Retirement Financing: An Optimal Reform Approach

Abstract

We study Pareto optimal policy reforms aimed at overhauling retirement financing as an integral part of the tax and transfer system. Our framework for policy analysis is a heterogeneous-agent overlapping-generations model that performs well in matching the aggregate and distributional features of the U.S. economy. We present a test of Pareto optimality that identifies the main source of inefficiency in the status quo policies. Our test suggests that lack of asset subsidies late in life is the main source of inefficiency when annuity markets are incomplete. We solve for Pareto optimal policy reforms and show that progressive asset subsidies provide a powerful tool for Pareto optimal reforms. On the other hand, earnings tax reforms do not always yield efficiency gains. We implement our Pareto optimal policy reform in an economy that features demographic change. The reform reduces the present discounted value of net resources consumed by each generation by about 7 to 11 percent in the steady state. These gains amount to a one-time lump-sum transfer to the initial generation equal to 10.5 percent of GDP.

1 Introduction

The government in the United States, and in many other developed countries, plays a crucial role in the provision of old-age consumption. In the United States, for example, a major fraction of the older population relies heavily on their Social Security income. Old-age benefits provided by the Social Security program are 40 percent of all income of older people. Moreover, these benefits are the main source of income for half of the older population.1 On the other hand, these programs are a major source of cost for governments. In the United States, Social Security payouts are 30 percent of total government outlays. The severity of these costs together with an aging population has made reforms in the retirement system a necessity.

Various reforms have been proposed to reduce the cost of these programs or raise revenue to fund them. Typically, these proposals only target reform of the payroll tax and old-age benefits. Moreover, with a few exceptions, they focus on gains to future generations and often ignore the impact of reforms on current generations (see our discussion of related literature in Section 1.1). While such reforms have their merit, they require interpersonal comparison of utilities and are not necessarily robust to the variety of the political arrangements through which these reforms are determined. Alternatively, one can consider Pareto improving reforms: reforms that improve everyone's welfare. It is thus important to know under what conditions Pareto improving policy reforms are feasible. Moreover, what policy instruments are essential in achieving such reforms, and how large are the efficiency gains arising from these reforms?

In this paper, we propose a theoretical and quantitative analysis of Pareto improving policy reforms which view payroll taxes, old-age benefits, etc. as part of a comprehensive fiscal policy. On the theory side, we expand on Werning (2007) and provide a test of Pareto optimality of a tax and transfer schedule in an overlapping-generations economy with many tax instruments (i.e., taxes on earnings and savings). We then use the theory to investigate the possibility of Pareto optimal reforms in a quantitative model consistent with aggregate and distributional features of the U.S. economy. Our main result is that earnings tax reforms are not always a major source of efficiency gains in a Pareto optimal reform, but asset subsidies play an essential role in producing efficiency gains.

We use an overlapping-generations framework in which individuals of each cohort are heterogeneous in their earning ability, mortality, and discount factor. We assume those with higher earning ability have lower mortality. This assumption is motivated by the empirical research that documents a negative correlation between lifetime income and mortality (see, e.g., Cristia (2009), Waldron (2013)). We also assume higher-ability individuals are more patient. The motivation for this assumption is the observed heterogeneity in savings rates across income groups (see, e.g., Dynan, Skinner, and Zeldes (2004)). This feature also allows us to match the distribution of wealth in our calibration. Finally, annuity markets are incomplete.2

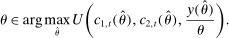

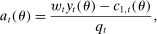

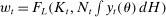

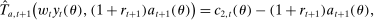

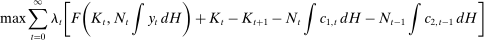

Our goal is to characterize the set of Pareto optimal fiscal policies, that is, nonlinear earnings tax and transfers during working age, asset taxes, and Social Security benefits. The evaluation of fiscal policies is based on the allocations that they induce in a competitive equilibrium where economic agents face these policies. In particular, a sequence of fiscal policies is Pareto optimal if one cannot find another sequence of policies whose induced allocations deliver at least the same welfare to each type of individual in each generation at a lower resource cost.

In this environment, the key question is whether a Pareto optimal reform (henceforth “Pareto reform”) is feasible. We show that, absent dynamic inefficiencies, a Pareto reform is only possible when there are inefficiencies within each generation. In other words, determining whether a sequence of policies can be improved upon comes down to checking the same property within each generation. An important implication of this result is that Pareto improvements cannot be achieved by simply replacing distortionary tax policies. This is because in an economy with heterogeneity, distortionary taxes may be efficient, as they serve a purpose: they balance redistributive motives in a society with incentives. It is well known that the set of Pareto optimal nonlinear income taxes is potentially large.3 In other words, judgment about the Pareto optimality of a tax system is not possible by simply examining the tax rates.

In order to examine the optimality of a given tax and transfer system, we extend the analysis of Werning (2007) to our overlapping-generations economy and derive the criteria for optimality for each generation. A tax system is optimal if it satisfies two criteria, an inequality constraint for the earnings tax schedule and a tax-smoothing relationship between various taxes (between contemporaneous earnings and savings taxes and between savings taxes over time). The inequality test of earnings taxes is standard from Werning (2007), and it is equivalent to the existence of nonnegative Pareto weights on different individuals that rationalize the observed tax function. The novel prediction of our analysis is the tax-smoothing relationship between various taxes. Together, these conditions can be tested for any tax schedule, as we do in our quantitative exercise.

Our tests imply that optimality of the asset tax schedule is tied to the incompleteness in the annuity markets and to earnings taxes. In other words, if redistributive motives inherent in observed policies are captured in earnings taxes, then the tax-smoothing relationship ties the optimal level of asset taxes to these redistributive motives (earnings taxes). This condition implies that optimal asset taxes must have two components. First, they must have a subsidy component that captures the inefficiencies arising from incompleteness in annuity markets. More specifically, with incomplete annuity markets, a subsidy to savings can index asset returns to individual mortality rates and therefore complete the market. Second, optimal asset taxes must have a tax component that stems from the increasing demand for savings from more productive individuals above and beyond usual consumption-smoothing reasons. In effect, since more productive individuals have a higher valuation for consumption in the future (due to their lower mortality and higher discount factor), taxation of future consumption can relax redistributive motives by the government, which in turn leads to lower taxes on earnings. The nature and magnitude of optimal asset taxes is determined by the balance of these two effects.

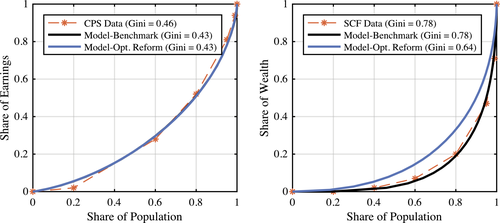

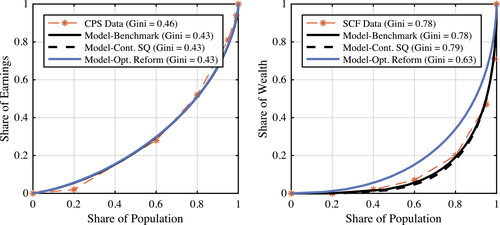

With this theoretical characterization as a guide, we turn to a quantitative version of our model. Specifically, we calibrate our model economy to the status quo policies in the United States (income taxes, payroll taxes, and old-age transfers), aggregate measures of hours worked and capital stock, and the distribution of earnings and wealth. Our model can successfully match the key features of the U.S. data, particularly the cross-sectional distribution of earnings and wealth.

