Attitudes Toward ESG Reporting in a Crisis Economy: Insights From Interviews With Ukrainian Agricultural Enterprises

Funding: This work has received funding through the MSCA4Ukraine program funded by the European Union. However, views and opinions expressed are those of the author(s) only and do not necessarily reflect those of the European Union. Neither the European Union nor the MSCA4Ukraine Consortium as a whole nor any individual member institutions of the MSCA4Ukraine Consortium can be held responsible for them.

ABSTRACT

This article explores how ESG reporting practices evolve in high-risk, low-institutional contexts by examining Ukrainian agricultural enterprises operating under conditions of war, economic instability, and EU integration pressures. Drawing on semi-structured interviews, we show that, unlike highly institutionalized ESG models in the Global West, Ukrainian agricultural companies adopt pragmatic, survival-oriented approaches to sustainability. ESG engagement centers on business continuity and community support—balancing moral imperatives with operational needs. A low level of institutionalization fosters authenticity and reduces greenwashing risk, yet widespread skepticism persists regarding the feasibility of reporting without clear financial incentives. These findings challenge the assumptions of global ESG frameworks and highlight the need to reorient standards toward financial materiality in crisis economies. We propose an adaptive ESG reporting model that reduces compliance burdens for SMEs and outline policy measures—including advisory services, simplified procedures, financial incentives, and targeted education—to facilitate context-sensitive ESG integration.

1 Introduction

Globally, ESG reporting has evolved from a societal expectation into a rapidly institutionalized norm, with a growing number of business entities disclosing their environmental impact through various initiatives. As of 2023, the Global Reporting Initiative (GRI) framework is employed by 78% of the world's largest revenue-generating companies, whereas 68% of the top 5800 firms across 58 countries (N100) now integrate GRI standards into their reporting practices (KPMG 2022). Similarly, over 23,000 companies, representing a market capitalization of USD 67 trillion, disclosed their environmental impact via the Carbon Disclosure Project (CDP) platform in 2023 (CDP 2023; cf. Ahenkan et al. 2025). Notably, 90% of Fortune 500 companies reporting to CDP adhere to the Greenhouse Gas Protocol's standards and recommendations (GHG Protocol 2024). Additionally, more than 5000 organizations have aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) to deliver climate-related financial reports (Financial Stability Board 2023), whereas over 6000 companies and financial institutions have set science-based targets under the Science Based Targets initiative, with another 3500 committed to future decarbonization efforts (SBTi 2024).

Despite the growing prevalence of ESG reporting, concerns remain that expanded disclosure requirements—while enhancing informational quality—have done little to transform corporate behavior (cf. Jauernig and Valentinov 2019). In view of these concerns, Arvidsson and Dumay (2021) advocate for a shift toward performance-oriented ESG indicators that reflect firms' actual contributions to sustainable development. However, such reforms are constrained by the absence of a clear definition of ESG and the lack of standardized metrics, which collectively undermine the efficacy of both regulatory frameworks and corporate environmental strategies (Trahan and Jantz 2023). In this context, ESG reporting tends to be dominated by the “business case” rationale—an orientation that, as Herzig (2023), 348–349) argues, deflects attention from substantive ESG concerns and narrows the scope of corporate accountability. Ultimately, this rationale may erode firms' obligations to stakeholders and society at large (Herzig 2023, 367).

We identify two interconnected dimensions of Herzig's (2023) concern. One involves the rise of normative expectations as a counterweight to the dominance of the business case. As firms emphasize financial rationales for ESG reporting, stakeholders often respond by asserting a “moral case”—the belief that organizations should engage in ESG practices on ethical grounds, irrespective of economic returns (Rasche et al. 2023, 20). Yet when these moral expectations exceed what is operationally feasible, they risk appearing overly idealistic (Milne and Gray 2013), potentially reducing ESG disclosures to symbolic gestures or “simulacra” (Boiral 2013). A second dimension of this tension lies in critiques of ESG reporting as disingenuous or performative. Reports that construct an image of sustainability unmoored from actual practice invite allegations of greenwashing and bluewashing—accusations that ESG disclosures function more as marketing devices than as indicators of substantive ethical conduct (Cho et al. 2015; Jauernig and Valentinov 2019; He et al. 2024). Still, such critiques may overstate the problem. Empirical evidence suggests that ESG investments are not merely symbolic; firms with stronger ESG performance often demonstrate superior financial outcomes (Khan et al. 2016), indicating that economic and ethical motives can, at times, be mutually reinforcing.

In light of these conceptual tensions, we seek to extend ESG scholarship by examining how the interplay between business rationales, moral imperatives, materiality, and skepticism unfolds in the context of Ukraine's ongoing military conflict. Although business ethics and management research has increasingly explored how entrepreneurship and sustainable development intersect with armed conflict and contribute to peacebuilding (Joseph et al. 2023; Miklian et al. 2019), ESG reporting in conflict zones remains significantly understudied (cf. Oukes et al. 2024; Reyad et al. 2024). Existing literature tends to focus on stable or emerging economies, where firms are presumed to have the institutional security and resource capacity necessary for sustained ESG engagement. Ukraine presents a compelling counter-case. Having adopted International Financial Reporting Standards (IFRS) in 2012, it now faces the complex task of aligning with European Sustainability Reporting Standards (ESRS), particularly Standards S1 and S2. Yet in conflict environments, the conventional ESG calculus is upended. The business–morality dichotomy takes on new meaning as the moral imperative may contract from abstract sustainability goals to the more immediate ethical duty of survival. This reorientation raises fundamental questions about corporate accountability and the risks of performative compliance under conditions of extreme precarity.

Relative to ESG practices in the Global West1, Ukraine's ESG reporting assumes particular significance given the country's pursuit of EU accession and its deepening trade integration with European markets. These dynamics are amplified by emerging regulatory instruments such as the Carbon Border Adjustment Mechanism (CBAM), introduced in October 2023, which aims to levy carbon tariffs on imports from jurisdictions lacking equivalent emissions-reduction measures (European Commission 2023a). During the CBAM's transitional phase (2023–2025), importers must report embedded emissions via the Taxud Authentication Portal (European Commission 2023c). This evolving regulatory landscape elevates ESG disclosure from a voluntary gesture to a strategic necessity, particularly for Ukrainian firms seeking to sustain or expand their access to EU value chains.

Our analysis focuses on ESG reporting within Ukraine's agricultural sector—a domain of strategic importance, contributing over 10% of national GDP (Danyliak et al. 2023) and, before the full-scale Russian invasion, accounting for nearly 50% of global vegetable oil exports and 14% of global grain exports (FAO 2022). Existing ESG scholarship has identified agriculture and agribusiness as particularly challenging domains for sustainability reporting, due in part to the complexity of ecological systems and data asymmetries (Jindřichovská et al. 2020). Concerns persist that standardization efforts to date have failed to ensure the long-term sustainability of agri-food systems (Meemken et al. 2021). Empirical assessments reveal persistent reporting gaps, particularly in disclosing ecosystem transformations and climate resilience measures (Gerber et al. 2024). Moreover, some studies find no significant relationship between ESG reporting and the operational, financial, or market performance of agricultural firms (Buallay 2022), whereas others highlight inconsistencies in data comparability within the EU (Anguiano-Santos et al. 2024).

