Application of Sinusoidal Function in Financial Crisis Early Warning and Detection System

Abstract

With the deepening of economic and financial globalization and integration, the possibility of financial crisis in a country or a region has obviously increased. Therefore, it is particularly important to prevent and resolve the financial crisis, especially the regional financial crisis. Therefore, this paper studies the application of sine signal function in financial crisis early warning and detection system. According to the principle of “different frequencies are uncorrelated,” the derivation process of a single sinusoidal signal with noise in the crisis warning period is also applicable to the case of multiple sinusoidal signals, so the program can also be used to detect multiple sinusoidal signals in the crisis warning period at the same time. The research shows that the approximate frequency of the frequency to be measured is estimated before measurement, the initial driving force frequency is set in the range of 1–2 times of the estimated value, and the program is executed to search the extreme value of the variance of the output. The frequency value of the driving force corresponding to the extreme value of variance is the frequency value of the signal to be measured, and the simulation results show that the accuracy is about 2%. Therefore, through the application of sine signal function in the financial crisis early warning and detection system, it can provide forward-looking suggestions for the economic policymakers of various countries, so as to take effective preventive measures in advance for the possible international financial crisis in the future. While the prediction accuracy is not absolute, the findings provide meaningful insights.

1. Introduction

The cause of the financial crisis is the subprime mortgage crisis in the United States, and the important reason why the subprime mortgage crisis developed into an international financial crisis is that the financial system is not well regulated. Credit rating agencies did not realize the huge potential risks of loan-based credit derivatives, so such high-risk derivatives were sold to financial institutions all over the world in large quantities, and the danger was only a front line [1]. In order to achieve the purpose of early warning, it is necessary for us to give an accurate and quantitative definition of financial crisis. Under the background of economic and financial globalization and deepening integration, the possibility of financial crisis in a country or region is obviously increased. Therefore, it is particularly important to prevent and resolve a financial crisis, especially a regional financial crisis. Early warning detection is an important part in preventing a regional financial crisis. It is more important to prevent the financial crisis in advance than to resolve it afterwards. Through research on global financial crisis events, it is found that before the crisis, relevant economic and financial variables have abnormal fluctuations. Real-time monitoring of early warning indicators, timely detection and identification of risks, and early adoption of preventive measures can effectively prevent the emergence of the crisis and reduce the damage caused by the crisis [2]. There are no universally recognized events reflecting the financial crisis in China, such as bank failures, liquidity collapses, and sharp devaluation of exchange rates. Therefore, in China’s macrofinancial stability monitoring practice, the probability of abnormal samples is extremely low, resulting in the lack of sufficient abnormal data representing abnormal fluctuations of early warning objects when applying these methods. Another transmission mechanism of the crisis is through interbank deposits. The spillover effect of a single bank’s dilemma can affect the entire banking system through interbank borrowing. Factors such as the size of financial institutions, the functions of interbank markets, and other financial markets will determine the possibility of infection. In this sense, the bank risk in the new market is greater.

Therefore, this paper studies the early warning of financial crisis through the sine signal function and constructs a detection system in this paper. Find rules from massive data for detection, analysis, prediction, and early warning. These three types of methods have their own characteristics and are widely used in monitoring and early warning practices in different fields. However, there is no universally recognized event reflecting the financial crisis in China, such as bank failure, liquidity collapse, and sharp devaluation of the exchange rate. The idea of establishing a detection system is that the detection system must be very sensitive to the sinusoidal signal to be detected [3]. When the system is under specific conditions, the sine signal function is introduced into the system, and the existence of the signal can make the system undergo a phase transition. When processing signals, the number of signals must be detected first, and then, the subsequent processing can be determined according to the situation. Therefore, the detection of the number of sinusoidal signals in noise is of great significance [4]. The common method is to transform the sampled signal first and then determine the signal through the spectral peak. The sine signal function or sine wave is a mathematical curve describing smooth periodic oscillation, and the sine wave is a continuous wave. Nature itself has many typical sine curves, such as sound waves, light waves, seismic waves, and waves on the ocean surface. Artificial equipment can also have sinusoidal motion. Because the phase transition of the system is caused by the sinusoidal signal function mixed with noise, these two points have strong engineering practical significance compared with other sinusoidal signal function detection algorithms. Finally, the feasibility of the method is verified by computer simulation, and the limitations of the method are discussed so that the sinusoidal signal covered by noise can be detected.

