Who drives the digital revolution in agriculture? A review of supply-side trends, players and challenges

Editor in charge: Craig Gundersen

[The copyright line for this article was changed on 30 March 2021 after original online publication.]

Abstract

Digital agriculture offers far-reaching opportunities for accelerating agricultural transformation. Based on empirical evidence and guided by economic theory, this study shows that digital agriculture is driven by private firms, including established input firms and global software firms and start-ups that are new to agriculture. Although there are concerns that digital agriculture will enhance the market power of large agribusiness enterprises and increase the digital divide, a combination of new actors and public action can help accelerate the supply of digital agricultural technology, manage threats of market concentration, and harness the opportunities of digital agriculture for all.

Some periods in agricultural development were characterized by changes so dramatic that they became known as “agricultural revolutions,” such as the Green Revolution. Digitalization may cause the next agricultural revolution as it has a unique potential to make crop and livestock production more efficient and environmentally friendly, thereby creating substantial benefits for farmers, consumers, and society at large (Basso & Antle, 2020). Promising digital tools exist not only for farmers in industrialized countries but also for farmers, including smallholders, in developing countries. This is in particular the case for digital tools that are not embodied in agricultural machineries, such as apps and digital platforms that run on smartphones (CTA, 2019). Given its transformative power, there are, however, also concerns related to digital agriculture. Critics warn of digital divides between urban and rural areas, large and small farms, male and female farmers, and farmers in industrialized and developing countries (e.g., Aker et al., 2016).

Many studies exist that analyze the new digital technologies and services available to farmers for buying inputs, for digital finance and for accessing farm management information as well as prices of inputs and outputs. An increasing number of studies examine the adoption and the impact of digital agricultural technologies, both in industrialized and in developing countries (see, e.g., reviews by Lowenberg-DeBoer and Erickson (2019) and CTA (2019); also Benami and Carter (2020) and Khanna (2020) in this special issue). However, there are few systematic studies on the industries that provide digital technology and their incentives to supply this technology to different categories of farmers. This gap in the literature is rather surprising since the public debate on the suppliers of digital tools for agriculture has attracted considerable controversy. On the one hand, there are exciting stories about innovative start-up companies that supply digital technologies, even to small-scale farmers in the developing world, such as “Uber for Tractors” (Venkataraman, 2016). On the other hand, there is a widespread concern that digital agriculture will further increase the market power of large-scale agribusiness enterprises (Curbing Corporate Power, 2018). Moreover, new players are entering the agricultural input industries, including software “giants” such as Google's parent Alphabet1 as well as big companies more renowned for innovative “hardware,” such as Bosch.2 The implications of these new trends in the supply of digital technologies on the agricultural input industries and farmers, farm laborers, and consumers are largely unclear. Hence, there is little reliable information that governments can use to develop good policies and that interest groups and civil society can draw on to influence such policies.

The present study aims to address this knowledge gap by examining the supply side of digital agriculture, focusing on three objectives. The first is to apply concepts of economic theory to identify the opportunities and challenges of supplying digital technologies to farmers.3 The second objective is to empirically assess major trends in the major industries that supply those technologies. The third objective of this article is to analyze the specific challenges of supplying disembodied digital tools such as farm management advice to smallholders in developing countries.

The article is structured as follows: Section 2 provides an overview of major applications of digital tools in crop and livestock production. Section 3 develops a conceptual framework for the article. Section 4 presents empirical information on the structure of the industries supplying digital tools for agriculture and identifies major trends in industry structure and investments. Section 5 discusses the opportunities and challenges of supplying digital tools to smallholder farmers in developing countries. Section 6 identifies some key policies that governments and donor agencies may use to strengthen the supply of digital tools, taking the specific needs of small-scale farmers in the developing world into account.

DIGITAL TECHNOLOGIES IN AGRICULTURE – AN OVERVIEW

Using the distinction between embodied and disembodied innovations, which has long been established in agricultural economics (Sunding & Zilberman, 2007), digital technologies may be divided into two main categories: precision farming technologies for crop and livestock, which are embodied into physical devices such as agricultural machines or sensors attached to animals; and disembodied software tools, such as advisory apps, farm management software, and online platforms.

Embodied digital technologies: Precision farming

Precision farming technologies for crop production

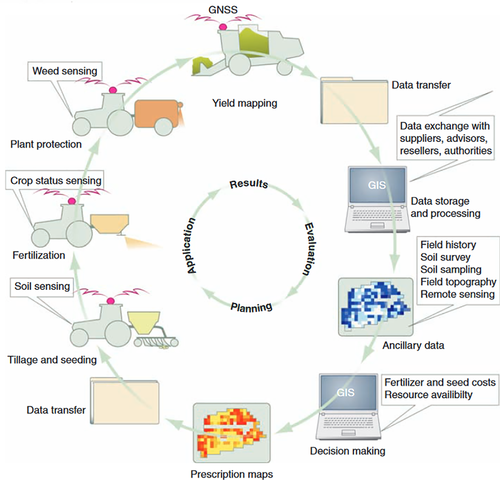

Precision farming was originally developed for crop production in the 1990s (e.g., Auernhammer & Schuller, 1999; Lowenberg-deBoer, 1997). Data for precision farming are created by a variety of sensing technologies, including proximal sensing (e.g., sensors that measure, say, nitrate in the soil) as well as remote sensing (e.g., satellite imaging). Precision farming typically involves a spatial Decision Support System based on a Geographic Information System (GIS), which may take information from crop simulation models into account to identify the amount of input that should be applied in a specific section of a field to achieve the yields that will maximize, say, expected farm profit. Many major crop farming activities (e.g., tillage and seeding, application of inorganic or organic fertilizer, weed and pest control) can benefit from a precision farming approach (e.g., as depicted in Figure 1). To allow for a site-specific application of inputs, agricultural machines (e.g., the sowing machine, the fertilizer or liquid manure spreader, or the pesticide sprayer) need to be designed in such a way that the amount applied can be varied within the field, a technology that is referred to as Variable Rate Technology (VRT). Moreover, the tractor needs to be enabled to communicate with the respective implements. To make this possible across different brands of tractors and implements, the ISOBUS standard (ISO 11783) has been developed (Paraforos et al., 2019). Precision farming also requires the tractor, or other self-propelled machines such as combine harvesters, to be fitted with a positioning system, which relies on a Global Navigation Satellite System (GNSS), such as the Global Positioning System (GPS) of the US. In advanced precision farming systems, application rates may be tailored to the individual plant, due to the high accuracy in guidance systems achieved by RTK (Real-Time Kinematic) positioning.