We investigate ESG reporting in Ukraine's agricultural sector through semi-structured interviews with 30 enterprises across 18 regions, conducted between April and July 2024. We focused on how managers and chief accountants conceptualize sustainable development, navigate implementation challenges, and assess their organizational readiness, particularly in light of ongoing war and economic volatility. The findings reveal a pragmatic, outcome-oriented logic guiding ESG engagement, as firms seek to reconcile the demands of contemporary sustainability frameworks with the exigencies of operating under crisis conditions.

Our findings advance theoretical understanding of ESG reporting by highlighting how the tension between business rationales and moral imperatives unfolds under conditions of economic crisis. We also engage with the phenomena of greenwashing and reporting skepticism—issues that are magnified when firms operate in high-risk, resource-constrained environments. Although global ESG systems are increasingly framed around the principle of double materiality (Eccles et al. 2014), existing literature offers limited insight into how such frameworks can be adapted to unstable markets, where financial materiality tends to dominate (cf. Joseph et al. 2023; Khan et al. 2016). In addressing this gap, we develop an adaptive ESG reporting model tailored to crisis economies—one that mitigates regulatory burdens across different segments of the value chain. We also consider how EU regulatory pressure may act as a conduit for integrating Ukrainian agribusinesses into European markets, a topic that remains underexplored. Finally, by tracing the transformation of Ukraine's national ESG infrastructure amid war and institutional fragility, we identify mechanisms through which sustainability reporting can remain viable, even when business survival is the overriding concern. These insights contribute both to ongoing theoretical debates on ESG institutionalization and to practical efforts aimed at building economic resilience and sustainable development capacity in conflict-affected regions.

The paper proceeds as follows. We begin by situating ESG reporting within the broader context of Ukraine's agricultural sector and regulatory environment. We then outline the research design and present empirical findings from our interviews. The discussion section connects these insights to ongoing theoretical debates in ESG scholarship, whereas the concluding section outlines implications for policy and practice in both the Ukrainian context and broader crisis economies.

2 The Landscape of ESG Reporting in Ukraine: Background and Context

Ukrainian companies, particularly those embedded in European value chains, face growing pressure to align with ESG standards. The Corporate Sustainability Reporting Directive has emerged as a key regulatory force, affecting not only firms seeking cross-border partnerships and international capital but also high-environmental-risk entities within shared supply networks (KPMG 2024). Although the proposed Omnibus Regulation introduces limited relief, such as restricting information demands from large firms to their smaller counterparts (Nossa Data 2025), compliance with both the CSRD and the ESRS remains inevitable. In agriculture, this is particularly evident among listed holdings such as Astarta, Agrotron, and IMC, which are already subject to EU disclosure obligations.

In parallel with regulatory mandates, Ukrainian businesses are also responding to increasing demands from international investors and financial institutions, which increasingly view ESG integration as essential to strategic viability. Notably, 47% of Ukrainian companies report heightened demands for transparency and ESG reporting from institutional investors and regulatory bodies (KPMG 2021). ESG reports have begun to emerge across various sectors, including energy and infrastructure (Ukrenergo, Energoatom, DTEK), telecommunications (Vodafone Ukraine), metallurgy (Metinvest, ArcelorMittal Kryvyi Rih), and consulting and services (BDO in Ukraine) (Sustainability Magazine 2024). For example, Metinvest B.V. ranks 97th out of 161 companies in the global steel industry, placing it within the upper half of the ESG rankings and indicating relatively robust ESG management practices compared to its industry peers (Sustainalytics 2024).

Amid these varied pressures, Ukraine has accelerated institutional changes in 2024 to establish frameworks for nonfinancial reporting. In March, the Ministry of Economy inaugurated the Green Transition Office, dedicated to reducing environmental impact and supporting a low-emissions economy (Ministry of Economy of Ukraine 2024b). In October, the Decarbonization Fund began issuing low-interest loans (at rates of 7% and 9%)2 for investments in energy generation equipment, solar power installations, heat pumps, cogeneration systems, alternative heating methods, thermal modernization, and distributed generation projects (Decentralization 2024). Several key regulatory acts have been adopted to support sustainable development. The National Energy and Climate Plan through 2030 sets ambitious targets, including a 65% reduction in greenhouse gas emissions from 1990 levels and achieving a 27% renewable energy share in total consumption (Ministry of Economy of Ukraine 2024a). Additionally, the Strategy for the Implementation of Sustainable Development Reporting by Enterprises aims to establish comprehensive sustainability reporting standards by 2030, enhancing Ukrainian businesses' access to international capital markets and attracting foreign investment (Cabinet of Ministers of Ukraine 2024). To achieve this same goal, the Sustainability Reporting Platform (SR-Platform 2023) has recently been developed.

Further regulatory measures include the introduction of a mandatory environmental tax and state-mandated statistical reporting on ESG indicators. Entities emitting more than 500 tons of carbon dioxide annually are subject to a carbon tax in Ukraine, currently set at 30 UAH3 per ton, and are required to submit an Environmental Tax Declaration. This declaration mandates quarterly reporting on pollutant emissions, discharges into water bodies, waste disposal, and radioactive waste generation, with calculated tax liabilities corresponding to each pollution type (Ministry of Finance of Ukraine 2015). Businesses must also submit statistical reports on environmental protection, covering aspects of groundwater extraction, water use, greenhouse gas emissions, waste management, used oil recycling, and environmental protection expenditures (Ministry of Ecology and Natural Resources of Ukraine 2015, 2016; State Statistics Service of Ukraine 2022a, 2023, 2022b; Cabinet of Ministers of Ukraine 2012).

Additionally, Ukraine has established the online platform “EcoSystem,” providing public access to real-time data on air quality, water conditions, and natural resource status (Cabinet of Ministers of Ukraine 2021). The platform includes registries managed by the Ministry of Environmental Protection and Natural Resources, allowing enterprises to submit environmental reports and apply for permits. Through EcoSystem, citizens can also report environmental violations, with 516 complaints submitted to date. Following inspections by the State Ecological Inspection, 102 cases of confirmed environmental damage have been documented, totaling 15 billion UAH (Ministry of Environmental Protection and Natural Resources of Ukraine 2022; State Ecological Inspection of Ukraine 2024).

Recent developments in ESG reporting are particularly consequential for Ukraine's agricultural sector, whose post-war recovery is tightly linked to European integration and the demand for greater economic transparency. Currently, Ukraine controls 26.5 million hectares of arable land—down from 32.7 million before the full-scale invasion (Emerson 2022)—and agricultural employment has declined from 509,400 workers in 2021 to 404,900 in 2023 (Litvinov et al. 2024). The sector is marked by a diverse array of legal and organizational forms. In the pre-war period, agricultural production was distributed among 12,672 corporate enterprises and 26,629 registered farms (collectively producing 68% of output), alongside 4.6 million household producers (32%) (State Statistics Service 2022c). For analytical clarity and to support comparison with EU agricultural structures, we adopt a typology aligned with the Farm Sustainability Data Network (FSDN), which classifies farms based on cultivated land area. By this standard, small enterprises (≤ 100 ha) comprised 54.2% of firms but accounted for just 3.8% of cultivated land; medium-sized enterprises (100.01–1000 ha) represented 32.0% of firms and 22.1% of cultivated land; and large enterprises (> 1000 ha) made up 13.8% of firms while managing 74.1% of cultivated area. This structural concentration highlights the critical role of large-scale producers in both ESG compliance and integration into EU markets.

