Economic precariousness: A new channel in the housing market cycle

Abstract

Demographic and institutional elements, as important drivers of the housing market, should not be neglected because it is not only financial and monetary elements that matter in the case of the housing market. In this context, one relationship, which still remains unclear, is the relationship between the housing and the labour markets. Some research has been undertaken to support the hypothesis that high rates of homeownership lead to high unemployment via increases in the reservation wage. However, further research is needed to address the possible implications of the institutional settings of the labour market in the dynamics of the housing market. The aim of this paper is to bring some light on the link between both markets. In particular, this contribution explains how the housing cycle could be “amplified” via a new channel, that is, economic precariousness, which is closely related to job insecurity. Subsequently, we provide evidence in the case of five developed economies, Ireland, the Netherlands, Spain, the United Kingdom, and the United States, over the period 1985–2013.

1 INTRODUCTION

“Job insecurity is a condition wherein employees lack the assurance that their jobs will remain stable from day to day, week to week, or year to year. Depending on the discipline and political leanings of authors, job insecurity can be referenced in a variety of ways. For instance, ‘boundaryless careers’, ‘flexibility’, ‘new employer-employee contracts’, and ‘organisational restructuring’ can sometimes be used as euphemisms for the dismantling of workplace protections for secure employment (Pollert, 1988; Sweet, Moen, & Meiksins, 2007). But these terms can also be used to highlight positive aspects of job and organisational redesigns, some of which workers find liberating (Heckscher, 1988; Piore & Sabel, 1984)” (Work and Family Researchers Network, 2010).1

Drawing attention to the “negative” side of this definition, economists might wonder whether there are “knock-on” effects of job insecurity, which go beyond the traditional impacts on GDP and employment outcomes. Although there are some strands of the existing literature, which focus on the impact of job insecurity on the well-being of society (Berloffa & Modena, 2012), an interesting dimension that needs to be explored is the role that job precariousness could play in the dynamics of the housing market, which could eventually drive the business cycle (Leamer, 2007).

This contribution builds on the research undertaken by Arestis and Gonzalez-Martinez (2015), which raised the issue that the poor quality of employment in a given economy could favour the collapse of the housing market and impair its recovery.2 It also explores further this issue as a component of a broader concept namely, “economic precariousness” and encapsulates this discussion in a conceptual framework. In particular, the proposed model investigates economic precariousness by focusing on three dimensions: (a) precarious labour market, (b) precarious employment relations, and (c) precarious social and political relations. More specifically, this investigation attempts to provide a quantification of the impact of economic precariousness on house prices. To the best of our knowledge, only the relationship between job insecurity and house prices has been explored qualitatively by Kupke and Marano (2003). In the second part of this contribution, we proceed to test econometrically our hypothesis in order to quantify the impact of economic precariousness on house prices in the case of Ireland, the Netherlands, Spain, the United Kingdom, and the United States. This econometric exercise is conducted by means of cointegration techniques.

The remainder of this paper is structured as follows. Section 2 elaborates on our conceptual framework. Sections 3 focuses on the econometric technique that is employed in the section that follows. Section 4 presents the data sources, some stylised facts, as well as the relevant empirical estimates. Finally, Section 5 provides some concluding remarks.

2 CONCEPTUAL FRAMEWORK

Some interest in the investigation of the links between housing and labour markets has emerged from a recent contribution. In particular, Blanchflower and Oswald (2013) focus on the U.S. market and find evidence, which supports the argument that high rates of home ownerships are a precursor to rising unemployment.3 The explanation for this phenomenon is based on three propositions: (a) higher rates of home ownership reduce labour mobility; (b) higher rates of dwelling proprietorship increases commuting times; and (c) rising homeownership rates reduce creation of new businesses.4 However, the existence of negative externalities of home ownership in the outcomes of the labour market is a controversial issue because not all economists agree on the sign of the mentioned externalities. For instance, Flatau, Forbes, Hendershott, and Wood (2003) point to a positive effect of getting into the property market as a result of the evolution of the labour market. Flatau et al. (op. cit.) emphasise the existence of incentives to continue in employment in the case of those home owners who are highly indebted, as well as the incentive for seeking a job quicker than those who did not get into debt to acquire a property.5

More specifically, this paper is concerned with the possible implications of economic precariousness in terms of its impact on demand for housing and subsequently, on house prices. Essentially, the testable hypothesis of this contribution relates to the evolution of house prices along with the outcomes of the labour market, by assuming that the latter can be a driver for the former. In particular, our investigation focuses on identifying the power that several indicators, which capture economic precariousness, could have in order to explain the evolution of house prices.

