Green bonds as a bridge to the UN sustainable development goals on environment: A climate change empirical investigation

Abstract

The United Nations Sustainable Development Goals (SDGs) made an urgent call for action by all the countries across the globe, with an aim to end poverty, improve health and education, reduce inequality, and spur economic growth – all of this is intended to be achieved while tackling climate change and working to protect environment and preserve earth. However, these goals cannot be achieved unless money is mobilised to finance climate change mitigation and adaptation efforts across the world. In response, various manifestations of green bonds have appeared in the market and these are considered as a bridge to the achievement of the SDGs – this is because climate mitigation and adaptation are integral to successful implementation of the SDGs. Using the Capital Asset Pricing Model, Fama–French Three Factor, Carhart Four Factor and Fama–French Five Factor pricing models, our study provides empirical evidence that the announcement of green bonds issuance lead to positively abnormal return on stocks. We divided our dataset into two parts. The first part of the dataset is from 01/01/2013 to 30/06/2018 and later part analyses the period from 01/07/2018 to 30/06/2022. The consistent results highlight the firms' and investors' efforts towards climate action (SDG13) and strongly suggest that green bonds play an important role as a bridge to the SDGs.

1 INTRODUCTION

The UN's Sustainable Development Goals (SDGs) related to environment are aimed at achieving global sustainability for future economies and societies. Understandably, the climate and the social themes are intertwined and, directly or indirectly, underpin all the SDGs. For instance, the Climate Action (SDG13) is linked to other SDGs including the Food Production (SDG2), Health (SDG3), Water (SDG6), Energy (SDG7), Building & Transport (SDG9), City Infrastructure (SDG11), Sea (SDG14) and Agriculture (SDG15). Specifically, the achieved level of climate action is bound to affect the achievement of other SDGs. Since the UN announced its 2030 Agenda, various manifestations of green climate bonds have appeared in the market, such as the Social Bonds, Sustainability Bonds, Environmental, Social and Governance (ESG) Bonds, and the Sustainable Development Goal (SDG) Bonds. Consequently, green bonds are considered as a bridge to the SDGs in a sense that climate mitigation and adaptation are integral to successful implementation of the SDGs (Climate Bonds Initiative, 2018, 2019a, 2019b, 2019c).

European Investment Bank issued the first Green Bond, namely Climate Awareness Bond, in 2007. Subsequently, the market for green bonds witnessed multidimensional expansion. Not only did it expand geographically, but it also experienced a consistent increase in its total issue amount, while many new types of green bonds were issued over time such as, green sovereign bonds, green mortgage backed securities, and green Islamic bonds, to name a few. Green bond market also witnessed an expansion in terms of the type of issuers, whereby, the issuers of green bonds include supernatural organisations, various banking and non-banking financial institutions, and corporate organisations (Tang & Zhang, 2019). Therefore, Green Bonds are a significant extension to the existing corporate finance instruments. However, there has been none to very limited research regarding the potential impact on the shareholders' value and, particularly, how it reflects on shareholders' returns – arguably, this is important to examine for establishing the empirical evidence of ‘Green Bonds as a bridge to the Sustainable Development Goals’.

The objective of the green financing is to improve the level of financial movements (for example, banking, insurance, and investment) from various sectors such as public, private and non-profit towards sustainable development. The purpose is to support such financial mechanisms that aim at increasing engagement across countries, financial controllers, and financial divisions, in such a way that capital allocation facilitates sustainable development. It will develop the production and consumption arrangements of future. Green financial instruments such as green bonds assist this alignment as they stimulate public-private partnership for sustainable development (for example, see Nassani et al., 2020; and Yoshino et al., 2018).

The green bonds market highlights numerous benefits such as the transparency of green finance information available to shareholders, supporting investors to adopt their long-term climate strategies, and facilitating investors to pursue their green investment priorities. Thus, green bonds market helps the bond issuers to inform their long-term sustainability strategies, develops internal synergies between the sustainability and financial departments, and enhances communication between the borrowers and lenders. Moreover, green bonds help to implement the national climate policies through increased awareness and efficient capital allocation, specifically in the context of shifting capital towards low-carbon and the climate robust projects (Shishlov et al., 2016).

Green initiatives, however, cannot prove effective unless shareholders and investors demonstrate interest in supporting these initiatives. We argue that such support might arise if investors perceive that adoption of green measures can help these companies gain a competitive advantage over other firms and results in better financial performance (Bruhn-Tysk & Eklund, 2002; Bullinger et al., 1999; Elkington, 1994; Lawrence, 1997; Salzmann et al., 2005). These companies may also generate higher returns as green activities result in (1) reducing the costs of production, (2) ultimately increase revenues owing to an introduction of new/innovative technologies, and (3) are characterised by a reduced capital intensity owing to lean production (Epstein & Young, 1998; Florida, 1996; Hart & Milstein, 2003; King & Lenox, 2001; Orsato, 2006; Schaltegger & Figge, 2000). Thus, these companies may prove more profitable and financially stronger compared to the ones not taking such initiatives (Auer, 2016; Herremans et al., 1993; Jeong et al., 2018). Furthermore, these companies are less likely to be exposed to environmental lawsuits or penalties (Dhaliwal et al., 2011) and also benefit from employee loyalty which may bring further benefits of improved productivity and lower costs of production (Auer, 2016; McGuire et al., 1988; Sauer, 1997). This implies that, the announcement of Green Bond issue may send a good signal to the market about future profitability of the company and may result in an increased demand for firm's shares. Moreover, such announcements may result in an increased visibility, media exposure and label effect for the firm (Tang & Zhang, 2019).

According to the shareholder or agency perspective, social and environmental activities attract additional costs that tend to reduce profitability, since the payoffs of ESG activities are lower than their costs. Ethical firms generate a lower rate of return owing to an increase in the expenses incurred on monitoring of their social responsibility status – this is usually termed as ‘ethical penalty’ (Michelson et al., 2004; Pasewark & Riley, 2009). Being green implies that as these firms do not invest in profitable yet unsustainable business ventures. Consequently, their ability to earn profits and reduce risk through diversified investments is limited (Climent & Sarino, 2011).This perspective suggests that profit maximisation should be the only social responsibility of the firms, and thus involvement in ethical and sustainable perspective will decrease the firm's value (Friedman, 1970; Harjoto & Laksmana, 2018). Following this perspective, the green bonds issuance announcement signifies that the issuing firms will have to incur additional expenditure on sustainable business practice, resulting in decreased revenue generation. The institutional theory of CSR activities also suggests that managers use corporate social and philanthropic activities for maximising their self-interest and enhancing personal reputation at the expense of shareholders, while many studies found an inverse relationship between financial aspects of the firm and social responsibility (Barnea & Rubin, 2010; Brown et al., 2006; Jeong et al., 2018; Wright & Ferris, 1997). This results in a decrease in firm's value and leads to negative stock market returns (Brammer & Millington, 2006; Wright & Ferris, 1997). In such instances, firm's stock prices should react negatively to such announcements.

In this backdrop, this study investigates the pertinent research question if the announcement of green bonds issue influences stock returns. The answer to this question helps us uncover the potential for green bonds to serve as a bridge to the achievement of SDGs and, arguably, should be manifested through the movements in share value and returns. Thus, this study is aimed at establishing empirical evidence for the role of green bonds as a bridge to the achievement of SDGs and, in doing so, it makes several contributions to the existing literature and elaborate our key research question.

We have divided our dataset into two sections. The first section of the dataset explains the results from 01/01/2013 to 30/06/2018 into our main article and the results from the second section covering the period from 01/07/2018 to 30/06/2022 are provided in the Appendix A (Tables A1, A2, A3, A4, A5; Figures A1-A3). The major reason to divide the dataset into two sections is to capture the precise evidence on green bond announcement and its influence on stock market returns before the market face distortions such as abnormal shocks from COVID-19 and abrupt changes in various macroeconomic indicators for example, high inflation, high interest rates, announcement of lockdown, and so forth.

