In search of light in the darkness: What can we learn from ethical, sustainable and green investments?

Abstract

We analyse time-varying risk spillover and dependence to assess the systemic risk benefits of ethical, sustainable, and green investments. Our data comprise sustainable investments from ethical, environmental, social and governance (ESG), and green bonds. We investigate the link to major asset classes, including equity, commodity, and currency markets. We find evidence of close connection between the major asset classes and sustainable assets, except green bonds. We also explore the improvement in hedging efficiency from combining ethical and ESG investments with commodities and currencies over investment horizons. Our analysis based on systemic risk measures indicates that there is evidence of lower time-scale systemic risk connectedness in the case of commodities and currencies combined with ethical and ESG assets. These findings have significant implications for portfolio managers, policymakers, and market participants.

1 INTRODUCTION

Ethical and sustainable assets are an emerging alternative to investment in conventional assets due to their ability to provide financial stability and the benefits of portfolio diversification. Ethical, environmental, social and governance (EESG) assets have grown rapidly over the past decade, with a growing number of firms and businesses transforming their operations and services in the direction of more ethical and sustainable practices. Furthermore, in the aftermath of global financial crisis of 2008–09, there was a seismic shift in the investment principles of many market participants towards more ethical and sustainable investments. EESG is becoming an essential part of portfolios because market participants are becoming more aware of unethical business practices and climate change, and want their investments to have a positive impact. The sustainability assets under management have increased substantially, and their growth is likely to be sustained due to market participants' growing awareness of EESG issues. Therefore, it is important to evaluate the systemic risk contribution of EESG assets to identify their systemic importance, from investment allocation, risk management, regulatory, and academic viewpoints. This analysis aims to provide relevant knowledge to market participants, regulatory agencies, and academics by evaluating the connectedness dynamics of EESG assets with conventional asset classes.

Ethical business practices, climate concerns, human rights, and management structures are becoming an integral part of investment allocation decisions. Market participants are diverting their resources and investment from conventional assets to sustainable assets. For instance, some oil and gas producers are responding to climate change by diverting their investments from fossil fuel to renewable energy. Similarly, market participants are considering the ethical, social, and environmental behaviour of firms before making asset allocation decisions. In portfolio management decisions, EESG measures allow the market participants to achieve high long-run returns while contributing to ethical, environmental, and societal outcomes by influencing the EESG behaviour of firms.

EESG assets exhibit less volatility than conventional assets, primarily due to less leverage, more socially responsible investing (SRI), abstention from unethical business practices and decisions, and enhanced activities to reduce environmental concerns (Balcilar et al., 2015). Furthermore, the consideration of EESG-related factors restricts companies from taking unnecessary risks, thereby increasing stakeholder value by focusing on long-term sustainable operations and services. EESG-based regulations and criteria have reduced excessive risk-taking by management, speculative investments, interest-rate swaps, and other similar behaviours, thus adding values to stakeholder groups.

Despite the rapid growth of EESG-related investments, there is only limited literature that examines the inclusion of EESG-related assets in portfolios to attain diversification and risk management benefits. Prior literature on EESG investment looks mainly at the risk-adjusted performance of EESG compliant firms with conventional assets (e.g., Ashwin Kumar et al., 2016; Atan et al., 2018; Garefalakis & Dimitras, 2020; Maiti, 2021; Sassen et al., 2016) or the interconnectedness of EESG assets and conventional assets (e.g., Hkiri et al., 2017; Kenourgios et al., 2016; Narayan & Bannigidadmath, 2017; Rizvi et al., 2015). However, these studies fails to provide a comprehensive overview of interconnectedness dynamics over various frequency horizons.

Previous several studies investigated the ethical, sustainable, and green investments with conventional asset classes (stock, currency, commodity, etc.) using the directionality approach (Shahbaz et al. (2021), Hammoudeh et al., (2020)), volatility modelling approach (Tolliver et al. (2020), Dutta et al. (2020), Pham (2016)), directionality vs. dependence in the different horizons (Yahya et al., (2020), Elie et al. (2019)), Wavelet-based dependence and causality (Ferrer et al. (2021), Lee et al. (2021)) and structural VAR (Reboredo and Ugolini (2020), Reboredo et al., (2020)) and potential macroeconomic and financial driver using panel regression analysis(Gianfrate et al., (2019), Jiang et al. (2020)).

In this paper, we contributes to the literature on EESG in the following ways. We evaluate the connectedness and systemic uncertainty exposure of nine key EESG related assets to asymmetric shocks in conventional assets. To our knowledge, this kind of study has not been conducted before. Understanding the asymmetric impact of positive and negative shocks from conventional assets on EESG investment has significant implications for portfolio allocation and risk management decisions. Furthermore, our analysis yields significant insights for policymakers and regulators, in addition to helping investors devise strategies to decouple the impact of uncertainty shocks from conventional assets to EESG assets.

In addition, we propose a wavelet-based asymmetric copulas and systemic risk approach (Adrian & Brunnermeier, 2016) to explore the asymmetric impact of conventional asset shocks on EESG assets. The wavelets enable us to decompose the underlying return series into a set of subsequent wavelets corresponding to short-, medium-, and long-run trends. By utilizing wavelet-based approaches, we capture the heterogeneous preferences of investors who tend to invest over varying frequency horizons. Earlier studies are constrained from evaluating connectedness dynamics over short-run horizon. However, the literature shows that the investment horizon tends to depend on the preferences of the market participants (Barunik & Vacha, 2018; Bekiros & Marcellino, 2013; Berger, 2015; Shahzad et al., 2021; Yahya et al., 2019). Therefore, in this study, we will provide a comprehensive overview of the variation in symmetric and asymmetric connectedness and spillovers among the underlying assets over various investment time horizons (Al-Yahyaee et al., 2020). Finally, we present several dynamic portfolio diversification and risk management strategies based on investments in conventional assets, along with EESG-based assets that may enable market participants to achieve portfolio diversification and risk management potential over a range of investment horizons.

Our findings indicate that with some exceptions, the EESG assets exhibit significantly positive asymmetric connectedness and risk exposure with the financial indices. This implies that the financial indices and the EESG assets are closely integrated, that is, EESG assets exhibit homogeneous characteristics with respect to these indices. However, we do find weak-to-moderate negative dependence between financial indices and S&P Green Bonds, suggesting portfolio diversification and risk management potential for market participants. Furthermore, our results indicate a weak negative to moderately positive connection for commodities and exchange rates, implying a greater opportunity to realize risk management and diversification benefits. Our findings indicate that gold can serve as a safe haven for market participants that invest in EESG assets. These findings are supported by the systemic risk measure, indicating a significantly lower systemic risk contribution for commodities and currencies with EESG assets. In terms of optimal portfolio weights, our findings generally point to a higher proportion of capital to be invested in EESG assets compared to the conventional assets in our sample to capture diversification benefits. Finally, hedging is expensive for EESG assets and financial indices and there is significantly lower improvement in hedging efficiency for these assets. For the commodities and exchange rates, however, it is much less costly to hedge a long position in EESG and hedging efficiency indicates a significant reduction in uncertainty.

The rest of the paper is structured as follows. Section 2 describes the methodological framework. Section 3 presents the data and stochastic properties. Section 3.3 discusses the empirical findings and their implications. Section 4 concludes.

2 METHODOLOGY

In this section, we describe our methological framework.

2.1 Wavelet transform

2.2 Time-varying copula

2.3 Value-at-risk, CoVaR, and ΔCoVaR

2.4 Portfolio weights, hedge ratios and hedging effectiveness

To evaluate the portfolio diversification and risk management potential from the perspective of an investor's trading behaviour, we examine the variations in hedging effectiveness over several investment horizons by using wavelet-based copulas. For instance, an investor's choice may vary over different investment horizons (represented by frequencies), suggesting the preference for a particular frequency. Therefore, this approach captures the market trading mechanics and the heterogeneous behaviour of the market participants with varying frequencies.

3 DATA AND STOCHASTIC PROPERTIES

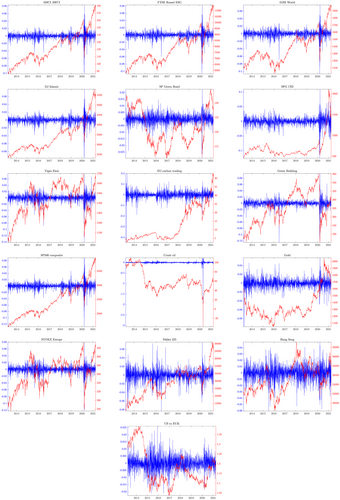

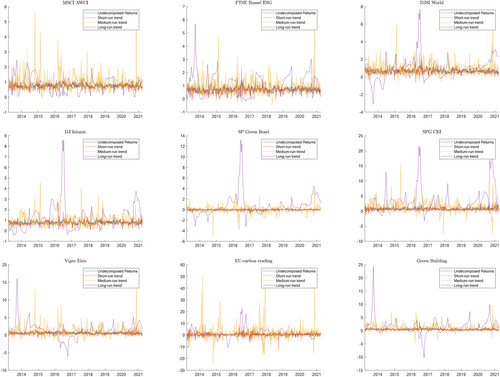

We utilize daily data from March 19, 2013 to March 31, 2021 of ethical and sustainable investment assets including MSCI Environmental, Social and Governance (MSCIWESG), FTSE4Good Index (FTSE4GLB), Dow Jones Sustainability Index (DJSIW), Dow Jones Ethical Equity Index (DJIM), S&P Green Bond Index (SPGRNSI), S&P Global Clean Energy Index (SPGCLE), Vigeo Eiris (Vigeo), EU-Carbon trading–EEX-EU CO2 Emissions (EEXEUAS), and S&P Green Building (SPGBUI). We evaluate the performance of these indices against the major financial indices (S&P 500 composite (S&P 500), STOXX Europe (STOXX), Nikkei 225 (Nikkei), Hang Seng), commodities (crude oil and gold), and exchange rate (USD to EUR). The data utilized in this study is collected from Thomson Reuters DataStream. The sample span is selected based on the data availability. For instance, the Vigeo Eiris has data available from November 2013. To evaluate the impact of COVID-19 on the investment allocation and risk management decisions, we divided the dataset into pre- and during-COVID period. This is of significant interest as to explore the dynamics of risk management and hedging potential of each ESG indexes against various major asset classes for various market participants. Figure 1 illustrates the development of price and return series for pre- and during-COVID period.

3.1 Description of variables

The MSCI ESG Leaders (MSCIWESG) is an index of the highest Environmental, Social and Governance (ESG) rated companies in each sector of the parent index. The FTSE4Good Index (FTSE4GLB) is designed to estimate the performance of companies demonstrating ESG practices. The DJ sustainability index (DJSIW) tracks the stock performance of the world's leading companies in terms of economic, environmental, and social criteria. The DJ ethical equity index (DJIM) screens companies based on their number of Shariah (Islamic law) companies. The S&P Green Bond Index (SPGRNSI) tracks the global green bond market. The S&P Global Clean Energy Price Index (SPGCLE) provides liquid and tradable exposure to 30 companies from around the world that are involved in clean energy related businesses. The Vigeo Eiris Index stocks are the companies rated highest for control of corporate social responsibility risk and contribution to sustainable development. EU-Carbon trading – EEX-EU CO2 Emissions is a cornerstone of the EU's policy to combat climate change and its key instrument for the cost-effective reduction of greenhouse gas emissions. Figure 1 shows the development of price and return series over the sample period.

