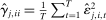

Inference in Group Factor Models With an Application to Mixed-Frequency Data

Abstract

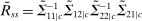

We derive asymptotic properties of estimators and test statistics to determine—in a grouped data setting—common versus group-specific factors. Despite the fact that our test statistic for the number of common factors, under the null, involves a parameter at the boundary (related to unit canonical correlations), we derive a parameter-free asymptotic Gaussian distribution. We show how the group factor setting applies to mixed-frequency data. As an empirical illustration, we address the question whether Industrial Production (IP) is still the dominant factor driving the U.S. economy using a mixed-frequency data panel of IP and non-IP sectors. We find that a single common factor explains 89% of IP output growth and 61% of total GDP growth despite the diminishing role of manufacturing.

1 Introduction

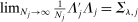

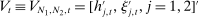

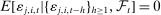

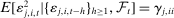

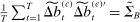

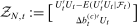

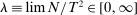

Estimating and testing for the existence of common factors among large panels with group-specific factors is of interest in various areas in economics as well as other fields. For instance, for the unobservable pervasive factors  and

and  estimated from two separate panels of data, one may be interested in testing how many factors are common between them. In this paper, a new test is introduced for the number of canonical correlations between vectors

estimated from two separate panels of data, one may be interested in testing how many factors are common between them. In this paper, a new test is introduced for the number of canonical correlations between vectors  and

and  equal to 1 and its asymptotic distribution is derived for large T and N, where N denotes the minimum cross-sectional size across groups, in the context of approximate factor models in the spirit of Bai and Ng (2002), Stock and Watson (2002), and Bai (2003). While there is an extensive literature on approximate group factor models, there does not exist a unifying inferential theory for large panel data framework.1 Our main theoretical contribution is an inference procedure for the number of common and group-specific factors based on canonical correlation analysis of the principal components (PCs) estimates on each group. The first-stage estimation of PCs affects the subsequent canonical correlation analysis, and this complicates the asymptotic analysis. As a result, the asymptotic distribution of the test statistics is nonstandard in terms of convergence rates and involves a nontrivial bias correction. We show that, under the null of

equal to 1 and its asymptotic distribution is derived for large T and N, where N denotes the minimum cross-sectional size across groups, in the context of approximate factor models in the spirit of Bai and Ng (2002), Stock and Watson (2002), and Bai (2003). While there is an extensive literature on approximate group factor models, there does not exist a unifying inferential theory for large panel data framework.1 Our main theoretical contribution is an inference procedure for the number of common and group-specific factors based on canonical correlation analysis of the principal components (PCs) estimates on each group. The first-stage estimation of PCs affects the subsequent canonical correlation analysis, and this complicates the asymptotic analysis. As a result, the asymptotic distribution of the test statistics is nonstandard in terms of convergence rates and involves a nontrivial bias correction. We show that, under the null of  common factors across the two groups, the sum of the

common factors across the two groups, the sum of the  largest estimated canonical correlations minus

largest estimated canonical correlations minus  , recentered and rescaled by (parameter-dependent) functions of N and T, converges in distribution to a standard Gaussian. We also provide a feasible version of the statistic, propose estimators for the common and group-specific factors, and characterize their asymptotic distribution. The inference procedure is general in scope and also of interest in many applications other than the one considered in this paper. Our work is most closely related to Chen (2010, 2012), Wang (2012), Ando and Bai (2015), and Breitung and Eickmeier (2016). However, the existing literature does not provide a comprehensive asymptotic treatment of group factor models for large T and N, especially regarding testing hypotheses on the number of common and group-specific factors.

, recentered and rescaled by (parameter-dependent) functions of N and T, converges in distribution to a standard Gaussian. We also provide a feasible version of the statistic, propose estimators for the common and group-specific factors, and characterize their asymptotic distribution. The inference procedure is general in scope and also of interest in many applications other than the one considered in this paper. Our work is most closely related to Chen (2010, 2012), Wang (2012), Ando and Bai (2015), and Breitung and Eickmeier (2016). However, the existing literature does not provide a comprehensive asymptotic treatment of group factor models for large T and N, especially regarding testing hypotheses on the number of common and group-specific factors.

As a specific application of group factor models, we consider panels of data sampled at different frequencies and study the role of Industrial Production (IP) sectors in the U.S. economy. Our empirical application revisits the analysis of Foerster, Sarte, and Watson (2011) who used factor methods to decompose industrial production into components arising from aggregate shocks and idiosyncratic sector-specific shocks. They focused exclusively on the IP sectors. We have fairly extensive data on U.S. industrial production. They consist of 117 sectors that make up aggregate IP, each sector roughly corresponding to a four-digit industry classification using NAICS. These data are published monthly, and therefore cover a rich panel. On the other hand, contrary to IP, we do not have monthly or quarterly data for the cross-section of U.S. output across non-IP sectors, but we do so on an annual basis. Indeed, the U.S. Bureau of Economic Analysis provides Gross Domestic Product (GDP) and Gross Output by industry—not only IP sectors—annually. Hence, we have a panel consisting of  (H for high-frequency) IP sector growth series sampled across MT time periods, where

(H for high-frequency) IP sector growth series sampled across MT time periods, where  for quarterly data and

for quarterly data and  for monthly data, with T the number of years. Moreover, we also have a panel of

for monthly data, with T the number of years. Moreover, we also have a panel of  (L for low frequency) non-IP sectors—such as Services and Construction, for example—which is only observed over T years. Hence, generically speaking, we have a high-frequency panel data set of size

(L for low frequency) non-IP sectors—such as Services and Construction, for example—which is only observed over T years. Hence, generically speaking, we have a high-frequency panel data set of size  and a low-frequency panel data set of size

and a low-frequency panel data set of size  . We allow for the presence of three types of unobservable factors: (1) those which explain variations in both panels/groups, and therefore are common factors, (2) group-specific (in our application, frequency-specific) factors—namely, (a) those exclusively pertaining to IP, and (b) those exclusively affecting non-IP sectors.

. We allow for the presence of three types of unobservable factors: (1) those which explain variations in both panels/groups, and therefore are common factors, (2) group-specific (in our application, frequency-specific) factors—namely, (a) those exclusively pertaining to IP, and (b) those exclusively affecting non-IP sectors.

Using the inferential theory for group factor models developed in this paper, we find that a single common factor explains around 89% of the variability in the aggregate IP output growth index, and a factor specific to IP has very little additional explanatory power, during the period 1977–2011. This implies that the single common factor can be interpreted as an IP factor. Moreover, a large part of the variability of GDP output growth in service sectors, such as Transportation and warehousing (62%); Arts, entertainment, recreation, accommodation, and food services (53%), as well as other sectors, for example, Retail trade (31%), are also explained by the common factor. A single low-frequency factor, unrelated to manufacturing but related to sectors such as Finance, insurance, real estate, rental and leasing (21%); Educational services, health care social assistance (18%), as well as Government (22%), drives GDP growth variability. The results reflect the great advantage of the mixed-frequency setting—compared to the single-frequency one—in the context of our IP and GDP sector application. The mixed-frequency panel setting allows us to identify and estimate the high-frequency values of factors common to IP and non-IP sectors. With IP (i.e. high-frequency) data only, we cannot assess what is common with the non-IP sectors. With low-frequency data only, we cannot estimate the high-frequency common factors from a large cross-section.

The rest of the paper is organized as follows. In Section 2, we introduce the group factor model and discuss identification. In Section 3, we study estimation and inference on the number of common factors. The large sample theory appears in Section 4. Section 5 introduces mixed-frequency group factor models, whereas Section 6 presents the results of a Monte Carlo study. Section 7 covers the empirical application. Section 8 concludes the paper. The Technical Appendix of the paper provides regularity conditions and proofs of theorems. The Supplemental Material Andreou, Gagliardini, Ghysels, and Rubin (2019), henceforth referred to as Online Appendix (OA), provides the proofs of lemmas, reports supplementary theoretical results on identification and estimation, provides an extensive description of the data set used in the empirical application, supplementary empirical results, as well as the details about the Monte Carlo simulation design and results.