Our study makes the following three major contributions. First, the paper examines stock market reaction to the announcement of the green bonds issuance by the USA listed companies. Second, to the best of our knowledge, this paper is the first one to apply all the empirical asset pricing models, that is, Capital Asset Pricing Model (CAPM), Fama–French Three Factor, Carhart Four Factor, and Fama–French Five Factor Models from 01/01/2013 to 30/06/2018. Furthermore, in the extended dataset from 01/07/2018 to 30/06/2022, we have used constant model, adjusted market model and augmented market model because market had extreme abnormal returns during the pandemic, lockdown announcements, COVID-19 death announcements and other macro-economic variables such as high inflation and interest rates, which overshadow the influence of green bond announcement. Second, this study contributes to the literature on financial instruments that have an objective to develop “social and environmental impact alongside financial return” (e.g., Barber et al., 2018; Flammer, 2015; Global Impact Investing Network, 2018). Finally, our paper adds to the empirical evidence on the companies' environmental responsibilities and the resultant stock market performance (e.g., Flammer, 2015; Guenster et al., 2011; Klassen & McLaughlin, 1996) and firm valuation (e.g., Kruger, 2015). Event study methodology has been adopted to capture, for the USA listed companies, the effect of ‘green bonds announcement’ on ‘share returns’.

The remainder of the paper is structured as follows. A review of the literature and development of hypothesis is presented in the following section. It is followed by an explanation of the data and methodology. The findings and analysis are subsequently discussed in the next section. We conclude with the implications of the study and also reflect on the contributions made to the literature.

2 LITERATURE REVIEW & HYPOTHESES

2.1 Green activities and the SDGs

The rise of environmental and climate change initiatives in corporate sector is largely driven as a response to the investor-led movements. Prior to early 1990's, corporate environment and sustainability activities were unaccounted for, until corporations faced a societal backlash, which can be inferred as a ‘double movement’. As presented by Polanyi (1944) the concept of ‘double movement’ suggests that privatisation and liberalisation activities are followed by an attempt to control and account for corporate power. The purpose is to ensure that corporations act in alignment with societal interests, rules, customs and traditions. This gives rise to new structures of governance, aimed at constraining and steering corporate behaviour. Such governance structures are formed independent of government intervention and might be termed as business self-regulation (Haufler & Pfluger, 2007) or civil regulation (Zadek, 2007). These arrangements involve collaborations between society and business and provide primary logic underlying corporate climate change and sustainability practices.

As a ‘double movement’ response for restraining unsustainable corporate activities, civil society called for responsible corporate practices. One such response from the non-state actors was in the form of collaborations and cooperation among various elements of business/civil society who assumed agency in global environment governance (Biermann et al., 2010). Thereby, various corporate stakeholders developed codes of conduct for steering corporate behaviour (MacLeod & Park, 2011). One prime contributor to corporations' sustainability and climate change practices was financial sector. The 17 United Nations Sustainable Development Goals (SDGs) made an urgent call for action by all countries across the globe, with an aim to end poverty, improve health and education, reduce inequality, and spur economic growth – all of this is intended to be achieved while tackling climate change and working to protect environment and preserve earth. However, these goals cannot be achieved unless money is mobilised to finance climate change adaptation and mitigation efforts across the world.

Owing to a lack of resources, competing policy priorities and political will, the international community of nation-states cannot, alone, finance such initiatives (Keohane & Madsbjerg, 2016). While climate change initiatives require an investment of trillions of dollars in building climate resilient infrastructure, the Paris Agreement explicitly called private sector financing to support the development of green technologies. The main players that are involved in corporate environmental and sustainability governance are the institutional investors. Thus, mutual funds, insurance companies and pension funds assumed the key role, while individual investors also actively participated in promoting corporate climate change activities. Dozens of investor networks emerged as a part of this phenomenon and UN Principles on Responsible Investment, also indicate a significant effort to utilise collective investor power of shareholders in steering corporate behaviour (MacLeod & Park, 2011). Owing to an increased regulatory and social backlash, managers are now expected to adopt such strategies that enhance environmental performance by producing more output with minimum input so as to have minimum environmental impact through increased eco-efficiency (Figge & Hahn, 2012).

The sustainable development goals within 2030 agenda and Paris agreement under United Nations framework convention on climate change (UNFCCC) are the main global initiative for highlighting the economic-environment growth. The Scholars and practitioners also played an active role in this movement for the promotion of sustainable business practices and are actively advocating the case for ‘green business’ for more than 30 years (Figge & Hahn, 2012; Margolis & Walsh, 2003; Orlitzky et al., 2003). These efforts place a special focus on investigating in establishing the links between financial rewards and corporate sustainability practices. Indeed, various studies have found a positive relationship between the two (Epstein & Roy, 2003; Hart & Milstein, 2003; Orsato, 2006; Schaltegger & Figge, 2000); thus providing a justification for the use of green activities as a modern panacea for successful business. However, this increased sustainability and green activism raises distresses for owners' concerning profitability and returns. The managers, in such situations, might have to decide if they should adopt a strategy focusing on a higher return on capital or to place attention on sustainable business activities which might require efficient use of resources.

This study investigates if, despite an intense promotion of green business by regulators and society, with academics joining hands in advancing green initiatives, shareholders value and welcome the initiatives of green financing in the corporate sector. Since UN SDGs can only be effectively achieved through an active participation from the corporate sector, it is imperative to examine if investors value the corporate sectors' involvement in sustainability and environment through green bond financing. The answer to this question is pertinent for the future of green and impact investing, and to empirically establish the role of green bonds as a bridge to SDGs.

2.2 Hypotheses development

The proponents for green and sustainable business argue that sustainable business organisations exploit win–win situations, as they provide a hybrid for environmental protection and monetary success. Adoption of measures as environmental impact assessment, pollution prevention and cleaner production help these companies gain a competitive advantage over other firms and results in better financial performance (Bruhn-Tysk & Eklund, 2002; Bullinger et al., 1999; Elkington, 1994; Lawrence, 1997; Salzmann et al., 2005). Market logic suggests that green investments create economic value for investors by providing higher returns on capital (Risi, 2018). These higher returns are argued to be the consequence of reduction in the costs of production (for example, through a reduced and efficient use of energy and other resources), an increase in revenues owing to an introduction of new/innovative products and services, and a reduced capital intensity owing to lean production (Epstein & Young, 1998; Florida, 1996; Hart & Milstein, 2003; King & Lenox, 2001; Orsato, 2006; Schaltegger & Figge, 2000).

Companies making green and socially responsible investments may prove more profitable and financially stronger compared to the ones not taking such initiatives (Auer, 2016; Herremans et al., 1993; Jeong et al., 2018). This is because such companies are less likely to be exposed to environmental lawsuits or penalties (Dhaliwal et al., 2011). Furthermore, these companies also benefit from employee loyalty, which may bring further benefits of improved productivity and lower costs of production (Auer, 2016; McGuire et al., 1988; Sauer, 1997; Taghizadeh-Hesary & Yoshino, 2019). Some provide that the environmentally and socially responsible companies earn good reputation and image for their products and services (Cui et al., 2020). Resultantly, this leads to an increase in sales (Brown & Dacin, 1997), ability to attract highly talented employees (Edmans, 2011; Epstein & Roy, 2001; Landon & Smith, 1997) and higher levels of employee commitment (Turban & Greening, 1996). Thus, such companies may take advantages of higher employee morale, better consumer loyalty and may also attract lenient treatment by the regulators (Brown et al., 2006; Jensen, 2002; Jensen & Murphy, 1990). Similarly, other researchers (e.g., Banker & Mashruwala, 2007; Mishra & Suar, 2010; Waddock & Graves, 1997) provide that the companies involved in superior social and environmental activities demonstrate better financial performance.