In Ukraine's agricultural sector, corporate social responsibility (CSR) disclosures play a dual role: They not only enhance firms' reputational standing among stakeholders but also contribute to the development of a supportive institutional infrastructure (Gagalyuk et al. 2021). Yet, ESG reporting remains limited in scope. Only a handful of large agricultural holdings—such as Kernel Holding and Astarta Holding—currently publish formal ESG reports (Kernel Holding 2023; Astarta Holding 2023). Interviews with 20 large-scale enterprises in 2023 indicate that firms engaged in export operations, public capital markets, or partnerships with international financial institutions are more likely to adopt sustainability practices and engage in reporting. However, even among these firms, structural barriers persist. Respondents cited wartime disruption, limited technical expertise, lack of incentives, financial constraints, mistrust of regulatory bodies, and corruption as major impediments to further ESG integration (UCAB 2023). By contrast, a 2023 survey of 120 small and medium-sized producers revealed more fundamental gaps in both perception and capacity. Many equate sustainable agriculture primarily with organic production, yet view these practices as economically unviable because of low price premiums. They also expressed concerns about the complexity of EU compliance requirements and called for stronger state oversight. Overall, smaller enterprises remain ill-equipped for consistent, high-quality nonfinancial reporting, citing knowledge deficits, institutional instability, and limited access to financial services as key constraints (Danyliak et al. 2023).

These barriers to ESG reporting in agriculture reflect broader institutional and organizational challenges that persist despite mounting regulatory and market pressures. Recent initiatives—such as the formation of green transformation agencies and the adoption of national sustainability strategies—signal alignment with EU integration efforts and external support during wartime, yet these measures often suffer from insufficient operational detail and limited capacity for implementation. For example, the Strategy for the Implementation of Sustainable Development Reporting by Enterprises (Cabinet of Ministers of Ukraine 2024), whereas ambitious in scope, lacks the procedural clarity required to support ESG practices at the firm level. Existing reporting frameworks, including statistical and tax forms covering environmental domains such as water use, waste management, and emissions, remain fragmented and are not fully aligned with international standards such as IFRS S1–S2, GRI, or ESRS. Moreover, social and governance indicators—core to a comprehensive ESG approach—are frequently excluded. Even where environmental datasets exist, outdated methodologies for data collection and verification hinder their reliability and cross-national comparability.

3 Research Methods

3.1 Research Design, Sampling, and Data Collection

Between April and July 2024, we conducted semi-structured interviews with 30 Ukrainian agricultural enterprises operating across 18 regions, including areas in the east and south that are directly or potentially affected by active conflict. To capture variation in ESG engagement, a purposive sampling strategy was employed, ensuring diversity in firm size, market orientation, and levels of reporting activity.

Table 1 summarizes the distribution of sampled enterprises by landholding size, trade orientation, and ESG reporting practices. Large enterprises (over 1000 ha), which dominate exports and are subject to external accountability pressures, were most frequently represented. Medium-sized firms primarily supply products to exporters and are governed by national tax and environmental reporting regulations. Small enterprises, oriented toward local markets, generally engage in ad hoc or minimal ESG reporting.

| Size of enterprise (hectares) | Quantity | Trade orientation | ESG reporting focus |

|---|---|---|---|

| Large (> 1000.01 ha) | 18 | Exports to EU and other countries | ESG compliance with trade partners and stock exchange requirements |

| Medium (100.01–1000 ha) | 9 | Supplies to exporters | Tax, statistical, and environmental reporting compliance |

| Small (≤ 100 ha) | 3 | Local market focus | Unsystematic or absent reporting |

Each interview lasted approximately 1 h and was conducted via phone. The semi-structured format allowed respondents—primarily managers and chief accountants—to elaborate on themes beyond the predefined protocol. The resulting data set comprises 60 pages of transcribed responses, allowing for both pattern identification and context-sensitive interpretation.

The primary aim of these interviews was to investigate the drivers motivating Ukrainian agricultural enterprises to prepare ESG reports by examining their perceptions of sustainable development, readiness to adopt ESG practices, and the barriers to attracting investment in sustainable agriculture. Understanding these drivers is especially pertinent in the context of martial law, which introduces additional risks that can influence both enterprises' readiness for change and their perceptions of sustainability and reporting.

Given the high levels of social and economic uncertainty during periods of conflict and potential occupation, semi-structured interviews provide a methodologically robust approach to gathering contextually rich data, allowing for a balance between structure and flexibility (Bryman 2012; Kvale and Brinkmann 2009). This method is particularly valuable in extreme conditions, where respondents' perspectives are shaped by the need for rapid adaptation, as it allows them to articulate their experiences more freely (King 2004).

The interviews were conducted with managers and chief accountants of the participating enterprises, using 11 questions designed to balance standard aspects of sustainability with issues unique to Ukraine's current wartime context. Managers and chief accountants were selected as respondents due to their direct responsibility for strategic management and financial decisions impacting sustainable development. In our view, their insights are essential for studying ESG reporting. For example, we included the question, “How do you understand the concept of ‘sustainable development’?” to assess respondents' general perceptions of sustainability under martial law, where resource constraints and economic uncertainty are prominent factors (Creswell 2013).

Other questions, such as “Do you undertake any activities at your enterprise that could be defined as ‘sustainable agricultural practices’?” and “What risks are preventing investment in sustainable agricultural practices?” were intended to elicit specific examples of sustainable practices during wartime and to identify critical barriers unique to this period (Patton 2015). Additional questions, including “How has the opening of the land market as of January 1, 2024, affected your enterprise?” and “What does your enterprise expect from Ukraine's EU integration (threats, opportunities)?” were crafted to assess how the intersection of war and macroeconomic developments is influencing corporate strategy and the integration of ESG factors into these strategies.

Importantly, we sought responses to the direct question, “What could encourage you to prepare sustainability reports?” Previous studies suggest that common motivations for integrated reporting include regulatory requirements, transparency for investors and stakeholders, and enhancing corporate image (Eccles et al. 2014). However, for Ukrainian enterprises operating under wartime conditions, these factors alone may be insufficient, necessitating a more contextualized understanding of the incentives for ESG reporting.

3.2 Data Analysis

We employed thematic analysis to examine the interview data, enabling us to identify recurring patterns that reflect the underlying motivations, barriers, and contextual contingencies shaping ESG reporting practices among Ukrainian agricultural enterprises. Our analytic process unfolded in three stages.

In the first stage, each co-author independently reviewed the transcripts and conducted open coding to surface emergent concepts. In the second stage, we engaged in collaborative coding discussions to consolidate themes and cluster them into broader analytical categories. Finally, we conducted a cross-case comparison by firm size, allowing us to assess variation in ESG-related attitudes and practices across enterprise scales.

This process yielded five dominant themes, presented in Table 2. These themes reflect both institutional constraints and adaptive strategies related to ESG implementation in crisis settings.

| Theme | Description | Binary coding (1 = yes; 0 = no)a |

|---|---|---|

| Operational ESG priorities | Enterprises engage in wartime social support (e.g., aid to communities and military) and implement environmentally sound practices (e.g., precision farming, fertilizer reduction), yet these actions are rarely systematically disclosed in official ESG reports. | 1 = ESG actions occur but are not formally reported; 0 = no ESG actions reported or implemented. |

| Regulatory pressure and practical constraints | EU-aligned ESG frameworks are viewed as complex and burdensome, with low awareness, limited training, and minimal advisory support impeding adoption. | 1 = respondent mentions regulatory or resource-related constraints; 0 = no such concerns expressed. |

| Financial materiality and the land market | ESG reporting is valued primarily for its potential to unlock subsidies, financing, or market access, especially concerning land acquisition and investment. Without financial incentives, ESG is seen as burdensome. | 1 = financial incentives as motivators are cited; 0 = no reference to financial motivations. |

| Skepticism toward ESG reporting | Respondents express doubt about the reliability, relevance, or impact of ESG disclosures, often citing poor internal metrics and unclear benefits. | 1 = scepticism or reluctance toward ESG reporting is expressed; 0 = no scepticism mentioned. |

| Sustainability investments and wartime innovation | Firms mention investments in decentralized energy, resilient infrastructure, and adaptive technologies. Some reference risk assessments related to conflict. | 1 = concrete innovation or adaptation practices cited; 0 = no mention or lack of capacity to implement. |

- a A binary coding approach—similar to that employed in ESG rating frameworks such as the MSCI KLD 400 Social Index—was adopted to enable cross-case comparison and thematic quantification. The MSCI KLD index applies binary indicators to evaluate firms' performance across environmental, social, and governance dimensions, offering precedent for structured, comparative assessments of ESG practices [Available at: https://www.msci.com/indexes/index/700727].

