Impact of Big Five personality traits on tax non-compliance intentions: Mediation effect of perceived tax-fairness

Abstract

Established behavioural theories have been used to study the impact of perceptions, attitudes and behaviour on tax compliance however the literature have overlooked the relationship between the personality traits of taxpayers as defined by the five-factor model (FFM) on tax non-compliance. This study aims to fill this gap by proposing a model using the FFM personality traits that examines the impact of the Big Five personality on tax non-compliance intentions, and investigates whether the relationships are mediated by tax-fairness perception. Survey questionnaire were collected from 503 taxpayers working in various professions in Malaysia. Using structural equation modelling to conduct the multivariate analysis, the results were determined using Smart PLS. The results of the analysis indicate that conscientiousness, agreeableness and extraversion are negatively related to tax non-compliance intention, while neuroticism positively influences tax non-compliance intention. Moreover, openness to new experience had no significant effect on tax non-compliance intention. Finally, tax-fairness perception partially mediates all the relationships except for openness.

1 INTRODUCTION

Tax revenues are among the primary sources of income for most governments around the globe. Without a steady revenue stream, for instance through income tax, value added tax, sales tax, and so on, the government machinery will not be able to function effectively (Ghilarducci, 2018). Tax evasion or tax non-compliance manifests itself when taxpayers hide their income and/or inflate expenses to pay lower amounts in taxes than expected; such practises lead to revenue shortfall for governments. Past research has tried to determine the drivers of such tax non-compliance behaviour based on demographic features of taxpayers and other factors that were considered from perspectives of economic theories and behavioural psychology theories (Beer et al., 2018; Pukeliene & Kazemekaityte, 2016; Walsh, 2012). An OECD-World Bank report on tax evasion reveals that conventional approaches to combat tax evasion by threat of punishment have not yielded significant results. The report suggests that research on determinants of tax non-compliance behaviour need to delve deeper into aspects of human psychology that can provide clues on how to develop more effective interventions (The World Bank Report, 2018).

Research indicates that relatively fewer studies have examined the relationship between human psychological traits and tax evasion behaviour. Despite the fact that a recent study has looked at the influence of neuroticism, agreeableness and conscientiousness on taxpayer compliance (Huels & Parboteeah, 2019), it appears that there is a dearth of studies employing all dimensions of the five-factor model (FFM) of personality traits developed by Costa Jr. and McCrae (1992) to investigate whether dominant aspects of taxpayer personalities influence tax non-compliance behaviour.

The FFM framework on personality is based on a set of five broad human personality trait domains that are also referred to as the “Big Five” in the literature: agreeableness, extraversion, conscientiousness, openness, and neuroticism (Huels & Parboteeah, 2019). The framework was developed to represent the variability of personality in individuals, and its' use of only five dimensions, makes a more parsimonious conceptualization of human personality traits compared to prior studies (Soto & Jackson, 2013). There is a broad consensus among personality psychologists that the FFM framework captures the most vital and basic individual differences in personality traits (Lim & Chapman, 2021). Furthermore, Rosid et al. (2018) argue that personality traits of individuals are likely to have an influence on their tax-fairness perceptions.

The extant literature related to behaviour of taxpayers indicates that an important factor that drives disposition of taxpayers towards proper compliance with tax rules is perception of fairness of the taxation policies in their society (Muslichah & Graha, 2018). In a qualitative study by Verboon and Goslinga (2009), the authors found that it was important for taxpayers to feel that they were both procedural fairness in the tax assessment as well as empathetic behaviour from tax officials. Whenever people perceived unfairness in treatment and processes, they would resist paying the whole amount of their tax dues. In another study by Braithwaite (2003), procedural justice in tax assessment was found to have significant influence on tax-fairness perceptions of people. Furthermore, such fairness perceptions were significantly related to their decision-making regarding tax avoidance behaviour. Additionally, Hassan et al. (2021) studied tax compliance behaviour of taxpayers in relation to their perceptions about government spending with revenue collected from taxes. The authors found that when individual taxpayers believed that the revenue collected by the government through taxes is misused, they developed a negative view of the fairness of the tax system.

With regards to empirical research related to tax-fairness and tax compliance, it is deemed important to point out that the relationship between the two constructs in the academic literature have been primarily based on established behavioural theories such as theory of Planned Behaviour and Theory of Reasoned Action, and so on, (Azmi et al., 2016). Although the relationship between tax-fairness and tax non-compliance behaviour has been established; however, the manner in which such relationships are affected by personality traits of taxpayers appear to be understudied. Therefore, the primary goal of this study is to explore how such relationships are affected by personality traits of taxpayers. Deriving a finer-grained understanding about the interaction between personality traits, tax-fairness perceptions, and tax non-compliance intentions, are expected to carry significance for both the body of knowledge as well as policymaking and implementation of tax policies.