The proponents of green business contend that superior sustainability practices bring financial payoffs, creates shareholder value, and satisfy the social demand for corporate responsibility (Reinhardt, 2000). One of the main drivers of green initiatives is, therefore, the financial success of a corporation. This implies that, the announcement of Green Bond issue may send a good signal to the market about future profitability of the company and may result in an increased demand for firm's shares. Moreover, such announcements may result in an increased visibility, media exposure and label effect for the firm (Tang & Zhang, 2019). While social and environmental activities improve firm's image, investors value firm visibility (Grullon et al., 2004). This is because organisational visibility helps in reducing the information asymmetry between management and stakeholders (Brammer & Millington, 2006). Furthermore, green bond issuance announcements also result in a greater media exposure compared to the convention bond issuance announcements – the issuers of green bonds make declarations to that effect through a press releases (Tang & Zhang, 2019). Therefore, these announcements my provide a validation to the firm's claims of sustainable business practices and is noticed by both the bond and the stock market investors and is likely to result in an increased stock price.

Green bonds are also known to improve transparency in corporate affairs (Shishlov et al., 2016). The corporations issuing green bonds provide valuable information on how the capital from green bond issue will be invested, the types of the projects that will be financed and how the firm is intending to make investments in environmentally sustainable projects. The companies with high commitment to sustainability are more transparent in their reporting practices (Fernandez-Feijoo et al., 2014). Stakeholder information expectations also posit a major motivator for an increased corporate disclosure and transparency (Dando & Swift, 2003). Green label effect also provides an assurance to the investors that the firm's green and sustainable plans have been externally verified by a second party (Tang & Zhang, 2019).

Importantly, green bonds also support investors to adopt their long-term climate strategies and encourage them to embrace green investments. The extant literature suggests that the ethical and responsible investors prefer responsible companies, regardless of the expected returns (Jeffrey, 2006; Nagy & Obenberger, 1994). Such investors do not consider wealth maximisation to be the ultimate goal (Beal et al., 2005) and would prefer green investment even if returns are slightly lower than on the alternative conventional investments (Pasewark & Riley, 2009; Sparkes, 1998). Consequently, green bonds benefit the bond issuers to inform their long-term sustainability strategies, develop internal synergies between sustainability and financial departments, and to enhance communication between the borrowers and lenders. Additionally, green bonds help to implement the national climate policies through increased awareness and efficient capital allocation, specifically in the context of shifting capital towards low-carbon and climate robust projects. Understandably, the profitability motive serves as an important driver of investment decisions and even the ethical investors are concerned about return on their investment.

Therefore, literature suggests that, on the day of announcement of green bonds issuance, the shareholders react positively, and positive abnormal returns are observed. This leads us to our first hypothesis;

H1.The announcement of green bonds issuance leads to positively abnormal return on stocks.

If H1 holds true, it can conveniently be concluded that green bonds serve as a bridge to the SDGs. This is because, as highlighted in the literature above, issuance of the green bonds as well as the abnormal returns (after the green bonds announcement) highlight the firms' and investors' efforts towards climate action (SDG13).

Alternatively, it is argued that green and sustainable firms are significantly different in their approach towards investment. Being green implies that as these firms do not investment in profitable yet unsustainable business ventures. Consequently, their ability to earn profits and reduce risk through diversified investments is limited (Climent & Sarino, 2011). Furthermore, ethical firms generate a lower rate of return owing to an increase in the expenses incurred on monitoring of their social responsibility status – this is usually termed as ‘ethical penalty’ (Michelson et al., 2004; Pasewark & Riley, 2009). The process of issuing green bonds can be cumbersome since, despite the well-accepted usefulness of green bonds, the potential costs associated with their issuance are also substantial (Bhutta et al., 2022). These costs may include third party certification and auditor fees to be paid for annual review. While the issuance of green bonds can be expensive and costly, corporations can continually engage in such initiatives only if shareholders value them.

Shareholders, however responsible they might be, do care for the returns. Investment in green products might result in poor returns since it limits the opportunities to diversify and hedge risk (Pasewark & Riley, 2009).

According to the shareholder or agency perspective, social and environmental activities attract additional costs that tend to reduce profitability, since the payoffs of ESG activities are lower than their costs. This perspective suggests that profit maximisation should be the only social responsibility of the firms, and thus involvement in ethical and sustainable perspective will decrease the firm's value (Friedman, 1970; Harjoto & Laksmana, 2018). Following this perspective, the green bonds issuance announcement signifies that the issuing firms will have to incur additional expenditure on sustainable business practice, resulting in decreased revenue generation. In such instances, firm's stock prices should react negatively to such announcements. The institutional theory of CSR activities also suggests that managers use corporate social and philanthropic activities for maximising their self-interest and enhancing personal reputation at the expense of shareholders, while many studies found an inverse relationship between financial aspects of the firm and social responsibility (Barnea & Rubin, 2010; Brown et al., 2006; Jeong et al., 2018; Wright & Ferris, 1997). This results in a decrease in firm's value and leads to negative stock market returns (Brammer & Millington, 2006; Wright & Ferris, 1997).

The opponents of social and environmental investments also argue that social and sustainability activities inversely impact firm performance as these firms are at a comparative disadvantage to the conventional firms. Based on the assumptions of neo-classical theory, there is empirical evidence suggesting a negative relationship between ESG activities and financial performance (Fisher-Vanden & Thorburn, 2011; Gillan et al., 2021; Jacobs et al., 2010; Lyon et al., 2013). Furthermore, some argue that a reduction in information asymmetry and an increased visibility makes the ethical and responsible firms subject to a greater scrutiny by stakeholders and regulators (Brammer & Millington, 2006). Existing literature has also found an evidence for lower profitability among more visible firms when compared with the less visible firms (Erfle & McMillan, 1990; Li et al., 2017). Thus, we contend that, following the announcement of green bonds issuance, investors may punish firms for their commitment to sustainability perspective, resulting in negative abnormal returns. This leads us to develop our second hypothesis;

H2.The announcement of green bonds issuance leads to negatively abnormal return on stocks.

The last perspective in relation to sustainable and green investments suggests that such activities neither add nor reduce firm's value as these are not priced (Hamilton et al., 1993; Humphrey et al., 2012; Statman, 2006; Zhao et al., 2018). Several studies (see, for example, Fernandez & Matallın, 2008; Jones et al., 2008; Cortez et al., 2009; Saeidi et al., 2015; Nguyen et al., 2021 and Gianfrate & Peri, 2019) postulate that there are no significant differences between the performance and returns of firms with better environmental and social performance when compared with the conventional investments. This leads us to develop our third hypothesis;

H3.The announcement of green bonds issuance does not affect return on stocks.

3 RESEARCH METHODOLOGY

This study used the event study methodology to investigate the effect of green bonds announcement on the returns of USA listed companies into two separate datasets, for the period 01/01/2013 to 30/06/2018 and 01/07/2018 to 30/06/2022. The main reason to divide the dataset into two periods is to capture the precise evidence on green bond announcement and its influence on stock market returns before the market faced distortions such as abnormal shocks from COVID-19 and abrupt changes in various macroeconomic indicators such as high inflation, announcement of high interest rates, announcement of lockdown, and so forth. We have reported our results from 01/07/2018 to 30/06/2022 into Appendix A.

Event studies have been conducted by Pettit (1972), Aharony and Swary (1980), Brown and Warner (1980), Masulis (1980), Venkatesh (1989) and Akhigbe and Madura (1996). Likewise, a study on the effect of earnings announcements was conducted by Dennis and McConnell (1986), insider trading research was conducted by Hillier and Marshall (2003) and, for example, recently on Brexit issue and its effect on stock markets by Ramiah et al. (2017).

Event studies identify the performance and behaviour of corporate events through stock prices. In financial economics, an enormous event studies literature has been developed during the last few decades. However, from corporate perspective, event studies' importance becomes visible at the time of abnormal performance, which has an impact on the wealth of firms' shareholders/claimholders. The event studies mostly emphasise announcement effects in the short-term and provide a background understanding of any relevant corporate decision policy. Notably, in capital markets, event studies perform a significant role in the testing of market efficiency, since abnormal security returns after a specific corporate event are inconsistent with market efficiency (Brown & Warner, 1980; Fama, 1991).