2 Identification in Group Factor Models

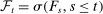

(2.1)

(2.1) collects observations for

collects observations for  individuals in group j,

individuals in group j,  and

and  are the matrices of factor loadings, and

are the matrices of factor loadings, and  is the vector of error terms, with

is the vector of error terms, with  and

and  (for simplicity, we focus on cases involving only two groups). The dimensions of the common factor

(for simplicity, we focus on cases involving only two groups). The dimensions of the common factor  and the group-specific factors

and the group-specific factors  ,

,  are respectively

are respectively  ,

,  , and

, and  . In the absence of common factors, we set

. In the absence of common factors, we set  , while in cases without group-specific factors, we set

, while in cases without group-specific factors, we set  ,

,  The group-specific factors

The group-specific factors  and

and  are orthogonal to the common factor

are orthogonal to the common factor  . Since the unobservable factors can be standardized, we assume

. Since the unobservable factors can be standardized, we assume

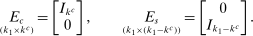

(2.2)

(2.2) denotes the identity matrix of order k (we refer to (2.2) as Assumption A.2 in the list of regularity conditions in Appendix A). We allow for a nonzero covariance

denotes the identity matrix of order k (we refer to (2.2) as Assumption A.2 in the list of regularity conditions in Appendix A). We allow for a nonzero covariance  between group-specific factors.

between group-specific factors.In standard linear latent factor models, the normalization induced by an identity factor variance-covariance matrix identifies the factor space up to an orthogonal rotation (and change of signs). Under an identification condition implied by our set of assumptions, the rotational invariance of (2.1)–(2.2) allows only for separate rotations among the components of  , among those of

, among those of  , and finally those of

, and finally those of  . The rotational invariance of (2.1)–(2.2) therefore maintains the interpretation of common and group-specific factors.2 We consider the generic setting of equation (2.1) and let

. The rotational invariance of (2.1)–(2.2) therefore maintains the interpretation of common and group-specific factors.2 We consider the generic setting of equation (2.1) and let  , for

, for  , be the dimensions of the pervasive factor spaces for the two groups, and define

, be the dimensions of the pervasive factor spaces for the two groups, and define  . We collect the factors of each group in the

. We collect the factors of each group in the  -dimensional vectors

-dimensional vectors  , and define their variance and covariance matrices:

, and define their variance and covariance matrices:  . From (2.2), we have

. From (2.2), we have  for

for  . We want to show that the factor space dimensions

. We want to show that the factor space dimensions  ,

,  ,

,  are identifiable using canonical correlation analysis applied to

are identifiable using canonical correlation analysis applied to  and

and  . In particular, we want to propose an identification strategy for these dimensions and the corresponding factor spaces using canonical correlations and directions. Before stating the main identification result, let us first recall some basics from canonical analysis (see, e.g., Anderson (2003) and Magnus and Neudecker (2007)). Let

. In particular, we want to propose an identification strategy for these dimensions and the corresponding factor spaces using canonical correlations and directions. Before stating the main identification result, let us first recall some basics from canonical analysis (see, e.g., Anderson (2003) and Magnus and Neudecker (2007)). Let  ,

,  , denote the ordered canonical correlations between

, denote the ordered canonical correlations between  and

and  . The

. The  largest eigenvalues of matrices

largest eigenvalues of matrices  and

and  are the same, and are equal to the squared canonical correlations

are the same, and are equal to the squared canonical correlations  ,

,  between

between  and

and  . The associated eigenvectors

. The associated eigenvectors  (resp.

(resp.  ), with

), with  , of matrix R (resp.

, of matrix R (resp.  ) standardized such that

) standardized such that  (resp.

(resp.  ) are the canonical directions which yield the canonical variables

) are the canonical directions which yield the canonical variables  (resp.

(resp.  ).

).

The next proposition deals with determining  , the number of common factors, using canonical correlations between the vectors

, the number of common factors, using canonical correlations between the vectors  and

and  which are unobserved and estimated by principal components.

which are unobserved and estimated by principal components.

Proposition 1.Under Assumption A.2, the following hold:

- (i) If

, the largest

, the largest  canonical correlations between

canonical correlations between  and

and  are equal to 1, and the remaining

are equal to 1, and the remaining  canonical correlations are strictly less than 1.

canonical correlations are strictly less than 1. - (ii) Let

be the

be the  matrix whose columns are the canonical directions for

matrix whose columns are the canonical directions for  associated with the

associated with the  canonical correlations equal to 1, for

canonical correlations equal to 1, for  . Then

. Then  (up to an orthogonal matrix), for

(up to an orthogonal matrix), for  .

. - (iii) If

, all canonical correlations between

, all canonical correlations between  and

and  are strictly less than 1.

are strictly less than 1. - (iv) Let

(resp.

(resp.  ) be the

) be the  (resp.

(resp.  ) matrix whose columns are the eigenvectors of matrix R (resp.

) matrix whose columns are the eigenvectors of matrix R (resp.  ) associated with the smallest

) associated with the smallest  (resp.

(resp.  ) eigenvalues. Then

) eigenvalues. Then  (up to an orthogonal matrix) for

(up to an orthogonal matrix) for  .

.

Proposition 1 shows that the number of common factors  , the common factor space spanned by

, the common factor space spanned by  , and the spaces spanned by group-specific factors, can be identified from the canonical correlations and canonical variables of

, and the spaces spanned by group-specific factors, can be identified from the canonical correlations and canonical variables of  and

and  (see OA Appendix C.1 for the proof). Therefore, the factor space dimensions

(see OA Appendix C.1 for the proof). Therefore, the factor space dimensions  ,

,  , and factors

, and factors  and

and  ,

,  , are identifiable (up to a rotation) from information that can be inferred by disjoint principal component analysis (PCA) on the two groups. Indeed, disjoint PCA on the two groups allows us to identify the dimensions

, are identifiable (up to a rotation) from information that can be inferred by disjoint principal component analysis (PCA) on the two groups. Indeed, disjoint PCA on the two groups allows us to identify the dimensions  ,

,  , and vectors

, and vectors  and

and  up to linear one-to-one transformations. The latter indeterminacy does not prevent identifiability of the common and group-specific factors from Proposition 1, due to the invariance of canonical correlations and canonical variables under linear one-to-one transformations of vectors

up to linear one-to-one transformations. The latter indeterminacy does not prevent identifiability of the common and group-specific factors from Proposition 1, due to the invariance of canonical correlations and canonical variables under linear one-to-one transformations of vectors  .3

.3

3 Estimation and Inference on the Number of Common Factors

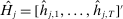

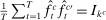

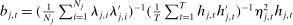

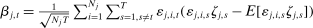

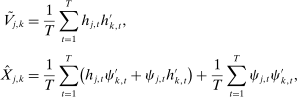

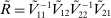

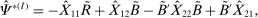

3.1 Estimators

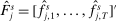

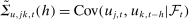

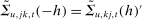

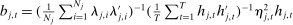

in each group

in each group  is known, and also that the true number of common factors

is known, and also that the true number of common factors  is known. Proposition 1 suggests the following estimation procedure for the common factors. Let

is known. Proposition 1 suggests the following estimation procedure for the common factors. Let  and

and  be estimated (up to a rotation) by extracting the first

be estimated (up to a rotation) by extracting the first  principal components (PCs) from each sub-panel j, and denote by

principal components (PCs) from each sub-panel j, and denote by  these PC estimates of the factors,

these PC estimates of the factors,  . Let

. Let  be the

be the  matrix of estimated PCs extracted from panel

matrix of estimated PCs extracted from panel  associated with the largest

associated with the largest  eigenvalues of matrix

eigenvalues of matrix  ,

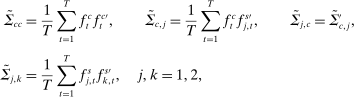

,  . Let

. Let  denote the empirical covariance matrix of the estimated vectors

denote the empirical covariance matrix of the estimated vectors  and

and  , that is,

, that is,  , and let matrices

, and let matrices  and

and  be defined as

be defined as

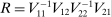

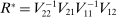

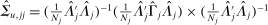

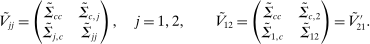

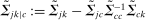

(3.1)

(3.1) for

for  . Matrices

. Matrices  and

and  have the same nonzero eigenvalues. The

have the same nonzero eigenvalues. The  largest eigenvalues of

largest eigenvalues of  (resp.

(resp.  ), denoted by

), denoted by  ,

,  , are the first

, are the first  squared sample canonical correlation between

squared sample canonical correlation between  and

and  . The associated

. The associated  canonical directions, collected in the

canonical directions, collected in the  matrix

matrix  (resp.

(resp.  matrix

matrix  ), are the eigenvectors associated with the

), are the eigenvectors associated with the  largest eigenvalues of matrix

largest eigenvalues of matrix  (resp.

(resp.  ), normalized to have length 1 with respect to

), normalized to have length 1 with respect to  (resp.

(resp.  ). It also holds that

). It also holds that

(3.2)

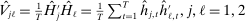

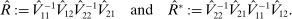

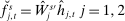

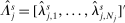

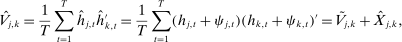

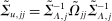

(3.2)Definition 1.Two estimators of the common factors vector are  and

and  .