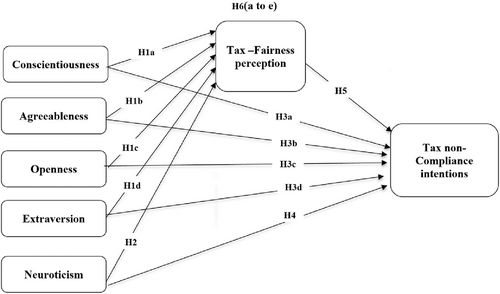

In light of the preceding discourse, a conceptual framework is proposed in this study, where personality traits based on the FFM (i.e., conscientiousness, agreeableness, openness, extraversion and neuroticism) represent the independent variables that are hypothesised to be drivers of tax-fairness perceptions and tax non-compliance intentions. Furthermore, tax-fairness perceptions are posited to be a mediator in the relationships between the personality traits and tax non-compliance intentions. Hence, the assumption behind the framework developed for the current study, is based on the premise that individual personality of taxpayers is likely to influence their perceptions about, fairness of taxation regimes, and subsequently their disposition regarding paying taxes.

2 LITERATURE REVIEW

Tax non-compliance (tax evasion) is the under-reporting of taxable income to pay lower amounts of taxes than is legally due (Allingham & Sandmo, 1972). Tax evasion differs from tax avoidance, which is considered legal, while evasion is achieved through fraudulent means, and is considered a financial crime (Sandmo, 2005; Wenzel, 2004). Scholarly works have looked into tax non-compliance behaviour from various perspectives, such as demographic features (e.g., Jackson & Milliron, 1986), fairness perceptions (Gilligan & Richardson, 2005; Rosid et al., 2018; Saad, 2014), complexity of tax laws (Katz & Ott, 2006; Pau et al., 2007), taxpayer knowledge about intent and calculation of taxes (Azmi et al., 2016; Tan & Chin-Fatt, 2000), religiosity (Nazaruddin, 2019) and other socio-political and economic factors (Kasipillai et al., 2003; Marandu et al., 2015).

Although some of the aforesaid studies have attempted to identify the antecedents of behavioural intentions in terms of tax non-compliance, bulk of these studies have focused on either demographic factors (Devos, 2008), or socio-economic theories of behaviour (Hasseldine & Li, 1999). Relatively few studies have investigated influence of psychosocial determinants of tax non-compliance behaviour (e.g., Arbex et al., 2018; Pickhardt & Prinz, 2014).

The FFM has been applied by researchers in various contexts and in different fields of study, demonstrating that FFM traits impact perceptions, attitudes and human behaviour. For instance, in the context of technology adoption, the personality traits appear to impact technology acceptance behaviour (Benlian & Hess, 2010; Stajkovic et al., 2018). Furthermore, in the field of criminology, studies show that these traits have an impact on deviant and anti-social behaviour (Guay et al., 2016; Jolliffe, 2013; Vize et al., 2018). The link between tax-fairness perception and tax non-compliance intentions have been founded on well-known theoretical models such as the Theory of Planned Behaviour, Theory of Reasoned Action, and so on, (Azmi et al., 2016). However, how such relationships are affected by personality traits of taxpayers appears to be understudied.

2.1 Tax non-compliance intentions

Three (3) review articles stand out in the body of knowledge with regards to research on behaviour regarding tax obligations: Jackson and Milliron (1986), Andreoni et al. (1998) and Pickhardt and Prinz (2014). The findings of the review papers suggest that there are two main streams of thought regarding behaviour of individuals to comply with or evade tax payments. One stream of research focuses on economic parameters, while the other delves into social and psychological issues. The latter stream suggests that beliefs and attitudes of taxpayers determine intentions and behaviour. Some studies have found that moral values have a bearing on tax compliance intentions (Alm et al., 1992).

2.2 Tax-fairness perception

In the extant literature on taxation, fairness perceptions regarding tax policies and regulations are believed to influence public attitude towards tax compliance (e.g., Bin-Nashwan et al., 2020; Gilligan & Richardson, 2005; Hartner et al., 2008; Jimenez & Iyer, 2016; Tan & Chin-Fatt, 2000). Besides other factors, perceived tax-fairness has a bearing on the taxpayers' voluntariness in meeting their obligations to ensure the government's tax revenue targets are being met (Azmi et al., 2016). When individuals perceive that society over-burdens the less fortunate with various forms of taxes compared with a small percentage of wealthy people who are paying a relatively low amount in taxes compared to their total wealth. Such perceptions can snowball into behavioural manifestations where hiding income and inflating expenses to pay less tax become the default script (Deyganto, 2018).

Chan et al. (2000) found that when taxpayers perceive that tax collected by the government was not being fairly allocated, it contributed to perception of unfairness regarding taxation. The work by Gerbing (1988) was significant in the development of a multidimensional conceptualisation of perceived tax-fairness. Based on the distributive justice theory, the construct was composed of perceptions about general fairness, distribution of tax burden, exchange with government, attitude towards taxation of wealthy individuals and preferred tax structure.