The conceptual framework, which is presented in this section, follows the traditional approach initiated by Poterba (1984) in which house prices are explained as a function of several fundamentals, such as income, mortgage rates, demographics, and taxation among others (Holly & Jones, 1997; Milne, 1991; Andrews, 2010; Haffner & Oxley, 2011).6 However, Conefrey and Whelan (2012) highlight that quite often this traditional approach does not take into account the evolution of supply-side variables when modelling house prices.7

(1)

(1)Focusing on the drivers of house prices, which are included in Equation (1), the existence of a positive relationship between disposable income and house prices has been well documented (Andrews, 2010; Case & Shiller, 2003; Igan & Loungani, 2012). Nevertheless, Gallin (2003) challenges the extended view that house prices and income are cointegrated. Gallin (op. cit.) uses data at the national level, which cover a period of 27 years and find that the mentioned data do not support the conventional assumption of cointegration among both variables. It also provides some empirical evidence in the case of a panel of 95 metro areas in the United States over a 23-year period to provide further evidence to support this view.8,9 However, the great financial crisis of 2007/2008 has favoured a transition in the focus of the existing literature. From a mere discussion of the existence of a comovement between these two variables, the investigation of the interactions between income inequality and house prices has become a priority. The existence of a possible correlation between income inequality and house prices is the argument explored by Green and Shaheen (2014), who concentrate on the U.K. case.10 It is argued that the increase in income and wealth of the upper class is a contributory factor of the unprecedented high house prices, which are preventing many potential first-home buyers to get into the “property ladder.” In other words, income inequality is “fuelling” house prices by two mechanisms: (a) home sellers have now available a bigger pool of “top” buyers, who are able and willing to pay more for the properties, which are in the market; and (b) rising “spare” financial resources looking for high profitability have permitted the wealthy to speculate with the value of the property. This phenomenon should be a key line of action for policymakers who are facing a bigger share of the potential first-home buyers, who are locked in an unaffordable rental market, as well as potential second-home buyers who are “trapped” in overcrowded homes.11

Moving onto the discussion of the “price-to-rent” ratio, we refer to Ayuso and Restoy (2006) who propose two different approaches to approximate the price-to-rent ratio in the context of equilibrium in the housing market: (a) by computing the present discounted sum of the expected rents minus the present discounted sum of expected returns on any portfolio and (b) by estimating a linear function of the discounted sum of expected rates of growth of rents and the discounted sum of the expected growth of consumption. Ayuso and Restoy (op. cit.) also categorise the existing body of literature on house-price models according to the following typology: (a) the “macroeconomic approach,” which emanates from Poterba (1984) and considers house prices as a function of income, interest rates, and some supply-side variables and (b) the “financial approach,” which follows Case and Shiller (1988) and Clayton (1996) and points to a relationship between housing prices and rents. In this second approach, the impact of the explanatory elements comes from the demand for real estate services and their influence on rents.12 Some empirical evidence on the evolution of this ratio in the period prior to the great financial crisis of 2007/200 is provided by Sommer, Sullivan, and Verbrugge (2013) who develop a dynamic equilibrium model of housing tenure, which covers both home ownership and rented properties. Subsequently, their model is tested empirically in the case of the United States, where it is found that 50% of the increase in the price-to-rent ratio over the period 1995–2006 is due to a combination of low interest rates, lax interest rates, and higher incomes.

As acknowledged in the existing literature, there is a relationship between macroeconomic determinants and the housing market (Panagiotidis & Printzis, 2015). Focusing on the outcomes of the labour market, which usually are measured in terms of employment/unemployment, it has been reported that the causality between these two elements is bidirectional. A key contribution to this contribution is the study of Rogers and Winkler (2013) that provides some empirical evidence on the relationship between the housing and labour market crises, which occurred in the United States in early 2007. Roger and Winkler (op. cit.) and based on the timing of the mentioned crisis, propose the following typology to categorise the metropolitan statistical areas (MSAs) across the country: (a) MSAs where the housing market crisis preceded the crisis in the labour market, (b) MSAs in which the labour market crisis happened first, and (c) both crises are concurrent. At the national scale, the first pattern was the one observed, whereas the analysis at MSA level revealed that the second pattern was the dominant.

As mentioned earlier, there is a strand of literature, which claims that the rising rates of unemployment that have been identified across countries in the last few decades can be partially explained by rising rates of home ownership (Oswald, 1996, 1997). Nevertheless, there is another group of economists that have produced some empirical evidence on the decrease of house prices that can be attributed to increasing unemployment (Panagiotidis & Printzis, 2015; Schnure, 2005). Essentially, our testable hypothesis builds on the views of the latter group of contributors, while attempting to account for economic precariousness in order to supplement the existing evidence. Our proposal builds on Kalleberg (2009), Standing (2011), Wilson and Ebert (2013), and Tammes, Roberts, and Berrington (2014), who consider economic precariousness as a multidimensional phenomenon. More specifically, these contributors define the following dimensions: (a) precarious labour market, (b) precarious employment relations, and (c) precarious social and political relations.13

(2)