3.2 Descriptive statistics and stochastic properties

We estimate the continuously compounded return for each asset in our sample as the logarithmic difference between two consecutive prices at and as .3 Table 1 reports the summary statistics and stochastic properties for all the variables in our sample. The average annualized returns ranges from −52.89% for crude oil to 30.53% for the EEXEUAS; the annualized standard deviation ranges from 124.3% for crude oil to 5.6% for SPGRNSI. In terms of reward-to-risk measure (Sharpe, 1994), crude oil (−0.434) provides the lowest reward in terms of risk taken; the S&P 500 offers the highest.4 The distribution of return for nearly all the assets exhibits negative skewness, except for US to EUR, and the value of kurtosis larger than 4 for all assets. Taken together, our findings indicate that all the return series demonstrate skewed and leptokurtic distributions, indicating that the distributions exhibit fat tails and are asymmetric characteristics. The formal Jarque-Bera (JB) normality test upholds the non-Gaussian pattern and strongly rejects the null of normality for all the assets in our sample. The Ljung-Box test-statistics with 23 lags on returns and squared returns are significant at the 1% threshold, indicating that both the return and squared return series are serially correlated. The ARCH test with 23 lags are significant at the 1% threshold, indicating the rejection of null-hypothesis of homoscedasticity for all commodities, thus favouring the utilization of GARCH-type framework to capture the underlying stylized facts, for instance, clustering of volatilities and time-varying dynamics.

| Mean | SD | SR | Max | Min | Skew | Kurt | JB | Q (23) | Q2 (23) | ARCH (23) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSCI World ESG | 8.848 | 0.142 | 0.553 | 0.084 | −0.101 | −1.418 | 27.740 | 0.000 | 328.5*** | 2857.8*** | 810.3*** |

| FTSE Good Global | 8.103 | 0.144 | 0.493 | 0.084 | −0.107 | −1.497 | 27.249 | 0.000 | 275.9*** | 2323.5*** | 710.2*** |

| DJSI World | 7.043 | 0.144 | 0.418 | 0.077 | −0.106 | −1.449 | 23.339 | 0.000 | 219.6*** | 1806.5*** | 620.7*** |

| DJ Islamic | 10.195 | 0.142 | 0.650 | 0.079 | −0.096 | −1.206 | 22.919 | 0.000 | 262.6*** | 2585.6*** | 820.9*** |

| S&P Green Bond | −0.388 | 0.056 | −0.248 | 0.023 | −0.030 | −0.626 | 9.703 | 0.000 | 54.1*** | 642.6*** | 326.5*** |

| S&P Clean Energy | 14.574 | 0.223 | 0.608 | 0.110 | −0.125 | −0.766 | 14.661 | 0.000 | 148.6*** | 2069.5*** | 620.6*** |

| Euronext Vigeo | 5.660 | 0.179 | 0.260 | 0.078 | −0.141 | −1.462 | 21.410 | 0.000 | 72.7*** | 680.3*** | 313.6*** |

| EEX-EU CO2 Emissions | 30.532 | 0.501 | 0.589 | 0.202 | −0.447 | −1.515 | 25.798 | 0.000 | 96.8*** | 167.8*** | 405.3*** |

| S&P Green Building | 4.394 | 0.168 | 0.202 | 0.096 | −0.125 | −1.983 | 32.809 | 0.000 | 192.4*** | 1054.3*** | 384.8*** |

| S&P500 | 11.449 | 0.171 | 0.612 | 0.090 | −0.128 | −1.058 | 25.602 | 0.000 | 452.2*** | 3328.6*** | 898.5*** |

| Crude oil | −52.898 | 1.243 | −0.434 | 0.224 | −3.060 | −30.999 | 1161.392 | 0.000 | 298.2*** | 66.0*** | 66.8*** |

| Gold | 0.749 | 0.158 | −0.016 | 0.058 | −0.098 | −0.557 | 11.647 | 0.000 | 30.9*** | 162.7*** | 135.2*** |

| STOXX | 4.545 | 0.167 | 0.212 | 0.081 | −0.122 | −1.203 | 17.510 | 0.000 | 66.5*** | 911.2*** | 424.5*** |

| Nikkei | 10.331 | 0.207 | 0.450 | 0.077 | −0.083 | −0.291 | 8.233 | 0.000 | 45.4*** | 622.2*** | 244.2*** |

| Hang Seng | 3.070 | 0.177 | 0.117 | 0.049 | −0.060 | −0.375 | 5.544 | 0.000 | 13.6*** | 416.7*** | 188.0*** |

| US to EUR | −1.119 | 0.077 | −0.276 | 0.026 | −0.023 | 0.028 | 5.405 | 0.000 | 38.0*** | 397.2*** | 153.9*** |

- Note: This table reports the summary statistics and stochastic properties of all the series. We present the mean annualized figures of mean and standard deviation. SR corresponds to the Sharpe ratio and JB represents the p-values from the Jarque-Bera normality test. Q (23), Q2 (23), and ARCH (23) present the test-statistics of serial correlation on returns and squared returns, and conditional heteroscedasticity with 23 lags, respectively. *** and ** represents the rejected of null-hypothesis of no autocorrelation and conditional homoscedasticity at 1% and 5% threshold level.

3.3 Empirical analysis and results

We follow a two-step procedure proposed by Joe (1998) to estimate copulas. The first step of this procedure consists of estimation of univariate marginal distribution frameworks for both the undecomposed and the decomposed return series.5 Based on the filtered returns from the ARMA(1,0)-EGARCH(1,1) specification, we evaluate the connectedness structure between each of the ethical, environmental, sustainable, and governance assets (EESG) with that of the major financial markets, commodities, and currencies by utilizing various symmetric and asymmetric time-varying copula frameworks. Based on the filtered returns from the EGARCH framework, we examine the connectedness structure between the EESG in the second step of this procedure by estimating various copula frameworks.

Panels A and B of Table 2 summarizes the estimated parameters from the best-suited copula framework (time-varying Student-t copula) and the AIC values of different copula frameworks, respectively.6 The best-suited copula framework is selected based on the lowest AIC values (Panel B of Table 2). From Panel A, for the relationship of S&P500 with the underlying ethical and sustainable investment assets, we report significantly strong and positive connectedness for most of the underlying assets. The dependence parameter is strongly significant at the 1% threshold and ranges from to for the SPGRNSI and MSCIWESG, respectively. Overall, the connectedness structure of EESG assets with S&P500 are characterized from weakly negative to strongly positive dependence. The degrees of freedom (DoF) parameters are low and strongly significant between S&P500 and for nearly all the EESG assets in our sample. This indicates the potential for joint extreme movements and tail dependence of these EESG assets with S&P500. Furthermore, the parameter capturing the asymmetric impact of positive and negative shocks on the conditional connectedness, , is strongly significant for most of the EESG assets indicating that the negative and positive shocks exhibit an asymmetric impact on the conditional connectedness parameter. The parameter is strongly significantly at the 1% threshold indicating that the connectedness structure is time-varying for these assets. Overall, these findings indicate that the S&P500 and the underlying EESG assets are strongly positively dependent and that there is strong information connectedness between these assets, except for SPGRNSI. Similar results are reported in Panel D (STOXX), Panel E (Nikkei), and Panel F (Hang Seng). This indicate that the underlying EESG assets behaves in a similar fashion with other developed financial markets.

| Panel A: Student-t copula parameters | Panel B: AIC of different copulas | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| ρ | DoF | α | β | Student-t | Gaussian | Clayton | SJC | ||

| Panel A: S&P500 | MSCI World ESG | 0.923*** | 5.822*** | 0.037*** | 0.940*** | −4143.6 | −4052.4 | −3496.4 | −3479.7 |

| FTSE Good Global | 0.850*** | 7.756*** | 0.041*** | 0.939*** | −2883.1 | −2833.9 | −2429.4 | −2445.6 | |

| DJSI World | 0.775*** | 8.804*** | 0.034*** | 0.939*** | −2026.0 | −1995.6 | −1706.7 | −1963.2 | |

| DJ Islamic | 0.903*** | 6.236*** | 0.051*** | 0.917*** | −3739.7 | −3652.1 | −3202.8 | −3209.1 | |

| S&P Green Bond | −0.062*** | 13.811*** | 0.038*** | 0.901*** | −35.1 | −25.4 | 6.1 | 35.9 | |

| S&P Clean Energy | 0.526*** | 6.851*** | 0.018*** | 0.953*** | −742.9 | −696.5 | −644.0 | −730.7 | |

| Euronext Vigeo | 0.546*** | 9.709*** | 0.030*** | 0.880*** | −753.4 | −736.4 | −643.1 | −742.0 | |

| EEX-EU CO2 Emissions | 0.125*** | 17.004*** | 0.009*** | 0.985*** | −57.5 | −52.9 | 5.7 | −38.6 | |

| S&P Green Building | 0.524*** | 13.386*** | 0.024*** | 0.959*** | −720.6 | −710.2 | −633.8 | −479.7 | |

| Panel B: Crude oil | MSCI World ESG | 0.258*** | 16.534*** | 0.024* | 0.883*** | −156.4 | −151.0 | 5.6 | −143.0 |

| FTSE Good Global | 0.257*** | 15.890*** | 0.029** | 0.862*** | −156.3 | −151.1 | 5.6 | −151.4 | |

| DJSI World | 0.264*** | 18.586** | 0.034*** | 0.827*** | −163.9 | −160.3 | 5.6 | −158.1 | |

| DJ Islamic | 0.274*** | 14.860*** | 0.027** | 0.845*** | −177.4 | −170.2 | 5.6 | −170.7 | |

| S&P Green Bond | 0.016*** | 22.090* | 0.043 | 0.542* | −6.7 | −5.0 | 6.0 | 12.6 | |

| S&P Clean Energy | 0.239*** | 14.981*** | 0.009** | 0.985*** | −141.1 | −134.0 | 5.6 | −137.9 | |

| Euronext Vigeo | 0.178*** | 35.835** | 0.032* | 0.911*** | −89.9 | −90.5 | 5.7 | −82.0 | |

| EEX-EU CO2 Emissions | 0.208*** | 133.692 | 0.008 | 0.983*** | −97.9 | −99.8 | 5.7 | −87.1 | |

| S&P Green Building | 0.169*** | 14.684*** | 0.028** | 0.842*** | −173.0 | −67.2 | 5.7 | −143.0 | |

| Panel C: Gold | MSCI World ESG | −0.120*** | 7.441*** | 0.031*** | 0.915*** | −72.7 | −43.9 | 6.0 | 53.2 |

| FTSE Good Global | −0.003 | 5.217*** | 0.033*** | 0.912*** | −78.2 | −18.3 | 6.0 | 10.7 | |

| DJSI World | 0.025*** | 4.995*** | 0.030*** | 0.913*** | −85.5 | −20.4 | 6.0 | −0.4 | |

| DJ Islamic | 0.020*** | 5.571*** | 0.030*** | 0.907*** | −66.6 | −16.3 | 6.0 | 3.3 | |

| S&P Green Bond | 0.490*** | 9.491*** | 0.030** | 0.921*** | −626.0 | −597.3 | 5.3 | −608.9 | |

| S&P Clean Energy | 0.035*** | 7.254*** | 0.027*** | 0.918*** | −41.6 | −11.5 | 6.0 | 3.2 | |

| Euronext Vigeo | −0.177*** | 8.918*** | 0.020*** | 0.958*** | −97.1 | −73.9 | 6.1 | 69.8 | |

| EEX-EU CO2 Emissions | −0.031*** | 18.904** | 0.012* | 0.975*** | −11.4 | −8.3 | 6.0 | 31.1 | |

| S&P Green Building | 0.082*** | 6.450*** | 0.025** | 0.887*** | −64.1 | −19.1 | 5.9 | −15.0 | |

| Panel D: STOXX | MSCI World ESG | 0.757*** | 9.101*** | 0.052*** | 0.888*** | −1833.5 | −1808.8 | −1471.1 | −1769.6 |

| FTSE Good Global | 0.745*** | 8.166*** | 0.044*** | 0.930*** | −1781.6 | −1743.8 | −1447.7 | −1741.4 | |

| DJSI World | 0.765*** | 7.088*** | 0.053*** | 0.913*** | −1997.1 | −1938.0 | −1738.3 | −1913.3 | |

| DJ Islamic | 0.656*** | 8.421*** | 0.039*** | 0.920*** | −1233.5 | −1201.2 | −1051.2 | −1204.8 | |

| S&P Green Bond | −0.170*** | 6.683*** | 0.035*** | 0.951*** | −195.9 | −147.1 | 6.1 | 65.7 | |

| S&P Clean Energy | 0.482*** | 8.120*** | 0.036*** | 0.931*** | −633.7 | −600.8 | −551.7 | −609.9 | |

| Euronext Vigeo | 0.958*** | 7.316*** | 0.073*** | 0.912*** | −5503.5 | −5441.8 | −4604.9 | −4032.2 | |

| EEX-EU CO2 Emissions | 0.144*** | 16.506** | 0.010** | 0.983*** | −65.4 | −60.8 | 5.7 | −50.9 | |

| S&P Green Building | 0.548*** | 11.315*** | 0.047*** | 0.922*** | −840.0 | −821.9 | −666.9 | −779.7 | |

| Panel E: Nikkei | MSCI World ESG | 0.387*** | 19.312*** | 0.044 | 0.000 | −338.8 | −335.6 | 5.5 | −330.5 |

| FTSE Good Global | 0.373*** | 16.888** | 0.019 | 0.825*** | −319.8 | −304.2 | 5.6 | −310.0 | |

| DJSI World | 0.332*** | 15.859** | 0.014 | 0.927*** | −248.0 | −236.5 | 5.6 | −244.0 | |

| DJ Islamic | 0.314*** | 26.691 | 0.039 | 0.000 | −213.7 | −213.2 | 5.6 | −211.7 | |

| S&P Green Bond | −0.054*** | 16.560*** | 0.014*** | 0.972*** | −20.0 | −14.6 | 6.0 | 36.7 | |

| S&P Clean Energy | 0.254*** | 14.180*** | 0.010** | 0.969*** | −146.9 | −139.5 | 5.7 | −148.6 | |

| Euronext Vigeo | 0.316*** | 34.009 | 0.031 | 0.038 | −213.8 | −214.1 | 5.6 | −220.2 | |

| EEX-EU CO2 Emissions | 0.033*** | 73.545*** | 0.021** | 0.861*** | −1.3 | −0.7 | 5.9 | 7.9 | |

| S&P Green Building | 0.315*** | 18.759 | 0.012** | 0.960*** | −222.1 | −219.4 | 5.6 | −219.8 | |

| Panel F: Hang Seng | MSCI World ESG | 0.358*** | 199.931 | 0.032 | 0.001 | −281.8 | −283.9 | 5.3 | −250.8 |

| FTSE Good Global | 0.402*** | 51.52 | 0.017** | 0.946*** | −372.7 | −373.9 | 5.2 | −333.7 | |

