Medical insurance, labor supply, and anti-poverty initiatives: Micro-evidence from China

Abstract

The high cost of medical care and its association with poverty have given rise to a growing concern for developing countries, but how insurance plans affect household income and alleviate poverty has been rarely discussed. This study aims to bridge this research gap by examining a medical insurance reform in China, a major program of the targeted poverty alleviation (TPA) strategy, which offers higher reimbursement rates and lower medical deductibles for low-income households. We use an administrative data set on impoverished people in a Chinese county to examine how exogenous changes in the medical insurance system affect the income structure of low-income households. We apply a two-part model to a Difference-in-Differences framework, with households that received reimbursement of the insurance reform as the treatment group and others as the control group. Our results imply that the medical insurance reform could increase the overall household income diversity. The mechanism analysis suggests that the medical insurance reform improves the health conditions of patients and encourages caregivers to engage more in off-farm work.

1 INTRODUCTION

The high cost of medical care and its association with poverty, especially with regard to low-income people in rural areas, are growing concerns for developing countries. Low-income households are particularly vulnerable to illnesses because poverty restricts their access to the resources required to prevent risks and adopt healthy behaviors (Phelan et al., 2010). Additionally, health risks lead to unintended (or even catastrophic) expenditures (Özgen Narcı et al., 2015), severely increasing households' financial vulnerability. To address these pressing issues, governments and policymakers around the world have increasingly turned their attention to implementing healthcare reforms aimed at improving accessibility and financial protection, particularly for rural low-income communities. In this study, we attempt to investigate the influence of a medical insurance reform in China for low-income people and explore the underlying economic mechanism behind its effects.

In developing countries, poverty and poor health are intertwined: poverty leads to illnesses and poor health, which, in turn, results in financial vulnerability (Ma et al., 2016; Schultz & Tansel, 1997). For example, in 2015, illnesses were one of the leading causes of poverty in China, affecting 42% of the low-income population.1 The proportion of low-income households returning to poverty due to illnesses reached 44.1%, among which 7.3 million people suffered from primary and chronic diseases (Liu et al., 2016).

Therefore, the implementation of universal health coverage reforms has been frequently considered as a measure that can help relieve households' medical burden. In the Chinese context, these measures have been adopted as one of the new Sustainable Development Goals to reduce the population's financial impoverishment due to health expenditure as well as to increase residents' access to key health services (United Nations, 2015). Previous studies on the relationship among health risks, insurance, and poverty alleviation have mainly discussed the reduction of household medical expenditure (Cheng et al., 2015; Galárraga et al., 2010; Powell & Seabury, 2018; Tao et al., 2020). Scholars have debated whether and to what extent different types of medical insurance can reduce patients' “Out-of-Pocket” (OOP) expenditure, with some researchers extending this discussion to social equality (Chen et al., 2019; Costa-Font et al., 2021; Wagstaff et al., 2009).

Nevertheless, how insurance plans affect households' income and alleviate poverty has scarcely been discussed, although it is an equally important topic. Compared with basic universal insurance, many of the most important government programs, including education poverty alleviation programs, residence relocation programs, basic living allowance programs, and more generous medical insurance plans, which transfer more resources to low-income households. Standard economic theory predicts that such programs may end the vicious cycle of poverty and illness in the long term by increasing household income (Alam & Mahal, 2014; Baicker et al., 2014; Wang & Zhou, 2020). It is recognized that health condition has a significant impact on household income structure (Ettner, 1996; Wagstaff, 2002). Thus, understanding the size and mechanism of such effects on the income structure of rural low-income households is an increasingly critical issue, as income diversification (i.e., expanding beyond agricultural activities and engaging with off-farm sectors) is a common adaptation strategy for rural households in developing countries to manage risks (Davis et al., 2017; Démurger et al., 2010; Ellis, 2000).

We aim to discuss some critical questions in this study: What are the effects of medical insurance reform on low-income households? To what extent is income diversification driven by the new medical insurance scheme? Through which mechanisms does the scheme impose various effects on the income structure? Can medical insurance reform improve low-income, rural households' long-term risk management ability and help them escape the vicious cycle of poverty and illness?

To address these issues, this study exploits the medical insurance reform as a quasi-natural experiment to answer these questions by investigating the various effects on the income structure of low-income households. We decompose the effects into intensive and extensive margins (Staub, 2014). The extensive margin is driven by the participation effect and change in the probability of participation, whereas the intensive margin is driven by the conditional-on-positives effect and difference in the outcome given the participation. In previous research, some studies have already analyzed the extensive and intensive effect of health policy on labor supply (Kolstad & Kowalski, 2016; Staub, 2014). However, few of them take health conditions as an important factor, and this study aims to carefully decompose these two effects and the underlying mechanisms. Specifically, we adopt a two-part model based on the statistical decomposition of the density of the outcome into a process that generates zeros and a process that generates positive values.

We apply this method to the universal medical insurance system in rural China. The target county analyzed in this study has been covered by the New Cooperative Medical Scheme (NCMS) and the Critical Illness Insurance (CII) since 2014. At the beginning of 2017, the local government introduced the “Five Lines of Health Insurance Defense” (FLHID) policy, which offers higher reimbursement rates and lower medical deductibles for low-income households. That medical insurance reform functioned as an exogenous shock. This expansion in the generosity of insurance coverage points to a natural experiment using a Difference-in-Differences (DID) design.

To address the possible correlation in our DID framework, we add several other reforms that existed during the same period as additional control variables, which would alleviate the potential confounds. In the empirical strategy, we classify the control and treatment groups based on whether a household had received the reimbursement of the insurance reform, and then we construct a continuous DID variable according to the percentage of family members who had received the benefits of the insurance reform, similar to the approach of Nunn and Qian (2011). To assess the magnitude of our estimated effects, we calculate to what extent the change in the income structure can be explained by exogenous changes in the medical insurance scheme. Our estimates suggest that the FLHID reform is beneficial for low-income households, as it encourages them to engage in off-farm work and increases their income diversity. The overall effect observed from our baseline estimation is 1.4 percentage points, with intensive margins of 0.5% and extensive margins of 1.2 percentage points. We also include household health conditions and the wage rate of off-farm to analyze the mechanism. The insurance reform first improves the health condition of the patients in the families, and at the same time releases the labor force of the caregivers as they have more possibility to participate in higher paying off-farm work, so as to improve the income diversity of the family and their ability to resist risks.