(2)Moving onto the discussion of the contribution of unemployment to the evolution of house prices, it needs to be mentioned that the existence of a bidirectional relationship between house prices and unemployment has been well documented. A recent contribution by Liu, Miao, and Zha (2013) provides some empirical evidence on the role played by real estate prices in terms of the increase in the volatility of the labour market in the United States. In a similar vein, Pinter (2015), who focuses on the relationship between house prices and the labour market in the United Kingdom case, reports that the “collateral” channel is the underlying mechanism that drives the mentioned relationship. In other words, Pinter (2015) suggests that a decline in real estate prices affects negatively firms' borrowing capacity, which slows down job creation and accelerates job destruction. Another interesting finding of this contribution is that there is some comovement between house prices and job separation rates, as well as between house prices and job finding rates.14 Bearing in mind this existing body of literature, our contribution focuses on the impact of long-term unemployment because those households that are affected by this phenomenon are more likely to be excluded from home ownership than those who are affected by frictional unemployment. Moreover, this indicator also allows us to control for labour insecurity, and subsequently, this permits us to represent a precarious labour market in our analysis. This is so because an increase in long-term unemployment can affect the perception of security about the current job that those who are in employment have.15,16 In this sense, contributors can expect a change in the attitude towards home ownership of those who are exposed to strong job insecurity for a certain period, that is, an increase in agents' risk-aversion related to the possibility of losing the current employment, which could have a deterrent effect on the decision of acquiring a property. Further discussion also relates to the fact that rising unemployment and economic insecurity for those in employment have important implications for specific groups of population, for example, young adults, whereby such a decline in the rate of households' formation, as well as an increase in coresidence with parents for longer periods can occur.17

An additional indicator to account for the second dimension of economic precariousness exists, that is, precarious employment relations is the full-time-to-part-time employment ratio.18 Following the definition proposed by Eurofound (2013), job insecurity can be assessed on the basis of (a) job (in) security or self-perceived job security, (b) perceived chance of losing one's job within the next 6 months/year/and so forth, (c) perception of difficulties of finding an adequate new job, and (d) increased stress of losing one's job.19 Bearing in mind item (c), our theoretical proposition includes the full-time-to-part-time employment as a “naïve” indicator of difficulties that workers can encounter when looking for a suitable job, which in this context is defined as a “full-time” position. In spite of the fact that the availability of part-time positions could be a suitable option for particular groups of the population, such as young workers who are on the process of being awarded tertiary degrees or mothers with young children (Shagvaliyeva & Yazdanifard, 2014). It is true that in a context of high unemployment, part-time jobs are accepted by workers, who would be willing and able to work on full-time basis if they were given the relevant opportunity.20,21 Further discussion of the negative implications of part-time employment is provided in the study by Torns (2001), which provides empirical evidence in the case of Spain.22 Some concerns that are raised in the mentioned contribution are the gender discrimination issues, which emanate in some countries, along with a negative effect that could affect most of the wage-earners population.

Furthermore, Equation (2) also includes an indicator to measure explicitly employment protection. This indicator fits within the mentioned economic precariousness framework through the third dimension, that is, precarious social and political, where two types of “precariousness” are identified: (a) representation insecurity, which could be measured by means of trade union representation and (b) social insecurity, which could be measured in terms of social benefits and social policies. Focusing on the employment protection indicator that we have proposed, the rationale for including this variable in a demand for housing model builds on Kupke and Marano (2003), who conduct a survey to explore how job insecurity affects the behaviour of first-time home buyers in the case of Australia.23 This survey reports that 60% of the respondents to it confirmed that their decision of acquiring a property was influenced by their perception of security about their current jobs. Thus, those home buyers affected by these concerns either bought less expensive properties or took “smaller” loans than they would have done otherwise. At the microlevel, this investigation also reveals that job insecurity seems to be more important than income when taking the decision of buying or renting a property. Susilawati and Wong (2014) also explore qualitatively this issue in the case of Australia and point to low income and reduced job security as the main barriers that young, first-time buyers have to face in order to get into the property market.

3 ECONOMETRIC TECHNIQUE

In order to select a suitable econometric technique, we proceed to analyse the order of integration of the time series under scrutiny. In doing so, various unit root/stationarity tests are applied: (a) the augmented Dickey-Fuller (Dickey & Fuller, 1979, 1981) tests, (b) the Phillips-Perron (Phillips & Perron, 1988) test, (c) the Kwiatkowski-Phillips-Schmidt-Shin (Kwiatkowski, Phillips, Schmidt, & Shin, 1992) test, (d) the generalized least squares (GLS)-based Dickey-Fuller (Nelson & Plosser, 1982) test, and (e) the Lee and Stazicich (2003) unit root test with two breaks, which are endogenously determined. As suggested by this set of tests, our dataset is a combination of I(0) and I(1) time series.24 In order to explore how the relationships between the mentioned time series change through time, as well as accounting for the different order of integration in our dataset, we estimate the relationship described in Equation (2) by means of the Autoregressive Distributed Lag (ARDL), also known as the bounds-testing cointegration approach (Pesaran, 1997; Pesaran & Shin, 1999; Pesaran, Shin, & Smith, 2001) and is an alternative to the cointegration/error-correction methodology. The ARDL estimates simultaneously the long-run and short-run parameters.25 The preference for this technique over other cointegration approaches, such as the Johansen (Johansen, 1991) test, relies mainly in the fact the ARDL bounds test for cointegration is the only technique that can be applied when the sample under consideration is a mixture of trend-stationary and difference-stationary time series. Nevertheless, even in the case of the relevant samples comprising only of I(1) time series, the ARDL approach would still be more suitable because it performs better than the Johansen test in the case of small sample sizes (Nayaran, 2005). It is clearly the case that the ARDL represents a rigorous econometric methodology.

