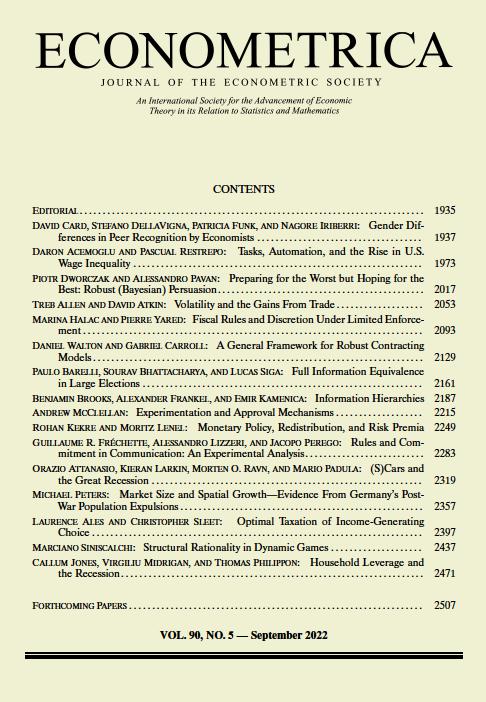

A General Framework for Robust Contracting Models

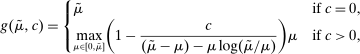

Abstract

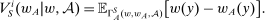

We study a class of models of moral hazard in which a principal contracts with a counterparty, which may have its own internal organizational structure. The principal has non-Bayesian uncertainty as to what actions might be taken in response to the contract, and wishes to maximize her worst-case payoff. We identify conditions on the counterparty's possible responses to any given contract that imply that a linear contract solves this maxmin problem. In conjunction with a Richness property motivated by much previous literature, we identify a Responsiveness property that is sufficient—and, in an appropriate sense, also necessary—to ensure that linear contracts are optimal. We illustrate by contrasting several possible models of contracting in hierarchies. The analysis demonstrates how one can distill key features of contracting models that allow their findings to be carried beyond the bilateral setting.

1 Introduction

Suppose that a principal wishes to write an incentive contract to induce productive effort. How should she structure the incentives so as to optimally ensure their effectiveness? A rich theoretical literature has explored this question, giving arguments in favor of one or another form of contract.

However, this literature has generally focused on models involving a single principal and a single agent. In reality, agency often takes place beyond simple bilateral relationships. For example, the principal may be a firm or government office, procuring a good of unpredictable quality from a supplier, and committing to a payment that depends on the realized quality; but the supplier has its own internal agency problem, since the representative who signs the contract with the principal may not be the same worker who produces the good. Can we abstract away from the specificity of bilateral contracting models to understand when and why their lessons carry over to models of more complex organizations?

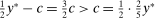

In this paper, we focus on one such lesson that has arisen frequently: that linear contracts—which simply pay some fixed fraction of the output produced—perform well by aligning the expected payoffs of the two parties. The literature on this theme has generally drawn on the idea that there may be a large space of possible actions by the agent, a notion that we formalize subsequently under the name of “Richness.” With a narrow space of possible actions, the structure of the optimal contract may be nonlinear and finely tuned to the known possibilities; but under richness, any such nonlinearities are vulnerable to strategic gaming by the agent. Incarnations of this idea have appeared in static moral hazard models (Diamond (1998), Carroll (2015), Barron, Georgiadis, and Swinkels (2020), Antić (2021)), dynamic moral hazard (Holmström and Milgrom (1987)), and screening as well (Malenko and Tsoy (2020)).

We focus more specifically on the following version of the argument, based on robustness to uncertainty: Consider a principal (“she”) and an agent (“he”), both risk-neutral, who agree to a contract that pays the agent 1/4 of whatever output he produces. Suppose that the principal does not know exactly what productive actions the agent is able to take, but she knows he has some action available that will give him an expected payoff of at least 1500 under this contract. Then, even without any information about what other actions are available, the principal can be sure the agent will get a payoff at least 1500 and, therefore, she gets at least 4500 for herself (since she receives 3/4 of output against the agent's 1/4). This argument was developed previously by Carroll (2015), which formalized this idea of a guarantee for the principal via a worst-case criterion, and showed more generally that linear contracts are optimal under such a criterion.

To see the difficulty in generalizing this conclusion beyond the simple bilateral setting, consider now a three-player hierarchy: The principal contracts with a supervisor (also “she”); the supervisor then subcontracts with an agent, and the agent chooses the action that determines output. Payments in both contracts are functions of output only. There are (at least) three natural ways to write this model, with different informational assumptions:

- (i) As in the bilateral model, the principal knows some actions available to the agent, but there may be other actions that she does not know about. The supervisor, however, fully knows the agent's production technology.

- (ii) The supervisor may know more actions than the principal does, but she suspects that the agent has still more actions available. Thus, the supervisor maximizes a worst-case objective with respect to unknown actions the agent may have; the principal has uncertainty over both the agent's possible actions and the supervisor's knowledge.

- (iii) The supervisor knows no more than the principal does; both of them face the same uncertainty about the agent's technology (and both maximize for the worst case).

We outline these three models more carefully in Section 2. All three of them allow a large space of possible actions by the agent, and indeed, all three satisfy our formal Richness condition. Yet, it turns out that linear contracts maximize the principal's worst-case criterion in models (i) and (ii), but not in model (iii) in general. (This will be shown in our later analysis.) Thus, the details of the model matter, and it may not be initially obvious what, beyond Richness, is needed.

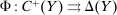

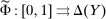

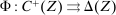

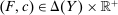

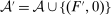

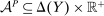

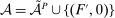

Our paper aims to identify the additional condition at a high level of generality—and, in the process, obtain a better understanding of the essential ingredients behind the linearity argument. To do this, we abstract away from any particular organizational form. Instead, the principal contracts with a counterparty of unspecified structure. The principal's uncertainty about the environment is described by a correspondence Φ, where  specifies the distributions over output that she thinks may potentially arise when she offers contract w. The principal wants to choose w to maximize her expected net profit in the worst case. Throughout, we maintain the background assumptions that the principal is risk-neutral and uses the worst-case criterion; the focus is on understanding the properties of Φ that are central to the linearity argument.

specifies the distributions over output that she thinks may potentially arise when she offers contract w. The principal wants to choose w to maximize her expected net profit in the worst case. Throughout, we maintain the background assumptions that the principal is risk-neutral and uses the worst-case criterion; the focus is on understanding the properties of Φ that are central to the linearity argument.

We formalize the Richness property by requiring that, whenever some distribution over output is a possible response to a given contract w (i.e., lies in  ), any other distribution with the same expected output but higher expected payment to the counterparty is also possible. That is, the counterparty has the flexibility to extract maximal payment for a given expected output. In this form, it is clear that Richness by itself cannot pick out linear contracts, since it says nothing about how Φ varies when the contract changes.

), any other distribution with the same expected output but higher expected payment to the counterparty is also possible. That is, the counterparty has the flexibility to extract maximal payment for a given expected output. In this form, it is clear that Richness by itself cannot pick out linear contracts, since it says nothing about how Φ varies when the contract changes.

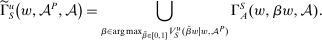

The needed additional property that we identify is Responsiveness, which expresses that the counterparty's behavior responds to the incentives provided by expected payment. Responsiveness requires that when one contract w is replaced by a new contract  , such that every distribution that might have been chosen in response to w earns a higher expected payment than before, while some other distribution not chosen under w earns a lower payment than before, this unchosen distribution remains unchosen.

, such that every distribution that might have been chosen in response to w earns a higher expected payment than before, while some other distribution not chosen under w earns a lower payment than before, this unchosen distribution remains unchosen.

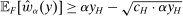

We show that the Richness and Responsiveness properties together imply that linear contracts give the best guarantees for the principal.1 This allows the lesson about the robustness of linear contracts to apply to a broad class of models of contracting with diverse organizational forms. We formally develop the general framework, define Richness and Responsiveness, and present this result in Section 3.

