 2018; Ciambotti and Pedrini, 2021; Gupta et al., 2020), as their external sources of finance must accept the hybrid nature of these ventures.

Business angels (henceforth, BAs) are a pivotal source of external finance for early-stage start-ups (Maxwell, Jeffrey and Lévesque, 2011), especially during economic and financial crises (Mason and Botelho, 2021; Mason and Harrison, 2015). Additionally, BAs provide value-added contributions (Dutta and Folta, 2016; Sørheim and Botelho, 2016) that typically enhance the growth aspirations of new ventures (Cox, Lortie and Stewart, 2017; Fassin and Drover, 2017). Impact investing has been progressively endorsed by the angel community (OECD, 2019), as testified by the worldwide emergence of specialized angel groups that focus on this type of investment.1 Impact investing has been commonly understood as an investment that aims to achieve social and/or environmental benefits while generating economic returns (Höchstädter and Scheck, 2015; Tekula and Shah, 2016). This type of investment requires: (i) investor willingness to create social and/or environmental impact; and (ii) that the benefits generated can be measurable and, consequently, regularly tracked (Höchstädter and Scheck, 2015).

In this study, we identify the characteristics of a new type of angel investor – the social impact business angel (henceforth, SBA). SBAs are defined as angels who intentionally prioritize investments in ventures with a significant social impact and who have invested in at least one venture of this type. We examine the distinctive personal characteristics, professional experience, and investment expertise of SBAs. We then explore how the investment process of SBAs differs from that of non-social BAs, and how social impact concerns are integrated into their approach. Finally, we propose a conceptual model that integrates the relationships between individual characteristics/previous experiences (professional and investment), likelihood of acting as an SBA, and management of the investment process, with the inclusion of both economic and impact concerns.

To the best of our knowledge, this work is one of the first to study impact investments in the angel investing context. First, the extent to which SBAs are distinctive is still an unexplored area of the BA literature. Extant evidence on what characterizes this type of investment is currently limited (Botelho, Mason and Chalvatzis, 2022; Silby and Nicholas, 2015). Our research contributes to overcoming this gap in the literature by addressing the following first overarching research question: ‘How do the individual characteristics of SBAs differ from those of non-social BAs?’

Second, while the impact investing literature has long aimed to understand how investors balance social impact and financial evaluations (Agrawal and Hockerts, 2021; Islam, 2022; Lee, Adbi and Singh, 2020), very little is known about the investment practices of SBAs. Our research responds to calls for more research on impact investment decision-making (Islam, 2022; Lee, Adbi and Singh, 2020) by focusing on the SBAs’ investment process. Thus, we introduce a second interrelated research question: ‘How distinctive is the SBAs’ investment process?’

Consistent with other works (e.g. Owen et al., 2023; Peltokorpi, 2023), we adopt a mixed-method design, combining quantitative and qualitative methods (Creswell, 2013; Kaplan, 2015). This methodological approach provides greater depth and breadth of information and is suited for studying a research topic that is at least partially new (Edmondson and McManus, 2007; Yauch and Steudel, 2003).

Our results show that investor characteristics can moderately explain how SBAs differ from non-social angels. For example, a professional background such as being a freelancer or entrepreneur, positively affects the likelihood of making impact investments. Our findings contribute to extending the debate on the relevance of differences in individual investor characteristics and their impact on investment behaviour (Harrison, Botelho and Mason, 2016; Mitteness, Sudek and Cardon, 2012). In particular, we extend the findings of previous studies on how individual characteristics are related to BAs’ engagement in impact investing (e.g. Botelho, Mason and Chalvatzis, 2022) with a quantitative approach. We also find that SBAs follow an investment process similar to that of other BAs. However, during the investment process, SBAs conduct additional evaluations focused on the impact potential of opportunities. This is consistent with the impact investment literature (e.g. Block, Hirschmann and Fisch, 2021), which has noted that issues related to the authenticity of the founding team and similarities to other investors play a role in investors’ criteria. One conclusion of this finding is that SBAs have a hybrid approach between traditional BAs and impact investors. Additionally, SBAs use heuristics in their investment decisions, which has been previously identified in the angel investing literature (Maxwell, Jeffrey and Lévesque, 2011). Identifying the peculiarities and logics of the SBA impact investment process opens research avenues in both the related literatures while responding to calls for new research in this area from the angel (Tenca, Croce and Ughetto, 2018) and impact (Lee, Adbi and Singh, 2020) investing literatures.

The remainder of this paper is organized as follows. The following section illustrates the background literature and the research gaps. We then present the research design and the data collection process. This is followed by the results, and then the details of the integrated conceptual model. Finally, some conclusions are offered.

Background literature

Individual characteristics of angel investors

BAs’ characteristics were the focus of first-generation studies (Landström, 1993; Mason and Harrison, 2000; Mason, Harrison and Chaloner, 1991; Stedler, and Peters, 2003; Riding and Short, 1988 among others). This early angel research, known as ABC studies, focused on the attitudes, behaviour, and characteristics of angel investors (Botelho, 2017), portraying BAs as male, middle-aged, high-net-worth individuals, with considerable entrepreneurial experience and networks (Tenca, Croce and Ughetto, 2018).2

Some second-generation studies clustered angels by individual characteristics, highlighting a certain level of heterogeneity among the population of angels in terms of demographics, including income and education (Shane, 2008; Szerb et al., 2007), investing experience and competences (Avdeitchikova, 2008; Sørheim and Landström, 2001), investment practices and post-investment involvement (Lahti, 2011; Landström, 1992), and motivations (Freear, Sohl and Wetzel, 1994; Robinson and Cottrell, 2007). Prior studies have examined to what extent BAs’ distinct characteristics affect their modus operandi (see Tenca, Croce and Ughetto, 2018 for a review).

Individual characteristics of impact investors

Understanding the main characteristics of impact investors and their modus operandi is an emerging research area in entrepreneurial finance. To date, most impact investment research focuses on the institutional investor market rather than on individuals (see Table A1 in Appendix 1), and very limited evidence on angels that aim to achieve social or environmental goals is provided. Two main factors contribute to this. First, the opacity and inconsistencies of the impact investment industry (Agrawal and Hockerts, 2021; Höchstädter and Scheck, 2015) make it easier to identify institutional investors rather than individuals. Second, the identification of individuals investing in start-ups is challenging (Mason, Botelho and Harrison, 2019), also owing to the lack of homogeneity of the angel population (Harrison, Botelho and Mason, 2016), which makes it harder to construct high-quality samples of angel investors (Tenca, Croce and Ughetto, 2018). Scarlata, Walske and Zacharakis (2017) noticed that not all types of impact investor have been sufficiently analysed, in particular in an entrepreneurial finance context. Indeed, the few studies that focus on individual impact investors (Apostolakis et al., 2018; Block, Hirschmann and Fisch, 2021; Gautier, Pache and Santos, 2023; Lee, Adbi and Singh, 2020; Schrötgens and Boenigk, 2017) completely neglect angel financing.

