Are “Education Lotteries” Less Regressive? Evidence from Texas

Abstract

With little exception, research has shown that state-sponsored lotteries are regressive in the aggregate, in that lottery sales do not increase proportionately with area income. We test whether the purpose of lottery revenues mitigates this spatial regressivity. In August of 1997, the statutory earmark for Texas Lottery proceeds moved from the General Fund to the Foundation School Fund, which supports K-12 education. Beginning in 2000, the lottery was increasingly marketed as a funding stream for public schools. Drawing on a content analysis of lottery commission press releases from 1993 to 2006, we find that Instant game sales were modestly responsive to education messaging, in that sales became noticeably less regressive in the wake of more intense reminders of the education component of the state lottery. It is likely that unobserved heterogeneity in local sales factors played a much bigger role than education marketing.

1 Introduction

Since the first modern state-sponsored lottery was instituted in New Hampshire in 1964, lotteries have proliferated to 42 states and the District of Colombia. With little exception, research has shown that these lotteries are a highly regressive form of public revenue generation, in that purchases do not increase proportionate to individual or aggregate income.1 Aggregate regressivity is mutable, however, and attenuated with larger jackpots and more expensive instant (scratch-off) games.2 The use of lottery revenues may matter as well. Landry and Price (2007) find that demand for lottery tickets rises when revenues are earmarked for education. They also find that casino gambling does not substitute for lottery play in states that earmark lottery proceeds for education. This suggests that the education earmark makes a substantive difference in the population of lottery players. Recent work has shown that this difference may be correlated with income. In Tennessee, lottery revenues are predominantly directed toward in-state college scholarships, and Mitchell (2011) shows that instant sales are increasing in the number of local students who are awarded lottery-funded scholarships. This suggests that a sense of targeted altruism among higher-income players may offset some part of disproportionate lottery spending by lower-income players. Or in the aggregate, that earmarks for public goods may shift lottery sales toward higher income areas. Can earmarks for lottery revenues mitigate their inherent regressivity? We address this question by exploiting changes in the structure and marketing of the Texas Lottery.

Texas Lottery tickets were first sold in 1992, with all sales going to the state's General Fund. In August of 1997, state lawmakers approved a bill to dedicate lottery revenues to K-12 education via the Foundation School Fund (FSF), but the flow of lottery revenues was diverted in name only. Legislators and the media were aware that shifting revenues from general spending to school spending would not necessarily increase resources available to local schools. On the contrary, overestimates of projected lottery revenues could expose school budgets to significant losses, as had been the case in other states with earmarked lottery revenues (Guerra 1997). In late 1997, the Texas Lottery Commission considered an effort to increase sales by re-branding the lottery as a boon for local schools but concluded that doing so would be insincere. Alluding to the fungible nature of state finance, one representative remarked that “[d]edicating the lottery didn't mean one nickel more for education.”3 By mid-2000, however, the lottery changed course and increasingly emphasized its education outlays. For instance, the Texas Lottery Commission added a crawling text box to its website announcing how much had been contributed to the Foundation School Fund (more than $3 billion as of September 2000).

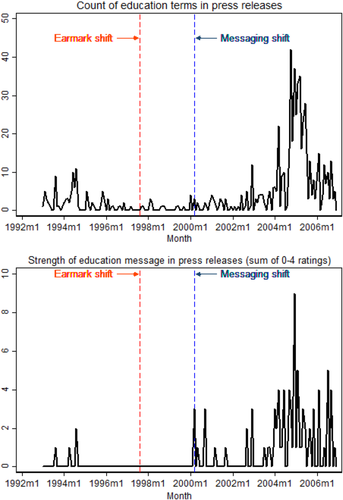

Additional evidence of a lottery messaging shift is found in Figure 1. We obtained 2070 Texas Lottery Commission press releases from the years 1993–2006 and rated the potency of the official education message in two ways. First, a content analysis counted the frequency of terms related to education and public schools in each press release.4 At the median, there were 10 press releases per month and just one instance of a word related to education over the course of the month.5 The top panel of Figure 1 clearly illustrates that this objective measure of the education message was modest before, during, and immediately after lottery revenues were shifted from the General Fund to the FSF. Beginning in early 2000, shortly before the Commission's official website was updated to draw attention to education outlays, the text count of education terms began to grow, peaking at 42 terms in October 2004. This rise in our objective measure of the lottery's education marketing coincides with a similar spike in a more subjective measure depicted in the bottom panel of Figure 1. Each press release was rated 0–4 in terms of how much it discussed the lottery's role in funding public schools. The bottom panel of Figure 1 plots the time path of the monthly sum of these ratings. The median monthly rating (summed over all press releases in that month) was zero, and the maximum was nine. A sharp shift in subjective education messaging can be pinpointed to the first quarter of the year 2000.

Notes: The figures plot assessments of the strength of the education component in 2074 Texas Lottery Commission press releases. The upper panel plots the average count of education-relevant words per month. The lower panel plots monthly mean ratings assigned by a subjective reader (0–4 range, with 4 meaning that the entire press release was devoted to the lottery's relationship to public schools).