| DJSI World | 0.410*** | 35.856** | 0.022** | 0.942*** | −395.6 | −396.0 | 5.1 | −359.0 | |

| DJ Islamic | 0.399*** | 137.334 | 0.03 | 0.573 | −358.4 | −360.3 | 5.2 | −321.2 | |

| S&P Green Bond | 0.029*** | 14.506*** | 0.033** | 0.901*** | −20.4 | −13.5 | 5.9 | 10.4 | |

| S&P Clean Energy | 0.396*** | 28.444 | 0.025*** | 0.957*** | −394.3 | −393.8 | 5.1 | −372.9 | |

| Euronext Vigeo | 0.373*** | 20.110** | 0.020** | 0.949*** | −326.2 | −323.5 | 5.2 | −315.8 | |

| EEX-EU CO2 Emissions | 0.061*** | 161.4 | 0.014 | 0.967 | −13.5 | −15.4 | 5.8 | 1.5 | |

| S&P Green Building | 0.375*** | 26.695 | 0.033*** | 0.918*** | −339.7 | −339.1 | 5.1 | −314.4 | |

| Panel G: US 2 EURO | MSCI World ESG | −0.056*** | 7.954*** | 0.034** | 0.920*** | −58.5 | −30.7 | 6.1 | 32.5 |

| FTSE Good Global | 0.193*** | 5.603*** | 0.035*** | 0.932*** | −162.6 | −112.6 | 5.6 | −121.1 | |

| DJSI World | 0.239*** | 4.803*** | 0.040*** | 0.930*** | −234.2 | −166.5 | 5.5 | −184.0 | |

| DJ Islamic | 0.129*** | 6.954*** | 0.030** | 0.930*** | −88.0 | −53.7 | 5.7 | −51.0 | |

| S&P Green Bond | 0.864*** | 10.163*** | 0.024** | 0.971*** | −3050.7 | −3022.2 | −2340.7 | −2266.0 | |

| S&P Clean Energy | 0.109*** | 11.769*** | 0.029* | 0.927*** | −56.1 | −44.5 | 5.7 | −30.2 | |

| Euronext Vigeo | −0.133*** | 6.213*** | 0.039*** | 0.939*** | −155.1 | −105.7 | 6.3 | 52.3 | |

| EEX-EU CO2 Emissions | 0.051*** | 17.134** | 0.024 | 0.787*** | −8.5 | −4.4 | 5.8 | 3.0 | |

| S&P Green Building | 0.210*** | 9.632*** | 0.055*** | 0.899*** | −159.5 | −138.3 | 5.5 | −133.7 | |

- Note: This table reports the parameters DCC-Student-t copula and the AIC values of various symmetric and asymmetric models. ***, **, and * indicate the significance at the 1%, 5%, and 10% level.

In contrast to the financial markets, the copula estimates between crude oil and EESG assets indicate significant weak to moderately positive connectedness structure. Specifically, the dependence parameter varies from to for the SPGRNSI and DJIM, respectively. The DoF parameters are significant for nearly all the underlying EESG assets indicating the flow of extreme co-movements for these assets. Whereas, for some of the EESG assets, the parameter is high and significant indicating that the Student-t distribution converges to the standard normal distribution. The parameter is significant for most of the EESG assets indicating the asymmetric impact of positive and negative shocks on the conditional dependence. The parameter is strongly significant at the threshold for all the EESG assets suggesting that the time-varying connectedness structure for these assets. In general, the weak negative to moderately positive connectedness structure between crude oil and the underlying EESG assets indicate the potential to attain risk management and diversification benefits.

From the copula between gold and the underlying EESG assets, we observe weak negative and statistically significant dependence structure for most of the assets. The level of dependence varies from to for Vigeo and SPGRNSI, respectively. However, the DoF parameters are small and significant for all the underlying EESG assets indicating the strong potential for extreme co-movements among the assets. In addition, the parameters and are significant for all the assets, suggesting asymmetric impact of positive and negative shocks and time-varying conditional connectedness pattern. Similarly, for the copula between exchange rate (US2EUR) and underlying EESG assets, we report weak negative ( for Vigeo) to strong positive dependence ( for SPGRNSI). The DoF, , and parameters are all significant for all the EESG assets indicating potential for tail dependence, asymmetric shocks, and persistency in conditional dependence among the assets.

In general, estimation of copula frameworks indicate evidence of weak negative to strong positive connectedness among the assets the undecomposed series. Specifically, the EESG assets exhibit strong positive co-movement with the four major financial indices (S&P500, STOXX, Nikkei, and Hang Seng), with exception of S&P Green Bond which demonstrate neutral to weak negative dependence with the four financial indices. Regarding commodities and exchange rate, we observe primarily weak negative to weak positive connectedness among the assets. This may primarily be attributed to the significant increase in investments in the EESG assets in recent years. Over the last decade, the issuance of sustainable debt has shown exponential growth, increased by more than 9200% from $5 billion in 2012 to $465 billion in 2019 (Rutigliano, 2020), leading investors to divert their resources from traditional conventional indexes to more sustainable investment. These findings are in accordance with Abu-Alkheil et al. (2017), Dewandaru et al. (2014), Mensi et al. (2015), and Yilmaz et al. (2015) who reported an increased dependence between the financial and Islamic indexes.

3.4 VaR, CoVaR and delta CoVaR

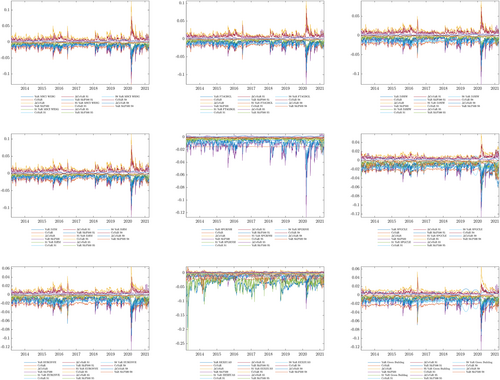

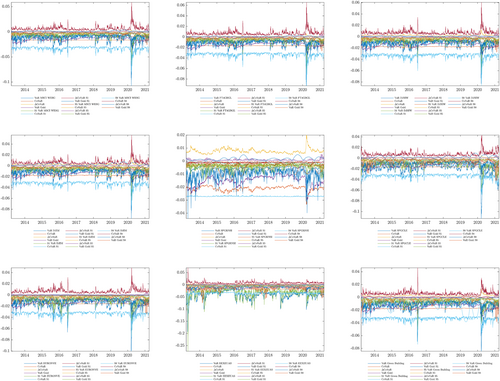

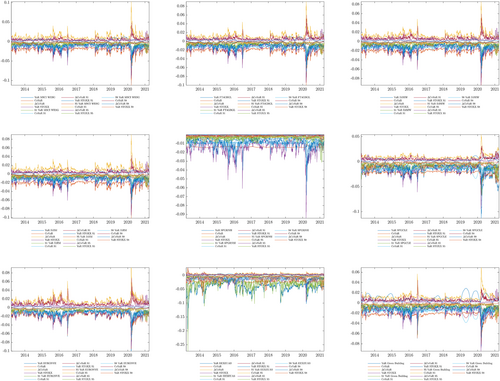

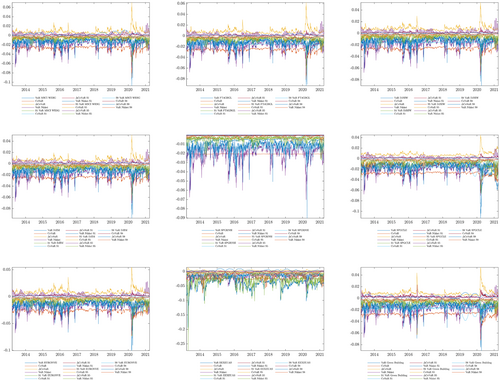

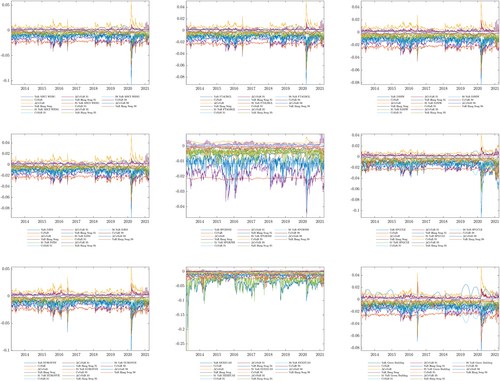

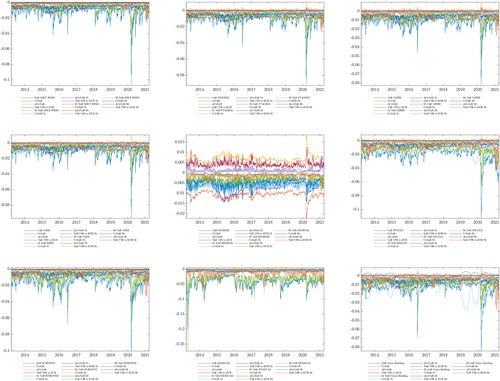

Based on the time-varying Student-t copula framework, the optimal framework, we estimate the VaR, CoVaR, and for each of the underlying series in our dataset. In addition, we provide the robustness checks for these measures over various investment horizons. Given heterogeneous investor's behaviour and time-horizon of investment, we transform the return series into the short-, medium-, and long-term horizons that correspond to variations over 2–4 days, 32–64 days, and 256–512 days, respectively. We then estimate the VaR, CoVaR, and for each subsequent wavelet.

Tables 3 and 4 provides the summary statistics of the VaR estimates for various investment horizons for the pre- and during-COVID period, respectively. Estimations of VaR for the undecomposed return series indicate that the EESG assets, in general, provide lower risk for the undertaken investment. The mean daily VaR of EESG assets ranges from −0.52% to −4.37% and −0.61% to −4.57% for SPGRNSI and EEXEUAS for the pre- and during-COVID, respectively. Whereas, the average VaR of the conventional assets ranges from −0.783% to −3.34% and −0.73% to −13.94% for US2EUR and crude oil for the pre- and during-COVID subsamples, respectively. This may be attributed to the investors' sentiments and trust in the management of the organization in abstaining from the unethical practices and towards a sustainable growth model. For example, over the post-crisis period, the investments in ethical and sustainable assets have substantially increased (GSIA, 2018), indicating a diversion of resources and investment towards heterogeneous operations and services offer by EESG and ethical assets. The mean VaR of the short-run trend follows the similar structure as that of the undecomposed return series for both the pre- and during-COVID subsamples. Like the undecomposed series, the VaR estimates of the EESG assets are lower than the traditional financial indices. It is noteworthy that the VaR has significantly reduced over the short-run trend for both subsamples. The VaR structure for the medium-run trend closely follows the undecomposed and short-run trend for both subsamples. However, in the long run, the mean VaR of the traditional financial indexes are lower than the EESG assets indicating a lower risk for the investment in the traditional assets over the long-term horizon for both subsamples.

| Undecomposed series | Short-run trend | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | Std dev | Mean | Median | Max | Min | Std dev | |

| MSCI World ESG | −1.151 | −1.009 | −0.332 | −4.219 | 0.509 | −0.651 | −0.566 | −0.167 | −2.748 | 0.321 |

| FTSE Good Global | −1.133 | −1.033 | −0.441 | −4.474 | 0.449 | −0.666 | −0.592 | −0.207 | −3.267 | 0.311 |

| DJSI World | −1.214 | −1.126 | −0.487 | −4.628 | 0.441 | −0.718 | −0.656 | −0.275 | −3.650 | 0.313 |

| DJ Islamic | −1.169 | −1.063 | −0.459 | −3.660 | 0.477 | −0.664 | −0.584 | −0.192 | −2.467 | 0.324 |

| S&P Green Bond | −0.521 | −0.504 | −0.317 | −0.853 | 0.100 | −0.333 | −0.315 | −0.152 | −0.919 | 0.103 |

| S&P Clean Energy | −1.799 | −1.722 | −0.899 | −3.834 | 0.492 | −1.019 | −0.935 | −0.347 | −3.534 | 0.400 |

| Euronext Vigeo | −1.526 | −1.388 | −0.622 | −6.648 | 0.655 | −0.937 | −0.835 | −0.290 | −4.776 | 0.461 |

| EEX-EU CO2 Emissions | −4.375 | −4.056 | −1.780 | −19.397 | 1.745 | −3.099 | −2.727 | −0.913 | −27.338 | 1.690 |

| S&P Green Building | −1.303 | −1.215 | −0.647 | −6.927 | 0.489 | −0.758 | −0.688 | −0.295 | −6.253 | 0.355 |

| S&P500 | −1.389 | −1.194 | −0.485 | −4.869 | 0.650 | −0.845 | −0.712 | −0.233 | −3.696 | 0.466 |

| Crude oil | −3.341 | −3.073 | −1.719 | −11.896 | 1.048 | −2.237 | −1.940 | −0.646 | −10.092 | 1.138 |

| Gold | −1.444 | −1.381 | −0.867 | −2.478 | 0.334 | −0.958 | −0.870 | −0.427 | −4.409 | 0.371 |

