Banks, Liquidity Management, and Monetary Policy

Abstract

We develop a tractable model of banks' liquidity management with an over-the-counter interbank market to study the credit channel of monetary policy. Deposits circulate randomly across banks and must be settled with reserves. We show how monetary policy affects the banking system by altering the trade-off between profiting from lending and incurring greater liquidity risk. We present two applications of the theory, one involving the connection between the implementation of monetary policy and the pass-through to lending rates, and another considering a quantitative decomposition behind the collapse in bank lending during the 2008 financial crisis. Our analysis underscores the importance of liquidity frictions and the functioning of interbank markets for the conduct of monetary policy.

1 Introduction

The transmission and implementation of monetary policy operates through the banking system. In practice, central banks set a target for the interbank market rate and implement that target via open market operations and standing facilities. The ultimate goal is to affect the amount of credit, and thus overall economic activity. It is therefore of paramount importance to understand how monetary policy affects the interbank market and, in turn, how the interbank market affects the real economy.

The leading macroeconomic framework is used for monetary policy analysis, the New Keynesian model, abstracts from the implementation and transmission of monetary policy through the interbank market. In the New Monetarist framework, interactions between money and credit are explicit, but frictions in the interbank market and its impact on bank credit have received little attention.1 Moreover, for the most part, the focus of analysis has been on a sole policy instrument, either a nominal interest rate or the nominal quantity of money. Following the 2008 financial crisis, however, disruptions in interbank markets have been met with a broad set of policy responses designed to inject liquidity into the financial system and mitigate contractions in credit. These events call for a model that can be used to analyze the effects of frictions in the interbank market and the transmission of monetary policy through the banking system.

This paper provides a tractable general equilibrium model with a banking system that articulates a notion of the credit channel of monetary policy. At the heart of the theory lies a liquidity management problem that emerges from frictions in the interbank market. Liquidity management concerns the trade-off between holding high-yield illiquid loans and low-yield liquid assets. By influencing this trade-off, monetary policy affects the supply of credit and gives rise to a credit channel. In support of this transmission channel, we document an empirical relationship between measures of disturbances in the interbank market and liquidity premia. We put this framework to work in two quantitative applications that showcase the importance of examining the transmission of monetary policy through the banking system.

In the theory, banks are competitive. Their portfolio is composed of deposits, loans, government bonds, and reserves. When a bank grants a loan and simultaneously issues deposits, it gains intermediation profits. However, deposits circulate in an unpredictable way, and thus banks face deposit withdrawal shocks. When a deposit is transferred out of a bank, another bank absorbs that liability. As occurs in practice, that transfer is settled with reserves.2 If a deposit withdrawal is too large, the bank will end short of reserves. The bank can sell bonds in exchange for reserves, but this may not be enough. At that point, the bank must incur the expense of borrowing reserves, either from the discount window at a penalty rate or from the interbank market. The interbank market is over-the-counter (OTC). The probability of finding a counterpart in the interbank market depends on the scarcity of reserves: when few banks have reserve surpluses, the interbank market rate is high, and hence a shortage is expensive. Thus, the efficiency and tightness of the interbank market affect the degree of liquidity risk. By holding a large buffer of liquid assets composed of bonds and reserves, a bank reduces its exposure to liquidity risk at the expense of intermediation profits. Tilting this trade-off, monetary policy affects the supply of bank credit by affecting liquidity premia.

From a methodological standpoint, a contribution of this paper is to integrate an OTC interbank market into a dynamic general equilibrium model of the banking system. The interbank market here is modeled after Afonso and Lagos (2015), who study the federal funds market in a repeated OTC setting and deliver predictions for the intraday volume of interbank market loans and the distribution of interbank rates. That model takes the distribution of reserve balances as a primitive. Here, the distribution of balances is endogenous, as it results from banks' portfolio management, which is in turn influenced by monetary policy. We show that, despite the nonlinear nature of the liquidity frictions, the bank's problem features aggregation, and thus the economy behaves as if there were a representative bank. The model's analytical tractability makes the analysis transparent and amenable to various applications, both theoretical and quantitative.

Analyzing the transmission of monetary policy through the banking system reveals several insights. In contrast to models in which reserve requirements exogenously determine the demand for reserves, monetary policy here affects the risk-return trade-off between holding reserves vis-à-vis loans. The central bank alters this trade-off through open market operations, both conventional and unconventional, and by setting interest rates on reserves and discount window lending. We show that, although the composition between government bonds and reserves is indeterminate for an individual bank—implying that total holdings of liquid assets are the correct measure of the precautionary liquidity demand—the composition matters at the macro level. We show that a policy that swaps bonds for reserves has aggregate effects on liquidity premia by altering the interbank market tightness. Moreover, by absorbing illiquid assets into the central bank's balance sheet, unconventional open market operations have even more potent effects. At the limit, when the interbank market shuts down entirely, only unconventional open market operations remain effective.

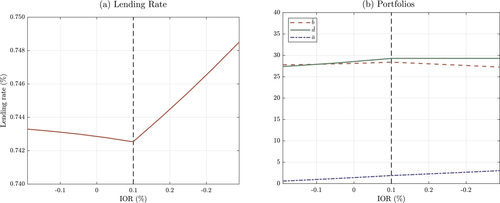

A central insight of the paper is that the implementation of monetary policy matters for macroeconomic outcomes. We first study how the pass-through from the interest on reserves to credit is potentially nonmonotonic and depends critically on the interaction with capital requirements. When the interest on reserves is low, deposits are in effect more costly and capital requirements do not bind. As the interest on reserves increases, banks expand deposits, reserves, and potentially credit. Once capital requirements bind, further increases in the interest on reserves necessarily contract lending. The analysis reveals that reserves can be complements to or substitutes for bank lending, depending on whether capital requirement constraints bind. We then examine how the interest on reserves and the central bank's balance sheet constitute independent policy instruments. Crucially, we show how configurations that achieve the same target for the interbank market rate generate a different lending rate and pass-through. In particular, configurations with a larger balance sheet induce a larger credit supply and a higher pass-through from the interbank market rate to the lending rate. Taken together, these findings imply that the questions on how to set a target for the policy rate and how to implement it, must be analyzed together.

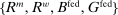

A final contribution is to employ the framework to quantitatively examine the credit crunch during the U.S. financial crisis after 2008. In particular, we examine the role of aggravated liquidity conditions, as evidenced by the severe collapse in the interbank market and the increase in discount window borrowing. We devise a procedure to reverse engineer the shocks required to match the data and then feed the model with counterfactuals. Our findings suggest that disruptions to the matching efficiency of the interbank market and to the volatility of funding played a substantial role around the time of the Lehman Brothers bankruptcy. By 2010, loan demand became the dominant factor. Turning to policy, we study the contribution of conventional and unconventional open market operations to mitigating the credit crunch. We find that conventional operations had a negligible effect, while unconventional ones had a sizable impact. The quantitative analysis suggests that the move toward unconventional open market operations during the crisis was critical for the attenuation of the credit crunch.

Related Literature

Our paper relates to several branches of the literature in monetary economics, banking, and macroeconomics. One branch studies monetary policy implementation through banks' reserve management in partial equilibrium real models. Building on the seminal work of Poole (1968), several studies have analyzed recent proposed changes in monetary policy frameworks (Ennis and Weinberg (2007); Keister, Martin, and McAndrews (2008); Keister and McAndrews (2009); Ennis and Keister (2008); Martin, McAndrews, Palida, and Skeie (2013); Bech and Keister (2017)). At the center of our analysis on monetary policy, implementation is a downward sloping relation between liquidity and the interbank market rate, a feature that is common with these studies. In our model, however, it is derived in the context of an OTC interbank market, which enables us to study the interaction between monetary policy and disruptions in the interbank markets.3 Our central contribution to this literature is to examine monetary policy implementation through the lens of a dynamic general equilibrium monetary model. Analyzing interbank market rates, credit, and prices in a unified framework underscores how the choice of the target interest rate and how to implement that rate are inherently linked.

The paper also builds on the banking literature. Important examples include Diamond (1984); Diamond and Dybvig (1983); Boyd and Prescott (1986); Allen and Gale (1998); Holmstrom and Tirole (1998); and Gu, Mattesini, Monnet, and Wright (2013). For the most part, these theories have evolved separately from macroeconomics. Gertler and Karadi (2011) and Curdia and Woodford (2009) incorporated a banking sector into quantitative New Keynesian models. Following these studies, a growing literature has examined how shocks to bank equity or leverage constraints disrupt financial intermediation.4 A distinct approach is taken by Corbae and D'Erasmo (2013, 2018), who provide a model with heterogeneous banks and analyze the role of bank concentration and how it interacts with capital requirements. The present paper emphasizes interbank market frictions and the transmission of monetary policy through the liquidity premium.

The OTC nature of the interbank market builds on monetary search theory. Seminal contributions in this literature are Kiyotaki and Wright (1989) and Lagos and Wright (2005). The interbank market here is a version of the OTC model developed by Afonso and Lagos (2015).5 Related studies also include Freeman (1996) and Smith (2002), who study environments where inside money is used as a medium of exchange, as a result of spatial frictions. Williamson (2012) study an environment in which assets of different maturities have different properties as mediums of exchange. Relative to this earlier work, we have little to say about the foundations that bring about a banking architecture. Here, the focus is on the effects of trading frictions in the interbank market and the transmission of monetary policy through the credit channel.