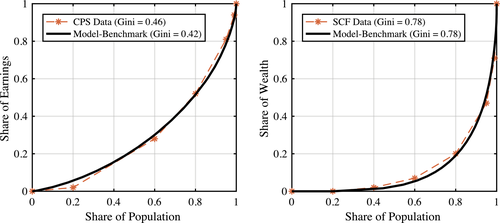

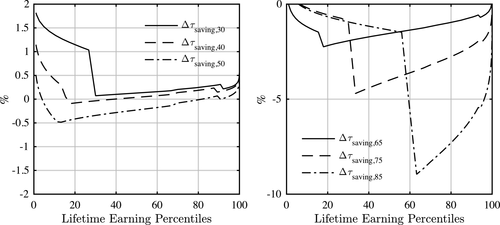

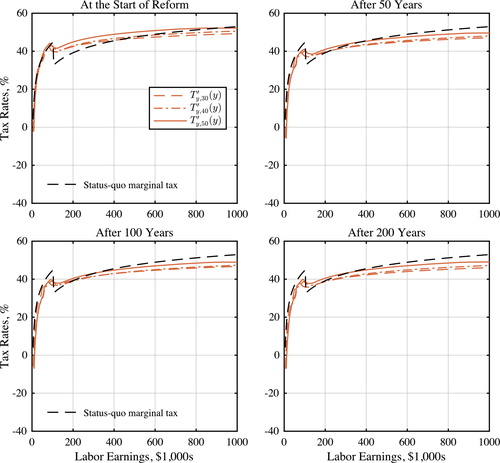

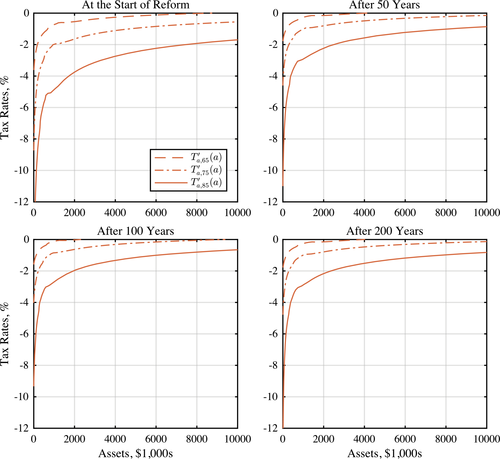

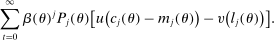

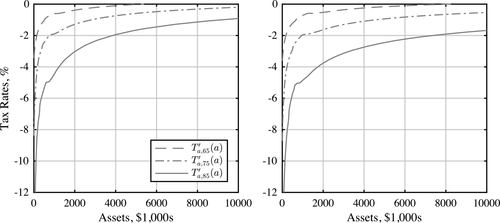

Using this quantitative model, we first apply our Pareto optimality test to assess the optimality of the status quo policies. Our tests show that these policies fail the efficiency test described above. While the earnings tax inequality is violated, this violation only occurs at the income levels close to the Social Security maximum earnings cap. In fact, since marginal tax rates fall around this cap, the tax is regressive and thus fails the inequality criterion. Beside this violation, earnings taxes pass our inequality test for all other earnings levels, and their deviation from optimality tests is small. On the other hand, our results show that the asset tax schedule violates our equality test at almost all ages and for all income levels. This suggests that savings tax (or subsidy) reforms—as opposed to earnings tax reforms—are a source of gains.

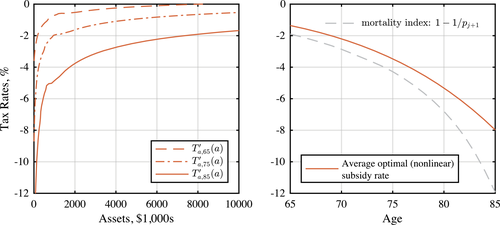

Next, we solve the problem of minimizing the cost of delivering the status quo welfare to each individual in each generation (i.e., the welfare associated with allocations induced by the status quo policies). The cost savings associated with this problem capture the potential efficiency gains in optimal reforms and identify the main elements of a Pareto optimal reform. This exercise confirms the results of the test: earnings taxes barely change compared to the status quo, while asset taxes are negative and progressive; that is, assets must be subsidized and asset-poor individuals must face a higher subsidy rate than asset-rich individuals.

That assets must be subsidized shows that the incompleteness in the annuity markets is the primary source of welfare gains. In addition, it shows that heterogeneity in mortality and discount rates play a secondary role in determining asset taxes. Furthermore, since, in our model, poorer individuals have a higher mortality rate, they must face a higher subsidy in order for the return on their savings to be indexed to their mortality. This effect leads to progressive subsidies.

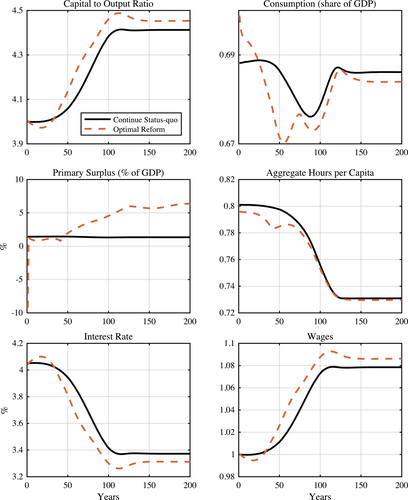

We conduct our quantitative exercises in two forms. First, we consider the steady state of an economy with currently observed U.S. demographics. This exercise shows that asset subsidies could be significant. In particular, the average subsidy rate post-retirement is 5 percent. Overall, implementing optimal policies reduces the present value of net resources used by each cohort by 11 percent. This is equivalent to a 0.82 percent reduction in the status quo consumption of all individuals, keeping their welfare unchanged.4

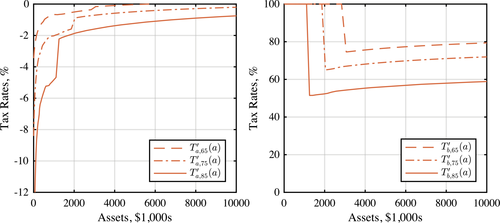

Second, we consider an aging economy that experiences a fall in population growth and mortality (as projected by the U.S. Census Bureau). In this economy, and along the demographic transition, we solve for Pareto optimal reform policies that do not lower the welfare of any individual in any birth cohort relative to the continuation of status quo. Our numerical results concerning the transition economy confirm our main findings: asset subsidies are significant and crucial in generating efficiency gains. However, the gains for each birth cohort are smaller relative to the previous exercise. The present discount value of net resources used by each cohort in the new steady state falls by about 7 percent. We distribute all the gains along the transition path to the initial generations in a lump-sum fashion. This amounts to a one-time lump-sum transfer of about 10.5 percent of current U.S. GDP.

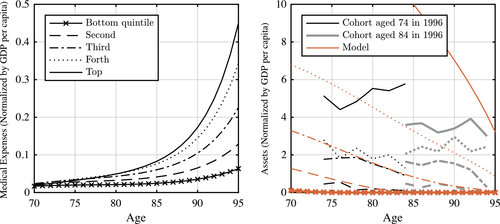

In order to highlight the importance of asset subsidies, we conduct another quantitative exercise in which we restrict reforms to policies that do not include asset subsidies and old-age transfers. In a sense, this is the best that can be achieved by phasing out retirement benefits and reforming payroll taxes. We find that these policies do not improve efficiency. In other words, they deliver the status quo welfare at a higher resource cost than the status quo policies. Finally, we also check the robustness of our results to the inclusion of other saving motives, namely, presence of out-of-pocket medical expenditure late in life (as emphasized by the seminal work of De Nardi, French, and Jones (2010)) and warm-glow bequests. Our quantitative exercises illustrate that our main findings are robust to these changes.

Asset subsidies are central to our proposed optimal policy. These subsidies resemble some of the features of the U.S. tax code and retirement system. Tax breaks for home ownership, retirement accounts (eligible IRAs, 401(k), 403(b), etc.), and subsidies for small business development are a few examples of such programs, whose estimated cost was $367 billion in 2005 (about 2.8 percent of GDP). Moreover, these programs mostly benefit higher-income individuals.5 One view of our proposed optimal policy is to extend and expand such policies to include broader asset categories and, more importantly, continue during the retirement period. Our result also highlights the need for progressivity in these subsidies, contrary to the current observed outcome. An important feature of the U.S. tax code is that it penalizes the accumulation of assets in tax-deferred accounts beyond the age of 70 and a half. Our analysis implies that these features are at odds with the optimal policy prescribed by our model and their removal can potentially yield significant efficiency gains.

1.1 Related Literature

Our paper contributes to various strands in the literature on policy reform. We contribute to the large and growing literature on retirement financing, most of which studies the implications of a specific set of policy proposals. For example, Nishiyama and Smetters (2007) studied the effect of privatization of Social Security. Kitao (2014) compared different combinations of tax increase and benefit cuts within the current Social Security system. McGrattan and Prescott (2017) proposed phasing out Social Security and Medicare benefits and removing payroll taxes. Blandin (2018) studied the effect of eliminating the Social Security maximum earnings cap.

We depart from the existing literature in two important aspects. First, we do not restrict the set of policies at the outset. Therefore, our results can inform us about which policy instrument is an essential part of a reform. As a result, we find that changing the marginal tax rates on labor earnings is not a major contributor to an optimal policy reform. Second, we focus explicitly on Pareto optimal policies and derive the condition that can inform us about the feasibility of Pareto improving policy reforms. In that regard, our paper is close to Conesa and Garriga (2008), who characterized a Pareto optimal reform in an economy without heterogeneity within each cohort and found Pareto optimal linear taxes (a Ramsey exercise).

Our paper is also related to a large literature on optimal policy design. The common approach in this literature is to take a stand on specific social welfare criteria and find optimal policies that maximize social welfare. For example, Conesa and Krueger (2006) and Heathcote, Storesletten, and Violante (2017) studied the optimal progressivity of a tax formula for a parametric set of tax functions, while Huggett and Parra (2010) and Heathcote and Tsujiyama (2015) did the same using a Mirrleesian approach that does not impose a parametric restriction on policy instruments (similar to our paper). One drawback of this approach is that it relies on the choice of the social welfare function. Consequently, the resulting policy proposals can improve efficiency while at the same time provide redistribution across individuals.6 Moreover, the resulting policies are conditional on a particular welfare function which might or might not be conforming to the political institutions that are determinants of government policies in a certain country. The benefit of our approach is that it does not rely on an arbitrary welfare function by providing nonnegative gains to all individuals. To the best of our knowledge, this is the first paper that proposes this approach to optimal policy reform in a dynamic quantitative setting.7

Our paper also contributes to the literature on dynamic optimal taxation over the life cycle. Similarly to Weinzierl (2011), Golosov, Troshkin, and Tsyvinski (2016), and Farhi and Werning (2013b), we provide analytical expressions for distortions and summarize insights from those expressions. However, unlike these cited works, which focus on labor distortions over the life cycle, we focus on intertemporal distortions. Furthermore, we emphasize the role of policy during the retirement period, thus relating our work to Golosov and Tsyvinski (2006), who studied the optimal design of the disability insurance system, and Shourideh and Troshkin (2017) and Ndiaye (2018), who focused on an optimal tax system that provides incentive for an efficient retirement age.