Overall, the impact investing literature has shown that individual characteristics can influence: (i) the decision to invest (Smith et al., 2022), (ii) portfolio composition (Block, Hirschmann and Fisch, 2021), and (iii) engagement strategies (Lee, Adbi and Singh, 2020). Lee, Adbi and Singh (2020) noted that personal traits affect an investor's capacity to identify investment portfolios that optimize both financial and social outcomes. The same study highlighted that personal experiences and knowledge play a more significant role in the investment decision of individual impact investors than the potential returns that an opportunity may generate. Smith et al. (2022) showed how religious identity influenced the investment behaviours of Christian impact investors. According to Schrötgens and Boenigk (2017), age can predict the willingness to invest in impact opportunities. These authors found that younger investors were more likely to contribute part of their money to social impact investments. This is consistent with other studies that have identified that younger people have a higher likelihood of considering impact investments as a potential investment outlet (Apostolakis et al., 2018). A similar result can be found in the angel literature, as Botelho, Mason and Chalvatzis (2022) showed that BAs who have invested exclusively in green businesses tend to be younger. Similarly to BAs, individual impact investors have been presented as a heterogenous population with distinctive traits.3

Investment process in angel research

Most of the studies that look at the BA investment process have identified and described its different stages (Feeney, Haines and Riding, 1999; Haines, Madil and Riding, 2003; Mason and Harrison, 1996; Van Osnabrugge and Robinson, 2000). The multistage nature of the models developed has facilitated the understanding of stage specificities and the actions associated with each step. Haines, Madil and Riding (2003) present a seven-stage linear model characterizing the process from deal origination to exit.4 These stages are the result of the combination of previous models (Tyebjee and Bruno, 1984; Van Osnabrugge and Robinson, 2000) and reflect three sub-stages: investment motivations, investment criteria, and finding deals. Similar frameworks have been developed in the later angel investing literature (e.g. Paul, Whittam and Wyper, 2007). However, despite these developments, research on the BA investment process is still underdeveloped, with scholars highlighting potential future avenues of inquiry (Tenca, Croce and Ughetto, 2018). This literature gap has been amplified by the rise of angel groups, with the academic community still to investigate the impacts of these changes (Mason, Botelho and Harrison, 2019).

Investment process in impact investing research

Understanding how an investment process is handled by angel investors who are willing to invest in social impact start-ups is relevant and timely because it poses both a challenge and an opportunity for policy and practice. To the best of our knowledge, no studies have specifically focused on the distinct investment process followed by SBAs and, therefore, on how social and financial criteria are blended by these novel impact investors. In their preliminary work, Silby and Nicholas (2015) provided an overview of the phenomenon of angel impact investing by reporting specific examples of best practices, main tools used, and organizations involved. Botelho, Mason and Chalvatzis (2022) analysed BAs’ investment motivations on a subset of impact investments, namely financing green/clean businesses. Siefkes, Bjørgum and Sørheim (2023) studied the sustainability value-adding activities that BAs provide to the start-ups in which they invest, while Siefkes (2024) explored how BAs develop the know-how needed to offer sustainability-value-adding support.

Understanding how an investment process is handled by SBAs is particularly challenging as the adoption of existing metrics to assess the performance of social impact start-ups is still evolving and is by no means standard practice (Grimes, Gehman and Cao, 2018). A few reasons can be highlighted for the lack of adoption of universal metrics. First, there is the variety of existing social or sustainability certifications and the consequent difficulty in determining which metrics are the most appropriate to adopt. Second, investors want metrics that can balance economic and social or environmental evaluation logics (Glänzel and Scheuerle, 2016). For all these reasons, the limited legitimacy of existing impact metrics, especially in early-stage contexts, is not surprising (Grimes, Gehman and Cao, 2018). Lee, Adbi and Singh (2020) suggested that, in order to address the abovementioned issues, scholars and impact investors should transcend the conventional thinking that presents business and charity as separate domains. This suggestion was previously defended by Jackson (2013), who applied the theory of change to offer a mix of qualitative and quantitative methods to evaluate impact investments. Similarly, King (2017) endorses a holistic approach to evaluate social impact enterprises by using both qualitative and quantitative methods to measure potential social and economic value. Instead, Thompson (2023) reported a simplified investment process by showing how the impact and profit logics and related risks evolve as the process unfolds.5

In addition, investor heterogeneity in this domain clearly affects the variability of methods used to evaluate impact investments, with some investors emphasizing social gains, while others focus more on financial returns (Islam, 2022). It follows that the investment processes followed by different types of impact investor could be distinct (Elitzur and Gavious, 2003; Paul, Whittam and Wyper, 2007).

Method

Data sources

Consistent with other studies on angel investing (Mason, Botelho and Zygmunt, 2017) and impact investing (Harrer and Owen, 2022), this work adopted a mixed-method design, combining quantitative and qualitative methods (Creswell, 2013; Kaplan, 2015). We relied upon a quantitative analysis based on data collected, in 2021, through a survey of identified BAs. We then complemented this with 10 semi-structured interviews with SBAs. In accordance with Creswell (2013), we followed a sequential explanatory strategy. Initially, we used quantitative methods to understand how distinctive SBAs are, and followed this by a qualitative approach to explain the particularities of their investment process. Saunders, Lewis and Thornhill (2015) defend this approach, referring to, among others, three aspects that generate greater and dovetailed understandings of hitherto unexplored phenomena: facilitation, complementarity, and the study of different aspects.

One of the challenges in angel research is how to identify a population of BAs. To deal with this limitation, an original and comprehensive database of Italian BAs was developed. For more information about the two-step process undertaken to create our database, see Appendix 2.

An online survey was sent to the 1209 identified BAs, asking questions on demographics, investment behaviour, and investment preferences. The survey was developed in conjunction with gatekeepers of angel groups/networks and an entrepreneurial association supporting social impact start-ups. Given the novelty of impact investment, the involvement of practitioners was expected to provide additional insights that had not been identified in the literature. Nine angel organizations were actively involved in the data collection by sending the survey link to their members. A total of 378 responses were collected, with 359 being considered valid, representing a response rate of 30%. Response rates are not easy to calculate in angel research (see Botelho, 2017); nevertheless, the levels of participation achieved are in line with similar studies in the Italian literature (Bonini et al., 2018; Capizzi, Croce and Tenca, 2022). To increase data accuracy, two additional restrictions were imposed. First, participants had to have conducted at least one angel investment. Second, information about investing needed to be reported. A total of 147 data points were eliminated, which resulted in a final sample of 212 observations.

The sample collected is consistent with previous studies of the Italian angel market. The data reveal a strong male bias (92%) and an average age of 53 years. Most participants held a bachelor's degree (90%), with some having previously been an entrepreneur (42%). The average length of time as an angel investor was 6 years, with the majority of participants (54%) focusing on a specific sector or technology. Most BAs (83%) had invested as part of an angel group/network, and one-third invested solely through these organizations. On average, BAs in our sample had invested a total of €315,653 in nine opportunities, representing an average investment of €38,856 (median = €20,000). In terms of portfolio performance, on average, our participants had exited from 12% of their investments.

Participants were classified into two groups. The first comprised SBAs, and the second group consisted of all other (non-social) investors. SBAs were defined as investors who prioritize investments in social impact6 and who had conducted at least one angel investment in these start-ups. Thus, the other (non-social) BA group included angel investors who declared that they did not prioritize social impact investments, regardless of whether they had invested in this type of opportunity.