2.3 Five-factor model (Big Five personality traits)

Personality has a vital impact on people's psychology and behavioural manifestations (Benlian & Hess, 2010; Contrada et al., 1990). Both personality and social cognition are significant predictors of human behaviour (Stajkovic et al., 2018). Researchers have widely employed two theories in investigating how human personality traits influence their behaviour. First is the FFM (Barrick & Mount, 1991; John & Srivastava, 1999) and second is the Social Cognition theory (Bandura, 1986). This study employs the FFM originally proposed by Costa Jr. and McCrae (1992). The reason behind this is that, research on how human traits could be considered as predictors of tax-compliance behaviour can help regulatory bodies to customise tax regulations and policies that take into account the influence of human personality traits to comply with tax laws and regulations.

The FFM framework, which is also referred to as the Big Five, is based on five dimensions: extraversion (as opposed to introversion), agreeableness (as opposed to antagonism), conscientiousness (as opposed to lacking in direction), neuroticism (as opposed to emotional stability) and openness to new experience (as opposed to close-mindedness). These traits are considered as innate disposition of individuals to behave in a certain manner and their behaviours are considered inherent regardless of observational contexts (Barnett et al., 2015).

Highly extraverted individuals are sociable and assertive, rather than being reserved and preferring to stay in the background. Agreeable individuals are polite and are programmed to look for amiable solutions, rather than being argumentative and conflict seeking. Conscientious individuals are orderly and like structure, rather than being disorganised and lacking in discipline. Neurotic individuals are provoked quickly and are prone to negative emotions such as irritation, anger and anxiety, rather than being tranquil and emotionally resilient (Barnett et al., 2015). Finally, individuals with openness to experience have a broad range of interests and rather than being resistant to change, they see change as a new positive experience. There is a broad consensus among personality psychologists that the FFM conceptualises the dominant human traits that drive their behaviour (Gilligan & Richardson, 2005; Huels & Parboteeah, 2019; John et al., 2008; Rosid et al., 2018; Soto & Jackson, 2013).

3 THEORETICAL FRAMEWORK AND HYPOTHESES

The FFM model has been used effectively in various fields and contexts to study manifestations of peoples' personality on perceptions, intentions and behaviours. For example, in the field of information technology, studies have shown that FFM traits impact new technology adoption behaviour of individuals that are expected to use them in their work (Mahmud et al., 2017; Murugesan & Jayavelu, 2017). Benlian and Hess (2010) studied how FFM personality traits of employees impacted their perceptions about complexity of new enterprise resource planning software and subsequent intentions to adopt the new technology; the study found that personality affected perceptions and behavioural intentions regarding adoption of new technology.

Similarly, the FFM personality traits have been applied in understanding anti-social behaviour (Dam et al., 2018; Jolliffe, 2013; Vize et al., 2018; Wiebe, 2004). However, there seems to be a dearth of studies that deploy the FFM to examine how personality traits are likely to interact with perceptions and intentions towards tax obligations. Therefore, drawing parables from studies in other contexts, the FFM theory offers a sound platform to study how the Big Five personality traits impact tax non-compliance intentions with the possibility that such relationships are mediated by perceptions of tax-fairness.

3.1 Relationship between FFM personality traits, tax-fairness perceptions and tax non-compliance intentions

Based on the premise of the FFM theory, conscientiousness, agreeableness, openness, extraversion and neuroticism are all expected to influence perceptions and intentions of taxpayers. The FFM theory does not suggest in any way that people only have a single personality trait, instead it argues that certain personality traits will be dominant in individuals (Costa Jr. & McCrae, 1992). Therefore, the following discourse from the FFM literature leads to the development of a set of hypotheses.

3.1.1 Conscientiousness

Conscientiousness refers to a sense of responsibility and being structured, methodical and goal oriented (Digman, 1989). Research undertaken in various contexts on individuals with high levels of conscientiousness indicate the association between personality traits and task performance—such individuals generally perform better at work, are more productive and are cognisant of their obligations (Barrick & Mount, 1991). The opposite of conscientiousness would be lacking in direction or having low sense of responsibility. Conscientious people have been found to be more likely to follow rules and regulations (Benlian & Hess, 2010). Moreover, literature indicates a negative correlation between conscientiousness and anti-social behaviour (Vize et al., 2018). Therefore, it is expected that people whose dominant trait is conscientiousness, will have a more positive view of tax policies and will be more inclined to meet their tax obligations, which means they will have a positive outlook on tax-fairness and will be less likely to display tax non-compliance intentions.

3.1.2 Agreeableness

Individuals who manifest high levels of agreeableness in their personality are characterised by strong traits of kindness, tolerance, being trust-worthy and amiable (Barrick & Mount, 1991). The antonym of agreeableness would be antagonistic, that is, individuals who are prone to harbouring conflicting views that lead to similar actions. Antagonistic people have been shown to be inclined towards delinquent behaviour (Wiebe, 2004).

