Pandemic-induced economic policy uncertainty and US stock exchanges

Abstract

This study investigates the impacts of pandemic-induced economic policy uncertainties (PIEPU) on the S&P500, Nasdaq-100, and Dow Jones indexes (stock returns). To this aim, for the first time, newly created IDEMV (the Infectious Disease Equity Market Volatility index (henceforth, PIEPU index) is used. The Autoregressive Distributed Lag (ARDL) model and the Toda and Yamamoto (Journal of Econometrics, 1995, 66, pp. 225–250) causality test are applied for the 2009–2020 period. Empirical findings indicate that rises in the PIEPU index lead to falls of only the S&P500 and Dow Jones indexes. Corporations in the tech-heavy Nasdaq100 index do not negatively respond to rises in the PIEPU index. Additionally, the negative impacts of the rises in the specifically COVID-19 based-constructed PIEPU (DCOVPIEPU) index on the S&P500 and Dow Jones indexes are higher than the negative impacts of the general PIEPU index. This can be interpreted to mean that the larger the magnitude and spread rate of a pandemic, the larger the negative impacts on stock returns. In the sample period of this study, COVID-19 is the largest and most destructive pandemic compared to H1N1 and Ebola.

1 INTRODUCTION

COVID-19 pandemic as a multidimensional phenomenon attracted many scholars to examine its impacts in different areas such as public health (Heymann & Shindo, 2020; Polychronis & Roupa, 2020), education (Dennis, 2020: Torda, 2020), economy (Alhassan et al., 2020; Siddiquei & Khan, 2020; Singh & Neog, 2020), environment (Alola & Bekun, 2020; Balsalobre-Lorente et al., 2020), trade (Escaith & Khorana, 2021; Vidya & Prabheesh, 2020). On the other hand, the COVID-19 pandemic (known as the “great lockdown” in the IMF report (2020)1 to echo the Great Depression) has heightened unprecedented uncertainties in the economy and led to massive losses for businesses. According to Baker, Bloom, Davis, and Terry (2020), the magnitude of uncertainty caused by this pandemic is larger than the 2008 financial crisis and close to that of the Great Depression. Hence, rising economic uncertainties may have negative impacts on stock exchanges. Therefore, this study aims to investigate the potential impacts of the pandemic-induced economic policy uncertainties (PIEPU) on US stock exchanges through the S&P500, Nasdaq-100, and Dow Jones indexes. To this aim, the newly created Infectious Disease Equity Market Volatility (IDEMV2) index by Baker, Bloom, Davis, Kost, et al. (2020) is used. To the best of our knowledge, this is the first attempt using this index in an empirical study related to stock exchanges.

2 CONSTRUCTION OF IDEMV INDEX

The IDEMV was constructed as a news-based index. In the construction of this index, first, articles across approximately 3000 US newspapers are scanned and terms that mention at least one term in each of ID, E, M, and V are counted in the following four sets:

ID: (epidemic, pandemic, virus, flu, disease, Coronavirus, Mers, Sars, Ebola, H5N1, H1N1)

E: (economic, economy, financial)

M: (“stock market”, equity, equities, “Standard and Poors”)

V: (volatility, volatile, uncertain, uncertainty, risk, risky)

As a result of all these steps and instructions so far, we can conclude that the IDEMV, constructed on the volatilities through the EMV tracker, including ID terms, will give us a kind of pandemic-induced economic policy uncertainty index. Therefore, the IDEMV index will henceforth be replaced with the pandemic-induced economic uncertainty (PIEPU) index in this study. Especially in regards to the COVID-19 pandemic, using this index may provide a wide range of application fields to researchers who want to test the impacts of PIEPU in their empirical models. This daily index is available as of 1985. It is believed that the findings of this study will also support some empirical studies (Arouri et al., 2016; Christou et al., 2017; Ongan & Gocer, 2017; Paule-Vianez et al., 2020; Peng et al., 2018) that test the impacts of changes in the economic policy uncertainty (EPU5) index on US stock returns. The EPU index, created by Baker et al. (2016), was also constructed based on newspaper articles (with similar technical instructions to those for the PIEPU index). However, the EPU index (2020) does not specifically consider the uncertainties caused by pandemics, like the PIEPU index, which was used in this study.

