Attention Focus and Attention Framework: A Configuration Perspective of Attention to Innovation

Abstract

The current understanding of the unique contribution of single factors to attention may underestimate the complexity involved in attention allocation. This study aims to design an attention framework and examine the interdependencies between organisational and contextual factors that affect firm attention to exploitation, exploration, and ambidexterity. Drawing on a longitudinal study from 2008 to 2021, we use a configurational approach and identify seven distinct attention configurations as a result of different factor interdependencies, shedding light on how stability in attention configurations produces consistent attention focus. We also identify four change pathways that illustrate how configurations could be modified in response to radical environmental changes. Our study contributes to the attention-based view by stressing the importance of two alignments that explain a firm's high performance: between attention and contextual factors; between attention and organisational factors. Methodologically, the novelty of the configurational approach is its ability to capture configuration stability in normal external conditions and trace sudden changes in attention focus and configuration paths under extreme external conditions. This study also enhances exploitation and exploration research on managing attention configuration pathways in terms of path flexibility, path emergence, and path deterioration.

Introduction

The attention-based view (ABV) has been widely recognised as a perspective that explains firms’ behaviour as the result of situated managerial attention, contextualised in organisational structures and environmental conditions (Ocasio, 1997). Accordingly, a plethora of research has explored the link between firm-level attention, behaviour, and outcomes (Brielmaier and Friesl, 2022; Kammerlander and Ganter, 2015; Rhee and Leonardi, 2018). Given the importance of firm attention focus, it is not clear for example why with similar top management team (TMT) composition, firms may have different attention foci to entrepreneurship issues (Tuggle, Schnatterly and Johnson, 2010), customer issues (Umashankar, Bahadir and Bharadwaj, 2021) and corporate social responsibility (Fu, Tang and Chen, 2020). One promising way to reconcile these incoherent findings is to look for an innovative approach that studies how underlying factors shape attention allocation in combination rather than independently.

Both theoretical and empirical discussions suggest that attention is influenced by multiple factors. Attention is informed by organisational factors such as organisational structure (Dutt and Joseph, 2019; Vuori and Huy, 2016), TMT heterogeneity (Koryak et al., 2018) and resources (Stevens et al., 2015). One limitation of this stream of research is that it often considers the influential power of a single factor, which oversimplifies the complexity of attention because of the interdependencies of multiple factors. For example, GE succeeds in integrating attention to embrace new ideas for organisational adaptation (Josepha and Ocasio, 2012), whilst Nokia struggles to integrate attention and subsequently neglects emerging issues (Vuori and Huy, 2016). Both cases use organisation structure as the explanatory factor, but the Nokia case also suggests the importance of the TMT – their interpretation of external competition and the shared emotions that lead to the negation of external threats (Vuori and Huy, 2016), implying the combinational effect of factors that influence attentional results. Besides organisational factors, the ABV highlights the importance of attention contingency, embedded in contextual conditions (Ocasio, 1997). The volatility in environments further adds complexity to attention allocation. For instance, industry-specific deregulation in the airline industry, together with changes in TMT composition, led to the subsequent attentional reorientation (Cho and Hambrick, 2006). Therefore, the existing literature calls for a configurational approach for a holistic understanding of attention, in which the interdependencies of organisational and contextual factors are examined to understand their combined effects on attention allocation.

We answer this call by designing an attention framework and applying it to attention allocation in key issues of innovation. We ask: How do organisational and contextual factors in combination shape decision-maker's attention to exploitation, exploration or ambidexterity? Such a configurational approach permits us to draw on Ocasio's attention structures of three organisational factors – the rules of the game, players and resources (Ocasio, 1997) and four contextual factors – market, technology, industry and firm performance identified in extant attention research (Cho and Hambrick, 2006; Ghobadian et al., 2022; Stevens et al., 2015). With the aim of elaborating theory on attention configurations and pathways, fuzzy-set qualitative comparative analysis (fsQCA) is a useful method. First, fsQCA enables us to avoid the ‘correlational theorising’ perspective (Furnari et al., 2021) and ‘net-effects thinking’ (Ragin, 2008). For theorists and practitioners, it is important to know the unique contribution of a particular explanatory factor to attention allocation, but equally significant to understand why the same factor might exhibit contradictory attributes at times. fsQCA is thus well suited to understanding the causal complexity of attention antecedents. Second, when external conditions change unexpectedly, fsQCA becomes instrumental to trace changes in the attention focus and configuration paths and helps gain a holistic understanding of such changes.

By focusing on attention to innovation and the configurational approach to examine interdependencies between organisational and contextual factors, this paper makes three contributions. First, we construct an attention framework that assesses two forms of alignment – matches between attention and contextual conditions and between attention and organisational settings, a parsimonious but powerful framework to understand attention allocation. Second, we apply fsQCA to attention research by unravelling the complex relations between attention antecedents. Methodologically, it is novel to use fsQCA to trace configuration stability in normal conditions and sudden changes in attention focus and configuration in extreme external conditions. Third, with attention to exploration and exploitation, we put forward three implications for managing configuration paths: path flexibility, path emergence and path deterioration.

Theoretical background

Attention focus and attention structures

Decision-makers are constantly overwhelmed by a large volume of issues, but their attention focus is selective and limited depending on their cognitive limitations, the available time individuals have for the issue and their judgements of issue consequences (Nicolini and Korica, 2021; Ocasio, 1997). The focus of attention is further contextualised by the characteristics of the situation decision-makers face. That is, in addition to individual characteristics, the conditions of the circumstances add complexity and variety to decision-makers' attention foci. At the organisational level, firms rely on certain mechanisms to influence and control the sustained attention of decision-makers so that their subsequent actions could be guided by consistent rather than fragmented attention foci (Ocasio, 1997). Some researchers suggest that such control mechanisms reside in a firm's organisational architecture, for example, corporate structure (Dutt and Joseph, 2019), cross-functional and specialised channels (Joseph and Ocasio, 2012), whilst others believe there are dedicated attention structures that provide legitimacy, importance and relevance to the issues that guide decision-makers (Ocasio, 1997; Ren and Guo, 2011; Stevens et al., 2015). We follow the attention structure approach because the architecture approach affects the distribution of attention across different divisions within an organisation, whilst the structure approach emphasises the attention initiation. Three organisational factors in this study comprise the grounding pillar for attention structures: decision-makers – the players who influence the firm's attention allocation and regulation (Umashankar, Bahadir and Bharadwaj, 2021), who rely on formal and informal principles; the rules of the game to interpret the organisational environment and reality, to provide attention direction for appropriate actions and behaviour (Angulo-Ruiz, Pergelova and Dana, 2020), and whose attention focus would be constrained or facilitated by tangible and intangible assets; and resources (McCann and Shinkle, 2017). Attention is also situated in contextual factors in which decision-makers centre their focus (Ocasio, 1997). The firm's financial performance is one important contextual factor that affects attention allocation (Stevens et al., 2015) because performance is commonly used as a means of evaluating managerial effectiveness (Tuggle, Schnatterly and Johnson, 2010). The rate of change in environmental conditions in technology, market, and industry impinges upon decision-makers' attention focus and decision (Ghobadian et al., 2022). The changing dynamism in the industry causes disturbance in the market (Papanikolaou and Schmidt, 2020) and firm performance (Ghobadian et al., 2022), demanding adaptations in attention to address the environmental crisis (Wenzel, Stanske and Lieberman, 2020). In this study, we include key organisational and contextual factors and examine their interdependencies that shape decision-makers' attention allocation.