3.1 Procedure for event studies

It is important to know the process to undertake an event study. The starting point for managing an event study is to recognise the event of interest and classify the time period over which the security prices of the companies involved will be examined, called the event window. For instance, in this paper the event is the announcement of green bonds and the event window is 1 day from the green bond announcement. In this paper, we have 15 days event window and −16 to −90 days estimation window. However, it is common to define the event window as longer than the particular period of interest, allowing the investigation of periods around the event. Generally, the period of attention is spread to several days, including at least the announcement day and the day after the announcement. The event window expresses the effects of price movements observed after the stock market closes on the day of the announcement. It is important to note, however, that periods before an event and after an event may also be of interest (Henry & Leone, 2015; Ullah et al., 2021).

Event study methodology is a flexible technique which allows researchers to measure the impact of announcements and events over short (Cowan, 1992) or long event windows (Brown & Warner, 1980). It is promising for investigators to recognise the influence of particular event on stock returns, profitability and stock valuations over a period of short and long event windows. Therefore, we have adopted in our analysis the long window −15 to +15 days and different short event windows (for e.g., −1 to +1, −1 to +3, −1 to +5, etc.)

Further, we have collected green bonds and announcement data from Bloomberg. The selection criteria of nine industries and 225 announcements are based on latest availability of data from Bloomberg. that is, from 01/01/2013 to 30/06/2018.

3.2 Model estimation

3.3 Asset pricing models

3.3.1 Capital asset-pricing model

3.3.2 Fama–French three factor model

= factor loadings (other than market β). These loading are characterized as the time series regression slope(s).

= intercept of regression equation and error term, repectively.

representing ‘small minus big’ and indicating ‘high minus low’. The showing the excess return of small over big stocks (measured by market cap). The factor highlighting the excess return of stocks with a high market-to-book ratio over stocks with a low market-to-book ratio (Fama & French, 1993). The model has been examined in many financial studies (e.g., Al-Mwalla & Karasneh, 2011; Foye et al., 2013; Grauer & Janmaat, 2010; Gregory et al., 2013).

3.3.3 Carhart four-factor model

The Carhart's (1997) model has been used by the many studies in finance (e.g., Arouri & Teulon, 2014; Boamah, 2015; Gregory et al., 2013).

3.3.4 Fama–French five factor model

Fama French five factor model has been applied to many studies recently (e.g., Chiah et al., 2016; Kubota & Takehara, 2018; Lin, 2017).

4 FINDING AND DISCUSSIONS

4.1 Descriptive statistics

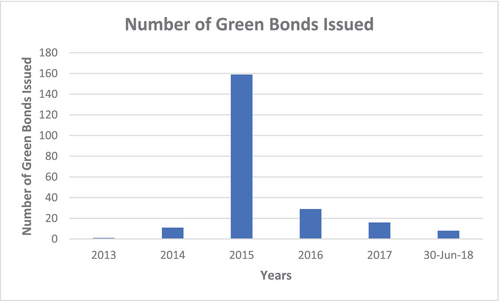

The first green bond was issued by the Bank of America Corp, on November 2013, amounting to $500 million. Green bond market in the USA raised aggressively in year 2015 and mainly Tesla Energy Operations Inc./DE issued green bonds. Figure 1 is showing issuance of green bonds from year 2013 till 30th June 2018 in the US markets. After 2015 the green bond market became steady and continued to expand in a stable mode.

Table 1 illustrates that our initial sample included 225 unique green bond announcements for particular companies in US markets. It can be observed that Tesla Energy Operations Inc./DE announced 142 green bonds announcement and highest in the period of 2013 till June 2018. The second most green bond issuance announcements of 39 observed in Overseas Private Investment Corp.

| Issuer name | Number of green bond announcements |

|---|---|

| Alexandria Real Estate Equities Inc. | 1 |

| Apple Inc. | 2 |

| Avangrid Inc. | 1 |

| Azure Power Energy Ltd. | 2 |

| Bank of America Corp. | 4 |

| Covanta Holding Corp. | 1 |

| Digital Realty Trust LP | 1 |

| DTE Electric Co. | 1 |

| Georgia Power Co. | 1 |

| Green Bancorp Inc. | 2 |

| Lm Group Holding A/S | 1 |

| Massachusetts Institute of Technology | 1 |

| MidAmerican Energy Co. | 3 |

| Morgan Stanley | 1 |

| NRG Yield Operating LLC | 3 |

| Overseas Private Investment Corp. | 39 |

| Pattern Energy Group Inc. | 2 |

| Prologis International Funding II SA | 1 |

| Regency Centers Corp. | 2 |

| Southern Power Co. | 6 |

| TerraForm Power Operating LLC | 5 |

| Tesla Energy Operations Inc./DE | 142 |

| Toyota Motor Credit Corp. | 1 |

| Vornado Realty LP | 1 |

| Westar Energy Inc. | 1 |

| Total Announcements | 225 |

Table 2 shows the number of green bonds issued, on the industry basis. The most dominating industries are energy and financial institution/services. The energy sector had an overall 169 green bonds announcements, whereas financial institution/services had 45 green bonds announcements. It can be argued that awareness of green financing is widely spread over to other sectors of the economy in USA markets.

| Industry | Number of green bonds issued |

|---|---|

| Real Estate | 5 |

| Computer hardware Computer software | 2 |

| Energy and Utilities | 19 |

| Financial Institution / Services | 45 |

| Electric and Gas Utilities | 8 |

| Banking | 2 |

| Education | 1 |

| Logistics | 1 |

| Automotive Energy | 142 |

| Total | 225 |

Table 3 shows summary statistics of the green bonds characteristics. Considering all the green bonds in panel A, the average coupon is 3.525%, maturity in years 9.23 and amount issued in bonds is 127.068 million. The panel B highlights the specific energy sector, which observed 169 or 75% of announcements for green bonds in the US markets. The average coupon, maturity and amount issued are 3.494%, 7.52 years and 119.599 million respectively.

| Panel A | All green bonds characteristics | |||

|---|---|---|---|---|

| Mean | Median | Std. | N | |

| All green bonds | ||||

| Coupon (percent) | 3.525 | 3.6 | 1.533 | 225 |

| Maturity (years) | 9.23 | 9.92 | 6.648 | 225 |

| Amount Issued (millions) | 127.068 | 8.3 | 310.3181 | 225 |

| Panel B | All energy issuer green bonds characteristics | |||

|---|---|---|---|---|

| Mean | Median | Std. | N | |

| Energy issuer green bonds (Includes energy and utilities, electric and gas utilities and automotive energy) | ||||

| Coupon (percent) | 3.494 | 3.6 | 1.532 | 169 |

| Maturity (years) | 7.52 | 5 | 5.644 | 169 |

| Amount issued (millions) | 119.599 | 7.25 | 290.133 | 169 |

4.2 Abnormal returns using asset pricing models

We have implemented four asset pricing models, that is, single factor model (CAPM), three factor model Fama–French model, four factor Carhart model and five factor Fama–French model.

The CAPM shows strongly positive and statistically significant increase in abnormal returns, on the day of announcement of green bonds. Moreover, the percentage change of abnormal returns from day −1 (−0.5523) to announcement day 0 (0.7697) is 39.36%. It is clearly indicating the investors' positive reactions on the announcement of green bonds. The positive abnormal reaction continues around the announcement date from event day 0 till day 3. However, we have evidence of negative statistically significant abnormal returns on pre-event day on −6 day. It is arguable if the green bonds information was partly anticipated prior to the event day. Moreover, pre-event window has positive statistical significance level at day −8 (0.5097) and −10 (0.5525).