Benlian and Hess (2010) found a positive and significant correlation of agreeableness with perceptions and attitudes towards technology adoption. In the field of criminology, Jolliffe (2013) reported that people with agreeable personality traits are less likely to be involved in crime. Therefore, it is expected that higher levels of agreeableness will lead to more positive perceptions on tax-fairness and lower inclination towards tax non-compliance behaviour.

3.1.3 Openness

An individual with openness to new experiences will be curious and inquisitive (Costa Jr. & McCrae, 1992). Dam et al. (2018) found that open-minded people were more comfortable with their current state and were less likely to display anti-social behaviour. The opposite of openness would be close mindedness about new experiences and being resistant to change. Open-minded individuals with curiosity and desire to learn will be motivated to understand intent and structure of tax policies and will be more inclined towards having a positive perception of tax-fairness and a negative view of tax evasion.

3.1.4 Extraversion

People who are extraverted are characterised by being sociable, gregarious, confident and assertive (Barrick & Mount, 1991). According to Zmud (1979) people with extraverted nature have been found to have a positive attitude towards social norms and obligations to society. Wiebe (2004) reported that extraversion and delinquent behaviour are negatively correlated. The sociable nature of extraverted people would suggest that they would be more understanding towards the need to fullfill tax obligations. Therefore, it is expected that high levels of extraversion will lead to positive perceptions of tax-fairness and consequently lower levels of tax non-compliance intentions.

3.1.5 Neuroticism

Neuroticism is the degree to which an individual is irritated, angry, anxious or worried by a stimuli (Barrick & Mount, 1991). The opposite of a neurotic individual would be someone who is emotionally stable and is not easily triggered. Hurtz and Donovan (2000, p.876) state that “it appears that being calm, secure, well-adjusted and having low anxiety has a small but consistently positive impact on job performance.” Dam et al. (2018) and Huels and Parboteeah (2019) report that people with neurotic traits are more prone to committing crimes. In general, neurotic people are triggered easily towards negative emotions (Benlian & Hess, 2010), and therefore are likely to harbour negative tax-fairness perceptions and consequently display higher levels of tax non-compliance intentions. Based on the above discourse, the set of hypotheses (see Table 1) are posited.

| Code | Hypotheses on the effect of FFM traits on tax non-compliance intentions |

|---|---|

| H1 (a–d) | Conscientiousness, agreeableness, openness and extraversion will have negative influence on tax non-compliance intentions |

| H2 | Neuroticism has a positive effect on tax non-compliance intentions |

| H3 (a–d) | Conscientiousness, agreeableness, openness and extraversion, will have positive influence on tax-fairness perceptions |

| H4 | Neuroticism has a negative effect on tax-fairness perceptions |

3.2 Relationship between tax-fairness perception and tax non-compliance intentions

The relationship between tax-fairness perception and tax non-compliance behaviour has been tested by several studies using either Theory of Planned Behaviour (Azmi et al., 2016; Gilligan & Richardson, 2005) or Theory of Reasoned Action (Saad, 2012; Tan & Chin-Fatt, 2000). Therefore, being in alignment with the findings in the above-mentioned literature, this study hypothesise that:

Hypothesis H5.Tax-fairness perception will have a negative effect on tax non-compliance behaviour.

3.3 Mediation hypotheses

Mediation will occur if tax-fairness perception accounts for the relationship between FFM personality traits and tax non-compliance intentions. Azmi et al. (2016) found that tax-fairness perceptions mediate the relationship between tax knowledge, tax complexity and voluntary tax compliance. Similarly, a different set of studies (e.g., Katz & Ott, 2006; Porcano, 1988) suggest that whether taxpayers consider tax laws to be fair and less complex will have a bearing on their intentions and likelihood of complying with tax obligations. Furthermore, Lewis et al. (2014) found that the relationships between personality and anti-social behaviour were mediated by perceptions of social support. Hence, it may be deduced that perceptions of fairness accounts for the relationship between personality and intentions to act against social norms such as obligations to pay taxes. Therefore, the current study (Figure 1) posits that tax-fairness perceptions will mediate the relationship between the five (5) FFM personality traits and tax non-compliance intention, leading to the following hypotheses:

Hypothesis H6(a–e).Tax-fairness perception mediates the relationship between personality traits (conscientiousness, agreeableness, openness, extraversion and neuroticism) and tax non-compliance behaviour.

4 RESEARCH METHOD

This study deploys the survey method by collecting primary data through self-administered questionnaires (Rowley, 2014). The scales used in the instrument were adopted and adapted from articles published in reputed journals.

4.1 Measurement of Big Five personality traits

The most widely recognised scale for measuring FFM personality traits is the NEO Personality Inventory Revised (NEO-PI-R) developed by Costa Jr. and McCrae (1992). The original NEO-PI-R scale had 240 items, which was later shortened by the authors for the sake of expediency in social science research. The five components of Big Five personality (Conscientiousness, Agreeableness, Openness, Extraversion and Neuroticism) were measured with 60-items (John & Srivastava, 1999). The scale was further shortened by Barnett et al. (2015) to 30 items which is adopted in this study measured on a seven-point Likert scale (see Appendix Table A1).