This study makes three contributions to the literature. First, it builds on previous studies, including Smith et al. (2001), Losch et al. (2012), Demissie, (2013), Zhao (2014), and Dedehouanou and McPeak (2020), on the determinants of income diversification in various settings. Such studies have emphasized household features (i.e., size, amount of farmland, and productive population structure) as well as individual characteristics (i.e., gender, education, and skills) as the primary determinants. However, in this article, we consider the impact of medical insurance reform, an important policy variable, on the household income diversification while controlling other poverty alleviation policies in the same period. At the same time, variables such as health and labor force, which are less considered in other literatures, are also included in the analysis.

Second, the FLHID that increased public insurance coverage in poor counties is established as an exogenous shock in the present study to avoid the sample selection problem that often emerges in insurance studies. In other words, medical insurance reform is mandated, and whether residents opt for insurance schemes is determined externally. Additionally, using a continuous DID framework, we examine the heterogeneous treatment effects of the reform in the field of health insurance and separate the impact of other poverty alleviation policies on households' income structure during the study period.

Third, it is increasingly recognized that patients should not be treated as isolated individuals in economic evaluations (Basu & Meltzer, 2005). Some studies analyzed the spillover effect of caregiving, for example, the influence on the mental and physical health, opportunity cost, and social isolation of caregivers (Basu & Meltzer, 2005; Bobinac et al., 2010; Kumagai, 2017). Robison et al. (2009) note that inadequate income-based long-term care services of caregivers relate to multiple negative outcomes. Through the mechanism test, this article further shows that medical insurance increases the health conditions of patients and releases the labor force of caregivers, thus increasing the income diversity index of households. At the same time, the conclusions of this article can provide a reference for policymakers in poor rural areas in other developing countries to improve the quality of the labor force through generous health insurance policies to further promote poverty alleviation.

The rest of this article is organized as follows. Section 2 presents the institutional background of the Chinese medical insurance system as well as information on the target county analyzed in this study. Section 3 describes the data and variables used in our study. Section 4 constructs the DID framework and introduces the estimation approach. Section 5 presents the model estimation results, mechanism tests, and heterogeneity analysis. Section 6 concludes.

2 INSTITUTIONAL BACKGROUND

2.1 Medical insurance plans in rural China

In rural China, the NCMS is the primary insurance plan aimed at providing citizens with universal access to healthcare and reducing the financial burden on all rural residents. The NCMS was established in 2003, and its enrollment rate reached 99.36% by 2016.2 Additionally, the proportion of OOP expenditure in health expenditure has decreased dramatically, from 60.13% in 2000 to 35.91% by 2016 (Tao et al., 2020).3 However, despite these accomplishments, patients continue to face heavy financial burdens because the OOP medical expenditure remains unaffordable for many households (Cheng et al., 2015; Wagstaff et al., 2009), while the NCMS covers only a limited number of medical services (Lei & Lin, 2009). Meanwhile, Ma et al. (2016) found that the NCMS has widened the gap in income-related inequity in rural China. Therefore, it has played a limited role in reducing inequalities in health services (Chen et al., 2019; Ma et al., 2016; Wang et al., 2016).

As noted by Wagstaff et al. (2018), reimbursement rates and coverage are also important aspects. To further reduce the financial burden of residents with acute diseases and improve the equality between high- and low-income households, China implemented the CII in 2012 to supplement basic medical insurance. In particular, the CII provides a single lump-sum payment to patients diagnosed with severe or critical diseases (i.e., Gatzert & Maegebier, 2015; Longo, 2010); the average reimbursement rate after the implementation of the CII is 50%–70%.4

Evidence shows that the implementation of the CII has reduced patients' short-term OOP medical expenditure (Zhang et al., 2019). Specifically, Jiang et al. (2019) found that medical debt has decreased by RMB 7209 (approximately $1100) on average for all patients under the CII coverage. However, wealthy households benefit more from this policy. Further, the CII's effect on improving equality, enhancing risk management, and reducing the incidence of catastrophic health expenditure is relatively limited (Fang et al., 2018).

To lift nearly 100 million impoverished rural people out of poverty by 2020, China initiated the TPA strategy in 2013, a state-led policy aimed at alleviating poverty by analyzing the features of low-income areas and households. In addition to these nationwide medical insurance schemes driven by the TPA program, local governments have formulated a medical insurance reform for all low-income households. In this article, we will investigate whether the new medical insurance scheme (FLHID) can further prevent financial risks and alleviate poverty in these areas to promote the goal of the TPA program.

2.2 Target county and its healthcare system

We employ a proprietary data set at the household level from the target county, which is a national poverty-stricken county in the middle of China. To help the county eradicate poverty, the local government has been documenting the poor at the household level since 2014 to obtain comprehensive data. When the TPA program was initiated that year, the county registered 41,829 poor people in 12,308 households from 73 villages, with the poverty incidence rate reaching 14.9%.

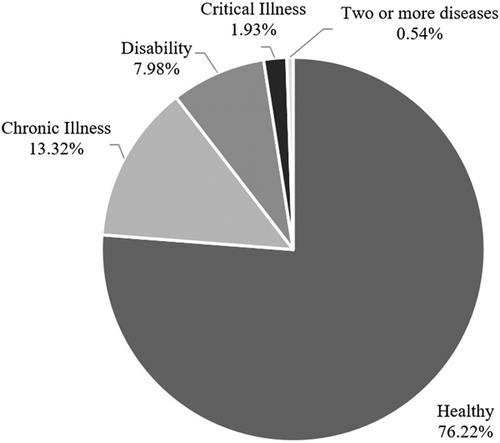

However, only 76% of the registered poor individuals were physically healthy. The remaining 24% suffered from chronic illnesses, critical illnesses, and disabilities, according to the data from 2014 (see Figure 1). At the household level, nearly half of the poor households had patients in 2014. Hence, the health condition of the registered poor households placed severe pressure on the county's medical system. Also, the registered poor households comprised members who were unemployed, low-educated, and low-skilled, with a high proportion of sick or disabled individuals. Disease was the leading cause of poverty, accounting for 28.33% of the registered poor households.