Finally, a burgeoning literature explores other issues related to monetary policy transmission and implementation through banks' liquidity management: Piazzesi and Schneider (2018) study the link between the payments system and securities markets with a focus on asset pricing and price-level determination; Piazzesi, Rogers, and Schneider (2019) incorporates nominal rigidities; De Fiore, Hoerova, and Uhlig (2018) study the role of collateral assets for liquidity management and unconventional monetary policy; Chen, Ren, and Zha (2017) analyze the implications for shadow banking in China; Arce, Nuño, Thaler, and Thomas (2019) evaluate floors versus corridor regimes with New Keynesian ingredients; Bigio and Sannikov (2019) study the implications for individual insurance and productive efficiency; Bianchi, Bigio, and Engel (2020) provide a theory linking exchange rate fluctuations to banks' liquidity management.

Outline

The paper is organized as follows. Section 2 presents the model, and Section 3 provides theoretical results. Section 4 presents evidence on the correlation between interbank market spreads and the liquidity premium. Section 5 presents the calibration of the model and the applications. Section 6 concludes. All proofs are in the Appendix or in the Online Supplementary Material (Bianchi and Bigio (2022)).

2 The Model

We present a dynamic general equilibrium model of the banking system featuring an OTC interbank market. The presentation of the model begins with the liquidity management problem of an individual bank, followed by the description of the interbank market. We then introduce the non-financial block of the model, describing households and firms, and analyze the policies of the central bank, which we refer to as the Fed. After characterizing the problems of all agents, we define the general equilibrium and analyze the transmission of monetary policy.

2.1 Banks: Preferences and Budgets

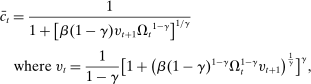

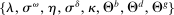

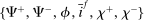

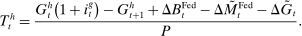

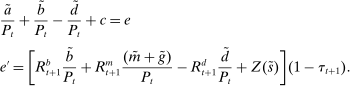

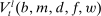

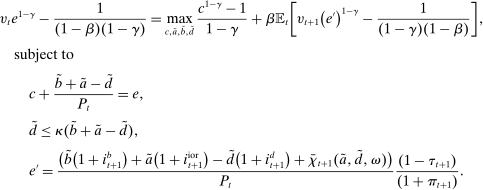

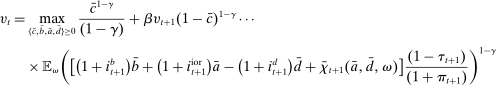

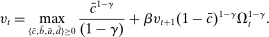

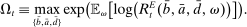

Preferences

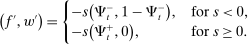

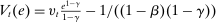

are given by

are given by

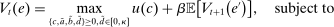

(1)

(1) is the time discount factor, and

is the time discount factor, and  is the utility function over the consumption good with

is the utility function over the consumption good with  .

.Timing

Time is discrete, indexed by t, and of infinite horizon. Each period is divided into two stages: a lending (l) and a balancing (b) stage. In the lending stage, banks make portfolio decisions. In the balancing stage, banks experience random idiosyncratic withdrawals of deposits. A deposit withdrawn from one bank is transferred to another bank. That transaction must be settled with reserves. If banks lack reserves to settle that transaction, they can sell government bonds, borrow reserves from other banks or from the Fed at a penalty rate. We describe next the two stages—a summary of the timeline of events is found in Figure 11 in the Online Appendix E.

Lending Stage

Banks enter the lending stage with a portfolio of assets/liabilities and collect/make associated interest payments. Among assets, banks hold loans,  , and liquid assets in the form of reserves,

, and liquid assets in the form of reserves,  , or government bonds,

, or government bonds,  . On the liability side, banks issue demand deposits,

. On the liability side, banks issue demand deposits,  , discount window loans,

, discount window loans,  , and net interbank loans,

, and net interbank loans,  (which is positive if the bank has borrowed funds and negative if the bank has lent funds). All assets are nominal (denominated in units of reserves).6 Reserves are the numeraire and

(which is positive if the bank has borrowed funds and negative if the bank has lent funds). All assets are nominal (denominated in units of reserves).6 Reserves are the numeraire and  is the price level.

is the price level.

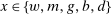

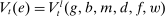

During the lending stage, banks choose real dividends,  , and a portfolio. The portfolio is a choice

, and a portfolio. The portfolio is a choice  , which corresponds to holdings of loans, reserves, government bonds, and deposits, respectively. We use

, which corresponds to holdings of loans, reserves, government bonds, and deposits, respectively. We use  to denote a portfolio variable chosen in the lending stage and

to denote a portfolio variable chosen in the lending stage and  to denote the end-of-period portfolio variable in the balancing stage (and the beginning-of-period portfolio variable for

to denote the end-of-period portfolio variable in the balancing stage (and the beginning-of-period portfolio variable for  ). Aggregate holdings are denoted in uppercase letters, for example,

). Aggregate holdings are denoted in uppercase letters, for example,  represents the aggregate loan supply.

represents the aggregate loan supply.

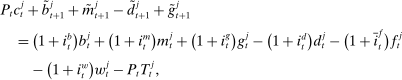

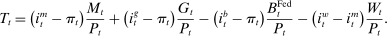

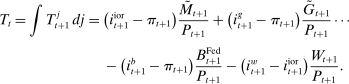

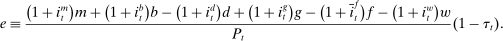

(2)

(2) ,

,  , and

, and  , denote the nominal returns on loans, government bonds, and deposits, respectively. The policy rates

, denote the nominal returns on loans, government bonds, and deposits, respectively. The policy rates  and

and  are interest on reserves and discount window loans set by the Fed. These rates satisfy

are interest on reserves and discount window loans set by the Fed. These rates satisfy  ; otherwise, there is a pure arbitrage to the detriment of the Fed. The rate

; otherwise, there is a pure arbitrage to the detriment of the Fed. The rate  represents the fed funds rate, the average rate at which banks borrow in the interbank market, a market described below. All interest rates indexed with t are accrued between period

represents the fed funds rate, the average rate at which banks borrow in the interbank market, a market described below. All interest rates indexed with t are accrued between period  and t. Finally,

and t. Finally,  denotes taxes that are set to be proportional to bank equity.

denotes taxes that are set to be proportional to bank equity. (3)

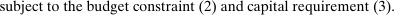

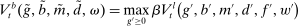

(3)The problem of the bank in the lending stage is to choose the portfolio and dividend payments, subject to the budget constraint (2) and the capital requirement (3).

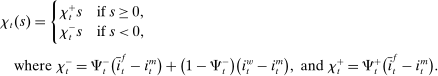

Balancing Stage

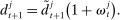

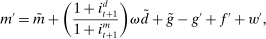

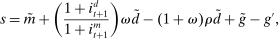

. At the start of the balancing stage, banks experience an idiosyncratic withdrawal shock

. At the start of the balancing stage, banks experience an idiosyncratic withdrawal shock  . The shock generates a random inflow/withdrawal of deposits

. The shock generates a random inflow/withdrawal of deposits  ; hence, the end-of-balancing-stage deposits are given by

; hence, the end-of-balancing-stage deposits are given by

(4)

(4) is positive, the bank receives deposit inflows from other banks. When

is positive, the bank receives deposit inflows from other banks. When  is negative, the bank loses deposits to other banks. The withdrawal shock has a cumulative distribution

is negative, the bank loses deposits to other banks. The withdrawal shock has a cumulative distribution  common to all banks with support

common to all banks with support  , where

, where  . The distribution is continuous and satisfies

. The distribution is continuous and satisfies  for all t, implying that deposits are reshuffled but preserved within banks.

for all t, implying that deposits are reshuffled but preserved within banks.The randomness of ω captures the unpredictability and complexity of the payments system. The circulation of deposits is a fundamental feature of the payments system, because it enables banks to facilitate transactions between third parties: When a bank issues a loan, a borrower is credited with deposits. As the borrower makes payments to third parties, deposits are transferred to other banks. The outflow of a deposit from one bank is an inflow to another. Because the receptor bank absorbs a liability, an asset also must be transferred to settle the transaction.7 As it occurs in practice, reserve balances at the Fed are the settlement instrument.

(5)

(5) (6)

(6) , it borrows reserves in an OTC interbank market or from the discount window. If it ends in surplus, a bank lends in the interbank market or holds reserves at the Fed. The reserves with which the bank ends the period—which must satisfy equation (5)—are therefore given by

, it borrows reserves in an OTC interbank market or from the discount window. If it ends in surplus, a bank lends in the interbank market or holds reserves at the Fed. The reserves with which the bank ends the period—which must satisfy equation (5)—are therefore given by

(7)

(7)Interbank Market

Withdrawal shocks generate a distribution of reserve surpluses and deficits across banks. When the interbank market opens, banks with a surplus want to lend, and banks with a deficit want to borrow. Because of the matching frictions, banks on either side of the market may be unable to lend/borrow all of their balances. If a bank in deficit cannot obtain enough funds in the interbank market, it must borrow the remainder from the discount window. If a bank in surplus is unable to lend all of its surplus, it deposits the balance at the Fed and earns interest on reserves. In equilibrium, because interbank rates lie between the interest rates on reserves and discount loans, banks will seek to trade in the interbank market before trading with the Fed. All loans are repaid before the next lending stage.