.

, and similarly for

, and similarly for  , that is, the estimated common factor values match in-sample the normalization condition of identity variance-covariance matrix in (2.2). Let matrix

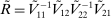

, that is, the estimated common factor values match in-sample the normalization condition of identity variance-covariance matrix in (2.2). Let matrix  (resp.

(resp.  ) be the

) be the  (resp.

(resp.  ) matrix collecting

) matrix collecting  (resp.

(resp.  ) eigenvectors associated with the

) eigenvectors associated with the  (resp.

(resp.  ) smallest eigenvalues of matrix

) smallest eigenvalues of matrix  (resp.

(resp.  ), normalized to have length 1 with respect to the matrix

), normalized to have length 1 with respect to the matrix  (resp.

(resp.  ). It also holds that

). It also holds that  ,

,  The estimators of the group-specific factors can be defined analogously to the estimators of the common factors:

The estimators of the group-specific factors can be defined analogously to the estimators of the common factors:  . By construction,

. By construction,  and

and  (resp.

(resp.  and

and  ) are orthogonal in-sample. An alternative estimator for the group-specific factors

) are orthogonal in-sample. An alternative estimator for the group-specific factors  (resp.

(resp.  ) is obtained by computing the first

) is obtained by computing the first  (resp.

(resp.  ) principal components of the variance-covariance matrix of the residuals of the regression of

) principal components of the variance-covariance matrix of the residuals of the regression of  (resp.

(resp.  ) on the estimated common factors.4 Let

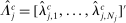

) on the estimated common factors.4 Let  be the

be the  matrix of estimated common factors, and

matrix of estimated common factors, and  the

the  matrix collecting the estimated loadings:

matrix collecting the estimated loadings:

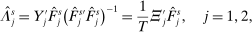

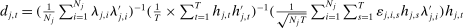

(3.3)

(3.3) be the residuals of the regression of

be the residuals of the regression of  on the estimated common factor

on the estimated common factor  , for

, for  , and

, and  be the

be the  matrix of the regression residuals, for

matrix of the regression residuals, for  .

.

Definition 2.Estimators of the specific factors  (resp.

(resp.  ) are defined as the first

) are defined as the first  (resp.

(resp.  ) PCs of sub-panel

) PCs of sub-panel  (resp.

(resp.  ), namely, the columns of the

), namely, the columns of the  matrix

matrix  are the eigenvectors associated with the

are the eigenvectors associated with the  largest eigenvalues of matrix

largest eigenvalues of matrix  , normalized to have

, normalized to have  for

for  .

.

is orthogonal in-sample both to

is orthogonal in-sample both to  and to

and to  . This sample orthogonality property matching the population one (see (2.2)) explains why we focus on the estimation procedure in Definition 2 compared to

. This sample orthogonality property matching the population one (see (2.2)) explains why we focus on the estimation procedure in Definition 2 compared to  ,

,  . Moreover, we define

. Moreover, we define  as the

as the  matrix collecting the loadings estimators:

matrix collecting the loadings estimators:

(3.4)

(3.4) and

and  , and the normalization of

, and the normalization of  for

for  .

.3.2 Inference on the Number of Common Factors via Canonical Correlations

of the common factor space. To do so, we first consider the case where the number of pervasive factors

of the common factor space. To do so, we first consider the case where the number of pervasive factors  and

and  in each sub-panel is known, hence

in each sub-panel is known, hence  is also known, and we relax this assumption in the next section. From Proposition 1, dimension

is also known, and we relax this assumption in the next section. From Proposition 1, dimension  is the number of unit canonical correlations between

is the number of unit canonical correlations between  and

and  . We consider the hypotheses:

. We consider the hypotheses:  ,

,  and finally,

and finally,  , where

, where  are the ordered canonical correlations of

are the ordered canonical correlations of  and

and  . Hypothesis

. Hypothesis  corresponds to the absence of common factors. Generically,

corresponds to the absence of common factors. Generically,  corresponds to the case of

corresponds to the case of  common factors and

common factors and  and

and  group-specific factors in each group. The largest possible number of common factors is

group-specific factors in each group. The largest possible number of common factors is  . In order to select the number of common factors, let us consider the following sequence of tests:

. In order to select the number of common factors, let us consider the following sequence of tests:  against

against  , for each

, for each  . To test

. To test  against

against  , for any given

, for any given  , we consider

, we consider

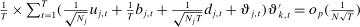

(3.5)

(3.5) corresponds to the sum of the

corresponds to the sum of the  largest sample canonical correlations of

largest sample canonical correlations of  and

and  . We reject the null

. We reject the null  when

when  is negative and large. The critical value is obtained from the large sample distribution of the statistic when

is negative and large. The critical value is obtained from the large sample distribution of the statistic when  ,

,  ,

,  , provided in Section 4. The number of common factors is estimated by sequentially applying the tests starting from

, provided in Section 4. The number of common factors is estimated by sequentially applying the tests starting from  .

.3.3 Estimation and Inference When  and

and  Are Unknown

Are Unknown

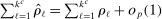

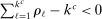

When the true number of pervasive factors is not known, but consistent estimators  and

and  , say, are available, the asymptotic distribution and rate of convergence for the test statistic

, say, are available, the asymptotic distribution and rate of convergence for the test statistic  based on

based on  and

and  is the same as those based on the true number of factors. Intuitively, this holds because the consistency of estimators

is the same as those based on the true number of factors. Intuitively, this holds because the consistency of estimators  , that is,

, that is,  for

for  , implies that the estimation error for the number of pervasive factors is asymptotically negligible.5 Therefore, the asymptotic distributions and rates of convergence of the test statistics and factors estimators will be derived assuming that the true dimensions

, implies that the estimation error for the number of pervasive factors is asymptotically negligible.5 Therefore, the asymptotic distributions and rates of convergence of the test statistics and factors estimators will be derived assuming that the true dimensions  in each group,

in each group,  , are known. Examples of consistent estimators for the numbers of pervasive factors include the tests proposed by Bai and Ng (2002) (applied in Section 7), Onatski (2010), or Ahn and Horenstein (2013).

, are known. Examples of consistent estimators for the numbers of pervasive factors include the tests proposed by Bai and Ng (2002) (applied in Section 7), Onatski (2010), or Ahn and Horenstein (2013).

4 Large Sample Theory

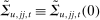

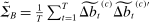

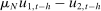

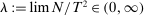

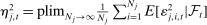

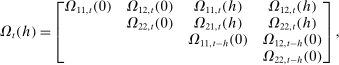

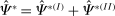

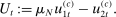

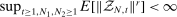

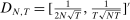

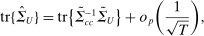

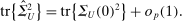

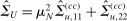

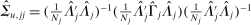

. Let us denote

. Let us denote  and

and  . Without loss of generality, we set

. Without loss of generality, we set  , which implies

, which implies  . We assume that

. We assume that

(4.1)

(4.1) and slower than

and slower than  . They accommodate both the case where

. They accommodate both the case where  and

and  grow at the same rate, and the case where

grow at the same rate, and the case where  grows faster than

grows faster than  , namely,

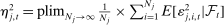

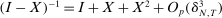

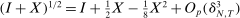

, namely,  . To derive the large sample distribution of the test statistic for the number of common factors, we deploy an asymptotic expansion for the estimated PCs in each group, which extends results in Bai and Ng (2002, 2006), Stock and Watson (2002), and Bai (2003), and we report in Proposition 3 in Appendix B. For

. To derive the large sample distribution of the test statistic for the number of common factors, we deploy an asymptotic expansion for the estimated PCs in each group, which extends results in Bai and Ng (2002, 2006), Stock and Watson (2002), and Bai (2003), and we report in Proposition 3 in Appendix B. For  and

and  , the estimate

, the estimate  is asymptotically equivalent (in a sense made precise in Proposition 3), up to negligible terms, to

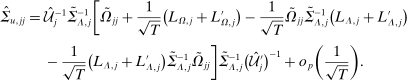

is asymptotically equivalent (in a sense made precise in Proposition 3), up to negligible terms, to

(4.2)

(4.2) ,

,  is a nonsingular stochastic factor rotation matrix,

is a nonsingular stochastic factor rotation matrix,  , and

, and  is the limit average error variance conditional on the sigma field

is the limit average error variance conditional on the sigma field  generated by current and past factor values

generated by current and past factor values  , and

, and  . The zero-mean term

. The zero-mean term  drives the randomness in group factor estimates conditional on factor path. Vector

drives the randomness in group factor estimates conditional on factor path. Vector  is measurable with respect to the factor path and induces a bias term at order

is measurable with respect to the factor path and induces a bias term at order  in principal components estimates. Vectors

in principal components estimates. Vectors  and

and  depend on sample sizes but, for convenience, we omit the indices

depend on sample sizes but, for convenience, we omit the indices  , T.