Another strand of literature our paper is related to studies the role of Social Security in providing longevity insurance. Hubbard and Judd (1987), İmrohoroǧlu, İmrohoroǧlu, and Joines (1995), Hong and Ríos-Rull (2007), and Hosseini (2015) (among many others) have examined the welfare-enhancing role of providing an annuity income through Social Security when the private annuity insurance market has imperfections. Caliendo, Guo, and Hosseini (2014) pointed out that the welfare-enhancing role of Social Security in providing annuitization is limited because Social Security does not affect individuals' intertemporal trade-offs. In this paper, we pinpoint the optimal distortions and policies that address this shortcoming in the system by emphasizing that any optimal retirement system (whether public, private, or mixed) must include features that affect individuals' intertemporal decisions on the margin. In our proposed implementation, those features take the form of a nonlinear subsidy on assets.

Finally, our paper is related to the literature on the observed lack of annuitization in the United States. Friedman and Warshawsky (1990) showed that if one is to consider the high fees (what they referred to as “load factor”) on annuities provided in the market together with adverse selection, the standard model without bequest motives can go a long way in explaining the lack of annuitization. Diamond (2004) and Mitchell, Poterba, Warshawsky, and Brown (1999) pointed to taxes on insurance companies as well as high overhead costs (marketing and administrative costs as well as other corporate overhead) behind the high transaction costs. In particular, observing that the government cost of handling Social Security is much lower, Diamond (2004) suggested government-provided annuities—a task that our saving subsidies achieve. Our paper can be thought of as a quantitative evaluation of this idea in reforming the retirement benefit system in the United States.

The rest of the paper is organized as follows: Section 2 lays out a two-period OLG framework where we provide intuition for our results; in Section 3, we describe the benchmark model used in our quantitative exercise; in Section 4, we calibrate the model; in Section 5, we discuss our quantitative results in steady state; in Section 6, we discuss reforms in an aging economy; in Section 7, we study various robustness exercises; and in Section 8, we present our conclusions.

2 Pareto Optimal Policy Reforms: A Basic Framework

In this section, we use a basic framework to provide a theoretical analysis of Pareto optimal policy reforms. In particular, we extend the static analysis in Werning (2007) to a dynamic OLG economy in order to characterize the determinants of a Pareto optimal policy reform.

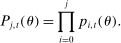

. There is a continuum of individuals born in each period. Each individual lives for at most two periods. Upon birth, each individual draws a type

. There is a continuum of individuals born in each period. Each individual lives for at most two periods. Upon birth, each individual draws a type  from a continuous distribution

from a continuous distribution  that has density

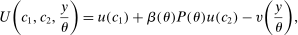

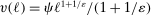

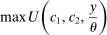

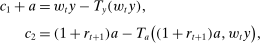

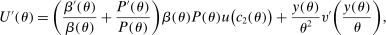

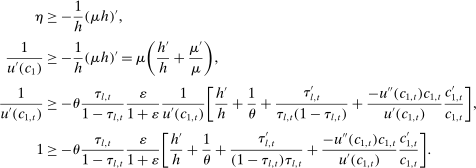

that has density  . This type determines various characteristics of the individual such as labor productivity, mortality risk, and discount rate. We assume that an individual's preferences are represented by the following utility function over bundles of consumption and hours worked,

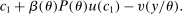

. This type determines various characteristics of the individual such as labor productivity, mortality risk, and discount rate. We assume that an individual's preferences are represented by the following utility function over bundles of consumption and hours worked,  :

:

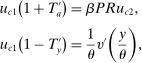

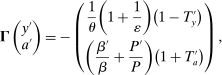

is the discount factor,

is the discount factor,  is the survival probability, θ is labor productivity,

is the survival probability, θ is labor productivity,  is strictly concave, and

is strictly concave, and  is strictly convex. For simplicity, we assume that

is strictly convex. For simplicity, we assume that  , where ℓ is hours worked.

, where ℓ is hours worked.Production is done using labor and capital, with the production function given by  , where K is capital and L is total effective labor; for ease of notation,

, where K is capital and L is total effective labor; for ease of notation,  here is taken to be NDP (net domestic product). In addition, population grows at rate n, and

here is taken to be NDP (net domestic product). In addition, population grows at rate n, and  is total population at t.

is total population at t.

is the net return on investment after depreciation, while

is the net return on investment after depreciation, while  is the average wage rate in the economy. Note that in the above equations, we have allowed the second period taxes,

is the average wage rate in the economy. Note that in the above equations, we have allowed the second period taxes,  , to depend on wealth and earnings, which can potentially capture a redistributive and history-dependent Social Security benefit formula together with taxes on assets. In addition, we have imposed incomplete annuity markets. In particular, the price of assets purchased when individuals are young is the same for all individuals and normalized to 1, even though individuals could be heterogeneous in their survival probability. This assumption is consistent with the observation that private annuity markets in the United States are very small.8 Finally, we assume that upon the death of an individual, his or her non-annuitized asset is collected by the government.

, to depend on wealth and earnings, which can potentially capture a redistributive and history-dependent Social Security benefit formula together with taxes on assets. In addition, we have imposed incomplete annuity markets. In particular, the price of assets purchased when individuals are young is the same for all individuals and normalized to 1, even though individuals could be heterogeneous in their survival probability. This assumption is consistent with the observation that private annuity markets in the United States are very small.8 Finally, we assume that upon the death of an individual, his or her non-annuitized asset is collected by the government. together with

together with  and

and  , where subscript t represents the period in which the individual is born, total

, where subscript t represents the period in which the individual is born, total  is capital in period t, and

is capital in period t, and  is total effective hours. Such allocation is feasible if it satisfies the usual market clearing conditions:

is total effective hours. Such allocation is feasible if it satisfies the usual market clearing conditions:

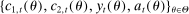

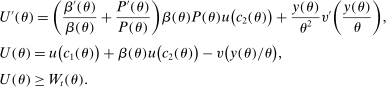

. For a given set of taxes and initial stock of physical capital, we refer to the profile of utilities that arise in equilibrium as induced by policies

. For a given set of taxes and initial stock of physical capital, we refer to the profile of utilities that arise in equilibrium as induced by policies  ,

,  .

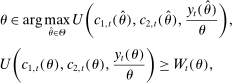

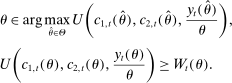

.In this context, for a given policy  ,

,  and its induced welfare profile,

and its induced welfare profile,  , a Pareto reform is a sequence of policies

, a Pareto reform is a sequence of policies  ,

,  whose induced welfare,

whose induced welfare,  , satisfies

, satisfies  with strict inequality for a positive measure of θ's and some t. Notice that in our definition of Pareto reforms, we allowed for policies to be time-dependent in order to have flexibility in the reforms. A pair of policies is thus said to be Pareto optimal if a Pareto reform does not exist.

with strict inequality for a positive measure of θ's and some t. Notice that in our definition of Pareto reforms, we allowed for policies to be time-dependent in order to have flexibility in the reforms. A pair of policies is thus said to be Pareto optimal if a Pareto reform does not exist.

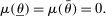

The following proposition shows our first result about the existence of Pareto optimal reforms:

Proposition 1. (Diamond)Consider an allocation  induced by a pair of policies

induced by a pair of policies  ,

,  . Suppose that

. Suppose that  for some positive γ; then the pair

for some positive γ; then the pair  and

and  is Pareto optimal if and only if, for all

is Pareto optimal if and only if, for all  ,

,

(P)

(P) (1)

(1) (2)

(2)The proof can be found in the 8.

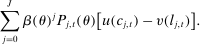

The above proposition is an extension of the results in Diamond (1965) to an environment with heterogeneity and second best policies. It states that when the economy is dynamically efficient,  , then the possibility of a Pareto optimal reform depends on whether tax and transfer schemes exhibit inefficiencies within some generation. To the extent that dynamic efficiency seems to be the case in the data, the only possible Pareto optimal reforms can come from within-generation inefficiencies.9 In other words, the Pareto reform problem can be separated across generations and comes down to finding inefficiencies of policies within each generation. Note that a usual asymmetric information assumption is imposed on allocations, to reflect that not all tax policies are feasible. In particular, tax policies that directly depend on individuals' characteristics (e.g., ability types and mortality) are not available. As is well-known from the public finance literature, the set of Pareto efficient tax functions is potentially large.10 This implies that distortionary taxes (payroll, earnings, etc.) cannot necessarily be removed, since they could satisfy the condition in Proposition 1.

, then the possibility of a Pareto optimal reform depends on whether tax and transfer schemes exhibit inefficiencies within some generation. To the extent that dynamic efficiency seems to be the case in the data, the only possible Pareto optimal reforms can come from within-generation inefficiencies.9 In other words, the Pareto reform problem can be separated across generations and comes down to finding inefficiencies of policies within each generation. Note that a usual asymmetric information assumption is imposed on allocations, to reflect that not all tax policies are feasible. In particular, tax policies that directly depend on individuals' characteristics (e.g., ability types and mortality) are not available. As is well-known from the public finance literature, the set of Pareto efficient tax functions is potentially large.10 This implies that distortionary taxes (payroll, earnings, etc.) cannot necessarily be removed, since they could satisfy the condition in Proposition 1.