4.2 Measurement of tax non-compliance behaviour

To measure tax non-compliance behaviour, the study adopted Gilligan and Richardson's (2005) 15-item scale to measure tax non-compliance. The items measure how respondents express their opinions regarding certain scenarios.

4.3 Measurement of perceived tax-fairness

Based on the work by Gerbing (1988) on tax-fairness perception, Gilligan and Richardson (2005) developed a modified scale to measure taxpayer fairness perceptions about tax policies and regulations. The current study adopted Gilligan and Richardson's (2005) 21-item scale, which is a five-point Likert type scale with questions about fairness perception).

4.4 Data collection process and sample size

Printed survey questionnaires were distributed to taxpayers present at the office of the Inland Revenue Board of Malaysia (IRBM) in Kuala Lumpur, Malaysia. The IRBM does not disclose taxpayers' profiles; as a result, probability sampling was not feasible. Malaysian taxpayers submit their reports on the basis of self-assessment system either online or physically. Over several consecutive working days, visitors to the IRBM office were requested to fill out the questionnaire. After distributing over 1200 questionnaires, 535 survey forms were returned. Upon initial scrutiny of the survey forms, 32 entries were discarded as more than 25% of the questions were left unanswered (Hair et al., 2013). Finally, 503 returned forms were usable for further analysis. The table developed by Krejcie and Morgan (1970) for sample size adequacy, indicates a minimum of 384 respondents for a large population that is over 1 million, as in this case. Hence, sample size adequacy requirements are met.

5 DATA ANALYSIS

To analyse the data, SPSS (Version 23) and Smart-PLS (Version 3.2) were utilised. The analysis was conducted in two phases. In the first phase, SPSS was used to complete the following tasks: (i) data preparation (e.g., coding, checking and managing missing data, monotone response, test for outliers, etc.); (ii) to generate demographic characteristics of the respondents; (iii) to compute frequencies, means and SD of the data against each variable in the model; and (iv) to conduct analysis for common method variance (CMV). SPSS is widely used by researchers for data analysis (Hair et al., 2016; Ramayah et al., 2018).

In the second phase, partial least squares-structural equation modelling (PLS-SEM) using Smart PLS (v.3.2) was employed to assess construct validity and internal consistency reliability of the measurements and to test the hypotheses by evaluating the structural model.

5.1 Demographic features of respondents

Demographic details of the respondents are presented in Table 2. The majority of the respondents were male and working as employees in various organisations. The largest age group was between 31 and 40 years category, and the majority of the respondents had university degrees. One extra question was added to the questionnaire seeking to know why the individuals were physically visiting the tax office when online self-assessment was possible. An overwhelming majority noted that they were either appearing for appeals related to random audits or to seek information on ambiguity in the tax calculation method.

| Variables | Category | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 403 | 80.1 |

| Female | 100 | 19.9 | |

| Age | 20–30 | 107 | 21.3 |

| 31–40 | 217 | 43.2 | |

| 41–50 | 143 | 28.4 | |

| 51–60 | 31 | 6.0 | |

| 61 and above | 5 | 0.01 | |

| Source of primary income | Employment | 236 | 47.0 |

| Own business | 80 | 15.9 | |

| Property income | 64 | 12.6 | |

| Other sources | 123 | 24.6 | |

| Total years as taxpayer | 1–5 | 47 | 9.3 |

| 6–10 | 160 | 31.7 | |

| 11–15 | 247 | 49.2 | |

| 15 and above | 49 | 9.8 |

5.2 Measurement model: Construct validity

Tables presented in Appendix shows the outer loadings of all items for all variables in the modified measurement model after deleting items with factor loadings below the recommended benchmark of 0.5 (Byrne, 2013). According to the results of outer loadings, all the items were retained except six items under the dimensions of personality. These items were deleted from the initial measurement model due to low factor loadings that were lower than the recommended cut-off (<0.5), suggesting their low contribution to related constructs (Hair et al., 2016).

The measures for internal consistency reliability were determined through composite reliability (CR) (Gefen et al., 2000). Cronbach's Alpha was not reported keeping in mind some of its shortcomings suggested by scholars (McNeish, 2018). All the values of CR were above 0.7 suggesting that internal consistency reliability requirements were met.

Furthermore, all the average variance extracted (AVE) values were above the recommended value of AVE ≥0.50, suggesting that convergent validity requirements were met (Hair et al., 2016). To determine discriminant validity both Fornell and Larcker (1981) criteria and heterotrait-monotrait (HTMT) (Henseler et al., 2015) criteria were applied. The results indicated that discriminant validity was achieved (Hair et al., 2016).

5.3 Multicollinearity test

To measure the possible influence of lateral collinearity, the variance inflation factor (VIF) was computed. The study's two (2) endogenous variables (tax-fairness perceptions and tax non-compliance intentions) show the highest VIF of 1.816 indicating that the values were below the cut-off of 3.3 (Diamantopoulos & Siguaw, 2006), implying that multicollinearity was not an issue (Hair et al., 2016).