We utilize annual county-level sales data for Lotto Texas and Instant games alongside year-by-year variance in the objective measure of the lottery's education marketing to estimate whether the purpose of lottery sales works against the inherent tendency for lower income areas to contribute relatively more to sales. Results suggest that this may be the case, although to a very small degree and only for Instant game sales. An incremental increase in the lottery's education marketing—as proxied by more education terms in official press releases—is followed by a statistically significant rise in the income gradient with respect to sales. And yet, the education message would have to be an order of magnitude more potent than its peak value in order for the lottery to be conditionally progressive. The interactive effect of income and education marketing does not appear to vary by area racial profiles, educational attainment, or religiosity, nor does the effect of education marketing on total sales vary by these local characteristics. News media attention directed at the lottery, and in particular, the sentiment of news on the lottery, has a complicated relationship with sales. News reports on the lottery tend to lower overall sales, exacerbate aggregate regressivity, and offset the education component of the Lottery Commission's official message. Results are sensitive to the inclusion of controls for county fixed effects and time trends, suggesting that unobserved spatial heterogeneity (both fixed and time varying) is shaping the income gradient to a much greater degree than statewide marketing efforts. We conclude that while education marketing may shift some sales toward more affluent counties, the effect is small and dominated by heterogeneous unobserved factors.

2 Conceptual Framework

Although a lottery is not a conventional form of taxation, it does impose an implicit tax, in expectation, on players. A fixed portion of the cost of a lottery ticket is state revenue. Viewed in this way, the lottery tax is in fact very high relative to the expected prize (often 50% or more). For instance, in fiscal year 2010, the Texas Lottery Commission transferred $989.14 million to the state for its lottery-funded education programs while awarding $2.3 billion in prizes. This implies an average tax rate of 43.3%.6 Abundant research, effectively summarized by Grote and Matheson (2011), has shown that lottery play and lottery sales increase at a rate of less than one-for-one with income, effectively making state lotteries a highly regressive source of public funds.

To be clear, much of this vein of the research literature tests for an aggregate sales response to variation in area income, measured at the county or perhaps zip code level. Point estimates are best interpreted as aggregate sales-to-income gradients and not stand-ins for individual income elasticities. Garrett (2016) outlines the ecological fault lines in the assumption that aggregate income gradients speak for individual income elasticities. Nevertheless, the aggregate response has important policy implications and is more readily attainable than the individual income elasticity.

A retrospective analysis of prior research is suggestive that heterogeneity in earmarks may be driving some of the variation in reported income elasticities. Mikesell (1989), for instance, notes that Illinois defied the conventional wisdom that lotteries are a highly regressive form of taxation, finding near-proportionality. However, there is no discussion of the Illinois lottery's earmark for education, which may be a salient oversight. Hansen, Miyazaki and Sprott (2000), in an investigation of five states' lottery programs, find marginally less regressivity in states that earmarked for education than general fund states. Finally, Garrett (2012) estimates a much lower elasticity for Texas Instant games after the earmark than do Price and Novak (1999) using data from the Texas Lottery's years as a general fund revenue stream.

Once we cast a lottery purchase as a voluntary tax or contribution to public coffers, it is straightforward to posit the idea that lottery play is an impure public good, producing private consumption as well as the public good. Players gain utility from consuming a lottery ticket or instant game as well as from the “warm glow” of supporting primary and secondary education. Kotchen (2006) offers a model for so-called “green market” goods, which provide both consumption and public services. Within this framework, consumers may be independently motivated by the private benefit and social services of goods, but hybrid goods exhibiting both features can change consumers' contribution behavior, sometimes sub-optimally.

Lottery purchases are distinct from other tax-generating purchases such as consumer goods, groceries, or real property for a number of reasons. First, the purchase of lottery goods is entirely substitutable or avoidable. Andreoni (1990) and Ottoni-Wilhelm, et al. (2017) demonstrate that as a result of the warm glow effect, impure altruists are not indifferent between donating voluntarily to a cause and contributing through compulsory taxes. While the tax on lottery purchases is compulsory, the purchase itself is entirely voluntary. Second, the sales tax on consumer purchases in Texas ranges from 6.25 to 8.25%7, whereas the implicit sales tax on a lottery purchase may exceed 40% (authors' calculations). This substantial difference renders the consumer contribution to the public good and subsequent warm glow a more significant consideration.

Morgan (2000) frames lotteries as a means of overcoming the free rider problem in the provision of public goods and demonstrates that additive public and private benefits motivate contributions even among risk-neutral, non-altruistic individuals. That is, individuals may rationally purchase a lottery ticket at a price greater than the expected prize value.

To the question at hand, in order for an education lottery to be less regressive in the aggregate than a generic public lottery it must attract more higher-income purchasers at either the extensive or intensive margin. This result is premised on the idea—as yet, untested—that higher-income purchasers view an earmarked lottery as a fundraiser for schools, and that the bundled gameplay is more attractive or more convenient than making direct donations. In the framework of Kotchen's (2006) model of green markets and impure altruism, perhaps higher-income players are more apt to view lottery purchases and school funding as complements. Another necessary condition is that consumers view education lotteries as non-fungible, or at least as imperfect substitutes for other public sector resources. This notion has merit: Jones (2015) finds that the introduction of an education lottery crowds out private giving to education organizations. In a series of experiments, Lange, List, and Price (2007) demonstrate that the dual nature of lottery ticket benefits induces more participation. Mitchell (2011) finds that purchases of Tennessee lottery instant tickets, which funds scholarships for Tennessee high school graduates, are higher in counties where more students receive scholarships. A priori, therefore, we would expect an education lottery to have a more progressive income gradient. This need not be the case, however, and we acknowledge that the theoretical underpinnings are ambiguous. We cannot rule out the idea that lower-income buyers exhibit more impure altruism toward public schools, or that buyers of all income levels view the public portion of lottery proceeds as equivalent to their involuntary taxes and direct donations.