As a final step, a sample of SBAs was created from the original survey data. With the aim of capturing richer insights from SBAs’ investment processes, we selected SBAs who had at least 50% of their angel portfolio in social impact investments. This approach enhances the likelihood of finding behavioural differences, as more experienced investors tend to be more conscious of their actions (Zimmerman, 2008). Out of a total of 55 SBAs, 23 met the selection criteria, of whom 10 agreed to be interviewed. Table 1 depicts information about the 10 SBAs interviewed.

| ID | Main job positions | Age (years) | Investing experience (years) | Investments in the portfolio (n) |

|---|---|---|---|---|

| SBA1 | Manager and psychologist | 67 | 12 | 4 |

| SBA2 | Manager and consultant | 56 | 3 | 3 |

| SBA3 | Manager and consultant | 31 | 3 | 10 |

| SBA4 | Researcher and manager | 41 | 6 | 5 |

| SBA5 | Manager | 59 | 12 | 2 |

| SBA6 | Entrepreneur and consultant | 35 | 2 | 3 |

| SBA7 | Consultant and manager | 59 | 2 | 8 |

| SBA8 | Manager and entrepreneur | 56 | 9 | 30 |

| SBA9 | Manager and entrepreneur | 54 | 8 | 20 |

| SBA10 | University professor | 46 | 7 | 5 |

Semi-structured interviews were enriched with complementary data collected from secondary sources and archival data (e.g. personal websites, social media, newspaper articles, press-releases, blogs, and additional materials shared by the interviewees, for example personal notes). According to Puhakka (2017), this procedure increases the reliability and validity of research, while allowing the identification of any ex-post rationalization. A team of three researchers developed an interview protocol. On average, interviews lasted approximately 1 h and were performed online. All interviews were conducted and transcribed in Italian and only later translated into English. At the end of this process, a document of 153 single-spaced A4 pages was produced, which included about 3000 statements/comments.

Analysis

The sample analysed was the primary sample of 212 BAs, of whom only 148 provided all the data needed for the regression analyses (Model 1 in Table 5). Of these BAs, 25 also participated in a similar survey in the previous year; their responses from the previous year were used to test the robustness of the regression analyses (Models 3 and 4 in Table 5) by introducing a variable for the year of the survey to control for time-varying omitted variables. Furthermore, as the smaller number of SBAs compared with non-social BAs could lead to endogeneity problems, two regression models were run on a sample in which each SBA was matched with a non-social BA (Models 2 and 4 in Table 5). The comparison group of non-social BAs was identified using nearest-neighbour propensity score matching without replacement (e.g. Dehejia and Wahba, 2002) by means of the MatchIt package for the R language (Stuart et al., 2011). The propensity score was estimated using logistic regression. The matched samples included an equal number of SBAs and non-social BAs who were similar in terms of gender, years of experience in angel investing, and the primary geographic areas in which they operated.

Table 2 describes the variables included in the regression model. These variables were chosen with the aim of providing a broad explanation of what might influence an angel to invest in social impact start-ups. One feature that characterizes the human capital endowment of BAs is the know-how accumulated over years of investment activity, which often reflects a non-codified knowledge of the industry. BAs with years of investment experience are better able to identify the potential of business opportunities and are therefore potentially more receptive to an emerging investment area such as social impact investing.

| Variable name | Definition |

|---|---|

| SBAi | Dummy variable = 1 if the BAi is an SBA; = 0 otherwise (i.e. other non-social BAs) |

| Agei | BAi’s age |

| Genderi | Dummy variable = 1 if the BAi is female; = 0 if male |

| Areai | Categorical variable indicating the geographic areas where the BAi mainly operates: ‘Central Italy’, ‘South and Insular Italy’, ‘Northeast Italy’, ‘Northwest Italy’, ‘Abroad’ |

| Educationi | Categorical variable for education of the BAi: ‘Primary education or secondary education’, ‘Bachelor's degree’, ‘Master's, Executive or PhD education’ |

| Occupationi | Categorical variable for the present occupation of the BAi: ‘Other’, ‘Manager or employed in a company’, ‘Consultant or freelance’, ‘Entrepreneur’ |

| BA experiencei | Total years of the BAi's experience in angel investing |

| BA organizationi | Dummy variable = 1 if the BAi invests at least sometimes with a BA organization; = 0 otherwise |

| Specialized BAi | Dummy variable = 1 if the BAi invests only in specific technologies or sectors; = 0 otherwise (i.e. in all the technologies and sectors) |

| Extra servicesi | Dummy variable = 1 if the BAi provides supporting services to the invested start-ups; = 0 otherwise |

| Total no. of investmentsi | Total number of start-ups invested in by the BAi before the end of the last observation year |

| Total amount investedi | Total amount invested by the BAi before the end of the last observation year (in thousands of euros) |

| Total no. of exitsi | Total number of exits of the BAi before the end of the last observation yea. |

| Annual no. of investmentsi | Number of investments of the BAi in the last observation year |

| Annual amount investedi | Amount invested by the BAi in the last observation year (in thousands of euros) |

| Yeari | Year in which the BAi took the survey |

- Note: Years: 2020 and 2019.

- Source: original data collection in 2021 and 2020.

Accumulated investment knowledge helps to compensate for the ambiguity of a sector where the definition of players, practices, and standards remains uncertain and ambiguous. Age is another individual-level component that reflects different degrees of flexibility and risk-taking. Younger angels may be more flexible and risk-taking, and thus better able to seize new opportunities and secure greater commitments to new social impact ventures. In addition, an angel's level of education may reflect greater codified and cognitive knowledge that could be transferred to newly formed fields, as well as greater commitment, confidence, and problem-solving skills that may be required to manage investment opportunities in emerging domains. Investing with a BA group may be another driver that could influence an angel to invest in social impact start-ups, given the synergistic benefits that can arise from the heterogeneity of skills and professional backgrounds of the angels belonging to the group, which in turn broaden the strategic and evaluative perspectives for assessing social impact ventures. Finally, industry-specific experience, often in the form of uncodified knowledge of people, technologies, and other companies, can enable BAs to exploit promising market opportunities in this new emerging field.

A multiple case study approach was applied to address the second research question, ‘How distinctive is the SBAs' investment process?’ The unit of analysis was the investment process of each individual investor. As noted by Garg and Eisenhardt (2017), a multiple case study methodology is well suited when a process is the object of study, and the angel investing literature has already demonstrated its suitability for investigating the investment process of BAs (Bonnet and Wirtz, 2012; Cohen and Wirtz, 2022). A multiple case study approach has been suggested as a suitable method for angel research as it allows exploration of the factors that influence the potentially variable directions of the investment process (Bessière, Stéphany and Wirtz, 2020). This was supplemented by a CASET approach, as it is a template that provides 10 clear criteria to assess and develop robust case studies (Goffin et al., 2019). According to this framework, our research design achieved a score of 9 out of 10. As emphasized by Goffin et al. (2019), out of the 818 studies analysed in their work, only 23 studies (i.e. less than the 3%) obtained an overall quality score of 8 or more and are therefore indicated as ‘exemplary studies’.

A cross-case analysis was carried out. This follows the suggestions of Eisenhardt and Graebner (2007) and consists of a four-step process. In the first step, data were organized by participants in chronological order, with each story being reviewed and approved by three researchers. The 10 cases described the investment process of each individual investor. Then, similar to in other investment process studies (e.g. Cohen and Wirtz, 2022), the data were coded following an abductive procedure. In fact, we started from a given framework about the investment process of BAs derived from the prior literature (Haines, Madill and Riding, 2003). Transcriptions were independently read to generate first-order codes inductively. On average, each case was read four times by the two researchers. The generated codes were reviewed by the two researchers, who reached a 94% intercoder agreement.7 According to Saldaña (2021), this is an adequate level of agreement. At the end of this process, 2305 codes were generated. These first-order codes were conceptually aggregated into broader categories. As we were particularly interested in exploring the investment process of SBAs and the criteria involved, we looked for descriptions of investment stages, criteria, and the way these elements influenced the investment decision. Preliminary categories were compared, discussed, and revised by the researchers involved in the coding process. In line with previous literature (e.g. Mair, Battilana and Cardenas, 2012), the coders recoded the texts each time preliminary categories were created. At the end of this phase, a comparison between the codes identified by the researchers revealed that no new codes had emerged in the data, and therefore, in line with the consolidated literature (e.g. Birks and Mills, 2022; Given, 2015; Saunders et al., 2018), saturation in coding had been achieved.