Precision farming technologies for livestock production

The term “precision livestock farming” has been coined in analogy to the concept of precision farming for crops (Wathes et al., 2008). Precision livestock farming is made possible by attaching sensors to animals, or to the barn equipment used in livestock production. Sensors can be used to monitor a cow's health status, identify when she comes in heat, or is about to calve. Moreover, such sensors measure phenotypic fitness traits of cows that can be used in breeding programs. Cameras are also used to monitor livestock, including pigs and poultry.

Precision livestock farming also refers to the management of barn equipment. For example, the movement of animals within the barn, or the barn climate can be controlled using sensors and automated equipment (Jungbluth et al., 2017).

New types of precision farming equipment: Robots and drones

Digitalization has also enabled new types of equipment such as drones and robots to be used for precision farming in both crop and livestock production. Both types of equipment have benefitted from advances in sensor and positioning technologies and computing power. Drones may be used to apply inputs such as agrochemicals or to monitor grazing animals (Vayssade et al., 2019). Small field robots are especially suitable for crop-care and monitoring activities and may be used in a swarm concept (e.g., Shamshiri et al., 2018). In livestock production, milking robots were introduced in the 1990s and are now widely used in industrialized countries (Rodenburg, 2017). Robots are also used for feeding and barn cleaning (Jungbluth et al., 2017).

Disembodied digital technologies: Advisory apps, farm management software, and digital platforms

There is a range of digital technologies for agriculture that are “software” solutions, which can be operated on smartphones, tablets, laptops, and other computers. Since these digital technologies are not embodied in specific crop or livestock farming equipment, they can be considered as disembodied digital agricultural technologies. At a generic level, the use of digital equipment by agricultural extension and advisory services and farmers to interact easily and remotely represents a considerable advance in service provision (e.g., Anderson, 2020).

Advisory apps are developed to help the farmer manage specific activities, such as decisions about fertilizer or agrochemicals or deciding on the feed composition for livestock. Some of these apps use functions that smartphones typically have, such as taking photos, and they often use generally available social media.

Farm management software or Farm Management Information Systems (FMIS) provide more comprehensive software solutions to assist farmers in managing the entire farm or branches thereof. There is a wide variety of such systems, which differ concerning agricultural domains, modeling approaches, delivery models, and stakeholders that they serve (Tummers et al., 2019).

Digital platforms allow farmers to exchange information with other farmers or to be linked to other actors in a value chain. These digital software tools may be divided into platforms that facilitate farmers’ access to the providers of specific agricultural inputs or machinery services, or to access “end-to-end” solutions, which include facilitation of input supply, financial services, and marketing of outputs (CTA, 2019).

CHALLENGES AFFECTING THE SUPPLY-SIDE OF DIGITAL AGRICULTURAL TECHNOLOGIES: A THEORETICAL PERSPECTIVE

The previous section described some of the digital technologies and services that businesses, NGOs, and governments can provide. In this section, concepts of economic theory are applied to analyze the challenges that suppliers of digital technologies face when they attempt to make these viable business or government services, which is based on Section 2, provides an overview of the different types of technologies and their characteristics.

Challenges to create incentives for private investment in digital technologies

Private companies may lack incentives to invest in digital technologies for several reasons, which are discussed in the following.

Nature of the good

In economics, four types of goods are distinguished according to the criteria excludability and rivalry in consumption: public goods (nonrival, nonexcludable), private goods (rival, excludable), common-pool resources (rival, nonexcludable), and club goods (nonrival, excludable) (Musgrave, 1959). Market failures exist for public goods and common-pool resources.

Classifies the digital technologies identified in Section 2 according to these criteria and according to the distinction between embodied and disembodied innovations. The following implications arise for the supply of digital technologies:

Embodied versus disembodied innovations: Innovations that are embodied in physical products, which comprise all hardware technologies used in precision agriculture, are private goods (Table 1). The same applies to robots and drones. Software that is specifically used to operate agricultural machinery can be considered to be similar as it has no use without the respective equipment. Thus, market failure does not occur for these technologies due to the nature of the product, even though it may occur for other reasons, as further discussed below. In contrast, the software solutions that are not linked to precision farming equipment, in particular advisory apps, farm management software, and digital platforms, can be considered as disembodied innovations. As mentioned, they still require some form of hardware to be operated, such as smartphones or computers. In regions where such devices are not widespread, the market for the respective software products is, therefore, limited.

| Type of digital technology | Type of good | Suitable for small suppliers/start-ups | Implications for possible types of suppliers |

|---|---|---|---|

| Hardware for precision farming (crops and livestock) | |||

| Positioning systems for tractors and other self-propelled machines | Private | Yes | Ag machinery manufacturers or other firms |

| Sensors (incl. Sensors in machinery and sensors attached to animals) | Private | Yes | Different types of suppliers depending on types of sensors |

| Machinery with capability for variable rate application | Private | Yes | Ag machinery manufacturers, other firms may supply components |

| Field robots and drones | Private | Yes | Ag machinery manufacturers or other firms |

| Software for precision farming (crops and livestock) | |||

| Software required to operate machinery | Private | No | Ag machinery manufacturers |

| Software used for optimization of operations | Club | Yes | Ag machinery manufacturers, other agro-input industries (fertilizers, agro-chemicals, seeds) or software developers |

| Software not linked to agricultural machinery | |||

| Advisory apps and farm management software | Public Club Merit |

Yes | All types of agro-input industries; software developers. Public extension services |

| Digital Platforms | Club Merit |

Yes | All types of agribusiness firms (up-stream and down-stream); software developers; service providers; public extension services |

| Supporting infrastructure and services | |||

| Global Navigation Satellite Systems (GNSS) | Public | No | Need for provision by governments |

| Mobile broadband networks | Club | No | Supply by large private firms possible; need for regulation due to network effects and to ensure that rural areas are served |

| Data storage and cloud computing infrastructure and services | Private | No | Big data companies |

| Agronomic data and information to be used for precision farming and advisory apps | Public Club |

Partly | Investment by public or private sector required (applied agricultural research) |

- Source: Compiled by the authors.

Club goods and public goods: According to the classification of types of goods, software solutions are considered as club goods, if they can be protected by intellectual property rights, as is usually the case for software (Hofmokl, 2010). Users may be required to pay a license fee or to “pay” by allowing the provider to use the farm data collected through the software. In the case of advisory apps, however, the service provided has the nature of a public good if the advice is not farm specific. The public good nature of nonfarm-specific agricultural advice is not limited to digital solutions, it is well recognized as a market failure that justifies the public investment in agricultural advisory services (e.g., Anderson & Feder, 2004).