All the registered poor households in the county were covered by the NCMS and CII at the start of our study period (i.e., 2014). At the beginning of 2017, the local government introduced the FLHID policy for all poor households, a free upgrade to the previous insurance scheme; this new scheme offers higher reimbursement rates and lower medical deductibles. Under the FLHID, medical expenses for patients from poor households are reimbursed by basic medical insurance, critical illness insurance, critical illness supplementary insurance, medical assistance, and medication for the poor sequentially. According to the official reimbursement plans,5 the reimbursement rate can reach approximately 100%, which means that patients' OOP expenditure is relatively low (see Appendix). The medical insurance reform is a full-coverage program for poor households, and the actual reimbursement rate obtained from our sample data is approximately 96%, which significantly reduces the medical expenditure burden on poor households.

3 DATA

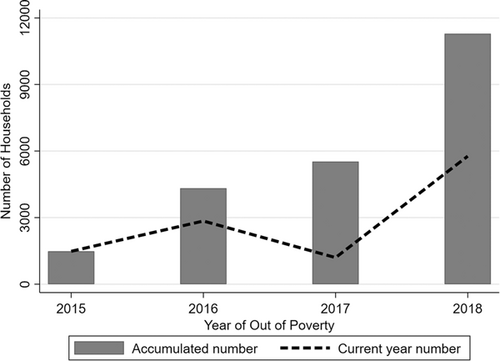

The data set we used in this study is a full-sample administrative poverty population data set of the target county, which is a national poverty-stricken county in the middle of China,6 obtained from the National Poverty Alleviation and Development Information System. Families below the national poverty line are identified as poor households (Jian Dang Li Ka Hu), which were first identified by the government in December 2013. The poor households had much lower income levels, smaller family sizes, and worse health conditions compared to nonpoor households. As the poor households list is adjusted annually, it is an unbalanced panel data set, covering 12,101 households (43,849 individuals) from 73 villages from 2014 to 2018. Our sample data covers all the registered poor households that are also FLHID program enrollees from the target county. Due to privacy and confidentiality, we were unable to obtain data on nonpoor households who were not insured. All poor households are covered by medical insurance at government expense, excluding the self-selection problem of buying medical insurance because the household is in poor health. To better explore the effects of medical insurance, household income, health insurance reimbursements, other reforms, and other household data are collected at the end of each year. Figure 2 shows the poverty alleviation process of these households from the beginning of 2015–2018. Altogether, 93% of the studied households overcame poverty, leaving only 1086 still being recognized as poor by the beginning of 2018. The definitions of our main variables are reported in Table 1.

| Variable | Unit | Variable definitions |

|---|---|---|

| Wage | Yuan | Household's annul off-farm wage income |

| Income | Yuan | Household's annual income |

| Wage/Income | - | Income structure index |

| Health condition | - | Average health level of family members |

| Labor status | - | Average labor capacity level of family members |

| Family size | - | Number of family member |

| Age | - | Average age of family members |

| Education | - | Average education level of family members |

| Farm to forest | Mu | Areas of farmland to forests |

| Grass area | Mu | Areas of grass lands |

| Fruit area | Mu | Areas of fruit lands |

| Agricultural area | Mu | Areas of agricultural lands |

| Irrigable areas | Mu | Areas of irrigable lands |

| Wooded area | Mu | Areas of forest lands |

| Water area | Mu | Areas of water surface |

| Operational cost | Yuan | Cost of operational activities |

| Retire insurance | Yuan | Retirement benefits |

| Toilet | 0–1 | Whether families have sanitary toilets |

| Farm cooperation | 0–1 | Whether families join farm cooperation |

| Dis_mainroad | kilometer | Distance from main road of village |

| Housing area | square meter | Gross residential areas |

| Dibao subsidy | 0–1 | Whether the household benefit from the Dibao subsidy |

| Doudi subsidy | 0–1 | Whether the household benefit from the Doudi subsidy |

| Trans_subsidy | 0–1 | Whether the household benefit from the transportation subsidy |

| Disabled benefit | 0–1 | Whether the household benefit from the Disabled subsidy |

| House renovation | 0–1 | Whether the household benefit from the house renovation |

| MTO | 0–1 | Whether the household benefit from the Move to opportunity |

| Student subsidy | 0–1 | Whether the household benefit from the Student subsidy |

| Illness | 0–1 | Whether illnesses are the main cause of poverty |

| Householder | 0–1 | Whether a family member is the head of the household |

| Wage rate | Yuan | =Wage/Month, where month is the time of off-farm work within a year |

- Note: The last seven variables in the table represent policy variables. The “Dibao subsidy” policy provides a certain amount of monthly or annual subsidy to individuals whose per capita income falls below the local minimum living standard (2960 yuan). The “Doudi subsidy” policy offers a monthly subsidy to widows, widowers, the elderly living alone, and disabled individuals. The “Trans_subsidy” policy provides subsidies for transportation expenses to impoverished residents based on their specific circumstances. The “Disabled benefit” policy grants monetary subsidies to disabled individuals. The “House renovation” policy involves relocating or renovating housing for residents living in poor conditions and providing a certain amount of relocation assistance. The “MTO” policy offers transportation expense subsidies to registered impoverished laborers for starting businesses or seeking employment outside their registered area. The “Student subsidy” policy provides a certain amount of subsidy based on the grade level of children from impoverished families attending school.

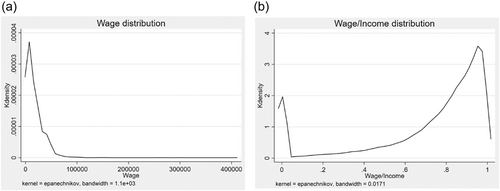

Our main dependent variables are wages and the ratio of household wages to total income. As noted by Adato et al. (2006) and Kijima et al. (2006), earning off-farm wages may reduce the variability in total income and improve the resilience and coping capacity of farming households facing farming income risk. Thus, it is appropriate to consider wages/income as an income diversification index in our research. Figure 3 shows the kernel density curves of wage/income and wages. Figure 3a shows two critical statistical features of wages. First, it displays substantial skewness, with long right-tailed distributions. Second, the distributions have a considerable point mass at zero. Figure 3b shows that the kernel density curve of our income diversification index has a skewed bimodal distribution clustered at 0 and between 0.8 and 1. Based on the asymmetry in the distribution of the dependent variable, single-model approaches may face difficulties in accurate estimation due to the assumption of a balanced data distribution. However, the two-part model can divide the data into two segments: one segment for handling nonzero values and another segment specifically tailored to address zero values. This division enables a more effective estimation process, allowing for better predictions.