3 DATA AND EMPIRICAL MODELS

3.1 Data

We obtained the data of the S&P500, Nasdaq-100, and Dow Jones indexes from the Federal Reserve Bank of St. Louis (FED, 2020). The data of the IDEMV (henceforth, PIEPU) index, created by Baker, Bloom, Davis, Kost, et al. (2020), were obtained from https://www.policyuncertainty.com/infectious_EMV.html. We used daily series and the sample period of the study is January 05, 2009 to May 18, 2020, with 2862 observations.

3.2 Empirical models

To investigate the potential impacts of pandemic-induced economic uncertainties on US stock returns, we apply both the Autoregressive Distributed Lag (ARDL) model and Toda and Yamamoto (1995) causality test. Appropriate analysis methods and casualty test were selected according to the results of the unit root tests.

3.2.1 ARDL model

3.2.2 Causality test

4 EMPIRICAL RESULTS

Before running the models, we must first make sure the series are stationary. To this aim, we apply the ADF (Dickey & Fuller, 1981), PP (Phillips & Perron, 1988), and KPSS (Kwiatkowski et al., 1992) unit root tests. The results of these three tests are reported in Table 1.

| ADF | PP | KPSS | |

|---|---|---|---|

| −11.66*** (0.00) | −61.90*** (0.00) | 0.03*** | |

| −12.55*** (0.00) | −61.02*** (0.00) | 0.03*** | |

| −11.62*** (0.00) | −61.89*** (0.00) | 0.03*** | |

| −2.52(0.10) | −1.50 (0.12) | 678.87 | |

| −12.73*** (0.00) | −206.01*** (0.00) | 0.17*** | |

| −2.34 (0.15) | −1.67 (0.12) | 725.24 | |

| −12.62*** (0.00) | −72.91*** (0.00) | 0.01*** |

- Note: Critical values in the KPSS test are 0.73, 0.46, and 0.34 for 1%, 5%, and 10%, respectively. p-values are in the parenthesis. First differences. *** denotes significance at 1% level. ADF: Augmented Dickey Fuller Test. PP: Phillips-Perron Test. KPSS: Kwiatkowski-Phillips-Schmidt -Shin Test.

Test results in Table 1 indicate that the series is stationary at different levels. Hence, to test long-run relations, we apply the bounds testing cointegration approach by Pesaran et al. (2001). The results of bound testing are reported in Table 2. The null hypothesis of this test is that there is “No cointegration.”

| (1) S&P 500 | (2) Dow Jones | (3) Nasdaq-100 | |

|---|---|---|---|

| Model 1 | 9.14** | 11.05*** | 10.26*** |

| Model 2 | 8.48*** | 10.14*** | 7.17** |

| Critical values | |||

| 10% | 5% | 1% | |

| Lower bounds (for k = 1) | 5.59 | 6.56 | 8.74 |

| Upper bounds (for k = 1) | 6.26 | 7.30 | 9.63 |

| Lower bounds (for k = 2) | 4.19 | 4.87 | 6.34 |

| Upper bounds (for k = 2) | 5.06 | 5.85 | 7.52 |

- Note: The values are F-statistics. k is the number of independent variables. *** and ** denote significances at 1% and 5% levels.

Test results in Table 2 indicate that the series have significant long-run (cointegration) relations, since the F-statistics of the models are higher than the upper bounds at 1% and 5% levels. Hence, to estimate the coefficients, we apply the ARDL model. Test results of this approach for Model 1 (without specific COVID-19 effect) and Model 2 (with specific COVID-19 effect) are reported in Tables 3 and 4, respectively.

| Unnormalized long-run | Normalized long-run | Short-run | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (1) | (2) | (3) | (1) | (2) | (3) | ||

| S&P500 | Dow Jones | Nasdaq-100 | S&P500 | Dow Jones | Nasdaq-100 | S&P 500 | Dow Jones | Nasdaq-100 | ||

| 0.85*** (0.00) | 0.85*** (0.00) | 0.87*** (0.00) | — | — | — | −0.12*** (0.00) | −0.13*** (0.00) | −0.11*** (0.00) | ||

| 0.19*** (0.00) | 0.22*** (0.00) | 0.16*** (0.00) | — | — | — | 0.07*** (0.00) | 0.09*** (0.00) | 0.05*** (0.00) | ||

| −0.07*** (0.00) | −0.07*** (0.00) | −0.05*** (0.00) | — | — | — | — | 0.01*** (0.00) | — | ||