Having noted that, as a supplement to the Richness property, Responsiveness is sufficient to make linear contracts optimal, we next ask if it is also necessary. To address this question, in Section 4, we give a converse result. For this, we develop an auxiliary framework in which contracts specify payment as a function of a physical outcome, and Φ describes the counterparty's behavior in response to such contracts; the principal's value for each possible outcome is a separate parameter of the model. (For example, one can think of a supplier that can produce different goods, and a contract specifies a payment for each. How the supplier reacts to any given contract is independent of how much the principal values each good.) The Responsiveness property and a strengthened version of Richness can be expressed in this setting. When they hold, our main linearity result immediately implies that the principal can always maximize her guarantee by offering a linear contract, meaning one that pays proportionally to the principal's value for the realized outcome. Our converse shows that, once we ignore certain contracts that can be ruled out a priori as never optimal, if Responsiveness is violated, then there exists a valuation for the principal under which linear contracts are not optimal. This shows that our Responsiveness condition captures, at a formal level, the specific cross-contract restriction on behavior needed for the linearity result.

After presenting the results above, in Section 5 we analyze the robust principal-agent model and hierarchical models (i)–(ii) sketched above in more detail to indicate how the Richness and Responsiveness properties can be verified. (The Online Supplementary Material, Walton and Carroll (2022), in Section S-1, presents two further applications to illustrate the breadth of our framework.) Section 6 examines hierarchical model (iii), where Responsiveness is violated and linear contracts can fail to be optimal.

A reader might think that our whole exercise is unnecessary because the models where linear contracts turn out to be optimal can be easily reduced to bilateral contracting models anyway. This reaction is misplaced. For example, one might try to reduce hierarchical model (i) to a robust principal-agent model by combining the supervisor and agent into a single entity, whose cost of producing any output distribution is defined as the cost for the supervisor to induce the agent to choose that distribution in the original hierarchical model. However, this reduction fails because it does not preserve the structure of uncertainty needed to apply the result from the robust principal-agent model. In Section 7, we explain this failure in further detail. We also describe what the worst-case environment in the hierarchical model actually looks like; it is quite different from the worst-case in the principal-agent model.

Although the substantive results in this paper concern linear contracts, our conceptual framework more generally offers a way to express and prove results for contracting models without relying on a particular organizational structure. Robustness arguments for linear contracts naturally call for such a framework, because, as Section 7 shows, there does not seem to be any easy reduction argument that would allow us to directly extend the results from bilateral environments to more complex ones. In principle, the same methodology is applicable in the analysis of other forms of contracts and properties of contracting models that favor them. To illustrate by example, we demonstrate, in Section S-3 of the Online Supplementary Material, a result on concave contracts analogous to our main theorem on linear contracts: under Responsiveness and a particular weakening of Richness, concave contracts are optimal.

Our work connects to several branches of literature. First, it naturally relates to the body of work on linear contracts and their robustness against large spaces of actions, mentioned previously. While many of the arguments in this literature are thematically related, which helps motivate our interest in focusing on linear contracts, we certainly do not claim that all of these previous findings are special cases of the results developed here. Also related is the literature explaining other kinds of simple incentive structures as robust in unknown environments, such as Frankel (2014), Garrett (2014), and Carroll and Meng (2016).

There is also considerable previous work on incentives in hierarchies and more complex structures, mostly focusing on comparison across organizational forms (surveyed in Mookherjee (2006, 2013)). (There is a separate and more distant strand of literature on hierarchies, such as Tirole (1986), that focuses on issues of collusion.) Yet there seems to be little work studying how organizational structure interacts with the optimal choice of contractual form.

Finally, closest in spirit to the present work are several recent papers that study robust moral hazard contracting in different organizational environments. In particular, there is the work of Dai and Toikka (2022), which studies robust incentives for a team (and which inspired one of the additional applications explored in the Online Supplementary Material). Others in this line are Marku, Ocampo, and Tondji (2022), which takes up a common agency model, and Kambhampati (2022), which considers two agents who produce independently but are known to share a common technology.

2 Overview of Examples

We begin with brief descriptions of our main example applications, meant to give context for the general framework introduced in Section 3. The examples will be presented in formal detail in Section 5.

Robust Principal-Agent Model. In the basic application, the principal contracts directly with an agent, offering a contract that specifies payment as a function of output. Limited liability applies (in this example and throughout the paper): the contract can never pay less than zero. The agent can take any of various actions; an action is modeled as a pair, consisting of a probability distribution over output and a (nonnegative) effort cost incurred by the agent. The principal knows of some set of actions that are definitely available to the agent. But the principal does not know the true production technology, that is, the set of actions actually available. For any contract she can offer, she evaluates it based on her guaranteed payoff, that is, her expected net profit (after paying the agent) in the worst case over all possible technologies consistent with her knowledge. The guarantee of a contract is typically strictly positive, because the principal knows that the agent is optimizing under the true production technology, so will not take a totally unproductive action if he is known to have a better action available. The analysis of Carroll (2015) showed that the best guarantee for the principal is attained by a linear contract, and we shall recover this result as one instance of our general framework.

Hierarchical Model (i). In this model, the principal offers a contract to a supervisor, again specifying (nonnegative) payment as a function of output. The supervisor, after seeing this contract, in turn offers a contract to the agent, also specifying (nonnegative) payment as a function of output. The agent privately chooses his action, output is produced, and then both the supervisor and agent are paid according to their respective contracts.

In this model, we assume that the supervisor knows the agent's technology, so when she writes a contract, she is solving a standard, Bayesian version of a principal-agent problem, in which the “output” produced by the agent is not the output in the original model but rather the payment received by the supervisor. The principal, as before, knows only some actions available to the agent, but does not know the full technology, and evaluates contracts by the worst-case expected payoff over possible technologies.

Hierarchical Model (ii). The hierarchical structure is as in the previous model, but now the supervisor's knowledge is different: she may know of actions that the principal does not, but is uncertain as to whether there are still more actions available, and writes her contract with the agent to maximize her own worst-case guarantee. Note that the relationship between the supervisor and the agent is now described by the robust principal-agent model above; this implies that the supervisor has an optimal contract in which she offers the agent some fixed fraction of the payment she receives from the principal.

The principal does not know the full technology, nor how much of it is known by the supervisor, and again uses the worst-case criterion.

Hierarchical model (iii). In this version of the hierarchical model, the supervisor and the principal are symmetrically uninformed: the supervisor knows only as much about the technology as the principal does, and (as in model (ii)) maximizes a worst-case guarantee when contracting with the agent.

Model (iii) can be expressed in the language of our general framework below, but it does not satisfy the conditions for our linearity result (in particular, the Responsiveness property is violated), and indeed the result may fail, as we shall show in Section 6.

In Section S-1 of the Online Supplementary Material, we give two more examples to illustrate the breadth of potential applications for our framework. In the first example, a supervisor contracts with a team of two agents who play differentiated roles in producing output. The second example is a simplified version of the model of Dai and Toikka (2022); the principal contracts directly with a team of agents, and we simply assume that payments to the team are split equally among the agents.

One might argue that these models make some demanding assumptions. The limited liability restriction, which we maintain throughout, may be less natural in the kinds of firm-to-firm settings where hierarchies naturally arise than it would be in contracting with individuals.2 In addition, hierarchical models (ii) and (iii) impose the worst-case criterion as a positive description of the supervisor's behavior, unlike in the principal-agent model, where worst-case maximization can be viewed simply as a language for expressing statements about robustness properties of contracts. Nonetheless, our goal here is not to write down the most defensible model of contracting in hierarchies, but simply to illustrate that there are various models one could consider, only some of which deliver linear contracts, and thereby to motivate the search for their common features.

3 Main Framework and Result

First, some notational conventions. We write  for the space of Borel distributions on a metric space X. We equip

for the space of Borel distributions on a metric space X. We equip  with the weak topology. For

with the weak topology. For  ,

,  is the degenerate distribution putting probability 1 on x. We also write

is the degenerate distribution putting probability 1 on x. We also write  for the set of nonnegative real numbers, and equip it with the usual topology. We write

for the set of nonnegative real numbers, and equip it with the usual topology. We write  for the convex hull of X, when

for the convex hull of X, when  . We write

. We write  for the space of continuous functions from X to

for the space of continuous functions from X to  , equipped with the sup-norm,

, equipped with the sup-norm,  . Recall that when X is compact,

. Recall that when X is compact,  is a Banach space. We write

is a Banach space. We write  for the subset of

for the subset of  consisting of functions whose values lie in

consisting of functions whose values lie in  .