Strategies to ensure the appropriability of club goods: Companies can use various strategies to ensure the appropriability of returns to investments they make in software. In the case of precision technologies, patents can be used, which may also require farmers to use original spare parts, thus creating additional income opportunities for machine manufacturers. Due to the linkage between hardware and software in precision farming, companies can also create high “switching costs” for their customers (Porter, 1980), e.g., by developing farm management software that can only use data derived from the agricultural machines of that manufacturer.

Merit goods: Concerning small-holder farmers in developing countries, agricultural advice may be considered as a merit good that farmers are not willing to pay for since they do not see its value in advance, or they are not able to pay for due to financial constraints and poverty (e.g., Birner & Anderson, 2007). The merit good situation may also apply to farm management software and digital platforms. Therefore, public or donor investment or other types of business models may be required to develop markets for such digital technologies in developing countries, as further discussed in Section 5.

Need for complementary investments

Digital agriculture relies on the provision of general digital infrastructure and services, as shown in the last four rows of Table 1. GNSS can be considered as a public good, which requires public investment. Mobile phone networks are affected by well-known market failures, especially network externalities and high set-up costs that can lead to natural monopolies. Experience indicates that publicly regulated private investment by telecommunications companies or public-private partnerships has been successful in addressing the respective market failures (FAO, 2019). Advisory apps, farm management software, and the software components of precision farming technologies may require public investment in generating agronomic information, as further discussed below.

Need for a sufficient size of the market in relation to development costs

Firms will only have incentives to invest in digital agriculture if the expected size of the market is sufficiently large in relation to the costs of developing, buying, and marketing digital technology.

Market size

The potential size of the market for digital agricultural technologies depends on farmers’ demand, which is influenced by the number of farmers who potentially benefit from the technology and have access to funds to purchase the technology. This demand is influenced by a range of factors (cf. Khanna, 2020 in this special issue), which are further explained in the following:

Level of mechanization and economies of scale: Since the precision farming technologies are embodied in agricultural machinery, their market size is determined by the level of mechanization across different regions of the world. Digital technologies that exhibit economies of scale at the farm level lead to further limitations of market size, since only the larger-scale farmers are likely to adopt them. Economies of scale differ across the digital technologies listed in Table 1. They are likely to be the greatest for most precision farming technologies and least for the advisory apps.

Input prices, including labor costs and output prices: Since most digital tools aim to encourage more efficient use of agricultural inputs, such as fertilizer, agro-chemicals, and feeds for livestock; the profitability of the respective digital tools depends on input prices. As further pointed out below, this may create an opportunity for developing countries, where input prices are often relatively high due to transportation and transaction costs. Moreover, rising costs of farm labor, as observed in both developing and industrialized countries, will increase the profitability of adopting digital tools that save labor or facilitate the employment of less-skilled labor. Output prices, i.e., the prices of agricultural commodities, influence the profitability of the adoption of digital technologies as well.

Environmental regulations and public pressure: The public pressure for sustainable agriculture and organic food production in industrialized, as well as developing countries, is likely to increase the demand for digital technologies that reduce the use of agro-chemicals. The debate on glyphosate use is a prominent example. The pressure to reduce the use of fertilizers and pesticides provides an incentive to large agricultural chemical firms to develop farmer advisory services that promote the efficient use of these inputs and which could attract farmers to their products and increase the demand for agrochemicals.

Possibility to transfer the digital technology across regions and farming systems: The market size for digital agricultural technologies is largely influenced by the extent to which these technologies can be applied in different farming systems, possibly with adjustments, across the world. Large agro-input industries typically follow a strategy of making high R&D investments in genetic improvement of crops, development of active ingredients for pesticides, or construction of new agricultural machinery and then introducing these innovations to the largest possible markets worldwide. Since global agriculture relies on a rather limited number of crops and livestock species, this approach has worked rather well for these companies, even though regional adjustments are often required. To what extent a similar approach can be used for digital agricultural technologies depends on the type of digital technology. Advisory apps and farm management software, for example, need to be able to capture farm-specific and local conditions. This may be the reason software developers tend to concentrate on large countries with large areas of similar farming systems.

Cost of developing digital technologies for agriculture

The cost of developing digital technologies is influenced by the following factors:

Capability of the technology and availability of complementary agronomic data: The investment costs required to develop digital agricultural technologies depend on the type of technology. Technologies that link hardware and software components (e.g., sensors, precision farming equipment) are likely to be more expensive to develop than disembodied software solutions. Technologies that only have monitoring and control functions are likely to have lower development costs than technologies that have optimization or autonomy capabilities, since they will require modeling, machine learning, or other artificial intelligence tools. The costs will also depend on the extent to which agronomic data, e.g., data required for crop modeling are available in the public domain for a wide range of farming systems, or whether the respective data have to be generated by companies that develop the digital tools. Only the large agro-input companies are likely able to generate their data through field trials or partnerships, whereas small companies may generally have to rely on publicly available data.

Type of company: Different types of companies may face different development costs for the same type of digital technology due to comparative advantages. For the case of embodied precision farming technologies, the companies that produce the respective hardware (agricultural machinery or sensors) are likely to have a comparative advantage in producing the corresponding digital tools.

Need for a conducive business environment

The supply of digital technologies for agriculture is influenced by the business environment, which differs across countries. The business environment has several components, some of which are specific to digitalization and/or to agriculture, while others apply more generally. They include digital infrastructure, access to finance, digital skills, the regulatory environment, which includes aspects such as tax rules, contract enforcement, protection of intellectual property rights, and trading across borders (World Bank, 2019, 2020).

Will digitalization lead to more concentration among supplying firms?

Market concentration in the agricultural input industries for crops is already rather high, as shown in Section 4. The reasons for this market concentration are the long development periods and the high development costs for new crop varieties and for new agro-chemicals, which induce firms to apply them to global markets. This strategy, which is typical for science-based industries, may imply increasing returns to scale, an important driver of market concentration (Niosi, 2000). Another driver of market concentration is regulatory costs (Smart et al., 2017). The question is whether digitalization is an additional driver of market concentration. Potential effects point to different directions, as shown in the following:

Self-reinforcing processes: In industries that are already highly concentrated, digitalization may lead to a self-reinforcing trend: the larger firms can conduct more research, produce more innovations, provide finance for innovative start-ups and, by buying the most successful start-ups, provide incentives for venture capitalists to invest in start-ups in this industry. Moreover, they may buy start-ups to prevent competing innovations from entering the market.

Access to big data from farmers: All digital technologies listed in collect digital data from farmers, which are, in principle, available to the providers of the respective digital technologies. NGOs have voiced the concern that access to such big data from a large number of farmers may reinforce the ongoing trends of concentration in the input industries (Curbing Corporate Power, 2018). Manufacturers of agricultural equipment (such as tractors) or livestock equipment (such as milking robots) may use the data collected by digital tools to reduce the costs of optimizing their machinery and, thus, gain further competitive advantage. Another concern is that they may use this information in their pricing strategies, thus increasing their profit margin at the expense of the farmers.