| — | −0.01 (0.30) | — | — | — | — | — | — | — | ||

| 0.007 (0.44) | 0.007 (0.47) | 0.0001 (0.31) | −0.018* (0.07) | −0.026***(0.00) | −0.013 (0.19) | 0.007 (0.41) | 0.007 (0.45) | 0.0001 (0.28) | ||

| −0.008 (0.43) | −0.008 (0.40) | −0.009 (0.41) | — | — | — | 0.0002** (0.02) | 0.004*** (0.00) | 0.0002* (0.06) | ||

| −0.004 (0.68) | −0.006 (0.49) | −0.006 (0.57) | — | — | — | 0.002** (0.03) | 0.003*** (0.00) | 0.0001 (0.13) | ||

| −0.0002**(0.04) | −0.0002**(0.03) | −0.0001 (0.15) | — | — | — | 0.0001 (0.20) | - | |||

| — | −0.0001 (0.22) | — | — | — | — | −0.01*** (0.00) | −0.01*** (0.00) | −0.01*** (0.000) | ||

| 0.09*** (0.00) | 0.14*** (0.00) | 0.11*** (0.00) | 6.94*** (0.00) | 9.18*** (0.00) | 7.59*** (0.00) | 0.09*** (0.00) | 0.14*** (0.00) | 0.11*** (0.00) | ||

| 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.33 | 0.38 | 0.26 | ||

| 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.30 | 0.35 | 0.23 | ||

| 359509.2 (0.00) | 270077.8 (0.00) | 508615.1 (0.00) | 35950.2 (0.00) | 27077.8 (0.00) | 508615.1 (0.00) | 14.01 (0.00) | 12.80 (0.00) | 11.00 (0.00) | ||

| 2.00 | 1.99 | 1.99 | 2.00 | 1.99 | 1.99 | 2.00 | 1.99 | 1.99 | ||

| 0.57 (0.75) | 0.75 (0.69) | 0.07 (0.96) | 0.57 (0.75) | 0.75 (0.69) | 0.07 (0.96) | 0.57 (0.75) | 0.75 (0.69) | 0.07 (0.96) | ||

- Note: p-values are in the parenthesis. *, **, and *** denote significances at 10%, 5%, and 1% levels.

| Unnormalized long-run | Normalized long-run | Short-run | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (1) | (2) | (3) | (1) | ((2) | (3) | ||

| S&P500 | Dow Jones | Nasdaq-100 | S&P500 | Dow Jones | Nasdaq-100 | S&P500 | Dow Jones | Nasdaq-100 | ||

| 0.85*** (0.00) | 0.85*** (0.00) | 0.87*** (0.00) | — | — | — | −0.13*** (0.00) | −0.13*** (0.00) | −0.11*** (0.00) | ||

| 0.20*** (0.00) | 0.22*** (0.00) | 0.16*** (0.00) | — | — | — | 0.06** (0.00) | 0.08*** (0.00) | 0.04*** (0.00) | ||

| −0.06*** (0.00) | −0.08*** (0.00) | −0.04*** (0.00) | — | — | — | — | — | — | ||

| 0.0001 (0.24) | 0.0001 (0.30) | 0.0001 (0.35) | 0.008 (0.27) | 0.006 (0.32) | 0.007 (0.37) | — | — | — | ||

| −0.006***(0.00) | −0.0008*** (0.00) | −0.0003 (0.12) | −0.04*** (0.00) | −0.05*** (0.00) | −0.02 (0.12) | −0.01*** (0.00) | −0.01*** (0.00) | −0.01*** (0.00) | ||

| 0.10*** (0.00) | 0.14*** (0.00) | 0.10*** (0.00) | 6.88*** (0.00) | 9.11*** (0.00) | 7.55*** (0.00) | 0.10*** (0.00) | 0.14*** (0.00) | 0.10*** (0.00) | ||

| 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.34 | 0.40 | 0.25 | ||

| 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.33 | 0.38 | 0.24 | ||

| 48096.9 (0.00) | 451971.9 (0.00) | 678180.8 | 480296.9 (0.00) | 451971.9 (0.00) | 678180.8 | 25.49 (0.00) | 29.78 (0.00) | 18.79 (0.00) | ||

| 1.99 | 1.99 | 1.99 | 1.99 | 1.99 | 1.99 | 1.99 | 1.99 | 1.99 | ||

| 0.08 (0.95) | 1.59 (0.45) | 0.09 (0.95) | 0.08 (0.95) | 1.59 (0.45) | 0.09 (0.95) | 0.08 (0.95) | 1.59 (0.45) | 0.09 (0.95) | ||

- Note: p-values are in the parenthesis. *, **, and *** denote significances at 10%, 5%, and 1% levels.