The interbank market is an OTC search market. We follow closely the basic formulation in Afonso and Lagos (2015) but render analytic solutions following Bianchi and Bigio (2017) that allow us to embed this friction into the dynamic model. The interbank market operates sequentially through N trading rounds. At the beginning of the trading session, each bank gives an order to a continuum of traders. If  (

( ), the bank gives an order to lend (borrow). Each trader must close an infinitesimal position, as in Atkeson, Eisfeldt, and Weill (2015). This “large family” assumption simplifies the solution of the bargaining problem by making the marginal value of the interbank loan depend only on the sign of the balance, and not on the scale. Absent this assumption, it becomes necessary to keep track of the identity of matching banks in their bargaining problems—the resulting problem of determining the distribution of matches among numerous combinations would be intractable.

), the bank gives an order to lend (borrow). Each trader must close an infinitesimal position, as in Atkeson, Eisfeldt, and Weill (2015). This “large family” assumption simplifies the solution of the bargaining problem by making the marginal value of the interbank loan depend only on the sign of the balance, and not on the scale. Absent this assumption, it becomes necessary to keep track of the identity of matching banks in their bargaining problems—the resulting problem of determining the distribution of matches among numerous combinations would be intractable.

The probability of a match at a given round is the outcome of a matching function that depends on the aggregate amount of surplus and deficit positions that remain open at each round. When traders meet, they bargain over the rate and split the surplus according to Nash bargaining. Key for the determination of the interbank market rate at any given round, are the rates and probabilities of finding a match in future rounds.

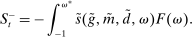

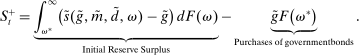

denotes the aggregate surplus and

denotes the aggregate surplus and  denotes the aggregate deficit.9 If we consider a Leontief matching function with efficiency parameter λ and take the limit of N rounds to infinity (keeping the overall number of matches per balancing stage constant), we arrive at the following proposition that characterizes the split between interbank market and discount window loans,

denotes the aggregate deficit.9 If we consider a Leontief matching function with efficiency parameter λ and take the limit of N rounds to infinity (keeping the overall number of matches per balancing stage constant), we arrive at the following proposition that characterizes the split between interbank market and discount window loans,  , as a function of θ.

, as a function of θ.

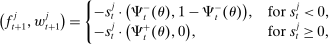

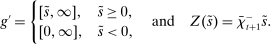

Proposition 1.Given θ, the amount of interbank market loans and discount window loans for a bank with surplus  is

is

(8)

(8) . Analytic expressions for

. Analytic expressions for  are presented in Appendix A.

are presented in Appendix A.

Banks short of reserves patch a fraction  of their deficit in the interbank market and the fraction

of their deficit in the interbank market and the fraction  in the discount window. Similarly, a bank with surplus lends a fraction

in the discount window. Similarly, a bank with surplus lends a fraction  in the interbank market and keeps the remaining balance,

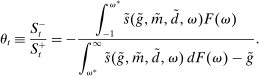

in the interbank market and keeps the remaining balance,  , at the Fed. These fractions are endogenous objects that depend on market tightness. If many banks are in deficit (surplus), the probability that a deficit bank finds a match is low (high). Market clearing in the interbank market requires

, at the Fed. These fractions are endogenous objects that depend on market tightness. If many banks are in deficit (surplus), the probability that a deficit bank finds a match is low (high). Market clearing in the interbank market requires  . We say that the interbank market is active if

. We say that the interbank market is active if  and inactive otherwise.

and inactive otherwise.

Proposition 1 also characterizes the mean interbank market rate,  , as a function of the market tightness. The Fed funds rate is a weighted average of the corridor rates

, as a function of the market tightness. The Fed funds rate is a weighted average of the corridor rates  and

and  . The weight, given by

. The weight, given by  , is an endogenous bargaining power, as in Afonso and Lagos (2015). If many banks are in deficit, the Fed funds rate is closer to

, is an endogenous bargaining power, as in Afonso and Lagos (2015). If many banks are in deficit, the Fed funds rate is closer to  because this lowers the outside option and the bargaining power of banks in deficit. Conversely, the Fed funds rate is closer to

because this lowers the outside option and the bargaining power of banks in deficit. Conversely, the Fed funds rate is closer to  if more banks are in surplus.10

if more banks are in surplus.10

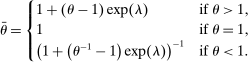

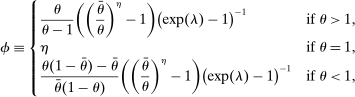

As shown in Appendix A, the functional forms for  and

and  depend on two structural parameters: the matching efficiency, λ, and the bargaining power, η. In particular, for given θ, a higher efficiency leads to higher fractions of matches

depend on two structural parameters: the matching efficiency, λ, and the bargaining power, η. In particular, for given θ, a higher efficiency leads to higher fractions of matches  , and a higher η increases the effective bargaining power of banks in deficit, lowering the Fed funds rate.

, and a higher η increases the effective bargaining power of banks in deficit, lowering the Fed funds rate.

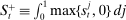

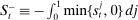

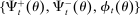

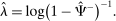

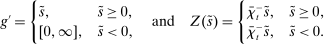

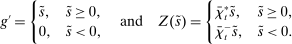

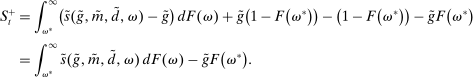

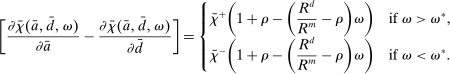

A single function, which we call liquidity yield function, encodes the payoffs from having surplus or deficit of reserves and reflects the activity in the interbank market.

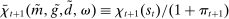

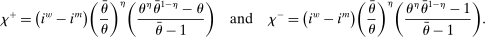

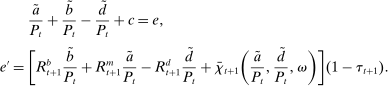

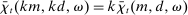

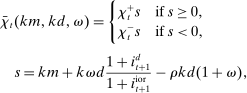

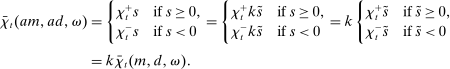

Definition 2.The liquidity yield function is

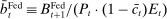

(9)

(9) , the bank earns an average yield

, the bank earns an average yield  per unit of surplus and when

per unit of surplus and when  , the bank pays an average yield

, the bank pays an average yield  per unit of deficit. The fact that

per unit of deficit. The fact that  creates a kink in χ and generates a positive wedge between the marginal cost of reserve deficits and the marginal benefit of surpluses.11

creates a kink in χ and generates a positive wedge between the marginal cost of reserve deficits and the marginal benefit of surpluses.11

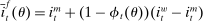

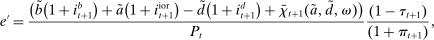

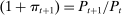

The liquidity yield function will be used below to characterize the dynamic bank problem. We use  to denote the real liquidity yield function in terms of the portfolio where

to denote the real liquidity yield function in terms of the portfolio where  is the gross inflation rate. We also define

is the gross inflation rate. We also define  to be the gross returns on asset

to be the gross returns on asset  .

.

Discussion of Model Features

Some model features that merit discussion are designed to capture institutional features of the banking system. A first feature is that banks are endowed with risk-averse preferences. These preferences are necessary to generate slow-moving bank equity, as observed in practice, and can be rationalized by costs of equity issuances.

A second feature has to do with the nature of settlements in the balancing stage. When banks receive deposit outflows, they must settle with the bank absorbing the deposits using reserves. This feature is in line with actual institution arrangement and can be microfounded by appealing to informational frictions (Cavalcanti, Erosa, and Temzelides; Lester, Postlewaite, and Wright (2012)). Upon facing withdrawal shocks, banks can trade government bonds in exchange for reserves, but loans are illiquid. The lack of a liquid market for loans can be explained by a moral hazard problem. On the other hand, the assumption of a Walrasian exchange for government bonds is for simplicity, but it captures that this is a deep market that operates with relatively fewer frictions.12 In addition, the interbank market is modeled as an OTC market. This feature is the empirically relevant one, as established by Ashcraft and Duffie (2007), and in line with the bilateral and unsecured nature of this market.

Finally, we note that positive reserve requirements, are not essential for the theory. What is key for the emergence of liquidity premia is that there is a lower bound on reserve holdings.13

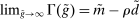

2.2 Nonfinancial Sector

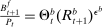

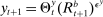

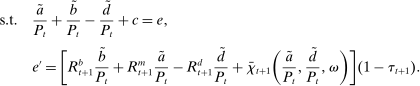

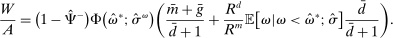

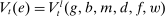

The nonfinancial block is presented in detail in the Online Appendix F. This block is composed of households that supply labor and save in deposits, currency, and government bonds. Firms produce the final consumption good using labor and are subject to a working capital constraints. This block delivers endogenous demand schedules for working capital loans, and household's deposits, government bonds, and currency. These household schedules emerge from asset-in-advance constraints, as in Lucas and Stokey (1983). We purposefully work with quasi-linear preferences, as in Lagos and Wright (2005), so that these schedules are not forward-looking. The schedules for the asset-demand system of the non-financial block are summarized in the proposition below.