The impact of the financial crisis on China is mainly from the physical aspect. Due to the reduction of external demand, China’s export-oriented economic structure has been impacted, and economic growth has slowed down but still maintained a high growth. The research on early warning of financial crisis through sine signal function needs new progress, and the research on early warning of international financial crisis needs more systematic discussion [5]. This kind of irrational decline seriously deviates from China’s economic fundamentals, which is a strong evidence of the contagion of the financial crisis. As China’s economic aggregate has entered second place in the world, the financial system has gradually opened up, macroeconomic policy adjustment and external relevance have increased, and the interaction of financial market fluctuations has increased. On the basis of drawing on existing research and combining the characteristics of international financial crisis with sine signal function, we should rethink the international financial crisis early warning mechanism, strive to make new progress in both theoretical and empirical research, and establish an effective international financial crisis early warning and detection system [6, 7]. According to the internal operation mechanism of the macrofinancial system with sine signal function, selecting a monitoring indicator system that can correctly describe, reflect, and measure the operation characteristics and situation of macrofinance is the premise and basis for establishing a scientific and perfect macrofinancial monitoring and early warning system. Therefore, through the application of the sine signal function in the financial crisis early warning and detection system, it can provide forward-looking suggestions for the economic policymakers of various countries, so as to take effective preventive measures in advance for the possible international financial crisis in the future. Although it cannot guarantee the 100% accuracy of the prediction results, the research in this paper still has important practical significance. Artificial intelligence models, especially deep learning models such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), have significant advantages in processing complex, high-dimensional data. They can automatically extract features and learn potential patterns of financial crises from large amounts of historical data. In contrast, the sine signal function method may focus more on capturing the dynamic changes in financial markets through periodic analysis. Although it may not be as adept at handling complex data as deep learning models, it has unique advantages in capturing market cyclical fluctuations, and the model is relatively simple and easy to interpret. This paper constructs a financial risk monitoring index system. Based on the factor analysis method, the functional relationship between nonsystematic risk monitoring indicators and financial risk is given. In addition, it is also pointed out that, in addition to the measurement of this comprehensive risk degree, the development of financial risk into crisis is mainly due to the role of a certain risk in financial risk as a catalyst leading to the bankruptcy of financial institutions or the outbreak of crisis. Therefore, he introduced other risks that may lead to various crisis situations into the model and established a more complete risk measurement model integrating systematic risk and unsystematic risk.

- 1.

The financial subject composition model is constructed. The current media reports on the financial crisis focus on stabilizing people’s minds and building confidence. Although this model meets the needs of political stability and economic development, the correct guidance of public opinion is not to avoid practical difficulties, or even whitewash peace, but to reflect the actual situation more truthfully, comprehensively, and accurately.

- 2.

Structure of financial crisis early warning and detection system. In terms of the teacher arrangement of animation performance courses under the network information environment, teachers of performance specialty are arranged to take the post, effectively avoiding the switching between various systems and fully reducing the complexity of the system and the difficulty in learning.

The overall structure of this paper consists of five parts.

The first section describes the background and significance of financial crisis early warning detection. The second section mainly introduces the research content of financial crisis early warning detection and the research content of sine signal function in financial crisis early warning detection. The third section describes the definition and classification of financial crisis and constructs the sine signal function in the financial crisis early warning detection system. The fourth section is the simulation experiment and the description of the experimental results. The fifth section is the summary of the full text.

2. Related Work

Artificial intelligence, especially machine learning technology, is playing an increasingly important role in financial crisis warning systems. Machine learning algorithms can learn and extract features from large amounts of historical data to predict future financial trends and risks. For example, support vector machine (SVM), decision tree, random forest, and other algorithms have been widely used in financial risk assessment and early warning. These algorithms are capable of handling nonlinear relationships and high-dimensional data, improving the prediction accuracy and robustness of early warning systems. In addition, deep learning, as a branch of machine learning, has shown great potential in financial crisis warning. Deep learning models, such as neural networks, can automatically learn complex features of data and approximate the dynamics of the real financial system through multiple layers of nonlinear transformations. This ability gives deep learning models a significant advantage in identifying early signals of financial crises. The application of big data technology in financial crisis warning systems cannot be ignored. Big data technology can process and analyze large-scale data from multiple channels, formats, and speeds, providing a richer source of information for early warning systems. By integrating data from financial markets such as banks, securities, and foreign exchange, as well as macroeconomic indicators and international trade data, big data technology can reveal the complexity and correlation of financial risks, thereby improving the comprehensiveness and accuracy of early warning systems. Looking for a systematic pattern in the origin of financial crises means that we should not be limited to the latest crisis but study a larger sample, or the final result cannot stand the test of more practical experience. We have fully considered the possibility of financial risks in various fields of economy and finance, comprehensively analyzed the main sources of financial risks in China, and analyzed how to set up early warning indicators through these sources, which is relatively lacking in related research. Therefore, in view of the above problems, more and more scholars began to study the financial crisis early warning and detection.