3 Data

The Texas Lottery Commission provided sales data for Lotto Texas, a jackpot game limited to Texas purchasers, as well as summative instant games for each ZIP Code and each month from January 1993 through December 2006. They also provided the advertised prize level for every Lotto Texas drawing between 1993 and 2006. There are two drawings each week. For the purpose of this analysis, an annual average of the advertised prize is calculated along with its square.8 Table 1 lists summary statistics for lottery sales, text counts, and other county covariates. Households spent $13.43 on instant scratch-off games per month, typically, and $3.95 per month on Lotto Texas tickets.9 The average advertised prize was $1.5 million.

| Mean | St. Dev. | |

|---|---|---|

| ln(per household Instant sales) | 2.233 | (0.953) |

| ln(per household Lotto Texas sales) | 0.872 | (1.071) |

| ln(median household income) | 10.341 | (0.217) |

| Number of Texas Lottery Commission press releases per month | 12.391 | (8.856) |

| Education message text count | 3.911 | (7.213) |

| News media score (standard deviations from the mean) | 0.007 | (1.000) |

| Average Lotto jackpot (millions) | 1.493 | (0.878) |

| Black population share (0–100) | 6.674 | (7.238) |

| Hispanic population share (0–100) | 27.449 | (22.694) |

| Percent holding a Bachelor's degree (0–100) | 15.235 | (6.137) |

| Percent in an urban locale | 42.747 | (30.410) |

| Percent adhering to any religion (0–100) | 0.769 | (0.196) |

| Percent adhering to evangelical Christianity (0–100) | 0.375 | (0.181) |

| Number of households | 32,727 | (114,985) |

| Unemployment rate (0–100) | 5.740 | (3.299) |

| Cash 5 game available (0/1) | 0.809 | (0.393) |

| TX Millionaire game available (0/1) | 0.623 | (0.485) |

| TX 2-Step game available (0/1) | 0.407 | (0.491) |

| Mega Millions game available (0/1) | 0.222 | (0.415) |

| County borders a state without a lottery (0/1) | 0.087 | (0.282) |

| County borders a state without a multi-state jackpot (0/1) | 0.019 | (0.135) |

| Share of month that passes before largest jackpot (0–100) (used only for monthly sales panel model) | 65.797 | (29.340) |

- Notes: Summary statistics for 42,064 county-months.

As Price and Novak (1999) note. instant games are far more regressive than Lotto Texas. Furthermore, jackpot game purchases are increasing in the size of the jackpot (Oster 2004). Considering the documented differences in purchase behavior between these two games, we analyze them separately.

The Texas Lottery Commission also provided all press releases from this time period. We analyze the textual content of the press releases to gain insight into systematic shifts in the lottery corporation's messaging during this time period. Relative to other marketing materials, the standardized format of press releases lends itself to content analysis (Humphreys 2011). Although few potential lottery consumers read them, press releases are an important piece of any organization's broader marketing communications strategy (Belch and Belch 2015). We note, for instance, that the uptick in the count of education words in Commission press releases took place at roughly the same time that an education ticker was added to the Commission website. Therefore, while we cannot observe every aspect of the Commission's marketing (such as in-store displays, commercials, or billboards), we assume that intertemporal variation in the content of press releases co-moved with education messaging through these other channels. There were 12.39 press releases per month on average, with four out of 4000 words, typically, related to education.10 We use a count of education words per year (and, in more granular specifications, per month) as a proxy for the strength of the intended education message in lottery marketing.

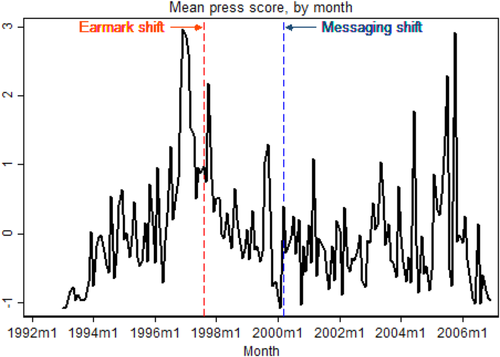

In addition to an index of Commission messaging around education, our analysis incorporates a second measure of information about the lottery derived from the news media. To begin, we obtain a proxy for the Commission's overall presence in the local news media. We use Lexis Nexis and Newsbank archives for seven of the largest Texas newspapers to identify the number of times that the exact phrase “Texas Lottery” was published each year (and, in alternative specifications, each month) from 1993 to 2006 in a particular paper.11 There were 6395 editions with such pieces across these years and outlets, and many editions included multiple relevant articles. Then, for each year and each of the 252 counties in our analytical sample, we construct a weighted average of the hit count across all seven papers, with weights (i) rising with Euclidean proximity between a given county and a given newspaper's headquarters and (ii) rising with that newspaper's state circulation share as of the year 2000.12 We transform the weighted average to have mean zero and standard deviation equal to one by month. To get a sense of trends in news attention directed at the lottery, Figure 2 plots the time path of the normalized news score. We see that a wave of media attention closely preceded the earmark shift in 1997. This was not driven by anticipation of the earmark, but rather, by allegations of financial impropriety between the lottery's director and primary contractor (e.g., Kuempel 1997). A later burst of attention in 2005 was tied to inflated jackpot advertisements (Brooks 2005) and the nomination of former Commission head Harriet Miers to the United States Supreme Court (Mason 2005). Looking across time, the media score has a near-zero pairwise correlation with the education message proxy derived from press releases, suggesting that the Commission's formal communication channels have little give and take with realized media attention related to the lottery.