Differences and commonalities across the 10 cases were analysed in a third stage. According to Eisenhardt (1989), this practice should be used to improve theoretical building. Then, the generated categories were compared with the investment process model suggested by Haines, Madill and Riding (2003) and the decision criteria coding scheme suggested by Botelho, Harrison and Mason (2023). According to Gioia, Corley and Hamilton (2013, p. 21), a comparison between findings from an inductive coding process and the relevant literature allows us ‘not only to see whether what we are finding has precedents, but also whether we have discovered new concepts’. Yin (2013) also defends this approach (analytic generalization) to generalize findings within an existing theory. Building on this methodological approach, the final categories were linked to the literature on the investment process and criteria of BAs through a systematic double-coding procedure. For this reason, statements were coded on the basis of references to the single stages. Similarly, statements were also coded based on the investment criteria, resulting in the identification of additional and peculiar SBA investment criteria related to the social or environmental impact. To increase confidence in the intercoder reliability of our overall results, two researchers were also involved in this phase. Table 3 shows the thematic codes and examples of representative quotes for each thematic code.

| Stages and specific contents | ||

|---|---|---|

| Stagea | Thematic code | Examples of representative quotes |

| Deal origination | BA organizations |

‘I am starting to rely on clubs to save time’ (SBA4) ‘I invest through the BA group of which I am a member’ (SBA7) |

| Incubators and accelerators |

‘I also look for possible investments through an incubator in my city’ (SBA1) ‘Accelerators and incubators introduce start-ups to me’ (SBA3) |

|

| Personal contacts |

‘There is word of mouth among BAs’ (SBA1) ‘I was offered investments by people who knew me’ (SBA9) |

|

| Initial screening | Economic evaluation |

‘I attempt to understand whether the venture will be able to also generate economic value for itself and its investors’ (SBA3) ‘I look at the potential for economic growth’ (SBA10) |

| Impact evaluation |

‘I attempt to evaluate whether there is a positive social or environmental impact generated by the start-up’ (SBA2) ‘I also evaluate the social or environmental impact’ (SBA10) |

|

| Greenwashing or impact washing |

‘I try to eliminate the risk of greenwashing’ (SBA2) ‘I try to eliminate the risk of impact washing completely. If I perceive that the entrepreneur only wants to use the impact for marketing purposes, namely, to do green or impact washing, I am not interested in the investment, not even if there is an economic return’ (SBA3) ‘Impact washing is what I evaluate right away’ (SBA7) |

|

| Due diligence | Validation of economic information |

‘I also engage external parties to check their reliability’ (SBA5) ‘Through due diligence, I check whether everything is confirmed’ (SBA6) |

| Validation of social impact information |

‘I check any past problem, and I try to carry out an appropriate investigation of what is declared’ (SBA5) ‘When potential investees declare a social impact, I request documents attesting to this positive impact’ (SBA9) |

|

| Negotiation | Identification of the deal |

‘Then, there is the phase in which some negotiation takes place’ (SBA4) ‘Subsequently, we define the conditions’ (SBA6) |

| Decision-making | Trade-off between social impact goals and business potential outcomes |

‘If, however, I see that there is a negative impact, even if the financial risk is low, I do not invest’ (SBA2) ‘In my opinion, if a startup is doing badly economically, the social or environmental impact goals will not be achieved’ (SBA 4) ‘The decision […] is balanced on both the axes: profit and sustainability’ (SBA5) |

| Post-investment activity | Mitigation of the business risk |

‘Having something to put into the startup is important. I have seen that just putting money in does not produce an impact’ (SBA1) ‘I try to support them to mitigate the business (impact and financial) risk’ (SBA7) ‘I try to be a good example for the startups I invest in’ (SBA10) |

| Investment criteria | ||

|---|---|---|

| Typology | Criteriab | Examples of representative quotes |

| Economic | The people |

‘First of all, the entrepreneur must believe in [the entrepreneurial project] unconditionally’ (SBA1) ‘It is important for me to understand if they have the know-how to develop it’ (SBA6) ‘I evaluate the team on the basis of its ability and attitude to listen and change quickly’ (SBA8) |

| Financial considerations |

‘Let there be few in the cap table’ (SBA1) ‘One of the things I look at is the cap table of a start-up’ (SBA2) ‘Very fragmented cap tables usually become a problem later on’ (SBA9) ‘Having some turnover is a criterion of preference’ (SBA4) ‘If you pitch me a business idea that already raised money, that makes a difference’ (SBA6) |

|

| Attributes of the business |

‘It must be a scalable business’ (SBA1) ‘I ensure that the investment meets defined financial metrics’ (SBA6) |

|

| Market |

‘I look at whether there is a detailed competitor analysis’ (SBA3) ‘I look at the market, therefore, what size of the market can be reached with that type of solution, how competitive the market is’ (SBA6) ‘The investment must be more market-driven’ (SBA7) ‘A project must certainly respond to a market demand’ (SBA8) |

|

| Social or environmental impact | Team's experience and authenticity |

‘[I look for] people who demonstrate that what they are telling me in terms of social impact is something they believe in’ (SBA 2) ‘So, [experience in social impact activities] is an extra guarantee for me because it is not just something that the founder believes in, but it comes from an experience that he/she did’ (SBA3) ‘I consider the person-related risks: maybe they are creating social impact enterprise only because they see a business opportunity in it, and not because they believe in social impact enterprises’ (SBA10) |

| Stakeholders’ ethical evaluation |

‘If funds particularly oriented towards sustainability and social impact are involved, I give more credibility to the project’ (SBA3) ‘Especially when it pertains to social impact, if there are big players involved in the start-up, they could affect both positively and negatively what the goals of the start-up are’ (SBA4) ‘You need to have stakeholders with the same values and similar motivations’ (SBA5) |

|

| Impact-oriented activities |

‘I look at start-ups that carry out activities that influence consumer behaviour towards sustainability’ (SBA5) ‘I am interested in understanding what initiatives are actually taken within the companies to ensure the achievement of social or environmental goals’ (SBA7) |

|

| Impact metrics |

‘I look at the type of impact indicator they choose to show’ (SBA3) ‘Impact metrics are elements that give you an indication of the path they want to take’ (SBA9) |

|

| Social impact certifications |

‘Having a certification, which implies a commitment to positive impact, gives me a little more confidence that the good intentions are true’ (SBA6) ‘If they received a social impact certification, it is a little more probable that they believe it. Either way, they have tried to understand it and spent time on it’ (SBA10) |

|

Results

SBAs and non-social BAs: A comparison of their characteristics

Table 4 depicts the descriptive statistics of the variables used in the regression analysis. SBAs constitute over a quarter of our sample (25.9%), with 55 of the 212 participants conducting this type of investment. Descriptive statistics indicate a few differences between SBAs and their counterparts. On average, considering the single variables, the only statistically significant difference between the two groups is that SBAs invested less than their counterparts in 2020, according to independent-sample t-tests (t(191) = 1.852, p = 0.066). More hypothesis tests are reported in Table 4. However, when all the variables were considered together in a logit regression model, more differences emerged. Results of the logistic regression on the likelihood of being an SBA are shown in Table 5 and indicate the presence of some differences between SBAs and their non-social counterparts.