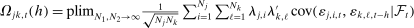

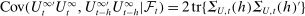

, T. be the conditional covariance between

be the conditional covariance between  and

and  , that is,

, that is,

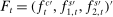

, for j,

, for j,  and

and  We set

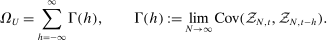

We set  . Moreover, let us define the (probability) limits

. Moreover, let us define the (probability) limits  and

and  , and let

, and let  be the large sample counterpart of

be the large sample counterpart of  .

.

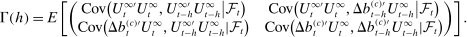

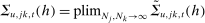

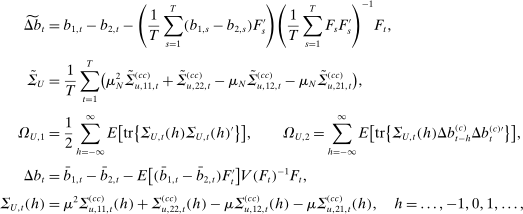

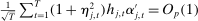

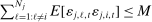

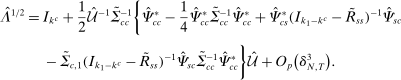

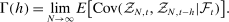

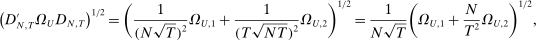

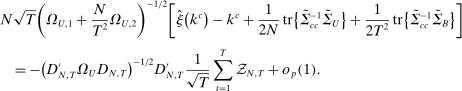

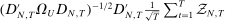

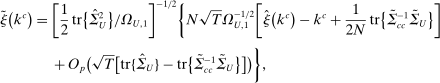

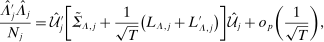

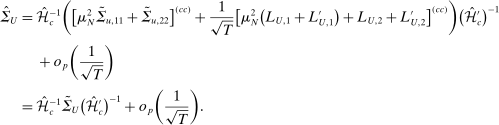

Theorem 1.Under Assumptions A.1–A.7, and the null hypothesis  of

of  common factors, we have

common factors, we have

(4.3)

(4.3) ,

,  , and

, and

block of a vector, and the upper index

block of a vector, and the upper index  denotes the upper-left

denotes the upper-left  block of a matrix.

block of a matrix.

Proof.See Appendix B.1. □

The matrix  is the upper-left

is the upper-left  block of the limit covariance matrix between

block of the limit covariance matrix between  and

and  , where the weight

, where the weight  accounts for the different sample sizes in the two sub-panels. Vectors

accounts for the different sample sizes in the two sub-panels. Vectors  and

and  are residuals of the orthogonal projection of

are residuals of the orthogonal projection of  onto

onto  in-sample, and of

in-sample, and of  onto

onto  in the population, respectively. In fact, the orthogonal projection of vector

in the population, respectively. In fact, the orthogonal projection of vector  along vector

along vector  can be absorbed in the transformation matrix

can be absorbed in the transformation matrix  in expansion (4.2), and therefore is asymptotically immaterial for the computation of canonical correlations and for the large sample distribution of the test statistic.

in expansion (4.2), and therefore is asymptotically immaterial for the computation of canonical correlations and for the large sample distribution of the test statistic.

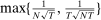

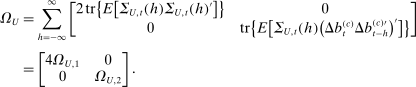

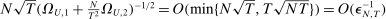

(Assumption A.1). It covers the variety of convergence rates and asymptotic biases and variances the statistic

(Assumption A.1). It covers the variety of convergence rates and asymptotic biases and variances the statistic  features, for different relative growth rates of sample dimensions

features, for different relative growth rates of sample dimensions  when

when  , namely,

, namely,

if

if  . In particular, the convergence rate of the statistic is

. In particular, the convergence rate of the statistic is  . When

. When  (see below), the convergence rate is

(see below), the convergence rate is  and the asymptotic variance is

and the asymptotic variance is  for

for  . Note that, if the PCs in the groups were observed, then testing for unit canonical correlations would be degenerate, as it involves testing for deterministic relationships between random vectors. The estimation errors of the PCs drive the asymptotic distribution of the statistic, with a nonstandard convergence rate. It might be surprising that we find an asymptotic Gaussian distribution when testing a hypothesis for a parameter at the boundary, that is, canonical correlations equal to 1. What makes the test asymptotically Gaussian is the fact that there is a re-centering of the statistic due to the sampling error in the first-step estimates of the PCs, and a CLT applies to the recentered squared estimation errors. The re-centering term involves a component of order

. Note that, if the PCs in the groups were observed, then testing for unit canonical correlations would be degenerate, as it involves testing for deterministic relationships between random vectors. The estimation errors of the PCs drive the asymptotic distribution of the statistic, with a nonstandard convergence rate. It might be surprising that we find an asymptotic Gaussian distribution when testing a hypothesis for a parameter at the boundary, that is, canonical correlations equal to 1. What makes the test asymptotically Gaussian is the fact that there is a re-centering of the statistic due to the sampling error in the first-step estimates of the PCs, and a CLT applies to the recentered squared estimation errors. The re-centering term involves a component of order  and a component of order

and a component of order  . One may wonder whether this Gaussian asymptotic distribution is a good approximation for the small sample distribution of the recentered and rescaled

. One may wonder whether this Gaussian asymptotic distribution is a good approximation for the small sample distribution of the recentered and rescaled  . In Section 6 and OA Section E, we report the results of extensive Monte Carlo simulations showing that this is the case in a setting that mimics our empirical application.

. In Section 6 and OA Section E, we report the results of extensive Monte Carlo simulations showing that this is the case in a setting that mimics our empirical application. , we need consistent estimators for the unknown scalars

, we need consistent estimators for the unknown scalars  and

and  , and matrices

, and matrices  and

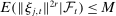

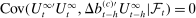

and  in Theorem 1. To simplify the analysis, we assume at this stage that the errors

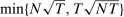

in Theorem 1. To simplify the analysis, we assume at this stage that the errors  are (i) uncorrelated across sub-panels j and individuals i, at all leads and lags, and (ii) a conditionally homoscedastic martingale difference sequence for each individual i, conditional on the factor path, that is,

are (i) uncorrelated across sub-panels j and individuals i, at all leads and lags, and (ii) a conditionally homoscedastic martingale difference sequence for each individual i, conditional on the factor path, that is,

(4.4)

(4.4) (4.5)

(4.5) and

and  do not depend on time. The projection residual

do not depend on time. The projection residual  vanishes because

vanishes because  , where

, where  , is spanned by

, is spanned by  . This explains why

. This explains why  is null and the convergence rate is

is null and the convergence rate is  . Similarly,

. Similarly,  , so that the bias term at order

, so that the bias term at order  is zero.6 Under (4.4), the bias component

is zero.6 Under (4.4), the bias component  in the PC estimates is immaterial since it can be absorbed in the transformation matrix

in the PC estimates is immaterial since it can be absorbed in the transformation matrix  in (4.2). In fact, Connor and Korajczyk (1986) and Bai (2003, Theorem 4) showed that the principal component estimator is consistent even for fixed T in such a case. In Theorem 2 below, we replace

in (4.2). In fact, Connor and Korajczyk (1986) and Bai (2003, Theorem 4) showed that the principal component estimator is consistent even for fixed T in such a case. In Theorem 2 below, we replace  with its large sample limit

with its large sample limit  , matrices

, matrices  and

and  by consistent estimators. We show that the estimation error for

by consistent estimators. We show that the estimation error for  in the bias adjustment is of order

in the bias adjustment is of order  , and therefore the asymptotic distribution of the statistic is unchanged.

, and therefore the asymptotic distribution of the statistic is unchanged.

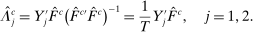

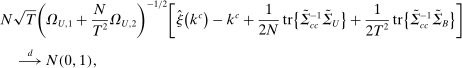

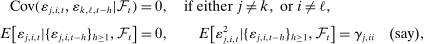

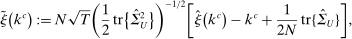

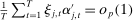

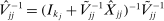

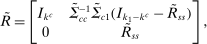

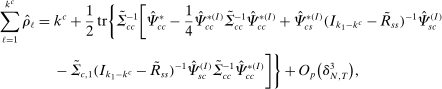

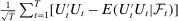

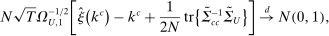

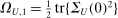

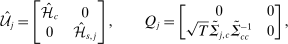

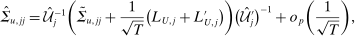

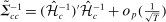

Theorem 2.Let  , with

, with  , where

, where  ,

,  and

and  are the loadings estimators defined in equations (3.3) and (3.4),

are the loadings estimators defined in equations (3.3) and (3.4),  with

with  , and

, and  , for

, for  . Define the test statistic:

. Define the test statistic:

(4.6)

(4.6)- (i) Under the null hypothesis

of

of  common factors, we have

common factors, we have  .