| STOXX | −1.461 | −1.320 | −0.556 | −6.083 | 0.639 | −0.906 | −0.798 | −0.265 | −4.042 | 0.448 |

| Nikkei | −2.037 | −1.830 | −0.749 | −6.763 | 0.833 | −1.242 | −1.105 | −0.398 | −6.030 | 0.593 |

| Hang Seng | −1.861 | −1.805 | −1.067 | −3.663 | 0.428 | −1.080 | −1.005 | −0.549 | −3.080 | 0.335 |

| US 2 EUR | −0.783 | −0.748 | −0.400 | −1.455 | 0.229 | −0.489 | −0.449 | −0.166 | −1.320 | 0.180 |

| Medium-run trend | Long-run trend | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | Std dev | Mean | Median | Max | Min | Std dev | |

| MSCI World ESG | −0.314 | −0.269 | −0.020 | −1.365 | 0.207 | −0.230 | −0.170 | 0.000 | −0.817 | 0.208 |

| FTSE Good Global | −0.310 | −0.261 | −0.016 | −1.391 | 0.219 | −0.229 | −0.178 | −0.001 | −0.797 | 0.204 |

| DJSI World | −0.346 | −0.294 | −0.015 | −1.305 | 0.228 | −0.120 | −0.097 | −0.015 | −0.385 | 0.083 |

| DJ Islamic | −0.332 | −0.288 | −0.013 | −1.086 | 0.224 | −0.318 | −0.278 | −0.001 | −0.991 | 0.241 |

| S&P Green Bond | −0.137 | −0.119 | −0.008 | −0.445 | 0.085 | −0.112 | −0.096 | −0.014 | −0.328 | 0.077 |

| S&P Clean Energy | −0.631 | −0.525 | −0.035 | −2.826 | 0.444 | −0.840 | −0.640 | −0.001 | −3.359 | 0.720 |

| Euronext Vigeo | −0.439 | −0.380 | −0.043 | −1.663 | 0.281 | −0.194 | −0.163 | −0.025 | −0.596 | 0.138 |

| EEX-EU CO2 Emissions | −1.329 | −1.073 | −0.048 | −7.481 | 1.037 | −0.872 | −0.715 | −0.002 | −2.275 | 0.656 |

| S&P Green Building | −0.408 | −0.336 | −0.041 | −2.574 | 0.310 | −1.219 | −1.045 | −0.006 | −3.841 | 0.946 |

| S&P500 | −0.310 | −0.259 | −0.021 | −1.571 | 0.208 | −0.087 | −0.068 | −0.009 | −0.342 | 0.076 |

| Crude oil | −1.083 | −0.775 | −0.028 | −18.798 | 1.596 | −1.775 | −0.979 | −0.002 | −10.198 | 2.339 |

| Gold | −0.446 | −0.396 | −0.056 | −1.437 | 0.259 | −0.452 | −0.370 | −0.001 | −1.538 | 0.365 |

| STOXX | −0.381 | −0.335 | −0.018 | −1.227 | 0.240 | −0.269 | −0.227 | −0.001 | −0.719 | 0.205 |

| Nikkei | −0.535 | −0.435 | −0.048 | −2.326 | 0.377 | −0.255 | −0.243 | 0.000 | −0.690 | 0.171 |

| Hang Seng | −0.476 | −0.425 | −0.057 | −1.338 | 0.277 | −0.443 | −0.393 | −0.001 | −1.241 | 0.328 |

| US 2 EUR | −0.213 | −0.189 | −0.012 | −0.726 | 0.135 | −0.191 | −0.147 | −0.001 | −0.630 | 0.163 |

- Note: This table reports the summary statistics of the VaR estimates for the short-, medium-, and long-term horizons. The VaR is estimated based on the conditional variances from the ARMA(1,0)-EGARCH(1,1) framework.

| Undecomposed series | Short-run trend | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | Std dev | Mean | Median | Max | Min | Std dev | |

| MSCI World ESG | −1.887 | −1.370 | −0.536 | −10.746 | 1.566 | −1.061 | −0.774 | −0.260 | −6.596 | 0.894 |

| FTSE Good Global | −1.803 | −1.350 | −0.586 | −9.276 | 1.390 | −1.042 | −0.790 | −0.346 | −7.063 | 0.857 |

| DJSI World | −1.717 | −1.321 | −0.606 | −8.284 | 1.230 | −0.996 | −0.766 | −0.277 | −6.481 | 0.772 |

| DJ Islamic | −1.890 | −1.529 | −0.596 | −9.706 | 1.383 | −1.089 | −0.843 | −0.228 | −6.546 | 0.850 |

| S&P Green Bond | −0.613 | −0.550 | −0.394 | −1.406 | 0.201 | −0.358 | −0.328 | −0.174 | −1.051 | 0.138 |

| S&P Clean Energy | −3.406 | −2.938 | −1.004 | −11.299 | 1.762 | −1.824 | −1.551 | −0.477 | −6.712 | 1.011 |

| Euronext Vigeo | −2.290 | −1.842 | −0.876 | −10.036 | 1.495 | −1.382 | −1.130 | −0.501 | −7.369 | 0.867 |

| EEX-EU CO2 Emissions | −4.569 | −4.193 | −2.884 | −10.258 | 1.287 | −3.171 | −2.952 | −1.378 | −8.965 | 1.207 |

| S&P Green Building | −2.087 | −1.700 | −0.665 | −8.441 | 1.379 | −1.039 | −0.848 | −0.355 | −4.109 | 0.660 |

| S&P500 | −2.326 | −1.733 | −0.723 | −12.733 | 1.838 | −1.385 | −1.034 | −0.292 | −9.338 | 1.138 |

| Crude oil | −13.941 | −3.675 | −2.224 | −475.093 | 47.668 | −5.290 | −2.275 | −0.880 | −195.084 | 14.908 |

| Gold | −1.872 | −1.817 | −1.119 | −2.996 | 0.431 | −1.121 | −0.994 | −0.459 | −3.983 | 0.503 |

| STOXX | −1.999 | −1.648 | −0.770 | −9.432 | 1.304 | −1.254 | −1.050 | −0.429 | −6.857 | 0.815 |

| Nikkei | −2.174 | −1.841 | −1.195 | −7.029 | 0.996 | −1.304 | −1.139 | −0.460 | −9.025 | 0.726 |

| Hang Seng | −2.199 | −2.130 | −1.275 | −4.716 | 0.606 | −1.260 | −1.150 | −0.623 | −4.410 | 0.468 |

| US 2 EUR | −0.734 | −0.739 | −0.425 | −1.068 | 0.164 | −0.456 | −0.438 | −0.229 | −1.060 | 0.140 |

| Medium-run trend | Long-run trend | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | Std dev | Mean | Median | Max | Min | Std dev | |

| MSCI World ESG | −0.511 | −0.323 | −0.025 | −2.568 | 0.542 | −0.164 | −0.122 | −0.002 | −0.534 | 0.120 |

| FTSE Good Global | −0.550 | −0.376 | −0.046 | −2.687 | 0.565 | −0.246 | −0.177 | −0.003 | −0.606 | 0.189 |

| DJSI World | −0.556 | −0.356 | −0.057 | −2.729 | 0.577 | −0.120 | −0.123 | −0.030 | −0.252 | 0.046 |

| DJ Islamic | −0.547 | −0.371 | −0.019 | −2.641 | 0.549 | −0.410 | −0.361 | −0.015 | −0.839 | 0.252 |

| S&P Green Bond | −0.200 | −0.129 | −0.014 | −0.860 | 0.195 | −0.152 | −0.166 | −0.038 | −0.218 | 0.055 |

| S&P Clean Energy | −0.803 | −0.417 | −0.076 | −4.266 | 0.981 | −1.354 | −1.420 | −0.007 | −2.619 | 0.756 |

| Euronext Vigeo | −0.746 | −0.497 | −0.032 | −3.409 | 0.728 | −0.191 | −0.188 | −0.038 | −0.558 | 0.100 |

| EEX-EU CO2 Emissions | −1.585 | −1.328 | −0.228 | −5.564 | 1.147 | −0.427 | −0.355 | −0.013 | −1.224 | 0.348 |

| S&P Green Building | −0.639 | −0.300 | −0.040 | −3.853 | 0.873 | −1.332 | −1.188 | −0.050 | −2.766 | 0.763 |

| S&P500 | −0.516 | −0.347 | −0.017 | −2.500 | 0.532 | −0.069 | −0.049 | −0.015 | −0.193 | 0.042 |

| Crude oil | −4.084 | −1.073 | −0.130 | −36.533 | 8.234 | −2.642 | −1.569 | −0.051 | −9.799 | 2.522 |

| Gold | −0.417 | −0.348 | −0.030 | −1.348 | 0.297 | −0.689 | −0.760 | −0.021 | −0.985 | 0.260 |

| STOXX | −0.629 | −0.407 | −0.051 | −3.126 | 0.667 | −0.198 | −0.127 | −0.009 | −0.488 | 0.143 |

| Nikkei | −0.681 | −0.521 | −0.080 | −2.744 | 0.554 | −0.154 | −0.130 | −0.007 | −0.457 | 0.104 |

| Hang Seng | −0.645 | −0.628 | −0.054 | −1.871 | 0.377 | −0.408 | −0.326 | −0.011 | −0.859 | 0.286 |

| US 2 EUR | −0.146 | −0.120 | −0.011 | −0.565 | 0.114 | −0.249 | −0.271 | −0.010 | −0.420 | 0.111 |

- Note: This table reports the summary statistics of the VaR estimates for the short-, medium-, and long-term horizons. The VaR is estimated based on the conditional variances from the ARMA(1,0)-EGARCH(1,1) framework.

The VaR provides an estimate of the maximum expected loss of an asset, given a tail probability. Therefore, we utilize the CoVaR and to evaluate how the systemic risk of an EESG asset depends on some extreme event of conventional assets. In addition, the preferences of the investors tend to differ over frequency horizons (represented by frequencies), indicating their preferences for a particular frequency. Therefore, to capture the heterogeneity of investment patterns caused by economic shocks, we estimate the CoVaR and for short-, medium-, and long-term trends. This process allows us to capture diverse trading horizons due to stock market fluctuations and cycles of different lengths. Therefore, a shock with a stronger short-term (long-term) impact is expected to exhibit higher power in high (low) frequency, indicating short-term (long-term) systemic connectedness when transmitted to other assets. For instance, a permanent variation in the expectation of an investor regarding the soundness of an individual underlying asset may be better reflected by the long-term systemic risk and connectedness structure than by short-term ones. In accordance with the theoretical assertion, Bandi and Tamoni (2017), Baruník and Křehlík (2018), and Cogley (2001) argue that the time-preferences of investors' consumption and the resultant consumption growth have distinct cyclical components that produce shocks with heterogeneous frequency responses.

Tables 5 and 6 reports the descriptive statistics of the CoVaR estimates for various investment horizons for the pre- and during-COVID subsamples, respectively. For the undecomposed series over both subsamples, the mean CoVaR for the EESG and the financial indices are significantly higher than they are for the commodity and forex markets. This is because the EESG assets exhibit homogeneous properties to those of the financial indices and heterogeneous characteristics with the commodity and forex market. Furthermore, it implies that these financial indices are more sensitive to uncertainty shocks from the EESG assets, indicating a seismic change in the investment principles of the market participants towards a more positive kind of EESG investing. However, the highest CoVaR estimates are observed for crude oil over both subsamples. For the pre-COVID period, it can be argued that the crude oil exhibit unfavorability towards sustainability, resulting an increased estimates of CoVaR. Whereas, for the latter subsample, the significant decline in crude oil futures prices to subzero level during the pandemic led to a significantly higher estimates of CoVaR. The CoVaR between gold and EESG assets indicates significantly lower CoVaR estimates over both subsamples. This may be attributed to the flight-to-safety phenomenon, indicating that the market participants are embedding the EESG-related uncertainties with a safer asset. In contrast, the lowest estimates of CoVaR are observed for the exchange rate, indicating a significantly lower responsiveness of US to EUR exchange rate to risk shocks in the EESG indices.