.

3.1 The Modeling Framework

There is a principal, who contracts with a counterparty, which will subsequently produce (stochastic) output that accrues naturally to the principal. The principal can provide incentives by promising payments to the counterparty.

There is an exogenously given set  of possible output values. We assume Y is nonempty and compact, and normalize

of possible output values. We assume Y is nonempty and compact, and normalize  , and denote

, and denote  . A contract is a function

. A contract is a function  .3 Note that this definition incorporates the limited liability restriction: the contract must pay a nonnegative amount.

.3 Note that this definition incorporates the limited liability restriction: the contract must pay a nonnegative amount.

is a constant. The special case

is a constant. The special case  is called the zero contract.

is called the zero contract.We take as given a nonempty-valued correspondence  , the outcome correspondence.

, the outcome correspondence.  describes the set of distributions over output y that the counterparty may generate in response to contract w, from the principal's point of view. The multiple-valuedness of

describes the set of distributions over output y that the counterparty may generate in response to contract w, from the principal's point of view. The multiple-valuedness of  thus reflects the principal's uncertainty (about the production technology, or other aspects of the environment). Note that the interpretation of

thus reflects the principal's uncertainty (about the production technology, or other aspects of the environment). Note that the interpretation of  is not simply that distribution F may be physically feasible, but rather that it might actually occur in response to contract w. For example, if the principal knows that the counterparty is able to produce output 0 with probability 1, but would never do so in response to w because some other distribution is better incentivized, then we would have

is not simply that distribution F may be physically feasible, but rather that it might actually occur in response to contract w. For example, if the principal knows that the counterparty is able to produce output 0 with probability 1, but would never do so in response to w because some other distribution is better incentivized, then we would have  . For now, we treat the correspondence Φ as exogenously given; in each of the individual applications in Section 5, we will in turn define Φ from more primitive objects.

. For now, we treat the correspondence Φ as exogenously given; in each of the individual applications in Section 5, we will in turn define Φ from more primitive objects.

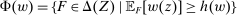

We now consider the following properties that Φ may have.

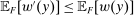

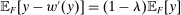

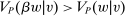

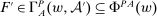

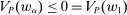

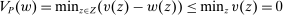

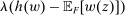

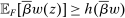

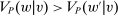

Richness.Suppose  ,

,  , and

, and  is another distribution such that

is another distribution such that  and

and  . Then

. Then  .

.

This property essentially says that the set of possible responses to a given contract is sufficiently broad: for any distribution that the counterparty might produce, any other distribution with the same expected output but higher average payment to the counterparty is also possible. Even more simply put, for any given expected output, the principal worries that the counterparty will extract the highest possible average payment.

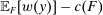

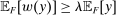

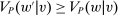

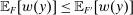

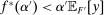

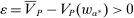

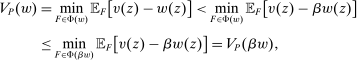

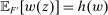

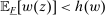

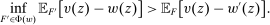

Responsiveness.Suppose  and

and  such that

such that  . Suppose that

. Suppose that  for all

for all  , while

, while  . Then

. Then  .

.

This property expresses how the possible outcomes respond to the incentives provided by expected payment. If an “old” contract w is replaced by a “new” contract  , such that any distribution that the counterparty might have produced under the old contract now pays more (in expectation) than before, while some other distribution F pays less than before, the counterparty will not switch to choosing F.

, such that any distribution that the counterparty might have produced under the old contract now pays more (in expectation) than before, while some other distribution F pays less than before, the counterparty will not switch to choosing F.

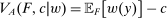

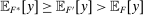

One way to understand Responsiveness is to consider a standard principal-agent problem without uncertainty: The counterparty is a single agent, and there is some fixed, mutually known set of output distributions F that he can produce, each with an associated cost  . When the principal offers contract w, the agent chooses F to maximize

. When the principal offers contract w, the agent chooses F to maximize  . Thus

. Thus  is the set of maximizers F. This model satisfies Responsiveness: Consider any

is the set of maximizers F. This model satisfies Responsiveness: Consider any  , and

, and  for which the hypotheses of Responsiveness are satisfied. If F is not even feasible, clearly

for which the hypotheses of Responsiveness are satisfied. If F is not even feasible, clearly  . Otherwise, F is feasible but not optimal under w. Then let

. Otherwise, F is feasible but not optimal under w. Then let  be an optimal choice. So

be an optimal choice. So  . Since

. Since  while

while  , we have

, we have  , that is, F remains nonoptimal under

, that is, F remains nonoptimal under  .

.

Intuitively, we would expect Responsiveness to be satisfied when the counterparty is a single agent who maximizes expected value as in the example above, or more generally, when the counterparty has a “leader” who understands the environment and maximizes expected value (such as the supervisor in hierarchical model (i)). But it also turns out to be satisfied in some other models, such as hierarchy (ii) where the leader is not expected-value-maximizing. We discuss further in Section 5.3.

For simplicity, we have not included a participation constraint. An earlier version of the paper (Walton and Carroll (2019)) describes how such a constraint can be accommodated, by restricting the principal's choice of contracts to a subset of  , interpreted as the set of contracts that the counterparty is sure to accept, and assuming an appropriate structure on this subset.

, interpreted as the set of contracts that the counterparty is sure to accept, and assuming an appropriate structure on this subset.

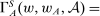

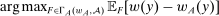

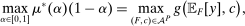

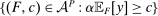

3.2 Linearity Result

Now we come to the first main result: our conditions are sufficient for optimality of linear contracts.

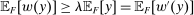

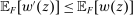

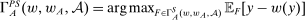

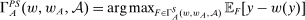

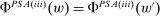

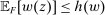

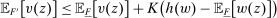

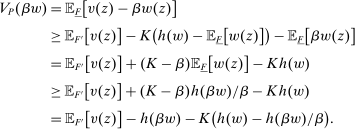

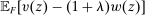

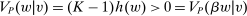

Theorem 1.Suppose the correspondence  has the Richness and Responsiveness properties. Then, for any contract w, there is a linear contract

has the Richness and Responsiveness properties. Then, for any contract w, there is a linear contract  such that

such that  .

.

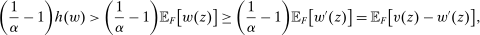

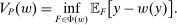

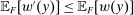

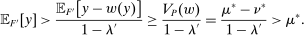

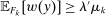

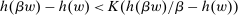

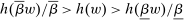

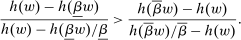

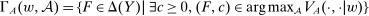

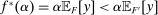

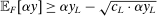

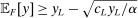

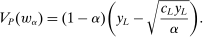

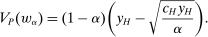

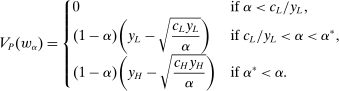

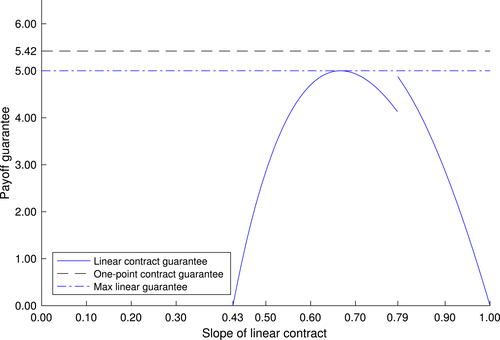

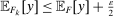

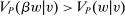

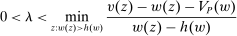

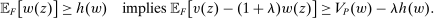

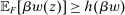

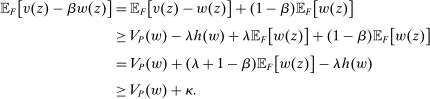

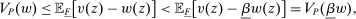

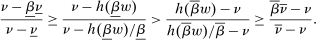

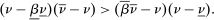

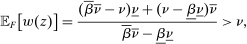

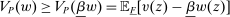

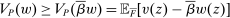

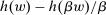

We prove Theorem 1 constructively, by using the worst-case scenario under w to determine the slope of  . The argument is illustrated in Figure 1. First, for any given level of expected output, say μ, Richness ensures that the principal is worried about the highest expected payment ν; this highest expected payment is given by the concavification of w, call it ŵ. Concavity of ŵ implies that the ratio