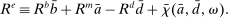

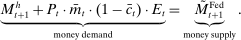

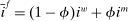

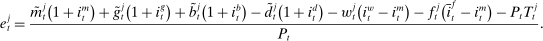

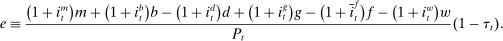

Proposition 3.Given the nonfinancial sector block presented in Appendix F, we have that: (i) The firm loan demand is  and output is

and output is  with

with  ;

;

(ii) The household deposits, currency, and government bond demand schedules have the form

for all

for all  and where

and where  is the corresponding rate of return to the household.

is the corresponding rate of return to the household.The household schedules are iso-elastic as long as returns are lower than the inverse of household discount factor  .14 The parameters

.14 The parameters  and

and  are, respectively, elasticity and scale coefficients, which depend on structural parameters regarding technology and household preferences; see Table 4 in Appendix F for the conversion from the structural to the reduced form parameters in these schedules. The parameter

are, respectively, elasticity and scale coefficients, which depend on structural parameters regarding technology and household preferences; see Table 4 in Appendix F for the conversion from the structural to the reduced form parameters in these schedules. The parameter  represent an asset satiation point.

represent an asset satiation point.

A convenient property is that once we solve for the equilibrium real rates—by equating the asset supply and demand schedules derived from banks and the reduced form schedules obtained from the nonfinancial sector—we can obtain output, employment, and household consumption. For the rest of the paper, we do not make further references to the nonfinancial block and work directly with the iso-elastic portion of these schedules—there always exists a  that guarantees that this is the case.

that guarantees that this is the case.

2.3 Monetary and Fiscal Authority

The Fed's policy tools are the discount window rate, the interest on reserves and open market operations (OMO), both conventional and unconventional. On the asset side, the Fed holds discount window loans,  , private loans,

, private loans,  , and government bonds,

, and government bonds,  . Government bonds are issued by the fiscal authority, which we denote by

. Government bonds are issued by the fiscal authority, which we denote by  . The supply of Fed liabilities

. The supply of Fed liabilities  can be held as currency by households or as bank reserves (i.e.,

can be held as currency by households or as bank reserves (i.e.,  ).

).

(10)

(10) , and taxes on banks, T, to balance the budget constraint.

, and taxes on banks, T, to balance the budget constraint. (11)

(11) are set as a residual, in the spirit of passive fiscal policy.15

are set as a residual, in the spirit of passive fiscal policy.152.4 Competitive Equilibrium

The competitive equilibrium is defined as follows.16

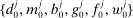

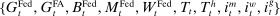

Definition 4.Given an initial distribution  and a deterministic sequence of government policies

and a deterministic sequence of government policies  , a competitive equilibrium is a deterministic path for aggregates

, a competitive equilibrium is a deterministic path for aggregates  , a stochastic sequence of bank policies

, a stochastic sequence of bank policies  , a deterministic sequence of interest rates

, a deterministic sequence of interest rates  , a deterministic sequence for the price level

, a deterministic sequence for the price level  , and a deterministic sequence of matching probabilities

, and a deterministic sequence of matching probabilities  , such that

, such that

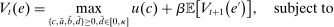

- (i) bank policies solve the banks' optimization problems, and

are given by Proposition 1;

are given by Proposition 1; - (ii) the government's budget constraint (10) is satisfied and the tax on banks follow (11);

- (iii) households and firms are on their supply/demand schedules, as given by Proposition 3;

- (iv) markets for deposits, loans, reserves, and government bonds clear;

- (v) the matching probabilities

and the Fed funds rate

and the Fed funds rate  are consistent with the market tightness,

are consistent with the market tightness,  , induced by the aggregate surplus and deficit

, induced by the aggregate surplus and deficit  and

and  , as given by Proposition 1.

, as given by Proposition 1.

We refer to a stationary equilibrium as a competitive equilibrium in which all real aggregates are constant and the value of all nominal variables grow at a constant rate. A steady-state equilibrium is a stationary competitive equilibrium in which the price level is constant.

3 Theoretical Analysis

We first examine the bank's portfolio problem and show that it can be reduced to only two choices, one about leverage and the other one about liquidity. We then provide an aggregation result by which aggregate equity is the only state variable. Finally, we examine the liquidity premia and the monetary policy transmission.

3.1 Recursive Bank Problems

Denote by  and

and  the bank value functions during the lending and balancing stages, respectively. To keep track of aggregate states, which follow a deterministic path, we index the policy and value functions by t. To ease notation, we omit the individual superscript j and suppress the time subscripts inside the Bellman equations.

the bank value functions during the lending and balancing stages, respectively. To keep track of aggregate states, which follow a deterministic path, we index the policy and value functions by t. To ease notation, we omit the individual superscript j and suppress the time subscripts inside the Bellman equations.

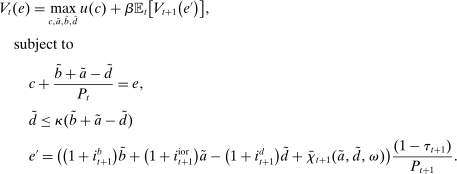

At the beginning of each lending stage, the individual states are  . Recall that choices in the lending stage are consumption, c, and portfolio variables

. Recall that choices in the lending stage are consumption, c, and portfolio variables  . These portfolio variables together with the idiosyncratic shock, ω, become the initial states in the balancing stage. The continuation value is the expected value of the balancing stage

. These portfolio variables together with the idiosyncratic shock, ω, become the initial states in the balancing stage. The continuation value is the expected value of the balancing stage  under the probability distribution of ω.

under the probability distribution of ω.

We have the following bank problem in the lending stage.

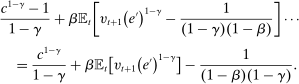

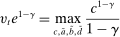

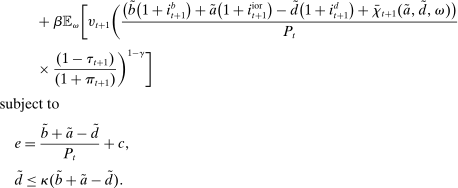

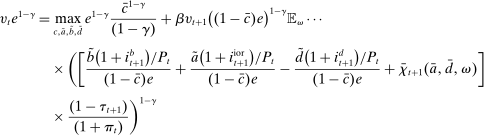

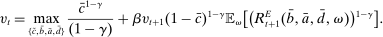

Problem 5. (Lending-Stage Bank Problem)

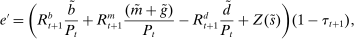

(12)

(12)

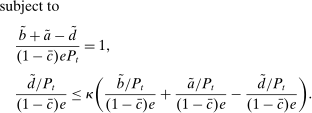

In turn, the balancing-stage problem is the following.

Problem 6. (Balancing-Stage Bank Problem)

(13)

(13) (Evolution of loans)

(Evolution of loans) (Evolution of deposits)

(Evolution of deposits) (Evolution of reserves)

(Evolution of reserves) (Reserve surplus)

(Reserve surplus) (Interbank market)

(Interbank market) , banks in deficit choose to sell all government bonds. In equilibrium, as long as the amount of government bonds held by banks in deficit does not exceed the surplus of reserves, we have that

, banks in deficit choose to sell all government bonds. In equilibrium, as long as the amount of government bonds held by banks in deficit does not exceed the surplus of reserves, we have that  and banks in surplus are indifferent between selling their reserve surplus for bonds. We assume this case holds for the rest of the paper.17

and banks in surplus are indifferent between selling their reserve surplus for bonds. We assume this case holds for the rest of the paper.17

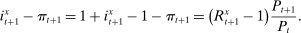

(14)

(14) ). The following proposition presents the characterization.

). The following proposition presents the characterization.

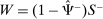

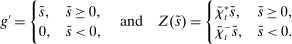

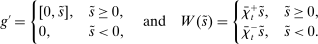

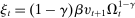

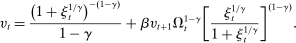

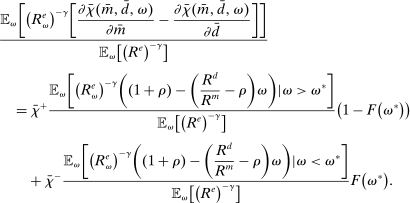

Proposition 7. (Homogeneity and Portfolio Separation)The bank's problem has the following features:

- (i) Problems 5 and 6 can be combined into a single Bellman equation with equity as the only individual state variable, and the holdings of government bonds and reserves can be consolidated into a single liquid asset

,

,

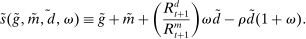

(15)

(15)

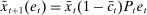

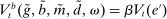

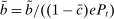

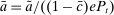

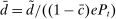

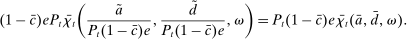

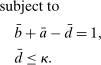

- (ii) The optimal portfolio in (15) is given by the solution to

(16)

(16) - (iii) The optimal bank dividend–equity ratio

is

and

is

and (17)

(17) .

. - (iv) Portfolios scale with equity. We have that

from (15) can be recovered from the optimal portfolio weights

from (15) can be recovered from the optimal portfolio weights  obtained in (16) via the relationship

obtained in (16) via the relationship  . The individual holdings of reserves and government bonds satisfy

. The individual holdings of reserves and government bonds satisfy  .

.

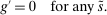

There are four items in Proposition 7. Item (i) shows that we can synthesize the value functions in (12) and (13) into a single Bellman equation with real equity as a single state variable. The liquidity yield function, χ, shows up in this Bellman equation summarizing parsimoniously the liquidity frictions. Equation (15) is, in effect, a portfolio savings problem. The bank starts with equity, e, can lever by issuing deposits  , pays dividends, and makes portfolio investments. The choice of assets can be split into loans,

, pays dividends, and makes portfolio investments. The choice of assets can be split into loans,  , and liquid assets, ã—the composition of liquid assets between reserves and government bonds is indeterminate. The continuation value of the bank depends on next period equity

, and liquid assets, ã—the composition of liquid assets between reserves and government bonds is indeterminate. The continuation value of the bank depends on next period equity  , which in turn depends on the realized portfolio return. The proposition establishes that, although there is a distribution of bank equity, all banks are replicas of a representative bank: item (ii) indicates that banks choose the same portfolio weights; item (iii) shows that all banks feature the same dividend rate; and item (iv) shows that banks' portfolio investments are linear in equity.