| Undecomposed | Short-run trend | Medium-run trend | Long-run trend | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | ||

| Panel A: S&P500 | MSCI World ESG | −1.849 | −1.680 | 0.606 | −1.201 | −1.098 | 0.392 | −0.378 | −0.332 | 0.208 | −0.244 | −0.185 | 0.207 |

| FTSE Good Global | −1.965 | −1.850 | 0.513 | −1.390 | −1.301 | 0.372 | −0.376 | −0.328 | 0.219 | −0.186 | −0.148 | 0.149 | |

| DJSI World | −2.188 | −2.092 | 0.477 | −1.557 | −1.486 | 0.356 | −0.424 | −0.375 | 0.219 | −0.117 | −0.100 | 0.062 | |

| DJ Islamic | −1.908 | −1.783 | 0.565 | −1.265 | −1.164 | 0.409 | −0.408 | −0.363 | 0.230 | −0.275 | −0.243 | 0.187 | |

| S&P Green Bond | −1.522 | −1.524 | 0.015 | −0.889 | −0.895 | 0.035 | −0.320 | −0.309 | 0.051 | −0.132 | −0.120 | 0.058 | |

| S&P Clean Energy | −2.221 | −2.180 | 0.257 | −1.492 | −1.446 | 0.219 | −0.538 | −0.478 | 0.252 | −0.278 | −0.221 | 0.205 | |

| Euronext Vigeo | −2.252 | −2.164 | 0.418 | −1.514 | −1.456 | 0.260 | −0.465 | −0.423 | 0.202 | −0.113 | −0.101 | 0.053 | |

| EEX-EU CO2 | −2.098 | −2.061 | 0.199 | −1.241 | −1.213 | 0.124 | −0.389 | −0.361 | 0.112 | −0.178 | −0.156 | 0.092 | |

| S&P Green Build | −2.321 | −2.253 | 0.379 | −1.434 | −1.389 | 0.231 | −0.434 | −0.387 | 0.199 | −0.498 | −0.433 | 0.357 | |

| Panel B: Crude oil | MSCI World ESG | −4.462 | −4.337 | 0.448 | −3.239 | −3.164 | 0.285 | −0.823 | −0.802 | 0.096 | −3.987 | −3.148 | 2.913 |

| FTSE Good Global | −4.493 | −4.396 | 0.432 | −3.284 | −3.215 | 0.288 | −0.836 | −0.810 | 0.118 | −3.446 | −2.864 | 2.320 | |

| DJSI World | −4.526 | −4.445 | 0.406 | −3.287 | −3.229 | 0.292 | −0.869 | −0.840 | 0.127 | −2.487 | −2.181 | 1.074 | |

| DJ Islamic | −4.570 | −4.467 | 0.463 | −3.195 | −3.126 | 0.280 | −0.770 | −0.757 | 0.065 | −3.389 | −3.106 | 1.698 | |

| S&P Green Bond | −3.854 | −3.850 | 0.025 | −2.704 | −2.709 | 0.026 | −0.319 | −0.373 | 0.247 | −1.669 | −1.610 | 0.284 | |

| S&P Clean Energy | −4.710 | −4.665 | 0.283 | −3.250 | −3.196 | 0.258 | −0.781 | −0.762 | 0.079 | −2.907 | −2.480 | 1.536 | |

| Euronext Vigeo | −4.530 | −4.427 | 0.489 | −3.290 | −3.223 | 0.304 | −0.910 | −0.878 | 0.153 | −2.103 | −1.882 | 0.973 | |

| EEX-EU CO2 | −5.147 | −5.042 | 0.578 | −3.471 | −3.376 | 0.431 | −0.721 | −0.716 | 0.022 | −2.805 | −2.521 | 1.184 | |

| S&P Green Build | −4.401 | −4.341 | 0.332 | −3.304 | −3.252 | 0.262 | −0.615 | −0.632 | 0.075 | −8.848 | −7.687 | 6.319 | |

| Panel C: Gold | MSCI World ESG | −1.654 | −1.649 | 0.018 | −3.239 | −3.164 | 0.285 | −0.340 | −0.332 | 0.035 | −0.210 | −0.181 | 0.100 |

| FTSE Good Global | −1.677 | −1.670 | 0.032 | −3.284 | −3.215 | 0.288 | −0.341 | −0.332 | 0.040 | −0.191 | −0.171 | 0.083 | |

| DJSI World | −1.784 | −1.770 | 0.067 | −3.287 | −3.229 | 0.292 | −0.348 | −0.338 | 0.042 | −0.166 | −0.152 | 0.049 | |

| DJ Islamic | −1.797 | −1.779 | 0.083 | −3.195 | −3.126 | 0.280 | −0.347 | −0.339 | 0.043 | −0.328 | −0.297 | 0.188 | |

| S&P Green Bond | −2.083 | −2.060 | 0.142 | −2.704 | −2.709 | 0.026 | −0.346 | −0.335 | 0.052 | −0.227 | −0.203 | 0.118 | |

| S&P Clean Energy | −1.646 | −1.642 | 0.022 | −3.250 | −3.196 | 0.258 | −0.366 | −0.351 | 0.062 | −0.327 | −0.271 | 0.204 | |

| Euronext Vigeo | −1.544 | −1.548 | 0.020 | −3.290 | −3.223 | 0.304 | −0.344 | −0.336 | 0.035 | −0.093 | −0.094 | 0.005 | |

| EEX-EU CO2 | −1.724 | −1.712 | 0.065 | −3.471 | −3.376 | 0.431 | −0.360 | −0.344 | 0.063 | 0.085 | 0.054 | 0.132 | |

| S&P Green Build | −1.772 | −1.758 | 0.078 | −3.304 | −3.252 | 0.262 | −0.338 | −0.329 | 0.038 | 0.002 | −0.013 | 0.078 | |

| Panel D: STOXX | MSCI World ESG | −2.076 | −1.941 | 0.484 | −1.308 | −1.245 | 0.237 | −0.452 | −0.403 | 0.224 | −0.395 | −0.302 | 0.321 |

| FTSE Good Global | −2.084 | −1.986 | 0.437 | −1.332 | −1.268 | 0.263 | −0.462 | −0.412 | 0.230 | −0.368 | −0.297 | 0.283 | |

| DJSI World | −2.134 | −2.043 | 0.456 | −1.340 | −1.283 | 0.287 | −0.500 | −0.445 | 0.241 | −0.226 | −0.194 | 0.115 | |

| DJ Islamic | −2.229 | −2.131 | 0.444 | −1.321 | −1.269 | 0.210 | −0.525 | −0.478 | 0.242 | −0.407 | −0.365 | 0.254 | |

| S&P Green Bond | −1.409 | −1.416 | 0.039 | −0.943 | −0.953 | 0.052 | −0.255 | −0.259 | 0.021 | −0.072 | −0.074 | 0.010 | |

| S&P Clean Energy | −2.181 | −2.144 | 0.234 | −1.463 | −1.424 | 0.188 | −0.540 | −0.488 | 0.217 | −0.369 | −0.296 | 0.259 | |

| Euronext Vigeo | −1.758 | −1.631 | 0.600 | −1.129 | −1.035 | 0.426 | −0.440 | −0.389 | 0.244 | −0.162 | −0.138 | 0.105 | |

| EEX-EU CO2 | −2.226 | −2.184 | 0.233 | −1.410 | −1.372 | 0.172 | −0.460 | −0.426 | 0.136 | −0.309 | −0.267 | 0.178 | |

| S&P Green Build | −2.270 | −2.198 | 0.400 | −1.448 | −1.398 | 0.253 | −0.501 | −0.449 | 0.221 | −0.957 | −0.827 | 0.706 | |

| Panel E: Nikkei | MSCI World ESG | −2.669 | −2.577 | 0.332 | −1.537 | −1.525 | 0.044 | −0.524 | −0.478 | 0.211 | −0.372 | −0.287 | 0.294 |

| FTSE Good Global | −2.628 | −2.561 | 0.299 | −1.559 | −1.547 | 0.048 | −0.539 | −0.491 | 0.221 | −0.220 | −0.188 | 0.126 | |

| DJSI World | −2.682 | −2.626 | 0.281 | −1.585 | −1.574 | 0.053 | −0.561 | −0.512 | 0.216 | −0.131 | −0.122 | 0.030 | |

| DJ Islamic | −2.543 | −2.488 | 0.251 | −1.557 | −1.546 | 0.045 | −0.562 | −0.519 | 0.217 | −0.155 | −0.147 | 0.050 | |

| S&P Green Bond | −2.065 | −2.068 | 0.014 | −1.408 | −1.410 | 0.010 | −0.373 | −0.373 | 0.000 | −0.078 | −0.080 | 0.009 | |

| S&P Clean Energy | −2.772 | −2.741 | 0.195 | −1.604 | −1.592 | 0.059 | −0.590 | −0.542 | 0.198 | −0.176 | −0.155 | 0.076 | |

| Euronext Vigeo | −2.696 | −2.621 | 0.354 | −1.624 | −1.607 | 0.077 | −0.586 | −0.537 | 0.233 | −0.166 | −0.149 | 0.075 | |

| EEX-EU CO2 | −2.491 | −2.468 | 0.129 | −1.456 | −1.453 | 0.014 | −0.471 | −0.450 | 0.084 | −0.462 | −0.393 | 0.288 | |

| S&P Green Build | −2.757 | −2.701 | 0.308 | −1.707 | −1.681 | 0.132 | −0.530 | −0.487 | 0.183 | −0.403 | −0.357 | 0.251 | |

| Panel F: Hang Seng | MSCI World ESG | −2.344 | −2.267 | 0.276 | −1.340 | −1.324 | 0.063 | −0.452 | −0.422 | 0.136 | −0.338 | −0.269 | 0.239 |

| FTSE Good Global | −2.319 | −2.264 | 0.245 | −1.337 | −1.320 | 0.069 | −0.451 | −0.418 | 0.149 | −0.303 | −0.252 | 0.203 | |

| DJSI World | −2.400 | −2.347 | 0.265 | −1.358 | −1.339 | 0.097 | −0.480 | −0.444 | 0.160 | −0.208 | −0.180 | 0.096 | |

| DJ Islamic | −2.375 | −2.314 | 0.277 | −1.345 | −1.329 | 0.068 | −0.486 | −0.452 | 0.171 | −0.348 | −0.314 | 0.201 | |

| S&P Green Bond | −2.129 | −2.122 | 0.043 | −1.164 | −1.165 | 0.009 | −0.450 | −0.433 | 0.079 | −0.147 | −0.140 | 0.033 | |

| S&P Clean Energy | −2.366 | −2.336 | 0.184 | −1.438 | −1.415 | 0.111 | −0.499 | −0.463 | 0.154 | −0.348 | −0.282 | 0.236 | |

| Euronext Vigeo | −2.481 | −2.407 | 0.350 | −1.491 | −1.457 | 0.152 | −0.466 | −0.438 | 0.136 | −0.256 | −0.229 | 0.119 | |

| EEX-EU CO2 | −2.273 | −2.247 | 0.143 | −1.269 | −1.259 | 0.046 | −0.459 | −0.434 | 0.103 | −0.168 | −0.156 | 0.051 | |

| S&P Green Build | −2.541 | −2.485 | 0.311 | −1.477 | −1.444 | 0.167 | −0.421 | −0.395 | 0.108 | −0.877 | −0.763 | 0.620 | |

| Panel G: US to EUR | MSCI World ESG | −0.775 | −0.777 | 0.008 | −0.520 | −0.526 | 0.024 | −0.106 | −0.112 | 0.027 | 0.079 | 0.053 | 0.103 |

| FTSE Good Global | −0.889 | −0.870 | 0.083 | −0.594 | −0.588 | 0.026 | −0.126 | −0.128 | 0.011 | −0.068 | −0.064 | 0.020 | |

| DJSI World | −0.925 | −0.905 | 0.089 | −0.600 | −0.594 | 0.030 | −0.128 | −0.130 | 0.008 | −0.089 | −0.086 | 0.032 | |

| DJ Islamic | −0.908 | −0.890 | 0.079 | −0.578 | −0.574 | 0.015 | −0.125 | −0.127 | 0.012 | −0.083 | −0.081 | 0.027 | |

| S&P Green Bond | −1.112 | −1.075 | 0.182 | −0.660 | −0.634 | 0.137 | −0.224 | −0.199 | 0.112 | −0.074 | −0.069 | 0.034 | |

| S&P Clean Energy | −0.866 | −0.857 | 0.049 | −0.593 | −0.588 | 0.023 | −0.148 | −0.146 | 0.007 | −0.071 | −0.070 | 0.018 | |

| Euronext Vigeo | −0.670 | −0.685 | 0.065 | −0.492 | −0.502 | 0.039 | −0.100 | −0.107 | 0.031 | 0.002 | −0.006 | 0.031 | |

| EEX-EU CO2 | −0.901 | −0.891 | 0.049 | −0.555 | −0.555 | 0.004 | −0.167 | −0.162 | 0.020 | −0.016 | −0.020 | 0.021 | |

| S&P Green Build | −0.882 | −0.862 | 0.086 | −0.591 | −0.584 | 0.031 | −0.135 | −0.136 | 0.005 | −0.194 | −0.173 | 0.125 | |

- Note: This paper presents the summary statistics of the conditional VaR (CoVaR) between EESG assets and the conventional assets for the original and decomposed return series.