Phillips et al. show that the sources of China’s financial risks are mainly concentrated in five aspects: banking, securities market, foreign exchange reserves and foreign debts, international capital flows, and bubble economy. The credit risk of China’s banking industry is still one of the most important risks, and the risk of maturity structure mismatch of assets and liabilities has increased significantly [8]. Tak et al. pointed out that the regional financial crisis refers to a balanced system with certain structural characteristics and functions formed through division of labor and cooperation among financial crisis subjects such as financial markets and financial institutions in a certain time and space [9]. Bertoncel et al. analyzed the sources of China’s financial risks through factor analysis; the established early warning indicators are synthesized into five common factors, which, respectively, reflect the risks of macroeconomic operation, foreign trade market, financial market, securities market, and external economic environment [10]. Gidea et al. indicated that the selection of financial early warning indicators should reflect the important factors of financial crisis and strive to describe the possibility of financial crisis comprehensively, objectively, and accurately. Science is the soul and core of the whole system, and it is also the first principle to be followed in the process of establishing the whole early warning system [11]. Polak et al. put forward that the financial early-warning detection system is an organic whole composed of various elements, which requires that the corresponding levels have sufficient coverage to take into account the main factors related to the crisis [12]. Petropoulos et al. studied China’s financial crisis from three aspects: financial crisis subject, financial crisis regulation, and financial environment, and pointed out that the most prominent financial crisis problems in China at present are in the financial crisis system, the institutional defects of financial property rights, the serious destruction of the self-regulation mechanism of financial crisis, and the serious harm of financial crisis to the balance and optimization of financial crisis [13]. Filippopoulou et al. put forward that we should focus on strengthening the risk control of macroeconomy, foreign trade, and bank credit. In addition, the internal stability mechanism of China’s stock market is not perfect, the ability to resist risks is weak, and the stock market lacks the proper functions of value discovery and resource optimal allocation, which brings great risks to the financial operation. Therefore, the stock market should also pay attention to it and take necessary measures to control its potential risks [14]. Virtanen et al. started with the financial legal system, combined economics with legal research, and explained the current situation of the legal environment in China’s financial ecology with economic theory; that is, the legislation lags behind, the judiciary lacks independence, and the law enforcement efficiency is low [15]. Boin analyzes the exogenous or endogenous problems of money supply based on the analysis perspective of financial crisis early warning and detection system. They use the system theory point of view to analyze the relationship between the financial crisis or financial systems [16]. Bardoscia et al. believe that the complexity of the global economic situation and the structural characteristics of China’s foreign exchange reserve make the security of China’s foreign exchange reserves face greater risks, and the huge opportunity cost of huge reserves reduces the return on assets and increases the risk of inflation [17]. The sine function is a type of trigonometric function with characteristics such as periodicity and volatility. In the financial field, these characteristics enable sine functions to simulate the volatility and cyclical changes of financial data, providing a theoretical basis for financial crisis warning. With the increasing complexity of global financial markets, traditional financial crisis warning methods are gradually exposing their limitations. The sine function is introduced to improve the accuracy and sensitivity of early warning systems due to its unique mathematical properties. In particular, in fields such as signal processing and risk assessment, the application of sine functions has achieved certain results. In financial markets, data such as prices and trading volumes often exhibit volatility. The sine function can smooth and denoise these fluctuating signals, thereby extracting useful warning information. At present, some studies have attempted to apply sine functions to financial crisis warning systems. These studies typically verify the effectiveness of sine functions in improving warning accuracy and reducing false alarm rates through empirical analysis. For example, research has found that warning systems combined with sine functions have a longer warning time window before financial crises occur compared to traditional methods, providing users with more response time.