Based on the evidenced provided by Fama–French three factor model, we have very strong and statistically significant abnormal returns surrounded by the green bond announcement date. The results indicate day 0 is statistically significant and investors responded on the news of green bonds positively. Moreover, if we compare the abnormal returns from day −1 to 0, the change in abnormal returns is 132.2%. It is also interesting to note that very close post event days have positive abnormal returns and statistically significant results, that is, day +2. In Fama–French three factor model, pre event window negative abnormal returns results at day −1, −6, −15 and at −2 at significance level of 0.01 and 0.10 respectively. To illustrate the results on day 0, the announcement of green bonds has significantly positive and indicating the response of investors on the news. The change of abnormal returns from day −1 to 0 is 121.63%. As similar with the CAPM model, we have observed post event days (+1, +2 and + 11) that have positive abnormal returns in Fama–French three factor model and statistically significant. On the other hand, post event negative abnormal returns observed at day 4 and 11 at significance level of 0.01 and day 14 at significance level of 0.10.

The abnormal returns for Carhart four factor showing statistically significant results surrounded by event day. For instance, day −1, 0 and 2 are statistically significant and change of abnormal returns from day −1 to 0 is 116.99%. We have observed negative abnormal returns that is statistically significant on pre-event window at day −1 and −6, at 0.01 significance level, and −15 at 0.10 significance level. The pre-event window has positive abnormal returns on day −8, −10 and −13 at significance level of 0.01. The post event window has negative abnormal returns at day +4 and +14 at significance level of 0.01 and day +6 at significance level of 0.10. The positive abnormal returns have been observed on day 2 and 11 at significance level of 0.01.

Abnormal returns in Fama–French five factor model is strongly positive and significant on the day of announcement and showing significant results around the event date. The change of abnormal returns from day −1 to 0 is 112.11%. The abnormal returns on the pre-event window is negatively significant on day −1 and −6 at significance level of 0.01 and positively significant on day −8 and −10 at 0.01 and day −13 at 0.10. The post event days are negatively significant at day +4 and +14 at significant level of 0.10 and positively significant on day 2 and 11 at significance level of 0.01.

In the table 4, we have use four asset pricing models and observed that on the day of the announcement of green bonds, the abnormal returns are strongly positive and statistically significant. Moreover, the change in abnormal returns from a day before (−1) event towards event day (0) is highly positive in all four models. It is also noticed that the percentage change of abnormal returns from pre-event (−1) to event day 0 is maximum among all event window of −15 to +15. Based on the evidences, investors reacted positively to the green bonds' announcement. Thus, hypothesis H1 is accepted which implies that green bonds do serve as a bridge to the UN sustainable development goals. This is because, increase in share prices and the abnormal returns highlights the firms' and investors' efforts for climate mitigation and adaptation that, directly or indirectly, underlie all the SDGs. Our results are aligned with the findings from a number of existing studies (for example see; Wermers, 2000; Ke & Ramalingegowda, 2005; Piotroski & Roulstone, 2005).

| Event days | Abnormal returns CAPM | Abnormal return Fama French - three factor model | Abnormal returns Carhart four factor model | Abnormal returns Fama French - five factor model |

|---|---|---|---|---|

| Day −15 | −0.2527 (−1.3358) |

−0.3830*** (−2.1237) |

−0.3299* (−1.8506) |

−0.2790 (−1.4778) |

| Day −14 | 0.1626 (0.9908) |

0.0636 (0.3749) |

0.0909 (0.5375) |

0.0362 (0.2113) |

| Day −13 | 0.2610* (1.8027) |

0.3221*** (2.2917) |

0.3007*** (2.0693) |

0.2793* (1.8645) |

| Day −12 | −0.0203 (−0.1183) |

0.0046 (0.0256) |

0.0514 (0.2878) |

−0.0652 (−0.3698) |

| Day −11 | −0.1070 (−1.1333) |

−0.0477 (−0.4411) |

0.0528 (0.4891) |

−0.0093 (−0.0925) |

| Day −10 | 0.5525*** (2.7587) |

0.6309*** (3.1293) |

0.6555*** (3.3219) |

0.6242*** (3.1713) |

| Day −9 | −0.0046 (−0.0231) |

−0.1206 (−0.6433) |

−0.1324 (−0.7079) |

−0.2316 (−1.2135) |

| Day −8 | 0.5097*** (2.4518) |

0.4535*** (2.2169) |

0.4138*** (2.0267) |

0.4567*** (2.2707) |

| Day −7 | −0.1168 (−0.6932) |

−0.1222 (−0.7403) |

−0.1332 (−0.7854) |

−0.0024 (−0.0145) |

| Day −6 | −0.4937*** (−4.3883) |

−0.6407*** (−5.6742) |

−0.5559*** (−4.9014) |

−0.6794*** (−6.4103) |

| Day −5 | 0.0626 (0.3774) |

0.1362 (0.8010) |

0.1624 (0.9317) |

0.2473 (1.4124) |

| Day −4 | 0.0605 (0.3513) |

−0.0710 (−0.4024) |

−0.1114 (−0.6214) |

−0.0197 (−0.1122) |

| Day −3 | −0.1830 (−1.0772) |

−0.1893 (−1.1532) |

−0.1974 (−1.1989) |

−0.1704 (−1.0487) |

| Day −2 | −0.3067 (−1.5448) |

−0.3881* (−1.7430) |

−0.3344 (−1.5560) |

−0.3492 (−1.6146) |

| Day −1 | −0.5523*** (−4.0229) |

−0.4891*** (−3.4299) |

−0.4199*** (−3.1613) |

−0.3337*** (−2.4312) |

| Day 0 | 0.7697*** (4.8913) |

0.7272*** (4.1206) |

0.7500*** (4.2677) |

0.7874*** (4.4246) |

| Day 1 | 0.1131 (0.7754) |

0.1034 (0.6624) |

0.1043 (0.6646) |

−0.0032 (−0.0210) |

| Day 2 | 0.5915*** (2.8976) |

0.5974*** (2.9028) |

0.6154*** (3.0342) |

0.5658*** (2.7707) |

| Day 3 | 0.0491 (0.2599) |

−0.0229 (−0.1209) |

−0.0769 (−0.4164) |

−0.0569 (−0.3069) |

| Day 4 | −0.0940 (−0.7087) |

−0.2932*** (−2.2464) |

−0.3436*** (−2.6707) |

−0.2227* (−1.6601) |

| Day 5 | −0.1252 (−0.5569) |

0.0058 (0.0272) |

−0.0139 (−0.0633) |

0.1041 (0.4869) |

| Day 6 | −0.2633 (−1.5287) |

−0.2329 (−1.3487) |

−0.2858* (−1.6872) |

−0.1566 (−0.9260) |

| Day 7 | −0.1207 (−0.7912) |

−0.1889 (−1.2606) |

−0.1569 (−1.0186) |

−0.1344 (−0.8762) |

| Day 8 | 0.0099 (0.0568) |

−0.0002 (−0.0013) |

−0.0518 (−0.2784) |

0.0447 (0.2481) |

| Day 9 | −0.0770 (−0.4067) |

−0.0744 (−0.4228) |

0.0340 (0.1877) |

0.0409 (0.2340) |

| Day 10 | −0.3253*** (−2.0466) |

−0.2211 (−1.2240) |

−0.1653 (−0.9162) |

−0.1829 (−1.0478) |

| Day 11 | 0.3463*** (2.2120) |

0.4266*** (2.6476) |

0.4240*** (2.5492) |

0.4511*** (2.9009) |

| Day 12 | 0.1196 (0.8924) |

0.1168 (0.8594) |

0.1390 (1.0669) |

0.1403 (0.9971) |

| Day 13 | 0.1691 (0.8535) |

0.1018 (0.4942) |

0.0460 (0.2211) |

−0.0176 (−0.0866) |

| Day 14 | −0.0373 (−0.2844) |

−0.2369* (−1.8022) |

−0.2769*** (−2.1735) |

−0.2215* (−1.6601) |

| Day 15 | 0.0041 (0.0202) |

0.1597 (0.8262) |

0.2262 (1.1539) |

0.2571 (1.3895) |

- Note: t-statistics are in parenthesis; ***p < 0.01, **p < 0.05, *p < 0.1.