| Undecomposed | Short-run trend | Medium-run trend | Long-run trend | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | ||

| Panel A: S&P500 | MSCI World ESG | −2.727 | −2.111 | 1.867 | −1.703 | −1.352 | 1.093 | −0.576 | −0.387 | 0.545 | −0.179 | −0.137 | 0.120 |

| FTSE Good Global | −2.730 | −2.212 | 1.588 | −1.841 | −1.538 | 1.027 | −0.616 | −0.442 | 0.563 | −0.198 | −0.147 | 0.139 | |

| DJSI World | −2.732 | −2.303 | 1.329 | −1.872 | −1.611 | 0.876 | −0.627 | −0.434 | 0.554 | −0.117 | −0.119 | 0.034 | |

| DJ Islamic | −2.761 | −2.334 | 1.636 | −1.802 | −1.491 | 1.073 | −0.629 | −0.448 | 0.565 | −0.345 | −0.307 | 0.196 | |

| S&P Green Bond | −1.508 | −1.518 | 0.029 | −0.880 | −0.891 | 0.047 | −0.358 | −0.315 | 0.118 | −0.162 | −0.172 | 0.041 | |

| S&P Clean Energy | −3.061 | −2.816 | 0.921 | −1.932 | −1.783 | 0.553 | −0.635 | −0.416 | 0.555 | −0.424 | −0.443 | 0.216 | |

| Euronext Vigeo | −2.740 | −2.454 | 0.954 | −1.765 | −1.622 | 0.489 | −0.686 | −0.508 | 0.523 | −0.112 | −0.111 | 0.038 | |

| EEX-EU CO2 | −2.120 | −2.077 | 0.147 | −1.246 | −1.230 | 0.089 | −0.416 | −0.389 | 0.124 | −0.115 | −0.105 | 0.049 | |

| S&P Green Build | −2.927 | −2.627 | 1.067 | −1.617 | −1.492 | 0.430 | −0.583 | −0.364 | 0.562 | −0.541 | −0.487 | 0.288 | |

| Panel B: Crude oil | MSCI World ESG | −5.111 | −4.656 | 1.380 | −3.604 | −3.348 | 0.794 | −0.915 | −0.827 | 0.253 | −3.066 | −2.470 | 1.684 |

| FTSE Good Global | −5.138 | −4.701 | 1.339 | −3.633 | −3.399 | 0.795 | −0.966 | −0.872 | 0.303 | −3.629 | −2.847 | 2.157 | |

| DJSI World | −4.990 | −4.625 | 1.133 | −3.547 | −3.331 | 0.720 | −0.987 | −0.875 | 0.322 | −2.491 | −2.526 | 0.592 | |

| DJ Islamic | −5.268 | −4.918 | 1.341 | −3.564 | −3.350 | 0.736 | −0.832 | −0.781 | 0.158 | −4.032 | −3.688 | 1.777 | |

| S&P Green Bond | −3.877 | −3.861 | 0.050 | −2.698 | −2.706 | 0.035 | −0.137 | −0.341 | 0.567 | −1.817 | −1.869 | 0.203 | |

| S&P Clean Energy | −5.636 | −5.366 | 1.015 | −3.769 | −3.593 | 0.652 | −0.812 | −0.743 | 0.175 | −4.003 | −4.144 | 1.614 | |

| Euronext Vigeo | −5.102 | −4.766 | 1.117 | −3.584 | −3.417 | 0.572 | −1.077 | −0.942 | 0.396 | −2.080 | −2.060 | 0.700 | |

| EEX-EU CO2 | −5.212 | −5.087 | 0.426 | −3.489 | −3.433 | 0.308 | −0.726 | −0.721 | 0.024 | −2.003 | −1.871 | 0.629 | |

| S&P Green Build | −4.934 | −4.671 | 0.937 | −3.511 | −3.369 | 0.488 | −0.559 | −0.641 | 0.210 | −9.602 | −8.644 | 5.097 | |

| Panel C: Gold | MSCI World ESG | −1.654 | −1.649 | 0.018 | −3.239 | −3.164 | 0.285 | −0.340 | −0.332 | 0.035 | −0.210 | −0.181 | 0.100 |

| FTSE Good Global | −1.677 | −1.670 | 0.032 | −3.284 | −3.215 | 0.288 | −0.341 | −0.332 | 0.040 | −0.191 | −0.171 | 0.083 | |

| DJSI World | −1.784 | −1.770 | 0.067 | −3.287 | −3.229 | 0.292 | −0.348 | −0.338 | 0.042 | −0.166 | −0.152 | 0.049 | |

| DJ Islamic | −1.797 | −1.779 | 0.083 | −3.195 | −3.126 | 0.280 | −0.347 | −0.339 | 0.043 | −0.328 | −0.297 | 0.188 | |

| S&P Green Bond | −2.083 | −2.060 | 0.142 | −2.704 | −2.709 | 0.026 | −0.346 | −0.335 | 0.052 | −0.227 | −0.203 | 0.118 | |

| S&P Clean Energy | −1.646 | −1.642 | 0.022 | −3.250 | −3.196 | 0.258 | −0.366 | −0.351 | 0.062 | −0.327 | −0.271 | 0.204 | |

| Euronext Vigeo | −1.544 | −1.548 | 0.020 | −3.290 | −3.223 | 0.304 | −0.344 | −0.336 | 0.035 | −0.093 | −0.094 | 0.005 | |

| EEX-EU CO2 | −1.724 | −1.712 | 0.065 | −3.471 | −3.376 | 0.431 | −0.360 | −0.344 | 0.063 | 0.085 | 0.054 | 0.132 | |

| S&P Green Build | −1.772 | −1.758 | 0.078 | −3.304 | −3.252 | 0.262 | −0.338 | −0.329 | 0.038 | 0.002 | −0.013 | 0.078 | |

| Panel D: STOXX | MSCI World ESG | −2.778 | −2.286 | 1.491 | −1.611 | −1.399 | 0.660 | −0.666 | −0.462 | 0.588 | −0.293 | −0.227 | 0.186 |

| FTSE Good Global | −2.736 | −2.295 | 1.352 | −1.650 | −1.436 | 0.725 | −0.715 | −0.532 | 0.593 | −0.390 | −0.294 | 0.263 | |

| DJSI World | −2.656 | −2.245 | 1.273 | −1.595 | −1.384 | 0.706 | −0.723 | −0.510 | 0.612 | −0.227 | −0.231 | 0.063 | |

| DJ Islamic | −2.900 | −2.564 | 1.287 | −1.597 | −1.437 | 0.553 | −0.758 | −0.567 | 0.592 | −0.503 | −0.452 | 0.266 | |

| S&P Green Bond | −1.373 | −1.398 | 0.078 | −0.931 | −0.946 | 0.070 | −0.240 | −0.257 | 0.047 | −0.067 | −0.065 | 0.007 | |

| S&P Clean Energy | −2.945 | −2.722 | 0.838 | −1.843 | −1.714 | 0.476 | −0.624 | −0.435 | 0.480 | −0.554 | −0.578 | 0.273 | |

| Euronext Vigeo | −2.459 | −2.048 | 1.370 | −1.540 | −1.307 | 0.801 | −0.707 | −0.491 | 0.632 | −0.159 | −0.157 | 0.076 | |

| EEX-EU CO2 | −2.252 | −2.202 | 0.172 | −1.417 | −1.395 | 0.123 | −0.493 | −0.460 | 0.150 | −0.189 | −0.169 | 0.094 | |

| S&P Green Build | −2.911 | −2.594 | 1.127 | −1.648 | −1.511 | 0.470 | −0.666 | −0.423 | 0.624 | −1.041 | −0.934 | 0.570 | |

| Panel E: Nikkei | MSCI World ESG | −3.151 | −2.813 | 1.023 | −1.594 | −1.554 | 0.124 | −0.725 | −0.533 | 0.552 | −0.279 | −0.219 | 0.170 |

| FTSE Good Global | −3.074 | −2.773 | 0.926 | −1.617 | −1.578 | 0.132 | −0.782 | −0.606 | 0.569 | −0.229 | −0.187 | 0.117 | |

| DJSI World | −3.003 | −2.750 | 0.784 | −1.632 | −1.593 | 0.131 | −0.761 | −0.571 | 0.548 | −0.131 | −0.132 | 0.017 | |

| DJ Islamic | −2.922 | −2.733 | 0.728 | −1.616 | −1.582 | 0.117 | −0.770 | −0.599 | 0.532 | −0.174 | −0.164 | 0.053 | |

| S&P Green Bond | −2.053 | −2.061 | 0.028 | −1.406 | −1.409 | 0.013 | −0.373 | −0.373 | 0.000 | −0.073 | −0.072 | 0.007 | |

| S&P Clean Energy | −3.410 | −3.224 | 0.700 | −1.722 | −1.682 | 0.148 | −0.667 | −0.494 | 0.437 | −0.231 | −0.238 | 0.080 | |

| Euronext Vigeo | −3.109 | −2.867 | 0.808 | −1.698 | −1.656 | 0.145 | −0.840 | −0.634 | 0.603 | −0.164 | −0.163 | 0.054 | |

| EEX-EU CO2 | −2.506 | −2.478 | 0.095 | −1.457 | −1.455 | 0.010 | −0.491 | −0.471 | 0.093 | −0.267 | −0.235 | 0.153 | |

| S&P Green Build | −3.251 | −3.007 | 0.870 | −1.812 | −1.740 | 0.246 | −0.666 | −0.466 | 0.515 | −0.433 | −0.395 | 0.203 | |

| Panel F: Hang Seng | MSCI World ESG | −2.743 | −2.463 | 0.849 | −1.420 | −1.364 | 0.174 | −0.581 | −0.458 | 0.355 | −0.262 | −0.213 | 0.138 |

| FTSE Good Global | −2.685 | −2.437 | 0.760 | −1.420 | −1.364 | 0.190 | −0.614 | −0.496 | 0.383 | −0.319 | −0.251 | 0.188 | |

| DJSI World | −2.703 | −2.465 | 0.740 | −1.444 | −1.373 | 0.239 | −0.628 | −0.487 | 0.405 | −0.208 | −0.211 | 0.053 | |

| DJ Islamic | −2.792 | −2.583 | 0.802 | −1.434 | −1.383 | 0.177 | −0.650 | −0.515 | 0.418 | −0.424 | −0.383 | 0.211 | |

| S&P Green Bond | −2.168 | −2.141 | 0.086 | −1.162 | −1.164 | 0.011 | −0.508 | −0.443 | 0.181 | −0.164 | −0.170 | 0.024 | |

| S&P Clean Energy | −2.968 | −2.793 | 0.661 | −1.663 | −1.587 | 0.282 | −0.559 | −0.425 | 0.340 | −0.516 | −0.538 | 0.248 | |

| Euronext Vigeo | −2.889 | −2.650 | 0.798 | −1.638 | −1.555 | 0.287 | −0.615 | −0.495 | 0.353 | −0.253 | −0.251 | 0.085 | |

| EEX-EU CO2 | −2.289 | −2.258 | 0.105 | −1.271 | −1.265 | 0.033 | −0.485 | −0.459 | 0.114 | −0.134 | −0.128 | 0.027 | |

| S&P Green Build | −3.039 | −2.793 | 0.876 | −1.609 | −1.519 | 0.311 | −0.501 | −0.383 | 0.303 | −0.951 | −0.857 | 0.500 | |

| Panel G: US to EUR | MSCI World ESG | −0.734 | −0.744 | 0.028 | −0.483 | −0.496 | 0.040 | −0.098 | −0.112 | 0.041 | −0.046 | −0.045 | 0.003 |

| FTSE Good Global | −0.950 | −0.900 | 0.153 | −0.594 | −0.582 | 0.044 | −0.141 | −0.140 | 0.003 | −0.054 | −0.051 | 0.010 | |

| DJSI World | −0.951 | −0.904 | 0.147 | −0.606 | −0.591 | 0.053 | −0.143 | −0.142 | 0.004 | −0.061 | −0.062 | 0.007 | |

| DJ Islamic | −0.961 | −0.923 | 0.146 | −0.562 | −0.557 | 0.017 | −0.132 | −0.134 | 0.008 | −0.088 | −0.083 | 0.028 | |

| S&P Green Bond | −1.190 | −1.107 | 0.263 | −0.688 | −0.651 | 0.167 | −0.267 | −0.201 | 0.184 | −0.106 | −0.113 | 0.029 | |

| S&P Clean Energy | −1.001 | −0.967 | 0.130 | −0.606 | −0.595 | 0.041 | −0.157 | −0.148 | 0.021 | −0.087 | −0.090 | 0.025 | |

| Euronext Vigeo | −0.650 | −0.672 | 0.075 | −0.439 | −0.457 | 0.062 | −0.069 | −0.091 | 0.064 | −0.045 | −0.045 | 0.001 | |

| EEX-EU CO2 | −0.901 | −0.891 | 0.035 | −0.517 | −0.518 | 0.006 | −0.146 | −0.145 | 0.004 | −0.035 | −0.037 | 0.008 | |

| S&P Green Build | −0.952 | −0.910 | 0.151 | −0.594 | −0.581 | 0.044 | −0.153 | −0.145 | 0.021 | −0.213 | −0.194 | 0.098 | |

- Note: This paper presents the summary statistics of the conditional VaR (CoVaR) between EESG assets and the conventional assets for the original and decomposed return series.

The CoVaR estimates for the short-, medium-, and long-run trends closely follows the structure of the undecomposed series over both subsamples. Notably, the estimates of CoVaR significantly as the investment horizon becomes longer, indicating a decreased sensitivity to risk shocks over both subsamples. Overall, these findings indicate that the risk spillover from the EESG assets to financial indices are significantly higher than the commodities and the forex markets, implying similarity to the financial indices and difference from the commodity and currency markets.