The explanatory variable is a policy-treated term defined as . Treated groups are defined as households with at least one family member who actually received reimbursement from the FLHID. We study whether the actual usage of the insurance can affect a family's working decisions and income composition under an exogenous policy shock. Further details of our DID design are presented in the next section. Table 2 reports the summary statistics of our main variables based on the grouping of control and treatment groups.

| Control group | Treatment group | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| N | Mean | Std. Dev | Max | Min | N | Mean | Std. Dev | Max | Min | |

| Dependent variables | ||||||||||

| Wage | 166,702 | 17,763 | 16,285 | 410,000 | 0 | 33,430 | 17,812 | 15,383 | 150,000 | 0 |

| Wage/Income | 166,702 | 0.7 | 0.3 | 1.0 | 0 | 33,430 | 0.7 | 0.3 | 1.0 | 0 |

| Explanatory variables | ||||||||||

| Treatment × Post | 166,702 | 0 | 0.000 | 0 | 0 | 33,430 | .436 | 0.496 | 1 | 0 |

| Continuous Treatment × Post | 166,702 | 0 | 0.000 | 0 | 0 | 33,430 | .135 | 0.199 | 1 | 0 |

| Control variables | ||||||||||

| Health condition | 166,702 | 0.5 | 0.7 | 6.0 | 0 | 33,430 | 0.6 | 0.8 | 6.0 | 0 |

| Labor status | 166,702 | 0.6 | 0.3 | 1.5 | 0 | 33,430 | 0.6 | 0.3 | 1.7 | 0 |

| Family size | 166,702 | 4.0 | 1.4 | 11.0 | 1 | 33,430 | 4.3 | 1.5 | 10.0 | 1 |

| Age | 166,702 | 38.1 | 12.2 | 94.0 | 1 | 33,430 | 39.3 | 11.9 | 91.0 | 13 |

| Education | 166,702 | 2.4 | 0.8 | 5.0 | 0 | 33,430 | 2.4 | 0.7 | 4.5 | 0 |

| Farm to forest | 166,702 | 0.3 | 0.5 | 3.7 | 0 | 33,430 | 0.3 | 0.5 | 2.9 | 0 |

| Grass area | 166,702 | 0.0 | 0.0 | 2.9 | 0 | 33,430 | 0.0 | 0.0 | 4.8 | 0 |

| Fruit area | 166,702 | 0.6 | 1.1 | 4.8 | 0 | 33,430 | 0.7 | 1.1 | 4.8 | 0 |

| Agricultural area | 166,702 | 1.2 | 0.4 | 3.4 | 0 | 33,430 | 1.2 | 0.4 | 4.5 | 0 |

| Irrigable area | 166,702 | 0.9 | 0.5 | 3.4 | 0 | 33,430 | 0.9 | 0.5 | 2.6 | 0 |

| Wooded area | 166,702 | 2.0 | 1.1 | 5.8 | 0 | 33,430 | 2.0 | 1.1 | 5.3 | 0 |

| Water area | 166,702 | 0.0 | 0.0 | 3.6 | 0 | 33,430 | 0.0 | 0.1 | 2.8 | 0 |

| Operational cost | 166,702 | 3.4 | 3.1 | 13.4 | 0 | 33,430 | 3.5 | 3.2 | 12.6 | 0 |

| Retire insurance | 166,702 | 2.8 | 3.5 | 9.9 | 0 | 33,430 | 3.6 | 3.6 | 9.7 | 0 |

| Illness | 166,702 | 0.2 | 0.4 | 1.0 | 0 | 33,430 | 0.4 | 0.5 | 1.0 | 0 |

| Toilet | 166,702 | 0.9 | 0.2 | 1.0 | 0 | 33,430 | 0.9 | 0.2 | 1.0 | 0 |

| Farm cooperation | 166,702 | 0.4 | 0.5 | 1.0 | 0 | 33,430 | 0.4 | 0.5 | 1.0 | 0 |

| Dis_Mainroad | 166,702 | 0.4 | 0.4 | 3.7 | 0 | 33,430 | 0.4 | 0.4 | 3.4 | 0 |

| Housing area | 166,702 | 4.5 | 0.4 | 11.4 | 0 | 33,430 | 4.6 | 0.4 | 7.0 | 0 |

| Dibao benefit | 166,702 | 0.3 | 0.5 | 1.0 | 0 | 33,430 | 0.4 | 0.5 | 1.0 | 0 |

| Doudi benefit | 166,702 | 0.1 | 0.2 | 1.0 | 0 | 33,430 | 0.1 | 0.2 | 1.0 | 0 |

| Trans_subsidy | 166,702 | 0.2 | 0.4 | 1.0 | 0 | 33,430 | 0.2 | 0.4 | 1.0 | 0 |

| Disabled benefit | 166,702 | 0.1 | 0.3 | 1.0 | 0 | 33,430 | 0.1 | 0.3 | 1.0 | 0 |

| House renovation | 166,702 | 0.1 | 0.2 | 1.0 | 0 | 33,430 | 0.1 | 0.2 | 1.0 | 0 |

| MTO | 166,702 | 0.0 | 0.2 | 1.0 | 0 | 33,430 | 0.0 | 0.2 | 1.0 | 0 |

| Student subsidy | 166,702 | 0.7 | 0.5 | 1.0 | 0 | 33,430 | 0.7 | 0.5 | 1.0 | 0 |

| Other variables | ||||||||||

| Illness | 166,702 | 0.2 | 0.4 | 1.0 | 0 | 33,430 | 0.4 | 0.5 | 1.0 | 0 |

| Householder | 166,702 | 0.3 | 0.458 | 1 | 0 | 33,430 | 0.268 | 0.443 | 1 | 0 |

| Wage rate | 166,702 | 1078.238 | 2533.154 | 135,000 | 0 | 33,430 | 1009.814 | 2391.198 | 60,000 | 0 |

- Note: We use Health Condition to reflect households’ average health level. The local government categorizes the health condition of family members into six categories, ranging from 0 (healthy) to 5 (disability, critical illness). Within a household, the Health Condition variable is obtained by assigning values based on each member's health condition and then averaging all the members’ scores. Household members’ labor force status is also assigned according to their labor capacity (0 = skilled labor; 1 = general workforce; 2 = no labor or disability). Labor Status, which reflects the average labor force at the household level, is calculated in a manner similar to Health Condition. To determine the average education level, we divide the family members into six categories and calculate the average at the household level. Please refer to the appendix for details on variable assignment. variables in the “Others” category are used in the tests, with “Illness” and Householder used in the heterogeneity analysis and “Wage Rate” used in the mechanism tests.