The research on financial early warning systems began with reflection and summarization of financial crisis events. With the deepening development of financial liberalization and economic globalization, financial crises have occurred frequently around the world, bringing huge impacts to the economies of various countries. In order to effectively respond to financial crises, scholars and practitioners from various countries have begun to work on building financial warning systems to provide early warning and prevention before crises occur. Early warning indicators are the foundation for building a financial early warning system. These indicators typically include macroeconomic indicators, financial market indicators, and financial institution indicators, used to reflect the operational status and potential risks of the financial system. The warning model is the core of the financial warning system. It uses mathematical processing and statistical analysis of warning indicators to determine whether the financial system is in a crisis state. Common warning models include parametric models, nonparametric models, and machine learning models. Data processing is an important part of financial early warning systems. It includes steps such as data collection, data cleaning, data conversion, and feature extraction to ensure the accuracy and reliability of warning indicators. Quantitative research is one of the main research methods for financial early warning systems. It establishes an early warning model through statistical analysis of historical data and verifies the predictive ability of the model. Quantitative research has the advantages of objectivity and verifiability, but it may also be limited by factors such as data quality and model assumptions. For emerging economies, it is more difficult to accurately predict the banking crisis by using the monthly data of sinusoidal signal function than the currency crisis. Within the sample, the average noise signal of banking crisis under sinusoidal signal function is higher than that of currency crisis; similarly, the prediction performance of currency crisis is much better than that of banking crisis outside the sample. The contagion effect of intercountry crisis shows that we should pay more attention to the unique economic basic factors of the country when we understand the vulnerability of currency crisis in new markets by sinusoidal signal function.

3. Research Method

3.1. Definition and Classification of Financial Crisis

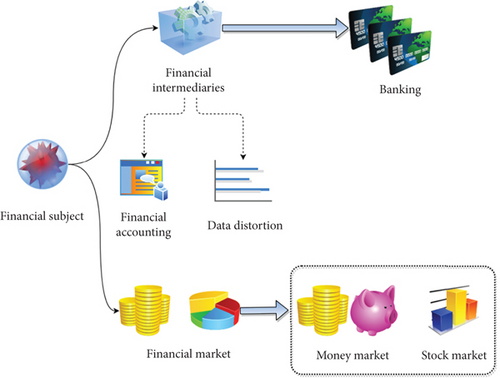

Finance is one of the key components of the national economy and plays a crucial role. In a broad sense, finance includes all economic activities related to currency circulation, issuance, settlement, and financing. In the process of various financial transactions, property and reputation pose a threat, which makes the expected income uncertain, among which the uncertainty of loss is commonly referred to as financial risk. With the promotion of economic integration and financial globalization, especially the increasing trend of securitization of various assets and derivatives of financial products, financial innovations emerge endlessly, and China’s financial risks are increasing. Although a large number of financial institutions have not closed down and no serious financial crisis has occurred, this does not mean that China’s financial institutions are exposed to systemic financial risks. With the increasing interaction between financial markets of various countries in the modern economy, the financial crisis is more likely to spread from one country to many countries and more likely to cause an international financial crisis. At present, the financial crisis has entered the middle stage of development. Although, as reported by various media, the global economic situation has shown signs of improvement and the economy has begun to recover, this is far from the end of the financial crisis [18]. The financial industry is faced with certain risks in a variety of uncertain economic and business environments. Financial risks trigger financial crises, which originate from financial risks. A financial crisis is the limit effect of financial risk. It is also necessary to describe the form of financial crisis. The change of financial subjects is an important factor in the generation of a financial crisis [19]. The financial body, namely, the financial system, is composed of financial intermediaries and financial markets. China’s banking intermediary system constitutes the main content of financial intermediaries.

General rules of early warning experiment are as follows. First, looking for a systematic model in the origin of the financial crisis means that it cannot be limited to the latest crisis (or a series of crises). It is to study a larger sample. Otherwise, the distinction between important factors and less important factors may lead to too many explanations, or the final results cannot stand the test of more practical experience. Second, we should pay attention to the banking crisis as we pay attention to the currency crisis. The literature on the leading indicators of a financial crisis mostly involves a currency crisis. However, the cost of a banking crisis in developing countries is higher than that of a currency crisis. The banking crisis seems to be a more important reason for the currency crisis. Third, try to use a relatively wide set of early warning indicators because there are many causes of financial crises in emerging economies. Therefore, a large number of indicators are needed to reflect potential risk sources. Fourth, use the out-of-sample test to judge the usefulness of leading indicators. The performance of a model within the sample will make people optimistic that the model can also perform well outside the sample.