, which in turn depends on the realized portfolio return. The proposition establishes that, although there is a distribution of bank equity, all banks are replicas of a representative bank: item (ii) indicates that banks choose the same portfolio weights; item (iii) shows that all banks feature the same dividend rate; and item (iv) shows that banks' portfolio investments are linear in equity.

A key takeaway of the proposition is that the model aggregates. While aggregation is known to hold under linear budget constraints and homothetic preferences, a contribution here is to show that aggregation also holds despite a kink in the return function. This showcases how to integrate search frictions into a standard dynamic model with a representative agent.

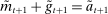

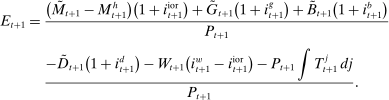

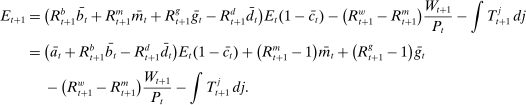

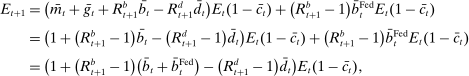

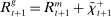

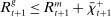

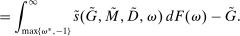

(18)

(18) . This equation says that next-period aggregate equity is given by the current aggregate equity net of dividend payments times the aggregate portfolio return. Implicit in (18) is that (i) the returns on interbank market loans cancel out on aggregate; (ii) Fed profits and the interest earned on government bonds by banks are compensated with taxes.

. This equation says that next-period aggregate equity is given by the current aggregate equity net of dividend payments times the aggregate portfolio return. Implicit in (18) is that (i) the returns on interbank market loans cancel out on aggregate; (ii) Fed profits and the interest earned on government bonds by banks are compensated with taxes.Another takeaway from Proposition 7 is that at the individual level, the composition between reserves and government bonds is indeterminate. Key to this result is that there is a Walrasian market between reserves and government bonds that allows banks to freely reverse any portfolio mix between reserves and government bonds once they face a withdrawal shock. This is different for loans, which stay with the bank and, therefore, the portfolio mix matters.

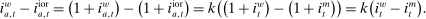

(19)

(19) (20)

(20) from the market-clearing condition for government bonds,

from the market-clearing condition for government bonds,

(21)

(21) to obtain the demand for reserves. Equation (20) then shows that for a given weight on liquid assets ā, the market tightness increases with a higher value of

to obtain the demand for reserves. Equation (20) then shows that for a given weight on liquid assets ā, the market tightness increases with a higher value of  . The important lesson is that, even though reserves and government bonds are perfect substitutes at the individual bank level, the composition of liquid assets matters at a macroeconomic level.

. The important lesson is that, even though reserves and government bonds are perfect substitutes at the individual bank level, the composition of liquid assets matters at a macroeconomic level.Discussion on Aggregation Property

Thanks to this aggregation property, the model provides a sharp characterization of the bank liquidity management problem and renders a transparent analysis of monetary policy transmission. Moreover, from a computational point of view, a notable advantage is that the model is straightforward to compute, as aggregate equity is the single state variable. On the other hand, a limitation is that the model cannot speak to features such as heterogeneous responses to monetary policy, size-dependent policies, or shocks that give rise to changes in concentration, which emerge in models with an endogenous size distribution (see Corbae and D'Erasmo (2018)).

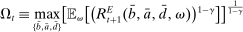

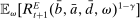

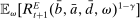

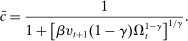

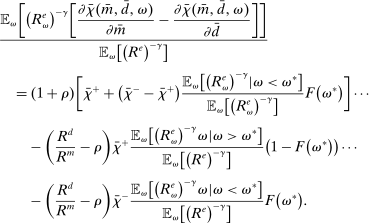

3.2 Liquidity Premia

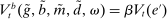

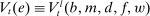

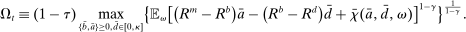

, total liquid assets ā, and deposits

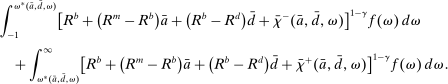

, total liquid assets ā, and deposits  to maximize the certainty equivalent of the bank's return on equity:

to maximize the certainty equivalent of the bank's return on equity:

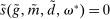

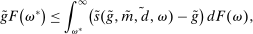

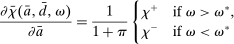

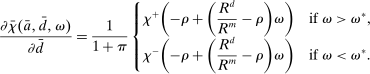

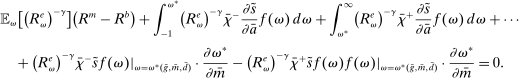

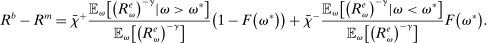

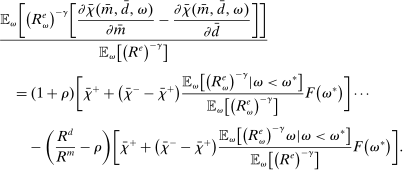

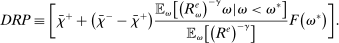

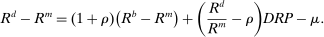

Proposition 8. (Liquidity Premia)Let  be a solution to the portfolio problem in Proposition 7. Then we have the following equilibrium liquidity premia (LP) on loans, government bonds, and deposits:

be a solution to the portfolio problem in Proposition 7. Then we have the following equilibrium liquidity premia (LP) on loans, government bonds, and deposits:

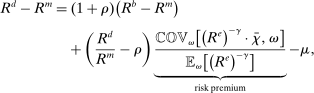

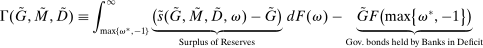

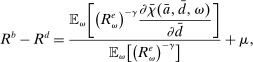

(Loan LP)

(Loan LP) (Gov. Bond LP)

(Gov. Bond LP) (Deposit LP)

(Deposit LP) is the Lagrange multiplier on the leverage constraint and

is the Lagrange multiplier on the leverage constraint and  . Furthermore,

. Furthermore,  . The last two inequalities become equalities if

. The last two inequalities become equalities if  .

.

Proposition 8 displays the LP of each asset relative to reserves.18 Consider first Loan LP. Loans command a higher direct return than reserves because reserves also yield a return in the interbank market. The premium is a risk-adjusted interbank market return: if the bank ends in surplus, a marginal reserve is lent out at an average of  while if the bank ends in deficit, the marginal reserve has an additional value of

while if the bank ends in deficit, the marginal reserve has an additional value of  . We say that banks are satiated if the premium is zero.

. We say that banks are satiated if the premium is zero.

The Gov. Bond LP is also positive but lower than the premium on loans.19 In a deficit state, a bank that holds a government bond sells it and saves the spread  . The bank therefore obtains

. The bank therefore obtains  the next period, which is the same as the return of reserves in a deficit state. To guarantee positive reserve and government bond holdings, we must have that the return on a surplus state must also be equalized. Because reserves yield

the next period, which is the same as the return of reserves in a deficit state. To guarantee positive reserve and government bond holdings, we must have that the return on a surplus state must also be equalized. Because reserves yield  in a surplus state, we have that the return on bonds must satisfy

in a surplus state, we have that the return on bonds must satisfy  . This positive premium reflects how payments clear with reserves but not with government bonds.20

. This positive premium reflects how payments clear with reserves but not with government bonds.20

Finally, Deposit LP can be of either sign. The deposit LP has three terms: The first term captures the expected change in the surplus, considering the reserve requirement—the effect is proportional to the LP of loans because withdrawals are mean zero, and is therefore positive. The second term is a liquidity-risk premium, which captures that an increase in deposits raises liquidity risk. The risk premium is present even if banks are risk neutral because the concavity in χ produces endogenous risk-aversion.

Role of OTC Frictions

The analysis of liquidity premia clarifies the fundamental role of OTC frictions for the transmission of monetary policy. As we take the efficiency parameter  , we recover a Walrasian interbank market.21 In a Walrasian market, if the banking system has an overall excess of reserves, we have

, we recover a Walrasian interbank market.21 In a Walrasian market, if the banking system has an overall excess of reserves, we have  , while if the banking system has an overall deficit of reserves, we have

, while if the banking system has an overall deficit of reserves, we have  . Meanwhile, if aggregate excess reserves are exactly zero, the Fed funds rate is indeterminate. This implies that the costs of deficits equals the benefits of a surplus,

. Meanwhile, if aggregate excess reserves are exactly zero, the Fed funds rate is indeterminate. This implies that the costs of deficits equals the benefits of a surplus,  and changes in withdrawal risks would have no effects. In addition, OMO would be neutral unless aggregate excess reserves change sign, for example, in a Walrasian market with

and changes in withdrawal risks would have no effects. In addition, OMO would be neutral unless aggregate excess reserves change sign, for example, in a Walrasian market with  , there no effects of OMO because aggregate excess reserves are always positive in this case.

, there no effects of OMO because aggregate excess reserves are always positive in this case.