Notes: The figure plots the cross-sectional mean of normalized county press scores across time. Press scores are computed as the weighted average number of “Texas Lottery” hits in seven area newspapers each month. Weights between a given county and newspaper are decreasing in that paper's circulation share and the Euclidean distance between the county and the newspaper's headquarters. The nominal score is transformed to have mean equal to zero and standard deviation equal to one, by month.

Figure 2 illustrates the volume of news attention over time, but results discussed below focus on the sentiment of media attention as a competitor to the Commission's generally positive press releases. We classify the prevailing sentiment of each news article as positive, negative, or neutral, further classifying articles relating to the 1996 and 2005 scandals in a separate category. We find that 71% of the sentiment expressed in media mentions is neutral, and just 13% is negative or reporting on Commission scandals. A modal media piece related to the lottery is one that names and sometimes interviews a local winner. Only 337 editions out of 6395 even mention the education funding role of the lottery.13 These observations underscore ambiguous a priori expectations for the effect of the news score on lottery sales and illustrate that the press is not necessarily a conduit for the Lottery Commission's marketing strategy. In specifications to follow, we combine quantity and sentiment measures of news hits into a subjective news score by summing coded sentiment across all articles in a given time (with negative articles coded as −1, neutral articles as 0, and positive articles as 1), once again applying distance and circulation weights for each county.

In order to accommodate tests of lottery sales as a function of a wide variety of covariates, we aggregate zip-level sales to 252 Texas counties, excluding two very small counties with missing data on lottery sales or income. County aggregation allows us to construct a panel of covariates, which includes median household income, religiosity, and demographic profiles. Notes on data sources are included in Appendix. Intercensal values for population, race, and education are interpolated from the 1990, 2000, and 2010 censuses. Annual measures of counties' median household income are drawn from Small Area Income and Poverty Estimates. Unemployment is reported monthly by county by the Bureau of Labor Statistics. Looking again to Table 1, median household income typically amounted to $33,515, and unemployment measured 5.74%. Although the use of aggregate demand models is well established in the literature on lottery sales, Garrett (2016) notes that there are important limitations to the use of aggregate demand data to estimate income elasticities and gain insight on individual consumer behavior. In the absence of individual panel data with both lottery consumption and income information; however, county-level movements in sales will illustrate how the spatial sales-to-income gradient changes in the wake of “warmer” marketing.

We merge county-level sales, census, and labor data to survey data on religious adherence. The American Religion Data Archives executed a survey of religious activity in all U.S. counties for a single period of collection between 1999 and 2001.14 We use these data to calculate the percentage of each county's population that adheres to evangelical Christianity (37.5%), which holds an unfavorable view of gambling and public lotteries (Ellison and McFarland 2011).

Following on the findings of Tosun and Skidmore (2004) and Ghent and Grant (2012), we control for the possibility of cross-state border shopping with indicator variables for county-months in which the bordering state did not operate a lottery. Separately, we control for county-years (and, in an alternative specification, county-months) during which Texas offered a multi-state jackpot lottery but the bordering state did not (Texas joined Mega Millions in December 2003). This accounts for complementarity in cross-border shoppers entering Texas to purchase Mega Millions tickets who incidentally purchase instant games or Lotto tickets as well.

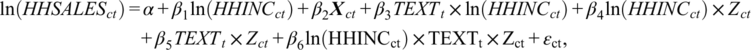

4 Empirical Strategy and Results

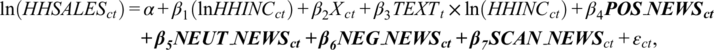

(1)

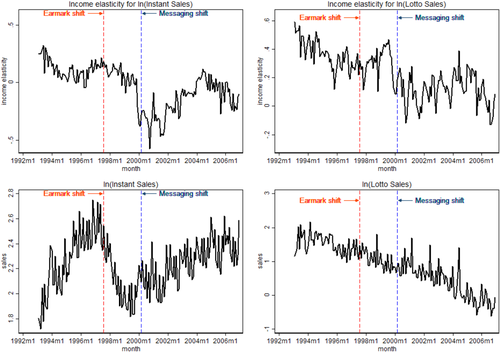

(1)Before turning to Equation 1 results in full, we first use this framework to visualize month-by-month patterns in the statewide sales-income gradient. Specifically, we estimate Equation 1 for each month of the panel, omitting variables that do not have cross-sectional variation at a given point in time, including the text count. The top two panels of Figure 3 plot β1 coefficient estimates for log-income, respectively, for Instant and Lotto Texas sales. The month at which funding shifted from the general fund to the Foundation School Fund is denoted by the leftmost dashed line (August 1997). The month at which the commission's marketing message shifted to emphasize education—as pinpointed by our subjective ratings of press releases—is denoted by the rightmost dashed line (March 2000). Recall that the income elasticity for a progressive good is greater than one, whereas that for a regressive good is less than one. An extreme example of a regressive good is an inferior good, where the income elasticity is negative. The two series of cross-sectional results for the estimated income gradient indicate that both games became more regressive, non-monotonically, in the months and years following the earmark shift. The Instant series of income coefficients reversed course shortly after the messaging shift, whereas the Lotto series maintained an increasingly regressive trend. The bottom two panels of Figure 3 plot the unconditional path of average log per-household sales for Instant and Lotto games. Note that the 1998–2001 fall in the Instant income gradient closely follows a decline in overall Instant sales, and similarly, that the recovery in sales after 2001 is joined by a rise in the Instant income gradient. Average Lotto sales exhibit a steady decline in Figure 3, alongside a declining trend in the income coefficient with respect to Lotto sales. Together, these observations imply that fluctuations in overall sales are driven by higher-income areas more so than lower-income areas.