Proposition 1 and the above discussion highlight the main task at hand in finding Pareto optimal reforms: we have to characterize tax schedules,  and

and  , that solve problem (P). This is similar to the standard Pareto optimal tax problem as studied by Werning (2007) for a static economy. The difference compared to Werning's model is that the government has access to multiple instruments (i.e., tax on earnings and assets). As we establish, the fact that the government has access to multiple instruments introduces new restrictions on optimal taxes. The key implication is that Pareto optimal taxes must satisfy the following property: distortions along different margins adjusted by elasticities must be equated for all individuals of the same type. This result is akin to smoothing of distortions along different margins. The following proposition presents this result:

, that solve problem (P). This is similar to the standard Pareto optimal tax problem as studied by Werning (2007) for a static economy. The difference compared to Werning's model is that the government has access to multiple instruments (i.e., tax on earnings and assets). As we establish, the fact that the government has access to multiple instruments introduces new restrictions on optimal taxes. The key implication is that Pareto optimal taxes must satisfy the following property: distortions along different margins adjusted by elasticities must be equated for all individuals of the same type. This result is akin to smoothing of distortions along different margins. The following proposition presents this result:

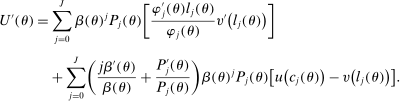

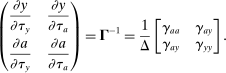

Proposition 2.Consider a pair of policies  and

and  and suppose that it induces an allocation without bunching, that is,

and suppose that it induces an allocation without bunching, that is,  and

and  are one-to-one functions of θ. Then the pair

are one-to-one functions of θ. Then the pair  ,

,  is Pareto optimal only if it satisfies

is Pareto optimal only if it satisfies

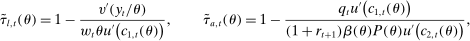

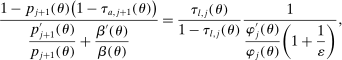

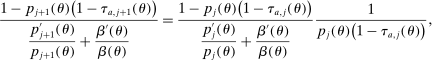

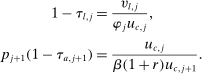

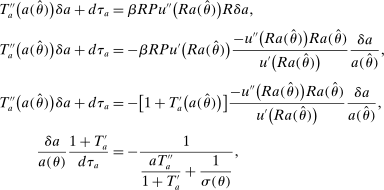

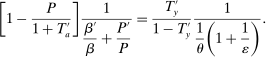

(3)

(3) and

and  are the wedges induced by the tax schedule; and

are the wedges induced by the tax schedule; and

The proof can be found in the 8.

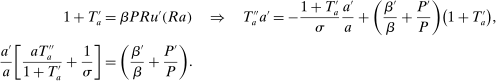

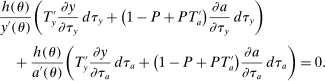

Equation (3) is the main dynamic implication of the test of Pareto optimality. It states that distortions to labor and assets margin must comove, holding other things constant. In other words, given any profile of labor taxes, which is determined by the profile of Pareto weights, the asset tax profile is determined by (3). Note that in (3),  is the increase in government's revenue per person from a unit increase in assets of workers of type θ, 11 while

is the increase in government's revenue per person from a unit increase in assets of workers of type θ, 11 while  is the same thing except for earnings. As we describe below, equation (3) states that the behavioral increase12 in government's revenue from a small increase in asset taxes for individuals of type θ must be equal to that of earnings taxes. In this sense, this result states that with two nonlinear taxes, the distortions adjusted by behavioral responses must be equated across the two schedules.

is the same thing except for earnings. As we describe below, equation (3) states that the behavioral increase12 in government's revenue from a small increase in asset taxes for individuals of type θ must be equal to that of earnings taxes. In this sense, this result states that with two nonlinear taxes, the distortions adjusted by behavioral responses must be equated across the two schedules.

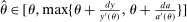

. In this formulation, there is no income effect and, therefore, the calculation of individual responses to tax perturbations is simpler. In Appendix B.2, we show how this analysis works in a model with income effect. Starting with the tax function

. In this formulation, there is no income effect and, therefore, the calculation of individual responses to tax perturbations is simpler. In Appendix B.2, we show how this analysis works in a model with income effect. Starting with the tax function  and

and  ,13 consider the following perturbation of any tax schedule:

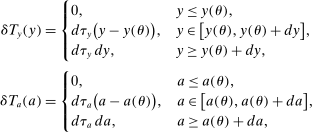

,13 consider the following perturbation of any tax schedule:

increases by

increases by  , while the marginal asset tax rate for the bracket

, while the marginal asset tax rate for the bracket  decreases by dτ, where dτ and δ are two small positive numbers. Note that for all types with assets higher than

decreases by dτ, where dτ and δ are two small positive numbers. Note that for all types with assets higher than  and earnings higher than

and earnings higher than  , this perturbation leaves their welfare, income, and marginal taxes unchanged. This is because for these types, the change in tax on earnings cancels out that of the tax on assets. As for types close to θ, since only their marginal tax changes (taxes paid on their last earned unit of earnings and assets), their welfare change is second order. By the envelope theorem, the change in welfare for them is proportional to the size of the tax change, and the measure of people affected is also small. This implies that the above tax perturbation is feasible, up to a possible second-order violation of the participation constraint (2); the utility of individuals close to θ changes by a small amount which leads to a second-order change in welfare. Therefore, at the optimum, it should not raise government revenue. Note that the same holds for the reverse of this perturbation and, as a result, at the optimum the perturbation should keep government revenue unchanged.

, this perturbation leaves their welfare, income, and marginal taxes unchanged. This is because for these types, the change in tax on earnings cancels out that of the tax on assets. As for types close to θ, since only their marginal tax changes (taxes paid on their last earned unit of earnings and assets), their welfare change is second order. By the envelope theorem, the change in welfare for them is proportional to the size of the tax change, and the measure of people affected is also small. This implies that the above tax perturbation is feasible, up to a possible second-order violation of the participation constraint (2); the utility of individuals close to θ changes by a small amount which leads to a second-order change in welfare. Therefore, at the optimum, it should not raise government revenue. Note that the same holds for the reverse of this perturbation and, as a result, at the optimum the perturbation should keep government revenue unchanged.

is the behavioral response of earnings to an earnings tax increase of magnitude dτ, and

is the behavioral response of earnings to an earnings tax increase of magnitude dτ, and  is the response of assets to an increase in asset tax of magnitude dτ. Moreover,

is the response of assets to an increase in asset tax of magnitude dτ. Moreover,  is the measure of individuals whose marginal earnings taxes increase, while

is the measure of individuals whose marginal earnings taxes increase, while  is the measure of individuals whose marginal asset taxes decrease.14 Some algebra, deferred to Appendix B, shows that the above equation becomes (3).

is the measure of individuals whose marginal asset taxes decrease.14 Some algebra, deferred to Appendix B, shows that the above equation becomes (3).This discussion highlights the key implication of Pareto optimality in dynamic environments where the government can impose multiple nonlinear taxes along different margins. As we have argued, small offsetting perturbations of nonlinear taxes preserve Pareto optimality, up to a second-order effect on people whose marginal taxes are perturbed. Since these perturbations have offsetting mechanical effects, it must be that their behavioral effect on government's revenue must be equated. This equalization of the behavioral response across different instruments can be thought of as sort of a tax smoothing. As we show in Section 3.5, in an extended version of this model the same results hold. Moreover, as our quantitative analysis establishes, the failure of this test of Pareto optimality is significant for status quo U.S. policies and leads to the main source of efficiency gains in Pareto optimal reforms.

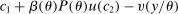

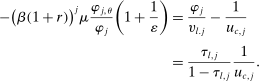

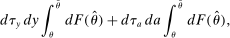

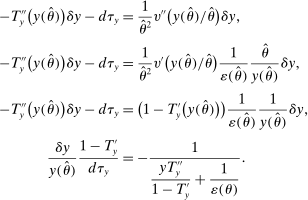

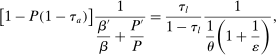

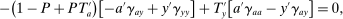

(4)

(4) , captures the inefficiencies arising from the incompleteness of annuity markets. This reflects the fact that in the absence of annuities, a subsidy to savings can provide annuity returns and thus complete the market. We should note that even absent any heterogeneity, the market incompleteness assumption implies that

, captures the inefficiencies arising from the incompleteness of annuity markets. This reflects the fact that in the absence of annuities, a subsidy to savings can provide annuity returns and thus complete the market. We should note that even absent any heterogeneity, the market incompleteness assumption implies that  is nonzero and equal to

is nonzero and equal to  , where P is the probability of survival.

, where P is the probability of survival.The second component is more subtle and stems from the increasing demand for savings from more productive individuals above and beyond usual consumption-smoothing reasons. In effect, since more productive individuals have a higher valuation for consumption in the second period (they have a higher discount factor and a higher survival rate), taxation of second-period consumption can relax redistributive motives by the government, which in turn leads to lower taxes on earnings.15 Note that when  and

and  , our model becomes the model studied by Atkinson and Stiglitz (1976) and, as a result, the above formula becomes

, our model becomes the model studied by Atkinson and Stiglitz (1976) and, as a result, the above formula becomes  ; that is, savings taxes should be zero.

; that is, savings taxes should be zero.