Compatibility of digital tools production: In crop production, one can expect market concentration to increase if data exchange between tractors and implements (e.g., seeders, fertilizer spreaders, etc.) is only feasible if tractors and implements are produced by the same company. This challenge has been addressed by the ISOBUS standard mentioned above. In the livestock sector, the ISOAgriNet standard was established (Jungbluth et al., 2017, p. 48). Another example of a tool to improve compatibility is AgriRouter, a platform that was created by several agricultural machinery companies as a universal platform to exchange data across different hardware and software providers.4

Substitution of existing products: Market concentration could be reduced if companies enter the market that manufactures products that substitute for existing products (Porter and Heppelman, 2014). As explained in section 2, digitalization facilitates the use of new types of machinery, such as small field robots and drones. New players or established companies in other industries may well have a comparative advantage in developing these new types of machines.

SUPPLY OF DIGITAL AGRICULTURAL TECHNOLOGIES AND SERVICES

- First, large multinational agricultural input companies supplying seeds, fertilizers, plant protection products (pesticides), and agricultural machinery. Typically, their headquarters are in the U.S., Europe, China, and India. They build up their digital agricultural services by investing internally and by buying small software and hardware companies. They can market digital agricultural technologies and services through their existing networks of dealers.

- Second, large multinational software and big-data companies such as IBM, Microsoft, and SAP in the U.S. and Europe, TCS in India, and Tencent and Alibaba in China, investing in digital agricultural technology.

- Third, nonagricultural “hardware” companies developing digital agricultural technology. The German engineering firm, Bosch, is an example of a company that moved from providing hydraulic systems for tractors (among other products) to providing sensors and software for precision agriculture.

- Fourth, start-up companies, which are the source of many of the most creative digital agricultural technologies in both industrialized and developing countries. Most seem to be independent entrepreneurs, often from outside agriculture (e.g., Hello Tractor). These start-ups are financed by venture capitalists or multinational input and tech firms. Some start-ups spin off from information technology firms, e.g., Climate Corps spun off from Google, while others spun off from input companies, such as Monsanto. Finally, some spun off from universities, for example, Agronomic Technology Corp (ATC) from Cornell University, which was purchased by Yara after being spun off.5

There is a fifth source—agricultural processing and trading companies—that provides information and inputs to increase farm productivity and the quality of products that farmers sell to them. These, however, are beyond the scope of this article.

Investment by multinational input companies

Most of the major multinational input firms are investing in research and development on digital agriculture and purchasing new technology from other firms. For example, Bayer's 2019 annual report says: “We aim to drive the transformation of our business as we look to offer tailored solutions to our customers, automate processes and increase R&D productivity. At the same time, we are digitally connecting farms on a leading common platform to help create new value for our customers.” (Bayer, 2020, p. 30). Unfortunately for the present attempts to quantify the size and trends of investments in digital agriculture, Bayer does not report how much of its $2.6 billion of crop science research is on digital agriculture. Bayer's program on digital agriculture (then part of Monsanto) took a big step forward in 2013 when it purchased Climate Corps for $930 million (see Table 2 below).

| Target firm | Target country | Acquirer | Description | Year | Amount |

|---|---|---|---|---|---|

| Antelliq | France | Merck | Digital Animal Management | 2018 | $2.4bn |

| The Climate Corporation | USA | Monsanto | Farm Management Software (SW) | 2013 | $930m |

| Agraquest | USA | Bayer | Biopesticide | 2012 | $425m |

| Blue River Technologies | USA | Deere and Company | Robotics & Computer Vision | 2017 | $305m |

| Granular | USA | DuPont | Farm Management SW | 2017 | $300m |

| Oxitec Ltd. | UK | Intrexon | Biopesticide | 2015 | $160m |

| Gavita Holland | Netherlands | Scott's Miracle Gro | Indoor Growing | 2016 | $136m |

| Pasteuria Biosciences | USA | Syngenta | Biological Nematicides | 2012 | $113m |

| Wolf Trax | USA | Compass Minerals | Fertilizer Micronutrients | 2014 | $85m |

| Agrible. Inc. | USA | Nutrien Ltd. | Predictive Analytics & Decision SW | 2018 | $63m |

| 640 Labs | USA | Climate Corporation | Data Analysis and Optimization | 2014 | N/A |

| Farmeron | Croatia | Virtue Nutrition | Performance Analytics Livestock SW | 2016 | N/A |

| proPlant | Germany | Bayer | Farm Management SW | 2016 | N/A |

| Adapt-N | USA | Yara International | Nitrogen Management SW | 2017 | N/A |

| AgSolver | USA | EFC Systems | Agronomic Planning & Sustainability | 2017 | N/A |

| VitalFields | Estonia | Climate Corporation | Full-Service Farm Mgmt. | 2017 | N/A |

| Geosys (Land O'Lakes) | USA | UrtheCast Corp | Satellite Imagery | 2018 | N/A |

| Mavrx | USA | Taranis | Satellite Imagery Analytics | 2018 | N/A |

| Strider | Argentina | Syngenta | Field Monitoring SW | 2018 | N/A |

- Source: AgFunder (2019a).

The largest agricultural seeds, biotech, and pesticide firms in 2017 were the combinations or Bayer and Monsanto; ChemChina and Syngenta, DuPont and Dow, and BASF. The new Bayer has about $23 billion in sales. The acquisition of Syngenta by ChemChina puts it in second place followed by Dow and DuPont (the agricultural part is now called Corteva), and BASF.

The top firms in the farm equipment industry are Deere & Company, followed by CNH Industrial (with brands such as Case and Ford), AGCO (with brands such as Massey Ferguson and Fendt), Kubota, and Claas.6 However, the Indian company Mahindra and Mahindra and the Chinese companies YTO Group and Foton-Lovol, which dominate their home markets, are expanding rapidly to challenge the traditional leaders globally.