(3)

(3)In order to validate our estimates, we apply the following tests: (a) the Breusch-Godfrey Serial Correlation LM (Breusch, 1979; Godfrey, 1978), which explores the absence of autocorrelation, (b) a test based on the regression of squared residuals, which tests for the homoscedasticity of the residuals, (c) the Ramsey's RESET test, which accounts for whether the model has been properly specified, (d) a normality test, and (e) the CUSUM and the CUSUM of squares (Brown, Durbin, & Evans, 1975) tests to analyse the stability of the parameters.2728

4 EMPIRICAL EVIDENCE

4.1 Data sources

For the purpose of this paper, we analyse a dataset, which covers the period 1985–2013 for the following economies: Ireland, the Netherlands, Spain, the United Kingdom, and the United States. Although data on house prices is available for more recent years, the OECD database on Employment Protection ends in 2013. The end period is determined by the availability of data in all the countries included in our sample. The choice of countries that have been included in our sample comprises of economies that are characterised by different institutional settings of the labour market in order to ensure sufficient variability among the countries under consideration, as it is shown in detail in Section 4.2.

In order to gather the required data, three different data sources have been consulted. In particular, the relevant time series on house prices are published by the Federal Reserve Bank of Dallas, which provides the International House Price Database.29 Moreover, the OECD database on Employment Protection Legislation has been used to obtain the following indicators: “Strictness of employment protection - individual and collective dismissals (regular contracts)” and “Strictness of employment protection - temporary contracts.”30 The OECD is also the data provider for data on the Standardised Price-to-Rent Ratio.31 The data on unemployment by duration that has been used are also published by the OECD.

4.2 Some stylised facts

Before presenting our econometric results, an overview of the dynamics of the housing and labour markets in the economies under consideration is presented.

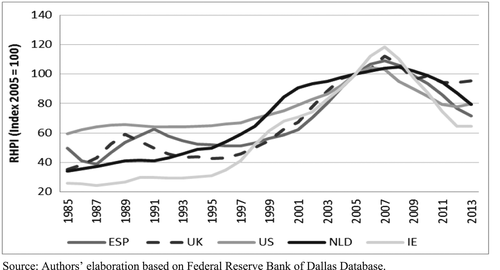

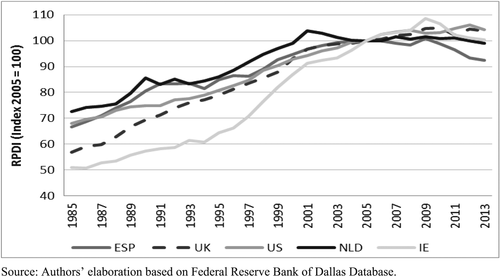

To begin with, we focus on the evolution of house prices. As shown in Figure 1, the housing markets in the United Kingdom and Spain peaked in 1989 and 1991, respectively. With the exception of these two peaks, house prices were following an upward trend during more than 20 years until the waves of crashes of the market in 2007–2008. The behavioural trends that the house prices have shown after the collapse of the relevant markets are very heterogeneous. In particular, the strongest drop in house prices happened in Ireland, although there are currently some fears of the existence of a bubble in the Dublin housing market. An important process of adjustment also took place in the Spanish market with a 29% correction over a period of 8 years. On the contrary, house prices in the Dutch and the British markets have shown a more dynamic behaviour, with prices being above the precrisis level in 2016. House prices have also reached decade-level highs in the case of the United States.32

In terms of the evolution of income, Figure 2 reports a sustained increase of personal disposable income over the vast majority of the period under scrutiny. Nevertheless, two important facts deserved to be mentioned: (a) personal disposable income in real terms has been slightly falling since the beginning of 2000s in the Netherlands and (b) the collapse of the housing market and the subsequent recessionary phase that economy went through, have hit disposable income considerably in Spain and Ireland.

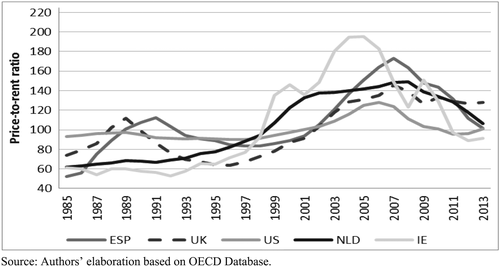

Drawing attention to the rental housing market, Figure 3 reports that the price-to-rent ratio peaked in 1989 and 1991 in the United Kingdom and Spain, respectively. More recently, this ratio reached a historical maximum in 2004–2005 in Ireland, whereas the period-level high in the Spanish case appears in 2007. Moreover, the data report a substantial fall in the price-to-rent ratio in the Netherlands, which has been taking place from 2008 onwards.