Attention framework and the configurational approach

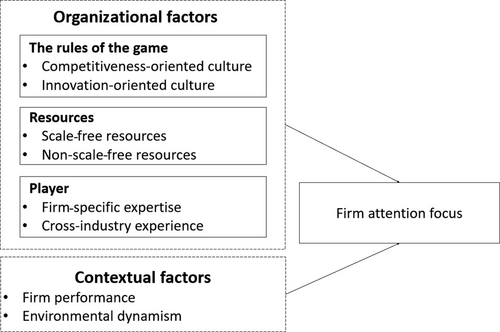

To include both key organisational and contextual factors expected to regulate decision-makers’ attention to innovation, we develop an attention framework (see Figure 1). This framework combines three organisational factors – the rules of the game, resources and players and four contextual factors – market, technology, industry and firm performance. Next, we discuss how the configurational approach is suitable to understand interdependencies between these factors contained in the framework.

The impact of the rules of the game on players’ attention allocation is contextualised by firm performance (Stevens et al., 2015), market acceptance (Angulo-Ruiz, Pergelova and Dana, 2020) and industry volatility (Berchicci and Tarakci, 2022), which create attention tension between different organisational goals. Radical environmental changes in the market (Cho and Hambrick, 2006), industry (Ghobadian et al., 2022) and technology (Eggers and Kaplan, 2009) prompt players to utilize their experience and expertise to reorient their attention to renewal or other organisational changes. Resources such as R&D are deemed instrumental to regulate players’ attention to firm profitability (Mithani, 2017), but the simultaneous pursuit of different resources – such as internal R&D and external knowledge acquisition – creates attention competition (Wang, Yu and Cui, 2020). Although prior literature indicates interdependencies between organisational and contextual factors and supports the inclusion of the selected ones, for this study the complexity involved in interdependencies is hard to capture with linear relationships. Besides, the effects of the selected factors are largely unexplored in innovation management using configurations. Next, we explain how we operationalize our seven factors of innovation management.

Operationalizing the configurational approach in innovation management

It is challenging for decision-makers to manage innovation when technology, global competition and market demand are in a state of flux. Whilst extant research has largely emphasised organisational ambidexterity, which aims to embrace a firm's current viability and future agility at the same time (Kiss et al., 2020; Luger, Raisch and Schimmer, 2018), recent studies have also noticed circumstances where exploitation or exploration separately could lead to a firm's superior performance (Bhandari et al., 2020; Fitzgerald et al., 2021; Yan, Tsinopoulos and Xiong, 2021). Thus, research has studied organisational mechanisms such as structures (Phelps, 2010), processes (Benner and Tushman, 2003), culture (Khan and Mir, 2019) and capabilities (Schulze and Brusoni, 2022) that enable differentiation, separation and integration of ambidexterity. Recently, decision-makers’ attention is considered a critical factor influencing firms’ innovation behaviour, such as short-termism (Kleinknecht et al., 2020), continuous improvement (Koryak et al., 2018) and business model innovation (Kleinknecht et al., 2020). Within this emerging stream of research, it is important to understand what configurations may lead attention to innovation. Next, we justify our proxy choice for the potential configurational components.

The rules of the game

The rules of the game are a set of implicit norms, values and incentives that interpret what is deemed as appropriate behaviour in organizations (Ocasio, 1997). Stevens et al. (2015) interpret the rules as a utilitarian identity, while Ren and Guo (2011) regard the rules as a strategic orientation. Both proxies are manifested in qualitative or survey-based data collections, which do not fit with our longitudinal data collection. We interpret the rules as organisational culture because they are ‘the mobilization of consciousness and purpose, the codification of meaning, the emergence of normative patterns, the rise and fall of systems of leadership and strategies of legitimization’ (Pettigrew, 1979: 576). This interpretation concurs with Ocasio's ideas that the rules should indicate control (Fligstein, 1990), logic (Jackson and Dutton, 1988) and paradigm (Brown, 1978) for pragmatic and motivational implications (Ocasio, 1997). Among various cultural types, the competitiveness and innovation cultures (Pandey and Pandey, 2019) hold different influences on decision-makers’ attention to exploitation and exploration, or both. A competitiveness culture focuses on stability and consistency through long-term, clear goals for increased market share, revenue and profitability (Denison and Neale, 2000). The culture celebrates competition and ambitious market targets (O'Reilly, Chatman and Caldwell, 1991), and is outcome driven – fortifying goals or task accomplishment to achieve increased market share, revenue and profitability (Cameron and Quinn, 2011). An innovation culture is less concerned about stability, but it embraces experimentation and risk-taking (Denison and Neale, 2000), emphasises the product leader position with cutting-edge technologies (Cameron and Quinn, 2006) and welcomes new challenges and opportunities (O'Reilly, Chatman and Caldwell, 1991) to demonstrate creativity.

Empirical evidence of the impact of these two cultures on decision-makers’ attention allocation to innovation activities is mixed. Some studies show the competing facets of attention tension. For example, the competitiveness culture governs the attention focus on exploitation through increasing productivity (Kashan, Wiewiora and Mohannak, 2021). The innovation culture directs decision-makers’ attention to exploration, which encourages deviation from existing routines and fosters a strong desire to continuously challenge the existing environment (Jin, Navare and Lynch, 2019). Other studies suggest two cultures that do not differentiate between the attention paid to incremental and radical innovations, as the effects of the cultures are similar and complementary to new ideas and risk tolerance (Büschgens, Bausch and Balkin, 2013). Having an ambidextrous culture of both competitiveness and innovation benefits decision-makers’ attention on embracing innovation, flexibility and effectiveness, without losing the focus on stability, routinisation and efficiency (Wang and Rafiq, 2014), and this culture of ambidexterity is particularly important in a dynamic market environment (Khan and Mir, 2019). Nevertheless, the pursuit of either single or ambidextrous orientated cultures, as antecedents of attention allocation, must be intertwined with operational-level organisational resources, and decision-makers’ knowledge, hence more research is needed to examine the combined efforts of the higher level of culture and the operational level of players and resources together.

Players

Players are an important element of an attention framework as they affect not only the allocation but also the regulation of organisational attention. Players possess specific expertise, skills and values, all of which influence which issues they should be attentive to. The focus of this study is the TMT, who are the most salient players and often the decision-makers of the firm (Koryak et al., 2018; Ocasio, 1997). Whilst many studies examine the presence of a certain type of decision-makers as an antecedent of attention allocation (see Fu, Tang and Chen, 2020; Umashankar, Bahadir and Bharadwaj, 2021), we follow research that examines decision-makers’ knowledge (Bjornali, Knockaert and Erikson, 2016; Koryak et al., 2018), because their ‘presence’ indicates the expertise they bring and utilise when regulating attention. We investigate decision-makers’ depth of knowledge – firm-specific expertise and breadth of knowledge on perceptions and perspectives – cross-industry experience.