3.3 Methodological Limitations

This study was conducted under significant logistical and security constraints, which may limit the generalizability of the findings. First, restricted access to active conflict zones likely excluded enterprises facing the most acute ESG challenges, thereby skewing the sample toward relatively more stable regions. Second, given the political and economic importance of EU integration, some respondents may have framed their answers in aspirational rather than empirically grounded terms, potentially introducing social desirability bias. Third, our findings are sector-specific and may not directly extend to other high-impact industries, such as energy or manufacturing, that operate under different institutional logics.

Nonetheless, we mitigated these constraints by sampling a diverse range of enterprise sizes and locations across accessible regions. Although the results are not intended to be statistically representative, they offer analytically rich insights into how ESG is interpreted and practiced under conditions of prolonged crisis.

4 Empirical Results

This section presents findings from 30 semi-structured interviews with Ukrainian agricultural enterprises, focusing on how ESG engagement is shaped under conditions of war, institutional transition, and European integration. Thematic analysis surfaced five dominant patterns related to ESG motivation, skepticism, and adaptive strategy. Most of the interviewed enterprises specialize in the cultivation of grains and oilseeds. The respondent pool was demographically concentrated: 80% were aged 35–65, and 83% held the position of chief accountant, underscoring their central role in financial oversight and sustainability-related reporting.

4.1 Operational ESG Priorities

The first theme concerns how ESG practices are enacted operationally, often without formal recognition as “sustainable development.” Many enterprises engage in practices aligned with ESG principles (e.g., community support, resource-efficient farming), yet a shared conceptual understanding of sustainability is noticeably absent.

Roughly one-fifth of respondents equated sustainable development with environmental stewardship, whereas another fifth acknowledged confusion or unfamiliarity with the term. This semantic gap underscores a broader issue: ESG actions often precede ESG discourse, particularly in crisis settings where operational continuity eclipses abstract definitions.

Such interpretations illustrate how sustainability is framed in practical, technologically-oriented terms, rather than through normative or regulatory language. This disconnect between action and articulation reflects the broader institutional fragmentation in Ukraine's sustainability ecosystem.It is about modern technologies and environmental preservation. (Respondent 5, Medium, South)

Such accounts suggest a diffuse but emerging understanding of sustainability as a multi-dimensional practice, albeit one that is often decoupled from formal ESG reporting structures.Sustainable development means using management practices that reduce environmental harm, minimize pollution of soil, water, and air, and also take into account the needs of employees and the community. (Respondent 14, Large, Center)

Under martial law, the prioritization of social responsibility intensified, particularly among large and medium-sized enterprises. Nearly all respondents from these categories reported ongoing support for the army, internally displaced persons, and local communities. Yet, these actions—despite their scope and social value—remain largely absent from formal disclosure, reflecting both institutional gaps and a disjunction between operational and reporting systems.

We are constantly helping the community. We take care of two schools and a kindergarten… support the military… donate to brigades… maintain roads and public spaces. (Respondent 28, Large, South)

These efforts reflect an expanded conception of corporate responsibility, although they are rarely documented through formal ESG disclosures. This discrepancy underscores the informal, relational nature of legitimacy in Ukraine's crisis context, where moral and operational imperatives often converge, but outside standardized reporting channels.

We use the No-till system, which helps us limit carbon emissions… We've switched to liquid fertilizers and use precision farming. (Respondent 3, Medium, North)

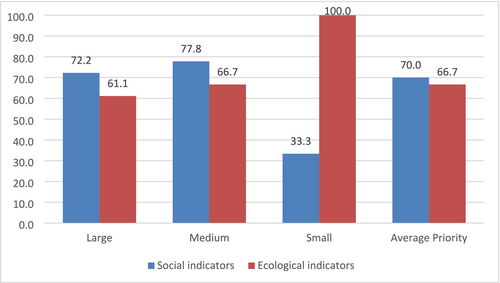

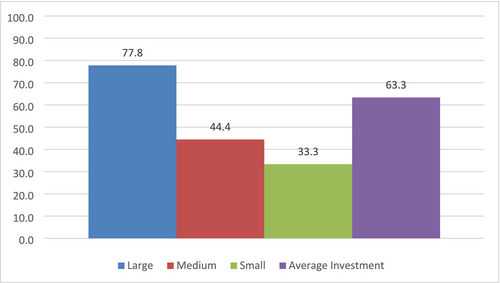

Interestingly, small enterprises were more likely to exhibit locally grounded environmental practices. Their embeddedness in communities where employees and landowners reside fosters an acute sensitivity to ecological degradation, even in the absence of regulatory incentives. In contrast, large and medium firms, while active, often reported only selectively, with many initiatives omitted from official statistical or tax filings (see Figure 1).

Source: Developed by authors based on interview data.

4.2 EU Regulatory Pressure and Practical Constraints

European integration has introduced new institutional pressures for Ukrainian agricultural enterprises, particularly concerning ESG reporting. As Ukraine's largest trading partner, the European Union imported goods worth EUR 22.8 billion in 2023, with grain, vegetable oils, and oilseeds among the top export categories (European Commission 2023b). Firms seeking to remain competitive within EU markets increasingly confront expectations related to environmental stewardship, labor rights, and corporate transparency.

These expectations are shaped by a complex regulatory ecosystem that includes the Farm–to-Fork Strategy (European Commission 2020), the Organic Production and Labelling Regulation (European Parliament 2018), and the Sustainable Finance Disclosure Regulation (European Parliament and Council 2019). For countries like Poland, accession to the EU was accompanied by transitional support mechanisms under the Common Agricultural Policy (OECD 2023)—a precedent that underscores the importance of capacity-building alongside compliance. Similar instruments may be critical in Ukraine's post-war reconstruction, particularly if ESG reporting is to serve both as a governance tool and as a means of investor signaling within EU supply chains.

Against this backdrop, our interviews sought to understand how Ukrainian agricultural enterprises interpret these regulatory shifts and how they reconcile aspirational ESG frameworks with domestic institutional and resource constraints.