| Variables | BA | Obs. | Mean | Median | Std dev. | Min | Max | Avg. diff. | 95% Conf. interval | d.o.f. | T | p-value |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SBA | SBA | 55 | 1.000 | 1 | 0.000 | 1 | 1 | |||||

| Other BA | 157 | 0.000 | 0 | 0.000 | 0 | 0 | ||||||

| All | 212 | 0.259 | 0 | 0.439 | 0 | 1 | ||||||

| Age (years) | SBA | 55 | 52.982 | 55 | 10.869 | 27 | 84 | −0.377 | [−3.647, 2.894] | 210 | −0.227 | 0.821 |

| Other BA | 157 | 52.605 | 53 | 10.489 | 26 | 78 | ||||||

| All | 212 | 52.703 | 53 | 10.564 | 26 | 84 | ||||||

| BA experience (years) | SBA | 55 | 5.455 | 5 | 3.891 | 1 | 22 | 0.930 | [−0.454, 2.314] | 209 | 1.325 | 0.187 |

| Other BA | 156 | 6.385 | 5 | 4.662 | 1 | 30 | ||||||

| All | 211 | 6.142 | 5 | 4.484 | 1 | 30 | ||||||

| Total amount invested (thousand €) | SBA | 51 | 214.269 | 130 | 322.456 | 5 | 2000 | 137.798 | [−8.958, 284.555] | 191 | 1.852 | 0.066 |

| Other BA | 142 | 352.067 | 155 | 494.477 | 5 | 3000 | ||||||

| All | 193 | 315.654 | 150 | 458.638 | 5 | 3000 | ||||||

| Total no. of investments | SBA | 55 | 8.673 | 5 | 9.630 | 1 | 50 | 0.348 | [−2.729, 3.425] | 196 | 0.223 | 0.824 |

| Other BA | 143 | 9.021 | 5 | 9.910 | 1 | 79 | ||||||

| All | 198 | 8.924 | 5 | 9.810 | 1 | 79 | ||||||

| Total no. of exits | SBA | 55 | 0.800 | 0 | 2.076 | 0 | 11 | 0.315 | [−0.277, 0.906] | 210 | 1.048 | 0.296 |

| Other BA | 157 | 1.115 | 0 | 1.857 | 0 | 10 | ||||||

| All | 212 | 1.033 | 0 | 1.916 | 0 | 11 | ||||||

| Annual amount invested (thousand €) | SBA | 49 | 70.380 | 35 | 125.211 | 3 | 800 | 3.566 | [−28.983, 36.115] | 167 | 0.216 | 0.829 |

| Other BA | 120 | 73.946 | 48 | 83.353 | 1 | 500 | ||||||

| All | 169 | 72.912 | 40 | 96.971 | 1 | 800 | ||||||

| Annual no. of investments | SBA | 55 | 2.600 | 2 | 1.872 | 0 | 10 | −0.299 | [−1.124, 0.527] | 199 | −0.713 | 0.477 |

| Other BA | 146 | 2.301 | 2 | 2.882 | 0 | 27 | ||||||

| All | 201 | 2.383 | 2 | 2.643 | 0 | 27 |

- Note: Year 2020. d.o.f., degrees of freedom. Please see Table 2 for definitions and data sources.

| Social business angel | ||||

|---|---|---|---|---|

| Dependent variable | Model 1: | Model 2: | Model 3: | Model 4: |

| One-year model | One-year model – Matched sample | Two-year model | Two-year model – Matched sample | |

| Age | 0.029 | 0.038 | 0.035+ | 0.044 |

| (0.021) | (0.030) | (0.020) | (0.027) | |

| Gender – Female | 1.009 | 0.602 | 1.111+ | 0.609 |

| (0.630) | (0.743) | (0.602) | (0.696) | |

| Occupation – Manager or employed in a company | 1.559 | 2.436* | 1.801+ | 2.465* |

| (1.054) | (0.977) | (1.021) | (1.204) | |

| Occupation – Consultant or freelance | 2.163* | 2.590** | 2.133* | 2.312* |

| (0.979) | (0.869) | (0.983) | (1.125) | |

| Occupation – Entrepreneur | 2.540* | 2.953** | 2.509* | 2.546* |

| (1.016) | (0.946) | (0.978) | (1.123) | |

| BA organization – Yes | −1.892* | −1.490+ | −1.963** | −1.565* |

| (0.741). | (0.843) | (0.666) | (0.750) | |

| Specialized BA – Yes | 0.302 | 0.079 | −0.155 | −0.376 |

| (0.464) | (0.583) | (0.413) | (0.521) | |

| Extra services – Yes | 0.538 | 0.517 | 0.528 | 0.413 |

| (0.442) | (0.522) | (0.409) | (0.485) | |

| BA experience | 0.040 | 0.234* | 0.012 | 0.141 |

| (0.079) | (0.115) | (0.061) | (0.099) | |

| Total no. of exits | −0.209 | −0.320 | ||

| (0.248) | (0.222) | |||

| Total no. of investments | 0.013 | 0.064 | 0.007 | 0.042 |

| (0.047) | (0.043) | (0.037) | (0.046) | |

| Total amount invested | −0.003** | −0.005** | −0.003* | −0.005** |

| (0.001) | (0.002) | (0.001) | (0.002) | |

| Annual amount invested | 0.007* | 0.013** | 0.008* | 0.012* |

| (0.003) | (0.004) | (0.003) | (0.005) | |

| Annual no. of investments | −0.063 | −0.186 | −0.044 | −0.113 |

| (0.149) | (0.181) | (0.122) | (0.174) | |

| Area dummies | Included | Included | Included | Included |

| Education dummies | Included | Included | Included | Included |

| Year | −0.073 | 1.224+ | ||

| (0.522) | (0.722) | |||

| Constant | −3.907 | −3.031 | 142.598 | −2.5e + 03+ |

| (2.396) | (2.545) | (1054.961) | (1459.380) | |

| Observations | 148 | 96 | 173 | 112 |

| Wald chi-squared | 33.590 | 24.510 | 35.341 | 29.711 |

| Prob > chi-squared | 0.029 | 0.221 | 0.018 | 0.075 |

| Pseudo R-squared | 0.171 | 0.184 | 0.161 | 0.192 |

| Log likelihood | −77.289 | −54.327 | −91.978 | −62.491 |

- Notes: The output reports the regression coefficients and, in parentheses, robust standard errors. Year 2020 for Models 1–4 and 2019 for Models 3 and 4. Total no. of exits omitted in Models 3 and 4 because not available for the two years. Variable definitions and sources are provided in Table 2.

- +p < 0.10, * p < 0.05, ** p < 0.01, *** p < 0.001.

The results show that individuals who have a main occupation are more likely to be SBAs. In Model 4, compared with participants who are retired or not working, current managers or employees of a company have a 37.7% higher probability of being SBAs [χ2(1, N = 112) = 7.28, p = 0.007], while the probability is 34.8% higher for consultants or freelancers [χ2(1, N = 112) = 8.97, p = 0.003] and 39.2% higher for entrepreneurs [χ2(1, N = 112) = 11.91, p = 0.001]. This result is in line with the previous literature on impact investing (Gautier, Pache and Santos, 2023; Smith et al., 2022), which shows that different characteristics and personal experiences can influence and change individual investors’ engagement in impact investing. According to Schumpeter's theory of economic development (Schumpeter, 2021), participation in certain occupations requires the ability to tackle unexplored areas, to be innovative, and to be particularly responsive to customer demand. In fact, people who carry out an occupational activity are usually immersed in entrepreneurial activities, solving problems that have never been faced before or creating innovations. For this reason, the knowledge and attributes needed to make decisions in these activities lie outside the known and are therefore surrounded by uncertainty. Moreover, because they are still involved in a working environment, it is reasonable to assume that these people are more aware of the tendencies that are immediately apparent in the demands of their customers, which they need to take into account in order to achieve good work results. According to the literature (Höchstädter and Scheck, 2015; Islam, 2022), there are many knowledge and structural aspects to be built in the evolving field of impact investing. At the same time, there is a growing demand to create more resilient, sustainable, and inclusive societies (OECD, 2019, 2020), in which impact investing can play a key role. Based on all these considerations, it is reasonable to conclude that BAs who are still working have the necessary skills to consider impact investing as an exciting opportunity, without being deterred by the current knowledge and structure gap in this investment area.