The longer decision-makers work for a firm, the deeper their understanding of the details and nuances of the firm's resources, operations, customers and technologies (Cummings, Eggers and Wang, 2022). Prior research has found that firm-specific expertise directs decision-makers’ attention to activities associated with exploitation, as it is readily accessible to support the exploitation of existing knowledge (Shepherd, Mcmullen and Ocasio, 2017), but narrows the knowledge corridor for product innovativeness (Marvel, Wolfe and Kuratko, 2020). Cross-industry experience widens decision-makers’ horizons to incorporate varied interests, perspectives and values from other industries (Ener, 2019). Hence, decision-makers with a wider industrial experience are more likely to increase their attention to exploration (Koryak et al., 2018), entrepreneurial issues (Cho and Hambrick, 2006; Tuggle, Schnatterly and Johnson, 2010) and distant opportunities (Bjornali, Knockaert and Erikson, 2016). Despite these contrasting relationships, scholars also argue that cross-industry experience might govern decision-makers’ attention on exploitation, because designing and implementing effective exploitation is more cognitively complex than usually considered (Katila and Ahuja, 2002), and exploitation can involve problem-solving heuristics (Koryak et al., 2018). These recent studies address the complexity involved in the influence of decision-makers’ knowledge on attention allocation.

Resources

The accumulated stock of resources of an organisation can affect its strategic behaviour. This is because access to certain resources influences how decision-makers regulate their attention focus (Brielmaier and Friesl, 2022). Extant research tends to examine the effect of slack resources on decision-makers’ attention to corporate social responsibilities (Khan and Mir, 2019; Stevens et al., 2015). In this study, we are interested in two types of resources that hold strong implications for innovation (Kang and Kim, 2019). The first type is scale-free resources, which are fungible across different products/markets whose value will not be reduced or diminished by assumptions. Technologies, for instance, are not subject to opportunity costs as there are no inherent constraints on how many product lines can use the same technology (Levinthal and Wu, 2010). The second type is non-scale-free resources, which incur opportunity costs and ‘must be allocated among alternative activities, and the use of these resources in one activity precludes their use in other settings' (Levinthal and Wu, 2010: 781). Examples of non-scale-free resources include R&D costs and operational resources that, once they have been invested in one activity, are difficult to recover.

Arguably, scale-free resources may potentially regulate decision-makers’ attention to exploitation. This is because previously developed technologies, knowledge of current customers, sales strategies and distribution channels direct decision-makers’ attention to reuse these resources and support the incremental improvement of product/service exploitation. However, generating different solutions to improve processes of exploitation also requires dedicated non-scale-free resources, such as operational resources that need to be purposefully built to implement alternative solutions, limiting the likelihood of redeploying the resources in other contexts (Voss, Sirdeshmukh and Voss, 2008). Ample financial resources can protect investments in scouting out new opportunities and shelter the organization from resource depletion if such efforts fail (O'Brien, 2003), thus regulating decision-makers’ attention to exploration. Nevertheless, too much reliance on non-scale-free resources increases the cost of exploration. The attention focus therefore should also be shaped by the utilisation of non-scale-free resources to balance the costs and benefits associated with exploration. Empirically, we know little about how scale-free and non-scale-free resources regulate managers’ attention to exploitation and exploration or ambidexterity.

Situated attention

Prior research suggests that the relationships between attention focus, environmental dynamism and firm performance are complex (Stevens et al., 2015). Scholars have shown that when firms face low-performance challenges, the TMT would be more attentive to the costs and risks associated with any new business opportunities (Stevens et al., 2015), and a stable high-performance level regulates decision-makers’ attention to explorative innovations as the high performance relaxes the focus of attention on activities associated with the short-term return (Xu, Zhou and Du, 2019). This argument is contested by the view that managers’ attention in high-performing firms appears to be more risk averse than in low-performing firms (Hoskisson et al., 2017) because high-performing firms are less incentivised to conduct exploration if their set targets are met (Greve, 2003). Adding external factors, the volatility in the environment (i.e. technology, market and industry) implies that maintaining ambidextrous attention would benefit firm performance in a stable environment, but will become detrimental when environment dynamism is high (Luger, Raisch and Schimmer, 2018). It is unclear how firms configure their attention, influenced by different contextual factors.

Methods

In this study, we use fsQCA (Ragin, 2008) to examine the interdependencies between firm organisational and contextual factors that influence a firm's attention focus. fsQCA treats sample firms as cases which are constituted by combinations of theoretically relevant attributes (i.e. organisational and contextual factors of attention framework) and the relationships between these attributes and the outcome of interest (i.e. focus on exploitation, exploration or ambidexterity). The relationships are understood through the examination of set membership (Fiss, 2007). This set-theoretic perspective seeks causes that apply to a particular context rather than a generic regression pattern for all contexts (Crilly, Zollo and Hansen, 2012), thus helping us to understand the contingency of attention configurations.

Sample

The study's setting is the information communications technology (ICT) sector due to three reasons. First, ICT is a broad category that includes a range of high-tech industries (e.g. electronics, photonics, semiconductors, quantum computing, software and data processing). As fsQCA does not provide a generalisation implication beyond the sample (Greckhamer, Misangyi and Fiss, 2013), a broad ICT category allowed us to apply our findings to a wider population. Second, we chose the time frame 2008–2017 to study the attention focus of ICT firms during a slow-changing environment. A 10-year time frame enabled us to observe the stability of attention configurations, which supported consistent attention focus for the firm's innovation management. Also, looking at the period 2018–2021 allowed us to see an environmental disturbance in factor alignment. Third, we chose listed ICT companies on the New York Stock Exchange and NASDAQ because some of the measures for our variables could only be collected from listed companies. We used six sources for data collection: (1) firm press releases for attention foci; (2) four workplace review sites (Glassdoor, Indeed, Comparably and Kununu) for the rules of the game; (3) the USPTO database for resources; (4) BoardEx for players’ knowledge; (5) 10-K forms for firm performance and resources; and (6) the Compustat database for environmental dynamism. We excluded any peripheral manufacturing and services and emphasised key activities of ICT, including communications equipment, semiconductors, wireless communication equipment, software and data processing. This gave us 147 listed companies covering 12 standard industrial classification (SIC) codes1 and 1058 firm-year observations.