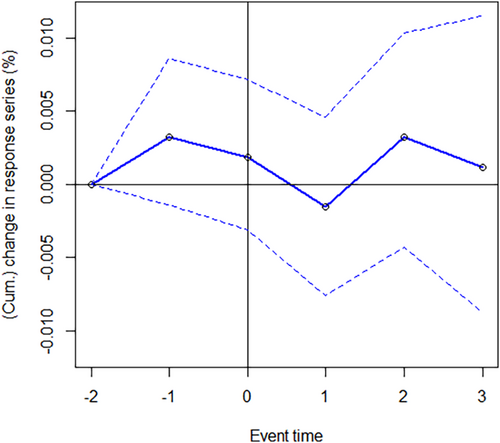

4.3 Cumulative average abnormal returns

The panel A in the Table 5 showing CAPM model provides positive evidence of statistically significant cumulative average abnormal return on the event window of day −1 to +3 (0.9681) at 0.01. Moreover, the event window of day −1 to +5 (0.7786) is also statistically significant at the level of 0.10. Both the outcomes might have been in response to the announcements of green bonds. In general, the equity market event performance around the announcement date is consistent with an efficient capital market in the semi strong form.

| Event windows | Cumulative abnormal return (CAPM model) | t-value (CAAR) |

|---|---|---|

| Panel A: Single factor model (CAPM) | ||

| Day −1 to +1 | 0.3275 | (1.5779) |

| Day −1 to +3 | 0.9681*** | (3.0845) |

| Day −1 to +5 | 0.7786* | (1.7570) |

| Day −1 to +7 | 0.4184 | (0.7978) |

| Day −1 to +10 | 0.0791 | (0.1285) |

| Day −1 to +15 | 0.6556 | (0.8057) |

| Panel B: Three-factor Model (Fama–French) | ||

| Day −1 to day +1 | 0.3348 | (1.3624) |

| Day −1 to day +3 | 0.9093*** | (2.9855) |

| Day −1 to day +5 | 0.6456 | (1.5510) |

| Day −1 to day +7 | 0.2449 | (0.5068) |

| Day −1 to day +10 | −0.0121 | (−0.0204) |

| Day −1 to day +15 | 0.5176 | (0.6643) |

| Panel C: Four-Factor Model (Carhart) | ||

| Day −1 to day +1 | 0.4171* | (1.7179) |

| Day −1 to day +3 | 0.9557*** | (3.2200) |

| Day −1 to day +5 | 0.6295 | (1.5014) |

| Day −1 to day +7 | 0.2126 | (0.4357) |

| Day −1 to day +10 | 0.0506 | (0.0836) |

| Day −1 to day +15 | 0.5633 | (0.7148) |

| Panel D: Five-factor Model (Fama–French) | ||

| Day −1 to day +1 | 0.4195* | (1.8101) |

| Day −1 to day +3 | 0.9284*** | (3.2887) |

| Day −1 to day +5 | 0.8104*** | (2.0630) |

| Day −1 to day +7 | 0.5336 | (1.1713) |

| Day −1 to day +10 | 0.4556 | (0.8282) |

| Day −1 to day +15 | 1.0079 | (1.4003) |

- Note: t-statistics are in parenthesis; ***p < 0.01, **p < 0.05, *p < 0.1.

The panel B in the Table 5 indicates Fama–French three factor model and provides the evidence that the event window of day −1 to +3 (0.9093) is strongly significant at 0.01 level. Moreover, none of the other event window is showing any significance results for cumulative average abnormal return. Similarly, the evidence of green bond impact is intensely visible around the announcement dates.

The panel C in the Table 5 showing Carhart four factor model and illustrate the results of cumulative average abnormal return as positively significant around the event windows. For example, event windows of day −1 to day +1 and day −1 to +3 are statistically significant at 0.10 and 0.01, respectively. The results strongly support the arguments of semi-strong form of efficiency. Since the cumulative average abnormal return CAAR are significant around the event date, this indicates that cumulative returns are other than zero on the announcement date of green bonds.

Finally, panel D in the Table 5 highlighted Fama–French five factor model and indicates that cumulative average abnormal return is positively significant on the event windows of day −1 to day +1, day −1 to day +3 and day −1 to day +5, at significance level of 0.10, 0.01 and 0.01 respectively. Overall, trend of the cumulative average abnormal return has been positive which indicates that the information of green bonds was received well by investors. Therefore, Fama–French five factor model also supports the semi strong form of market efficiency.

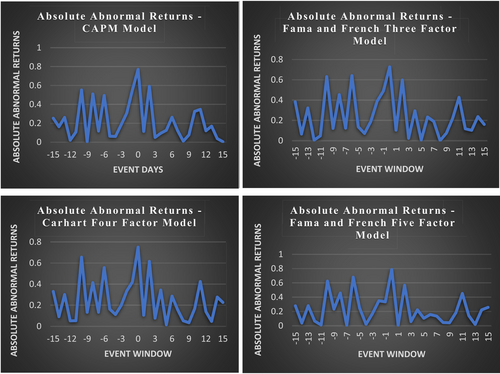

The following Figure 2 is developed on the basis of absolute value of abnormal returns, by using all the asset pricing models, that is, CAPM, Fama–French three factor, Carhart four factor and Fama–French five factor models. The absolute abnormal returns are calculated over 31 days from −15 to +15 around the green bond announcement date. Overall 225 green bond announcement events are collected over the period of 2013– June 30th 2018 from a total of 25 companies.

Another piece of evidence in support of this position, particularly on the day of the announcement, can be found in the signalling hypothesis of green bonds announcement. Many researchers have supported the signalling theory, including Charest (1978), Asquith and Mullins Jr (1983), Kalay and Loewenstein (1986), Impson (1997) and Nissim and Ziv (2001).

4.4 Robustness of results

We have implemented asset pricing models, that is, single factor model (CAPM), three factor model Fama–French model and five factor Fama–French model for robustness check by excluding the year 2015. There are substantial Green bonds issued in 2015 as compared with the other years, therefore, we have excluded the 2015 to show significance of our results are being driven by an overall data.

The Table 6 shows statistically significant abnormal returns, surrounded the day of announcement of green bonds. Our robustness check for abnormal returns are align with our earlier results after excluding year 2015 from the data.

| Event days | Abnormal returns CAPM | Abnormal return Fama French - three factor model | Abnormal returns Fama French - five factor model |