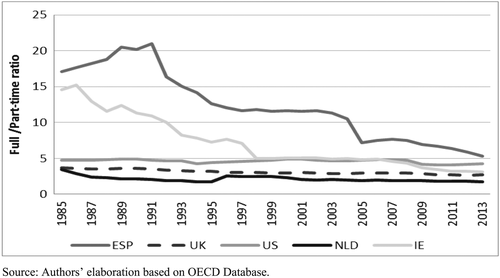

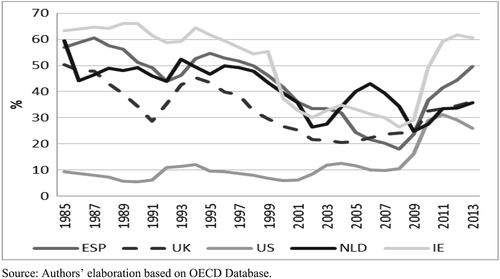

Focusing on the behaviour of the labour market, Figure 4 reports some convergence in terms of the “full-time-to-part time employment” ratio across the five countries that are included in our investigation. However, two different patterns can be identified in this period. Countries like Spain and Ireland presented extremely high levels of full-time employment compared with part-time employment at the beginning of the period, whereas this ratio has been fairly stable in the case of the United Kingdom, the United States, and the Netherlands. As shown in Figure 4, the lowest value for this ratio over the past decades is relevant in the case of the Netherlands.

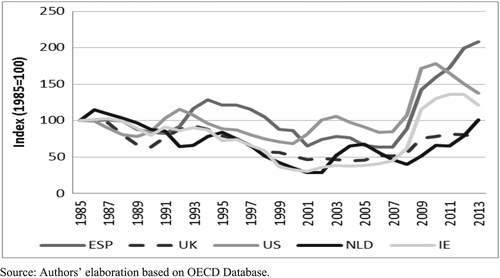

Figure 5 shows the evolution of total employment in levels over the period 1985–2013. Unprecedented levels of unemployment were reached in Spain after the collapse of the housing market. Unemployment also increased substantially in the United States due to the same reason as in the Spanish case, although it started to decline from 2010 onwards. A similar pattern can be observed in the case of Ireland where the recovery started in 2011–2012. In contrast, an increase in unemployment after 2008 is reported in the Netherlands, whereas it was stable in the United Kingdom case between 2009 and 2013.

Finally, Figure 6 displays the historical trends followed by the long-run unemployment as a percentage of total unemployment. This percentage was fairly stable and low in the case of the United States over the precrisis period. In contrast, this ratio was especially high in the case of Ireland, Spain, and the Netherlands back in the 1980s, although it has been following a downward trend since then. Figure 6 also shows that long-run unemployment has exploded during the post-crisis period in Spain and Ireland, where an intense job-destruction process took place after the collapse of the housing market there.

4.3 Econometric results

The ARDL bounds test for cointegration suggests that there is a cointegrating relationship among the variables under consideration in all the cases with the exception of Spain, in which no comovement in the long run is found.33,34 In the case of the Spanish economy, a model in first differences is estimated by means of OLS (see Table 2). This model can be interpreted as a short-run model. Table 1 reports the parameters of the long-run estimates that have been computed in the case of the rest of countries.

| Cointegrating relationship | ||||||

|---|---|---|---|---|---|---|

| Intercept | L_ID | PR | L_UL | L_FP | L_EP | |

| Ireland | −8.7775*** | 2.8315*** | −0.16591** | 0.61182*** | ||

| Netherlands | −3.99300** | 1.5998*** | 0.00605*** | 0.53956* | ||

| Spain | _ | _ | _ | _ | _ | _ |

| United Kingdom | −0.01542 | 0.7408*** | 0.0086133*** | 0.25616* | ||

| United States | 0.73086*** | 0.65088*** | 0.00912*** | −0.03468** | ||

- Note.

- * ,

- ** , and

- *** indicate statistical significance and rejection of the null at the 10%, 5%, and 1% significance levels, respectively.

To begin with, we focus on the effect of personal disposable income. As reported in Table 1, a 1% increase in personal disposable income has a significant positive impact in all the countries under consideration. The highest elasticity is reported in the case of Ireland where a 1% increase in personal disposable income will lead to a 2.83% increase in real house prices. The lowest elasticities are found in the United Kingdom and the United States, which are in the range of 0.65–0.75%.

Moving onto the discussion of the impact of changes in the price-to-rent ratio, the estimates reported in Table 1 have identified a positive and significant semielasticity between the mentioned ratio and house prices in the case of the Netherlands, the United Kingdom, and the United States (0.006%, 0.008%, and 0.009%, respectively).

Moreover, Table 1 also shows a negative effect on real house prices that emanates from an increase in the share of long-run unemployment over total unemployment. This impact is significant in the case of Ireland and the United States. The long-run elasticity that has been estimated is −0.17% in the former case and −0.03% in the later.

As suggested by our testable hypothesis, an improvement in the overall quality of the employment variable, which is proxied by the full-time-to-part-time employment ratio, will drive the housing market to a position characterised by higher house prices resulting from a stronger solvent demand for housing. This positive impact is found in the case of Ireland and the Netherlands (0.61% and 0.54%, respectively).

Additionally, a positive effect of employment protection on house prices is found in the case of the United Kingdom. In particular, Table 1 indicates that a 1% increase in the employment protection index will increase house prices by 0.25%.