Data and set calibration

Outcome: Firm attention focus

One way to measure attention focus was through content analysis, based on March's (1991) or Uotila et al.’s (2009) word lists, which capture decision-makers’ attention in letters to investors. One limitation of this approach was potential impression management in that firms deliberately used keywords to upsell their attention, which had hardly any impact on actions. The other limitation was that some press releases might be congested by a particularly high number of exploration or exploitation-related words. This would potentially inflate the attention focus. In this study, we drew insight from Luger, Raisch and Schimmer (2018) and utilised the activity-based exploration–exploitation measure. We conjectured that long-term attention focus would link to activity outcomes. For each press release, we first identified if it was related to any of the following eight activities: acquisition, alliance, geographical market expansion, product/service market expansion, organisation structure, products and services, sales and distribution, and top management team. For each activity, we provided guidelines on how to differentiate between exploration and exploitation. Table 1 presents an overview of each activity, its classification of exploration or exploitation and illustrative quotes from the press releases for each activity. Second, of 23,505 press releases in a 14-year period, we identified 8068 releases that were associated with one of the eight core activities. We then assigned each press release to a particular exploration or exploitation-related activity. Third, for each firm we aggregated the number of all exploration-related activities or exploitation-related activities between the years 2008–2017 and 2018–2020 separately. Biases may occur due to the number of years that press releases were made available and an uneven distribution of the number of press releases among sample companies. To address these biases, we divided the sum by the number of years of press releases and the total number of press releases to obtain an activity ratio for each firm. We then used the following rule to calibrate exploration and exploitation, respectively: the 80th percentile of the activity ratios was the anchor for full membership; the 20th percentile was the anchor for non-membership; and the median value was the crossover anchor point.

| Category (no. observations) | Definition of exploration and exploitation activities (definitions are mostly adapted from Luger, Raisch and Schimmer, 2018) | Illustrative quotes from press releases |

|---|---|---|

| Acquisition (468) | Acquisition exploration. Acquisitions that are aimed to expand a firm's existing businesses/operations. Focus on innovation, access to new markets and/or offering new product/service categories. | Evolving Systems acquires Six Sense Media to accelerate move to mobile marketing – a new service sector. Combining SSM's real-time analytics and campaign capabilities with Evolving Systems’ Dynamic SIM Allocation™ (DSA) and Mobile Data Enablement™ (MDE) solutions will allow the Company to create a highly personalized experience that engages subscribers in real time from the first-time subscriber's power on their new devices right through their day-to-day usage. (Evolving Systems) |

| Acquisition exploitation. Acquisitions are aimed to strengthen a firm's existing businesses/operations. Focus on efficiency and/or scale of economy. | Acquiring managed hosting and cloud computing services to our business service helps increase existing market share and gain performance and reliability advantages by eliminating in-house ownership of server equipment and costly information technology (IT) systems management staff. (8 × 8 Inc.) | |

| Alliance (352) | Alliance exploration. Alliances are aimed to expand a firm's existing businesses/operations. Focus on innovation, access to new markets and/or offering new product/service categories. | Our strategic partnership with AWS allows us to leverage their cloud-based products, services, and expertise to build next-generation products at speed and redesign our overall IT structure. (Change Healthcare) |

| Alliance exploitation. Alliances are aimed to strengthen a firm's existing businesses/operations. Focus on efficiency, scale of economy and/or core business. | The tremendous solution offerings from IBM, coupled with our unique Agilysys products, position us to provide our existing customers with technology specifically designed to meet their individual needs. IBM RSS is a valued business partner of Agilysys and this recognition is further proof of the solid relationship we share. (Tina Stehle, Senior Vice President and General Manager of Agilysys Hospitality Solutions Group) | |

| Geographical market expansion (205) | Market exploration. Entering into new geographical markets. | We have rolled out 12 new locations in [the] United States and Canada and manage the ecosystem from design to day 2 support. (CREX Inc.) |

| Market exploitation. Strengthening, consolidating, revisiting/withdrawing in (from) existing markets. | We started building our own transfer network since 2008. We have so far strengthened a 2300-km transfer network, a main network frame covering from Beijing, Tianjing, Jinan, Xuzhou, Wuxi, Suzhou, Shanghai, to Hangzhou. (Song Wang, ChinaCache CEO) | |

| Product/service market expansion (81) | Product/service market exploration. Expanding into new industries. | Our digital marketing technology solutions have application in a wide variety of industries. New industries in which we sell our solutions include hospitality, branded retail, automotive, food service and retail healthcare. The planning, development, implementation and maintenance of technology-enabled experiences is relatively new and evolving. Moreover, a number of participants in these industries have only recently started considering or expanding the adoption of these types of technologies, solutions and experiences as part of their overall marketing strategies. (Creative Realities Inc.) |

| Product/service market exploitation. Withdrawal from unrelated industries, consolidate core business. | Healthcare is [the] second biggest revenue source for Cognizant. It accounts for 29.5% of Cognizant's revenue in 2015. However, with the new President Trump coming into power, the Act will be changed substantially. We have suspended contributions to the Centene-Health Net deal and concentrated on consolidation of healthcare. (Cognizant Technology Solutions Corp.) | |

| Organization structure (64) | Structure exploration. Creation of new business units, ventures or subsidiaries, decentralization of operation. | Suzhou SuperEngine is a new subsidiary that works on leading spatial-temporal big-data processing technology. SuperEngine aims to make key disruptive innovations in computer graphics system and spatial-temporal data management. (LuoKung Technology Corp.) |

| Structure exploitation. Restructuring existing organization structures, workforce, introduction of organisational efficiency processes or programmes. | The company is undertaking a series of actions to lower its cost structure and improve efficiencies. These actions include a restructuring plan to reduce its worldwide workforce by approximately 18% in comparison to 30 September 2008, along with other cost cutting measures. (Mobile TeleSystems) | |

| Products and services (578) | Product/service exploration. Introduction of new product/service categories. | The new product DMC3 from AspenTech combines industry DMCplus technology with most innovation tools for creation and maintenance of work of managing programs, providing a full range of required functions. The launch of Aspen DMC3 provides to the production engineer an opportunity, allowing the use of available data on [the] technology process for [the] formation of more effective forecast models in managerial applications. (Aspen Technology) |

| Product/service exploitation. Extension/adaptation/refinement of existing product/service categories. | Looking ahead, we believe that macro trends, including continuing demand for more bandwidth and an increasing number of applications for optics, industrial lasers and sensors, will continue to work in our favour. Our recent improvement in existing sensors & microelectronics allows us to continuously attract new customers, as well as engage in additional projects with existing customers. (Tom Mitchell, Chief Executive Officer of Fabrinet) | |

| Sales and distribution (106) | S&D exploration. Launch of new sales and distribution channels or strategies. | One example of 45 innovation projects from the second half of 2010 to the second half of 2012 is [a] new sales channel via online for iPad sales. The total expected financial outcome is approximately 16.7 billion Korean Won. (KT Corp.) |

| S&D exploitation. Rebranding, restructuring and/or terminating existing sales and distribution channels; pricing and promoting strategies. | We have restructured our retail channels to focus on [a] lower-cost centralized telesales model and highly efficient offshore recruiting model. (Mastech Holding Inc.) | |

| Top management team (432) | TMT exploration. Outsiders join the TMT; reconfiguration of TMT. | RealNetworks has hired Thomas Nielsen as its new president and CEO. Nielsen, who will also join the board, most recently served as VP of the Digital Imaging Group at Adobe Systems. (RealNetworks Inc.) |

| TMT exploitation. Promotion of internal TMT members. | Shahram Askarpour joined IS&S in 2003 as Vice President of Engineering. In March 2012 he was promoted to President. Since his appointment, he has been a key contributor to the company's leadership, strategy and technology. (Innovative Solutions & Support) |