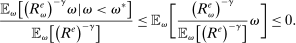

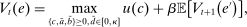

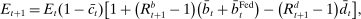

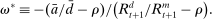

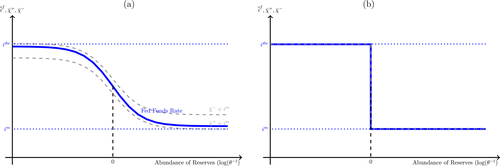

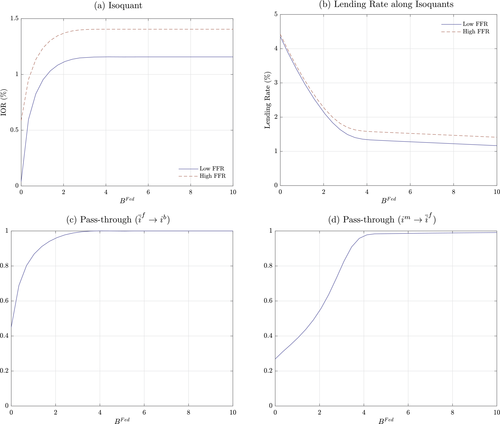

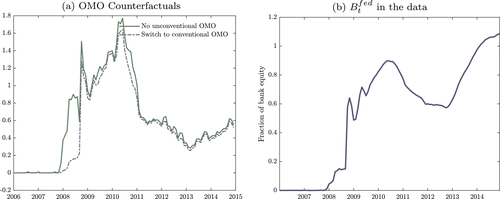

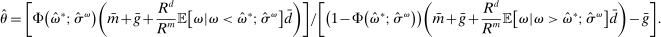

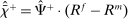

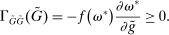

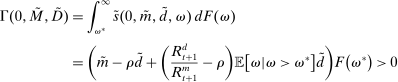

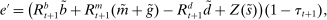

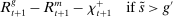

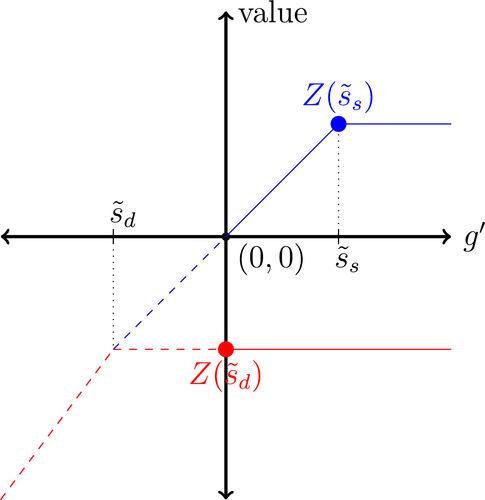

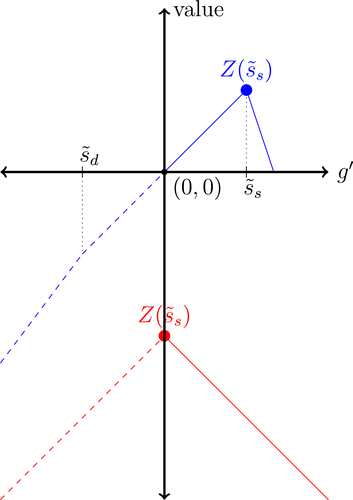

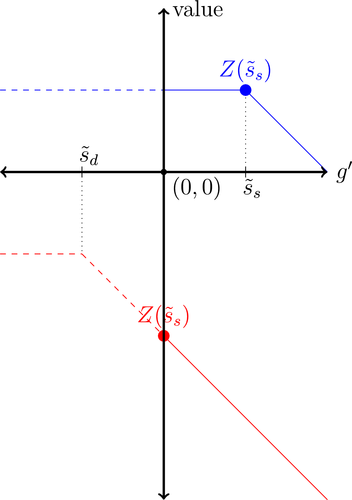

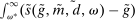

Figure 1 presents  ,

,  and the Fed funds rate as a function of the log inverse of market tightness θ, for the frictional OTC market (left panel) and the Walrasian market (right panel). In the case of the OTC market, we can see how as liquidity increases and we move along the x-axis, the Fed funds rate falls closer to the floor of the corridor. The figure illustrates how depending on the target for the interbank market rate, the central bank can adjust the amount of liquidity to aim at a desired target.

and the Fed funds rate as a function of the log inverse of market tightness θ, for the frictional OTC market (left panel) and the Walrasian market (right panel). In the case of the OTC market, we can see how as liquidity increases and we move along the x-axis, the Fed funds rate falls closer to the floor of the corridor. The figure illustrates how depending on the target for the interbank market rate, the central bank can adjust the amount of liquidity to aim at a desired target.

OTC versus Walrasian markets.

The classic Poole model also generates a smooth downward curve for the interbank market rate as a function of the real supply of government liquidity, as in Figure 1(a). However, it does so by assuming that the interbank market, modeled as a Walrasian market, closes before withdrawal shocks are realized. Like Afonso and Lagos (2015), our model can thus be seen as a microfoundation of such a downward-sloping relationship.22 Notably, the model predicts that withdrawal risk can have very different implications depending on the interbank market's functioning. Another notable difference is that the Poole framework is, in effect, a partial equilibrium model and, therefore, does not allow for a joint analysis of prices, credit, and macroeconomic aggregates. When we present the model's applications in the next section, we will show how embedding this OTC interbank market in a general equilibrium model gives rise to novel policy implications regarding monetary policy transmission. Namely, we will show that whether the central bank hits the target by shifting the balance sheet or by changing corridor rates has macroeconomic effects.

3.3 Policy Analysis

This section analyzes the effects of monetary policy. The main insight is that Fed policies can alter the liquidity premium and induce real effects, a formalization of the credit channel. Let us first discuss the price-level determination.

Price-Level Determination

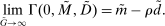

(22)

(22) , and a set of real rates, the portfolio demand for total real liquid assets is determined. The price level must be such that, at equilibrium real rates, the real supply of liquid assets equals the real liquidity demand. Once we substitute the clearing condition for government bonds, (21) and use

, and a set of real rates, the portfolio demand for total real liquid assets is determined. The price level must be such that, at equilibrium real rates, the real supply of liquid assets equals the real liquidity demand. Once we substitute the clearing condition for government bonds, (21) and use  , we obtain a quantity equation but now expressed in a more familiar way, in terms of monetary balances:

, we obtain a quantity equation but now expressed in a more familiar way, in terms of monetary balances:

(23)

(23)We note that the price level remains determined, even if banks are satiated with reserves. In this regard, our paper relates to Ennis (2018), who analyzes the link between money and prices in a perfect-foresight model with a static banking system. He shows that when capital requirements are slack, a policy of paying interest on reserves equal to the market return of the risk-free asset leads to an indeterminacy result, but when the capital requirement constraint binds, the real demand for reserves is determined, and hence the price level. One difference in our setup is that the presence of equity constraints in our framework implies that the price level is determined even absent binding capital requirements. In addition, here, the price level is determined through a quantity theory equation involving both government bonds and reserves.

Classical Monetary Properties

The model features classic long-run neutrality: an increase in the scale of  leads to a proportional increase in the price level without any changes in real allocations. On the other hand, changes in the permanent growth rate of the Fed's balance sheet do have real effects, unless all nominal policy rates are adjusted by inflation to keep real rates constant—and when the demand for real currency balances is perfectly inelastic. Both results are proven in the Online Appendix F.

leads to a proportional increase in the price level without any changes in real allocations. On the other hand, changes in the permanent growth rate of the Fed's balance sheet do have real effects, unless all nominal policy rates are adjusted by inflation to keep real rates constant—and when the demand for real currency balances is perfectly inelastic. Both results are proven in the Online Appendix F.

OMO

Policies that produce real effects operate through the liquidity premium. We define conventional (unconventional) OMO as a swap between reserves and government bonds (loans). The next proposition characterizes the effects of an OMO by which the Fed exchanges reserves for loans and government bonds in the initial period and reverses the operation the following period.

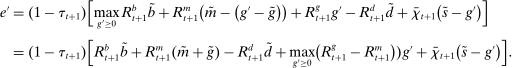

Proposition 9. (Real Effects of OMO)Consider an original policy sequence with a Fed balance sheet  and an OMO at

and an OMO at  reversed at

reversed at  . That is, consider an alternative policy sequence that differs from the original one only in that

. That is, consider an alternative policy sequence that differs from the original one only in that  ,

,  , and

, and  , for

, for  and

and  and

and  . We have the following two cases:

. We have the following two cases:

(i) Functioning interbank market: If  , then the OMO has effects on prices and aggregate asset allocations if and only if banks are not satiated with reserves at

, then the OMO has effects on prices and aggregate asset allocations if and only if banks are not satiated with reserves at  under the original allocation.

under the original allocation.

(ii) Interbank market shutdown: If  , and the operation is conventional (

, and the operation is conventional ( ) the OMO induces the same sequence of prices and real asset allocations; If the operation is unconventional (

) the OMO induces the same sequence of prices and real asset allocations; If the operation is unconventional ( ), then the OMO has effects on prices and aggregate asset allocations if and only if banks are not satiated with reserves at

), then the OMO has effects on prices and aggregate asset allocations if and only if banks are not satiated with reserves at  under the original allocation.

under the original allocation.