All the models displayed in Table 1 include an intercept, which is statistically significant in all the cases with the exception of the United Kingdom.

Table 2 presents the parameters of the error-correction models that have been estimated for the purpose of the short-run analysis.

| Error-correction model | ||||||||

|---|---|---|---|---|---|---|---|---|

| Intercept | ΔL_PH | ΔL_ID | ΔPR | ΔL_UL | ΔL_FP | ΔL_EP | EL_PH | |

| Ireland | −4.3269** | 0.62466*** (1) | 1.151*** (0) | −0.20058*** (0) | −0.054244 (0) | −0.49296*** | ||

| −0.33693 (2) | 0.86098** (1) | 0.11527** (1) | ||||||

| −0.90289*** (2) | ||||||||

| Netherlands | −0.91128* | 0.68501*** (1) | −0.01213 (0) | 0.00474*** (0) | 0.18699*** (0) | −0.22822** | ||

| −0.68196*** (1) | −0.00321* (1) | |||||||

| Spain | 0.010142 | 1.105609* (1) | −0.157222*** (0) | - | ||||

| United Kingdom | −0.0071081 | 0.48636*** (1) | 0.34149*** (0) | 0.0084476*** (0) | 0.11808 (0) | −0.46097*** | ||

| −0.0032692** (1) | ||||||||

| United States | 0.36356*** | 0.32378*** (0) | 0.00726*** (0) | 0.00484 (0) | −0.49744*** | |||

- Note.

- * ,

- ** , and

- *** indicate statistical significance and rejection of the null at the 10%, 5%, and 1% significance levels, respectively. Number of lag(s) is provided in the parenthesis.

To begin with, we comment on the role of real house prices as an explanatory variable of house prices in a short-run horizon. More specifically, there is a positive elasticity between house prices and house prices lagged by one period in the case of Ireland, the Netherlands, and the United Kingdom (0.62%, 0.69%, and 0.49%, respectively).

As shown in Table 2, an important determinant of real house prices in the short run is personal disposable income. With the exception of the Dutch market, in which a negative relationship between these two variables has been found (−0.01 and −0.68), a positive relationship has been identified in Ireland (1.15 and 0.86), the United Kingdom (0.34), and the United States (0.32).

Moreover, a positive and significant effect of an increase in the price-to-rent ratio on real house prices is found in the case of the Netherlands (0.005), the United Kingdom (0.008), and the United States (0.007).

Furthermore, a negative impact on house prices, which emanates from an increase in the long-run unemployment has been identified in the Irish market (−0.20), although a positive relationship between both variables has been reported in t-1 (0.12).

As advanced in Equation (2), there is a positive effect of an increase in full-time employment on house prices in the case of the Netherlands (0.19). Table 2 also displays a positive effect of rising employment protection on house prices in the case of the United Kingdom, as shown by a 0.12% elasticity.

We turn our attention next to the error-correction term, which explains the percentage of the disequilibrium between the short-run dynamics and the long-run equilibrium relationship that is eliminated in each period. In most countries, around 50% of the differences between the short-run models and the long-run equilibrium are reduced each year, whereas this percentage falls to 20% in the case of the Netherlands.

Drawing attention to the Spanish case in which no comovement among the variables is found in the long run, a model in first differences has been estimated. The estimates reported in Table 2 suggests that a 1% increase in personal disposable income will provoke a 1.11% increase in real house prices, whereas a 1% increase in the share of long-run employment over total employment will mitigate the previous effect and lead to a −0.16% decline in house prices measured in real terms.

Further discussion of these results is required. In general terms, the estimated parameters support empirically the model proposed in Equation (2). For example, the importance of housing affordability in determining the demand for housing is illustrated by the positive elasticity that has been found in all the countries. As discussed above, our econometric results point to a positive relationship between house prices and the rental price. These findings are in line with those reported by Poterba (1984) among other contributors.

Elaborating on the impact of economic precariousness on house prices, the parameters that have been indicated in the case of each dimension have the expected sign. Our results suggest that the strongest effect emanates from the long-run unemployment, although the full-time-to-part-time employment ratio also plays a considerable role. However, the employment protection indicator that we have employed is only significant in one of the countries under consideration. It may be the case that a longer period of analysis, which could permit us to track more changes in social and political relations could improve the significance of this variable in our analysis. Unfortunately, the unavailability of relevant time series data prevents us from conducting such exercise.

In spite of the importance of job insecurity in the housing market that our analysis has revealed, our results are in conflict with those reported by Kupke and Marano (2003), who point to job (in) security as an element that is more important than income in the decision of acquiring a property. A possible explanation of this discrepancy is the level at which the analysis is conducted, that is, the relationship identified by Kupke and Marano (2003) is valid at the micro level, but it cannot be verified at the macrolevel.