The rules of the game

Pandey and Pandey (2019) used natural language processing techniques to computerise textual analysis of organisational culture. Their study produced trait codes for the competitiveness-oriented and innovation-oriented cultures, setting a solid foundation for the use of content analysis to measure two cultural foci of firms and confirming the robustness of different validity tests. We used content analysis of the four largest workplace review sites on employees’ experience of organisational culture (see illustrative quotes in Table 2). A total of 10,136 employee comments were obtained over 14 years. We went through two steps to ensure the quality of content analysis. First, we used Pandey and Pandey's (2019) word list that differentiates between competitiveness-oriented and innovation-oriented cultures. To improve validity, two research assistants (who are in their final PhD year, specializing in innovation research) and one author rated all the words or terms on a scale of 1 to 7: 1 being definitely competitiveness-oriented and 7 definitely innovation-oriented, with 4 being neither or unsure. The interrater reliability for the three judges was 83%. We retained the words that all researchers rated 6 and above. To validate the seed words/phrases of the two culture orientations, we asked 16 senior managers from seven of our sample companies to evaluate our words/phrases. Table 2 presents the word lists that were used in this study.

| Types of organisational culture | Keywords/phrases used in content analysis | Illustrative quotes from workplace review sites: Glassdoor, Indeed, Comparably and Kununu |

|---|---|---|

| Competitiveness-oriented culture | Accomplishment, acknowledged leader, additional market share, growing market, admired companies, aggressively growing, an edge, are winning, brand leadership, brand-focused strategy, capture * market, clear leader, compelling advantage, compete, competition, competitive, competitors, continue * expand*, continue * grow, continue * lead, continued * success. |

Due to the nature of Cerner's business in healthcare technology, there are a lot of areas for processes and guidelines improvements within your work environment in order to be competitive… We have strong leadership to capture and grow market. (Cerner Corp., Comparably) It is an aggressively growing organization with employee friendly policies. It is a place for growth, both personal and career, with support systems at the ready if you are self-driven and engaged. (Tucows Inc., Indeed) Work was challenging, often was pressurized by targets, growing market and competition. Opportunities to learn new software. Pay was decent, there were corporate activities. Some flexibility however the travel was very demanding. (Agilysys Inc., Glassdoor) Nice people, nice work life balance, smart engineers. It is questionable whether the overall goal of the commercial part of the company is realistic – too ambitious about the additional market share. That said, I've learned a lot from other engineers here, which is nice. (Digimarc Corp., Indeed) |

| Innovation-oriented culture | Advancing science, boldest decisions, breakthrough, competency development, conduct testing, continue creating, continuous evolution, *create, creative*, cutting-edge science, deep-rooted expertise, design, *award, develop, discovery. |

Virtually no learning curve, you get thrown to deep water in the middle of the ocean and somebody shouting at you “Swim or die” !!!. Huge pressure on new ideas, designs and creativity. (Evolving Systems, Kununu) Great place to work! Awesome team of dedicated engineers working on exciting products. Deep-rooted expertise and talent – people working on brilliant ideas. Offices and clients located around the globe. It is a very dynamic and fast paced company. (Inpixon, Indeed) I'm surrounded by very intelligent people and have learned a lot in a short period of time. The work is challenging and there are a ton of projects that can be happening at the same time. It is an agile organization and does not mind the boldest decisions. Overall, it has been a great place to work so far. (GTY Technology Holdings, Indeed) Great place to work as it gives you space to be creative. A lot of room for continuous learning. (Synchronoss Technologies Inc., Glassdoor) |

Second, we built four tags of sentence parsing for the single keywords. If the sentence parsing tag was Subjective verb, Attribute or Complement, the noun, gerund or verb was retained in the next step of keyword counts. If the parsing tag was Adverbial, we followed two rules to retain positive ADV. Rule 1: Positive adverb ∩ verb → Positive verb. Rule 2: Negative adverb ∩ verb → Negative verb. Content analysis was conducted using a computer programme in R language specifically written for this study.

Third, to avoid biases, we removed the top 10th percentile of the comments containing a high word count only on one culture type. We also used the total word count divided by the number of employees who made these comments to balance the difference between high and low-reviewed firms. Next, we calculated the average word count per firm and year during our study period and then calibrated the 80th percentile as full membership, the bottom 20th percentile as non-membership and the median value as the crossover anchor point.

Resources

To measure scale-free resources, we considered patents which are not subject to opportunity costs (Kang and Kim, 2019). For each patent, we analysed its backward citations in the last 5 years. We computed average repeated citation counts for each firm over 14 years. We also used the number of patents as an alternative measure for scale-free resources.

For non-scale-free resources, we followed Kang and Kim's (2019) suggestion and used R&D budget and free cash flow, both of which are subject to opportunity costs. We measured the combined R&D budget and free cash flow by computing the Euclidean distance from the origin (Kang and Kim, 2019). The bigger the Euclidean distance, the more non-scale-free resources the firm had. Both scale-free and non-scale-free resources used the same calibration rules (80th percentile, bottom 20th percentile and median) as we used for the rules of the game.

Players

Players in this study included executive directors and senior managers. The longer they stayed in the same company and the more functional roles they had taken, the richer the specific experience accumulated about that company by the person (Acquaah, 2012). Firm-specific expertise was computed in three steps: (1) for each decision-maker, their expertise was measured by the number of different functional areas and the number of years that the manager had worked for the same company; (2) the sum of total functional areas and years served was taken for the whole senior management team between 2008 and 2021; (3) this sum was divided by the number of observed years and the number of senior managers in each company (to avoid size bias). As with managers’ cross-industry experience, we drew insight from Ener (2019) and considered the number of different industries that the manager had worked for in addition to the ICT industry, which indicated the breadth of the decision-maker's experience. The same calibration rules were followed as previously applied to resources.

Firm performance

Following Stevens et al. (2015), we operationalised firm performance as the return on total assets (ROA). ROA is not affected by a firm's financial leverage and is a good indicator of a firm's internal management (He and Huang, 2011). The same calibration rules were applied to this variable.

Environmental dynamism

Dynamism was measured by industry revenue, industry R&D expenses and industry profit, representing volatility in the market, technology and industry (Bourgeois, 1985). We started by selecting all companies in our 12 sample SIC codes from the Compustat database from 2003 to 2016, 5 years preceding the year of examination. To differentiate between high and low dynamism, we used standard errors divided by the mean of each respective variable over the past 5 years. We followed Greckhamer et al. (2008) by looking at the distribution of dynamism scores of the 12 sample sectors. We set a breakpoint of the 70th percentile: companies in sectors that belonged to the upper quartile being coded as highly dynamic – full membership, with the remaining percentile for null membership.

Results

We conducted sufficiency analyses by marking a truth table that generated 256 possible combinations of fuzzy sets under study (Ragin, 2008). Next, we set a priori minimum thresholds for consistency and the frequency of classes per configuration. For frequency, following Misangyi and Acharya (2014), we set the minimum acceptable frequency to three cases per configuration. For consistency, we identified all configurations that had at least three cases and a minimum raw consistency >0.85 (Ragin, 2008), followed by an elimination of any configurations that had a PRI consistency <0.75 (Misangyi and Acharya, 2014). We used the fsQCA 3.0 software (Ragin and Davey, 2016) to conduct our analyses and report consistency and coverage figures for each analysis.