5.4 Structural model analysis

The first step in assessing the significance of the relationships in the proposed hypotheses in the path model is to utilise the bootstrapping approach (Wong, 2013). This technique assesses the statistical significance of the coefficients and subsequently the error of the estimated path coefficients (Chin, 1998). The standardised path coefficients (β), the significance of the paths, and the R2-values for the endogenous construct were determined.

The results of the bootstrapping procedure (Table 3) show that all the paths were significant except the relationship between Openness and Tax-Fairness Perception (β = 0.035, p = 0.223) and also the relationship between Openness and Tax Non-Compliance Intentions (β = −0.007, p = 0.468). All the other paths were significant which was also supported by the values of confidence intervals (CI) that did not straddle a zero-value (Ramayah et al., 2018). Therefore, the relationships between conscientiousness, agreeableness, extraversion and tax-fairness perceptions were positive and significant (β = 0.411, p < 0.001, β = 0.365, p < 0.001, β = 0.157, p = 0.001), and the relationship of these variables with tax non-compliance intention was negative and significant (β = −0.181, p < 0.001, β = −0.274, p < 0.001, β = −0.233, p < 0.001). On the other hand, the relationship between neuroticism and tax-fairness perception was negative and significant (β = −0.138, p = 0.004). Further, neuroticism positively impacted tax non-compliance intention (β = 0.111, p = 0.017). The above results indicate that all the hypotheses were all supported, except H-1c and H-3c both related to openness were found to be statistically non-significant.

| PATH | Β | SE | t value | p value | 95% CI | |

|---|---|---|---|---|---|---|

| IVs to MED | LB | UB | ||||

| CONS- > TFP | 0.411 | 0.048 | 8.522 | <0.001 | 0.332 | 0.493 |

| AGREE- > TFP | 0.365 | 0.055 | 4.833 | <0.001 | 0.176 | 0.356 |

| OPEN- > TFP | 0.029 | 0.045 | 0.761 | 0.423 | −0.04 | 0.111 |

| EXTRA- > TFP | 0.157 | 0.05 | 3.112 | 0.001 | 0.072 | 0.238 |

| NEUR- > TFP | −0.138 | 0.046 | 2.617 | 0.004 | −0.193 | −0.043 |

| MED to DV | ||||||

| FC- > PF | 0.913 | 0.051 | 3.807 | <0.001 | 0.107 | 0.278 |

| IVs to DV | ||||||

| CONS- > TAXEV | −0.181 | 0.053 | 3.38 | <0.001 | 0.091 | 0.265 |

| AGREE > TAXEV | −0.274 | 0.052 | 5.23 | <0.001 | 0.184 | 0.357 |

| OPEN- > TAXEV | −0.007 | 0.083 | 0.08 | 0.468 | −0.111 | 0.167 |

| EXTRA > TAXEV | −0.233 | 0.057 | 4.092 | <0.001 | 0.131 | 0.32 |

| NEUR- > TAXEV | 0.111 | 0.052 | 2.122 | 0.017 | −0.196 | −0.025 |

The R2-values or coefficients of determination computed indicated that the combined effect of the exogenous variables explained 27.3% of variation in tax non-compliance behaviour and 31.4% tax-fairness perceptions.

5.5 Mediation analysis

Following guidelines provided by Hair et al. (2016) to test for mediation, bootstrapping was done to compute the indirect effect of tax-fairness on the relationships between the personality traits on tax non-compliance behaviour (Table 4). According to the results, tax-fairness perception significantly mediated the relationship between four of the FFM personality traits and tax non-compliance behaviour: conscientiousness (βab = 0.080, p < 0.001), agreeableness (βab = 0.052, p = 0.001), extraversion (βab = 0.031, p = 0.01) and neuroticism (βab = −0.023, p = 0.001). Only in the case of openness, it appears that tax-fairness perception does not mediate the relationship between openness and tax non-compliance intention (βab = 0.018, p = 0.436). Furthermore, from the values of VAF (variance accounted for), the highest mediation effect was related to conscientiousness (VAF = 30.65%) followed by agreeableness (17.16%), which can be interpreted as mediation (Hair et al., 2016).

| Path | a*b | SE | t value | p value | VAF% | 95% CI | |

|---|---|---|---|---|---|---|---|

| LL | UL | ||||||

| CONS- > TFP > DV | 0.080 | 0.022 | 3.673 | <0.001 | 30.65 | 0.074 | 0.116 |

| AGREE > TFP > DV | 0.052 | 0.017 | 3.157 | 0.001 | 16.11 | 0.037 | 0.080 |

| OPEN- > TFP > DV | 0.018 | 0.009 | 0.718 | 0.436 | – | −0.005 | 0.013 |

| EXTRA- > TFP > DV | 0.031 | 0.013 | 2.318 | 0.01 | 11.74 | 0.021 | 0.054 |

| NEUR- > TFP > DV | −0.023 | 0.012 | 2.005 | 0.001 | 17.16 | −0.034 | −0.016 |

- Note: IV: CONS, AGREE, OPEN, EXTRA, & NEUR represent FFM personality traits, DV: TAXEV.