The fertilizer industry has also gone through a series of mergers and acquisitions but remains the least concentrated input industry. The Norwegian multinational fertilizer company Yara with sales of about $13 billion, is the leader and expanded globally through acquisitions in India, South America, and elsewhere (Yara International, 2019). Agrium merged with Potash Canada to become Nutrien7 and Mosaic acquired Vale's fertilizer business to expand in South America.8

The animal health industry is another input industry that is investing in digital agriculture. The leading corporations are Zoetis, Merck Animal Health, and Merial (Sneeringer et al., 2019, p. 7), which was recently acquired by Boehringer Ingelheim.9

Although information on their investments in their research and development (R&D) in digital agriculture is not available, it is possible to track their interest in digital technology by looking at their investments in purchasing R&D firms or buying a share of start-up firms. Some of these data are available from venture capital companies such as AgFunder.com. The largest agribusiness acquisitions from 2012 to 2018 are shown in Table 2. Four of the top five acquisitions of start-up firms with deals valued at almost $4 billion were purchases of firms dealing with precision agriculture by the major agricultural input companies. In this list, 14 of 19 acquisitions were related to digital agriculture. The firm that made the largest acquisition is Merck Animal Health, followed by Monsanto, Deere and Company, and DuPont. Also, Nutrien, Yara, Climate Corporation (owned by Monsanto and now Bayer), and Syngenta made purchases.

Asian American and Latin American-based agricultural input companies are also buying companies and developing digital technology for both large farms in North and South America but also small farms in Asia. Mahindra Farm Equipment (an Indian firm which claims to be the third biggest global tractor producer by volume) bought a share of the Swiss digital agriculture firm Gamaya (Autocar Professional, 2019) and established an agricultural research center connected to Virginia Tech University. The biggest Chinese tractor company, YTO, is developing driverless tractors and the second largest, Foton Lovol, bought the Italian precision agriculture equipment company MaterMacc (Lovol, 2015).

The investments shown in Table 2 may just be the “tip of the iceberg” of investments by the private sector in digital agriculture because it neglects billions of dollars of the in-house investments of the big companies and purchases whose prices were not announced. Also, these data may miss equally large early-stage investments in small firms around the world, which are not captured by firms such as AgFunder.com.

Investment by large information technology companies

The second major source of digital agricultural technology is the information technology companies such as IBM, Microsoft, Google, and SAP. Over the past decade, IBM has developed a large number of services for the food and agricultural sector.10 It is applying artificial intelligence in its Watson Decision Platform for Agriculture to provide farm management information to farmers based on data on weather, soils, equipment, farmers’ practices and visual images from satellites, drones, and aircraft. IBM partnered with the fertilizer firm Yara to expand its agricultural programs internationally. It has also developed services to support food value chains using blockchain, sensors and market information in the IBM Food Trust platform.

The other center of innovation and investment by large ICT companies is China (Owen, 2019). Chinese firms started in the e-commerce area providing platforms to sell agricultural and nonagricultural goods from small towns and villages. They then moved into selling agricultural inputs to farmers. As the Chinese economy and their sales have started to slow down, Alibaba, Baidu, JD.com, Tencent and DJA have turned to agriculture and food as a new area for growth for their more advanced tools. Unlike IBM, Microsoft, and SAP, they appear to have concentrated more on applying Artificial Intelligence and other digital tools to livestock disease control and production - particularly in swine production.

In Africa, the mobile phone provider Safaricom in Kenya has been the pioneer in providing digital services starting with a digital banking service called mPesa. It then developed DigiFarm which was launched in 2017 offering “discounted products, customized information on farming best practices and access to credit and other financial facilities.” (CTA, 2019, p. 100.) The supply of digital agriculture in Africa and other developing areas is discussed in more detail in section 5.

Nonagricultural manufacturing companies

This third source of providers is companies that provide the hardware components needed to make digital agriculture work. These would include manufacturers of sensors, drones, and smart equipment. In Europe one of the most prominent examples is Bosch, a major engineering multinational based in Germany. In agricultural equipment Bosch moved from providing hydraulic equipment to sensor technology, machine connectivity systems and the Internet of Things.11 In China, XAG is an example of a start-up that originally marketed drones to consumers and small-scale businesses in 2007. It shifted to focus on agriculture in 2013 to produce drones to apply pesticides. By 2019 it had over 27,000 drones in operation (Chan, 2019).

Allflex, the largest producer of electronic identification ear tags for livestock, started in New Zealand in the 1950s as a collaboration between a small manufacturer and a farm to produce plastic identification tags for animals. It expanded globally and in the 1980s started research on electronic tags, which was commercialized in 1992.12 It became part of Antelliq which was acquired by Merck Animal Health for $2.4 billion in 2018 (Table 2 above).

The Brazilian company Solinftec consisted of a group of automation engineers. It started by automating sugar mills. When it saw inefficiencies in the value chain that brought the sugarcane to the mills, it developed devices and software to monitor the location of the farm equipment and coordinate them so that the sugarcane would be at the mills when needed. It then moved into the management of soybean value chains and production in Brazil and then to the US, Russia, and Ukraine (AgFunder, 2019c).

Small firms and start-ups

Lastly, there are hundreds of small firms that are essential to the development and supply of digital innovations for agribusinesses and farmers. Figure 2 shows examples of the many types of firms that supply digital technology to the farm in the middle. At the top are examples of Farm Management Software firms then moving clockwise there are the precision agriculture firms, suppliers of market places for business to business transactions, robotics, etc. As with other types of firms supplying digital technology, data on investments by small firms are scarce. Early-stage investments in precision agriculture in 2018 were $945 million in “farm management software, sensing, internet of things,” $852 million in “agribusiness marketplaces” and $368 million in “robotics and mechanization” (AgFunder, 2019a). Burwood-Taylor (2019) shows growth in investments in upstream agri-food startups from $ 2.2 billion in 2012 to $6.9 billion in 2018. Investments in upstream technologies are far exceeded by downstream investments in categories such as eGrocer (a lifestyle cooking app) at $3.6 billion (AgFunder, 2019a). There is some evidence that private venture capital for agricultural technology innovation has been declining since 2018. Day (2020) reports that “Q1-2020 investment levels [in ag-tech start-ups] were around $550 million, which is far below the ~$1 billion raised in the first quarter of the past two years,” which may be due to “a Covid-19 induced investment pullback.”

The main locations of early-stage investment in upstream companies in the AgFunder database are in the US and Europe. In emerging economies, Israel is a leader in developing upstream firms to service commercial farmers globally. According to AgFunder (2019b, p. 11), “in 2017 alone, Israelis raised more investment funding for upstream technologies than did China, and nearly as much as India did over 5 years.” Chinese and Indian investments are primarily in downstream activities such as eGrocer companies.

Many firms supply digital technology for agriculture in Sub-Saharan Africa (SSA). The most popular suppliers of these services are commercial enterprises (54% of registered users), mobile network operators (20%), governments (20%), NGOs (5%), and large agribusiness such as Mars and Olam (1%) (CTA, 2019, p. 100). One unique aspect in Africa is the large role that foreign donors play in financing private firms that provide digital technology. CTA (2019) reports that donors provided $206 million annually while private firms supplied $55 million. The main types of digital technology accessed are advisory services with 22.6 million registered users, financial access (5.6 million users), market linkages (2.5 million users), and value chain management (2.4 million users) (CTA, 2019, p. 102).