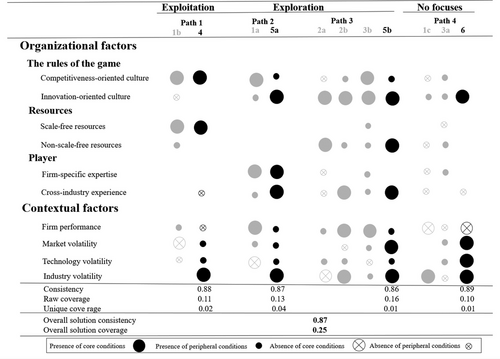

Figure 2 reports a combination of parsimonious and intermediate solutions produced by the fsQCA software. The parsimonious solution is based on simplified assumptions and presents the most important conditions which cannot be left out of any solution. These conditions are deemed core as they withstand both easy and difficult counterfactual analysis, indicating strong causal relationships with the outcomes. Intermediate solutions only withstand the easy counterfactual analysis and contain both core and peripheral conditions. Peripheral conditions suggest weak causal relationships with the outcomes. Core conditions are denoted by large black circles as presence and large crossed circles as absence, whilst peripheral conditions are presented by small black circles as presence and small crossed circles as absence. Thus, with fsQCA, we could identify whether the presence or absence of core or peripheral conditions (and their combinations) are consistent with the presence or absence of a particular outcome.

Figure 2 shows three configurations (1a, 1b and 1c) and two configurations (2a and 2b) that direct firm senior managers’ attention to exploitation and exploration, respectively. It also presents two configurations that hold a dual attention focus (3a and 3b). Next, we explain how organisational and contextual factors in combination regulate the allocation of varied attention foci.

A single-attention focus

Attention to exploitation

Configuration 1a can be profiled by the presence of decision-makers’ firm-specific expertise, cross-industry experience and the competitiveness and innovation cultures that sustain an attention focus on exploitation. The absence of technology volatility indicated that firms’ existing technologies would suffice, considering short to medium-run technology trends. High market volatility and firm high performance suggested constant pressure on senior managers for revenue growth, despite frequent changes in market structure. Under these conditions, senior managers in exemplary firms such as Fabrinet anchored their attention on exploitation by concentrating on managers’ specific expertise to maximise the utilisation of existing know-how in product/service variations and upgrades to attract new customers and serve existing customers. Managers’ cross-industry experience helped close the internal, specific expertise gap – seeking unconventional connections between existing ideas and technologies by offering a fresh understanding of new perspectives. Besides, the competitiveness culture shaped the attention focus by concentrating on competition, ambitious targets and fortified goal accomplishment to achieve increased revenue through being cost-effective. Meanwhile, the innovation culture helped support attention, appreciating creativity and new solutions to difficult problems in product/service exploitation.

Configuration 1b can be profiled by the presence of firm scale-free and non-scale-free resources and a single competitiveness culture that regulates senior managers’ attention to exploitation. Compared to configuration 1a, the contextual factors in configuration 1b indicated a more certain environment and a stable market change pattern. Senior managers thus paid attention to core product/service consolidation shaped by key resources and the competitiveness culture. Scale-free sources, like patents, had enabled senior managers to focus their attention on the ongoing exploitation of patent applications (e.g. see 8 × 8 Inc. in its duplicate use of patents to consolidate its product lines around a single cloud platform service). Similarly, non-scale-free resources, such as available finance, provided sufficient cash flow for acquisitions and alliances – a strategic means to obtain desirable technologies (e.g. Automatic Data Processing Inc.) and to set decision-makers’ attention on product/service consolidation. The single competitiveness culture favoured attention to exploitation but stressed the importance of consolidation efficiency to grow revenue.

Configuration 1c can be profiled by the presence of a sole innovation culture that failed to direct decision-makers’ attention to exploration, but to exploitation instead. The contextual factors of this configuration showed unstable profit and performance decline. Decision-makers concentrated on organization restructuring through downsizing both operations and workforce, aiming at the improved performance (e.g. Mobile TeleSystems). Though an innovation culture was part of this configuration, it did not produce exploration attention due to the accumulated low morale caused by costcutting and loss of manpower. For example, reductions in R&D investment (non-scale-free resources) stalled new knowledge inquiry while rationalisation was emphasized. The elimination of positions, departments and even divisions in the firms created a loss in senior managers’ valuable knowledge (both firm-specific and cross-industry). The absence of managers’ knowledge and non-scale-free resources had directed managers’ attention to exploitation, aiming at performance improvement by restructuring.

Attention to exploration

Configuration 2a shows a profile where both the innovation culture and the non-scale-free resources channelled senior managers’ attention to exploration. The contextual factors in this configuration showed that firms had efficiently used their assets to generate profits, despite the turbulence in the technological environment. This configuration was observed in exemplar firms (e.g. LuoKung Technology Corp.), which had used new ventures to prioritise the development of leading technologies in niche markets. Rather than waiting for opportunities, they tried to create opportunities for themselves and respond to changes in the technology market. Various non-scale-free resources, for example, R&D staff (e.g. Evolving Systems Inc.), advanced testing equipment (e.g. Inpixon) and software purchase (e.g. Asure Software) enabled exemplar firms to stay abreast of the competition. The emphasis on innovation culture helped managers to aim for continuous exploration through pioneering initiatives, cutting-edge technologies and fast response to technology changes.

Configuration 2b is profiled by non-scale-free resources, cross-industry experience and the competitiveness and innovation cultures that shape decision-makers’ attention to exploration. Volatile technology changes required concentrating on emerging technology while unstable industry profits justified the economic return of exploration. Configuration 2a showed little concern for rationalisation, but configuration 2b (see exemplar firms like Proofpoint Inc.) kept up with the trade-off between exploring novel know-how and budget and efficiency constraints. The inclusion of both cultures reflected a tension in managers’ attention foci: the innovation culture pulled managers to creative solutions while the competitiveness culture pulled for deliverables and productivity. The pairing of non-scale-free resources and cross-industry expertise became instrumental in alleviating such tension. Cross-industry experience curbed the influence of non-scale-free resources on decision-makers’ attention (e.g. scientific discovery, technology evolution) by calling for a consideration of the potential applicability and scalability of the exploration.

Ambidextrous attention

Configuration 3a includes blends of non-scale-free resources, firm-specific expertise and two cultures that put a dual-attention focus on senior managers’ agenda. Uncertainty in both technology and market environments drove senior managers to stay attentive to exploration. Exemplar firms (e.g. BlackBerry) had been driven by the innovation culture and non-scale-free resources to emphasise product/service innovation. The subsequent product/service success established a strong market position. Years of market leader position had established a competitiveness culture, which allowed excessive attention on product exploitation to satisfy a unique group of customers (e.g. enterprise preferences in BlackBerry), hence overlooking competition elsewhere (e.g. Android and iOs systems for other customer groups in the BlackBerry case). Loss of dominant market position on previously successful products forced managers to consider business and product transformation. The appointment of a new CEO speeded up this transition process (e.g. the ceasing of hardware manufacturing for software security in BlackBerry in 2013). Maintaining performance was a struggle during the transition. The innovation culture and non-scale-free resources were cannibalised by competitiveness. Said differently, experimentation and risk-taking for a new business direction clashed with decision-makers’ specific expertise entrenched in the prior business for exploitation.