. - (ii) Under the alternative hypothesis

, we have

, we have  .

.

Proof.See Appendix B.2. □

The feasible asymptotic distribution in Theorem 2 is the basis for a one-sided test of the null hypothesis of  common factors. The rejection region for a test of the null hypothesis at asymptotic level α is

common factors. The rejection region for a test of the null hypothesis at asymptotic level α is  , where

, where  is the α-quantile of the standard Gaussian distribution for

is the α-quantile of the standard Gaussian distribution for  . From Theorem 2 (ii), the test is consistent.

. From Theorem 2 (ii), the test is consistent.

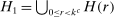

One way to implement the model selection procedure to estimate the number of common factors  proposed in Section 3.2 consists in testing sequentially the null hypothesis

proposed in Section 3.2 consists in testing sequentially the null hypothesis  , against the alternative

, against the alternative  , using the test statistic

, using the test statistic  defined in Theorem 2 for any generic number r of common factors. A “naive” procedure is initiated with

defined in Theorem 2 for any generic number r of common factors. A “naive” procedure is initiated with  , proceeds backwards, and is stopped at the largest integer

, proceeds backwards, and is stopped at the largest integer  such that the null

such that the null  cannot be rejected, that is,

cannot be rejected, that is,  . Otherwise, set

. Otherwise, set  if the test rejects the null

if the test rejects the null  for all

for all  . This “naive” procedure is not a consistent estimator of the number of common factors. Indeed, asymptotically, a nonzero probability α of underestimating

. This “naive” procedure is not a consistent estimator of the number of common factors. Indeed, asymptotically, a nonzero probability α of underestimating  exists coming from the type I error of the test of

exists coming from the type I error of the test of  against

against  , when the true number of factors

, when the true number of factors  is strictly positive.

is strictly positive.

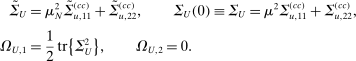

, for any integer

, for any integer  , is obtained allowing the asymptotic size α to go to zero as N,

, is obtained allowing the asymptotic size α to go to zero as N,  . The following Proposition 2 (proved in OA Appendix C.2) defines a consistent inference procedure for the number of common factors.

. The following Proposition 2 (proved in OA Appendix C.2) defines a consistent inference procedure for the number of common factors.

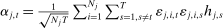

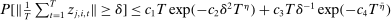

Proposition 2.Let  be a sequence of real scalars defined in the interval

be a sequence of real scalars defined in the interval  for any

for any  , such that (i)

, such that (i)  and (ii)

and (ii)  for

for  . Then, under Assumptions A.1–A.9, the estimator of the number of common factors defined as

. Then, under Assumptions A.1–A.9, the estimator of the number of common factors defined as

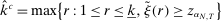

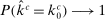

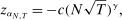

, if

, if  for all

for all  , is consistent, that is,

, is consistent, that is,  under

under  , for any integer

, for any integer  .

.

against

against  . Condition (ii) is a lower bound on the convergence rate to zero of the asymptotic size, and is used to keep asymptotically zero probability of type II error of each step of the procedure. The conditions in Proposition 2 are satisfied, for example, for

. Condition (ii) is a lower bound on the convergence rate to zero of the asymptotic size, and is used to keep asymptotically zero probability of type II error of each step of the procedure. The conditions in Proposition 2 are satisfied, for example, for  such that

such that

(4.7)

(4.7) and

and  .7

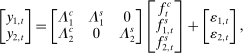

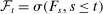

.75 Mixed-Frequency Group Factor Models

The idea to apply group factor analysis to mixed-frequency data is novel as frequency-based grouping can indeed be the basis of identification strategies and statistical inference. In this section, we explore this topic as it pertains to our empirical application. We consider a setting where both low- and high-frequency data are available. Let  be the low-frequency (LF) time units. Each time period

be the low-frequency (LF) time units. Each time period  is divided into M sub-periods with high-frequency (HF) dates

is divided into M sub-periods with high-frequency (HF) dates  , with

, with  . Moreover, we assume a panel data structure with a cross-section of size

. Moreover, we assume a panel data structure with a cross-section of size  of high-frequency data and

of high-frequency data and  of low-frequency data. It will be convenient to use a double time index to differentiate low- and high-frequency data. Specifically, we let

of low-frequency data. It will be convenient to use a double time index to differentiate low- and high-frequency data. Specifically, we let  , for

, for  , be the high-frequency data observation i during sub-period m of low-frequency period t. Likewise, we let

, be the high-frequency data observation i during sub-period m of low-frequency period t. Likewise, we let  , with

, with  , be the observation of the ith low-frequency series at t. These observations are gathered into the

, be the observation of the ith low-frequency series at t. These observations are gathered into the  -dimensional vectors

-dimensional vectors  , for all m, and the

, for all m, and the  -dimensional vector

-dimensional vector  , respectively.

, respectively.

,

,  , and

, and  , respectively. The first represents a vector of factors which affect both high- and low-frequency data (we use again superscript C for common), whereas the other two types of factors affect exclusively high (superscript H) and low (marked by L) frequency data. We denote by

, respectively. The first represents a vector of factors which affect both high- and low-frequency data (we use again superscript C for common), whereas the other two types of factors affect exclusively high (superscript H) and low (marked by L) frequency data. We denote by  ,

,  , and

, and  the dimensions of these factors. The latent factor model with high-frequency data sampling is

the dimensions of these factors. The latent factor model with high-frequency data sampling is

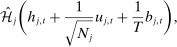

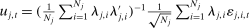

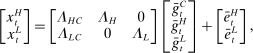

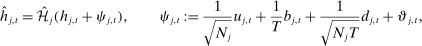

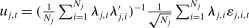

(5.1)

(5.1) and

and  , and

, and  ,

,  ,

,  , and

, and  are matrices of factor loadings. The vector

are matrices of factor loadings. The vector  is unobserved for each high-frequency sub-period and the measurements, denoted by

is unobserved for each high-frequency sub-period and the measurements, denoted by  , depend on the observation scheme, which can be either flow-sampling or stock-sampling (or some general linear scheme).

, depend on the observation scheme, which can be either flow-sampling or stock-sampling (or some general linear scheme). across all m, that is,

across all m, that is,  .8 Then, model (5.1) implies

.8 Then, model (5.1) implies

(5.2)

(5.2) ,

,  ,

,  , and the aggregated factors:

, and the aggregated factors:  ,

,  , H, L. Then we can stack the observations

, H, L. Then we can stack the observations  and

and  and write

and write

(5.3)

(5.3) and group-specific factors

and group-specific factors  and

and  . The normalized latent common and group-specific factors

. The normalized latent common and group-specific factors  ,

,  , satisfy the counterpart of (2.2).

, satisfy the counterpart of (2.2).The results in Sections 2, 3, and 4 can be applied for identification and inference in the mixed-frequency factor model. Using the same arguments in the mixed-frequency setting of equation (5.3), identification can be achieved for the aggregated factors  ,

,  , and

, and  , and the factor loadings

, and the factor loadings  ,

,  ,

,  , and

, and  . Consequently, the estimators and test statistics developed for the group factor model (2.1) can also be used to define estimators for the loadings matrices

. Consequently, the estimators and test statistics developed for the group factor model (2.1) can also be used to define estimators for the loadings matrices  ,

,  ,

,  ,

,  , and the aggregated factor values

, and the aggregated factor values  ,

,  , and the test statistic for the common factor space dimension

, and the test statistic for the common factor space dimension  in equation (5.3). We denote these estimators

in equation (5.3). We denote these estimators  ,

,  ,

,  ,

,  ,

,  , and also the infeasible and feasible test statistics

, and also the infeasible and feasible test statistics  and

and  . Once the factor loadings are identified from (5.3) and estimated, the values of the common and high-frequency factors for sub-periods

. Once the factor loadings are identified from (5.3) and estimated, the values of the common and high-frequency factors for sub-periods  are identifiable by cross-sectional regression of the high-frequency data on loadings

are identifiable by cross-sectional regression of the high-frequency data on loadings  and

and  in (5.1). More specifically, the estimators of the common and high-frequency factor values are

in (5.1). More specifically, the estimators of the common and high-frequency factor values are  ,

,  ,

,  , where

, where  (the asymptotic distribution of the factor estimates is provided in OA Proposition D.7). Hence,

(the asymptotic distribution of the factor estimates is provided in OA Proposition D.7). Hence,  and

and  are obtained by regressing

are obtained by regressing  on

on  and

and  across

across  , for any

, for any  and

and  . Consequently, with flow-sampling, we can identify and estimate

. Consequently, with flow-sampling, we can identify and estimate  and

and  at all high-frequency sub-periods. On the other hand, only

at all high-frequency sub-periods. On the other hand, only  , that is, the within-period sum of the low-frequency factor, is identifiable by the paired panel data set consisting of

, that is, the within-period sum of the low-frequency factor, is identifiable by the paired panel data set consisting of  combined with

combined with  . This is not surprising, since we have no high-frequency observations available for the LF data.