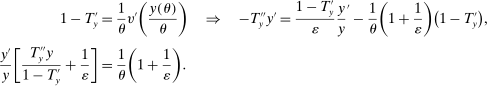

We should note a subtle point about forces towards progressivity of savings tax or subsidies in our setup. When income and mortality are positively correlated, that is,  , the market incompleteness component,

, the market incompleteness component,  , is negative and increases with θ. In other words, workers with lower productivity face a higher subsidy. This can be interpreted as a progressive subsidy on savings. This force towards “progressivity” in the subsidy on savings is independent of government's redistributive motive and purely comes from efficiency reasons. As an example, suppose that there is no government expenditure and government does not care about redistribution at all. In this case, the optimal labor income taxes are zero;

, is negative and increases with θ. In other words, workers with lower productivity face a higher subsidy. This can be interpreted as a progressive subsidy on savings. This force towards “progressivity” in the subsidy on savings is independent of government's redistributive motive and purely comes from efficiency reasons. As an example, suppose that there is no government expenditure and government does not care about redistribution at all. In this case, the optimal labor income taxes are zero;  , yet saving subsidies are progressive.

, yet saving subsidies are progressive.

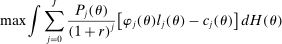

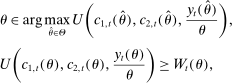

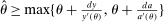

In addition to the above, a Pareto optimal tax system must also satisfy another condition that is equivalent to the existence of Pareto weights. That is, for any Pareto optimal tax schedule, nonnegative Pareto weights on individuals must exist so that the tax functions maximize the value of a weighted average of the utility of individuals. As shown by Werning (2007), the existence of such Pareto weights is equivalent to inequalities in terms of taxes, distribution of productivities, and labor supply elasticities. This inequality must also be satisfied in our model:

Proposition 3.A pair of policies  and

and  is efficient only if it satisfies the following relationships:

is efficient only if it satisfies the following relationships:

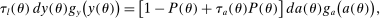

(5)

(5)In addition, if optimal allocations under the tax functions are fully characterized by an individual's first-order conditions, then (3) and (5) are sufficient for efficiency.

The proof is relegated to the 8.

The above formula implies that a tax schedule is more likely to be negative (1) the higher is the rate of change in the skill distribution, (2) the higher is the slope of the marginal tax rate, (3) the stronger is the income effect, and (4) the lower is the Frisch elasticity of labor supply. These forces can be identified in (5). An important observation is that when taxes become regressive, that is,  , a Pareto improving reform is more likely.16

, a Pareto improving reform is more likely.16

Our analysis here points towards the key properties that can, in principle, provide sources of gain for Pareto optimal reforms. Note that given the generality of our result, our analysis will apply whether transitional issues in policies are considered or not. In other words, either taxes are inefficient, in which case one can always find a rearrangement of resources across generations and find a possible Pareto improvement, or taxes are efficient, in which case it is impossible to find such an improvement.

In what follows, we develop a quantitative model that does fairly well in matching basic moments of consumption, earnings, and wealth distribution. We will use this model to test for potential inefficiencies and compute the magnitude of cost savings that Pareto optimal reforms can provide.

3 The Model

In this section, we develop a heterogeneous-agent overlapping-generations model that extends the ideas discussed in Section 2 and is suitable for our quantitative policy analysis. Our description of the policy instruments is general and includes the current U.S. status quo policies as a special case. The model is rich enough and is calibrated in Section 4 to match U.S. aggregate data and cross-sectional observations on earnings and asset distribution. In Section 3.5, we show how this model can be used to derive Pareto optimal policies.

3.1 Demographics, Preferences, and Technology

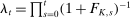

Time is discrete, and the economy is populated by  overlapping generations. A cohort of individuals is born in each period

overlapping generations. A cohort of individuals is born in each period  . The number of newborns grows at rate

. The number of newborns grows at rate  . Upon birth, each individual draws a type

. Upon birth, each individual draws a type  from a continuous distribution

from a continuous distribution  that has density

that has density  . This parameter determines three main characteristics of an individual: life-cycle labor productivity profile, survival rate profile, and discount factor. In particular, an individual of type θ has a labor productivity of

. This parameter determines three main characteristics of an individual: life-cycle labor productivity profile, survival rate profile, and discount factor. In particular, an individual of type θ has a labor productivity of  at age j. We assume that

at age j. We assume that  and thus refer to individuals with a higher value of θ as more productive. Everyone retires at age R, and

and thus refer to individuals with a higher value of θ as more productive. Everyone retires at age R, and  for

for  .

.

(this is the probability of being alive at age

(this is the probability of being alive at age  , conditional on being alive at age j).17 Nobody survives beyond age J (with

, conditional on being alive at age j).17 Nobody survives beyond age J (with  for all θ and t). As a result, the survival probability at age j for those who are born in period t is

for all θ and t). As a result, the survival probability at age j for those who are born in period t is

. Thus, that individual's preferences over streams of consumption and hours worked are given by

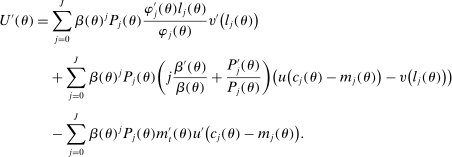

. Thus, that individual's preferences over streams of consumption and hours worked are given by

(6)

(6) and

and  are consumption and hours worked for an individual of θ at j who is born in period t.

are consumption and hours worked for an individual of θ at j who is born in period t. . In this formulation,

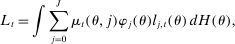

. In this formulation,  is aggregate per capita stock of capital, and

is aggregate per capita stock of capital, and  is the aggregate effective units of labor per capita. Effective labor is defined as labor productivity,

is the aggregate effective units of labor per capita. Effective labor is defined as labor productivity,  , multiplied by hours,

, multiplied by hours,  . Its aggregate value is the sum of the units of effective labor across all individuals alive in each period. In other words,

. Its aggregate value is the sum of the units of effective labor across all individuals alive in each period. In other words,

is the share of type θ of age j in the population in period t. Finally, capital depreciates at rate δ. Therefore, the return on capital net of depreciation is

is the share of type θ of age j in the population in period t. Finally, capital depreciates at rate δ. Therefore, the return on capital net of depreciation is  .

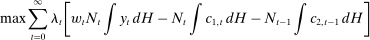

.3.2 Markets and Government

We assume that individuals supply labor in the labor market and earn a wage  per unit of effective labor. In addition, individuals have access to a risk-free asset and cannot borrow. The assets of the deceased in each period t convert to bequests and are distributed equally among the living population in period t.18 Our main assumption here is that annuity markets do not exist. As discussed in Section 2, this assumption is in line with the observed low volume of trade in annuity markets in the United States and other countries.19

per unit of effective labor. In addition, individuals have access to a risk-free asset and cannot borrow. The assets of the deceased in each period t convert to bequests and are distributed equally among the living population in period t.18 Our main assumption here is that annuity markets do not exist. As discussed in Section 2, this assumption is in line with the observed low volume of trade in annuity markets in the United States and other countries.19

The government uses nonlinear taxes on earnings from supplying labor, including the Social Security tax, while we assume that there is a linear tax on capital income and consumption. The revenue from taxation is then used to finance transfers to workers and Social Security payments to retirees. While transfers are assumed to be equal for all individuals, Social Security benefits are not and depend on individuals' lifetime income.

(7)

(7)

is the rate of return on assets

is the rate of return on assets  ;

;  and

and  are the earnings tax and asset tax functions, respectively;

are the earnings tax and asset tax functions, respectively;  are transfers to working individuals;

are transfers to working individuals;  is the retirement benefit from the government; and

is the retirement benefit from the government; and  is the income earned from bequests. The dependence of retirement benefits on lifetime earnings is captured by

is the income earned from bequests. The dependence of retirement benefits on lifetime earnings is captured by  , which is given by

, which is given by

There is a corporate tax rate  paid by producers. Therefore, the return on assets,

paid by producers. Therefore, the return on assets,  , is equal to

, is equal to  .21 We assume that the government taxes households' holding of government debt at an equal rate and, therefore, the interest paid on government debt is also

.21 We assume that the government taxes households' holding of government debt at an equal rate and, therefore, the interest paid on government debt is also  .

.

(8)

(8) is per capita government purchases,

is per capita government purchases,  is per capita government debt, and

is per capita government debt, and  is population growth rate at t, which can be calculated as a function of mortality rates and

is population growth rate at t, which can be calculated as a function of mortality rates and  . Finally, goods and asset market clearing implies

. Finally, goods and asset market clearing implies

(9)

(9) (10)

(10) (11)

(11)3.3 Equilibrium

The equilibrium of this economy is defined as allocations where individuals maximize (6) subject to (7), while the government budget constraint (8), market clearings (9), (10), and (11) must hold. The equilibrium is stationary (or in steady state) when all policy functions, demographics parameters, allocations, and prices are independent of calendar period t.

This sums up our description of the economy. In the next section, we describe our approach to analyzing an optimal reform within the framework specified above. Note that we have not specified any details of the status quo policies yet. We will do that in Section 4 where we impose detailed parametric specifications of the U.S. tax and Social Security policies and calibrate this model to the U.S. data. We can then apply our optimal reform approach to the calibrated model and conduct our optimal reform exercise.