5 CONCLUDING REMARKS

The aim of this paper is to improve our understanding of the role played by economic precariousness in the evolution of the housing market. More specifically, our contribution investigates quantitatively how economic precariousness could influence the dynamics of the housing market by affecting housing affordability and individuals' preference for dwelling. In other words, economic precariousness in general and job insecurity in particular, have the potential to affect transitions to adulthood and the rate of formation of new households, which eventually has repercussions on the demand for housing. In particular, we propose an inverted function for the demand for housing, which includes a choice of five explanatory variables: (a) personal disposable income in real terms, (b) the price-to-rent ratio, (c) long-run unemployment, (d) the ratio of full-time-to-part-time employment, and (e) an employment protection indicator. The last three items permit us to account for the three dimensions of economic precariousness: (a) precarious labour market, (b) precarious employment relations, and (c) precarious social and political relations.

Then, we proceed to estimate econometrically the mentioned function in a dataset that covers the following economies: Ireland, the Netherlands, Spain, the United Kingdom, and the United States. The estimated parameters are in line with the conceptual discussion presented in this paper. They are also consistent with the standard theory that highlights the existence of a positive relationship between house prices and disposable income, as well as the existence of some comovement between house prices and rental prices. Additionally, this contribution reports empirical evidence to support the following hypotheses: (a) rising long-run unemployment, which is sustained through time, affects house prices negatively; (b) a deterioration of the quality of the jobs, as measured by an increase in the relative number of part-time positions, would have a negative effect on housing affordability, which affects house prices negatively; and (c) an increase in employment protection, which improves households' expectations and has a reflection on their financial capacity, would lead to an increase in house prices through its impact on the demand for housing. These findings relate to the three dimensions that fall under the umbrella of “economic precariousness” and “untap” a new channel for policy makers to intervene in the housing market.

ENDNOTES

- 1 See also Sweet (2006) for further discussion of this concept.

- 2 Arestis and Gonzalez-Martinez (2015) provide some evidence of this relationship in the case of Spain. In particular, Arestis and Gonzalez-Martinez (op. cit.) estimate a function that shows how real residential investment is related to real disposable income, the strictness of employment protection, as well as the quality of employment across the economy, which is measured by the ratio “full-time employment-to-total employment.”

- 3 See also Oswald (1996, 1997) for further details on the negative externalities that the housing market can exert on the labour market.

- 4 The initial discussion of the relationship between the unemployment and the housing market dates back to the 1980s as shown in McCormick (1983) and Minford, Ashton, and Peel (1988), who focus on the U.K. housing market.

- 5 This incentive is also applicable in the case of the rental market, in which individuals who are paying rents that are below market rates are less “concerned” about looking for another job if they get into unemployment. Flatau et al. (2003) provide empirical evidence in the case of Australia.

- 6 Poterba (1984) describes the quantity demanded for housing services as a function of the real rent price of those services and the stock of houses, which is given in the short run. In equilibrium, the real rental price of the mentioned housing services is the one that balances the desired quantity of housing services with the service flow, which exists in the market at that point. Along the same vein, Muellbauer and Murphy (1997) capture the behaviour of the housing market by means of (a) an equation of demand for housing services that includes as explanatory factors the average real income, as well as the real user cost of housing services and (b) a function of the supply of housing services, which accounts for house prices, population, and the existing stock of housing.

- 7 Conefrey and Whelan (op. cit.) expand a traditional model in which house prices are a function of GDP and interest rates by including a measure of monthly supply of dwellings, as well as an indicator of vacancies.

- 8 As discussed in Gallin (2003), the existence of comovement between income and house prices would allow market-observers to identify those cases in which house prices are above or below the equilibrium level based on the evolution of the gap between these two variables.

- 9 Despite Gallin's (2003) criticism of the use of cointegration tests applied to time series, in the case of small samples, for example, 27 periods of data, we do not think that the application of panel data techniques will perform well in this case because there is a substantial degree of heterogeneity across the time series, which could potentially compound our panel.

- 10 Green and Shaheen (2014) also suggest that housing assets can be a source of inequality in several respects; for example, home ownership itself, the quality, and the location of the dwelling where a family leaves could play a crucial role in the quality of the education that the youngest members of the family could receive.

- 11 It needs to be mentioned that an additional implication of higher house prices is that large down payments are required to enter in the market, which “lock in” the rental market a rising proportion of first-home buyers. In the long run, this phenomenon has a negative impact on the rate of home ownership, whereas in the short run, it pushes up rental prices.

- 12 Ayuso and Restoy (2006) consider as the main drawback of a vast majority of the models, which follow the financial approach, the fact that they estimate static relationships among housing prices, interest rates, and rents. This kind of static analysis could only be valid under the assumption of constant expected housing price appreciation. Actually, these models are biased in terms of their speculative home buyers' behaviour suggestion. This is so everytime the model shows a gap between observed prices and the corresponding value according to the fundamentals of the market. Moreover, the majority of the models do not account for the effect of taxation on rents.

- 13 See also Tammes et al. (2014) for further discussion on the types that can be identified and a choice of indicators that can be used to measure each type of economic precariousness.

- 14 Pinter (2015) provides some estimates to quantify the negative impact that unemployment and job separation rates have on house prices. Pinter (op cit.) also reports an estimated positive impact of job finding rates on house prices.

- 15 See also Payne and Jones (1987) for further details on how long-run unemployment can affect attitudes towards employment.