Notes: The top two figures plot parameter estimates for β1 from month-by-month estimates of Equation 1, omitting controls without cross-sectional variation. The bottom two figures plot log per-household sales for each game, by month.

The empirical exercise to follow uses the panel structure of the data to parameterize and further condition the link between the education message depicted in the top panel of Figure 1 and the time path of income gradients in Figure 3. Since the education message varied intertemporally but not spatially, identifying variation hinges on the assumption that the potency of the Commission's education marketing was conditionally orthogonal to the error term and any unobserved components of lottery sales. We partially relax this assumption in the Alternative Specifications section by allowing for fixed and time-varying unobserved county heterogeneity in some specifications.

Table 2, columns 1 and 4, lists estimated coefficients for Equation 1 with controls for all covariates except education messaging. Columns 1 and 4 show that the aggregate sales-income gradient for Instant Games and Lotto Texas, respectively, are statistically different from one.16 This is consistent with the findings of Combs et al. (2008). Furthermore, we find that the sales-to-income gradient is smaller for instant games, which is consistent with the study by Price and Novak (1999). Although we find that a larger jackpot for Lotto Texas decreases purchases of Lotto Texas, on average, our results are consistent with Oster (2004) in that areas with higher average incomes respond more strongly to larger jackpots.17 Furthermore, we find that there are significant spillover gains in complementary Instant sales. The introduction of the Cash 5 instant game increased overall Instant sales by 38.1% but reduced Lotto sales by 19.7%. Lotto Texas appears to be the game of choice for cross-border shoppers: bordering a state without a lottery increases Lotto Texas sales by 25%.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| ln(Per Household Instant Game Sales) | ln(Per Household Lotto Texas Sales) | |||||

| ln(median household income) | −0.169 (0.274) | −0.169 (0.274) | 0.260 (0.267) | 0.179 (0.264) | 0.177 (0.264) | 0.391 (0.262) |

| Education message (total text count 10) | −0.004*** (0.001) | −0.276*** (0.085) | −0.037*** (0.001) | −0.172* (0.090) | ||

| Education message × ln(median household income) | 0.026*** (0.008) | 0.013 (0.009) | ||||

| Average Lotto Texas prize (tens of millions) | 2.022*** (0.550) | 1.967*** (0.550) | 5.746*** (0.805) | −1.263** (0.521) | −1.724*** (0.518) | 0.156 (0.876) |

| Average Lotto prize squared | −1.349*** (0.030) | −1.320*** (0.027) | −1.307*** (0.027) | −0.063** (0.030) | 0.183*** (0.026) | 0.189*** (0.026) |

| Average Lotto prize × ln(median household income) | 0.248*** (0.053) | 0.248*** (0.053) | −0.121 (0.076) | 0.156*** (0.053) | 0.153*** (0.052) | −0.031 (0.082) |

| Cash 5 game available | 0.381*** (0.015) | 0.383*** (0.016) | 0.385*** (0.016) | −0.197*** (0.013) | −0.177*** (0.013) | −0.176*** (0.014) |

| Bordering state without lottery | 0.032 (0.124) | 0.032 (0.124) | 0.032 (0.124) | 0.250** (0.126) | 0.252** (0.126) | 0.252** (0.126) |

Bordering state without multi-state jackpot |

−0.129** (0.054) | −0.127** (0.054) | −0.128** (0.053) | 0.082 (0.059) | 0.095 (0.059) | 0.095 (0.059) |

| County-years | 3525 | 3525 | 3525 | 3525 | 3525 | 3525 |

| R2 | 0.571 | 0.571 | 0.571 | 0.671 | 0.674 | 0.674 |

- Notes: Robust standard errors clustered at the county level are in parentheses below each coefficient. Unreported control variables include other county covariates listed in Table 1 and a quadratic time trend. All t-test are with respect to zero.

- *Significant at 10%.

- **Significant at 5%.

- ***Significant at 1%.

Columns 2 and 5 of Table 2 report results when we add the annual education message proxy to Equation 1. Doing so has little bearing on point estimates for log-income, average jackpot, or other controls. Coefficients on text counts are interpreted as the effect of 10 additional education terms in year t's Lottery Commission press releases—well over the standard deviation of 7.2—on the log of sales. From column 2, findings suggest that a more potent education message modestly decreases both Instant game and Lotto Texas sales. In recent years, the Texas Lottery's purpose and effectiveness in supporting public education has become a point of controversy (Oberg 2011). With that in mind, marketing the lottery as a windfall for education may have the unintended effect of cooling demand for scratch-off games and Lotto tickets if consumers view such marketing as hollow. At the same time, emphasizing the education services of the state lottery may crowd out more lucrative marketing efforts.