4 ECONOMETRIC SPECIFICATION

4.1 DID design

In the context of the exogenous shock of the insurance reform, our key independent variable follows a standard DID strategy. With the context that the whole sample are covered by the FLHID, family members who received reimbursement represent the group who actually enjoyed the benefit of the insurance, thus their families can be defined as the treatment group. And those households who never received reimbursement from the insurance reform during the study period are otherwise the control group. So, the DID variable is , where Treatment is a binary variable to measure whether there is at least one family member who received the benefit of the insurance. In addition, we also apply a continuous measure of the treatment group to capture more variation in the data, following Nunn and Qian (2011). Specifically, it measures the percentage of family members in a household who have received the reimbursement. Households with values of (0, 1] are placed in the treatment group, whereas those with a value of zero are placed in the control group. The design of the DID variable assesses to what extent the change in the income structure can be explained by exogenous changes in the medical insurance scheme. This setting of the treatment and control groups separates the effects of other poverty alleviation policies on households' income structure during our study period. As the FLHID was introduced at the beginning of 2017 and all the other data are collected at the end of each research year, data from 2014 to 2016 are used to establish the prereform trends for the DID analysis, whereas data from 2017 to 2018 belong to the postreform period.

The coefficient of interest in Equation (1) is α1, which measures whether the income diversity of households increased after their family members received reimbursement after the insurance reform in 2017. A positive coefficient indicates that households that actually enjoyed the benefit of the FLHID could increase the income diversity of the households.

Our identification strategy is predicated on the assumption that there were no other events, apart from those we have accounted for and controlled, that occurred around 2017 and influenced the income composition of households. We address this issue by adding reasonable control variables, including several other reforms that may affect households' income structure, into the basic equation.

4.2 The two-part model

This study investigates whether the income structure of households diverged due to the insurance reform. However, given the features of our dependent variables, it is tempting to ignore the skewness and mass at zero by using the ordinary least squares regression (Deb et al., 2017) to model such outcomes, especially in the context of natural experiments. Thus, we introduce a two-part model to measure the effect of the insurance reform.

The two-part model was first used to study medical services and medical expenditure by Duan et al.(1984) and then widely adopted in health insurance areas and for other mixed discrete-continuous outcomes (Buchmueller et al., 2020; Carey, 2015; Liu et al., 2010). Specifically, a typical two-part model is structured as follows: the first part determines the threshold between the zero and nonzero values of the outcome, whereas the second part explains the distribution of the outcome, provided it is positive.

Equation (4) is estimated using the maximum likelihood approach, as described by Duan et al. (1984). In particular, the coefficients β1 and γ1 measure the extensive margin, whereas β2 and γ2 measure the intensive margin.

5 RESULTS

5.1 Baseline regression

We first use log wages (i.e., ln (Wage)) as the dependent variable to test the intuitive relationship between off-farm earnings and the reform. The results of Table 3 are presented with year fixed effects. Table 3 Panel A model (1)–(3) shows that households who used health services are more likely to carry out off-farm activities and have higher off-farm wages than households who never used medical services when the new medical insurance scheme is implemented. For the overall treatment effect shown in model (3), off-farm wage income increases by 6.1% for households with at least one family member who received reimbursement from the insurance reform. Table 3 Panel B replaces the binary treatment variable with the continuous treatment design, thus DID is a continuous variable. The result of model (9) shows that for the overall treatment effect, off-farm wage increases by 21.2% if the proportion of family members that went to the hospital increase 1 unit, which is consistent with model (3). Both of the results show that the insurance tends to increase the off-farm work participation and wage.

| Variable | ln (wage) | Wage/income | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Probit | GLM | Total | Probit | GLM | Total | |

| Panel A: Standard DID | ||||||

| Treatment × Post | 0.005* | 0.015** | 0.061** | 0.005* | 0.012*** | 0.014*** |

| (0.003) | (0.007) | (0.027) | (0.003) | (0.002) | (0.003) | |

| Treatment | −0.006*** | −0.026*** | −0.077*** | −0.006*** | −0.009*** | −0.012*** |

| (0.002) | (0.005) | (0.016) | (0.002) | (0.001) | (0.002) | |

| Health condition | −0.010*** | −0.093*** | −0.172*** | −0.010*** | −0.010*** | −0.032*** |

| (0.001) | (0.003) | (0.006) | (0.001) | (0.001) | (0.001) | |

| Labor status | 0.181*** | 0.298*** | 1.879*** | 0.182*** | 0.181*** | 0.057*** |

| (0.002) | (0.008) | (0.019) | (0.002) | (0.002) | (0.002) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Other policies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 200,132 | 179,202 | 200,132 | 200,132 | 179,202 | 200,132 |

| (7) | (8) | (9) | (10) | (11) | (12) | |

| Probit | GLM | Total | Probit | GLM | Total | |

| Panel B: Continuous DID | ||||||

| Treatment × Post | 0.010* | 0.135*** | 0.212*** | 0.010* | 0.046*** | 0.048*** |

| (0.006) | (0.022) | (0.057) | (0.006) | (0.006) | (0.007) | |

| Treatment | −0.023*** | −0.154*** | −0.347*** | −0.023*** | −0.041*** | −0.052*** |

| (0.004) | (0.015) | (0.037) | (0.004) | (0.004) | (0.004) | |

| Health condition | −0.010*** | −0.093*** | −0.171*** | −0.010*** | −0.032*** | −0.035*** |

| (0.001) | (0.003) | (0.006) | (0.001) | (0.001) | (0.001) | |

| Labor status | 0.180*** | 0.296*** | 1.874*** | 0.180*** | 0.057*** | 0.171*** |

| (0.002) | (0.008) | (0.019) | (0.002) | (0.002) | (0.002) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Other policies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 200,132 | 179,202 | 200,132 | 200,132 | 179,202 | 200,132 |

- Note: The dependent variables are ln (Wage) and Wage/Income. DID variable is . The Treatment variable of Panel A is a binary variable and that of Panel B is a continuous variable. The estimation results of the marginal effects based on the maximum likelihood approach are presented. Robust standard errors are in parentheses. Year FE is the year fixed effects. ***, **, and * denote significance levels of 1%, 5%, and 10%, respectively.