|---|---|---|---|

| Day 15 | −0.4609*** (−2.2239) |

−0.5809*** (−2.7446) |

−0.5881*** (−2.8983) |

| Day 14 | 0.0449 (0.1273) |

−0.5015 (−1.2919) |

−0.3211 (−0.9807) |

| Day 13 | −0.7703*** (−3.0980) |

−0.6734*** (−2.4224) |

−1.1626*** (−3.2262) |

| Day 12 | 0.2768 (1.3920) |

−0.0321 (−0.1186) |

0.0998 (0.3149) |

| Day 11 | −0.3212*** (−2.2011) |

−0.1750 (−0.8120) |

−0.2756 (−1.6729) |

| Day 10 | 0.8906*** (2.2142) |

0.7290* (1.8515) |

0.5246 (1.1774) |

| Day 9 | 0.4221 (0.8346) |

−0.0692 (−0.2379) |

−0.0965 (−0.3848) |

| Day 8 | −0.2407 (−1.2310) |

0.0873 (0.5830) |

0.1073 (0.6086) |

| Day 7 | 0.1510 (0.4893) |

0.6241 (1.4915) |

0.5188 (1.2418) |

| Day 6 | 0.1444 (0.5169) |

−0.0974 (−0.3844) |

−0.2243 (−1.1355) |

| Day 5 | −0.4616 (−1.2057) |

−0.1656 (−0.5338) |

−0.0583 (−0.2013) |

| Day 4 | −0.1170 (−0.5892) |

−0.2744* (−1.7466) |

−0.2358 (−1.1933) |

| Day 3 | −0.6968 (−1.2854) |

−0.7981 (−1.3814) |

−0.8717 (−1.6437) |

| Day 2 | −0.2883 (−0.5507) |

−0.8995 (−1.3095) |

−0.6608 (−0.9480) |

| Day 1 | −0.9654*** (−2.2416) |

−1.0876*** (−2.2824) |

−0.7625 (−1.5811) |

| Day 0 | 0.4808 (1.4037) |

−0.7909* (−1.7811) |

−0.4930 (−1.0259) |

| Day 1 | −0.5389 (−1.5254) |

−0.8171* (−1.8224) |

−0.7331* (−1.8255) |

| Day 2 | −0.6726*** (−3.5341) |

0.2543 (0.8910) |

0.5452 (1.5850) |

| Day 3 | 0.2800 (1.2090) |

0.3087 (1.6669) |

0.0879 (0.4425) |

| Day 4 | 0.2805 (1.2117) |

0.3458 (1.3665) |

0.3171 (1.0625) |

| Day 5 | −0.0588 (−0.2795) |

−0.1063 (−0.6315) |

0.0036 (0.0218) |

| Day 6 | 0.2673 (0.8723) |

0.1144 (0.4064) |

0.4222 (1.4754) |

| Day 7 | −0.1145 (−0.3642) |

−0.1218 (−0.3732) |

0.0587 (0.1727) |

| Day 8 | −0.4693 (−1.1679) |

−0.5896 (−1.3272) |

−0.1800 (−0.3898) |

| Day 9 | 1.0993* (1.8282) |

0.7677* (1.7204) |

0.6476 (1.3139) |

| Day 10 | −0.4981* (−1.7691) |

−0.3718 (−1.0911) |

0.0151 (0.0512) |

| Day 11 | −0.6411*** (−2.8683) |

−0.7053*** (−3.3792) |

−0.2047 (−0.9993) |

| Day 12 | −0.5193*** (−2.0928) |

−0.2485 (−1.0378) |

−0.2004 (−0.9711) |

| Day 13 | 0.2871 (1.5733) |

0.3824 (1.6861) |

−0.0865 (−0.3470) |

| Day 14 | −0.2742 (−1.1663) |

−0.3066 (−1.3716) |

0.1399 (0.5931) |

| Day 15 | 0.0963 (0.1779) |

0.3523 (0.9052) |

0.9242*** (2.7878) |

- Note: t-statistics are in parenthesis; ***p < 0.01, **p < 0.05, *p < 0.1.

The Table 7 indicates results for cumulative average abnormal returns of single factor model (CAPM), three factor model Fama–French model and five factor Fama–French model after excluding year 2015. In all asset pricing models the results are statistically significant around the announcement date, that is, (day −1 to +1). Our results are robust after excluding the year 2015.

| Event windows | Cumulative abnormal return (CAPM model) | t-value (CAAR) |

|---|---|---|

| Panel A: Single factor model (CAPM) | ||

| Day −1 to +1 | −1.0055*** | (−2.0950) |

| Day −1 to +3 | −1.3982*** | (−2.5291) |

| Day −1 to +5 | −1.1634 | (−1.6368) |

| Day −1 to +7 | −0.9453 | (−0.9987) |

| Day −1 to +10 | −0.5782 | (−0.6099) |

| Day −1 to +15 | −2.1110 | (−1.6314) |

| Panel B: Three-factor Model (Fama–French) | ||

| Day −1 to day +1 | −2.6261*** | (−3.2510) |

| Day −1 to day +3 | −2.0631*** | (−2.6340) |

| Day −1 to day +5 | −1.7999* | (−1.9801) |

| Day −1 to day +7 | −1.7583 | (−1.4472) |

| Day −1 to day +10 | −1.8614 | (−1.3453) |

| Day −1 to day +15 | −2.8750* | (−1.7489) |

| Panel C: Five-factor Model (Fama–French) | ||

| Day −1 to day +1 | −1.9422*** | (−2.7259) |

| Day −1 to day +3 | −1.3091* | (−1.8213) |

| Day −1 to day +5 | −0.9891 | (−1.0996) |

| Day −1 to day +7 | −0.5945 | (−0.5180) |

| Day −1 to day +10 | −0.3148 | (−0.2719) |

| Day −1 to day +15 | −0.4022 | (−0.3138) |

- Note: t-statistics are in parenthesis; ***p < 0.01, **p < 0.05, *p < 0.1.

In summary, our results indicate the existence of positive significant cumulative abnormal returns on the day of green bond issue. Specifically, the results also indicate significant positive results and illustrate investor's recognition of the green projects through green financing. In other words, sustainable business practices, that is, environment-friendly green bonds are considered as a measure of sustainable business for investors. Further, our positive significant results on the day of announcement also identify our investors' long-term commitment towards climate. This is despite the fact that returns on green financing might be lower than on other mode of financing (Climent & Sarino, 2011). Thus we conclude that green bonds can effectively serve as a bridge for achievement of UN SGDs.

5 CONCLUSION

Our paper traced investors' response to firms' environmental, social and governance (ESG) activities in the form of green bond financing. We have examined four different empirical asset pricing models, using the pre- and post-event window from 01/01/2013 to 30/06/2018 and extended our results in the Appendix A by using constant model, adjusted market model and augmented market model from 01/07/2018 to 30/06/2022. The empirical results demonstrate the existence of positive significant cumulative abnormal returns on the day of green bond issue announcement. Specifically, the results indicate significant positive results and illustrate investor's recognition of the green projects through green financing. In other words, sustainable business practices, that is, environment-friendly green bonds are considered as a measure of sustainable business for investors. Further, our positive significant results on the day of announcement also identify our investors' long-term commitment towards climate. This is despite the fact that returns on green financing might be lower than on other mode of financing (Climent & Sarino, 2011).

We conclude that investors are acknowledging the climate issues, taking climate action, and encouraging firms through voting for environment-friendly bond financing. These empirical results imply that the positive reaction of shareholders to the announcement of green bonds issuance suggests their positive attitude towards ESG activities of the firms. Therefore, green bonds are a bridge to the sustainable development goals and can prove an effective tool for financing green initiatives in future.

Our study has some important implications for future. First, achievement of UN's SDG's is not possible unless corporate sector and private investors do not mobilise finance for it. Policy makers should devote in environmentally responsible education, provide appropriate information, and concentrate on users' green preferences. Second, being aware of investors' preferences in terms of green initiatives allows corporations to design appropriate products for targeting investors with a preference for green initiatives and enhance green mandate in the society. Third, this study highlights that investors trust green bond investments and value corporations' issuing green bonds. Therefore, we call for more green bond initiatives to be undertaken by corporate sector. Our results also suggest that understanding of green financing is truly beneficial for investors –this facilitates implementation of the green climate policies and provides a channel to divert the resources towards low carbon emission projects.

It is pertinent to note certain limitations of our study. Since green bonds are a new innovative financial instrument, a limited amount of data is available for their study yet. For example, the data for the trading volume of green bonds on daily/monthly/quarterly basis is currently unavailable. Therefore, we call for research to capture various interesting dimension regarding green financing once relevant data becomes available. We also recognise various limitations inherent to the use of an event study methodology. First, assumptions used in the event study are not adequate. For instance, stock returns do not fully reflect all available information in the inefficient markets of the real world. Moreover, extreme news/events may possibly influence stock returns more than our event such as pandemic, announcement of COVID-19 deaths, announcement of lockdowns, abnormal movements of macroeconomic variables, that is, high interest rates and inflation. Second, adjustments in the estimation window and event windows are generally a constraint when using event study methodology. It is challenging to determine exact length of estimation window based on relationship between accurate estimation window and likely parameters shifts. Third, the selection of specific models to examine the expected returns might influence results in terms of size and the significance of abnormal returns. Finally, thin volume stocks over the estimation and event window may provide variation while applying event study methodology.