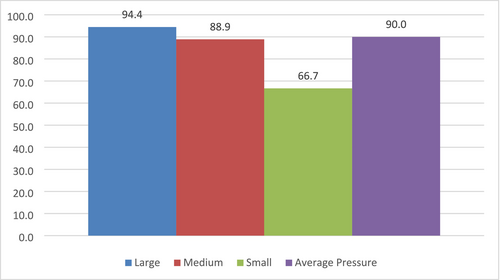

Our findings indicate that perceptions of regulatory pressure vary by enterprise size, reflecting differing levels of exposure to European markets and institutional readiness. Large enterprises, which are directly embedded in export markets and subject to stock exchange and investor scrutiny, report the most intense compliance demands. Medium-sized enterprises face notable pressure as indirect suppliers, whereas small firms, primarily oriented toward local markets, encounter minimal external ESG obligations. Despite these differences, regulatory expectations are broadly perceived as complex and burdensome, especially in light of persistent domestic challenges such as corruption and bureaucratic inefficiency (see Figure 2).

Source: Developed by authors based on interview data.

There are many discrepancies with European norms—corruption, bureaucracy. To bring everything in line will take time. There's a big question as to whether our products will remain competitive. If we talk about sustainable development reporting, we need to understand why we should do it. (Respondent 10, Medium, North)

Farmers in Europe are protesting sustainable development norms… There are too many restrictions. Government control is good, but in their case, it's too much. You can only grow what is allowed, and subsidies are given only for specific crops. (Respondent 14, Large, Center)

We're ready to prepare a sustainable development report. All data about the farm's activities is available. However, we need training and quality consultation. (Respondent 19, Large, West)

Taken together, these accounts illustrate a convergence of regulatory aspiration and institutional constraint. Although firms acknowledge the strategic value of ESG compliance, particularly for accessing European markets, the gap between ambition and implementation remains wide. This tension underscores the need for targeted technical assistance and institutional scaffolding to bridge the compliance divide.

4.3 Financial Materiality and the Agricultural Land Market

Financial materiality emerged as a dominant theme across all interviews, particularly concerning the agricultural land market. Under the CSRD, double materiality emphasizes not only how firms affect the environment and society but also how sustainability issues impact financial performance. In the Ukrainian context, land ownership and access to capital are critical domains where this relationship is most salient. We interpret ESG reporting as a mechanism that can enhance firms' investment attractiveness in three interconnected ways. First, enterprises seeking to purchase land often require external financing, and ESG disclosures signal transparency and long-term viability to lenders and investors. Second, land consolidation is increasingly associated with adherence to environmental standards, encouraging firms to report on resource use, soil health, and biodiversity conservation. Third, as new land users enter rural communities, social responsibility becomes essential for maintaining legitimacy and securing land tenure.

These dynamics must be understood in light of Ukraine's evolving land governance system. Following decades of privatization beginning in 1992 and a long-standing moratorium on land sales, the land market was partially liberalized in July 2021, allowing private citizens to sell land in parcels of up to 100 ha. A second phase of reform began on January 1, 2024, extending purchase rights to legal entities—including agricultural enterprises—up to a limit of 10,000 ha per entity. This institutional shift has made ESG performance not merely a reputational issue but a strategic consideration tied to land access, investment, and long-term competitiveness.

Currently, most agricultural land in Ukraine is owned by private individuals, and most land transactions involve leasing, which exceeds buying and selling. Since the July 2021 market opening for the purchase and sale of farmland plots among solely private individuals, 199,842 purchase transactions have been made, covering 444,260 ha at an average price of UAH 36,096 per hectare (USAID 2024).

In discussing the agricultural land market, respondents expressed concerns about the weakness of the land market institutions, which create risks of land grabbing4 and negatively impact the implementation of sustainable land use practices and reporting. Despite the opening of the land market for the purchase and sale of agricultural land, especially for agricultural enterprises, nearly half of the surveyed enterprises refrained from purchasing land.

The financial dimensions of land ownership emerged as a critical factor influencing ESG disclosure strategies. Most farmland operated by Ukrainian agricultural enterprises is still leased from smallholder landowners—private individuals who gained ownership through land reform. In this environment, firms face both legal uncertainty and competitive pressure. Some respondents feared that landowners might reclaim or sell their land to third parties, whereas others raised concerns about raider seizures involving collusion with corrupt officials.

The permission to buy and sell agricultural land has created the risk of losing land, as landowners can take the land back and sell it. We are still unable to purchase land. (Respondent 4, Small, North)

The opening of the agricultural land market in 2024 has hurt us. Landowners are offering us the land, but we do not have the funds to purchase it. Some plots have already been sold to third parties, and this threatens our use of the land. (Respondent 21, Large, South)

These land-related pressures shape how firms view ESG reporting. Rather than treating sustainability disclosure as a reputational strategy, many enterprises approach it more pragmatically—linking it to financial incentives and access to capital. Across the sample, small firms were most explicit in framing ESG reporting as a pathway to investment or subsidy access. Medium-sized enterprises similarly emphasized financial outcomes, often tied to export opportunities or credit. Larger enterprises while slightly more reserved in this regard, also connected reporting to tangible economic benefits.

If the publication of the report leads to an increase in the company's income, access to affordable loans, investments, and more opportunities to receive green subsidies… this could stimulate us to prepare it. (Respondent 17, Small, North)

We expect the opening of sales markets, improvement of logistics… we expect access to affordable loans. Financial support and additional income could encourage us to prepare sustainable development reporting. (Respondent 30, Medium, North)

We are ready to prepare such a report if we understand that it will bring additional income. After all, we undergo certification and report during exports… It is also important to have a guarantee that no one will deceive us. This often happens due to corruption, bureaucracy, and lack of control. (Respondent 27, Large, South)

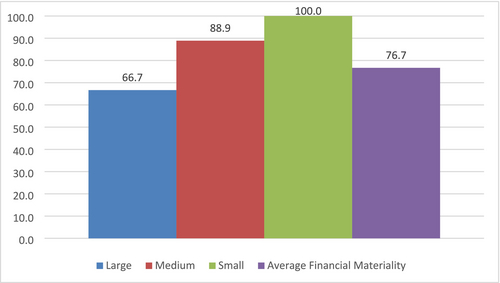

Taken together, these responses reveal a dominant logic of instrumental ESG engagement: sustainability reporting is embraced when it is tightly linked to financial returns and institutional stability. This underscores the critical role of economic incentives and governance credibility in embedding ESG practices in fragile institutional environments (see Figure 3).

Source: Developed by authors based on interview data.

4.4 Skepticism Toward ESG Reporting

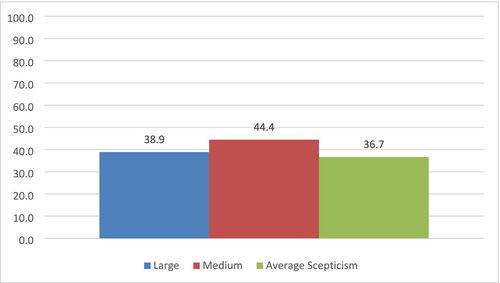

A notable theme across interviews, particularly among large and medium-sized enterprises, was measured skepticism toward ESG reporting. This skepticism did not reflect overt rejection of sustainability principles, nor was ESG viewed as a vehicle for greenwashing. Rather, it emerged from concerns about bureaucratic inefficiencies, unreliable internal performance indicators, and uncertainty about the tangible impact of disclosure on environmental and social outcomes.

We are not ready to prepare a sustainable development report at the moment. There is uncertainty regarding the current indicators. To prepare the report, we need knowledge. If there are consultants on these matters, it would be very helpful. (Respondent 6, Medium, Center)

Source: Developed by authors based on interview data.

After the EU introduces the carbon tariff… if Ukraine comes up with some reporting documents that will allow avoiding or reducing such a tariff, it will be a significant incentive… But right now, it's hard to say whether there will be any effect from such a report and what its size will be. (Respondent 2, Large, South)

Interestingly, small enterprises expressed no skepticism, likely due to their limited engagement with ESG systems in the first place. This absence suggests not endorsement, but nonparticipation, reinforcing earlier findings about their dependence on external incentives to trigger ESG adoption.