The proposition establishes that, when banks are satiated with reserves, open market operations are irrelevant, as in Wallace (1981). In effect, when banks are satiated, all assets are perfect substitutes. As a result, for every unit of loans (government bonds) that the Fed purchases, banks reduce loan holdings (government bonds) by one unit and increase reserves by the same amount.24 In effect, there are no changes in the real returns. Moreover, there are no changes in the price level.25 Away from satiation, however, the operations alter the liquidity premium and induce a change in the total amount of loans. When the Fed swaps government bonds or loans for reserves, this increases the relative abundance of reserves and reduces the costs from being short of reserves for an individual bank. As a result, for a given level of bank equity, this contributes to reduce the liquidity premium. Ultimately, this increases the supply of bank lending.

Moreover, the swap of government bonds or loans for reserves leads to an increase in the price level, but not one-for-one. Notice that for a given price level, a conventional OMO keeps constant the total amount of liquid assets. At the same time, since the composition is tilted toward reserves, market tightness θ falls (see equation (20)), leading to a lower demand for total liquid assets. It then follows from (22) that the price level increases but less than proportional to the increase in  .

.

Finally, an important result is that standard operations are irrelevant if the interbank market is shut down ( ). When the interbank market is shut down, the benefits of holding liquid assets are independent of the abundance of reserves on the aggregate because reserves cannot be lent to other banks. In particular, we have

). When the interbank market is shut down, the benefits of holding liquid assets are independent of the abundance of reserves on the aggregate because reserves cannot be lent to other banks. In particular, we have  ,

,  . As a result, a swap of reserves for government bonds simply changes the composition of liquid assets without any real effects. This result shows that, in an extreme event of an interbank market shutdown, the Fed should conduct unconventional OMO if it aims to reduce the liquidity premium and stimulate credit.

. As a result, a swap of reserves for government bonds simply changes the composition of liquid assets without any real effects. This result shows that, in an extreme event of an interbank market shutdown, the Fed should conduct unconventional OMO if it aims to reduce the liquidity premium and stimulate credit.

Bounds on the Lending Rate and the Friedman Rule

This section describes the set of rates that can be induced by the Fed in a stationary equilibrium and connects with a banking version of the Friedman rule. We refer to the Friedman rule as a monetary policy where the Fed lends at the discount window without penalty, that is, when the discount window rate equals the rate on reserves.

Definition 10. (Friedman Rule)Monetary policy is consistent with a Friedman rule if  .

.

Under this rule,  . Hence, banks are satiated, not through large holdings of liquid assets but through free borrowing from the discount window.26 As a result, there are no liquidity premia. This rule is in the same vein as the common version of the Friedman rule, under which the nominal interest rate on government bonds is zero, and there is no opportunity cost of holding currency. Likewise, in this banking version, there is no cost of being short of reserves. Moreover, with strictly positive liquid assets, there is also no opportunity cost of holding reserves, since

. Hence, banks are satiated, not through large holdings of liquid assets but through free borrowing from the discount window.26 As a result, there are no liquidity premia. This rule is in the same vein as the common version of the Friedman rule, under which the nominal interest rate on government bonds is zero, and there is no opportunity cost of holding currency. Likewise, in this banking version, there is no cost of being short of reserves. Moreover, with strictly positive liquid assets, there is also no opportunity cost of holding reserves, since  .

.

Notice that, as defined here, there are many values of  consistent with this Friedman rule, and as we will show, there is a different loan rate associated with each value of

consistent with this Friedman rule, and as we will show, there is a different loan rate associated with each value of  .27 We denote by

.27 We denote by  the stationary loan rate that prevails if the monetary authority follows a Friedman rule associated with a fixed stationary interest on reserves

the stationary loan rate that prevails if the monetary authority follows a Friedman rule associated with a fixed stationary interest on reserves  . The following proposition characterizes this stationary loan rate, focusing on the case with

. The following proposition characterizes this stationary loan rate, focusing on the case with  and

and  .

.

Proposition 11. (Stationary Loan Rate Under Friedman Rule)Assume that  and

and  . Consider the following parameter condition:

. Consider the following parameter condition:

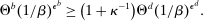

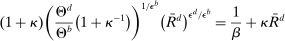

(24)

(24) be the unique solution to

be the unique solution to

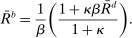

Slack Capital Requirements: If (24) holds, then capital requirements are slack and

(25)

(25) , then

, then  (with

(with  binding strictly if

binding strictly if  ). In all cases, the deposit rate equals

). In all cases, the deposit rate equals  .

.Binding Capital Requirements: If (24) does not hold, capital requirements are binding and

(26)

(26) . Moreover, if

. Moreover, if  , then

, then  (with

(with  strictly binding if

strictly binding if  ).

).To characterize the stationary lending rate, Proposition 11 exploits the fact that in any stationary equilibrium, the return on bank equity equals  . There are two cases to consider depending on whether capital requirements bind, as determined by (24). Consider first the case of slack capital requirements. In this case, we know that the deposit rate must equal the loan rate. We also have that if

. There are two cases to consider depending on whether capital requirements bind, as determined by (24). Consider first the case of slack capital requirements. In this case, we know that the deposit rate must equal the loan rate. We also have that if  , banks are at a corner of liquid assets and

, banks are at a corner of liquid assets and  . Instead, if

. Instead, if  , banks hold liquid assets in equilibrium, in which case

, banks hold liquid assets in equilibrium, in which case  . Notice that because in general equilibrium the after-tax return of liquid assets is zero, a loan rate

. Notice that because in general equilibrium the after-tax return of liquid assets is zero, a loan rate  guarantees stationarity. When the capital requirement constraint binds, the characterization is similar except that there is a spread between the loan rate and the deposit rate. As a result, we have that

guarantees stationarity. When the capital requirement constraint binds, the characterization is similar except that there is a spread between the loan rate and the deposit rate. As a result, we have that  becomes equal to

becomes equal to  for lower values of

for lower values of  compared to the case with slack capital requirements.28

compared to the case with slack capital requirements.28

Observe that  can be raised to any arbitrary level simply by raising

can be raised to any arbitrary level simply by raising  . Intuitively, there is no upper bound on the lending rate because the Fed has the ability to crowd out loans by paying a higher interest rate on reserves (financed with bank taxes). On the flip side, by lowering the rate on reserves, the Fed lowers the lending rate, but only to the point where reserves are no longer held in equilibrium. Once banks are at a corner with zero reserves, further declines in

. Intuitively, there is no upper bound on the lending rate because the Fed has the ability to crowd out loans by paying a higher interest rate on reserves (financed with bank taxes). On the flip side, by lowering the rate on reserves, the Fed lowers the lending rate, but only to the point where reserves are no longer held in equilibrium. Once banks are at a corner with zero reserves, further declines in  have no effects.

have no effects.

Proposition 11 applies to stationary equilibria induced by the Friedman rule. Next, we discuss how the characterization of  allows us to obtain bounds on the lending rate that can be induced by policies away from the Friedman rule.

allows us to obtain bounds on the lending rate that can be induced by policies away from the Friedman rule.

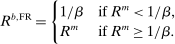

Corollary 12.Consider any stationary policy sequence such that  and

and  and let

and let  . Then the stationary lending rate satisfies

. Then the stationary lending rate satisfies  .

.

The corollary says that, if we consider any policy such that  , then the lending rate induced by the Friedman rule constitutes a lower bound. The qualification

, then the lending rate induced by the Friedman rule constitutes a lower bound. The qualification  is important, as it ensures that banks hold positive liquid assets in equilibrium. The idea is that considering equilibrium with strictly positive liquid assets, a policy that raises the liquidity premium necessarily raises the lending rate above the one that would prevail under the Friedman rule.29

is important, as it ensures that banks hold positive liquid assets in equilibrium. The idea is that considering equilibrium with strictly positive liquid assets, a policy that raises the liquidity premium necessarily raises the lending rate above the one that would prevail under the Friedman rule.29

The Friedman rule is not only useful for understanding the set of rates that can be induced by policies but also for characterizing efficiency. The following proposition establishes the Friedman rule is sufficient to achieve efficiency when capital requirements do not bind.30

Proposition 13.Assume that (24) holds, and that households have the same discount factor as banks  . Then the stationary equilibrium is efficient if the Fed follows a Friedman rule policy where

. Then the stationary equilibrium is efficient if the Fed follows a Friedman rule policy where  .

.

Discussion on Normative Issues

The results here regard positive analysis. Having established that a version of the Friedman rule achieves efficiency, it is important to discuss what frictions outside the model could motivate a deviation from the Friedman rule. First, because of macroprudential concerns, the Fed may want to reduce the amount of bank credit and use monetary policy for such an objective, as advocated by Stein (2012). Another concern relates to the costs of eliminating liquidity premia. For example, eliminating the LP may require the Fed to hold a large balance sheet, exposing it to credit risk or interest-rate risk, features outside of this model. Finally, there is a moral hazard consideration when lending reserves freely (see Cavalcanti, Erosa, and Temzelides (1999), Hoerova and Monnet (2016)). We leave for future work the assessment of the tradeoffs that emerge in the face of these considerations. However, we believe our model provides a useful setup to study these normative aspects. Section 5.2 shows indeed how the Fed can use different instruments to balance multiple policy objectives.

4 Empirical Evidence

Over the last decade, a large empirical literature has developed conveying evidence that liquidity frictions play an important role in financial markets. The goal of this section is twofold. First, we provide new evidence that specifically point toward the importance of the interbank market. Second, we discuss other available empirical evidence that supports our key mechanism.