The limitations of our paper also offer avenues for future research. In particular, for future research, it will be interesting to examine the information of cost/liquidity hypothesis. This would enable to observe if the excess returns are being driven by cost of trading or information (for e.g., see Zhang and Gregoriou (2020)3). Moreover, researchers can test the liquidity in their asset pricing model by following Florackis et al. (2011)4 and also examine seven factors model by Gregoriou et al. (2019)5.

Finally the policy recommendations of our study include (i) government might introduce tax-exemptions on green bonds floatation and coupon payments or at least lower taxes in comparison with conventional bonds; (ii) focus must be placed on increasing awareness and investing more on the environmentally responsible education; (iii) policy makers should bring more transparency into the green projects, it will enhance issuer's creditworthiness and lastly (iv) cost related with arrangement of green projects should reduce. The policy makers should take these measures carefully in order to encourage mature investors to take leverage position in this innovative instrument.

CONFLICT OF INTEREST STATEMENT

There are no conflicts of interest to declare.

Endnotes

APPENDIX A: Extended Dataset Analysis from 01/07/2018 to 30/06/2022

| Issuer name | Number of green bond announcements |

|---|---|

| AES Corp. | 2 |

| Jabil Inc. | 1 |

| JPMorgan Chase & Co. | 2 |

| Kilroy Realty LP | 1 |

| Kimco Realty Corp. | 1 |

| Lucid Group Inc. | 1 |

| Micron Technology Inc. | 1 |

| Mondelez International Holdings Netherland BV | 1 |

| MP Materials Corp. | 1 |

| NiSource Inc. | 1 |

| Norfolk Southern Corp. | 1 |

| Ormat Technologies Inc. | 1 |

| Owens Corning | 1 |

| PepsiCo Inc. | 1 |

| Plug Power Inc. | 1 |

| PNC Financial ervices Group Inc. | 1 |

| Predential Financial Inc. | 1 |

| Prologis LP | 1 |

| Realty Income Corp. | 2 |

| Sonoco Products Co. | 1 |

| Stem Inc. | 1 |

| Sunnova Energy Corp. | 1 |

| UDR Inc. | 2 |

| Verizon Communication Inc. | 4 |

| VF Corp. | 1 |

| Alexandria Real Estate Equities Inc. | 3 |

| Visa Inc. | 2 |

| Welltower Inc. | 3 |

| Xylem Inc. | 1 |

| Ameren Illinios Co. | 1 |

| Apple | 1 |

| AvalonBay | 2 |

| Avangrid Inc. | 2 |

| Bank of America Corp. | 1 |

| BloomEnergy Corp. | 1 |

| Boston Properties LP | 3 |

| Brookfield Property Finance | 3 |

| Citigroup Inc. | 6 |

| Clearway Energy Operating LLC | 7 |

| Consolidated Edison Co of New York Inc. | 2 |

| Dana Inc. | 1 |

| Dominion Energy Inc. | 1 |

| DTE Electric Co. | 4 |

| Duke Energy Progress LLC | 1 |

| Duke Reality Lp | 3 |

| Enphase Energy LLC | 1 |

| Equinix Inc. | 4 |

| Federal Realty Investment Trust | 1 |

| Fifth Third Bancorp | 1 |

| Fisker Inc. | 1 |

| Ford Motor Co. | 1 |

| Hannon Armstrong Sustainable Infrastructure | 1 |

| Healthpeak Properties Inc. | 2 |

| Total Announcements | 92 |

| Industry | Number of green bonds issued |

|---|---|

| Automotive Energy | 3 |

| Beverages Food processing | 1 |

| Computer hardware, Computer software and Technology | 12 |

| Consumer sector | 2 |

| Electric and Gas Utilities | 1 |

| Energy and Utilities | 26 |

| Financial Institution / Services | 14 |

| General Building Materials | 1 |

| Healthcare industry | 2 |

| Logistics | 1 |

| Manufacturing services | 3 |

| Real Estate | 26 |

| Total | 92 |

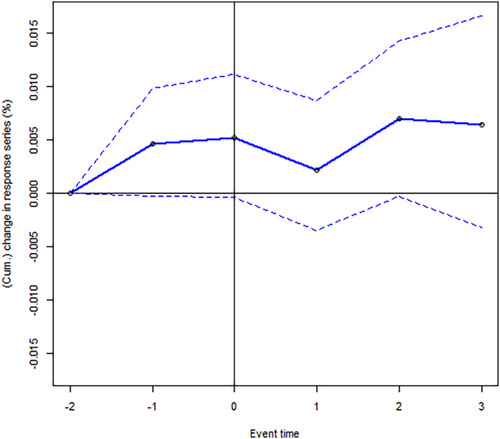

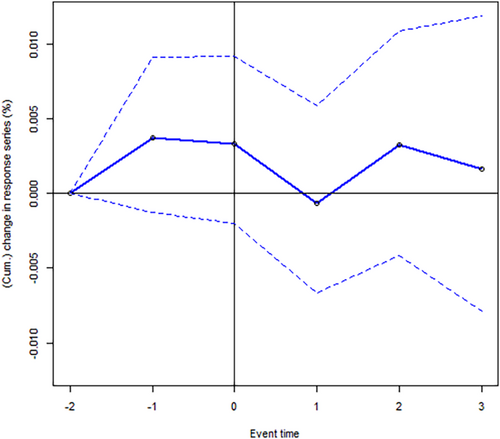

| Event days | 2.5% | Mean | 97.5% |

|---|---|---|---|

| Panel A constant model | |||

| −2 | −0.0002 | 0.005 | 0.010 |

| −1 | −0.0003 | 0.005 | 0.011 |

| 0 | −0.004 | 0.002 | 0.009 |

| 1 | −0.0002 | 0.007 | 0.014 |

| 2 | −0.003 | 0.006 | 0.017 |

| Panel B Adjusted Market Model | |||

| −2 | −0.001 | 0.004 | 0.009 |

| −1 | −0.002 | 0.003 | 0.009 |

| 0 | −0.007 | −0.001 | 0.006 |

| 1 | −0.004 | 0.003 | 0.011 |

| 2 | −0.008 | 0.002 | 0.012 |

| Panel C Augmented Market Model | |||

| −2 | −0.001 | 0.003 | 0.009 |

| −1 | −0.003 | 0.002 | 0.007 |

| 0 | −0.007 | −0.002 | 0.004 |

| 1 | −0.004 | 0.003 | 0.011 |

| 2 | −0.008 | 0.001 | 0.012 |

| Event window | Cumulative average abnormal returns |

|---|---|

| (−5, −1) | 0.0015 |

| (−2, 0) | 0.0029 |

| (0, 0) | 0.0046 |

| (−1, +1) | 0.0034 |

| (+1,+5) | 0.0055 |

- Note: We have divided our event window of (−5 to +5) into sub event windows, that is, (−5, −1), (−2, 0), (0, 0), (−1, +1) and (+1, +5). Overall pre and post event window shows positive cumulative abnormal returns. Further, on the day of event our cumulative returns has positive reaction on the announcement of green bonds.

| Statistical efficiency across the three variants | ||

|---|---|---|

| 2.5% | 97.5% | |

| Width of the bootstrap 95% confidence interval from “Constant Model” to Adjusted Market Model. | −0.001660800 | −0.001926805 |

| Width of the bootstrap 95% confidence interval from “Constant Model” to Augmented Market Model adjustment. | −0.017049199 | −0.006687028 |

- Note: The table shows small reduction in the width of the bootstrap 95% confidence interval from the Constant Model to Market Model adjustment. Further, a small change also observed when going from Market Model to Augmented Market Model.

Open Research

DATA AVAILABILITY STATEMENT

We have mentioned the sources of data in our paper specifically in the Table 1. The data that support the findings of this study are available from the corresponding author upon reasonable request.