(2)

(2) (3)

(3) (4)

(4)Results from Equations 3 and 4 are presented in Table 3. Most importantly, we find that the inclusion of a news score to control for the media presence and sentiment toward the lottery in local media coverage does not affect our central finding that a stronger education message in lottery marketing shifts the distribution of instant game lottery purchases toward counties with higher average incomes. Increasingly positive sentiment in the news media, however, significantly decreases lottery sales by an economically meaningful amount for both Instant and Lotto games. In columns 2 and 4, we unpack the effect of news sentiment into its component parts and find that this offsetting effect is driven by negative and neutral coverage, whereas positive coverage and scandal coverage drive lottery sales up.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| ln(Per Household Instant Games) | ln(Per Household LOTTO Games) | |||

| ln(median household income) | 0.196 (0.268) | 0.201 (0.273) | 0.335 (0.260) | 0.368 (0.263) |

| Education message (total text count 10) | −0.227*** (0.086) |

−0.234*** (0.084) | −0.130 (0.088) | −0.155* (0.085) |

| Education message × ln(median household income) | 0.022*** (0.008) | 0.024*** (0.008) | 0.010 (0.008) | 0.013 (0.008) |

| Net media score | −0.196*** (0.071) | −0.171*** (0.064) | ||

| Positive media score | 0.089** (0.043) | 0.159*** 0.039) | ||

| Neutral media score | −0.184** (0.085) | −0.225*** (0.075) | ||

| Negative media score | −0.157*** (0.026) | −0.140*** (0.024) | ||

| Scandal media score | 0.094*** (0.011) | 0.074*** (0.010) | ||

| Average Lotto Texas prize (tens of millions) | 5.472*** (0.830) | 6.164*** (0.908) | −0.082 (0.885) | 0.857 (0.950) |

| Average Lotto prize squared | −1.386*** (0.041) | −1.679*** (0.107) | 0.121*** (0.037) | −0.179* (0.099) |

| Average Lotto prize × ln(median household income) | −0.057 (0.080) | −0.045 (0.081) |

0.025 (0.083) |

0.019 (0.083) |

| Cash 5 game available | 0.508*** (0.050) | 0.326*** (0.037) | −0.069 (0.044) | −0.252*** (0.032) |

| Bordering state without lottery | −0.039 (0.121) | −0.034 (0.121) | 0.190 (0.124) | 0.201 (0.125) |

| Bordering state without multi-state jackpot | −0.109** (0.054) | −0.128** (0.053) | 0.111* (0.059) | 0.074 (0.058) |

| County-years | 3525 | 3525 | 3525 | 3525 |

| R2 | 0.585 | 0.588 | 0.684 | 0.687 |

- Notes: Robust standard errors clustered at the county level are in parentheses below each coefficient. Unreported control variables include other county covariates listed in Table 1 and a quadratic time trend. All t-test are with respect to zero.

- *Significant at 10%.

- **Significant at 5%.

- ***Significant at 1%.

(5)

(5)| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Z Variable | Black Population Share (0–100) | Share with Bachelor's Degree or Higher (0–100) | Share Adhering to Evangelical Christianity (0–100) | Net Media Score (Standard Deviations From Mean) | ||||

| Sales outcome (log, per household) | Instant | Lotto | Instant | Lotto | Instant | Lotto | Instant | Lotto |

| ln(median household income) | −0.112 (0.332) | 0.060 (0.318) | 0.055 (0.315) | 0.236 (0.299) | 0.250 (0.311) | 0.367 (0.303) | −0.626 (0.390) | −0.346 (0.384) |

| Z variable (de-meaned percentage points) | 0.8671** (0.422) | 0.7364*(0.414) | 0.0949 (0.227) | 0.1065 (0.210) | −0.3794*** (0.137) | −0.3204** (0.134) | 6.4227*** (2.244) | 5.3712** (2.195) |

| Education message (text count ÷ 10) | −0.1817* (0.093) | −0.1055 (0.091) | −0.1587 (0.111) | −0.0043 (0.105) | −0.2701** (0.107) | −0.1491 (0.104) | 0.2706 (0.191) | 0.2419 (0.185) |

| Education message × ln(median household income) | 0.0180** (0.009) | 0.0074 (0.009) | 0.0158 (0.011) | −0.0025 (0.010) | 0.0264** (0.010) | 0.0115 (0.010) | −0.0254 (0.018) | −0.026 (0.018) |

| ln(median household income) × Z | −0.0859** (0.041) | −0.0743* (0.040) | −0.0157 (0.021) | −0.0154 (0.020) | 0.0365*** (0.013) | 0.0305** (0.013) | −0.6422*** (0.217) | −0.5380** (0.212) |

| Education message × Z | 0.017 (0.011) | 0.005 (0.009) | 0.001 (0.006) | −0.004 (0.005) | 0.004 (0.003) | 0.004 (0.003) | 0.1506** (0.070) | −0.006 (0.058) |

| Education message × ln(median household income) × Z | −0.0016 (0.001) | −0.0005 (0.001) |

−0.0001 (0.001) | 0.0004 (0.001) | −0.0004 (0.000) | −0.0004 (0.000) | −0.0149** (0.007) | 0.0002 (0.006) |

| County-years | 3525 | 3525 | 3525 | 3525 | 3525 | 3525 | 3525 | 3525 |

| R2 | 0.459 | 0.59 | 0.445 | 0.582 | 0.459 | 0.59 | 0.468 | 0.595 |

- Notes: Robust standard errors clustered at the county level are in parentheses below each coefficient. Unreported control variables include other county covariates listed in Table 1 and a quadratic time trend. All t-test are with respect to zero.

- *Significant at 10%.

- **Significant at 5%.