We also find that being a member of an angel group/network is associated with a reduction in the likelihood of being an SBA (Model 4). Our analysis revealed that being part of an angel group/network decreases the probability of being SBAs of 28.5% [χ2(1, N = 112) = 6.08, p = 0.014]. This result could be explained by the novelty of impact investments (Höchstädter and Scheck, 2015), which requires additional knowledge and expertise that may not be available to angel groups/networks yet. While being part of an angel group allows members to invest in a broader range of opportunities to diversify their portfolios (Mason and Botelho, 2014; Mason, Botelho and Harrison, 2013), such a finding indicates that SBAs seek their deals from organizations focused on impact investments (e.g. social incubators and accelerators, specialized angel groups, and so on). This denotes the importance of an entrepreneurial ecosystem of organizations solely focused on impact opportunities (Han and Shah, 2020; Sansone et al., 2020).

In terms of amounts invested, our findings indicate that (a) angels who had invested a higher total amount during their career were less likely to be SBAs, while (b) those who had invested higher amounts in the last year of observation were more likely to be SBAs. The observed effect reflects the growth of impact investing in recent years and its novelty (GIIN, 2023; Islam, 2022). In addition, it points to the association between cumulated invested amounts and group belongings, which can explain self-selection into impact investing.

Lastly, even though Model 3 shows a slightly significant difference between SBAs and non-social BAs in terms of gender and age, such evidence is weak and does not hold with the matched sample in Model 4, which manages potential endogeneity issues.

SBA investment process

Our interviews revealed that SBAs follow a seven-stage investment process very similar to the one described by Haines, Madil and Riding (2003). The novelty in angel impact investment does not arise in the number of stages but in what occurs in these stages. The distinctiveness of the process can be highlighted by the importance given by angels to social and/or environmental impact and by the way they balance the trade-offs between economic and impact outcomes. One investor (SBA10) noted ‘I only invest in start-ups with a social aim’, while another angel (SBA5) highlighted that when investing in impact ventures they need to ‘balance the two axes: profitability and sustainability’. As argued earlier on the basis of our quantitative results, SBAs are used to operating under uncertainty by developing innovative and original solutions to overcome it. This characteristic is particularly useful for working in impact investing, which SBAs see as a potential opportunity rather than an insurmountable barrier. The need for the investment opportunities to potentially generate social and/or environmental benefits and the ability to tackle uncertainty also occur throughout the investment process. The stages of the SBA investment process and the criteria applied are shown in Table 3.

As shown in Table 3, like their counterparts, SBAs rely on their networks to originate deals, with angel groups/networks, incubators and accelerators, and personal contacts being referred to as the key sources of deals. A distinctive element of the deal origination stage is the nature of the organizations sourcing deals for SBAs; that is, often opportunities arise from social incubators, communities of hybrid enterprises, or social impact angel groups/networks. This effect can also be observed by the high number of participants (5 out of 10) who were affiliated with social impact angel groups/networks.

In the next stage, the initial screening, SBAs review opportunities with two sets of criteria in mind. On the one hand, economic factors are reviewed, such as evidence of market demand, potential growth, and current sales. Overall, investors aim to understand if the opportunity has the potential to generate a financial return. On the other hand, SBAs seek evidence that the people involved with the opportunity, and the described strategy, are social impact-focused. Additionally, investors evaluate if the opportunity can fulfil its impact promises or if there is evidence of greenwashing and/or impact washing. In order to make this assessment, SBAs often attempt to understand whether the social or environmental impact is integrated within the corporate mission or if it is just an additional element. Our results show that, at this stage, SBAs conduct a preliminary evaluation of the potential benefits/risks involved to understand if they can tolerate the proposed levels of risk/return. If so, the opportunity will move to the due diligence stage.

At the due diligence stage, SBAs begin a detailed examination of the elements stated in the opportunity. On the one hand, SBAs assess the economic claims made by the entrepreneurs, to understand the reliability of the business case and the potential risks if the facts and details declared are false. Our results show that SBAs give significant relevance to a traditional financial evaluation, with the entrepreneurial team, finance and market analysis being considered most relevant. Then, investors examine if the growth potential is confirmed, and if so, the economic validation is completed. On the other hand, SBAs examine whether the claims about impact can be validated. The team's authenticity, other stakeholders’ past experiences, how impact and business activities are integrated, the presence of social impact certifications (e.g. B Corp certification), and the adoption of impact metrics are some examples of areas evaluated by SBAs. Overall, our results indicate that, at this stage, SBAs require a minimum acceptance threshold for social/environmental impact and economic benefits. This was exemplified by SBA7, who said that, ‘they [need to] pass an acceptance threshold’, and SBA8, who stated that, ‘based on a very precise ranking, they are admitted or not admitted to the next selection phase’.

The negotiation stage of SBAs is equivalent to what has previously been reported in the BA literature. As noted in previous research, at this stage, investors and entrepreneurs agree the deal conditions (e.g. valuation, equity stake). This is not a surprising result, as it can be associated with constraints in measuring impact, which makes it less likely to be contracted as an outcome.

In the following stage, decision-making, SBAs evaluate whether the suggested levels of social impact and financial risks are acceptable. Investors take a compensatory approach (Ruiz, Cabello and Pérez-Gladish, 2018) to understand the trade-offs presented by the opportunity. This approach was emphasized by one investor, who noted that, ‘If, however, I see that there is a negative impact, even if the financial risk is low, I do not invest’ (SBA2). If the suggested positive outcomes compensate the negative results, then the SBA will fund the opportunity.

Finally, at the post-investment stage, SBAs attempt to be actively hands-on with the activities of their investee ventures. Like other angels, SBAs aim to enable their investments to achieve their full potential by mitigating the risks. However, SBAs extend the areas of support by providing value-added contributions focused on impact outcomes. SBA7 highlighted that, ‘I try to support them to mitigate the business [impact and financial] risk’.

These findings provide a rich insight into the investment process of SBAs, not only extending the investment process model proposed by Haines, Madill and Riding (2003) by showing how impact considerations are incorporated, but also broadening our understanding of an impact investment process involving individual early-stage impact investors. The specific checking for potential greenwashing and/or impact washing in the initial screening, the social impact assessments as part of the due diligence, and the initial balance between social and economic impact assessments represent the innovations introduced by the SBA investment process. In particular, the introduction of these distinctive impact assessments in a consolidated investment process allows SBAs to balance their need to assess and potentially limit risks related to both economic and social or environmental outcomes at an early stage. Figure 1 depicts a diagram of the aforementioned investment process. The diagram presents both the distinctive elements associated with the social impact components and the well-established economic features.

Towards an integrated model of individual and process-based relationships in SBA investing

Our twofold analysis provides a rich insight into SBAs’ investment modus operandi. We have provided a vivid portrait of the factors that make SBAs somewhat distinct from their counterparts in term of individual characteristics and professional and investment experience. At the same time, we have highlighted that SBAs follow a very similar process to that of non-social angels (Haines, Madill and Riding, 2003), but adopting, however, more nuanced evaluations based upon impact considerations.