When the tax function and Social Security benefits are calibrated to those for the United States, we refer to the resulting equilibrium allocations and welfare as status quo allocations and welfare. We refer to the status quo welfare of an individual of type θ who is born in period t by  .

.

3.4 Remark on Annuity Markets

Throughout the analysis in this paper, we assume that there are no markets for annuities. This is in line with the observed lack of annuitization in the United States. As Poterba (2001), Benartzi, Previtero, and Thaler (2011), and many others have mentioned, the annuity market in the United States is very small. According to Hosseini (2015)'s calculation based on HRS, only 5 percent of the elderly hold private annuities in their portfolio.22 Moreover, the offered annuities have very high transaction costs and low yields (see Friedman and Warshawsky (1990) and Mitchell et al. (1999)), and are not effectively used by individuals (see Brown and Poterba (2006)).23

Various reasons have been proposed as leading to lack of annuitization in the United States: the presence of Social Security as an imperfect substitute, adverse selection in the annuity market, low yields on offered annuities due to overhead and other costs, bequest motives, and complexity of choice faced by individuals (see Benartzi, Previtero, and Thaler (2011) and Diamond (2004)). All of these reasons warrant government intervention in annuity markets. In our paper, we have focused on the extreme case where the government fully takes over the annuity market. This role for the government was also discussed in detail by Diamond (2004). It would be interesting to study the case where annuity markets are present and government intervention crowds out the private market. This, however, is beyond the scope of our paper.

3.5 Optimal Policy Reform in the Quantitative Framework

Our optimal policy-reform exercise is very similar to the one in the two-period model provided in Section 2. It builds on the positive description of the economy in Section 3. In particular, we use the distribution of welfare implied by the model in Section 3 and consider a planning problem that chooses policies in order to minimize the cost of delivering this distribution of welfare, the status quo utility profile  , to a particular representative cohort of individuals. We show how the efficiency tests discussed in Section 2 extend to the dynamic environment. For simplicity, we assume steady state and do not consider the changes in prices resulting from the reforms. Later, in our quantitative exercise, we allow for both transitions and changes in prices.

, to a particular representative cohort of individuals. We show how the efficiency tests discussed in Section 2 extend to the dynamic environment. For simplicity, we assume steady state and do not consider the changes in prices resulting from the reforms. Later, in our quantitative exercise, we allow for both transitions and changes in prices.

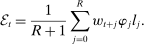

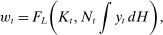

3.5.1 A Planning Problem

The set of policies that we allow for in our optimal reform are very similar to those described in Section 3. In particular, we allow for nonlinear and age-dependent taxation of assets. Moreover, we allow for nonlinear and age-dependent taxation of earnings together with flat Social Security benefits (i.e., Social Security benefits are independent of lifetime earnings). Therefore, given any tax and benefit structure, each individual maximizes utility (6) subject to the budget constraints (7).

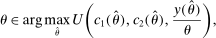

The planning problem associated with the optimal reform finds the policies described above to maximize the net revenue for the government (i.e., present value of receipts net of expenses). In this maximization, the government is constrained by the optimizing behavior by individuals—as described above, the feasibility of allocations and the requirement that each individual's utility must be above  . We also focus on the steady-state problem for the government and ignore issues related to transition.

. We also focus on the steady-state problem for the government and ignore issues related to transition.

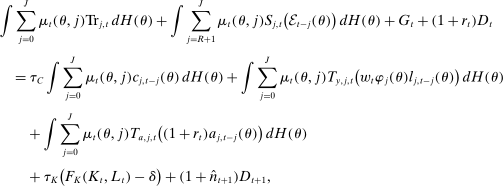

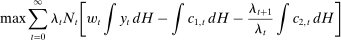

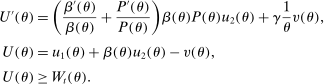

(P1)

(P1) (12)

(12) (13)

(13) (14)

(14)3.5.2 Test of Pareto Optimality

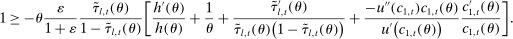

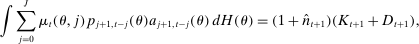

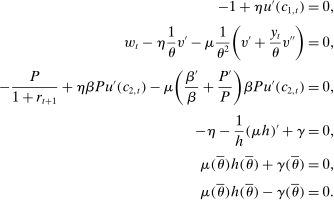

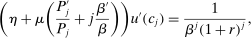

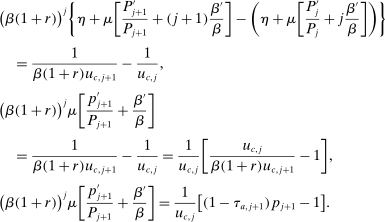

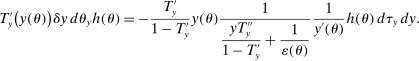

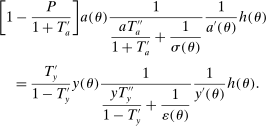

(15)

(15)The following proposition presents tests of Pareto optimality for the quantitative framework developed above:

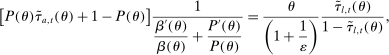

Proposition 4.The wedges induced by any Pareto optimal tax schedule must satisfy the following equality constraints:

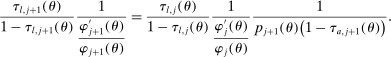

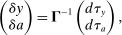

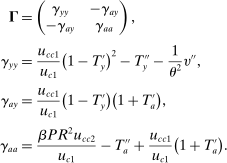

(16)

(16) (17)

(17) (18)

(18) is the intertemporal elasticity of substitution at age 0.

is the intertemporal elasticity of substitution at age 0.Moreover, when the first-order conditions are sufficient for describing the behavior of consumers, the above conditions are also sufficient for any Pareto optimal tax schedule.26

The above formulas are the equivalents of the optimality formulas in Section 2. In particular, as it might be apparent, equations (16) and (17) are the equivalents of the tax-smoothing relationship (3).

Similarly, equation (17) states that the behavioral increase in government revenue must be equated for an increase in taxes at age j and age  . Note that since these tax perturbations are done in two different ages, in order for them to be welfare neutral, the magnitude of the perturbations must be adjusted. The last term in (17) performs this age adjustment; by definition of the savings wedge,

. Note that since these tax perturbations are done in two different ages, in order for them to be welfare neutral, the magnitude of the perturbations must be adjusted. The last term in (17) performs this age adjustment; by definition of the savings wedge,  . In other words, the age adjustment is equal to the ratio of marginal utilities of consumption adjusted by the interest rate. Finally, as before, inequality (18) is equivalent to the nonnegativity of the implied Pareto weights.

. In other words, the age adjustment is equal to the ratio of marginal utilities of consumption adjusted by the interest rate. Finally, as before, inequality (18) is equivalent to the nonnegativity of the implied Pareto weights.

Equation (17) is informative about the behavior of savings wedges—marginal tax rates—over time. Specifically, it highlights the role of the changes in the gradient of the survival over the life cycle, that is,  . An increase in this gradient with age leads to a decline in subsidies or increase in taxes on savings. This goes back to a mechanism that we have already discussed in Section 2: a higher gradient of survival leads to a higher value of consumption late in life and higher demand for saving. Taxation of savings is then a way to prevent productive individuals from earning less and saving less and, as a result, reducing the deadweight loss of taxation of earnings. From an alternative perspective, when the gradient of survival is high, saving increases quickly with productivity, which in turn reduces the density of number of workers at a certain asset level. Hence, the tax-smoothing intuition in Section 2 would imply that taxes (subsidies) must be higher (lower). As we show in our quantitative exercise, the gradient of survival is positive and increases with age. This would imply that subsidies become more progressive as individuals age.

. An increase in this gradient with age leads to a decline in subsidies or increase in taxes on savings. This goes back to a mechanism that we have already discussed in Section 2: a higher gradient of survival leads to a higher value of consumption late in life and higher demand for saving. Taxation of savings is then a way to prevent productive individuals from earning less and saving less and, as a result, reducing the deadweight loss of taxation of earnings. From an alternative perspective, when the gradient of survival is high, saving increases quickly with productivity, which in turn reduces the density of number of workers at a certain asset level. Hence, the tax-smoothing intuition in Section 2 would imply that taxes (subsidies) must be higher (lower). As we show in our quantitative exercise, the gradient of survival is positive and increases with age. This would imply that subsidies become more progressive as individuals age.

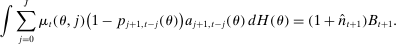

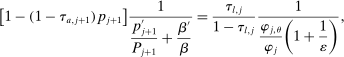

(19)

(19)Finally, note that whether the above tests are satisfied determines the Pareto optimality of a tax system. Away from the optimum, that is, when these conditions are violated, in general it is difficult to determine what margins must be adjusted. In our numerical simulations, however, often the magnitude of the violation is indicative of the significance of the reform. In other words, when the above conditions are violated significantly, the gains from a reform in the associated policies are significant. In what follows, we show that the main source of violation is the equations associated with savings wedges and, thus, they are the main source of gains.

3.5.3 Optimal Taxes

So far, we have mainly focused on optimal allocations and wedges. It is possible to construct taxes whose marginals coincide with the wedges described above. In the Supplemental Material (Hosseini and Shourideh (2019)), we provide a monotonicity condition which, if satisfied, implies the existence of tax functions that implement the efficient allocation. This monotonicity condition is a condition on allocations that result from the planning problem. While we have no way of theoretically checking that the monotonicity conditions are satisfied, our numerical simulations always involve a check that ensures that they are. Needless to say, in all our simulations, the monotonicity constraints are satisfied.