The financial market includes the money market and stock market, as shown in Figure 1.

The current media reports on the financial crisis are mostly from the perspective of stabilizing people’s minds and building confidence. Although this meets the needs of political stability and economic development, the correct guidance of public opinion is not to avoid practical difficulties, or even whitewash peace, but to reflect the actual situation more truthfully, comprehensively, and accurately.

- 1.

As a part of the banking economic crisis, the cyclical financial crisis broke out with the outbreak of the economic crisis. Banking crises generally originate from the asset side of the bank’s balance sheet. When the problem of deteriorating asset quality is exposed or the public’s expectation of currency depreciation increases, large-scale public withdrawal of deposits will occur. Therefore, the bank squeeze is not so much the cause of the banking problem as the result. After the banking crisis broke out, some financial institutions with serious problems were forced to close, merged, or taken over by the government.

- 2.

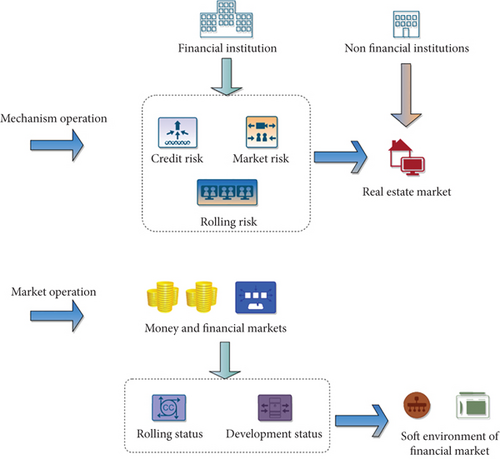

The structure diagram of the financial crisis early warning and detection system was constructed. As the cost of economic adjustment caused by financial crises is very expensive, it is necessary to seek economic variables that can be used as early warning signals of crises in the financial crisis early warning detection system. In the financial crisis early warning and detection system with sine signal function, if the input signal to be measured does not contain periodic signals with the same frequency as the policy force, the system state will remain in a chaotic critical state.

The low level of operation and management of financial institutions has always been an important factor hindering their development. China’s commercial banks, especially state-owned commercial banks, have not really established an operating mechanism of independent operation, self-responsibility for profits and losses, self-risk, and self-restraint. The idea of extensive operation has not fundamentally changed. There is still a tendency to attach importance to development, management, business, monitoring, quantity, quality, scale, and efficiency. The early warning and control of financial risks are aimed at solving the problems that may cause financial asset losses in the development of financial markets. The early warning system can propose effective measures to solve these problems. Build a sound information indicator system for the healthy and safe operation of the financial industry. At this stage, in the process of development of China’s financial industry, there are problems such as the lag of financial legislation and the lack of regulatory laws. It seriously impacts the development of commercial banks and other financial institutions and seriously affects national security and social stability. Therefore, it is very important to build a financial risk early warning system for commercial banks.