Based on these results, we replace the dependent variable with the income diversification index to determine the relationships among the income diversification, insurance policy, and health condition variables. Our results are reported as marginal effects to better understand the implications of the model coefficients and changes in health expenditure due to changes in our explanatory variables. Table 3 model (4)–(6), (10)–(12) show the effects of our explanatory variables on the income diversification index, wage/income.

The DID variable reflects household behavior under the reform shock. As the two designs of DID variables have similar outcomes, the following explanation will mainly follow the standard DID design in model (4)–(6). It is shown that when the insurance plan becomes more generous, the probability of performing off-farm work increases by 0.5% for the households with at least one family member who went to the hospital after the implementation of the FLHID (model (4)), while the income diversification index increases by 1.2 percentage points (model (5)). The total treatment effect shows that the income diversification index increases by 1.4 percentage points when at least one family member who went to the hospital after the implement of the FLHID (model (6)). This finding suggests that the FLHID reform increases the probability of families engaging in off-farm work, thus expanding their ability to prevent risks compared with engaging in farm work alone. In addition, model (5) presents the intensive margins. We see that households' income diversification also increases dramatically under the insurance reform, indicating that families earn more from off-farm work. If we sum the two effects of the reform, the differences in household income increase significantly, thereby improving households' resistance to financial risks.

Overall, health condition presents negative effects for both the Probit Model and the GLM, with a treatment effect of −3.2 percentage points in model (6). This finding implies that the probability of participating in off-farm jobs and earning off-farm wages decreases as households' health conditions deteriorate. Also, the result shows that labor status has positive impact on off-farm work participation and income. For the overall effect, income diversification index will increase 5.7% if households have better labor capability (model (6)). These findings suggest that health and labor conditions are important factors deciding off-farm participation and wages. In the following mechanism tests, we will also further study the role of these two factors in the relationship between insurance reform and income diversity.

5.2 Robustness tests

5.2.1 Parallel trend test

An essential assumption of the DID method is the ex-ante parallel trend assumption, which states that before the insurance reform, the changing trend of the treatment and control groups over time was parallel. If the income diversification index (y) of the treatment and control groups had different trends before the reform, it would be impossible to assess whether the FLHID reform or other unobservable factors caused the subsequent changes. This study uses the event analysis method to test the parallel trend assumption. Specifically, we construct a period dummy variable, that is, a year variable observing the years before the reform. Then, we multiply the dummy variable by a 0–1 treatment variable and add it to the basic regression model to examine if the results are significant. Table 4 shows the parallel trend test.

| Variable | (1) | (2) |

|---|---|---|

| ln (Wage) | Wage/Income | |

| Year (T-3)×Treat | 0.015 | −0.016 |

| (0.115) | (0.011) | |

| Year (T-2)×Treat | 0.031 | −0.010 |

| (0.114) | (0.010) | |

| Year (T-1)×Treat | 0.043 | −0.015 |

| (0.113) | (0.010) | |

| Joint test of significance | 0.088 | −0.041 |

| Controls | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 114,622 | 114,622 |

- Note: The table reports results for the parallel trend assumption test based on Equation (1), where the trend is replaced by year binary indicators. The dependent variables are ln (Wage) and Wage/Income. The estimation results are based on OLS estimation. The statistics of joint significance test (F-stat) are reported. Year FE is the year fixed effects.

We see that the coefficient of the interaction between the treatment group and the variables in the dummy period before the reform is insignificant, indicating that the treatment and control groups meet the parallel trends condition (model (1)–(2)). The parallel trends test shows that before the FLHID reform, there was no difference between the income diversification index and off-farm wage of treatment and control groups.

5.2.2 PSM-DID

DID can well solve the endogeneity problem and obtain the policy treatment effect through differential differentiation, but it cannot well solve the sample bias problem, while PSM can solve this problem by mitigating other differences between the experimental and control groups that interfere with the study results. Thus, this article adopts the PSM-DID by year with reference to Heyman et al. (2007), Böckerman and Ilmakunnas (2009). Table 5 so as to more accurately evaluate the effect of medical insurance on improving rural household income diversity. The specific verification steps were as follows: (1) PSM was used to find the control group with the characteristics closest to the experimental group; (2) DID regression was performed between the matched experimental group and the control group.

| Variable | Wage/Income | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Probit | GLM | Total | |

| Panel A: Standard DID | |||

| Treatment × Post | 0.003 | 0.007*** | 0.008*** |

| (0.003) | (0.002) | (0.003) | |

| Treatment | −0.005*** | −0.006*** | −0.009*** |

| (0.002) | (0.001) | (0.002) | |

| Health condition | −0.012*** | −0.033*** | −0.037*** |

| (0.001) | (0.001) | (0.001) | |

| Labor status | 0.180*** | 0.060*** | 0.174*** |

| (0.002) | (0.003) | (0.003) | |

| Controls | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 134,211 | 120,452 | 134,211 |

| (4) | (5) | (6) | |

| Probit | GLM | Total | |

| Panel B: continuous DID | |||

| Treatment × Post | 0.002 | 0.009*** | 0.009*** |

| (0.002) | (0.002) | (0.002) | |

| Treatment | −0.003** | −0.006*** | −0.007*** |

| (0.001) | (0.001) | (0.001) | |

| Health condition | −0.012*** | −0.033*** | −0.037*** |

| (0.001) | (0.001) | (0.001) | |

| Labor status | 0.180*** | 0.060*** | 0.174*** |

| (0.002) | (0.003) | (0.003) | |

| Controls | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 134,211 | 120,452 | 134,211 |

- Note: The dependent variable is Wage/Income. DID variable is . The Treatment variable of Panel A is a binary variable and that of Panel B is a continuous variable. The estimation results of the marginal effects based on the maximum likelihood approach are presented. Robust standard errors are in parentheses. Year FE is the year fixed effects. ***, **, and * denote significance levels of 1%, 5%, and 10%, respectively.