Furthermore, while in most of our analysis we focus on taxes on savings and earnings, it is possible to think about alternative implementations of efficient allocations. For example, another implementation of efficient allocations is via earnings taxes and Social Security benefit formulas that are indexed to income as well as assets. If the goal is to provide a progressive asset subsidy, this indexation must occur so that an increase in households' saving increases their retirement benefit, while this indexation must be progressive, that is, it must be higher for workers with lower income and assets. For an asset tax, the implication is similar.27 An alternative way of implementing this policy is to use a personalized nonlinear consumption tax that varies with age. A declining (increasing) consumption tax can then replicate the saving subsidies (taxes).

4 Calibration

In this section, we calibrate the model described in Section 3 by choosing parametric specifications and parameter values. We will estimate some of the parameters independently (e.g., wage/productivity profiles or mortality profiles), and we choose the rest of the parameters (e.g., discount factor) so that the model matches targets from the U.S. data.

4.1 Earning Ability Profiles

at age j can be written as

at age j can be written as

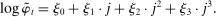

is an age-dependent productivity shifter given by

is an age-dependent productivity shifter given by

. We calculate this as the ratio of all reported labor earnings to total reported hours. For labor earnings, we use the sum over a list of variables on salaries and wages, separate bonuses, the labor portion of business income, overtime pay, tips, commissions, professional practice or trade payments, and other miscellaneous labor income converted to constant 2000 dollars. In order to avoid well-known issues in the raw data, we use Heathcote, Perri, and Violante's (2010) version of the PSID data. The resulting estimated parameters are

. We calculate this as the ratio of all reported labor earnings to total reported hours. For labor earnings, we use the sum over a list of variables on salaries and wages, separate bonuses, the labor portion of business income, overtime pay, tips, commissions, professional practice or trade payments, and other miscellaneous labor income converted to constant 2000 dollars. In order to avoid well-known issues in the raw data, we use Heathcote, Perri, and Violante's (2010) version of the PSID data. The resulting estimated parameters are  ,

,  ,

,  , and

, and  .

.Moreover, we assume the type-dependent fixed effect θ has a Pareto-lognormal distribution with parameters  . This distribution approximates a lognormal distribution with parameters

. This distribution approximates a lognormal distribution with parameters  and

and  at low incomes and a Pareto distribution with parameter

at low incomes and a Pareto distribution with parameter  at high values. It therefore allows for a heavy right tail at the top of the ability and earnings distribution. For this reason, it is commonly used in the literature (see Golosov, Troshkin, and Tsyvinski (2016), Badel and Huggett (2014), and Heathcote and Tsujiyama (2015)).28 We choose the tail parameter and variance parameter to be

at high values. It therefore allows for a heavy right tail at the top of the ability and earnings distribution. For this reason, it is commonly used in the literature (see Golosov, Troshkin, and Tsyvinski (2016), Badel and Huggett (2014), and Heathcote and Tsujiyama (2015)).28 We choose the tail parameter and variance parameter to be  and

and  , respectively. The location parameter is set to

, respectively. The location parameter is set to  so that

so that  has mean 0. With these parameters, the cross-section variance of log hourly wages in the model is 0.36. Also, the ratio of median hourly wages to the bottom decile of hourly wages is 2.3. These statistics are consistent with the reported facts on the cross-section distribution of hourly wages in Heathcote, Perri, and Violante (2010).

has mean 0. With these parameters, the cross-section variance of log hourly wages in the model is 0.36. Also, the ratio of median hourly wages to the bottom decile of hourly wages is 2.3. These statistics are consistent with the reported facts on the cross-section distribution of hourly wages in Heathcote, Perri, and Violante (2010).

4.2 Demographics and Mortality Profiles

is constant and is equal to 1 percent. The model period is 1 year. Individuals start earning income at age 25, they all retire at age 65, and nobody survives beyond 100 years of age. Each individual has a Gompertz force of mortality

is constant and is equal to 1 percent. The model period is 1 year. Individuals start earning income at age 25, they all retire at age 65, and nobody survives beyond 100 years of age. Each individual has a Gompertz force of mortality

(20)

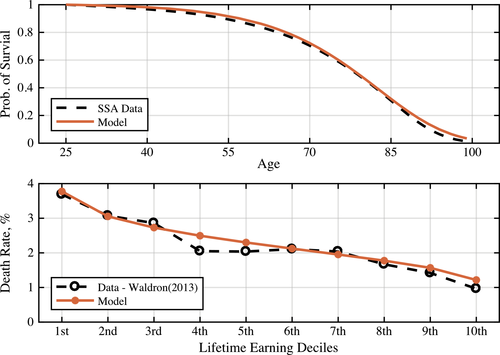

(20)The Gompertz distribution is widely used in the actuarial literature (see, e.g., Horiuchi and Coale (1982)) and economics (see, for example, Einav, Finkelstein, and Schrimpf (2010)). The second term in equation (20) determines the changes in mortality by age and is common across all types. The first term is decreasing in θ and determines the gradient of mortality in the cross section. Therefore, a higher-ability person has a lower mortality at all ages. The key parameter is  , which determines how mortality varies with ability. To choose this parameter, we use data on the male mortality rate across lifetime earnings deciles reported in Waldron (2013). She used Social Security Administration data to estimate mortality differentials at ages 67–71 by lifetime earnings deciles. Table I shows the estimated annual mortality rates for 67- to 71-year-old males born in 1940.29 This piece of evidence points to large differences in death rates across different income groups, with the poorest deciles almost four times more likely to die than the richest decile. We use these data to calibrate parameter

, which determines how mortality varies with ability. To choose this parameter, we use data on the male mortality rate across lifetime earnings deciles reported in Waldron (2013). She used Social Security Administration data to estimate mortality differentials at ages 67–71 by lifetime earnings deciles. Table I shows the estimated annual mortality rates for 67- to 71-year-old males born in 1940.29 This piece of evidence points to large differences in death rates across different income groups, with the poorest deciles almost four times more likely to die than the richest decile. We use these data to calibrate parameter  .

.

|

Lifetime Earnings Decilesa |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

1st |

2nd |

3rd |

4th |

5th |

6th |

7th |

8th |

9th |

10th |

|

|

Deaths (per 10,000) |

369 |

307 |

286 |

205 |

204 |

211 |

204 |

167 |

142 |

97 |

Parameter  is chosen to match the average survival probability from cohort life tables for the Social Security area by year of birth and sex for males of the 1940 birth cohort (Table 7 in Bell and Miller (2005)). Finally,

is chosen to match the average survival probability from cohort life tables for the Social Security area by year of birth and sex for males of the 1940 birth cohort (Table 7 in Bell and Miller (2005)). Finally,  is chosen so that mortality at age 25 is 0. The parameters that give the best fit to the mortality data in Table I and average mortality data are

is chosen so that mortality at age 25 is 0. The parameters that give the best fit to the mortality data in Table I and average mortality data are  ,

,  , and

, and  . Figure 1 shows the fit of the model in terms of matching mortality across the lifetime earnings deciles in Waldron (2013). Once we have the mortality hazard

. Figure 1 shows the fit of the model in terms of matching mortality across the lifetime earnings deciles in Waldron (2013). Once we have the mortality hazard  , we can find the survival probability

, we can find the survival probability  .

.

Using this parameterization, we find there are 4 workers per each retiree in the steady state. This is consistent with U.S. Census Bureau estimates.30

4.3 Preferences and Technology

We assume a constant relative risk aversion over consumption,  , and constant Frisch elasticity for disutility over hours worked,

, and constant Frisch elasticity for disutility over hours worked,  . The risk aversion parameter is

. The risk aversion parameter is  , and the elasticity of labor supply is

, and the elasticity of labor supply is  . The weight of leisure in utility ψ is chosen so that, in the model, the average number of annual hours worked is 2000.

. The weight of leisure in utility ψ is chosen so that, in the model, the average number of annual hours worked is 2000.

to match a capital to output ratio of 4.31 The other parameter,

to match a capital to output ratio of 4.31 The other parameter,  , determines the degree of heterogeneity in the discount factor. The larger is

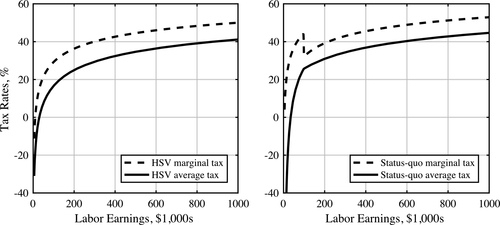

, determines the degree of heterogeneity in the discount factor. The larger is  , the larger is the dispersion in the discount factor across ability types. We choose this parameter to match the wealth Gini index of 0.78 based on the 2007 Survey of Consumer Finances (SCF).

, the larger is the dispersion in the discount factor across ability types. We choose this parameter to match the wealth Gini index of 0.78 based on the 2007 Survey of Consumer Finances (SCF).The aggregate production function is Cobb–Douglas with a capital share parameter  , and the depreciation rate is

, and the depreciation rate is  . These are chosen to match the average ratio of capital income and investment relative to GDP in the United States over the period 2000–2010.