- 16 The evolution of the long-term unemployment can also affect the evolution of expectations about future economic growth for all actors who are involved in the market, that is, borrowers, firms, and banks.

- 17 See also Berrington and Stone (2014) for further discussion and empirical evidence in the case of the United Kingdom.

- 18 As reported in Tammes et al. (2014), the number of part-time contracts can be used to measure employment insecurity.

- 19 See also Eurofound (2013) for empirical evidence at the European-Member-State level of the evolution of job insecurity in the post-crisis period. Eurofound (op. cit.) reports a rise in job insecurity in all the European countries that have been included in the present contribution.

- 20 See also Tilly (1996) for an extensive discussion of the positive and negative implications of part-time employment.

- 21 See also Masson and Ottosson (2011) for further discussion and empirical evidence on the role of individual characteristics on the probability of leaving part-time employment.

- 22 Torns (2001) also refers to the dual labour market that operates in the Netherlands, where the existence of part-time jobs has favoured gender and ethnic groups.

- 23 The survey mentioned in the text, was a postal survey of first-time home buyers conducted over the period 1999–2000. The survey covers 3% of total home buyers in South Australia.

- 24 The results of these tests are available from the authors upon request.

- 25 The ARDL bounds test for cointegration is a more suitable approach than the two-steps cointegration approach (Engle & Granger, 1987) because all the variables are treated endogenously.

- 26 The ARDL bounds test for cointegration requires the use of either the F test or the Wald test. More specifically, the value of the Wald/F test needs to be compared against a set of critical values: (a) the lower bound, which represents the case in which all the regressors are purely trend stationary and (b) the upper bound, which relates to the case where the time series are first difference stationary. If the F test/Wald test exceeds the upper bound, the null hypothesis is rejected, and cointegration is assumed. In this particular case, we have assumed a maximum lag length of 3 years (see, Enders, 2004, for further discussion), although the right lag length of the conditional ECM has been chosen by means of the Schwarz Bayesian Information Criterion (SBC).

- 27 With the exception of the CUSUM and the CUSUM of squares tests, the results of these tests are reported in the appendix. The results of the CUSUM and the CUSUM of squares tests are available from the authors upon requests.

- 28 Microfit 4.1 and EViews 8.0 are the econometric packages that have been used to implement the ARDL bounds test for cointegration and estimate the ECM conditional models.

- 29 This database provides quarterly data on real house prices and personal disposable income in real terms. In both cases, the data cover the period 1975:Q1-2015:Q4, using 2005 as the reference year. These data have been annualised by computing annual average values. It can be downloaded at: http://www.dallasfed.org/institute/houseprice/ (accessed in June 2016).

- 30 This database is available at: http://www.oecd.org/employment/emp/oecdindicatorsofemploymentprotection.htm (accessed in June 2016).

- 31 These data are available at: http://stats.oecd.org/ and is published as part of the OECD Analytical House Prices Indicators.

- 32 Data and further details on the evolution of house prices and rental prices in individual countries can be found at: http://www.globalpropertyguide.com (accessed in June 2016).

- 33 See the Appendix (Table A1) for a summary of the results for the ARDL bounds test for cointegration.

- 34 As an alternative exercise, we have also applied the Johansen test for cointegration (Johansen, 1991). In all the cases, this test has shown the existence of a cointegrating relationship. In the case of Spain, this alternative approach also points to the existence of cointegration between the variables. Unfortunately, the mentioned relationship is not consistent with the testable hypothesis of this paper, and therefore, it should not be given any further consideration. As mentioned above, it needs to be noted that the Johansen test for cointegration can be only used in the case of a sample in which all the variables are I(1), which is not the case in terms of this contribution. Additionally, it should be emphasised that the ARDL bounds test for cointegration is more suitable than the Johansen cointegration test because our sample size is a small one, and the former is specifically designed for the mentioned sample sizes. That is the reason why only the ARDL results are reported in this paper. The results of the Johansen test are mentioned here only for reference.

APPENDIX A

| Bounds test for cointegration | |||||

|---|---|---|---|---|---|

| Wald test | Serial correlation | Functional form | Normality | Heteroscedasticity | |

| Ireland | 27.7646*** (0.000) | 0.7981 (0.372) | 1.9916 (0.158) | 0.1934 (0.908) | 3.4763 (0.062) |

| Netherlands | 172.7833*** (0.000) | 1.0553 (0.304) | 5.3811 (0.020) | 1.7703 (0.413) | 1.2754 (0.259) |

| Spain | 0.5126 (0.474) | 4.7207 (0.030) | 1.8582 (0.173) | 0.6398 (0.726) | 1.1578 (0.282) |

| United Kingdom | 363.8543*** (0.000) | 1.2182 (0.270) | 1.2615 (0.261) | 1.9954 (0.369) | 0.1424 (0.706) |

| United States | 750.3184*** (0.000) | 1.0514 (0.305) | 3.2555 (0.071) | 0.5201 (0.771) | 1.9595 (0.162) |

- Note.

- * ,

- ** , and

- *** indicate statistical significance and rejection of the null at the 10%, 5%, and 1% significance levels, respectively. Numbers in parentheses indicates the p value for each test.