Although the regression results using PSM exhibit some differences in significance at the first stage compared with the baseline regression (model (1) and model (4)), the second-stage and overall effects reveal that the insurance reform significantly improves income diversity (model (2)–(3) and model (5)–(6)). Consequently, even if there are slight discrepancies in the regression coefficients between PSM and the baseline regression, these minor differences do not affect the conclusion.

In addition, we conducted a placebo test, which showed that the unobserved features had little effect on the estimated results after 1000 randomized treatments.7

5.3 Mechanism tests

The previous section showed the relationship between the shock of the new insurance reform and income diversification. It is shown that the usage of the FLHID can significantly improve the income diversification of households. Here, we apply two mechanism tests, (1) health condition of the patients; (2) wage rate of off-farm, to further investigate the mechanism and check the stability of our results. We suppose that insurance policies can have a dual effect. On the one hand, they can improve the health condition of patients, and on the other hand, they can release caregivers' labor force, enabling them to engage in higher-paying nonagricultural work. As a result, this can enhance overall income diversification within households.

Second, we replace the Health Conditionit in Equation (6) with Avg. Wageit, which equal to off-farm wage divides the total month of off-farm working. This equation is used to assess whether the insurance policy have improved off-farm labor wages at the individual level, we measure the extent to which individuals are able to attain higher wages within a given time. The enhancement of this indicator plays a crucial role in augmenting income diversification within households.

As shown in Table 6, under the insurance reform, patients became healthier, with a total effect of 9% increment in health condition (model (3)). And the policy also increases the unit paying of off-farm work for caregivers, with 4.9% increasement among those already working off-farm (model (8)). However, as shown in panel B (model (6)), there is no significant evidence to show the increment of off-farm payment for patients. One reasonable explanation could be the observation period is relatively short, so the health enhancement effect has not significantly changed the patient's labor decision in a short period of time. But it may improve the patient's labor ability and family income in the long run. This result of mechanism tests explains how the reform the increase in the income diversification index. Specifically, it first improves the health condition of unhealthy individuals, which may increase their ability to work in the long term. Second, the improved health of the patient has reduced the burden on the family caregivers, which largely increased the possibility of caregivers to participate in high-paying nonfarm work. The combination of these two effects positively enables the reform to enhance the income diversity and resilience of households.

| (1) | (2) | (3) | ||||

|---|---|---|---|---|---|---|

| Probit | GLM | Total | ||||

| Panel A: health condition | ||||||

| Patients × Post | 0.017*** | 0.226*** | 0.090*** | |||

| (0.006) | (0.038) | (0.016) | ||||

| Patients treatment | 0.122*** | 0.008 | 0.237*** | |||

| (0.004) | (0.025) | (0.010) | ||||

| Controls | Yes | Yes | Yes | |||

| Year FE | Yes | Yes | Yes | |||

| Observations | 176,725 | 44,624 | 176,725 | |||

| (4) | (5) | (6) | (7) | (8) | (9) | |

| Probit | GLM | Total | Probit | GLM | Total | |

| Panel B: wage rate | ||||||

| Patients × Post | −0.013 | −0.017 | −0.102 | |||

| (0.010) | (0.030) | (0.078) | ||||

| Patients treatment | −0.158*** | −0.003 | −1.219*** | |||

| (0.007) | (0.020) | (0.052) | ||||

| Caregivers × Post | −0.002 | 0.049*** | 0.004 | |||

| (0.006) | (0.016) | (0.050) | ||||

| Caregivers treatment | 0.045*** | 0.006 | 0.352*** | |||

| (0.004) | (0.011) | (0.033) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 176,725 | 44,624 | 176,725 | 190,109 | 64,807 | 190,109 |

- Note: The dependent variable of panel A is Health Condition. The dependent variable of panel B is Wage Rate. The estimation results of the marginal effects based on the maximum likelihood approach are presented. Robust standard errors are in parentheses. Year FE is the year fixed effects. ***, **, and * denote significance levels of 1%, 5%, and 10%, respectively.

5.4 Heterogeneity analysis

| Variable | Wage/Income | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Probit | GLM | Total | |

| Panel A: Householder | |||

| Treatment × Post × Householder | 0.011** | 0.004 | 0.013** |

| (0.006) | (0.004) | (0.005) | |

| Treatment | 0.004 | 0.001 | 0.004 |

| (0.004) | (0.002) | (0.004) | |

| Householder treatment | −0.117*** | −0.031*** | −0.118*** |

| (0.001) | (0.001) | (0.001) | |

| Controls | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 200,132 | 179,202 | 200,132 |

| (4) | (5) | (6) | |

| Probit | GLM | Total | |

| Panel B: Illness | |||

| Treatment × Post × Illnesses | −0.003 | 0.008*** | 0.005 |

| (0.005) | (0.003) | (0.004) | |

| Treatment | 0.006* | 0.008*** | 0.012*** |

| (0.003) | (0.002) | (0.003) | |

| Illnesses treatment | 0.016*** | 0.007*** | 0.017*** |

| (0.001) | (0.001) | (0.001) | |

| Controls | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 200,132 | 179,202 | 200,132 |

- Note: The dependent variable is Wage/Income. The estimation results of the marginal effects based on the maximum likelihood approach are presented. Robust standard errors are in parentheses. Year FE is the year fixed effects. ***, **, and * denote significance levels of 1%, 5%, and 10%, respectively.

6 CONCLUSION

Using a full-sample registered poverty population data set of a Chinese county, which is a national poverty-stricken county in the middle of China, this study investigates whether an exogenous shock in medical insurance can affect the income structure of low-income households. To explain the treatment effect of the policy shock, we employ a DID framework and a two-part model to estimate the empirical results.

Our findings suggest that the FLHID reform is beneficial for rural low-income households, as it encourages them to engage in off-farm work and increase their income diversity. The overall effect observed from our baseline estimation is 1.4 percentage points, with intensive margins of 0.5% and extensive margins of 1.2 percentage points.

These findings have several important implications. First, generous insurance reform is beneficial for rural low-income households as it reduces households' loss of health shocks and improves their income diversification, which increases households' financial risk management capability. Compared with previous studies, which have mainly investigated the effect of insurance on reducing household expenditure, our study presents another approach to alleviating poverty arising from illnesses among China's rural population; it highlights that insurance enhances income diversification, stability, and sustainability.