- Abbreviations: TAXEV, tax non-compliance (tax evasion) intention; TFP, tax-fairness perception; VAF, variance accounted for.

6 DISCUSSIONS, LIMITATIONS AND FUTURE DIRECTIONS

This study investigated the relationships between the FFM personality traits and taxpayers' behavioural intentions regarding tax-fairness perception and non-compliance intentions. The results of the study show that agreeableness, conscientiousness and extraversion all have a negative relationship with tax non-compliance intention. This indicates that individuals with such dominant personality traits are more likely to comply with their social obligations regarding tax payments. The three referenced traits are positive and desirable human personality dimensions that have been found to lead to positive attitudes and behaviours in other contexts also. For instance, Barnett et al. (2015) found that individual employees with these traits showed willingness to embrace new technologies and had a positive desire to learn and contribute to their jobs. Similarly, in the field of criminology, Wiebe (2004) showed that experimental participants with such dominant traits displayed less likelihood of delinquent behaviour. Furthermore, these traits appeared to have a positive impact on tax-fairness perceptions. Hence, such individuals would harbour a positive view of tax policies and regulations, and perceive them as necessary for the greater good of society.

The influence of openness on tax-fairness perception and tax non-compliance intention was found to be non-significant. This result also mirrors the findings of Rothmann and Coetzer (2003), which showed that openness had no significant impact on job performance. Therefore, it may be deduced that openness to new experiences, although a positive personality trait, does not impact perceptions and behavioural intentions when it comes to tax obligations.

Finally, neuroticism was found to be positively associated with tax non-compliance intentions and negatively with tax-fairness perception. The study by Benlian and Hess (2010) shows that people with dominant neurotic traits were resistant to organisational norms and change. In their study, they found that such individuals often resisted the adoption of new technology in their workplace. Furthermore, Dam et al. (2018) found that such individuals were more prone to delinquent acts and anti-social behaviour. Thus taxpayers with such dominant personality traits are likely to have negative views on the fairness of the tax system and be inclined to evade taxes.

Numerous studies have been conducted in the past to unearth the reasons why people try to avoid paying their tax dues. Some of the earlier studies such as Allingham and Sandmo (1972) have tried to determine taxpayer's disposition to voluntarily report their true tax liabilities based on the possibility of facing fines if any evasive actions are detected. Most of the research focus in the past has been to investigate the association between measures by tax authorities and tax compliance by taxpayers. However, the outcome of the current study demonstrates that the challenge related to tax avoidance, needs to be examined beyond economic motives. The reality is that the reasons for tax non-compliance by people, is not simple or straightforward. This study demonstrates that spotlight needed to be brought to the possibility that people's personality traits have a significant role in their disposition regarding meeting their tax obligations.

Among the limitations of this study is the fact that the data was collected from individuals who filled out information on all the variables together, which exposes it to the possibility of common method bias, thus a study of how the perceptions and intentions of respondents change over time may provide a more robust finding. In addition, contextual circumstances such as socio-economic conditions were not considered in this study, which may have an important role in the perceptions and intentions of the taxpayers. Another point that may be considered as scope for future research is to examine the influence of both inside (e.g., zest, optimism, etc.) along with the outside personality traits mentioned in this study. Finally, many other variables not considered in this study may be at play, and hence future researchers are encouraged to consider the role of constructs such as threat of penalties, prevalence of corruption, existing social support, etc.

7 IMPLICATIONS

The findings of this study have implications for both theory and practise. First, the study enriches the existing literature on tax behaviour by providing a nuanced view of how dominant personality traits of individuals are likely to determine their tendency for tax evasion. The discovery that certain personality traits, if dominant in an individual, are likely to influence their intentions and behaviour when it comes to meeting tax obligations may pave the way for theory building that connects personality to tax compliance intentions.

Second, from the perspective of tax authorities, it may be useful knowledge that personality traits such as agreeableness, conscientiousness and extraversion have a positive relationship with tax compliance. On the other hand, individuals with neurotic personality traits are more likely to be prone to tax non-compliance. Considering the fact that in today's age of big data analytics, organisations have gained expertise in mapping people's personality types, and thus regulators may be able to determine which taxpayers are likely to evade taxes. Finally, policymakers can benefit from this study by designing information campaigns that take into account people's personalities and how they may respond to the ways in which information on tax obligations are displayed. Hence, appropriately patterned information dissemination on the social impact of tax non-compliance may result in positive outcomes in terms of enhanced tax revenue.