3.2. Construction of Sinusoidal Signal Function in Financial Crisis Early Warning and Detection System

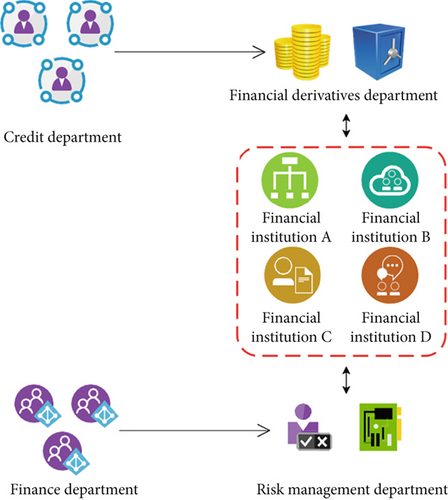

In developing countries, the inefficiency of the banking industry caused by unsound market rules and weak supervision is usually covered by loan inflation and asset price inflation, and then, a financial crisis generally does not occur. At present, the financial crisis has entered the medium-term development stage, and we should further combine the development vision and perspective to make strategic adjustments to China’s economic structure in the future. On the one hand, we should warn against the current structural problems such as China’s export-oriented economy and the excessive proportion of low-end energy-consuming products; on the other hand, we should also see the turning point brought by the financial crisis for China’s economic structure adjustment. The mixed operation of China’s financial industry is developing rapidly, and innovative financial products are constantly being introduced. Capital flows frequently among financial institutions, and the associated risks are increasing. Bank funds enter the securities market through various channels, and there are big risks in treasury bond repurchase, entrusted wealth management, and pledged loans. The supervision of financial institutions mainly focuses on compliance supervision, attaches great importance to the supervision of auditing and winning, and neglects the supervision of the safety, liquidity, and profitability of financial institutions. Policy is a kind of resource, and the adjustment of policy means the adjustment of interests. The promulgation of every policy and the revision of every rule are pregnant with huge market changes and business opportunities. It is hoped that economic news reports from the perspective of the audience can predict and interpret changes in economic policies and future economic trends, so as to lay out the layout ahead of time and seek advantages and avoid disadvantages. As most of the asset risks of financial institutions are formed in the credit department, the management ability of a financial institution’s credit department and its ability to evaluate and control asset risks, once the credit department has a crisis, that is, the financial institution will face a risk of debt, thus making the financial institution face a crisis, which is the transmission of the crisis among various departments within financial intermediaries. The path of crisis generation within financial institutions is shown in Figure 2.

When the system is under specific conditions, the sine signal is introduced into the system, and the existence of the signal can make the system undergo a phase transition. According to the change in the dynamic behavior of the system, the signal is detected. The structure of the financial crisis early warning detection system is shown in Figure 3.

It can also be extended to the detection of multiple signals.

At the system level, macroeconomic factors, such as the impact on interest rates, exchange rate depreciation, commodity prices, economic growth slowdown, and capital outflows, are also important determinants of the crisis. But in fact, it is impossible to find such an indicator because it will change the expectations of decision-makers and the public. As a periodic function, the volatility of sine signals makes them a powerful tool for analyzing the cyclical fluctuations in financial markets. The periodic characteristics of sine signals can effectively capture the cyclical oscillation patterns of the market. By fitting historical price data with sine signals, financial analysts can more accurately determine the cyclical characteristics of the market and predict future market trends. This method can provide more accurate prediction results compared to traditional time series analysis or regression analysis. In risk management, sine signals (especially their derivative cosine functions) can be used to describe the regression characteristics and volatility of financial markets. Based on sine signal data fitting analysis, financial institutions can better evaluate the risk level and potential returns of financial assets, thereby formulating effective risk management strategies. As a result, decision-makers will take action to prevent the occurrence of the crisis, or the public will take sinusoidal signal action to reduce losses and avoid the occurrence of the crisis in advance. However, what is more important is to continuously improve the overall incentive framework under the sine signal function so that financial institutions and enterprises in the private sector have the will and ability to reasonably manage their financial risks. This requires a good level of macroeconomic management, including appropriate exchange rate management and ensuring that all the pillars for achieving stability in the financial and corporate sectors are in place.

4. Analysis and Discussion of Results

Theoretically, during the early warning period of a financial crisis, all indicators may send out correct signals every month; that is, the number of months that may send out correct signals in each crisis is equal to the number of months in the early warning period. The four indicators that performed poorly in predicting the currency crisis and the banking crisis were removed, thus reducing the number of indicators in the early warning indicator system to five. According to the statistical test results of these five indicators, we give them different weights, as shown in Table 1.

| Index name | Currency crisis | Banking crisis |

|---|---|---|

| Deviation degree of real exchange rate | 11 | 11 |

| Stock index | 9 | 9 |

| Production index | 9 | 8 |

| Real interest rate of deposit | 5 | 8 |

| Bank balance | 3 | 6 |

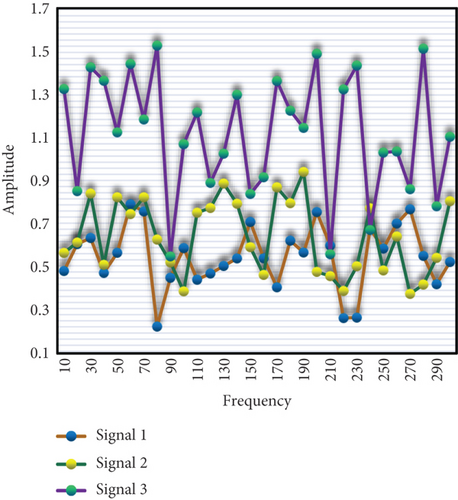

Before measurement, estimate the approximate frequency of the frequency to be measured, set the initial impulse frequency within 1–2 times of the estimated value, and execute the program to search the extreme value of the variance output. From the previous analysis, we know that the driving force frequency value corresponding to the extreme variance is the frequency value of the signal to be measured. The experimental results are shown in Table 2. The simulation results show that the accuracy is about 2%.