Test results of normalized long-run estimates of Model 1 (without specific COVID-19 effect) in Table 3 indicate that rises in the PIEPU index lead to falls of only the S&P500 and Dow Jones indexes. Furthermore, the negative impacts of rises in the PIEPU index on the Dow Jones index (−0.026) are higher than the negative impacts on the S&P500 index (−0.018). There is no significant impact of the PIEPU index on the tech-heavy Nasdaq-100 index. This can be interpreted to mean that tech-heavy corporations do not negatively respond to rises in the PIEPU index in the long run. Furthermore, the negative impacts of rises in the PIEPU index on these three indexes are similar in the short run. The error correction mechanisms work since their coefficients are significantly negative. Test results of Model 2 (with specific COVID-19 effect) are reported in Table 4.

Test results of normalized long-run estimates in Model 2 (with specific COVID-19 effect) in Table 4 indicate that the rises in the PIEPU index have no significant impacts on any of the three stock indexes. However, rises in the specifically COVID-19 based-constructed PIEPU () index lead to falls of only the S&P500 and Dow Jones indexes. Comparison of the EIEPU and indexes (variables) in Model 1 and Model 2 indicate that negative impacts of rises in the index on the S&P500 and Dow Jones indexes are higher (−0.04: −0.05 in Table 4) than the negative impacts of the general EIEPU index (−0.018: −0.026 in Table 3). This can be interpreted to mean that the larger the magnitude and spread rate of a pandemic, the larger the negative impacts on stock returns. In the sample period of this study, the COVID-19 is the largest and most destructive pandemic compared to the H1N1 and Ebola.

Additionally, test results of the Toda and Yamamoto (1995) causality test are reported in Table 5. It should be noted that this causality test approach was selected because the series of the study are stationary at different levels.

14 [LR, FPE, AIC] |

1 | 13.77 | 0.54 | |

10 [LR, FPE, AIC] |

1 | 26.92*** | 0.00 | |

16 [FPE, AIC] |

1 | 13.49 | 0.70 | |

10 [LR, FPE, AIC, HQ] |

1 | 37.07*** | 0.00 | |

9 [LR, FPE, AIC, HQ] |

1 | 8.16 | 0.61 | |

5 [LR, FPE, AIC, HQ] |

1 | 4.95 | 0.54 |

- Abbreviations: AIC, Akaike information criterion; FPE, final prediction error; HQ: Hannan-Quinn information criterion; LR, sequential modified LR test statistic (each test at 5% level).

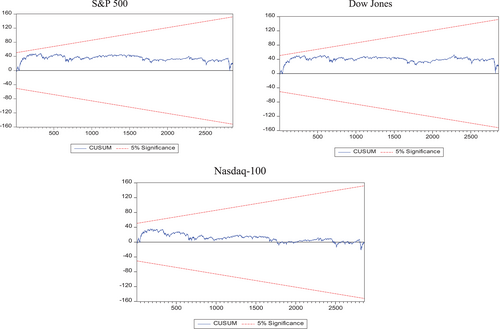

Test results in Table 5 indicate that there are causalities from the DCOVPIEPU index only to the S&P500 and Dow Jones indexes. These findings completely affirm-support the results of the ARDL model since we could not find a causal relationship from the DCOVPIEPU index to the tech-heavy Nasdaq-100 index. Furthermore, the Dow Jones index is most negatively affected by the rises in the DCOVPIEPU index, similar to what happens with the ARDL model and the PIEPU index. Descriptive statistics and CUSUM charts of both models are reported in Table A1 and Figures A1 and A2. It should also be noted that the empirical findings of this study affirm the findings of past studies that focus on the impacts of the COVID-19 pandemic on stock markets. For instance, Alber and Saleh (2020) applied the generalized method of moments (GMM) procedure for the stock markets of the Gulf Cooperation Council (GCC) countries. They found that the COVID-19 pandemic has negative impacts on the returns of the stock in these countries. Le et al. (2020) applied the panel-regression model for the Vietnam stock market and found that this pandemic has significant negative impacts on stock returns. Basistha and Bora (2021) used the generalized autoregressive conditional heteroscedasticity model for India and found that COVID-19 has increased the volatility during the pandemic period. Burdekin and Harrison (2021) applied the pooled ordinary least squares (OLS) analysis for 80 countries. They found that this pandemic worsened relative stock market performances. Shehzad et al. (2020) used the asymmetric power GARCH model for the United States, Italy, Japan, and China. They found that COVID-19 negatively affects the stock returns of the S&P 500. They also found no negative impacts on the Nasdaq composite index. Khan et al. (2020) applied the panel data analysis for major stock markets and found that this pandemic negatively affected these markets. Although this study mainly affirms the findings of the studies mentioned above, it differs from them in two ways. First, we created and used our COVID-19 based-constructed index (DCOVPIEPU), as explained in the empirical model section. Second, it also compares the magnitude and spread rate of COVID-19 with previous pandemics such as H1N1 and Ebola.