Huels and Parboteeah (2019) did consider the potential influence of three out of five dimensions of the FFM model, to examine how the three factors affect tax compliance behaviour. The aforementioned study found that neuroticism, agreeableness and conscientiousness had significant relationships with individual tax compliance behaviour. The current study investigates the influence of all the five factors of the model, and determines that except for openness, all the other four factors have significant relationship with both tax-fairness perceptions as well as tax non-compliance behaviour. Furthermore, the current study examines the mediating effect of tax-fairness perceptions. Therefore, this research expands the literature by considering all five factors of FFM model and also validates the mediating role of tax-fairness perceptions.

8 CONCLUSION

This study is important for several reasons. First, from the standpoint of theory building, the role of personality of individuals in the tax compliance literature needed to be brought into the discourse. Scholarly efforts have been overwhelmingly focused on associations between socio-economic factors and tax-compliance behaviour, whereas relatively less attention has been paid to variables that are related to perceptions and behaviour of individual taxpayers. It is hoped that one of the contributions of this study would be to move the conversation towards investigating how inherent human traits could be considered as predictors of tax-compliance behaviour. Future research into the highlighted stream of studies may unravel clues for regulatory bodies to customise tax regulations and policies that take into account the influence of human personality traits.

Finally, since tax-fairness perception plays a mediating role between most of the personality traits of taxpayers and non-compliance intentions, policy makers and regulators may be able to design and disseminate information campaigns for the general public in alignment with the knowledge gained from this study. This could increase public awareness on the intent behind taxes and how the collection and distribution is being done for the greater good of society. Such information campaigns may actually create more positive outlook towards tax policies of governments and encourage people to be more compliant with their tax obligations.

Appendix

| Strongly agree = 1 | Agree = 2 | Slightly agree = 3 | Neutral = 4 | Slightly disagree = 5 | Disagree = 6 | Strongly disagree = 7 |

| Factor | Item | Cronbach's α (reported) |

|---|---|---|

| Conscientiousness (as opposed to being directionless) | 1. I am always prepared | 0.74 |

| 2. I waste my time (reverse-coded) | ||

| 3. I find it difficult to get down to work (reverse-coded) | ||

| 4. I get chores done tight away | ||

| 5. I carry out my plans | ||

| 6. I shirk on my duties (reverse-coded) | ||

| Agreeableness (as opposed to antagonistic) | 1. I have a good word for everyone | 0.76 |

| 2. I get back at others (reverse-coded) | ||

| 3. I make people feel at ease | ||

| 4. I have a sharp tongue (reverse-coded) | ||

| 5. I cut others to pieces (reverse-coded) | ||

| 6. I insult people | ||

| Openness to experience (as opposed to close-mindedness) | 1. I believe in the importance of art | 0.76 |

| 2. I enjoy hearing new ideas | ||

| 3. I am not interested in abstract ideas (reverse-coded) | ||

| 4. I do not like art (reverse-coded) | ||

| 5. I do not enjoy going to art museums (reverse-coded) | ||

| Extraversion (as opposed to Introversion) | 1. I would describe my experiences as somewhat dull (reverse-coded) | 0.79 |

| 2. I am skilled in handling social situations | ||

| 3. I know how to captivate people | ||

| 4. I have little to say (reverse-coded) | ||

| 5. I don't talk a lot (reverse-coded) | ||

| 6. I am the life of the party | ||

| Neuroticism (as opposed to being emotionally stable) | 1. I am not easily bothered with things | 0.71 |

| 2. I am often down in the dumps (reverse-coded) | ||

| 3. I panic easily (reverse-coded) | ||

| 4. I rarely get irritated | ||

| 5. I seldom feel blue | ||

| 6. I feel comfortable with myself | ||

| 7. I have frequent mood swings (reverse-coded) |

Biographies

Dr. Suaad Jassem is an Assistant Professor at Al Zahra College for Women, Department of Managerial and Financial Sciences, Muscat, Sultanate of Oman. She holds PhD from University of Malaya, Department of Business and Accountancy, Kuala-Lumpur, Malaysia. She holds a Bachelor and Master's degree in science of Accountancy. She has working experience in both academic and practical practice and has contributed and presented research papers in international conferences. Her area of interest includes, sustainability balanced scorecard architecture, enterprise risk management, managerial accounting, and decision-making. Her articles have been published in journals such as Sustainability, Journal of Family Business Management and Management and Foundation of Management.

Yasser A. Al-Rawi is a senior lecturer at Department of Accounting, Administration and Economics at the University of Anbar in Iraq. Yasser is a PhD graduate from Malaysia. His research focuses on accounting, sustainability, and taxation. Yasser have also peer reviewed many articles in national, international Scopus and Clarivate journals. Currently he is writing many articles in the accounting sustainability and Islamic taxation. Yasser's research ID is Orcid https://orcid.org/0000-0002-3464-8863. In addition, WOS research ID is AAO-7632-2021.

Adil Hussein Ali is an Assistant Professor at Department of Accounting, Administration and Economics at University of Anbar in Iraq. Adil has obtained his MSC from the University of Baghdad. His research focus is in accounting and auditing, he also have peer reviewed many articles in national magazine. Currently Adils research ID is Orcid https://orcid.org/0000-0001-5118-635.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.