. The argument is illustrated in Figure 1. First, for any given level of expected output, say μ, Richness ensures that the principal is worried about the highest expected payment ν; this highest expected payment is given by the concavification of w, call it ŵ. Concavity of ŵ implies that the ratio  , the expected payment per dollar of expected output, is decreasing in μ. So, among all distributions in

, the expected payment per dollar of expected output, is decreasing in μ. So, among all distributions in  , the one with the lowest expected output μ is also the one for which the fraction of output ceded to the agent is highest; hence, this must be the worst-case distribution. The resulting outcome is shown as point

, the one with the lowest expected output μ is also the one for which the fraction of output ceded to the agent is highest; hence, this must be the worst-case distribution. The resulting outcome is shown as point  in Figure 1. We then take

in Figure 1. We then take  to be the linear contract that passes through this same point. Under

to be the linear contract that passes through this same point. Under  , the payment-per-output ratio is constant, so this new contract both pays more than the old one for higher expected output and pays less for lower expected output. By Responsiveness,

, the payment-per-output ratio is constant, so this new contract both pays more than the old one for higher expected output and pays less for lower expected output. By Responsiveness,  can only motivate the counterparty to produce higher expected output than w—which in turn means higher expected profit for the principal, since linearity ensures that expected output and expected profit are aligned.

can only motivate the counterparty to produce higher expected output than w—which in turn means higher expected profit for the principal, since linearity ensures that expected output and expected profit are aligned.

Constructing a linear contract w′ with as good or better guarantee than some initial contract w.

The above proof sketch is imprecise about the distinction between weak and strict inequalities, and also implicitly assumes that the inf in the definition of  is attained, which it may not be. The full proof below fills in these gaps. While we have used the concavification ŵ for intuition, the formal proof does not need to refer to it.

is attained, which it may not be. The full proof below fills in these gaps. While we have used the concavification ŵ for intuition, the formal proof does not need to refer to it.

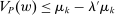

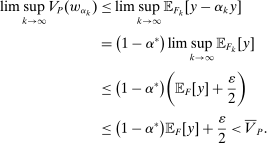

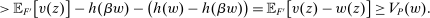

Proof.We may assume that  , since otherwise we can just take

, since otherwise we can just take  to be the zero contract. Now, let

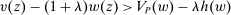

to be the zero contract. Now, let  . Note that this expression is well-defined, since every

. Note that this expression is well-defined, since every  satisfies

satisfies  . In fact, for every

. In fact, for every  , we have

, we have  , and thus λ is bounded above by

, and thus λ is bounded above by  .

.

Now define the linear contract  . We will show that

. We will show that  .

.

Let  be a sequence of distributions in

be a sequence of distributions in  approaching the inf in the definition of

approaching the inf in the definition of  :

:  . By taking a subsequence, we can assume that

. By taking a subsequence, we can assume that  converges to some limiting distribution

converges to some limiting distribution  . Put

. Put  ,

,  and

and  . Since

. Since  for each k, we have

for each k, we have  . We claim that equality must hold. If not, pick

. We claim that equality must hold. If not, pick  with

with  . By definition of λ, there exists

. By definition of λ, there exists  such that

such that  . Since

. Since  , we have

, we have

as well. Take

as well. Take  to be an appropriate convex combination of

to be an appropriate convex combination of  and

and  so that

so that  . Then we have

. Then we have  (since the latter inequality holds both for the component

(since the latter inequality holds both for the component  and, trivially, for

and, trivially, for  ). Hence, either

). Hence, either  , or else we can apply Richness to the distributions

, or else we can apply Richness to the distributions  and

and  to conclude

to conclude  . Either way,

. Either way,  contains a distribution with expected output

contains a distribution with expected output  and expected payment at least

and expected payment at least  . This means that

. This means that  . But taking

. But taking  gives

gives  , a contradiction. Thus, we conclude

, a contradiction. Thus, we conclude  as claimed.

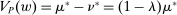

as claimed.This implies that  . We can complete the proof by showing that

. We can complete the proof by showing that  . Since every distribution F satisfies

. Since every distribution F satisfies  , it suffices to show that

, it suffices to show that  for every

for every  .

.

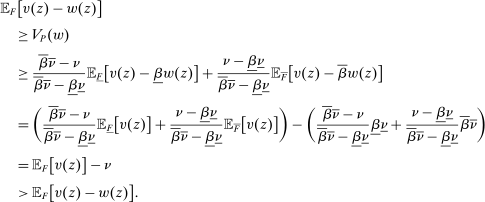

Consider any distribution  such that

such that  ; we need to show

; we need to show  . Put

. Put  . Let F be a convex combination of

. Let F be a convex combination of  and

and  such that

such that  . We have

. We have  , since this inequality holds both for the component

, since this inequality holds both for the component  and (trivially) for

and (trivially) for  . Since

. Since  , we have

, we have  . Moreover,

. Moreover,  , while for every

, while for every  , we have

, we have  ; thus, Responsiveness implies

; thus, Responsiveness implies  . Since F has the same expected output and the same expected payment under

. Since F has the same expected output and the same expected payment under  as

as  does, Richness then implies

does, Richness then implies  . Q.E.D.

. Q.E.D.

This shows that Richness and Responsiveness are sufficient for linear contracts; but are they necessary? In Section 4, we will give a converse result that aims toward addressing this question.

For the moment, we simply note that neither property can be dropped entirely. Richness alone would not give us the result, since we clearly need some assumption on how  varies with w. For a more concrete example, in Section 6 we will note that in hierarchical model (iii), Φ satisfies Richness, but the conclusion of Theorem 1 can fail.

varies with w. For a more concrete example, in Section 6 we will note that in hierarchical model (iii), Φ satisfies Richness, but the conclusion of Theorem 1 can fail.

To see that Responsiveness alone is not sufficient, just consider a standard principal-agent problem without uncertainty, as was used to illustrate Responsiveness above. As is well known, usually a nonlinear contract is strictly optimal. For example, under standard specifications with a discrete output space and just two possible distributions F, an optimal contract pays only for the one realization of output that achieves the highest likelihood ratio, and pays zero for all other realizations.4

3.3 Existence of Optimum

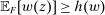

We have still been imprecise on one point: The verbal interpretation given to Theorem 1 is that a linear contract is optimal for the principal. Indeed, if an optimal contract exists, then there is one that is linear. However, it may happen that no optimal contract exists. In this case, under the conditions of Theorem 1, the supremum payoff  is approached, but not attained, by linear contracts.

is approached, but not attained, by linear contracts.

It can be useful to have a handy way to check that existence is indeed satisfied in any given model. Define the correspondence  by

by  (recall that

(recall that  was the linear contract of slope α).

was the linear contract of slope α).

Proposition 2.Suppose that Φ satisfies Richness and Responsiveness. If moreover  is lower hemicontinuous, then there exists a contract maximizing

is lower hemicontinuous, then there exists a contract maximizing  (and, in fact, the maximum is attained by a linear contract).

(and, in fact, the maximum is attained by a linear contract).

The proof (a straightforward limiting argument) is in the Appendix. In the examples in Section 5, we use this result to show that an optimal contract exists.

4 A Converse Result

We have argued that, given Richness, the addition of Responsiveness is sufficient for optimal contracts to be linear. To argue that we have really identified the right condition, we should show that Responsiveness is necessary as well. Of course, in the framework so far, this cannot be exactly right: many contracts are clearly far from optimal (e.g., any contract that always pays more than the value of output), so violations of Responsiveness among such contracts are irrelevant. This suggests we should look for a more general framework, in which Responsiveness can be defined at the level of a class of models, so that Responsiveness becomes necessary to ensure that all instances within the class deliver linear contracts.