Has digital agriculture changed the structure of the agricultural input industry?

Digital agriculture has influenced input industry structure in three ways. The first and perhaps most important impact has been increased investments by new groups of investors and companies from outside what is traditionally considered the agricultural input industry. The first new group is big ICT companies such as IBM, Google, and Alibaba. The second new group is the industrial firms such as Bosch or XAG, who have expanded their role in agriculture or moved into agriculture for the first time. The third group is start-up companies, some of which are from universities, from IT and big input firms but most (in terms of numbers) are entrepreneurs with some knowledge of software and agriculture and access to funding.

The second important impact of digital agriculture on input industry structure has been the vertical integration of major input firms into the provision of farm management services. The input firms are shifting from input-based-business models (e.g., providing herbicides) towards service-based-business models (e.g., providing a weed-free field). Input companies are buying companies that provide short- and long-term weather prediction, crop and livestock management software, and other components to make digital platforms to provide farm management recommendations to farmers. Indian machinery companies such as Mahindra Farm Equipment buy sensor producers and software companies set up rural business hubs to sell machinery services to small farmers. Animal health companies are buying companies that provide sensors and tags for animals (e.g., Merck purchased Antelliq).

So far, there is no strong evidence that the emergence of digital agriculture has had much impact on horizontal integration of input firms such as the recent mergers and acquisitions of the major input companies described above. There was some discussion of Bayer's interest in Monsanto's Climate Crops digital agriculture subsidiary and ChemChina's interest in Syngenta's farm management platform (Rogers, 2018). There were, however, far more compelling reasons such as the complementary of market strengths of Monsanto in seeds and biotech and Bayer's strength in pesticides and Syngenta's strength in pesticide innovation and biotech combined with ChemChina's market power in generic pesticides in China and elsewhere.

CHALLENGES FOR THE SUPPLY OF DIGITAL AGRICULTURE IN DEVELOPING COUNTRIES

The previous sections showed that there are major technological advances related to digital agriculture (section 3) and that there are increasing numbers of companies investing in the research underpinning the supply of such technologies (section 4). However, the supply of technologies for digital agriculture also faces challenges. Khanna (2020) discusses these aspects for developed countries. This article focuses on the specific challenges in developing countries.

Challenges affecting the spread of embodied technology in nonmechanized farming systems

The possibilities of digital agriculture in developing countries are largely shaped by the level of mechanization. In mechanized farming systems that allow the use of vehicle-mounted sensors and variable-rate technology, digital agriculture solutions similar to those used in industrialized countries can be observed in developing countries. In nonmechanized farming systems where farmers rely mainly on animal traction and manual labor, such as the majority of farmers in Sub-Saharan Africa, the spread of embodied digital agriculture faces constraints. This is unless smallholder farmers can access digital agriculture via solutions pooling farmers (“virtual land consolidation”) and service markets. The solutions offered by service markets may be less cohesive but different elements of digital agriculture may be applied nonetheless. An example is the hiring of laser land leveling in India and Pakistan (Aryal et al., 2015).

These challenges do not imply that digital agriculture has no role to play for farmers in developing countries. While farmers rely on their senses (rather than sensors), their brains (rather than processing software), and their hands (rather than variable-rate technology), they still must make site-specific decisions, which digital agriculture can support. Thus, disembodied decision support tools running on feature-phones and smartphones may be an entry point for digital agriculture in low-mechanized countries.

Also, digital agriculture may help to improve the efficiency of agricultural markets, thus making it easier for agribusinesses such as banks, agrochemical dealers, and mechanization services providers as well as agro-processors and supermarkets to work with them. For example, digital tools may improve mechanization markets, which are often excluding smallholder farmers (Adu-Baffour et al., 2019; Daum & Birner, 2017, 2020). To change this, various digital services have emerged, which are referred to as “Uber for tractors” (see Daum et al., 2020 and Box 1 for further discussion on Hello Tractor).

The approach of Hello Tractor, founded 2014 in Nigeria, centres on a device for remote tractor monitoring and a digital booking platform. The monitoring device records GPS data, maintenance needs and fuel level, thereby simplifying the supervision of tractors and operators. The booking platform matches tractors with farmers who request services, thereby contributing to higher machinery utilization and lower transaction costs. So far, Hello Tractor has fitted around 600 tractors with the monitoring device. However, as not all tractor owners offer services and as the Nigerian tractor market is dominated by large tractor fleet owners, the number of individual Uber for tractor providers is rather constrained (Daum et al., 2020). While the Uber for tractors case might suggest that smallholder farmers use their phones to hire tractors, few Nigerian smallholder farmers yet own smartphones—and yet fewer trust them enough for making business transactions. Thus, as for the traditional Nigerian tractor markets, Hello Tractor works with booking agents who pool demand from several smallholder farmers against a 10% commission. Hello Tractor's direct benefits for smallholder farmers are mixed. Both traditional tractor markets and Hello Tractor booking agents charge similar prices and waiting times are similar. Considering that such business models can increase the overall supply of services, indirect benefits through lower prices for both types of service may be important. Benefits for tractor owners are also mixed. For large contractors, who own several dozen tractors and migrate across agro-ecological zones, Hello Tractor's technology helps to monitor tractors and to organize customers. For individual tractor owners and small associations offering services within their own community, benefits are less clear. Typically, such tractor owners have longstanding relationships with their customers and may not see the benefits of using a costly app (Daum et al., 2020). |

Concerning livestock, mechanization does not play a prominent role in the early phases of development. However, digital agriculture offers a range of interesting options that refer to collecting data from their animals, which can be used to support decisions by smallholder livestock keepers. As value addition is often higher in livestock production than in crop production (especially, in intensive systems such as dairy farming), digital agriculture will likely play a significant role in many developing situations.

Supply challenges for digital tools that provide decision-support for farmers

While disembodied decision-support tools have greater potential in nonmechanized systems, they are not without challenges. While there are many exciting examples of digital tools in developing countries, many lack viable business models (Baumüller, 2018; Deichmann et al., 2018; CTA, 2019;). According to the CTA (2019, 2020), in Africa, “the vast majority of [digital agriculture] businesses still rely on donor funding” as “farmers are unlikely to pay for (…) services (especially advisory services) and that data is (sic) challenging to monetise.”