Building on the evidence we have collected, our results depict a situation in which acting as an SBA is a function of individual characteristics, investment experience, and professional experience. Ultimately, these factors have a direct impact on individual investment behaviour (preferences and activity), which in turn affects how the investment process is handled. We propose a conceptual model that follows two traditional approaches in entrepreneurship and impact investment research.

First, we conceptualize investor behaviour based on individual characteristics and professional and investment experience, along the tradition of the early first-generation studies in angel financing (Botelho, 2017). Our evidence is framed in the human capital tradition that has been widely endorsed in the angel literature. Previous research has shown that human capital plays a key role in the decision-making style of BAs (Wirtz et al., 2020) and their ability to identify value creation (Collewaert and Manigart, 2016). However, Bonnet et al. (2022) found that some prior work experience had no effect on investors’ active involvement in angel group activities. We extend the understanding of the impact of human capital on investment preferences and post-investment activities of BAs. We find that investor characteristics, professional experience, and investment experience can moderately explain how SBAs differ from non-social angels. However, having a sector-specific knowledge (e.g. as a freelancer or entrepreneur) leads to self-selection into impact investing. This might be explained by the fact that angels with deep sector knowledge can help drive the opportunity for impact that their experience in the sector reveals. In fact, these professional backgrounds require high levels of proactivity, autonomy, problem-solving, and risk-taking (Mohamed et al., 2023; Schumpeter, 2021), which are highly valuable in impact investing (Gautier, Pache and Santos, 2023; Smith et al., 2022) and are abilities suitable for overcoming the barriers to entry that characterize impact investments.

Another important factor contributing to the decision to become an SBA is the role played by angel groups. Our findings suggest that being part of an angel group reduces the likelihood of being an SBA. Similarly, investors with higher total investment amounts, who tend to be part of angel groups/networks, are less likely to be SBAs. If one of the reasons to self-select into impact investing is to be autonomous and pro-active (as shown by our previous results on professional backgrounds), being members of angel groups may not necessarily imply an active involvement in all angel activities. This could be due to the nature of the institutions associated with angel activity, as they typically promote opportunities in different sectors as a mechanism of portfolio diversification. As such, human interactions could be constrained by institutions, as institutional theory suggests (North, 1990). In this regard, our findings seem to contradict previous angel research, which indicates the importance of the existence of institutions as a mechanism for the development of angel investing (Scheela and Jittrapanun, 2012).

Second, we theorize how impact and economic concerns affect the investment process of SBAs. Our results on SBA deal flow show that SBAs follow a process very similar to that of non-social angels (Haines, Madill and Riding, 2003). There are no new stages in the investment process, only an additional sub-evaluation focused on impact consideration. It is also possible to observe this novelty in terms of investment criteria, as SBAs consider a wider range of issues compared with their counterparts. This has been a topic of investigation by impact scholars (e.g. Gautier, Pache and Santos, 2023; Paetzold and Busch, 2014; Smith et al., 2022). Figure 2 depicts the suggested model.

Looking in more detail, our results show how SBAs combine angel investing criteria (Botelho, Harrison and Mason, 2023) and impact investing approaches (Haines, Madill and Riding, 2003) to make early-stage impact investments. The level of uncertainty affecting this type of impact investment is much higher, both in terms of economic and social impact outcomes. Combining the consolidated early-stage investment process derived from the angel investing experience with social impact assessments allows SBAs to assess and potentially limit the risk related to the materiality of the economic and social impact outcomes claimed by their potential investees. This original approach opens the door to new perspectives on impact investing evaluations. Indeed, the literature has largely highlighted the lack of adoption of consolidated metrics and approaches to assess the performance and risks associated with social impact ventures (Grimes, Gehman and Cao, 2018; Hoogendoorn, Van der Zwan and Thurik, 2019), suggesting the need for novel approaches transcending the conventional evaluation that considers business and charity as separate domains (Lee, Adbi and Singh, 2020). Extending previous impact investing literature on investment processes (e.g. Jackson, 2013; King, 2017; Reeder et al., 2015; Thompson, 2023), the approach of SBAs suggests how this goal can be achieved through an innovative individual perspective. Building on a distinctive hybrid logic and, in particular, introducing impact assessment into a consolidated investment approach, the investment process of SBAs shows how it is possible to harmonize the assessment of financial and social impacts or environmental risks in an early-stage context.

Conclusions

There are five main original contributions from our research. First, we identified, defined, and studied a new type of angel investor – SBAs. These are angels who invest in and support start-ups with a significant social impact. Our findings extend our understanding of BA heterogeneity (Sørheim and Botelho, 2016) by showing how SBAs are somewhat distinct from their counterparts in term of individual characteristics, investment experience, and, especially, modus operandi. This supports the critical views of Croce and colleagues (2020) on a homogeneous approach in angel research.

Second, our findings identify a new type of impact investor. This contribution is particularly relevant given the scarcity of studies on individual impact investors. Additionally, our study contributes to efforts to scale the impact investing industry (GIIN, 2022) by characterizing a new source of external finance acting to create societal and financial benefits. The rise of angel investors as a source of impact investments can have considerable repercussions in the entrepreneurial ecosystem, as these investors provide more than money to the investee companies (Politis, 2008).

Third, in terms of the investment process, while our findings show that SBAs follow a process similar to that of other BAs (Haines, Madill and Riding, 2003), specific sub-stages that solely focus on issues associated with the impact potential were identified. Extending previous impact investing literature (e.g. Thompson, 2023), this result supports the appeals of Lee, Adbi and Singh (2020) for future research to address how investors assess impact and financial risks by showing that angels conduct independent evaluations on whether the opportunity should progress, considering both risk factors. This finding also validates the calls for new research on the BA investment process by Tenca and colleagues (2018), as it shows that to evaluate novel types of investments, angels will have to introduce new procedures to capture the idiosyncrasies of such opportunities. As previously noted, hybrid organizations will have dual goals, and hence investors will have to evaluate a broader scope of potential outcomes as the investment process unfolds. This has been previously identified in the impact investing literature (e.g. Gautier, Pache and Santos, 2023; Smith et al., 2022).

Fourth, the findings show that SBAs have a broader range of investment criteria, as they include impact issues such as greenwashing, impact washing, and authenticity. Given the particularities of impact investments, this is not a surprising result. Impact is hard to define and measure (Choi and Majumdar, 2014; Molecke and Pinkse, 2017), resulting in investors being sceptical about potential societal benefits. Moreover, the levels of uncertainty associated with early-stage investment will increase the scrutiny of investors, especially when opportunities present intangible benefits. Our exploration of SBAs revealed an original approach to facing uncertainty by combining angel and impact investing evaluations.

Fifth, we offer a conceptual model to theorize a new phenomenon. We conceptualize how individual characteristics and experiences (professional and investment) will impact the likelihood of being an SBA and that these factors can explain the distinctiveness of this type of investor. Additionally, we suggest that SBAs consider economic and impact concerns during the investment process. This is a first attempt to conceptualize SBAs investing in impact opportunities, opening the door for future research on individual investment approaches to impact investing. For example, future research could adopt the proposed conceptual model to explore similarities and differences between BAs and other investors, highlighting the novelties introduced by different types of impact investors. The conceptual model and findings of the present study could also serve as a useful basis for further exploration of the relationship between the individual characteristics of impact investors and their particular modus operandi. Our conceptual model suggests the relevance of this relationship, and the application of our model to the study of other impact investors could confirm this relevance.