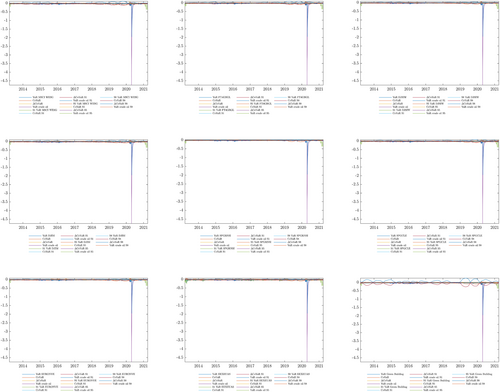

Tables 7 and 8 presents the summary statistics of the Delta CoVaR for the undecomposed and the decomposed return series for the pre and during-COVID subsamples, respectively. The is estimated as the difference between the VaR of an underlying EESG returns conditional on the extreme movement of financial indices, commodities, and currencies, and the VaR of the underlying EESG returns conditional on the median values (normal state) of financial indices, commodities, and currencies return. The provides an estimate of systemic risk contribution of an EESG asset to the other assets in our sample. Similar to the CoVaR estimates, the of the major financial indexes are significantly higher than that of commodity and currency markets over both subsamples. These findings are consistent with our prior expectations of the similarities to major financial indices, indicating that the EESG assets are systemically more important in financial markets. The lower estimates of in the case of commodities and currencies indicate the heterogeneous properties of EESG with these assets. The higher systemic risk connectedness of EESG to the financial indices are consistent with Hkiri et al. (2017); Jain et al. (2019); Kenourgios et al. (2016); Rizvi et al. (2015); Umar et al. (2020); Yilmaz et al. (2015); Abu-Alkheil et al. (2017). They report significantly greater connectedness and cointegration between the conventional financial indices and the EESG assets. The lower systemic risk contribution over the long-term horizon is consistent with Abu-Alkheil et al. (2017) who report “absence of cointegration” between conventional financial indices and the EESG assets over the long-term horizon. Furthermore, the lower risk contribution of EESG to commodities and currencies is consistent with Mensi et al. (2015), indicating that less of a connection between Sharia stocks, gold and U.S. treasury bills (T-bills) can present a hedging opportunity for the six GCC stock markets.

| Undecomposed | Short-run trend | Medium-run trend | Long-run trend | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | ||

| Panel A: S&P500 | MSCI World ESG | −1.418 | −1.249 | 0.606 | −0.802 | −0.698 | 0.392 | −0.321 | −0.275 | 0.208 | −0.230 | −0.171 | 0.207 |

| FTSE Good Global | −1.329 | −1.214 | 0.513 | −0.804 | −0.714 | 0.372 | −0.311 | −0.263 | 0.219 | −0.166 | −0.129 | 0.149 | |

| DJSI World | −1.340 | −1.244 | 0.477 | −0.828 | −0.758 | 0.356 | −0.339 | −0.289 | 0.219 | −0.087 | −0.070 | 0.062 | |

| DJ Islamic | −1.419 | −1.294 | 0.565 | −0.837 | −0.736 | 0.409 | −0.342 | −0.297 | 0.230 | −0.242 | −0.211 | 0.187 | |

| S&P Green Bond | 0.077 | 0.075 | 0.015 | 0.114 | 0.108 | 0.035 | −0.084 | −0.073 | 0.051 | −0.086 | −0.074 | 0.058 | |

| S&P Clean Energy | −0.965 | −0.924 | 0.257 | −0.554 | −0.508 | 0.219 | −0.357 | −0.297 | 0.252 | −0.238 | −0.181 | 0.205 | |

| Euronext Vigeo | −0.994 | −0.906 | 0.418 | −0.526 | −0.468 | 0.260 | −0.320 | −0.278 | 0.202 | −0.075 | −0.063 | 0.053 | |

| EEX-EU CO2 | −0.484 | −0.448 | 0.199 | −0.227 | −0.199 | 0.124 | −0.143 | −0.115 | 0.112 | −0.121 | −0.099 | 0.092 | |

| S&P Green Build | −1.024 | −0.956 | 0.379 | −0.495 | −0.450 | 0.231 | −0.264 | −0.218 | 0.199 | −0.457 | −0.392 | 0.357 | |

| Panel B: Crude oil | MSCI World ESG | −1.048 | −0.923 | 0.448 | −0.583 | −0.507 | 0.285 | −0.149 | −0.128 | 0.096 | −3.242 | −2.403 | 2.913 |

| FTSE Good Global | −1.120 | −1.023 | 0.432 | −0.623 | −0.553 | 0.288 | −0.167 | −0.141 | 0.118 | −2.582 | −1.999 | 2.320 | |

| DJSI World | −1.142 | −1.061 | 0.406 | −0.681 | −0.623 | 0.292 | −0.197 | −0.168 | 0.127 | −1.520 | −1.214 | 1.074 | |

| DJ Islamic | −1.163 | −1.060 | 0.463 | −0.574 | −0.505 | 0.280 | −0.096 | −0.083 | 0.065 | −2.202 | −1.919 | 1.698 | |

| S&P Green Bond | −0.130 | −0.126 | 0.025 | 0.086 | 0.082 | 0.026 | 0.403 | 0.350 | 0.247 | −0.420 | −0.361 | 0.284 | |

| S&P Clean Energy | −1.064 | −1.019 | 0.283 | −0.654 | −0.600 | 0.258 | −0.113 | −0.094 | 0.079 | −1.781 | −1.354 | 1.536 | |

| Euronext Vigeo | −1.165 | −1.061 | 0.489 | −0.616 | −0.548 | 0.304 | −0.242 | −0.210 | 0.153 | −1.368 | −1.148 | 0.973 | |

| EEX-EU CO2 | −1.408 | −1.302 | 0.578 | −0.786 | −0.691 | 0.431 | −0.027 | −0.022 | 0.022 | −1.554 | −1.270 | 1.184 | |

| S&P Green Build | −0.899 | −0.839 | 0.332 | −0.561 | −0.509 | 0.262 | 0.099 | 0.081 | 0.075 | −8.105 | −6.944 | 6.319 | |

| Panel C: Gold | MSCI World ESG | −0.042 | −0.037 | 0.018 | −0.583 | −0.507 | 0.285 | −0.053 | −0.046 | 0.035 | −0.112 | −0.083 | 0.100 |

| FTSE Good Global | −0.082 | −0.075 | 0.032 | −0.623 | −0.553 | 0.288 | −0.057 | −0.048 | 0.040 | −0.093 | −0.072 | 0.083 | |

| DJSI World | −0.189 | −0.176 | 0.067 | −0.681 | −0.623 | 0.292 | −0.066 | −0.056 | 0.042 | −0.070 | −0.056 | 0.049 | |

| DJ Islamic | −0.209 | −0.190 | 0.083 | −0.574 | −0.505 | 0.280 | −0.064 | −0.055 | 0.043 | −0.244 | −0.212 | 0.188 | |

| S&P Green Bond | −0.747 | −0.724 | 0.142 | 0.086 | 0.082 | 0.026 | −0.084 | −0.073 | 0.052 | −0.174 | −0.150 | 0.118 | |

| S&P Clean Energy | −0.081 | −0.077 | 0.022 | −0.654 | −0.600 | 0.258 | −0.088 | −0.073 | 0.062 | −0.237 | −0.180 | 0.204 | |

| Euronext Vigeo | 0.048 | 0.043 | 0.020 | −0.616 | −0.548 | 0.304 | −0.056 | −0.048 | 0.035 | 0.007 | 0.006 | 0.005 | |

| EEX-EU CO2 | −0.159 | −0.147 | 0.065 | −0.786 | −0.691 | 0.431 | −0.080 | −0.065 | 0.063 | 0.173 | 0.142 | 0.132 | |

| S&P Green Build | −0.210 | −0.196 | 0.078 | −0.561 | −0.509 | 0.262 | −0.051 | −0.042 | 0.038 | 0.101 | 0.086 | 0.078 | |

| Panel D: STOXX | MSCI World ESG | −1.133 | −0.998 | 0.484 | −0.484 | −0.422 | 0.237 | −0.347 | −0.297 | 0.224 | −0.357 | −0.265 | 0.321 |

| FTSE Good Global | −1.132 | −1.034 | 0.437 | −0.568 | −0.504 | 0.263 | −0.328 | −0.277 | 0.230 | −0.315 | −0.244 | 0.283 | |

| DJSI World | −1.283 | −1.192 | 0.456 | −0.668 | −0.611 | 0.287 | −0.374 | −0.319 | 0.241 | −0.162 | −0.130 | 0.115 | |

| DJ Islamic | −1.116 | −1.018 | 0.444 | −0.431 | −0.379 | 0.210 | −0.359 | −0.312 | 0.242 | −0.329 | −0.287 | 0.254 | |

| S&P Green Bond | 0.205 | 0.199 | 0.039 | 0.170 | 0.161 | 0.052 | 0.034 | 0.029 | 0.021 | 0.015 | 0.013 | 0.010 | |

| S&P Clean Energy | −0.878 | −0.841 | 0.234 | −0.478 | −0.438 | 0.188 | −0.309 | −0.257 | 0.217 | −0.301 | −0.229 | 0.259 | |

| Euronext Vigeo | −1.429 | −1.302 | 0.600 | −0.862 | −0.768 | 0.426 | −0.386 | −0.335 | 0.244 | −0.148 | −0.124 | 0.105 | |

| EEX-EU CO2 | −0.568 | −0.525 | 0.233 | −0.314 | −0.276 | 0.172 | −0.172 | −0.139 | 0.136 | −0.234 | −0.191 | 0.178 | |

| S&P Green Build | −1.082 | −1.010 | 0.400 | −0.541 | −0.491 | 0.253 | −0.293 | −0.242 | 0.221 | −0.906 | −0.776 | 0.706 | |

| Panel E: Nikkei | MSCI World ESG | −0.777 | −0.684 | 0.332 | −0.091 | −0.079 | 0.044 | −0.325 | −0.279 | 0.211 | −0.327 | −0.242 | 0.294 |

| FTSE Good Global | −0.775 | −0.708 | 0.299 | −0.103 | −0.092 | 0.048 | −0.314 | −0.265 | 0.221 | −0.140 | −0.108 | 0.126 | |

| DJSI World | −0.790 | −0.734 | 0.281 | −0.124 | −0.114 | 0.053 | −0.335 | −0.286 | 0.216 | −0.043 | −0.034 | 0.030 | |

| DJ Islamic | −0.631 | −0.575 | 0.251 | −0.092 | −0.080 | 0.045 | −0.322 | −0.280 | 0.217 | −0.065 | −0.057 | 0.050 | |

| S&P Green Bond | 0.072 | 0.070 | 0.014 | 0.031 | 0.030 | 0.010 | 0.000 | 0.000 | 0.000 | 0.014 | 0.012 | 0.009 | |

| S&P Clean Energy | −0.734 | −0.703 | 0.195 | −0.149 | −0.136 | 0.059 | −0.281 | −0.234 | 0.198 | −0.088 | −0.067 | 0.076 | |

| Euronext Vigeo | −0.843 | −0.768 | 0.354 | −0.156 | −0.139 | 0.077 | −0.369 | −0.320 | 0.233 | −0.105 | −0.088 | 0.075 | |

| EEX-EU CO2 | −0.315 | −0.291 | 0.129 | −0.026 | −0.023 | 0.014 | −0.107 | −0.086 | 0.084 | −0.378 | −0.309 | 0.288 | |

| S&P Green Build | −0.835 | −0.779 | 0.308 | −0.283 | −0.257 | 0.132 | −0.242 | −0.200 | 0.183 | −0.322 | −0.276 | 0.251 | |

| Panel F: Hang Seng | MSCI World ESG | −0.645 | −0.568 | 0.276 | −0.128 | −0.111 | 0.063 | −0.210 | −0.180 | 0.136 | −0.267 | −0.198 | 0.239 |

| FTSE Good Global | −0.636 | −0.581 | 0.245 | −0.148 | −0.132 | 0.069 | −0.211 | −0.179 | 0.149 | −0.225 | −0.175 | 0.203 | |

| DJSI World | −0.746 | −0.693 | 0.265 | −0.226 | −0.207 | 0.097 | −0.247 | −0.211 | 0.160 | −0.135 | −0.108 | 0.096 | |

| DJ Islamic | −0.695 | −0.634 | 0.277 | −0.138 | −0.122 | 0.068 | −0.254 | −0.220 | 0.171 | −0.261 | −0.227 | 0.201 | |

| S&P Green Bond | −0.226 | −0.219 | 0.043 | 0.028 | 0.026 | 0.009 | −0.129 | −0.112 | 0.079 | −0.049 | −0.042 | 0.033 | |

| S&P Clean Energy | −0.692 | −0.663 | 0.184 | −0.282 | −0.259 | 0.111 | −0.218 | −0.182 | 0.154 | −0.273 | −0.208 | 0.236 | |

| Euronext Vigeo | −0.832 | −0.758 | 0.350 | −0.309 | −0.275 | 0.152 | −0.216 | −0.187 | 0.136 | −0.167 | −0.140 | 0.119 | |

| EEX-EU CO2 | −0.347 | −0.321 | 0.143 | −0.084 | −0.074 | 0.046 | −0.131 | −0.106 | 0.103 | −0.066 | −0.054 | 0.051 | |

| S&P Green Build | −0.841 | −0.785 | 0.311 | −0.357 | −0.324 | 0.167 | −0.143 | −0.117 | 0.108 | −0.795 | −0.681 | 0.620 | |

| Panel G: US to EUR | MSCI World ESG | 0.021 | 0.019 | 0.009 | 0.030 | 0.026 | 0.014 | 0.024 | 0.021 | 0.016 | −0.005 | −0.004 | 0.004 |

| FTSE Good Global | −0.128 | −0.117 | 0.049 | −0.034 | −0.031 | 0.016 | −0.002 | −0.001 | 0.001 | −0.012 | −0.009 | 0.011 | |

| DJSI World | −0.148 | −0.137 | 0.053 | −0.050 | −0.046 | 0.021 | −0.003 | −0.002 | 0.002 | −0.018 | −0.015 | 0.013 | |

| DJ Islamic | −0.127 | −0.116 | 0.050 | −0.014 | −0.012 | 0.007 | 0.005 | 0.004 | 0.003 | −0.035 | −0.030 | 0.027 | |

| S&P Green Bond | −0.691 | −0.670 | 0.131 | −0.408 | −0.386 | 0.124 | −0.131 | −0.114 | 0.080 | −0.060 | −0.052 | 0.041 | |

| S&P Clean Energy | −0.137 | −0.131 | 0.036 | −0.041 | −0.037 | 0.016 | −0.013 | −0.011 | 0.009 | −0.028 | −0.021 | 0.024 | |

| Euronext Vigeo | 0.079 | 0.072 | 0.033 | 0.067 | 0.059 | 0.033 | 0.039 | 0.034 | 0.025 | −0.003 | −0.002 | 0.002 | |

| EEX-EU CO2 | −0.114 | −0.105 | 0.047 | 0.014 | 0.012 | 0.008 | −0.005 | −0.004 | 0.004 | 0.019 | 0.016 | 0.015 | |

| S&P Green Build | −0.145 | −0.135 | 0.053 | −0.050 | −0.045 | 0.023 | −0.010 | −0.008 | 0.007 | −0.155 | −0.133 | 0.121 | |