Overall, skepticism across the sample reflects rational instrumentalism rather than ideological resistance. ESG reporting is not dismissed outright but is viewed through a cost–benefit lens: Firms are willing to engage if there is a clear financial or strategic return. This supports our broader argument that effective ESG promotion must account for the economic mechanisms that shape reporting behavior, particularly in settings marked by institutional fragility and capacity constraints.

4.5 Adaptive ESG Innovation Under Wartime Constraints

A final theme concerns how enterprises navigate wartime disruptions through adaptive investments in sustainability. Interviewees described numerous barriers to ESG implementation—including workforce shortages, rising input costs, and unstable logistics—all exacerbated by the conditions of martial law. These disruptions constrain long-term planning and capital investment, particularly in the domain of environmental technologies and reporting systems.

We are experiencing a personnel shortage due to mobilization. If mechanics are drafted, it will cause a collapse. Sales have also become challenging. We export directly via ports and railways, and this year, transportation has been a serious issue. (Respondent 19, Large, West)

The wartime context has pushed firms to reconsider their investment strategies. Some large enterprises reported prioritizing decentralized energy solutions, upgrading machinery to improve resource efficiency, and adopting digital platforms to enhance logistics resilience. These actions signal a shift toward strategic ESG adaptation—not driven by external regulation alone, but by the exigencies of conflict.

Although these innovations are not always reflected in formal ESG reports, they reflect a deeper recalibration of what sustainability means in crisis economies. In this sense, wartime ESG practices challenge standard models of compliance and reveal a more dynamic relationship between survival, legitimacy, and innovation.

Military conflict emerged as the most significant risk to investing in sustainable agricultural practices, with enterprises seeking state support, state guarantees, and stability. Despite the issuance of 42,847 soft loans worth UAH 170.5 billion under the “Affordable Loans 5–7–9%” state program during martial law (Ministry of Finance of Ukraine 2023), the volume of assistance was deemed insufficient.

The situation is highly unstable, and there is always the threat of property destruction due to hostilities. Corruption and a lack of control over regulations add to the risks. (Respondent 8, Large, Center)

We are facing multiple challenges, including instability, power outages, and communication problems, especially with logistics. We are also dealing with weak state support. (Respondent 16, Large, Center)

Taken together, these accounts reveal how investment decisions under wartime conditions are shaped not only by economic calculation but also by governance trust and physical security. In such environments, ESG engagement becomes contingent on the broader risk infrastructure, with firms pursuing sustainability only when institutional scaffolding is credible and consistent.

Investment capacity during wartime varied sharply by firm size. When asked about their current priorities, nearly half of the respondents stated they were unable to invest due to financial or logistical constraints. A smaller subset of firms—primarily large enterprises—reported targeted investments in storage facilities, which they described as critical to safeguarding outputs during air raids.

This focus on physical resilience reflects a broader recalibration of strategic priorities. In 2022, the Food and Agriculture Organization (FAO) supplied Ukraine with 30,000 grain storage bags and 105 equipment sets, covering roughly 30% of the country's 6-million-ton storage deficit (FAO 2023). Although such measures provided partial relief, enterprises emphasized the importance of independent risk-mitigation infrastructures, especially as military threats became a constant in their strategic calculations.

As illustrated in Figure 5, large enterprises were most active in adopting adaptive technologies, ranging from modern grain dryers and decentralized energy systems to precision cultivation equipment. Medium-sized firms also implemented efficiency-oriented measures but faced resource constraints. Small firms showed the lowest investment levels, reinforcing their structural vulnerability.

Source: Developed by authors based on interview data.

We are expanding our grain elevator, which runs on propane-butane… We're also investing in land cultivation equipment and sprayers. (Respondent 11, Large, North)

We do not abuse herbicides… We use precision-applied liquid fertilizers… We also implement anti-erosion measures and treat the land with modern German equipment. (Respondent 9, Medium, East)

Across all firm types, risk analysis and threat mitigation have become integral to business planning. Reflecting such practices in ESG reporting would not only document compliance, but also demonstrate strategic foresight and operational resilience—reframing reporting from a regulatory burden to a signal of adaptive capacity under duress.

5 Discussion

This section situates our findings within the broader ESG literature and debates on sustainable development reporting. In Ukraine, ESG engagement reflects a hybrid logic, where business strategy and moral imperatives converge under conditions of crisis. We show how financial materiality shapes reporting practices, challenging the universality of global standards and underscoring the need for flexible frameworks in high-risk environments. Finally, we highlight the authenticity of ESG efforts in a low-institutionalized context, where pragmatically driven sustainability contrasts with the often performative reporting observed in more stable markets.

5.1 Business Strategy or Moral Justification of ESG Reporting?

The interviews show that most respondents associate sustainable development with concrete social initiatives (e.g., support for the army and local communities) and ecological practices (e.g., lean tillage, minimizing environmental harm). Their orientation is shaped by practical constraints—economic pressures from war, fluctuating market prices, and logistical disruptions—highlighting a rational, necessity-driven approach. Rather than invoking abstract ethical ideals, respondents' concerns are grounded in immediate challenges. War, corruption, and economic instability emerge as major barriers to ecological investment, reinforcing a focus on survival. New practices, such as energy-efficient technologies, are implemented only when they offer specific, expected outcomes. This pragmatic approach aligns with the business case for sustainability and echoes Trahan and Jantz's (2023) argument that ESG should function not only as a tool for improving environmental performance but as a strategic means of achieving corporate resilience, especially where social and economic factors are central to long-term viability.

In contrast to ESG practices in the Global West, where a stable socio-economic environment enables firms to frame sustainability as a moral imperative linked to long-term goals (Eccles et al. 2014), Ukrainian enterprises pursue ESG reporting with an emphasis on operational continuity under extreme conditions. This produces a selective and adaptive interaction with ESG, where actions are judged by their direct impact on business viability (Arvidsson and Dumay 2021), rather than alignment with formal external standards. This dynamic reflects Herzig's (2023) observation of a dominant business-case logic, which can risk undermining public trust when social and environmental issues are neglected or insufficiently addressed. Although Western ESG practices often emphasize strict compliance with international indicators, Ukrainian firms assess success through tangible, often local outcomes, such as energy decentralization or soil restoration, rather than global ESG rankings. This perspective aligns with Rasche et al. (2023), who caution that a business-only orientation may lead to formal compliance at the expense of substance, whereas ethical expectations can drive more responsible and balanced corporate behavior.

It is important to note that Ukrainian agroholdings that export are often motivated to disclose ESG information due to requirements from stock exchanges on which their securities are listed. Small and medium-sized enterprises (SMEs), however, are not subject to these requirements. As Barro et al. (2024) observe, rural populations—including local communities and consumers—are often excluded from formal ESG disclosure processes. Yet in Ukraine, the dynamic differs. Daily communication between local leaders and rural residents, including through local newspapers and social media, means these communities may be more informed about company activities than external investors who skim a single ESG page in an annual report. Local stakeholders may be less interested in quantified indicators, but they closely observe a firm's visible actions and investments at the community level—aligning ESG with moral, rather than merely regulatory, expectations.