Specifically, we will now consider a framework in which output is not directly measured in payoff units. Instead, the counterparty produces “physical” outputs, for example, the counterparty may be a supplier that can produce different types of goods. Contracts specify payment as a function of the physical output. The principal, in turn, derives some monetary value from each possible physical output. The principal's valuation of outputs is now an additional parameter in the model; it matters for the principal's preferences but is irrelevant to the counterparty's behavior. Here, Responsiveness will be sufficient to ensure that, no matter what this valuation is, a linear contract (one that pays proportionally to the principal's value) is optimal, and we will argue that Responsiveness is essentially necessary for this conclusion as well.

Thus, for this section only, we consider a given nonempty set Z of physical outputs. We take Z to be finite (and endowed with the discrete metric), and we denote a typical element by z. A contract is now a function  . We take as given a nonempty-valued outcome correspondence

. We take as given a nonempty-valued outcome correspondence  .

.

We reformulate the Richness property for this setting as follows:

Strong Richness.

- (a) Suppose

,

,  , and

, and  such that

such that  . Then

. Then  .

. - (b) For every

, the set

, the set  is closed.

is closed.

Part (a) of this property is stronger than our original Richness property because it drops the restriction that F and  should have the same expected output; this restriction cannot be formulated when output does not have a numeric value. We do not view this loss as a major sacrifice. In our applications in Section 5, this restriction matters only because it allows us to include tie-breaking assumptions on the counterparty's behavior (e.g., assuming that if the agent is indifferent between multiple distributions, he chooses the one that is better for the principal); without such assumptions, an optimal contract can sometimes fail to exist. Part (b) of Strong Richness is a technical condition that helps rule out some inconvenient boundary cases.

should have the same expected output; this restriction cannot be formulated when output does not have a numeric value. We do not view this loss as a major sacrifice. In our applications in Section 5, this restriction matters only because it allows us to include tie-breaking assumptions on the counterparty's behavior (e.g., assuming that if the agent is indifferent between multiple distributions, he chooses the one that is better for the principal); without such assumptions, an optimal contract can sometimes fail to exist. Part (b) of Strong Richness is a technical condition that helps rule out some inconvenient boundary cases.

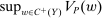

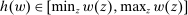

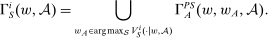

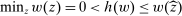

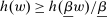

Together, parts (a) and (b) imply that, for each w, there exists a threshold  such that

such that  .

.

We can formulate Responsiveness exactly as in our main framework, since it made no reference to the value of output.

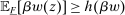

Responsiveness.Suppose  , and

, and  such that

such that  . Suppose that

. Suppose that  for all

for all  , while

, while  . Then

. Then  .

.

such that

such that  . For any valuation and any contract, the principal's guarantee is then defined as

. For any valuation and any contract, the principal's guarantee is then defined as

in our previous framework.

in our previous framework.We can now say that a contract w is linear given v if there exists a constant  such that

such that  for all z.

for all z.

We will also say that w is grounded if  . We will focus our attention on grounded contracts (note that, given any v, any linear contract is grounded). This is justified if, for example,

. We will focus our attention on grounded contracts (note that, given any v, any linear contract is grounded). This is justified if, for example,  whenever w and

whenever w and  are two contracts that differ by a constant: then, if a contract is not grounded, the principal can subtract a constant from it without changing incentives and so improve her own payoff. (All of our example applications satisfy this property of invariance to constant translations.)

are two contracts that differ by a constant: then, if a contract is not grounded, the principal can subtract a constant from it without changing incentives and so improve her own payoff. (All of our example applications satisfy this property of invariance to constant translations.)

Suppose that Φ satisfies Strong Richness and Responsiveness. Theorem 1 implies that, given any valuation v, for any contract w, there is a contract  that is linear given v and satisfies

that is linear given v and satisfies  .

.

A conjecture might be that this conclusion fails whenever Responsiveness is violated: that is, if Φ satisfies Strong Richness but not Responsiveness, there exists some choice of valuation v for which a nonlinear contract gives a strictly higher guarantee than any linear one. We will show a slightly weaker version of this statement: Given Φ, some contracts can be quickly ruled out as never optimal regardless of v, except in degenerate cases. We can think of these contracts as “irrelevant.” We will show that if there is a violation of Responsiveness involving “relevant” (and grounded) contracts, then v can be chosen so that a nonlinear contract does better than linear.

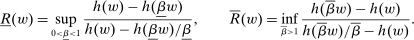

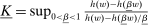

Given Φ satisfying Strong Richness, let h be the threshold function defined above; and, for  and

and  , write βw for the contract obtained by scaling w pointwise by β.

, write βw for the contract obtained by scaling w pointwise by β.

Now say that a contract w is scaling-dominated if, for every v such that  , there exists some

, there exists some  such that

such that  . These are the contracts we regard as irrelevant. They can be identified as nonoptimal using only a very small part of the correspondence Φ (namely, its values on the scalar multiples βw). Thus we can identify whether w is scaling-dominated using only the values of h on its scalar multiples, and the next proposition characterizes explicitly when this happens.

. These are the contracts we regard as irrelevant. They can be identified as nonoptimal using only a very small part of the correspondence Φ (namely, its values on the scalar multiples βw). Thus we can identify whether w is scaling-dominated using only the values of h on its scalar multiples, and the next proposition characterizes explicitly when this happens.

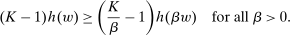

Proposition 3.Assume Strong Richness, and let w be a grounded contract. Then w is scaling-dominated if and only if it satisfies at least one of the following five conditions:

- (i)

.

. - (ii) There exists

such that

such that  .

. - (iii) For every positive number K, there exists

such that

such that  .

. - (iv) For every number

, there exists

, there exists  such that

such that  and

and  .

. - (v) There exist

and

and  such that

such that  and

and

Moreover, if none of these conditions is satisfied, we can choose v such that w is linear given v,  , and

, and  for all

for all  .

.

With our focus on contracts that are not scaling-dominated, we can now give our statement on the necessity of Responsiveness.

Theorem 4.Assume Φ satisfies Strong Richness but fails to satisfy Responsiveness between some two contracts  , where

, where  is grounded and not scaling-dominated. Then the valuation v can be chosen so that w gives a strictly higher guarantee than any linear contract.

is grounded and not scaling-dominated. Then the valuation v can be chosen so that w gives a strictly higher guarantee than any linear contract.

The proofs of Proposition 3 and Theorem 4 are left to the Appendix; we just give sketches here.

For the “if” direction of Proposition 3, we go through the conditions one by one. In each case, we use the statement of the condition to identify the relevant rescaling βw that does better than w. (In conditions (iii) and (iv), where β depends on K, we must first choose K appropriately depending on the valuation v.) For the “only if” direction, it suffices to prove the last statement of the proposition; thus we wish to choose v to be proportional to the given contract w (thus making w linear) and pick the constant of proportionality so that w is in fact optimal among linear contracts. Writing down the conditions needed for this to happen, it turns out that we run into difficulty precisely when one of (i)–(v) holds.

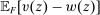

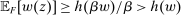

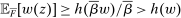

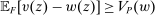

For Theorem 4, the key observation is that when Responsiveness is violated between contracts  , and

, and  is linear, then w gives a strictly better guarantee than

is linear, then w gives a strictly better guarantee than  does. (Refer back to Figure 1: a violation of Responsiveness means that some low-output distributions are possible under

does. (Refer back to Figure 1: a violation of Responsiveness means that some low-output distributions are possible under  but not under w.) Thus, to prove Theorem 4, we can invoke the last statement of Proposition 3 to choose v such that the given

but not under w.) Thus, to prove Theorem 4, we can invoke the last statement of Proposition 3 to choose v such that the given  is optimal among linear contracts. The foregoing observation then implies that w does strictly better than

is optimal among linear contracts. The foregoing observation then implies that w does strictly better than  , and thus better than any linear contract.

, and thus better than any linear contract.

As a final remark, we note that the lengthy conditions in Proposition 3 can be somewhat simplified if we assume that Φ satisfies the following additional property.

Scaling Monotonicity.For any  and any

and any  ,

,  .

.