- ***Significant at 1%.

Coefficients of interest are β5, which estimates how the sales-to-income gradient of lottery demand with respect to county characteristic Zct changes with the education message, and β6, which demonstrates how the interactive effect of education messaging and the income gradient varies with Zct. In particular, the latter assesses whether education messaging mitigates regressivity more or less depending on observable county features.18

Looking to the last row of results in Table 4, it appears that regressivity changes evenly across counties in the wake of a more potent education lottery marketing scheme—there are small and imprecise, and inconsistently signed effects of the interaction ln(HHINCct) × TEXTt × Zct for Zct describing race, educational attainment, and religious sentiment. We find that the regressive nature of sales intensifies with a larger black population share but is offset somewhat by a larger share of the population adhering to evangelical Christianity. For Instant games, but not Lotto Texas, sentiment in the news media offsets the progressive effects of education messaging, reverting to some degree the pattern of sales across higher and lower income places with stronger education messaging. A one standard deviation increase in the net sentiment of news about the lottery along with a 10-word increase in the Commission's education message reduces the income gradient for Instant games sales by 1.5 log points (column 7).19 Perhaps buyers perceive Commission messaging and press information channels to be substitutes, in which case the formal message is muted by information broadly related to the lottery.

5 Alternative Specifications

Tables 5 and 6 list results from alternative specifications of Equation 3. Column 1 of each table is identical to baseline results in columns 1 and 3 of Table 3. Recall that these baseline specifications use annual aggregations of monthly lottery sales data, education word counts in press releases, and press mentions to align with annual observations of county-level income from Small Area Income and Poverty Estimates. Column 2 of each table takes full advantage of the monthly panel of sales and marketing data by interpolating each annual observation of income along with population, race, and education, which are obtained from the decennial census and already interpolated for intercensal years.20 Interpolating annual data by month requires the choice of a reference month. For census and income data, we use April to be consistent with the decennial census. In the monthly specification, text counts are lagged one month to allow other lottery marketing channels to catch up to, and buyers respond to, the shifts in messaging reflected in press releases. Monthly averages of the advertised prize are calculated along with squared values. We also include the share of the month that passes prior to the month's largest jackpot. Typically, about two-thirds of the month passed before the month's largest jackpot was advertised.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Baseline | Monthly Sales Panel | Fixed Effects | Fixed Effects and Time Trends | Subjective Education Message | |

| ln(median household income) | 0.196 (0.268) | 0.160(0.263) | −0.064(0.119) | 0.077(0.110) | 0.115(0.276) |

| Education message(total text count 10) | −0.227***(0.086) | −1.229***(0.281) | −0.007(0.049) | −0.028(0.042) | −1.329*(0.686) |

| Education message × ln(median household income) | 0.022***(0.008) | 0.120***(0.027) | 0.000(0.005) | 0.002(0.004) | 0.146**(0.066) |

| Net media score(standard deviations from mean) | −0.196***(0.071) | −0.104***(0.039) | −0.006(0.011) | −0.003(0.006) | −0.189***(0.072) |

| County-months | 3525 | 42,064 | 3525 | 3525 | 3525 |

| R2 | 0.585 | 0.564 | 0.606 | 0.775 | 0.586 |

- Notes: Robust standard errors clustered at the county level are in parentheses below each coefficient. Unreported control variables include other county covariates listed in Table 1 and a quadratic time trend. Additional fixed effects are included as indicated in column headers. All t-test are with respect to zero.

- *Significant at 10%.

- **Significant at 5%.

- ***Significant at 1%.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Baseline | Monthly Sales Panel | Fixed Effects | Fixed Effects and Time Trends | Subjective Education Message | |

| ln(median household income) | 0.335 (0.260) | 0.38 (0.252) | 0.152 (0.109) | −0.108 (0.076) | 0.278 (0.268) |

| Education message (total text count 10) | −0.130 (0.088) | −0.669** (0.280) | 0.086* (0.049) | 0.024 (0.032) | −0.395 (0.717) |

| Education message × ln(median household income) | 0.010 (0.008) | 0.059** (0.027) | −0.012** (0.005) | −0.006* (0.003) | 0.051 (0.069) |

| Ned media score (standard deviations from mean) | −0.171*** (0.064) | −0.076** (0.036) | 0.059*** (0.013) | 0.045*** (0.005) | −0.174*** (0.065) |

| County-months | 3525 | 42,064 | 3525 | 3525 | 3525 |

| R2 | 0.685 | 0.679 | 0.962 | 0.985 | 0.683 |

- Notes: Robust standard errors clustered at the county level are in parentheses below each coefficient. Unreported control variables include other county covariates listed in Table 1 and a quadratic time trend. Additional fixed effects are included as indicated in column headers. All t-test are with respect to zero.

- *Significant at 10%.

- **Significant at 5%.

- ***Significant at 1%.

The third column in each table reports results from a version of Equation 3 that conditions on county fixed effects as well as all other time-varying covariates included in the baseline specification. Column 4 in each table represents models with controls for county fixed effects and linear county-specific time trends. Although our central question concerns the effect of lottery messaging on the progressivity of spatial variation in sales, within-county responses to the Commission's education message are also interesting. Column 5 models substitute the subjective measure of the Commission's education message, depicted in the bottom panel of Figure 1, in lieu of the text count.