Additionally, companies engaged in land demining or employing internally displaced persons exhibit concern for community and environmental welfare, but also advance their own economic survival by bringing land and labor back into productive use. This suggests that moral justification and business logic are not in conflict, but mutually reinforcing. In contrast to the Western context, where morality and profitability are often seen in tension, Ukrainian enterprises frequently align moral considerations with business goals. In this setting, ESG reporting reflects both regulatory compliance and voluntary moral engagement, supporting survival and economic viability alike.

5.2 Extreme Financial Materiality as a Path to Rethinking Global ESG Reporting Systems

Our findings reinforce the concept of financial materiality outlined in ESG reporting literature, which posits that only those environmental, social, and governance factors materially affecting a firm's financial outcomes and long-term viability should be prioritized (Eccles et al. 2014). In Ukraine, ESG reporting is seen as valuable only when tied to concrete financial benefits, such as subsidies, market access, affordable credit, or investment, particularly for land acquisition. In the absence of such incentives, ESG disclosure is often viewed as an administrative burden, in line with Khan et al.'s (2016) argument that firms prioritize financially material ESG issues and largely disregard non-material sustainability efforts with limited business impact. This raises a key question: Is ESG reporting in Ukraine's agricultural sector merely an intensified expression of financial materiality, or does it point to the need for rethinking global ESG standards?

On one hand, Ukraine represents an extreme manifestation of global ESG trends, where firms focus on ESG metrics with direct financial or regulatory implications. The prioritization of survival-oriented, financially driven ESG practices mirrors broader investor behavior, particularly in conflict zones with institutional fragility. However, unlike symbolic reporting practices criticized by Milne and Gray (2013), which often mask limited real-world sustainability outcomes, ESG activity in Ukraine tends to reflect concrete operational responses to immediate risks, suggesting substance over form.

On the other hand, Ukraine challenges the very structure of current global ESG frameworks, which are largely designed for stable institutional environments. These frameworks often fail to accommodate the realities of crisis economies. As Joseph et al. (2023) argue, sustainable business in conflict zones demands a specialized approach—one that can both respond to crisis and contribute to economic recovery and peacebuilding. The Ukrainian case supports this view, suggesting a need to recalibrate ESG systems to better account for volatility, instability, and acute risk.

Rather than rejecting the double materiality principle, our findings suggest a need for improved harmonization between its components. Financial materiality—focused on how ESG factors affect profitability, investment appeal, and regulatory access—defines immediate priorities for firms operating under duress. In contrast, impact materiality—how firms affect the environment, labor, or society—remains secondary in crisis settings, though its long-term strategic value is widely acknowledged.

As economic and geopolitical instability becomes more globally pervasive, the limitations of traditional ESG frameworks are increasingly evident. A shift is needed: Global ESG standards must evolve to account for crisis conditions that reshape corporate priorities. Although short-term focus on financial materiality is often necessary for survival, long-term sustainable development depends on the deeper integration of social and environmental dimensions. This rebalancing is essential to ensure that ESG reporting remains credible and effective—not just in stable markets, but in fragile economies where sustainability is both more difficult and more urgent.

5.3 High Authenticity in Conditions of Low Institutionalization

A central question emerging from our interviews was whether ESG integration among Ukrainian agricultural enterprises reflects strategic necessity or rational non-compliance with formal standards. Our findings reveal moderate skepticism, up to 50% among medium and large enterprises, primarily driven by uncertainty about their own indicators rather than attempts at image manipulation. Respondents questioned whether their practices met international benchmarks, whether ESG reporting would be reliable and whether it would yield tangible environmental or social impacts. Concerns also centered on the cost and effort of reporting in the absence of clear benefits.

Importantly, our data contradict assumptions that ESG disclosures in Ukraine are opportunistic. Contrary to He et al. (2024), who suggest firms may manipulate reporting for reputational gain, we found no evidence of such “glossy” disclosures. In fact, companies often avoided reporting altogether unless incentivized by regulatory or financial pressures. This reluctance reflects not hypocrisy, but pragmatic resource allocation under extreme constraints. Paradoxically, such skepticism may foster greater authenticity, as firms report only on practices aligned with real capabilities and operational priorities.

This contrasts sharply with highly institutionalized ESG environments. In the Global West, adherence to standards such as GRI, SASB, ESRS, and TCFD is widely expected, enabling the integration of ESG into corporate strategy and public discourse. Yet, this institutionalization has also enabled symbolic compliance. As Cho et al. (2015) and Boiral (2013) argue, high ESG ratings do not guarantee transparency or impact; reports may obscure harmful practices and function as reputational tools. Excessive moral expectations—on climate change, human rights, inequality—can create unrealistic burdens that firms address rhetorically rather than substantively.

By contrast, ESG in Ukraine operates in a context of low institutionalization. Firms face weak national frameworks, limited awareness of sustainability principles, and harsh operating conditions shaped by war, corruption, and economic instability. Despite this, their sustainability actions tend to be authentic, oriented toward survival and resilience, such as decentralized energy use and local supply stabilization, rather than compliance for its own sake. Our findings challenge conclusions by Jauernig and Valentinov (2019), who argue that CSR activities often serve to deflect accusations of hypocrisy. In Ukraine, ESG efforts are internally motivated and context-driven, not constructed for external approval.

The absence of formalized expectations reduces performative pressure, limiting the incentive for greenwashing. Instead, ESG activity is grounded in feasibility and necessity, not symbolic alignment with global frameworks. This reflects a pragmatic, honest engagement with sustainability, focused less on moral obligation than on operational continuity. In crisis contexts, such as Ukraine's, the lack of institutionalization may paradoxically foster a more authentic and adaptive sustainability logic—one that reflects the lived challenges of instability rather than the aspirational norms of stable economies.

6 Implications for Policy and Management

This section outlines the key practical implications of our findings for policymakers, regulators, and corporate leaders. The Ukrainian case reveals not only the limitations of applying global ESG standards in high-risk environments but also the potential to develop a context-sensitive ESG reporting model grounded in operational realities. Amid economic instability and military threats, ESG practices in Ukraine have emerged as adaptive and resilient, offering valuable insights for managing sustainability in fragile settings. The following subsections address implications for policy and legal frameworks, the reshaping of ESG norms in Ukraine's agricultural sector under EU influence, the design of ESG models suited to crisis conditions, and the development of corporate strategies that align sustainability with survival and long-term viability.

6.1 Policy and Legal Regulation

Geopolitical instability and military conflict demand a rebalancing of financial and impact materiality in ESG reporting. Current global ESG standards are designed for stable institutional environments and often fail to account for the realities of crisis economies. We argue that, at the global level, ESG frameworks should prioritize financial materiality, enabling firms to assess business continuity risks in conflict-prone contexts. Impact materiality—capturing long-term environmental and social dimensions—should serve as a critical complement, not a prerequisite.

Regionally, Ukraine's integration into the EU exposes its agricultural enterprises to competition with European producers who benefit from agroecological subsidies and established sustainability frameworks. In this context, Ukraine requires an adaptive ESG transition model that reduces regulatory burdens while supporting the integration of sustainable practices into business operations.

At the national level, policy should focus on developing advisory services to support SMEs in sustainability reporting. This could be reinforced by reforms in vocational and higher education to incorporate ESG reporting and sustainability consulting into financial training curricula. Strengthening the institutional infrastructure for accountability can be further advanced through agricultural producer associations and independent consulting centers. These organizations can both raise awareness about the benefits of the green transition and provide critical feedback on implementation barriers and practical solutions.