Our findings are, however, subject to some limitations. First, our study is based on only one country, and, although there is a significant body of angel research using Italian data (Butticè, Croce and Ughetto, 2021; Capizzi, Croce and Tenca, 2022), questions can be asked about how impact investment differs in other angel markets (e.g. the United States and UK). A promising avenue for future studies could be to test the relationships we have advanced in our study by adopting a larger sample based on multi-country data. Notwithstanding the widely recognized difficulty of sampling BAs (Tenca, Croce and Ughetto, 2018), the identification of larger quantitative or qualitative samples to explore SBAs could also contribute to corroborating the generalizability of the exploration carried out. In this direction, the present study suggests the effectiveness of an original sampling method that could be replicated in future research in different ecosystems.

Second, we define SBAs as investors who prioritize impact investments. The required prioritization could be seen as very restrictive because it excludes investors who conduct impact investments but do not give priority to them, which could capture additional behavioural variability. Scouting what motivates angels’ willingness to undertake impact investments is a fruitful area of research for entrepreneurial finance scholars. If impact is not a short-term trend, then scholars should question if, for instance, this increased focus is a sign that BAs are giving more emphasis to their altruistic motivations rather than to economic motives (Sullivan and Miller, 1996).

Third, we have focused on a restricted number of individual characteristics affecting the propensity to become an SBA. Other studies could look at other individual characteristics to understand the impact of these features on the likelihood of angels conducting impact investments. For example, is an angel more likely to conduct impact investment if they have worked in (i) polluting industries, (ii) male-dominated companies, and (iii) industries with a high wage difference across roles?

Fourth, we used self-reported data, which could add biases as investors might aim to provide a socially desirable answer rather than the true one (Dalton and Ortegren, 2011). Again, future research could use classifications of angels based upon the nature of their investments, with the aid of consolidated metrics to identify what is impact from what cannot be considered as such.

Finally, we did not focus our study on an organizational perspective, in particular on angel groups/networks. This could be particularly important as it can capture and potentially measure the effect of specialized organizations in promoting impact. This opens new directions for scholars studying the organized side of the angel market. Are generalist angel groups rather than specialized groups pushing more towards impact investing practices? What types of organizations (generalist versus specific) provide the most significant contribution for the development of a niche entrepreneurial ecosystem based upon impact assessments?

Acknowledgements

The authors acknowledge each researcher and organization that supported the data collection for this study. The authors would like to thank Beatrice Taricco and Federica Abatematteo for their support in the data gathering and analysis phase. The authors also acknowledge Giuliano Sansone and Emma Bill for their suggestions and comments. Finally, the authors would like to thank each one of the 10 interviewees who, despite their tight schedules, gave time to discuss and explore the phenomenon of social impact business angels.

Open access publishing facilitated by Politecnico di Torino, as part of the Wiley - CRUI-CARE agreement.

Biographies

Davide Viglialoro is a lecturer in Strategy and Entrepreneurship at the Norwich Business School (University of East Anglia). He obtained his PhD in Management, Production and Design at Politecnico di Torino. He took a Master of Science degree in Law at Università degli Studi di Torino. His research focuses on angel investing, impact investing, social entrepreneurship, and venture studios. He has supervised a number of reports on angel investing and social start-ups.

Tiago Botelho is Professor of Entrepreneurship and Innovation at the Norwich Business School (University of East Anglia). He has previously studied economics, finance and management at Universidade Autónoma de Lisboa (UAL), Fundação Getúlio Vargas (FGV) and the University of Glasgow, Glasgow, UK. He has authored/coauthored papers in several academic journals: British Journal of Management, Regional Studies, Annals of Operational Research, International Small Business Journal, Small Business Economics, Social Economic Review, IEEE Transactions on Engineering Management, Technological Forecasting and Social Change, Venture Capital: An International Journal of Entrepreneurial Finance, Strategic Change, Socio-Economic Planning Sciences, and European Planning Studies. He is an editorial board member of Venture Capital: An International Journal of Entrepreneurial Finance. His research interests include entrepreneurial finance, in particular business angel decision-making. [Correction added on 11 September 2024, after first online publication: The biography of Tiago Botelho has been updated in this version.]

Elisa Ughetto is a Full Professor at Politecnico di Torino, where she teaches accounting and corporate finance and entrepreneurial finance at undergraduate level. She is associate editor of the Journal of Small Business Management. She has been a visiting scholar at the European Investment Fund and at Washington University in St. Louis. She has worked on several research projects funded by the European Union and the European Investment Bank. Her current research interests are in the areas of economics of innovation, finance, and management of intellectual property rights. She has contributed articles to international refereed journals, such as British Journal of Management, Research Policy, Cambridge Journal of Economics, Journal of Corporate Finance, Journal of Banking and Finance, Industrial and Corporate Change, International Journal of Production Economics, Social Science and Medicine, Small Business Economics, International Small Business Journal, Journal of Small Business Management, Journal of Business Research, Regional Studies, International Business Review, The Manchester School, Technological Forecasting and Social Change, R&D Management, International Entrepreneurship and Management Journal.

Alessandro Laspia is a PhD candidate at Politecnico di Torino. He served as a visiting PhD student at Copenhagen Business School. He co-founded the student association ‘Social Innovation Teams Polito’ to help develop social entrepreneurship and social innovation. Since July 2019 he has collaborated with Social Innovation Monitor (SIM) on social innovation and social entrepreneurship research themes. Currently, he is studying start-ups with a significant social impact and their supporting ecosystem.

Paolo Landoni is a Full Professor at Politecnico di Torino, where he teaches innovation and entrepreneurship. He also teaches at MBA, Executive MBA and ad hoc executive courses in several business schools. His research is on innovation and entrepreneurship, specifically open and social innovation, sustainability, business ethics and corporate social responsibility. He has published seven books, and papers in journals such as Entrepreneurship Theory and Practice and Research Policy. He serves as a consultant for firms, non-profit organizations and governmental institutions for innovation strategies. He has been a founder, investor, and advisor for start-ups and nonprofit organizations.

References

- 1 Such groups and networks can be found, to name just a few examples, in Italy (Angels4Impact – A4I), Switzerland (Geneva Angel Investor Network – GAIN), and the UK (Angel Academe).

- 2 Typically, the proportion of male investors varied across the different studies, with only recent studies showing that female investors represent more than 10% of the angel population (for more information see Harrison, Botelho and Mason, 2020). In terms of age, the representative BA is in the age group of 45–60 years (Mason and Botelho, 2014). Regarding wealth levels, Gaston (1989) observed that the median net worth of a BA is $750,000, while Coveney and Moore (1998) showed that, on average, UK BAs invest £113,000. In term of entrepreneurial experience, Gaston (1989) showed that 83% of BAs had some entrepreneurial experience, while Bygrave (2009) described the vast majority of BAs as “wealthy entrepreneurs” (Bygrave, 2009, p. 172). This entrepreneurial experience enabled BAs to develop an extensive network to facilitate access to investment opportunities (Riding and Short, 1988).

- 3 For instance, Block, Hirschmann and Fisch (2021) found that equity impact investors significantly differed from donors and debt investors, as this group was more male-dominated, with individuals having a distinctive educational background, higher levels of entrepreneurial experience, and more impact investments in their portfolios.

- 4 (1) Deal origination, (2) Initial screening, (3) Due diligence, (4) Negotiation, (5) Decision-making, (6) Post-investment activity, and (7) Exit.

- 5 A preliminary version of Thompson's framework was used by Reeder et al. (2015).

- 6 In the present study, we define start-ups with significant social impact as those whose aim is to introduce a positive social impact through the creation of social innovation, namely ‘a novel solution to a social problem that is more effective, efficient, sustainable, or just than existing solutions and for which the value created accrues primarily to society as a whole rather than private individuals’ (Phills, Deiglmeier and Miller, 2008, p. 36).

- 7 A third researcher was involved to solve the 6% disagreement.