. This is not surprising, since we have no high-frequency observations available for the LF data.

One can consider an alternative approach to inference on the number of common factors and their estimated values. Instead of first aggregating the high-frequency data as in equation (5.3) and then applying PCA in each group, one can extract the principal components directly on the high-frequency panel (and the low-frequency panel) and then aggregate the high-frequency PCA estimates. The procedure then continues identically in both approaches. In our Monte Carlo experiments, the performances of the two approaches are found to be similar (see Section 6 and OA Section E for more details). In the empirical application, the results are almost indistinguishable (see OA Section D.11.2).

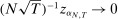

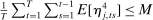

6 Monte Carlo Simulation Analysis

The objectives of the Monte Carlo simulation study are: to assess the adequacy of the asymptotic distribution of  to approximate its small sample counterpart, to evaluate the finite sample size and power properties of tests for

to approximate its small sample counterpart, to evaluate the finite sample size and power properties of tests for  based on the statistics

based on the statistics  and

and  , and to compare the sequential testing procedure for

, and to compare the sequential testing procedure for  in Proposition 2, vis-à-vis the alternative procedures suggested by Chen (2012) and Wang (2012). We perform our simulations in the context of the mixed-frequency setting of Section 5 to align the analysis with the empirical application.

in Proposition 2, vis-à-vis the alternative procedures suggested by Chen (2012) and Wang (2012). We perform our simulations in the context of the mixed-frequency setting of Section 5 to align the analysis with the empirical application.

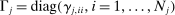

Section E of the OA reports a detailed description of the simulation designs and tables of results. The data generating process (DGP) is the high-frequency model (5.1) with flow-sampled LF variables. The idiosyncratic innovations are independent of the factors, serially i.i.d., and possibly weakly cross-sectionally correlated within each panel—corresponding to an approximate factor model. We consider  high-frequency sub-periods, as in our empirical application with yearly and quarterly data, and different numbers of factors across DGPs, namely,

high-frequency sub-periods, as in our empirical application with yearly and quarterly data, and different numbers of factors across DGPs, namely,  , and

, and  , and 5. The DGP for the vector of stacked factors

, and 5. The DGP for the vector of stacked factors  is

is  , where

, where  is a common scalar AR coefficient for all the

is a common scalar AR coefficient for all the  factors and

factors and  . The innovations

. The innovations  are i.i.d.

are i.i.d.  , where

, where  is a block-matrix such that

is a block-matrix such that  , for

, for  ,

,  and

and  . The scaling term ς ensures that the factor normalization in (2.2) holds for

. The scaling term ς ensures that the factor normalization in (2.2) holds for  , while the scalar parameter ϕ generates correlation between pairs of HF and LF specific factors. Factor loadings are simulated from a multivariate zero-mean Gaussian distribution, such that the cross-sectional distribution of

, while the scalar parameter ϕ generates correlation between pairs of HF and LF specific factors. Factor loadings are simulated from a multivariate zero-mean Gaussian distribution, such that the cross-sectional distribution of  's of the regressions of observables on factors mimics the empirical application. We run 4000 simulations for each DGP, and consider

's of the regressions of observables on factors mimics the empirical application. We run 4000 simulations for each DGP, and consider  ,

,  , T as small as the ones in our empirical applications, and progressively increase them.

, T as small as the ones in our empirical applications, and progressively increase them.

All the results summarized below are qualitatively similar (1) when different values of the factor autocorrelation  are considered, namely, 0 and 0.6, (2) for different (small) levels of the weak cross-sectional correlation of the idiosyncratic errors, and (3) for different magnitudes of the pervasiveness of the factors as measured by the theoretical

are considered, namely, 0 and 0.6, (2) for different (small) levels of the weak cross-sectional correlation of the idiosyncratic errors, and (3) for different magnitudes of the pervasiveness of the factors as measured by the theoretical  's for regressions of the simulated observables on the factors. We refer the reader to the OA for additional details.

's for regressions of the simulated observables on the factors. We refer the reader to the OA for additional details.

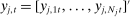

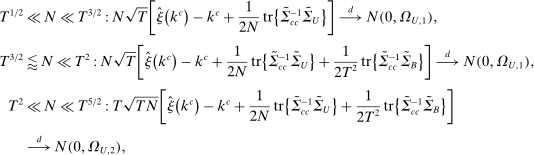

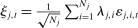

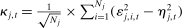

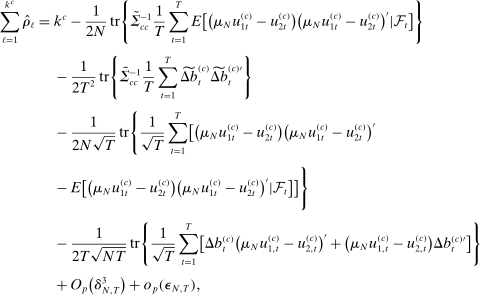

6.1 Asymptotic Gaussian Distribution, Size, and Power Properties

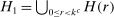

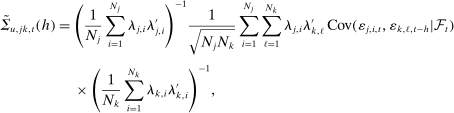

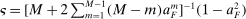

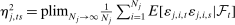

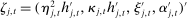

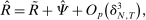

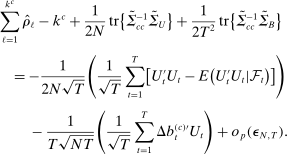

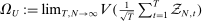

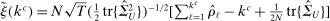

First, we want to verify whether the Gaussian asymptotic distribution provides a good small sample approximation for the infeasible statistic  . Figure 1 displays the empirical distribution of

. Figure 1 displays the empirical distribution of  , computed under the null of

, computed under the null of  common factors from data simulated from a DGP with

common factors from data simulated from a DGP with  , and overlapped with the asymptotic

, and overlapped with the asymptotic  distribution. For small sample sizes as

distribution. For small sample sizes as  , and

, and  , the empirical distribution approximates well a normal distribution with unit standard deviation, but is centered around a small positive value: the empirical mean and standard deviation are 0.16, and 1.14, respectively. Nevertheless, the left tail of this empirical distribution resembles relatively well the one of a standard Gaussian. As the sample sizes grow to

, the empirical distribution approximates well a normal distribution with unit standard deviation, but is centered around a small positive value: the empirical mean and standard deviation are 0.16, and 1.14, respectively. Nevertheless, the left tail of this empirical distribution resembles relatively well the one of a standard Gaussian. As the sample sizes grow to  , and

, and  , the empirical distribution of

, the empirical distribution of  has empirical mean and standard deviation of 0.02 and 1.01, respectively, and almost perfectly overlaps with the asymptotic distribution. As these results are qualitatively similar for alternative DGPs and sample sizes, we conclude that our asymptotic theory provides a good approximation also in small samples.

has empirical mean and standard deviation of 0.02 and 1.01, respectively, and almost perfectly overlaps with the asymptotic distribution. As these results are qualitatively similar for alternative DGPs and sample sizes, we conclude that our asymptotic theory provides a good approximation also in small samples.

Small sample distribution of the recentered and rescaled  statistic. The figure displays the histograms of the empirical distribution of the recentered and rescaled

statistic. The figure displays the histograms of the empirical distribution of the recentered and rescaled  statistic computed on mixed-frequency panels of observations, for different sample sizes NH, NL, T, simulated from a DGP where kC = kH = kL = 1, all factors and idiosyncratic terms are generated from Gaussian random variables, and M = 4. The solid line corresponds to the asymptotic standard Gaussian distribution of the recentered and rescaled statistic.

statistic computed on mixed-frequency panels of observations, for different sample sizes NH, NL, T, simulated from a DGP where kC = kH = kL = 1, all factors and idiosyncratic terms are generated from Gaussian random variables, and M = 4. The solid line corresponds to the asymptotic standard Gaussian distribution of the recentered and rescaled statistic.