. These are chosen to match the average ratio of capital income and investment relative to GDP in the United States over the period 2000–2010.

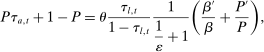

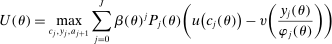

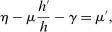

4.4 Social Security

Social Security taxes are levied on labor earnings, up to a maximum taxable, as in the actual U.S. system. Benefits are paid as a nonlinear function of the average taxable earnings over lifetime.32 Let e be labor earnings and  be maximum taxable earnings. We set

be maximum taxable earnings. We set  equal to 2.47 times the average earnings in the economy,

equal to 2.47 times the average earnings in the economy,  . The Social Security tax rate is

. The Social Security tax rate is  .33 There is also a Medicare tax rate,

.33 There is also a Medicare tax rate,  , which applies to the entire earnings.

, which applies to the entire earnings.

). We use the same benefit formula that the U.S. Social Security Administration uses to determine the primary insurance amount (PIA) for retirees:

). We use the same benefit formula that the U.S. Social Security Administration uses to determine the primary insurance amount (PIA) for retirees:

To account for Medicare benefits, we assume each individual in retirement will receive an additional transfer independent of that individual's earnings history. We choose this value so that the aggregate Medicare benefits are 3 percent of GDP.34

4.5 Income Taxes and Government Purchases

, in which

, in which  is labor earnings and

is labor earnings and  is the Social Security and Medicare payroll taxes that the worker pays. The second term reflects the effective tax credit individuals get for the portion of Social Security tax paid by their employers. We assume retirement benefits are not taxed.

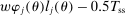

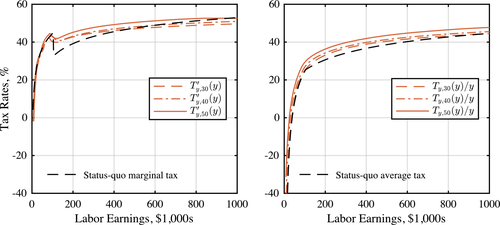

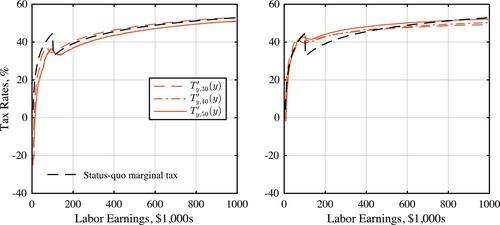

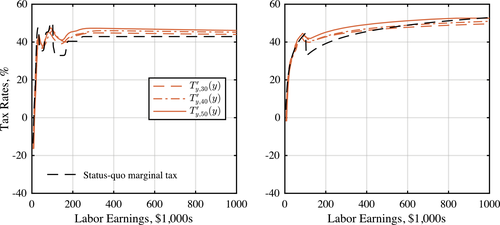

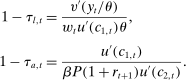

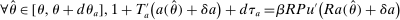

is the Social Security and Medicare payroll taxes that the worker pays. The second term reflects the effective tax credit individuals get for the portion of Social Security tax paid by their employers. We assume retirement benefits are not taxed.The tax function of this form is extensively used to approximate the effective income taxes in the United States. The parameter τ determines the progressivity of the tax function, while λ determines the level (the lower λ is, the higher are the total tax revenues for a given τ). Heathcote, Storesletten, and Violante (2017) estimated a value of 0.151 for τ, based on PSID income data and income tax calculations using NBER's TAXSIM program. We use their estimated value for τ and choose λ. We refer to this tax function as HSV tax function. The left panel in Figure 2 illustrates the resulting marginal and average taxes as functions of annual earnings in constant 2000 dollars.

Tax functions. The left panel is the calibrated HSV tax function,  . The right panel is the effective tax function (including HSV tax, payroll tax, and transfers). The discontinuity is due to the Social Security cap on taxable earnings.

. The right panel is the effective tax function (including HSV tax, payroll tax, and transfers). The discontinuity is due to the Social Security cap on taxable earnings.

Finally, we assume the government debt is 47 percent of GDP.36 The transfers  are chosen such that the government budget constraint (equation (8)) is satisfied in stationary equilibrium.

are chosen such that the government budget constraint (equation (8)) is satisfied in stationary equilibrium.

To summarize, individuals pay three different types of taxes on their earnings: HSV nonlinear tax, Social Security payroll tax (subject to a maximum taxable cap), and Medicare tax. In addition, they receive the transfer  prior to retirement. The right panel in Figure 2 shows the resulting marginal and average tax on the sum of all these taxes and transfers. The discontinuity in the marginal tax is due to Social Security's maximum taxable earnings cap. In addition to earnings taxes, we assume that there is a proportional tax on consumption. This tax allows us to match the government's balance sheet. In particular, part of the government's revenue comes from consumption tax, which is not captured by the earnings tax and transfers, as estimated by Heathcote, Storesletten, and Violante (2017). In our steady-state analysis, the value of this consumption tax, represented by

prior to retirement. The right panel in Figure 2 shows the resulting marginal and average tax on the sum of all these taxes and transfers. The discontinuity in the marginal tax is due to Social Security's maximum taxable earnings cap. In addition to earnings taxes, we assume that there is a proportional tax on consumption. This tax allows us to match the government's balance sheet. In particular, part of the government's revenue comes from consumption tax, which is not captured by the earnings tax and transfers, as estimated by Heathcote, Storesletten, and Violante (2017). In our steady-state analysis, the value of this consumption tax, represented by  , is fixed and is set to 5.5 percent, as calculated in Mendoza, Razin, and Tesar (1994). In our analysis of the economy under transition, we assume that this consumption tax is increased to finance the increase in the retirement benefits paid out by the government.

, is fixed and is set to 5.5 percent, as calculated in Mendoza, Razin, and Tesar (1994). In our analysis of the economy under transition, we assume that this consumption tax is increased to finance the increase in the retirement benefits paid out by the government.

Finally, we assume that there is a (corporate) capital income tax of 33 percent, which is paid by the firms. We assume that this rate is fixed and remains unchanged under the reform. As a result, the implied after-tax return on all assets is  and is the same for everyone.37 This is also the interest rate that the government pays on its debt. We assume that households do not pay any tax on their savings—beyond the corporate income tax. In general, measurement of savings taxes in the cross section is very difficult.38 This is because of the vast differences in the tax code in the treatment of different types of savings. In reality, a significant fraction of savings are held in tax-deferred retirement accounts39 (which are tax deductible and are treated as income during retirement), whose tax treatment is possibly progressive. On the other hand, richer individuals who hold stocks and bonds can have more sophisticated strategies to minimize their tax burden. These facts motivate us to use no savings taxes in our benchmark calibration. In order to check the robustness of this assumption, we provide two robustness exercises in the Supplemental Material: an exercise with a flat and positive savings tax and one with a progressive savings tax.40

and is the same for everyone.37 This is also the interest rate that the government pays on its debt. We assume that households do not pay any tax on their savings—beyond the corporate income tax. In general, measurement of savings taxes in the cross section is very difficult.38 This is because of the vast differences in the tax code in the treatment of different types of savings. In reality, a significant fraction of savings are held in tax-deferred retirement accounts39 (which are tax deductible and are treated as income during retirement), whose tax treatment is possibly progressive. On the other hand, richer individuals who hold stocks and bonds can have more sophisticated strategies to minimize their tax burden. These facts motivate us to use no savings taxes in our benchmark calibration. In order to check the robustness of this assumption, we provide two robustness exercises in the Supplemental Material: an exercise with a flat and positive savings tax and one with a progressive savings tax.40

4.6 Calibration Results

Table II lists the parameters that are either taken from other studies, or estimated or calculated independent of the model structure. Their sources and estimation or calculation procedures are outlined in the previous paragraphs. Table III lists the parameters that are calibrated using the model by matching some moments in the U.S. data. The top panel lists the parameter values. The bottom panel shows the targeted moments in the data and the resulting values in the model.

|

Parameter |

Description |

Values/source |

|---|---|---|

|

Demographics |

||

|

J |

maximum age |

75 (100 years old) |

|

R |

retirement age |

40 (65 years old) |

|

n |

population growth rate |

0.01 |

|

Mj(θ) |

mortality hazard |

see text |

|

Preferences |

||

|

σ |

risk aversion parameter |

1 |

|

ε |

elasticity of labor supply |

0.5 |

|

Labor productivity |

||

|

σθ |

Pareto-lognormal variance parameter |

0.6 |

|

aθ |

Pareto-lognormal tail parameter |

3 |

|

μθ |

Pareto-lognormal location parameter |

−0.33 |

|

Technology |

||

|

α |

capital share |

0.435 |

|

δ |

depreciation rate |

0.048 |

|

Government policies |

||

|

|

Social Security and Medicare tax rates |

0.124, 0.029 |

|

|

Social Security benefit formula |

see text |

|

τc |

consumption tax |

0.055 |

|

τ, λ |

parameters of income tax function |

0.151, 4.74 |

|

G |

government purchases |

8% of GDP |

|

D |

government debt |

47% of GDP |

- a For details on the calculation of capital share, government expenditure, and government debt, see Supplemental Material.

|

Parameters |

Description |

Values |

|---|---|---|

|

β0 |

discount factor: level |

0.976 |

|

β1 |

discount factor: elasticity w.r.t θ |

0.014 |

|

ψ |