| Frequency to be measured | Variance extremum | Measured frequency |

|---|---|---|

| 10 | 1.27 | 10.2 |

| 100 | 1.36 | 99.9 |

| 200 | 1.65 | 197.2 |

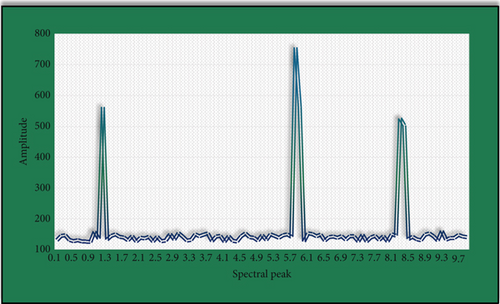

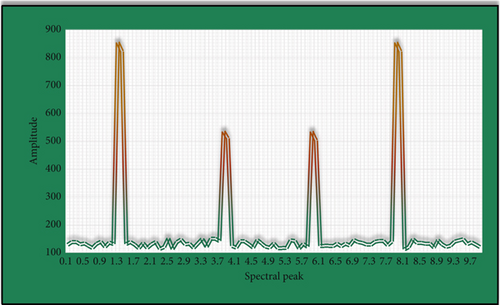

According to the principle of “different frequencies are uncorrelated,” the derivation process of a single sinusoidal signal with noise in the early warning period of a crisis is also applicable to the case of multiple sinusoidal signals, so this program can also be used to detect multiple sinusoidal signals in the early warning period of a crisis at the same time, as shown in Figure 4.

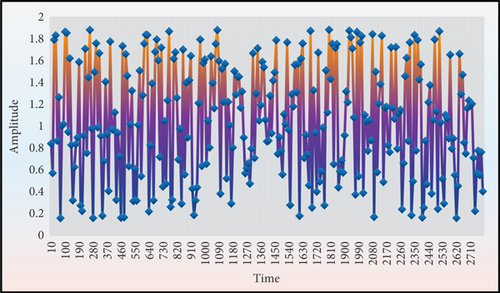

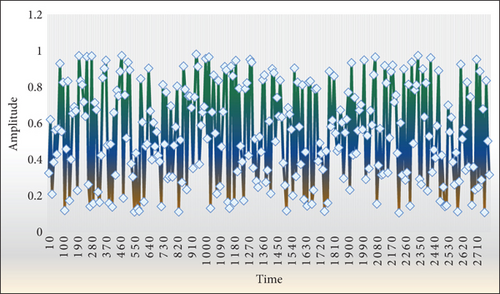

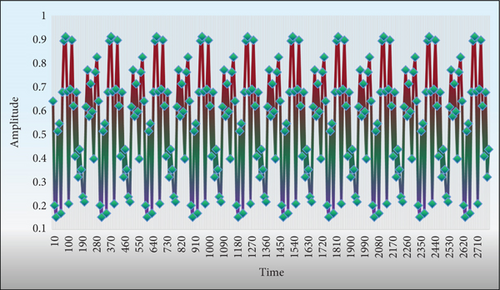

From Figures 5, 6, and 7, we can see that the original signal is disordered and irregular due to the influence of noise; after an early warning, the periodicity of the signal is shown; after three warnings, the signal shows obvious periodicity, and the influence of noise is basically eliminated. It can be seen that the sine signal function can indeed improve the signal-to-noise ratio of financial crisis warning.