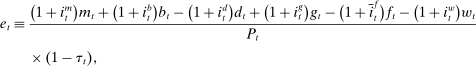

A central prediction of the theory is that frictions in the interbank markets are translated, at the macro level, into a premium for liquid assets. To examine whether this relationship is present in the data, one needs measures both of the frictions in the interbank market and asset liquidity premia.

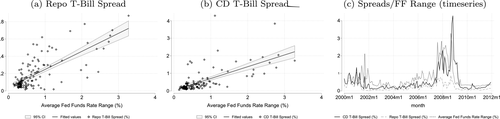

Regarding the measure of liquidity premia, we use two measures constructed in Nagel (2016): the spreads between the generalized collateral repo rate (GC) and the certificate deposit (CD) with respect to the 3 month T-bill rate.31 It is worth noting that the liquidity premium is large, reaching 4% around 2008, indicating that banks are willing to forgo large returns to hold assets that can be easily sold.

Regarding the measurement of interbank market frictions, the relevant variable in our model is the spread  . To the extent that the matching probabilities are not observable, the spread is also unobserved. As a proxy, we use the dispersion in interbank market rates, also proposed in recent work by Altavilla, Carboni, Lenza, and Uhlig (2019).32 Indeed, our model predicts that high withdrawal risk and matching efficiency in the interbank market produce greater dispersion in interbank rates. More precisely, we first use the daily distribution of the Fed fund rates provided by the New York Fed and compute the daily spread between the maximum and the minimum interbank market rates observed.33 We then construct a monthly time series by averaging the daily observations. We denote this variable as FF range.

. To the extent that the matching probabilities are not observable, the spread is also unobserved. As a proxy, we use the dispersion in interbank market rates, also proposed in recent work by Altavilla, Carboni, Lenza, and Uhlig (2019).32 Indeed, our model predicts that high withdrawal risk and matching efficiency in the interbank market produce greater dispersion in interbank rates. More precisely, we first use the daily distribution of the Fed fund rates provided by the New York Fed and compute the daily spread between the maximum and the minimum interbank market rates observed.33 We then construct a monthly time series by averaging the daily observations. We denote this variable as FF range.

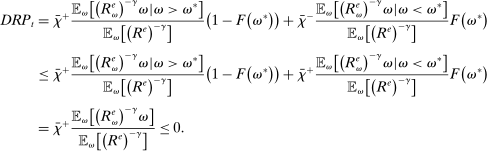

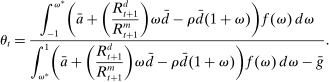

Equipped with these measures, we proceed to test the relationship between the two variables. To be clear, our goal is not to establish causality but to argue that these variables are positively correlated, as suggested by the model. Panels (a) and (b) of Figure 2 present the scatter points of the GC and CD against the FF range series, respectively, and panel (c) presents the monthly series for the GC and CD spreads and the FF range, from June 2000 and December 2011. Table I reports results from an ordinary least squares regression. The positive correlation between the FF range and the two measures of liquidity premia is striking. Columns (1) and (4) present the results for the baseline univariate regressions. Columns (2) and (5) show that the sign of the regression coefficients are unchanged after the average Fed funds rate is included, an indication that dispersion in rates captures information not contained in the policy target. Similarly, the correlation remains even when we include the VIX index, which suggests that dispersion in rates is picking up uncertainty inherent to the interbank market. The standard deviation of FF range series is 60bps, so the average impact on liquidity premia are 16bps and 36bps on the GC and CD spreads, respectively. This average impact may seem small. However, the FF range series is highly skewed (Hamilton (1996)). The FF Range series is above 200bps in 5% of the sample, and these events produce an impact of 50bps and 120bps on the GC and CD spreads, respectively. Online Appendix L presents additional robustness exercises.

Liquidity premia and Fed funds range. Note this one: Each point in the scatter plots in panels (a) and (b) represent a monthly observation. Panel (c) presents the associated time series. Online Appendix K.1 provides details of the data series.

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|---|---|---|---|---|---|---|

|

GC Spread |

GC Spread |

GC Spread |

CD Spread |

CD Spread |

CD Spread |

|

|

FF Range |

0.208 |

0.175 |

0.159 |

0.672 |

0.721 |

0.587 |

|

(12.57) |

(11.08) |

(9.75) |

(10.17) |

(10.32) |

(8.95) |

|

|

FF Rate |

0.0291 |

0.0374 |

−0.0428 |

0.0232 |

||

|

(5.95) |

(6.87) |

(−1.98) |

(1.06) |

|||

|

VIX |

0.0857 |

0.687 |

||||

|

(3.10) |

(6.17) |

|||||

|

Constant |

0.0395 |

−0.00523 |

−0.272 |

0.0330 |

0.0988 |

−2.038 |

|

(2.53) |

(−0.33) |

(−3.11) |

(0.53) |

(1.41) |

(−5.79) |

|

|

Observations |

138 |

138 |

138 |

138 |

138 |

138 |

- Note: t statistics in parentheses.

These results on the importance of interbank market frictions should not come as a surprise in light of other available evidence.34 The scale of the interbank market is large: banks in the United States clear about 3.3 trillion USD transactions daily. At a narrative level, the August 2019 Senior Financial Officer Survey reports that the primary reason why banks currently hold reserves is to meet deposit outflows. In fact, 72% of the respondents regard as very important holding reserves to meet deposit outflows (compared with 10% who regard as very important to earn the interest on reserves).35 In the next section, we calibrate our model and show how interbank market frictions matter for the monetary transmission.

5 Applications

We now provide two applications of our model to address key questions at the intersection of monetary policy and banking. We use a version of the model calibrated to the United States banking system, as we explain next.

5.1 Calibration

We calibrate the steady state of the model using data from 2006 as a reference period. In Section 5.3, we then extend the calibration analysis to the crisis and post-crisis period. Online Appendix K.1 provides the details of data measurements and sources.

Model Period

We define the time period to be a month and use annualized rates to describe the calibration. The choice of a month is guided by several factors. On the one hand, the Federal funds market operates daily, and reserve requirements have been traditionally computed based on a two-week window average over end-of-day balances. On the other hand, bank portfolio decisions and loan sales typically take longer than two weeks to materialize.36 In addition, shocks and overall positions in the interbank market are likely to be persistent, whereas they are not in the model. Capturing these institutional details would require a more complex model with multiple balancing stages and additional state variables to keep track of lagged reserve requirements. We view a monthly model as a parsimonious compromise between the daily nature of the Federal funds market, the bi-weekly nature of regulation, and the lower frequency of bank portfolio adjustments. The choice of a monthly model is also practical. Once we turn to the application in Section 5.3, most data are available monthly.

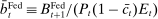

Additional Features

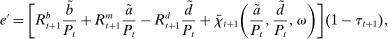

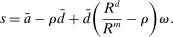

We extend the environment with two additional features to enrich the quantitative applications. These features only modify the portfolio problem (16) without altering any other condition in the model. First, we allow for Epstein–Zin preferences. Assuming a unit intertemporal elasticity of substitution (IES), this implies that the dividend rate simplifies to  . Second, we introduce credit risk. In particular, we assume that the return of loans is given by

. Second, we introduce credit risk. In particular, we assume that the return of loans is given by  , where δ follows a log-normal distribution with standard deviation

, where δ follows a log-normal distribution with standard deviation  and zero mean. The shock δ is distributed identically across banks and is independent of ω. By the law of large numbers, the average return across banks is

and zero mean. The shock δ is distributed identically across banks and is independent of ω. By the law of large numbers, the average return across banks is  ; hence the law of motion for aggregate equity remains the same. We introduce this second feature because it allows us to devise a procedure to match key moments in the data and to provide an exact decomposition of the decline in credit in Section 5.3. The volatility that we need to replicate the asset portfolio is small. In scale, it is about 6% of the liquidity premium.

; hence the law of motion for aggregate equity remains the same. We introduce this second feature because it allows us to devise a procedure to match key moments in the data and to provide an exact decomposition of the decline in credit in Section 5.3. The volatility that we need to replicate the asset portfolio is small. In scale, it is about 6% of the liquidity premium.

Distribution of Withdrawal Shocks

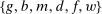

For the distribution of withdrawal shocks, Φ, we assume that  is distributed log-normal with standard deviation

is distributed log-normal with standard deviation  and zero mean. A log-normal distribution approximates well the empirical distribution of excess reserves.

and zero mean. A log-normal distribution approximates well the empirical distribution of excess reserves.

External Calibration

We set  externally. We list their values in Table II. We set the risk aversion to 10, a standard calibration of Epstein–Zin preferences used in asset pricing models (e.g., Bansal and Yaron (2004)). With a unit IES, stationarity of aggregate bank equity implies

externally. We list their values in Table II. We set the risk aversion to 10, a standard calibration of Epstein–Zin preferences used in asset pricing models (e.g., Bansal and Yaron (2004)). With a unit IES, stationarity of aggregate bank equity implies  . Given the targeted portfolios and returns explained below, we obtain a discount factor

. Given the targeted portfolios and returns explained below, we obtain a discount factor  .37

.37

|

Value |

Reference |

|

|---|---|---|

|

External Parameters |

||

|

Discount factor |

β = 0.981 |

Stationarity |

|

Risk aversion |

γ = 10 |

|

|

Interest on reserves |

im = 0 |

Observed |

|

Discount window rate |

iw = 11% |

Measured Stigma |

|

Steady-state inflation |

π = 2% |

Inflation Target |

|

Fed holdings of loans |