Given Strong Richness, this property is equivalent to the statement that  is weakly increasing in β. In words, it says that the counterparty responds positively to rescaling of incentives (but does not say anything about responses to changes in the shape of incentives). It is satisfied in the robust principal-agent model and all three versions of the hierarchical model.

is weakly increasing in β. In words, it says that the counterparty responds positively to rescaling of incentives (but does not say anything about responses to changes in the shape of incentives). It is satisfied in the robust principal-agent model and all three versions of the hierarchical model.

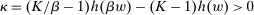

, (iv)

, (iv)  , (v)

, (v)  , where

, where

5 Applications

We now return to our main framework where output  is directly measured in payoff units. We proceed to detail the various applications that were previewed in Section 2, showing how they are instances of the general framework. We indicate how to verify Richness and Responsiveness, as well as lower hemicontinuity. (Some of the formalities are deferred to the Online Supplementary Material.) Hierarchical model (iii) does not satisfy Responsiveness and so is left to the next section.

is directly measured in payoff units. We proceed to detail the various applications that were previewed in Section 2, showing how they are instances of the general framework. We indicate how to verify Richness and Responsiveness, as well as lower hemicontinuity. (Some of the formalities are deferred to the Online Supplementary Material.) Hierarchical model (iii) does not satisfy Responsiveness and so is left to the next section.

5.1 Robust Principal-Agent Model

. If action

. If action  is taken, output is drawn according to the distribution F and the agent incurs an effort cost of c. We define a technology to be a nonempty, compact subset of

is taken, output is drawn according to the distribution F and the agent incurs an effort cost of c. We define a technology to be a nonempty, compact subset of  , interpreted as the set of actions available to the agent. Given a contract

, interpreted as the set of actions available to the agent. Given a contract  and technology

and technology  , the agent maximizes objective

, the agent maximizes objective

. We assume that the principal does not know

. We assume that the principal does not know  . Instead, there is an exogenously given technology

. Instead, there is an exogenously given technology  , representing all actions that are known by the principal to be available to the agent. The agent's actual technology is known only to satisfy

, representing all actions that are known by the principal to be available to the agent. The agent's actual technology is known only to satisfy  .

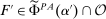

. ; this is the set of distributions that can result when the agent maximizes

; this is the set of distributions that can result when the agent maximizes  over

over  given w. Continuity of w and compactness of

given w. Continuity of w and compactness of  ensure that

ensure that  is nonempty. Finally, as a tie-breaking condition, we assume that when the agent is indifferent among actions, he chooses the one best for the principal; we call such actions principal-preferred. Formally, this set is denoted as

is nonempty. Finally, as a tie-breaking condition, we assume that when the agent is indifferent among actions, he chooses the one best for the principal; we call such actions principal-preferred. Formally, this set is denoted as  . This assumption helps to ensure that an optimal contract w exists (discussed more momentarily). Now the outcome correspondence is defined as

. This assumption helps to ensure that an optimal contract w exists (discussed more momentarily). Now the outcome correspondence is defined as

.

.This is the same model as the one considered in Carroll (2015). In our framework, we reproduce the main result of that paper, by verifying that Richness and Responsiveness hold in this model. We also verify that the restricted correspondence  is lower hemicontinuous, so a maximizing linear contract exists; this existence is needed later when we embed this model in a principal-supervisor-agent hierarchy, as it ensures that the supervisor's behavior is well-defined.

is lower hemicontinuous, so a maximizing linear contract exists; this existence is needed later when we embed this model in a principal-supervisor-agent hierarchy, as it ensures that the supervisor's behavior is well-defined.

Proposition 5.There exists a linear contract maximizing  .

.

Essentially, Richness holds because, for any F that might be chosen for some technology, the more-remunerative  might then also be chosen if it turned out to also be available. Responsiveness holds by the same argument as in the principal-agent model without uncertainty sketched in Section 3.1, repeated for each possible technology. The formal proof ends up a bit lengthy because of tie-breaking technicalities.

might then also be chosen if it turned out to also be available. Responsiveness holds by the same argument as in the principal-agent model without uncertainty sketched in Section 3.1, repeated for each possible technology. The formal proof ends up a bit lengthy because of tie-breaking technicalities.

Proof.(Richness) Let  ,

,  , so that there exists a technology

, so that there exists a technology  containing action

containing action  such that

such that  for all

for all  . Let

. Let  such that

such that  and

and  . Consider an alternative technology

. Consider an alternative technology  . Then

. Then

, so

, so  . If

. If  , then F being principal-preferred implies that

, then F being principal-preferred implies that  is principal-preferred in

is principal-preferred in  . Otherwise,

. Otherwise,  , and hence the agent strictly prefers taking action

, and hence the agent strictly prefers taking action  to all other actions in

to all other actions in  , so

, so  is principal-preferred since it is the only element of

is principal-preferred since it is the only element of  . So

. So  .

.(Responsiveness) Let  and

and  satisfy the conditions of the Responsiveness property. If we can show for any technology

satisfy the conditions of the Responsiveness property. If we can show for any technology  that

that  , then

, then  . Take any technology

. Take any technology  containing

containing  for some

for some  , and take

, and take  . By the hypothesis of Responsiveness and agent optimality,

. By the hypothesis of Responsiveness and agent optimality,

(1)

(1) . Otherwise, they are all equalities. In this case, it is possible for

. Otherwise, they are all equalities. In this case, it is possible for  only if

only if  and

and  as well. If this holds, principal tie-breaking under w and the hypothesis of Responsiveness along with the equalities in (1) imply

as well. If this holds, principal tie-breaking under w and the hypothesis of Responsiveness along with the equalities in (1) imply

, so

, so  .

.Now we have verified Richness and Responsiveness, so by Theorem 1, we can restrict to linear contracts when maximizing  . It remains to verify that

. It remains to verify that  is lower hemicontinuous.

is lower hemicontinuous.

(Lower Hemicontinuity) Let  ,

,  , and let

, and let  be an open neighborhood of F in

be an open neighborhood of F in  . We want to show that there exists

. We want to show that there exists  such that

such that  implies that

implies that  is nonempty, where

is nonempty, where  is the Euclidean ball of radius η around α restricted to

is the Euclidean ball of radius η around α restricted to  .

.

If  , then any technology

, then any technology  containing

containing  has

has  for any

for any  , and F is principal-preferred, giving

, and F is principal-preferred, giving  already. So we can assume that

already. So we can assume that  . Then choose

. Then choose  such that

such that  .

.

Let  be a technology for which the agent produces distribution F. We can assume without loss that

be a technology for which the agent produces distribution F. We can assume without loss that  . By Berge's theorem,

. By Berge's theorem,  defined by

defined by  is continuous.

is continuous.

We claim that there exists some η such that  implies

implies  . If

. If  , then this claim follows from the fact that

, then this claim follows from the fact that  together with continuity of

together with continuity of  . So focus on

. So focus on  , and suppose no such η exists. Then there is some sequence of

, and suppose no such η exists. Then there is some sequence of  and corresponding optimal actions

and corresponding optimal actions  , which we can assume (by taking a subsequence) converge to

, which we can assume (by taking a subsequence) converge to  , where

, where  . This contradicts that F has largest mean among zero-cost actions in

. This contradicts that F has largest mean among zero-cost actions in  (which follows from principal-preferred tie-breaking).

(which follows from principal-preferred tie-breaking).

Hence, for any  , constructing new technology

, constructing new technology  yields

yields  as the unique maximizer of

as the unique maximizer of  over

over  , so

, so

, and

, and  . Q.E.D.

. Q.E.D.

One comment on interpretation: The above proof relies (as do many others later) on adding an arbitrary action of the form  to the technology. It may seem unrealistic to allow the agent to produce large amounts of output at zero cost. However, the fact that the unknown actions are totally unrestricted is not crucial; the logic can be carried over to more detailed models that incorporate lower bounds on plausible effort costs. (See Carroll (2015), Section II.A, for more details.)

to the technology. It may seem unrealistic to allow the agent to produce large amounts of output at zero cost. However, the fact that the unknown actions are totally unrestricted is not crucial; the logic can be carried over to more detailed models that incorporate lower bounds on plausible effort costs. (See Carroll (2015), Section II.A, for more details.)