As can be seen from Table 3, when the background noise is white noise in the early warning period of crisis, the detection accuracy of this method can reach about 3%. When the background noise in the early warning period of crisis is colored noise, the detection accuracy can reach about 5%. When there is noise in the early warning period of crisis, the measurement accuracy is lower than that in the ideal noiseless background. From the experimental results, it can be seen that the detection performance of this method is better than that of the commonly used time domain method, and the accuracy of the modern spectral method with better effect is 5%.

| Noise type | Frequency to be measured | Extreme value of variance | Measured frequency |

|---|---|---|---|

|

5 | 3.0 | 4.88 |

| 50 | 3.6 | 49.7 | |

| 100 | 3.8 | 96.8 | |

| White Gaussian noise | 5 | 4.5 | 5.7 |

| 50 | 4.9 | 49.7 | |

| 100 | 5.3 | 95.4 | |

The system is in a periodic state, but there is still some noise interference in the output, so the variance value caused is increased, but the increase of variance will not affect its distribution law. In the audible frequency range of human ears, noise with the same energy is called white noise. Colored noise, like white noise, is also a kind of random noise and has a continuous noise spectrum. The difference is that its power spectral density is inversely proportional to the frequency. The difference between the input signal of Gaussian white noise and the input signal of colored noise is that the threshold value of the input signal-to-noise ratio of the system is different.

The detection results are closely related to the amplitude, frequency, and phase estimation results. If the frequency estimation deviation is large, the spectrum “bifurcation” phenomenon similar to the figure will appear in the process of “eliminating” the signal, and the algorithm is invalid. If the amplitude estimation deviation is too large, a spectral peak will be left at the same position of the spectrum during the “elimination” of the signal, affecting signal detection, as shown in Figures 8 and 9.

It can be found from Figures 8 and 9 that the phase estimation deviation is inaccurate, and similar results will occur. The problem of “residual peak” caused by the deviation of amplitude and phase estimation can be solved by detecting the peak at the same position only once; that is, if the same frequency is detected after a position estimation frequency, it will not be considered. However, the problem of frequency estimation error can only be solved by improving the estimation accuracy. It can be seen that it should be used together with the high-precision estimation method of sinusoidal signal frequency parameters.

5. Conclusions

The country should anticipate the future financial crisis and be ready for it. In order to limit the risk of financial crisis and the impact effect of actual crisis, it is necessary to conduct real-time monitoring on vulnerability and financial risk. Therefore, this paper conducts research through the application of sine signal function in the financial crisis early warning detection system. The research shows that the approximate frequency of the frequency to be measured is estimated before the measurement, the initial policy power frequency is set within 1–2 times of the estimated value, and the extreme value of the variance output by executing the program search. The power frequency value corresponding to the extreme value of variance is the frequency value of the signal to be measured, and the simulation results show that the accuracy is about 2%. It can be concluded that the method proposed in this paper has a good antinoise performance, and some crisis emergency plans are also very useful, especially the plan on how to deal with the first signal of early banking crisis because the first signal of the initial banking crisis often determines whether a more systematic banking crisis will occur. In addition, the influence of negative frequency leakage is fully considered in the frequency estimation algorithm, so the proposed method can also provide highly accurate estimates when the frequency is very small. With the deepening of reform and opening up, the continuous promotion of economic globalization and financial liberalization, there will be more and more complex factors affecting the healthy development of China’s economy and finance. This requires the use of sinusoidal signal function to constantly improve the early warning detection of China’s financial crisis, so as to effectively monitor financial risks and protect China’s stable economic development. The research results and analysis are based on theory. During the early warning period of financial crisis, all indicators will send correct signals every month. Due to the lack of actual simulation and verification, the prediction of financial crisis is limited. In the future, more actual indicators need to be referred to for analysis.

This study is mainly based on theory. Although simulation results show an accuracy of about 2%, in actual financial markets, the occurrence of financial crises is influenced by numerous complex factors. Therefore, relying solely on theoretical verification may not fully reflect the real situation. Research has shown that, during financial crisis warning periods, all indicators send out the correct signals every month, but this conclusion lacks validation with actual data. Actual data may contain more noise and uncertainty; therefore, in-depth analysis of the actual data is needed to verify the effectiveness of the method. In the future, it is necessary to continuously adjust and optimize the model parameters and structure to improve the adaptability and predictive ability of the model. At the same time, it is possible to explore the introduction of advanced technologies such as machine learning into models to improve the intelligence level of early warning systems.

Conflicts of Interest

The author declares no conflicts of interest.

Funding

This paper was supported by the Soft Science Research Program of Henan Province, Research on Carbon Emission Estimation and Trend of Henan Province Based on Machine Learning (232400411119).

Open Research

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon request.