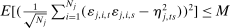

The tables in OA Section E.5 display the empirical size of the tests for the null hypotheses of  or 2, common factors corresponding to nominal sizes of

or 2, common factors corresponding to nominal sizes of  ,

,  , and

, and  . They also report the empirical power of tests for the null hypothesis of

. They also report the empirical power of tests for the null hypothesis of  common factors, when the true number of common factors is

common factors, when the true number of common factors is  . We observe that the asymptotic Gaussian distribution provides an overall very good approximation for the left tail of the infeasible test statistics

. We observe that the asymptotic Gaussian distribution provides an overall very good approximation for the left tail of the infeasible test statistics  under the null, even for samples as small as

under the null, even for samples as small as  , and

, and  , corroborating the graphical evidence of Figure 1. For the vast majority of sample sizes, and simulation designs, the size distortions are in the order of 1% to maximum 3% for the designs in which

, corroborating the graphical evidence of Figure 1. For the vast majority of sample sizes, and simulation designs, the size distortions are in the order of 1% to maximum 3% for the designs in which  . The size distortions for the feasible statistic

. The size distortions for the feasible statistic  are from 1% to 12% larger than those of the infeasible statistic when

are from 1% to 12% larger than those of the infeasible statistic when  , and

, and  . The designs in which

. The designs in which  for samples as small as

for samples as small as  , and

, and  feature larger size distortions for smaller samples due to the fact that, by construction of the designs, the signal-to-noise ratio for each of the two common factors is halved compared with the designs in which

feature larger size distortions for smaller samples due to the fact that, by construction of the designs, the signal-to-noise ratio for each of the two common factors is halved compared with the designs in which  . As expected, when either the sample sizes, or the signal-to-noise ratio of the common factors increase, the size distortions monotonically disappear. The power of the feasible test statistics is always equal to 1, with the exception of designs with

. As expected, when either the sample sizes, or the signal-to-noise ratio of the common factors increase, the size distortions monotonically disappear. The power of the feasible test statistics is always equal to 1, with the exception of designs with  , and

, and  .

.

6.2 Estimation of the Number of Common Factors

We compare the following three estimators of  : (a) the consistent sequential testing procedure of our Proposition 2, (b) a selection procedure based on the penalized information criterion of Theorem 3.7 in Chen (2012), and (c) the three-steps selection procedure proposed by Wang (2012).9 We focus on the average estimated number of common factors computed over the 4000 simulations.

: (a) the consistent sequential testing procedure of our Proposition 2, (b) a selection procedure based on the penalized information criterion of Theorem 3.7 in Chen (2012), and (c) the three-steps selection procedure proposed by Wang (2012).9 We focus on the average estimated number of common factors computed over the 4000 simulations.

We consider both the case in which the true numbers of pervasive factors  and

and  in the two panels are known, and the case where they are estimated using the

in the two panels are known, and the case where they are estimated using the  information criterion of Bai and Ng (2002). Generally, the estimates of

information criterion of Bai and Ng (2002). Generally, the estimates of  and

and  are very precise and do not affect significantly the estimation of

are very precise and do not affect significantly the estimation of  . The only exceptions are the smaller samples with

. The only exceptions are the smaller samples with  , and the DGPs with many pervasive factors in the LF panel, say

, and the DGPs with many pervasive factors in the LF panel, say  , where the

, where the  criterion tends to severely underestimate the values of

criterion tends to severely underestimate the values of  , while the

, while the  produces better estimates.10 The critical value for our selection procedure is as in equation (4.7), with

produces better estimates.10 The critical value for our selection procedure is as in equation (4.7), with  , and

, and  .

.

For a small number—say not larger than 3—of uncorrelated specific factors, the penalized information criterion proposed in Chen (2012) yields the correct number of factors in almost all simulations for any sample size, while our selection procedure is less accurate only for sample sizes as small as  , and

, and  : the average value of

: the average value of  ranges between 0.85 and 1 for

ranges between 0.85 and 1 for  . The average value of

. The average value of  for our selection procedure approaches quickly the true value

for our selection procedure approaches quickly the true value  as the sample sizes increase.

as the sample sizes increase.

The procedure of Chen (2012) overestimates  when the correlation ϕ among the specific factors increases from 0 to 0.7, and 0.95. The overestimation is much less severe for our sequential test procedure, also in larger samples, which also features a faster improvement in performance as the sample sizes increase. We observe a monotonic decrease in the precision across all the estimators when the number of specific factors becomes as large as 5; nevertheless, the deterioration in performance is less pronounced for our procedure. Finally, the consistent three-steps selection procedure of Wang (2012) performs similarly to the one of Chen (2012) in DGPs with a small number of uncorrelated specific factors. However, as either ϕ or the numbers of specific factors increase, this procedure largely overestimates

when the correlation ϕ among the specific factors increases from 0 to 0.7, and 0.95. The overestimation is much less severe for our sequential test procedure, also in larger samples, which also features a faster improvement in performance as the sample sizes increase. We observe a monotonic decrease in the precision across all the estimators when the number of specific factors becomes as large as 5; nevertheless, the deterioration in performance is less pronounced for our procedure. Finally, the consistent three-steps selection procedure of Wang (2012) performs similarly to the one of Chen (2012) in DGPs with a small number of uncorrelated specific factors. However, as either ϕ or the numbers of specific factors increase, this procedure largely overestimates  and becomes the worst among the three considered.

and becomes the worst among the three considered.

7 Empirical Application

Recent public policy debates argue that manufacturing has been declining in the United States and most jobs have migrated overseas to lower wage countries. The share of the Industrial Production (IP) sector declined from more than 25% to roughly 18% during our sample period 1977–2011. However, the fact that its size shrank does not necessarily exclude the possibility that the IP sector still is a key factor of total U.S. output. When studying the role of the IP sector, we face a conundrum. On the one hand, we have 117 sectors that make up aggregate IP. These data are published monthly, and therefore cover a rich time series and cross-section. On the other hand, contrary to IP, we do not have monthly or quarterly data regarding the cross-section of U.S. output across non-IP sectors, but we do so on an annual basis. Using the class of mixed-frequency group factor models proposed in Section 5, the objective of the empirical application is to shed light on the key question of interest, namely, whether, despite the shrinking size of IP sectors, the factors related to IP are still dominant determinants of U.S. output fluctuations.

7.1 Data Description

For the IP sectors, we use the same 117 IP sectoral growth rates indices sampled at quarterly frequency from 1977.Q1 to 2011.Q4, as in Foerster, Sarte, and Watson (2011) for comparison.11 The data for all the remaining non-IP sectors consist of the annual growth rates of real GDP for the following 42 sectors: 35 Services, Construction, Farms, Forestry-fishing, and related activities, General government (federal), Government enterprises (federal), General government (state and local), and Government enterprises (state and local). These LF data are published by the Bureau of Economic Analysis (BEA).12 Hence we consider the panel of these yearly GDP sectoral and the quarterly IP data given that one of the objectives of this application is to study the comovements among these different sectors. A description of the practical implementation of our procedure appears in OA Section D.9.13

7.2 Common, Low-, and High-Frequency Factors

We assume that our data set follows the factor structure for flow-sampling as in equation (5.2), with  and

and  corresponding to the 117 quarterly IP series and the 42 annual GDP non-IP sector data series, respectively, for the period 1977.Q1–2011.Q4. We exclude the annual series related to IP sectors from the annual GDP panel in order to avoid double counting. Let

corresponding to the 117 quarterly IP series and the 42 annual GDP non-IP sector data series, respectively, for the period 1977.Q1–2011.Q4. We exclude the annual series related to IP sectors from the annual GDP panel in order to avoid double counting. Let  be the

be the  panel of the yearly observations of the IP indices growth rates computed as the sum of the quarterly growth rates

panel of the yearly observations of the IP indices growth rates computed as the sum of the quarterly growth rates  ,

,  , for year t, and let

, for year t, and let  be the

be the  panel of the yearly growth rates of the non-IP indices. Let also

panel of the yearly growth rates of the non-IP indices. Let also  be the

be the  panel of quarterly IP indices growth rates.

panel of quarterly IP indices growth rates.