Configuration 3b contains all elements of organisational factors and adopts ambidextrous attention. The main uncertainty was caused by increased competition, which drove attention to pursuing stable revenue through exploitation, as well as far-reaching exploration for above-market performance. Even the importance of the competitiveness and innovation cultures emphasised short- and long-term return trade-offs, requiring managers to balance time and energy instead of switching between exploitation and exploration. Differing from configuration 2b, by which decision-makers focused on new technological exploration with the consideration of technology scalability, the focus in this configuration was on stretching existing technologies either for new product/service categories or new industries. Cross-industry experience and non-scale-free resources served to regulate managers’ attention towards exploring new applications for existing technologies and exceeding customers’ expectations. Meanwhile, firm-specific expertise and scale-free resources afforded enough operational competence to implement the exploration initiatives. Exemplar firms in this configuration (e.g. Oracle Cerner, Fiserv Inc.) sought cooperation and synergism between exploitation and exploration.

Attention configurations under discontinuous environmental conditions

Figure 3 shows four configurations of attention framework (4, 5a, 5b and 6) under environmental turbulence during the economic crisis in 2018 and the Covid-19 pandemic from 2019 to 2021. Under these extreme circumstances, we traced four possible change pathways: one for exploitation, two for exploration and one for no attention focus. The first pathway is configuration 1b to 4. Adjusting from a rather stable to a dynamic environment, configuration 1b temporarily suspended investment in non-scale-free resources (e.g. paused investment in technology acquisition for new technologies) and relied on its existing scale-free resources (e.g. existing technologies) to regulate decision-makers’ attention to the utilisation of existing technologies. The second pathway, 1a to 5a, represents a contrasting case. Exemplar firms responded to increased uncertainty in technology and industry by increasing the influence of innovation culture and cross-industry experience. Paying more attention to experimentation was seen as a solution to tackle the environmental shock. The third pathway is configuration 2a, 2b and 3b to configuration 5b. Whilst configuration 2b remained largely unchanged in the disruptive environments, configuration 2a incorporated some appreciation of the competitiveness culture and broad industry experience to justify the economic return of exploration. Configuration 3b temporarily reduced its investment in factors that facilitated attention to exploitation (i.e. scale-free resources and firm-specific expertise), pushing decision-makers’ attention to exploration. The last pathway indicated two configurations, 1c and 3a to 6. Firms following this path suffered from attention drift. In the case of 1c to 6, despite the recognition of innovation culture, the continuous scarce resources and knowledge made it difficult for decision-makers to reorient their attention to exploration. In the case of 3a to 6, industry volatility affected continuous investment in technology development, and the gradual diminishment of previous firm-specific expertise created confusion on decision-makers’ attention focus.

Additional analysis

Whereas fsQCA is useful to identify sufficient conditions for the configurations of attention, we also performed necessary condition analysis (NCA) to understand what organisational factors are necessary for attention to exploitation or exploration (Dul, 2016a, 2016b). NCA with logistic transformed data suggested that all six measures of organisational factors had a necessity effect size that was greater than zero (Table 3), which indicated the complex causality among organisational factors. Although the effect sizes were very small (0.01–0.09), competitive culture (0.09), scale-free resources (0.06) and firm-specific expertise (0.07) had bigger effect sizes on attention to exploitation compared to innovation culture (0.08), non-scale-free resources (0.07) and cross-industry experience (0.06), which had larger effect sizes on attention to exploration (Table 3). These value differences in effect sizes implied the relative influences of six measures on exploitation and exploration.

| Attention to exploitation | Attention to exploration | |||

|---|---|---|---|---|

| Necessary condition | Effect size logistic transformation | Effect size standardized transformation | Effect size logistic transformation | Effect size standardized transformation |

| Competitiveness culture | 0.09 | 0.37* | 0.01 | 0.14* |

| Innovation culture | 0.02 | 0.13* | 0.08 | 0.41* |

| Scale-free resources | 0.06 | 0.26* | 0.01 | 0.11* |

| Non-scale-free resources | 0.01 | 0.12* | 0.07 | 0.32* |

| Firm-specific expertise | 0.07 | 0.31* | 0.02 | 0.10* |

| Cross-industry experience | 0.01 | 0.10* | 0.06 | 0.29* |

- Note: 0 < d < 0.1, small effect; 0.1 ≤ d < 0.3, medium effect*; 0.3 ≤ d < 0.5, large effect**; d ≥ 0.5, very large effect***.

Discussion

Using a configurational approach, we aimed to shed light on interdependencies between organisational and contextual factors that regulate firm attention to exploitation, exploration or ambidexterity. In so doing, we make the following three contributions.

Unpacking the black box of attention allocation

Although attention allocation is one of the main topics of the ABV, there is insufficient understanding of its underlying mechanisms that explain attentional outcomes as extant research tends to seek single causes as the main explanatory mechanism (Brielmaier and Friesl, 2022). To address this gap, our attention framework encapsulates key organisational factors of the rules of the game, resources and players (Ocasio, 1997) and key contingencies of the market, technology, industry and firm performance. Thus, the framework enables a nuanced examination of two forms of alignment – matches between attention and contextual factors and between attention and organisational factors.

The seven configurations (1a–3b) provide vivid illustrations for alignments and misalignments. Configurations 1a, 1b, 2a, 2b and 3b are examples of alignments judged by firms’ high performance. We find that market, technology and industry exert different influences on attention foci: market volatility urges attention to existing know-how extension (1a and 3b); technology volatility encourages attention to leading technologies (2a and 2b); and industry volatility demands attention to sustain profits (2b and 3b). If these attentional demands are matched to organisational factors, then effective alignment is observed: attention to extending existing know-how matches players’ knowledge and the dual cultures (1a and 3b); attention to leading technologies aligns with the non-scale-free resources and the innovation culture (2a and 2b); and attention to stable profits matches the competitiveness culture (2b and 3b). Orlikowski and Yates (2002) suggest that organisational factors could be temporal since a situation is transitory and the organisational settings should be flexible to support attention as required. Our results recognise attention temporality but also stress the importance of configurational stability in the attention framework. Environment cues may instigate new attention requests but the rigidity in organisational factors (Ener, 2019), as well as decision-makers’ prior mental model (Gruber, MacMillan and Thompson, 2013; Kaplan, Murray and Henderson, 2003), affect how external conditions should be reacted to. Even if the first alignment (between attention and contextual factors) is achieved, like configurations 1c (match between the exploitation focus and industry dynamics) and 3a (match between ambidextrous attention and market and technology volatilities), the second alignment with internal culture, players’ knowledge and resources might be slow to adjust, as seen in both cases 1c and 3a. Therefore, the inclusion of organisational and contextual factors and the two forms of alignment make our attention framework a parsimonious but powerful tool to understand attention allocation.