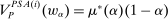

5.2 Hierarchical Model (i)

The three hierarchical models that we analyze have the following structure. The principal contracts with a supervisor, who, after observing this contract, writes a contract with an agent. We assume that, for reasons outside the model, the principal cannot contract directly with the agent. We assume that the supervisor does not directly affect production in any way; the only role the supervisor plays is as an intermediary between the principal and the agent. Technology for the agent is the same as in Section 5.1. The contract from the principal to the supervisor is the w of our general framework; the contract from the supervisor to the agent is denoted  , and we assume both contracts depend solely on output, so that

, and we assume both contracts depend solely on output, so that  .

.

The agent's objective is the same as in the robust principal-agent model, but now the agent receives payment from the supervisor, not directly from the principal. Thus, given contract  and technology

and technology  , the agent maximizes objective

, the agent maximizes objective  over

over  .

.

In all versions of the hierarchical model, we assume that the principal does not know  . Like the robust principal-agent model, there is an exogenously given technology

. Like the robust principal-agent model, there is an exogenously given technology  , representing all actions known by the principal to be available to the agent. Let

, representing all actions known by the principal to be available to the agent. Let  be defined as before, noting that

be defined as before, noting that  refers to the contract between supervisor and agent (henceforth “S-A contract”).

refers to the contract between supervisor and agent (henceforth “S-A contract”).

In hierarchical model (i), we assume that the supervisor is perfectly informed of  , which must include the actions known to the principal, that is,

, which must include the actions known to the principal, that is,  . The supervisor wants to maximize the expected difference between payments from the principal and payments to the agent. In addition, we restrict the set of permitted S-A contracts to some exogenously given compact set

. The supervisor wants to maximize the expected difference between payments from the principal and payments to the agent. In addition, we restrict the set of permitted S-A contracts to some exogenously given compact set  , which is assumed to contain all linear contracts with slope in the interval

, which is assumed to contain all linear contracts with slope in the interval  . This assumption is necessary to ensure the supervisor always has a best reply. (Without some such restriction, one can find situations, similar to Mirrlees (1999), in which no optimal contract for the supervisor exists. See the earlier version, Walton and Carroll (2019), for an example and more discussion.)

. This assumption is necessary to ensure the supervisor always has a best reply. (Without some such restriction, one can find situations, similar to Mirrlees (1999), in which no optimal contract for the supervisor exists. See the earlier version, Walton and Carroll (2019), for an example and more discussion.)

and

and  , define

, define

. Thus

. Thus  is the set of distributions that are best for the supervisor among the agent's optimal choices. This again represents a tie-breaking condition, and we refer to elements of

is the set of distributions that are best for the supervisor among the agent's optimal choices. This again represents a tie-breaking condition, and we refer to elements of  as supervisor-preferred. The supervisor's objective in hierarchical model (i) is then

as supervisor-preferred. The supervisor's objective in hierarchical model (i) is then

is a slight abuse of notation: this is a set of distributions, not a single distribution, but the expectation is well-defined since it is the same for all distributions in this set (and the set is nonempty; see the proof of Lemma 6 below). The “i” in

is a slight abuse of notation: this is a set of distributions, not a single distribution, but the expectation is well-defined since it is the same for all distributions in this set (and the set is nonempty; see the proof of Lemma 6 below). The “i” in  stands for “informed.”

stands for “informed.” . Now define

. Now define

, this is the set of output distributions that are possible, given that the supervisor is choosing contract

, this is the set of output distributions that are possible, given that the supervisor is choosing contract  to optimize

to optimize  , and the agent is maximizing given

, and the agent is maximizing given  , along with the tie-breaking conditions.

, along with the tie-breaking conditions.

.

.This completes the description of the model. We should make sure  is nonempty-valued; this is done in the lemma below.

is nonempty-valued; this is done in the lemma below.

Lemma 6.For each w,  is nonempty.

is nonempty.

The proof of this lemma, and remaining proofs in this section, are deferred to the Online Supplementary Material, as they are either technical or similar to previous proofs.

To analyze the model, it helps to restate the definition of  . The distribution F lies in

. The distribution F lies in  if and only if there exists a triple

if and only if there exists a triple  , where

, where  is a technology,

is a technology,  , and

, and  , that satisfies the following conditions:

, that satisfies the following conditions:

- (a) Supervisor maximization: the contract

maximizes

maximizes  over

over  ;

; - (b) Agent maximization: action

lies in

lies in  and, given contract

and, given contract  , this action maximizes the agent's payoff over

, this action maximizes the agent's payoff over  ;

; - (c) Supervisor-preferred tie-breaking: given

, action

, action  maximizes the supervisor's payoff over actions satisfying (b);

maximizes the supervisor's payoff over actions satisfying (b); - (d) Principal-preferred tie-breaking: given

, action

, action  maximizes the principal's payoff over actions satisfying (b)–(c).

maximizes the principal's payoff over actions satisfying (b)–(c).

A triple  satisfying these conditions will be called a PSA(i)-certificate for F under w.

satisfying these conditions will be called a PSA(i)-certificate for F under w.

The following lemma shows that in searching for such a certificate, we can focus on cases where  and

and  (recall that

(recall that  denotes the zero contract).

denotes the zero contract).

Lemma 7.For any w and F, we have  if and only if there exists a PSA(i)-certificate for F under w of the form

if and only if there exists a PSA(i)-certificate for F under w of the form  .

.

To see why this is, take the following perspective on the supervisor's problem: Any choice of contract  will induce the agent to produce some distribution F. Rather than view the supervisor as choosing

will induce the agent to produce some distribution F. Rather than view the supervisor as choosing  , we can view her as directly choosing what F to induce, and then inducing it in the least costly way. Now, if there is some technology

, we can view her as directly choosing what F to induce, and then inducing it in the least costly way. Now, if there is some technology  under which the supervisor would choose to induce F, then under

under which the supervisor would choose to induce F, then under  , the supervisor is all the more inclined to induce F, since she can do so costlessly by offering the agent the zero contract. The lemma follows from this observation, together with careful verification of the tie-breaking conditions.

, the supervisor is all the more inclined to induce F, since she can do so costlessly by offering the agent the zero contract. The lemma follows from this observation, together with careful verification of the tie-breaking conditions.

We can now show that the model falls under our general framework, and thus we have the following.

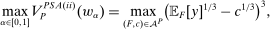

Proposition 8.There exists a linear contract maximizing  .

.

We verify the Richness and Responsiveness properties, as well as the lower hemicontinuity property, by arguments very similar to those used in the robust principal-agent model. Along the way, Lemma 7 helps to simplify by reducing the space of possibilities to consider.

5.3 Hierarchical Model (ii)

Hierarchical model (ii) closely resembles the previous hierarchical model. The key difference is that the supervisor is not perfectly informed of  . Instead, the supervisor is now uncertain about

. Instead, the supervisor is now uncertain about  but we assume she is at least as well informed as the principal is. Specifically, the principal knows about technology

but we assume she is at least as well informed as the principal is. Specifically, the principal knows about technology  , the supervisor knows about technology

, the supervisor knows about technology  , and the true technology is

, and the true technology is  , with

, with  . The principal, for her part, is uncertain about both

. The principal, for her part, is uncertain about both  and

and  . Since the model continues to focus on the principal's problem,

. Since the model continues to focus on the principal's problem,  is a primitive of the model, whereas

is a primitive of the model, whereas  and

and  are free variables. We also no longer restrict the supervisor to contracts in

are free variables. We also no longer restrict the supervisor to contracts in  , since such a restriction will not be needed for existence of an optimal S-A contract; thus the supervisor may offer any contract

, since such a restriction will not be needed for existence of an optimal S-A contract; thus the supervisor may offer any contract  .

.

and

and  as in hierarchical model (i). The supervisor's objective in hierarchical model (ii) is

as in hierarchical model (i). The supervisor's objective in hierarchical model (ii) is

is the informed supervisor objective of hierarchical model (i), and

is the informed supervisor objective of hierarchical model (i), and  is the supervisor's knowledge of the technology. We write “u” to denote “uninformed.” In words, the supervisor maximizes expected money received minus money paid, given the agent's strategic response, in the worst case over all possible technologies containing

is the supervisor's knowledge of the technology. We write “u” to denote “uninformed.” In words, the supervisor maximizes expected money received minus money paid, given the agent's strategic response, in the worst case over all possible technologies containing  .