Specification checks for Instant sales (Table 5) show that interpolation serves to intensify our central finding that a stronger education message reduces the strongly regressive nature of lottery sales. Making full use of all 42,064 county-months of sales data increases the offsetting effects of the education message from 2.2 log points in column 1 to 12.0 log points in column 2. It is immediately clear from columns 3 and 4 of Table 4 that conditional on county fixed effects, changes in countywise Instant sales are essentially unresponsive to changes in income and Commission marketing schemes. Negative point estimates for the uninteracted text count are attenuated considerably once we control for county fixed effects. These findings underscore the idea that education lotteries have slight bearing on the sales-to-income gradient.

Substituting the subjective rating of press releases (summed over the month) for the summed text count, similarly, does not alter our main conclusions. A one-point increase in monthly education ratings offsets the income regressivity of Instant sales by 14.6 log points.

Turning to variants on Equation 3 specification for Lotto sales (Table 6), we find that when using the full panel of county-month observations, the interaction of the education message with income is statistically significant. That is, a 10-word increase in the count of education words in press releases leads to a 5.9 log point increase in the area income gradient. We see a similar, but insignificant coefficient in column 5 which relies on the subjective measure. Conditional on county fixed effects a more potent education message is associated with significantly more regressive Lotto sales (column 3). This may be attributable, to some extent, to time-varying unobserved heterogeneity since the interactive effect of the education message and area income is reduced by half when we condition on both county fixed effects and county-specific time trends (column 4).

6 Discussion

The analysis presented here offers modest evidence that Texans are responsive to the purported use of lottery revenues in ways that make sales less regressive across space. Sales shift toward richer counties following more potent education messaging through official channels, which are likely to indicate shifts in the broader marketing scheme of the lottery. We find that Instant Games and Lotto Texas sales are both regressive with respect to area income and that this was especially true in the three years immediately after revenues were earmarked for the Foundation School Fund. Press releases from the Texas Lottery Commission, however, virtually ignored the education earmark during this time. Beginning in the year 2000, the Commission began marketing the “education lottery” more vigorously, a sharp shift in messaging which we detect using subjective and objective assessments of the Commission's press releases. Shortly thereafter, the conditional area sales to income gradient began trending upward in the case of Instant sales but steadily downward for Lotto sales. We estimate that an additional 10 words per month related to education in the press releases (1.4 times the standard deviation) is associated with a rise of 2.6% in the income gradient with respect to Instant sales (from an imprecisely estimated baseline of 0.260) but a statistically insignificant rise in the income gradient for Lotto Texas sales. The education message is not likely to make the Texas Lottery conditionally progressive on its own—far out-of-sample extrapolations suggest that to do so would require two times the maximum education message observed between 1993 and 2006. Moreover, results are greatly attenuated and statistically insignificant when we condition on county fixed effects and time trends, suggesting that unobserved factors other than statewide marketing play a much greater role in moving local demand for Instant and Lotto play.

We do not find that area regressivity is more sensitive to the education message in counties that are more educated, more religiously affiliated, or more racially diverse. We do, however, find some evidence that print media attention related to the Texas Lottery may offset some of the progressivity-enhancing effects of official Commission messaging, suggesting that the two channels of information are substitutes.

To conclude, we find suggestive evidence that dedicating lottery revenues to fund public schools tilts the composition of sales of Instant games toward wealthier areas but has a trivial or negative effect on total lottery sales. Contemporaneous accounts suggest that Texans understand the fungible nature of state revenue streams, which may explain why we do not see a greater impact of the “education lottery” message on the income gradient with respect to lottery sales. It remains to be seen if a lottery with a true windfall for public schools would elicit more progressive participation.

Acknowledgements

The authors are grateful for comments and suggestions from Donald Bruce, William Fox, Seth Gershenson, Nicholas Nagle, William Neilson, James Cowan, Michael Price, participants of the 2013 Southern Economic Association and 2016 Association for Education Finance and Policy meetings, and three anonymous reviewers. Data were provided by the Texas Lottery Commission, with funding graciously provided by the University of Tennessee Department of Economics and Center for Business and Economic Research. We thank John Richmond, Mary Elizabeth Glenn, and Bilal Celik for outstanding research assistance. Opinions and findings discussed here do not reflect those of the Texas Lottery Commission. All errors are our own.

Endnotes

Appendix: Data Source Notes

| Data | Source |

|---|---|

| Sales of Instant Games and Lotto Texas | Texas Lottery Commission |

| Average Lotto Texas Jackpots | Texas Lottery Commission |

| Press releases, 1993–2006: Used to derive a proxy for education messaging equal to the total count of words related to education issued in a given month's press releases | Texas Lottery Commission |

| Press score, 1993–2006: A mean-zero, standard deviation one measure of press attention on the lottery (monthly hits of “Texas Lottery” in regional newspapers listed at right), weighted according to each county's relative distance from each news source | Lexis Nexis and Newsbank searches for appearances of “Texas Lottery Commission” in seven Texas newspapers: Austin American-Statesman, Corpus Christi Caller-Time, Dallas Morning News, El Paso Times, Houston Chronicle, Lubbock Avalanche-Journal, and San Antonio Express-News. |

| Population, housing counts, demographics, urbanicity | Census 1990, 2000, 2010 |

| Median household income | Small Area Income and Poverty Estimates, Census Bureau |

| Unemployment | Bureau of Labor Statistics |

| Religious adherence | The Association of Religious Data Archives, Religious Congregation Membership Study |

| Texas Lottery games timeline | Texas Lottery website, “Commission History and Milestones” |