Second, the mechanism analysis results show that the treatment effect induced by the insurance reform affects households in two ways. The first is by increasing the health condition of the patients, thereby reducing the cost of patient care for families. It may enhance patients' ability to work in the long term. The second method is applied by increasing the caregivers' off-farm working payment per unit of time, resulting in greater income diversification.

Third, the FLHID reform aims to alleviate poverty among low-income households. However, the high reimbursement rate of the system places enormous pressure on government finances, and high subsidies are unsustainable. Nevertheless, the reform is expected to be effective and sustainable in the long run, even if the insurance benefits fall in the future. The current medical insurance system encourages rural households to participate in off-farm work, which is conducive to increasing long-term human capital. Once farmers join the off-farm labor market, they can enjoy the FLHID's benefits, including medical insurance for urban residents. This could further alleviate the health risks associated with poverty. Therefore, the FLHID reform provides an excellent example of addressing the issue of poverty due to illness in developing countries in the long term, in line with China's Sustainable Development Goals.

ACKNOWLEDGMENTS

The authors would like to thank Xinye Zheng, Lunyu Xie, Jiaying Chen, and seminar participants at Renmin University of China, for their valuable suggestions on our work. Li Su greatly appreciates financial support by the National Social Science Funds (Grant No. 21BJY08). Financial support from the research fund of Renmin University of China (Grant No. 22XNLG12) is gratefully acknowledged.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflict of interest.

ETHICS STATEMENT

Not applicable.

APPENDIX A: A REIMBURSEMENT RULES OF THE FLHID

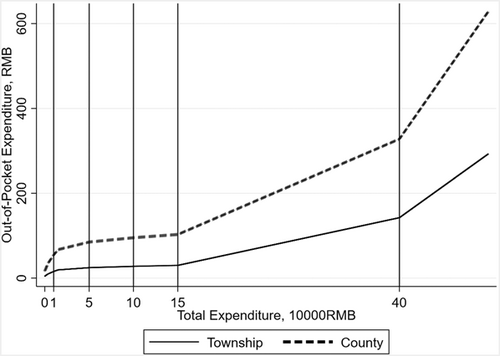

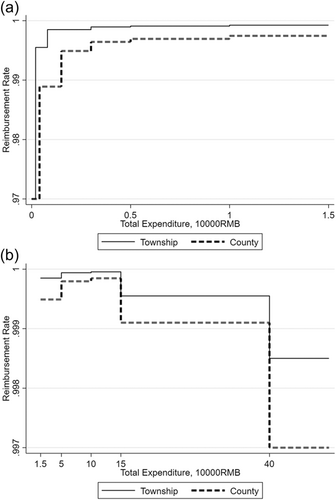

The FLHID adopts nonlinear layered reimbursement rules (as the sample involves only the township and county levels, only these two layers are shown). Patients' medical expenses are reimbursed by basic medical insurance, critical illness insurance, critical illness supplementary insurance, medical assistance, and medication for the poor sequentially in that order.

The detailed rules are as follows. The first line of defense is basic medical insurance; the reimbursement rates and deductibles vary according to the hospital level (see Table A1).

| Total expenditure | Reimbursement rate | |

|---|---|---|

| County | Township | |

| 200–800 | 70% | - |

| 800– | 90% | - |

| 400–1500 | - | 63% |

| 1500– | - | 83% |

The second line of defense is the CII. The CII can pay a proportion of the agreed medical expenses beyond the deductible amount. The maximum annual reimbursement rate is 400,000 yuan (see Table A2).

| Total expenditure | Reimbursement rate |

|---|---|

| 15,000–50,000 | 50% |

| 50,000–100,000 | 60% |

| 100,000– | 70% |

- Abbreviation: CII, Critical Illness Insurance.

The third line of defense is critical illness supplementary insurance. For the medical expenses of registered low-income households, those exceeding the deductible of the CII are first reimbursed by the CII while the remainder is reimbursed via supplementary insurance. The deductible of the supplementary insurance is 3,000 yuan; no cap is set. Detailed information is provided in Table A3.

| Total expenditure | Reimbursement rate |

|---|---|

| 3000–5000 | 30% |

| 5000–10,000 | 40% |

| 10,000–15,000 | 50% |

| 15,000–50,000 | 80% |

| 50,000– | 90% |

- Abbreviation: CII, Critical Illness Insurance.

The fourth line of defense is medical assistance. The reimbursement rate is 70%, capped at 22,000 yuan.

The fifth line of defense is medication for the poor. After being compensated by the first four lines, the remainder of the agreed expenses are paid in accordance with the hospital level. The reimbursement rate of a township hospital is 95% at the township level and 90% at the county level, capped at RMB 22,000. Figure A1 describes the structure of the FLHID. And Figure A2 shows reimbursement rate of the FLHID.

APPENDIX B: ASSIGNMENT OF VARIABLES

The health, labor, and education variables are assigned as Table B1.

| Health code | Individual's health condition |

|---|---|

| 0 | Healthy individual |

| 1 | Chronic diseases |

| 2 | Disability |

| 3 | Critical illness |

| 4 | Disability, Chronic diseases |

| 5 | Disability, Critical illness |

| Education code | Individual's Education Level |

| 0 | Illiterate or Semi-illiterate |

| 1 | Pre-school child |

| 2 | Primary school |

| 3 | Junior middle school |

| 4 | Senior middle school |

| 5 | College or above |

| Labor code | Individual's Labor Status |

| 0 | Skilled workforce |

| 1 | General workforce |

| 2 | No labor or disability |

Open Research

DATA AVAILABILITY STATEMENT

The authors do not have permission to share data.

REFERENCES

- 1 The National Rural Revitalization Administration, 2016.

- 2 Chinese Statistic Yearbook, 2017.

- 3 At the beginning of 2017, NCMS and the Urban Resident Basic Medical Insurance were integrated into the Basic Medical Insurance for Urban and Rural Residents, so the data of the NCMS were not counted separately.

- 4 Guiding Opinions on Carrying out Critical Disease Insurance for Urban and Rural Residents 2012, 2012.

- 5 See the Appendix.

- 6 In 2013, 832 counties in China were certified as national poverty-stricken by the National Rural Revitalization Administration; they were all located in the western, southern, and central regions. China targeted eradicating extreme poverty in rural areas and uplifting its most vulnerable citizens by the end of 2020. In November 2020, China delisted all 832 national poverty-stricken counties 1 month ahead of schedule.

- 7 Results are available upon request.