We start by selecting the number of factors in each sub-panel, which are of dimensions  for

for  and

and  and

and  for

for  . We use the

. We use the  and

and  information criteria of Bai and Ng (2002), following the empirical literature. For the panels of IP growth rate at quarterly (

information criteria of Bai and Ng (2002), following the empirical literature. For the panels of IP growth rate at quarterly ( ) and annual (

) and annual ( ) frequencies,

) frequencies,  selects two factors for each panel, whereas the more strict

selects two factors for each panel, whereas the more strict  criterion selects one factor for

criterion selects one factor for  and two factors for

and two factors for  . For the annual GDP (non-IP) sectors panel, both

. For the annual GDP (non-IP) sectors panel, both  and

and  select a single factor.14 Our results corroborate the evidence in Foerster, Sarte, and Watson (2011), suggesting that there are either one or two pervasive factors in the quarterly IP growth data. While the

select a single factor.14 Our results corroborate the evidence in Foerster, Sarte, and Watson (2011), suggesting that there are either one or two pervasive factors in the quarterly IP growth data. While the  and

and  choose factors in an unconditional setup, we are also interested in the explanatory power of these factors in a conditional setup. Hence the empirical analysis proceeds with two factors for each panel,

choose factors in an unconditional setup, we are also interested in the explanatory power of these factors in a conditional setup. Hence the empirical analysis proceeds with two factors for each panel,  , in order to avoid potentially omitted factors/variables in explaining economic activity growth and subsequently re-assess the conditional significance of factors using the BIC criterion.15

, in order to avoid potentially omitted factors/variables in explaining economic activity growth and subsequently re-assess the conditional significance of factors using the BIC criterion.15

In order to select the number of common and frequency-specific factors, we follow our proposed procedure in Proposition 2. The estimated canonical correlations of the first two PC's estimated in each sub-panel  and

and  are used to compute the value of the feasible standardized test statistic

are used to compute the value of the feasible standardized test statistic  in (4.6) and Theorem 2, for testing the null hypotheses of

in (4.6) and Theorem 2, for testing the null hypotheses of  and

and  common factors.16 The first canonical correlation is

common factors.16 The first canonical correlation is  , while the second one is

, while the second one is  . These results are consistent with the presence of one common factor in each of the two mixed-frequency data sets considered, as represented by hypothesis

. These results are consistent with the presence of one common factor in each of the two mixed-frequency data sets considered, as represented by hypothesis  in Section 3.2. The values of the statistics are

in Section 3.2. The values of the statistics are  and

and  for the null hypotheses of

for the null hypotheses of  and

and  common factors, respectively. The test rejects the null hypothesis of the presence of two common factors (

common factors, respectively. The test rejects the null hypothesis of the presence of two common factors ( ), for significance levels as small as 0.05%, while we cannot reject the null of one common factor at the 5% significance level. Our selection procedure detailed in Proposition 2 with critical level as in (4.7) with

), for significance levels as small as 0.05%, while we cannot reject the null of one common factor at the 5% significance level. Our selection procedure detailed in Proposition 2 with critical level as in (4.7) with  and

and  , produces the estimate

, produces the estimate  . Hence, we select a model with

. Hence, we select a model with  .

.

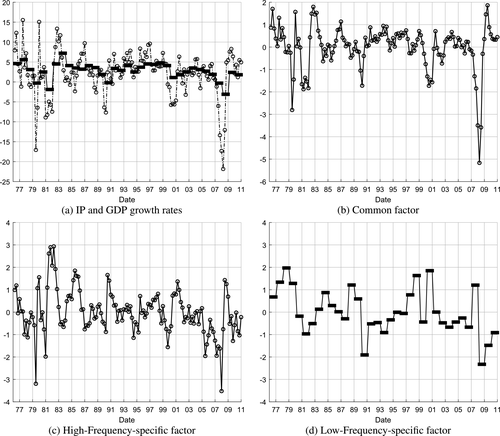

In Figure 2, Panel (a) plots the IP and GDP growth rates during the period 1977–2011 and the remaining Panels (b)–(d) present the estimated factor paths from the panels of 42 GDP sectors and 117 IP indices for the common, the HF-specific, and the LF-specific factors, respectively. All factors are standardized to have zero mean and unit variance in the sample and their sign is chosen so that the majority of the associated loadings are positive. A visual inspection of the plots reveals that the common factor in Panel (b) resembles the IP index in Panel (a), with a large decline corresponding to the Great Recession following the financial crisis of 2007–2008 and the positive spike associated to the recent economic recovery. On the other hand, the LF-specific factor displayed in Panel (d) features a less dramatic fall during the Great Recession, and actually features a positive spike in 2008, followed by large negative values in the following years. This constitutes preliminary evidence suggesting that some non-IP sectors could feature different responses to the recent financial crisis.

The relationship of factors with the sectoral GDP and IP growth series, in a regression context, reveals additional information about the conditional correlations of the factors with specific economic activity growth sectors. This in turn can help us shed light on which IP and non-IP series are driving the factors. We start with a disaggregated analysis, and examine the relative importance of the common and frequency-specific factors in explaining the variability across all sectoral growth rates. For each sector in the panel, we regress the GDP or IP index growth rates on (i) the common factor only, (ii) the specific factor only, for non-IP and IP series, respectively, and (iii) both common and specific factors. In Table I, we report the quantiles of the empirical distribution of the adjusted  (denoted

(denoted  ) of these regressions. In addition, we report the percentage value of the times the BIC (denoted by %BIC) selects, among the aforementioned three regression models (i)–(iii), the alternative factor conditional information set (common and/or frequency-specific), for each sectoral index in the cross-section.17

) of these regressions. In addition, we report the percentage value of the times the BIC (denoted by %BIC) selects, among the aforementioned three regression models (i)–(iii), the alternative factor conditional information set (common and/or frequency-specific), for each sectoral index in the cross-section.17

and Percentage Values of BIC of the Regressions With Common and/or Frequency-Specific Factors From Economic Activity Indices Growth Ratesa

and Percentage Values of BIC of the Regressions With Common and/or Frequency-Specific Factors From Economic Activity Indices Growth Ratesa|

|

||||||

|---|---|---|---|---|---|---|

|

Factors |

10% |

25% |

50% |

75% |

90% |

% BIC |

|

Observables: Gross Domestic Product, 1977–2011 |

||||||

|

common |

−2.2 |

−0.5 |

11.5 |

28.9 |

42.9 |

38.1 |

|

common, LF-specific |

0.1 |

9.2 |

25.4 |

34.5 |

60.3 |

28.6 |

|

LF-specific |

−2.8 |

−2.3 |

5.7 |

15.7 |

22.4 |

33.3 |

|

Observables: IP, 1977.Q1–2011.Q4 |

||||||

|

common |

0.3 |

4.8 |

20.3 |

36.0 |

60.0 |

42.7 |

|

common, HF-specific |

1.1 |

6.8 |

28.7 |

45.3 |

63.4 |

48.7 |

|

HF-specific |

−0.7 |

−0.1 |

3.0 |

11.2 |

23.5 |

8.5 |

- a

The regressions in the first three lines involve the growth rates of the 42 non-IP sectors as dependent variables, while those in the last three lines involve the growth rates of the 117 IP indices as dependent variables. The explanatory variables are factors estimated from the same indices using a mixed-frequency factor model with

. Reported are the adjusted

. Reported are the adjusted  of the regressions on common and/or frequency-specific factors for different quantiles of the cross-section. The last column reports the percentage values that the BIC chooses the specific factor type regression model.

of the regressions on common and/or frequency-specific factors for different quantiles of the cross-section. The last column reports the percentage values that the BIC chooses the specific factor type regression model.

From the first three lines in Table I, we observe that adding the LF-specific factor to the common factor regressions for the non-IP indices yields an increment of the median  around 14% (going from 11.5% to 25.4%) and the 90% quantile of

around 14% (going from 11.5% to 25.4%) and the 90% quantile of  increases by 17%. Adjusting for the number of the variables in the factor regression models, the BIC favors the model with both the common and the LF-specific factors in explaining the GDP growth rate in 29% of the sectors, whereas the model with the common factor alone is selected in about 38% of the series. When the high-frequency-specific factor is added to the common factor, it contributes an increment of around 8% in the median

increases by 17%. Adjusting for the number of the variables in the factor regression models, the BIC favors the model with both the common and the LF-specific factors in explaining the GDP growth rate in 29% of the sectors, whereas the model with the common factor alone is selected in about 38% of the series. When the high-frequency-specific factor is added to the common factor, it contributes an increment of around 8% in the median  for the IP sectors. The 49% BIC value provides strong evidence that both the common and high-frequency factors explain the IP sectoral growth rate. Overall, the results in Table I show that the common factor turns out to be pervasive for most of the IP and non-IP sectors alike as demonstrated by both the relative

for the IP sectors. The 49% BIC value provides strong evidence that both the common and high-frequency factors explain the IP sectoral growth rate. Overall, the results in Table I show that the common factor turns out to be pervasive for most of the IP and non-IP sectors alike as demonstrated by both the relative  vis-à-vis those with just the frequency-specific factor.

vis-à-vis those with just the frequency-specific factor.