. , define

, define

from hierarchical model (i). It now depends also on

from hierarchical model (i). It now depends also on  since this determines the supervisor's behavior.

since this determines the supervisor's behavior.

.

.As before, we should check nonemptiness.

Lemma 9.For each w,  is nonempty.

is nonempty.

We comment that this is where we use the lower hemicontinuity result from the robust principal-agent model: it ensures that the supervisor has an optimal choice of  —in fact, one in which

—in fact, one in which  is proportional to w—so that the union in the definition of

is proportional to w—so that the union in the definition of  is not empty.

is not empty.

To analyze the model, we proceed in a fashion similar to the previous hierarchical model. Distribution F is in  if there exists a situation in which the agent would choose it—where now such a situation is described by a quadruple

if there exists a situation in which the agent would choose it—where now such a situation is described by a quadruple  , meeting conditions analogous to (a)–(d) in hierarchical model (i). We refer to such a quadruple as a PSA(ii)-certificate for F under w. We can formulate an analogue of Lemma 7 for this model (see Lemma S-6 in the Online Supplementary Material): F lies in

, meeting conditions analogous to (a)–(d) in hierarchical model (i). We refer to such a quadruple as a PSA(ii)-certificate for F under w. We can formulate an analogue of Lemma 7 for this model (see Lemma S-6 in the Online Supplementary Material): F lies in  if and only if there exists such a PSA(ii)-certificate in which

if and only if there exists such a PSA(ii)-certificate in which  ,

,  and, moreover,

and, moreover,  .

.

This fact is useful in showing that the model satisfies our two properties, and thereby obtaining our linearity result.

Proposition 10.There exists a linear contract maximizing  .

.

Again, the proof follows the same basic argument as for the principal-agent model (and as for hierarchical model (i)).

It might not be obvious that this model satisfies Responsiveness, since the supervisor is no longer modeled as an expected-utility maximizer. However, the key is that Responsiveness is a property on the correspondence Φ, which gathers the counterparty's behavior across all possible environments (in this case, all possible  and

and  ); it does not have to hold in each environment individually. In this model, Lemma S-6 shows, in effect, that we can restrict attention to a crucial subset of possible environments: those in which the supervisor knows that she can induce distribution F for free by offering the zero contract, and she chooses to do so. In this subset of environments, the supervisor does act like an expected-utility maximizer, and this suffices to imply Responsiveness.

); it does not have to hold in each environment individually. In this model, Lemma S-6 shows, in effect, that we can restrict attention to a crucial subset of possible environments: those in which the supervisor knows that she can induce distribution F for free by offering the zero contract, and she chooses to do so. In this subset of environments, the supervisor does act like an expected-utility maximizer, and this suffices to imply Responsiveness.

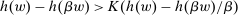

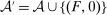

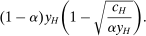

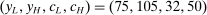

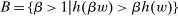

6 An Example Where Responsiveness Fails

In this section, we describe version (iii) of the hierarchical model, where the principal is no longer uncertain as to what the supervisor does and does not know. Instead, the supervisor, like the principal, knows only that the technology  is a superset of the given

is a superset of the given  , and she contracts with the agent so as to maximize her own worst-case payoff. We give an example to show that linear contracts can fail to be optimal. In the process, we also observe that this model satisfies Richness, but not Responsiveness in general. In fact, this example is an illustration of Theorem 4, as will be discussed briefly later.

, and she contracts with the agent so as to maximize her own worst-case payoff. We give an example to show that linear contracts can fail to be optimal. In the process, we also observe that this model satisfies Richness, but not Responsiveness in general. In fact, this example is an illustration of Theorem 4, as will be discussed briefly later.

Here are the details. We take  as in the first two versions of the model. For any contract5

as in the first two versions of the model. For any contract5  to the agent, and any true technology

to the agent, and any true technology  , define

, define  as before. Define

as before. Define  as in model (i), and define

as in model (i), and define  as in model (ii). This is the supervisor's objective.

as in model (ii). This is the supervisor's objective.

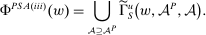

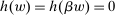

Assume for the moment that  (in the language of Section 4, w is grounded). As in model (ii), we can apply the robust principal-agent analysis to the supervisor-agent relationship here to conclude that the supervisor has an optimal contract that takes the form

(in the language of Section 4, w is grounded). As in model (ii), we can apply the robust principal-agent analysis to the supervisor-agent relationship here to conclude that the supervisor has an optimal contract that takes the form  for some constant

for some constant  ; however, there may also exist optimal choices of

; however, there may also exist optimal choices of  that are not of this form. We assume that the supervisor uses an optimal contract of this form (but if multiple choices of β are optimal, we remain agnostic about which one is chosen). This restriction on the supervisor's behavior will simplify the analysis, but it is not in keeping with model (ii) where no such restriction was made. With a little more work, one can verify that the lessons of this section are unchanged if the restriction is removed; details are included in an earlier version of this paper (Walton and Carroll (2019)).

that are not of this form. We assume that the supervisor uses an optimal contract of this form (but if multiple choices of β are optimal, we remain agnostic about which one is chosen). This restriction on the supervisor's behavior will simplify the analysis, but it is not in keeping with model (ii) where no such restriction was made. With a little more work, one can verify that the lessons of this section are unchanged if the restriction is removed; details are included in an earlier version of this paper (Walton and Carroll (2019)).

, and the supervisor has presented him with a contract that is optimal and linear (from the supervisor's point of view) given

, and the supervisor has presented him with a contract that is optimal and linear (from the supervisor's point of view) given  . The union arises due to the possibility of multiple optimal choices of β. And now, the outcome correspondence is given by

. The union arises due to the possibility of multiple optimal choices of β. And now, the outcome correspondence is given by

(For simplicity, we do not bother with principal-preferred tie-breaking; adding such a tie-break would not change the substantive conclusions.)

For completeness, we should also define  when w is not grounded, although such contracts will play no role in the subsequent analysis. For simplicity, for any such w, let

when w is not grounded, although such contracts will play no role in the subsequent analysis. For simplicity, for any such w, let  be the grounded contract obtained by subtracting the constant

be the grounded contract obtained by subtracting the constant  from w, and just put

from w, and just put  .

.

Now  is fully defined, and accordingly, the principal's objective

is fully defined, and accordingly, the principal's objective  is defined as usual.

is defined as usual.

Now let us analyze the model. We first formally note, as promised previously, the following.

Proposition 11.The correspondence  satisfies Richness.

satisfies Richness.

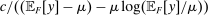

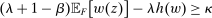

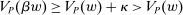

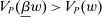

Next, if the principal offers a (grounded) contract w, what fraction β will the supervisor share with the agent? The analysis of the robust principal-agent problem (see Carroll (2015)) gives the answer: the supervisor will identify action  for which

for which  is maximal, and as long as this quantity is positive, the supervisor will set the corresponding value

is maximal, and as long as this quantity is positive, the supervisor will set the corresponding value  . (If there happens to be more than one optimal

. (If there happens to be more than one optimal  , then all corresponding β's are optimal for the supervisor. Also, if there is no known action with

, then all corresponding β's are optimal for the supervisor. Also, if there is no known action with  , then the supervisor cannot obtain a positive guarantee, so every

, then the supervisor cannot obtain a positive guarantee, so every  is optimal—they all give the supervisor a guarantee of zero.) Accordingly, let us say that the contract w targets the action

is optimal—they all give the supervisor a guarantee of zero.) Accordingly, let us say that the contract w targets the action  if this action maximizes

if this action maximizes  over

over  , and the contract is nondegenerate if the corresponding value of

, and the contract is nondegenerate if the corresponding value of  is strictly positive.

is strictly positive.

We can further use the principal-agent analysis to explicitly characterize the possible responses by the agent (proof in the Online Supplementary Material).

Lemma 12.Suppose w is grounded and nondegenerate, and  is an optimal choice for the supervisor. A distribution

is an optimal choice for the supervisor. A distribution  lies in

lies in  for some

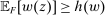

for some  if and only if

if and only if

(2)

(2) is the targeted action leading to slope β.