One key challenge for the supply of digital tools is a trade-off between market size (users paying for services) and development costs. Users will only pay for digital services if they receive continuously and tailored information and benefits. Many of the “low hanging fruits” of digital agriculture (Aker et al., 2016), such as general agronomic advice, are repeated seasonally and not tailored to specific users. Such advice is nonexcludable and can easily be shared with others, which can undermine the incentives to pay (Fabregas et al., 2019). Providing more user-specific advice is possible; however, it comes with higher development costs per unit of service, which are lower for more standardized services (Baumüller, 2018; Hatt et al., 2013). Another reason for limited willingness to pay can be that some digital support services are not too useful for farmers controlling only a few hectares of land or few animals. Additional challenges are a lack of ICT literacy and complementary services and infrastructures such as access to agronomic data, connectivity, and reliable electricity (Baumüller, 2018).

Table 3 provides a classification of some of the different business models used in developing countries. Digital service may be provided for free to farmers, traders, and consumers enabled by funding from network operators, donors, input companies, or provided against a fee, which can be paid as part of a subscription or on a pay per use basis.

| Types of business models | Targeted users | Source of finance | Examples | Financial sustainability | |

|---|---|---|---|---|---|

| Users get digital service for free | |||||

| 1) | Mobile network operators provide free digital agriculture service to drive customer uptake and loyalty | Farmers, traders, consumers | Mobile network operators | DigiFarm (offered by Safaricom), iCow (in cooperation with Safaricom) | Mixed, relies on continuous support from the mobile network providers. |

| 2) | Users get free advice from processing industries | Farmers Traders |

Agricultural processors, supermarkets | ITC e-Choupal 4.0 | Yes, if processors can get lower-priced, higher quality products from farmers |

| 3) | Users can use digital agriculture service for free since service providers primary aim is to promote products or collect data from users | Farmers, traders, | Input providers, processors, donors, governments | Xarvio™ SCOUTING app (offered by BASF) | Yes, if the benefits from marketing and data collection are larger than the development costs |

| 4) | Users can use digital agriculture service for free since primary funding comes from governments | Farmers, traders, consumers | Governments | Namibian Livestock Identification and Traceability System | Mixed, depends on continuous government support |

| 5) | Users can use digital agriculture service for free since primary funding comes from donor organizations | Farmers, traders, consumers | Donors | AfriScout and the Fall Armyworm Monitoring and Early Warning System | Mixed, depends on continuous donor support |

| Users have to pay for digital service | |||||

| 6) | Users of digital agriculture service pay for service via subscriptions or on a pay per use base | Farmers, traders, consumers | Farmers, traders, consumers | RML AgTech | Mixed, the only evidence of benefits to farmers comes from studies of suppliers. Some evidence of use. |

| 7) | Digital agriculture service for internal business processes or services – paid by businesses | Input providers, processors, supermarkets | Input providers, processors, supermarkets | Hello Tractor | Yes, evidence of tractor service providers paying Hello Tractor in Nigeria |

- Source: Structure is adapted from Hatt et al. (2013). The cells are based on the judgments of the authors.

DigiFarm and iCow in Kenya are examples of digital tools financed fully or partially by network providers (model 1). Such business models hinge on continuous support from the network providers. Network providers are likely to support such digital tools as long as they ensure customer uptake and loyalty. Since this can easily change, both DigiFarm and iCow have plans to gradually charge fees for services.

E-Choupal 4.0 from ITC, a tobacco and food processing company in India is an example where an agro-processor provides digital tools for free (model 2).13 However, agro-processors are most likely to do this when they get lower-priced, higher-quality products from farmers. Another example is the Chitale Dairy cooperative in Maharashtra, which uses an IoT approach to track animals, and has used the obtained data to achieve breed improvement and increased milk yields (Bhattacharya, 2017).

Xarvio™ SCOUTING app is an example where an input provider offers a digital service for free; the main aim is to promote products and collect data from users (model 3).14 Such business models hinge on the input companies seeing the value of marketing and collecting data. These data can help companies to develop better pesticides, seeds, and breeds, which may help to make them more competitive.

The Namibian Livestock Identification and Traceability System and AfriScout are examples of digital services financed by governments (model 4) or donors (model 5). The financial sustainability of such models hinges on the support of governments and donors who want to see benefits for farmers and society at large. Depending on the nature of the service provided, public support may indeed be justified. For example, Prinsloo and de Villiers (2017) argue that the Namibian Livestock Identification and Traceability System, which uses electronic ear-tagging of cattle, has been successful in controlling outbreaks of Foot and Mouth Disease. AfriScout, which is supported by USAID, partnering with Google, among others, helps pastoralists to organize the use of public pastures and water bodies.15

RML AgTech is an example of a business model where farmers or businesses themselves have to pay (model 6). RML AgTech offers different subscription models ranging from US$22 to $75 per year to obtain agronomic advice and data on commodity prices, crop, and weather. RML also offers on-demand detection of crop diseases costing about $1 to $2 per transaction (Burwood-Taylor, 2017). If farmers and businesses have to pay for digital services, they need to see clear benefits. Regarding the farm-level impact of digital agriculture in developing countries, mostly only case studies are available, some of which show positive farm benefits. Saito et al. (2015) find that their decision support tool for field-specific fertilizer application allowed rice farmers to raise profits by up to US$640 (from a baseline of US$1200 to US$1500) per hectare. Casaburi et al. (2014) showed that simple farm-cycle-based SMS advice helped Kenyan farmers to raise yields by around 10%—especially for farmers with limited prior agronomic training. However, as shown by Fabregas et al. (2019), market failures such as nonrivalry, nonexcludability, and asymmetric information can undermine the success of subscription models.

Another business model centers on agricultural businesses paying for digital services that improve their internal business processes or services (model 7). An example of this is Hello Tractor, which supports tractor owners with digital technologies that facilitate the supervision of tractors and operators and the organization of customers. The success of this business model in terms of profits to the tractor owners and Hello Tractor is still unclear, however (see Box 1). While the company makes some money from the sales and subscription fees related to the GPS device that facilitates the supervision of tractors and operators, Hello Tractor continues to rely on start-up funds to keep the company in business (Daum et al., 2020). Hello Tractor's recent partnerships with IBM and John Deere in Nigeria and its expansion into Kenya suggest its business plan is sufficiently promising for investors and large companies to support its expansion.

Not all of the models described in Table 2 seem financially sustainable. The financial sustainably of models where farmers get digital services for free does not hinge on farmers paying for the services but farmers still need to see some benefits to use the digital service. Moreover, such models often rely on support from organizations outside of the agricultural value chain such as mobile network providers (model 1), governments (model 4), and donors (model 5). Yet, mobile network providers may discover that other digital services are better able to build customer loyalty, public digital services may be stopped when a change in government takes place and the sustained funding by donors can be limited by short project cycles. Models where input providers offer a digital service for free (model 3) can be financially sustainable but depend on the extent of sales and data that can be generated (and how useful the latter are). Models where farmers or businesses such as agro-processors or service providers pay for the digital service (models 2, 6, and 7) seem most promising regarding financial sustainability.