6.2 Shaping a New ESG Landscape in Ukraine's Agricultural Sector Under EU Integration

A key theme emerging from our interviews was the integration of Ukraine's agricultural sector into the European Union and its implications for ESG reporting. As Ukraine remains in the early stages of implementing EU-aligned sustainability standards, this transitional phase offers a unique opportunity to assess the sector's readiness to incorporate ESG principles into existing tax, statistical, and environmental reporting systems. This is relevant not only for exporters but also for upstream suppliers in the value chain, significant contributors to emissions, soil degradation, and biodiversity loss.

Our findings suggest that EU integration creates a dual dynamic for ESG: It offers access to economic recovery and European markets while simultaneously imposing regulatory demands—phytosanitary, environmental, labor, and transparency-related—that may overwhelm businesses operating under crisis conditions. We identify three core implications of this integration process.

First, EU frameworks such as CSRD, the Farm-to-Fork Strategy, CBAM, and the EU Taxonomy are premised on economic stability—a condition that does not reflect the current Ukrainian reality. Second, Ukrainian agricultural enterprises must compete with EU producers who benefit from substantial subsidies and well-established sustainability systems, raising equity concerns in ESG implementation. Third, the rigid application of EU reporting requirements may be ill-suited to conflict-affected economies. Instead, a more flexible approach—emphasizing gradual alignment and realistic goal-setting—is essential (Trahan and Jantz 2023).

Accordingly, Ukraine's EU accession process should be accompanied by adapted ESG reporting mechanisms. This includes limiting information demands from large firms to SME partners, simplifying reporting and audit procedures, and providing technical assistance to help SMEs measure and communicate sustainability performance. These insights may also inform ESG integration strategies in other economies navigating post-conflict recovery and institutional transformation.

6.3 ESG Reporting Model Adapted to Crisis Situations

Our findings point to the need for an adaptive ESG reporting model tailored to crisis economies, such as Ukraine. Unlike traditional models developed in the Global West, which are grounded in institutional stability and long-term strategic planning, the adaptive model responds to high volatility caused by war, economic shocks, and weak financial infrastructure. It emphasizes flexibility, situational responsiveness, and a recalibration of ESG priorities in line with immediate business and societal needs.

Table 3 compares conventional ESG frameworks in stable markets with the adaptive features required in crisis contexts. The model outlines key differences across six dimensions: market conditions, regulatory frameworks, materiality, institutionalization, authenticity, and moral justification. It illustrates how ESG in Ukraine has evolved under duress, not as a compliance mechanism, but as a survival strategy. This context challenges existing global ESG standards and calls for a more flexible architecture that can support firms navigating extreme risk environments. The adaptive ESG model also carries broader implications for global sustainability governance. It suggests that financial materiality must be foregrounded in crisis contexts, whereas impact materiality can be phased in as stability improves. Moreover, the alignment between moral responsibility and business continuity, rather than their separation, may offer a more realistic foundation for ESG in fragile settings. These insights can inform the redesign of ESG frameworks, especially within EU policy and emerging economies facing systemic disruption.

| Criterion | Traditional ESG model (Global West) | Adaptive ESG model (crisis economies, e.g., Ukraine) |

|---|---|---|

| Market conditions and ESG approach | Stable, predictable market conditions; ESG integrated into long-term strategic planning | High instability due to war and economic crisis; ESG commitments are situational and driven by immediate needs |

| Regulatory environment | Strong institutional enforcement of international standards (e.g., GRI, SASB, CSRD, TCFD) | Weak institutions and inconsistent enforcement require flexible, context-sensitive reporting mechanisms |

| ESG landscape formation | Shaped by investor expectations and global ESG rankings | Shaped by EU integration pressures; requires tailored, less burdensome ESG pathways, especially for SMEs |

| Materiality focus | Double materiality emphasized; financial and impact dimensions weighted equally | Financial materiality prioritized; environmental and social impacts treated as forward-looking or secondary |

| Authenticity and institutionalization | High institutionalization may foster symbolic compliance and “greenwashing” risks | Low institutionalization fosters substantive, pragmatic ESG engagement tied to operational constraints |

| Business versus moral justification | Business strategies and moral imperatives may conflict or be pursued separately | Moral and business rationales are aligned, with ESG practices supporting enterprise survival and continuity |

Source: Developed by authors based on interview data.

6.4 Corporate ESG Strategies

Our interview findings highlight three key barriers to the adoption of ESG reporting in Ukraine's agricultural sector: limited knowledge of nonfinancial reporting methodologies, uncertainty around meeting ESG performance indicators, and a lack of clarity on the benefits relative to the costs of disclosure.

Addressing these challenges requires greater awareness of sustainable agricultural practices and the strategic value of ESG integration. Educational initiatives and stakeholder engagement—bringing together regulators, investors, local communities, and advisory services—can help enterprises evaluate the potential advantages of ESG reporting before embedding it into their strategies. For example, when adopting environmental practices such as zero-tillage, firms should be equipped to assess both financial incentives, such as subsidies, green loans, carbon credits, or tax relief, and nonfinancial gains like enhanced reputation and stakeholder trust.

Given the high costs of ESG compliance—including environmental data collection, staff training, financial consulting, and third-party audits—these support mechanisms are especially critical for firms operating in conflict-affected or resource-constrained markets. Clear visibility into both the financial and strategic returns on ESG investments can improve adoption and ensure that sustainability becomes a value-creating component of business strategy rather than a regulatory burden.

7 Conclusions

Our study reveals how ESG reporting practices evolve under extreme conditions—specifically war, economic instability, European integration pressures, and institutional fragility. It offers an empirically grounded starting point for understanding ESG dynamics in crisis economies. We highlight the dual role of ESG in Ukraine, where moral imperatives reinforce business logic. Firms engage in sustainability not only for survival, but also out of a heightened sense of social responsibility, as shown through support for the military, demining, and aid to displaced populations.

We also observe an intensified form of financial materiality shaping ESG engagement. Ukrainian enterprises prioritize initiatives that yield direct economic returns, such as subsidies or market access, and often forgo reporting in the absence of such incentives. This challenges the normative assumptions of global ESG frameworks, positioning financial materiality as the dominant logic in high-risk, low-institutional environments, with impact materiality operating as a longer term complement.

Notably, the low degree of institutionalization reduces incentives for symbolic compliance or greenwashing. Skepticism toward ESG reporting reflects practical constraints, not reputational manipulation. Firms doubt their ability to meet performance benchmarks, but do not seek to misrepresent them. European integration adds a further layer of complexity: Although alignment with EU standards is crucial for access to capital and markets, this transition must be calibrated to local realities. We propose a flexible ESG reporting model that reduces regulatory burdens, especially for SMEs, whereas supporting gradual integration aligned with business continuity imperatives.

Future research might expand on this foundation through larger samples and quantitative analysis to assess causal mechanisms. Comparative studies of ESG development in post-conflict economies—such as Syria, Afghanistan, and South Sudan—could further illuminate how sustainability frameworks adapt in fragile institutional settings, offering insights into global ESG standard reform.

Acknowledgments

The authors are grateful to the three anonymous reviewers for their valuable comments. This project has received funding through the MSCA4Ukraine project, which is funded by the European Union. However, the views and opinions expressed are those of the author(s) alone and do not necessarily reflect the views of the European Union. Neither the European Union nor the MSCA4Ukraine Consortium as a whole nor any individual member institutions of the MSCA4Ukraine Consortium can be held responsible for them. Open Access funding enabled and organized by Projekt DEAL.

Conflicts of Interest

The authors declare no conflicts of interest.

Endnotes

Open Research

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.