Advancing understanding of a configurational approach

Scholars have suggested that TMT diversity increases attention to exploration (Koryak et al., 2018; Tuggle, Schnatterly and Johnson, 2010), yet we know little about why such effects occur. Using fsQCA, we gain a deeper understanding of how attention antecedents interact to shape attention allocation. We find that different combinations of organisational factors may lead to the same attentional outcome. For instance, the competitiveness culture in combination with resources (see configuration 1a) or the player's knowledge (see configuration 1b) all lead to exploitation. Factors combined in the same way may also exhibit different influences. For example, competitiveness and innovation cultures combined may shape different attention outcomes: exploitation in configuration 1a, exploration in configuration 2b and ambidexterity in configurations 3a and 3b. Prior research suggests the competing facets of a competitiveness culture (Kashan, Wiewiora and Mohannak, 2021): firm-specific expertise (Shepherd, Mcmullen and Ocasio, 2017) that regulates attention to exploitation versus innovation culture (Jin, Navare and Lynch, 2019) and non-scale-free resources (O'Brien, 2003) and cross-industry experience (Bjornali, Knockaert and Erikson, 2016; Koryak et al., 2018) that direct attention to exploration. Our findings suggest the relative influence of these factors. Competitiveness culture, scale-free resources and firm-specific expertise are relatively influential on exploitation (see configurations 1a and 1b of the core conditions, as also confirmed by NCA), whilst innovation culture, non-scale-free resources and cross-industry experience are prominent in directing attention to exploration (configuration 2a and 2b of the core conditions and NCA).

Methodologically, the novelty of fsQCA is its ability to capture stability in attention configurations over a 10-year period under normal environmental conditions. fsQCA is also novel in tracing sudden changes in attention focus and the configuration paths triggered by the 2018 financial crisis and the Covid-19 pandemic. The changing conditions in our study concur with recent literature that Covid-19 created substantial challenges in the market, technology and industry (Shankar, 2020). The literature suggests that firms which respond in a timely fashion to environmental changes outperform firms that fail to respond (Wright and Nyberg, 2017). However, when a crisis is seen as an infrequent occurrence (e.g. Covid-19), not all firms are attentive to such an event (Ghobadian et al., 2022). Interestingly, all seven configurations in this study show modifications, though not all have responded properly to external stimuli. There are three observations here (Figure 2): (a) keeping ambidextrous attention in unstable conditions is unmanageable, as this not only stretches attention capacity (Bauer and Friesl, 2022) but also potentially loses the attention purpose by deterring managers from engaging in more exploration or exploitation-focused issues (Luger, Raisch and Schimmer, 2018) (see path 3b–5b); (b) attention to exploration provides more avenues to sustain performance (paths 1a–5a and 3b–5b) than to exploitation (path 1b–4); and (c) firms that fail to maintain alignment in normal conditions might enter a downward spiral of recovery. Two configurations (1c and 3c) lost their attention focus during the pandemic and found themselves even more difficult to recover.

Addition to attention to exploration and exploitation

From the attention viewpoint, we add new insight into the academic conversation on exploration/exploitation. Organisational theorists have identified different approaches to managing ambidexterity (Andriopoulos and Lewis, 2009; Boumgarden, Nickerson and Zenger, 2012), but our research provides additional understanding of attention pathways between exploration, exploitation and ambidexterity under extreme conditions (see Figure 2). First, we find path flexibility to allow minor adjustments in configurations to reorient attention focus. Path 2 (1a to 5a) and Path 3 (3b to 5b) all adopt minor changes in organisational factors by upscaling peripheral conditions into core ones as a reorientation to exploration provides more chances to retain performance. This suggests some resilience in attention configurations by incorporating incremental changes to avoid significant disturbances as a strategy to address an ad-hoc external shock. Second, some organisational factors are more difficult to upscale than others, thus exhibiting contrasting effects on the emergence of new pathways. We find that non-scale-free resources are difficult to upscale quickly and therefore 1b could only migrate to 4 instead of creating a new pathway, say 1b to 5b. In contrast, cross-industry experience is comparably easy to acquire through new hiring, hence facilitating the creation of new pathways: 1a to 5a; 2a to 5b; 3b to 5b. Third, moving away from previous configurations might be potentially dangerous causing configuration deterioration. The implication for attention management is that some temporary, discontinuous changes in configurations might be detrimental as firms may face a quick decay in existing knowledge, skills and cultures (March, 1991).

Conclusion

This paper sets off to explore the complex relationships between organisational and contextual factors of the attention framework that collectively allocates attention to exploitation, exploration and ambidexterity. We theoretically unravel that the attention framework is the conjunction of factors where the attention focus has multiple causes; that different factors can lead to the same attention outcome; and that factors may exhibit different influences on attention. This paper develops three managerial implications. First, having a single or an ambidextrous attention focus can lead to high performance, but such performance implies a fit between attention, organisational and contextual factors. Maintaining ambidextrous attention poses more demands on coordination between firm cultures, resources and players’ knowledge. Second, managers’ awareness of the nuances of each contextual condition as variations in the market, technology and industry provides different opportunities for attention configurations. Third, under discontinuous conditions, attention configurations need adjustments to address uncertainty. Managers need to consider the pathway for changes, as temporary suspension of investments in certain organisational factors might cause deterioration in knowledge and resources that are difficult to recover.

This study is not free from limitations. One of the biggest research challenges is to operationalise constructs that are suitable for a longitudinal study. Instead of the two variables we selected for each internal condition (due to the constraints set by the number of variables that could be included in the configuration approach), there are other promising avenues for variable selections in future research. For example, this study measured firm attention focus on an activity-based proxy as an indirect measure. More direct measures could be retrieved from firms’ internal reports, minutes or other internal documents that capture firms’ attention focus over time. The rules of the game could be measured by organisational logic, beliefs and visions. Any development in quantitative data collection would improve our understanding of the impact of the rules on attention allocation in a longer time frame. Even for culture, organisations might choose other culture types, such as control and coordination-oriented, customer-oriented, human-resource oriented and team-oriented (Pandey and Pandey, 2019). Similarly, slack resources may show different influences on attention distribution. Furthermore, this research takes the upper-echelons view and studies the attention framework at the firm level. We wonder whether the attention framework varies depending on the level of management within an organisation.

Biographies

Jing Cai is a Senior Lecturer at the University of Aberdeen Business School. She received her PhD in Management from the Management School, University of Sheffield. She has broad research interests, including open strategy, platform ecosystem, firm strategy, technology management and innovation management. Her work focuses on technology management, innovation and business strategy and has been published in Research Policy, Long Range Planning and International Journal of Innovation Management.

J. Ignacio Canales is Professor of Strategic Management at the University of Aberdeen Business School. Previously he was a Professor, Reader and Senior Lecturer in Strategy at the University of Glasgow and a Lecturer in Management at the University of St Andrews. He received a PhD in Management from IESE Business School in 2004 after a successful career in industry in his home country of Chile. His research focuses on the strategy-making process and has been published in the Academy of Management Review, Journal of Management Studies and Long Range Planning.

References

- 1 SIC codes covered in this study: 2630, 3576, 3674, 6110, 6120, 6201, 6311, 7370, 7371, 7372, 7373 and 7374.