DISCUSSION, POLICY IMPLICATIONS, AND CONCLUDING REMARK

Diverse private companies as main drivers of growth

This article has shown that the supply of digital agriculture is growing rapidly. Predictions for the global growth of digital agriculture in 2019 were 12.6% (Mordor Intelligence, 2020) and more recent estimates that try to account for COVID-19 still predict an annual growth of 9.9% (Markets and Markets, 2020). This growth is driven by a dramatic decline in the costs of high-speed internet, cloud services, satellites, computers, cellphones, and smartphones, the pressure to reduce agricultural labor, save resources such as water and land, and reduce agrochemical use, and growth in the prices of food (section 3).

The main messages of this article are that private firms are the major developers and suppliers of digital agricultural technology and that there are many new players in this field. Section 4 has shown that the companies supplying digital agricultural technology consist of four groups: agricultural input firms; software/big data companies; engineering and hardware companies from outside agriculture; and thousands of small and medium-sized companies. The headquarters of most large firms are in North America, Europe, China, and India but many of the small firms are located in Africa. While large farms in high- and middle-income companies are the major markets, many small companies, as well as some large input firms, are targeting smaller farms in developing countries, often with support from donors (CTA, 2019).

Government policies to create an enabling business environment

Despite the optimistic outlook, there are constraints to growth that government interventions might help overcome. Governments can support entrepreneurs in this field by establishing policies that create a more conducive environment for private businesses, such as easy registration procedures for new businesses, good access to credit, protection of intellectual property rights, and facilitating trade across borders. Ensuring the reliability of internet access is also important, considering that internet shutdowns may not only occur due to weak infrastructure, but also for political reasons. Also, four other policies could encourage more equitable growth of digital technology for agriculture, as detailed below.

Promoting skills development at all levels

Investing in human capacity, i.e., skills development is an important component of the enabling environment for digital agriculture for three different target groups for skills development: farmers, government staff, and computer specialists. Farmers need “digital literacy,” which can be defined as basic skills that enable farmers to use digital tools, such as cell phone messaging, apps, and platforms developed for farmers. A second target group for skills development is the government's employees. To achieve this goal, digital agriculture needs to be integrated into the curricula of extension education as well as training programs for staff members already in service. A third target group for skills development consists of various computer specialists.

Ensuring growth of communication infrastructure

An essential component of the enabling digitalization environment is the provision of communication infrastructure for telephone and internet in rural areas. As pointed out in section 3, digital infrastructure provision is affected by market failure, but this does not imply that governments themselves need to provide this infrastructure. Past experience has shown that the liberalization of the telecommunication sector has helped to increase overall access by fostering competition and allowing private sector firms—both foreign and domestic—to supply digital services (IEG, 2011). Another promising policy instrument to ensure access to communication infrastructure in rural areas is Universal Service and Access Funds (USAFs) or similar instruments (Thakur & Potter, 2018). These funds are typically financed by mandatory contributions by mobile network operators and other telecommunication providers. They can be used to create infrastructure, improve access to underserved groups and invest in other components of the enabling environment. Whatever the source of funding, there is clearly much more that needs to be done; cogent data are seemingly less than ideal, e.g., as assembled at https://www.internetworldstats.com/stats.htm, and with not much more than 40% “Penetration” in Africa, wide regional disparities in access are surely unacceptable.

Conducting research and collecting data in support of digital agriculture

The providers of digital farm management information apps need to rely on insights from applied agricultural research, much of which is of a public-good nature. For example, the developer of an app that advises farmers on how to feed their cows may program software that gives advice based on the breed, lactation status, and milk yield of the cow. To develop such an app, the developer needs information about the nutrient content of different feedstuffs that are available in the region and of the nutritional requirements of the breeds of cows that are kept in the region. There is a wide range of such research-based information that app developers could use to develop more effective apps with lower development costs (CTA, 2019). Examples include weather forecast data based on regional prediction models; soil maps based on soil samples; fertilizer recommendations based on experiments for different crops and soil types and recommendations for prevention and treatment of crop diseases.

Policies to manage concentration in agricultural input industries

As discussed in sections 3 and 4, digitalization may further increase market concentration in the input industries. One important instrument against market concentration is antitrust regulation. Mergers have to be approved by the national regulatory agencies of the countries in which the companies are active. The Bayer-Monsanto merger showed that regulatory authorities take digital technologies into account, as Bayer had to divest its digital business to BASF as a requirement for the merger with Monsanto.

The trends towards “smart, connected” implements in agriculture may lead to pressure for concentration, if these products are not compatible with each other, as in the case of data exchange between tractors and implements across brands. So far, the self-regulation of the industry by developing common standards has helped to keep this problem in check. In the case of tractors and implements, the ISOBUS (ISO 11783) standard has been established and in precision livestock farming, the ISOAgriNet standard (Jungbluth et al., 2017, p. 48).

Investing in public R&D (section 6.2.3.) can also limit market concentration if it makes the foundations of developing digital tools for agriculture available to a broad set of potential entrepreneurs, thus preventing a situation where only a few big companies can make the necessary research investments. This applies to both the sensor technologies used in digital agriculture and for the software tools.

CONCLUDING REMARKS

Digital agriculture technology has the potential to create an agricultural revolution, making crop and livestock production more efficient and more environmentally friendly and contributing to higher productivity. This article shows that digital agriculture is driven by a vibrant set of actors, comprising not only large global input industries but also many new players such as software companies and thousands of start-up companies. These actors target different categories of farmers—from large-scale farmers in industrialized countries to smallholder farmers in developing countries. There are, however, concerns that digital agriculture could increase the market power of large agribusiness enterprises.

In developing countries, public efforts could help turn the many exciting private-sector examples of digital agriculture into viable industries and spread their benefits to a larger number of farmers and consumers. Interventions that have promise include policies for an enabling business environment, developing knowledge and skills, providing communication infrastructure and financing applied research in support of digital technologies. Public action is not only needed to harness the opportunities created by digital agriculture but also to manage its potential threats, such as increasing concentration in agricultural input industries. A combination of private efforts and smart public action is required to ensure that digital agriculture will result in an “agricultural revolution” that benefits farmers, farm laborers, and consumers as well as the environment across the globe.

ACKNOWLEDGEMENTS

We would like to thank the World Bank for their financial support, Kateryna G. Schroeder and Julian Lampietti of Agriculture Global Practice at the World Bank for their guidance and comments, Jock Anderson for his comments, and an anonymous referee and the editor, Craig Gundersen, for their valuable comments. All errors are our own.