- Note: This paper presents the summary statistics of the Delta CoVaR between EESG assets and the conventional assets for the original and decomposed return series.

| Undecomposed | Short-run trend | Medium-run trend | Long-run trend | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | Mean | Median | Std | ||

| Panel A: S&P500 | MSCI World ESG | −2.296 | −1.680 | 1.867 | −1.304 | −0.952 | 1.093 | −0.519 | −0.330 | 0.545 | −0.165 | −0.123 | 0.120 |

| FTSE Good Global | −2.095 | −1.577 | 1.588 | −1.254 | −0.952 | 1.027 | −0.552 | −0.378 | 0.563 | −0.178 | −0.127 | 0.139 | |

| DJSI World | −1.884 | −1.455 | 1.329 | −1.144 | −0.882 | 0.876 | −0.541 | −0.349 | 0.554 | −0.087 | −0.089 | 0.034 | |

| DJ Islamic | −2.272 | −1.845 | 1.636 | −1.374 | −1.063 | 1.073 | −0.564 | −0.382 | 0.565 | −0.313 | −0.275 | 0.196 | |

| S&P Green Bond | 0.091 | 0.082 | 0.029 | 0.122 | 0.112 | 0.047 | −0.122 | −0.079 | 0.118 | −0.116 | −0.127 | 0.041 | |

| S&P Clean Energy | −1.805 | −1.560 | 0.921 | −0.994 | −0.845 | 0.553 | −0.455 | −0.236 | 0.555 | −0.384 | −0.403 | 0.216 | |

| Euronext Vigeo | −1.482 | −1.196 | 0.954 | −0.777 | −0.634 | 0.489 | −0.541 | −0.362 | 0.523 | −0.074 | −0.073 | 0.038 | |

| EEX-EU CO2 | −0.507 | −0.464 | 0.147 | −0.232 | −0.216 | 0.089 | −0.170 | −0.142 | 0.124 | −0.058 | −0.048 | 0.049 | |

| S&P Green Build | −1.631 | −1.331 | 1.067 | −0.678 | −0.553 | 0.430 | −0.413 | −0.194 | 0.562 | −0.500 | −0.446 | 0.288 | |

| Panel B: Crude oil | MSCI World ESG | −1.698 | −1.242 | 1.380 | −0.947 | −0.692 | 0.794 | −0.241 | −0.153 | 0.253 | −2.321 | −1.725 | 1.684 |

| FTSE Good Global | −1.765 | −1.329 | 1.339 | −0.972 | −0.737 | 0.795 | −0.297 | −0.203 | 0.303 | −2.765 | −1.982 | 2.157 | |

| DJSI World | −1.605 | −1.240 | 1.133 | −0.941 | −0.725 | 0.720 | −0.315 | −0.202 | 0.322 | −1.524 | −1.559 | 0.592 | |

| DJ Islamic | −1.861 | −1.512 | 1.341 | −0.942 | −0.729 | 0.736 | −0.158 | −0.107 | 0.158 | −2.844 | −2.500 | 1.777 | |

| S&P Green Bond | −0.153 | −0.137 | 0.050 | 0.093 | 0.085 | 0.035 | 0.585 | 0.381 | 0.567 | −0.568 | −0.620 | 0.203 | |

| S&P Clean Energy | −1.990 | −1.720 | 1.015 | −1.173 | −0.997 | 0.652 | −0.143 | −0.074 | 0.175 | −2.877 | −3.018 | 1.614 | |

| Euronext Vigeo | −1.736 | −1.401 | 1.117 | −0.910 | −0.743 | 0.572 | −0.409 | −0.274 | 0.396 | −1.346 | −1.326 | 0.700 | |

| EEX-EU CO2 | −1.472 | −1.348 | 0.426 | −0.805 | −0.749 | 0.308 | −0.033 | −0.027 | 0.024 | −0.752 | −0.620 | 0.629 | |

| S&P Green Build | −1.432 | −1.169 | 0.937 | −0.768 | −0.627 | 0.488 | 0.155 | 0.073 | 0.210 | −8.859 | −7.901 | 5.097 | |

| Panel C: Gold | MSCI World ESG | −0.068 | −0.049 | 0.055 | −0.947 | −0.692 | 0.794 | −0.086 | −0.055 | 0.091 | −0.080 | −0.059 | 0.058 |

| FTSE Good Global | −0.129 | −0.097 | 0.098 | −0.972 | −0.737 | 0.795 | −0.101 | −0.069 | 0.103 | −0.099 | −0.071 | 0.077 | |

| DJSI World | −0.266 | −0.205 | 0.188 | −0.941 | −0.725 | 0.720 | −0.105 | −0.067 | 0.107 | −0.070 | −0.072 | 0.027 | |

| DJ Islamic | −0.334 | −0.271 | 0.241 | −0.942 | −0.729 | 0.736 | −0.105 | −0.071 | 0.105 | −0.315 | −0.277 | 0.197 | |

| S&P Green Bond | −0.878 | −0.789 | 0.285 | 0.093 | 0.085 | 0.035 | −0.123 | −0.080 | 0.119 | −0.236 | −0.257 | 0.084 | |

| S&P Clean Energy | −0.151 | −0.131 | 0.077 | −1.173 | −0.997 | 0.652 | −0.112 | −0.058 | 0.137 | −0.383 | −0.401 | 0.215 | |

| Euronext Vigeo | 0.071 | 0.057 | 0.046 | −0.910 | −0.743 | 0.572 | −0.094 | −0.063 | 0.091 | 0.007 | 0.007 | 0.004 | |

| EEX-EU CO2 | −0.166 | −0.152 | 0.048 | −0.805 | −0.749 | 0.308 | −0.096 | −0.080 | 0.070 | 0.084 | 0.069 | 0.070 | |

| S&P Green Build | −0.334 | −0.273 | 0.219 | −0.768 | −0.627 | 0.488 | −0.079 | −0.037 | 0.108 | 0.110 | 0.098 | 0.063 | |

| Panel D: STOXX | MSCI World ESG | −1.834 | −1.342 | 1.491 | −0.787 | −0.575 | 0.660 | −0.560 | −0.356 | 0.588 | −0.256 | −0.190 | 0.186 |

| FTSE Good Global | −1.783 | −1.343 | 1.352 | −0.886 | −0.672 | 0.725 | −0.581 | −0.398 | 0.593 | −0.337 | −0.242 | 0.263 | |

| DJSI World | −1.804 | −1.394 | 1.273 | −0.923 | −0.712 | 0.706 | −0.597 | −0.384 | 0.612 | −0.163 | −0.167 | 0.063 | |

| DJ Islamic | −1.787 | −1.451 | 1.287 | −0.708 | −0.547 | 0.553 | −0.591 | −0.401 | 0.592 | −0.426 | −0.374 | 0.266 | |

| S&P Green Bond | 0.241 | 0.216 | 0.078 | 0.183 | 0.168 | 0.070 | 0.049 | 0.032 | 0.047 | 0.021 | 0.023 | 0.007 | |

| S&P Clean Energy | −1.643 | −1.420 | 0.838 | −0.857 | −0.728 | 0.476 | −0.393 | −0.203 | 0.480 | −0.486 | −0.510 | 0.273 | |

| Euronext Vigeo | −2.130 | −1.718 | 1.370 | −1.274 | −1.040 | 0.801 | −0.653 | −0.437 | 0.632 | −0.145 | −0.143 | 0.076 | |

| EEX-EU CO2 | −0.594 | −0.544 | 0.172 | −0.322 | −0.299 | 0.123 | −0.206 | −0.172 | 0.150 | −0.113 | −0.093 | 0.094 | |

| S&P Green Build | −1.723 | −1.406 | 1.127 | −0.741 | −0.604 | 0.470 | −0.458 | −0.216 | 0.624 | −0.990 | −0.883 | 0.570 | |

| Panel E: Nikkei | MSCI World ESG | −1.259 | −0.921 | 1.023 | −0.148 | −0.108 | 0.124 | −0.526 | −0.334 | 0.552 | −0.234 | −0.174 | 0.170 |

| FTSE Good Global | −1.221 | −0.919 | 0.926 | −0.161 | −0.122 | 0.132 | −0.557 | −0.381 | 0.569 | −0.150 | −0.107 | 0.117 | |

| DJSI World | −1.111 | −0.858 | 0.784 | −0.171 | −0.132 | 0.131 | −0.535 | −0.344 | 0.548 | −0.043 | −0.044 | 0.017 | |

| DJ Islamic | −1.010 | −0.820 | 0.728 | −0.150 | −0.116 | 0.117 | −0.531 | −0.360 | 0.532 | −0.084 | −0.074 | 0.053 | |

| S&P Green Bond | 0.085 | 0.076 | 0.028 | 0.034 | 0.031 | 0.013 | 0.000 | 0.000 | 0.000 | 0.018 | 0.020 | 0.007 | |

| S&P Clean Energy | −1.372 | −1.186 | 0.700 | −0.267 | −0.227 | 0.148 | −0.358 | −0.185 | 0.437 | −0.142 | −0.150 | 0.080 | |

| Euronext Vigeo | −1.256 | −1.014 | 0.808 | −0.230 | −0.188 | 0.145 | −0.623 | −0.417 | 0.603 | −0.104 | −0.102 | 0.054 | |

| EEX-EU CO2 | −0.329 | −0.301 | 0.095 | −0.027 | −0.025 | 0.010 | −0.128 | −0.107 | 0.093 | −0.183 | −0.151 | 0.153 | |

| S&P Green Build | −1.329 | −1.085 | 0.870 | −0.388 | −0.316 | 0.246 | −0.378 | −0.178 | 0.515 | −0.352 | −0.314 | 0.203 | |

| Panel F: Hang Seng | MSCI World ESG | −1.044 | −0.764 | 0.849 | −0.208 | −0.152 | 0.174 | −0.339 | −0.215 | 0.355 | −0.191 | −0.142 | 0.138 |

| FTSE Good Global | −1.002 | −0.754 | 0.760 | −0.232 | −0.176 | 0.190 | −0.375 | −0.256 | 0.383 | −0.241 | −0.173 | 0.188 | |

| DJSI World | −1.048 | −0.810 | 0.740 | −0.312 | −0.240 | 0.239 | −0.395 | −0.254 | 0.405 | −0.136 | −0.139 | 0.053 | |

| DJ Islamic | −1.113 | −0.904 | 0.802 | −0.227 | −0.176 | 0.177 | −0.418 | −0.283 | 0.418 | −0.337 | −0.296 | 0.211 | |

| S&P Green Bond | −0.266 | −0.239 | 0.086 | 0.030 | 0.027 | 0.011 | −0.187 | −0.122 | 0.181 | −0.066 | −0.072 | 0.024 | |

| S&P Clean Energy | −1.295 | −1.119 | 0.661 | −0.507 | −0.431 | 0.282 | −0.278 | −0.144 | 0.340 | −0.442 | −0.463 | 0.248 | |

| Euronext Vigeo | −1.241 | −1.001 | 0.798 | −0.456 | −0.372 | 0.287 | −0.364 | −0.244 | 0.353 | −0.164 | −0.162 | 0.085 | |

| EEX-EU CO2 | −0.363 | −0.332 | 0.105 | −0.086 | −0.080 | 0.033 | −0.157 | −0.131 | 0.114 | −0.032 | −0.027 | 0.027 | |

| S&P Green Build | −1.339 | −1.093 | 0.876 | −0.489 | −0.399 | 0.311 | −0.223 | −0.105 | 0.303 | −0.869 | −0.775 | 0.500 | |