5 CONCLUSION

The world is experiencing unprecedented uncertainty due to the COVID-19 pandemic. This study investigates the impacts of PIEPU on the S&P500, Nasdaq-100, and Dow Jones indexes (stock returns). Our findings indicate that economic policy uncertainties caused by pandemics have significantly negative impacts on stock returns (except for the Nasdaq-100 index). These negative impacts increase more in direct proportion to the magnitude of the pandemic, as we detected in this study concerning the case of COVID-19. Thus, these findings may show policymakers, investors, and businesses that public health and universal healthcare investments are essential for financial markets and economies following the COVID-19 pandemic.

CONFLICT OF INTEREST

We confirm that this work is original and has not been published elsewhere nor is it currently under consideration for publication elsewhere.

Appendix A

| Log(PIEPU) | Log(S&P500) | Log(DOW Jones) | Log(Nasdaq-100) | |

|---|---|---|---|---|

| Mean | 1.98 | 7.49 | 9.69 | 8.33 |

| Median | 0.00 | 7.57 | 9.72 | 8.40 |

| Maximum | 8.83 | 8.13 | 10.29 | 9.19 |

| Minimum | 0.00 | 6.52 | 8.79 | 7.15 |

| Std. Dev. | 2.31 | 0.36 | 0.34 | 0.48 |

| Skewness | 0.58 | −0.30 | −0.18 | −0.17 |

| Kurtosis | 2.04 | 2.06 | 2.16 | 2.01 |

| Jarque-Bera | 270.3 | 147.3 | 99.1 | 130.8 |

| Probability | 0.00 | 0.00 | 0.00 | 0.00 |

| Sum | 5657.63 | 21435.65 | 27733.01 | 23840.46 |

| Sum Sq. Dev. | 15317.74 | 380.8993 | 335.535 | 648.8037 |

| Observations | 2862 | 2862 | 2862 | 2862 |

- Note: The differences of max. and min. values and standard deviations of the variables are low. The number of observations is enough.

Biographies

Dr. Ongan earned his Ph.D. degree in 1995. He became Associate Professor in Macroeconomics in 2005 and Full Professor in 2010. He has been teaching Intermediate Macroeconomics and Comparative Economics at the University of South Florida, Tampa. Before this university, he taught at St. Mary's College of Maryland, Maryland, USA. He is a former Fulbright scholar at Michigan State University and the University of Rhode Island. Dr. Ongan published many books and peer-reviewed papers.

Dr. Gocer, an associate professor of macroeconomics, specializes in econometric analysis. He has a book on econometrics, 8 book chapters, more than 90 scientific international articles on economics and finance, and more than 50 conference papers. In addition, he teaches economics and econometrics to undergraduate and graduate students and is a referee for many scientific.

Mrs. Ayse Ongan She completed her Master's degree at the Fuqua School of Business in Finance at Duke University in 2021. Her undergrad degree is in finance at the University of South Florida, Tampa. She has been working as a Banking Analyst at McKinsey Tampa, Florida.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.

REFERENCES

- 1 For full report, refer to: https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/

- 2 For technical details of this index, refer to: https://www.policyuncertainty.com/infectious_EMV.html.

- 3 For technical instruction details of this index, refer to Baker et al. (2019) and https://www.policyuncertainty.com/EMV_monthly.html

- 4 For terms in the categories, refer to: https://www.policyuncertainty.com/EMV_monthly.html

- 5 For the technical detail of the EPU index, refer to: https://www.policyuncertainty.com/methodology.html